UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT COMPANY

| Investment Company Act file number: | 811-07239 |

| Name of Registrant: | Vanguard Horizon Funds |

| Address of Registrant: | P.O. Box 2600

Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

| Date of fiscal year end: | September 30 |

| Date of reporting period: | October 1, 2006 - March 31, 2007 |

| Item 1: | Reports to Shareholders |

| |

Vanguard® Strategic Equity Fund |

| |

| |

| |

> Semiannual Report | |

| |

| |

| |

March 31, 2007 | |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

> During the first half of its 2007 fiscal year, Vanguard Strategic Equity Fund returned 13.1%, well above the return of the broad U.S. stock market and nearly a full percentage point ahead of the average return of its peer mutual funds.

> The fund’s emphasis on mid- and small-capitalization shares, which performed well during the six months, helped drive its strong return and outperformance of the broad market.

> Steel companies dominated the top spots on the list of the fund’s best performers, while several software companies landed near the bottom.

Contents | |

| |

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Advisor’s Report | 6 |

Fund Profile | 8 |

Performance Summary | 9 |

Financial Statements | 10 |

About Your Fund’s Expenses | 25 |

Trustees Approve Advisory Arrangement | 27 |

Glossary | 28 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended March 31, 2007 | |

| Total |

| Returns |

Vanguard Strategic Equity Fund | 13.1% |

MSCI US Small + Mid Cap 2200 Index | 12.4 |

Average Mid-Cap Core Fund1 | 12.3 |

Dow Jones Wilshire 5000 Index | 8.9 |

Your Fund’s Performance at a Glance |

September 30, 2006–March 31, 2007 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard Strategic Equity Fund | $23.07 | $24.79 | $0.26 | $0.98 |

1 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

During a six-month period that was good for large-capitalization shares but even better for mid- and small-cap stocks, Vanguard Strategic Equity Fund provided a return of 13.1%. This strong performance was comfortably ahead of the return of the broad market, and it topped the average return of similar funds as well as the return of an index benchmark that the fund closely follows.

The first table on page 1 shows the total returns (capital change plus reinvested distributions) for the fund and its comparative measures.

Six-month stock market return reflected disparate market moods

The broad U.S. stock market stitched together a solid six-month return from patches of strength and weakness. Stock prices rallied at the start of the period, pulled back in February—in part, a reaction to the Chinese market’s swoon—then recovered in March, buoyed by generally benign economic and corporate-profit reports.

Small-cap stocks outpaced large-caps, and international stocks outperformed their U.S. counterparts—patterns that have been in place for much of the past few years.

As the Fed sat tight, bonds produced coupon-like returns

The Federal Reserve Board remained offstage during the six months, keeping its target for the federal funds rate at 5.25% throughout the period. Despite some interim back-and-forth, longer-term bond yields

2

finished the period pretty much where they started. With rates—and prices—more or less stable, bonds’ returns were consistent with their coupons.

The broad taxable bond market returned 2.8% for the six-month period. The municipal securities market posted a return of 1.9%. Money market instruments, one of the fixed income market’s bright spots in recent months, returned 2.5% for the half-year, as measured by the Citigroup 3-Month Treasury Bill Index.

The fund’s gain was powered by industrials and consumer stocks

Your fund’s six-month return of 13.1% was excellent in absolute terms and solid when compared with the return of the broad

U.S. stock market and the MSCI US Small + Mid Cap 2200 Index. To be sure, a double-digit return in just a half-year is something to be grateful for, but it should never be something that you expect from any investment.

By design, the Strategic Equity Fund’s sector weightings vary little from those of the index benchmark. The fund’s advisor, Vanguard Quantitative Equity Group, uses computer models to identify the most promising stocks in each sector. This means that, although the weightings of the fund and the index will be similar, the returns within sectors will often be different. Attempting to make these differences positive is what active management is all about.

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended March 31, 2007 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

Russell 1000 Index (Large-caps) | 8.2% | 11.8% | 6.9% |

Russell 2000 Index (Small-caps) | 11.0 | 5.9 | 10.9 |

Dow Jones Wilshire 5000 Index (Entire market) | 8.9 | 11.4 | 7.8 |

MSCI All Country World Index ex USA (International) | 15.5 | 20.3 | 17.4 |

| | | |

Bonds | | | |

Lehman Aggregate Bond Index (Broad taxable market) | 2.8% | 6.6% | 5.4% |

Lehman Municipal Bond Index | 1.9 | 5.4 | 5.5 |

Citigroup 3-Month Treasury Bill Index | 2.5 | 5.0 | 2.5 |

| | | |

CPI | | | |

Consumer Price Index | 1.2% | 2.8% | 2.8% |

1 Annualized.

3

For both the fund and the index, all of the ten sectors recorded positive returns. The range of returns, however, was quite wide. Materials companies (which accounted for only about 5% of the fund and the index) recorded a heady gain of more than 40%, while financials and information technology concerns returned 5% and 6%, respectively.

The fund gained an edge over the index through its selections in the materials sector and the consumer discretionary sector (retailers and entertainment companies) but gave up some ground to the benchmark in financials and information technology shares. Specifically, terrific returns from steel companies helped boost the fund’s return, as did the strong performance of several retailers.

See the Advisor’s Report on page 6 for more details on the fund’s model and performance.

In its quest for superior performance, the fund has been aided by its extremely low expenses. The table below illustrates its significant cost advantage over competing funds. This advantage has helped maximize investors’ share of the long-term rewards produced by the advisor’s stock-picking talents. Over the past ten years, the fund’s average annual return is higher than the index’s return by nearly a full percentage point.

Annualized Expense Ratios1 | | |

Your fund compared with its peer group | | |

| | Average |

| | Mid-Cap |

| Fund | Core Fund |

Strategic Equity Fund | 0.31% | 1.83% |

1 Fund expense ratio reflects the six months ended March 31, 2007. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2006.

4

A stock-market guarantee: Prices will fluctuate

During the past six months, stock prices did what they have always done and will forever do: They fluctuated. When all was said and done, the fluctuations added up to a rewarding half-year for the Strategic Equity Fund. But, of course, volatility can have a downside as well.

Fortunately, the key to meeting your long-term investment goals does not involve calculating when market fluctuations will work against you and when they will work in your favor. Rather, it involves building a portfolio that is diversified among asset classes and within them. The Strategic Equity Fund can play an important role in such a portfolio by providing disciplined, low-cost exposure to mid- and small-cap stocks.

Thank you for investing with Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

April 12, 2007

5

Advisor’s Report

For the six months ended March 31, 2007, Vanguard Strategic Equity Fund returned 13.1%, topping the 12.4% gain of the fund’s market benchmark, the MSCI Small + Mid Cap 2200 Index. The broad U.S. stock market returned 8.9%.

The investment environment

During this period, small- and mid-capitalization stocks once again outperformed their large-cap brethren. Large-cap stocks, which are not included in our benchmark, were up about 7%, while mid-cap and small-cap stocks each gained about 12%.

Over the past several years, smaller stocks have tended to outperform larger stocks. This tendency has helped the fund’s benchmark index to outperform broad market averages, which are dominated by large-caps. Because our strategy ties the fund tightly to the benchmark, its rise helped lift our performance above the broad market.

However, it is likely that in some future period this market tendency will reverse. When that happens, the fund’s return—reflecting our portfolio risk control, which links us to our benchmark—will likely lag behind that of large-cap-dominated market indexes. We cannot predict when this change will occur, and we will not modify our management of the fund in an attempt to anticipate it. Our goal is to outperform the fund’s mid- and small-cap benchmark, not to time changes in market factors. In our opinion, the potential rewards associated with timing market factors are not worth the additional risk.

Our investment approach

In our report on the fund’s 2006 fiscal year, we lamented that, while our model had been successful in identifying attractive stocks, we had been unlucky when selecting the particular stocks that made up our portfolio. The “luck” component improved during the past six months. Our model was again quite successful at picking stocks for us to choose from, and we had the added benefit of good fortune in our choices.

To oversimplify, our fund’s performance has three components: the return of the benchmark, our model’s stock-picking ability, and some amount of luck. Over the long run, we expect that last component to average out to zero.

The heart of our process is our stock-selection model. It contains three elements, each of which measures a stock’s attractiveness relative to its capitalization and industry peers. The first element measures a stock’s valuation; the second evaluates earnings quality; and the last considers market sentiment. These three elements are combined into an overall rating for each stock. To construct our portfolio, we combine the stock ratings with risk measures to minimize our exposure to industry and other factors. The resulting portfolio should capture the benchmark’s return plus the result of our model’s stock selection.

The fund’s successes and shortfalls

Our best performance over the six months was in the materials industry, where our model picked United States Steel, Steel Dynamics, and AK Steel, each of which

6

was up dramatically for the period. Our model was also successful in the consumer durables and technology industries.

Conversely, the model underperformed in the software industry, picking RealNetworks and Transaction Systems Architects, both of which dropped in value. These disparate results in the same period are typical of a quantitative process like ours and of a portfolio that holds many securities.

The stock-specific risk we assume in the portfolio has paid off so far this year, but it could reward or punish us in the near term. We look forward to the remainder of the fiscal year, believing that the fund offers a strong mix of stocks with attractive valuation and growth characteristics relative to its underlying benchmark.

James D. Troyer,

Principal and Portfolio Manager

Joel M. Dickson, Principal

Vanguard Quantitative Equity Group

April 11, 2007

7

Fund Profile

As of March 31, 2007

Portfolio Characteristics | | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 735 | 2,144 | 4,948 |

Median Market Cap | $4.1B | $4.1B | $30.6B |

Price/Earnings Ratio | 15.8x | 20.8x | 17.6x |

Price/Book Ratio | 2.5x | 2.6x | 2.8x |

Yield | 1.0% | 1.2% | 1.7% |

Return on Equity | 13.8% | 14.0% | 16.9% |

Earnings Growth Rate | 19.1% | 18.7% | 20.8% |

Foreign Holdings | 0.2% | 0.0% | 0.7% |

Turnover Rate | 75%3 | — | — |

Expense Ratio | 0.31%3 | — | — |

Short-Term Reserves | 0% | — | — |

Sector Diversification (% of portfolio) | |

| | Comparative | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 16% | 16% | 12% |

Consumer Staples | 3 | 3 | 9 |

Energy | 8 | 8 | 9 |

Financials | 21 | 21 | 22 |

Health Care | 10 | 10 | 11 |

Industrials | 13 | 13 | 11 |

Information Technology | 15 | 15 | 15 |

Materials | 6 | 6 | 4 |

Telecommunication | | | |

Services | 2 | 2 | 3 |

Utilities | 6 | 6 | 4 |

Volatility Measures4 | |

| Fund Versus | Fund Versus |

| Comparative Index1 | Broad Index2 |

R-Squared | 0.98 | 0.89 |

Beta | 1.06 | 1.47 |

Ten Largest Holdings5 (% of total net assets) |

| | |

Mirant Corp. | independent power | |

| producers and | |

| energy traders | 1.0% |

AmerisourceBergen Corp. | health care | |

| distributors | 1.0 |

Parker Hannifin Corp. | industrial machinery | 1.0 |

Cummins Inc. | construction and | |

| farm machinery and | |

| heavy trucks | 1.0 |

Safeco Corp. | property and | |

| casualty insurance | 0.9 |

Terex Corp. | construction and | |

| farm machinery and | |

| heavy trucks | 0.9 |

Nabors Industries, Inc. | oil and gas drilling | 0.9 |

Tesoro Petroleum Corp. | oil and gas refining | |

| and marketing | 0.9 |

Fiserv, Inc. | data processing and | |

| outsourced services | 0.9 |

Helmerich & Payne, Inc. | oil and gas drilling | 0.9 |

Top Ten | | 9.4% |

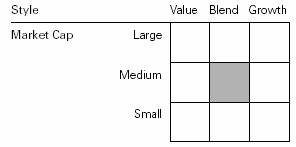

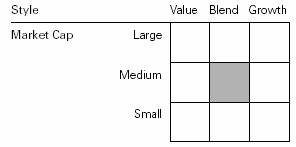

Investment Focus

1 MSCI US Small + Mid Cap 2200 Index.

2 Dow Jones Wilshire 5000 Index.

3 Annualized.

4 For an explanation of R-squared, beta, and other terms used here, see the Glossary on page 28.

5 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

8

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

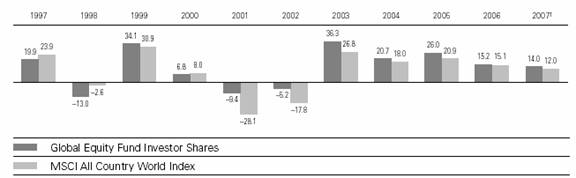

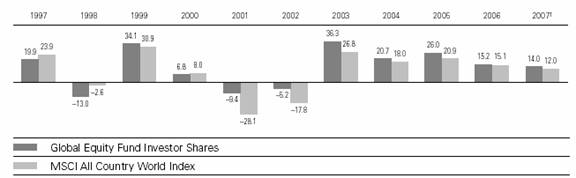

Fiscal-Year Total Returns (%): September 30, 1996–March 31, 2007

Average Annual Total Returns: Periods Ended March 31, 2007 |

| | | | |

| Inception Date | One Year | Five Years | Ten Years |

Strategic Equity Fund | 8/14/1995 | 9.01% | 13.52% | 13.04% |

1 Six months ended March 31, 2007.

2 The Spliced Small and Mid Cap Index reflects the returns of the Russell 2800 Index through May 31, 2003, and the MSCI US Small + Mid Cap 2200 Index thereafter.

Note: See Financial Highlights table on page 21 for dividend and capital gains information.

9

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2007

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks (99.8%)1 | | |

Consumer Discretionary (16.3%) | | |

| Polo Ralph Lauren Corp. | 760,580 | 67,045 |

| Whirlpool Corp. | 757,800 | 64,345 |

| Darden Restaurants Inc. | 1,411,300 | 58,131 |

| Nordstrom, Inc. | 1,090,900 | 57,752 |

| Guess ?, Inc. | 1,375,800 | 55,706 |

| Royal Caribbean | | |

| Cruises, Ltd. | 1,076,319 | 45,378 |

| Phillips-Van Heusen Corp. | 719,100 | 42,283 |

| Brinker International, Inc. | 1,045,900 | 34,201 |

| Abercrombie & Fitch Co. | 449,300 | 34,003 |

| Men’s Wearhouse, Inc. | 603,350 | 28,388 |

| Lamar Advertising Co. | | |

| Class A | 419,021 | 26,386 |

| Cablevision Systems | | |

| NY Group Class A | 805,600 | 24,514 |

* | Liberty Media Corp.— | | |

| Capital Series A | 206,396 | 22,825 |

* | AutoNation, Inc. | 1,052,047 | 22,345 |

| Newell Rubbermaid, Inc. | 675,146 | 20,990 |

| Jackson Hewitt | | |

| Tax Service Inc. | 623,600 | 20,067 |

| Dillard’s Inc. | 572,100 | 18,725 |

* | Wyndham Worldwide Corp. | 518,500 | 17,707 |

* | Skechers U.S.A., Inc. | 501,200 | 16,825 |

| Ruby Tuesday, Inc. | 581,800 | 16,639 |

* | Payless ShoeSource, Inc. | 464,000 | 15,405 |

* | AnnTaylor Stores Corp. | 367,900 | 14,267 |

| VF Corp. | 171,994 | 14,210 |

| Sherwin-Williams Co. | 208,357 | 13,760 |

| Sinclair Broadcast Group, Inc. | 887,816 | 13,717 |

* | Gemstar-TV Guide | | |

| International, Inc. | 3,217,485 | 13,481 |

| Eastman Kodak Co. | 571,300 | 12,889 |

* | DSW Inc. Class A | 304,200 | 12,840 |

* | Jack in the Box Inc. | 176,900 | 12,229 |

| Liz Claiborne, Inc. | 285,000 | 12,212 |

| Thor Industries, Inc. | 300,000 | 11,817 |

* | Charming Shoppes, Inc. | 908,858 | 11,770 |

| Meredith Corp. | 193,320 | 11,095 |

* | Harris Interactive Inc. | 1,809,900 | 10,914 |

| Idearc Inc. | 310,175 | 10,887 |

| Jones Apparel Group, Inc. | 352,800 | 10,842 |

* | ITT Educational Services, Inc. | 130,500 | 10,634 |

| Bob Evans Farms, Inc. | 284,017 | 10,494 |

* | CSK Auto Corp. | 594,600 | 10,227 |

* | ^Chipotle Mexican Grill, Inc. | 161,600 | 10,035 |

| Tim Hortons, Inc. | 326,800 | 9,941 |

| E.W. Scripps Co. Class A | 216,100 | 9,655 |

* | Tenneco Automotive, Inc. | 375,400 | 9,558 |

| Mattel, Inc. | 343,400 | 9,468 |

| Washington Post Co. Class B | 12,378 | 9,451 |

| Belo Corp. Class A | 497,400 | 9,286 |

| ArvinMeritor, Inc. | 494,600 | 9,026 |

* | Dollar Tree Stores, Inc. | 217,490 | 8,317 |

* | Genesco, Inc. | 200,200 | 8,314 |

* | RCN Corp. | 305,580 | 7,808 |

| Modine Manufacturing Co. | 338,600 | 7,754 |

| Harte-Hanks, Inc. | 281,000 | 7,753 |

| Catalina Marketing Corp. | 238,170 | 7,521 |

| H & R Block, Inc. | 353,200 | 7,431 |

* | Mohawk Industries, Inc. | 90,425 | 7,419 |

| Kimball International, Inc. | | |

| Class B | 370,086 | 7,135 |

| Domino’s Pizza, Inc. | 218,100 | 7,082 |

* | ^Nutri/System Inc. | 134,276 | 7,037 |

* | JAKKS Pacific, Inc. | 285,500 | 6,823 |

| K-Swiss, Inc. | 252,351 | 6,819 |

* | Big Lots Inc. | 209,600 | 6,556 |

| Cato Corp. Class A | 280,050 | 6,550 |

| The McClatchy Co. Class A | 197,400 | 6,240 |

* | Visteon Corp. | 701,800 | 5,993 |

| Steven Madden, Ltd. | 177,780 | 5,191 |

| Brown Shoe Co., Inc. | 122,900 | 5,162 |

| Sonic Automotive, Inc. | 175,000 | 4,988 |

* | Cox Radio, Inc. | 350,331 | 4,782 |

* | ^Krispy Kreme Doughnuts, Inc. | 459,253 | 4,680 |

| *Lear Corp. | 112,600 | 4,111 |

| World Wrestling | | |

| Entertainment, Inc. | 209,087 | 3,408 |

10

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Group 1 Automotive, Inc. | 83,500 | 3,321 |

* | Expedia, Inc. | 141,015 | 3,269 |

* | The Dress Barn, Inc. | 154,780 | 3,221 |

| Tempur-Pedic | | |

| International Inc. | 123,600 | 3,212 |

| Stewart Enterprises, Inc. | | |

| Class A | 395,258 | 3,186 |

| Ross Stores, Inc. | 86,749 | 2,984 |

| Sotheby’s | 66,278 | 2,948 |

* | Rent-A-Center, Inc. | 103,893 | 2,907 |

* | ^Select Comfort Corp. | 158,200 | 2,816 |

* | The Gymboree Corp. | 63,400 | 2,540 |

| Asbury Automotive | | |

| Group, Inc. | 86,300 | 2,438 |

| Dover Downs Gaming & | | |

| Entertainment, Inc. | 185,850 | 2,394 |

| Saks Inc. | 111,400 | 2,322 |

| Sealy Corp. | 130,500 | 2,281 |

* | Getty Images, Inc. | 46,800 | 2,276 |

| Ethan Allen Interiors, Inc. | 59,000 | 2,085 |

| American Greetings Corp. | | |

| Class A | 89,000 | 2,066 |

* | Steak n Shake Co. | 121,208 | 2,033 |

* | Spanish Broadcasting | | |

| System, Inc. | 499,974 | 2,000 |

| Building Materials | | |

| Holding Corp. | 103,900 | 1,882 |

| The Buckle, Inc. | 51,150 | 1,826 |

| Aaron Rents, Inc. | 68,800 | 1,819 |

| Movado Group, Inc. | 61,100 | 1,799 |

* | Papa John’s International, Inc. | 60,621 | 1,782 |

* | Scholastic Corp. | 54,600 | 1,698 |

| UniFirst Corp. | 44,200 | 1,696 |

* | The Warnaco Group, Inc. | 59,100 | 1,678 |

| Service Corp. International | 139,900 | 1,659 |

| International Speedway Corp. | 31,684 | 1,638 |

| FTD Group, Inc. | 98,900 | 1,635 |

| Interactive Data Corp. | 62,700 | 1,552 |

* | GSI Commerce, Inc. | 67,800 | 1,532 |

| Regal Entertainment Group | | |

| Class A | 76,747 | 1,525 |

| Wynn Resorts Ltd. | 12,300 | 1,167 |

| Sally Beauty Co. Inc. | 122,100 | 1,122 |

* | K2 Inc. | 79,200 | 958 |

* | O’Charley’s Inc. | 46,100 | 889 |

| RadioShack Corp. | 31,400 | 849 |

* | Penn National Gaming, Inc. | 18,966 | 805 |

| Kellwood Co. | 27,400 | 804 |

| Westwood One, Inc. | 101,602 | 698 |

| Haverty Furniture Cos., Inc. | 48,200 | 675 |

| OfficeMax, Inc. | 11,400 | 601 |

* | Vertrue Inc. | 11,600 | 558 |

| Xerium Technologies Inc. | 66,700 | 535 |

* | Audiovox Corp. | 35,500 | 523 |

| CSS Industries, Inc. | 12,700 | 476 |

* | Charlotte Russe Holding Inc. | 13,200 | 381 |

* | Jo-Ann Stores, Inc. | 13,300 | 362 |

| Wendy’s International, Inc. | 9,800 | 307 |

* | RC2 Corp. | 3,760 | 152 |

* | Town Sports International | | |

| Holdings, Inc. | 4,800 | 105 |

| Coinmach Service Corp. | | |

| Class A | 9,700 | 103 |

| | | 1,245,329 |

Consumer Staples (3.4%) | | |

| Carolina Group | 800,300 | 60,511 |

| The Pepsi Bottling Group, Inc. | 951,500 | 30,343 |

| The Estee Lauder Cos. Inc. | | |

| Class A | 381,400 | 18,631 |

| The Kroger Co. | 622,000 | 17,571 |

| Del Monte Foods Co. | 1,452,427 | 16,674 |

* | NBTY, Inc. | 287,283 | 15,237 |

| Longs Drug Stores, Inc. | 282,910 | 14,609 |

| Brown-Forman Corp. Class B | 155,107 | 10,169 |

* | Hansen Natural Corp. | 266,324 | 10,088 |

* | The Pantry, Inc. | 166,400 | 7,525 |

| ^The Andersons, Inc. | 160,600 | 7,131 |

| Molson Coors Brewing Co. | | |

| Class B | 56,400 | 5,337 |

* | Energizer Holdings, Inc. | 61,800 | 5,273 |

| Seaboard Corp. | 2,290 | 5,175 |

| J.M. Smucker Co. | 96,600 | 5,151 |

| Corn Products | | |

| International, Inc. | 135,500 | 4,822 |

| Ruddick Corp. | 120,700 | 3,631 |

* | Herbalife Ltd. | 69,700 | 2,732 |

* | Prestige Brands | | |

| Holdings Inc. | 227,500 | 2,696 |

* | Ralcorp Holdings, Inc. | 38,800 | 2,495 |

| Ingles Markets, Inc. | 44,400 | 1,813 |

* | Performance Food Group Co. | 57,991 | 1,790 |

* | Alliance One | | |

| International, Inc. | 186,300 | 1,720 |

| The Great Atlantic & | | |

| Pacific Tea Co., Inc. | 30,500 | 1,012 |

| ^Mannatech, Inc. | 62,984 | 1,012 |

* | USANA Health Sciences, Inc. | 21,000 | 984 |

* | Boston Beer Co., Inc. Class A | 28,000 | 934 |

| Weis Markets, Inc. | 18,300 | 818 |

| Premium Standard Farms Inc. | 34,770 | 732 |

| ^Vector Group Ltd. | 26,590 | 497 |

| The Topps Co., Inc. | 36,300 | 353 |

* | Wild Oats Markets Inc. | 16,667 | 303 |

| Universal Corp. (VA) | 2,600 | 160 |

| | | 257,929 |

Energy (8.3%) | | |

* | Nabors Industries, Inc. | 2,389,862 | 70,907 |

| Tesoro Petroleum Corp. | 704,400 | 70,743 |

| Helmerich & Payne, Inc. | 2,275,542 | 69,040 |

| Chesapeake Energy Corp. | 1,819,829 | 56,196 |

* | National Oilwell Varco Inc. | 586,100 | 45,593 |

| Tidewater Inc. | 744,100 | 43,589 |

11

| | | Market |

| | | Value• |

| | Shares | ($000) |

| ENSCO International, Inc. | 586,309 | 31,895 |

| Holly Corp. | 502,958 | 29,825 |

| Frontier Oil Corp. | 853,200 | 27,848 |

* | Cameron International Corp. | 425,500 | 26,717 |

* | Swift Energy Co. | 609,600 | 25,463 |

* | Unit Corp. | 405,012 | 20,490 |

| Noble Corp. | 233,511 | 18,373 |

* | Grey Wolf, Inc. | 2,017,419 | 13,517 |

* | Pioneer Drilling Co. | 957,400 | 12,149 |

* | Atwood Oceanics, Inc. | 189,600 | 11,128 |

| Hess Corp. | 148,027 | 8,211 |

* | Parker Drilling Co. | 639,200 | 6,002 |

* | Superior Energy | | |

| Services, Inc. | 163,347 | 5,631 |

| OMI Corp. | 197,200 | 5,297 |

* | NATCO Group Inc. | 139,200 | 4,749 |

* | ^Hercules Offshore, Inc. | 169,500 | 4,451 |

* | SEACOR Holdings Inc. | 43,300 | 4,261 |

* | Todco Class A | 99,525 | 4,014 |

* | Forest Oil Corp. | 95,700 | 3,193 |

| Overseas Shipholding | | |

| Group Inc. | 49,700 | 3,111 |

| GlobalSantaFe Corp. | 47,700 | 2,942 |

* | W-H Energy Services, Inc. | 50,200 | 2,346 |

| W&T Offshore, Inc. | 79,800 | 2,309 |

* | Bronco Drilling Co., Inc. | 89,745 | 1,487 |

* | Complete Production | | |

| Services, Inc. | 70,900 | 1,412 |

* | Global Industries Ltd. | 74,087 | 1,355 |

* | Basic Energy Services Inc. | 49,400 | 1,151 |

* | Trico Marine Services, Inc. | 24,700 | 920 |

| General Maritime Corp. | 30,200 | 872 |

* | Petroleum Development Corp. | 7,600 | 407 |

* | Mariner Energy Inc. | 9,000 | 172 |

| | | 637,766 |

Financials (21.1%) | | |

| Capital Markets (1.5%) | | |

| Ameriprise Financial, Inc. | 605,121 | 34,577 |

* | E*TRADE Financial Corp. | 1,342,169 | 28,481 |

| A.G. Edwards & Sons, Inc. | 384,700 | 26,614 |

| Raymond James | | |

| Financial, Inc. | 411,150 | 12,236 |

* | Knight Capital Group, Inc. | | |

| Class A | 472,753 | 7,488 |

| MCG Capital Corp. | 318,008 | 5,966 |

| SWS Group, Inc. | 42,500 | 1,054 |

| Gamco Investors Inc. Class A | 21,691 | 940 |

| Capital Southwest Corp. | 1,000 | 154 |

| | | |

| Commercial Banks (2.9%) | | |

| Synovus Financial Corp. | 1,999,957 | 64,679 |

| Huntington Bancshares Inc. | 1,929,251 | 42,154 |

| Colonial BancGroup, Inc. | 887,200 | 21,958 |

| Bank of Hawaii Corp. | 412,986 | 21,901 |

| TCF Financial Corp. | 298,300 | 7,863 |

| Wilmington Trust Corp. | 109,900 | 4,634 |

| City Holding Co. | 106,855 | 4,322 |

| BancorpSouth, Inc. | 170,933 | 4,179 |

| Hancock Holding Co. | 92,195 | 4,055 |

| Compass Bancshares Inc. | 53,700 | 3,695 |

| Whitney Holdings Corp. | 104,700 | 3,202 |

| Independent Bank Corp. (MI) | 149,035 | 3,036 |

| Trustmark Corp. | 92,400 | 2,591 |

| First Republic Bank | 46,531 | 2,499 |

| BancFirst Corp. | 49,522 | 2,295 |

| Hanmi Financial Corp. | 110,200 | 2,100 |

| Old National Bancorp | 100,800 | 1,833 |

| Park National Corp. | 18,600 | 1,757 |

| First Community | | |

| Bancshares, Inc. | 42,018 | 1,639 |

| F.N.B. Corp. | 96,400 | 1,624 |

| Great Southern Bancorp, Inc. | 46,480 | 1,361 |

| NBT Bancorp, Inc. | 56,252 | 1,318 |

| Community Trust Bancorp Inc. | 30,256 | 1,096 |

| Capital City Bank Group, Inc. | 26,900 | 896 |

| Sterling Financial Corp. (PA) | 38,588 | 857 |

| United Bankshares, Inc. | 23,881 | 837 |

| IBERIABANK Corp. | 14,700 | 818 |

| West Coast Bancorp | 24,842 | 794 |

| BOK Financial Corp. | 14,918 | 739 |

| Sandy Spring Bancorp, Inc. | 21,300 | 738 |

| Banner Corp. | 17,137 | 712 |

| Sky Financial Group, Inc. | 25,736 | 691 |

| First Source Corp. | 25,845 | 676 |

| Nara Bancorp, Inc. | 38,605 | 676 |

| United Community Banks, Inc. | 19,603 | 643 |

| Chittenden Corp. | 20,600 | 622 |

| First Indiana Corp. | 27,587 | 603 |

| Renasant Corp. | 23,500 | 580 |

| Suffolk Bancorp | 17,300 | 558 |

| Union Bankshares Corp. | 21,000 | 545 |

| Simmons First National Corp. | 17,942 | 540 |

| Peoples Bancorp, Inc. | 19,800 | 523 |

| Heartland Financial USA, Inc. | 19,469 | 521 |

| S.Y. Bancorp, Inc. | 20,700 | 515 |

| TriCo Bancshares | 21,042 | 498 |

| Tompkins Trustco, Inc. | 11,600 | 486 |

| First Financial Corp. (IN) | 15,000 | 464 |

| Wilshire Bancorp Inc. | 27,000 | 443 |

| Taylor Capital Group, Inc. | 10,300 | 361 |

| Provident Bankshares Corp. | 7,903 | 260 |

| Independent Bank Corp. (MA) | 7,411 | 244 |

| First Merchants Corp. | 7,586 | 180 |

| FirstMerit Corp. | 6,101 | 129 |

| | | |

| Consumer Finance (1.5%) | | |

* | AmeriCredit Corp. | 2,358,145 | 53,907 |

| The First Marblehead Corp. | 850,300 | 38,170 |

| Advanta Corp. Class B | 235,197 | 10,311 |

* | EZCORP, Inc. | 460,749 | 6,787 |

* | World Acceptance Corp. | 146,500 | 5,853 |

| Advance America, Cash | | |

| Advance Centers, Inc. | 14,723 | 227 |

12

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Diversified Financial Services (0.4%) | | |

| Leucadia National Corp. | 864,290 | 25,427 |

* | Primus Guaranty, Ltd. | 250,000 | 3,075 |

| Resource America, Inc. | 65,020 | 1,536 |

| | | |

| Insurance (4.2%) | | |

| Safeco Corp. | 1,082,402 | 71,904 |

| First American Corp. | 763,821 | 38,741 |

| Nationwide Financial | | |

| Services, Inc. | 482,700 | 25,998 |

| W.R. Berkley Corp. | 680,735 | 22,546 |

* | Arch Capital Group Ltd. | 307,300 | 20,961 |

| Zenith National | | |

| Insurance Corp. | 375,909 | 17,769 |

| American Financial | | |

| Group, Inc. | 439,500 | 14,961 |

| Ohio Casualty Corp. | 499,483 | 14,960 |

* | Philadelphia Consolidated | | |

| Holding Corp. | 278,324 | 12,243 |

| PartnerRe Ltd. | 172,400 | 11,816 |

| Endurance Specialty | | |

| Holdings Ltd. | 310,400 | 11,094 |

| Platinum Underwriters | | |

| Holdings, Ltd. | 344,200 | 11,042 |

| Everest Re Group, Ltd. | 109,800 | 10,559 |

| The Hanover Insurance | | |

| Group Inc. | 191,400 | 8,827 |

| Axis Capital Holdings Ltd. | 232,380 | 7,868 |

| Odyssey Re Holdings Corp. | 156,700 | 6,160 |

| Aspen Insurance | | |

| Holdings Ltd. | 169,000 | 4,429 |

| Safety Insurance Group, Inc. | 100,020 | 4,013 |

| Transatlantic Holdings, Inc. | 24,700 | 1,608 |

| Baldwin & Lyons, Inc. Class B | 33,300 | 847 |

| Commerce Group, Inc. | 27,010 | 811 |

| Horace Mann Educators Corp. | 36,300 | 746 |

| National Western Life | | |

| Insurance Co. Class A | 2,720 | 666 |

| Crawford & Co. Class B | 110,900 | 643 |

| IPC Holdings Ltd. | 22,000 | 635 |

| Torchmark Corp. | 6,000 | 394 |

| Presidential Life Corp. | 19,000 | 375 |

| Montpelier Re Holdings Ltd. | 19,900 | 345 |

* | CNA Surety Corp. | 15,800 | 333 |

| RenaissanceRe Holdings Ltd. | 4,500 | 226 |

| | | |

| Real Estate Investment Trusts (7.1%) | | |

| Host Hotels & Resorts | | |

| Inc. REIT | 1,231,800 | 32,409 |

| Archstone-Smith Trust REIT | 537,400 | 29,170 |

| Boston Properties, Inc. REIT | 239,400 | 28,106 |

| Avalonbay Communities, | | |

| Inc. REIT | 202,300 | 26,299 |

| SL Green Realty Corp. REIT | 159,426 | 21,870 |

| Health Care Properties | | |

| Investors REIT | 565,600 | 20,379 |

| Plum Creek Timber | | |

| Co. Inc. REIT | 495,600 | 19,537 |

| ProLogis REIT | 299,224 | 19,429 |

| The Macerich Co. REIT | 203,700 | 18,814 |

| Apartment Investment & | | |

| Management Co. | | |

| Class A REIT | 322,000 | 18,576 |

| Federal Realty Investment | | |

| Trust REIT | 182,400 | 16,529 |

| UDR, Inc. REIT | 517,500 | 15,846 |

| Camden Property Trust REIT | 221,300 | 15,560 |

| General Growth | | |

| Properties Inc. REIT | 234,500 | 15,142 |

| Essex Property Trust, | | |

| Inc. REIT | 107,300 | 13,893 |

| Taubman Co. REIT | 232,600 | 13,488 |

| Regency Centers Corp. REIT | 151,700 | 12,675 |

| BRE Properties Inc. | | |

| Class A REIT | 197,300 | 12,459 |

| Kimco Realty Corp. REIT | 229,573 | 11,189 |

| iStar Financial Inc. REIT | 236,800 | 11,089 |

| Highwood Properties, | | |

| Inc. REIT | 280,400 | 11,073 |

| Mack-Cali Realty Corp. REIT | 212,700 | 10,131 |

| FelCor Lodging Trust, | | |

| Inc. REIT | 364,700 | 9,471 |

| Cousins Properties, | | |

| Inc. REIT | 282,100 | 9,270 |

| Maguire Properties, | | |

| Inc. REIT | 257,000 | 9,139 |

| Tanger Factory Outlet | | |

| Centers, Inc. REIT | 223,300 | 9,019 |

| American Campus | | |

| Communities, Inc. REIT | 250,000 | 7,572 |

| Rayonier Inc. REIT | 142,050 | 6,108 |

| Post Properties, Inc. REIT | 129,600 | 5,927 |

| New Plan Excel Realty | | |

| Trust REIT | 177,196 | 5,853 |

| Nationwide Health | | |

| Properties, Inc. REIT | 179,200 | 5,602 |

^Thornburg Mortgage, | | |

Inc. REIT | 214,300 | 5,572 |

Home Properties, Inc. REIT | 104,700 | 5,529 |

Colonial Properties | | |

Trust REIT | 120,800 | 5,517 |

HRPT Properties Trust REIT | 443,500 | 5,455 |

CapitalSource Inc. REIT | 171,400 | 4,307 |

Equity Inns, Inc. REIT | 257,300 | 4,215 |

KKR Financial Corp. REIT | 145,100 | 3,980 |

Innkeepers USA Trust REIT | 236,100 | 3,844 |

Sunstone Hotel Investors, | | |

Inc. REIT | 121,800 | 3,320 |

Developers Diversified | | |

Realty Corp. REIT | 47,900 | 3,013 |

Potlatch Corp. REIT | 65,400 | 2,994 |

13

| | Market |

| | Value• |

| Shares | ($000) |

| Senior Housing Properties | | |

| Trust REIT | 122,400 | 2,925 |

| LaSalle Hotel Properties REIT | 59,600 | 2,763 |

| Saul Centers, Inc. REIT | 45,600 | 2,595 |

| AMB Property Corp. REIT | 42,400 | 2,493 |

| Pennsylvania REIT | 48,100 | 2,132 |

| BioMed Realty Trust, | | |

| Inc. REIT | 79,500 | 2,091 |

| American Financial | | |

| Realty Trust REIT | 179,800 | 1,812 |

| ^Impac Mortgage Holdings, | | |

| Inc. REIT | 281,600 | 1,408 |

| Duke Realty Corp. REIT | 29,200 | 1,269 |

| GMH Communities | | |

| Trust REIT | 115,000 | 1,149 |

| ^Novastar Financial, Inc. REIT | 149,600 | 748 |

| Spirit Finance Corp. REIT | 44,600 | 665 |

| Digital Realty Trust, Inc. REIT | 16,600 | 662 |

| Highland Hospitality | | |

| Corp. REIT | 36,400 | 648 |

| Omega Healthcare | | |

| Investors, Inc. REIT | 33,500 | 575 |

| Longview Fibre Co. REIT | 23,300 | 574 |

| Deerfield Triarc Capital | | |

| Corp. REIT | 37,900 | 568 |

| Inland Real Estate Corp. REIT | 30,700 | 563 |

| MFA Mortgage Investments, | | |

| Inc. REIT | 71,500 | 551 |

| Acadia Realty Trust REIT | 20,100 | 524 |

| Hospitality Properties | | |

| Trust REIT | 10,700 | 501 |

| Ashford Hospitality | | |

| Trust REIT | 41,900 | 500 |

| RAIT Financial Trust REIT | 17,700 | 495 |

| Anthracite Capital Inc. REIT | 38,700 | 464 |

| First Potomac REIT | 16,000 | 457 |

| Sun Communities, Inc. REIT | 5,700 | 177 |

| Annaly Mortgage | | |

| Management Inc. REIT | 7,600 | 118 |

| | | |

| Real Estate Management & Development (0.9%) |

| Forest City Enterprise | | |

| Class A | 232,800 | 15,407 |

| * CB Richard Ellis Group, Inc. | 418,200 | 14,294 |

| ^The St. Joe Co. | 260,100 | 13,606 |

| Jones Lang LaSalle Inc. | 118,800 | 12,388 |

| * Realogy Corp. | 363,700 | 10,769 |

| | | |

| * Move, Inc. | 513,100 | 2,843 |

| | | |

| Thrifts & Mortgage Finance (2.6%) |

| ^IndyMac Bancorp, Inc. | 1,286,505 | 41,232 |

| ^Downey Financial Corp. | 417,000 | 26,913 |

| MGIC Investment Corp. | 417,164 | 24,579 |

| The PMI Group Inc. | 539,800 | 24,410 |

| ^Corus Bankshares Inc. | 1,251,628 | 21,353 |

| * ^First Federal Financial Corp. | 346,000 | 19,663 |

| BankUnited Financial Corp. | 565,400 | 11,992 |

| Radian Group, Inc. | 138,241 | 7,587 |

| Webster Financial Corp. | 94,200 | 4,523 |

| PFF Bancorp, Inc. | 117,600 | 3,567 |

| WSFS Financial Corp. | 45,550 | 2,937 |

| First Financial Holdings, Inc. | 63,953 | 2,213 |

| TierOne Corp. | 53,701 | 1,452 |

| City Bank Lynnwood (WA) | 42,509 | 1,365 |

* | Ocwen Financial Corp. | 63,100 | 812 |

| First Place Financial Corp. | 24,900 | 534 |

| United Community | | |

| Financial Corp. | 44,500 | 492 |

| ITLA Capital Corp. | 4,130 | 215 |

| | | 1,613,206 |

Health Care (9.5%) | | |

| AmerisourceBergen Corp. | 1,469,157 | 77,498 |

| Manor Care, Inc. | 1,002,700 | 54,507 |

* | Barr Pharmaceuticals Inc. | 1,109,200 | 51,411 |

* | Humana Inc. | 691,800 | 40,138 |

* | Laboratory Corp. of | | |

| America Holdings | 494,064 | 35,884 |

| Mylan Laboratories, Inc. | 1,625,114 | 34,355 |

* | Community Health | | |

| Systems, Inc. | 898,399 | 31,669 |

* | Sciele Pharma, Inc. | 1,305,308 | 30,910 |

* | Haemonetics Corp. | 651,299 | 30,448 |

* | Pediatrix Medical | | |

| Group, Inc. | 521,300 | 29,745 |

* | Kinetic Concepts, Inc. | 442,600 | 22,413 |

* | ImClone Systems, Inc. | 451,400 | 18,404 |

* | Apria Healthcare Group Inc. | 524,400 | 16,912 |

* | King Pharmaceuticals, Inc. | 821,900 | 16,167 |

* | WellCare Health Plans Inc. | 133,600 | 11,389 |

* | IDEXX Laboratories Corp. | 125,348 | 10,984 |

* | Viasys Healthcare Inc. | 305,200 | 10,374 |

| Valeant Pharmaceuticals | | |

| International | 580,900 | 10,044 |

* | Cephalon, Inc. | 135,574 | 9,654 |

* | Applera Corp.-Celera | | |

| Genomics Group | 679,500 | 9,649 |

| | | | |

* | Alkermes, Inc. | 613,175 | 9,467 |

* | ^Advanced Medical | | |

| Optics, Inc. | 242,694 | 9,028 |

* | Illumina, Inc. | 305,400 | 8,948 |

* | LifePoint Hospitals, Inc. | 223,300 | 8,535 |

* | Adams Respiratory | | |

| Therapeutics, Inc. | 251,358 | 8,453 |

* | Zoll Medical Corp. | 314,734 | 8,388 |

* | Lincare Holdings, Inc. | 218,596 | 8,012 |

* | MedCath Corp. | 256,420 | 7,000 |

* | ^Enzon Pharmaceuticals, Inc. | 842,300 | 6,865 |

| Medicis Pharmaceutical Corp. | 216,700 | 6,679 |

* | K-V Pharmaceutical Co. | | |

| Class A | 259,700 | 6,422 |

* | Techne Corp. | 108,521 | 6,197 |

* | Magellan Health | | |

| Services, Inc. | 136,403 | 5,729 |

14

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Universal Health Services | | |

| Class B | 87,400 | 5,005 |

* | Immucor Inc. | 163,700 | 4,818 |

* | Par Pharmaceutical Cos. Inc. | 187,200 | 4,702 |

* | Palomar Medical | | |

| Technologies, Inc. | 110,057 | 4,397 |

* | Sierra Health Services, Inc. | 88,500 | 3,644 |

* | Kindred Healthcare, Inc. | 110,790 | 3,632 |

| IMS Health, Inc. | 120,900 | 3,586 |

| Perrigo Co. | 190,400 | 3,362 |

* | The Medicines Co. | 133,100 | 3,338 |

| Hillenbrand Industries, Inc. | 48,000 | 2,850 |

* | Ventana Medical | | |

| Systems, Inc. | 65,061 | 2,726 |

* | ^Telik, Inc. | 501,290 | 2,722 |

* | PAREXEL International Corp. | 75,650 | 2,721 |

* | Bruker BioSciences Corp. | 229,229 | 2,411 |

| Chemed Corp. | 47,200 | 2,311 |

* | Progenics | | |

| Pharmaceuticals, Inc. | 85,263 | 2,019 |

* | Bio-Rad Laboratories, Inc. | | |

| Class A | 27,500 | 1,921 |

* | ICU Medical, Inc. | 48,500 | 1,901 |

* | Tanox, Inc. | 94,526 | 1,773 |

* | Radiation Therapy | | |

| Services, Inc. | 51,900 | 1,590 |

| Alpharma, Inc. Class A | 64,100 | 1,544 |

* | New River | | |

| Pharmaceuticals Inc. | 21,938 | 1,396 |

| ^LCA-Vision Inc. | 33,000 | 1,359 |

| Datascope Corp. | 27,285 | 987 |

* | VCA Antech, Inc. | 26,300 | 955 |

| Young Innovations, Inc. | 34,000 | 925 |

* | BioMarin Pharmaceutical Inc. | 52,500 | 906 |

* | Noven Pharmaceuticals, Inc. | 38,685 | 897 |

| Vital Signs, Inc. | 15,855 | 824 |

| Mentor Corp. | 16,400 | 754 |

* | Greatbatch, Inc. | 29,478 | 752 |

* | Odyssey Healthcare, Inc. | 42,022 | 552 |

* | Alliance Imaging, Inc. | 37,800 | 330 |

* | AMN Healthcare | | |

| Services, Inc. | 13,900 | 314 |

* | Myriad Genetics, Inc. | 8,700 | 300 |

* | Merge Technologies, Inc. | 52,300 | 255 |

| Health Management | | |

| Associates Class A | 22,800 | 248 |

* | Digene Corp. | 5,600 | 237 |

* | eResearch Technology, Inc. | 29,100 | 229 |

* | AmSurg Corp. | 7,020 | 172 |

* | AMERIGROUP Corp. | 4,900 | 149 |

* | Genesis Healthcare Corp. | 2,300 | 145 |

| | | 727,937 |

Industrials (13.2%) | | |

| Parker Hannifin Corp. | 881,794 | 76,108 |

| Cummins Inc. | 506,700 | 73,330 |

* | Terex Corp. | 996,397 | 71,501 |

| Trinity Industries, Inc. | 1,518,120 | 63,640 |

* | AMR Corp. | 2,087,951 | 63,578 |

| Manpower Inc. | 858,575 | 63,337 |

| Cooper Industries, Inc. | | |

| Class A | 900,100 | 40,495 |

* | UAL Corp. | 998,129 | 38,099 |

| Steelcase Inc. | 1,445,062 | 28,742 |

| A.O. Smith Corp. | 578,000 | 22,091 |

| R.R. Donnelley & Sons Co. | 536,620 | 19,635 |

* | EMCOR Group, Inc. | 319,400 | 18,838 |

| Adesa, Inc. | 621,300 | 17,167 |

* | Allied Waste | | |

| Industries, Inc. | 1,306,788 | 16,452 |

| Ryder System, Inc. | 332,800 | 16,420 |

* | Gardner Denver Inc. | 449,960 | 15,681 |

| Con-way, Inc. | 293,400 | 14,623 |

| The Timken Co. | 471,200 | 14,282 |

* | McDermott International, Inc. | 259,750 | 12,723 |

* | NCI Building Systems, Inc. | 253,600 | 12,107 |

| Applied Industrial | | |

| Technology, Inc. | 474,975 | 11,651 |

| Lennox International Inc. | 313,200 | 11,181 |

| Republic Services, Inc. | | |

| Class A | 382,963 | 10,654 |

* | Foster Wheeler Ltd. | 180,400 | 10,534 |

| Herman Miller, Inc. | 312,641 | 10,470 |

| The Manitowoc Co., Inc. | 160,990 | 10,228 |

| Walter Industries, Inc. | 412,100 | 10,199 |

* | Genlyte Group, Inc. | 135,016 | 9,525 |

| Lincoln Electric Holdings, Inc. | 159,911 | 9,524 |

* | Thomas & Betts Corp. | 188,600 | 9,207 |

| Rockwell Automation, Inc. | 147,300 | 8,819 |

| Acuity Brands, Inc. | 149,500 | 8,139 |

* | United Rentals, Inc. | 293,900 | 8,082 |

| Kennametal, Inc. | 117,600 | 7,951 |

* | Labor Ready, Inc. | 407,500 | 7,738 |

| Harsco Corp. | 160,800 | 7,213 |

| Watsco, Inc. | 131,500 | 6,716 |

| Universal Forest | | |

| Products, Inc. | 132,908 | 6,586 |

* | ^Houston Wire & Cable Co. | 224,525 | 6,291 |

| Freightcar America Inc. | 126,087 | 6,074 |

* | General Cable Corp. | 112,500 | 6,011 |

| Apogee Enterprises, Inc. | 297,558 | 5,963 |

* | Consolidated Graphics, Inc. | 77,400 | 5,731 |

* | Continental Airlines, Inc. | | |

| Class B | 149,800 | 5,451 |

| Watson Wyatt & Co. Holdings | 111,700 | 5,434 |

* | Volt Information Sciences Inc. | 187,600 | 4,913 |

| Carlisle Co., Inc. | 109,804 | 4,714 |

| IKON Office Solutions, Inc. | 317,800 | 4,567 |

* | Cenveo Inc. | 178,300 | 4,333 |

* | Corrections Corp. of America | 79,950 | 4,222 |

* | United Stationers, Inc. | 69,430 | 4,160 |

| Crane Co. | 102,400 | 4,139 |

| McGrath RentCorp | 115,213 | 3,649 |

15

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Teleflex Inc. | 49,800 | 3,390 |

* | Amerco, Inc. | 47,500 | 3,325 |

* | US Airways Group Inc. | 68,600 | 3,120 |

* | Spherion Corp. | 342,600 | 3,022 |

* | Mobile Mini, Inc. | 110,956 | 2,971 |

| Viad Corp. | 76,250 | 2,943 |

| The Toro Co. | 56,600 | 2,900 |

| Regal-Beloit Corp. | 60,900 | 2,825 |

* | Acco Brands Corp. | 110,110 | 2,653 |

| Central Parking Corp. | 114,300 | 2,535 |

* | American Commercial | | |

| Lines Inc. | 78,000 | 2,453 |

| Barnes Group, Inc. | 106,000 | 2,439 |

| Triumph Group, Inc. | 42,025 | 2,326 |

* | Alliant Techsystems, Inc. | 25,647 | 2,255 |

| John H. Harland Co. | 43,800 | 2,244 |

* | Swift Transportation Co., Inc. | 70,000 | 2,181 |

| Kelly Services, Inc. Class A | 60,846 | 1,959 |

| Ameron International Corp. | 27,900 | 1,837 |

* | CBIZ Inc. | 215,500 | 1,530 |

* | ABX Air, Inc. | 213,146 | 1,460 |

| Cintas Corp. | 40,000 | 1,444 |

| Eagle Bulk Shipping Inc. | 71,603 | 1,388 |

| American Woodmark Corp. | 37,600 | 1,382 |

* | Republic Airways | | |

| Holdings Inc. | 52,900 | 1,215 |

| J.B. Hunt Transport | | |

| Services, Inc. | 44,800 | 1,176 |

| Knoll, Inc. | 48,200 | 1,149 |

* | TransDigm Group, Inc. | 27,600 | 1,004 |

| NACCO Industries, Inc. | | |

| Class A | 7,100 | 976 |

* | Accuride Corp. | 65,900 | 962 |

| Ennis, Inc. | 34,500 | 923 |

| Kaydon Corp. | 18,400 | 783 |

* | H&E Equipment | | |

| Services, Inc. | 28,407 | 611 |

| Interface, Inc. | 36,831 | 589 |

* | Rush Enterprises, Inc. | | |

| Class B | 26,300 | 476 |

| Pacer International, Inc. | 14,100 | 380 |

* | K&F Industries Holdings | 13,700 | 369 |

* | Ceradyne, Inc. | 5,500 | 301 |

* | Goodman Global, Inc. | 15,070 | 266 |

* | ExpressJet Holdings, Inc. | 41,700 | 244 |

| Kaman Corp. Class A | 9,157 | 213 |

* | Insituform Technologies Inc. | | |

| Class A | 7,600 | 158 |

| CIRCOR International, Inc. | 3,800 | 136 |

| Tredegar Corp. | 5,800 | 132 |

| The Brink’s Co. | 1,300 | 82 |

| | | 1,005,645 |

Information Technology (14.6%) | | |

* | Fiserv, Inc. | 1,312,983 | 69,667 |

* | Novellus Systems, Inc. | 1,944,900 | 62,276 |

| Harris Corp. | 1,200,400 | 61,160 |

* | Computer Sciences Corp. | 968,200 | 50,472 |

* | Flextronics | | |

| International Ltd. | 4,597,200 | 50,293 |

* | Alliance Data Systems Corp. | 582,900 | 35,918 |

* | Arris Group Inc. | 2,388,551 | 33,631 |

* | Anixter International Inc. | 496,000 | 32,706 |

* | LAM Research Corp. | 677,498 | 32,073 |

* | RealNetworks, Inc. | 3,525,822 | 27,678 |

* | Lexmark International, Inc. | 472,100 | 27,599 |

* | CSG Systems | | |

| International, Inc. | 991,178 | 24,799 |

* | CommScope, Inc. | 506,000 | 21,707 |

* | Transaction Systems | | |

| Architects, Inc. | 583,991 | 18,915 |

* | TIBCO Software Inc. | 2,064,300 | 17,588 |

* | Avnet, Inc. | 481,600 | 17,405 |

* | Zoran Corp. | 1,003,750 | 17,084 |

* | Micron Technology, Inc. | 1,359,842 | 16,427 |

* | MEMC Electronic | | |

| Materials, Inc. | 262,800 | 15,920 |

* | j2 Global | | |

| Communications, Inc. | 571,867 | 15,852 |

* | Cadence Design | | |

| Systems, Inc. | 743,400 | 15,656 |

* | Nuance | | |

| Communications, Inc. | 1,008,299 | 15,437 |

* | Silicon Image, Inc. | 1,861,047 | 15,186 |

* | ^UTStarcom, Inc. | 1,761,889 | 14,606 |

* | Informatica Corp. | 1,081,656 | 14,527 |

* | Plexus Corp. | 835,800 | 14,334 |

| National | | |

| Semiconductor Corp. | 548,000 | 13,229 |

* | ON Semiconductor Corp. | 1,464,900 | 13,067 |

* | MicroStrategy Inc. | 97,919 | 12,376 |

* | Brocade Communications | | |

| Systems, Inc. | 1,278,943 | 12,176 |

* | Coherent, Inc. | 380,398 | 12,074 |

* | LSI Logic Corp. | 1,124,900 | 11,744 |

* | Amkor Technology, Inc. | 882,200 | 11,010 |

* | BMC Software, Inc. | 346,536 | 10,670 |

* | Western Digital Corp. | 629,300 | 10,579 |

| MTS Systems Corp. | 260,926 | 10,134 |

* | DST Systems, Inc. | 130,400 | 9,806 |

* | Interwoven Inc. | 566,966 | 9,582 |

* | Sybase, Inc. | 373,585 | 9,444 |

* | Convergys Corp. | 330,100 | 8,388 |

* | Sykes Enterprises, Inc. | 430,700 | 7,856 |

| Technitrol, Inc. | 297,500 | 7,792 |

* | Fairchild Semiconductor | | |

| International, Inc. | 456,900 | 7,639 |

* | SRA International, Inc. | 303,700 | 7,398 |

* | MPS Group, Inc. | 520,104 | 7,359 |

* | MKS Instruments, Inc. | 273,450 | 6,978 |

* | International Rectifier Corp. | 181,800 | 6,947 |

* | Benchmark Electronics, Inc. | 335,175 | 6,925 |

* | Advanced Energy | | |

| Industries, Inc. | 326,357 | 6,867 |

* | ManTech International Corp. | 198,900 | 6,645 |

16

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Cymer, Inc. | 147,102 | 6,112 |

* | EarthLink, Inc. | 828,473 | 6,089 |

* | Vishay Intertechnology, Inc. | 435,400 | 6,087 |

* | Dolby Laboratories Inc. | 175,400 | 6,053 |

* | Progress Software Corp. | 193,524 | 6,038 |

* | Quest Software, Inc. | 351,000 | 5,711 |

* | ^RF Micro Devices, Inc. | 874,726 | 5,450 |

* | eSPEED, Inc. Class A | 554,616 | 5,269 |

* | Tyler Technologies, Inc. | 412,500 | 5,239 |

* | Hyperion Solutions Corp. | 100,500 | 5,209 |

* | Ness Technologies Inc. | 398,300 | 5,090 |

| Molex, Inc. | 175,062 | 4,937 |

* | Ansoft Corp. | 154,547 | 4,890 |

| Park Electrochemical Corp. | 160,000 | 4,339 |

* | Teradyne, Inc. | 250,300 | 4,140 |

* | Mentor Graphics Corp. | 250,650 | 4,096 |

* | BearingPoint, Inc. | 521,900 | 3,998 |

* | Rofin-Sinar Technologies Inc. | 67,202 | 3,977 |

| MoneyGram | | |

| International, Inc. | 135,200 | 3,753 |

| Bel Fuse, Inc. Class B | 87,218 | 3,376 |

* | Euronet Worldwide, Inc. | 118,800 | 3,191 |

* | Forrester Research, Inc. | 106,500 | 3,020 |

| AVX Corp. | 191,800 | 2,915 |

* | Veeco Instruments, Inc. | 148,525 | 2,896 |

* | Itron, Inc. | 42,600 | 2,771 |

* | Vignette Corp. | 146,007 | 2,711 |

| United Online, Inc. | 188,768 | 2,648 |

| Fair Isaac, Inc. | 66,500 | 2,572 |

* | ^OmniVision Technologies, Inc. | 197,300 | 2,557 |

* | Kopin Corp. | 750,000 | 2,535 |

* | Macrovision Corp. | 95,400 | 2,390 |

| CTS Corp. | 165,300 | 2,284 |

| Jack Henry & Associates Inc. | 80,400 | 1,934 |

* | Avocent Corp. | 69,300 | 1,869 |

* | Silicon Storage | | |

| Technology, Inc. | 328,653 | 1,620 |

* | Keane, Inc. | 116,900 | 1,587 |

* | Ciber, Inc. | 200,700 | 1,579 |

* | Paxar Corp. | 52,500 | 1,507 |

* | VeriSign, Inc. | 59,200 | 1,487 |

* | JDA Software Group, Inc. | 88,400 | 1,329 |

* | Genesis Microchip Inc. | 120,773 | 1,122 |

| Methode Electronics, Inc. | | |

| Class A | 64,000 | 945 |

* | IXYS Corp. | 79,202 | 810 |

* | Asyst Technologies, Inc. | 107,016 | 752 |

* | Trident Microsystems, Inc. | 35,470 | 712 |

* | DealerTrack Holdings Inc. | 19,304 | 593 |

* | Mattson Technology, Inc. | 53,882 | 490 |

* | MICROS Systems, Inc. | 9,000 | 486 |

* | Entegris Inc. | 41,600 | 445 |

* | SYNNEX Corp. | 20,100 | 427 |

* | Rogers Corp. | 9,400 | 417 |

* | Skyworks Solutions, Inc. | 53,300 | 306 |

* | Atmel Corp. | 47,000 | 236 |

| infoUSA Inc. | 15,900 | 153 |

| | | 1,118,750 |

Materials (5.6%) | | |

| Celanese Corp. Series A | 2,000,000 | 61,680 |

| United States Steel Corp. | 511,800 | 50,755 |

| Nucor Corp. | 672,900 | 43,826 |

| Texas Industries, Inc. | 427,400 | 32,282 |

* | Pactiv Corp. | 801,964 | 27,058 |

* | AK Steel Holding Corp. | 1,098,235 | 25,688 |

| Eastman Chemical Co. | 385,760 | 24,430 |

| Greif Inc. Class A | 212,500 | 23,611 |

| Steel Dynamics, Inc. | 512,164 | 22,125 |

* | OM Group, Inc. | 490,100 | 21,898 |

| RPM International, Inc. | 916,000 | 21,160 |

| Chaparral Steel Co. | 252,706 | 14,700 |

| Reliance Steel & | | |

| Aluminum Co. | 298,700 | 14,457 |

| Ashland, Inc. | 216,200 | 14,183 |

| Commercial Metals Co. | 392,600 | 12,308 |

| Quanex Corp. | 144,400 | 6,115 |

| Koppers Holdings, Inc. | 111,200 | 2,853 |

| Sonoco Products Co. | 73,000 | 2,743 |

| Cleveland-Cliffs Inc. | 24,000 | 1,536 |

| Carpenter Technology Corp. | 11,600 | 1,401 |

| Spartech Corp. | 35,000 | 1,027 |

| H.B. Fuller Co. | 27,800 | 758 |

| Nalco Holding Co. | 29,100 | 695 |

| Neenah Paper Inc. | 6,200 | 246 |

| | | 427,535 |

Telecommunication Services (1.9%) | | |

| Embarq Corp. | 708,923 | 39,948 |

* | Qwest Communications | | |

| International Inc. | 2,526,100 | 22,710 |

* | Cincinnati Bell Inc. | 4,208,500 | 19,780 |

| Telephone & Data | | |

| Systems, Inc. | 276,945 | 16,511 |

* | Crown Castle | | |

| International Corp. | 393,700 | 12,650 |

| CenturyTel, Inc. | 164,600 | 7,438 |

| Alaska Communications | | |

| Systems Holdings, Inc. | 451,346 | 6,657 |

* | Syniverse Holdings Inc. | 403,700 | 4,255 |

* | ^Global Crossing Ltd. | 107,800 | 2,965 |

* | Leap Wireless | | |

| International, Inc. | 42,865 | 2,828 |

| North Pittsburgh | | |

| Systems, Inc. | 70,142 | 1,527 |

| IDT Corp. Class B | 130,000 | 1,475 |

* | General Communication, Inc. | 58,900 | 825 |

* | Fibertower Corp. | 49,900 | 259 |

| Surewest Communications | 9,600 | 239 |

| Citizens Communications Co. | 7,018 | 105 |

| | | 140,172 |

Utilities (5.9%) | | |

* | Mirant Corp. | 1,918,300 | 77,614 |

17

| | Market |

| | Value• |

| Shares | ($000) |

Xcel Energy, Inc. | 2,493,145 | 61,556 |

Northeast Utilities | 1,500,000 | 49,155 |

CenterPoint Energy Inc. | 2,259,449 | 40,535 |

Pinnacle West Capital Corp. | 515,129 | 24,855 |

Energen Corp. | 439,872 | 22,385 |

NiSource, Inc. | 854,935 | 20,895 |

Westar Energy, Inc. | 606,200 | 16,683 |

PNM Resources Inc. | 496,760 | 16,045 |

FirstEnergy Corp. | 234,300 | 15,520 |

Southwest Gas Corp. | 344,000 | 13,371 |

Puget Energy, Inc. | 423,500 | 10,875 |

UGI Corp. Holding Co. | 366,140 | 9,780 |

* NRG Energy, Inc. | 123,300 | 8,883 |

MDU Resources Group, Inc. | 299,350 | 8,603 |

OGE Energy Corp. | 202,300 | 7,849 |

Nicor Inc. | 147,700 | 7,152 |

NSTAR | 200,100 | 7,028 |

Energy East Corp. | 247,700 | 6,034 |

Atmos Energy Corp. | 180,601 | 5,649 |

TECO Energy, Inc. | 224,725 | 3,868 |

WGL Holdings Inc. | 90,800 | 2,904 |

IDACORP, Inc. | 84,096 | 2,846 |

Black Hills Corp. | 76,200 | 2,802 |

Northwest Natural Gas Co. | 58,600 | 2,676 |

ALLETE, Inc. | 54,835 | 2,556 |

* El Paso Electric Co. | 70,900 | 1,868 |

CH Energy Group, Inc. | 22,500 | 1,096 |

The Laclede Group, Inc. | 33,900 | 1,054 |

Portland General Electric Co. | 14,600 | 426 |

Constellation Energy | | |

Group, Inc. | 4,200 | 365 |

| | 452,928 |

Total Common Stocks | | |

(Cost $6,491,531) | | 7,627,197 |

Temporary Cash Investments (1.8%)1 | | |

Money Market Funds (1.8%) | | |

2 Vanguard Market Liquidity | | |

Fund, 5.288% | 34,541,530 | 34,542 |

2 Vanguard Market Liquidity | | |

Fund, 5.288%—Note E | 103,292,000 | 103,292 |

| | 137,834 |

| Face | Market |

| Amount | Value• |

| ($000) | ($000) |

U.S. Agency Obligation (0.0%) | | |

3 Federal National Mortgage Assn. | | |

4 5.192%, 4/25/07 | 2,000 | 1,993 |

Total Temporary Cash Investments | | |

(Cost $139,827) | | 139,827 |

Total Investments (101.6%) | | |

(Cost $6,631,358) | | 7,767,024 |

Other Assets and Liabilities (–1.6%) | | |

Other Assets—Note B | | 18,402 |

Liabilities—Note E | | (140,166) |

| | (121,764) |

Net Assets (100%) | | |

Applicable to 308,436,025 outstanding $.001 | | |

par value shares of beneficial interest | | |

(unlimited authorization) | | 7,645,260 |

Net Asset Value Per Share | | $24.79 |

| | |

| | |

| | |

At March 31, 2007, net assets consisted of:5 |

| Amount | Per |

| ($000) | Share |

Paid-in Capital | 6,083,649 | $19.73 |

Undistributed Net | | |

Investment Income | 3,135 | .01 |

Accumulated Net | | |

Realized Gains | 422,744 | 1.37 |

Unrealized Appreciation | | |

Investment Securities | 1,135,666 | 3.68 |

Futures Contracts | 66 | — |

Net Assets | 7,645,260 | $24.79 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. See Note E in Notes to Financial Statements.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.6%, respectively, of net assets. See Note C in Notes to Financial Statements.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 The issuer operates under a congressional charter; its securities are neither issued nor guaranteed by the U.S. government. If needed, access to additional funding from the U.S. Treasury (beyond the issuer’s line of credit) would require congressional action.

4 Securities with a value of $1,993,000 have been segregated as initial margin for open futures contracts.

5 See Note C in Notes to Financial Statements for the tax-basis components of net assets.

18

Statement of Operations

| Six Months Ended |

| March 31, 2007 |

| ($000) |

Investment Income | |

Income | |

Dividends | 41,722 |

Interest1 | 662 |

Security Lending | 1,524 |

Total Income | 43,908 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 1,231 |

Management and Administrative | 8,782 |

Marketing and Distribution | 937 |

Custodian Fees | 95 |

Shareholders’ Reports | 91 |

Trustees’ Fees and Expenses | 5 |

Total Expenses | 11,141 |

Net Investment Income | 32,767 |

Realized Net Gain (Loss) | |

Investment Securities Sold | 438,882 |

Futures Contracts | 537 |

Realized Net Gain (Loss) | 439,419 |

Change In Unrealized Appreciation (Depreciation) | |

Investment Securities | 398,527 |

Futures Contracts | 49 |

Change in Unrealized Appreciation (Depreciation) | 398,576 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 870,762 |

1 Interest income from an affiliated company of the fund was $581,000.

Statement of Changes in Net Assets

19

| Six Months Ended | Year Ended |

| Mar. 31, 2007 | Sept. 30, 2006 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 32,767 | 74,818 |

Realized Net Gain (Loss) | 439,419 | 331,726 |

Change in Unrealized Appreciation (Depreciation) | 398,576 | (51,941) |

Net Increase (Decrease) in Net Assets Resulting from Operations | 870,762 | 354,603 |

Distributions | | |

Net Investment Income | (74,998) | (49,617) |

Realized Capital Gain1 | (282,684) | (340,229) |

Total Distributions | (357,682) | (389,846) |

Capital Share Transactions—Note F | | |

Issued | 676,382 | 2,273,341 |

Issued in Lieu of Cash Distributions | 338,748 | 365,856 |

Redeemed | (637,995) | (1,031,900) |

Net Increase (Decrease) from Capital Share Transactions | 377,135 | 1,607,297 |

Total Increase (Decrease) | 890,215 | 1,572,054 |

Net Assets | | |

Beginning of Period | 6,755,045 | 5,182,991 |

End of Period2 | 7,645,260 | 6,755,045 |

1 Includes fiscal 2007 and 2006 short-term gain distributions totaling $28,845,000 and $92,145,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed net investment income of $3,135,000 and $45,366,000.

20

Financial Highlights

| Six Months | | | Nov. 1, | | | |

| Ended | Year Ended | 2003, to | |

For a Share Outstanding | Mar. 31, | September 30, | Sept. 30, | Year Ended October 31, |

Throughout Each Period | 2007 | 2006 | 2005 | 20041 | 2003 | 2002 | 2001 |

Net Asset Value, | | | | | | | |

Beginning of Period | $23.07 | $23.28 | $19.70 | $17.85 | $13.01 | $13.68 | $18.07 |

Investment Operations | | | | | | | |

Net Investment Income | .12 | .27 | .19 | .13 | .13 | .14 | .16 |

Net Realized and Unrealized | | | | | | | |

Gain (Loss) on Investments | 2.84 | 1.17 | 4.49 | 1.85 | 4.84 | (.67) | (1.31) |

Total from | | | | | | | |

Investment Operations | 2.96 | 1.44 | 4.68 | 1.98 | 4.97 | (.53) | (1.15) |

Distributions | | | | | | | |

Dividends from | | | | | | | |

Net Investment Income | (.26) | (.21) | (.14) | (.13) | (.13) | (.14) | (.21) |

Distributions from | | | | | | | |

Realized Capital Gains | (.98) | (1.44) | (.96) | — | — | — | (3.03) |

Total Distributions | (1.24) | (1.65) | (1.10) | (.13) | (.13) | (.14) | (3.24) |

Net Asset Value, | | | | | | | |

End of Period | $24.79 | $23.07 | $23.28 | $19.70 | $17.85 | $13.01 | $13.68 |

| | | | | | | |

Total Return2 | 13.07% | 6.49% | 24.32% | 11.14% | 38.55% | –4.02% | –6.48% |

| | | | | | | |

Ratios/Supplemental Data | | | | | | | |

Net Assets, | | | | | | | |

End of Period (Millions) | $7,645 | $6,755 | $5,183 | $2,953 | $1,714 | $876 | $767 |

Ratio of Total Expenses to | | | | | | | |

Average Net Assets | 0.31%* | 0.35% | 0.40% | 0.45%* | 0.50% | 0.50% | 0.54% |

Ratio of Net Investment | | | | | | | |

Income to Average Net Assets | 0.91%* | 1.18% | 0.99% | 0.83%* | 1.04% | 0.94% | 1.06% |

Portfolio Turnover Rate | 75%* | 80% | 75% | 66% | 100% | 73% | 82% |

1 The fund’s fiscal year-end changed from October 31 to September 30, effective September 30, 2004.

2 Total returns do not reflect the 1% fee assessed through April 6, 2001, on redemptions of shares held in the fund for less than five years.

* Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund files reports with the SEC under the company name Vanguard Horizon Funds.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m. Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income

distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

22

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At March 31, 2007, the fund had contributed capital of $706,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.70% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes. The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year.

At March 31, 2007, the cost of investment securities for tax purposes was $6,631,358,000. Net unrealized appreciation of investment securities for tax purposes was $1,135,666,000, consisting of unrealized gains of $1,333,017,000 on securities that had risen in value since their purchase and $197,351,000 in unrealized losses on securities that had fallen in value since their purchase.

At March 31, 2007, the aggregate settlement value of open futures contracts expiring in June 2007 and the related unrealized appreciation (depreciation) were:

| | | ($000) |

| | Aggregate | Unrealized |

| Number of | Settlement | Appreciation |

Futures Contracts | Long Contracts | Value | (Depreciation) |

E-mini S&P 500 Index | 135 | 9,661 | (14) |

S&P 500 Index | 27 | 9,661 | 80 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

D. During the six months ended March 31, 2007, the fund purchased $2,746,825,000 of investment securities and sold $2,704,152,000 of investment securities, other than temporary cash investments.

E. The market value of securities on loan to broker-dealers at March 31, 2007, was $98,514,000, for which the fund received cash collateral of $103,292,000.

23

F. Capital shares issued and redeemed were:

| Six Months Ended | | Year Ended |

| March 31, 2007 | | Sept. 30, 2006 |

| Shares | | Shares |

| (000) | | (000) |

Issued | 27,660 | | 98,757 |

Issued in Lieu of Cash Distributions | 14,281 | | 16,547 |

Redeemed | (26,332) | | (45,160) |

Net Increase (Decrease) in Shares Outstanding | 15,609 | | 70,144 |

G. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes”. FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements. FIN 48 will be effective for the fund’s fiscal year beginning October 1, 2007. Management is in the process of analyzing the fund’s tax positions for purposes of implementing FIN 48; based on the analysis completed to date, management does not believe the adoption of FIN 48 will result in any material impact to the fund’s financial statements.

24

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended March 31, 2007 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

Strategic Equity Fund | 9/30/2006 | 3/31/2007 | Period1 |

Based on Actual Fund Return | $1,000.00 | $1,130.73 | $1.65 |

Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.39 | 1.56 |

1 The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.31%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

25

Note that the expenses shown in the table on page 25 are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs or account maintenance fees. They do not include your fund’s low-balance fee, which is described in the prospectus. If this fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the fund prospectus.

26

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard Strategic Equity Fund has renewed its investment advisory arrangement with The Vanguard Group, Inc. Vanguard—through its Quantitative Equity Group—serves as the fund’s investment advisor. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon its most recent evaluation of the advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others; however, no single factor determined whether or not the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both the short and long term, and took into account the organizational depth and stability of the advisor. Vanguard has been managing investments for more than two decades. George U. Sauter, Vanguard managing director and chief investment officer, has been in the investment management business since 1985, and has led the Quantitative Equity Group since 1987. James D. Troyer, the manager primarily responsible for the day-to-day management of the fund, has worked in investment management since 1979. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.