UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07239

Name of Registrant: Vanguard Horizon Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2011 – March 31, 2012

Item 1: Reports to Shareholders

|

| Semiannual Report | March 31, 2012 |

| Vanguard Strategic Equity Fund |

> For the six months ended March 31, 2012, Vanguard Strategic Equity Fund returned almost 30%, with small- and mid-capitalization stocks outpacing their large-cap counterparts.

> The fund outpaced the return of its benchmark and the average return of peer-group funds.

> Stock selection in energy and materials drove the fund’s performance.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 6 |

| Fund Profile. | 8 |

| Performance Summary. | 9 |

| Financial Statements. | 10 |

| About Your Fund’s Expenses. | 22 |

| Trustees Approve Advisory Arrangement. | 24 |

| Glossary. | 25 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose

performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we

strive to help clients reach their financial goals.

Your Fund’s Total Returns

Six Months Ended March 31, 2012

| |

| | Total |

| | Returns |

| Vanguard Strategic Equity Fund | 29.82% |

| MSCI US Small + Mid Cap 2200 Index | 28.32 |

| Mid-Cap Core Funds Average | 26.50 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper Inc. | |

Your Fund’s Performance at a Glance

September 30, 2011, Through March 31, 2012

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Strategic Equity Fund | $16.30 | $20.94 | $0.196 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

The stock market made significant gains in the six months ended March 31. With investors’ appetite for risk on the rise, small- and mid-cap stocks generally outpaced their large-cap counterparts, and Vanguard Strategic Equity Fund performed even better, thanks to skillful stock selection. The fund returned 29.82%, more than a percentage point ahead of the return of its benchmark, the MSCI US Small + Mid Cap 2200 Index, and more than 3 percentage points ahead of the average return for peer funds.

A surge of optimism fueled a powerful global rally in stocks

During the past six months, optimism displaced the apprehension that had restrained stock prices through summer 2011. The broad U.S. stock market returned more than 26%. Markets abroad returned more than 15%. Investors’ good spirits reflected confidence that the slow, grinding economic expansion in the United States was at last gathering momentum, and that Europe’s debt crisis could be contained.

By the end of the period, however, that confidence had begun to evaporate in the face of ambiguous economic reports and renewed concern about Europe. The abrupt mood swing was consistent with the financial markets’ volatility since the 2008–2009 financial crisis.

2

Aside from munis, most bonds saw subdued six-month returns

The broad taxable bond market produced a modest six-month return of 1.43%. In general, interest rates remained more or less steady at very low levels. In some segments of the bond market, however, yields crept lower still, boosting bond prices. The broad municipal bond market, for example, produced a solid six-month return of 3.91% as investors bid up muni prices.

As it has since December 2008, the Federal Reserve Board kept its target for the shortest-term interest rates between 0% and 0.25%. That policy has kept a tight lid on the returns available from money market funds and savings accounts.

Good stock selection, good market performance

With Greece apparently stepping back from the brink and the U.S. economy seeming to gain traction, domestic stocks rose higher across all sectors and market capitalization segments during the period. Within the small- and mid-cap segment, sector returns ranged from 4.5% for telecommunication services and 8.6% for utilities to more than 30% for sectors more sensitive to the economic cycle, including industrials, materials, consumer discretionary, and information technology.

While the fund’s benchmark benefited from the overall upswing in the market, the fund did even better, thanks to strong security selection by the fund’s advisor.

Market Barometer

| | | |

| | | | Total Returns |

| | | Periods Ended March 31, 2012 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 26.27% | 7.86% | 2.19% |

| Russell 2000 Index (Small-caps) | 29.83 | -0.18 | 2.13 |

| Dow Jones U.S. Total Stock Market Index | 26.60 | 7.16 | 2.47 |

| MSCI All Country World Index ex USA (International) | 15.37 | -7.18 | -1.56 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 1.43% | 7.71% | 6.25% |

| Barclays Capital Municipal Bond Index (Broad | | | |

| tax-exempt market) | 3.91 | 12.07 | 5.42 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.00 | 0.05 | 1.11 |

| |

| CPI | | | |

| Consumer Price Index | 1.10% | 2.65% | 2.24% |

3

Vanguard’s Equity Investment Group maintains sector weightings very close to those of the fund’s benchmark but uses sophisticated computer models to identify and invest in a limited number of stocks in each sector. Its models seek to identify stocks with attractive valuations, positive earnings momentum, and strong balance sheets. The fund held about 400 stocks during the six-month period; its benchmark comprises around 2,200 stocks.

The strength of the fund’s security selection was notable in the energy sector, where the fund’s holdings returned better than 43%, compared with about 27% for the benchmark. The fund’s return was driven by strong stock choices in the oil and gas segment, which benefited from an increase in the price of oil from less than

$80 to more than $100 per barrel during the six months. At the same time, the fund benefited from largely avoiding the coal segment, where prospects dimmed in the face of rapidly expanding supplies of cheap natural gas.

Within materials, the fund’s concentration on chemical companies allowed this sector to outperform. Information technology was another sector where the fund bested its benchmark; its holdings in computers and peripherals were helped by robust business spending.

Stock selection in health care was the main detractor from performance, largely because of missed opportunities among a few biotechnology and pharmaceutical stocks.

Expense Ratios

Your Fund Compared With Its Peer Group

| | |

| | | Peer Group |

| | Fund | Average |

| Strategic Equity Fund | 0.33% | 1.28% |

The fund expense ratio shown is from the prospectus dated January 26, 2012, and represents estimated costs for the current fiscal year. For the six months ended March 31, 2012, the fund’s annualized expense ratio was 0.30%. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2011.

Peer group: Mid-Cap Core Funds.

4

Staying the course has its advantages

Ups and downs in the market, as all seasoned investors know, are part and parcel of investing. The level of volatility seen last summer, however, as U.S. government debt was downgraded and the possibility of European government defaults loomed large, was unnerving to say the least.

Yet investors who rode out the storm were there to benefit from the strong upswing that followed. We believe that investors are best served by maintaining, through good markets and bad, a portfolio that is diversified across and within asset classes and that is consistent with their tolerance for risk.

Vanguard Strategic Equity Fund can play an important role in such a portfolio as it affords investors broad exposure to both small- and mid-cap U.S. stocks identified by our Equity Investment Group as having improving fundamentals and attractive valuations. And it does so at a low cost, which leaves more of the fund’s return in your pocket.

As always, thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

April 19, 2012

5

Advisor’s Report

For the six months ended March 31, 2012, the Strategic Equity Fund returned a robust 29.82%, outperforming its benchmark, the MSCI US Small + Mid Cap 2200 Index, by 1.5 percentage points. The fund also outperformed the broad market as risk appetites increased due to brighter economic news, increased investor confidence, and coordinated action by central banks.

At the sector level, industrials, materials, and consumer discretionary companies led mid- and small-cap results. Telecommunications and utilities were the laggards for the period. All ten sectors posted positive returns. These results mirrored trends in the broader market, where more economically sensitive sectors generally outperformed more defensive ones.

Since the equity market started its current rally last fall, investor concerns regarding a possible double-dip recession, slowing growth in China, and Europe’s troubles appear to have eased. Against this backdrop, data showing improvements in U.S. employment and housing and continued strength in U.S. manufacturing activity seem to have whetted investor appetite for equities. Valuations of U.S. stocks relative to bonds, measured by comparing earnings yields of stocks with coupon yields of 10-year U.S. Treasury bonds, indicate a level of attractiveness not seen since the early 1970s.

Although market volatility declined more than 60% during the period to below-average levels, it will likely stay with us for a while. U.S. budget and deficit problems remain unresolved, world economic growth is uncertain, and the outcome of the presidential election is still months away. (Volatility is measured by the CBOE Volatility Index, or VIX.)

Although overall portfolio performance is affected by the macroeconomic factors described above, our approach to investing focuses on specific stock fundamentals. Our model consists of these five components:

1. Valuation, which measures the price we pay for earnings and cash flows.

2. Growth, which considers the growth of earnings.

3. Management decisions, an assessment of the actions taken by company management that signal its informed opinions of a firm’s future.

4. Market sentiment, which captures how investors reflect their opinions of a company through their activity in the market.

5. Quality, which measures balancesheet strength and the sustainability of earnings.

6

Our risk-control process then neutralizes our exposure to market-capitalization, volatility, and industry risks relative to our benchmark. In our view, such risk exposures are not justified by the rewards available. The effect of these risk controls can be seen by analyzing the fund’s tracking error (a measure of performance volatility relative to its benchmark). The trailing 3-year tracking error of 2.35% is well within an acceptable range given the risk tolerance of this fund.

For the fiscal half-year, our stock selection model produced mixed results. Our management decisions and quality components were effective in distinguishing outperformers from underperformers, but our growth indicator was flat. Our market-sentiment and valuation indicators were not effective and, in fact, detracted from our results.

Our stock selection results were positive in seven out of ten sectors, neutral in two, and negative in one. Company selections within energy, materials, and consumer staples added most to our relative returns. In energy, Pioneer Natural Resources, CVR Energy, and Core Laboratories were the largest contributors. In materials, Rockwood Holdings, Eastman Chemical, and CF Industries boosted results. In consumer staples, Herbalife, and B&G Foods were the top performers. Selection results were disappointing in health care; most of our underperformance in this sector resulted from underweighted positions in Regeneron Pharmaceuticals and Pharmasset.

While we cannot predict how broader political or economic events will affect the markets, we are confident that the stock market can provide worthwhile returns for long-term investors. With that in mind, we believe that equity exposure will continue to play an important part in a diversified investment plan.

We thank you for your investment and look forward to the second half of the fiscal year.

James D. Troyer, CFA Principal and Portfolio Manager

James P. Stetler Principal and Portfolio Manager

Michael R. Roach, CFA Portfolio Manager

Vanguard Equity Investment Group

April 12, 2012

7

Strategic Equity Fund

Fund Profile

As of March 31, 2012

| | | |

| Portfolio Characteristics | | |

| | | MSCI US | |

| | | Small + | DJ |

| | | Mid Cap | U.S. Total |

| | | 2200 | Market |

| | Fund | Index | Index |

| Number of Stocks | 389 | 2,176 | 3,716 |

| Median Market Cap | $3.8B | $4.2B | $35.6B |

| Price/Earnings Ratio | 15.6x | 22.2x | 17.1x |

| Price/Book Ratio | 2.4x | 2.1x | 2.3x |

| Return on Equity | 11.5% | 12.2% | 18.1% |

| Earnings Growth Rate 12.1% | 6.7% | 8.5% |

| Dividend Yield | 1.2% | 1.4% | 1.9% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | | | |

| (Annualized) | 64% | — | — |

| Ticker Symbol | VSEQX | — | — |

| Expense Ratio1 | 0.33% | — | — |

| 30-Day SEC Yield | 0.95% | — | — |

| Short-Term Reserves | 0.3% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | MSCI US | |

| | | Small + | DJ |

| | | Mid Cap | U.S. Total |

| | | 2200 | Market |

| | Fund | Index | Index |

| Consumer | | | |

| Discretionary | 16.8% | 16.4% | 12.0% |

| Consumer Staples | 5.0 | 4.4 | 9.4 |

| Energy | 7.6 | 7.0 | 10.5 |

| Financials | 18.5 | 18.9 | 15.9 |

| Health Care | 10.7 | 10.8 | 11.5 |

| Industrials | 13.6 | 14.1 | 11.0 |

| Information | | | |

| Technology | 16.3 | 16.1 | 19.8 |

| Materials | 6.4 | 6.5 | 4.0 |

| Telecommunication | | | |

| Services | 0.7 | 1.0 | 2.5 |

| Utilities | 4.4 | 4.8 | 3.4 |

| | |

| Volatility Measures | | |

| | MSCI US | |

| | Small + | DJ |

| | Mid Cap | U.S. Total |

| | 2200 | Market |

| | Index | Index |

| R-Squared | 0.99 | 0.94 |

| Beta | 1.00 | 1.21 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| | |

| Ten Largest Holdings (% of total net assets) |

| |

| Limited Brands Inc. | Apparel Retail | 1.1% |

| CF Industries Holdings | Fertilizers & | |

| Inc. | Agricultural | |

| | Chemicals | 1.1 |

| Seagate Technology plc | Computer Storage | |

| | & Peripherals | 1.1 |

| KLA-Tencor Corp. | Semiconductor | |

| | Equipment | 1.0 |

| Western Digital Corp. | Computer Storage | |

| | & Peripherals | 1.0 |

| Pioneer Natural | Oil & Gas | |

| Resources Co. | Exploration & | |

| | Production | 1.0 |

| AmerisourceBergen | Health Care | |

| Corp. | Distributors | 1.0 |

| Herbalife Ltd. | Personal Products | 1.0 |

| Alliance Data Systems | Data Processing & | |

| Corp. | Outsourced | |

| | Services | 1.0 |

| Tempur-Pedic | | |

| International Inc. | Home Furnishings | 1.0 |

| Top Ten | | 10.3% |

The holdings listed exclude any temporary cash investments and equity index products.

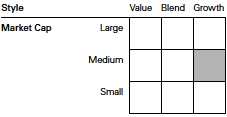

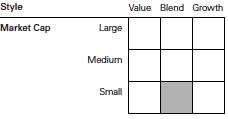

Investment Focus

1 The expense ratio shown is from the prospectus dated January 26, 2012, and represents estimated costs for the current fiscal year. For the six months ended March 31, 2012, the annualized expense ratio was 0.30%.

8

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

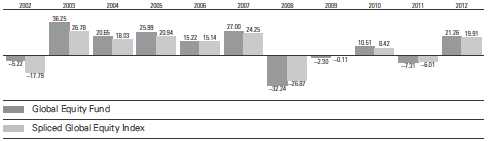

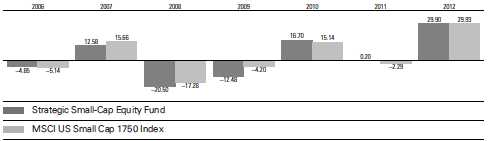

Fiscal-Year Total Returns (%): September 30, 2001, Through March 31, 2012

Spliced Small and Mid Cap Index: Russell 2800 Index through May 31, 2003; MSCI US Small + Mid Cap 2200 Index thereafter.

Note: For 2012, performance data reflect the six months ended March 31, 2012.

Average Annual Total Returns: Periods Ended March 31, 2012

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Strategic Equity Fund | 8/14/1995 | 4.34% | 0.27% | 6.69% |

See Financial Highlights for dividend and capital gains information.

9

Strategic Equity Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2012

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (99.4%)1 | | |

| Consumer Discretionary (16.7%) | |

| | Limited Brands Inc. | 773,850 | 37,145 |

| * | Tempur-Pedic | | |

| | International Inc. | 387,949 | 32,755 |

| | Polaris Industries Inc. | 436,782 | 31,514 |

| | Dillard’s Inc. Class A | 458,920 | 28,921 |

| * | Dollar Tree Inc. | 282,820 | 26,724 |

| * | Goodyear Tire & | | |

| | Rubber Co. | 2,068,700 | 23,211 |

| | Domino’s Pizza Inc. | 582,420 | 21,142 |

| | Wyndham | | |

| | Worldwide Corp. | 445,900 | 20,739 |

| | Garmin Ltd. | 435,200 | 20,433 |

| | Advance Auto Parts Inc. | 227,300 | 20,132 |

| | Virgin Media Inc. | 698,300 | 17,444 |

| * | Coinstar Inc. | 260,390 | 16,548 |

| | Ulta Salon Cosmetics & | | |

| | Fragrance Inc. | 172,700 | 16,042 |

| | Sotheby’s | 377,220 | 14,840 |

| | Dana Holding Corp. | 933,000 | 14,461 |

| * | Sirius XM Radio Inc. | 5,826,300 | 13,459 |

| | Buckle Inc. | 263,400 | 12,617 |

| * | Liz Claiborne Inc. | 895,300 | 11,961 |

| * | O’Reilly Automotive Inc. | 124,600 | 11,382 |

| | Brinker International Inc. | 404,250 | 11,137 |

| | Signet Jewelers Ltd. | 234,000 | 11,063 |

| ^ | Weight Watchers | | |

| | International Inc. | 137,720 | 10,631 |

| * | Tenneco Inc. | 277,995 | 10,327 |

| * | Crocs Inc. | 491,000 | 10,272 |

| * | Iconix Brand Group Inc. | 520,300 | 9,043 |

| *,^ | ITT Educational | | |

| | Services Inc. | 128,700 | 8,512 |

| | Harley-Davidson Inc. | 170,000 | 8,344 |

| | Bob Evans Farms Inc. | 206,751 | 7,799 |

| * | AMC Networks Inc. | | |

| | Class A | 154,425 | 6,892 |

| | Ameristar Casinos Inc. | 367,800 | 6,852 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Express Inc. | 251,500 | 6,282 |

| | Sinclair Broadcast | | |

| | Group Inc. Class A | 502,640 | 5,559 |

| * | Cheesecake Factory Inc. | 185,500 | 5,452 |

| | Sturm Ruger & Co. Inc. | 108,200 | 5,313 |

| * | Helen of Troy Ltd. | 152,500 | 5,186 |

| | Expedia Inc. | 132,850 | 4,442 |

| | Ross Stores Inc. | 69,524 | 4,039 |

| | PetSmart Inc. | 68,200 | 3,902 |

| | Foot Locker Inc. | 125,000 | 3,881 |

| | Regal Entertainment Group | | |

| | Class A | 257,500 | 3,502 |

| | Aaron’s Inc. | 106,200 | 2,751 |

| | Standard Motor | | |

| | Products Inc. | 145,150 | 2,575 |

| * | Vitamin Shoppe Inc. | 54,800 | 2,423 |

| * | Pier 1 Imports Inc. | 125,900 | 2,289 |

| | Blyth Inc. | 26,700 | 1,998 |

| * | Liberty Interactive Corp. | | |

| | Class A | 86,900 | 1,659 |

| * | Red Robin Gourmet | | |

| | Burgers Inc. | 43,300 | 1,610 |

| | Service Corp. International | 128,200 | 1,443 |

| | Interpublic Group | | |

| | of Cos. Inc. | 113,400 | 1,294 |

| * | Journal | | |

| | Communications Inc. | | |

| | Class A | 215,261 | 1,212 |

| * | BorgWarner Inc. | 13,900 | 1,172 |

| | DSW Inc. Class A | 21,100 | 1,156 |

| * | AFC Enterprises Inc. | 60,045 | 1,018 |

| | Cato Corp. Class A | 36,294 | 1,003 |

| * | American Public | | |

| | Education Inc. | 26,200 | 996 |

| | | | 564,499 |

| Consumer Staples (5.0%) | | |

| | Herbalife Ltd. | 482,478 | 33,204 |

| | Dr Pepper Snapple | | |

| | Group Inc. | 772,908 | 31,079 |

| | Whole Foods Market Inc. | 273,000 | 22,714 |

10

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Constellation Brands Inc. | | |

| | Class A | 638,900 | 15,072 |

| * | Dean Foods Co. | 1,240,604 | 15,024 |

| | B&G Foods Inc. Class A | 471,620 | 10,616 |

| * | Monster Beverage Corp. | 155,854 | 9,677 |

| | Lancaster Colony Corp. | 108,519 | 7,212 |

| * | Boston Beer Co. Inc. | | |

| | Class A | 62,000 | 6,621 |

| | Safeway Inc. | 276,000 | 5,578 |

| * | Energizer Holdings Inc. | 50,100 | 3,716 |

| * | Smithfield Foods Inc. | 155,677 | 3,429 |

| | Andersons Inc. | 36,700 | 1,787 |

| | SUPERVALU Inc. | 204,100 | 1,165 |

| | Cal-Maine Foods Inc. | 26,000 | 995 |

| | Nu Skin Enterprises Inc. | | |

| | Class A | 15,000 | 869 |

| | | | 168,758 |

| Energy (7.6%) | | |

| | Pioneer Natural | | |

| | Resources Co. | 299,300 | 33,399 |

| * | Tesoro Corp. | 1,055,000 | 28,316 |

| * | CVR Energy Inc. | 985,850 | 26,372 |

| | Helmerich & Payne Inc. | 482,092 | 26,009 |

| | Core Laboratories NV | 192,000 | 25,261 |

| | Western Refining Inc. | 1,035,300 | 19,484 |

| * | Rosetta Resources Inc. | 311,645 | 15,196 |

| * | Denbury Resources Inc. | 616,800 | 11,244 |

| * | Superior Energy | | |

| | Services Inc. | 399,951 | 10,543 |

| * | Stone Energy Corp. | 323,212 | 9,241 |

| | HollyFrontier Corp. | 219,200 | 7,047 |

| | Range Resources Corp. | 120,700 | 7,018 |

| * | SEACOR Holdings Inc. | 70,600 | 6,762 |

| * | Helix Energy Solutions | | |

| | Group Inc. | 354,800 | 6,315 |

| | W&T Offshore Inc. | 158,250 | 3,336 |

| | Kinder Morgan | | |

| | Management LLC | 40,378 | 3,013 |

| * | Plains Exploration & | | |

| | Production Co. | 58,000 | 2,474 |

| | Crosstex Energy Inc. | 172,475 | 2,439 |

| * | Cloud Peak Energy Inc. | 151,300 | 2,410 |

| * | OYO Geospace Corp. | 17,250 | 1,817 |

| * | Contango Oil & Gas Co. | 29,000 | 1,708 |

| * | Energy Partners Ltd. | 101,600 | 1,688 |

| | Delek US Holdings Inc. | 105,300 | 1,633 |

| | Alon USA Energy Inc. | 157,800 | 1,428 |

| * | Swift Energy Co. | 34,300 | 996 |

| | Berry Petroleum Co. | | |

| | Class A | 18,800 | 886 |

| | Cabot Oil & Gas Corp. | 21,400 | 667 |

| | | | 256,702 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Financials (18.4%) | | |

| | Torchmark Corp. | 635,595 | 31,684 |

| * | Arch Capital Group Ltd. | 771,726 | 28,739 |

| | Discover Financial Services | 816,225 | 27,213 |

| | American Financial | | |

| | Group Inc. | 539,689 | 20,821 |

| * | World Acceptance Corp. | 338,783 | 20,751 |

| | KeyCorp | 2,401,630 | 20,414 |

| * | NASDAQ OMX Group Inc. | 729,200 | 18,886 |

| | Kimco Realty Corp. | 828,000 | 15,947 |

| | Commerce Bancshares Inc. | 388,530 | 15,743 |

| | Bank of the Ozarks Inc. | 483,720 | 15,121 |

| | Moody’s Corp. | 356,400 | 15,004 |

| | Digital Realty Trust Inc. | 201,200 | 14,883 |

| | Camden Property Trust | 208,900 | 13,735 |

| | Taubman Centers Inc. | 178,750 | 13,040 |

| | CBL & Associates | | |

| | Properties Inc. | 679,874 | 12,863 |

| | Extra Space Storage Inc. | 445,840 | 12,836 |

| | Northwest Bancshares Inc. | 948,000 | 12,040 |

| | Post Properties Inc. | 256,600 | 12,024 |

| | Douglas Emmett Inc. | 525,300 | 11,982 |

| | Hospitality Properties Trust | 445,200 | 11,785 |

| | Lexington Realty Trust | 1,268,300 | 11,402 |

| | Sun Communities Inc. | 260,743 | 11,298 |

| * | Forest City Enterprises Inc. | | |

| | Class A | 656,805 | 10,286 |

| | Brandywine Realty Trust | 870,832 | 9,997 |

| | Entertainment | | |

| | Properties Trust | 215,200 | 9,981 |

| | Cash America | | |

| | International Inc. | 207,300 | 9,936 |

| | Assured Guaranty Ltd. | 571,200 | 9,436 |

| | Huntington | | |

| | Bancshares Inc. | 1,459,000 | 9,411 |

| | ProAssurance Corp. | 99,800 | 8,793 |

| | Assurant Inc. | 216,300 | 8,760 |

| * | Credit Acceptance Corp. | 85,779 | 8,665 |

| * | First Industrial Realty | | |

| | Trust Inc. | 687,825 | 8,495 |

| * | Strategic Hotels & | | |

| | Resorts Inc. | 1,279,200 | 8,417 |

| | American Campus | | |

| | Communities Inc. | 178,000 | 7,960 |

| | Allied World Assurance Co. | | |

| | Holdings AG | 107,800 | 7,403 |

| * | Altisource Portfolio | | |

| | Solutions SA | 119,709 | 7,259 |

| | Nelnet Inc. Class A | 278,312 | 7,211 |

| | BOK Financial Corp. | 127,221 | 7,160 |

| | Colonial Properties Trust | 313,160 | 6,805 |

| * | Ezcorp Inc. Class A | 196,709 | 6,384 |

| | DCT Industrial Trust Inc. | 1,043,500 | 6,157 |

11

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | International | | |

| | Bancshares Corp. | 238,425 | 5,043 |

| | UMB Financial Corp. | 109,088 | 4,880 |

| | Omega Healthcare | | |

| | Investors Inc. | 222,700 | 4,735 |

| | Liberty Property Trust | 123,500 | 4,411 |

| | City Holding Co. | 125,905 | 4,371 |

| | Provident Financial | | |

| | Services Inc. | 293,425 | 4,264 |

| | People’s United | | |

| | Financial Inc. | 312,600 | 4,139 |

| | Amtrust Financial | | |

| | Services Inc. | 130,400 | 3,505 |

| | Cathay General Bancorp | 185,510 | 3,284 |

| | Erie Indemnity Co. Class A | 42,100 | 3,281 |

| | First Horizon National Corp. | 316,000 | 3,280 |

| | Fulton Financial Corp. | 306,600 | 3,219 |

| | Highwoods Properties Inc. | 96,046 | 3,200 |

| | CVB Financial Corp. | 255,300 | 2,997 |

| | First Financial | | |

| | Bankshares Inc. | 85,032 | 2,994 |

| | Republic Bancorp Inc. | | |

| | Class A | 106,911 | 2,557 |

| * | American Capital Ltd. | 288,089 | 2,498 |

| | CubeSmart | 200,900 | 2,391 |

| | Prosperity Bancshares Inc. | 47,900 | 2,194 |

| | Umpqua Holdings Corp. | 154,000 | 2,088 |

| * | iStar Financial Inc. | 279,055 | 2,023 |

| | Webster Financial Corp. | 82,500 | 1,870 |

| | Ramco-Gershenson | | |

| | Properties Trust | 148,300 | 1,812 |

| | First Citizens | | |

| | BancShares Inc. Class A | 9,300 | 1,699 |

| | Bancfirst Corp. | 38,783 | 1,689 |

| * | Texas Capital | | |

| | Bancshares Inc. | 48,400 | 1,676 |

| | American Capital | | |

| | Agency Corp. | 51,300 | 1,515 |

| | Oritani Financial Corp. | 94,900 | 1,393 |

| | Apartment Investment & | | |

| | Management Co. | 51,300 | 1,355 |

| | RLI Corp. | 18,300 | 1,311 |

| | Southside Bancshares Inc. | 53,966 | 1,193 |

| | Old National Bancorp | 87,200 | 1,146 |

| | AvalonBay Communities Inc. | 7,600 | 1,074 |

| * | Investors Bancorp Inc. | 71,400 | 1,072 |

| | Ashford Hospitality | | |

| | Trust Inc. | 110,790 | 998 |

| | NBT Bancorp Inc. | 41,330 | 913 |

| | Camden National Corp. | 25,345 | 891 |

| * | Rouse Properties Inc. | 63,100 | 854 |

| | MFA Financial Inc. | 92,300 | 690 |

| | | | 621,232 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Health Care (10.6%) | | |

| | AmerisourceBergen Corp. | | |

| | Class A | 841,604 | 33,395 |

| * | Watson | | |

| | Pharmaceuticals Inc. | 468,000 | 31,384 |

| * | WellCare Health Plans Inc. | 434,100 | 31,203 |

| | Perrigo Co. | 282,650 | 29,201 |

| | Omnicare Inc. | 816,600 | 29,046 |

| | Humana Inc. | 312,400 | 28,891 |

| | Cooper Cos. Inc. | 323,015 | 26,394 |

| * | Mylan Inc. | 896,800 | 21,030 |

| * | Cubist Pharmaceuticals Inc. | 290,900 | 12,581 |

| * | Health Net Inc. | 303,900 | 12,071 |

| * | Salix Pharmaceuticals Ltd. | 183,305 | 9,623 |

| * | Magellan Health | | |

| | Services Inc. | 188,600 | 9,206 |

| * | Charles River Laboratories | | |

| | International Inc. | 234,900 | 8,478 |

| * | Medicines Co. | 400,975 | 8,048 |

| * | Alexion | | |

| | Pharmaceuticals Inc. | 80,300 | 7,457 |

| | Medicis | | |

| | Pharmaceutical Corp. | | |

| | Class A | 180,700 | 6,792 |

| * | Idenix Pharmaceuticals Inc. | 656,178 | 6,424 |

| * | LifePoint Hospitals Inc. | 143,135 | 5,645 |

| * | Akorn Inc. | 447,367 | 5,234 |

| * | Viropharma Inc. | 160,600 | 4,829 |

| * | Par | | |

| | Pharmaceutical Cos. Inc. | 109,221 | 4,230 |

| * | Centene Corp. | 60,300 | 2,953 |

| * | Thoratec Corp. | 83,400 | 2,811 |

| * | Health Management | | |

| | Associates Inc. Class A | 361,348 | 2,428 |

| * | Arthrocare Corp. | 85,200 | 2,288 |

| * | Vertex | | |

| | Pharmaceuticals Inc. | 55,500 | 2,276 |

| * | Mettler-Toledo | | |

| | International Inc. | 10,291 | 1,901 |

| | Ensign Group Inc. | 67,000 | 1,820 |

| * | Spectrum | | |

| | Pharmaceuticals Inc. | 133,900 | 1,691 |

| | Universal American Corp. | 130,700 | 1,409 |

| | PDL BioPharma Inc. | 185,400 | 1,177 |

| * | Genomic Health Inc. | 38,408 | 1,176 |

| * | Greatbatch Inc. | 47,400 | 1,162 |

| | Chemed Corp. | 18,200 | 1,141 |

| * | Jazz Pharmaceuticals plc | 19,200 | 931 |

| | Computer Programs & | | |

| | Systems Inc. | 15,100 | 853 |

| * | Bio-Rad Laboratories Inc. | | |

| | Class A | 8,200 | 850 |

| * | RTI Biologics Inc. | 166,700 | 617 |

| | | | 358,646 |

12

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Industrials (13.5%) | | |

| * | United Rentals Inc. | 682,162 | 29,258 |

| | KBR Inc. | 786,200 | 27,949 |

| * | BE Aerospace Inc. | 583,850 | 27,132 |

| | Gardner Denver Inc. | 394,652 | 24,871 |

| | Iron Mountain Inc. | 840,600 | 24,209 |

| | Pitney Bowes Inc. | 1,228,650 | 21,600 |

| | Sauer-Danfoss Inc. | 406,923 | 19,125 |

| | Towers Watson & Co. | | |

| | Class A | 265,100 | 17,515 |

| * | Delta Air Lines Inc. | 1,606,200 | 15,917 |

| | Triumph Group Inc. | 236,866 | 14,842 |

| | Cintas Corp. | 281,300 | 11,004 |

| | Toro Co. | 148,200 | 10,539 |

| * | AGCO Corp. | 222,950 | 10,525 |

| * | Alaska Air Group Inc. | 279,790 | 10,022 |

| | Textron Inc. | 344,800 | 9,596 |

| * | Colfax Corp. | 260,900 | 9,194 |

| | Kennametal Inc. | 190,600 | 8,487 |

| * | EnerSys | 242,357 | 8,398 |

| | Applied Industrial | | |

| | Technologies Inc. | 179,200 | 7,370 |

| | Cubic Corp. | 148,520 | 7,022 |

| | HEICO Corp. | 125,700 | 6,485 |

| * | Moog Inc. Class A | 126,500 | 5,426 |

| * | Avis Budget Group Inc. | 379,900 | 5,376 |

| | Barnes Group Inc. | 202,000 | 5,315 |

| * | US Airways Group Inc. | 675,000 | 5,123 |

| | NACCO Industries Inc. | | |

| | Class A | 44,000 | 5,120 |

| * | Trimas Corp. | 225,800 | 5,056 |

| * | Generac Holdings Inc. | 199,800 | 4,905 |

| | AO Smith Corp. | 108,500 | 4,877 |

| | Amerco Inc. | 45,740 | 4,826 |

| * | Dollar Thrifty Automotive | | |

| | Group Inc. | 59,640 | 4,825 |

| | Macquarie | | |

| | Infrastructure Co. LLC | 141,900 | 4,681 |

| * | Consolidated Graphics Inc. | 102,073 | 4,619 |

| | Donaldson Co. Inc. | 126,800 | 4,531 |

| * | Corrections Corp. of | | |

| | America | 161,300 | 4,405 |

| * | JetBlue Airways Corp. | 847,500 | 4,144 |

| | Werner Enterprises Inc. | 154,737 | 3,847 |

| | Belden Inc. | 99,300 | 3,764 |

| | Aircastle Ltd. | 285,200 | 3,491 |

| | Ceradyne Inc. | 95,300 | 3,103 |

| * | Hexcel Corp. | 125,400 | 3,011 |

| * | KAR Auction Services Inc. | 178,000 | 2,885 |

| | Armstrong World | | |

| | Industries Inc. | 58,800 | 2,868 |

| | Crane Co. | 55,400 | 2,687 |

| * | United Continental | | |

| | Holdings Inc. | 122,100 | 2,625 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Steelcase Inc. Class A | 255,700 | 2,455 |

| * | General Cable Corp. | 83,500 | 2,428 |

| * | Nielsen Holdings NV | 79,700 | 2,402 |

| | Standex International Corp. | 57,750 | 2,379 |

| * | Thomas & Betts Corp. | 32,800 | 2,359 |

| | Mueller Industries Inc. | 48,800 | 2,218 |

| | Hubbell Inc. Class B | 27,000 | 2,122 |

| | Deluxe Corp. | 86,113 | 2,017 |

| | Primoris Services Corp. | 93,500 | 1,502 |

| * | WESCO International Inc. | 22,000 | 1,437 |

| | Actuant Corp. Class A | 49,100 | 1,423 |

| * | Blount International Inc. | 84,082 | 1,402 |

| | ITT Corp. | 56,500 | 1,296 |

| | United Stationers Inc. | 39,922 | 1,239 |

| * | Huntington Ingalls | | |

| | Industries Inc. | 29,100 | 1,171 |

| | JB Hunt Transport | | |

| | Services Inc. | 20,000 | 1,087 |

| | G&K Services Inc. Class A | 31,100 | 1,064 |

| * | RSC Holdings Inc. | 46,300 | 1,046 |

| * | Huron Consulting | | |

| | Group Inc. | 26,100 | 980 |

| * | Orbital Sciences Corp. | 68,700 | 903 |

| * | ICF International Inc. | 35,000 | 888 |

| | Franklin Electric Co. Inc. | 17,600 | 864 |

| * | Taser International Inc. | 170,000 | 738 |

| | | | 457,990 |

| Information Technology (16.2%) | |

| | Seagate Technology plc | 1,327,150 | 35,767 |

| | KLA-Tencor Corp. | 638,475 | 34,746 |

| * | Western Digital Corp. | 814,300 | 33,704 |

| * | Alliance Data | | |

| | Systems Corp. | 260,600 | 32,825 |

| * | Gartner Inc. | 706,269 | 30,115 |

| * | Anixter International Inc. | 412,108 | 29,890 |

| | IAC/InterActiveCorp | 499,500 | 24,521 |

| * | CACI International Inc. | | |

| | Class A | 349,000 | 21,739 |

| * | Electronic Arts Inc. | 1,298,500 | 21,399 |

| * | Fiserv Inc. | 282,900 | 19,630 |

| * | Cadence Design | | |

| | Systems Inc. | 1,598,200 | 18,923 |

| * | LSI Corp. | 2,000,700 | 17,366 |

| * | Avnet Inc. | 456,000 | 16,594 |

| | Cypress | | |

| | Semiconductor Corp. | 875,200 | 13,679 |

| * | FEI Co. | 240,900 | 11,831 |

| | Lexmark International Inc. | | |

| | Class A | 353,806 | 11,761 |

| | Avago Technologies Ltd. | 285,600 | 11,130 |

| * | Freescale Semiconductor | | |

| | Holdings I Ltd. | 658,150 | 10,129 |

| * | Tech Data Corp. | 182,700 | 9,913 |

13

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Kulicke & Soffa | | |

| | Industries Inc. | 712,600 | 8,858 |

| * | Advanced Micro | | |

| | Devices Inc. | 1,044,535 | 8,377 |

| | Jabil Circuit Inc. | 332,900 | 8,362 |

| * | Cardtronics Inc. | 283,896 | 7,452 |

| | OPNET | 236,574 | 6,861 |

| | Fair Isaac Corp. | 155,500 | 6,827 |

| | DST Systems Inc. | 103,230 | 5,598 |

| * | Lattice | | |

| | Semiconductor Corp. | 855,850 | 5,503 |

| * | Fairchild Semiconductor | | |

| | International Inc. Class A | 357,290 | 5,252 |

| * | Silicon Graphics | | |

| | International Corp. | 500,588 | 4,846 |

| | Plantronics Inc. | 110,900 | 4,465 |

| * | Insight Enterprises Inc. | 198,800 | 4,360 |

| * | SYNNEX Corp. | 113,274 | 4,320 |

| | Diebold Inc. | 105,800 | 4,075 |

| * | Aspen Technology Inc. | 195,500 | 4,014 |

| * | Manhattan Associates Inc. | 79,200 | 3,764 |

| * | Ultratech Inc. | 115,400 | 3,344 |

| * | Teradyne Inc. | 186,917 | 3,157 |

| * | Netgear Inc. | 81,106 | 3,098 |

| | MAXIMUS Inc. | 74,940 | 3,048 |

| * | Novellus Systems Inc. | 51,400 | 2,565 |

| * | JDA Software Group Inc. | 87,900 | 2,416 |

| * | Mentor Graphics Corp. | 150,000 | 2,229 |

| * | Stamps.com Inc. | 76,900 | 2,144 |

| * | Plexus Corp. | 58,900 | 2,061 |

| * | Electronics for Imaging Inc. | 122,300 | 2,033 |

| * | Unisys Corp. | 92,400 | 1,822 |

| * | Integrated Device | | |

| | Technology Inc. | 249,800 | 1,786 |

| * | BMC Software Inc. | 43,800 | 1,759 |

| * | CommVault Systems Inc. | 33,900 | 1,683 |

| * | Formfactor Inc. | 267,200 | 1,491 |

| * | Monolithic Power | | |

| | Systems Inc. | 75,600 | 1,487 |

| | NIC Inc. | 115,750 | 1,404 |

| | Heartland Payment | | |

| | Systems Inc. | 47,600 | 1,373 |

| | MercadoLibre Inc. | 14,000 | 1,369 |

| * | Liquidity Services Inc. | 26,500 | 1,187 |

| | MKS Instruments Inc. | 34,400 | 1,016 |

| | Blackbaud Inc. | 30,300 | 1,007 |

| * | Flextronics | | |

| | International Ltd. | 134,670 | 974 |

| * | Quantum Corp. | 340,600 | 892 |

| * | Brightpoint Inc. | 105,000 | 845 |

| * | Anadigics Inc. | 334,200 | 792 |

| * | Ceva Inc. | 34,800 | 790 |

| | | | 546,368 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Materials (6.3%) | | |

| | CF Industries Holdings Inc. | 198,500 | 36,256 |

| | Eastman Chemical Co. | 622,736 | 32,189 |

| | Domtar Corp. | 310,125 | 29,580 |

| * | Rockwood Holdings Inc. | 534,010 | 27,849 |

| * | Coeur d’Alene Mines Corp. | 697,300 | 16,554 |

| | Buckeye Technologies Inc. | 279,608 | 9,498 |

| * | WR Grace & Co. | 144,800 | 8,370 |

| | Westlake Chemical Corp. | 127,386 | 8,253 |

| | Innophos Holdings Inc. | 162,985 | 8,169 |

| * | Graphic Packaging | | |

| | Holding Co. | 999,019 | 5,515 |

| * | Georgia Gulf Corp. | 134,900 | 4,705 |

| | Sherwin-Williams Co. | 35,900 | 3,901 |

| | Noranda Aluminum | | |

| | Holding Corp. | 366,600 | 3,655 |

| * | KapStone Paper and | | |

| | Packaging Corp. | 161,600 | 3,184 |

| | Neenah Paper Inc. | 93,600 | 2,784 |

| | Haynes International Inc. | 43,100 | 2,730 |

| * | Innospec Inc. | 87,200 | 2,649 |

| * | TPC Group Inc. | 48,540 | 2,146 |

| * | LSB Industries Inc. | 52,400 | 2,039 |

| | Schweitzer-Mauduit | | |

| | International Inc. | 27,589 | 1,905 |

| | NewMarket Corp. | 5,222 | 979 |

| | Albemarle Corp. | 14,600 | 933 |

| | | | 213,843 |

| Telecommunication Services (0.7%) | |

| * | MetroPCS | | |

| | Communications Inc. | 2,050,587 | 18,496 |

| * | Vonage Holdings Corp. | 2,490,680 | 5,504 |

| | Consolidated | | |

| | Communications | | |

| | Holdings Inc. | 61,874 | 1,215 |

| | | | 25,215 |

| Utilities (4.4%) | | |

| | CMS Energy Corp. | 1,346,062 | 29,613 |

| | CenterPoint Energy Inc. | 820,300 | 16,176 |

| | Portland General | | |

| | Electric Co. | 554,800 | 13,859 |

| | Northeast Utilities | 367,720 | 13,650 |

| | DTE Energy Co. | 223,350 | 12,291 |

| | Southwest Gas Corp. | 271,640 | 11,610 |

| | PNM Resources Inc. | 567,935 | 10,393 |

| | El Paso Electric Co. | 296,600 | 9,637 |

| | TECO Energy Inc. | 485,500 | 8,520 |

| | ONEOK Inc. | 92,345 | 7,541 |

| | NSTAR | 81,255 | 3,951 |

| | NorthWestern Corp. | 88,397 | 3,135 |

| | WGL Holdings Inc. | 44,671 | 1,818 |

| | Vectren Corp. | 39,700 | 1,154 |

| | Pinnacle West Capital Corp. | 23,700 | 1,135 |

14

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | MGE Energy Inc. | 25,000 | 1,110 |

| | Laclede Group Inc. | 27,600 | 1,077 |

| | Ameren Corp. | 28,700 | 935 |

| | | | 147,605 |

| Total Common Stocks | | |

| (Cost $2,704,480) | | 3,360,858 |

| Temporary Cash Investments (1.0%)1 | |

| Money Market Fund (0.9%) | | |

| 2,3 | Vanguard Market | | |

| | Liquidity Fund, | | |

| | 0.123% | 32,869,993 | 32,870 |

| |

| | | Face | |

| | | Amount | |

| | | ($000) | |

| U.S. Government and Agency Obligations (0.1%) |

| 4,5 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.040%, 4/24/12 | 1,000 | 1,000 |

| 4,5 | Freddie Mac | | |

| | Discount Notes, | | |

| | 0.050%, 4/4/12 | 1,000 | 1,000 |

| 4,5 | Freddie Mac | | |

| | Discount Notes, | | |

| | 0.050%, 4/24/12 | 600 | 600 |

| | | | 2,600 |

| Total Temporary Cash Investments | |

| (Cost $35,470) | | 35,470 |

| Total Investments (100.4%) | | |

| (Cost $2,739,950) | | 3,396,328 |

| |

| | Market |

| | Value |

| | ($000) |

| Other Assets and Liabilities (-0.4%) | |

| Other Assets | 8,326 |

| Liabilities3 | (22,774) |

| | (14,448) |

| Net Assets (100%) | |

| Applicable to 161,481,005 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,381,880 |

| Net Asset Value Per Share | $20.94 |

| |

| |

| At March 31, 2012, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 3,879,369 |

| Overdistributed Net Investment Income | (982) |

| Accumulated Net Realized Losses | (1,153,059) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 656,378 |

| Futures Contracts | 174 |

| Net Assets | 3,381,880 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $3,473,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100% and 0.4%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

3 Includes $3,636,000 of collateral received for securities on loan.

4 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the Federal Housing Finance Agency and it receives capital from the U.S. Treasury in exchange for senior preferred stock.

5 Securities with a value of $2,600,000 have been segregated as initial margin for open futures contracts.

See accompanying Notes, which are an integral part of the Financial Statements.

15

Strategic Equity Fund

Statement of Operations

| |

| | Six Months Ended |

| | March 31, 2012 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 23,000 |

| Interest1 | 15 |

| Security Lending | 336 |

| Total Income | 23,351 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 341 |

| Management and Administrative | 4,056 |

| Marketing and Distribution | 304 |

| Custodian Fees | 28 |

| Shareholders’ Reports | 6 |

| Trustees’ Fees and Expenses | 2 |

| Total Expenses | 4,737 |

| Net Investment Income | 18,614 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 123,503 |

| Futures Contracts | 3,296 |

| Realized Net Gain (Loss) | 126,799 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 654,963 |

| Futures Contracts | 1,646 |

| Change in Unrealized Appreciation (Depreciation) | 656,609 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 802,022 |

| 1 Interest income from an affiliated company of the fund was $15,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

16

Strategic Equity Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | March 31, | September 30, |

| | 2012 | 2011 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 18,614 | 36,888 |

| Realized Net Gain (Loss) | 126,799 | 521,680 |

| Change in Unrealized Appreciation (Depreciation) | 656,609 | (474,353) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 802,022 | 84,215 |

| Distributions | | |

| Net Investment Income | (32,559) | (41,795) |

| Realized Capital Gain | — | — |

| Total Distributions | (32,559) | (41,795) |

| Capital Share Transactions | | |

| Issued | 150,599 | 421,286 |

| Issued in Lieu of Cash Distributions | 30,266 | 39,080 |

| Redeemed | (324,906) | (849,470) |

| Net Increase (Decrease) from Capital Share Transactions | (144,041) | (389,104) |

| Total Increase (Decrease) | 625,422 | (346,684) |

| Net Assets | | |

| Beginning of Period | 2,756,458 | 3,103,142 |

| End of Period1 | 3,381,880 | 2,756,458 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($982,000) and $12,963,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

17

Strategic Equity Fund

Financial Highlights

| | | | | | | |

| | Six Months | | | | | |

| | | Ended | | | | | |

| For a Share Outstanding | March 31, | | | Year Ended September 30, |

| Throughout Each Period | | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $16.30 | $16.30 | $14.52 | $16.42 | $24.94 | $23.07 |

| Investment Operations | | | | | | | |

| Net Investment Income | | .113 | .210 | .221 | .184 | .240 | .270 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | | 4.723 | .017 | 1.759 | (1.843) | (6.090) | 2.840 |

| Total from Investment Operations | | 4.836 | .227 | 1.980 | (1.659) | (5.850) | 3.110 |

| Distributions | | | | | | | |

| Dividends from Net Investment Income | (.196) | (.227) | (.200) | (.241) | (.240) | (.260) |

| Distributions from Realized Capital Gains | — | — | — | — | (2.430) | (.980) |

| Total Distributions | | (.196) | (.227) | (.200) | (.241) | (2.670) | (1.240) |

| Net Asset Value, End of Period | | $20.94 | $16.30 | $16.30 | $14.52 | $16.42 | $24.94 |

| |

| Total Return1 | | 29.82% | 1.23% | 13.71% | -9.66% | -25.37% | 13.76% |

| |

| Ratios/Supplemental Data | | | | | | | |

| Net Assets, End of Period (Millions) | $3,382 | $2,756 | $3,103 | $3,549 | $4,822 | $7,699 |

| Ratio of Total Expenses to | | | | | | | |

| Average Net Assets | | 0.30% | 0.30% | 0.30% | 0.30% | 0.25% | 0.30% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | | 1.17% | 1.09% | 1.37% | 1.47% | 1.09% | 1.03% |

| Portfolio Turnover Rate | | 64% | 73% | 60% | 60% | 79% | 75% |

The expense ratio, net income ratio, and turnover rate for the current period have been annualized.

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2008–2011), and for the period ended March 31, 2012, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents fees charged to borrowers plus income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

19

Strategic Equity Fund

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At March 31, 2012, the fund had contributed capital of $497,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.20% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of March 31, 2012, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 3,360,858 | — | — |

| Temporary Cash Investments | 32,870 | 2,600 | — |

| Futures Contracts—Liabilities1 | (64) | — | — |

| Total | 3,393,664 | 2,600 | — |

| 1 Represents variation margin on the last day of the reporting period. | | | |

D. At March 31, 2012, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini Russell 2000 Index | June 2012 | 196 | 16,223 | 149 |

| E-mini S&P MidCap 400 Index | June 2012 | 69 | 6,847 | 25 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

20

Strategic Equity Fund

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at September 30, 2011, the fund had available capital loss carryforwards totaling $1,281,317,000 to offset future net capital gains of $236,621,000 through September 30, 2017, and $1,044,696,000 through September 30, 2018. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending September 30, 2012; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balance above.

At March 31, 2012, the cost of investment securities for tax purposes was $2,739,950,000. Net unrealized appreciation of investment securities for tax purposes was $656,378,000, consisting of unrealized gains of $729,787,000 on securities that had risen in value since their purchase and $73,409,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the six months ended March 31, 2012, the fund purchased $1,005,409,000 of investment securities and sold $1,152,557,000 of investment securities, other than temporary cash investments.

G. Capital shares issued and redeemed were:

| | |

| | Six Months Ended | Year Ended |

| | March 31, 2012 | September 30, 2011 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 7,829 | 21,858 |

| Issued in Lieu of Cash Distributions | 1,630 | 2,125 |

| Redeemed | (17,118) | (45,260) |

| Net Increase (Decrease) in Shares Outstanding | (7,659) | (21,277) |

H. In preparing the financial statements as of March 31, 2012, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

21

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

22

| | | |

| Six Months Ended March 31, 2012 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Strategic Equity Fund | 9/30/2011 | 3/31/2012 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,298.22 | $1.72 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.50 | 1.52 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.30%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard Strategic Equity Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. Vanguard—through its Equity Investment Group—serves as the investment advisor to the fund. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both the short and long term, and took into account the organizational depth and stability of the advisor. The board noted that Vanguard has been managing investments for more than three decades. The Equity Investment Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board concluded that the advisor has carried out the fund’s investment strategy in disciplined fashion and that the fund has outperformed its benchmark over the most recent one-year period but underperformed it over the long term. The board noted that the fund has outperformed its peer group over both the short and long term. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was well below the average expense ratio charged by funds in its peer group and that the fund’s advisory fee rate was also well below its peer-group average. Information about the fund’s expenses appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section.

The board does not conduct a profitability analysis of Vanguard, because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees, and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board concluded that the fund’s low-cost arrangement with Vanguard ensures that the fund will

realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

24

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

25

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

26

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 179 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

| |

| InterestedTrustee1 | and Delphi Automotive LLP (automotive components); |

| Senior Advisor at New Mountain Capital; Trustee of |

| F. William McNabb III | The Conference Board. |

| Born 1957. Trustee Since July 2009. Chairman of the | |

| Board. Principal Occupation(s) During the Past Five | Amy Gutmann |

| Years: Chairman of the Board of The Vanguard Group, | Born 1949. Trustee Since June 2006. Principal |

| Inc., and of each of the investment companies served | Occupation(s) During the Past Five Years: President |

| by The Vanguard Group, since January 2010; Director | of the University of Pennsylvania; Christopher H. |

| of The Vanguard Group since 2008; Chief Executive | Browne Distinguished Professor of Political Science |

| Officer and President of The Vanguard Group and of | in the School of Arts and Sciences with secondary |

| each of the investment companies served by The | appointments at the Annenberg School for Commu- |

| Vanguard Group since 2008; Director of Vanguard | nication and the Graduate School of Education |

| Marketing Corporation; Managing Director of The | of the University of Pennsylvania; Director of |

| Vanguard Group (1995–2008). | Carnegie Corporation of New York, Schuylkill River |

| Development Corporation, and Greater Philadelphia |

| Chamber of Commerce; Trustee of the National |

| IndependentTrustees | Constitution Center; Chair of the Presidential |

| Commission for the Study of Bioethical Issues. |

| |

| Emerson U. Fullwood | JoAnn Heffernan Heisen |

| Born 1948. Trustee Since January 2008. Principal | Born 1950. Trustee Since July 1998. Principal |

| Occupation(s) During the Past Five Years: Executive | Occupation(s) During the Past Five Years: Corporate |

| Chief Staff and Marketing Officer for North America | Vice President and Chief Global Diversity Officer |

| and Corporate Vice President (retired 2008) of Xerox | (retired 2008) and Member of the Executive |

| Corporation (document management products and | Committee (1997–2008) of Johnson & Johnson |

| services); Executive in Residence and 2010 | (pharmaceuticals/medical devices/consumer |

| Distinguished Minett Professor at the Rochester | products); Director of Skytop Lodge Corporation |

| Institute of Technology; Director of SPX Corporation | (hotels), the University Medical Center at Princeton, |

| (multi-industry manufacturing), the United Way of | the Robert Wood Johnson Foundation, and the Center |

| Rochester, Amerigroup Corporation (managed health | for Talent Innovation; Member of the Advisory Board |

| care), the University of Rochester Medical Center, | of the Maxwell School of Citizenship and Public Affairs |

| Monroe Community College Foundation, and North | at Syracuse University. |

| Carolina A&T University. | |

| F. Joseph Loughrey |

| Rajiv L. Gupta | Born 1949. Trustee Since October 2009. Principal |

| Born 1945. Trustee Since December 2001.2 | Occupation(s) During the Past Five Years: President |

| Principal Occupation(s) During the Past Five Years: | and Chief Operating Officer (retired 2009) of Cummins |

| Chairman and Chief Executive Officer (retired 2009) | Inc. (industrial machinery); Director of SKF AB |

| and President (2006–2008) of Rohm Haas Co. | (industrial machinery), Hillenbrand, Inc. (specialized |

| (chemicals); Director of Tyco International, Ltd. | consumer services), the Lumina Foundation for |

| (diversified manufacturing and services), Hewlett- | |

| Packard Co. (electronic computer manufacturing), | |

| |

| | |

| Education, and Oxfam America; Chairman of the | Executive Officers | |

| Advisory Council for the College of Arts and Letters | | |

| and Member of the Advisory Board to the Kellogg | Glenn Booraem | |

| Institute for International Studies at the University | Born 1967. Controller Since July 2010. Principal |

| of Notre Dame. | Occupation(s) During the Past Five Years: Principal |

| | of The Vanguard Group, Inc.; Controller of each of |

| Mark Loughridge | the investment companies served by The Vanguard |

| Born 1953. Trustee Since March 2012. Principal | Group; Assistant Controller of each of the investment |

| Occupation(s) During the Past Five Years: Senior Vice | companies served by The Vanguard Group (2001–2010). |

| President and Chief Financial Officer at IBM (information | | |

| technology services); Fiduciary Member of IBM’s | Thomas J. Higgins | |

| Retirement Plan Committee. | Born 1957. Chief Financial Officer Since September |

| | 2008. Principal Occupation(s) During the Past Five |

| Scott C. Malpass | Years: Principal of The Vanguard Group, Inc.; Chief |

| Born 1962. Trustee Since March 2012. Principal | Financial Officer of each of the investment companies |

| Occupation(s) During the Past Five Years: Chief | served by The Vanguard Group; Treasurer of each of |

| Investment Officer and Vice President at the University | the investment companies served by The Vanguard |

| of Notre Dame; Assistant Professor of Finance at the | Group (1998–2008). | |

| Mendoza College of Business at Notre Dame; Member | | |

| of the Notre Dame 403(b) Investment Committee; | Kathryn J. Hyatt | |

| Director of TIFF Advisory Services, Inc. (investment | Born 1955. Treasurer Since November 2008. Principal |

| advisor); Member of the Investment Advisory | Occupation(s) During the Past Five Years: Principal of |

| Committees of the Financial Industry Regulatory | The Vanguard Group, Inc.; Treasurer of each of the |

| Authority (FINRA) and of Major League Baseball. | investment companies served by The Vanguard |