UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811- 07237 )

Exact name of registrant as specified in charter: Putnam Investment Funds

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

Registrant’s telephone number, including area code: (617) 292-1000

Date of fiscal year end: July 31, 2007

Date of reporting period: August 1, 2006— January 31, 2007

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition

in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing

what’s right for investors

We have below-average expenses and stringent investor protections, and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

Putnam

Growth Opportunities

Fund

1| 31| 07

Semiannual Report

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 13 |

| Expenses | 16 |

| Portfolio turnover | 18 |

| Risk | 18 |

| Your fund’s management | 19 |

| Terms and definitions | 22 |

| Trustee approval of management contract | 24 |

| Other information for shareholders | 29 |

| Financial statements | 30 |

| Brokerage commissions | 51 |

Cover photograph: Vineyard, Napa County, California © Charles O’Rear

Message from the Trustees

Dear Fellow Shareholder

Although the global economy continues to move forward, it has become apparent over the past few months that certain sectors of the U.S. economy may have slowed somewhat. We consequently consider slower job growth and perhaps a rise in the unemployment rate as possible developments for 2007. On the other hand, since the Federal Reserve (the Fed) stopped raising interest rates, stock prices have moved higher, bond yields have remained relatively low, and the weaker dollar appears to be making U.S. exports more competitive. With the benefit of this financial cushion, we believe 2007 may hold the potential for a renewed economic expansion.

As you may have heard, on February 1, 2007, Marsh & McLennan Companies, Inc. announced that it had signed a definitive agreement to sell its ownership interest in Putnam Investments Trust, the parent company of Putnam Management and its affiliates, to Great-West Lifeco Inc. Great-West Lifeco Inc. is a financial services holding company with operations in Canada, the United States, and Europe and is a member of the Power Financial Corporation group of companies. This transaction is subject to regulatory approvals and other conditions, including the approval of new management contracts by shareholders of a substantial number of Putnam funds at shareholder meetings expected to be held in May 2007. Proxy solicitation materials related to these meetings, which provide detailed information regarding the proposed transaction, were recently mailed. The transaction is currently expected to be completed by the middle of 2007.

Putnam’s team of investment and business professionals will continue to be led by Putnam President and Chief Executive Officer Ed Haldeman. Your Trustees have been actively involved through every step of the discussions, and we will continue in our role of overseeing the Putnam funds on your behalf.

2

We would like to take this opportunity to announce that a new independent Trustee, Kenneth R. Leibler, has joined your fund’s Board of Trustees. Mr. Leibler has had a distinguished career as a leader in the investment management industry. He is the founding Chairman of the Boston Options Exchange and currently serves as a Trustee of Beth Israel Deaconess Hospital in Boston; a lead director of Ruder Finn Group, a global communications and advertising firm; and a director of Northeast Utilities.

In the following pages, members of your fund’s management team discuss the fund’s performance and strategies for the fiscal period ended January 31, 2007, and provide their outlook for the months ahead. As always, we thank you for your support of the Putnam funds.

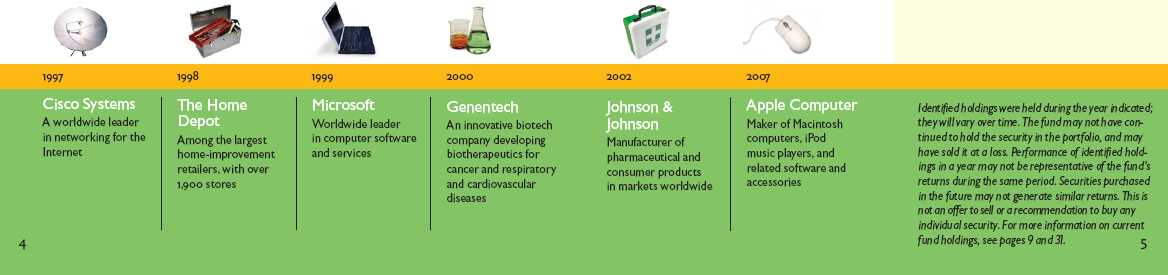

Putnam Growth Opportunities Fund:

seeking America’s biggest growing companies

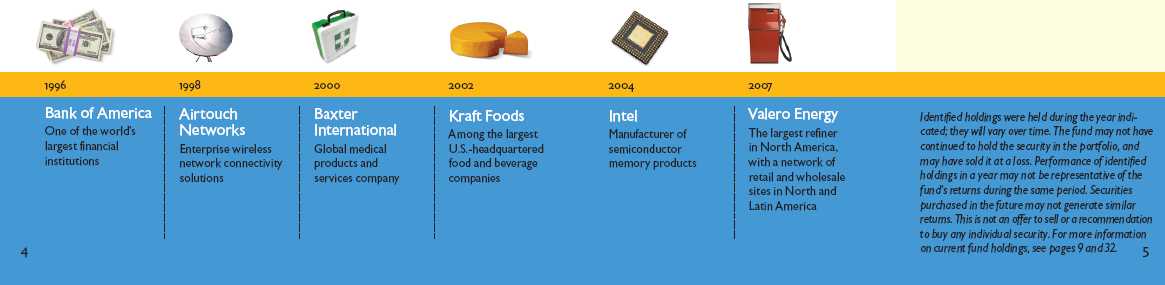

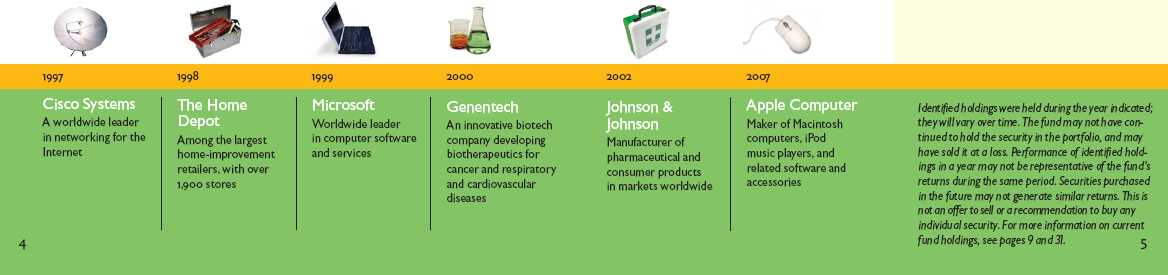

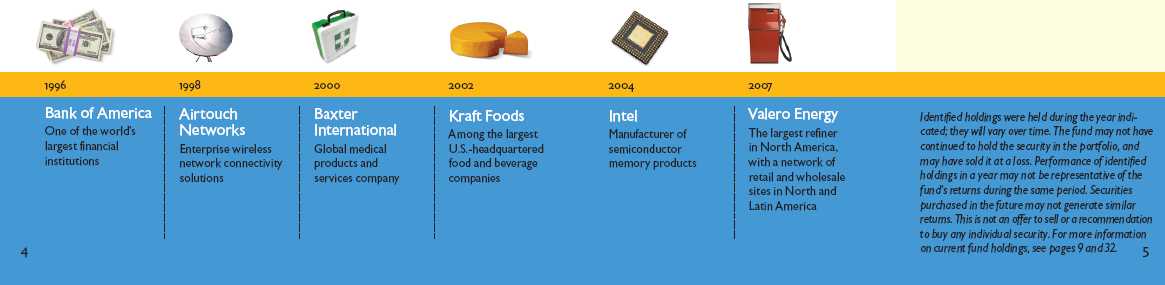

When Putnam Growth Opportunities Fund opened to the investing public in August 1997, its managers were committed to seeking growth potential in the types of U.S. companies that dominated the markets — large yet flexible, coupling the benefits of size and scale with the ability to respond to changing tastes and new technologies.

Nine years later, the fund continues to target the stocks of these companies, using rigorous research techniques to identify those believed to have both a competitive edge in markets around the world and the potential to gain market dominance and produce strong profits. Of course, as with any fund that invests in stocks, there are risks involved. The fund’s focus on large U.S. companies can affect its performance, particularly during times when large-cap stocks are out of favor. The management team seeks to manage this risk by investing with a long-term perspective, looking for companies it believes have the fundamental strength to deliver results over time, despite market setbacks. While the fund favors growth stocks, the team also seeks to cushion the impact of market volatility at times when this style of investing is out of favor.

In the fund’s first report to shareholders, then-Chairman of the Trustees George Putnam wrote of the management team: “Besides taking advantage of today’s opportunities, they have sought companies that have proved themselves in fair weather and foul, mindful that exuberant markets such as today’s do not last forever.”

While not all large-cap companies have been able to weather the tough times, many that were in the fund’s portfolio in the mid-1990s have continued to grow and prosper. Several of them, including Microsoft, Intel, and The Home Depot, have since been added to the select group of 30 companies that make up the Dow Jones Industrial Average.

Regardless of how market conditions change in the years ahead, your fund will continue to favor leading companies with dominant products, services, and barriers to entry against potential competitors. We believe that such companies, when the market underestimates the sustainability of their growth and returns, make attractive investments.

Stocks with above-average earnings growth may be more volatile, especially if earnings do not continue to grow.

In-depth analysis is key to

successful stock selection.

Drawing on the expertise of a dedicated team of stock analysts, the fund’s management team seeks attractive growth stocks. Once a stock is selected for the portfolio, it is regularly assessed by members of the team to ensure that it continues to meet their criteria, including:

Growth They examine each company’s financials, including its sales, earnings, and cash flow, and target those believed to offer growth potential.

Quality They look for characteristics such as solid management teams, sound business models, a record of strong performance, and high levels of free-cash flow generation and capital investment discipline.

Valuation They carefully consider how each stock is valued, seeking stocks whose valuations are attractive relative to the company’s growth potential.

Putnam Growth Opportunities Fund seeks to invest in leading large companies with the potential to grow rapidly.

Putnam Growth Opportunities Fund seeks capital appreciation by investing primarily in stocks of large U.S. companies. The fund targets established companies that management believes are leaders in their industries and have the potential to grow for a longer time and more profitably than the market expects. The portfolio may be appropriate for investors who are willing to assume above-average risk in pursuit of capital appreciation.

Highlights

• Putnam Growth Opportunities Fund’s class A shares returned 15.09% without sales charges for the six months ended January 31, 2007.

• The fund’s primary benchmark, the S&P 500 Index, returned 13.75% .

• The fund’s secondary benchmark, the Russell 1000 Growth Index, returned 15.12% .

• The average return of the fund’s Lipper peer group, Large-Cap Growth Funds, was 13.34% .

• Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 13.

Performance

Total return for class A shares for periods ended 1/31/07

Since the fund's inception (10/2/95), average annual return is 6.30% at NAV and 5.80% at POP.

| | Average annual return | | Cumulative return | |

| | NAV | | POP | | NAV | | POP | |

| |

| 10 years | 3.21% | | 2.65% | | 37.11% | | 29.91% | |

| |

| 5 years | 0.97 | | –0.12 | | 4.94 | | –0.60 | |

| |

| 3 years | 5.07 | | 3.20 | | 16.00 | | 9.91 | |

| |

| 1 year | 9.52 | | 3.75 | | 9.52 | | 3.75 | |

| |

| 6 months | — | | — | | 15.09 | | 9.04 | |

| |

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Returns at POP reflect a maximum sales charge of 5.25% . For the most recent month-end performance, visit www.putnam.com. For a portion of the period, this fund was sold on a limited basis with limited assets and expenses. Had expenses not been limited, returns would have been lower. A 1% short-term trading fee may apply.

6

Report from the fund managers

The period in review

We are pleased to report that your fund benefited from the rally in the stock market over the past six months, which represents the first half of its 2007 fiscal year. As market leadership shifted toward growth-oriented stocks, your fund’s focus on these stocks enabled it to deliver double-digit returns, well above the long-term average for stocks in general. Based on results at net asset value (NAV, or without sales charges), the fund outpaced both its benchmark index, the S&P 500 Index, and the average for its Lipper peer group, Large-Cap Growth Funds, though it trailed its secondary benchmark index. In addition, the fund ranked in the top 25% of funds in its Lipper peer group for the period. Gains within the consumer cyclical, technology, and financial sectors were the most notable contributors to relative performance. The success of our stock selection in these sectors more than offset weaker results from the fund’s holdings in the communications services and health-care sectors.

Market overview

The stock market rallied strongly during your fund’s semiannual reporting period, which began on August 1, 2006, and ended January 31, 2007. Gains were both substantial and broadly based, as corporations were rewarded for delivering double-digit earnings growth, on average. Supported by sustained rises in revenue and solid margins, many corporations are making wise use of their bountiful profits by focusing on rewarding shareholders — both directly, through buybacks and special dividend payments, and indirectly, with prudent capital investments and expansion. Also, there were signs that individual investors were finally returning to U.S. stocks in force, after having pulled back in the wake of the tech-stock crash and ensuing market slump earlier in the decade.

Growth-style investing also returned as the market leader. This represented a major shift from a persistent trend in the market both during the middle of 2006, and, in general, ever since the year 2000. The underperformance of

7

growth stocks was particularly intense from April until August, 2006. During these months, investors generally avoided growth stocks due to concerns about higher inflation and oil prices coupled with the effects of a weakening housing market on employment and consumer spending. In August, however, inflation data began to moderate, oil prices dropped, and the Fed refrained from raising interest rates. These positive events helped reverse the negative trend for growth stocks. For the remainder of the year, the overall economy continued expanding and investors’ returning confidence in the long-term potential of growth stocks led to increasing demand and higher prices.

Strategy overview

Your fund seeks capital appreciation by investing in stocks of large, highly competitive U.S. companies with strong revenue and earnings growth prospects. Our stock selection process is designed to allow the fund to participate when market conditions favor growth stocks in particular. As growth investors, we believe that market participants consistently underestimate the sustainability of growth and returns on capital that can be achieved by companies with unique and powerful competitive advantages. This is the market inefficiency we are attempting to exploit.

At each step of our process, we integrate quantitative and fundamental research methods. Our quantitative models examine historical data to assess

Market sector performance

These indexes provide an overview of performance in different market sectors for the six months ended 1/31/07.

| Equities | |

|

| S&P 500 Index (broad stock market) | 13.75% |

|

| Russell 1000 Growth Index (large-company growth stocks) | 15.12% |

|

| MSCI EAFE Index (international stocks) | 14.33% |

|

| Russell 2000 Index (small-company stocks) | 14.95% |

|

| Bonds | |

|

| Lehman Aggregate Bond Index (broad bond market) | 3.65% |

|

| Lehman Government Bond Index (U.S. Treasury and agency securities) | 3.05% |

|

| Citigroup World Government Bond Index (global government bonds) | 1.06% |

|

8

the strength, quality, and sustainability of earnings growth in the companies we follow and to determine the relative attractiveness of company valuations. Our fundamental research methods analyze industries and businesses, looking toward the future to forecast the potential growth of cash flows for each company. With these forecasts, we produce a range of possible outcomes for each company we research.

In addition, we work to keep the fund’s portfolio well balanced and broadly diversified. While its sector weightings and overall characteristics are generally similar to those of the primary benchmark, the S&P 500 Index, specific holdings and the weightings of these holdings will typically differ from the index because of our stock selection decisions. As of the end of the semiannual period, the fund is most overweight in consumer cyclicals, technology, and financial stocks, and is most underweight in the communications services, consumer staples, and utilities sectors, in comparison to the index.

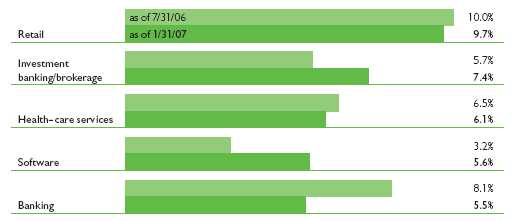

Your fund’s holdings

As concerns over housing and consumer spending waned in the second half of 2006, many of the fund’s holdings in the consumer cyclical sector gained in value. Retail stocks, in particular, benefited from their companies’ successful sales strategies and adept merchandising. Stocks such as Abercrombie & Fitch, Ross Stores,

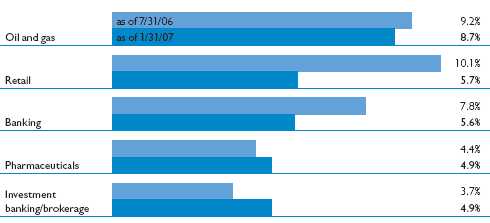

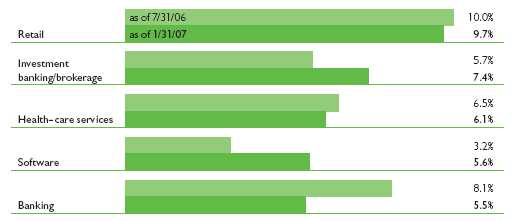

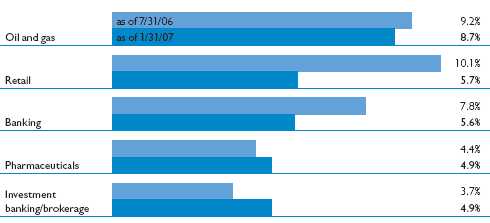

Comparison of top industry weightings

This chart shows how the fund’s top weightings have changed over the last six months.

Weightings are shown as a percentage of net assets. Holdings will vary over time.

9

and Kohl’s were among the holdings that contributed to the fund’s strength in this industry. Another holding in the sector, casino and hotel operator Las Vegas Sands, rose sharply on the strength of its existing properties as well as the continued optimism about the company’s growth prospects in Macau and Singapore.

Holdings within the financial sector also delivered strong performance, especially those in the investment banking, real estate, and mortgage finance industries. The stock of investment banking firm Goldman Sachs rose strongly as robust growth in securities trading and burgeoning merger-and-acquisition (M&A) activity continued to drive the company’s earnings higher. CB Richard Ellis Group, the world’s largest commercial real estate firm, benefited as the pace of corporate expansion has reinforced the demand for office space. The resulting reductions in vacancies and increases in rental rates were key factors in the company’s growth. The shares of mortgage-financier Countrywide Financial appreciated on signs of c onfidence that the company’s banking, insurance, and mortgage servicing businesses will reinforce its earnings and offset the slowdown in home-loan originations.

The renewal of investor confidence in growth-style investments was most evident in the performance of the technology sector. Fund holdings that benefited from this change of heart

Top holdings

This table shows the fund’s top holdings, and the percentage of the fund’s net assets that each comprised, as of 1/31/07. The fund’s holdings will change over time.

| Holding (percent of fund’s net assets) | | Industry |

|

| Cisco Systems, Inc. (2.8%) | | Communications equipment |

|

| Goldman Sachs Group, Inc. (The) (2.6%) | | Investment banking/brokerage |

|

| American International Group, Inc. (2.5%) | | Insurance |

|

| Capital One Financial Corp. (2.3%) | | Consumer finance |

|

| Bear Stearns Cos., Inc. (The) (2.2%) | | Investment banking/brokerage |

|

| UnitedHealth Group, Inc. (2.2%) | | Health-care services |

|

| Johnson & Johnson (2.2%) | | Pharmaceuticals |

|

| Staples, Inc. (2.2%) | | Retail |

|

| WellPoint, Inc. (2.1%) | | Health-care services |

|

| Procter & Gamble Co. (The) (2.1%) | | Consumer goods |

|

10

included stocks in the communications equipment, Internet services, and computer industries. Investors sent the shares of networking giant Cisco Systems sharply higher amid strong demand for its products, particularly from cable and telephone firms seeking to upgrade their networks for high-speed data and video. The fund’s overweight position in Internet auctioneer eBay gained in value, reflecting growth in the company’s merchandise listings and usage of its PayPal online payment service. An overweight position in EMC Corp. relative to the benchmark proved beneficial as the data storage company continued to post solid results and increase its sales in its high-profit software. A position in Apple also added to returns as strong Macintosh and iPod sales continued to fuel the company’s earnings.

In the health-care sector, the fund’s positions in Express Scripts, a health-care services company, and in Boston Scientific, a medical technology company, weakened results. Express Scripts’ stock fell as the company announced that proposed changes to drug pricing could have an adverse effect on its future results. The stock rallied late in the period, but not enough to offset the earlier decline. Boston Scientific’s stock lost value due to concerns about heart-product recalls and inconsistent growth, and the fund’s overweight position hurt performance relative to the primary benchmark. Given our revised expectations for the growth prospects of these companies, we have eliminated these positions.

Performance for the period was also hurt by a lack of exposure to the strong-performing communications services sector, coupled with lagging results from a holding in the wireless industry. The fund’s position in wireless carrier Sprint Nextel had an adverse impact on relative performance as the company’s lackluster subscriber growth disappointed investors. As with Boston Scientific and Express Scripts, we revised our view of this stock and sold the position.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

11

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

The remarkably sustained market rally of the second half of 2006 was fueled by strong corporate profitability and supported by a benign macroeconomic backdrop. As neither of these conditions seems likely to change in the near future, we expect continued market appreciation. While it seems unlikely that stocks will rally without interruption as in recent months, the basis of the bull market appears to be intact. Moreover, we anticipate that the ongoing and gradual transition of leadership to larger and more growth-oriented companies will persist further into 2007.

Currently, as a result of bottom-up stock selection decisions, the fund’s largest overweight, relative to the benchmark, is in the consumer sector, particularly retail cyclicals. The second-largest overweight is in technology stocks, as we continue to favor the technology services, software, and communications equipment industries. We are retaining significant underweights to the communications services, consumer staples, and utilities sectors, due to what we consider lack-luster growth prospects and unattractive valuations in all three sectors. We expect that the fund’s performance will continue to be rewarded as investors recognize that companies that are able to continue growing over the long term deserve a higher relative valuation than companies whose growth is more cyclical or inconsistent.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Stocks with above-average earnings growth may be more volatile, especially if earnings do not continue to grow.

12

Your fund’s performance

This section shows your fund’s performance for periods ended January 31, 2007, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581. Class Y shares are generally only available to corporate and institutional clients. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance

Total return for periods ended 1/31/07

| | | Class A | | | Class B | | | Class C | | | Class M | | | Class R | | Class Y |

| (inception dates) | | (10/2/95) | | | (8/1/97) | | | (2/1/99) | | | (8/1/97) | | | (1/21/03) | | (7/1/99) |

|

| | NAV | POP | NAV | CDSC | NAV | CDSC | NAV | POP | NAV | NAV |

| Annual average | | | | | | | | | | |

| (life of fund) | 6.30% | 5.80% | 5.46% | 5.46% | 5.52% | 5.52% | 5.71% | 5.41% | 6.03% | 6.50% |

|

| 10 years | 37.11 | 29.91 | 27.03 | 27.03 | 27.41 | 27.41 | 30.14 | 25.92 | 33.69 | 40.04 |

| Annual average | 3.21 | 2.65 | 2.42 | 2.42 | 2.45 | 2.45 | 2.67 | 2.33 | 2.95 | 3.42 |

|

| 5 years | 4.94 | –0.60 | 1.06 | –0.94 | 1.06 | 1.06 | 2.32 | –1.00 | 3.68 | 6.22 |

| Annual average | 0.97 | –0.12 | 0.21 | –0.19 | 0.21 | 0.21 | 0.46 | –0.20 | 0.73 | 1.21 |

|

| 3 years | 16.00 | 9.91 | 13.38 | 10.38 | 13.38 | 13.38 | 14.28 | 10.59 | 15.03 | 16.86 |

| Annual average | 5.07 | 3.20 | 4.27 | 3.35 | 4.27 | 4.27 | 4.55 | 3.41 | 4.78 | 5.33 |

|

| 1 year | 9.52 | 3.75 | 8.67 | 3.67 | 8.72 | 7.72 | 8.98 | 5.45 | 9.23 | 9.81 |

|

| 6 months | 15.09 | 9.04 | 14.71 | 9.71 | 14.68 | 13.68 | 14.74 | 11.01 | 14.91 | 15.20 |

|

Performance assumes reinvestment of distributions and does not account for taxes. Returns at public offering price (POP) for class A and M shares reflect a maximum sales charge of 5.25% and 3.25%, respectively. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year and is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and, except for class Y shares, the higher operating expenses for such shares.

For a portion of the period, this fund was sold on a limited basis with limited assets and expenses. Had expenses not been limited, returns would have been lower.

A 1% short-term trading fee may be applied to shares exchanged or sold within 7 days of purchase.

13

Comparative index returns

For periods ended 1/31/07

| | | S&P 500 | | | Russell 1000 | | | | Lipper Large-Cap Growth | |

| | | Index | | | Growth Index | | | | Funds category average * | |

|

| Annual average | | | | |

| (life of fund) | | 10.13% | | | 7.45% | | | | 7.02% | | |

|

| 10 years | 114.47 | | 62.85 | | | 69.34 | | |

| Annual average | 7.93 | | 5.00 | | | 5.23 | | |

|

| 5 years | 39.10 | | 19.24 | | | 17.13 | | |

| Annual average | 6.82 | | 3.58 | | | 3.12 | | |

|

| 3 years | 34.27 | | 22.68 | | | 21.05 | | |

| Annual average | 10.32 | | 7.05 | | | 6.52 | | |

|

| 1 year | 14.51 | | 9.95 | | | 4.96 | | |

|

| 6 months | 13.75 | | 15.12 | | | 13.34 | | |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month and 1-, 3-, 5-, and 10-year periods ended 1/31/07, there were 756, 731, 622, 511, and 194 funds, respectively, in this Lipper category.

Fund price and distribution* information

For the six-month period ended 1/31/07

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| Share value: | NAV | POP | NAV | NAV | NAV | POP | NAV | NAV |

| 7/31/06 | $12.99 | $13.71 | $12.24 | $12.40 | $12.48 | $12.90 | $12.88 | $13.22 |

|

| 1/31/07 | 14.95 | 15.78 | 14.04 | 14.22 | 14.32 | 14.80 | 14.80 | 15.23 |

|

* There were no distributions made during this period.

14

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/06

| | | Class A | | Class B | | Class C | | Class M | | Class R | Class Y |

| (inception dates) | | (10/2/95) | | (8/1/97) | | (2/1/99) | | (8/1/97) | | (1/21/03) | (7/1/99) |

| | | | NAV | | | POP | | | NAV | | | CDSC | | | NAV | | | CDSC | | | NAV | | | POP | | | NAV | | | NAV | |

|

| Annual average | | | | | | | | | | | |

| (life of fund) | | | 6.14% | | | 5.63% | | | 5.30% | | | 5.30% | | | 5.35% | | | 5.35% | | | 5.55% | | | 5.24% | | | 5.87% | | | 6.33% | |

|

| 10 years | | 43.31 | | 35.80 | | 32.83 | | 32.83 | | 33.20 | | 33.20 | | 35.92 | | 31.48 | | 39.79 | | 46.34 | |

| Annual average | | 3.66 | | 3.11 | | 2.88 | | 2.88 | | 2.91 | | 2.91 | | 3.12 | | 2.77 | | 3.41 | | 3.88 | |

|

| 5 years | | –0.70 | | –5.89 | | –4.33 | | –6.25 | | –4.41 | | –4.41 | | –3.14 | | –6.31 | | –1.90 | | 0.59 | |

| Annual average | | –0.14 | | –1.21 | | –0.88 | | –1.28 | | –0.90 | | –0.90 | | –0.64 | | –1.30 | | –0.38 | | 0.12 | |

|

| 3 years | | 15.03 | | 8.99 | | 12.41 | | 9.41 | | 12.43 | | 12.43 | | 13.25 | | 9.54 | | 14.12 | | 15.83 | |

| Annual average | | 4.78 | | 2.91 | | 3.98 | | 3.04 | | 3.98 | | 3.98 | | 4.23 | | 3.08 | | 4.50 | | 5.02 | |

|

| 1 year | | 9.27 | | 3.54 | | 8.45 | | 3.45 | | 8.42 | | 7.42 | | 8.69 | | 5.18 | | 9.04 | | 9.49 | |

|

| 6 months | | 10.67 | | 4.88 | | 10.27 | | 5.27 | | 10.22 | | 9.22 | | 10.40 | | 6.78 | | 10.54 | | 10.79 | |

|

15

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial advisor.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam Growth Opportunities Fund from August 1, 2006, to January 31, 2007. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 7.26 | $ 11.31 | $ 11.31 | $ 9.96 | $ 8.61 | $ 5.91 |

|

| Ending value (after expenses) | | $1,150.90 | $1,147.10 | $1,146.80 | $1,147.40 | $1,149.10 | $1,152.00 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/07. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

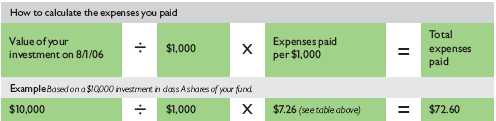

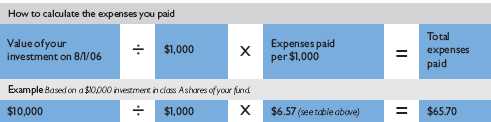

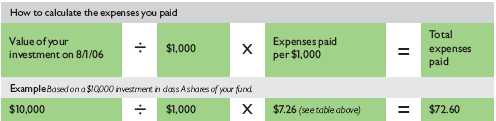

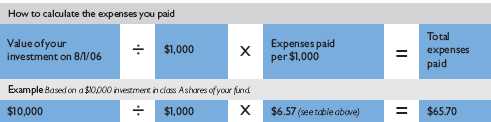

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2007, use the calculation method below. To find the value of your investment on August 1, 2006, go to www.putnam.com and log on to your account. Click on the “Transaction History” tab in your Daily Statement and enter 08/01/2006 in both the “from” and “to” fields. Alternatively, call Putnam at 1-800-225-1581.

16

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000* | | $ 6.82 | $ 10.61 | $ 10.61 | $ 9.35 | $ 8.08 | $ 5.55 |

|

| Ending value (after expenses) | | $1,018.45 | $1,014.67 | $1,014.67 | $1,015.93 | $1,017.19 | $1,019.71 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/07. The expense ratio may differ for each share class (see the last table in this section). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s average net assets have been used to pay ongoing expenses during the period.

| | | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Your fund's annualized | | | | | | | |

| expense ratio | | 1.34% | 2.09% | 2.09% | 1.84% | 1.59% | 1.09% |

|

| Average annualized expense | | | | | | | |

| ratio for Lipper peer group* | | 1.33% | 2.08% | 2.08% | 1.83% | 1.58% | 1.08% |

|

* Simple average of the expenses of all front-end load funds in the fund’s Lipper peer group, calculated in accordance with Lipper’s standard method for comparing fund expenses (excluding 12b-1 fees and without giving effect to any expense offset and brokerage service arrangements that may reduce fund expenses). This average reflects each fund’s expenses for its most recent fiscal year available to Lipper as of 12/31/06. To facilitate comparison, Putnam has adjusted this average to reflect the 12b-1 fees carried by each class of shares other than class Y shares, which do not incur 12b-1 fees. The peer group may include funds that are significantly smaller or larger than the fund, which may limit the comparability of the fund’s expenses to the simple average, which typically is higher than the asset-weighted average.

17

Your fund’s

portfolio turnover

Putnam funds are actively managed by teams of experts who buy and sell securities based on intensive analysis of companies, industries, economies, and markets. Portfolio turnover is a measure of how often a fund’s managers buy and sell securities for your fund. A portfolio turnover of 100%, for example, means that the managers sold and replaced securities valued at 100% of a fund’s assets within a one-year period. Funds with high turnover may be more likely to generate capital gains and dividends that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance.

Turnover comparisons

Percentage of holdings that change every year

| | | 2006 | 2005 | 2004 | 2003 | 2002 |

|

| Putnam Growth | | | | | | |

| Opportunities Fund | | 88% | 114% | 53% | 61% | 57% |

|

| Lipper Large-Cap Growth Funds | | | | | | |

| category average | | 90% | 96% | 92% | 102% | 105% |

|

Turnover data for the fund is calculated based on the fund's fiscal-year period, which ends on July 31. Turnover data for the fund's Lipper category is calculated based on the average of the turnover of each fund in the category for its fiscal year ended during the indicated year. Fiscal years vary across funds in the Lipper category, which may limit the comparability of the fund's portfolio turnover rate to the Lipper average. Comparative data for 2006 is based on information available as of 12/31/06.

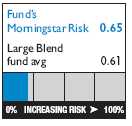

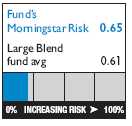

Your fund’s risk

This risk comparison is designed to help you understand how your fund compares with other funds. The comparison utilizes a risk measure developed by Morningstar, an independent fund-rating agency. This risk measure is referred to as the fund’s Morningstar Risk.

Your fund’s Morningstar® Risk

Your fund’s Morningstar Risk is shown alongside that of the average fund in its Morningstar category. The risk bar broadens the comparison by translating the fund’s Morningstar Risk into a percentile, which is based on the fund’s ranking among all funds rated by Morningstar as of December 31, 2006. A higher Morningstar Risk generally indicates that a fund’s monthly returns have varied more widely.

Morningstar determines a fund’s Morningstar Risk by assessing variations in the fund’s monthly returns — with an emphasis on downside variations — over a 3-year period, if available. Those measures are weighted and averaged to produce the fund’s Morningstar Risk. The information shown is provided for the fund’s class A shares only; information for other classes may vary. Morningstar Risk is based on historical data and does not indicate future results. Morningstar does not purport to measure the risk associated with a current investment in a fund, either on an absolute basis or on a relative basis. Low Morningstar Risk does not mean that you cannot lose money on an investment in a fund. Copyright 2007 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

18

Your fund’s management

Your fund is managed by the members of the Putnam Large-Cap Growth Team. Robert Ginsberg and Kelly Morgan are Portfolio Leaders of your fund. The Portfolio Leaders coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Large-Cap Growth Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

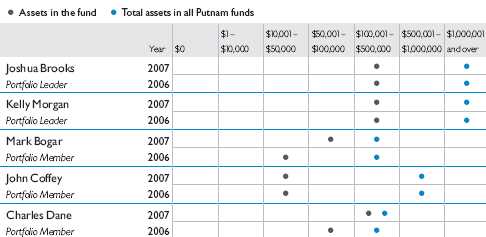

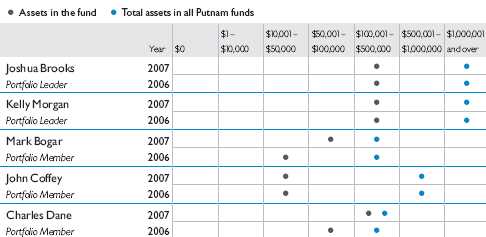

Investment team fund ownership

The table below shows how much the fund’s current Portfolio Leaders have invested in the fund and in all Putnam mutual funds (in dollar ranges). Information shown is as of January 31, 2007, and January 31, 2006.

Trustee and Putnam employee fund ownership

As of January 31, 2007, all of the Trustees of the Putnam funds owned fund shares. The table below shows the approximate value of investments in the fund and all Putnam funds as of that date by the Trustees and Putnam employees. These amounts include investments by the Trustees’ and employees’ immediate family members and investments through retirement and deferred compensation plans.

| | | Total assets in |

| | Assets in the fund | all Putnam funds |

|

| Trustees | $ 154,000 | $101,000,000 |

|

| Putnam employees | $5,380,000 | $454,000,000 |

|

19

Fund manager compensation

The total 2006 fund manager compensation that is attributable to your fund is approximately $160,000. This amount includes a portion of 2006 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2006 compensation paid to the Chief Investment Officer of the team and the Group Chief Investment Officer of the fund’s broader investment category for their oversight responsibilities, calculated based on the fund assets they oversee taken as a percentage of the total assets they oversee. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fisca l period-end. For personnel who joined Putnam Management during or after 2006, the calculation reflects annualized 2006 compensation or an estimate of 2007 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leaders

Robert Ginsberg is also a Portfolio Leader of Putnam Voyager Fund and a Portfolio Member of Putnam Discovery Growth Fund.

Kelly Morgan is also a Portfolio Leader of Putnam Voyager Fund and Putnam Research Fund.

Robert Ginsberg and Kelly Morgan may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

During the year ended January 31, 2007, Portfolio Member Saba Malak left your fund’s management team.

20

Putnam fund ownership by Putnam’s Executive Board

The table below shows how much the members of Putnam’s Executive Board have invested in all Putnam mutual funds (in dollar ranges). Information shown is as of January 31, 2007, and January 31, 2006.

| | | | | $1 – | $10,001 – | $50,001 – | $100,001 – | $500,001 – | $1,000,001 |

| | | Year | $0 | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | and over |

|

| Philippe Bibi | | 2007 | | | | | | | • |

|

|

| Chief Technology Officer | | 2006 | | | | | | | • |

|

| Joshua Brooks | | 2007 | | | | | | | • |

|

|

| Deputy Head of Investments | | 2006 | | | | | | | • |

|

| William Connolly | | 2007 | | | | | | | • |

|

|

| Head of Retail Management | | 2006 | | | | | | | • |

|

| Kevin Cronin | | 2007 | | | | | | | • |

|

|

| Head of Investments | | 2006 | | | | | | | • |

|

| Charles Haldeman, Jr. | | 2007 | | | | | | | • |

|

|

| President and CEO | | 2006 | | | | | | | • |

|

| Amrit Kanwal | | 2007 | | | | | | • | |

|

|

| Chief Financial Officer | | 2006 | | | | | | • | |

|

| Steven Krichmar | | 2007 | | | | | | | • |

|

|

| Chief of Operations | | 2006 | | | | | | • | |

|

| Francis McNamara, III | | 2007 | | | | | | | • |

|

|

| General Counsel | | 2006 | | | | | | | • |

|

| Jeffrey Peters | | 2007 | | | | | | | • |

|

|

| Head of International Business | | N/A | | | | | | | |

|

| Richard Robie, III | | 2007 | | | | | | • | |

|

|

| Chief Administrative Officer | | 2006 | | | | | | • | |

|

| Edward Shadek | | 2007 | | | | | | | • |

|

|

| Deputy Head of Investments | | 2006 | | | | | | | • |

|

| Sandra Whiston | | 2007 | | | | | | • | |

|

|

| Head of Institutional Management | | 2006 | | | | | | • | |

|

N/A indicates the individual was not a member of Putnam’s Executive Board as of 1/31/06.

21

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Public offering price (POP) is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. POP performance figures shown here assume the 5.25% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to eligible purchasers, including eligible defined contribution plans or corporate IRAs.

22

Comparative indexes

Citigroup World Government Bond Index is an unmanaged index of global investment-grade fixed-income securities.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Government Bond Index is an unmanaged index of U.S. Treasury and agency securities.

Morgan Stanley Capital International (MSCI) EAFE Index is an unmanaged index of equity securities from developed countries in Western Europe, the Far East, and Australasia.

Russell 1000 Growth Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their growth orientation.

Russell 2000 Index is an unmanaged index of the 2,000 smallest companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

23

Trustee approval of

management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months ending in June 2006, the Contract Committee met four times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independe nt Trustees. Upon completion of this review, the Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management contract, effective July 1, 2006.

This approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

• That such fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

24

Management fee schedules and categories; total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints, and the assignment of funds to particular fee categories. In reviewing fees and expenses, the Trustees generally focused their attention on material changes in circumstances — for example, changes in a fund’s size or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund, which had been carefully developed over the years, re-examined on many occasions and adjusted where appropriate. The Trustees focused on two areas of particular interest, as discussed further below:

• Competitiveness. The Trustees reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 10th percentile in management fees and in the 62nd percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2005 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense information may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints.

The Trustees noted that the expense ratio increases described above were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management, in consultation with the Contract Committee, has committed to maintain at least through 2007. These expense limitations give effect to a commitment by Putnam Management that the expense ratio of each open-end fund would be no higher than the average expense ratio of the competitive funds included in the fund’s relevant Lipper universe (exclusive of any applicable 12b-1 charges in each case). The Trustees observed that this commitment to limit fund expenses has served shareholders well since its inception. In order to ensure that the expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees requested, and Putnam Management agreed, to implement an additional expense limitation for certain funds for the twelve months beginning January 1, 2007 equal to the average expense ratio (exclusive of 12b-1 charges) of a custom peer group of competitive funds selected by Lipper based on the size of the fund. This additional expense limitation will be applied to those open-end funds that had above-average expense ratios (exclusive of 12b-1 charges) based on the Lipper custom peer group data for the period ended December 31, 2005. This additional expense limitation will be applied to your fund.

25

• Economies of scale. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. Conversely, as a fund shrinks in size — as has been the case for many Putnam funds in recent years — these breakpoints result in increasing fee levels. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedules in effect for the funds represented an appropriate sharing of economies of scale at current asset levels. In reaching this conclusion, the Trustees considered the Contract Committee’s stated intent to con tinue to work with Putnam Management to plan for an eventual resumption in the growth of assets, including a study of potential economies that might be produced under various growth assumptions.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis. Because many of the costs incurred by Putnam Management in managing the funds are not readily identifiable to particular funds, the Trustees observed that the methodology for allocating costs is an important factor in evaluating Putnam Management’s costs and profitability, both as to the Putnam fu nds in the aggregate and as to individual funds. The Trustees reviewed Putnam Management’s cost allocation methodology with the assistance of independent consultants and concluded that this methodology was reasonable and well-considered.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of the Investment Process Committee of the Trustees and the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods

26

and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and discussed with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. In particular, they noted the important contributions of Putnam Management’s leadership in attracting, retaining and supporting high-quality investment professionals and in systematically implementing an investment process that seeks to merge the best features of fundamental and quantitative analysis. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional changes to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Large-Cap Growth Funds) for the one-, three- and five-year periods ended March 31, 2006 (the first percentile being the best performing funds and the 100th percentile being the worst performing funds):

| One-year period | Three-year period | Five-year period |

|

| 65th | 95th | 94th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three- and five-year periods ended March 31, 2006, there were 694, 593, and 479 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future performance.)

The Trustees noted the disappointing performance for your fund for the three- and five-year periods ended March 31, 2006. In this regard, the Trustees considered that Putnam Management had made changes to the fund’s investment team that it believed would strengthen the investment process by focusing on a blend of quantitative techniques and fundamental analysis.

As a general matter, the Trustees concluded that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Large-Cap Growth Funds category for the one-, five- and ten-year periods ended December 31, 2006, were 17%, 85%, and 80%, respectively. Over the one-, five- and ten-year periods ended December 31, 2006, the fund ranked 122nd out of 723, 430th out of 505, and 149th out of 186 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

27

appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees concluded that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that may be useful to Putnam Management in managing the assets of the fund and of other clients. The Trustees indicated their continued intent to monitor the potential benefits associated with the allocation of fund brokerage to ensure that the principle of seeking “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company, all of which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but did not rely on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

28

Other information

for shareholders

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2006, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

29

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

30

The fund’s portfolio 1/31/07 (Unaudited)

| COMMON STOCKS (98.7%)* | | | |

|

| | Shares | | Value |

|

| Advertising and Marketing Services (0.8%) | | | |

| Omnicom Group, Inc. (S) | 49,600 | $ | 5,217,920 |

|

| |

| Aerospace and Defense (4.9%) | | | |

| Boeing Co. (The) | 85,200 | | 7,630,510 |

| L-3 Communications Holdings, Inc. | 45,300 | | 3,730,002 |

| Lockheed Martin Corp. | 111,400 | | 10,826,966 |

| United Technologies Corp. | 146,100 | | 9,937,722 |

| | | | 32,125,200 |

|

| |

| Airlines (1.0%) | | | |

| JetBlue Airways Corp. † (S) | 235,500 | | 3,221,640 |

| Southwest Airlines Co. (S) | 212,500 | | 3,208,750 |

| | | | 6,430,390 |

|

| |

| Automotive (0.9%) | | | |

| Harley-Davidson, Inc. (S) | 83,800 | | 5,721,026 |

|

| |

| Banking (5.5%) | | | |

| Bank of America Corp. | 169,000 | | 8,886,020 |

| Commerce Bancorp, Inc. (S) | 273,800 | | 9,248,964 |

| U.S. Bancorp (S) | 253,000 | | 9,006,800 |

| Wells Fargo & Co. | 258,100 | | 9,270,952 |

| | | | 36,412,736 |

|

| |

| Biotechnology (1.9%) | | | |

| Amgen, Inc. † # | 112,400 | | 7,909,588 |

| Genentech, Inc. † | 52,300 | | 4,569,451 |

| | | | 12,479,039 |

|

| |

| Broadcasting (0.4%) | | | |

| Grupo Televisa SA de CV ADR (Mexico) | 93,300 | | 2,748,618 |

|

| |

| Building Materials (0.6%) | | | |

| Sherwin-Williams Co. (The) | 62,100 | | 4,291,110 |

|

| |

| Commercial and Consumer Services (1.3%) | | | |

| Corporate Executive Board Co. (The) (S) | 19,400 | | 1,760,162 |

| Dun & Bradstreet Corp. (The) † | 37,731 | | 3,207,135 |

| Equifax, Inc. | 86,600 | | 3,596,498 |

| | | | 8,563,795 |

|

| |

| Communications Equipment (4.2%) | | | |

| Cisco Systems, Inc. † | 687,400 | | 18,277,966 |

| Qualcomm, Inc. | 240,600 | | 9,060,996 |

| | | | 27,338,962 |

31

| COMMON STOCKS (98.7%)* continued | | | |

|

| | Shares | | Value |

|

| Computers (4.7%) | | | |

| Apple Computer, Inc. † | 126,500 | $ | 10,844,845 |

| Dell, Inc. † | 342,500 | | 8,305,625 |

| EMC Corp. † | 540,800 | | 7,565,792 |

| Network Appliance, Inc. † | 105,100 | | 3,951,760 |

| | | | 30,668,022 |

|

| |

| Conglomerates (1.3%) | | | |

| Danaher Corp. (S) | 117,200 | | 8,679,832 |

|

| |

| Consumer Finance (4.1%) | | | |

| Capital One Financial Corp. | 187,100 | | 15,042,840 |

| Countrywide Financial Corp. | 266,800 | | 11,600,464 |

| | | | 26,643,304 |

|

| |

| Consumer Goods (2.9%) | | | |

| Colgate-Palmolive Co. | 75,600 | | 5,163,480 |

| Procter & Gamble Co. (The) | 210,900 | | 13,681,083 |

| | | | 18,844,563 |

|

| |

| Consumer Services (0.5%) | | | |

| Liberty Media Holding Corp. — Interactive Class A † | 130,700 | | 3,185,159 |

|

| |

| Electronics (0.9%) | | | |

| Amphenol Corp. Class A | 33,800 | | 2,288,936 |

| Microchip Technology, Inc. | 104,900 | | 3,646,324 |

| | | | 5,935,260 |

|

| |

| Energy (0.9%) | | | |

| Halliburton Co. | 210,600 | | 6,221,124 |

|

| |

| Financial (3.1%) | | | |

| American Express Co. | 143,700 | | 8,366,214 |

| Chicago Mercantile Exchange Holdings, Inc. (The) (S) | 7,209 | | 4,060,830 |

| Moody’s Corp. | 55,300 | | 3,957,268 |

| SLM Corp. | 90,000 | | 4,136,400 |

| | | | 20,520,712 |

|

| |

| Health Care Services (6.1%) | | | |

| Caremark Rx, Inc. | 89,700 | | 5,495,022 |

| Medco Health Solutions, Inc. † | 102,500 | | 6,069,025 |

| UnitedHealth Group, Inc. | 278,800 | | 14,570,088 |

| WellPoint, Inc. † | 177,400 | | 13,904,612 |

| | | | 40,038,747 |

|

| |

| Homebuilding (0.6%) | | | |

| NVR, Inc. † (S) | 5,775 | | 3,999,303 |

32

| COMMON STOCKS (98.7%)* continued | | | |

|

| | Shares | | Value |

|

| Insurance (4.3%) | | | |

| American International Group, Inc. | 242,400 | $ | 16,592,280 |

| Berkshire Hathaway, Inc. Class B † (S) | 1,691 | | 6,201,489 |

| Prudential Financial, Inc. | 60,300 | | 5,374,539 |

| | | | 28,168,308 |

|

| |

| Investment Banking/Brokerage (7.4%) | | | |

| Bear Stearns Cos., Inc. (The) | 89,400 | | 14,737,590 |

| BlackRock, Inc. (S) | 26,000 | | 4,361,760 |

| Franklin Resources, Inc. | 12,451 | | 1,483,039 |

| Goldman Sachs Group, Inc. (The) | 79,200 | | 16,803,072 |

| Morgan Stanley | 87,600 | | 7,252,404 |

| T. Rowe Price Group, Inc. | 85,900 | | 4,122,341 |

| | | | 48,760,206 |

|

| |

| Lodging/Tourism (1.6%) | | | |

| Las Vegas Sands Corp. † (S) | 46,400 | | 4,828,848 |

| Royal Caribbean Cruises, Ltd. | 80,100 | | 3,598,893 |

| Wyndham Worldwide Corp. † | 69,705 | | 2,174,796 |

| | | | 10,602,537 |

|

| |

| Machinery (0.9%) | | | |

| Parker-Hannifin Corp. | 70,200 | | 5,809,752 |

|

| |

| Medical Technology (2.5%) | | | |

| Becton, Dickinson and Co. | 55,100 | | 4,239,394 |

| Medtronic, Inc. | 141,500 | | 7,563,175 |

| St. Jude Medical, Inc. † | 109,000 | | 4,660,840 |

| | | | 16,463,409 |

|

| |

| Oil & Gas (5.2%) | | | |

| Devon Energy Corp. | 123,200 | | 8,635,088 |

| EOG Resources, Inc. | 108,600 | | 7,507,518 |

| Hess Corp. | 106,300 | | 5,739,137 |

| Occidental Petroleum Corp. | 88,000 | | 4,079,680 |

| Valero Energy Corp. | 153,300 | | 8,321,124 |

| | | | 34,282,547 |

|

| |

| Pharmaceuticals (3.2%) | | | |

| Barr Pharmaceuticals, Inc. † | 66,100 | | 3,537,672 |

| Johnson & Johnson | 211,900 | | 14,154,920 |

| Teva Pharmaceutical Industries, Ltd. ADR (Israel) (S) | 102,000 | | 3,580,200 |

| | | | 21,272,792 |

|

| |

| Publishing (1.8%) | | | |

| McGraw-Hill Cos., Inc. (The) | 176,900 | | 11,866,452 |

|

| |

| Real Estate (1.1%) | | | |

| CB Richard Ellis Group, Inc. Class A † | 185,900 | | 6,991,699 |

33

| COMMON STOCKS (98.7%)* continued | | | |

|

| | Shares | | Value |

|

| Restaurants (1.9%) | | | |

| Starbucks Corp. † | 137,000 | $ | 4,786,780 |

| Yum! Brands, Inc. | 122,600 | | 7,357,226 |

| | | | 12,144,006 |

|

| |

| Retail (9.7%) | | | |

| Abercrombie & Fitch Co. Class A (S) | 39,300 | | 3,125,922 |

| Bed Bath & Beyond, Inc. † | 103,700 | | 4,375,103 |

| Best Buy Co., Inc. | 125,500 | | 6,325,200 |

| CVS Corp. (S) | 84,700 | | 2,850,155 |

| Home Depot, Inc. (The) | 299,200 | | 12,189,408 |

| Kohl’s Corp. † | 69,500 | | 4,928,245 |

| Lowe’s Cos., Inc. (S) | 332,100 | | 11,195,091 |

| Ross Stores, Inc. (S) | 147,100 | | 4,764,569 |

| Staples, Inc. | 549,200 | | 14,125,424 |

| | | | 63,879,117 |

|

| |

| Semiconductor (1.0%) | | | |

| Applied Materials, Inc. | 353,600 | | 6,269,328 |

|

| |

| Software (5.6%) | | | |

| Adobe Systems, Inc. † | 190,900 | | 7,420,283 |

| Autodesk, Inc. † | 165,100 | | 7,218,172 |

| Microsoft Corp. (S) | 333,100 | | 10,279,466 |

| Oracle Corp. † | 679,600 | | 11,661,936 |

| | | | 36,579,857 |

|

| |

| Technology Services (5.5%) | | | |

| Accenture, Ltd. Class A (Bermuda) | 79,000 | | 2,982,250 |

| Automatic Data Processing, Inc. | 194,800 | | 9,295,856 |

| eBay, Inc. † (S) | 247,900 | | 8,029,481 |

| Google, Inc. Class A † | 20,525 | | 10,289,183 |

| Western Union Co. (The) | 260,200 | | 5,812,868 |

| | | | 36,409,638 |

|

| |

| Textiles (0.1%) | | | |

| Coach, Inc. † | 16,239 | | 744,721 |

|

| |

| Transportation Services (0.3%) | | | |

| Expeditors International of Washington, Inc. | 43,900 | | 1,874,091 |

|

| |

| Total common stocks (cost $594,606,998) | | $ | 648,183,282 |

34

| SHORT-TERM INVESTMENTS (10.7%)* | | | | |

|

| | | Principal amount | | Value |

|

| Interest in $183,000,000 joint tri-party repurchase | | | | |

| agreement dated January 31, 2007 with Bank | | | | |

| of America Securities, LLC due February 1, 2007 | | | | |

| with respect to various U.S. Government obligations | | | | |

| — maturity value of $14,802,158 for an effective | | | | |

| yield of 5.25% (collateralized by Freddie Mac | | | | |

| securities with a coupon rate of 5.00% due | | | | |

| July 1, 2035, valued at $186,660,001) | $ | 14,800,000 | $ | 14,800,000 |

| Short-term investments held as collateral for loaned | | | | |

| securities with yields ranging from 5.27% to 5.46% | | | | |

| and due dates ranging from February 1, 2007 | | | | |

| to March 23, 2007 (d) | | 55,484,043 | | 55,393,655 |

|

| |

| Total short-term investments (cost $70,193,655) | | | $ | 70,193,655 |

|

| |

| |

| TOTAL INVESTMENTS | | | | |

| Total investments (cost $664,800,653) | | | $ | 718,376,937 |

* Percentages indicated are based on net assets of $656,420,648.

† Non-income-producing security.

# A portion of this security was pledged and segregated with the custodian to cover margin requirements for futures contracts at January 31, 2007.

(d) See Note 1 to the financial statements.

(S) Securities on loan, in part or in entirety, at January 31, 2007.

At January 31, 2007, liquid assets totaling $9,018,750 have been designated as collateral for open futures contracts.

ADR after the name of a foreign holding stands for American Depository Receipts representing ownership of foreign securities on deposit with a custodian bank.

| FUTURES CONTRACTS OUTSTANDING at 1/31/07 (Unaudited) | | | | | |

| |

| | Number of | | | Expiration | Unrealized | |

| | contracts | Value | | date | appreciation | |

| |

| S&P 500 Index (Long) | 25 | $9,018,750 | | Mar-07 | $97,321 | |

The accompanying notes are an integral part of these financial statements.

35

Statement of assets and liabilities 1/31/07 (Unaudited)

| ASSETS | | |

|

| Investment in securities, at value, including $53,747,993 of securities on loan (Note 1): | | |

| Unaffiliated issuers (identified cost $664,800,653) | $ | 718,376,937 |

|

| Cash | | 7,573 |

|

| Dividends, interest and other receivables | | 392,947 |

|

| Receivable for shares of the fund sold | | 195,336 |

|

| Receivable for securities sold | | 9,034,715 |

|

| Receivable for variation margin (Note 1) | | 56,250 |

|

| Total assets | | 728,063,758 |

|

| |

| LIABILITIES | | |

|

| Payable for securities purchased | | 12,191,144 |

|