UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08764 |

|

UBS PACE Select Advisors Trust |

(Exact name of registrant as specified in charter) |

|

51 West 52nd Street, New York, New York | | 10019-6114 |

(Address of principal executive offices) | | (Zip code) |

|

Mark F. Kemper, Esq. UBS Global Asset Management 51 West 52nd Street New York, NY 10019-6114 |

(Name and address of agent for service) |

|

Copy to: Jack W. Murphy, Esq. Dechert LLP 1775 I Street, N.W. Washington, DC 20006-2401 |

|

Registrant’s telephone number, including area code: | 212-882 5000 | |

|

Date of fiscal year end: | July 31 | |

|

Date of reporting period: | July 31, 2007 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

UBS PACESM

Annual Report

July 31, 2007

UBS PACE Select Advisors Trust

Table of contents

| Introduction | | | 2 | | |

|

| Update Regarding Portfolio Changes | | | 4 | | |

|

| Portfolio Advisors' commentaries and schedules of investments | |

|

| UBS PACE Money Market Investments | | | 6 | | |

|

| UBS PACE Government Securities Fixed Income Investments | | | 14 | | |

|

| UBS PACE Intermediate Fixed Income Investments | | | 26 | | |

|

| UBS PACE Strategic Fixed Income Investments | | | 39 | | |

|

| UBS PACE Municipal Fixed Income Investments | | | 55 | | |

|

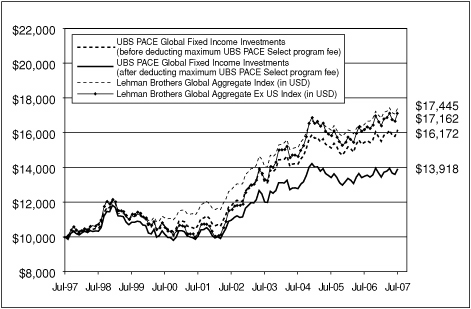

| UBS PACE Global Fixed Income Investments | | | 69 | | |

|

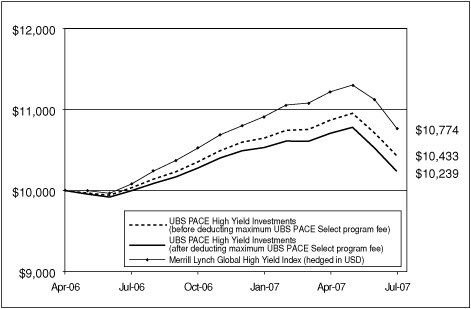

| UBS PACE High Yield Investments | | | 86 | | |

|

| UBS PACE Large Co Value Equity Investments | | | 97 | | |

|

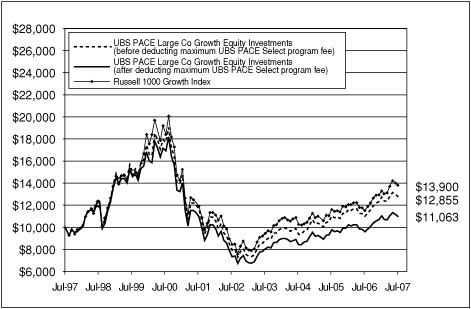

| UBS PACE Large Co Growth Equity Investments | | | 107 | | |

|

| UBS PACE Small/Medium Co Value Equity Investments | | | 118 | | |

|

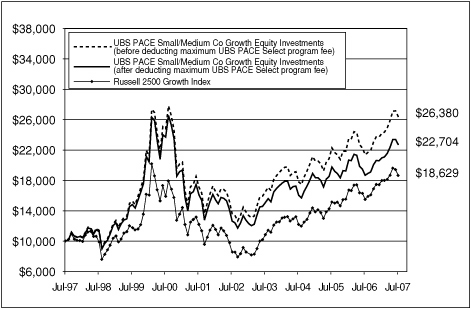

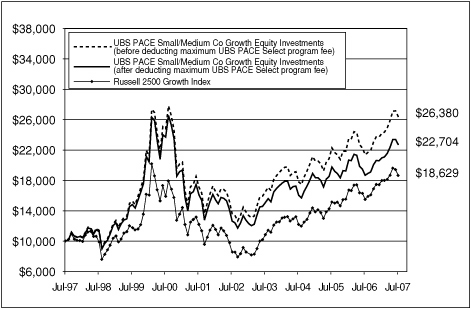

| UBS PACE Small/Medium Co Growth Equity Investments | | | 128 | | |

|

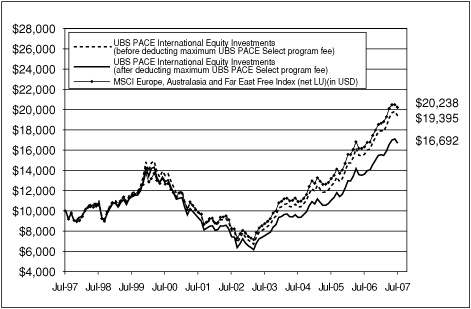

| UBS PACE International Equity Investments | | | 139 | | |

|

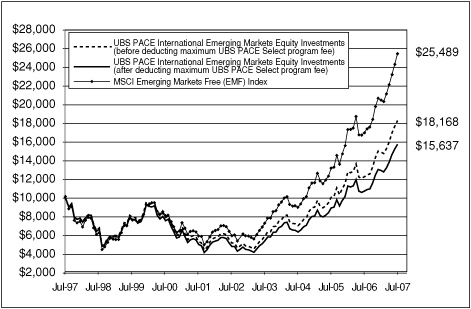

| UBS PACE International Emerging Markets Equity Investments | | | 155 | | |

|

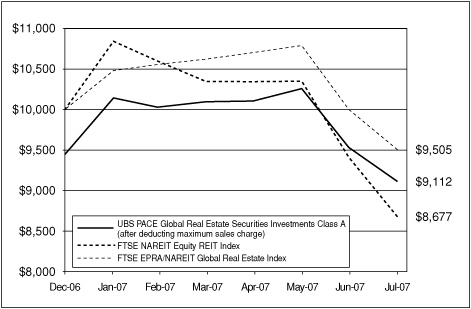

| UBS PACE Global Real Estate Securities Investments | | | 167 | | |

|

| UBS PACE Alternative Strategies Investments | | | 176 | | |

|

| Understanding your Portfolio's expenses | | | 196 | | |

|

| Statement of assets and liabilities | | | 202 | | |

|

| Statement of operations | | | 210 | | |

|

| Statement of changes in net assets | | | 214 | | |

|

| Financial highlights | | | 221 | | |

|

| Notes to financial statements | | | 290 | | |

|

| Report of independent registered public accounting firm | | | 333 | | |

|

| General information | | | 335 | | |

|

| Board approval of certain investment advisory agreements | | | 336 | | |

|

| Trustees and officers | | | 354 | | |

|

UBS PACE Select Advisors Trust offers multiple share classes representing interests in 15 separate Portfolios. (UBS PACE Money Market Investments offers only one share class.) Different classes of shares and/or Portfolios are offered by separate prospectuses.

For more information on a Portfolio or class of shares, contact your financial advisor. He or she can send you a current prospectus relating to a Portfolio or class of shares, which includes a discussion of investment risks, sales charges, expenses and other matters of interest. Before you invest, please carefully read the prospectus related to the Portfolio or class of shares in which you are interested.

1

UBS PACE Select Advisors Trust

Introduction

September 19, 2007

Dear UBS PACESM Shareholder,

We are pleased to provide you with the annual report for the UBS PACE Portfolios, comprising the UBS PACE Select Advisors Trust. This report includes summaries of the performance of each Portfolio and commentaries from the individual investment advisors regarding the events that affected Portfolio performance during the fiscal year ended July 31, 2007. Please note that the opinions of the advisors do not necessarily represent those of UBS Global Asset Management (Americas) Inc.

US economic growth fluctuated during the fiscal year. After expanding 2.4% in the second quarter of 2006, gross domestic product (GDP) grew 1.1% and 2.1% in the third and fourth quarters of the year, respectively. The economy then trailed off significantly over the first three months of 2007, with GDP growing a tepid 0.6%—its slowest rate since the fourth quarter of 2002. The weakening economy was attributed, in part, to the troubles in the housing market. The economy then picked up steam in the second quarter, as the preliminary estimate for GDP growth came in at 4.0%.

Economic news was largely positive on the international front. A report issued by the Organization for Economic Cooperation and Development (OECD) estimated that during 2007, growth in Europe and Japan was expected to eclipse that of the US for the first time since 2001. The OECD projected that the US economy would expand 2.1% in 2007, compared with 3.3% in 2006. In contrast, the estimates for growth during 2007 in the Eurozone and Japan were 2.7% and 2.4%, respectively.

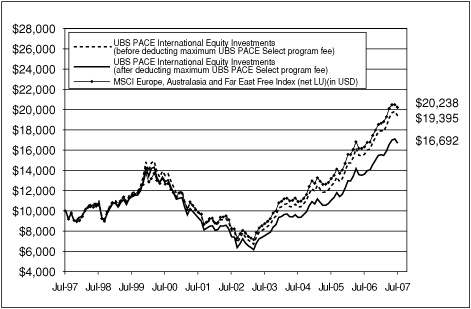

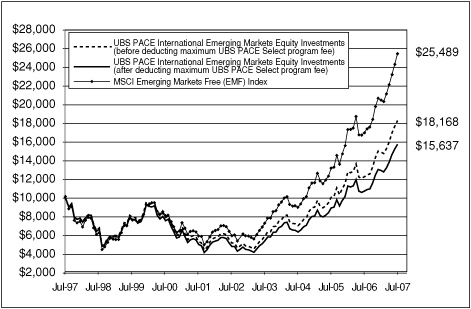

Despite periods of extreme volatility late in the reporting period, the US stock market generated solid results during the fiscal year. Over this period, the overall stock market, as measured by the S&P 500 Index, returned 16.13%. After rising during much of the period, stock prices began to fall sharply toward the end of July. The market's decline was largely attributed to the escalating troubles in the housing and subprime mortgage markets, liquidity concerns, some mixed corporate earnings results and surging oil prices. The international equity markets also gyrated late in the period but, overall, generated strong results, as the MSCI Europe, Australasia and Far East (EAFE)1 Index rose 24.42% over the reporting period. Emerging markets equities performed even better, as the MSCI Emerging Markets (EM) Index2 gained 50.94% during the 12-month period ended July 31, 2007.

The global bond markets also generated positive, albeit more modest gains over the 12-month reporting period. In the US, the Federal Reserve Board (the "Fed") kept short-term interest rates on hold at 5.25%. (However, after period end, at its September 18, 2007 meeting, the Fed lowered rates by 0.50%.) Due in part to a "flight to quality" amid the troubles in the stock and mortgage markets, both short- and long-term yields declined over the period. During that time, the overall US bond market, as measured by the Lehman Brothers U.S. Aggregate Bond Index, returned 5.58%.

Given solid economic growth and monetary tightening by many central banks, the international bond markets lagged their US counterparts, and the JP Morgan Global Government Bond Index returned 4.78%.

1. The MSCI EAFE Index consists of almost 1,000 stocks in 21 countries outside North and South America, and represents approximately 85% of the total market capitalization in these countries.

2. The MSCI EM Index measures equity market performance in the global emerging markets, and consists of approximately 25 market country indexes, including Argentina, Brazil, Malaysia and Thailand.

2

UBS PACE Select Advisors Trust

Introduction

Lower-quality fixed income securities, such as high yield bonds and emerging markets debt, generated better results despite weakening late in the period, as the Lehman Brothers High Yield Index and JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified1 returned 6.56% and 6.89%, respectively.

Given the recent volatility in the financial markets, there are conflicting views of what is in store for investors for the remainder of the year. As such, we believe it is extremely important to work closely with a professional financial advisor. He or she can help you maintain a well-diversified portfolio and remain focused on your long-term goals. As always, we appreciate your continued support. If you have any questions regarding your portfolio or your investment program, please contact your financial advisor.

Sincerely,

Kai R. Sotorp

President, UBS PACE Select Advisors Trust

Head of the Americas, UBS Global Asset Management (Americas) Inc.

1. The JP Morgan EMBI Global Diversified Index is an unmanaged Index of debt instruments of 31 emerging countries.

This report is intended to assist investors in understanding how the Portfolios performed during the 12-month period ended July 31, 2007. The views expressed in the Advisors' Comments sections are as of the end of the reporting period, reflect performance results gross of fees and expenses, and are those of the investment advisors. Advisors' comments on portfolios that have more than one manager are reflective of their portion of the portfolio only. The views and opinions in this report were current as of September 19, 2007. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the Advisors reserve the right to change their views about individual securities, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Portfolio's future investment intent.

3

UBS PACE Select Advisors Trust

Update regarding portfolio changes

Special updates:

As noted in the UBS PACE Select Advisors Trust semiannual report dated January 31, 2007, the following changes were approved by the Trust's Board, and implemented earlier in 2007.

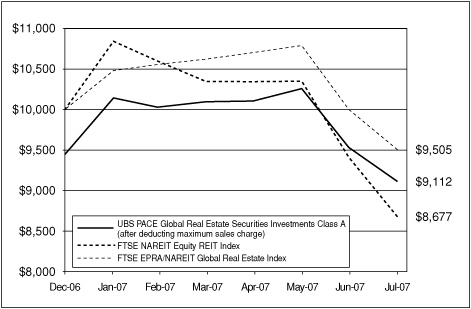

UBS PACE Global Real Estate Securities Investments – The global market in real estate-related securities, especially real estate investment trusts ("REITS"), has expanded over recent years and, with it, the availability of global investment opportunities. To that end, the Portfolio may increase its exposure to non-US global real estate-related securities opportunities as markets warrant, and as permitted by its investment policy. This should provide the Portfolio with greater global diversification and the potential to capture additional sources of return. Consequently, the Portfolio's name has been changed to UBS PACE Global Real Estate Securities Investments from UBS PACE Real Estate Securities I nvestments, to better reflect this aspect of its investment opportunity set. The name change became effective on March 26, 2007.

UBS PACE Small/Medium Co Growth Equity Investments – Delaware Management Company has been replaced by Copper Rock Capital Partners, LLC ("Copper Rock"), as one of the three advisors to the Portfolio. AG Asset Management LLC (formerly known as ForstmannLeff LLC) and Riverbridge Partners, LLC continue to manage portions of the Portfolio.

After the semiannual report was issued, the following significant event occurred:

Change in advisor for UBS PACE Large Co Growth Equity Investments – Wellington Management Company, LLP ("Wellington Management") assumed investment advisory responsibility with respect to a portion of the Portfolio, replacing GE Asset Management, in June 2007. Marsico Capital Management, LLC and SSgA Funds Management, Inc. continue to manage portions of the Portfolio as allocated by UBS Global Asset Management.

Additionally, while this annual report provides important information about the Portfolios for their fiscal period ended July 31, 2007, subsequent to the current fiscal year end, the following significant changes were approved by the Trust's Board and are effective as noted:

Change in advisor for UBS PACE Global Fixed Income Investments – Fischer Francis Trees & Watts, Inc. and its affiliates (collectively, "FFTW"), had served as an investment advisor to UBS PACE Global Fixed Income Invetments, along with Rogge Global Partners plc ("Rogge Global Partners"). Effective August 23, 2007, FFTW no longer serves as an investment advisor to the Portfolio, and Rogge Global Partners serves as the sole investment advisor to the Portfolio. In connection with its management of the Portfolio, Rogge Global Partners may increase the Portfolio's investments in certain derivative instruments, such as credit default swaps and inflation-linked swaps. The Board of Trustees of UBS PACE Select Advisors Trust has also approved a change to the non-fundamental investment policies of the Portfolio, in order to increase the Portfolio's abil ity to invest in high yield and emerging markets debt (and emerging markets currencies). This change will become effective as of October 1, 2007. UBS Global Asset Management believes that this policy change will enhance the Portfolio's ability to seek increased returns, but does involve some additional risk.

4

UBS PACE Select Advisors Trust

Update regarding portfolio changes

Fee waiver/expense reimbursement agreements for five UBS PACE Fixed Income Portfolios – Effective August 1, 2007, five of the UBS PACE Fixed Income Portfolios have entered into revised fee waiver/expense reimbursement agreements with UBS Global Asset Management, the Portfolios' manager, to further reduce the Portfolios' expenses. For the following PACE Portfolios, the ordinary annual portfolio operating expenses are being capped at lower "net expense" levels through November 30, 2008:

UBS PACE Government Securities Fixed Income Investments

UBS PACE Global Fixed Income Investments

UBS PACE Intermediate Fixed Income Investments

UBS PACE Strategic Fixed Income Investments

UBS PACE Municipal Fixed Income Investments

Further information regarding the fee waiver/expense reimbursement arrangements is contained in a "subsequent events" note on page 331.

Change in Investment Policy: UBS PACE Large Co Growth Equity Investments and UBS PACE Large Co Value Equity Investments

At a meeting held on September 19, 2007, the Board approved a change to the investment policies of UBS PACE Large Co Growth Equity Investments and UBS PACE Large Co Value Equity Investments. Under the current policy, large capitalization companies refer to companies with a total market capitalization of $6.0 billion or greater at the time of purchase. Effective November 30, 2007, large capitalization companies will mean companies with a total market capitalization of $3.0 billion or greater at the time of purchase.

UBS Global Asset Management (Americas) Inc., the Portfolios' manager, recommended this change and believes that this change may benefit the Portfolios by affording the Portfolios' investment advisors the flexibility to implement each Portfolio's investment strategy by selecting a greater number of companies represented in the Portfolio's benchmark.

Change in subadvisor for UBS PACE Alternative Strategies Investments. At the recommendation of UBS Global Asset Management, the Trust's Board appointed Goldman Sachs Asset Management, L.P. ("GSAM") to serve as an investment advisor to the Portfolio, effective September 11, 2007. Analytic Investors, Inc. and Wellington Management Company, LLP will also continue to manage portions of the Portfolio as allocated by UBS Global Asset Management.

Please note: This "Update regarding portfolio changes" section describes certain of the more significant changes that have occurred over the past several months, but does not purport to be a complete summary of all changes.

5

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Performance

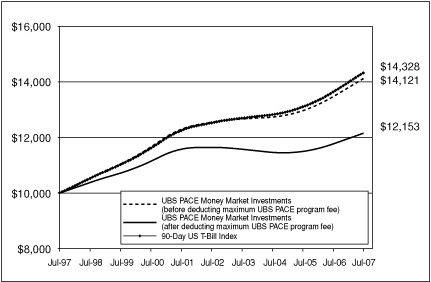

For the 12 months ended July 31, 2007, the Portfolio returned 4.86% (before the deduction of the maximum UBS PACE Select program fee; after the deduction of the maximum UBS PACE Select program fee, the Portfolio returned 3.29%). In comparison, the 90-Day US T-Bill Index (the "Index") returned 5.06%, and the median return for the Lipper Money Market Funds category was 4.68%. (Returns over various time periods are shown in the "Performance at a Glance" table on page 9. Please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.)

Market review

US economic growth was mixed during the fiscal year. After expanding 2.4% in the second quarter of 2006, gross domestic product (GDP) grew 1.1% and 2.1% in the third and fourth quarters of the year, respectively. The economy then weakened further during the first quarter of 2007, with GDP growing a modest 0.6%. This was attributed, in part, to the faltering housing market. The economy then appeared to rebound in the second quarter, as the preliminary estimate for GDP growth came in at 4.0%.

Just prior to the start of the review period, the Federal Reserve Board (the "Fed") raised the federal funds rate by 25 basis points (0.25%)—bringing it to 5.25%—where it remained throughout the reporting period. (The federal funds rate, or "fed funds" rate, is the rate that banks charge one another for funds they borrow on an overnight basis.) The Fed has repeatedly indicated that future rate movements would be data-dependent, as it attempts to ward off inflation and to keep the economy growing at a reasonable pace.

Following the conclusion of the reporting period, the Fed reacted to concerns over subprime lending (a type of lending that relies on risk-based pricing to serve borrowers who cannot obtain credit in the prime market) by providing greater amounts of liquidity to the market in order to facilitate normal market operations. The Fed followed this up by lowering the fed funds rate by 0.50% at its September 18, 2007 meeting, bringing it to 4.75%. The Fed has stated that it plans to continue monitoring the risks of rising inflation along with the potential for slower economic growth.

Advisor's comments

We initially focused on securities with maturities of three to six months, as the future direction of short-term interest rates was uncertain. This strategy allowed us to take advantage of the yield curve position, which was inverted for most of the period, and to lock in higher yields, while at the same time insulating the Portfolio to some degree from a possible Fed rate cut. (An inverted yield curve occurs when long-term interest rates have lower yields than short-term interest rates.)

UBS PACE Select Advisors Trust – UBS PACE Money Market Investments

Investment Advisor:

UBS Global Asset Management (Americas) Inc.

Portfolio Manager:

Michael H. Markowitz

Objective:

Current income consistent with preservation of capital and liquidity.

Investment process:

The Portfolio is a money market mutual fund and seeks to maintain a stable price of $1.00 per share, although it may be possible to lose money by investing in this Portfolio. The Portfolio invests in a diversified portfolio of high-quality money market instruments of governmental and private issuers. Security selection is based on the assessment of relative values and changes in market and economic conditions.

6

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Advisor's comments – concluded

Later in the fiscal year, we began using a "barbell" strategy (in which the maturities of securities in a portfolio are concentrated at opposite ends of the yield curve). While we continued to buy shorter-term securities, we also sought to extend the Portfolio's weighted average maturity with longer-term money market securities maturing within nine to 13 months. This was beneficial to performance, as the yield on one-year money market securities rose steadily higher late in the reporting period.

As always, quality, liquidity and yield remained paramount in our selection process for the Portfolio. We maintained relatively large positions in commercial paper (a short-term security often backed by a guarantee or a letter of credit from a bank or other entity), although we decreased this somewhat over the reporting period. Other short-term corporate obligations and certificates of deposit also comprised a fair amount of the Portfolio. Within these sectors, we found variable-rate securities, which offer interest rates that reset periodically, to be attractive, given the uncertainty of interest rate movements by the Fed. We purchased variable-rate securities linked to the fed funds rate, as well as those linked to the one-month and three-month LIBOR. (The LIBOR, or the London Interbank Offered Rate, is among the most common of benchmark interest rate indexes used to make adjustments to adjustable-rate securities.)

7

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

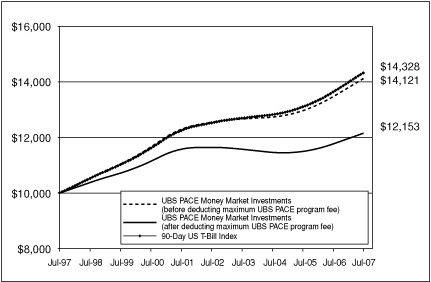

Comparison of change in value of a $10,000 investment in the Portfolio and the 90-Day US T-Bill Index

The graph depicts the performance of UBS PACE Money Market Investments versus the 90-Day US T-Bill Index over the 10 years ended July 31, 2007. Past performance does not predict future performance and the performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions. It is important to note that UBS PACE Money Market Investments is a professionally managed portfolio while the Index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

8

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Performance at a glance (unaudited)

| Average annual total returns for periods ended 07/31/07 | | 1 year | | 5 years | | 10 years | |

UBS PACE Money Market Investments before deducting

maximum UBS PACE Select program fee1 | | | 4.86 | % | | | 2.39 | % | | | 3.51 | % | |

UBS PACE Money Market Investments after deducting

maximum UBS PACE Select program fee1 | | | 3.29 | % | | | 0.87 | % | | | 1.97 | % | |

| 90-Day US T-Bill Index2 | | | 5.06 | % | | | 2.72 | % | | | 3.66 | % | |

| Lipper Money Market Funds median | | | 4.68 | % | | | 2.21 | % | | | 3.31 | % | |

For UBS PACE Money Market Investments, average annual total returns for periods ended June 30, 2007, after deduction of the maximum sales charge or UBS PACE Select program fee, were as follows: 1-year period, 3.29%; 5-year period, 0.81%; 10-year period, 1.97%.

For UBS PACE Money Market Investments, the 7-day current yield for the period ended July 31, 2007 was 4.72% (without maximum UBS PACE Select program fee and after fee waivers and/or expense reimbursements; the yield was 4.40% before fee waivers and/or expense reimbursements). With the maximum UBS PACE Select program fee, the 7-day current yield was 3.22% after fee waivers and/or expense reimbursements; the yield was 2.90% before fee waivers and/or expense reimbursements. The Portfolio's yield quotation more closely reflects the current earnings of the Portfolio than the total return quotation. Yields will fluctuate and reflect fee waivers.

1 The maximum annual UBS PACE Select program fee is 1.5% of the value of UBS PACE assets.

2 90-Day US T-Bills are promissory notes issued by the US Treasury and sold through competitive bidding, with a short-term maturity date, in this case, of three months. This Index is derived from secondary market interest rates as published by the Federal Reserve Bank.

Past performance does not predict future performance and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions. The return of an investment will fluctuate. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the payable dates. Current performance may be higher or lower than the performance data quoted.

Lipper peer group data calculated by Lipper Inc.; used with permission. The Lipper median is the return of the fund that places in the middle of a Lipper peer group.

An investment in UBS PACE Money Market Investments is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

9

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio statistics (unaudited)

| Characteristics | | 07/31/07 | |

| Net assets (mm) | | $ | 408.6 | | |

| Number of holdings | | | 98 | | |

| Weighted average maturity | | | 54 days | | |

| Portfolio composition1 | | 07/31/07 | |

| Commercial paper | | | 60.0 | % | |

| Certificates of deposit | | | 18.0 | | |

| Short-term corporate obligations | | | 14.4 | | |

| US government agency obligations | | | 4.7 | | |

| Bank notes | | | 2.7 | | |

| Repurchase agreement | | | 0.1 | | |

| Other assets less liabilities | | | 0.1 | | |

| Total | | | 100.0 | % | |

| Top 10 holdings1 | | 07/31/07 | |

| Alpine Securitization, 5.270% due 08/10/07 | | | 2.4 | % | |

| Morgan (J.P.) Chase & Co., 5.230% due 08/29/07 | | | 2.4 | | |

| KBC Financial Products International Ltd., 5.210% due 08/06/07 | | | 2.2 | | |

| Grampian Funding LLC, 5.185% due 11/21/07 | | | 2.2 | | |

| Bank of Ireland, 5.235% due 08/16/07 | | | 2.0 | | |

| Beta Finance, Inc., 5.230% due 08/22/07 | | | 2.0 | | |

| Federal Home Loan Bank, 5.200% due 10/10/07 | | | 1.8 | | |

| Bayerische Landesbank, 5.255% due 09/20/07 | | | 1.8 | | |

| Merrill Lynch & Co., 5.200% due 09/10/07 | | | 1.7 | | |

| Toyota Motor Credit Corp., 5.250% due 09/17/07 | | | 1.7 | | |

| Total | | | 20.2 | % | |

1 Weightings represent percentages of the Portfolio's net assets as of July 31, 2007. The Portfolio is actively managed and its composition will vary over time.

10

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

| US government agency obligations—4.65% | |

Federal Farm Credit Bank

5.240%, due 08/01/071 | | $ | 5,000,000 | | | $ | 4,999,874 | | |

Federal Home Loan Bank

5.200%, due 10/10/071 | | | 7,500,000 | | | | 7,497,725 | | |

Federal Home Loan

Mortgage Corp.

5.350%, due 03/26/08 | | | 3,000,000 | | | | 3,000,000 | | |

| 5.400%, due 07/21/08 | | | 3,500,000 | | | | 3,500,000 | | |

Total US government

agency obligations

(cost—$18,997,599) | | | 18,997,599 | | |

| Bank notes—2.69% | |

| Banking—US—2.69% | |

Bank of America N.A.

5.330%, due 12/17/07 | | | 5,000,000 | | | | 5,000,000 | | |

| 5.445%, due 08/01/071 | | | 6,000,000 | | | | 6,000,000 | | |

Total bank notes

(cost—$11,000,000) | | | 11,000,000 | | |

| Certificates of deposit—18.05% | |

| Banking—non-US—13.64% | |

Bank of Tokyo-Mitsubshi UFJ Ltd.

5.360%, due 08/08/07 | | | 3,250,000 | | | | 3,250,000 | | |

Barclays Bank PLC

5.360%, due 01/18/08 | | | 2,000,000 | | | | 2,000,000 | | |

| 5.465%, due 08/15/07 | | | 4,000,000 | | | | 4,000,000 | | |

Calyon N.A., Inc.

5.295%, due 09/28/071 | | | 4,000,000 | | | | 3,999,479 | | |

| 5.325%, due 01/16/08 | | | 4,000,000 | | | | 4,000,000 | | |

Deutsche Bank AG

5.345%, due 04/14/08 | | | 3,000,000 | | | | 3,000,000 | | |

| 5.405%, due 08/01/071 | | | 4,000,000 | | | | 4,000,000 | | |

Mizuho Corporate Bank Ltd.

5.310%, due 08/28/07 | | | 5,000,000 | | | | 5,000,000 | | |

Natexis Banque

5.365%, due 06/02/08 | | | 2,000,000 | | | | 2,000,000 | | |

| 5.525%, due 08/01/071 | | | 3,000,000 | | | | 3,000,000 | | |

Norinchukin Bank Ltd.

5.295%, due 10/10/07 | | | 4,000,000 | | | | 4,000,000 | | |

| 5.320%, due 08/16/07 | | | 4,000,000 | | | | 4,000,000 | | |

| 5.350%, due 01/28/08 | | | 2,000,000 | | | | 2,000,000 | | |

Royal Bank of Scotland PLC

5.290%, due 10/18/07 | | | 1,500,000 | | | | 1,499,965 | | |

Toronto-Dominion Bank

5.281%, due 10/05/07 | | | 5,000,000 | | | | 5,000,011 | | |

Westpac Banking Corp.

5.330%, due 08/28/07 | | | 5,000,000 | | | | 5,000,037 | | |

| | | | 55,749,492 | | |

| Banking—US—4.41% | |

American Express, Federal

Savings Bank

5.290%, due 08/08/07 | | | 3,000,000 | | | | 3,000,000 | | |

| | | Face

amount | | Value | |

| Certificates of deposit—(concluded) | |

| Banking—US—(concluded) | |

Citibank N.A.

5.310%, due 09/06/07 | | $ | 5,000,000 | | | $ | 5,000,000 | | |

US Bank N.A.

5.290%, due 08/30/071 | | | 5,000,000 | | | | 5,000,119 | | |

Wells Fargo Bank N.A.

5.290%, due 08/22/07 | | | 5,000,000 | | | | 5,000,000 | | |

| | | | 18,000,119 | | |

Total certificates of deposit

(cost—$73,749,611) | | | 73,749,611 | | |

| Commercial paper2—59.98% | |

| Asset backed—banking—2.41% | |

Atlantis One Funding

5.190%, due 01/07/08 | | | 7,000,000 | | | | 6,839,542 | | |

| 5.195%, due 08/24/07 | | | 3,000,000 | | | | 2,990,043 | | |

| | | | 9,829,585 | | |

| Asset backed—miscellaneous—17.38% | |

Alpine Securitization

5.270%, due 08/10/07 | | | 10,000,000 | | | | 9,986,825 | | |

Atlantic Asset Securitization LLC

5.280%, due 08/10/07 | | | 2,500,000 | | | | 2,496,700 | | |

Bryant Park Funding LLC

5.270%, due 08/08/07 | | | 6,000,000 | | | | 5,993,852 | | |

Chariot Funding LLC

5.380%, due 08/01/07 | | | 5,500,000 | | | | 5,500,000 | | |

Falcon Asset Securitization Corp.

5.260%, due 08/06/07 | | | 3,000,000 | | | | 2,997,808 | | |

| 5.260%, due 08/31/07 | | | 6,500,000 | | | | 6,471,508 | | |

Jupiter Securitization Co. LLC

5.265%, due 08/10/07 | | | 5,000,000 | | | | 4,993,419 | | |

Ranger Funding Co. LLC

5.270%, due 08/07/07 | | | 5,628,000 | | | | 5,623,057 | | |

| 5.280%, due 08/20/07 | | | 5,000,000 | | | | 4,986,067 | | |

Regency Markets No. 1 LLC

5.275%, due 08/20/07 | | | 5,000,000 | | | | 4,986,080 | | |

Sheffield Receivables Corp.

5.270%, due 08/06/07 | | | 6,000,000 | | | | 5,995,608 | | |

Thunderbay Funding

5.260%, due 08/23/07 | | | 6,000,000 | | | | 5,980,713 | | |

Variable Funding Capital Corp.

5.265%, due 08/10/07 | | | 5,000,000 | | | | 4,993,419 | | |

| | | | 71,005,056 | | |

| Asset backed—securities—12.09% | |

Beta Finance, Inc.

5.230%, due 08/22/07 | | | 8,000,000 | | | | 7,975,594 | | |

Cancara Asset Securitisation LLC

5.260%, due 08/13/07 | | | 5,000,000 | | | | 4,991,233 | | |

Clipper Receivables Co. LLC

5.280%, due 08/07/07 | | | 5,000,000 | | | | 4,995,600 | | |

Dorada Finance, Inc.

5.250%, due 08/15/07 | | | 3,000,000 | | | | 2,993,875 | | |

| 5.290%, due 08/15/07 | | | 5,000,000 | | | | 4,989,714 | | |

11

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

| Commercial paper2—(continued) | |

| Asset backed—securities—(concluded) | |

Grampian Funding LLC

5.185%, due 11/21/07 | | $ | 9,000,000 | | | $ | 8,854,820 | | |

Scaldis Capital LLC

5.230%, due 11/15/07 | | | 5,000,000 | | | | 4,923,003 | | |

Solitaire Funding LLC

5.235%, due 08/23/07 | | | 3,750,000 | | | | 3,738,003 | | |

| 5.250%, due 10/23/07 | | | 5,000,000 | | | | 4,939,479 | | |

| 5.275%, due 08/24/07 | | | 1,000,000 | | | | 996,630 | | |

| | | | 49,397,951 | | |

| Banking—non-US—6.34% | |

Alliance & Leicester PLC

5.250%, due 10/24/07 | | | 4,000,000 | | | | 3,951,000 | | |

Allied Irish Banks N.A., Inc.

5.240%, due 10/19/07 | | | 3,000,000 | | | | 2,965,503 | | |

Bank of Ireland

5.235%, due 08/16/07 | | | 8,000,000 | | | | 7,982,550 | | |

Depfa Bank PLC

5.200%, due 08/02/07 | | | 2,000,000 | | | | 1,999,711 | | |

KBC Financial Products

International Ltd.

5.210%, due 08/06/07 | | | 9,000,000 | | | | 8,993,488 | | |

| | | | 25,892,252 | | |

| Banking—US—12.05% | |

ABN-AMRO N.A. Finance, Inc.

5.240%, due 10/12/07 | | | 4,000,000 | | | | 3,958,080 | | |

Barclays US Funding Corp.

5.235%, due 08/01/07 | | | 3,000,000 | | | | 3,000,000 | | |

Bayerische Landesbank

5.255%, due 09/20/07 | | | 7,500,000 | | | | 7,445,260 | | |

| 5.265%, due 08/13/07 | | | 5,000,000 | | | | 4,991,225 | | |

HSBC USA, Inc.

5.255%, due 09/28/07 | | | 5,000,000 | | | | 4,957,668 | | |

ING (US) Funding LLC

5.250%, due 08/09/07 | | | 5,000,000 | | | | 4,994,167 | | |

Morgan (J.P.) Chase & Co.

5.230%, due 08/29/07 | | | 10,000,000 | | | | 9,959,322 | | |

Natexis Banques Populaires

US Finance Co. LLC

5.065%, due 09/07/07 | | | 1,000,000 | | | | 994,794 | | |

San Paolo IMI US Financial Co.

5.185%, due 10/24/07 | | | 4,000,000 | | | | 3,951,607 | | |

Societe Generale N.A., Inc.

5.270%, due 08/06/07 | | | 5,000,000 | | | | 4,996,340 | | |

| | | | 49,248,463 | | |

| Beverage/bottling—1.20% | |

Coca Cola Co.

5.175%, due 11/30/07 | | | 5,000,000 | | | | 4,913,031 | | |

| Brokerage—3.39% | |

Greenwich Capital Holdings, Inc.

5.170%, due 12/03/07 | | | 5,000,000 | | | | 4,910,961 | | |

| 5.190%, due 08/24/07 | | | 2,000,000 | | | | 1,993,368 | | |

| | | Face

amount | | Value | |

| Commercial paper2—(concluded) | |

| Brokerage—(concluded) | |

Merrill Lynch & Co., Inc.

5.200%, due 09/10/07 | | $ | 7,000,000 | | | $ | 6,959,556 | | |

| | | | 13,863,885 | | |

| Energy—integrated—2.08% | |

Koch Resources LLC

5.260%, due 08/10/07 | | | 3,500,000 | | | | 3,495,398 | | |

| 5.260%, due 08/17/07 | | | 5,000,000 | | | | 4,988,311 | | |

| | | | 8,483,709 | | |

| Finance—captive automotive—1.70% | |

Toyota Motor Credit Corp.

5.250%, due 09/17/07 | | | 7,000,000 | | | | 6,952,021 | | |

| Finance—noncaptive diversified—0.97% | |

General Electric Capital Corp.

5.150%, due 11/09/07 | | | 4,000,000 | | | | 3,942,778 | | |

| Metals & mining—0.37% | |

Rio Tinto Ltd.

5.270%, due 08/01/07 | | | 1,500,000 | | | | 1,500,000 | | |

Total commercial paper

(cost—$245,028,731) | | | 245,028,731 | | |

| Short-term corporate obligations—14.40% | |

| Asset backed—securities—7.49% | |

Asscher Finance Corp.

5.400%, due 07/09/083 | | | 2,000,000 | | | | 1,999,906 | | |

Beta Finance, Inc.

5.350%, due 10/23/073 | | | 1,000,000 | | | | 1,000,000 | | |

CC (USA), Inc. (Centauri)

5.330%, due 08/28/071,3 | | | 3,000,000 | | | | 3,000,067 | | |

| 5.340%, due 06/05/083 | | | 2,500,000 | | | | 2,499,797 | | |

| 5.375%, due 08/28/071,3 | | | 2,000,000 | | | | 2,000,325 | | |

Cullinan Finance Corp.

5.320%, due 08/01/071,3 | | | 3,000,000 | | | | 2,999,855 | | |

| 5.320%, due 01/16/083 | | | 1,500,000 | | | | 1,500,000 | | |

| 5.340%, due 10/10/071,3 | | | 1,500,000 | | | | 1,499,933 | | |

Dorada Finance, Inc.

5.455%, due 08/01/071,3 | | | 3,100,000 | | | | 3,100,245 | | |

K2 (USA) LLC

5.320%, due 10/15/071,3 | | | 5,000,000 | | | | 4,999,044 | | |

| 5.400%, due 06/16/083 | | | 3,000,000 | | | | 3,000,000 | | |

Links Finance LLC

5.325%, due 08/15/071,3 | | | 3,000,000 | | | | 3,000,039 | | |

| | | | 30,599,211 | | |

| Automobile OEM—0.43% | |

American Honda Finance Corp.

5.360%, due 09/27/071,3 | | | 1,750,000 | | | | 1,750,208 | | |

| Banking—non-US—3.91% | |

Caja Ahorros Barcelona

5.366%, due 10/23/071,3 | | | 4,000,000 | | | | 4,000,000 | | |

National Australia Bank Ltd.

5.290%, due 08/15/071,3 | | | 6,000,000 | | | | 6,000,000 | | |

12

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

| Short-term corporate obligations—(concluded) | |

| Banking—non-US—(concluded) | |

Societe Generale

5.310%, due 08/02/071,3 | | $ | 3,000,000 | | | $ | 3,000,000 | | |

Westpac Banking Corp.

5.300%, due 08/06/071,3 | | | 3,000,000 | | | | 3,000,000 | | |

| | | | 16,000,000 | | |

| Banking—US—0.98% | |

Citigroup Funding, Inc.

5.360%, due 08/01/071 | | | 2,000,000 | | | | 2,000,515 | | |

Wells Fargo & Co.

5.420%, due 09/28/071 | | | 2,000,000 | | | | 2,000,310 | | |

| | | | 4,000,825 | | |

| Finance—captive automotive—1.22% | |

Toyota Motor Credit Corp.

5.300%, due 08/01/071 | | | 2,000,000 | | | | 2,000,000 | | |

| 5.330%, due 10/09/071 | | | 3,000,000 | | | | 3,000,240 | | |

| | | | 5,000,240 | | |

| Finance—noncaptive diversified—0.37% | |

General Electric Capital Corp.

5.410%, due 10/15/071 | | | 1,500,000 | | | | 1,500,566 | | |

Total short-term

corporate obligations

(cost—$58,851,050) | | | 58,851,050 | | |

| | | Face

amount | | Value | |

| Repurchase agreement—0.12% | |

Repurchase agreement dated

07/31/07 with State Street

Bank & Trust Co., 4.720%

due 08/01/07, collateralized

by $489,918 US Treasury Notes,

4.250% to 6.125% due

08/15/07 to 11/15/13;

(value—$483,043); proceeds:

$473,062 (cost—$473,000) | | $ | 473,000 | | | $ | 473,000 | | |

Total investments

(cost—$408,099,991)—

99.89% | | | 408,099,991 | | |

Other assets in excess of

liabilities—0.11% | | | 462,351 | | |

Net assets (applicable to

408,563,102 shares of beneficial

interest outstanding equivalent

to $1.00 per share)—100.00% | | $ | 408,562,342 | | |

1 Variable rate security. The maturity dates reflect earlier of reset dates or stated maturity dates. The interest rates shown are the current rates as of July 31, 2007, and reset periodically.

2 Rates shown are the discount rates at date of purchase.

3 Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities, which represent 11.83% of net assets as of July 31, 2007, are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers.

OEM Original Equipment Manufacturer

Issuer breakdown by country of origin (unaudited)

| | | Percentage of

total investments | |

| United States | | | 71.1 | % | |

| Japan | | | 7.4 | | |

| United Kingdom | | | 4.9 | | |

| France | | | 3.9 | | |

| Australia | | | 3.4 | | |

| Ireland | | | 3.2 | | |

| Belgium | | | 2.2 | | |

| Germany | | | 1.7 | | |

| Canada | | | 1.2 | | |

| Spain | | | 1.0 | | |

| Total | | | 100.0 | % | |

Weighted average maturity—54 days

See accompanying notes to financial statements.

13

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Performance

For the 12 months ended July 31, 2007, the Portfolio's Class P shares returned 4.71% (before the deduction of the maximum UBS PACE Select program fee; 3.15% after the deduction of the maximum UBS PACE Select program fee). In comparison, the Lehman Brothers Mortgage-Backed Securities Index (the "Index") returned 5.60%, and the median return for the Lipper Intermediate US Government Funds category was 4.87%. (Returns for all share classes over various time periods are shown in the "Performance at a Glance" table on page 17. Please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.)

Market review

The Federal Reserve Board (the "Fed") remained on hold through the year ended July 31, 2007, after pausing in August 2006 with the federal funds rate at 5.25%. (The federal funds rate, or "fed funds" rate, is the rate that banks charge one another for funds they borrow on an overnight basis.) Even as worries about the subprime mortgage sector developed late in the review period, the Fed focused on stronger economic data, making it difficult for them to lower rates as they remained concerned about inflation. (Subprime mortgage loans are riskier loans, in that they are made to borrowers unable to qualify under traditional, more stringent criteria due to a limited or blemished credit history.) Tight labor markets kept the unemployment rate relatively low and produced real wage gains for consumers, which helped offset headwinds from the residential property market. In addition, measures of core inflation (consumer price inflation wi th the volatile food and energy prices stripped out) remained above the Fed's targeted range. Weakness in the subprime mortgage sector produced a significant tightening of credit conditions for lower-quality and first-time borrowers, yet another blow to an already soft housing market. The mortgage credit derivatives market widened significantly in response to the weakness.

Advisor's comments

During the fiscal year, the mortgage sector underperformed US Treasuries. During the first half of the period, the mortgage market was unable to withstand the pressures of the dramatic flattening of the Treasury bond yield curve (a yield curve flattens as the spread—or difference—between yields on long- and short-term Treasuries decreases). The deterioration in the mortgage credit market intensified in early 2007 as subprime loan delinquencies surpassed their 2001 peak, and many subprime lenders went out of business. Mortgages continued to stumble through the rest of the period, as the 10-year Treasury bond yield reached a five-year high. The Treasury bond selloff triggered a wave of MBS selling, as US banks and mortgage service

UBS PACE Select Advisors Trust – UBS PACE Government Securities Fixed Income Investments

Investment Advisor:

Pacific Investment Management Company LLC ("PIMCO")

Portfolio Manager:

W. Scott Simon

Objective:

Current income

Investment process:

The Portfolio invests primarily in mortgage-backed securities, along with government fixed income securities, including other types of bonds. The Portfolio also invests, to a lesser extent, in investment grade bonds of private issuers, including those backed by mortgages or other assets. The Portfolio's duration normally ranges between one and seven years. (Duration is a measure of a bond portfolio's sensitivity to interest rate changes.) PIMCO establishes duration targets based on its expectations for changes in interest rates, and then positions the Portfolio to take advantage of yield curve shifts. Securities are chosen for their value relative to other similar securities.

14

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Advisor's comments – concluded

companies sought to shed their exposure to these securities. Later in June 2007, news about the failure of two subprime-related hedge funds rekindled fears about subprime credit, and sparked a flight to quality as investors moved out of spread products into Treasury bonds (spread product refers to taxable bonds that are not Treasury securities). This shift continued into July and drove US Treasury bond yields lower.

In this environment, the Portfolio's duration was held above the benchmark, which benefited performance as interest rates fell over the fiscal year (duration is a measure of an investment's sensitivity to interest rate changes). Exposure to shorter maturities of the US yield curve through the use of eurodollar futures detracted from returns during the year, as expectations of the Fed easing diminished. (A eurodollar is US currency held in banks outside the US; futures refers to a contract that represents an obligation to exchange an instrument at a set price on a future date.) Coupon selection helped performance, as technical supply and demand factors created pockets of rich and inexpensive issues (the coupon is the interest rate on a fixed income security, as determined upon issuance). Exposure to high-quality, cash-equivalent, asset-backed securities added income to the Portfolio, and their prices remained relatively stable du ring the 12-month period. An overweight to 15-year conventional securities (FNMA/FHLMC) added to returns, as they outpaced the 30-year sector and broader index on a duration-adjusted basis. An overweight to 30-year conventional issues (FNMA/FHLMC) detracted from returns, as these securities underperformed their GNMA counterparts, also on a duration-adjusted basis. An overweight to 30-year FNMA 6.5% coupons helped returns, as this coupon outpaced the broader market. Finally, an overweight to discount 30-year issues detracted from returns as discount coupons underperformed premium coupons. (A discount bond is valued at a price less than its face value; a premium bond is priced higher than its face value.)

Special considerations

The Portfolio may be appropriate for long-term investors seeking current income who are able to withstand short-term fluctuations in the fixed income markets in return for potentially higher returns over the long term. The yield and value of the Portfolio change every day and can be affected by changes in interest rates, general market conditions and other political, social and economic developments, as well as specific matters relating to the issuers in which the Portfolio invests. It is important to note that an investment in the Portfolio is only one component of a balanced investment plan.

15

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

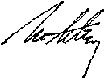

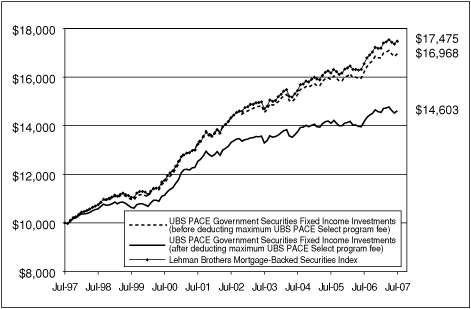

Comparison of change in value of a $10,000 investment in the Class P shares of the Portfolio and the Lehman Brothers Mortgage-Backed Securities Index

The graph depicts the performance of UBS PACE Government Securities Fixed Income Investments Class P shares versus the Lehman Brothers Mortgage-Backed Securities Index over the 10 years ended July 31, 2007. The performance of the other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes. Past performance does not predict future performance and the performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. It is important to note that UBS PACE Government Securities Fixed Income Investments is a professionally managed portfolio while the Index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

16

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Performance at a glance (unaudited)

| Average annual total returns for periods ended 07/31/07 | | | | 1 year | | 5 years | | 10 years | | Since

inception1 | |

| Before deducting | | Class A2 | | | 4.52 | % | | | 3.19 | % | | | N/A | | | | 4.31 | % | |

| maximum sales charge | | Class B3 | | | 3.73 | % | | | 2.41 | % | | | N/A | | | | 3.92 | % | |

| or UBS PACE Select | | Class C4 | | | 4.00 | % | | | 2.64 | % | | | N/A | | | | 4.25 | % | |

| program fee | | Class Y5 | | | 4.87 | % | | | 3.52 | % | | | N/A | | | | 4.64 | % | |

| | | Class P6 | | | 4.71 | % | | | 3.40 | % | | | 5.43 | % | | | 5.78 | % | |

| After deducting | | Class A2 | | | -0.19 | % | | | 2.24 | % | | | N/A | | | | 3.57 | % | |

| maximum sales charge | | Class B3 | | | -1.27 | % | | | 2.05 | % | | | N/A | | | | 3.92 | % | |

| or UBS PACE Select | | Class C4 | | | 3.25 | % | | | 2.64 | % | | | N/A | | | | 4.25 | % | |

| program fee | | Class P6 | | | 3.15 | % | | | 1.86 | % | | | 3.86 | % | | | 4.20 | % | |

| Lehman Brothers Mortgage-Backed Securities Index | | | | | 5.60 | % | | | 4.05 | % | | | 5.74 | % | | | 6.13 | % | |

| Lipper Intermediate US Government Funds median | | | | | 4.87 | % | | | 3.13 | % | | | 4.93 | % | | | 5.23 | % | |

Average annual total returns for periods ended June 30, 2007, after deduction of the maximum sales charge or UBS PACE Select program fee, were as follows: Class A—1-year period, 0.62%; 5-year period, 2.36%; since inception, 3.50%; Class B—1-year period, -0.45%; 5-year period, 2.16%; since inception, 3.86%; Class C—1-year period, 4.07%; 5-year period, 2.77%; since inception, 4.21%; Class Y—1-year period, 5.69%; 5-year period, 3.64%; since inception, 4.59%; Class P—1-year period, 4.04%; 5-year period, 2.00%; 10-year period, 3.98%; since inception, 4.18%.

The annualized gross and net expense ratios, respectively, for each class of shares as in the November 30, 2006 prospectuses, as supplemented on August 1, 2007 were as follows: Class A—1.14% and 1.07%; Class B—1.90% and 1.82%; Class C—1.72% and 1.57%; Class Y—0.81% and 0.78%; and Class P—0.93% and 0.82%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. UBS Global Asset Management (Americas) Inc. ("UBS Global AM") has entered into a written fee waiver/expense reimbursement agreement pursuant to which UBS Global AM is contractually obligated to waive its management fees and/or reimburse the Portfolio so that the ordinary total operating expenses of each class through November 30, 2008 (excluding dividend expense, borrowing costs and interest expense, if any) would not exceed the following: Class A—1.07%; Class B� 1;1.82%; Class C—1.57%; Class Y—0.82%; and Class P—0.82%. The Portfolio has agreed to repay UBS Global AM for any waived fees/reimbursed expenses to the extent that it can do so over the following three fiscal years without causing the Portfolio's expenses in any of those three years to exceed the expense caps described above. Additionally, UBS Global AM and the Portfolio have entered into a written fee waiver agreement pursuant to which UBS Global AM is contractually obligated to waive its management fees to the extent necessary to reflect the lower sub-advisory fee paid by UBS Global AM to PIMCO beginning August 1, 2007.

1 Since inception returns are calculated as of commencement of issuance or reissuance on August 24, 1995 for Class P shares, January 31, 2001 for Class A shares, December 18, 2000 for Class B shares, December 4, 2000 for Class C shares and February 2, 2001 for Class Y shares. Since inception returns for the Index and Lipper median are shown as of August 31, 1995, which is the month-end after the inception date of the oldest share class (Class P).

2 Maximum sales charge for Class A shares is 4.5%. Class A shares bear ongoing 12b-1 service fees.

3 Maximum contingent deferred sales charge for Class B shares is 5% imposed on redemptions and is reduced to 0% after a maximum of six years. Class B shares bear ongoing 12b-1 service and distribution fees.

4 Maximum contingent deferred sales charge for Class C shares is 0.75% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees.

5 The Portfolio offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees.

6 Class P shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but are subject to a maximum annual UBS PACE Select program fee of 1.5% of the value of Class P shares.

If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectuses.

The Lehman Brothers Mortgage-Backed Securities Index covers fixed rate securitized issues backed by the mortgage pools of the Government National Mortgage Association, the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association. Graduated Payment Mortgages are included, but Graduated Equity Mortgages are not. The average-weighted life is approximately eight years.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

Lipper peer group data calculated by Lipper Inc.; used with permission. The Lipper median is the return of the fund that places in the middle of a Lipper peer group.

17

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio statistics (unaudited)

| Characteristics | | 07/31/07 | |

| Weighted average duration | | | 4.7 | yrs. | |

| Weighted average maturity | | | 5.6 | yrs | |

| Average coupon | | | 5.10 | % | |

| Average quality1 | | | AAA | | |

| Net assets (mm) | | $ | 610.7 | | |

| Number of holdings | | | 421 | | |

| Portfolio composition2 | | 07/31/07 | |

| Bonds | | | 128.8 | % | |

| Futures and swaps | | | (0.0 | )3 | |

| Investments sold short | | | (14.4 | ) | |

| Cash equivalents and other assets less liabilities | | | (14.4 | ) | |

| Total | | | 100.0 | % | |

| Asset allocation2 | | 07/31/07 | |

| US government agency mortgage pass-through certificates | | | 119.9 | % | |

| Collateralized mortgage obligations | | | 4.8 | | |

| Asset-backed securities | | | 3.2 | | |

| Corporate notes | | | 0.8 | | |

| Stripped mortgage-backed securities | | | 0.1 | | |

| Futures and swaps | | | (0.0 | )3 | |

| Investments sold short | | | (14.4 | ) | |

| Cash equivalents and other assets less liabilities | | | (14.4 | ) | |

| Total | | | 100.0 | % | |

1 Credit quality ratings shown are based on the ratings assigned to portfolio holdings by Standard & Poor's Ratings Group, an independent rating agency.

2 Weightings represent percentages of the Portfolio's net assets as of July 31, 2007. The Portfolio is actively managed and its composition will vary over time.

3 Weighting represents less than 0.05% of the Portfolio's net assets as of July 31, 2007.

18

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

Government national mortgage

association certificates—10.42% | |

| GNMA | |

| 5.500%, due 12/15/32 | | $ | 133,257 | | | $ | 130,158 | | |

| 5.500%, due 07/15/33 | | | 935,692 | | | | 913,682 | | |

| 5.500%, due 12/15/33 | | | 7,968,552 | | | | 7,781,108 | | |

| 5.500%, due 01/15/34 | | | 2,646,738 | | | | 2,583,228 | | |

| 5.500%, due 02/15/34 | | | 265,332 | | | | 258,965 | | |

| 5.500%, due 03/15/34 | | | 568,995 | | | | 555,341 | | |

| 5.500%, due 04/15/34 | | | 793,484 | | | | 774,444 | | |

| 5.500%, due 05/15/34 | | | 841,053 | | | | 820,871 | | |

| 5.500%, due 06/15/34 | | | 202,293 | | | | 197,439 | | |

| 5.500%, due 07/15/35 | | | 789,322 | | | | 769,984 | | |

| 5.500%, due 08/15/35 | | | 369,108 | | | | 360,065 | | |

| 5.500%, due 10/15/35 | | | 4,378,206 | | | | 4,270,465 | | |

| 5.500%, due 11/15/35 | | | 395,769 | | | | 386,073 | | |

| 5.500%, due 12/15/35 | | | 9,027,039 | | | | 8,805,880 | | |

| 5.500%, due 01/15/36 | | | 5,070,183 | | | | 4,941,006 | | |

| 5.500%, due 05/15/36 | | | 309,368 | | | | 301,486 | | |

| 6.000%, due 04/15/36 | | | 264,408 | | | | 264,140 | | |

| 6.000%, due 05/15/36 | | | 154,232 | | | | 154,075 | | |

| 6.000%, due 06/15/36 | | | 62,858 | | | | 62,794 | | |

| 6.000%, due 07/15/36 | | | 3,706,636 | | | | 3,702,871 | | |

| 6.000%, due 08/15/36 | | | 5,085,218 | | | | 5,080,054 | | |

| 6.000%, due 09/15/36 | | | 466,901 | | | | 466,427 | | |

| 6.000%, due 10/15/36 | | | 412,040 | | | | 411,622 | | |

| 6.000%, due 12/15/36 | | | 562,786 | | | | 562,215 | | |

| 6.500%, due 08/15/361 | | | 1,021,644 | | | | 1,039,933 | | |

| 6.500%, due 09/15/361 | | | 1,416,659 | | | | 1,442,020 | | |

| 7.500%, due 08/15/21 | | | 10,066 | | | | 10,523 | | |

| 7.500%, due 09/15/23 | | | 1,103 | | | | 1,154 | | |

| 8.000%, due 12/15/07 | | | 932 | | | | 935 | | |

| 8.000%, due 08/15/09 | | | 11,957 | | | | 12,231 | | |

| 8.000%, due 02/15/23 | | | 2,904 | | | | 3,075 | | |

| 8.250%, due 04/15/19 | | | 611,895 | | | | 651,318 | | |

| 9.000%, due 08/15/09 | | | 148,464 | | | | 149,626 | | |

| 10.500%, due 02/15/19 | | | 35,142 | | | | 39,550 | | |

| 10.500%, due 06/15/19 | | | 42,344 | | | | 47,656 | | |

| 10.500%, due 07/15/19 | | | 101,277 | | | | 113,980 | | |

| 10.500%, due 08/15/19 | | | 14,446 | | | | 16,259 | | |

| 10.500%, due 07/15/20 | | | 4,276 | | | | 4,736 | | |

| 10.500%, due 08/15/20 | | | 48,890 | | | | 55,113 | | |

| 10.500%, due 09/15/20 | | | 4,006 | | | | 4,516 | | |

| 11.500%, due 05/15/19 | | | 3,914 | | | | 4,481 | | |

| GNMA II | |

| 9.000%, due 04/20/25 | | | 46,813 | | | | 50,431 | | |

| 9.000%, due 12/20/26 | | | 10,618 | | | | 11,446 | | |

| 9.000%, due 01/20/27 | | | 13,793 | | | | 14,878 | | |

| 9.000%, due 06/20/30 | | | 1,828 | | | | 1,975 | | |

| 9.000%, due 07/20/30 | | | 13,104 | | | | 14,151 | | |

| 9.000%, due 09/20/30 | | | 3,204 | | | | 3,460 | | |

| 9.000%, due 10/20/30 | | | 23,517 | | | | 25,396 | | |

| 9.000%, due 11/20/30 | | | 48,837 | | | | 52,739 | | |

| | | Face

amount | | Value | |

Government national mortgage

association certificates—(continued) | |

| GNMA II ARM | |

| 5.375%, due 04/20/18 | | $ | 27,727 | | | $ | 28,009 | | |

| 5.375%, due 05/20/21 | | | 9,274 | | | | 9,389 | | |

| 5.375%, due 06/20/22 | | | 258,461 | | | | 261,204 | | |

| 5.375%, due 04/20/24 | | | 227,434 | | | | 230,056 | | |

| 5.375%, due 05/20/25 | | | 207,885 | | | | 210,781 | | |

| 5.375%, due 06/20/25 | | | 82,832 | | | | 83,993 | | |

| 5.375%, due 04/20/26 | | | 474,491 | | | | 479,656 | | |

| 5.375%, due 06/20/26 | | | 220,991 | | | | 223,516 | | |

| 5.375%, due 04/20/27 | | | 148,787 | | | | 150,529 | | |

| 5.375%, due 04/20/30 | | | 115,230 | | | | 116,789 | | |

| 5.375%, due 05/20/30 | | | 2,137,926 | | | | 2,167,919 | | |

| 5.500%, due 06/20/30 | | | 55,239 | | | | 56,102 | | |

| 5.500%, due 07/20/30 | | | 463,927 | | | | 468,905 | | |

| 5.500%, due 08/20/30 | | | 387,197 | | | | 391,717 | | |

| 5.750%, due 07/20/17 | | | 22,311 | | | | 22,497 | | |

| 5.750%, due 09/20/21 | | | 311,669 | | | | 314,860 | | |

| 5.750%, due 08/20/25 | | | 63,397 | | | | 64,143 | | |

| 5.750%, due 09/20/25 | | | 72,163 | | | | 73,003 | | |

| 5.750%, due 08/20/26 | | | 78,527 | | | | 79,489 | | |

| 5.750%, due 09/20/26 | | | 12,051 | | | | 12,217 | | |

| 5.750%, due 07/20/27 | | | 31,189 | | | | 31,572 | | |

| 5.750%, due 08/20/27 | | | 84,509 | | | | 85,687 | | |

| 5.875%, due 05/20/18 | | | 9,310 | | | | 9,363 | | |

| 5.875%, due 06/20/19 | | | 74,143 | | | | 74,992 | | |

| 6.125%, due 11/20/21 | | | 49,341 | | | | 49,851 | | |

| 6.125%, due 11/20/22 | | | 92,540 | | | | 93,439 | | |

| 6.125%, due 12/20/24 | | | 1,737 | | | | 1,758 | | |

| 6.125%, due 10/20/25 | | | 52,433 | | | | 52,986 | | |

| 6.125%, due 12/20/25 | | | 10,112 | | | | 10,215 | | |

| 6.125%, due 10/20/26 | | | 36,901 | | | | 37,338 | | |

| 6.125%, due 12/20/26 | | | 46,603 | | | | 47,142 | | |

| 6.125%, due 11/20/27 | | | 143,002 | | | | 144,340 | | |

| 6.125%, due 12/20/27 | | | 14,351 | | | | 14,524 | | |

| 6.125%, due 10/20/29 | | | 49,021 | | | | 49,626 | | |

| 6.125%, due 10/20/30 | | | 64,587 | | | | 65,340 | | |

| 6.125%, due 09/20/31 | | | 54,660 | | | | 55,251 | | |

| 6.250%, due 02/20/28 | | | 7,227 | | | | 7,284 | | |

| 6.375%, due 01/20/23 | | | 204,979 | | | | 206,947 | | |

| 6.375%, due 03/20/23 | | | 101,408 | | | | 102,489 | | |

| 6.375%, due 01/20/24 | | | 250,997 | | | | 253,717 | | |

| 6.375%, due 01/20/25 | | | 22,758 | | | | 23,049 | | |

| 6.375%, due 02/20/25 | | | 59,008 | | | | 59,685 | | |

| 6.375%, due 03/20/25 | | | 83,699 | | | | 84,718 | | |

| 6.375%, due 03/20/26 | | | 46,551 | | | | 47,057 | | |

| 6.375%, due 01/20/27 | | | 297,054 | | | | 300,000 | | |

| 6.375%, due 02/20/27 | | | 38,601 | | | | 39,092 | | |

| 6.375%, due 01/20/28 | | | 32,041 | | | | 32,410 | | |

| 6.375%, due 02/20/28 | | | 20,362 | | | | 20,596 | | |

| 6.500%, due 01/20/18 | | | 291,193 | | | | 294,368 | | |

| 6.500%, due 03/20/25 | | | 36,759 | | | | 37,303 | | |

19

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

Government national mortgage

association certificates—(concluded) | |

| GNMA TBA | |

| 6.000%, TBA | | $ | 7,000,000 | | | $ | 6,989,066 | | |

| 6.500%, TBA | | | 550,000 | | | | 559,625 | | |

Total government national

mortgage association certificates

(cost—$63,899,301) | | | 63,651,579 | | |

Federal home loan mortgage

corporation certificates—27.93% | |

| FHLMC | |

| 5.000%, due 03/01/36 | | | 93,126 | | | | 87,608 | | |

| 5.000%, due 04/01/36 | | | 194,967 | | | | 183,416 | | |

| 5.000%, due 06/01/36 | | | 3,856,980 | | | | 3,621,283 | | |

| 5.000%, due 11/01/36 | | | 15,134,972 | | | | 14,238,289 | | |

| 5.500%, due 02/01/331 | | | 1,302,150 | | | | 1,264,000 | | |

| 5.500%, due 03/01/331 | | | 630,208 | | | | 611,744 | | |

| 5.500%, due 04/01/331 | | | 734,067 | | | | 712,560 | | |

| 5.500%, due 05/01/331 | | | 791,724 | | | | 768,528 | | |

| 5.500%, due 06/01/331 | | | 3,637,435 | | | | 3,530,866 | | |

| 5.500%, due 10/01/331 | | | 846,568 | | | | 821,765 | | |

| 5.500%, due 12/01/331 | | | 475,415 | | | | 461,486 | | |

| 5.500%, due 03/01/341 | | | 146,314 | | | | 141,875 | | |

| 5.500%, due 10/01/341 | | | 1,239,867 | | | | 1,203,542 | | |

| 5.500%, due 12/01/341 | | | 820,498 | | | | 795,606 | | |

| 5.500%, due 02/01/351 | | | 7,297,797 | | | | 7,076,399 | | |

| 5.500%, due 05/01/351 | | | 237,408 | | | | 229,977 | | |

| 5.500%, due 06/01/351 | | | 1,662,281 | | | | 1,610,254 | | |

| 5.500%, due 03/01/371 | | | 1,274,621 | | | | 1,231,373 | | |

| 5.500%, due 04/01/371 | | | 13,592,430 | | | | 13,131,240 | | |

| 5.500%, due 05/01/371 | | | 49,806,485 | | | | 48,116,556 | | |

| 6.000%, due 07/01/08 | | | 240,197 | | | | 241,059 | | |

| 7.000%, due 08/01/25 | | | 2,424 | | | | 2,507 | | |

| 7.500%, due 10/01/17 | | | 4,879 | | | | 5,119 | | |

| 8.000%, due 03/01/13 | | | 176,080 | | | | 186,273 | | |

| 8.500%, due 05/01/16 | | | 38,464 | | | | 39,072 | | |

| 9.000%, due 07/01/09 | | | 1,536 | | | | 1,580 | | |

| 9.000%, due 02/01/10 | | | 6,087 | | | | 6,330 | | |

| 9.000%, due 04/01/25 | | | 111,352 | | | | 114,839 | | |

| 9.750%, due 11/01/16 | | | 38,687 | | | | 40,322 | | |

| 10.500%, due 11/01/20 | | | 10,758 | | | | 11,021 | | |

| 11.000%, due 05/01/11 | | | 6,681 | | | | 6,857 | | |

| 11.000%, due 03/01/13 | | | 2,353 | | | | 2,415 | | |

| 11.000%, due 07/01/15 | | | 4,214 | | | | 4,712 | | |

| 11.000%, due 09/01/15 | | | 7,340 | | | | 7,702 | | |

| 11.000%, due 10/01/15 | | | 1,372 | | | | 1,503 | | |

| 11.000%, due 12/01/15 | | | 12,930 | | | | 14,419 | | |

| 11.000%, due 04/01/19 | | | 5,608 | | | | 6,287 | | |

| 11.000%, due 06/01/19 | | | 497 | | | | 557 | | |

| 11.000%, due 08/01/20 | | | 74 | | | | 82 | | |

| 11.000%, due 09/01/20 | | | 4,017 | | | | 4,485 | | |

| 11.500%, due 05/01/10 | | | 6,138 | | | | 6,315 | | |

| 11.500%, due 08/01/10 | | | 593 | | | | 640 | | |

| 11.500%, due 11/01/10 | | | 10,415 | | | | 11,257 | | |

| | | Face

amount | | Value | |

Federal home loan mortgage

corporation certificates—(concluded) | |

| 11.500%, due 09/01/14 | | $ | 1,791 | | | $ | 1,807 | | |

| 11.500%, due 01/01/16 | | | 3,514 | | | | 3,903 | | |

| 11.500%, due 01/01/18 | | | 11,969 | | | | 13,294 | | |

| 11.500%, due 05/01/19 | | | 6,880 | | | | 7,482 | | |

| 11.500%, due 06/01/19 | | | 22,896 | | | | 25,594 | | |

| FHLMC ARM | |

| 6.211%, due 10/01/29 | | | 24,756 | | | | 25,287 | | |

| 7.147%, due 01/01/28 | | | 121,008 | | | | 121,923 | | |

| 7.172%, due 11/01/27 | | | 231,532 | | | | 235,659 | | |

| 7.193%, due 10/01/23 | | | 288,046 | | | | 292,769 | | |

| 7.215%, due 07/01/24 | | | 455,488 | | | | 464,519 | | |

| 7.260%, due 07/01/28 | | | 579,639 | | | | 582,316 | | |

| 7.276%, due 04/01/29 | | | 558,269 | | | | 562,709 | | |

| 7.291%, due 11/01/29 | | | 1,025,969 | | | | 1,046,754 | | |

| 7.295%, due 06/01/28 | | | 878,244 | | | | 880,059 | | |

| 7.323%, due 12/01/29 | | | 364,102 | | | | 370,749 | | |

| 7.420%, due 01/01/30 | | | 126,146 | | | | 127,417 | | |

| 7.422%, due 11/01/25 | | | 565,101 | | | | 576,308 | | |

| 7.436%, due 01/01/29 | | | 461,823 | | | | 471,263 | | |

| 7.447%, due 10/01/27 | | | 561,177 | | | | 572,908 | | |

| 7.486%, due 10/01/27 | | | 767,712 | | | | 779,362 | | |

| FHLMC TBA | |

| 5.000%, TBA | | | 30,000,000 | | | | 28,134,360 | | |

| 6.000%, TBA | | | 35,000,000 | | | | 34,715,625 | | |

Total federal home loan mortgage

corporation certificates

(cost—$171,881,371) | | | 170,565,787 | | |

Federal housing administration

certificates—0.39% | |

| FHA GMAC | |

| 7.400%, due 02/01/21 | | | 1,154,371 | | | | 1,154,371 | | |

| 7.480%, due 04/01/19 | | | 95,120 | | | | 94,644 | | |

| FHA Reilly | |

| 6.896%, due 07/01/20 | | | 1,141,324 | | | | 1,124,205 | | |

Total federal housing

administration certificates

(cost—$2,392,471) | | | 2,373,220 | | |

Federal national mortgage

association certificates—81.18% | |

| FNMA | |

| 4.500%, due 10/01/19 | | | 21,817,326 | | | | 20,853,335 | | |

| 4.500%, due 02/01/20 | | | 1,464,111 | | | | 1,396,269 | | |

| 4.500%, due 04/01/20 | | | 3,018,653 | | | | 2,882,074 | | |

| 4.500%, due 09/01/20 | | | 1,052,809 | | | | 1,006,291 | | |

| 4.500%, due 10/01/20 | | | 32,691 | | | | 31,176 | | |

| 4.500%, due 12/01/21 | | | 29,659 | | | | 28,254 | | |

| 4.500%, due 03/01/22 | | | 931,382 | | | | 887,313 | | |

| 4.500%, due 05/01/22 | | | 32,210 | | | | 30,686 | | |

| 4.500%, due 06/01/22 | | | 937,650 | | | | 893,284 | | |

| 4.500%, due 07/01/22 | | | 5,000,000 | | | | 4,763,419 | | |

20

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

Federal national mortgage

association certificates—(continued) | |

| 5.000%, due 09/01/171 | | $ | 39,100 | | | $ | 38,131 | | |

| 5.000%, due 10/01/171 | | | 1,807,217 | | | | 1,762,443 | | |

| 5.000%, due 05/01/181 | | | 988,067 | | | | 962,932 | | |

| 5.000%, due 06/01/181 | | | 21,293 | | | | 20,762 | | |

| 5.000%, due 07/01/181 | | | 25,189 | | | | 24,548 | | |

| 5.000%, due 08/01/181 | | | 470,790 | | | | 458,814 | | |

| 5.000%, due 10/01/181 | | | 1,481,242 | | | | 1,443,561 | | |

| 5.000%, due 11/01/181 | | | 7,742,781 | | | | 7,545,810 | | |

| 5.000%, due 12/01/181 | | | 153,359 | | | | 149,458 | | |

| 5.000%, due 02/01/191 | | | 7,582,765 | | | | 7,376,275 | | |

| 5.000%, due 04/01/191 | | | 2,120,571 | | | | 2,062,825 | | |

| 5.000%, due 05/01/191 | | | 646,392 | | | | 628,790 | | |

| 5.000%, due 06/01/191 | | | 1,623,638 | | | | 1,579,803 | | |

| 5.000%, due 07/01/191 | | | 10,302,827 | | | | 10,022,350 | | |

| 5.000%, due 08/01/191 | | | 2,671,483 | | | | 2,598,735 | | |

| 5.000%, due 09/01/191 | | | 45,541 | | | | 44,301 | | |

| 5.000%, due 10/01/191 | | | 1,442,513 | | | | 1,403,232 | | |

| 5.000%, due 12/01/191 | | | 1,838,877 | | | | 1,788,802 | | |

| 5.000%, due 01/01/201 | | | 3,137,293 | | | | 3,047,932 | | |

| 5.000%, due 02/01/201 | | | 3,951,476 | | | | 3,838,197 | | |

| 5.000%, due 03/01/201 | | | 1,108,466 | | | | 1,076,354 | | |

| 5.000%, due 04/01/201 | | | 5,194,063 | | | | 5,044,110 | | |

| 5.000%, due 05/01/201 | | | 47,172 | | | | 45,803 | | |

| 5.000%, due 06/01/201 | | | 43,717 | | | | 42,449 | | |

| 5.000%, due 07/01/201 | | | 1,586,051 | | | | 1,540,030 | | |

| 5.000%, due 08/01/201 | | | 3,706,018 | | | | 3,598,484 | | |

| 5.000%, due 09/01/201 | | | 1,366,965 | | | | 1,327,300 | | |

| 5.000%, due 10/01/201 | | | 28,560,161 | | | | 27,731,455 | | |

| 5.000%, due 02/01/211 | | | 182,353 | | | | 177,062 | | |

| 5.000%, due 12/01/331 | | | 34,142,017 | | | | 32,213,773 | | |

| 5.000%, due 08/01/351 | | | 307,905 | | | | 289,665 | | |

| 5.000%, due 09/01/351 | | | 296,420 | | | | 278,860 | | |

| 5.000%, due 10/01/351 | | | 32,571,619 | | | | 30,642,092 | | |

| 5.000%, due 02/01/361 | | | 51,942,895 | | | | 48,865,823 | | |

| 5.500%, due 05/01/14 | | | 9,181 | | | | 9,135 | | |

| 5.500%, due 06/01/17 | | | 261,694 | | | | 258,819 | | |

| 5.500%, due 01/01/18 | | | 18,494 | | | | 18,350 | | |

| 5.500%, due 06/01/20 | | | 35,701 | | | | 35,298 | | |

| 5.500%, due 07/01/20 | | | 90,845 | | | | 89,821 | | |

| 5.500%, due 10/01/20 | | | 92,529 | | | | 91,487 | | |

| 5.500%, due 12/01/20 | | | 31,825 | | | | 31,467 | | |

| 5.500%, due 01/01/21 | | | 182,705 | | | | 180,487 | | |

| 5.500%, due 02/01/21 | | | 182,582 | | | | 180,345 | | |

| 5.500%, due 03/01/21 | | | 1,311,998 | | | | 1,295,923 | | |

| 5.500%, due 04/01/21 | | | 919,360 | | | | 908,095 | | |

| 5.500%, due 05/01/21 | | | 318,667 | | | | 314,763 | | |

| 5.500%, due 06/01/21 | | | 1,906,646 | | | | 1,883,285 | | |

| 5.500%, due 07/01/21 | | | 1,161,393 | | | | 1,147,187 | | |

| 5.500%, due 08/01/21 | | | 782,716 | | | | 773,125 | | |

| 5.500%, due 10/01/21 | | | 992,372 | | | | 980,966 | | |

| 5.500%, due 11/01/21 | | | 1,913,087 | | | | 1,889,648 | | |

| 5.500%, due 12/01/21 | | | 1,817,915 | | | | 1,795,641 | | |

| 5.500%, due 02/01/22 | | | 770,468 | | | | 761,028 | | |

| 5.500%, due 03/01/22 | | | 6,072,120 | | | | 5,997,335 | | |

| | | Face

amount | | Value | |

Federal national mortgage

association certificates—(continued) | |

| 5.500%, due 04/01/22 | | $ | 47,181 | | | $ | 46,600 | | |

| 5.500%, due 06/01/22 | | | 534,503 | | | | 527,921 | | |

| 5.500%, due 07/01/22 | | | 6,809,287 | | | | 6,725,422 | | |

| 5.500%, due 08/01/22 | | | 2,510,381 | | | | 2,479,463 | | |

| 5.500%, due 02/01/32 | | | 95,680 | | | | 92,858 | | |

| 5.500%, due 11/01/32 | | | 1,859,758 | | | | 1,805,434 | | |

| 5.500%, due 01/01/33 | | | 951,439 | | | | 923,647 | | |

| 5.500%, due 02/01/33 | | | 565,210 | | | | 548,613 | | |

| 5.500%, due 06/01/33 | | | 175,703 | | | | 170,543 | | |

| 5.500%, due 09/01/33 | | | 648,374 | | | | 629,334 | | |

| 5.500%, due 10/01/33 | | | 941,952 | | | | 914,292 | | |

| 5.500%, due 11/01/33 | | | 242,216 | | | | 235,103 | | |

| 5.500%, due 12/01/33 | | | 947,406 | | | | 919,584 | | |

| 5.500%, due 01/01/34 | | | 340,610 | | | | 330,608 | | |

| 5.500%, due 04/01/34 | | | 923,215 | | | | 894,884 | | |

| 5.500%, due 07/01/34 | | | 563,654 | | | | 547,102 | | |

| 5.500%, due 01/01/35 | | | 410,612 | | | | 397,585 | | |

| 5.500%, due 04/01/35 | | | 5,133,763 | | | | 4,970,886 | | |

| 5.500%, due 05/01/35 | | | 8,972,853 | | | | 8,688,173 | | |

| 5.500%, due 06/01/35 | | | 1,908,428 | | | | 1,847,880 | | |

| 5.500%, due 07/01/35 | | | 598,127 | | | | 579,150 | | |

| 5.500%, due 08/01/35 | | | 1,740,221 | | | | 1,685,009 | | |

| 5.500%, due 01/01/36 | | | 857,083 | | | | 829,891 | | |

| 5.500%, due 02/01/36 | | | 856,253 | | | | 829,087 | | |

| 5.500%, due 03/01/36 | | | 23,760,503 | | | | 23,006,654 | | |

| 5.500%, due 04/01/36 | | | 928,646 | | | | 897,349 | | |

| 5.500%, due 07/01/36 | | | 413,382 | | | | 399,451 | | |

| 5.500%, due 12/01/36 | | | 20,000,158 | | | | 19,326,107 | | |

| 6.000%, due 01/01/32 | | | 144,348 | | | | 143,933 | | |

| 6.000%, due 04/01/32 | | | 160,859 | | | | 160,335 | | |

| 6.000%, due 09/01/32 | | | 162,756 | | | | 162,225 | | |

| 6.000%, due 10/01/32 | | | 177,391 | | | | 176,813 | | |

| 6.000%, due 01/01/33 | | | 353,983 | | | | 352,830 | | |

| 6.000%, due 02/01/33 | | | 287,128 | | | | 285,987 | | |

| 6.000%, due 06/01/33 | | | 374,747 | | | | 373,257 | | |

| 6.000%, due 07/01/33 | | | 228,764 | | | | 227,854 | | |

| 6.000%, due 10/01/33 | | | 240,087 | | | | 239,132 | | |

| 6.000%, due 11/01/33 | | | 689,966 | | | | 687,222 | | |

| 6.000%, due 02/01/34 | | | 2,423,834 | | | | 2,414,196 | | |

| 6.000%, due 05/01/34 | | | 155,891 | | | | 155,015 | | |

| 6.000%, due 09/01/34 | | | 437,607 | | | | 435,149 | | |

| 6.000%, due 01/01/35 | | | 1,134,938 | | | | 1,128,023 | | |

| 6.000%, due 02/01/35 | | | 854,401 | | | | 848,716 | | |

| 6.000%, due 04/01/35 | | | 11,852 | | | | 11,765 | | |

| 6.000%, due 05/01/35 | | | 976,351 | | | | 969,308 | | |

| 6.000%, due 06/01/35 | | | 522,326 | | | | 519,562 | | |

| 6.000%, due 07/01/35 | | | 1,977,425 | | | | 1,962,965 | | |

| 6.000%, due 08/01/35 | | | 740,744 | | | | 735,327 | | |

| 6.000%, due 09/01/35 | | | 988,398 | | | | 981,170 | | |

| 6.000%, due 10/01/35 | | | 282,005 | | | | 279,943 | | |

| 6.000%, due 04/01/36 | | | 777,405 | | | | 770,793 | | |

| 6.000%, due 08/01/36 | | | 873,938 | | | | 866,505 | | |

| 6.000%, due 09/01/36 | | | 4,147,988 | | | | 4,112,710 | | |

| 6.000%, due 10/01/36 | | | 45,448 | | | | 45,061 | | |

21

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2007

| | | Face

amount | | Value | |

Federal national mortgage

association certificates—(continued) | |

| 6.000%, due 11/01/36 | | $ | 1,061,474 | | | $ | 1,052,445 | | |

| 6.000%, due 12/01/36 | | | 813,692 | | | | 806,771 | | |

| 6.500%, due 09/01/12 | | | 11,718 | | | | 11,980 | | |

| 6.500%, due 12/01/12 | | | 26,490 | | | | 27,083 | | |

| 6.500%, due 01/01/13 | | | 4,297 | | | | 4,394 | | |

| 6.500%, due 02/01/13 | | | 27,578 | | | | 28,197 | | |

| 6.500%, due 03/01/13 | | | 47,412 | | | | 48,475 | | |

| 6.500%, due 04/01/13 | | | 4,679 | | | | 4,784 | | |

| 6.500%, due 06/01/13 | | | 73,536 | | | | 75,191 | | |

| 6.500%, due 07/01/13 | | | 13,559 | | | | 13,864 | | |

| 6.500%, due 08/01/13 | | | 18,500 | | | | 18,916 | | |

| 6.500%, due 09/01/13 | | | 123,501 | | | | 126,280 | | |

| 6.500%, due 10/01/13 | | | 37,248 | | | | 38,086 | | |

| 6.500%, due 11/01/13 | | | 61,453 | | | | 62,837 | | |

| 6.500%, due 07/01/19 | | | 143,738 | | | | 147,400 | | |

| 6.500%, due 04/01/26 | | | 8,651 | | | | 8,806 | | |

| 6.500%, due 03/01/29 | | | 91,876 | | | | 93,844 | | |

| 6.500%, due 05/01/29 | | | 220,808 | | | | 225,513 | | |

| 6.500%, due 03/01/36 | | | 3,743,189 | | | | 3,781,411 | | |

| 6.500%, due 04/01/36 | | | 48,161 | | | | 48,653 | | |

| 6.500%, due 05/01/36 | | | 5,731,916 | | | | 5,790,445 | | |

| 6.500%, due 06/01/36 | | | 4,243,433 | | | | 4,286,762 | | |

| 6.500%, due 07/01/36 | | | 596,426 | | | | 602,516 | | |

| 6.500%, due 08/01/36 | | | 4,214,720 | | | | 4,257,757 | | |

| 6.500%, due 09/01/36 | | | 112,903 | | | | 114,056 | | |

| 6.500%, due 10/01/36 | | | 2,803,151 | | | | 2,831,774 | | |

| 6.500%, due 11/01/36 | | | 1,380,657 | | | | 1,394,755 | | |

| 7.500%, due 06/01/24 | | | 2,340 | | | | 2,451 | | |

| 7.500%, due 07/01/24 | | | 6,182 | | | | 6,474 | | |

| 7.500%, due 08/01/24 | | | 33,335 | | | | 34,912 | | |

| 7.500%, due 12/01/24 | | | 2,624 | | | | 2,748 | | |

| 7.500%, due 06/01/25 | | | 12,267 | | | | 12,850 | | |

| 7.500%, due 07/01/25 | | | 9,670 | | | | 10,131 | | |

| 7.500%, due 10/01/26 | | | 23,145 | | | | 24,240 | | |

| 7.500%, due 11/01/26 | | | 58,888 | | | | 61,636 | | |

| 8.000%, due 11/01/26 | | | 58,841 | | | | 61,849 | | |

| 8.500%, due 09/01/25 | | | 160,583 | | | | 171,538 | | |

| 9.000%, due 05/01/09 | | | 67,435 | | | | 68,357 | | |

| 9.000%, due 10/01/19 | | | 78,413 | | | | 84,113 | | |

| 9.000%, due 02/01/26 | | | 38,088 | | | | 41,075 | | |

| 9.250%, due 04/01/10 | | | 17,835 | | | | 18,123 | | |

| 9.250%, due 04/01/13 | | | 1,553 | | | | 1,578 | | |

| 9.250%, due 05/01/14 | | | 12,245 | | | | 12,296 | | |

| 9.250%, due 12/01/15 | | | 7,480 | | | | 7,601 | | |

| 9.500%, due 12/01/09 | | | 3,414 | | | | 3,543 | | |

| 10.000%, due 08/01/19 | | | 41,812 | | | | 45,290 | | |

| 10.250%, due 03/01/11 | | | 1,979 | | | | 2,071 | | |

| 10.500%, due 02/01/12 | | | 1,361 | | | | 1,474 | | |

| 10.500%, due 07/01/13 | | | 2,393 | | | | 2,453 | | |