UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07239

Name of Registrant: Vanguard Horizon Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2014 – September 30, 2015

Item 1: Reports to Shareholders

Annual Report | September 30, 2015

Vanguard Strategic Equity Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Fund Profile. | 10 |

| Performance Summary. | 11 |

| Financial Statements. | 13 |

| Your Fund’s After-Tax Returns. | 28 |

| About Your Fund’s Expenses. | 29 |

| Glossary. | 31 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows us to help millions of clients around the world reach their financial goals.

| | | | |

| Your Fund’s Total Returns | | | | |

| |

| |

| |

| |

| Fiscal Year Ended September 30, 2015 | | | | |

| | | | | Total |

| | | | | Returns |

| Vanguard Strategic Equity Fund | | | | 2.01% |

| MSCI US Small + Mid Cap 2200 Index | | | | 0.65 |

| Mid-Cap Core Funds Average | | | | -1.58 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | | |

| |

| |

| Your Fund’s Performance at a Glance | | | | |

| September 30, 2014, Through September 30, 2015 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Strategic Equity Fund | $32.02 | $30.82 | $0.354 | $1.519 |

1

Chairman’s Letter

Dear Shareholder,

The fiscal year ended September 30, 2015, was a volatile one for financial markets. Initially, stock prices headed higher amid largely positive developments regarding the domestic economy. As the period progressed, however, the ride got bumpier. A number of concerns affected investor sentiment, including the pace of growth at home and abroad and the fall in the price of oil and other commodities. The prospect of a Federal Reserve rate hike, the impact of a strong U.S. dollar on corporate profits, and seemingly lofty stock market valuations also weighed on returns.

The outcome for U.S. stocks as a whole was a slightly negative performance. But domestic mid- and small-capitalization stocks, which tend to be more insulated from developments abroad, managed to stay above water, and Vanguard Strategic Equity Fund returned 2.01% for the period. This put it ahead of its benchmark, the MSCI US Small + Mid Cap 2200 Index, which returned 0.65%, and well out in front of its peers’ average return of –1.58%.

Returns varied widely by sector. For the fund, three sectors posted double-digit gains and three produced double-digit declines. Relative to the benchmark, strong stock selection in information technology and consumer discretionary made the biggest contributions to its outperformance. This helped to offset subpar selection results from other sectors including materials and financials.

2

If you own shares of your fund in a taxable account, you may wish to review the funds’ after-tax returns that appear later in this report.

Please note that as of September 30, 2015, the Strategic Equity Fund had realized capital gains equal to about 9% of fund assets. Gains will be distributed in December.

China’s economic woes weighed on global stocks

The broad U.S. stock market returned –0.49% for the 12 months. The final two months were especially rocky as investors worried in particular about the global ripple effects of slower economic growth in China.

For much of the fiscal year, investors were preoccupied with the possibility of an increase in short-term interest rates. On September 17, the Fed announced that it would hold rates steady for the time being, a decision that to some investors indicated the Fed’s concern about the fragility of global markets.

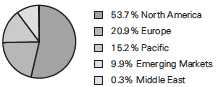

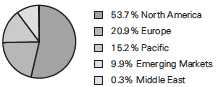

International stocks returned about –11% as the dollar’s strength against many foreign currencies weighed on results. Returns for emerging markets, which were especially hard hit by concerns about China, trailed those of the developed markets of the Pacific region and Europe.

| | | |

| Market Barometer | | | |

| |

| | | Average Annual Total Returns |

| | Periods Ended September 30, 2015 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | -0.61% | 12.66% | 13.42% |

| Russell 2000 Index (Small-caps) | 1.25 | 11.02 | 11.73 |

| Russell 3000 Index (Broad U.S. market) | -0.49 | 12.53 | 13.28 |

| FTSE All-World ex US Index (International) | -11.34 | 2.87 | 2.19 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 2.94% | 1.71% | 3.10% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.16 | 2.88 | 4.14 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.02 | 0.02 | 0.04 |

| |

| CPI | | | |

| Consumer Price Index | -0.04% | 0.93% | 1.73% |

3

Taxable bonds recorded gains as investors searched for safety

The broad U.S. taxable bond market returned 2.94% as investors gravitated toward safe-haven assets amid global stock market turmoil. Stimulative monetary policies from the world’s central banks, declining inflation expectations, and global investors’ search for higher yields also helped lift U.S. bonds.

The yield of the 10-year Treasury note ended September at 2.05%, down from 2.48% a year earlier. (Bond prices and yields move in opposite directions.)

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –7.67%; the dollar’s strength was again a significant factor. Without this currency effect, international bonds advanced modestly.

The Fed’s 0%–0.25% target for short-term interest rates continued to limit returns for money market funds and savings accounts.

The fund’s quantitative screening produced benchmark-beating results

The fund’s advisor, Vanguard Quantitative

that consider criteria such as valuations, earnings growth potential, and market sentiment.

This screening process met with success in seven of the ten market sectors. Relative outperformance was especially strong for information technology holdings in software, IT services, and semiconductors.

Consumer discretionary was another top-performing sector. The advisor’s company-by-company analysis resulted in benchmark-beating returns for its selections among cable TV, footwear, internet retailing, and automotive parts companies.

Energy stocks continued to suffer from the sharp drop in the price of oil, returning roughly –45% for the benchmark index. Although the fund’s holdings in equipment and services disappointed, they produced an above-benchmark return in this sector. The fund succeeded primarily by avoiding coal stocks and limiting its exposure to oil and gas exploration and production companies.

In financials, consumer finance and regional banks underperformed for the fund. Materials was an even bigger detractor from relative results, mainly because of stakes in the metals and mining segment.

For more information about the advisor’s management of the fund, please see the Advisor’s Report that follows this letter.

| |

| Total Returns | |

| Ten Years Ended September 30, 2015 | |

| | Average |

| | Annual Return |

| Strategic Equity Fund | 6.95% |

| MSCI US Small + Mid Cap 2200 Index | 7.79 |

| Mid-Cap Core Funds Average | 6.59 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

| |

|

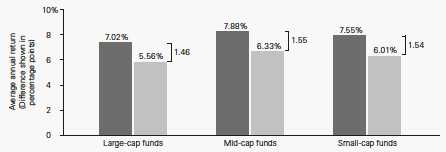

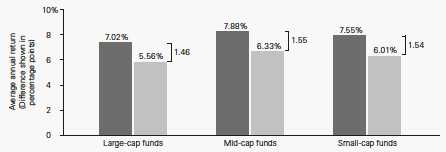

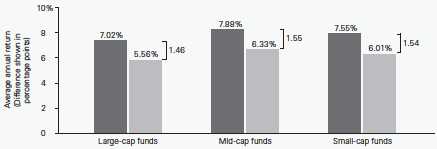

| Staying the course can help you stay closer to your fund’s return |

| |

| When stock markets are highly volatile, as in recent months, it’s tempting to run for cover. |

| But the price of panic can be high. |

| |

| A rough measure of what can be lost from attempts to time the market is the difference |

| between the returns produced by a fund and the returns earned by the fund’s investors. |

| |

| The results shown in the Performance Summary later in this report are your fund’s time- |

| weighted returns—the average annual returns investors would have earned if they invested |

| a lump sum in the fund at the start of the period and reinvested any distributions they had |

| received. Their actual returns, however, depend on whether they subsequently bought or |

| sold any shares. There’s often a gap between this dollar-weighted return for investors and |

| the fund’s time-weighted return, as shown below. |

| |

| Many sensible investment behaviors can contribute to the difference in returns, but industry |

| cash flow data suggest that one important factor is the generally counterproductive effort to |

| buy and sell at the “right” time. Keeping your emotions in check can help narrow the gap. |

| |

| Mutual fund returns and investor returns over the last decade |

|

| Average fund return |

| Average investor return |

| |

| Notes: Data are as of December 31, 2014. The average fund returns and average investor returns are from Morningstar. The average |

| fund returns are the average of the funds’ time-weighted returns in each category. The average investor returns assume that the growth |

| of a fund’s total net assets for a given period is driven by market returns and investor cash ow. To calculate investor return, a fund’s |

| change in assets for the period is discounted by the return of the fund to isolate how much of the asset growth was driven by cash ow. |

| A model, similar to an internal rate-of-return calculation, is then used to calculate a constant growth rate that links the beginning total |

| net assets and periodic cash ows to the ending total net assets. |

| Sources: Vanguard and Morningstar, Inc. |

6

Fund added another positive year to its long-term track record

Vanguard Strategic Equity Fund produced an average annual return of 6.95% over the past decade, lagging the 7.79% return of its benchmark index. The advisor struggled to keep up with its benchmark going into and coming out of the 2008–2009 financial crisis. This period, when investors were focused more on macroeconomic concerns than on individual company fundamentals, accounts for much of the fund’s shortfall. The advisor has had more success of late, and this fiscal year marks the fund’s fifth consecutive year of outperformance.

The fund’s average annual return over the last ten years has outpaced that of its peers.

A dose of discipline is crucial when markets become volatile

Although the broad U.S. stock market has posted gains for six straight calendar years—from 2009 to 2014—that streak may not last a seventh. Stocks tumbled in August and swung up and down in September.

Nobody can control the direction of the markets or reliably predict where they’ll go in the short term. However, investors can control how they react to volatility.

During periods of market adversity, it’s more important than ever to keep sight of one of Vanguard’s key principles: Maintain perspective and long-term discipline. Whether you’re investing for yourself or on behalf of clients, your success is affected greatly by how you respond—or don’t respond—during turbulent markets. (You can read Vanguard’s Principles for Investing Success at vanguard.com/research.)

As I’ve written in the past, the best course for long-term investors is generally to ignore daily market moves and not make decisions based on emotion. (See the box on page 6 for more discussion on the benefit of staying the course.) This is also a good time to evaluate your portfolio and make sure your asset allocation is aligned with your time horizon, goals, and risk tolerance.

The markets are unpredictable and often confounding. Keeping our long-term plans clearly in focus can be essential as we weather these periodic storms.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

October 15, 2015

7

Advisor’s Report

For the fiscal year ended September 30, 2015, the Strategic Equity Fund had a total return of 2.01%, outpacing its benchmark index by 1.36 percentage points. Overall, stocks struggled—the broad U.S. equity market (as measured by the MSCI US Investable Market Index) returned –0.39%. Large-capitalization stocks lagged smaller-caps, and growth-oriented stocks outpaced value. Equities outside the United States returned roughly –9%. Emerging markets were a large contributor to that result as they returned about –19%.

Sector performance in the benchmark index was mixed, although a majority produced positive results. Health care, consumer staples, and information technology did best, but energy, materials, and telecommunication services lagged.

After six straight years of positive returns, the U.S. stock market declined slightly for the period. The Federal Reserve held off on raising interest rates to facilitate further progress toward its employment and inflation targets. Second-quarter real GDP increased at an annual rate of 3.9% compared with an increase of 0.6% in the first quarter. This growth reflected contributions from exports, an acceleration in personal consumption expenditures, and an increase in state and local government spending.

The unemployment rate continued to fall. The U.S. nonfarm payroll rose by 142,000 in September, and the unemployment rate declined to 5.1% from 5.9% a year ago.

The economic slowdown overseas, especially in emerging markets, added to recent market volatility. Emerging-market currencies have lost value against the U.S. dollar. The possibility that the Fed might raise interest rates by the end of 2015 pushed the dollar up and spurred capital outflows from these countries. Many emerging economies were also affected by weak commodity prices that contributed to lower export growth. China’s continuing slowdown still represents significant downside risk to overall emerging-market performance.

Although we seek to understand the impact of macro factors on fund performance, our investment process is focused on specific stock fundamentals. We compare stocks within the same industry groups to identify those with characteristics that we believe will help them outperform over the long run.

We use a strict quantitative model to analyze valuation and other factors centered on fundamental growth. We then use the results to construct our portfolio. Our goal is to maximize expected return and minimize exposure to risks that our research indicates do not improve returns, such as deviations from market-capitalization and sector weightings relative to the benchmark.

For the fiscal year, the growth, management decisions, and sentiment components of our model boosted the fund’s results. However, the quality and valuation components did not perform

8

as expected. The model’s effectiveness was mixed. Stock selection was positive in five sectors, virtually flat in two, and negative in three. The strongest results were in information technology, consumer discretionary, and industrials. We underper-formed primarily in materials, financials, and consumer staples.

At the individual stock level, the largest contributions came from overweighted positions in Electronic Arts, Manhattan Associates, and Qorvo. Compared with the benchmark, we benefited from underweighting or avoiding stocks including NetApp and Trimble Navigation.

Unfortunately, we were not able to avoid all disappointments. Overweighted positions in Century Aluminum, Alcoa, and United States Steel directly lowered results. And underweighted positions in Vulcan Materials and Martin Marietta Materials, which our model did not select, hurt the fund’s relative performance.

We continue to believe that constructing a portfolio that focuses on the fundamentals described above will benefit investors over the long term, although we recognize that risk can reward or punish us in the near term. We feel that the fund offers a strong mix of stocks with attractive valuation and growth characteristics relative to its benchmark index.

We thank you for your investment and look forward to the coming year.

Portfolio Managers:

James D. Troyer, CFA, Principal

James P. Stetler, Principal

Michael R. Roach, CFA

Vanguard Quantitative Equity Group

October 16, 2015

9

Strategic Equity Fund

Fund Profile

As of September 30, 2015

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | | U.S. |

| | | MSCI US | Total |

| | | Small + | Market |

| | | Mid Cap | FA |

| | Fund | 2200 Index | Index |

| Number of Stocks | 426 | 2,188 | 4,000 |

| Median Market Cap | $3.9B | $5.9B | $46.5B |

| Price/Earnings Ratio | 17.5x | 25.0x | 20.2x |

| Price/Book Ratio | 2.6x | 2.3x | 2.5x |

| Return on Equity | 13.9% | 13.5% | 17.2% |

| Earnings Growth | | | |

| Rate | 14.1% | 11.5% | 10.1% |

| Dividend Yield | 1.8% | 1.7% | 2.1% |

| Foreign Holdings | 1.0% | 0.0% | 0.0% |

| Turnover Rate | 70% | — | — |

| Ticker Symbol | VSEQX | — | — |

| Expense Ratio1 | 0.27% | — | — |

| 30-Day SEC Yield | 1.55% | — | — |

| Short-Term Reserves | 0.1% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | | DJ |

| | | | U.S. |

| | | MSCI US | Total |

| | | Small + | Market |

| | | Mid Cap | FA |

| | Fund | 2200 Index | Index |

| Consumer Discretionary | 17.1% | 16.7% | 13.7% |

| Consumer Staples | 5.3 | 4.5 | 8.7 |

| Energy | 4.9 | 4.4 | 6.3 |

| Financials | 21.6 | 22.5 | 18.3 |

| Health Care | 10.7 | 10.8 | 14.4 |

| Industrials | 13.6 | 13.5 | 10.6 |

| Information Technology | 15.9 | 16.3 | 19.6 |

| Materials | 5.1 | 5.4 | 3.1 |

| Telecommunication | | | |

| Services | 0.4 | 0.9 | 2.1 |

| Utilities | 5.4 | 5.0 | 3.2 |

| | |

| Volatility Measures | | |

| | MSCI US | DJ |

| | Small + | U.S. Total |

| | Mid Cap | Market |

| | 2200 Index | FA Index |

| R-Squared | 0.97 | 0.91 |

| Beta | 0.98 | 1.07 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| | |

| Ten Largest Holdings (% of total net assets) |

| Electronic Arts Inc. | Home Entertainment | |

| | Software | 1.2% |

| Tesoro Corp. | Oil & Gas Refining & | |

| | Marketing | 1.0 |

| Best Buy Co. Inc. | Computer & | |

| | Electronics Retail | 1.0 |

| FirstEnergy Corp. | Electric Utilities | 1.0 |

| Cintas Corp. | Diversified Support | |

| | Services | 0.9 |

| Everest Re Group Ltd. | Reinsurance | 0.9 |

| CDW Corp. | Technology | |

| | Distributors | 0.9 |

| Bunge Ltd. | Agricultural Products | 0.9 |

| Computer Sciences | Data Processing & | |

| Corp. | Outsourced Services | 0.9 |

| Voya Financial Inc. | Diversified Financial | |

| | Services | 0.9 |

| Top Ten | | 9.6% |

The holdings listed exclude any temporary cash investments and equity index products.

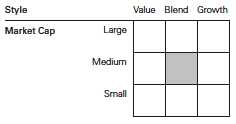

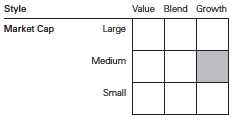

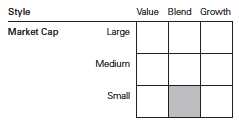

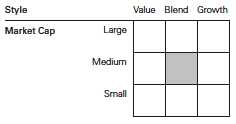

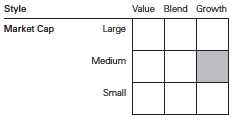

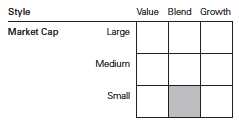

Investment Focus

1 The expense ratio shown is from the prospectus dated January 27, 2015, and represents estimated costs for the current fiscal year. For the fiscal year ended September 30, 2015, the expense ratio was 0.21%.

10

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

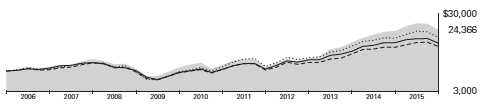

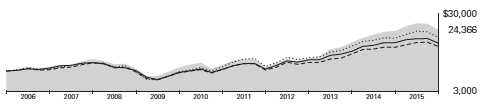

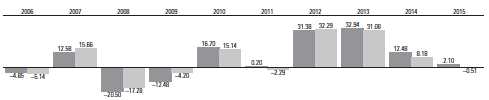

Cumulative Performance: September 30, 2005, Through September 30, 2015

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | |

| | Periods Ended September 30, 2015 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| |

| Strategic Equity Fund* | 2.01% | 16.10% | 6.95% | $19,588 |

| MSCI US Small + Mid Cap 2200 | | | | |

| Index | 0.65 | 13.38 | 7.79 | 21,181 |

| |

| Mid-Cap Core Funds Average | -1.58 | 11.41 | 6.59 | 18,928 |

| Dow Jones U.S. Total Stock Market | | | | |

| Float Adjusted Index | -0.55 | 13.26 | 7.06 | 19,778 |

Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend and capital gains information.

11

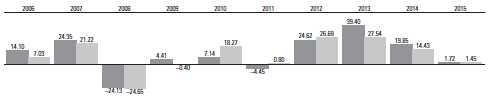

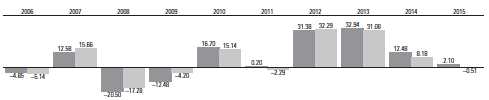

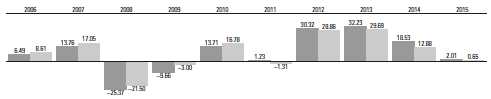

Strategic Equity Fund

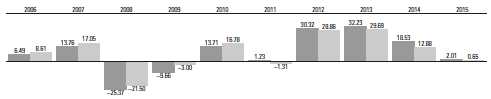

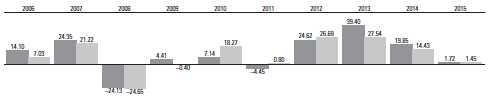

Fiscal-Year Total Returns (%): September 30, 2005, Through September 30, 2015

| |

| Strategic Equity Fund |

| MSCI US Small + Mid Cap 2200 Index |

12

Strategic Equity Fund

Financial Statements

Statement of Net Assets

As of September 30, 2015

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Common Stocks (99.6%)1 | | |

| Consumer Discretionary (17.1%) | |

| | Best Buy Co. Inc. | 1,526,300 | 56,656 |

| * | Skechers U.S.A. Inc. | | |

| | Class A | 366,400 | 49,127 |

| | Big Lots Inc. | 1,002,900 | 48,059 |

| | American Eagle | | |

| | Outfitters Inc. | 2,797,300 | 43,722 |

| | Expedia Inc. | 364,800 | 42,930 |

| | Leggett & Platt Inc. | 1,034,600 | 42,677 |

| * | American Axle & | | |

| | Manufacturing | | |

| | Holdings Inc. | 1,953,200 | 38,947 |

| | Cooper Tire & Rubber Co. | 968,800 | 38,277 |

| | Darden Restaurants Inc. | 553,250 | 37,920 |

| * | O’Reilly Automotive Inc. | 149,100 | 37,275 |

| ^ | Outerwall Inc. | 635,590 | 36,184 |

| | Brinker International Inc. | 684,950 | 36,076 |

| | Domino’s Pizza Inc. | 291,820 | 31,490 |

| | Hasbro Inc. | 423,500 | 30,551 |

| * | Murphy USA Inc. | 445,000 | 24,453 |

| | Nutrisystem Inc. | 865,000 | 22,940 |

| | Jack in the Box Inc. | 275,000 | 21,186 |

| * | NVR Inc. | 12,200 | 18,608 |

| | DR Horton Inc. | 632,300 | 18,564 |

| | Carter’s Inc. | 184,500 | 16,723 |

| * | Pinnacle Entertainment Inc. | 485,848 | 16,441 |

| * | Madison Square Garden Co. | |

| | Class A | 225,800 | 16,289 |

| | Marriott Vacations | | |

| | Worldwide Corp. | 212,300 | 14,466 |

| * | Strayer Education Inc. | 262,400 | 14,424 |

| | Wyndham Worldwide Corp. | 200,100 | 14,387 |

| | Foot Locker Inc. | 177,013 | 12,740 |

| | Lear Corp. | 116,400 | 12,662 |

| * | Helen of Troy Ltd. | 138,800 | 12,395 |

| | Caleres Inc. | 358,800 | 10,954 |

| * | BJ’s Restaurants Inc. | 248,400 | 10,689 |

| | World Wrestling | | |

| | Entertainment Inc. Class A | 617,300 | 10,432 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Grand Canyon | | |

| | Education Inc. | 256,000 | 9,725 |

| * | Tower International Inc. | 368,200 | 8,748 |

| * | Burlington Stores Inc. | 149,600 | 7,636 |

| * | Starz | 202,700 | 7,569 |

| | Interpublic Group of | | |

| | Cos. Inc. | 378,300 | 7,237 |

| | Harman International | | |

| | Industries Inc. | 74,400 | 7,142 |

| * | Denny’s Corp. | 572,700 | 6,317 |

| | Cablevision Systems Corp. | | |

| | Class A | 189,800 | 6,163 |

| | News Corp. Class A | 464,000 | 5,856 |

| | Cato Corp. Class A | 167,600 | 5,703 |

| * | Boyd Gaming Corp. | 321,800 | 5,245 |

| * | Iconix Brand Group Inc. | 384,800 | 5,203 |

| | Gannett Co. Inc. | 327,800 | 4,829 |

| * | Fossil Group Inc. | 85,100 | 4,755 |

| | Whirlpool Corp. | 30,900 | 4,550 |

| * | G-III Apparel Group Ltd. | 67,300 | 4,150 |

| | News Corp. Class B | 323,500 | 4,147 |

| * | Live Nation | | |

| | Entertainment Inc. | 166,900 | 4,012 |

| | Columbia Sportswear Co. | 67,200 | 3,951 |

| * | Universal Electronics Inc. | 82,800 | 3,480 |

| | AMC Entertainment | | |

| | Holdings Inc. | 105,900 | 2,668 |

| | Barnes & Noble Inc. | 216,400 | 2,621 |

| * | Select Comfort Corp. | 118,700 | 2,597 |

| * | Penn National Gaming Inc. | 150,900 | 2,532 |

| * | lululemon athletica Inc. | 46,200 | 2,340 |

| * | Barnes & Noble | | |

| | Education Inc. | 156,945 | 1,995 |

| * | Deckers Outdoor Corp. | 34,000 | 1,974 |

| * | Michaels Cos. Inc. | 84,200 | 1,945 |

| * | Liberty Interactive Corp. | | |

| | QVC Group Class A | 66,424 | 1,742 |

| | Oxford Industries Inc. | 21,200 | 1,566 |

| * | Unifi Inc. | 44,600 | 1,330 |

13

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | ServiceMaster Global | | |

| | Holdings Inc. | 26,200 | 879 |

| | Libbey Inc. | 23,900 | 779 |

| * | Gray Television Inc. | 53,100 | 678 |

| | | | 980,308 |

| Consumer Staples (5.3%) | | |

| | Bunge Ltd. | 700,600 | 51,354 |

| ^ | Pilgrim’s Pride Corp. | 2,120,700 | 44,068 |

| | Clorox Co. | 316,600 | 36,577 |

| ^ | Cal-Maine Foods Inc. | 668,100 | 36,485 |

| * | SUPERVALU Inc. | 4,851,200 | 34,832 |

| ^ | Sanderson Farms Inc. | 492,000 | 33,736 |

| * | USANA Health | | |

| | Sciences Inc. | 131,000 | 17,558 |

| | Ingles Markets Inc. | | |

| | Class A | 235,600 | 11,269 |

| | Dr Pepper Snapple | | |

| | Group Inc. | 109,690 | 8,671 |

| | ConAgra Foods Inc. | 181,000 | 7,332 |

| | Lancaster Colony Corp. | 55,619 | 5,422 |

| | Dean Foods Co. | 292,000 | 4,824 |

| | Pinnacle Foods Inc. | 107,500 | 4,502 |

| | Fresh Del Monte | | |

| | Produce Inc. | 84,600 | 3,343 |

| | Campbell Soup Co. | 44,900 | 2,275 |

| | Coty Inc. Class A | 67,900 | 1,837 |

| | | | 304,085 |

| Energy (4.9%) | | |

| | Tesoro Corp. | 584,100 | 56,798 |

| | Noble Corp. plc | 3,096,700 | 33,785 |

| | Western Refining Inc. | 726,100 | 32,035 |

| | PBF Energy Inc. Class A | 1,090,212 | 30,777 |

| | Alon USA Energy Inc. | 1,589,700 | 28,726 |

| | Core Laboratories NV | 280,400 | 27,984 |

| | Plains GP Holdings LP | | |

| | Class A | 1,026,700 | 17,967 |

| * | Oil States International Inc. | 615,122 | 16,073 |

| | HollyFrontier Corp. | 208,300 | 10,173 |

| * | WPX Energy Inc. | 1,131,700 | 7,492 |

| | Atwood Oceanics Inc. | 415,600 | 6,155 |

| * | FMC Technologies Inc. | 164,990 | 5,115 |

| | Delek US Holdings Inc. | 127,700 | 3,537 |

| * | Cameron International Corp. | 54,526 | 3,344 |

| | Green Plains Inc. | 133,600 | 2,600 |

| * | Matrix Service Co. | 25,700 | 577 |

| | | | 283,138 |

| Financials (21.5%) | | |

| | Everest Re Group Ltd. | 307,500 | 53,302 |

| | Voya Financial Inc. | 1,295,100 | 50,211 |

| | Huntington | | |

| | Bancshares Inc. | 4,577,100 | 48,517 |

| | AmTrust Financial | | |

| | Services Inc. | 751,800 | 47,348 |

| * | MGIC Investment Corp. | 4,705,900 | 43,577 |

| | Radian Group Inc. | 2,620,400 | 41,691 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Assured Guaranty Ltd. | 1,623,160 | 40,579 |

| | KeyCorp | 2,564,830 | 33,368 |

| | Aspen Insurance | | |

| | Holdings Ltd. | 533,500 | 24,792 |

| | Extra Space Storage Inc. | 320,540 | 24,733 |

| | Navient Corp. | 2,056,400 | 23,114 |

| | Apartment Investment & | | |

| | Management Co. | 519,000 | 19,213 |

| | Lamar Advertising Co. | | |

| | Class A | 364,800 | 19,035 |

| | Kimco Realty Corp. | 759,500 | 18,555 |

| | Hospitality Properties Trust | 723,200 | 18,499 |

| *,^ | Credit Acceptance Corp. | 92,361 | 18,183 |

| * | Walker & Dunlop Inc. | 685,800 | 17,886 |

| | Axis Capital Holdings Ltd. | 328,400 | 17,642 |

| | Weingarten Realty Investors | 528,900 | 17,512 |

| | CoreSite Realty Corp. | 338,300 | 17,402 |

| | CyrusOne Inc. | 523,800 | 17,107 |

| | Ryman Hospitality | | |

| | Properties Inc. | 338,700 | 16,674 |

| * | Santander Consumer USA | | |

| | Holdings Inc. | 808,900 | 16,518 |

| | EPR Properties | 317,400 | 16,368 |

| | Sovran Self Storage Inc. | 173,500 | 16,361 |

| | Universal Insurance | | |

| | Holdings Inc. | 548,400 | 16,200 |

| | Omega Healthcare | | |

| | Investors Inc. | 460,000 | 16,169 |

| * | LendingTree Inc. | 169,400 | 15,759 |

| | Associated Banc-Corp | 854,300 | 15,352 |

| | GEO Group Inc. | 502,900 | 14,956 |

| | DuPont Fabros | | |

| | Technology Inc. | 577,400 | 14,943 |

| | Jones Lang LaSalle Inc. | 101,600 | 14,607 |

| | Corrections Corp. of | | |

| | America | 478,732 | 14,142 |

| | Popular Inc. | 466,700 | 14,108 |

| | First American Financial | | |

| | Corp. | 361,100 | 14,108 |

| | Reinsurance Group of | | |

| | America Inc. Class A | 143,920 | 13,038 |

| | Regency Centers Corp. | 202,700 | 12,598 |

| * | PRA Group Inc. | 237,000 | 12,542 |

| | CBL & Associates | | |

| | Properties Inc. | 905,800 | 12,455 |

| | Summit Hotel | | |

| | Properties Inc. | 1,066,400 | 12,445 |

| | PacWest Bancorp | 288,065 | 12,332 |

| | Host Hotels & Resorts Inc. | 764,300 | 12,084 |

| | RLJ Lodging Trust | 472,700 | 11,945 |

| | Cathay General Bancorp | 393,800 | 11,798 |

| *,^ | World Acceptance Corp. | 425,619 | 11,424 |

| | Pennsylvania REIT | 560,800 | 11,121 |

| | Equity LifeStyle | | |

| | Properties Inc. | 189,300 | 11,087 |

14

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | BioMed Realty Trust Inc. | 534,600 | 10,681 |

| | PrivateBancorp Inc. | 275,800 | 10,571 |

| ^ | Lexington Realty Trust | 1,222,900 | 9,906 |

| | UDR Inc. | 283,620 | 9,779 |

| | Allied World Assurance | | |

| | Co. Holdings AG | 255,300 | 9,745 |

| * | Cowen Group Inc. | | |

| | Class A | 2,102,500 | 9,587 |

| | Validus Holdings Ltd. | 210,600 | 9,492 |

| | Hersha Hospitality Trust | | |

| | Class A | 408,775 | 9,263 |

| | Ashford Hospitality | | |

| | Trust Inc. | 1,402,700 | 8,557 |

| * | Heritage Insurance | | |

| | Holdings Inc. | 432,700 | 8,537 |

| * | E*TRADE Financial Corp. | 315,400 | 8,305 |

| * | Realogy Holdings Corp. | 209,916 | 7,899 |

| | Washington Federal Inc. | 334,700 | 7,614 |

| | Digital Realty Trust Inc. | 115,050 | 7,515 |

| | Chambers Street Properties | 989,400 | 6,421 |

| | National Retail | | |

| | Properties Inc. | 171,500 | 6,220 |

| | HCI Group Inc. | 151,100 | 5,858 |

| | Camden Property Trust | 78,000 | 5,764 |

| | Inland Real Estate Corp. | 638,500 | 5,172 |

| | First Industrial Realty | | |

| | Trust Inc. | 236,500 | 4,955 |

| | RAIT Financial Trust | 965,300 | 4,788 |

| * | Marcus & Millichap Inc. | 101,800 | 4,682 |

| | Alexandria Real Estate | | |

| | Equities Inc. | 53,900 | 4,564 |

| | Government Properties | | |

| | Income Trust | 282,300 | 4,517 |

| | CIT Group Inc. | 109,900 | 4,399 |

| | CubeSmart | 161,500 | 4,394 |

| | Home Properties Inc. | 55,500 | 4,149 |

| * | Piper Jaffray Cos. | 102,200 | 3,697 |

| * | Strategic Hotels & | | |

| | Resorts Inc. | 259,500 | 3,579 |

| | Post Properties Inc. | 58,400 | 3,404 |

| | Highwoods Properties Inc. | 87,100 | 3,375 |

| | Nelnet Inc. Class A | 96,512 | 3,340 |

| | Columbia Property Trust Inc. | 137,800 | 3,197 |

| | LaSalle Hotel Properties | 108,700 | 3,086 |

| | Monogram Residential | | |

| | Trust Inc. | 314,700 | 2,930 |

| | National Health Investors Inc. | 47,300 | 2,719 |

| | Chesapeake Lodging Trust | 89,400 | 2,330 |

| | HCC Insurance Holdings Inc. | 29,000 | 2,247 |

| | Investment Technology | | |

| | Group Inc. | 167,900 | 2,240 |

| | Ramco-Gershenson | | |

| | Properties Trust | 148,300 | 2,226 |

| * | INTL. FCStone Inc. | 86,200 | 2,128 |

| | Progressive Corp. | 65,000 | 1,992 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Brixmor Property Group Inc. | 83,600 | 1,963 |

| | Apollo Residential | | |

| | Mortgage Inc. | 153,400 | 1,942 |

| | Central Pacific Financial | | |

| | Corp. | 87,400 | 1,833 |

| | Mid-America Apartment | | |

| | Communities Inc. | 21,400 | 1,752 |

| | International Bancshares | | |

| | Corp. | 63,900 | 1,599 |

| | Brandywine Realty Trust | 123,032 | 1,516 |

| | CareTrust REIT Inc. | 132,227 | 1,501 |

| | Cardinal Financial Corp. | 56,200 | 1,293 |

| | Ashford Hospitality | | |

| | Prime Inc. | 92,014 | 1,291 |

| | Universal Health Realty | | |

| | Income Trust | 26,700 | 1,253 |

| | Pinnacle Financial | | |

| | Partners Inc. | 24,900 | 1,230 |

| * | First NBC Bank Holding Co. | 34,900 | 1,223 |

| | Great Southern Bancorp Inc. | 28,000 | 1,212 |

| * | First BanCorp | 321,600 | 1,145 |

| | Medical Properties Trust Inc. 103,200 | 1,141 |

| * | Capital Bank Financial Corp. | 28,100 | 849 |

| | Northfield Bancorp Inc. | 52,400 | 797 |

| | Chatham Lodging Trust | 34,100 | 733 |

| | Maiden Holdings Ltd. | 43,300 | 601 |

| | Agree Realty Corp. | 12,000 | 358 |

| | Getty Realty Corp. | 20,300 | 321 |

| | RE/MAX Holdings Inc. | 5,300 | 191 |

| | One Liberty Properties Inc. | 3,300 | 70 |

| | | | 1,235,038 |

| Health Care (10.6%) | | |

| * | Quintiles Transnational | | |

| | Holdings Inc. | 709,900 | 49,388 |

| * | Centene Corp. | 836,550 | 45,366 |

| * | Charles River Laboratories | | |

| | International Inc. | 684,900 | 43,505 |

| * | Hologic Inc. | 910,200 | 35,616 |

| * | PAREXEL International | | |

| | Corp. | 573,100 | 35,486 |

| * | ABIOMED Inc. | 353,000 | 32,744 |

| * | Isis Pharmaceuticals Inc. | 545,500 | 22,049 |

| * | Edwards Lifesciences Corp. | 152,100 | 21,624 |

| | CR Bard Inc. | 104,000 | 19,376 |

| *,^ | Merrimack | | |

| | Pharmaceuticals Inc. | 1,899,400 | 16,164 |

| | ResMed Inc. | 311,583 | 15,878 |

| | Chemed Corp. | 116,300 | 15,523 |

| * | Affymetrix Inc. | 1,802,700 | 15,395 |

| * | VCA Inc. | 278,700 | 14,673 |

| * | Community Health | | |

| | Systems Inc. | 313,100 | 13,391 |

| * | INC Research Holdings Inc. | | |

| | Class A | 326,000 | 13,040 |

| * | Natus Medical Inc. | 329,900 | 13,015 |

15

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Infinity | | |

| | Pharmaceuticals Inc. | 1,302,600 | 11,007 |

| * | Eagle Pharmaceuticals Inc. | 137,500 | 10,179 |

| * | NewLink Genetics Corp. | 262,900 | 9,422 |

| * | Depomed Inc. | 466,085 | 8,786 |

| | PDL BioPharma Inc. | 1,739,100 | 8,748 |

| | Universal Health Services | | |

| | Inc. Class B | 69,416 | 8,664 |

| * | Mettler-Toledo | | |

| | International Inc. | 29,764 | 8,475 |

| * | Lannett Co. Inc. | 196,800 | 8,171 |

| * | ICU Medical Inc. | 73,900 | 8,092 |

| | Ensign Group Inc. | 182,600 | 7,784 |

| * | Sucampo Pharmaceuticals | | |

| | Inc. Class A | 378,300 | 7,517 |

| * | United Therapeutics Corp. | 53,800 | 7,061 |

| * | AMN Healthcare | | |

| | Services Inc. | 229,800 | 6,896 |

| * | Molina Healthcare Inc. | 96,900 | 6,672 |

| *,^ | Sequenom Inc. | 3,459,000 | 6,053 |

| * | Bruker Corp. | 323,400 | 5,313 |

| * | Alere Inc. | 102,300 | 4,926 |

| * | Health Net Inc. | 76,000 | 4,577 |

| * | Henry Schein Inc. | 34,000 | 4,512 |

| * | Merit Medical Systems Inc. | 171,300 | 4,096 |

| * | Amedisys Inc. | 102,900 | 3,907 |

| * | Array BioPharma Inc. | 796,900 | 3,634 |

| * | Integra LifeSciences | | |

| | Holdings Corp. | 55,900 | 3,329 |

| | Phibro Animal Health Corp. | | |

| | Class A | 100,600 | 3,182 |

| | West Pharmaceutical | | |

| | Services Inc. | 56,500 | 3,058 |

| * | LifePoint Health Inc. | 43,000 | 3,049 |

| * | PRA Health Sciences Inc. | 74,500 | 2,893 |

| * | Veeva Systems Inc. Class A | 119,000 | 2,786 |

| * | Incyte Corp. | 24,000 | 2,648 |

| * | LHC Group Inc. | 49,900 | 2,234 |

| * | Waters Corp. | 18,500 | 2,187 |

| * | Masimo Corp. | 56,100 | 2,163 |

| * | MacroGenics Inc. | 70,900 | 1,519 |

| | Quality Systems Inc. | 118,200 | 1,475 |

| *,^ | Orexigen Therapeutics Inc. | 653,500 | 1,379 |

| * | Cambrex Corp. | 30,300 | 1,202 |

| * | Triple-S Management Corp. | |

| | Class B | 57,600 | 1,026 |

| | | | 610,855 |

| Industrials (13.5%) | | |

| | Cintas Corp. | 623,400 | 53,457 |

| * | Spirit AeroSystems | | |

| | Holdings Inc. Class A | 1,018,500 | 49,234 |

| | Huntington Ingalls | | |

| | Industries Inc. | 436,400 | 46,760 |

| * | JetBlue Airways Corp. | 1,804,600 | 46,505 |

| | Alaska Air Group Inc. | 558,180 | 44,347 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Hawaiian Holdings Inc. | 1,788,500 | 44,140 |

| | Pitney Bowes Inc. | 1,893,000 | 37,576 |

| | AO Smith Corp. | 568,200 | 37,041 |

| | Trinity Industries Inc. | 1,481,500 | 33,586 |

| * | United Rentals Inc. | 454,200 | 27,275 |

| ^ | Greenbrier Cos. Inc. | 832,100 | 26,719 |

| *,^ | TASER International Inc. | 1,211,100 | 26,674 |

| * | Meritor Inc. | 2,010,500 | 21,372 |

| | Masco Corp. | 626,900 | 15,785 |

| | Deluxe Corp. | 281,613 | 15,697 |

| * | Wabash National Corp. | 1,456,500 | 15,424 |

| * | Dycom Industries Inc. | 197,100 | 14,262 |

| * | American Woodmark Corp. | 219,000 | 14,207 |

| * | Virgin America Inc. | 375,400 | 12,850 |

| | Rockwell Collins Inc. | 152,700 | 12,497 |

| | Stanley Black & Decker Inc. | 125,233 | 12,145 |

| | L-3 Communications | | |

| | Holdings Inc. | 108,100 | 11,299 |

| | CEB Inc. | 156,400 | 10,688 |

| | Aircastle Ltd. | 503,200 | 10,371 |

| | GATX Corp. | 228,500 | 10,088 |

| | Acuity Brands Inc. | 55,500 | 9,745 |

| | Comfort Systems USA Inc. | 282,500 | 7,701 |

| | Allison Transmission | | |

| | Holdings Inc. | 270,000 | 7,206 |

| | Korn/Ferry International | 206,700 | 6,836 |

| | General Cable Corp. | 494,300 | 5,882 |

| | Standex International Corp. | 78,050 | 5,881 |

| | Owens Corning | 136,900 | 5,737 |

| | Interface Inc. Class A | 237,700 | 5,334 |

| | Hyster-Yale Materials | | |

| | Handling Inc. | 89,500 | 5,176 |

| | Douglas Dynamics Inc. | 232,600 | 4,619 |

| | RR Donnelley & Sons Co. | 314,200 | 4,575 |

| | Robert Half International Inc. | 84,000 | 4,297 |

| | SkyWest Inc. | 240,500 | 4,012 |

| | ManpowerGroup Inc. | 48,400 | 3,963 |

| | Steelcase Inc. Class A | 202,600 | 3,730 |

| | Allegion plc | 56,400 | 3,252 |

| | ITT Corp. | 85,800 | 2,868 |

| | Global Brass & Copper | | |

| | Holdings Inc. | 128,500 | 2,636 |

| | KBR Inc. | 130,000 | 2,166 |

| | Graco Inc. | 32,000 | 2,145 |

| | Textron Inc. | 55,000 | 2,070 |

| | Equifax Inc. | 20,000 | 1,944 |

| | Griffon Corp. | 120,400 | 1,899 |

| | Lincoln Electric Holdings Inc. | 35,000 | 1,835 |

| | Insperity Inc. | 38,400 | 1,687 |

| | Quanex Building Products | | |

| | Corp. | 91,900 | 1,670 |

| | Cubic Corp. | 38,800 | 1,627 |

| * | Aerojet Rocketdyne | | |

| | Holdings Inc. | 99,300 | 1,607 |

| | Briggs & Stratton Corp. | 66,500 | 1,284 |

16

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Federal Signal Corp. | 89,200 | 1,223 |

| | HNI Corp. | 27,700 | 1,188 |

| | ESCO Technologies Inc. | 31,500 | 1,131 |

| | Carlisle Cos. Inc. | 12,800 | 1,118 |

| | Heidrick & Struggles | | |

| | International Inc. | 56,200 | 1,093 |

| * | Blount International Inc. | 194,900 | 1,086 |

| | Ennis Inc. | 57,600 | 1,000 |

| | G&K Services Inc. Class A | 15,000 | 999 |

| *,^ | Enphase Energy Inc. | 247,976 | 917 |

| * | Moog Inc. Class A | 15,500 | 838 |

| | John Bean Technologies | | |

| | Corp. | 17,200 | 658 |

| * | Babcock & Wilcox | | |

| | Enterprises Inc. | 38,500 | 647 |

| | Knoll Inc. | 28,200 | 620 |

| | | | 775,901 |

| Information Technology (15.9%) | |

| * | Electronic Arts Inc. | 975,500 | 66,090 |

| | CDW Corp. | 1,284,500 | 52,485 |

| | Computer Sciences Corp. | 827,800 | 50,810 |

| * | Manhattan Associates Inc. | 799,841 | 49,830 |

| * | Gartner Inc. | 575,491 | 48,301 |

| | Booz Allen Hamilton | | |

| | Holding Corp. Class A | 1,735,300 | 45,482 |

| * | Aspen Technology Inc. | 1,186,400 | 44,976 |

| * | ARRIS Group Inc. | 1,494,000 | 38,799 |

| | Heartland Payment | | |

| | Systems Inc. | 578,800 | 36,470 |

| | MAXIMUS Inc. | 515,180 | 30,684 |

| | Lexmark International Inc. | | |

| | Class A | 1,048,400 | 30,383 |

| * | Cirrus Logic Inc. | 935,418 | 29,475 |

| *,^ | Ambarella Inc. | 503,924 | 29,122 |

| | DST Systems Inc. | 276,270 | 29,047 |

| * | Synaptics Inc. | 319,900 | 26,379 |

| | Skyworks Solutions Inc. | 279,100 | 23,503 |

| *,^ | Advanced Micro | | |

| | Devices Inc. | 13,658,835 | 23,493 |

| | Broadridge Financial | | |

| | Solutions Inc. | 414,100 | 22,920 |

| | EarthLink Holdings Corp. | 2,549,800 | 19,838 |

| * | MicroStrategy Inc. Class A | 91,600 | 17,997 |

| * | Tech Data Corp. | 260,600 | 17,851 |

| * | Blackhawk Network | | |

| | Holdings Inc. | 368,936 | 15,639 |

| | NVIDIA Corp. | 578,500 | 14,260 |

| * | Ciena Corp. | 626,100 | 12,973 |

| | SYNNEX Corp. | 146,074 | 12,425 |

| * | Super Micro Computer Inc. | 432,400 | 11,787 |

| | Avnet Inc. | 269,100 | 11,485 |

| | Science Applications | | |

| | International Corp. | 271,500 | 10,917 |

| *,^ | VASCO Data Security | | |

| | International Inc. | 577,900 | 9,847 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| *,^ | Cimpress NV | 124,200 | 9,453 |

| | Lam Research Corp. | 127,900 | 8,356 |

| | Jabil Circuit Inc. | 362,500 | 8,109 |

| * | Fiserv Inc. | 89,300 | 7,734 |

| * | Gigamon Inc. | 235,900 | 4,720 |

| * | Flextronics International Ltd. | 422,952 | 4,458 |

| *,^ | Angie’s List Inc. | 877,000 | 4,420 |

| * | Freescale | | |

| | Semiconductor Ltd. | 105,200 | 3,848 |

| | Jack Henry & | | |

| | Associates Inc. | 47,900 | 3,334 |

| | Blackbaud Inc. | 57,200 | 3,210 |

| * | ePlus Inc. | 39,800 | 3,147 |

| | CSG Systems | | |

| | International Inc. | 92,200 | 2,840 |

| * | Sanmina Corp. | 122,200 | 2,611 |

| * | Sykes Enterprises Inc. | 98,100 | 2,502 |

| | Western Union Co. | 130,363 | 2,394 |

| * | Mellanox Technologies Ltd. | 42,700 | 1,614 |

| | Diebold Inc. | 48,300 | 1,438 |

| * | Advanced Energy | | |

| | Industries Inc. | 50,300 | 1,323 |

| * | CACI International Inc. | | |

| | Class A | 16,800 | 1,243 |

| * | ON Semiconductor Corp. | 62,100 | 584 |

| | | | 910,606 |

| Materials (5.0%) | | |

| | Sealed Air Corp. | 1,057,409 | 49,571 |

| | Avery Dennison Corp. | 840,900 | 47,570 |

| * | Berry Plastics Group Inc. | 1,135,889 | 34,156 |

| | Ashland Inc. | 217,800 | 21,915 |

| | Ball Corp. | 316,000 | 19,655 |

| | Bemis Co. Inc. | 489,700 | 19,378 |

| * | Chemtura Corp. | 509,900 | 14,593 |

| * | Century Aluminum Co. | 2,900,894 | 13,344 |

| *,^ | Trinseo SA | 383,917 | 9,694 |

| | Graphic Packaging | | |

| | Holding Co. | 636,819 | 8,145 |

| | Neenah Paper Inc. | 117,200 | 6,831 |

| | AptarGroup Inc. | 93,300 | 6,154 |

| | Domtar Corp. | 165,700 | 5,924 |

| * | Ferro Corp. | 537,200 | 5,882 |

| * | Stillwater Mining Co. | 516,300 | 5,333 |

| | Mercer International Inc. | 434,800 | 4,361 |

| | International Flavors & | | |

| | Fragrances Inc. | 36,600 | 3,779 |

| | Valspar Corp. | 52,100 | 3,745 |

| | NewMarket Corp. | 8,922 | 3,185 |

| | Newmont Mining Corp. | 115,000 | 1,848 |

| | Sonoco Products Co. | 46,700 | 1,763 |

| | Calgon Carbon Corp. | 54,700 | 852 |

| * | US Concrete Inc. | 17,100 | 817 |

| * | Kraton Performance | | |

| | Polymers Inc. | 34,000 | 609 |

| | | | 289,104 |

17

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Telecommunication Services (0.4%) | |

| | Inteliquent Inc. | 306,700 | 6,849 |

| * | Level 3 | | |

| | Communications Inc. | 110,800 | 4,841 |

| | Telephone & Data | | |

| | Systems Inc. | 141,600 | 3,534 |

| * | Cincinnati Bell Inc. | 977,500 | 3,050 |

| * | General Communication Inc. | |

| | Class A | 66,500 | 1,148 |

| * | Vonage Holdings Corp. | 140,400 | 825 |

| | | | 20,247 |

| Utilities (5.4%) | | |

| | FirstEnergy Corp. | 1,754,400 | 54,930 |

| | Entergy Corp. | 698,300 | 45,459 |

| | WGL Holdings Inc. | 605,600 | 34,925 |

| | Vectren Corp. | 823,900 | 34,612 |

| | UGI Corp. | 929,650 | 32,370 |

| | AES Corp. | 2,198,800 | 21,526 |

| | New Jersey Resources | | |

| | Corp. | 702,200 | 21,087 |

| | PNM Resources Inc. | 431,435 | 12,102 |

| | American States Water Co. | 262,600 | 10,872 |

| | Ameren Corp. | 256,900 | 10,859 |

| | Portland General Electric Co. 273,100 | 10,097 |

| | Atmos Energy Corp. | 121,200 | 7,051 |

| | DTE Energy Co. | 67,000 | 5,385 |

| * | Talen Energy Corp. | 324,800 | 3,281 |

| | IDACORP Inc. | 25,400 | 1,644 |

| | Unitil Corp. | 37,500 | 1,383 |

| | Chesapeake Utilities Corp. | 12,300 | 653 |

| | | | 308,236 |

| Total Common Stocks | | |

| (Cost $5,343,177) | | 5,717,518 |

| Temporary Cash Investments (2.1%)1 | |

| Money Market Fund (2.1%) | | |

| 2,3 | Vanguard Market | | |

| | Liquidity Fund, | | |

| | 0.189% | 120,165,621 | 120,166 |

| |

| | | Face | |

| | | Amount | |

| | | ($000) | |

| U.S. Government and Agency Obligations (0.0%) |

| 4,5 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.208%, 12/9/15 | 2,000 | 1,999 |

| Total Temporary Cash Investments | |

| (Cost $122,165) | | 122,165 |

| Total Investments (101.7%) | | |

| (Cost $5,465,342) | | 5,839,683 |

| |

| | Amount |

| | ($000) |

| Other Assets and Liabilities (-1.7%) | |

| Other Assets | |

| Investment in Vanguard | 536 |

| Receivables for Investment Securities Sold 19,153 |

| Receivables for Accrued Income | 6,837 |

| Receivables for Capital Shares Issued | 1,706 |

| Total Other Assets | 28,232 |

| Liabilities | |

| Payables for Investment Securities | |

| Purchased | (17,741) |

| Collateral for Securities on Loan | (98,637) |

| Payables for Capital Shares Redeemed | (5,126) |

| Payables to Vanguard | (6,829) |

| Other Liabilities | (132) |

| Total Liabilities | (128,465) |

| Net Assets (100%) | |

| Applicable to 186,255,040 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 5,739,450 |

| Net Asset Value Per Share | $30.82 |

18

| |

| Strategic Equity Fund | |

| |

| |

| |

| At September 30, 2015, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 4,790,584 |

| Undistributed Net Investment Income | 53,032 |

| Accumulated Net Realized Gains | 521,691 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 374,341 |

| Futures Contracts | (198) |

| Net Assets | 5,739,450 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $96,216,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.7%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $98,637,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full faith and credit of the U.S. government.

5 Securities with a value of $1,300,000 have been segregated as initial margin for open futures contracts.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

19

| |

| Strategic Equity Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | September 30, 2015 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 92,881 |

| Interest1 | 57 |

| Securities Lending | 4,031 |

| Total Income | 96,969 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 1,082 |

| Management and Administrative | 10,334 |

| Marketing and Distribution | 961 |

| Custodian Fees | 74 |

| Auditing Fees | 33 |

| Shareholders’ Reports | 58 |

| Trustees’ Fees and Expenses | 6 |

| Total Expenses | 12,548 |

| Net Investment Income | 84,421 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 613,339 |

| Futures Contracts | 124 |

| Realized Net Gain (Loss) | 613,463 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | (609,530) |

| Futures Contracts | 531 |

| Change in Unrealized Appreciation (Depreciation) | (608,999) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 88,885 |

| 1 Interest income from an affiliated company of the fund was $54,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

20

| | |

| Strategic Equity Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended September 30, |

| | 2015 | 2014 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 84,421 | 59,506 |

| Realized Net Gain (Loss) | 613,463 | 731,563 |

| Change in Unrealized Appreciation (Depreciation) | (608,999) | 6,972 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 88,885 | 798,041 |

| Distributions | | |

| Net Investment Income | (60,071) | (56,549) |

| Realized Capital Gain | (257,765) | — |

| Total Distributions | (317,836) | (56,549) |

| Capital Share Transactions | | |

| Issued | 1,082,468 | 895,563 |

| Issued in Lieu of Cash Distributions | 301,093 | 52,365 |

| Redeemed | (807,310) | (536,280) |

| Net Increase (Decrease) from Capital Share Transactions | 576,251 | 411,648 |

| Total Increase (Decrease) | 347,300 | 1,153,140 |

| Net Assets | | |

| Beginning of Period | 5,392,150 | 4,239,010 |

| End of Period1 | 5,739,450 | 5,392,150 |

1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $53,032,000 and $34,092,000.

See accompanying Notes, which are an integral part of the Financial Statements.

21

| | | | | |

| Strategic Equity Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| For a Share Outstanding | | | Year Ended September 30, |

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $32.02 | $27.34 | $21.02 | $16.30 | $16.30 |

| Investment Operations | | | | | |

| Net Investment Income | . 466 | .361 | .4261 | .249 | .210 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | .207 | 4.679 | 6.244 | 4.667 | .017 |

| Total from Investment Operations | .673 | 5.040 | 6.670 | 4.916 | . 227 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.354) | (. 360) | (. 350) | (.196) | (. 227) |

| Distributions from Realized Capital Gains | (1.519) | — | — | — | — |

| Total Distributions | (1.873) | (. 360) | (. 350) | (.196) | (. 227) |

| Net Asset Value, End of Period | $30.82 | $32.02 | $27.34 | $21.02 | $16.30 |

| |

| Total Return2 | 2.01% | 18.53% | 32.23% | 30.32% | 1.23% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $5,739 | $5,392 | $4,239 | $3,254 | $2,756 |

| Ratio of Total Expenses to Average Net Assets | 0.21% | 0.27% | 0.28% | 0.29% | 0.30% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.41% | 1.19% | 1.75%1 | 1.25% | 1.09% |

| Portfolio Turnover Rate | 70% | 60% | 64% | 67% | 73% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.043 and 0.18%, respectively, resulting from a special dividend received in connection with a merger between T-Mobile US Inc. and Metro PCS Communications Inc. in May 2013.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

22

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate settlement values of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended September 30, 2015, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of aggregate settlement values at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2012–2015), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

23

Strategic Equity Fund

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counter-parties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counter-party risk, in the absence of a default the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at September 30, 2015, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At September 30, 2015, the fund had contributed to Vanguard capital in the amount of $536,000, representing 0.01% of the fund’s net assets and 0.21% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

24

Strategic Equity Fund

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of September 30, 2015, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 5,717,518 | — | — |

| Temporary Cash Investments | 120,166 | 1,999 | — |

| Futures Contracts—Assets1 | 433 | — | — |

| Futures Contracts—Liabilities1 | (44) | — | — |

| Total | 5,838,073 | 1,999 | — |

| 1 Represents variation margin on the last day of the reporting period. | | | |

D. At September 30, 2015, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini S&P MidCap 400 Index | December 2015 | 85 | 11,585 | (308) |

| E-mini Russell 2000 Index | December 2015 | 104 | 11,397 | 110 |

| | | | | (198) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from net investment income and realized capital gains. Accordingly, the fund has reclassified $5,410,000 from undistributed net investment income, and $39,604,000 from accumulated net realized gains, to paid-in capital.

25

Strategic Equity Fund

For tax purposes, at September 30, 2015, the fund had $59,640,000 of ordinary income and $521,719,000 of long-term capital gains available for distribution.

At September 30, 2015, the cost of investment securities for tax purposes was $5,465,602,000. Net unrealized appreciation of investment securities for tax purposes was $374,081,000, consisting of unrealized gains of $913,198,000 on securities that had risen in value since their purchase and $539,117,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended September 30, 2015, the fund purchased $4,527,153,000 of investment securities and sold $4,176,983,000 of investment securities, other than temporary cash investments.

G. Capital shares issued and redeemed were:

| | |

| | Year Ended September 30, |

| | 2015 | 2014 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 32,774 | 29,053 |

| Issued in Lieu of Cash Distributions | 9,610 | 1,751 |

| Redeemed | (24,537) | (17,464) |

| Net Increase (Decrease) in Shares Outstanding | 17,847 | 13,340 |

H. Management has determined that no material events or transactions occurred subsequent to September 30, 2015, that would require recognition or disclosure in these financial statements.

26

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Vanguard Horizon Funds and the Shareholders of Vanguard Strategic Equity Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Strategic Equity Fund (constituting a separate portfolio of Vanguard Horizon Funds, hereafter referred to as the “Fund”) at September 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2015 by correspondence with the custodian and brokers, by agreement to the underlying ownership records of the transfer agent and the application of alternative auditing procedures where securities purchased had not been received, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 10, 2015

|

| |

| Special 2015 tax information (unaudited) for Vanguard Strategic Equity Fund |

| |

| This information for the fiscal year ended September 30, 2015, is included pursuant to provisions of |

| the Internal Revenue Code. |

| |

| The fund distributed $297,370,000 as capital gain dividends (20% rate gain distributions) to |

| shareholders during the fiscal year. |

| |

| The fund distributed $55,806,000 of qualified dividend income to shareholders during the fiscal year. |

| |

| For corporate shareholders, 79.0% of investment income (dividend income plus short-term gains, |

| if any) qualifies for the dividends-received deduction. |

27

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2015. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| | | |

| Average Annual Total Returns: Strategic Equity Fund | | | |

| Periods Ended September 30, 2015 | | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 2.01% | 16.10% | 6.95% |

| Returns After Taxes on Distributions | 0.62 | 15.58 | 6.20 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 2.28 | 13.03 | 5.54 |

28

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.