UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8748 |

|

Wanger Advisors Trust |

(Exact name of registrant as specified in charter) |

|

One Financial Center, Boston, Massachusetts | | 02111 |

(Address of principal executive offices) | | (Zip code) |

|

James R. Bordewick, Jr., Esq.

Columbia Management Advisors, LLC

One Financial Center

Boston, MA 02111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-617-426-3750 | |

|

Date of fiscal year end: | December 31, 2007 | |

|

Date of reporting period: | December 31, 2007 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Wanger International Select

2007 Annual Report

| NOT FDIC INSURED | | May Lose Value | |

|

| NOT BANK ISSUED | | No Bank Guarantee | |

|

Wanger International Select

2007 Annual Report

| | | Table of Contents | |

| | 1 | | | Understanding Your Expenses | |

|

| | 2 | | | Ponzi Schemes and Politicians' Dreams | |

|

| | 4 | | | Performance Review | |

|

| | 6 | | | Statement of Investments | |

|

| | 10 | | | Statement of Assets and Liabilities | |

|

| | 10 | | | Statement of Operations | |

|

| | 11 | | | Statement of Changes in Net Assets | |

|

| | 12 | | | Financial Highlights | |

|

| | 13 | | | Notes to Financial Statements | |

|

| | 16 | | | Report of Independent Registered Public Accounting Firm | |

|

| | 17 | | | Federal Income Tax Information | |

|

| | 18 | | | Management Fee Evaluation of the Senior Officer | |

|

| | 22 | | | Board Approval of the Advisory Agreement | |

|

| | 24 | | | Board of Trustees & Management of Wanger Advisors Trust | |

|

Columbia Wanger Asset Management, L.P. ("CWAM") is one of the leading global small- and mid-cap equity managers in the United States with more than 37 years of small- and mid-cap investment experience. As of December 31, 2007, CWAM manages $36.8 billion in assets and is the investment adviser to Wanger U.S. Smaller Companies, Wanger International Small Cap, Wanger Select, Wanger International Select (together, the "Wanger Advisors Trust Funds") and the Columbia Acorn Family of Funds. Columbia Management Group, LLC ("Columbia Management") is the investment management division of Bank of America Corporation. Columbia Management entities furnish investment management services and products for institutional and individual investors. The Wanger Advisor Trust Funds and the Columbia Acor n Family of Funds (together with other funds advised by Columbia Management Affiliates, the "Columbia Funds") are distributed by Columbia Management Distributors, Inc., member of FINRA, SIPC, part of Columbia Management and an affiliate of Bank of America Corporation. CWAM is an SEC-registered investment adviser and indirect, wholly owned subsidiary of Bank of America Corporation. CWAM is part of Columbia Management.

Please consider the investment objectives, risks, charges and expenses for the Fund carefully before investing. Contact 1-888-4-WANGER for a prospectus, which contains this and other important information about the Fund. You should read it carefully before you invest.

The views expressed in "Ponzi Schemes and Politicians' Dreams" and in the Performance Review reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific company securities should not be construed as a recommendation or investment advice.

Wanger International Select 2007 Annual Report

Understanding Your Expenses

As a Fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption or exchange fees. There are also ongoing costs, which generally include investment advisory fees and other Fund expenses. The information on this page is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund's expenses

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The information in the following table is based on an initial, hypothetical investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using actual operating expenses and total return for the Fund. The amount listed in the "Hypothetical" column assumes that the return each year is 5% before expenses and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See the "Compare with other fu nds" information for details on using the hypothetical data.

Estimating your actual expenses

To estimate the expenses that you actually paid over the period, first you will need your account balance at the end of the period.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," you will find a dollar amount in the column labeled "Actual." Multiply this amount by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

July 1, 2007 – December 31, 2007

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid during

period ($) | | Fund's annualized

expense ratio (%)* | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Wanger International Select | | | 1,000.00 | | | | 1,000.00 | | | | 1,085.90 | | | | 1,019.26 | | | | 6.20 | | | | 6.01 | | | | 1.18 | | |

*For the six months ended December 31, 2007.

Expenses paid during the period are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Fund. Expenses paid during the period do not include any insurance charges imposed by your insurance company's separate account. The hypothetical example provided is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees that may be incurred by shareholders of other funds. Expenses paid during the period do not include any insurance charges imposed by your insurance company's separate accounts.

1

Wanger International Select 2007 Annual Report

Ponzi Schemes and Politicians' Dreams

Each December I attend The University of Chicago Business Forecast luncheon. Typically the event features economic forecasts by two economists, plus a summary of world political and economic issues provided by Professor Marvin Zonis.1 At this year's luncheon Professor Zonis stated that the U.S. Government had $50 trillion of unfunded liabilities. That's a staggering figure! Could it really be correct?

"Trust Me" Trust Funds

I've found that there is no precise U.S. Government unfunded liability number, though there are estimates. The U.S. Government Accountability Office (GAO) notes material weaknesses in federal government accounting in general, but has expressed an unqualified opinion on its 2007 Statement of Social Insurance. Any calculation of unfunded liabilities requires numerous actuarial assumptions plus a time horizon. The calculations by various government agencies cover liabilities for 75 years into the future.

However, it does appear that Professor Zonis' $50 trillion estimate was wrong. That number is now too low. On December 17, 2007, the GAO estimated that the U.S. Government's total reported liabilities, net social insurance commitments, and other fiscal exposures were approximately $53 trillion.2 With apologies to the late Senator Everett Dirksen (Republican: Illinois), it seems that a trillion here and a trillion there adds up.3

Despite well-publicized concerns about Social Security, Medicare is in worse shape. Created in the 1930s, Social Security seems to have been a warm-up for bigger unfunded liabilities later on. Social Security is better funded, as Social Security tax rates are higher than Medicare tax rates. Medicare was signed into law in 1965 and spending for the program quickly ran out of control. The original cost estimate for Medicare hospital insurance in 1990, for example, was $9 billion; the actual cost that year hit $67 billion!4 According to the GAO, Medicare alone has over $36 trillion of unfunded liabilities.

But what of the Social Security and Medicare Trust Funds, the Funds that politicians promised to put in a "lock box?" It turns out the politicians spent the money elsewhere and the Trust Funds loaned their money to the U.S. Treasury by buying government bonds. The Trust Funds have no true third-party assets, but simply have promises from the U.S. Treasury to pay in the future. In order for the payments to be made the Treasury will have to raise taxes, cut other spending, borrow or print money.

What was the latest change that politicians made concerning unfunded liabilities? They increased them, by adding prescription drugs to Medicare's benefits. This addition is noteworthy for three reasons. First, little new funding was created; enrollee premiums cover only about 25% of costs. Second, the program's costs and benefits are highly skewed. Baby boomers will have a net benefit of about $20,000 each while younger workers and future generations will have net costs of between $2,500 and $4,200 each.5 Third, when the new benefits were fully implemented in 2006, they drove a 19% increase in Medicare costs, the largest increase in decades. Over $10 trillion of Medicare's unfunded liability is from the drug program.

What are this year's presidential candidates saying about the unfunded liability problem? Virtually nothing and, even though taxpayers cannot afford Social Security, Medicare and other existing programs, some candidates are touting new proposals that substantially broaden federal health care spending. These plans include additional entitlements and mandatory, subsidized, health insurance participation. Cost estimates are dubious but range from $50 to $120 billion yearly.

Given the huge existing liabilities and proposals for additional benefits it appears that the U.S. Government is operating an enormous Ponzi Scheme.6 Initial participants benefit but most taxpayers are likely to lose.

Large Liabilities and Possible Solutions

$53 trillion is a huge number, nearly four times all the goods and services produced in the United States in 2007. Currently Social Security is running a yearly surplus while Medicare is running a deficit. But the aging of baby boomers is driving yearly Medicare and Social Security spending higher, so the programs' cash needs will become very large in the next decade. Medicare deficits are projected to consume 25% of all federal income taxes by 2020. By 2050, Social Security, Medicare, and Medicaid will grow from 9% to 18% of GDP. This contrasts to total federal spending averaging about 20% of GDP over the last 50 years.7

Some of the richest people in America say their taxes are too low. What if they were taxed at 100%? Not 100% of income but 100% of their net worth! This "Che Guevara lite" (confiscation without murder) solution, if applied to the 2007 Forbes list of the richest 400 Americans, would yield a one-time receipt of $1.54 trillion. That would cover 2.9% of the problem, but is of course not a real solution as it would destroy capitalism.

How about raising tax rates on all of us? The Laffer Curve8 exists—there is an income tax rate that will yield the highest dollar amount of taxes, and that rate appears to be well under 100%. Even famed British economist John Maynard Keynes said that reducing too-high tax rates results in higher tax revenues. Very high tax rates choke economic activity and spur

2

Wanger International Select 2007 Annual Report

taxpayers to take legal and illegal measures to reduce payments.

Since federal income taxes began in 1913, there have been three rounds of major income tax rate cuts in the United States, and each resulted in faster economic growth and, ultimately, higher taxes collected. Paradoxically, though the rate cuts provided those with higher incomes the largest benefits, higher income people ended up paying greater percentages of total tax collections. A number of countries, including former Soviet republics, have adopted low, flat income tax rates and have seen economic growth surge and tax receipts increase.

No one knows what income tax rates create the highest tax revenues over the long run. In the last 50 years, the highest marginal tax rates in the United States have varied from a pre-Kennedy rate cut peak of 91% to a post-Reagan rate cut trough of 28%. Surprisingly, total federal government revenues as a percentage of GDP during that period have varied modestly, from 16.1% to 20.9%. Fiscal 2007 revenues were a bit above the midpoint, at 18.8% of GDP.9

While somewhat higher tax rates would probably increase near-term tax revenues, it is unlikely that substantially higher income tax rates alone can boost government receipts to the 30% or so of GDP eventually needed to fully fund the promised benefits. Massive value added taxes or sales taxes would likely be needed to provide tax revenue percentages that high. But huge tax hikes of any sort are likely to hurt economic growth, and additional solutions are needed.

As substantial liabilities become due in the next decade, there is an increased likelihood that voters will elect more courageous politicians that will strive to control spending and enact needed reforms. Perhaps the best single reform would be to restore more free market elements to our health care system. There needs to be more price transparency plus incentives for individuals and health care providers to control spending. Streamlined drug approval processes and additional tort reform would also help.

Incentives for innovation, rather than arbitrary price controls, are crucial. Improved technology has enabled over a 99.99% reduction in the cost of genome mapping in the last seven years. As costs continue to drop and advances continue to be made in biotechnology and pharmaceuticals, new ways to diagnose, treat and cure diseases are likely. Treatments customized to genetic factors promise to be much more effective and result in fewer side effects than many current drugs. The Wanger Funds have begun to own stocks in companies that are pursuing genetic tests, novel drugs and devices, plus information technology for better managing health care administration.

Outside the health care sector, Professor Jeremy Siegel has suggested that a solution for America's savings and retirement crisis will be sales of American assets to foreigners, especially those from countries with higher savings rates and younger populations. Innovative small- and mid-cap companies appear particularly attractive to foreigners, especially now that the dollar has weakened.

Charles P. McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, L.P.

Opinions expressed in this essay are those of the author and are not necessarily those of Columbia Wanger Asset Management, its parent organizations or the Board.

1 Marvin Zonis is a professor emeritus at the Graduate School of Business at The University of Chicago, where he teaches courses on International Political Economy, Leadership and Business Strategy in the Era of E-Commerce.

2 Estimates by the Congressional Budget Office, Medicare trustees, and some private sources are higher.

3 Dirksen has been quoted as saying, "A billion here and a billion there, and pretty soon you're talking real money," but the Dirksen Congressional Center has been unable to verify the statement.

4 Source: American Enterprise Institute for Public Policy Research website, www.aei.org, "Medicare Prescription Drugs: Medical Necessity Meets Fiscal Insanity," by Joseph Antos and Jagadeesh Gokhale. Posted February 17, 2005.

5 Ibid.

6 In the 1920's, Charles Ponzi enticed investors with a bogus investment opportunity that promised a 40% return on their investment in just 90 days. Early investors were paid with dollars from later investors but most lost their money. Ponzi served four years in prison for this fraud, and then proceeded to promote other dubious ventures. He died in a charity ward of a Rio de Janeiro hospital in 1949.

7 Included in testimony on the future of Social Security presented by the Concord Coalition (www.concordcoalition.org) to a Senate special committee on aging, February 3, 2005.

8 The Laffer Curve is used to illustrate the concept of taxable income elasticity, the idea that government can maximize tax revenue by setting tax rates at an optimum point and that neither a 0% tax rate nor a 100% tax rate will generate government revenue. The curve was popularized by U.S. economics professor Arthur Laffer (b. 1940).

9 Congressional Budget Office testimony, "The Long-term Budget Outlook," December 13, 2007.

3

Wanger International Select 2007 Annual Report

Performance Review Wanger International Select

Christopher J. Olson

Portfolio Manager

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. For daily and most recent month-end performance updates, please call 1-888-4-WANGER.

Wanger International Select ended the year up 21.78%. This return more than doubled the Fund's benchmark index, the S&P/Citigroup World ex-US Cap Range $2-10B Index, which posted a 9.84% annual gain. The Fund's strong outperformance can be largely attributed to its lack of exposure to financial stocks during a volatile period for the sector. Early in the year, we became concerned about the fundamentals of the banks and their operating environment. Higher interest rates, funding concerns, all-time low bad debt levels and overvalued housing markets in a number of countries around the world painted a worsening picture of the financial companies that we owned. Due to our concerns, we sold completely out of all of the Fund's bank holdings.

Big winners in the year included Japan's Nintendo. The stock gained 147% from our initial purchase price early in the year. The company is enjoying very strong demand for its Wii gaming console and associated video games. Potash Corp. of Saskatchewan was another big winner, gaining 201%. The company is the world's largest producer of potash and is benefiting from the positive impact that higher agricultural prices are having on fertilizer prices. Contract drilling companies Atwood Oceanics and Diamond Offshore also posted nice gains in the year on strong demand for their services. Atwood was up over 104% while Diamond Offshore gained 43%. Exchange operators Hong Kong Exchanges and Clearing, up more than 160%, and Singapore Exchange, up 152%, rose as investor dollars from overseas, as well as growing local investment, pushed trading to record levels for these exchanges.

On the downside, new position Uranium One was off more than 29% for the annual period due to a setback in the startup of one of its uranium mines in Kazakhstan. Japanese real estate investment manager Kenedix had the largest 12-month dollar loss, also falling 30% due to rising interest rates in Japan and concerns that real estate will suffer. Irish beverage company C&C Group fell 19% in the Fund before we sold it. Company earnings and sales declined due to increased competition and poor summer weather.

Global equity markets are entering an interesting and potentially volatile period as the United States works through its significant financial problems and enters what appears to be a much slower period of economic growth. We believe that this will impact economies and companies around the world. While this may mean additional risks for investors, we believe it may also give us additional opportunities to pick up some very good companies at compelling prices.

International investments involve greater potential risks, including less or different regulation, currency fluctuations, economic instability and political developments. Investments in small- and mid-cap companies may be subject to greater volatility and price fluctuations because they may be thinly traded and less liquid. Investing in emerging markets may involve greater risks than investing in more developed countries.

Fund's Positions in Mentioned Holdings

As a % of net assets, as of 12/31/07

| Nintendo | | | 3.7 | % | |

| Potash Corp. of Saskatchewan | | | 3.2 | | |

| Diamond Offshore | | | 3.2 | | |

| Hong Kong Exchanges and Clearing | | | 2.2 | | |

| Atwood Oceanics | | | 1.5 | | |

| Singapore Exchange | | | 1.4 | | |

| Uranium One | | | 1.3 | | |

| Kenedix | | | 1.1 | | |

| C&C Group | | | 0.0 | | |

Portfolio holdings are subject to change periodically and may not be representative of current characteristics and holdings.

4

Wanger International Select 2007 Annual Report

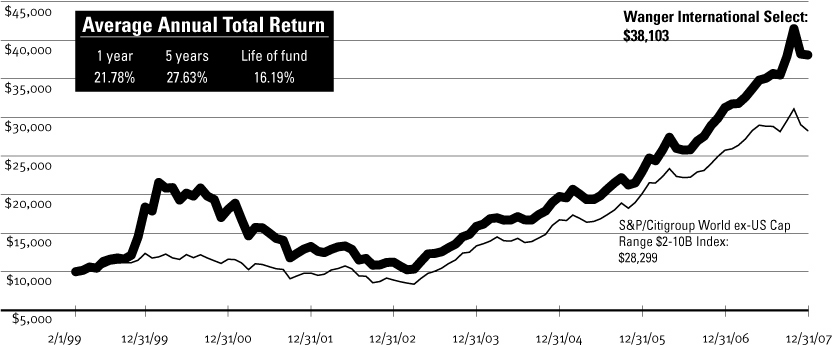

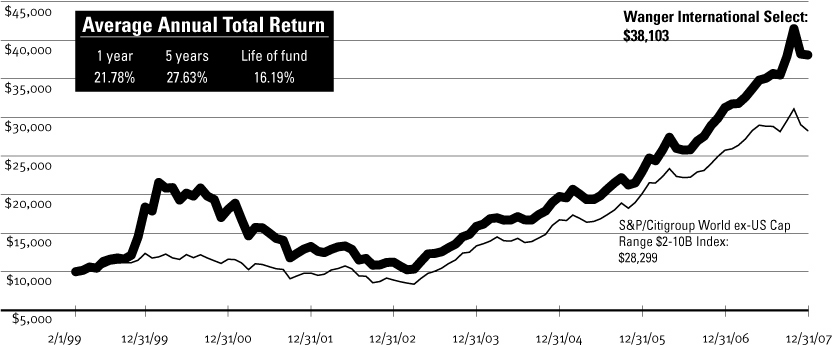

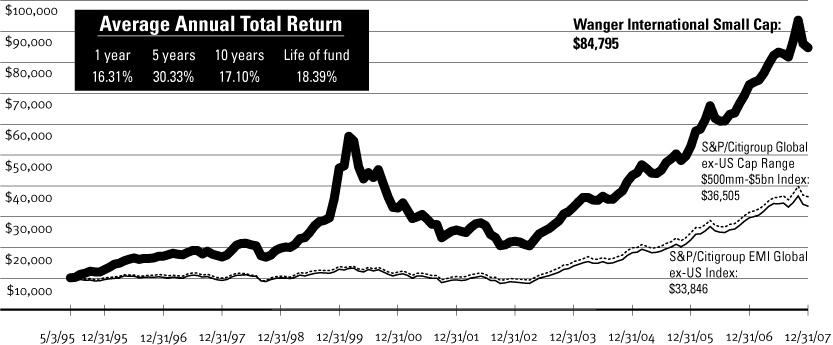

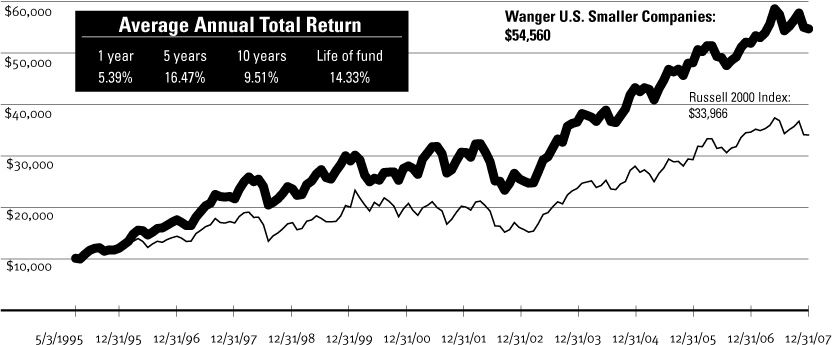

Growth of a $10,000 Investment in Wanger International Select

Total return for each period,

February 1, 1999 (inception date) through December 31, 2007

This graph compares the results of $10,000 invested in Wanger International Select on February 1, 1999 (the date the Fund began operations) through December 31, 2007, to the S&P/Citigroup World ex-US Cap Range $2-10B Index, with dividends and capital gains reinvested. Performance results reflect any fee waivers or reimbursements of Fund expenses by CWAM or any of its affiliates. Absent these fee waivers or reimbursement arrangements, performance results would have been lower. Performance shown here is past performance, which cannot guarantee future results. Current performance may be higher or lower. The investment return and principal value of an investment in the Fund will fluctuate so that Fund shares, when redeemed, may be worth more or less than their original cost. Performance changes over time. Current returns for the Fund may be different than that shown. For daily and most recent month-end performance updates, pl ease contact us at 1-888-4-WANGER.

Results to December 31, 2007

| | | 4th quarter | | 1 year | |

| Wanger International Select | | | 0.54 | % | | | 21.78 | % | |

S&P/Citigroup World ex-US

Cap Range $2-10B Index | | | -4.33 | | | | 9.84 | | |

| MSCI EAFE Index | | | -1.75 | | | | 11.17 | | |

NAV as of 12/31/07: $28.07

Performance numbers reflect all Fund expenses but do not include any insurance charge imposed by your insurance company's separate accounts. If performance included the effect of these additional charges, it would be lower.

The Fund's annual operating expense ratio is 1.19%. The annual operating expense ratio is as stated in the Fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and reimbursements as well as different time periods used in calculating the ratios.

All results shown assume reinvestment of distributions and do not reflect taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

The S&P/Citigroup World ex-U.S. Cap Range $2-10B Index is a subset of the broad market selected by the index sponsor representing the mid-cap developed market excluding the United States. The Morgan Stanley Capital International Europe, Australia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australia and the Far East. Indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings.

Top 5 Countries

As a % of net assets, as of 12/31/07

| Japan | | | 13.7 | % | |

| Netherlands | | | 10.3 | | |

| Switzerland | | | 7.5 | | |

| China | | | 7.1 | | |

| United Kingdom | | | 6.5 | | |

Top 10 Holdings

As a % of net assets, as of 12/31/07

1. Fugro (Netherlands)

Oilfield Services | | | 4.8 | % | |

2. Nintendo (Japan)

Entertainment Software & Hardware | | | 3.7 | | |

3. SES Global (France)

Satellite Broadcasting Services | | | 3.6 | | |

4. Diamond Offshore (United States)

Contract Driller | | | 3.2 | | |

5. Potash Corp. of Saskatchewan (Canada)

World's Largest Producer of Potash | | | 3.2 | | |

6. Hexagon (Sweden)

Measurement Equipment & Polymers | | | 2.9 | | |

7. Impala Platinum Holdings (South Africa)

Platinum Group Metals Mining & Refining | | | 2.8 | | |

8. Sino Gold (Australia)

Gold Mining in The People's Republic of China | | | 2.8 | | |

9. Lenovo Group (China)

Third Largest PC Vendor Globally | | | 2.8 | | |

10. Smith & Nephew (United Kingdom)

Medical Equipment & Supplies | | | 2.7 | | |

5

Wanger International Select 2007 Annual Report

Wanger International Select

Statement of Investments December 31, 2007

Number of

Shares | | | | Value | |

| | | | | Common Stocks – 94.7% | | | | | |

| | | Europe – 49.5% | |

| | | Netherlands – 10.3% | |

| | 46,000 | | | Fugro

Oilfield Services | | | $3,525,954

| | |

| | 48,000 | | | QIAGEN (a)

Life Science Company; DNA/RNA Purification | | | 1,030,871

| | |

| | 26,000 | | | SBM Offshore

Builds & Leases Offshore Vessels to

Process & Store Crude Oil | | | 815,540

| | |

| | 38,619 | | | Aalberts Industries

Flow Control & Heat Treatment | | | 761,191

| | |

| | 21,700 | | | OPG Groep

Health Care Supplies & Pharmacies | | | 599,549

| | |

| | 8,400 | | | Boskalis Westminster

Dredging & Maritime Contractor | | | 510,289

| | |

| | 21,500 | | | Wavin

Largest European Plastic Pipe Systems Company | | | 284,392

| | |

| | | | | | | | 7,527,786 | | |

| | | Switzerland – 7.5% | |

| | 21,000 | | | Kuehne & Nagel

Freight Forwarding/Logistics | | | 2,002,111

| | |

| | 12,000 | | | Synthes

Products for Orthopedic Surgery | | | 1,483,264

| | |

| | 2,800 | | | Nobel Biocare Holding

Dental Implants & Ceramic Crowns | | | 740,705

| | |

| | 2,265 | | | Swatch Group

Watch & Electronics Manufacturer | | | 679,069

| | |

| | 9,000 | | | Schindler

Elevator Manufacturer & Service Provider | | | 575,312

| | |

| | | | | | | | 5,480,461 | | |

| | | United Kingdom – 6.5% | |

| | 175,000 | | | Smith & Nephew

Medical Equipment & Supplies | | | 2,011,969

| | |

| | 83,000 | | | Intertek Testing

Testing, Inspection, Certification Services | | | 1,627,292

| | |

| | 125,000 | | | Informa Group

Global Publisher & Event Organizer | | | 1,143,381

| | |

| | | | | | | | 4,782,642 | | |

Number of

Shares | | | | Value | |

| | | Ireland – 5.1% | |

| | 300,000 | | | United Drug

Irish Pharmaceutical Wholesaler & Outsourcer | | | $1,729,940

| | |

| | 60,000 | | | IAWS Group

Baked Goods | | | 1,328,125

| | |

| | 20,000 | | | CRH

Global Building Materials | | | 694,413

| | |

| | | | | | | | 3,752,478 | | |

| | | Sweden – 4.3% | |

| | 105,000 | | | Hexagon

Measurement Equipment & Polymers | | | 2,165,261

| | |

| | 290,000 | | | Securitas Systems

Commercial Security Installation & Service | | | 1,023,119

| | |

| | | | | | | | 3,188,380 | | |

| | | France – 3.6% | |

| | 100,000 | | | SES Global

Satellite Broadcasting Services | | | 2,622,195

| | |

| | | Germany – 3.5% | |

| | 12,700 | | | Wincor Nixdorf

Retail POS Systems & ATM Machines | | | 1,196,829

| | |

| | 3,900 | | | Deutsche Boerse

Trading, Clearing, Settlement Services for

Financial Markets | | | 769,785

| | |

| | 305 | | | Porsche

Specialty Automobile Manufacturer | | | 614,635

| | |

| | | | | | | | 2,581,249 | | |

| | | Austria – 2.6% | |

| | 53,000 | | | Zumtobel

Lighting Systems | | | 1,902,421

| | |

| | | Greece – 2.5% | |

| | 94,000 | | | Intralot

Lottery & Gaming Systems & Services | | | 1,852,251

| | |

See accompanying notes to financial statements.

6

Wanger International Select 2007 Annual Report

Wanger International Select

Statement of Investments December 31, 2007

Number of

Shares | | | | Value | |

| | | Spain – 2.1% | |

| | 15,000 | | | Red Electrica de Espana

Spanish Power Grid | | | $942,689

| | |

| | 33,000 | | | Prisa

Leading Spanish-speaking Publisher | | | 613,579

| | |

| | | | | | | | 1,556,268 | | |

| | | Denmark – 1.5% | |

| | 10,000 | | | Novozymes

Industrial Enzymes | | | 1,128,647

| | |

| | | | | Total Europe | | | 36,374,778 | | |

| | | Asia – 24.4% | |

| | | Japan – 13.7% | |

| | 4,500 | | | Nintendo

Entertainment Software & Hardware | | | 2,732,165

| | |

| | 2,350 | | | Jupiter Telecommunications (a)

Largest Cable Service Provider in Japan | | | 1,987,975

| | |

| | 58,000 | | | Hoya

Opto-electrical Components & Eyeglass Lenses | | | 1,851,077

| | |

| | 20,000 | | | Ibiden

Electronic Parts & Ceramics | | | 1,381,432

| | |

| | 173,000 | | | Kansai Paint

Paint Producer in Japan, India, China

& Southeast Asia | | | 1,254,861

| | |

| | 500 | | | Kenedix

Real Estate Investment Management | | | 804,533

| | |

| | | | | | | | 10,012,043 | | |

| | | China – 7.1% | |

| | 2,340,000 | | | Lenovo Group

Third Largest PC Vendor Globally | | | 2,068,971

| | |

| | 1,484,000 | | | Jiangsu Expressway

Chinese Toll Road Operator | | | 1,601,440

| | |

| | 507,000 | | | China Shipping Development

China's Dominant Shipper for Oil & Coal | | | 1,322,178

| | |

| | 26,500 | | | VisionChina Media (a)

Advertising on Digital Screens in China's

Mass Transit System | | | 225,250

| | |

| | | | | | | | 5,217,839 | | |

Number of

Shares | | | | Value | |

| | | Hong Kong – 2.2% | |

| | 58,000 | | | Hong Kong Exchanges and Clearing

Hong Kong Equity & Derivatives Market Operator | | | $1,628,233

| | |

| | | Singapore – 1.4% | |

| | 112,000 | | | Singapore Exchange

Singapore Equity & Derivatives Market Operator | | | 1,023,792

| | |

| | | | | Total Asia | | | 17,881,907 | | |

| | | Other Countries – 19.0% | |

| | | South Africa – 6.0% | |

| | 60,000 | | | Impala Platinum Holdings

Platinum Group Metals Mining & Refining | | | 2,069,910

| | |

| | 58,000 | | | Naspers

Media & Education in Africa & other

Emerging Markets | | | 1,365,265

| | |

| | 109,000 | | | Uranium One (a)

Uranium Mines in South Africa, Kazakhstan,

Australia & the U.S. | | | 975,196

| | |

| | | | | | | | 4,410,371 | | |

| | | Canada – 5.5% | |

| | 16,200 | | | Potash Corp. of Saskatchewan

World's Largest Producer of Potash | | | 2,332,152

| | |

| | 552,300 | | | Petro Rubiales Energy (a)(b) | | | 803,310 | | |

| | 276,150 | | | Petro Rubiales Energy – Warrants (a)(b) | | | 152,352 | | |

| | 2,700 | | | Petro Rubiales Energy (a)

Oil Production & Exploration in Colombia | | | 3,967

| | |

| | 42,000 | | | RONA (a)

Leading Canadian Do-it-yourself Retailer | | | 725,568

| | |

| | | | | | | | 4,017,349 | | |

| | | United States – 4.7% | |

| | 16,500 | | | Diamond Offshore

Contract Driller | | | 2,343,000

| | |

| | 11,300 | | | Atwood Oceanics (a)

Offshore Drilling Contractor | | | 1,132,712

| | |

| | | | | | | | 3,475,712 | | |

See accompanying notes to financial statements.

7

Wanger International Select 2007 Annual Report

Wanger International Select

Statement of Investments December 31, 2007

Number of Shares

or Principal Amount | | | | Value | |

| | | Australia – 2.8% | |

| | 342,000 | | | Sino Gold (a)

Gold Mining in The People's Republic of China | | | $2,069,678

| | |

| | | | | Total Other Countries | | | 13,973,110 | | |

| | | Latin America – 1.8% | |

| | | Brazil – 1.8% | |

| | 50,100 | | | Bovespa (a)

Brazil Equity & Derivative Exchange | | | 965,410

| | |

| | 25,300 | | | BM&F (a)

Brazilian Derivatives Exchange | | | 355,337

| | |

| | | | | Total Latin America | | | 1,320,747 | | |

| Total Common Stocks (Cost: $51,804,634) – 94.7% | | | 69,550,542 | | |

| Short-Term Obligation – 6.1% | | | |

| $ | 4,502,000 | | | Repurchase Agreement with Fixed

Income Clearing Corp., dated 12/31/07,

due 01/02/08 at 3.00%, collateralized

by a U.S. Government Agency Obligation

maturing 03/05/12, market value $4,593,038 (repurchase proceeds $4,502,750) | | | 4,502,000 | | |

| Total Short-Term Obligation (Cost: $4,502,000) | | | 4,502,000 | | |

| Total Investments (Cost: $56,306,634) – 100.8% (c)(d) | | | 74,052,542 | | |

| Cash and Other Assets Less Liabilities – (0.8)% | | | (568,017 | ) | |

| Total Net Assets – 100.0% | | | 73,484,525 | | |

Notes to Statement of Investments:

(a) Non-income producing security.

(b) Denotes a restricted security, which is subject to restrictions on resale under federal securities laws. These securities, are valued in good faith by the Board of Trustees. At December 31, 2007, these securities amounted to $955,662 which represents 1.30% of total net assets. Additional information on these securities is as follows:

Security | | Acquisition

Dates | | Shares/

Par | | Cost | |

Value | |

| Petro Rubiales Energy | | 7/12/2007 | | | 552,300 | | | $ | 369,594 | | | $ | 803,310 | | |

Petro Rubiales Energy –

Warrants | | 7/12/2007 | | | 276,150 | | | | 78,779 | | | | 152,352 | | |

| | | | | | | $ | 448,373 | | | $ | 955,662 | | |

(c) At December 31, 2007, for federal income tax purposes cost of investments was $56,327,694 and net unrealized appreciation was $17,724,848 consisting of gross unrealized appreciation of $20,682,842 and gross unrealized depreciation of $2,957,994.

(d) On December 31, 2007, the Fund's total investments were denominated in currencies as follows:

| Currency | | Value | | % of Net

Assets | |

| Euro Dollars | | $ | 21,794,649 | | | | 29.7 | | |

| U.S. Dollars | | | 10,535,114 | | | | 14.3 | | |

| Japanese Yen | | | 10,012,043 | | | | 13.6 | | |

| Swiss Francs | | | 5,480,461 | | | | 7.5 | | |

| British Pounds | | | 4,782,642 | | | | 6.5 | | |

Other currencies less than

5% of total net assets | | | 21,447,633 | | | | 29.2 | | |

Cash and other assets less

liabilities | | | (568,017 | ) | | | (0.8 | ) | |

| | | $ | 73,484,525 | | | | 100.0 | | |

See accompanying notes to financial statements.

8

Wanger International Select 2007 Annual Report

Wanger International Select

Portfolio Diversification December 31, 2007

At December 31, 2007, the Fund's portfolio investments as a percent of net assets was diversified as follows:

| | | Value | | Percent | |

| Information | |

| Financial Processors | | $ | 3,421,811 | | | | 4.7 | % | |

| Computer Hardware & Related Equipment | | | 3,265,800 | | | | 4.4 | | |

| Comnsumer Software | | | 2,732,165 | | | | 3.7 | | |

| Satellite Broadcasting & Services | | | 2,622,195 | | | | 3.6 | | |

| CATV | | | 1,987,975 | | | | 2.7 | | |

| Semiconductors & Related Equipment | | | 1,851,077 | | | | 2.5 | | |

| Publishing | | | 1,756,960 | | | | 2.4 | | |

| TV Broadcasting | | | 1,365,265 | | | | 1.9 | | |

| Advertising | | | 225,250 | | | | 0.3 | | |

| | | | 19,228,498 | | | | 26.2 | | |

| Energy & Minerals | |

| Oil Services | | | 8,327,495 | | | | 11.3 | | |

| Mining | | | 7,446,936 | | | | 10.1 | | |

| Oil & Gas Producers | | | 959,628 | | | | 1.3 | | |

| | | | 16,734,059 | | | | 22.7 | | |

| Industrial Goods & Services | |

| Conglomerates | | | 4,307,884 | | | | 5.9 | | |

| Other Industrial Services | | | 4,204,715 | | | | 5.7 | | |

| Industrial Materials & Specialty Chemicals | | | 2,667,900 | | | | 3.6 | | |

| Electrical Components | | | 1,902,421 | | | | 2.6 | | |

| Outsourcing Services | | | 1,023,119 | | | | 1.4 | | |

| Construction | | | 694,413 | | | | 0.9 | | |

| | | | 14,800,452 | | | | 20.1 | | |

| | | Value | | Percent | |

| Health Care | |

| Medical Equipment & Devices | | $ | 4,235,938 | | | | 5.8 | % | |

| Pharmaceuticals | | | 1,729,940 | | | | 2.4 | | |

| Medical Supplies | | | 1,030,871 | | | | 1.4 | | |

| Health Care Services | | | 599,549 | | | | 0.8 | | |

| | | | 7,596,298 | | | | 10.4 | | |

| Consumer Goods & Services | |

| Casinos & Gaming | | | 1,852,251 | | | | 2.5 | | |

| Food & Beverage | | | 1,328,125 | | | | 1.8 | | |

| Other Durable Goods | | | 1,293,703 | | | | 1.8 | | |

| Retail | | | 725,569 | | | | 1.0 | | |

| | | | 5,199,648 | | | | 7.1 | | |

| Other Industries | |

| Transportation | | | 2,923,618 | | | | 4.0 | | |

| Regulated Utilities | | | 942,689 | | | | 1.3 | | |

| Real Estate | | | 804,533 | | | | 1.1 | | |

| | | | 4,670,840 | | | | 6.4 | | |

| Finance | |

| Brokerage & Money Management | | | 1,320,747 | | | | 1.8 | | |

| | | | 1,320,747 | | | | 1.8 | | |

| Total Common Stocks | | | 69,550,542 | | | | 94.7 | | |

| Short-Term Obligation | | | 4,502,000 | | | | 6.1 | | |

| Total Investments | | | 74,052,542 | | | | 100.8 | | |

Cash and Other Assets

Less Liabilities | | | (568,017 | ) | | | (0.8 | ) | |

| Net Assets | | | 73,484,525 | | | | 100.0 | | |

See accompanying notes to financial statements.

9

Wanger International Select 2007 Annual Report

Statement of Assets and Liabilities

December 31, 2007

| Assets: | |

| Investments, at cost | | $ | 56,306,634 | | |

| Investments, at value | | $ | 74,052,542 | | |

| Cash | | | 717 | | |

| Foreign currency (cost of $41) | | | 41 | | |

| Receivable for: | |

| Fund shares sold | | | 1,014 | | |

| Interest | | | 375 | | |

| Dividends | | | 58,134 | | |

| Foreign tax reclaims | | | 6,959 | | |

| Other assets | | | 8 | | |

| Total Assets | | | 74,119,790 | | |

| Liabilities: | |

| Payable for: | |

| Investments purchased | | | 227,385 | | |

| Fund shares repurchased | | | 304,313 | | |

| Investment advisory fee | | | 58,729 | | |

| Administration fee | | | 3,124 | | |

| Transfer agent fee | | | 12 | | |

| Trustees' fees | | | 94 | | |

| Audit fee | | | 12,950 | | |

| Custody fee | | | 7,933 | | |

| Reports to shareholders | | | 14,639 | | |

| Chief compliance officer expenses | | | 104 | | |

| Trustees' deferred compensation plan | | | 4,244 | | |

| Other liabilities | | | 1,738 | | |

| Total Liabilities | | | 635,265 | | |

| Net Assets | | $ | 73,484,525 | | |

| Composition of Net Assets: | |

| Paid-in capital | | $ | 41,093,411 | | |

| Undistributed net investment income | | | 214,513 | | |

| Accumulated net realized gain | | | 14,429,409 | | |

| Net unrealized appreciation on: | |

| Investments | | | 17,745,908 | | |

| Foreign currency translations | | | 1,284 | | |

| Net Assets | | $ | 73,484,525 | | |

| Fund Shares Outstanding | | | 2,617,838 | | |

Net asset value, offering price and

redemption price per share | | $ | 28.07 | | |

Statement of Operations

For the Year Ended December 31, 2007

| Investment Income: | |

| Dividends (net of foreign taxes withheld of $58,485) | | $ | 945,683 | | |

| Interest | | | 125,052 | | |

| Total Investment Income | | | 1,070,735 | | |

| Expenses: | |

| Investment advisory fee | | | 670,269 | | |

| Administration fee | | | 15,232 | | |

| Transfer agent fee | | | 147 | | |

| Reports to shareholders | | | 26,210 | | |

| Trustees' fees | | | 5,797 | | |

| Custody fee | | | 50,348 | | |

| Chief compliance officer expenses (See Note 4) | | | 8,958 | | |

| Other expenses (See Note 5) | | | 37,216 | | |

| Total Expenses | | | 814,177 | | |

| Custody earnings credit | | | (30 | ) | |

| Net Expenses | | | 814,147 | | |

| Net Investment Income | | | 256,588 | | |

Net Realized and Unrealized Gain (Loss) on

Investments and Foreign Currency: | |

| Net realized gain (loss) on: | |

| Investments | | | 14,886,293 | | |

| Foreign currency transactions | | | (19,990 | ) | |

| Net realized gain | | | 14,866,303 | | |

| Net change in unrealized depreciation on: | |

| Investments | | | (1,765,722 | ) | |

| Foreign currency translations | | | (24 | ) | |

| Net change in unrealized depreciation | | | (1,765,746 | ) | |

| Net Gain | | | 13,100,557 | | |

| Net Increase in Net Assets from Operations | | $ | 13,357,145 | | |

See accompanying notes to financial statements.

10

Wanger International Select 2007 Annual Report

Statement of Changes in Net Assets

| | | Year Ended December 31, | |

| Increase (Decrease) in Net Assets | | 2007 | | 2006 | |

| Operations: | |

| Net investment income | | $ | 256,588 | | | $ | 259,835 | | |

| Net realized gain on investments and foreign currency transactions | | | 14,866,303 | | | | 9,092,683 | | |

Net change in unrealized appreciation (depreciation)

on investments and foreign currency translations | | | (1,765,746 | ) | | | 7,550,578 | | |

| Net Increase in Net Assets from Operations | | | 13,357,145 | | | | 16,903,096 | | |

| Distributions to Shareholders: | |

| From net investment income | | | (491,093 | ) | | | (154,737 | ) | |

| From net realized gains | | | (7,887,030 | ) | | | — | | |

| Total Distributions to Shareholders | | | (8,378,123 | ) | | | (154,737 | ) | |

| Share Transactions: | |

| Subscriptions | | | 13,254,652 | | | | 20,098,821 | | |

| Distributions reinvested | | | 8,378,123 | | | | 154,737 | | |

| Redemptions | | | (15,721,645 | ) | | | (18,433,819 | ) | |

| Net Increase from Share Transactions | | | 5,911,130 | | | | 1,819,739 | | |

| Total Increase in Net Assets | | | 10,890,152 | | | | 18,568,098 | | |

| Net Assets: | |

| Beginning of period | | | 62,594,373 | | | | 44,026,275 | | |

| End of period | | | 73,484,525 | | | | 62,594,373 | | |

| Undistributed net investment income at end of period | | | 214,513 | | | | 56,352 | | |

See accompanying notes to financial statements.

11

Wanger International Select 2007 Annual Report

Financial Highlights

| | | Year Ended December 31, | |

| Selected data for a share outstanding throughout each period | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Net Asset Value, Beginning of Period | | $ | 26.62 | | | $ | 19.63 | | | $ | 17.19 | | | $ | 13.87 | | | $ | 9.86 | | |

| Income from Investment Operations: | |

| Net investment income (a) | | | 0.10 | | | | 0.11 | | | | 0.13 | | | | 0.04 | | | | 0.04 | | |

Net realized and unrealized gain on investments

and foreign currency transactions | | | 4.92 | | | | 6.94 | | | | 2.66 | | | | 3.33 | | | | 4.01 | | |

| Total from Investment Operations | | | 5.02 | | | | 7.05 | | | | 2.79 | | | | 3.37 | | | | 4.05 | | |

| Less Distributions to Shareholders: | |

| From net investment income | | | (0.21 | ) | | | (0.06 | ) | | | (0.35 | ) | | | (0.05 | ) | | | (0.04 | ) | |

| From net realized gains | | | (3.36 | ) | | | — | | | | — | | | | — | | | | — | | |

| Total Distributions to Shareholders | | | (3.57 | ) | | | (0.06 | ) | | | (0.35 | ) | | | (0.05 | ) | | | (0.04 | ) | |

| Net Asset Value, End of Period | | $ | 28.07 | | | $ | 26.62 | | | $ | 19.63 | | | $ | 17.19 | | | $ | 13.87 | | |

| Total Return (b) | | | 21.78 | % | | | 36.00 | % | | | 16.43 | % (c) | | | 24.34 | % | | | 41.24 | % (c) | |

| Ratios to Average Net Assets: | |

| Net expenses (d) | | | 1.18 | % | | | 1.19 | % | | | 1.32 | % | | | 1.43 | % | | | 1.45 | % | |

| Net investment income (d) | | | 0.37 | % | | | 0.47 | % | | | 0.76 | % | | | 0.29 | % | | | 0.39 | % | |

| Waiver | | | — | | | | — | | | | 0.00 | % (e) | | | — | | | | 0.09 | % | |

| Portfolio turnover rate | | | 69 | % | | | 61 | % | | | 48 | % | | | 71 | % | | | 59 | % | |

| Net assets, end of period (000's) | | $ | 73,485 | | | $ | 62,594 | | | $ | 44,026 | | | $ | 35,232 | | | $ | 26,928 | | |

(a) Net investment income per share was based upon the average shares outstanding during the period.

(b) Total return at net asset value assuming all distributions reinvested.

(c) Had the investment adviser not waived a portion of expenses, total return would have been reduced.

(d) The benefits derived from custody fees paid indirectly had an impact of less than 0.01%.

(e) Rounds to less than 0.01%.

See accompanying notes to financial statements.

12

Wanger International Select 2007 Annual Report

Notes to Financial Statements

1. Nature of Operations

Wanger International Select (the "Fund") is a series of Wanger Advisors Trust (the "Trust"), an open-end management investment company organized as a Massachusetts business trust. The investment objective of the Fund is to seek long-term growth of capital. The Fund is available only for allocation to certain life insurance company separate accounts established for the purpose of funding qualified and non-qualified variable annuity contracts and variable life insurance policies and may also be offered directly to certain types of pension plans and retirement arrangements.

2. Significant Accounting Policies

Security valuation

Securities of the Fund are valued at market value or, if a market quotation for a security is not readily available or is deemed not to be reliable because of events or circumstances that have occurred between the market quotation and the time as of which the security is to be valued, the security is valued at a fair value determined in accordance with procedures established by the Board of Trustees. A security traded on a securities exchange or in an over-the-counter market in which transaction prices are reported is valued at the last sales price at the time of valuation. A security traded principally on NASDAQ is valued at the NASDAQ official closing price. A security for which there is no reported sale on the valuation date is valued at the latest bid quotation. A short term debt obligation having a maturity of 60 days or less from the valuation date is valued at amortized cost, which approximates fair value. A security for which a market quotation is not readily available and any other assets are valued in accordance with procedures established by the Board of Trustees. The Trust has retained an independent statistical fair value pricing service to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for possible changes in value that may occur between the close of the foreign exchange and the time as of which the securities are to be valued. If a security is valued at fair value, that value may be different from the last quoted market price for the security.

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements ("SFAS 157"), was issued. SFAS 157 is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is evaluating the impact the application of SFAS 157 will have on the Fund's financial statement disclosures.

Repurchase agreements

The Fund may engage in repurchase agreement transactions. The Fund, through its custodians, receives delivery of underlying securities collateralizing each repurchase agreement. The Fund's custodian determines that the value of the underlying securities is at all times at least equal to the resale price. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

Foreign currency translations

Values of investments denominated in foreign currencies are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of investments and dividend and interest income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The gain or loss resulting from changes in foreign exchange rates is included with net realized and unrealized gain or loss from investments, as appropriate.

Security transactions and investment income

Security transactions are accounted for on the trade date (date the order to buy or sell is executed) and dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information is available to the Fund. Interest income is recorded on the accrual basis and includes amortization of discounts on debt obligations when required for federal income tax purposes. Realized gains and losses from security transactions are recorded on an identified cost basis.

Awards, if any, from class action litigation related to securities owned may be recorded as a reduction of cost of those securities. If the applicable securities are no longer owned, the proceeds are recorded as realized gains.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates.

Fund share valuation

Fund shares are sold and redeemed on a continuing basis at net asset value. Net asset value per share is determined daily as of the close of trading on the New York Stock Exchange ("the Exchange") on each day the Exchange is open for trading by dividing the total value of the Fund's investments and other assets, less liabilities, by the number of Fund shares outstanding.

Custody fees/Credits

Custody fees are reduced based on the Fund's cash balances maintained with the custodian. The amount is disclosed as a reduction of total expenses in the Statement of Operations.

Federal income taxes

The Fund has complied with the provisions of the Internal Revenue Code available to regulated investment companies and, in the manner provided therein, distributes all its taxable income, as well as any net realized gain on sales of investments and foreign currency transactions reportable for federal income tax purposes. Accordingly, the Fund paid no federal income taxes and no federal income tax provision was required.

Foreign capital gains taxes

Realized gains on certain countries may be subject to foreign taxes at the fund level, at rates ranging from 10%-15%. The Fund accrues for such foreign taxes on net realized and unrealized gains at the appropriate rate for each jurisdiction.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-date.

Indemnification

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also under the Trust's organizational documents, the Trustees and Officers of the Trust are indemnified against certain liabilities that may arise out of their duties to the Trust. However based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

3. Federal Tax Information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from

13

Wanger International Select 2007 Annual Report

Notes to Financial Statements, continued

GAAP. Reclassifications are made to the Fund's capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations.

For the year ended December 31, 2007, permanent book and tax basis differences resulting primarily from differing treatments for foreign currency transactions and passive foreign investment companies ("PFIC") adjustments were identified and reclassified among the components of the Fund's net assets as follows:

Undistributed

Net Investment

Income | | Accumulated

Net Realized

Gain/(Loss) | | Paid-In Capital | |

| $ | 392,666 | | | $ | (392,666 | ) | | | — | | |

Net investment income and net realized gains (losses), as disclosed on the Statement of Operations, and net assets were not affected by this reclassification.

The tax character of distributions paid during the years ended December 31, 2007 and December 31, 2006 were as follows:

| | | December 31, 2007 | | December 31, 2006 | |

| Distributions paid from: | |

| Ordinary Income* | | $ | 1,250,481 | | | $ | 154,737 | | |

| Long Term Capital Gains | | | 7,127,642 | | | | — | | |

* For tax purposes short-term capital gains distributions, if any, are considered ordinary income distributions.

As of December 31, 2007, the components of distributable earnings on a tax basis were as follows:

Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gains | | Net Unrealized

Appreciation* | |

| $ | 2,993,666 | | | $ | 11,671,315 | | | $ | 17,724,848 | | |

* The differences between book-basis and tax-basis net unrealized appreciation/depreciation are primarily due to deferral of losses from wash sales and PFIC adjustments.

The Funds adopted Financial Accounting Standards Board ("FASB") Interpretation No. 48, Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109 ("FIN 48") effective June 29, 2007. FIN 48 requires management to determine whether a tax position of the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax benefit to be recognized is measured as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. FIN 48 must be applied to all existing tax positions upon initial adoption and the cumulative effect, if any, is to be reported as an adjustment to net assets. Management has evaluated the known implications of FIN 48 on its computation of net assets for the Fund. As a result of this evaluation, management believes that FIN 48 does not have any effect on the Fund's financial statements. However, management's conclusions regarding FIN 48 may be subject to review and adjustment at a later date based on factors including, but not limited to, further implementation guidance from the FASB, new tax laws, regulations, and administrative interpretations (including relevant court decisions). The Fund's federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service. The Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

4. Transactions With Affiliates

Columbia Wanger Asset Management, L.P., ("CWAM") is a wholly owned subsidiary of Columbia Management Group, LLC, which in turn is an indirect wholly owned subsidiary of Bank of America Corporation ("BOA"). CWAM furnishes continuing investment supervision to the Fund and is responsible for the overall management of the Fund's business affairs.

Effective August 1, 2007, under the Fund's investment advisory agreement, fees are accrued daily based on the Fund's average daily net assets and paid monthly to CWAM at the annual rates shown in the table below:

| Average Daily Net Assets | | Annual Fee Rate | |

| Up to $500 million | | | 0.94 | % | |

| $500 million and over | | | 0.89 | % | |

Prior to August 1, 2007, as provided under the Fund's investment advisory agreement, fees were accrued daily based on the Fund's average daily net assets and paid monthly to CWAM as the annual rate of 0.99%.

For the year ended December 31, 2007, the Fund's effective investment advisory fee rate was 0.97%.

Through April 30, 2008, CWAM will reimburse the Fund to the extent that ordinary operating expenses (including custodial charges relating to overdrafts, if any), after giving effect to any balance credits from the Fund's custodian, exceed an annual percentage of 1.45% of average daily net assets. There was no reimbursement for the year ended December 31, 2007.

CWAM provides administrative services and receives an administration fee from the Fund. Prior to August 1, 2007, administrative services were covered under the Fund's investment advisory agreement in place between the Fund and CWAM. Effective August 1, 2007, under the Fund's new administration agreement, which provides the same types of administrative services that were provided under the investment advisory agreement, fees are accrued daily and paid monthly to CWAM at the annual rate of 0.05%. Accordingly, the investment advisory fees were decreased by 0.05% across all asset levels effective August 1, 2007 as well.

For the year ended December 31, 2007, the Fund's effective administration fee rate was 0.02%.

Certain officers and trustees of the Trust are also officers of CWAM. The Trust makes no direct payments to its officers and trustees who are affiliated with CWAM.

The Board of Trustees appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations. The Fund will pay its pro-rata share of the expenses associated with the Office of the Chief Compliance Officer. These expenses are disclosed separately as "Chief compliance officer expenses" in the Statement of Operations.

The Trust offers a deferred compensation plan for its independent trustees. Under that plan, a trustee may elect to defer all or a portion of his or her compensation. Amounts deferred are retained by the Trust and represent an unfunded obligation of the Trust. The value of amounts deferred is determined by reference to the change in value of Class Z shares of one or more series of the Columbia Acorn Trust or a money market fund as specified by the trustee. Benefits under the deferred compensation plan are payable when the trustee ceases to be a member of the Board of Trustees.

Columbia Management Distributors, Inc. (the "Distributor"), a wholly owned subsidiary of BOA, serves as the principal underwriter of the Trust and receives no compensation for its services.

Columbia Management Services, Inc. (the "Transfer Agent"), a wholly owned subsidiary of BOA, provides shareholder services to the Fund and has contracted with Boston Financial Data Services ("BFDS") to serve as subtransfer agent. For such services, the Transfer Agent receives a fee, paid

14

Wanger International Select 2007 Annual Report

Notes to Financial Statements, continued

monthly, at the annual rate of $21.00 per open account. The Transfer Agent also receives reimbursement for certain out-of-pocket expenses.

During the year ended December 31, 2007, the Fund had no purchases or sales transactions with Funds that have a common investment adviser.

5. Borrowing Arrangements

The Trust participates in a $150 million credit facility, which was entered into to facilitate portfolio liquidity. Interest is charged to each participating fund based on its borrowings at a rate per annum equal to the Federal Funds rate plus 0.50%. In addition, a commitment fee of 0.08% per annum of the unutilized line of credit is accrued and apportioned among the participating funds based on their relative net assets. The commitment fee is included in "Other expenses" in the Statement of Operations. No amounts were borrowed by the Fund under this facility during the year ended December 31, 2007.

6. Fund Share Transactions

Proceeds and payments on Fund shares as shown in the Statement of Changes in Net Assets are in respect of the following numbers of shares:

| | | Year ended

December 31, 2007 | | Year ended

December 31, 2006 | |

| Shares sold | | | 497,815 | | | | 919,957 | | |

Shares issued in reinvestment

of dividend distributions | | | 363,318 | | | | 7,482 | | |

| Less shares redeemed | | | (595,024 | ) | | | (818,880 | ) | |

| Net increase in shares outstanding | | | 266,109 | | | | 108,559 | | |

7. Investment Transactions

The aggregate cost of purchases and proceeds from sales other than short-term obligations for the year ended December 31, 2007 were $45,805,967 and $50,368,475, respectively.

8. Legal Proceedings

CWAM, Columbia Acorn Trust (another mutual fund family advised by CWAM), and the trustees of Columbia Acorn Trust (collectively, the "Columbia defendants") are named as defendants in class and derivative complaints that have been consolidated in a Multi-District Action (the "MDL Action") in the federal district court of Maryland. These lawsuits contend that defendants permitted certain investors to market time their trades in certain Columbia Acorn Funds. The MDL Action is ongoing. However, all claims against Columbia Acorn Trust and the independent trustees of Columbia Acorn Trust have been dismissed.

Columbia Acorn Trust and CWAM are also defendants in a class action lawsuit that alleges, in summary, that Columbia Acorn Trust and CWAM exposed shareholders of Columbia Acorn International Fund to trading by market timers by allegedly: (a) failing to properly evaluate daily whether a significant event affecting the value of the fund's securities had occurred after foreign markets had closed but before the calculation of the fund's net asset value ("NAV"); (b) failing to implement the fund's portfolio valuation and share pricing policies and procedures; and (c) failing to know and implement applicable rules and regulations concerning the calculation of NAV (the "Fair Valuation Lawsuit"). The Seventh Circuit ruled that the plaintiffs' state law claims were preempted under federal law resulting in the dismissal of plaintiffs' complaint. Plaintiffs appealed the Seventh Circuit's ruling to the United States Supreme Court. The Suprem e Court reversed the Seventh Circuit's ruling on jurisdictional grounds and the case was ultimately remanded to the state court.

On March 21, 2005, a class action complaint was filed against the Columbia Acorn Trust and CWAM seeking to rescind the CDSC assessed upon redemption of Class B shares of Columbia Acorn Funds due to the alleged market timing of the Columbia Acorn Funds (the "CDSC Lawsuit"). In addition to the rescission of sales charges, plaintiffs seek recovery of actual damages, attorneys' fees and costs. The case had been transferred to the MDL Action in the federal district court of Maryland.

On September 14, 2007, the plaintiffs and the Columbia defendants named in the MDL Action, including the Columbia Funds, entered into a stipulation of settlement with respect to all Columbia-related claims in the MDL Action described above, including the CDSC and Fair Valuation Lawsuits. The settlement is subject to court approval.

CWAM, the Columbia Acorn Funds and the Trustees of the Trust are also defendants in a consolidated lawsuit filed in the federal district court of Massachusetts alleging that CWAM used Fund assets to make undisclosed payments to brokers as an incentive for the brokers to market the Funds over other mutual funds to investors. The complaint alleges CWAM and the Trustees of Columbia Acorn Trust, along with certain affiliated entities and individuals, breached certain common law duties and federal laws.

On November 30, 2005, the judge dismissed all claims by plaintiffs and entered final judgment in favor of the defendants. The plaintiffs appealed to the United States Court of Appeals for the First Circuit on December 30, 2005. A stipulation and settlement agreement dated January 19, 2007 was filed in the First Circuit on February 14, 2007, with a joint stipulation of dismissal and motion for remand to obtain district court approval of the settlement. That joint motion was granted and the appeal was dismissed. On March 6, 2007, the case was remanded to the federal district court. The settlement, approved by the federal district court on September 18, 2007, became effective October 19, 2007. Pursuant to the settlement, the funds' adviser and/or its affiliates made certain payments, including plaintiffs' attorneys' fees and costs of notice to class members.

The Trust and CWAM intend to defend these suits vigorously.

As a result of these matters, or any adverse publicity or other developments resulting from them, there may be increased redemptions or reduced sales of Columbia Acorn fund shares, which could increase transaction costs or operating expenses, or have other adverse consequences for the Columbia Acorn funds. However, based on currently available information, the Columbia Acorn Trust believes that the likelihood that these lawsuits will have a material adverse impact on any fund is remote, and CWAM believes that the lawsuits are not likely to materially affect its ability to provide investment management services to the funds.

15

Wanger International Select 2007 Annual Report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Wanger International Select,

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Wanger International Select (a series of the Wanger Advisors Trust, hereinafter referred to as the "Fund") at December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the four years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion. The December financial highlights of the Fund for the period ended December 31, 2003 were audited by other independent auditors whose report dated February 6, 2004 expressed an unqualified opinion on those financial statements.

PricewaterhouseCoopers LLP

Chicago, Illinois

February 20, 2008

16

Wanger International Select 2007 Annual Report

Federal Income Tax Information (Unaudited)

For the fiscal year ended December 31, 2007, the Fund designated long-term capital gains of $11,680,663.

Foreign taxes paid during the fiscal year ended December 31, 2007, amounting to $58,485 ($0.02 per share) are expected to be passed through to shareholders as 100% allowable foreign tax credits for the year ending December 31, 2007.

17

Wanger International Select 2007 Annual Report

[Excerpt from:]

Wanger Advisors Trust

Management Fee Evaluation of the Senior Officer

Prepared Pursuant to the New York Attorney General's

Assurance of Discontinuance

June 2007

18

Wanger International Select 2007 Annual Report

Introduction

The New York Attorney General's Assurance of Discontinuance ("Order") entered into by Columbia Management Advisors, Inc. ("CMAI") and Columbia Management Distributors, Inc., ("CMDI" and collectively with "CMAI," "CMG") in February 2005, allows CMAI to manage or advise a mutual fund only if the trustees of the fund appoint a "Senior Officer" to perform specified duties and responsibilities. One of these responsibilities includes "managing the process by which proposed management fees (including but not limited to, advisory fees) to be charged the [Funds] are negotiated so that they are negotiated in a manner which is at arms' length and reasonable and consistent with this Assurance of Discontinuance."

This is the first year that the Columbia Acorn Trust and Wanger Advisors Trust (collectively, the "Trusts") and each series thereof (the "Acorn Funds," "WAT Funds" or collectively, the "Funds") have been overseen by the same Board of Trustees ("Board"). The Order provides that this Board must determine the reasonableness of proposed "management fees" by using either an annual competitive bidding process supervised by the Senior Officer or Independent Fee Consultant, or by obtaining "an annual independent written evaluation prepared by or under the direction of the Senior Officer or the Independent Fee Consultant."

"Management fees" are only part of the costs and expenses paid by mutual fund shareholders. The expenses can vary depending upon the class of shares held but usually include: (1) investment management or advisory fees to compensate analysts and portfolio managers for stock research and portfolio management, as well as the cost of operating a trading desk; (2) administrative expenses incurred to prepare registration statements and tax returns, calculate the Funds' net asset values, maintain effective compliance procedures and perform recordkeeping services; (3) transfer agency costs for establishing accounts, accepting and disbursing funds, as well as overseeing trading in Fund shares; (4) custodial expenses incurred to hold the securities purchased by the Funds; and (5) distribution expenses, including commissions paid to brokers that sell the Fund shares to investors.

Columbia Wanger Asset Management, L.P. ("CWAM"), the adviser to the Funds, has proposed that with respect to the Acorn Funds, the Columbia Acorn Trust continue the existing separate agreements governing the first two categories listed above: an advisory agreement governing portfolio management, and an administration agreement governing certain administration and clerical services. Together the fees paid under these two agreements are referred to as "management fees." CWAM proposes that the WAT Funds continue the existing single agreement governing both investment advisory and administrative services. A single management fee would cover both services. Other fund expenses are governed by separate agreements, in particular agreements with two CWAM affiliates: CMDI, the broker-dealer that underwrites and distributes the Funds' shares, and Columbia Management Services, Inc. ("CMSI"), the Funds' transfer agent. In conformity with the terms of the Order, this evaluation, therefore, addresses only the advisory and administrative contracts, and does not extend to the other agreements.

According to the Order, the Senior Officer's evaluation must consider at least the following:

(1) Management fees (including components thereof) charged to institutional and other clients of CWAM for like services;

(2) Management fees (including any components thereof) charged by other mutual fund companies for like services;

(3) Costs to CWAM and its affiliates of supplying services pursuant to the management fee agreements, excluding any intra-corporate profit;

(4) Profit margins of CWAM and its affiliates from supplying such services;

(5) Possible economies of scale as the Funds grow larger; and

(6) The nature and quality of CWAM's services, including the performance of each Fund.

In 2004, the Boards of the two Trusts, then separate groups, each appointed me Senior Officer under the Order. They also determined not to pursue a competitive bidding process and instead, charged me with the responsibility of evaluating the Funds' proposed advisory and administrative fee contracts with CWAM in conformity with the requirements of the Order. This Report is an annual evaluation required under the Order. In discharging their responsibilities, the independent Trustees have also consulted independent, outside counsel.

2007 Evaluation

This is the third annual evaluation prepared in connection with the Order. This evaluation follows the same structure as the earlier studies. Some areas are given more emphasis here, while others are given less. Still, the fundamental information gathered for this evaluation is largely the same as past years.

Process and Independence