UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: 811-07239 |

Name of Registrant: | Vanguard Horizon Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: September 30 |

Date of reporting period: October 1, 2011 – September 30, 2012 |

| Item 1: Reports to Shareholders |

Annual Report | September 30, 2012

Vanguard Strategic Equity Fund

> Vanguard Strategic Equity Fund returned 30.32% for the fiscal year ended

September 30, 2012.

> The fund’s return outpaced the 28.86% return posted by its benchmark index

and the 25.91% average return of peer-group funds.

> Bright spots in the portfolio included stock selections in the energy, materials,

and information technology sectors.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Fund Profile. | 10 |

| Performance Summary. | 11 |

| Financial Statements. | 13 |

| Your Fund’s After-Tax Returns. | 26 |

| About Your Fund’s Expenses. | 27 |

| Glossary. | 29 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Our cover photograph shows rigging on the HMSSurprise, a replica of an 18th-century Royal Navy frigate. It

was featured in the 2003 movie Master and Commander: The Far Side of the World, which was based on Patrick O’Brian’s sea

novels, set amid the Napoleonic Wars. Vanguard was named for another ship of that era, the HMSVanguard, which was the

flagship of British Admiral Horatio Nelson at the Battle of the Nile.

Your Fund’s Total Returns

| |

| Fiscal Year Ended September 30, 2012 | |

| |

| | Total |

| | Returns |

| Vanguard Strategic Equity Fund | 30.32% |

| MSCI US Small + Mid Cap 2200 Index | 28.86 |

| Mid-Cap Core Funds Average | 25.91 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper Inc. |

| | | | |

| Your Fund’s Performance at a Glance | | | |

| September 30, 2011, Through September 30, 2012 | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Strategic Equity Fund | $16.30 | $21.02 | $0.196 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

Vanguard Strategic Equity Fund fully participated in the stock market rally that took place during the 12 months ended September 30, 2012. The fund returned 30.32%, its highest annual return in nine years. That exceeded the 28.86% return of its benchmark, the MSCI US Small + Mid Cap 2200 Index, and the 25.91% average return of its peer group.

Whether the stock market is rising or falling, the fund’s advisor has a twofold task in selecting stocks for the portfolio: to outpace the returns of the fund’s benchmark sectors and to maintain, for each sector, a risk profile similar to the benchmark’s. To do so, the advisor,

Vanguard Equity Investment Group, relies on computer models that focus on key characteristics that influence a stock’s long-term performance, such as valuation levels, the sustainability of earnings, and balance-sheet strength. The advisor was particularly successful in energy, materials, and information technology but less so in the health care, industrial, and consumer discretionary sectors.

Note: If you hold shares in a taxable account, you may wish to review the table and discussion of after-tax returns for the fiscal year, based on the highest tax bracket, later in this report.

Stocks notched a powerful rally, with help from central bankers

U.S. stocks surged 30% in the 12 months ended September 30, 2012, outpacing the gains of their international counterparts. The rally came amid moves by U.S. and

2

European central bankers to quiet—at least temporarily—investors’ concerns about the U.S. economy and the finances of Euro-pean governments and banks.

U.S. stocks were the standouts, but European and emerging markets stocks also posted double-digit results. The developed markets of the Pacific region were the weakest performers but still recorded a modest advance.

In July, the president of the European Central Bank declared that policymakers would do whatever was needed to preserve the euro common currency.

That pronouncement was encouraging to investors, but Europe’s financial troubles

are by no means resolved. Vanguard economists believe the most likely scenario is that the Eurozone will “muddle through” for several years, with occasional spikes in market volatility, as fiscal tightening continues in the face of weak economic growth.

Bonds produced solid returns; future results may be more muted

Bonds once again advanced; the broad

U.S. taxable market returned about 5% for the 12 months. Among U.S. Treasuries, long-term bonds were particularly strong as they benefited from the Federal Reserve’s bond-buying program.

| | | |

| Market Barometer | | | |

| |

| | Average Annual Total Returns |

| | Periods Ended September 30, 2012 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 30.06% | 13.27% | 1.22% |

| Russell 2000 Index (Small-caps) | 31.91 | 12.99 | 2.21 |

| Dow Jones U.S. Total Stock Market Index | 30.00 | 13.29 | 1.53 |

| MSCI All Country World Index ex USA (International) | 14.48 | 3.17 | -4.12 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 5.16% | 6.19% | 6.53% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 8.32 | 5.99 | 6.06 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.08 | 0.63 |

| |

| CPI | | | |

| Consumer Price Index | 1.99% | 2.33% | 2.11% |

3

As bond prices rose, the yield of the 10-year U.S. Treasury note fell to a record low in July, closing below 1.5%. (Bond yields and prices move in opposite directions.) By the end of the period, the yield had climbed, but it still remained low by historical standards.

Bondholders have enjoyed years of strong returns. But as Tim Buckley, our incoming chief investment officer, has noted, investors shouldn’t be surprised if future results are much more modest. As yields tumble, the scope for further declines—and price increases—diminishes.

The Federal Reserve announced on September 13 that it would continue to hold its target for short-term interest rates

between 0% and 0.25% at least through mid-2015. The exceptionally low rates, in place since late 2008, kept a tight lid on returns from money market funds and savings accounts.

Energy stocks stood out in contributing to results

The advisor’s computer models (described in the Advisor’s Report that follows this letter) serve as a filter for stocks with the strong financial characteristics that can produce outstanding results over time.

Unlike with mutual funds that pay less attention to risk control, the approach aims to produce a lot of “singles,” rather than “home runs.”

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer Group |

| | Fund | Average |

| Strategic Equity Fund | 0.33% | 1.28% |

The fund expense ratio shown is from the prospectus dated January 26, 2012, and represents estimated costs for the current fiscal year. For

the fiscal year ended September 30, 2012, the fund’s expense ratio was 0.29%. The peer-group expense ratio is derived from data provided

by Lipper Inc. and captures information through year-end 2011.

Peer group: Mid-Cap Core Funds.

4

In trying to outperform the fund’s benchmark, Vanguard Equity Investment Group made particularly effective stock selections among companies in the entire energy-supply chain, from exploration to marketing. Selections in materials, especially among chemical manufacturers, also paid off. Information technology stocks were another major contributor to relative results; these included semi-conductor firms and companies that provide computer storage and peripheral equipment. Declines among computer hardware manufacturers somewhat offset these gains. Despite double-digit results in many cases, the fund’s holdings in the

health care, industrial, and consumer discretionary sectors underperformed their benchmark counterparts.

Some of these less successful holdings included biotechnology companies and providers of health care equipment, supplies, and services. Machinery and electric equipment makers dampened industrial sector returns, as did service firms, such as providers of office services and human resources consultants. In consumer discretionary, good selections among retail, restaurant, and leisure-industry stocks could not offset disap-pointing results from home-furnishing and home-building companies.

| |

| Total Returns | |

| Ten Years Ended September 30, 2012 | |

| | Average |

| | Annual Return |

| Strategic Equity Fund | 9.27% |

| Spliced Small and Mid Cap Index | 11.14 |

| Mid-Cap Core Funds Average | 9.18 |

| For a benchmark description, see the Glossary. | |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper Inc. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

5

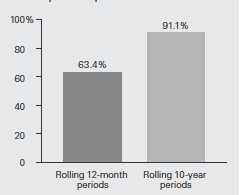

Over a decade, results have been mixed for the fund

The Strategic Equity Fund’s subpar performance during the 2008–2009 financial crisis and, to a lesser extent, the subsequent recovery is reflected in its mixed results over the past ten years.

The fund’s average annual return over that time is a solid 9.27%; that’s higher than the 8.77% return of the broad stock market, as measured by the Dow Jones U.S. Total Stock Market Index, and the 9.18% average return of peer funds.

But the Strategic Equity Fund lagged its benchmark, which returned 11.14% over the decade.

The fund’s strategies, and indeed those of many active stock pickers, were not especially effective in the years surrounding the crisis. Investing styles and strategies occasionally move in and out of favor, and the ten-year period includes a lengthy stretch when your fund’s approach was out of step with the market. With any actively managed fund, occasional periods of weakness can be thought of as the price we pay for the potential to outperform. We remain confident that the methodology used by Vanguard Equity Investment Group will, over time, accomplish the goal of maintaining the risk profile of the fund’s benchmark while providing competitive returns.

The lessons of the financial crisis remain relevant four years later

In September, the end of your fund’s fiscal year, we marked the fourth anniversary of Lehman Brothers’ collapse, the start of the 2008–2009 financial crisis. When the Lehman news broke, I was speaking to institutional clients at an event in Washington, D.C., all of three weeks into my new role as Vanguard’s CEO.

In the ensuing months, I was struck both by how fortunate I was to work with a great team of Vanguard “crew” and by the remarkable steadiness demonstrated by our clients. Many clients experienced significant losses, but signs of panic were few. On balance, they remained committed to their long-term investment programs and managed to benefit from the financial markets’ subsequent recovery.

As the crisis recedes further in time, it’s important not to lose sight of the lessons that it illuminated about investing and sound financial practices generally. First among those lessons is that diversification does work. Diversification didn’t immunize investors from the market’s decline, but it certainly helped to insulate them from the worst of it.

Second, saving money and living within your means are critical. Investors are acting on this lesson as they pay off debt, which

6

is a form of saving, and increase their savings rates from the dangerously low levels that prevailed before the crisis.

Third, having the courage to stick with a sound investment plan—as so many of our clients did—is important during volatile, uncertain times. Investors who resisted the urge to bail out of stocks at the depths of the crisis have largely been rewarded in the succeeding years.

I am very optimistic that, if investors embrace these lessons, they can give themselves a better chance of reaching their long-term goals. As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

October 17, 2012

7

Advisor’s Report

For the 12-month period that ended September 30, 2012, the Strategic Equity Fund returned 30.32%, outperforming the 28.86% return of its benchmark MSCI US Small + Mid Cap 2200 Index during a fiscal year that presented very different halves.

In the first six months, mid- and small-capitalization stocks rose more than 28%. By the second half, the market’s momentum had slowed dramatically, and mid-and small-cap stocks moved ahead by less than 1%. Mid- and small-cap stocks, the focus of your investment in the fund, underperformed the broad market MSCI US Investable Market 2500 Index for the full year by more than 1 percentage point. All ten sector groups generated positive returns within the benchmark, but the index’s results were best among health care, materials, and consumer discretionary companies. Telecommunications and consumer staples were the laggards within the small- and mid-cap universe.

Equity markets have staged quite a rally since last fall, but investor unease and economic worries are still prominent.

A “fiscal cliff” scenario could send the United States into recession if not resolved, and investors are concerned anew about the Eurozone crisis and slowing growth in China. Add to that stagnant employment, election-year uncertainty, and a lack of clarity on corporate profits, and it’s easy to see why investors’ appetite for riskier assets may be put on hold for a while. Market volatility declined substantially during this period, but it is likely to

persist amid our unresolved budget, deficit, and employment problems and anemic world economic growth.

These macro factors affect overall portfolio performance, but our approach to investing focuses on specific stock fundamentals and employs five components:

• Valuation, which measures the price we pay for earnings and cash flows.

• Growth, which considers the growth of earnings as a factor in how much we pay for them.

• Management decisions, which assesses the actions taken by company management that signal its informed opinions of a firm’s prospects and earnings.

• Market sentiment, which captures how investors reflect their opinions of a company through their activity in the market.

• Quality, which measures balance-sheet strength and the sustainability of earnings.

Using these components, we control risk by neutralizing our exposure to market capitalization, volatility, and industry risks relative to our benchmark. In our view, the rewards available do not justify such risk exposures. The effect of these risk controls can be seen by analyzing the fund’s tracking error—a measure of relative performance volatility. The trailing three-year tracking error of 2.44% is well within an acceptable range given this fund’s risk tolerance.

8

The results from our stock-selection model continued a trend from the first six months of the fiscal year. Our quality and management decisions signals remained effective in distinguishing outperformers from underperformers, but our valuation and market sentiment indicators detracted from results. The portfolio experienced modest gains from our growth signal.

The model’s effectiveness over the period across sectors was strong, as we produced positive stock-selection results in seven of the ten sectors in the benchmark. The sectors with the best absolute returns in the portfolio were materials (+54%), energy (+51%), and financials (+35%). Those with the weakest were utilities (+20%), telecommunications (+19%), and consumer staples (+19%).

Among individual stocks, the largest contributors came from overweight positions in Tesoro, United Rentals, and Western Refining. Comparing the portfolio’s performance with that of its benchmark, we benefited from underweighting or avoiding poor performers such as Green Mountain Coffee Roasters, Alpha Natural Resources, and Rovi.

Unfortunately, we could not avoid all bad performers. Overweights in Goodyear Tire & Rubber, Tempur-Pedic International, and Regeneron Pharmaceuticals directly lowered performance. Also, underweighting companies such as Equinix, Pharmasset, and Roper Industries that our model’s fundamentals did not positively identify hurt our overall relative outperformance.

Although we cannot predict with certainty the impact of broader political or economic events, we are confident that the stock market will provide worthwhile returns for long-term investors. With that in mind, we believe that equity exposure will continue to play an important part in a diversified investment plan.

We thank you for your investment and look forward to the new fiscal year.

James D. Troyer, CFA

Principal and Portfolio Manager

James P. Stetler

Principal and Portfolio Manager

Michael R. Roach, CFA

Portfolio Manager

Vanguard Equity Investment Group

October 22, 2012

9

Strategic Equity Fund

Fund Profile

As of September 30, 2012

| | | |

| Portfolio Characteristics | | |

| | | MSCI US | |

| | | Small + | DJ |

| | | Mid Cap | U.S. Total |

| | | 2200 | Market |

| | Fund | Index | Index |

| Number of Stocks | 390 | 2,174 | 3,638 |

| Median Market Cap | $3.6B | $4.2B | $35.6B |

| Price/Earnings Ratio | 14.6x | 20.8x | 17.0x |

| Price/Book Ratio | 2.1x | 2.0x | 2.2x |

| Return on Equity | 10.9% | 11.8% | 18.0% |

| Earnings Growth Rate | 9.4% | 7.9% | 10.4% |

| Dividend Yield | 1.5% | 1.5% | 2.0% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | 67% | — | — |

| Ticker Symbol | VSEQX | — | — |

| Expense Ratio1 | 0.33% | — | — |

| 30-Day SEC Yield | 1.19% | — | — |

| Short-Term Reserves | 0.3% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | MSCI US | |

| | | Small + | DJ |

| | | Mid Cap | U.S. Total |

| | | 2200 | Market |

| | Fund | Index | Index |

| Consumer Discretionary 17.2% | 16.5% | 12.0% |

| Consumer Staples | 3.3 | 4.1 | 9.5 |

| Energy | 6.7 | 7.1 | 10.4 |

| Financials | 19.9 | 19.8 | 16.0 |

| Health Care | 11.1 | 11.2 | 11.9 |

| Industrials | 13.3 | 13.7 | 10.6 |

| Information Technology | 15.9 | 15.3 | 19.2 |

| Materials | 7.0 | 6.5 | 3.9 |

| Telecommunication | | | |

| Services | 0.6 | 1.0 | 2.9 |

| Utilities | 5.0 | 4.8 | 3.6 |

| | |

| Volatility Measures | | |

| | MSCI US | |

| | Small + | DJ |

| | Mid Cap | U.S. Total |

| | 2200 | Market |

| | Index | Index |

| R-Squared | 0.99 | 0.94 |

| Beta | 1.02 | 1.18 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| |

| Ten Largest Holdings (% of total net assets) |

| CF Industries Holdings | Fertilizers & |

| Inc. | Agricultural |

| | Chemicals |

| Watson Pharmaceuticals | |

| Inc. | Pharmaceuticals |

| Seagate Technology plc | Computer Storage & |

| | Peripherals |

| Eastman Chemical Co. | Diversified Chemicals |

| AmerisourceBergen | Health Care |

| Corp. Class A | Distributors |

| Tesoro Corp. | Oil & Gas Refining & |

| | Marketing |

| O'Reilly Automotive Inc. | Automotive Retail |

| KLA-Tencor Corp. | Semiconductor |

| | Equipment |

| Polaris Industries Inc. | Leisure Products |

| Torchmark Corp. | Life & Health |

| | Insurance |

| Top Ten | |

| The holdings listed exclude any temporary cash investments and equity index products. |

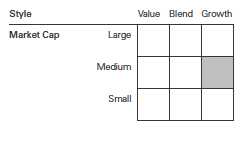

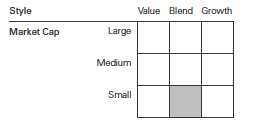

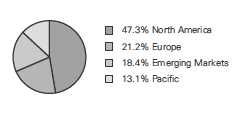

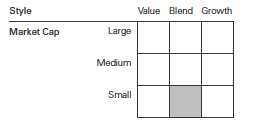

Investment Focus

1 The expense ratio shown is from the prospectus dated January 26, 2012, and represents estimated costs for the current fiscal year. For the

fiscal year ended September 30, 2012, the expense ratio was 0.29%.

10

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

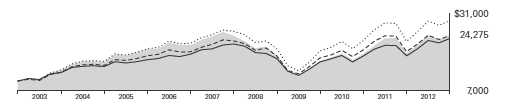

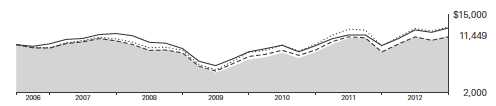

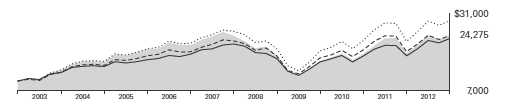

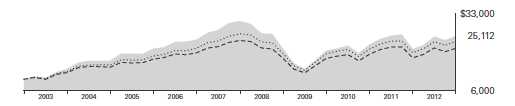

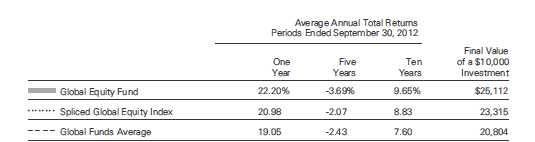

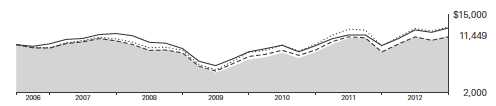

Cumulative Performance: September 30, 2002, Through September 30, 2012

Initial Investment of $10,000

| | | | | |

| | | | Average Annual Total Returns | |

| | | Periods Ended September 30, 2012 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Strategic Equity Fund | 30.32% | 0.23% | 9.27% | $24,275 |

| •••••••• | Spliced Small and Mid Cap Index | 28.86 | 2.49 | 11.14 | 28,742 |

| – – – – | Mid-Cap Core Funds Average | 25.91 | 1.41 | 9.18 | 24,077 |

| | Dow Jones U.S. Total Stock Market | | | | |

| | Index | 30.00 | 1.53 | 8.77 | 23,184 |

| For a benchmark description, see the Glossary. | | | | |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper Inc. |

See Financial Highlights for dividend and capital gains information.

11

Strategic Equity Fund

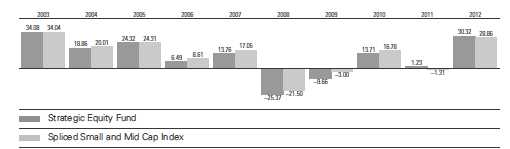

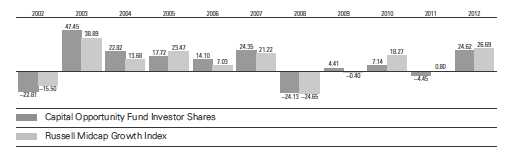

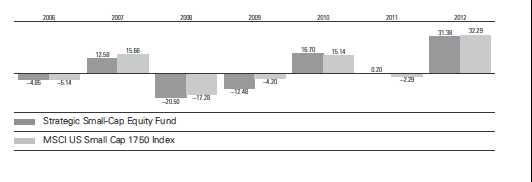

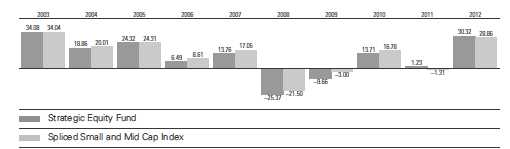

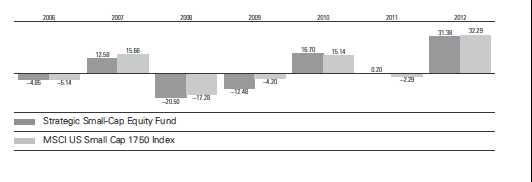

Fiscal-Year Total Returns (%): September 30, 2002, Through September 30, 2012

For a benchmark description, see the Glossary.

12

Strategic Equity Fund

Financial Statements

Statement of Net Assets

As of September 30, 2012

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (99.4%)1 | | |

| Consumer Discretionary (17.2%) | |

| * | O’ReillyAutomotive Inc. | 380,300 | 31,801 |

| | Polaris Industries Inc. | 372,782 | 30,147 |

| | Virgin Media Inc. | 987,500 | 29,072 |

| | Harley-Davidson Inc. | 670,600 | 28,413 |

| | Dillard’s Inc. Class A | 365,570 | 26,438 |

| | Wyndham Worldwide Corp. | 490,100 | 25,720 |

| | Advance Auto Parts Inc. | 367,800 | 25,172 |

| * | PulteGroup Inc. | 1,521,500 | 23,583 |

| | ExpediaInc. | 396,150 | 22,913 |

| ^ | Garmin Ltd. | 435,200 | 18,165 |

| * | Fifth & Pacific Cos. Inc. | 1,332,600 | 17,031 |

| | Gannett Co. Inc. | 951,600 | 16,891 |

| | Brinker International Inc. | 476,650 | 16,826 |

| ^ | Buckle Inc. | 361,100 | 16,405 |

| | Domino’s Pizza Inc. | 375,720 | 14,165 |

| | Dana Holding Corp. | 1,129,300 | 13,890 |

| * | Coinstar Inc. | 302,190 | 13,593 |

| | Foot Locker Inc. | 361,800 | 12,844 |

| ^ | Regal Entertainment Group | | |

| | Class A | 887,800 | 12,491 |

| | Jarden Corp. | 231,300 | 12,222 |

| | Thor Industries Inc. | 251,500 | 9,135 |

| | Bob Evans Farms Inc. | 206,751 | 8,090 |

| * | Conn’s Inc. | 358,900 | 7,914 |

| ^ | Sturm Ruger & Co. Inc. | 159,800 | 7,909 |

| * | Tenneco Inc. | 277,995 | 7,784 |

| | PVH Corp. | 75,000 | 7,029 |

| | Ross Stores Inc. | 108,024 | 6,978 |

| | Starwood Hotels & Resorts | | |

| | Worldwide Inc. | 117,300 | 6,799 |

| | CheesecakeFactory Inc. | 185,500 | 6,632 |

| | Ameristar Casinos Inc. | 367,800 | 6,547 |

| | PetSmart Inc. | 93,700 | 6,463 |

| | Sinclair Broadcast Group | | |

| | Inc. Class A | 502,640 | 5,635 |

| | Newell Rubbermaid Inc. | 261,600 | 4,994 |

| * | Francesca’s Holdings Corp. | 151,200 | 4,646 |

| | | |

| | American Eagle | | |

| | Outfitters Inc. | 199,000 | 4,195 |

| * | ExpressInc. | 251,500 | 3,727 |

| | Rent-A-Center Inc. | 103,400 | 3,627 |

| * | Vitamin Shoppe Inc. | 54,800 | 3,196 |

| | Aaron’s Inc. | 106,200 | 2,953 |

| * | Smith & Wesson | | |

| | Holding Corp. | 264,300 | 2,910 |

| | Scholastic Corp. | 78,000 | 2,479 |

| | Pier 1 Imports Inc. | 125,900 | 2,359 |

| * | Goodyear Tire & Rubber Co. | 184,600 | 2,250 |

| * | Arctic Cat Inc. | 49,700 | 2,061 |

| * | Dollar Tree Inc. | 41,000 | 1,979 |

| * | Lamar Advertising Co. | | |

| | Class A | 53,300 | 1,975 |

| | Blyth Inc. | 74,600 | 1,939 |

| * | Liberty Interactive Corp. | | |

| | Class A | 104,300 | 1,930 |

| | Brunswick Corp. | 81,700 | 1,849 |

| | Service Corp. International | 128,200 | 1,726 |

| | Cinemark Holdings Inc. | 68,200 | 1,530 |

| * | LeapFrog Enterprises Inc. | 167,900 | 1,514 |

| | Hot Topic Inc. | 172,600 | 1,502 |

| * | AFC Enterprises Inc. | 60,045 | 1,477 |

| | Brown Shoe Co. Inc. | 91,600 | 1,468 |

| * | Red Robin Gourmet | | |

| | Burgers Inc. | 43,300 | 1,410 |

| | Regis Corp. | 63,400 | 1,165 |

| * | Journal Communications | | |

| | Inc. Class A | 215,261 | 1,119 |

| | Cato Corp. Class A | 36,294 | 1,078 |

| | | | 557,755 |

| Consumer Staples (3.3%) | | |

| * | Dean Foods Co. | 1,599,704 | 26,155 |

| | Beam Inc. | 280,100 | 16,117 |

| | Herbalife Ltd. | 315,978 | 14,977 |

| | B&G Foods Inc. Class A | 471,620 | 14,295 |

| * | Monster Beverage Corp. | 204,254 | 11,062 |

| | Lancaster Colony Corp. | 108,519 | 7,949 |

13

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Safeway Inc. | 276,000 | 4,441 |

| | Universal Corp. | 75,400 | 3,839 |

| | Nu Skin Enterprises Inc. | | |

| | Class A | 69,900 | 2,714 |

| | Ingredion Inc. | 40,600 | 2,240 |

| | Cal-Maine Foods Inc. | 26,000 | 1,169 |

| * | Boston Beer Co. Inc. | | |

| | Class A | 9,800 | 1,097 |

| * | Pilgrim’s Pride Corp. | 189,900 | 970 |

| * | Central Garden and | | |

| | Pet Co. Class A | 60,800 | 735 |

| | | | 107,760 |

| Energy (6.7%) | | |

| | Tesoro Corp. | 762,400 | 31,945 |

| | Western Refining Inc. | 1,042,300 | 27,287 |

| | Core Laboratories NV | 192,000 | 23,324 |

| | Helmerich & Payne Inc. | 482,092 | 22,952 |

| | Energy XXI Bermuda Ltd. | 471,000 | 16,461 |

| * | Rosetta Resources Inc. | 311,645 | 14,928 |

| * | Helix Energy Solutions | | |

| | Group Inc. | 676,100 | 12,352 |

| * | Denbury Resources Inc. | 616,800 | 9,968 |

| | HollyFrontier Corp. | 219,200 | 9,046 |

| * | Stone Energy Corp. | 323,212 | 8,119 |

| | Delek US Holdings Inc. | 202,400 | 5,159 |

| * | Plains Exploration & | | |

| | Production Co. | 114,300 | 4,283 |

| * | Vaalco Energy Inc. | 460,100 | 3,934 |

| | Energen Corp. | 65,600 | 3,438 |

| * | Oil States International Inc. | 41,500 | 3,298 |

| | Crosstex Energy Inc. | 212,475 | 2,981 |

| * | EPLOil & Gas Inc. | 145,100 | 2,944 |

| * | Rentech Inc. | 1,113,900 | 2,740 |

| * | Hornbeck Offshore | | |

| | Services Inc. | 70,000 | 2,566 |

| * | OYO Geospace Corp. | 17,250 | 2,112 |

| * | Nabors Industries Ltd. | 148,100 | 2,078 |

| * | ION Geophysical Corp. | 280,100 | 1,944 |

| * | Contango Oil & Gas Co. | 33,800 | 1,661 |

| | Alon USA Energy Inc. | 118,200 | 1,619 |

| | Berry Petroleum Co. Class A | 18,800 | 764 |

| | | | 217,903 |

| Financials (19.7%) | | |

| | Torchmark Corp. | 583,995 | 29,988 |

| * | Arch Capital Group Ltd. | 653,726 | 27,247 |

| | Discover Financial Services | 670,025 | 26,620 |

| * | World Acceptance Corp. | 338,783 | 22,851 |

| | KeyCorp | 2,599,930 | 22,723 |

| | American Financial | | |

| | Group Inc. | 539,689 | 20,454 |

| | Host Hotels & | | |

| | Resorts Inc. | 1,097,100 | 17,608 |

| | NASDAQ OMX Group Inc. | 729,200 | 16,987 |

| | Commerce Bancshares Inc. | 388,530 | 15,669 |

| | | |

| | Kimco Realty Corp. | 759,500 | 15,395 |

| | Assurant Inc. | 409,700 | 15,282 |

| | Macerich Co. | 246,600 | 14,113 |

| | Digital Realty Trust Inc. | 189,200 | 13,216 |

| | Moody’s Corp. | 290,900 | 12,849 |

| | Huntington Bancshares | | |

| | Inc. | 1,841,000 | 12,703 |

| | Liberty Property Trust | 310,000 | 11,234 |

| | ExtraSpace Storage Inc. | 335,740 | 11,163 |

| | CBL& Associates | | |

| | Properties Inc. | 519,774 | 11,092 |

| | Douglas Emmett Inc. | 476,200 | 10,986 |

| | Weingarten Realty | | |

| | Investors | 386,500 | 10,865 |

| | Allied World Assurance | | |

| | Co. Holdings AG | 133,700 | 10,328 |

| | Post Properties Inc. | 215,300 | 10,326 |

| | Hospitality Properties Trust | 432,700 | 10,290 |

| * | Altisource Portfolio | | |

| | Solutions SA | 114,709 | 9,894 |

| | Brandywine Realty Trust | 806,832 | 9,835 |

| ^ | Lexington Realty Trust | 1,014,900 | 9,804 |

| * | Sunstone Hotel | | |

| | Investors Inc. | 881,000 | 9,691 |

| | Entertainment Properties | | |

| | Trust | 215,200 | 9,561 |

| | DCT Industrial Trust Inc. | 1,460,300 | 9,448 |

| | Protective Life Corp. | 349,800 | 9,168 |

| | Sun Communities Inc. | 205,143 | 9,051 |

| * | First Industrial Realty | | |

| | Trust Inc. | 687,825 | 9,038 |

| | ProAssurance Corp. | 99,800 | 9,026 |

| | Duke Realty Corp. | 578,100 | 8,498 |

| | East West Bancorp Inc. | 383,600 | 8,102 |

| | Cash America | | |

| | International Inc. | 207,300 | 7,996 |

| | Omega Healthcare | | |

| | Investors Inc. | 340,500 | 7,740 |

| * | American Capital Ltd. | 598,089 | 6,782 |

| | Bank of Hawaii Corp. | 141,900 | 6,474 |

| | CVB Financial Corp. | 532,900 | 6,363 |

| | BOK Financial Corp. | 101,021 | 5,970 |

| * | Texas Capital | | |

| | Bancshares Inc. | 110,600 | 5,498 |

| * | Credit Acceptance Corp. | 62,622 | 5,355 |

| | EverestRe Group Ltd. | 47,400 | 5,070 |

| | Apartment Investment & | | |

| | Management Co. Class A | 190,200 | 4,943 |

| | Nelnet Inc. Class A | 204,212 | 4,848 |

| | Regions Financial Corp. | 660,500 | 4,762 |

| | Provident Financial | | |

| | Services Inc. | 293,425 | 4,633 |

| | Umpqua Holdings Corp. | 338,000 | 4,357 |

| * | Forest City Enterprises | | |

| | Inc. Class A | 266,405 | 4,223 |

14

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Prospect Capital Corp. | 349,300 | 4,024 |

| | International Bancshares | | |

| | Corp. | 204,325 | 3,892 |

| | Amtrust Financial | | |

| | Services Inc. | 143,440 | 3,675 |

| | Pennsylvania REIT | 221,500 | 3,513 |

| | City Holding Co. | 95,105 | 3,409 |

| | Apollo Residential | | |

| | Mortgage Inc. | 153,400 | 3,381 |

| | UMB Financial Corp. | 68,888 | 3,354 |

| | Bank of the Ozarks Inc. | 93,420 | 3,220 |

| | Cathay General Bancorp | 185,510 | 3,202 |

| | AvalonBay Communities Inc. | 20,800 | 2,829 |

| | OldNational Bancorp | 200,000 | 2,722 |

| | CNOFinancial Group Inc. | 277,200 | 2,675 |

| * | First Cash Financial | | |

| | Services Inc. | 53,200 | 2,448 |

| | PrivateBancorp Inc. | | |

| | Class A | 152,500 | 2,439 |

| * | iStar Financial Inc. | 279,055 | 2,311 |

| | Webster Financial Corp. | 90,500 | 2,145 |

| * | St. Joe Co. | 109,100 | 2,127 |

| | Health Care REIT Inc. | 36,800 | 2,125 |

| | National Penn | | |

| | Bancshares Inc. | 210,800 | 1,920 |

| | Ramco-Gershenson | | |

| | Properties Trust | 148,300 | 1,858 |

| | Montpelier Re Holdings Ltd. | 83,000 | 1,837 |

| | CapitalSource Inc. | 226,000 | 1,713 |

| | Synovus Financial Corp. | 706,400 | 1,674 |

| | Bancfirst Corp. | 38,783 | 1,666 |

| | Susquehanna Bancshares | | |

| | Inc. | 157,400 | 1,646 |

| | Republic Bancorp Inc. | | |

| | Class A | 73,911 | 1,622 |

| | Oritani Financial Corp. | 94,900 | 1,428 |

| | HCC Insurance Holdings Inc. | 35,300 | 1,196 |

| | Primerica Inc. | 39,400 | 1,128 |

| | Validus Holdings Ltd. | 32,500 | 1,102 |

| | Camden National Corp. | 25,345 | 939 |

| | MFA Financial Inc. | 92,300 | 785 |

| | Southside Bancshares Inc. | 34,664 | 756 |

| | American Capital | | |

| | Agency Corp. | 21,300 | 737 |

| * | Citizens Republic | | |

| | Bancorp Inc. | 36,300 | 702 |

| | | | 642,319 |

| Health Care (11.0%) | | |

| * | Watson Pharmaceuticals | | |

| | Inc. | 421,800 | 35,920 |

| | AmerisourceBergen Corp. | | |

| | Class A | 841,604 | 32,578 |

| | Omnicare Inc. | 816,600 | 27,740 |

| * | Mylan Inc. | 986,300 | 24,066 |

| * | WellCare Health Plans Inc. | 417,100 | 23,587 |

| | | |

| * | Health Net Inc. | 910,000 | 20,484 |

| * | Regeneron | | |

| | Pharmaceuticals Inc. | 120,200 | 18,350 |

| | Cooper Cos. Inc. | 180,315 | 17,033 |

| | Perrigo Co. | 137,250 | 15,944 |

| * | Salix Pharmaceuticals Ltd. | 373,205 | 15,801 |

| | ResMed Inc. | 362,083 | 14,653 |

| * | Cubist Pharmaceuticals Inc. | 290,900 | 13,870 |

| * | LifePoint Hospitals Inc. | 274,035 | 11,723 |

| * | Pharmacyclics Inc. | 177,000 | 11,417 |

| * | Magellan Health | | |

| | Services Inc. | 188,600 | 9,734 |

| * | CharlesRiver Laboratories | | |

| | International Inc. | 234,900 | 9,302 |

| *,^ | Arena Pharmaceuticals Inc. | 844,000 | 7,022 |

| * | Medicines Co. | 267,875 | 6,914 |

| * | Cyberonics Inc. | 121,800 | 6,385 |

| * | Affymax Inc. | 248,400 | 5,231 |

| * | Thoratec Corp. | 141,100 | 4,882 |

| | PDL BioPharma Inc. | 482,100 | 3,707 |

| * | Wright Medical Group Inc. | 119,700 | 2,647 |

| * | Auxilium Pharmaceuticals | | |

| | Inc. | 92,500 | 2,263 |

| | West Pharmaceutical | | |

| | Services Inc. | 41,800 | 2,218 |

| *,^ | Questcor Pharmaceuticals | | |

| | Inc. | 112,400 | 2,079 |

| | Ensign Group Inc. | 67,000 | 2,051 |

| * | Molina Healthcare Inc. | 72,600 | 1,826 |

| *,^ | Spectrum Pharmaceuticals | | |

| | Inc. | 133,900 | 1,567 |

| * | HealthSouth Corp. | 61,600 | 1,482 |

| * | Genomic Health Inc. | 38,408 | 1,332 |

| | ChemedCorp. | 18,200 | 1,261 |

| * | Universal American Corp. | 130,700 | 1,208 |

| * | Akorn Inc. | 71,067 | 940 |

| * | Bio-Rad Laboratories Inc. | | |

| | Class A | 8,200 | 875 |

| | | | 358,092 |

| Industrials (13.2%) | | |

| | Textron Inc. | 1,139,900 | 29,831 |

| | Triumph Group Inc. | 445,366 | 27,849 |

| * | Delta Air Lines Inc. | 2,829,100 | 25,915 |

| ^ | Pitney Bowes Inc. | 1,228,650 | 16,980 |

| | Equifax Inc. | 339,200 | 15,800 |

| *,^ | USG Corp. | 679,300 | 14,911 |

| | Cintas Corp. | 343,600 | 14,242 |

| * | WESCO International Inc. | 235,500 | 13,471 |

| | Trinity Industries Inc. | 426,800 | 12,791 |

| | Dun & Bradstreet Corp. | 157,500 | 12,540 |

| * | EnerSys Inc. | 346,257 | 12,219 |

| * | US Airways Group Inc. | 1,146,200 | 11,989 |

| | Toro Co. | 296,400 | 11,791 |

| | Towers Watson & Co. | | |

| | Class A | 209,400 | 11,109 |

15

Strategic Equity Fund

| | | | |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| | AO Smith Corp. | | 175,900 | 10,121 |

| * | Alaska Air Group Inc. | | 279,790 | 9,809 |

| * | United Rentals Inc. | | 253,147 | 8,280 |

| | Sauer-Danfoss Inc. | | 205,323 | 8,256 |

| | Barnes Group Inc. | | 318,400 | 7,963 |

| * | Huntington Ingalls | | | |

| | Industries Inc. | | 185,000 | 7,779 |

| | NACCO Industries Inc. | | |

| | Class A | | 60,000 | 7,525 |

| | Applied Industrial | | | |

| | Technologies Inc. | | 179,200 | 7,424 |

| * | JetBlue Airways Corp. | 1,334,900 | 6,394 |

| | Manitowoc Co. Inc. | | 475,050 | 6,337 |

| | Hubbell Inc. Class B | | 74,900 | 6,047 |

| * | Trimas Corp. | | 239,700 | 5,779 |

| * | B/E Aerospace Inc. | | 133,750 | 5,631 |

| | Macquarie Infrastructure | | |

| | Co. LLC | | 129,900 | 5,388 |

| | Belden Inc. | | 143,000 | 5,274 |

| | Amerco Inc. | | 45,740 | 4,865 |

| * | Spirit Airlines Inc. | | 282,700 | 4,829 |

| * | Moog Inc. Class A | | 126,500 | 4,791 |

| | Aircastle Ltd. | | 386,600 | 4,380 |

| | Lincoln Electric | | | |

| | Holdings Inc. | | 111,400 | 4,350 |

| | Timken Co. | | 109,000 | 4,050 |

| | JB Hunt Transport | | | |

| | Services Inc. | | 73,800 | 3,841 |

| | ExelisInc. | | 330,500 | 3,417 |

| | Standex International Corp. | 76,450 | 3,398 |

| * | Hexcel Corp. | | 125,400 | 3,012 |

| * | Terex Corp. | | 121,000 | 2,732 |

| | Armstrong World | | | |

| | Industries Inc. | | 58,800 | 2,727 |

| | Lennox International Inc. | 55,000 | 2,660 |

| * | WABCO Holdings Inc. | | 46,100 | 2,659 |

| | Generac Holdings Inc. | | 115,100 | 2,635 |

| | Deluxe Corp. | | 86,113 | 2,632 |

| | GATXCorp. | | 61,400 | 2,606 |

| | Steelcase Inc. Class A | | 255,700 | 2,519 |

| * | General Cable Corp. | | 83,500 | 2,453 |

| | Mueller Industries Inc. | 48,800 | 2,219 |

| * | Teledyne Technologies Inc. | 32,100 | 2,035 |

| | Cooper Industries plc | | 27,000 | 2,027 |

| | RR Donnelley & Sons Co. | 188,900 | 2,002 |

| | Brink’s Co. | | 70,800 | 1,819 |

| * | GenCorp Inc. | | 178,200 | 1,691 |

| | Robbins & Myers Inc. | | 27,900 | 1,663 |

| | Mine Safety Appliances Co. | 40,500 | 1,509 |

| | Actuant Corp. Class A | | 49,100 | 1,405 |

| | Southwest Airlines Co. | 150,000 | 1,315 |

| | Franklin Electric Co. Inc. | 17,600 | 1,065 |

| * | Dycom Industries Inc. | | 74,000 | 1,064 |

| | United Stationers Inc. | | 39,922 | 1,039 |

| | | |

| * | Trex Co. Inc. | 30,200 | 1,030 |

| | G&KServices Inc. Class A | 31,100 | 974 |

| | Mueller Water Products Inc. | |

| | Class A | 165,600 | 811 |

| | Primoris Services Corp. | 59,700 | 779 |

| | FreightCar America Inc. | 28,764 | 512 |

| | | | 428,960 |

| Information Technology (15.8%) | |

| | Seagate Technology plc | 1,076,050 | 33,358 |

| | KLA-TencorCorp. | 632,475 | 30,172 |

| | Western Digital Corp. | 771,900 | 29,896 |

| * | Alliance Data Systems Corp. | 208,900 | 29,653 |

| | IAC/InterActiveCorp | 545,000 | 28,373 |

| * | Gartner Inc. | 608,991 | 28,068 |

| * | LSI Corp. | 3,500,400 | 24,188 |

| * | Cadence Design | | |

| | Systems Inc. | 1,827,400 | 23,510 |

| | Anixter International Inc. | 407,408 | 23,410 |

| * | Fiserv Inc. | 282,900 | 20,943 |

| * | CACIInternational Inc. | | |

| | Class A | 349,000 | 18,075 |

| * | CoreLogic Inc. | 572,700 | 15,194 |

| * | Avnet Inc. | 456,000 | 13,265 |

| | Lender Processing | | |

| | Services Inc. | 386,600 | 10,782 |

| * | CommVault Systems Inc. | 180,500 | 10,595 |

| | Fair Isaac Corp. | 233,000 | 10,313 |

| | Avago Technologies Ltd. | 285,600 | 9,957 |

| * | Teradata Corp. | 121,600 | 9,170 |

| * | Cardtronics Inc. | 283,896 | 8,454 |

| * | Tech Data Corp. | 182,700 | 8,276 |

| * | AOL Inc. | 225,900 | 7,958 |

| * | Kulicke & Soffa | | |

| | Industries Inc. | 748,600 | 7,785 |

| | FEI Co. | 141,300 | 7,560 |

| | MAXIMUS Inc. | 113,540 | 6,781 |

| | Jabil Circuit Inc. | 332,900 | 6,232 |

| | DST Systems Inc. | 103,230 | 5,839 |

| * | Aspen Technology Inc. | 192,800 | 4,984 |

| * | Advanced Micro | | |

| | Devices Inc. | 1,456,735 | 4,909 |

| * | Ingram Micro Inc. | 299,500 | 4,561 |

| * | Manhattan Associates Inc. | 79,200 | 4,536 |

| * | Unisys Corp. | 205,900 | 4,287 |

| | Total System Services Inc. | 180,600 | 4,280 |

| | Plantronics Inc. | 110,900 | 3,918 |

| * | SYNNEX Corp. | 113,274 | 3,690 |

| * | Ultratech Inc. | 115,400 | 3,621 |

| | Diebold Inc. | 105,800 | 3,567 |

| * | Insight Enterprises Inc. | 198,800 | 3,475 |

| * | NVIDIA Corp. | 260,200 | 3,471 |

| * | NETGEAR Inc. | 81,106 | 3,093 |

| | Heartland Payment | | |

| | Systems Inc. | 91,400 | 2,896 |

16

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Teradyne Inc. | 186,917 | 2,658 |

| * | Mentor Graphics Corp. | 150,000 | 2,322 |

| * | Acxiom Corp. | 118,700 | 2,169 |

| * | Electronicsfor Imaging Inc. | 122,300 | 2,031 |

| | Maxim Integrated | | |

| | Products Inc. | 75,250 | 2,003 |

| * | Advanced Energy | | |

| | Industries Inc. | 156,700 | 1,931 |

| * | Plexus Corp. | 58,900 | 1,784 |

| | NIC Inc. | 115,750 | 1,713 |

| * | FormFactor Inc. | 267,200 | 1,494 |

| * | Monolithic Power | | |

| | Systems Inc. | 75,600 | 1,493 |

| * | Integrated Device | | |

| | Technology Inc. | 249,800 | 1,469 |

| * | Silicon Graphics | | |

| | International Corp. | 156,788 | 1,427 |

| * | Itron Inc. | 31,500 | 1,359 |

| * | Freescale Semiconductor | | |

| | Ltd. | 142,200 | 1,352 |

| * | Volterra Semiconductor | | |

| | Corp. | 60,800 | 1,330 |

| * | Brocade Communications | | |

| | Systems Inc. | 201,700 | 1,193 |

| | Fidelity National Information | | |

| | Services Inc. | 38,000 | 1,186 |

| | Computer Sciences Corp. | 28,400 | 915 |

| * | Quantum Corp. | 537,800 | 866 |

| * | FlextronicsInternational Ltd. | 134,670 | 808 |

| | | | 514,598 |

| Materials (7.0%) | | |

| | CF Industries Holdings Inc. | 176,000 | 39,114 |

| | Eastman Chemical Co. | 582,536 | 33,210 |

| | Rockwood Holdings Inc. | 546,010 | 25,444 |

| * | Coeur d’Alene Mines Corp. | 579,300 | 16,701 |

| | Sherwin-WilliamsCo. | 85,000 | 12,657 |

| | Domtar Corp. | 147,275 | 11,530 |

| | Valspar Corp. | 190,400 | 10,682 |

| | Westlake Chemical Corp. | 127,386 | 9,307 |

| | Buckeye Technologies Inc. | 279,608 | 8,964 |

| * | WR Grace & Co. | 144,800 | 8,555 |

| | American Vanguard Corp. | 244,500 | 8,509 |

| | NewMarket Corp. | 32,822 | 8,090 |

| * | Graphic Packaging | | |

| | Holding Co. | 999,019 | 5,804 |

| | Georgia Gulf Corp. | 134,900 | 4,886 |

| | Cytec Industries Inc. | 56,800 | 3,722 |

| | Neenah Paper Inc. | 93,600 | 2,681 |

| | | |

| | Huntsman Corp. | 152,800 | 2,281 |

| | Haynes International Inc. | 43,100 | 2,248 |

| | FMCCorp. | 40,000 | 2,215 |

| * | ChemturaCorp. | 125,500 | 2,161 |

| * | KapStone Paper and | | |

| | Packaging Corp. | 88,600 | 1,984 |

| | Minerals Technologies Inc. | 26,300 | 1,866 |

| | Schweitzer-Mauduit | | |

| | International Inc. | 55,178 | 1,820 |

| * | Headwaters Inc. | 148,500 | 977 |

| | Albemarle Corp. | 14,600 | 769 |

| * | Innospec Inc. | 20,700 | 702 |

| | | | 226,879 |

| Telecommunication Services (0.6%) | |

| * | MetroPCS | | |

| | Communications Inc. | 1,650,287 | 19,325 |

| * | United States Cellular Corp. | 20,700 | 810 |

| | | | 20,135 |

| Utilities (4.9%) | | |

| | Ameren Corp. | 774,500 | 25,303 |

| | CMSEnergy Corp. | 1,012,662 | 23,848 |

| | Portland General | | |

| | Electric Co. | 687,500 | 18,590 |

| | PNM Resources Inc. | 662,335 | 13,929 |

| | DTEEnergy Co. | 223,350 | 13,388 |

| | Southwest Gas Corp. | 271,640 | 12,006 |

| | Pinnacle West Capital Corp. | 195,300 | 10,312 |

| | TECO Energy Inc. | 485,500 | 8,613 |

| | American Water Works | | |

| | Co. Inc. | 190,400 | 7,056 |

| | Wisconsin Energy Corp. | 151,700 | 5,714 |

| | NV Energy Inc. | 309,300 | 5,570 |

| | NorthWestern Corp. | 144,997 | 5,253 |

| | Avista Corp. | 150,100 | 3,864 |

| | WGL Holdings Inc. | 44,671 | 1,798 |

| | ClecoCorp. | 42,200 | 1,772 |

| | MGE Energy Inc. | 25,000 | 1,325 |

| | Laclede Group Inc. | 27,600 | 1,187 |

| | Vectren Corp. | 39,700 | 1,135 |

| | | | 160,663 |

| Total Common Stocks | | |

| (Cost $2,757,262) | | 3,235,064 |

| Temporary Cash Investments (2.0%)1 | |

| Money Market Fund (1.9%) | | |

| 2,3 | Vanguard Market | | |

| | Liquidity Fund, | | |

| | 0.163% | 61,776,773 | 61,777 |

17

Strategic Equity Fund

| | | |

| | | Face | Market |

| | | Amount | Valuet |

| | | ($000) | ($000) |

| U.S. Government and Agency Obligations (0.1%) |

| 4,5 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.135%, 12/12/12 | 500 | 500 |

| 4,5 | Freddie Mac | | |

| | Discount Notes, | | |

| | 0.140%, 11/13/12 | 1,500 | 1,500 |

| | | | 2,000 |

| Total Temporary Cash Investments | |

| (Cost $63,777) | | 63,777 |

| Total Investments (101.4%) | | |

| (Cost $2,821,039) | | 3,298,841 |

| Other Assets and Liabilities (-1.4%) | |

| Other Assets | | 8,784 |

| Liabilities3 | | (54,029) |

| | | | (45,245) |

| Net Assets (100%) | | |

| Applicable to 154,772,975 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,253,596 |

| Net Asset Value Per Share | | $21.02 |

| |

| At September 30, 2012, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 3,742,697 |

| Undistributed Net Investment Income | 20,089 |

| Accumulated Net Realized Losses | (986,552) |

| Unrealized Appreciation (Depreciation) | |

| InvestmentSecurities | 477,802 |

| Futures Contracts | (440) |

| Net Assets | 3,253,596 |

t See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $34,523,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to

futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.4%, respectively,

of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

3 Includes $36,285,000 of collateral received for securities on loan.

4 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the

Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange for

senior preferred stock.

5 Securities with a value of $1,600,000 have been segregated as initial margin for open futures contracts.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Strategic Equity Fund

Statement of Operations

| |

| | Year Ended |

| | September 30, 2012 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 47,968 |

| Interest1 | 37 |

| Security Lending | 890 |

| Total Income | 48,895 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 949 |

| Management and Administrative | 7,560 |

| Marketing and Distribution | 591 |

| Custodian Fees | 56 |

| Auditing Fees | 28 |

| Shareholders’ Reports | 22 |

| Trustees’ Fees and Expenses | 4 |

| Total Expenses | 9,210 |

| Net Investment Income | 39,685 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 289,002 |

| Futures Contracts | 4,304 |

| Realized Net Gain (Loss) | 293,306 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 476,387 |

| Futures Contracts | 1,032 |

| Change in Unrealized Appreciation (Depreciation) | 477,419 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 810,410 |

| 1 Interest income from an affiliated company of the fund was $35,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

19

Strategic Equity Fund

Statement of Changes in Net Assets

| | |

| | Year Ended September 30, |

| | 2012 | 2011 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 39,685 | 36,888 |

| Realized Net Gain (Loss) | 293,306 | 521,680 |

| Change in Unrealized Appreciation (Depreciation) | 477,419 | (474,353) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 810,410 | 84,215 |

| Distributions | | |

| Net Investment Income | (32,559) | (41,795) |

| Realized Capital Gain | — | — |

| Total Distributions | (32,559) | (41,795) |

| Capital Share Transactions | | |

| Issued | 237,519 | 421,286 |

| Issued in Lieu of Cash Distributions | 30,266 | 39,080 |

| Redeemed | (548,498) | (849,470) |

| Net Increase (Decrease) from Capital Share Transactions | (280,713) | (389,104) |

| Total Increase (Decrease) | 497,138 | (346,684) |

| Net Assets | | |

| Beginning of Period | 2,756,458 | 3,103,142 |

| End of Period1 | 3,253,596 | 2,756,458 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $20,089,000 and $12,963,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

20

Strategic Equity Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | Year Ended September 30, |

| Throughout Each Period | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $16.30 | $16.30 | $14.52 | $16.42 | $24.94 |

| Investment Operations | | | | | |

| Net Investment Income | 0.249 | .210 | .221 | .184 | .240 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 4.667 | .017 | 1.759 | (1.843) | (6.090) |

| Total from Investment Operations | 4.916 | .227 | 1.980 | (1.659) | (5.850) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.196) | (.227) | (.200) | (.241) | (.240) |

| Distributions from Realized Capital Gains | — | — | — | — | (2.430) |

| Total Distributions | (.196) | (.227) | (.200) | (.241) | (2.670) |

| Net Asset Value, End of Period | $21.02 | $16.30 | $16.30 | $14.52 | $16.42 |

| |

| Total Return1 | 30.32% | 1.23% | 13.71% | -9.66% | -25.37% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $3,254 | $2,756 | $3,103 | $3,549 | $4,822 |

| Ratio of Total Expenses to Average Net Assets | 0.29% | 0.30% | 0.30% | 0.30% | 0.25% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.25% | 1.09% | 1.37% | 1.47% | 1.09% |

| Portfolio Turnover Rate | 67% | 73% | 60% | 60% | 79% |

| 1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about |

| any applicable account service fees. |

See accompanying Notes, which are an integral part of the Financial Statements.

21

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended September 30, 2012, the fund’s average investment in futures contracts represented less than 1% of net assets, based on quarterly average aggregate settlement values.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2009–2012), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents fees charged to borrowers plus income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

22

Strategic Equity Fund

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At September 30, 2012, the fund had contributed capital of $458,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.18% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest

rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine

the fair value of investments).

The following table summarizes the market value of the fund’s investments as of September 30,

2012, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 3,235,064 | — | — |

| Temporary Cash Investments | 61,777 | 2,000 | — |

| Futures Contracts—Assets1 | 7 | — | — |

| Futures Contracts—Liabilities1 | (125) | — | — |

| Total | 3,296,723 | 2,000 | — |

| 1 Represents variation margin on the last day of the reporting period. |

D. At September 30, 2012, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini Russell 2000 Index | December 2012 | 158 | 13,184 | (318) |

| E-mini S&P MidCap 400 Index | December 2012 | 57 | 5,623 | (122) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss

23

Strategic Equity Fund

are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

For tax purposes, at September 30, 2012, the fund had $27,929,000 of ordinary income available for distribution. The fund used capital loss carryforwards of $327,088,000 to offset taxable capital gains realized during the year ended September 30, 2012. At September 30, 2012, the fund had available capital losses totaling $986,991,000 to offset future net capital gains. Of this amount, $954,229,000 is subject to expiration on September 30, 2018. Capital losses of $32,762,000 realized beginning in fiscal 2012 may be carried forward indefinitely under the Regulated Investment Company Modernization Act of 2010, but must be used before any expiring loss carryforwards.

At September 30, 2012, the cost of investment securities for tax purposes was $2,821,039,000. Net unrealized appreciation of investment securities for tax purposes was $477,802,000, consisting of unrealized gains of $553,441,000 on securities that had risen in value since their purchase and $75,639,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended September 30, 2012, the fund purchased $2,109,866,000 of investment securities and sold $2,368,368,000 of investment securities, other than temporary cash investments.

G. Capital shares issued and redeemed were:

| | |

| | Year Ended September 30, |

| | 2012 | 2011 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 12,157 | 21,858 |

| Issued in Lieu of Cash Distributions | 1,630 | 2,125 |

| Redeemed | (28,154) | (45,260) |

| Net Increase (Decrease) in Shares Outstanding | (14,367) | (21,277) |

H. In preparing the financial statements as of September 30, 2012, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

24

Report of Independent Registered

Public Accounting Firm

To the Trustees of Vanguard Horizon Funds and the Shareholders of Vanguard Strategic Equity Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Strategic Equity Fund (constituting a separate portfolio of Vanguard Horizon Funds, hereafter referred to as the “Fund”) at September 30, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2012 by correspondence with the custodian and broker and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 12, 2012

Special 2012 tax information (unaudited) for Vanguard Strategic Equity Fund

This information for the fiscal year ended September 30, 2012, is included pursuant to provisions of

the Internal Revenue Code.

The fund distributed $32,559,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 99.8% of investment income (dividend income plus short-term gains, if

any) qualifies for the dividends-received deduction.

25

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2012. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| | | |

| Average Annual Total Returns: Strategic Equity Fund | | | |

| Periods Ended September 30, 2012 | | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 30.32% | 0.23% | 9.27% |

| Returns After Taxes on Distributions | 30.11 | -0.37 | 8.55 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 19.93 | 0.06 | 8.04 |

26

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

27

| | | |

| Six Months Ended September 30, 2012 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Strategic Equity Fund | 3/31/2012 | 9/30/2012 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,003.82 | $1.41 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.66 | 1.42 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that

period is 0.28%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account

value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most

recent 12-month period.

28

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

29

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

Benchmark Information

Spliced Small and Mid Cap Index: Russell 2800 Index through May 31, 2003; MSCI US Small +

Mid Cap 2200 Index thereafter.

30

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 179 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

| |

| InterestedTrustee1 | and Delphi Automotive LLP (automotive components); |

| | Senior Advisor at New Mountain Capital; Trustee of |

| F. William McNabb III | The Conference Board. |

| Born 1957. Trustee Since July 2009. Chairman of the | |

| Board. Principal Occupation(s) During the Past Five | Amy Gutmann |