UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08764 |

|

UBS PACE Select Advisors Trust |

(Exact name of registrant as specified in charter) |

|

51 West 52nd Street, New York, New York | | 10019-6114 |

(Address of principal executive offices) | | (Zip code) |

|

Mark F. Kemper, Esq. UBS Global Asset Management 51 West 52nd Street New York, NY 10019-6114 |

(Name and address of agent for service) |

|

Copy to: |

Jack W. Murphy, Esq. Dechert LLP 1775 I Street, N.W. Washington, DC 20006-2401 |

|

Registrant’s telephone number, including area code: | 212-882 5000 | |

|

Date of fiscal year end: | July 31 | |

|

Date of reporting period: | July 31, 2009 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

UBS PACE Select Advisors Trust

Annual Report

July 31, 2009

Table of contents

| Introduction | | | 2 | | |

|

| Portfolio Advisor's and Sub-Advisors' commentaries and schedules of investments | |

|

| UBS PACE Money Market Investments | | | 5 | | |

|

| UBS PACE Government Securities Fixed Income Investments | | | 14 | | |

|

| UBS PACE Intermediate Fixed Income Investments | | | 28 | | |

|

| UBS PACE Strategic Fixed Income Investments | | | 41 | | |

|

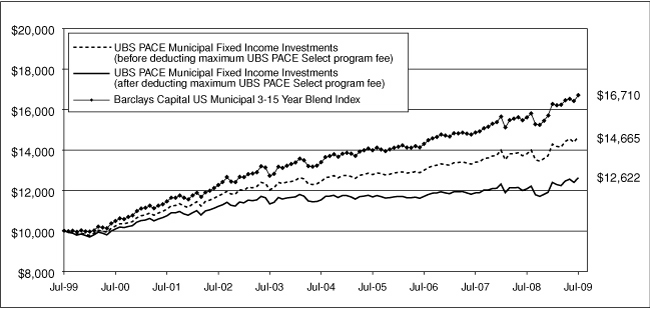

| UBS PACE Municipal Fixed Income Investments | | | 61 | | |

|

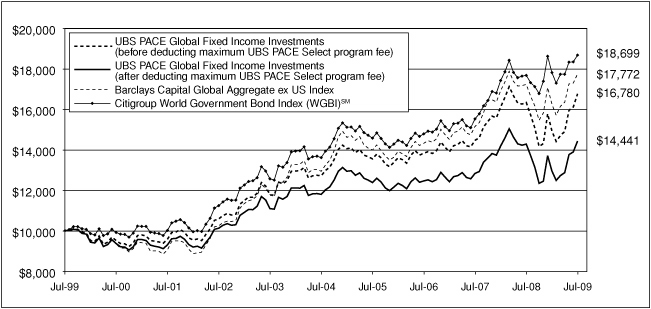

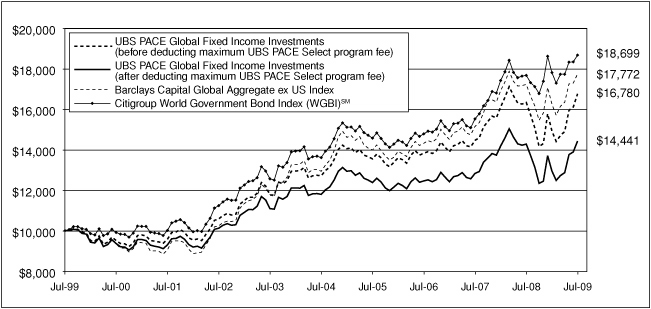

| UBS PACE Global Fixed Income Investments | | | 74 | | |

|

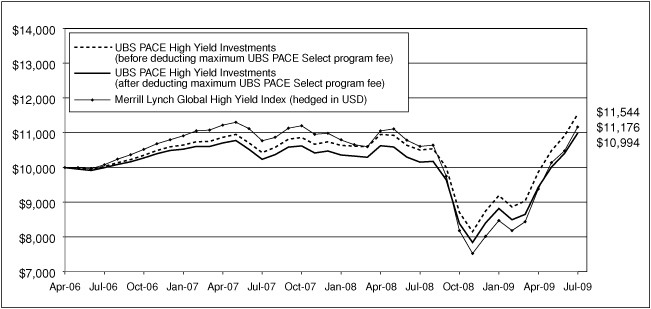

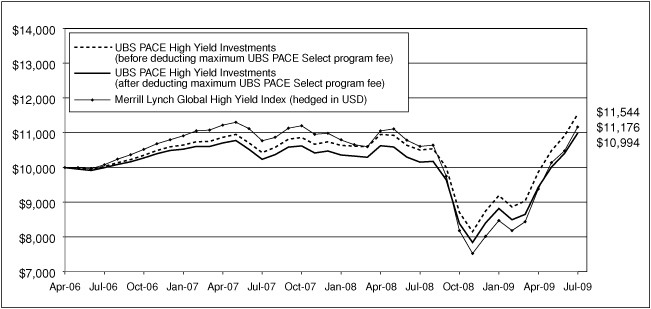

| UBS PACE High Yield Investments | | | 86 | | |

|

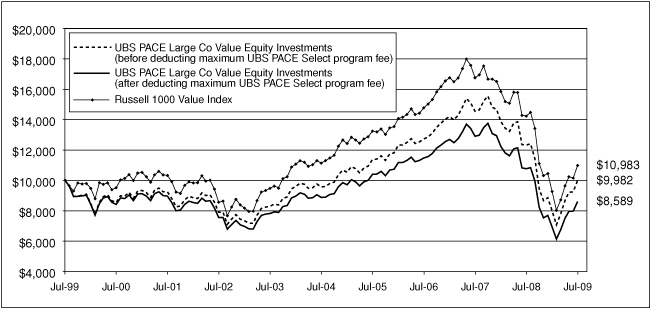

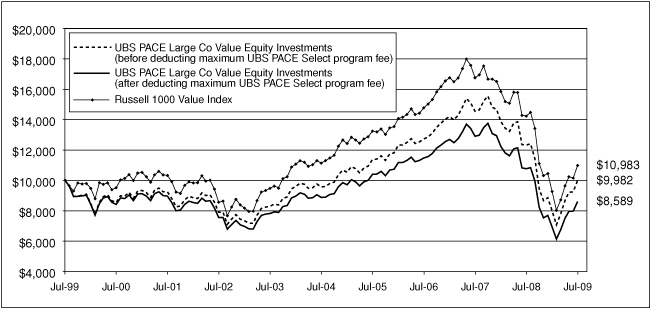

| UBS PACE Large Co Value Equity Investments | | | 100 | | |

|

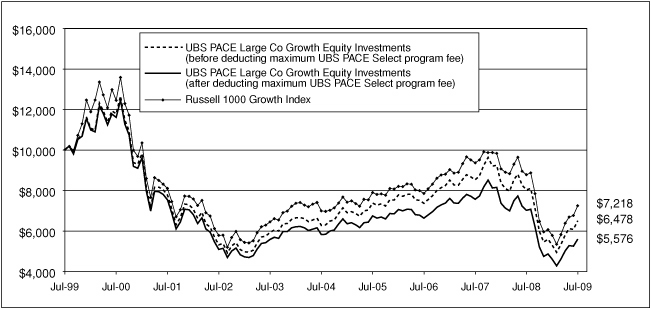

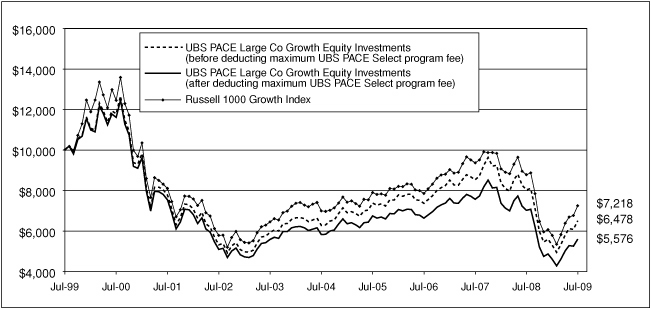

| UBS PACE Large Co Growth Equity Investments | | | 110 | | |

|

| UBS PACE Small/Medium Co Value Equity Investments | | | 122 | | |

|

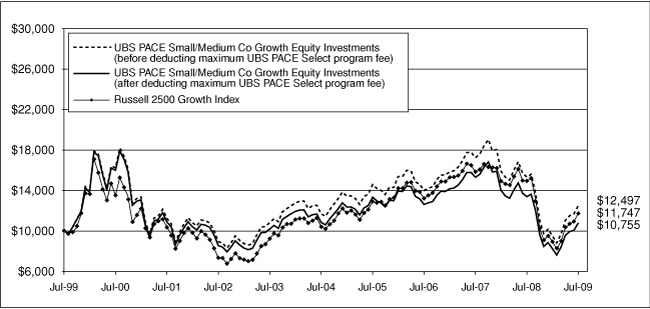

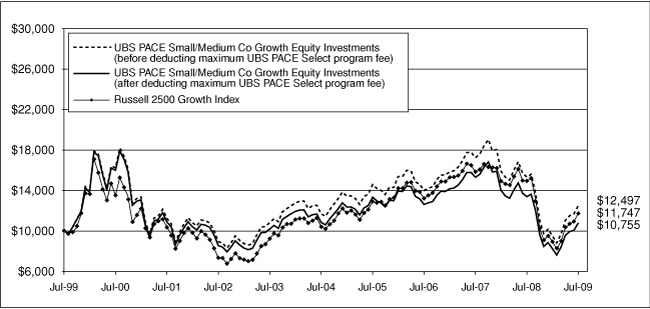

| UBS PACE Small/Medium Co Growth Equity Investments | | | 134 | | |

|

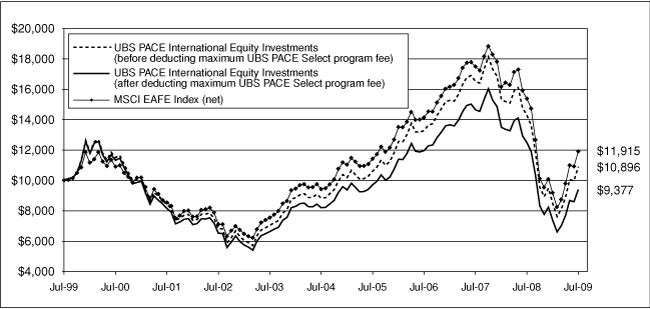

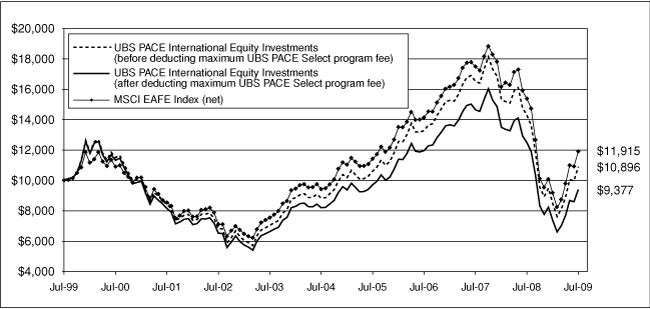

| UBS PACE International Equity Investments | | | 146 | | |

|

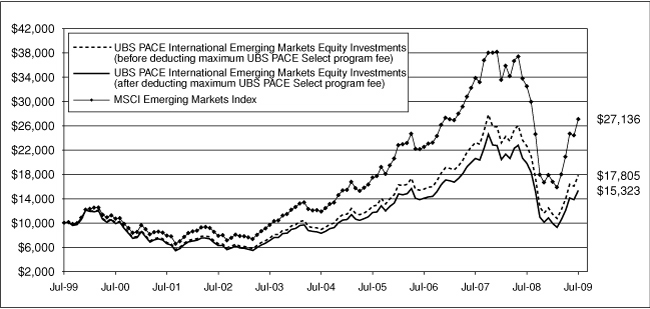

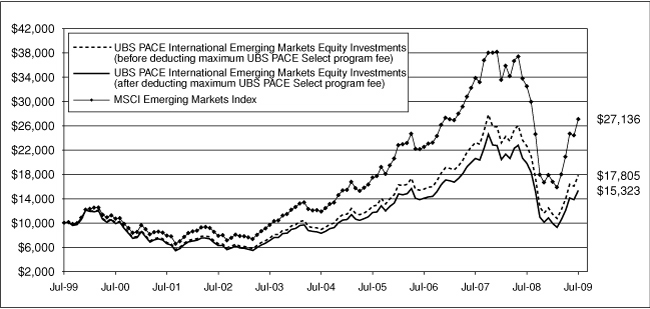

| UBS PACE International Emerging Markets Equity Investments | | | 159 | | |

|

| UBS PACE Global Real Estate Securities Investments | | | 171 | | |

|

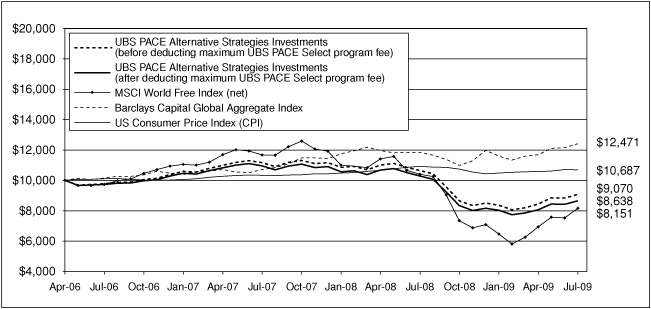

| UBS PACE Alternative Strategies Investments | | | 180 | | |

|

| Understanding your Portfolio's expenses | | | 210 | | |

|

| Statement of assets and liabilities | | | 216 | | |

|

| Statement of operations | | | 224 | | |

|

| Statement of changes in net assets | | | 228 | | |

|

| Financial highlights | | | 235 | | |

|

| Notes to financial statements | | | 288 | | |

|

| Report of independent registered public accounting firm | | | 331 | | |

|

| General information | | | 333 | | |

|

| Board approval of certain investment advisory agreements | | | 334 | | |

|

| Trustees and officers | | | 350 | | |

|

UBS PACE Select Advisors Trust offers multiple share classes representing interests in 15 separate Portfolios. (UBS PACE Money Market Investments offers only one share class.) Different classes of shares and/or Portfolios are offered by separate prospectuses.

For more information on a Portfolio or class of shares, contact your financial advisor. He or she can send you a current prospectus relating to a Portfolio or class of shares. Investors should carefully read and consider a mutual fund's investment objectives, risks, charges, and expenses before investing. The prospectus contains this and other information about a mutual fund. For a current prospectus, contact UBS Global Asset Management at 888-793 8637, or visit us on the Web at www.ubs.com/globalam-us.

1

UBS PACE Select Advisors Trust

Introduction

September 21, 2009

Dear UBS PACESM Shareholder,

We are pleased to provide you with the annual report for the UBS PACE Portfolios, comprising the UBS PACE Select Advisors Trust. This report includes summaries of the performance of each Portfolio and commentaries from the investment advisor and sub-advisors regarding the events that affected Portfolio performance during the 12 months ended July 31, 2009. Please note that the opinions of the sub-advisors do not necessarily represent those of UBS Global Asset Management (Americas) Inc.

Market review

The 12-month reporting period was marked by some of the most challenging economic and market conditions in a generation. The bursting of the housing bubble, a severe credit crunch, lower business and consumer spending and surging unemployment caused the US economy to weaken significantly, with US gross domestic product ("GDP") declining in each quarter of the reporting period.

Following the conclusion of the reporting period, however, signs of recovery were seen to be emerging. The Federal Reserve Board issued a statement on August 12, 2009 acknowledging that the economy had stabilized. In that statement, it wrote that it expects the US economy to remain weak for a time, noting that "economic activity is leveling out," and adding that "conditions in financial markets have improved further in recent weeks".

Economic growth outside the US was also poor during the reporting period. According to forecasts by the Organization for Economic Cooperation and Development ("OECD"), world economic growth is expected to contract 2.2% in 2009. From a regional perspective, Eurozone GDP declined 4.8% during the first quarter, while Japan's economy shrank 14.2% over the same period. However, as 2009 progressed, there were indications that the recession in the global economy was nearing a bottom. Accordingly, the OECD forecasts a rebound in world economic growth, projecting a 2.3% expansion in 2010.

Despite a strong finish, global equities perform poorly

In the equity markets, the reporting period was a study in contrasts. After a small gain in August 2008, stock prices declined during five of the next six months through February 2009. This was due to a number of factors, including the rapidly weakening global economy, turmoil in the financial markets, frozen credit conditions, a lack of liquidity and plunging corporate profits. However, after reaching a 12-year low on March 9, 2009, stock prices in the US rallied sharply given expectations that the worst of the global recession may be over. From its March low through July 31, 2009, the S&P 500 Index1 gained more than 45%. However, this was not enough to overcome the market's earlier weakness, and, all told, the S&P 500 Index declined 19.96% during the 12 months ended July 31, 2009.

The international equity markets delivered similar results. During the first seven months of the reporting period, both the equities of international developed markets (as measured by MSCI EAFE Index (net)2) and

1 The S&P 500 Index is an unmanaged, weighted index composed of 500 widely held common stocks varying in composition, and is not available for direct investment. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

2 The MSCI EAFE Index (net) is an index of stocks from 21 countries designed to measure the investment returns of developed economies outside of North America. Dividends are reinvested after the deduction of withholding tax, using tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates. Investors should note that indices do not reflect the deduction of fees and expenses.

2

UBS PACE Select Advisors Trust

emerging markets (as measured by the MSCI Emerging Markets Index3) were extremely weak. The impressive rally that began in mid-March was not enough to make up for the severity of the earlier decline, however, and international developed equity markets fell 22.60%, while emerging markets equities declined 16.57% during the reporting period as a whole.

Bonds significantly outperform stocks

The extreme shift in market sentiment was also evident in the fixed income markets. During much of the first half of the reporting period, heightened risk caused US investors to flock to the relative safety of short-term Treasury securities, causing their yields to fall and their prices to rise. In contrast, the spread sectors (that is, non-Treasury sectors) performed poorly. However, as the reporting period progressed, risk aversion abated and investors shunned Treasuries in favor of what they viewed as attractively valued and higher-yielding spread sectors.

During the 12 months ended July 31, 2009, the overall US bond market, as measured by the Barclays Capital US Aggregate Index,4 returned 7.85%. Turning to the riskier fixed income asset classes, high yield bonds and emerging markets debt generated extremely strong performance during the second half of the reporting period. This more than offset their earlier weakness, as the Merrill Lynch US High Yield Cash Pay Constrained Index5 returned 4.17% and the J.P. Morgan Emerging Markets Bond Index Global (EMBI Global)6 gained 4.24% during the 12-month reporting period.

3 The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 22 emerging market countries in Europe, Latin America and the Pacific Basin. The MSCI Emerging Markets Index excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

4 The Barclays Capital US Aggregate Index (formerly known as the Lehman Brothers US Aggregate Index) is an unmanaged index of the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The Index includes bonds from the treasury, government-related, corporate, mortgage-backed, asset-backed and commercial mortgage-backed sectors. US agency hybrid adjustable rate mortgage (ARM) securities were added to the Index on April 1, 2007. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

5 The Merrill Lynch US High Yield Cash Pay Constrained Index is an index of publicly placed non-convertible, coupon-bearing US domestic debt with a term to maturity of at least one year. The Index is market weighted, so that larger bond issuers have a greater effect on the Index's return. However, the representation of any single bond issue is restricted to a maximum of 2% of the total index. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

6 The J.P. Morgan Emerging Markets Bond Index Global (EMBI Global) is an unmanaged index which tracks total returns for US-dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans and Eurobonds. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

3

UBS PACE Select Advisors Trust

Looking for signs of a sustained recovery

As the reporting period demonstrated, the financial markets can experience periods of extreme volatility and unnerve even the most experienced investor. However, there are increasing signs that the severe global recession may be bottoming. In addition, the financial markets have largely stabilized following the extreme turmoil in 2008. Despite this, there could be periods of heightened volatility going forward as incoming economic data from around the globe is scrutinized. As always, it is important to work closely with a professional financial advisor. He or she can proactively monitor your investment portfolio and help you remain focused on your long-term financial goals. We appreciate your continued support.

Sincerely,

Kai R. Sotorp

President, UBS PACE Select Advisors Trust

Head—Americas, UBS Global Asset Management (Americas) Inc.

This report is intended to assist investors in understanding how the Portfolios performed during the 12-month period ended July 31, 2009. The views expressed in the Advisor and Sub-Advisors' Comments sections are as of the end of the reporting period, reflect performance results gross of fees and expenses, and are those of the investment advisor and/or sub-advisors. Sub-advisors' comments on Portfolios that have more than one sub-advisor are reflective of their portion of the Portfolio only. The views and opinions in this report were current as of September 21, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the investment advisor and sub-advisors reserve the right to change their views about individual securities, sectors and the markets at any time. As a result, the views expressed should not be relied upo n as a forecast of a Portfolio's future investment intent.

4

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Performance

For the 12 months ended July 31, 2009, the Portfolio returned 0.81% (before the deduction of the maximum UBS PACE Select program fee; after the deduction of the maximum UBS PACE Select program fee, the Portfolio declined 0.70%). In comparison, the 90-Day US T-Bill Index (the "benchmark") returned 0.65%, and the Lipper Money Market Funds category posted a median return of 0.77%. (Returns over various time periods are shown in the "Performance at a glance" table on page 8. Please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.) For a detailed commentary on the market environment in general during the reporting period, please refer to page two.

Advisor's Comments

Given the issues impacting the credit markets, we sought to maintain a high degree of liquidity in the Portfolio in order to minimize pricing volatility and to meet redemption requests. We did so by investing a significant portion of the Portfolio's new subscriptions in shorter-dated money market securities maturing within one to three months.

At the security level, we maintained a greater than usual level of diversification over the reporting period by investing in smaller positions. While the Portfolio is generally able to hold up to 5.00% in any one security (subject to certain exceptions), we typically purchased no more than 1.00% to 2.00% in any one nongovernment issuer, as part of our efforts to reduce risk and keep the Portfolio highly diversified.

In terms of the securities that we emphasized, at the beginning of the reporting period, the Portfolio held a significant exposure to commercial paper and US government and agency obligations. As the period continued, we increased the Portfolio's exposure to asset-backed commercial paper. This move followed measures taken by the Federal Reserve Board to improve the liquidity of asset-backed commercial paper in response to the turmoil in the credit markets. In addition, we increased the Portfolio's exposure to US government and agency obligations, while decreasing exposure to certificates of deposit and repurchase agreements over the period. (Repurchase agreements are transactions in which the seller of a security agrees to buy it back at a predetermined time and price or upon demand.)

UBS PACE Select Advisors Trust – UBS PACE Money Market Investments

Investment Advisor:

UBS Global Asset Management (Americas) Inc.

Portfolio Manager:

Robert Sabatino

Objective:

Current income consistent with preservation of capital and liquidity

Investment process:

The Portfolio is a money market mutual fund and seeks to maintain a stable price of $1.00 per share, although it may be possible to lose money by investing in this Portfolio. The Portfolio invests in a diversified portfolio of high-quality money market instruments of governmental and private issuers. Security selection is based on the assessment of relative values and changes in market and economic conditions.

5

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

A Note about the Temporary Guarantee Program for Money Market Funds

Following unprecedented turmoil in the credit markets, the US government announced the Temporary Guarantee Program for Money Market Funds (the "Program"). The Portfolio participated in the Program from the Program's inception in the fall of 2008 until it expired on September 18, 2009. Under the Program, the US Treasury guaranteed the share price of any publicly offered eligible money market mutual fund that applied and was accepted into it. Shareholders in money market funds enrolled in the Program were covered for the amounts they held as of the close of business on September 19, 2008 until September 18, 2009. The Portfolio did not encounter circumstances triggering a need to invoke the guarantee provided by the Program.

The Portfolio has maintained its net asset value ("NAV") of $1.00 per share* throughout the recent unprecedented turmoil and has continued to meet its stated goal, which is to provide current income consistent with preservation of capital and liquidity. We were pleased to have the Portfolio participate in the Program to provide an added level of protection for covered shareholders, until it expired. We want to reassure shareholders of the following:

• The Portfolio holds very high-quality assets. While we consider rating agencies' credit ratings, we rely first and foremost on our own proprietary research, conducted by dedicated teams of credit analysts. This approach benefited the Portfolio in the volatile environment that prevailed during the reporting period.

• UBS Global Asset Management (Americas) Inc. and its predecessor firms have been managing money market funds for more than 30 years; this is a key line of business for the firm, and we have dedicated significant resources to the management of the assets entrusted to us.

When the Program was introduced, it had an initial termination date of December 18, 2008. The Portfolio paid a fee of 0.01% of the value of the Portfolio's outstanding shares (valued at $1.00 per share for this purpose) as of September 19, 2008. This ensured Program coverage for the period from September 19, 2008 through December 18, 2008. The Program was extended twice—first through April 30, 2009, and then, finally, through September 18, 2009. The Portfolio paid additional fees calculated on the same basis, but at the rate of 0.015% for each of the two extension election periods, to continue to participate through September 18, 2009. This cost was absorbed by the Portfolio as a fund expense.

The Portfolio's yield did decline during the coverage period as a result of the Program participation fees through September 18, 2009.

* An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

6

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

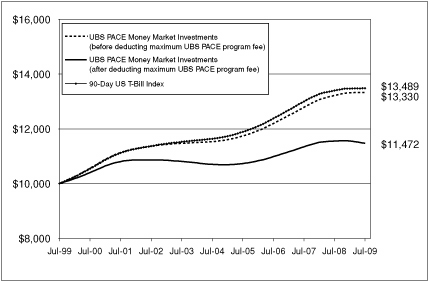

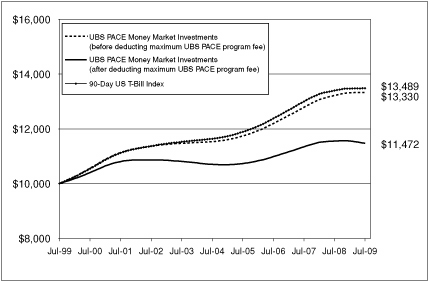

Comparison of change in value of a $10,000 investment in the Portfolio and the 90-Day US T-Bill Index (unaudited)

The graph depicts the performance of UBS PACE Money Market Investments versus the 90-Day US T-Bill Index over the 10 years ended July 31, 2009. Past performance does not predict future performance and the performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions. It is important to note that UBS PACE Money Market Investments is a professionally managed portfolio while the Index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

7

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Performance at a glance (unaudited)

| Average annual total returns for periods ended 07/31/09 | | 1 year | | 5 years | | 10 years | |

UBS PACE Money Market Investments before deducting

maximum UBS PACE Select program fee1 | | | 0.81 | % | | | 2.94 | % | | | 2.92 | % | |

UBS PACE Money Market Investments after deducting

maximum UBS PACE Select program fee1 | | | (0.70 | )% | | | 1.41 | % | | | 1.38 | % | |

| 90-Day US T-Bill Index2 | | | 0.65 | % | | | 3.00 | % | | | 3.04 | % | |

| Lipper Money Market Funds median | | | 0.77 | % | | | 2.81 | % | | | 2.77 | % | |

For UBS PACE Money Market Investments, average annual total returns for periods ended June 30, 2009, after deduction of the maximum UBS PACE Select program fee, were as follows: 1-year period, (0.53)%; 5-year period, 1.42%; 10-year period, 1.42%.

For UBS PACE Money Market Investments, the 7-day current yield for the period ended July 31, 2009 was 0.01% (without maximum UBS PACE Select program fee and after fee waivers and/or expense reimbursements; the yield was (0.05)% before fee waivers and/or expense reimbursements). With the maximum UBS PACE Select program fee, the 7-day current yield was (1.49)% after fee waivers and/or expense reimbursements; the yield was (1.55)% before fee waivers and/or expense reimbursements. The Portfolio's yield quotation more closely reflects the current earnings of the Portfolio than the total return quotation. Yields will fluctuate and reflect fee waivers.

1 The maximum annual UBS PACE Select program fee is 1.5% of the value of UBS PACE assets.

2 90-Day US T-Bills are promissory notes issued by the US Treasury and sold through competitive bidding, with a short-term maturity date, in this case, of three months. This Index is derived from secondary market interest rates as published by the Federal Reserve Bank. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

Past performance does not predict future performance and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions. The return of an investment will fluctuate. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the payable dates. Current performance may be higher or lower than the performance data quoted.

Lipper peer group data calculated by Lipper Inc.; used with permission. The Lipper median is the return of the fund that places in the middle of a Lipper peer group.

An investment in UBS PACE Money Market Investments is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

Not FDIC Insured. May lose value. No Bank guarantee.

8

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio statistics (unaudited)

| Characteristics | | 07/31/09 | |

| Net assets (mm) | | $ | 530.0 | | |

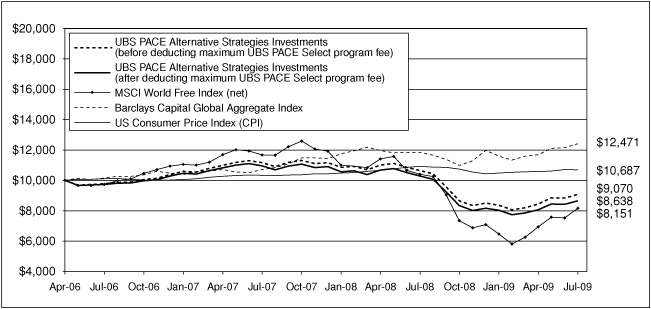

| Number of holdings | | | 92 | | |

| Weighted average maturity | | | 45 days | | |

| Portfolio composition1 | | 07/31/09 | |

| Commercial paper | | | 39.7 | % | |

| US government and agency obligations | | | 31.5 | | |

| Repurchase agreements | | | 14.1 | | |

| Certificates of deposit | | | 10.0 | | |

| Short-term corporate obligations | | | 3.2 | | |

| Bank notes | | | 2.5 | | |

| Money market fund | | | 1.9 | | |

| Other assets less liabilities | | | (2.9 | ) | |

| Total | | | 100.0 | % | |

| Top 10 holdings1 | | 07/31/09 | |

| Repurchase agreement with Deutsche Bank Securities, 0.190% due 08/03/09 | | | 9.2 | % | |

| Repurchase agreement with Barclays Bank PLC, 0.180% due 08/03/09 | | | 4.7 | | |

| Federal National Mortgage Association, 0.300% due 08/24/09 | | | 2.8 | | |

| US Treasury Bills, 0.285% due 10/29/09 | | | 2.3 | | |

| Federal Home Loan Bank, 0.650% due 09/10/09 | | | 1.9 | | |

| Federal Home Loan Mortgage Corp., 0.620% due 08/03/09 | | | 1.9 | | |

| Thames Asset Global Securitization No.1, 0.280% due 08/07/09 | | | 1.9 | | |

| Federal Home Loan Mortgage Corp., 0.215% due 08/28/09 | | | 1.9 | | |

| Federal Home Loan Bank, 0.210% due 08/17/09 | | | 1.9 | | |

| Dexia Delaware LLC, 0.290% due 08/13/09 | | | 1.9 | | |

| Total | | | 30.4 | % | |

1 Weightings represent percentages of the Portfolio's net assets as of July 31, 2009. The Portfolio is actively managed and its composition will vary over time.

9

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

US government and agency

obligations—31.50% | |

Federal Home Loan Bank

0.476%, due 08/13/091 | | $ | 5,000,000 | | | $ | 5,000,000 | | |

| 0.210%, due 08/17/092 | | | 10,000,000 | | | | 9,999,067 | | |

| 0.210%, due 08/21/092 | | | 10,000,000 | | | | 9,998,833 | | |

| 0.650%, due 09/10/091 | | | 10,000,000 | | | | 10,004,552 | | |

| 0.220%, due 09/28/092 | | | 5,000,000 | | | | 4,998,228 | | |

| 0.320%, due 12/21/092 | | | 3,000,000 | | | | 2,996,213 | | |

| 0.520%, due 06/01/10 | | | 3,000,000 | | | | 2,999,083 | | |

Federal Home Loan

Mortgage Corp.*

0.620%, due 08/03/091 | | | 10,000,000 | | | | 10,000,000 | | |

| 0.570%, due 08/17/092 | | | 5,000,000 | | | | 4,998,733 | | |

| 0.215%, due 08/28/091 | | | 10,000,000 | | | | 9,999,425 | | |

| 4.125%, due 11/30/09 | | | 7,000,000 | | | | 7,042,350 | | |

| 0.350%, due 02/16/102 | | | 5,000,000 | | | | 4,990,326 | | |

| 0.520%, due 07/16/102 | | | 5,000,000 | | | | 4,974,794 | | |

Federal National Mortgage

Association*

0.410%, due 08/03/091 | | | 7,000,000 | | | | 7,000,000 | | |

| 0.300%, due 08/24/092 | | | 15,000,000 | | | | 14,997,125 | | |

| 0.400%, due 10/13/091 | | | 5,000,000 | | | | 5,000,000 | | |

| 0.250%, due 10/26/092 | | | 5,000,000 | | | | 4,997,014 | | |

| 0.250%, due 11/16/092 | | | 10,000,000 | | | | 9,992,570 | | |

| 0.530%, due 12/21/092 | | | 5,000,000 | | | | 4,989,547 | | |

US Treasury Bills

0.180%, due 09/24/092 | | | 10,000,000 | | | | 9,997,300 | | |

| 0.285%, due 10/29/092,3 | | | 12,000,000 | | | | 11,991,545 | | |

| 0.235%, due 11/19/092 | | | 10,000,000 | | | | 9,992,820 | | |

Total US government and

agency obligations

(cost—$166,959,525) | | | | | | | 166,959,525 | | |

| Bank notes—2.54% | |

| Banking-US—2.54% | |

Bank of America N.A.

1.207%, due 08/06/091 | | | 5,000,000 | | | | 5,000,000 | | |

HSBC Bank USA, Inc.

3.875%, due 09/15/09 | | | 2,470,000 | | | | 2,471,632 | | |

Wells Fargo Bank N.A.

0.389%, due 08/19/091 | | | 4,000,000 | | | | 4,000,000 | | |

Westpac Banking Corp.

0.593%, due 08/14/091 | | | 2,000,000 | | | | 2,000,000 | | |

Total bank notes

(cost—$13,471,632) | | | | | | | 13,471,632 | | |

| Certificates of deposit—10.03% | |

| Banking-non-US—9.09% | |

Bank of Nova Scotia

0.430%, due 11/17/09 | | | 1,600,000 | | | | 1,597,936 | | |

| 1.100%, due 05/11/10 | | | 1,600,000 | | | | 1,600,000 | | |

BNP Paribas

0.500%, due 11/25/09 | | | 3,000,000 | | | | 3,000,000 | | |

Calyon N.A., Inc./New York

0.330%, due 11/02/09 | | | 5,000,000 | | | | 5,000,000 | | |

| 0.530%, due 12/18/09 | | | 2,000,000 | | | | 2,000,000 | | |

| Security description | | Face

amount | | Value | |

| Certificates of deposit—(concluded) | |

| Banking-non-US—(concluded) | |

Canadian Imperial Bank of

Commerce/Canada

0.250%, due 09/03/09 | | $ | 4,250,000 | | | $ | 4,250,000 | | |

Lloyds TSB Bank PLC

0.460%, due 10/19/09 | | | 5,700,000 | | | | 5,700,000 | | |

Natixis

0.650%, due 10/09/09 | | | 6,000,000 | | | | 6,000,000 | | |

Rabobank Nederland NV

0.520%, due 12/07/09 | | | 1,000,000 | | | | 1,000,000 | | |

Royal Bank of Canada

0.280%, due 08/24/09 | | | 5,000,000 | | | | 5,000,000 | | |

Societe Generale

0.500%, due 02/01/10 | | | 2,000,000 | | | | 2,000,000 | | |

Svenska Handelsbanken

0.350%, due 08/24/09 | | | 5,000,000 | | | | 5,000,000 | | |

Toronto-Dominion Bank

1.150%, due 08/20/09 | | | 5,000,000 | | | | 5,000,390 | | |

| 0.520%, due 01/25/10 | | | 1,000,000 | | | | 1,000,343 | | |

| | | | 48,148,669 | | |

| Banking-US—0.94% | |

Bank of America N.A.

0.400%, due 09/10/09 | | | 5,000,000 | | | | 5,000,000 | | |

Total certificates of deposit

(cost—$53,148,669) | | | | | | | 53,148,669 | | |

| Commercial paper2—39.68% | |

| Asset backed-banking—0.94% | |

Atlantis One Funding

0.400%, due 09/09/09 | | | 5,000,000 | | | | 4,997,833 | | |

| Asset backed-miscellaneous—18.65% | |

Amsterdam Funding Corp.

0.320%, due 08/10/09 | | | 5,000,000 | | | | 4,999,600 | | |

| 0.360%, due 09/18/09 | | | 5,000,000 | | | | 4,997,600 | | |

Barton Capital LLC

0.250%, due 08/07/09 | | | 2,876,000 | | | | 2,875,880 | | |

Chariot Funding LLC

0.250%, due 08/13/09 | | | 1,438,000 | | | | 1,437,880 | | |

| 0.230%, due 08/25/09 | | | 5,000,000 | | | | 4,999,234 | | |

Enterprise Funding Co. LLC

0.310%, due 10/05/09 | | | 5,000,000 | | | | 4,997,202 | | |

Kitty Hawk Funding Corp.

0.380%, due 09/18/09 | | | 7,541,000 | | | | 7,537,179 | | |

Market Street Funding LLC

0.350%, due 08/17/09 | | | 5,000,000 | | | | 4,999,222 | | |

Ranger Funding Co. LLC

0.400%, due 08/18/09 | | | 8,000,000 | | | | 7,998,489 | | |

| 0.300%, due 10/13/09 | | | 5,000,000 | | | | 4,996,958 | | |

Regency Markets No. 1 LLC

0.280%, due 08/20/09 | | | 5,000,000 | | | | 4,999,261 | | |

Sheffield Receivables Corp.

0.250%, due 08/25/09 | | | 5,000,000 | | | | 4,999,167 | | |

10

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

| Commercial paper2—(continued) | |

| Asset backed-miscellaneous—(concluded) | |

Thames Asset Global

Securitization No. 1

0.280%, due 08/07/09 | | $ | 10,000,000 | | | $ | 9,999,533 | | |

Variable Funding Capital Corp.

0.280%, due 09/09/09 | | | 4,000,000 | | | | 3,998,787 | | |

| 0.350%, due 09/28/09 | | | 10,000,000 | | | | 9,994,361 | | |

Windmill Funding Corp.

0.260%, due 08/10/09 | | | 5,000,000 | | | | 4,999,675 | | |

Yorktown Capital LLC

0.350%, due 10/09/09 | | | 5,000,000 | | | | 4,996,646 | | |

| 0.300%, due 10/13/09 | | | 5,000,000 | | | | 4,996,958 | | |

| | | | 98,823,632 | | |

| Asset backed-securities—1.89% | |

Clipper Receivables Co. LLC

0.170%, due 08/03/09 | | | 5,000,000 | | | | 4,999,953 | | |

| 0.300%, due 08/03/09 | | | 5,000,000 | | | | 4,999,917 | | |

| | | | 9,999,870 | | |

| Banking-non-US—1.51% | |

Dnb NOR ASA

1.000%, due 08/04/09 | | | 3,000,000 | | | | 2,999,750 | | |

Svenska Handelsbanken

0.540%, due 08/05/09 | | | 5,000,000 | | | | 4,999,700 | | |

| | | | 7,999,450 | | |

| Banking-US—13.39% | |

ANZ (Delaware), Inc.

0.500%, due 08/10/09 | | | 5,000,000 | | | | 4,999,375 | | |

Calyon N.A., Inc.

0.400%, due 09/01/09 | | | 5,000,000 | | | | 4,998,278 | | |

| 0.540%, due 01/19/10 | | | 2,000,000 | | | | 1,994,870 | | |

Danske Corp.

0.270%, due 08/03/09 | | | 3,000,000 | | | | 2,999,955 | | |

| 0.310%, due 08/17/09 | | | 5,000,000 | | | | 4,999,311 | | |

| 0.350%, due 10/09/09 | | | 5,000,000 | | | | 4,996,646 | | |

Deutsche Bank Financial LLC

0.300%, due 10/27/09 | | | 2,000,000 | | | | 1,998,550 | | |

Dexia Delaware LLC

0.290%, due 08/13/09 | | | 10,000,000 | | | | 9,999,034 | | |

ING (US) Funding LLC

0.250%, due 08/11/09 | | | 4,000,000 | | | | 3,999,722 | | |

| 0.400%, due 08/17/09 | | | 5,000,000 | | | | 4,999,111 | | |

| 0.400%, due 09/02/09 | | | 5,000,000 | | | | 4,998,222 | | |

Morgan (J.P.) Chase Funding, Inc.

0.310%, due 09/03/09 | | | 10,000,000 | | | | 9,997,158 | | |

Natexis Banques Populaires US

Finance Co. LLC

0.260%, due 08/31/09 | | | 5,000,000 | | | | 4,998,917 | | |

Societe Generale N.A., Inc.

0.600%, due 08/06/09 | | | 5,000,000 | | | | 4,999,583 | | |

| | | | 70,978,732 | | |

| Security description | | Face

amount | | Value | |

| Commercial paper2—(concluded) | |

| Brokerage—0.94% | |

RBS Holdings USA, Inc.

0.160%, due 08/03/09 | | $ | 5,000,000 | | | $ | 4,999,956 | | |

| Finance-captive automotive—0.57% | |

Toyota Motor Credit Corp.

0.280%, due 08/12/09 | | | 3,000,000 | | | | 2,999,743 | | |

| Food/beverage—0.28% | |

Nestle Capital Corp.

0.650%, due 02/16/10 | | | 1,500,000 | | | | 1,494,610 | | |

| Pharmaceuticals—1.51% | |

Pfizer, Inc.

0.230%, due 08/20/09 | | | 5,000,000 | | | | 4,999,393 | | |

| 0.320%, due 11/03/09 | | | 3,000,000 | | | | 2,997,493 | | |

| | | | 7,996,886 | | |

Total commercial paper

(cost—$210,290,712) | | | | | | | 210,290,712 | | |

| Short-term corporate obligations—3.17% | |

| Banking-non-US—1.32% | |

Lloyds TSB Group PLC

1.286%, due 08/07/091,4 | | | 5,000,000 | | | | 5,000,000 | | |

Nordea Bank AB

0.717%, due 09/24/091,4 | | | 2,000,000 | | | | 2,000,000 | | |

| | | | 7,000,000 | | |

| Banking-US—1.47% | |

HSBC Bank USA, Inc.

0.925%, due 10/14/091 | | | 4,000,000 | | | | 4,000,000 | | |

Wells Fargo & Co.

0.782%, due 09/23/091 | | | 3,800,000 | | | | 3,802,304 | | |

| | | | 7,802,304 | | |

| Finance-noncaptive consumer—0.38% | |

General Electric Capital Corp.

0.580%, due 10/20/091 | | | 2,000,000 | | | | 1,999,363 | | |

Total short-term

corporate obligations

(cost—$16,801,667) | | | | | | | 16,801,667 | | |

| Repurchase agreements—14.13% | |

Repurchase agreement dated

07/31/09 with Barclays Bank PLC,

0.180% due 08/03/09,

collateralized by $25,534,000

Federal Home Loan Bank

obligations, zero coupon

due 01/08/10;

(value—$25,500,806);

proceeds: $25,000,375 | | | 25,000,000 | | | | 25,000,000 | | |

11

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

| Repurchase agreements—(concluded) | |

Repurchase agreement dated

07/31/09 with Deutsche Bank

Securities, 0.190% due

08/03/09, collateralized by

$40,000,000 Federal Home Loan

Bank obligations, 3.000%

due 06/11/10, $6,631,000

Federal National Mortgage

Association obligations,

6.125% due 08/17/26 and

$6,603,000 Resolution Funding

Principal Strips, zero coupon

due 04/15/30;

(value—$49,980,300);

proceeds: $49,000,776 | | $ | 49,000,000 | | | $ | 49,000,000 | | |

Repurchase agreement dated

07/31/09 with State Street

Bank & Trust Co., 0.010%

due 08/03/09, collateralized

by $882,425 US Treasury Bills,

zero coupon due 08/27/09 to

09/10/09; (value—$882,336);

proceeds: $865,001 | | | 865,000 | | | | 865,000 | | |

Total repurchase agreements

(cost—$74,865,000) | | | | | 74,865,000 | | |

| Security description | | Number of

shares | | Value | |

| Investment of cash collateral from securities loaned—1.87% | |

| Money market fund—1.87% | |

UBS Private Money Market

Fund LLC5

(cost—$9,894,000) | | | 9,894,000 | | | $ | 9,894,000 | | |

Total investments

(cost—$545,431,205 which

approximates cost for federal

income tax purposes)—

102.92% | | | | | 545,431,205 | | |

Liabilities in excess of other

assets—(2.92)% | | | | | (15,472,696 | ) | |

Net assets (applicable to

529,948,181 shares of

beneficial interest outstanding

equivalent to $1.00 per share)—

100.00% | | $ | 529,958,509 | | |

* On September 7, 2008, the Federal Housing Finance Agency placed the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation into conservatorship, and the US Treasury guaranteed the debt issued by those organizations.

1 Variable rate security. The maturity dates reflect earlier of reset dates or stated maturity dates. The interest rates shown are the current rates as of July 31, 2009, and reset periodically.

2 Rates shown are the discount rates at date of purchase.

3 Security, or portion thereof, was on loan at July 31, 2009.

4 Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities, which represent 1.32% of net assets as of July 31, 2009, are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers.

5 The table below details the Portfolio's transaction activity in an affiliated issuer during the year ended July 31, 2009.

| Security description | | Value at

07/31/08 | | Purchases

during the

year ended

07/31/09 | | Sales

during the

year ended

07/31/09 | | Value at

07/31/09 | | Net income

earned from

affiliate for the

year ended

07/31/09 | |

| UBS Private Money Market Fund LLC | | $ | 0 | | | $ | 151,079,000 | | | $ | 141,185,000 | | | $ | 9,894,000 | | | $ | 5,504 | | |

12

UBS PACE Select Advisors Trust

UBS PACE Money Market Investments

Portfolio of investments—July 31, 2009

The following is a summary of the fair valuations according to the inputs used as of July 31, 2009 in valuing the Portfolio's investments:

| Measurements at 07/31/09 | |

| | | Quoted prices in

active markets for

identical investments

(Level 1) | | Significant other

observable inputs

(Level 2) | | Unobservable

inputs

(Level 3) | | Total | |

| US government and agency obligations | | $ | — | | | $ | 166,959,525 | | | $ | — | | | $ | 166,959,525 | | |

| Bank notes | | | — | | | | 13,471,632 | | | | — | | | | 13,471,632 | | |

| Certificates of deposit | | | — | | | | 53,148,669 | | | | — | | | | 53,148,669 | | |

| Commercial paper | | | — | | | | 210,290,712 | | | | — | | | | 210,290,712 | | |

| Short-term corporate obligations | | | — | | | | 16,801,667 | | | | — | | | | 16,801,667 | | |

| Repurchase agreements | | | — | | | | 74,865,000 | | | | — | | | | 74,865,000 | | |

Investment of cash collateral from

securities loaned | | | — | | | | 9,894,000 | | | | — | | | | 9,894,000 | | |

| Total | | $ | — | | | $ | 545,431,205 | | | $ | — | | | $ | 545,431,205 | | |

Issuer breakdown by country of origin (unaudited)

| | | Percentage of

total investments | |

| United States | | | 86.7 | % | |

| Canada | | | 3.4 | | |

| France | | | 3.3 | | |

| United Kingdom | | | 2.9 | | |

| Sweden | | | 2.2 | | |

| Norway | | | 0.5 | | |

| Japan | | | 0.5 | | |

| Switzerland | | | 0.3 | | |

| Netherlands | | | 0.2 | | |

| Total | | | 100.0 | % | |

Weighted average maturity—45 days

See accompanying notes to financial statements.

13

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Performance

For the 12 months ended July 31, 2009, the Portfolio's Class P shares returned 9.27% (before the deduction of the maximum UBS PACE Select program fee; after the deduction of the maximum UBS PACE Select program fee, the Portfolio returned 7.65%). In comparison, the Barclays Capital US Mortgage-Backed Securities Index (formerly known as the Lehman Brothers Mortgage-Backed Securities Index) (the "benchmark") returned 10.43%, and the Lipper US Mortgage Funds category posted a median return of 7.58%. (Returns for all share classes over various time periods are shown in the "Performance at a glance" table on page 17. Please note that the returns shown do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.) For a detailed commentary on the market environment in general during the reporting period, please refer to page two.

Sub-Advisor's comments

The Portfolio underperformed its benchmark during the reporting period in a difficult market environment. During the first half of the reporting period, a shorter-than-benchmark duration hurt relative performance, as did a longer-than-benchmark duration in the second half of the reporting period, as 10-year Treasury yields rose to an eight-month high. (Duration measures a portfolio's sensitivity to interest rate changes. A longer duration means that changes in market interest rates are likely to have a larger effect on the value of assets in the Portfolio.)

Positioning the Portfolio to benefit from a steepening yield curve helped performance, on both an absolute and a relative basis. (The yield curve plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. A "steepening yield curve" is one in which long-term bond yields increase relative to those of short-term bonds.) Our focus on securities with shorter maturities added to returns as investors flocked to these securities, following concerns that increases in the money supply could lead to inflation over the longer term.

An overweight to agency-guaranteed, AAA-rated mortgage-backed securities ("MBS") helped

UBS PACE Select Advisors Trust – UBS PACE Government Securities Fixed Income Investments

Investment Sub-Advisor:

Pacific Investment Management Company LLC ("PIMCO")

Portfolio Manager:

W. Scott Simon

Objective:

Current income

Investment process:

The Portfolio invests primarily in government fixed income securities which include US bonds, including those backed by mortgages, and related repurchase agreements. Mortgage-backed securities include "to be announced" or "TBA" securities which usually are traded on a forward commitment basis with an approximate principal amount and no defined maturity date issued or guaranteed by US government agencies and instrumentalities. The Portfolio also invests, to a lesser extent, in investment grade bonds of private issuers, including those backed by mortgages or other assets. The Portfolio may invest in bonds of varying maturities, but normally limits its duration to within two years (plus or minus) of the effective duration of the Portfolio's benchmark index. (Duration is a measure of a portfolio's sensitivity to interest rate changes.) PIMCO establishes duration targets based on its expectations for changes in interest rates, and th en positions the Portfolio to take advantage of yield curve shifts. PIMCO decides to buy and sell specific bonds based on an analysis of their values relative to other similar securities.

14

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Sub-Advisor's comments – concluded

performance during the reporting period.1 During this time, MBS outperformed Treasuries, and posted their eighth consecutive month of relative outperformance in July. The Federal Reserve introduced its MBS Purchase Program to provide support to mortgage and housing markets and to foster improved conditions in financial markets. The program has compressed MBS spreads—that is, the difference between the yields paid on these securities versus those paid on Treasuries—to narrower levels.

The Portfolio's exposure to nonagency mortgages detracted from relative performance during the second half of 2008, as a flight to quality amidst financial volatility drove prices down. While the prices of adjustable-rate mortgage-backed securities recovered somewhat in December, the sector detracted from the Portfolio's performance overall. In addition, the Portfolio's exposure to commercial MBS detracted from returns during the second half of 2008, as credit spreads widened during that time.

1 AAA is the highest rating assigned by Standard & Poor's Ratings Group to a debt obligation and indicates an extremely strong capacity to pay principal and interest.

Special considerations

The Portfolio may be appropriate for long-term investors seeking current income who are able to withstand short-term fluctuations in the fixed income markets in return for potentially higher returns over the long term. The yield and value of the Portfolio change every day and can be affected by changes in interest rates, general market conditions and other political, social and economic developments, as well as specific matters relating to the issuers in which the Portfolio invests. It is important to note that an investment in the Portfolio is only one component of a balanced investment plan.

15

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

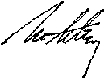

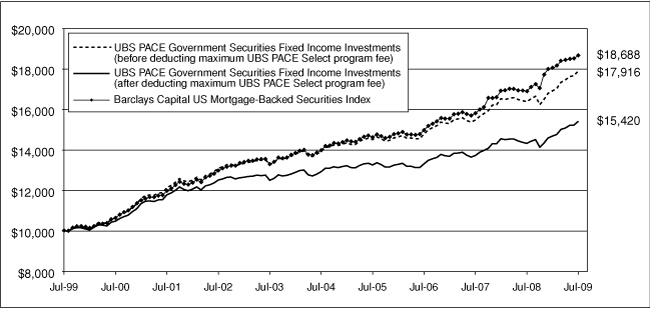

Comparison of change in value of a $10,000 investment in the Class P shares of the Portfolio and the Barclays Capital US Mortgage-Backed Securities Index (unaudited)

The graph depicts the performance of UBS PACE Government Securities Fixed Income Investments Class P shares versus the Barclays Capital US Mortgage-Backed Securities Index (formerly known as the Lehman Brothers Mortgage-Backed Securities Index) over the 10 years ended July 31, 2009. The performance of the other classes will vary from the performance of the class shown based on the difference in sales charges and fees paid by shareholders investing in different share classes. Past performance does not predict future performance and the performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. It is important to note that UBS PACE Government Securities Fixed Income Investments is a professiona lly managed portfolio while the Index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

16

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Performance at a glance (unaudited)

| Average annual total returns for periods ended 07/31/09 | | 1 year | | 5 years | | 10 years | | Since

inception1 | |

| Before deducting | | Class A2 | | | 9.09 | % | | | 4.92 | % | | N/A | | | 5.00 | % | |

| maximum sales charge | | Class B3 | | | 8.16 | % | | | 4.11 | % | | N/A | | | 4.69 | % | |

| or UBS PACE Select | | Class C4 | | | 8.45 | % | | | 4.37 | % | | N/A | | | 4.82 | % | |

| program fee | | Class Y5 | | | 9.29 | % | | | 5.22 | % | | N/A | | | 5.32 | % | |

| | | Class P6 | | | 9.27 | % | | | 5.15 | % | | | 6.00 | % | | | 6.03 | % | |

| After deducting | | Class A2 | | | 4.15 | % | | | 3.96 | % | | N/A | | | 4.43 | % | |

| maximum sales charge | | Class B3 | | | 3.16 | % | | | 3.77 | % | | N/A | | | 4.69 | % | |

| or UBS PACE Select | | Class C4 | | | 7.70 | % | | | 4.37 | % | | N/A | | | 4.82 | % | |

| program fee | | Class P6 | | | 7.65 | % | | | 3.58 | % | | | 4.43 | % | | | 4.45 | % | |

| Barclays Capital US Mortgage-Backed Securities Index7 | | | 10.43 | % | | | 5.97 | % | | | 6.45 | % | | | 6.49 | % | |

| Lipper US Mortgage Funds median8 | | | 7.58 | % | | | 3.98 | % | | | 4.90 | % | | | 4.91 | % | |

| Lipper Intermediate US Government Funds median8 | | | 6.88 | % | | | 4.43 | % | | | 5.41 | % | | | 5.41 | % | |

Average annual total returns for periods ended June 30, 2009, after deduction of the maximum sales charge or UBS PACE Select program fee, were as follows: Class A—1-year period, 2.44%; 5-year period, 3.88%; since inception, 4.32%; Class B—1-year period, 1.44%; 5-year period, 3.70%; since inception, 4.58%; Class C—1-year period, 5.97%; 5-year period, 4.32%; since inception, 4.72%; Class Y—1-year period, 7.46%; 5-year period, 5.16%; since inception, 5.21%; Class P—1-year period, 5.93%; 5-year period, 3.53%; 10-year period, 4.22%; since inception, 4.39%.

The annualized gross and net expense ratios, respectively, for each class of shares as in the November 28, 2008 prospectuses, were as follows: Class A—1.07% and 1.02%; Class B—1.84% and 1.77%; Class C—1.63% and 1.52%; Class Y—0.85% and 0.77%; and Class P—0.85% and 0.77%. Net expenses reflect fee waivers and/or expense reimbursements, if any, pursuant to an agreement that is in effect to cap the expenses. The Portfolio and UBS Global AM have entered into a written fee waiver agreement pursuant to which UBS Global AM is contractually obligated to waive its management fees through November 30, 2009 to the extent necessary to reflect the lower sub-advisory fee paid by UBS Global AM to PIMCO. The Portfolio and UBS Global AM have also entered into an additional written fee waiver/expense reimbursement agreement pursuant to which UBS Global AM is contractually obligated to waive its management fees and/or reimb urse the Portfolio so that the Portfolio's ordinary total operating expenses of each class through November 30, 2009 (excluding dividend expense, borrowing costs and interest expense, if any) would not exceed Class A—1.02%; Class B—1.77%; Class C—1.52%; Class Y—0.77% and Class P—0.77%. The Portfolio has agreed to repay UBS Global AM for any waived fees/reimbursed expenses under the preceding sentence to the extent that it can do so over the following three fiscal years without causing the Portfolio's expenses in any of those three years to exceed the expense caps described above.

1 Since inception returns are calculated as of commencement of issuance or reissuance on August 24, 1995 for Class P shares, January 31, 2001 for Class A shares, December 18, 2000 for Class B shares, December 4, 2000 for Class C shares and February 2, 2001 for Class Y shares. Since inception returns for the Index and Lipper median are shown as of August 31, 1995, which is the month-end after the inception date of the oldest share class (Class P).

2 Maximum sales charge for Class A shares is 4.5%. Class A shares bear ongoing 12b-1 service fees.

3 Maximum contingent deferred sales charge for Class B shares is 5% imposed on redemptions and is reduced to 0% after a maximum of six years. Class B shares bear ongoing 12b-1 service and distribution fees.

4 Maximum contingent deferred sales charge for Class C shares is 0.75% imposed on redemptions and is reduced to 0% after one year. Class C shares bear ongoing 12b-1 service and distribution fees.

5 The Portfolio offers Class Y shares to a limited group of eligible investors, including certain qualifying retirement plans. Class Y shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees.

6 Class P shares do not bear initial or contingent deferred sales charges or ongoing 12b-1 service and distribution fees, but are subject to a maximum annual UBS PACE Select program fee of 1.5% of the value of Class P shares.

7 The Barclays Capital US Mortgage-Backed Securities Index (formerly known as the Lehman Brothers Mortgage-Backed Securities Index) covers fixed rate securitized issues backed by the mortgage pools of the Government National Mortgage Association, the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association. Graduated Payment Mortgages and Graduated Equity Mortgages are excluded. The average-weighted life is approximately eight years. Investors should note that indices do not reflect the deduction of fees, expenses or taxes.

8 On February 9, 2009, Lipper changed the peer group classification for UBS PACE Government Securities Fixed Income Investments from Lipper Intermediate US Government Funds category to the Lipper US Mortgage Funds category.

If an investor sells or exchanges shares less than 90 days after purchase, a redemption fee of 1.00% of the amount sold or exchanged will be deducted at the time of the transaction, except as noted otherwise in the prospectuses.

Past performance does not predict future performance, and the performance information provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. The return and principal value of an investment will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance results assume reinvestment of all dividends and capital gain distributions at net asset value on the ex-dividend dates. Current performance may be higher or lower than the performance data quoted. For month-end performance figures, please visit http://www.ubs.com.

Lipper peer group data calculated by Lipper Inc.; used with permission. The Lipper median is the return of the fund that places in the middle of a Lipper peer group.

17

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio statistics (unaudited)

| Characteristics | | 07/31/09 | |

| Weighted average duration | | | 2.5 | yrs. | |

| Weighted average maturity | | | 2.9 | yrs. | |

| Average coupon | | | 4.42 | % | |

| Average quality1 | | | AAA | | |

| Net assets (mm) | | $ | 576.3 | | |

| Number of holdings | | | 450 | | |

| Portfolio composition2 | | 07/31/09 | |

| Bonds | | | 130.4 | % | |

| Options, futures and swaps | | | (0.2 | ) | |

| Investments sold short | | | (20.1 | ) | |

| Cash equivalents and other assets less liabilities | | | (10.1 | ) | |

| Total | | | 100.0 | % | |

| Asset allocation2 | | 07/31/09 | |

| US government agency mortgage pass-through certificates | | | 110.6 | % | |

| Collateralized mortgage obligations | | | 14.2 | | |

| Asset-backed securities | | | 5.2 | | |

| Corporate notes | | | 0.3 | | |

| Stripped mortgage-backed securities | | | 0.1 | | |

| Options, futures and swaps | | | (0.2 | ) | |

| Investments sold short | | | (20.1 | ) | |

| Cash equivalents and other assets less liabilities | | | (10.1 | ) | |

| Total | | | 100.0 | % | |

1 Credit quality ratings shown are based on the ratings assigned to portfolio holdings by Standard & Poor's Ratings Group, an independent rating agency.

2 Weightings represent percentages of the Portfolio's net assets as of July 31, 2009. The Portfolio is actively managed and its composition will vary over time.

18

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

| Government national mortgage association certificates—13.73% | |

GNMA

4.500%, due 05/15/39 | | $ | 6,999,303 | | | $ | 7,063,581 | | |

| 6.000%, due 10/15/31 | | | 5,737 | | | | 6,085 | | |

| 6.000%, due 03/15/34 | | | 6,910 | | | | 7,300 | | |

| 6.000%, due 08/15/34 | | | 10,687 | | | | 11,289 | | |

| 6.000%, due 02/15/36 | | | 14,720 | | | | 15,487 | | |

| 6.000%, due 04/15/36 | | | 12,735 | | | | 13,398 | | |

| 6.000%, due 07/15/36 | | | 200,488 | | | | 210,934 | | |

| 6.000%, due 07/15/37 | | | 3,943,491 | | | | 4,146,488 | | |

| 6.000%, due 11/15/37 | | | 1,301,803 | | | | 1,368,816 | | |

| 6.000%, due 03/15/38 | | | 481,963 | | | | 506,697 | | |

| 6.000%, due 05/15/38 | | | 3,974,354 | | | | 4,178,431 | | |

| 6.000%, due 07/15/38 | | | 354,047 | | | | 372,322 | | |

| 6.000%, due 08/15/38 | | | 2,100,505 | | | | 2,208,304 | | |

| 6.000%, due 09/15/38 | | | 2,732,174 | | | | 2,872,391 | | |

| 6.000%, due 10/15/38 | | | 1,620,259 | | | | 1,703,411 | | |

| 6.000%, due 11/15/38 | | | 434,725 | | | | 457,035 | | |

| 6.000%, due 02/15/39 | | | 470,402 | | | | 494,544 | | |

| 6.500%, due 01/15/36 | | | 48,210 | | | | 51,398 | | |

| 6.500%, due 09/15/36 | | | 1,335,481 | | | | 1,423,809 | | |

| 6.500%, due 02/15/37 | | | 70,057 | | | | 74,657 | | |

| 6.500%, due 01/15/38 | | | 53,327 | | | | 56,804 | | |

| 6.500%, due 06/15/38 | | | 183,005 | | | | 194,938 | | |

| 6.500%, due 07/15/38 | | | 829,233 | | | | 883,523 | | |

| 6.500%, due 11/15/38 | | | 49,753 | | | | 52,997 | | |

| 7.500%, due 08/15/21 | | | 7,013 | | | | 7,788 | | |

| 7.500%, due 09/15/23 | | | 1,030 | | | | 1,147 | | |

| 8.000%, due 02/15/23 | | | 1,879 | | | | 2,120 | | |

| 8.250%, due 04/15/19 | | | 491,723 | | | | 544,133 | | |

| 10.500%, due 02/15/19 | | | 31,637 | | | | 35,501 | | |

| 10.500%, due 06/15/19 | | | 38,389 | | | | 43,078 | | |

| 10.500%, due 07/15/19 | | | 78,574 | | | | 88,171 | | |

| 10.500%, due 07/15/20 | | | 3,903 | | | | 4,302 | | |

| 10.500%, due 08/15/20 | | | 37,626 | | | | 42,211 | | |

| 10.500%, due 09/15/20 | | | 3,699 | | | | 4,150 | | |

| 11.500%, due 05/15/19 | | | 3,546 | | | | 4,032 | | |

GNMA II

9.000%, due 04/20/25 | | | 28,923 | | | | 33,159 | | |

| 9.000%, due 12/20/26 | | | 8,043 | | | | 9,208 | | |

| 9.000%, due 01/20/27 | | | 13,248 | | | | 15,151 | | |

| 9.000%, due 06/20/30 | | | 1,681 | | | | 1,935 | | |

| 9.000%, due 09/20/30 | | | 1,332 | | | | 1,533 | | |

| 9.000%, due 10/20/30 | | | 8,736 | | | | 10,055 | | |

| 9.000%, due 11/20/30 | | | 29,772 | | | | 34,267 | | |

GNMA II ARM

4.125%, due 11/20/21 | | | 35,957 | | | | 36,728 | | |

| 4.125%, due 11/20/22 | | | 71,900 | | | | 72,883 | | |

| 4.125%, due 12/20/24 | | | 1,248 | | | | 1,267 | | |

| 4.125%, due 10/20/25 | | | 37,457 | | | | 37,956 | | |

| 4.125%, due 12/20/25 | | | 8,075 | | | | 8,179 | | |

| 4.125%, due 10/20/26 | | | 25,207 | | | | 25,598 | | |

| 4.125%, due 12/20/26 | | | 34,134 | | | | 34,653 | | |

| Security description | | Face

amount | | Value | |

| Government national mortgage association certificates—(concluded) | |

| 4.125%, due 11/20/27 | | $ | 102,657 | | | $ | 103,887 | | |

| 4.125%, due 12/20/27 | | | 11,938 | | | | 12,122 | | |

| 4.125%, due 10/20/29 | | | 17,917 | | | | 18,193 | | |

| 4.125%, due 10/20/30 | | | 40,905 | | | | 41,877 | | |

| 4.250%, due 02/20/28 | | | 5,153 | | | | 5,226 | | |

| 4.375%, due 01/20/23 | | | 140,257 | | | | 142,609 | | |

| 4.375%, due 03/20/23 | | | 68,992 | | | | 70,219 | | |

| 4.375%, due 01/20/24 | | | 181,686 | | | | 184,879 | | |

| 4.375%, due 01/20/25 | | | 16,656 | | | | 16,982 | | |

| 4.375%, due 02/20/25 | | | 41,389 | | | | 42,122 | | |

| 4.375%, due 03/20/25 | | | 61,662 | | | | 63,163 | | |

| 4.375%, due 03/20/26 | | | 31,536 | | | | 32,077 | | |

| 4.375%, due 01/20/27 | | | 213,266 | | | | 216,603 | | |

| 4.375%, due 02/20/27 | | | 22,717 | | | | 23,155 | | |

| 4.375%, due 01/20/28 | | | 24,581 | | | | 25,005 | | |

| 4.375%, due 02/20/28 | | | 13,636 | | | | 13,870 | | |

| 4.500%, due 01/20/18 | | | 204,907 | | | | 209,616 | | |

| 4.500%, due 03/20/25 | | | 29,872 | | | | 30,817 | | |

| 4.625%, due 07/20/17 | | | 13,764 | | | | 14,079 | | |

| 4.625%, due 09/20/21 | | | 196,458 | | | | 201,011 | | |

| 4.625%, due 08/20/25 | | | 45,395 | | | | 46,466 | | |

| 4.625%, due 09/20/25 | | | 54,927 | | | | 56,214 | | |

| 4.625%, due 08/20/26 | | | 57,531 | | | | 58,902 | | |

| 4.625%, due 09/20/26 | | | 8,936 | | | | 9,167 | | |

| 4.625%, due 07/20/27 | | | 22,560 | | | | 23,094 | | |

| 4.625%, due 08/20/27 | | | 53,789 | | | | 55,183 | | |

| 4.625%, due 07/20/30 | | | 300,146 | | | | 308,269 | | |

| 4.625%, due 08/20/30 | | | 222,633 | | | | 228,558 | | |

| 5.375%, due 04/20/18 | | | 17,874 | | | | 18,463 | | |

| 5.375%, due 05/20/21 | | | 8,199 | | | | 8,509 | | |

| 5.375%, due 06/20/22 | | | 180,883 | | | | 186,102 | | |

| 5.375%, due 04/20/24 | | | 209,444 | | | | 215,561 | | |

| 5.375%, due 05/20/25 | | | 143,261 | | | | 147,756 | | |

| 5.375%, due 06/20/25 | | | 37,548 | | | | 39,105 | | |

| 5.375%, due 04/20/26 | | | 296,136 | | | | 304,437 | | |

| 5.375%, due 06/20/26 | | | 138,766 | | | | 142,718 | | |

| 5.375%, due 04/20/27 | | | 79,722 | | | | 82,019 | | |

| 5.375%, due 04/20/30 | | | 57,896 | | | | 59,637 | | |

| 5.375%, due 05/20/30 | | | 1,181,857 | | | | 1,218,215 | | |

| 5.500%, due 05/20/18 | | | 7,985 | | | | 8,233 | | |

| 5.500%, due 06/20/19 | | | 52,356 | | | | 54,481 | | |

| 5.500%, due 06/20/30 | | | 25,564 | | | | 26,421 | | |

GNMA TBA

4.000%, TBA | | | 15,000,000 | | | | 14,692,968 | | |

| 4.500%, TBA | | | 1,000,000 | | | | 1,007,188 | | |

| 5.000%, TBA | | | 20,000,000 | | | | 20,531,240 | | |

| 5.500%, TBA | | | 7,700,000 | | | | 7,981,527 | | |

| 6.000%, TBA | | | 600,000 | | | | 629,813 | | |

Total government national

mortgage association

certificates

(cost—$77,375,525) | | | | | | | 79 | ,081,602 | |

19

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

| Federal home loan mortgage corporation certificates*—33.64% | |

FHLMC

4.000%, due 06/01/391 | | $ | 7,999,999 | | | $ | 7,838,871 | | |

| 4.000%, due 07/01/391 | | | 8,000,000 | | | | 7,838,872 | | |

| 5.000%, due 11/01/36 | | | 11,957,208 | | | | 12,272,591 | | |

| 5.500%, due 02/01/33 | | | 2,282,960 | | | | 2,376,809 | | |

| 5.500%, due 12/01/33 | | | 623,778 | | | | 649,421 | | |

| 5.500%, due 12/01/34 | | | 697,877 | | | | 726,130 | | |

| 5.500%, due 06/01/36 | | | 6,928,214 | | | | 7,204,365 | | |

| 5.500%, due 12/01/36 | | | 2,798,852 | | | | 2,903,414 | | |

| 5.500%, due 03/01/37 | | | 1,461,585 | | | | 1,515,503 | | |

| 5.500%, due 07/01/37 | | | 2,134,726 | | | | 2,213,477 | | |

| 5.500%, due 12/01/37 | | | 3,384,289 | | | | 3,509,135 | | |

| 5.500%, due 02/01/38 | | | 12,104,158 | | | | 12,550,683 | | |

| 5.500%, due 08/01/38 | | | 4,515,379 | | | | 4,681,698 | | |

| 5.500%, due 12/01/38 | | | 2,613,845 | | | | 2,710,123 | | |

| 6.000%, due 07/01/37 | | | 562,564 | | | | 590,174 | | |

| 6.000%, due 07/01/38 | | | 357,359 | | | | 374,877 | | |

| 6.000%, due 09/01/38 | | | 8,016,389 | | | | 8,409,363 | | |

| 6.000%, due 10/01/38 | | | 9,465,609 | | | | 9,929,626 | | |

| 6.000%, due 12/01/38 | | | 8,300,388 | | | | 8,707,285 | | |

| 6.000%, due 02/01/39 | | | 3,137,138 | | | | 3,290,925 | | |

| 6.000%, due 03/01/39 | | | 4,860,159 | | | | 5,098,411 | | |

| 7.000%, due 08/01/25 | | | 1,693 | | | | 1,869 | | |

| 7.500%, due 10/01/17 | | | 3,365 | | | | 3,759 | | |

| 8.000%, due 03/01/13 | | | 57,719 | | | | 64,490 | | |

| 9.000%, due 02/01/10 | | | 112 | | | | 117 | | |

| 9.000%, due 04/01/25 | | | 39,659 | | | | 40,305 | | |

| 9.750%, due 11/01/16 | | | 11,203 | | | | 11,395 | | |

| 10.500%, due 11/01/20 | | | 3,256 | | | | 3,281 | | |

| 11.000%, due 05/01/11 | | | 2,940 | | | | 3,121 | | |

| 11.000%, due 03/01/13 | | | 516 | | | | 546 | | |

| 11.000%, due 07/01/15 | | | 135 | | | | 137 | | |

| 11.000%, due 09/01/15 | | | 1,899 | | | | 2,150 | | |

| 11.000%, due 10/01/15 | | | 512 | | | | 556 | | |

| 11.000%, due 12/01/15 | | | 7,838 | | | | 8,700 | | |

| 11.000%, due 04/01/19 | | | 5,098 | | | | 5,905 | | |

| 11.000%, due 06/01/19 | | | 451 | | | | 522 | | |

| 11.000%, due 08/01/20 | | | 55 | | | | 64 | | |

| 11.000%, due 09/01/20 | | | 2,315 | | | | 2,660 | | |

| 11.500%, due 05/01/10 | | | 1,715 | | | | 1,774 | | |

| 11.500%, due 11/01/10 | | | 4,028 | | | | 4,229 | | |

| 11.500%, due 09/01/14 | | | 533 | | | | 554 | | |

| 11.500%, due 01/01/16 | | | 2,959 | | | | 3,424 | | |

| 11.500%, due 01/01/18 | | | 9,890 | | | | 11,445 | | |

| 11.500%, due 05/01/19 | | | 5,012 | | | | 5,441 | | |

| 11.500%, due 06/01/19 | | | 20,971 | | | | 24,658 | | |

FHLMC ARM

3.575%, due 07/01/28 | | | 272,172 | | | | 274,206 | | |

| 3.988%, due 11/01/29 | | | 721,247 | | | | 734,746 | | |

| 4.044%, due 11/01/27 | | | 193,496 | | | | 195,298 | | |

| 4.055%, due 04/01/29 | | | 369,955 | | | | 377,969 | | |

| 4.060%, due 06/01/28 | | | 590,845 | | | | 603,316 | | |

| 4.082%, due 11/01/25 | | | 438,820 | | | | 444,311 | | |

| 4.102%, due 12/01/29 | | | 166,923 | | | | 169,086 | | |

| Security description | | Face

amount | | Value | |

| Federal home loan mortgage corporation certificates*—(concluded) | |

| 4.114%, due 01/01/29 | | $ | 321,235 | | | $ | 325,405 | | |

| 4.240%, due 07/01/24 | | | 376,637 | | | | 381,984 | | |

| 4.319%, due 10/01/23 | | | 197,174 | | | | 201,003 | | |

| 4.345%, due 01/01/28 | | | 106,582 | | | | 108,302 | | |

| 4.361%, due 10/01/27 | | | 453,508 | | | | 464,601 | | |

| 4.767%, due 10/01/27 | | | 489,080 | | | | 499,592 | | |

| 5.091%, due 10/01/29 | | | 19,763 | | | | 20,050 | | |

| 5.375%, due 01/01/30 | | | 39,220 | | | | 39,674 | | |

FHLMC TBA

5.000%, TBA | | | 29,900,000 | | | | 30,572,750 | | |

| 5.500%, TBA | | | 47,000,000 | | | | 48,674,375 | | |

| 6.000%, TBA | | | 4,000,000 | | | | 4,191,248 | | |

Total federal home loan mortgage

corporation certificates

(cost—$191,403,060) | | | | | | | 193,870,771 | | |

Federal housing administration

certificates—0.25% | |

FHA GMAC

7.400%, due 02/01/21 | | | 538,014 | | | | 527,254 | | |

| 7.480%, due 04/01/19 | | | 14,808 | | | | 14,808 | | |

FHA Reilly

6.896%, due 07/01/20 | | | 910,384 | | | | 892,176 | | |

Total federal housing

administration certificates

(cost—$1,466,549) | | | | | | | 1,434,238 | | |

| Federal national mortgage association certificates*—62.93% | |

FNMA

4.000%, due 05/01/241 | | | 2,982,327 | | | | 3,014,353 | | |

| 4.000%, due 06/01/241 | | | 12,904,372 | | | | 13,042,948 | | |

| 4.000%, due 07/01/241 | | | 4,039,958 | | | | 4,083,341 | | |

| 4.500%, due 11/01/20 | | | 758,920 | | | | 787,229 | | |

| 4.500%, due 04/01/21 | | | 13,055 | | | | 13,423 | | |

| 4.500%, due 12/01/21 | | | 24,407 | | | | 25,096 | | |

| 4.500%, due 07/01/22 | | | 287,298 | | | | 295,350 | | |

| 4.500%, due 11/01/22 | | | 87,611 | | | | 90,878 | | |

| 4.500%, due 01/01/23 | | | 139,596 | | | | 143,508 | | |

| 4.500%, due 02/01/23 | | | 50,184 | | | | 51,591 | | |

| 4.500%, due 03/01/23 | | | 2,444,979 | | | | 2,510,841 | | |

| 4.500%, due 04/01/23 | | | 802,297 | | | | 824,783 | | |

| 4.500%, due 05/01/23 | | | 1,409,520 | | | | 1,449,023 | | |

| 4.500%, due 07/01/23 | | | 334,934 | | | | 344,321 | | |

| 4.500%, due 08/01/23 | | | 22,334 | | | | 22,960 | | |

| 4.500%, due 11/01/23 | | | 198,524 | | | | 204,088 | | |

| 4.500%, due 01/01/24 | | | 325,338 | | | | 334,424 | | |

| 4.500%, due 02/01/24 | | | 639,146 | | | | 657,001 | | |

| 4.500%, due 03/01/24 | | | 3,758,444 | | | | 3,863,402 | | |

| 4.500%, due 05/01/24 | | | 1,103,806 | | | | 1,134,632 | | |

| 4.500%, due 06/01/24 | | | 83,903 | | | | 86,246 | | |

| 4.500%, due 07/01/391 | | | 6,999,997 | | | | 7,046,946 | | |

| 5.000%, due 04/01/211 | | | 819,114 | | | | 855,043 | | |

20

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

| Federal national mortgage association certificates*—(continued) | |

| 5.000%, due 05/01/211 | | $ | 1,814,088 | | | $ | 1,893,660 | | |

| 5.000%, due 11/01/211 | | | 718,488 | | | | 750,003 | | |

| 5.000%, due 12/01/211 | | | 214,028 | | | | 223,416 | | |

| 5.000%, due 01/01/221 | | | 114,335 | | | | 119,211 | | |

| 5.000%, due 02/01/221 | | | 726,171 | | | | 755,527 | | |

| 5.000%, due 03/01/221 | | | 27,760 | | | | 28,883 | | |

| 5.000%, due 05/01/221 | | | 1,115,998 | | | | 1,161,295 | | |

| 5.000%, due 06/01/221 | | | 19,841 | | | | 20,643 | | |

| 5.000%, due 07/01/221 | | | 395,838 | | | | 411,840 | | |

| 5.000%, due 11/01/221 | | | 144,438 | | | | 150,277 | | |

| 5.000%, due 12/01/221 | | | 121,687 | | | | 126,606 | | |

| 5.000%, due 01/01/231 | | | 1,556,196 | | | | 1,618,943 | | |

| 5.000%, due 01/01/23 | | | 27,561 | | | | 28,676 | | |

| 5.000%, due 02/01/231 | | | 1,632,892 | | | | 1,698,046 | | |

| 5.000%, due 03/01/231 | | | 549,565 | | | | 571,577 | | |

| 5.000%, due 06/01/231 | | | 863,455 | | | | 897,908 | | |

| 5.000%, due 09/01/231 | | | 1,800,583 | | | | 1,873,373 | | |

| 5.000%, due 02/01/241 | | | 3,382,641 | | | | 3,519,388 | | |

| 5.000%, due 12/01/331 | | | 6,592,983 | | | | 6,786,865 | | |

| 5.000%, due 06/01/351 | | | 78,896,359 | | | | 81,038,967 | | |

| 5.000%, due 05/01/371 | | | 1,000,000 | | | | 1,024,501 | | |

| 5.000%, due 03/01/381 | | | 16,631,551 | | | | 17,038,105 | | |

| 5.000%, due 04/01/381 | | | 1,224,641 | | | | 1,254,578 | | |

| 5.000%, due 07/01/381 | | | 1,896,260 | | | | 1,942,614 | | |

| 5.000%, due 11/01/381 | | | 747,000 | | | | 765,261 | | |

| 5.500%, due 05/01/141 | | | 2,763 | | | | 2,918 | | |

| 5.500%, due 06/01/171 | | | 120,903 | | | | 123,820 | | |

| 5.500%, due 01/01/181 | | | 9,943 | | | | 10,519 | | |

| 5.500%, due 11/01/181 | | | 362,200 | | | | 383,184 | | |

| 5.500%, due 07/01/191 | | | 71,479 | | | | 75,397 | | |

| 5.500%, due 06/01/201 | | | 73,746 | | | | 77,604 | | |

| 5.500%, due 07/01/201 | | | 55,376 | | | | 58,273 | | |

| 5.500%, due 10/01/201 | | | 63,765 | | | | 67,100 | | |

| 5.500%, due 12/01/201 | | | 521,874 | | | | 549,174 | | |

| 5.500%, due 01/01/211 | | | 127,378 | | | | 133,719 | | |

| 5.500%, due 02/01/211 | | | 270,271 | | | | 283,648 | | |

| 5.500%, due 03/01/211 | | | 941,663 | | | | 988,273 | | |

| 5.500%, due 04/01/211 | | | 574,394 | | | | 602,826 | | |

| 5.500%, due 05/01/211 | | | 235,013 | | | | 246,644 | | |

| 5.500%, due 06/01/211 | | | 1,332,332 | | | | 1,398,279 | | |

| 5.500%, due 07/01/211 | | | 616,298 | | | | 646,851 | | |

| 5.500%, due 08/01/211 | | | 78,276 | | | | 82,151 | | |

| 5.500%, due 03/01/221 | | | 51,938 | | | | 54,468 | | |

| 5.500%, due 05/01/221 | | | 821,463 | | | | 861,482 | | |

| 5.500%, due 06/01/221 | | | 32,142 | | | | 33,708 | | |

| 5.500%, due 09/01/221 | | | 797,311 | | | | 836,153 | | |

| 5.500%, due 10/01/221 | | | 54,871 | | | | 57,544 | | |

| 5.500%, due 12/01/221 | | | 63,976 | | | | 67,093 | | |

| 5.500%, due 04/01/231 | | | 22,836 | | | | 23,949 | | |

| 5.500%, due 05/01/231 | | | 399,434 | | | | 418,871 | | |

| 5.500%, due 06/01/231 | | | 324,730 | | | | 340,531 | | |

| 5.500%, due 08/01/231 | | | 789,313 | | | | 827,766 | | |

| 5.500%, due 09/01/231 | | | 7,000,001 | | | | 7,340,626 | | |

| 5.500%, due 10/01/231 | | | 39,248 | | | | 41,158 | | |

| Security description | | Face

amount | | Value | |

| Federal national mortgage association certificates*—(continued) | |

| 5.500%, due 02/01/32 | | $ | 80,648 | | | $ | 84,140 | | |

| 5.500%, due 11/01/32 | | | 1,259,588 | | | | 1,311,762 | | |

| 5.500%, due 01/01/33 | | | 701,634 | | | | 730,696 | | |

| 5.500%, due 02/01/33 | | | 381,890 | | | | 397,470 | | |

| 5.500%, due 06/01/33 | | | 130,068 | | | | 135,374 | | |

| 5.500%, due 09/01/33 | | | 431,738 | | | | 449,351 | | |

| 5.500%, due 10/01/33 | | | 715,223 | | | | 744,401 | | |

| 5.500%, due 11/01/33 | | | 177,476 | | | | 184,717 | | |

| 5.500%, due 12/01/33 | | | 2,476,484 | | | | 2,578,619 | | |

| 5.500%, due 01/01/34 | | | 255,487 | | | | 265,910 | | |

| 5.500%, due 04/01/34 | | | 625,971 | | | | 651,117 | | |

| 5.500%, due 07/01/34 | | | 425,625 | | | | 442,989 | | |

| 5.500%, due 11/01/34 | | | 2,001,852 | | | | 2,082,269 | | |

| 5.500%, due 01/01/35 | | | 349,686 | | | | 363,515 | | |

| 5.500%, due 02/01/37 | | | 354,155 | | | | 367,386 | | |

| 5.500%, due 03/01/37 | | | 377,958 | | | | 392,078 | | |

| 5.500%, due 04/01/37 | | | 858,796 | | | | 890,880 | | |

| 5.500%, due 05/01/37 | | | 1,593,808 | | | | 1,653,350 | | |

| 5.500%, due 06/01/37 | | | 399,310 | | | | 414,228 | | |

| 5.500%, due 07/01/37 | | | 1,462,030 | | | | 1,516,649 | | |

| 5.500%, due 08/01/37 | | | 6,249,515 | | | | 6,500,567 | | |

| 5.500%, due 10/01/37 | | | 851,638 | | | | 883,455 | | |

| 5.500%, due 11/01/37 | | | 434,770 | | | | 451,013 | | |

| 5.500%, due 12/01/37 | | | 3,884,487 | | | | 4,029,607 | | |

| 5.500%, due 01/01/38 | | | 3,378,769 | | | | 3,504,996 | | |

| 5.500%, due 02/01/38 | | | 3,693,473 | | | | 3,830,860 | | |

| 5.500%, due 03/01/38 | | | 5,065,596 | | | | 5,253,764 | | |

| 5.500%, due 04/01/38 | | | 2,843,688 | | | | 2,949,321 | | |

| 5.500%, due 05/01/38 | | | 983,684 | | | | 1,020,224 | | |

| 5.500%, due 06/01/38 | | | 2,152,060 | | | | 2,232,819 | | |

| 5.500%, due 07/01/38 | | | 473,542 | | | | 491,133 | | |

| 5.500%, due 08/01/38 | | | 81,424 | | | | 84,449 | | |

| 5.500%, due 09/01/38 | | | 2,813,569 | | | | 2,918,083 | | |

| 5.500%, due 11/01/38 | | | 300,000 | | | | 311,144 | | |

| 6.000%, due 01/01/23 | | | 1,117,870 | | | | 1,186,589 | | |

| 6.000%, due 11/01/26 | | | 413,631 | | | | 437,784 | | |

| 6.000%, due 01/01/32 | | | 93,879 | | | | 99,381 | | |

| 6.000%, due 04/01/32 | | | 119,983 | | | | 126,902 | | |

| 6.000%, due 09/01/32 | | | 87,809 | | | | 92,873 | | |

| 6.000%, due 10/01/32 | | | 107,843 | | | | 114,062 | | |

| 6.000%, due 12/01/32 | | | 183,903 | | | | 194,509 | | |

| 6.000%, due 01/01/33 | | | 304,448 | | | | 322,006 | | |

| 6.000%, due 02/01/33 | | | 230,103 | | | | 243,122 | | |

| 6.000%, due 06/01/33 | | | 262,480 | | | | 277,330 | | |

| 6.000%, due 07/01/33 | | | 169,070 | | | | 178,636 | | |

| 6.000%, due 10/01/33 | | | 169,021 | | | | 178,584 | | |

| 6.000%, due 11/01/33 | | | 521,624 | | | | 551,137 | | |

| 6.000%, due 02/01/34 | | | 1,745,622 | | | | 1,844,385 | | |

| 6.000%, due 05/01/34 | | | 121,093 | | | | 127,736 | | |

| 6.000%, due 09/01/34 | | | 330,448 | | | | 348,576 | | |

| 6.000%, due 11/01/34 | | | 165,125 | | | | 174,184 | | |

| 6.000%, due 01/01/35 | | | 784,461 | | | | 826,965 | | |

| 6.000%, due 02/01/35 | | | 681,305 | | | | 717,663 | | |

| 6.000%, due 04/01/35 | | | 8,488 | | | | 8,932 | | |

21

UBS PACE Select Advisors Trust

UBS PACE Government Securities Fixed Income Investments

Portfolio of investments—July 31, 2009

| Security description | | Face

amount | | Value | |

| Federal national mortgage association certificates*—(continued) | |

| 6.000%, due 05/01/35 | | $ | 763,649 | | | $ | 803,774 | | |

| 6.000%, due 06/01/35 | | | 198,234 | | | | 208,613 | | |

| 6.000%, due 07/01/35 | | | 1,586,318 | | | | 1,669,376 | | |

| 6.000%, due 08/01/35 | | | 479,518 | | | | 504,625 | | |

| 6.000%, due 09/01/35 | | | 474,965 | | | | 499,834 | | |

| 6.000%, due 01/01/36 | | | 404,865 | | | | 426,063 | | |

| 6.000%, due 06/01/36 | | | 83,616 | | | | 87,864 | | |

| 6.000%, due 07/01/36 | | | 417,722 | | | | 438,941 | | |

| 6.000%, due 09/01/36 | | | 676,936 | | | | 711,322 | | |

| 6.000%, due 11/01/36 | | | 419,855 | | | | 441,183 | | |

| 6.000%, due 12/01/36 | | | 1,358,128 | | | | 1,427,116 | | |

| 6.000%, due 01/01/37 | | | 386,298 | | | | 405,920 | | |

| 6.000%, due 04/01/37 | | | 520,266 | | | | 546,206 | | |

| 6.000%, due 05/01/37 | | | 938,564 | | | | 985,360 | | |

| 6.000%, due 06/01/37 | | | 680,296 | | | | 714,215 | | |

| 6.000%, due 07/01/37 | | | 294,376 | | | | 309,329 | | |

| 6.000%, due 08/01/37 | | | 767,053 | | | | 805,297 | | |

| 6.000%, due 09/01/37 | | | 192,964 | | | | 202,584 | | |

| 6.000%, due 11/01/37 | | | 845,543 | | | | 887,700 | | |

| 6.000%, due 01/01/38 | | | 31,426 | | | | 32,993 | | |

| 6.000%, due 03/01/38 | | | 506,251 | | | | 531,226 | | |

| 6.000%, due 08/01/38 | | | 232,946 | | | | 244,439 | | |

| 6.000%, due 09/01/38 | | | 10,325,373 | | | | 10,837,560 | | |

| 6.000%, due 10/01/38 | | | 124,887 | | | | 131,048 | | |

| 6.000%, due 11/01/38 | | | 4,000,001 | | | | 4,197,337 | | |

| 6.500%, due 09/01/12 | | | 3,943 | | | | 4,199 | | |

| 6.500%, due 12/01/12 | | | 11,284 | | | | 12,017 | | |

| 6.500%, due 01/01/13 | | | 2,902 | | | | 3,096 | | |

| 6.500%, due 02/01/13 | | | 15,591 | | | | 16,604 | | |

| 6.500%, due 03/01/13 | | | 19,221 | | | | 20,470 | | |

| 6.500%, due 04/01/13 | | | 1,952 | | | | 2,079 | | |

| 6.500%, due 06/01/13 | | | 35,590 | | | | 37,970 | | |

| 6.500%, due 07/01/13 | | | 7,886 | | | | 8,412 | | |

| 6.500%, due 08/01/13 | | | 8,070 | | | | 8,609 | | |

| 6.500%, due 09/01/13 | | | 37,609 | | | | 40,122 | | |

| 6.500%, due 10/01/13 | | | 18,216 | | | | 19,435 | | |

| 6.500%, due 11/01/13 | | | 36,230 | | | | 38,652 | | |

| 6.500%, due 07/01/19 | | | 105,183 | | | | 113,935 | | |

| 6.500%, due 09/01/36 | | | 6,323,704 | | | | 6,774,777 | | |

| 6.500%, due 10/01/36 | | | 2,640,939 | | | | 2,829,318 | | |

| 6.500%, due 11/01/36 | | | 137,770 | | | | 147,597 | | |

| 6.500%, due 05/01/37 | | | 43,256 | | | | 46,321 | | |

| 6.500%, due 08/01/37 | | | 4,012,799 | | | | 4,297,154 | | |

| 6.500%, due 11/01/37 | | | 5,393,981 | | | | 5,776,209 | | |