UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8748 |

|

Wanger Advisors Trust |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq. Columbia Management Advisors, LLC One Financial Center Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | December 31, 2006 | |

|

Date of reporting period: | December 31, 2006 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Wanger International Select

2006 Annual Report

Wanger International Select

2006 Annual Report

Table of Contents

| | 1 | | | Understanding Your Expenses | |

|

| | 2 | | | Small Caps: The Dilbert Antidote | |

|

| | 5 | | | Performance Review | |

|

| | 7 | | | Statement of Investments | |

|

| | 11 | | | Statement of Assets and Liabilities | |

|

| | 11 | | | Statement of Operations | |

|

| | 12 | | | Statements of Changes in Net Assets | |

|

| | 13 | | | Financial Highlights | |

|

| | 14 | | | Notes to Financial Statements | |

|

| | 17 | | | Report of Independent Registered Public Accounting Firm | |

|

| | 18 | | | Unaudited Information | |

|

| | 19 | | | Management Fee Evaluation of the Senior Officer | |

|

| | 23 | | | Board Approval of the Amended and Restated Advisory Agreement | |

|

| | 25 | | | Board of Trustees and Management of Wanger Advisors Trust | |

|

| | 28 | | | Special Notice | |

|

Columbia Wanger Asset Management, L.P. ("Columbia WAM") is one of the leading global small-cap equity managers in the United States with more than 35 years of small- and mid-cap investment experience. Columbia WAM manages more than $32.9 billion in equities and is the investment adviser to Wanger U.S. Smaller Companies, Wanger International Small Cap, Wanger Select, Wanger International Select and the Columbia Acorn Family of Funds. Columbia Management Group, LLC ("Columbia Management") is the primary investment management division of Bank of America Corporation. Columbia Management entities furnish investment management services and advises institutional and mutual fund portfolios. Columbia WAM is an SEC-registered investment adviser and indirect, wholly owned subsidiary of Bank of America Corporation.

For more complete information about our funds, including the Columbia Acorn Funds, our fees, risks associated with investing, or expenses, call 1-888-4-WANGER for a prospectus. Read it carefully before you invest or send money. This report is not an offer of the shares of the Columbia Acorn Fund Family.

The discussion in the report of portfolio companies is for illustration only and is not a recommendation of individual stocks. The information is believed to be accurate, but the information and the views of the portfolio managers may change at any time without notice, and the portfolio managers may alter a Fund's portfolio holdings based on these views and the Fund's circumstances at that time.

Wanger International Select 2006 Annual Report

Understanding Your Expenses

As a Fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory and other Fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund's expenses

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the reporting period. The information in the following table is based on an initial, hypothetical investment of $1,000.00, which is invested at the beginning of the reporting period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "actual" column is calculated using actual operating expenses and total return for the Fund. The amount listed in the "hypothetical" column assumes that the return each year is 5% before expenses and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the reporting perio d. See the "Compare with other funds" information for details on using the hypothetical data.

Estimating your actual expenses

To estimate the expenses that you actually paid over the period, first you will need your account balance at the end of the period.

1. Divide your ending account balance by $1,000.00. For example, if an account balance was $8,600.00 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," you will find a dollar amount in the column labeled "Actual." Multiply this amount by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

July 1, 2006 – December 31, 2006

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid during

period ($) | | Fund's annualized

expense ratio (%)* | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Wanger International Select | | | 1,000.00 | | | | 1,000.00 | | | | 1,213.89 | | | | 1,019.41 | | | | 6.42 | | | | 5.85 | | | | 1.15 | | |

*For the six months ended December 31, 2006.

Expenses paid during the period are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Fund. As a shareholder of the Fund, you do not incur any transaction costs, such as sales charges, redemption or exchange fees. Expenses paid during the period do not include any insurance charges imposed by your insurance company's separate account. The hypothetical example provided is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund and do not reflect any transaction costs, such as sales charges or redemption or exchange fees that may be incurred by shareholders of other funds. Expenses paid during the period do not include any insurance charges imposed by your insurance company's separate accounts.

1

Wanger International Select 2006 Annual Report

Small Caps: The Dilbert Antidote

Small Caps vs. Large Caps

Small caps edged out large caps in 2006. The Russell 2500 Index appreciated 16.17%, barely more than the S&P 500's 15.79% return, but enough to keep the domestic small-cap winning streak intact.

Our data indicates that the current small-cap cycle began in March 1999. From the end of March 1999 through year-end 2006, the small-cap Russell 2500 Index returned a total of 144.40%, or 12.22% annually. In contrast, the large-cap S&P 500 Index gained 24.69%, or 2.89% annually.

Why have small caps beaten large caps so much for such a long cycle? By many measures, small caps were at 20-year record low relative valuations at the start of the cycle. In contrast, many large caps then seemed very expensive and of course the "bubble" did deflate starting in the first quarter of 2000.

Small-cap earnings growth also helps explain stock performance. Since the beginning of the March 1999 cycle, Russell 2500 Index earnings per share were up 11.11% annually, while large-cap S&P 500 Index earnings were up 7.10% annually. A combination of cheap stocks and faster earnings growth often provides superior investment results.

I have expressed concerns about small-cap valuations in the past. I was perhaps early or maybe just plain wrong. As a firm, we remain cautious, but note that there seems to be no "small-cap mania" or other obvious warning signal for the imminent end of the small-cap cycle. It has become more challenging to find small companies at reasonable prices, but when we see opportunities, we try to take them. For instance, many smaller stocks declined last summer while we believed the business environment was healthy. In September 2006 we took advantage of the slump and added to some of our domestic names at what we thought were good prices.

Small caps have also outperformed over the very long run. The Russell 2500 Index goes back only to 1978, but scholars have linked other time series to derive small- and large-cap performance numbers since 1926.1 From the beginning of 1926 until year-end 2006, small caps returned 12.32% annually while large caps had annual returns of 10.43%. The difference of 1.89% per year may not sound like much, but when compounded over 81 years it makes an enormous difference. A $1,000 investment in small caps would have appreciated to $12,195,329, while the same amount in large caps would have grown to "only" $3,088,420.2

Why have small caps clobbered large caps over the very long term? It seems that many large companies have had problems. We are all aware when a large company such as Enron has a sudden and dramatic collapse. It's big news (kind of like the Hindenburg disaster). But a substantial number of other large companies have more gradually lost market dominance and have provided poor returns to shareholders for years.

At the beginning of the 20th century, United States Steel was the largest stock on the New York Stock Exchange (NYSE). The company fell so far near the end of the century that it was added into the Russell 2500 Index. (As it recovered it was a major upside driver to the benchmark until it graduated out in June 2006.) More recently Kodak, General Motors and Sears spent at least one year between 1966 and 1971 among the top five NYSE capitalization companies. They now do not even rank among the top 300.3 These sorts of declines merit further analysis.

From the Desk of Dilbert

Since we are students of smaller companies, when considering reasons for large company declines, we need to turn to experts on large companies. Scott Adams, in his book, The Dilbert Principle, points out that he worked for a large company for seventeen years. He writes, "Most business books are written by consultants and professors who haven't spent much time in a cubicle."4

Adams parodies the experiences of employees and management of large companies. He makes his money writing comic strips on the topic. In Dilbert's world his company is a politicized bureaucracy populated by stupid, arrogant managers who do not value employees or customers. His boss is every employee's worst nightmare. Still, Adams' views from his cubicle do provide some useful and humorous insights.

Adams points out early on that people are idiots, including himself. He offers this true example of idiots on the customer side: "Kodak introduced a single use camera called the Weekender. Customers have called the support line to ask if it's okay to use it during the week."5 While this anecdote does not explain Kodak's decline it certainly supports Adams' point!

Since larger companies have more people, one may infer that they have more idiots. But, more seriously, Adams notes that large companies often systematically divert employees away from serving customers and place them on committees to develop things like Mission Statements. Once a Mission Statement ("a long awkward sentence that demonstrates management's inability to think clearly"6) is painstakingly created, next can come a Vision Statement. Large companies also like to hire consultants who in turn tell management (a) to change processes and

2

Wanger International Select 2006 Annual Report

structures but not the management, (b) to do what employees have been trying to tell them to do, or (c) to authorize more consulting. Worse yet ... "large companies have legal departments. No project is so risk-free that your company lawyer can't kill it." 7

Adams suggests obvious ways for large companies to succeed. They include focusing on improving employees and products rather than pursuing bureaucratic tasks or adopting the latest managerial fad.

The Innovator's Dilemma

For another take on the business world, we turned to Harvard Business School professor Clayton Christensen. His book, The Innovator's Dilemma,8 explains how well-managed companies often miss opportunities and are injured by new competitors offering disruptive innovations.

Well managed companies tend to listen to customers, study and forecast underlying demand, invest heavily in research, and watch for competitors. They develop improved new products or services that address large established markets and often promise higher margins.

Christensen explains that existing customers often do not want disruptive new products or services. Nascent markets are by nature tiny and unpredictable. At first, disruptive innovations often provide lower performance and margins. Success for these innovations seems unlikely and large companies appear rational to not invest in them.

But this seemingly rational path is often a mistake. Christensen's examples include makers of computer disk drives, minicomputers, mechanical excavators and steel. In each case, existing customers had little desire for innovative new products or processes, which admittedly had some inferior attributes like price/performance or quality vs. existing products. The innovators found niche customers who appreciated some aspects of the new product such as size, ruggedness, or cost, and then improved their products at a faster rate than competitors. What had been an inferior product became fully competitive, at a lower cost.

How can a large company compete against a possible disruptive innovation? Imagine a smart manager saying, "Hey guys, I've got this new, lower performance, lower-margin product that existing customers say they don't want, but we should invest in it anyway should a market develop, in which case we will improve it over time. And oh, by the way, we need to divert people from existing high margin products." That is unlikely. Instead, as Christensen points out, the company's management often decides to continue to go up market, producing high gross-margin products for existing customers. More often than not, this decision is a mistake. Companies unwilling to innovate tend to eventually lose market share.

Christensen offers possible ways for large companies to innovate. A favorite is to create a small, preferably remote, autonomous division with agility and a low-cost structure, whose sole focus is to develop an innovation and sell it to new customers. The division must be able to experience short-term failures and change tactics. Though some large companies have succeeded by taking this approach, few come to mind. This solution is anathema to Dilbert-style bureaucracies and managements.

Small Company Advantages

Most startups and small companies focus on hiring and keeping good employees and providing customers fine products or services. Many are created by refugees from large companies who rejected bureaucracies. Small companies with distinct cultures may not need 72-page expense policies. These companies appear to have more streamlined policies, and some seem to abide by a sort of simplified Golden Rule: "Serve the customers, spend company money wisely, and behave like the founder does." If Adams had started work at a small company he might have remained there, reasonably content. But the world would be poorer without Dilbert.

Christensen says, "Large companies often surrender emerging growth markets because smaller, disruptive companies are actually more capable of pursuing them... Their values embrace small markets, and their cost structures can accommodate lower margins. Their market research and resource allocation processes allow managers to proceed intuitively rather than having to be backed up by careful research and analysis, presented in PowerPoint."9 Small companies seem to have DNA that naturally corresponds to both Adams' and Christensen's managerial solutions.

We admit being clearly biased towards small caps but the reality is that more small companies fail than large companies (in part because there are more small companies to begin with). Small company failures are less newsworthy events and rarely warrant major stories (kind of like third-world bus plunges10). We've owned our share of disappointing companies, including a few bankruptcies.

While there are losers in both the large and small cap ranks, a minority of enormously

3

Wanger International Select 2006 Annual Report

successful small-cap companies with that innovative DNA have driven overall small-cap returns. That is why we believe small-cap investing can be a winner's game. We've had what we believe to be some spectacular winners over the life of our Funds. These have far offset our losers.

Charles P. McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, L.P.

1U.S. Small Stock Total Return (Morningstar/Ibbottson Encor Application) linked with the Russell 2500 Index on 12/31/1978. Large-cap data based on the S&P 500.

2Keep in mind that an investment cannot be made directly in an index, and past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment. The data assumes reinvestment of all income and does not account for taxes or transaction costs. Source: U.S. Small Stock Total Return linked with the Russell 2500 on 12/31/1978 and, for large caps, the S&P 500. Both equity categories soundly beat inflation. At year end 2006, $11,384 had the purchasing power of $1,000 in 1926. Inflation data from inflationdata.com, calculated using the CPI Index.

3As of January 9, 2007.

4Adams, Scott, The Dilbert Principle (New York: HarperCollins Publishers, 1996), pg. 4.

5Ibid., pg. 9.

6Ibid., pg. 36.

7Ibid., pg. 88.

8Christensen, Clayton M., The Innovator's Dilemma, (New York: HarperCollins Publishers, 1997)

9Ibid., pg. 192.

10In Tim Miller's The Panama Hat Trail (New York: William Morrow and Company, Inc., 1986), the author confesses his fears about Latin American bus rides. These fears have been brought on by years of reading standard, two-sentence bus-plunge pieces used by newspapers in the United States as fillers on the foreign-news page. The datelines change, but the headlines always include the words "bus plunge."

Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. A fund that maintains a relatively concentrated portfolio may be subject to greater risk than a fund that is more fully diversified.

The views expressed in this column are those of the author. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the author disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Wanger Advisors Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Wanger Advisors Fund. References to specific company securities should not be construed as a recommendation or investment advice.

Past performance is no guarantee of future results.

4

Wanger International Select 2006 Annual Report

Performance Review Wanger International Select

Christopher J. Olson

Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Performance may reflect any voluntary waivers or reimbursements of fund expenses by the Adviser or its affiliates. Absent these waivers, or reimbursement arrangements, performance results may be lower. For monthly performance updates, call 1-888-4-WANGER.

Wanger International Select gained an impressive 36.00% (without insurance charges) in 2006, outperforming the 27.88% gain of the S&P/Citigroup World ex-US Cap Range $2-10B Index. Outperformance was strong in a number of areas, particularly Ireland where the Fund was overweight. In a reversal from last year, the weakest market was Japan. The Fund was underweight in this market throughout the year.

Irish beverage company C&C Group ended the year up 159%. Strong sales and a well received launch of its cider product in the United Kingdom resulted in dramatic earnings upgrades for the stock. Hong Kong Exchanges and Clearing operates the Hong Kong equity and derivatives market and rose 169% in the Fund for the year. Increased trading volume and new stock listings from China drove this stock's stellar performance. Rounding out the top three, Ireland's IAWS Group, a manufacturer and distributor of baked goods, ended the year up 80%. The stock benefited from strong performance in its baked goods divisions and from the acquisition of Otis Spunkmeyer, a U.S. cookie dough manufacturer.

Even in such a strong year, there were some stocks that detracted from performance and, as was the case at mid-year, the common thread was Japan. In a year where the Fund was up 36%, both the Fund's Japanese portfolio and the Japanese weighting in its benchmark index were essentially flat. Daito Trust Construction, a developer of apartment and condo buildings in Japan, was down roughly 11% for the year. The stock fell as new construction orders slowed when it switched to a new order system. Ushio, a Japanese manufacturer of industrial light sources, fell 10% in the year. JSR, a maker of films and chemicals for LCD screens and electronics in Japan, fell 12% due to inventory build-ups in the LCD panel industry. The situation has since improved.

International mid-cap stocks have had a strong run for the last five years, which likely has some investors questioning how much steam is left in these names. While we can't predict the future, we are still finding attractively valued stocks to include in Wanger International Select.

International investments involve greater potential risks, including less regulation, currency fluctuations, economic instability and political developments. Investments in small- and mid-cap companies may be subject to greater volatility and price fluctuations because they may be thinly traded and less liquid. By maintaining a relatively concentrated portfolio, the fund may be subject to greater risk than a fund that is more fully diversified.

Fund's Positions in Mentioned Holdings

As of 12/31/06, the Fund's positions in the holdings mentioned were:

| C&C Group | | | 5.1 | % | |

| Hong Kong Exchanges and Clearing | | | 3.3 | % | |

| IAWS Group | | | 2.3 | % | |

| JSR | | | 2.1 | % | |

| Daito Trust Construction | | | 2.0 | % | |

| Ushio | | | 1.3 | % | |

5

Wanger International Select 2006 Annual Report

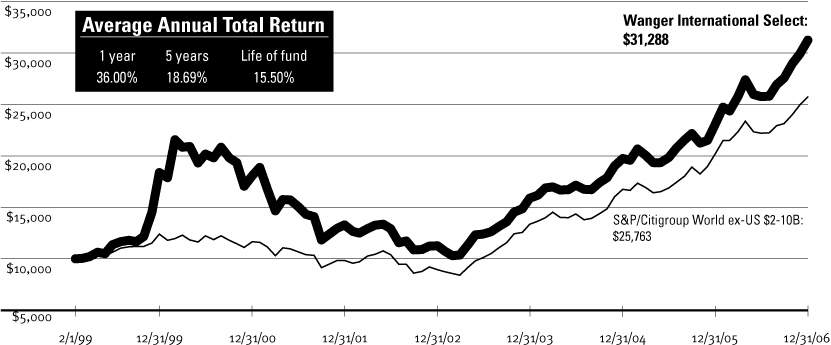

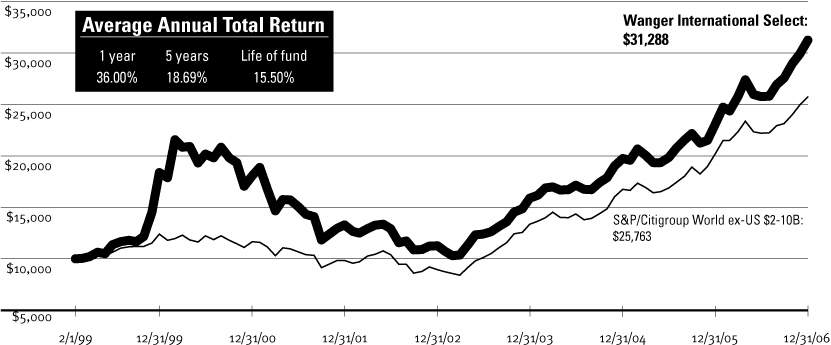

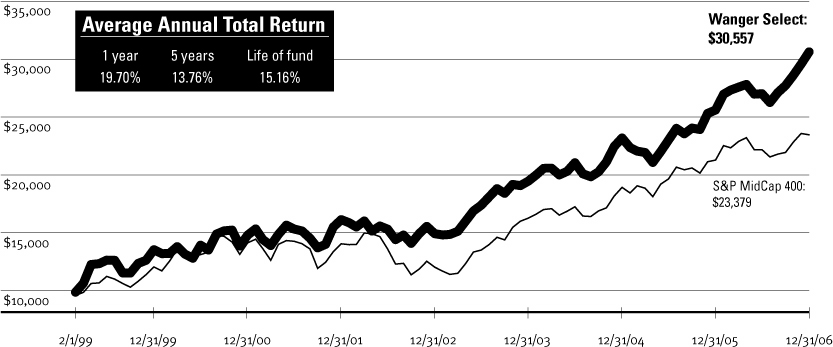

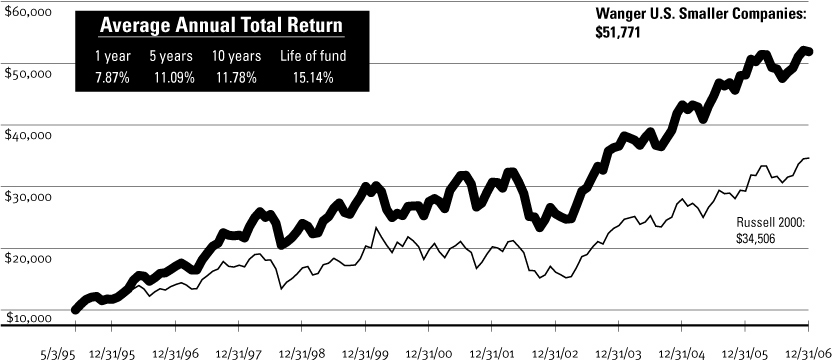

Growth of a $10,000 Investment in

Wanger International Select

Total return for each period,

February 1, 1999 (inception date) through December 31, 2006

This graph compares the results of $10,000 invested in Wanger International Select on February 1, 1999 (the date the Fund began operations) through December 31, 2006, to the S&P/Citigroup World ex-US Cap Range $2-10B Index, with dividends and capital gains reinvested. Performance results reflect any voluntary waivers or reimbursements of Fund expenses by the Advisor or its affiliates. Absent these waivers or reimbursement arrangements, performance results would have been lower. Performance shown here is past performance, which cannot guarantee future results. Current performance may be higher or lower. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance changes over time. Current returns for the Fund may be different than that shown. For monthly performance updates, please contact us at 1-8 88-4-WANGER.

Results to December 31, 2006

| | | 4th quarter | | 1 year | |

| Wanger International Select | | | 13.47 | % | | | 36.00 | % | |

S&P/Citigroup World ex-US

Cap Range $2-10B | | | 11.32 | | | | 27.88 | | |

| MSCI EAFE | | | 10.35 | | | | 26.34 | | |

NAV as of 12/31/06: $26.62

Performance numbers reflect all Fund expenses but do not include any insurance charge imposed by your insurance company's separate accounts. If performance included the effect of these additional charges, it would be lower.

The graph and table do not reflect tax deductions that a shareholder would pay on Fund distributions or the sale of Fund shares.

Due to ongoing market volatility, performance is subject to substantial short-term fluctuations

The S&P/Citigroup World ex-U.S. Cap Range $2-10B is a subset of the broad market, selected by the index sponsor, representing the mid-cap developed market, excluding the United States. MSCI EAFE is Morgan Stanley's Europe, Australasia and Far East Index, a widely recognized international benchmark that comprises 20 major markets in Europe, Australia and the Far East. All indexes are unmanaged and returns include reinvested dividends. It is not possible to invest directly in an index.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings.

Top 5 Countries

As a % of net assets, as of 12/31/06

| Japan | | | 22.0 | % | |

| Ireland | | | 18.6 | | |

| Switzerland | | | 9.8 | | |

| Canada | | | 7.3 | | |

| France | | | 5.7 | | |

Top 10 Holdings

As a % of net assets, as of 12/31/06

1. C&C Group

Beverage Company – Ireland | | | 5.1 | % | |

2. Bank of Ireland

Irish Commercial Bank – Ireland | | | 4.2 | | |

3. Anglo Irish Bank

Small Business & Middle Market Banking – Ireland | | | 3.8 | | |

4. Jupiter Telecommunications

Largest Cable Service Provider in Japan – Japan | | | 3.4 | | |

5. Hong Kong Exchanges and Clearing

Hong Kong Equity & Derivatives Market Operator – Hong Kong | | | 3.3 | | |

6. Synthes

Products for Orthopedic Surgery – Switzerland | | | 3.3 | | |

7. Northern Rock

Lowest Cost Mortgage Bank in UK – United Kingdom | | | 3.1 | | |

8. Alliance Atlantis Communication

CATV Channels, TV/Movie Production/Distribution – Canada | | | 3.0 | | |

9. SES Global

Satellite Broadcasting Services – France | | | 2.8 | | |

10. Hoya

Opto-electrical Components & Eyeglass Lenses — Japan | | | 2.8 | | |

6

Wanger International Select 2006 Annual Report

Wanger International Select

Statement of Investments December 31, 2006

Number of

Shares | | | | Value | |

| | | Common Stocks – 97.3% | |

| | | Europe – 55.2% | |

| | | Ireland – 18.6% | |

| | 180,000 | | | C&C Group

Beverage Company | | | $3,194,761

| | |

| | 115,000 | | | Bank of Ireland

Irish Commercial Bank | | | 2,649,218

| | |

| | 115,000 | | | Anglo Irish Bank

Small Business & Middle Market Banking | | | 2,384,406

| | |

| | 55,000 | | | IAWS Group

Baked Goods | | | 1,408,393

| | |

| | 262,500 | | | United Drug

Irish Pharmaceutical Wholesaler &

Outsourcer | | | 1,376,037

| | |

| | 40,000 | | | Grafton Group

Builders Materials Wholesaling &

Do-it-yourself Retailing | | | 668,522

| | |

| | | | | | | | 11,681,337 | | |

| | | Switzerland – 9.8% | |

| | 17,400 | | | Synthes | | | 2,074,136

Products for Orthopedic Surgery | | |

| | 940 | | | Geberit | | | 1,448,300

Plumbing Supplies | | |

| | 18,100 | | | Kuehne & Nagel

Freight Forwarding/Logistics | | | 1,316,756

| | |

| | 3,000 | | | Swatch Group

Watch & Electronics Manufacturer | | | 662,743

| | |

| | 10,300 | | | Schindler

Elevator Manufacturer & Service Provider | | | 647,626

| | |

| | | | | | | | 6,149,561 | | |

| | | France – 5.7% | |

| | 100,000 | | | SES Global

Satellite Broadcasting Services | | | 1,776,034

| | |

| | 9,500 | | | Neopost | | | 1,192,995

Postage Meter Machines | | |

| | 6,500 | | | Imerys | | | 576,743

Industrial Minerals Producer | | |

| | | | | | | | 3,545,772 | | |

Number of

Shares | | | | Value | |

| | | Germany – 5.4% | |

| | 8,600 | | | Wincor Nixdorf

Retail POS Systems & ATM Machines | | | $1,337,773

| | |

| | 525 | | | Porsche

Specialty Automobile Manufacturer | | | 667,729

| | |

| | 3,600 | | | Deutsche Boerse

Trading, Clearing, Settlement Services

for Financial Markets | | | 662,090

| | |

| | 34,000 | | | Depfa Bank

Investment Banker to Public Authorities | | | 609,836

| | |

| | 2,600 | | | Gagfah

German Residential Property | | | 82,332

| | |

| | | | | | | | 3,359,760 | | |

| | | Netherlands – 4.4% | |

| | 21,000 | | | Fugro

Oilfield Services | | | 1,003,089

| | |

| | 11,000 | | | Aalberts Industries

Flow Control & Heat Treatment | | | 950,927

| | |

| | 12,000 | | | USG People

Temporary Staffing Services | | | 521,469

| | |

| | 2,800 | | | Boskalis Westminster

Dredging & Maritime Contractor | | | 277,150

| | |

| | | | | | | | 2,752,635 | | |

| | | United Kingdom – 3.1% | |

| | 85,000 | | | Northern Rock

Lowest Cost Mortgage Bank in UK | | | 1,954,831

| | |

| | | Spain – 2.8% | |

| | 41,000 | | | Red Electrica de Espana

Spanish Power Grid | | | 1,755,441

| | |

| | | Denmark – 2.1% | |

| | 15,000 | | | Novozymes

Industrial Enzymes | | | 1,285,908

| | |

| | | Sweden – 2.0% | |

| | 30,000 | | | Hexagon

Measurement Equipment & Polymers | | | 1,277,109

| | |

| | | Czech Repulic – 1.3% | |

| | 5,400 | | | Komercni Banka

Leading Czech Universal Bank | | | 803,958

| | |

| | | | | Europe Total | | | 34,566,312 | | |

See accompanying notes to financial statements.

7

Wanger International Select 2006 Annual Report

Wanger International Select

Statement of Investments December 31, 2006

Number of

Shares | | | | Value | |

| | | Asia – 27.4% | |

| | | Japan – 22.0% | |

| | 2,650 | | | Jupiter Telecommunications (b)

Largest Cable Service Provider in Japan | | $2,126,132

| |

| | 45,000 | | | Hoya

Opto-electrical Components &

Eyeglass Lenses | | 1,756,876

| |

| | 30,000 | | | Aeon Mall

Suburban Shopping Mall Developer,

Owner & Operator | | 1,681,980

| |

| | 51,000 | | | JSR

Films & Chemicals for LCD

Screens & Electronics | | 1,321,724

| |

| | 27,000 | | | Daito Trust Construction

Apartment Builder | | 1,235,328

| |

| | 255 | | | Kenedix

Real Estate Investment Management | | 1,153,475

| |

| | 135,000 | | | Kansai Paint

Paint Producer in Japan, India,

China & Southeast Asia | | 1,069,623

| |

| | 14,500 | | | USS

Used Car Auctioneer | | 945,005

| |

| | 40,000 | | | Ushio

Industrial Light Sources | | 823,371

| |

| | 13,000 | | | Ibiden

Electronic Parts & Ceramics | | 656,640

| |

| | 43,000 | | | Park24

Parking Lot Operator | | 551,675

| |

| | 15,000 | | | Ito En

Bottled Tea & Other Beverages | | 457,397

| |

| | | | | | | | 13,779,226 | | |

| | | Hong Kong – 3.4% | |

| | 190,000 | | | Hong Kong Exchanges and Clearing

Hong Kong Equity & Derivatives

Market Operator | | 2,075,447

| |

| | | Singapore – 2.0% | |

| | 340,000 | | | Singapore Exchange

Singapore Equity & Derivatives

Market Operator | | 1,257,017

| |

| | | | | Asia Total | | | 17,111,690 | | |

Number of Shares

or Principal Amount | | | | Value | |

| | | Other Countries – 14.7% | |

| | | Canada – 7.3% | |

| | 44,000 | | | Alliance Atlantis Communication (b)

CATV Channels, TV/Movie

Production/Distribution | | | $1,904,661

| | |

| | 11,100 | | | Potash

World's Largest Producer of Potash | | | 1,592,628

| | |

| | 57,400 | | | RONA (b)

Leading Canadian Do-it-yourself Retailer | | | 1,033,658

| | |

| | | | | | | | 4,530,947 | | |

| | | South Africa – 4.7% | |

| | 60,500 | | | Impala Platinum Holdings

Platinum Group Metals Mining & Refining | | | 1,585,983

| | |

| | 58,000 | | | Naspers

Media & Education in Africa &

other Emerging Markets | | | 1,375,050

| | |

| | | | | | | | 2,961,033 | | |

| | | United States – 2.7% | |

| | 35,000 | | | Atwood Oceanics (b)

Offshore Drilling Contractor | | | 1,713,950

| | |

| | | | | Other Countries Total | | | 9,205,930 | | |

| Total Common Stocks (Cost of $41,372,302) – 97.3% | | | 60,883,932 | | |

| Short-Term Obligation – 2.1% | | | |

| $ | 1,331,000 | | | Repurchase Agreement with Fixed

Income Clearing Corp. dated 12/29/06,

due 01/02/07 at 5.15% collateralized

by Federal Home Loan Bank Bond,

maturing 01/19/16, market value of

$1,361,775 (repurchase

proceeds: $1,331,762) | | | 1,331,000 | | |

| | Total Short-Term Obligation (cost: $1,331,000) | | | | | | 1,331,000 | | |

| Total Investments (Cost: $42,703,302) – 99.4% (a) (c) | | | 62,214,932 | | |

| Cash and Other Assets Less Liabilities – 0.6% | | | 379,441 | | |

| Total Net Assets – 100.0% | | $ | 62,594,373 | | |

See accompanying notes to financial statements.

8

Wanger International Select 2006 Annual Report

Wanger International Select

Statement of Investments December 31, 2006

Notes to Statement of Investments:

(a) At December 31, 2006, for federal income tax purposes cost of investments was $43,165,914 and net unrealized appreciation was $19,049,018, consisting of gross unrealized appreciation of $19,793,361 and gross unrealized depreciation of $744,343.

(b) Non-income producing security.

(c) At December 31, 2006, the Fund's total investments were denominated in currencies as follows:

| Currency | | Value | | % of Net

Assets | |

| Euro Dollars | | $ | 23,094,946 | | | | 36.9 | % | |

| Japanese Yen | | | 13,779,226 | | | | 22.0 | | |

| Swiss Francs | | | 6,149,561 | | | | 9.8 | | |

| US Dollars | | | 4,637,578 | | | | 7.4 | | |

Other currencies less than

5% of total net assets | | | 14,553,621 | | | | 23.3 | % | |

| | | $ | 62,214,932 | | | | 99.4 | % | |

See accompanying notes to financial statements.

9

Wanger International Select 2006 Annual Report

Wanger International Select

Portfolio Diversification December 31, 2006

At December 31, 2006, the Fund's portfolio investments was diversified as follows:

| | | Value | | Percent

of Net Assets | |

| Industrial Goods & Services | |

| Speciality Chemicals | | $ | 4,253,998 | | | | 6.8 | % | |

| Conglomerates | | | 2,884,676 | | | | 4.6 | | |

| Construction | | | 2,683,628 | | | | 4.3 | | |

| Other Industrial Services | | | 1,964,382 | | | | 3.2 | | |

| Machinery | | | 1,192,995 | | | | 1.9 | | |

| Electrical Components | | | 823,371 | | | | 1.3 | | |

| Industrial Distribution | | | 668,522 | | | | 1.1 | | |

| Outsourcing & Training Services | | | 521,469 | | | | 0.8 | | |

| | | | 14,993,041 | | | | 24.0 | | |

| Information Technology | |

| Financial Processors | | | 3,994,554 | | | | 6.4 | | |

| Cable Television | | | 2,126,132 | | | | 3.4 | | |

| Television Programming | | | 1,904,661 | | | | 3.1 | | |

| Satellite Broadcasting | | | 1,776,034 | | | | 2.8 | | |

| Semiconductors & Related Equipment | | | 1,756,876 | | | | 2.8 | | |

| Television Broadcasting | | | 1,375,050 | | | | 2.2 | | |

| Computer Hardware & Related Equipment | | | 1,337,773 | | | | 2.1 | | |

| | | | 14,271,080 | | | | 22.8 | | |

| Consumer Goods & Services | |

| Food | | | 5,060,551 | | | | 8.1 | | |

| Retail | | | 2,715,638 | | | | 4.3 | | |

| Durables Goods | | | 1,330,472 | | | | 2.1 | | |

| Consumer Goods Distribution | | | 945,005 | | | | 1.5 | | |

| Other Consumer Services | | | 551,675 | | | | 0.9 | | |

| | | | 10,603,341 | | | | 16.9 | | |

| | | Value | | Percent

of Net Assets | |

| Finance | |

| Banks | | $ | 8,402,249 | | | | 13.4 | % | |

| | | | 8,402,249 | | | | 13.4 | | |

| Energy & Minerals | |

| Mining | | | 3,178,611 | | | | 5.1 | | |

| Oil Services | | | 2,994,189 | | | | 4.8 | | |

| | | | 6,172,800 | | | | 9.9 | | |

| Health Care | |

| Medical Equipment | | | 2,074,136 | | | | 3.3 | | |

| Pharmaceuticals | | | 1,376,037 | | | | 2.2 | | |

| | | | 3,450,173 | | | | 5.5 | | |

| Other Industries | |

| Regulated Utilities | | | 1,755,441 | | | | 2.8 | | |

| Real Estate | | | 1,235,807 | | | | 2.0 | | |

| | | | 2,991,248 | | | | 4.8 | | |

| Total Common Stocks | | | 60,883,932 | | | | 97.3 | | |

| Short-Term Obligation | | | 1,331,000 | | | | 2.1 | | |

| Total Investments | | | 62,214,932 | | | | 99.4 | | |

Cash & Other Assets

Less Liabilities | | | 379,441 | | | | 0.6 | | |

| Net Assets | | $ | 62,594,373 | | | | 100.0 | % | |

See accompanying notes to financial statements.

10

Wanger International Select 2006 Annual Report

Statement of Assets and Liabilities

December 31, 2006

| Assets: | |

| Investments, at cost | | $ | 42,703,302 | | |

| Investments, at value | | $ | 62,214,932 | | |

| Cash | | | 774 | | |

| Foreign currency (cost of $11,427) | | | 11,432 | | |

| Receivable for: | |

| Investments sold | | | 198,249 | | |

| Fund shares sold | | | 166,268 | | |

| Interest | | | 571 | | |

| Dividends | | | 72,595 | | |

| Foreign tax reclaims | | | 17,979 | | |

| Other Assets | | | 64 | | |

| Total Assets | | | 62,682,864 | | |

| Liabilities: | |

| Payable for: | |

| Fund shares repurchased | | | 9,226 | | |

| Investment advisory fee | | | 51,890 | | |

| Transfer agent fee | | | 12 | | |

| Trustees' fees | | | 250 | | |

| Custody fee | | | 753 | | |

| Other liabilities | | | 26,360 | | |

| Total Liabilities | | | 88,491 | | |

| Net Assets | | $ | 62,594,373 | | |

| Composition of Net Assets: | |

| Paid-in capital | | $ | 35,182,281 | | |

| Undistributed net investment income | | | 56,352 | | |

| Accumulated net realized gain | | | 7,842,802 | | |

| Net unrealized appreciation (depreciation) on: | | | | | |

| Investments | | | 19,511,630 | | |

| Foreign currency translations | | | 1,308 | | |

| Net Assets | | $ | 62,594,373 | | |

| Fund Shares outstanding | | | 2,351,729 | | |

| Net asset value per share | | $ | 26.62 | | |

Statement of Operations

For the Year Ended December 31, 2006

| Investment Income: | |

| Dividends (net of foreign taxes withheld of $62,151) | | $ | 834,485 | | |

| Interest | | | 82,938 | | |

| Total Investment Income | | | 917,423 | | |

| Expenses: | |

| Investment advisory fee | | | 548,729 | | |

| Transfer agent fee | | | 147 | | |

| Trustees' fees | | | 3,531 | | |

| Custody fee | | | 34,462 | | |

| Chief compliance officer expenses (See Note 4) | | | 1,106 | | |

| Non-recurring costs (See Note 9) | | | 370 | | |

| Other expenses (See Note 5) | | | 70,018 | | |

| Total Expenses | | | 658,363 | | |

Non-recurring costs assumed by Investment

Advisor (See Note 9) | | | (370 | ) | |

| Custody earnings credit | | | (405 | ) | |

| Net Expenses | | | 657,588 | | |

| Net Investment Income | | | 259,835 | | |

Net Realized and Unrealized Gain (Loss)

on Investments and Foreign Currency: | |

| Net realized gain (loss) on: | |

| Investments | | | 9,100,005 | | |

| Foreign currency transactions | | | (7,322 | ) | |

Net realized loss on investments

purchased/sold in error (See Note 8) | | | — | | |

| Net realized gain | | | 9,092,683 | | |

| Net change in unrealized appreciation on: | |

| Investments | | | 7,547,655 | | |

| Foreign currency translations | | | 2,923 | | |

Net change in unrealized

appreciation | | | 7,550,578 | | |

| Net Gain | | | 16,643,261 | | |

| Net Increase in Net Assets from Operations | | $ | 16,903,096 | | |

See Accompanying Notes to Financial Statements.

11

Wanger International Select 2006 Annual Report

Statements of Changes in Net Assets

| | | Year Ended December 31, | |

| Increase (Decrease) in Net Assets: | | 2006 | | 2005 | |

| Operations: | |

| Net investment income | | $ | 259,835 | | | $ | 299,187 | | |

| Net realized gain on investments and foreign currency transactions | | | 9,092,683 | | | | 3,589,539 | | |

Net change in unrealized appreciation on

investments and foreign currency translations | | | 7,550,578 | | | | 2,219,669 | | |

| Net Increase in Net Assets from Operations | | | 16,903,096 | | | | 6,108,395 | | |

| Distributions Declared to Shareholders: | |

| From net investment income | | | (154,737 | ) | | | (770,742 | ) | |

| Share Transactions: | |

| Subscriptions | | | 20,098,821 | | | | 12,185,603 | | |

| Distributions reinvested | | | 154,737 | | | | 770,742 | | |

| Redemptions | | | (18,433,819 | ) | | | (9,499,381 | ) | |

| Net Increase from Share Transactions | | | 1,819,739 | | | | 3,456,964 | | |

| Total Increase in Net Assets | | | 18,568,098 | | | | 8,794,617 | | |

| Net Assets: | |

| Beginning of period | | | 44,026,275 | | | | 35,231,658 | | |

| End of period | | $ | 62,594,373 | | | $ | 44,026,275 | | |

| Undistributed (overdistributed) net investment income at end of period | | $ | 56,352 | | | $ | (304,857 | ) | |

See accompanying notes to financial statements.

12

Wanger International Select 2006 Annual Report

Financial Highlights

| | | Year Ended December 31, | |

| Selected data for a share outstanding throughout each period | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net Asset Value, Beginning of Period | | $ | 19.63 | | | $ | 17.19 | | | $ | 13.87 | | | $ | 9.86 | | | $ | 11.64 | | |

| Income from Investment Operations: | |

| Net investment income (a) | | | 0.11 | | | | 0.13 | | | | 0.04 | | | | 0.04 | | | | 0.04 | | |

Net realized and unrealized gain (loss) on investments

and foreign currency transactions | | | 6.94 | | | | 2.66 | | | | 3.33 | | | | 4.01 | | | | (1.82 | ) | |

| Total from Investment Operations | | | 7.05 | | | | 2.79 | | | | 3.37 | | | | 4.05 | | | | (1.78 | ) | |

| Less Distributions Declared to Shareholders: | |

| From net investment income | | | (0.06 | ) | | | (0.35 | ) | | | (0.05 | ) | | | (0.04 | ) | | | — | | |

| Net Asset Value, End of Period | | $ | 26.62 | | | $ | 19.63 | | | $ | 17.19 | | | $ | 13.87 | | | $ | 9.86 | | |

| Total Return (b) | | | 36.00 | % | | | 16.43 | %(c) | | | 24.34 | % | | | 41.24 | %(c) | | | (15.29 | )%(c) | |

| Ratios to Average Net Assets: | |

| Expenses (d) | | | 1.19 | % | | | 1.32 | % | | | 1.43 | % | | | 1.45 | % | | | 1.45 | % | |

| Net investment income (d) | | | 0.47 | % | | | 0.76 | % | | | 0.29 | % | | | 0.39 | % | | | 0.35 | % | |

| Waiver | | | — | | | | 0.00 | %(e) | | | — | | | | 0.09 | % | | | 0.10 | % | |

| Portfolio turnover rate | | | 61 | % | | | 48 | % | | | 71 | % | | | 59 | % | | | 113 | % | |

| Net assets, end of period (000's) | | $ | 62,594 | | | $ | 44,026 | | | $ | 35,232 | | | $ | 26,928 | | | $ | 14,083 | | |

(a) Net investment income per share was based upon the average shares outstanding during the period.

(b) Total return at net asset value assuming all distributions reinvested.

(c) Had the Investment Adviser not waived a portion of expenses, total return would have been reduced.

(d) The benefits derived from custody fees paid indirectly had no impact.

(e) Rounds to less than 0.01%.

See accompanying notes to financial statements.

13

Wanger International Select 2006 Annual Report

Notes to Financial Statements

1. Nature of Operations

Wanger International Select (the "Fund") is a series of Wanger Advisors Trust (the "Trust"), an open-end management investment company organized as a Massachusetts business trust. The investment objective of the Fund is to seek long-term growth of capital. The Fund is available only for allocation to certain life insurance company separate accounts established for the purpose of funding qualified and non-qualified variable annuity contracts, and variable life insurance policies and may also be offered directly to certain types of pension plans and retirement arrangements.

2. Significant Accounting Policies

Security valuation

Securities of the Fund are valued at market value or, if a market quotation for a security is not readily available or is deemed not to be reliable because of events or circumstances that have occurred between the market quotation and the time as of which the security is to be valued, the security is valued at a fair value determined in accordance with procedures established by the Board of Trustees. A security traded on a securities exchange or in an over-the-counter market in which transaction prices are reported is valued at the last sales price at the time of valuation. A security traded principally on the NASDAQ is valued at the NASDAQ official closing price. A security for which there is no reported sale on the valuation date is valued at the latest bid quotation. A short-term debt obligation having a maturity of 60 days or less from the valuation date is valued at amortized cost, which approximates fair value. A security for which a market quotation is not readily available and any other assets are valued as determined in good faith under consistantly applied procedures established by and under the general supervision of the Board of Trustees. The Trust has retained an independent statistical fair value pricing service to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for possible changes in value that may occur between the close of the foreign exchange and the time as of which the securities are to be valued. If a security is valued at a "fair value," that value may be different from the last quoted market price for the security.

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements ("SFAS 157"), was issued. SFAS 157 is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management has recently begun to evaluate the impact the application of SFAS 157 will have on the Fund's financial statement disclosures.

Repurchase agreements

The Fund may engage in repurchase agreement transactions. The Fund, through its custodians, receives delivery of underlying securities collateralizing each repurchase agreement. The Fund's investment advisor determines that the value of the underlying securities is at all times at least equal to the repurchase prices including interest. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

Foreign currency translations

Values of investments denominated in foreign currencies are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of investments and dividend and interest income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The gain or loss resulting from changes in foreign exchange rates is included with net realized and unrealized gain or loss from investments, as appropriate.

Security transactions and investment income

Security transactions are accounted for on the trade date (date the order to buy or sell is executed) and dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information is available to the Fund. Interest income is recorded on an accrual basis and includes amortization of discounts and premiums on debt obligations when required for federal income tax purposes. Realized gains and losses from security transactions are reported on an identified cost basis.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimated.

Fund share valuation

Fund shares are sold and redeemed on a continuing basis at net asset value. Net asset value per share is determined daily as of the close of trading on the New York Stock Exchange ("the Exchange") on each day the Exchange is open for trading by dividing the total value of the Fund's investments and other assets, less liabilities, by the number of Fund shares outstanding.

Custody fees/Credits

Custody fees are reduced based on the Fund's cash balances maintained with the custodian. The Fund could have invested a portion of the assets utilized in connection with the expense offset arrangement in an income-producing asset if it had not entered into such an agreement. The amount is disclosed as a reduction of total expenses in the Statement of Operations.

Federal income taxes

The Fund has complied with the provisions of the Internal Revenue Code available to regulated investment companies and, in the manner provided therein, distributes all its taxable income, as well as any net realized gain on sales of investments and foreign currency transactions reportable for federal income tax purposes. Accordingly, the Fund paid no federal income taxes and no federal income tax provision was required.

Foreign Capital Gains Taxes

Realized gains in certain countries may be subject to foreign taxes at the fund level, at rates ranging from 10%-15%. The Fund accrues for such foreign taxes on net realized and unrealized gains at the appropriate rate for each jurisdiction.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-date.

Indemnification

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also under the Trust's organizational documents, the trustees and officers of the Trust are indemnified against certain liabilities that may arise out of their duties to the Trust. However based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

3. Federal Tax Information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from

14

Wanger International Select 2006 Annual Report

Notes to Financial Statements

GAAP. Reclassifications are made to the Fund's capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations.

For the year ended December 31, 2006, permanent book and tax basis differences resulting primarily from differing treatments for foreign currency transactions and passive foreign investment companies ("PFIC") adjustments were identified and reclassified among the components of the Fund's net assets as follows:

Overdistributed

Net Investment

Income | | Accumulated

Net Realized

Gain | |

Paid-In Capital | |

| $ | 256,111 | | | $ | (256,111 | ) | | $ | — | | |

Net investment income and net realized gains (losses), as disclosed on the Statement of Operations, and net assets were not affected by this reclassification.

The tax character of distributions paid during the years ended December 31, 2006 and December 31, 2005 was as follows:

| | | December 31, 2006 | | December 31, 2005 | |

| Distributions paid from: | |

| Ordinary Income* | | | 154,737 | | | $ | 770,742 | | |

* For tax purposes short-term capital gains distributions, if any, are considered ordinary income distributions.

As of December 31, 2006, the components of distributable earnings on a tax basis were as follows:

Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gains | | Net Unrealized

Appreciation

(Depreciation)* | |

| $ | 1,243,459 | | | $ | 7,118,294 | | | $ | 19,050,339 | | |

* The differences between book-basis and tax-basis net unrealized appreciation/depreciation are primarily due to deferral of losses from wash sales and PFIC adjustments.

Expired capital loss carryforwards, if any, are recorded as reduction of paid-in capital. Capital loss carryforwards of $993,509 were utilized during the year ended December 31, 2006 for the Fund.

In June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an Interpretation of FASB Statement No. 109 (the "Interpretation"). This Interpretation is effective for fiscal years beginning after December 15, 2006 and is to be applied to open tax positions upon initial adoption. This Interpretation prescribes a minimum recognition threshold and measurement method for the financial statement recognition of tax positions taken or expected to be taken in a tax return and also requires certain expanded disclosures. Management has recently begun to evaluate the application of this Interpretation to the Fund and has not at this time quantified the impact, if any, resulting from the adoption of this Interpre tation on the Fund's financial statements. Effective December 26, 2006, the U.S. Securities and Exchange Commission has extended required implementation of FIN 48 until June 29, 2007, for mutual funds.

4. Transactions With Affiliates

Columbia Wanger Asset Management, L.P., ("Columbia WAM") a wholly owned subsidiary of Columbia Management, Inc. (CM), which in turn is an indirect wholly owned subsidiary of Bank of America Corporation ("BOA"), furnishes continuing investment supervision to the Fund and is responsible for the overall management of the Fund's business affairs.

Under the Fund's investment management agreement, fees are accrued daily and paid monthly to Columbia WAM at the annual rate of 0.99% of average daily net assets.

The investment advisory agreement also provides that through April 30, 2007 Columbia WAM will reimburse the Fund to the extent that ordinary operating expenses (computed based on net custodian fees) exceed an annual percentage of 1.45% of average daily net assets. There was no reimbursement for the year ended December 31, 2006.

Certain officers and trustees of the Trust are also officers of Columbia WAM. The Trust makes no direct payments to its officers and trustees who are affiliated with Columbia WAM. For the year ended December 31, 2006, the Fund paid $3,531 to trustees not affiliated with Columbia WAM. The Board of Trustees appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations. The Fund will pay its pro-rata share of the expenses associated with the Office of the Chief Compliance Officer. These expenses are disclosed separately as "Chief compliance officer expenses" in the Statement of Operations.

Columbia Management Distributors, Inc. (the "Distributor"), a wholly owned subsidiary of BOA, serves as the principal underwriter of the Trust and receives no compensation for its services.

Columbia Management Services, Inc. (the "Transfer Agent"), a wholly owned subsidiary of BOA, provides shareholder services to the Fund and has contracted with Boston Financial Data Services ("BFDS") to serve as subtransfer agent. For such services, the Transfer Agent receives a fee, paid monthly, at the annual rate of $21.00 per open account. The Transfer Agent also receives reimbursement for certain out-of-pocket expenses.

During the year ended December 31, 2006, the Fund had no purchases or sales transactions with funds that have a common investment adviser.

5. Borrowing Arrangements

The Trust participates in a $150,000,000 credit facility, which was entered into to facilitate portfolio liquidity. Interest is charged to each participating fund based on its borrowings at rate per annum equal to the Federal Funds rate plus 0.50%. In addition, a commitment fee of 0.10% per annum for 2006 was accrued and apportioned among the participating funds based on their pro-rata portion of the unutilized line of credit. The commitment fee is included in "Other expenses" in the Statement of Operations. No amounts were borrowed by the Fund under this facility during the year ended December 31, 2006.

6. Fund Share Transactions

Proceeds and payments on Fund shares as shown in the Statements of Changes in Net Assets are in respect of the following numbers of shares:

| | | Year ended

December 31, 2006 | | Year ended

December 31, 2005 | |

| Shares sold | | | 919,957 | | | | 688,890 | | |

Shares issued in reinvestment

of dividend distributions | | | 7,482 | | | | 43,155 | | |

| Less shares redeemed | | | (818,880 | ) | | | (537,836 | ) | |

| Net increase in shares outstanding | | | 108,559 | | | | 194,209 | | |

7. Investment Transactions

The aggregate cost of purchases and proceeds from sales other than short-term obligations for the year ended December 31, 2006 were $33,909,678 and $32,651,297, respectively.

15

Wanger International Select 2006 Annual Report

Notes to Financial Statements

8. Other

During the year ended December 31, 2006, the Fund had a realized loss due to a trading error. The loss of $64 was reimbursed by Columbia WAM.

9. Legal Proceedings

Columbia WAM, Columbia Acorn Trust, another mutual fund family advised by Columbia WAM, and the trustees of Colombia Acorn Trust (collectively, the "Columbia defendants") are named as defendants in class and derivative complaints which have been consolidated in a Multi-District Action in the federal district court for the District of Maryland (the "MDL Action"). These lawsuits contend that defendants permitted certain investors to market time their trades in certain Columbia Acorn Funds. The MDL Action is ongoing. However, all claims against Columbia Acorn Trust and the independent trustees of Columbia Acorn Trust have been dismissed.

The Columbia Acorn Trust and Columbia WAM are also defendants in a class action lawsuit that alleges, in summary, that the Columbia Acorn Trust and Columbia WAM exposed shareholders of Columbia Acorn International fund to trading by market timers by allegedly (a) failing to properly evaluate daily whether a significant event affecting the value of that fund's securities had occurred after foreign markets had closed but before the calculation of the funds' net asset value (NAV"); (b) failing to implement the fund's portfolio valuation and share pricing policies and procedures; and (c) failing to know and implement applicable rules and regulations concerning the calculation of NAV (the "Fair Valuation Lawsuit"). The Seventh Circuit ruled that the plaintiffs' state law claims were preempted under federal law resulting in the dismissal of plaintiffs' complaint. Plaintiffs appealed the Seventh Circuit's ruling to the United States Su preme Court. The Supreme Court reversed the Seventh Circuit's ruling on jurisdictional grounds, and the case ultimately was remanded to the state court.

On March 21, 2005, a class action complaint was filed against the Columbia Acorn Trust and Columbia WAM seeking to rescind the Contingent Deferred Sales Charges assessed upon redemption of Class B shares of Columbia Acorn Funds due to the alleged market timing of the Columbia Acorn Funds. In addition to the rescission of sales charges, plaintiffs seek recovery of actual damages, attorneys' fees and costs. The case has been transferred to the MDL Action in the federal district court of Maryland.

On April 4, 2006, the plaintiffs and the Columbia defendants named in the MDL Action executed an agreement in principle intended to fully resolve all of the lawsuits consolidated in the MDL Action as well as the Fair Valuation Lawsuit. The court entered a stay after the parties executed a settlement agreement. The settlement has not yet been finalized or approved by the court.

Columbia WAM, the Columbia Acorn Funds and the trustees of Columbia Acorn Trust are also defendants in a consolidated lawsuit filed in the federal district court of Massachusetts alleging that Columbia WAM used fund assets to make undisclosed payments to brokers as an incentive for the brokers to market the Columbia Acorn Funds over the other mutual funds to investors. The complaint alleges Columbia WAM and the Trustees of the Trust breached certain common laws duties and federal laws.

On November 30, 2005, the court dismissed all of the claims alleged against all of the parties in the consolidated complaint. Plaintiffs timely filed a noticed of appeal of the district court's dismissal order with the First Circuit Court of Appeals. The parties subsequently executed a settlement term sheet to fully resolve all claims in the litigation. The settlement has not yet been finalized or approved by the court.

On or about January 11, 2005, a putative class action lawsuit was filed in federal district court in Massachusetts against the Columbia Acorn Trust and the trustees of Columbia Acorn Trust, along with the Columbia Advisers, the sub-administrator of the Wanger Advisors Funds and the Columbia Acorn Funds. The plaintiffs allege that the defendants failed to submit Proof of Claims in connection with settlements of securities class action lawsuits filed against companies in which the Columbia Acorn Funds held positions. The complaint seeks compensatory and punitive damages, and the disgorgement of all fees paid to the Columbia Advisers.

Plaintiffs have voluntarily dismissed the Columbia Acorn Trust and its independent trustees.

The Columbia Acorn Trust and Columbia WAM intend to defend these suits vigorously.

As a result of these matters or any adverse publicity or other developments resulting from them, there may be increased redemptions or reduced sales of Fund shares, which could increase transaction costs or operating expenses, or have other adverse consequences for the Funds.

However, based on currently available information, the Columbia Acorn Trust believes that the likelihood that these lawsuits will have a material adverse impact on any fund is remote, and Columbia WAM believes that the lawsuits are not likely to materially affect its ability to provide investment management services to the Funds.

For the year ended December 31, 2006, CM has assumed $370 in consulting services and legal fees incurred by the Fund in connection with these matters.

16

Wanger International Select 2006 Annual Report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Wanger International Select

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Wanger International Select (a series of the Wanger Advisors Trust, hereinafter referred to as the "Fund") at December 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the three years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2006 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion. The December financial highlights of the Fund for the periods ended December 31, 2003 and prior were audited by other independent auditors whose report dated February 6, 2004 expressed an unqualified opinion on those financial statements.

PricewaterhouseCoopers LLP

Chicago, Illinois

February 13, 2007

17

Wanger International Select 2006 Annual Report

Unaudited Information

Federal Income Tax Information

For the fiscal year ended December 31, 2006, the Fund designated long-term capital gains of $7,118,294.

Foreign taxes paid during the fiscal year ended December 31, 2006, amounting to $62,151 ($0.03 per share) are expected to be passed through to shareholders as 100% allowable foreign tax credits on Form 1099-DIV for the year ending December 31, 2006.

18

Wanger International Select 2006 Annual Report

[Excerpts from:]

Wanger Advisors Trust

Management Fee Evaluation of the Senior Officer

Prepared Pursuant to the New York Attorney General's

Assurance of Discontinuance

2006

19

Wanger International Select 2006 Annual Report

Introduction

The New York Attorney General's Assurance of Discontinuance ("Order") entered into by Columbia Management Advisors, Inc. ("CMAI") and Columbia Management Distributors, Inc., ("CMDI" and collectively with "CMAI," "CMG") in February 2005, allows CMAI to manage or advise a mutual fund, including the Wanger Advisors Trust's family of funds (the "WAT Funds" or "WAT" or "Trust"), only if the trustees of the WAT Funds appoint a "Senior Officer" to perform specified duties and responsibilities. One of these responsibilities includes "managing the process by which proposed management fees (including but not limited to, advisory fees) to be charged the [WAT Funds] are negotiated so that they are negotiated in a manner which is at arms' length and reasonable and consistent with this Assurance of Discontinuance."

The Order also provides that the Board of Trustees of the WAT Funds ("Board") must determine the reasonableness of proposed "management fees" by using either an annual competitive bidding process supervised by the Senior Officer or Independent Fee Consultant, or by obtaining "an annual independent written evaluation prepared by or under the direction of the Senior Officer or the Independent Fee Consultant."

"Management fees" are only part of the costs and expenses paid by mutual fund shareholders. The expenses can vary depending upon the class of shares held but usually include: (1) investment management or advisory fees to compensate analysts and portfolio managers for stock research and portfolio management, as well as the cost of operating a trading desk; (2) administrative expenses incurred to prepare registration statements and tax returns, calculate the Funds' net asset values, maintain effective compliance procedures and perform recordkeeping services; (3) transfer agency costs for establishing accounts, accepting and disbursing funds, as well as overseeing trading in Fund shares; and (4) custodial expenses incurred to hold the securities purchased by the Funds.

Columbia Wanger Asset Management, L.P. ("CWAM"), the adviser to the WAT Funds, has proposed that the Trust enter into an agreement that "bundles" the first two categories listed above: advisory and administrative services. The fees paid under this agreement are referred to as "management fees." Other fund expenses are governed by separate agreements, in particular agreements with two CWAM affiliates: CMDI, the broker-dealer that underwrites and distributes the WAT Funds' shares, and Columbia Management Services, Inc. ("CMSI"), the Funds' transfer agent. In conformity with the terms of the Order, this evaluation, therefore, addresses only the advisory and administrative contract between CWAM and the Trust, and does not extend to the other agreements.

According to the Order, the Senior Officer's evaluation must consider at least the following:

(1) Management fees (including components thereof) charged to institutional and other clients of CWAM for like services;

(2) Management fees (including any components thereof) charged by other mutual fund companies for like services;

(3) Costs to CWAM and its affiliates of supplying services pursuant to the management fee agreements, excluding any intra-corporate profit;

(4) Profit margins of CWAM and its affiliates from supplying such services;

(5) Possible economies of scale as the WAT Funds grow larger; and

(6) The nature and quality of CWAM's services, including the performance of each WAT Fund.

On November 17, 2004, the Board appointed me Senior Officer under the Order. The Board also determined not to pursue a competitive bidding process and instead, charged me with the responsibility of evaluating the WAT Funds' proposed advisory and administrative fee contract with CWAM in conformity with the requirements of the Order. This Report is an annual evaluation required under the Order. In discharging their responsibilities, the independent Trustees have also consulted independent, outside counsel.

2005 Evaluation

This is the second annual evaluation prepared in connection with the Order. The first annual evaluation ("2005 Evaluation") was issued on July 25, 2005. This evaluation follows the same structure as the 2005 Evaluation. Some areas are given more emphasis here, while others are given less. Still, the fundamental information gathered for this evaluation is the largely the same as last year. I have noted in this Report where methodologies diverged significantly.

This evaluation was performed in cooperation and regular communication with the Compliance/Contract Renewal Committee of the Board.

Process and Independence

The objectives of the Order are to insure the independent evaluation of the advisory fees paid by the WAT Funds as well as to insure that all relevant factors are considered. In my view, the contract renewal process has been conducted at arms-length and with independence in gathering, considering and evaluating all relevant data. At the outset of the process, the Trustees sought and obtained from CWAM and CMG a comprehensive compilation of data regarding Fund performance and expense, adviser profitability, and other information. In advance of the contract renewal process, the Board also explored CWAM's potential capacity restraints as they relate to the larger Columbia Acorn Fund complex managed by CWAM. The adviser's capacity to manage increasing assets is an issue posed by the size of the Columbia Acorn Fund, but impacts the domestic WAT Funds as well. Performance and expense data was obtained from both Morningstar and Lipper, the leading consultants in this area. The rankings prepared by Morningstar and Lipper were independent and were not influenced by the adviser. CWAM itself identified what it considers its competition in formulating its own peer group, and the Trustees considered that data as well.

20

Wanger International Select 2006 Annual Report

My evaluation of the advisory contract was shaped, as it was last year, by my experience as WAT's Chief Compliance Officer ("CCO"). As CCO, I report solely to the Board and have no reporting obligation to or employment relationship with CMG or its affiliates, except for administrative purposes. This too contributes to the independence of this evaluation. I have commented on compliance matters in evaluating the quality of service provided by CWAM.

Since the 2005 Evaluation was issued, the Board has considered the recommendations and conclusions of that Report. In connection with the July 2005 contract renewal, the Board added a breakpoint of 10 basis points for Wanger International Small Cap for assets in excess of $500 million. Since that fund now has assets of $1.2 billion, management fees were reduced as a result. The Board has also gathered data on payments made by CWAM to insurance company partners as part of the Board's on-going consideration of whether to institute Rule 12b-1 fees for the WAT Funds. Finally, it has gathered and considered data from CWAM regarding its capacity to invest fund assets effectively.

This Report, its supporting materials and the data contained in other materials submitted to the Compliance/Contract Committee of the Board, in my view, provide a thorough factual basis upon which the Board, in consultation with independent counsel as it deems appropriate, may conduct management fee negotiations that are in the best interests of the WAT Funds' shareholders.

Finally, it should be noted that in June 2006, the WAT and Columbia Acorn Boards agreed in principle to merge, subject to appropriate shareholder approval. In view of this development, the WAT Trustees are considering the extension of the existing advisory contract for an interim period that would facilitate a review of the agreement by the combined board following the proposed merger for the remainder of the renewal period (through July 2007). Regardless of how the WAT Trustees ultimately choose to proceed in this respect, this Report provides the WAT Board with sufficient information to make an informed decision at this time regarding the advisory contract.

The Fee Reductions Mandated under the Order