UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-07239 |

Name of Registrant: | Vanguard Horizon Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: September 30 | |

Date of reporting period: October 1, 2012 – September 30, 2013 |

Item 1: Reports to Shareholders | |

Annual Report | September 30, 2013

Vanguard Strategic Equity Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 9 |

| Fund Profile. | 11 |

| Performance Summary. | 12 |

| Financial Statements. | 14 |

| Your Fund’s After-Tax Returns. | 29 |

| About Your Fund’s Expenses. | 30 |

| Glossary. | 32 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship's wheel represents leadership and guidance, essential qualities in navigating difficult seas.

This one is a replica based on an 18th-century British vessel. The HMS Vanguard, another ship of that era, served as the

flagship for Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| |

| Fiscal Year Ended September 30, 2013 | |

| |

| | Total |

| | Returns |

| Vanguard Strategic Equity Fund | 32.23% |

| MSCI US Small + Mid Cap 2200 Index | 29.69 |

| Mid-Cap Core Funds Average | 27.58 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| September 30, 2012, Through September 30, 2013 | | | |

| |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Strategic Equity Fund | $21.02 | $27.34 | $0.350 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

Sluggish but sustained growth in the U.S. economy was enough to lift investor sentiment and push the broad stock market significantly higher during the fiscal year ended September 30, 2013. Small- and mid-capitalization stocks, the focus of Vanguard Strategic Equity Fund, gained even more than their large-cap counterparts as investors looked to these riskier investments for potentially greater returns.

The Strategic Equity Fund returned a very strong 32.23% for the 12 months, with all ten sectors posting double-digit gains. The fund’s result was more than two percentage points higher than the return of its benchmark, the MSCI US Small + Mid Cap 2200 Index, and more than four percentage points higher than the average return of its peer funds. Much of the outperformance came from the fund’s holdings in the industrial sector, although telecommunication services and health care made strong contributions as well.

Note: If you hold shares in a taxable account, you may wish to review the table of after-tax returns for the fiscal year, based on the highest federal income tax bracket, later in this report.

Stocks dodged obstacles to produce strong gains

Although their path wasn’t always smooth, U.S. stocks powered to a return of about 22% for the 12 months ended September 30. The U.S. economy

2

delivered only modest growth over the fiscal year, but investors’ appetite for stocks seemed to increase faster than companies’ profits.

In mid-September, U.S. stocks jumped when the Federal Reserve surprised investors by announcing that it had no immediate plans to unwind its stimulative bond-buying program. But in the waning days of that month, stocks slid ahead of the partial federal government shutdown that began October 1.

It’s natural for investors to be concerned by the situation in Washington. But as Sarah Hammer, a senior analyst in Vanguard Investment Strategy Group, noted in the midst of the temporary shutdown, they shouldn’t be unduly influenced by these events. “Investors are often best served by sticking to their long-term investment plans and avoiding short-term decisions based on the legislative outlook,” Ms. Hammer said. Our recurrent advice to stick to your plan may lack pizzazz, but it’s proven to be sound counsel over the decades.

International stocks generally posted strong results. Emerging market stocks, however, lagged amid worries about slowing economic growth.

Bond returns were negative despite September’s bounce

Investor concern about the Fed’s potential scaling back of its bond-buying program also affected the performance of bonds, which posted declines for the year. In

| | | |

| Market Barometer | | | |

| |

| | Average Annual Total Returns |

| | Periods Ended September 30, 2013 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 20.91% | 16.64% | 10.53% |

| Russell 2000 Index (Small-caps) | 30.06 | 18.29 | 11.15 |

| Russell 3000 Index (Broad U.S. market) | 21.60 | 16.76 | 10.58 |

| MSCI All Country World Index ex USA (International) | 16.48 | 5.95 | 6.26 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | -1.68% | 2.86% | 5.41% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -2.21 | 3.24 | 5.98 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.07 | 0.07 | 0.14 |

| |

| CPI | | | |

| Consumer Price Index | 1.18% | 2.34% | 1.37% |

3

September, however, bonds trimmed their losses after the Fed said it would continue the purchases.

The broad U.S. taxable bond market returned –1.68% for the fiscal year, and the yield of the 10-year Treasury note closed at 2.63%, down from 2.76% a month earlier. (Bond yields and prices move in opposite directions.) Municipal bonds returned –2.21% after rebounding a bit in September.

Money markets and savings accounts barely budged as the Fed’s target for short-term interest rates remained between 0% and 0.25%.

Industrials gave an outsized boost to 12-month performance

Like other funds that employ a quantitative investment strategy, Vanguard Strategic Equity Fund relies on a computer model to drive its stock selection process. What that model is looking for as it scans the mid- and small-cap segment of the U.S. market reflects the convictions of your fund’s advisor, Vanguard Equity Investment Group, about which characteristics of a stock are most predictive of future outperformance. Specifically, the fund’s model tries to identify companies with attractive valuations, positive earnings momentum, and strong balance sheets. At the same time, it tries not to stray

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer Group |

| | Fund | Average |

| Strategic Equity Fund | 0.29% | 1.23% |

The fund expense ratio shown is from the prospectus dated January 25, 2013, and represents estimated costs for the current fiscal year. For

the fiscal year ended September 30, 2013, the fund’s expense ratio was 0.28%. The peer-group expense ratio is derived from data provided

by Lipper, a Thomson Reuters Company, and captures information through year-end 2012.

Peer group: Mid-Cap Core Funds.

4

very far from the sector weightings of the benchmark. That process resulted in the fund’s holding about 440 stocks at the end of the fiscal year, compared with about 2,170 in its benchmark.

The advisor’s quantitative analysis proved particularly successful among industrial stocks, which accounted for roughly half of the fund’s advantage over the index. Airline holdings were among the top performers. There has been some consolidation in the industry leading to fuller flights, less intense competition, and higher ticket prices, all meaning opportunity for higher profit margins. Manufacturers of construction and industrial machinery stood out as well in this sector.

The telecommunication services sector represents a very small portion of the mid- and small-cap market, but strong gains for a few service providers nevertheless gave a significant boost to the fund’s return versus its benchmark.

| |

| Total Returns | |

| Ten Years Ended September 30, 2013 | |

| | Average |

| | Annual Return |

| Strategic Equity Fund | 9.12% |

| MSCI US Small + Mid Cap 2200 Index | 10.77 |

| Mid-Cap Core Funds Average | 9.20 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

5

| Investment insight | |

| Don’t let a trick of the calendar alter your course | |

| When making investment decisions, it’s important to weigh past returns with caution. |

| That’s because investment returns from any particular period are an unreliable anchor |

| for gauging the future. They can be highly date-dependent. | |

| |

| For example, take the five-year average annual return for the broad U.S. stock |

| market. That average just made a startling bounce: from 1.30% for the period |

| ended September 30, 2012, to 10.58% for the period ended September 30, 2013. |

| True, the market returned a hearty 21.60% in the most recent 12 months, but that’s |

| not enough to explain such a big leap in the average. Significantly, the year ended |

| September 30, 2008––when U.S. stocks returned –21.52% during the financial |

| crisis––has now rolled off the five-year calculation. | |

| |

| The important thing to remember is that historical returns are just that: historical. |

| Basing investment decisions on such date-dependent snapshots could easily lead |

| you to alter course––possibly in the wrong direction. Instead, Vanguard believes, you |

| should build your asset allocation strategy on long-term risk-and-return relationships, |

| always recognizing that no level of return is guaranteed. | |

| |

| Which five-year average should you count on? | |

| (Answer: None of them!) | |

| Average annual returns for U.S. stocks over five-year periods ended September 30 |

| |

| 2007 | 16.18% |

| 2008 | 5.70 |

| 2009 | 1.56 |

| 2010 | 0.92 |

| 2011 | –0.92 |

| 2012 | 1.30 |

| 2013 | 10.58 |

| Note: The U.S. stock market is represented by the Russell 3000 Index. |

| Source: Vanguard. |

6

In addition, the advisor found pockets of success among biopharmaceuticals, food and drug retailers, and computer storage and software companies.

Stock selection was less successful in materials, utilities, and, especially, energy. Some of the fund’s holdings in the oil and gas drilling segment did well, and avoiding coal stocks also helped. However, disappointments among oil and gas refiners and some companies involved in exploration and production caused the fund to lag its benchmark in this sector.

A challenging decade for quantitative funds

As all seasoned investors can tell you, any given investment strategy tends to work better under some market conditions than others. Quantitative funds in general struggled during the financial crisis, when the stock market dropped sharply across the board, and then post-crisis, when the overall market rebounded. That’s not surprising, as the advisors of quantitative funds use computer models to identify individual stocks that they believe are likely to perform better than their peers over time. This strategy has worked better in recent years, when stocks have generally moved less in lock-step with one another as investors focused more closely on the merits of individual companies.

So although the fund has outpaced both its benchmark and the average return of peer funds in each of the last three fiscal years, its average annual return over the past decade has lagged that of the index, 9.12% to 10.77%. The fund was just a step behind the 9.20% average for its peer group, which includes actively managed funds that do not use a quantitative approach.

Staying out of the rough by staying the course

Back in September 2008, global financial markets were stunned by the collapse of Lehman Brothers, which transformed the economic downturn already under way into the Great Recession. Fast-forward to 2013: The U.S. economy is growing, albeit slowly, and stock markets have set record highs.

When headlines are blaring and stock markets are sinking, it’s human nature to be tempted to head for the exits. But it’s important to stick with the principles of balance and diversification—and the portfolio asset allocation you established to meet your long-term goals. Bonds can provide ballast if stock prices keep falling, and, by remaining in the stock market, you will be able to participate when stocks begin to recover.

The benefit of staying the course was confirmed in a recent analysis of the performance of more than 58,000 self-directed Vanguard IRA® investors over the five years ended December 31, 2012. Vanguard compared actual returns earned by each investor with the hypothetical results of personalized index benchmarks, taking into consideration investors’ beginning and ending balances and any intervening cash flow.

7

The key finding: Those who stayed with their investment plans earned five-year returns commensurate with the calculated benchmarks, generally outperforming those who changed course. Investors who reacted to market events were much more likely to miss out on potential returns. (You can read more in Most Vanguard IRA Investors Shot Par by Staying the Course: 2008–2012 at vanguard.com/research.)

The results for the five years through 2012 are a good reminder that sticking with a simple, broad-based portfolio—even amid a financial tempest—can help minimize the chances of making a mistake that can reduce returns.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

October 16, 2013

8

Advisor’s Report

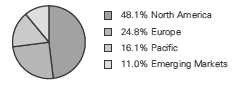

For the fiscal year ended September 30, 2013, Vanguard Strategic Equity Fund rewarded investors with a total return of 32.23%, outperforming its benchmark by 2.54 percentage points. While the broad U.S. equity market delivered a robust return above 20%, small-capitalization stocks outpaced larger-cap equities by around 10 percentage points. The U.S. equity market provided returns similar to those from other developed countries; emerging-market returns were basically flat.

The gains within our benchmark index were broad-based, coming from all ten sectors. Results were best in industrials, consumer discretionary, and consumer staples. The utilities and materials sectors were the laggards for the period, although their returns were positive.

Investors seemed to gain confidence at the start of the fiscal year as economic data around the world continued to improve, albeit at a snail’s pace. Here in the United States, the housing market continued its recovery, the unemployment rate slowly decreased, corporate balance sheets were strong, and profits held up. And the longer-term economic outlook was one of cautious optimism, with GDP growth expected to accelerate in 2014 and 2015.

More recently, however, macroeconomic events grabbed the headlines, which translated into greater market volatility. The Federal Reserve’s mixed signals on tapering its quantitative easing program, a jump in interest rates, and the budget deadlock between Congress and the White House that threatened to shut down the federal government (and did so on October 1) left investors guessing about the market’s prospects for the near term.

Although such dramas influence stock performance in the short term, we believe that long-term investing requires a focus on the underlying factors that influence companies’ growth.

Our investment approach is not unlike that of traditional fundamental managers, in that we employ a combination of valuation and other basic measures in assessing stocks. However, we do this through a strict quantitative process that compares all the stocks in our investment universe to highlight those with the potential to outperform the rest over the long run.

As we construct a portfolio based on the results from our model, we seek to minimize deviations from the benchmark’s characteristics in areas where we think there would be no reward. We believe that this metrics-focused process enables us to take advantage of inefficiencies in the market caused by biases in investor behavior.

9

Our model’s effectiveness across sectors was pleasing over the fiscal year, as our stock selection produced above-benchmark gains in seven of the ten sectors. The strongest relative results came from selection in industrials, telecommunication services, and health care. Selection results were negative in materials, utilities, and energy.

At the individual stock level, the largest contributors were overweight positions in Delta Air Lines, Virgin Media, Western Digital, and Rite Aid. In addition, we benefited in relative terms from underweighting or avoiding poorly performing stocks such as American Capital Agency and Royal Gold.

Unfortunately, we were not able to avoid all bad performers. Overweight positions in Energy XXI, CF Industries, and IAC/InterActiveCorp detracted from performance. Also, underweighting certain companies that our model’s metrics did not highlight, such as Netflix and Tesla Motors, reduced our outperformance relative to our benchmark.

Overall, the increased volatility we have seen in the markets is not surprising, considering how quickly stocks had been rising domestically and internationally. Markets will always be subject to

fluctuations brought on by new headline risks. We find that often there is too much focus on these typical market gyrations, the latest economic news, and short-term performance, and not enough on the fundamental principles that give investors the best chance of success.

Strategies such as ours shift the focus back to fundamentals by seeking to capture the spread between undervalued and overvalued stocks, which we believe will provide worthwhile returns for long-term investors. With that in mind, we believe that equity exposure will continue to play an important part of a diversified investment plan.

We thank you for your investment and look forward to the new fiscal year.

Portfolio Managers:

James D. Troyer, CFA, Principal

James P. Stetler, Principal

Michael R. Roach, CFA

Vanguard Equity Investment Group

October 18, 2013

10

Strategic Equity Fund

Fund Profile

As of September 30, 2013

| | | |

| Portfolio Characteristics | | |

| | | MSCI US | |

| | | Small + | DJ U.S |

| | | Mid Cap | Total |

| | | 2200 | Market |

| | Fund | Index | FA Index |

| Number of Stocks | 437 | 2,172 | 3,636 |

| Median Market Cap | $4.4B | $5.2B | $40.2B |

| Price/Earnings Ratio | 19.2x | 26.1x | 19.5x |

| Price/Book Ratio | 2.6x | 2.4x | 2.5x |

| Return on Equity | 11.6% | 11.4% | 16.5% |

| Earnings Growth Rate | 15.1% | 11.1% | 11.1% |

| Dividend Yield | 1.5% | 1.4% | 1.9% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | 64% | — | — |

| Ticker Symbol | VSEQX | — | — |

| Expense Ratio1 | 0.29% | — | — |

| 30-Day SEC Yield | 1.20% | — | — |

| Short-Term Reserves | 0.3% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | MSCI US | DJ U.S. |

| | | Small + | Total |

| | | Mid Cap | Market |

| | | 2200 | FA |

| | Fund | Index | Index |

| Consumer Discretionary | 16.0% | 16.9% | 13.3% |

| Consumer Staples | 5.3 | 4.4 | 8.7 |

| Energy | 6.0 | 6.6 | 9.6 |

| Financials | 19.7 | 20.0 | 17.3 |

| Health Care | 11.4 | 11.3 | 12.6 |

| Industrials | 14.8 | 14.3 | 11.4 |

| Information Technology | 16.0 | 15.4 | 17.9 |

| Materials | 5.8 | 5.8 | 3.8 |

| Telecommunication | | | |

| Services | 0.3 | 0.8 | 2.2 |

| Utilities | 4.7 | 4.5 | 3.2 |

| | |

| Volatility Measures | | |

| | MSCI US | |

| | Small + | |

| | Mid Cap | DJ U.S. |

| | 2200 | Total Market |

| | Index | FA Index |

| R-Squared | 0.98 | 0.94 |

| Beta | 1.04 | 1.22 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Delta Air Lines Inc. | Airlines | 1.2% |

| O'Reilly Automotive Inc. | Automotive Retail | 1.1 |

| Fidelity National | Data Processing & | |

| Information Services Inc. Outsourced Services | 1.0 |

| Western Digital Corp. | Computer Storage & | |

| | Peripherals | 1.0 |

| Seagate Technology plc | Computer Storage & | |

| | Peripherals | 1.0 |

| Alliance Data Systems | Data Processing & | |

| Corp. | Outsourced Services | 0.9 |

| ResMed Inc. | Health Care | |

| | Equipment | 0.9 |

| Core Laboratories NV | Oil & Gas Equipment | |

| | & Services | 0.9 |

| Mylan Inc. | Pharmaceuticals | 0.9 |

| Omnicare Inc. | Health Care Services | 0.9 |

| Top Ten | | 9.8% |

| The holdings listed exclude any temporary cash investments and equity index products. |

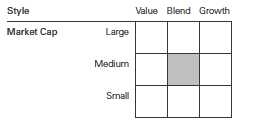

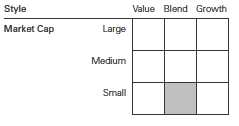

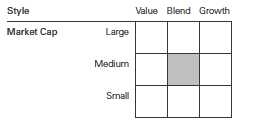

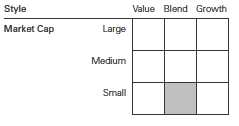

Investment Focus

1 The expense ratio shown is from the prospectus dated January 25, 2013, and represents estimated costs for the current fiscal year. For the fiscal year ended September 30, 2013, the expense ratio was 0.28%.

11

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

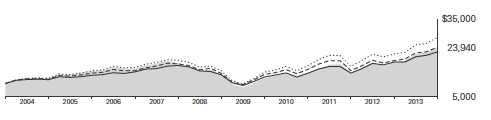

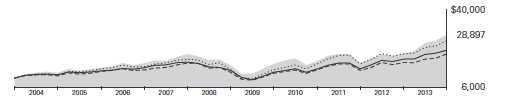

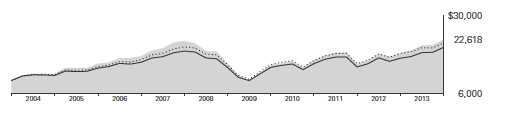

Cumulative Performance: September 30, 2003, Through September 30, 2013

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended September 30, 2013 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Strategic Equity Fund* | 32.23% | 12.37% | 9.12% | $23,940 |

| | MSCI US Small + Mid Cap 2200 | | | | |

| •••••••• | Index | 29.69 | 13.31 | 10.77 | 27,810 |

| – – – – | Mid-Cap Core Funds Average | 27.58 | 11.59 | 9.20 | 24,113 |

| | Dow Jones U.S. Total Stock Market | | | | |

| | Float Adjusted Index | 21.44 | 10.69 | 8.32 | 22,235 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

See Financial Highlights for dividend and capital gains information.

12

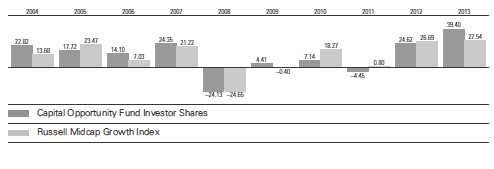

Strategic Equity Fund

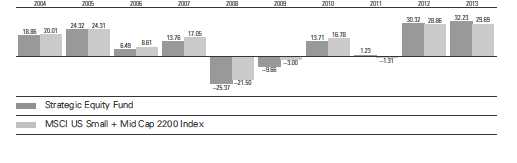

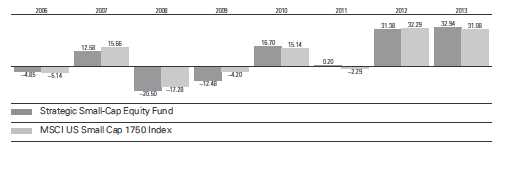

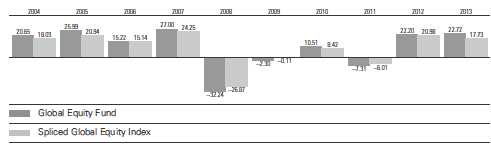

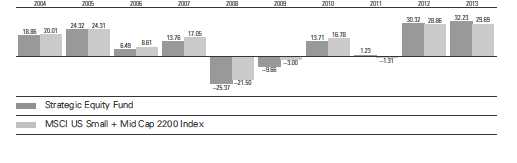

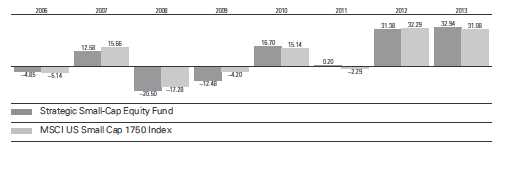

Fiscal-Year Total Returns (%): September 30, 2003, Through September 30, 2013

13

Strategic Equity Fund

Financial Statements

Statement of Net Assets

As of September 30, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (99.6%)1 | | |

| Consumer Discretionary (15.9%) | |

| * | O’Reilly Automotive Inc. | 349,300 | 44,567 |

| | Domino’s Pizza Inc. | 498,520 | 33,874 |

| | Gannett Co. Inc. | 1,114,500 | 29,857 |

| | GameStop Corp. Class A | 570,900 | 28,345 |

| | Dillard’s Inc. Class A | 337,170 | 26,400 |

| | Buckle Inc. | 445,000 | 24,052 |

| | PetSmart Inc. | 287,800 | 21,948 |

| | Brinker International Inc. | 516,950 | 20,952 |

| ^ | Sturm Ruger & Co. Inc. | 299,800 | 18,776 |

| | Hanesbrands Inc. | 262,800 | 16,375 |

| * | Conn’s Inc. | 283,900 | 14,206 |

| *,^ | Smith & Wesson | | |

| | Holding Corp. | 1,284,100 | 14,112 |

| * | Tenneco Inc. | 277,995 | 14,039 |

| | Wyndham Worldwide Corp. | 226,100 | 13,785 |

| * | Starz | 472,900 | 13,303 |

| | Hasbro Inc. | 268,000 | 12,633 |

| | Polaris Industries Inc. | 92,482 | 11,947 |

| | Foot Locker Inc. | 340,000 | 11,540 |

| * | Grand Canyon | | |

| | Education Inc. | 256,000 | 10,312 |

| * | Jack in the Box Inc. | 255,500 | 10,220 |

| | Thor Industries Inc. | 172,100 | 9,989 |

| * | Outerwall Inc. | 197,990 | 9,897 |

| | PulteGroup Inc. | 598,500 | 9,875 |

| *,^ | Hovnanian Enterprises | | |

| | Inc. Class A | 1,880,200 | 9,833 |

| * | Cabela’s Inc. | 150,300 | 9,473 |

| | Brown Shoe Co. Inc. | 401,600 | 9,426 |

| | Starwood Hotels & | | |

| | Resorts Worldwide Inc. | 141,200 | 9,383 |

| * | Goodyear Tire & | | |

| | Rubber Co. | 409,700 | 9,198 |

| * | ANN Inc. | 253,400 | 9,178 |

| | Best Buy Co. Inc. | 242,500 | 9,094 |

| | Whirlpool Corp. | 59,800 | 8,757 |

| | Dana Holding Corp. | 373,000 | 8,519 |

| | | |

| | Cheesecake Factory Inc. | 185,500 | 8,153 |

| * | TRW Automotive | | |

| | Holdings Corp. | 106,400 | 7,587 |

| * | Charter Communications | | |

| | Inc. Class A | 55,800 | 7,520 |

| | Newell Rubbermaid Inc. | 261,600 | 7,194 |

| | Brunswick Corp. | 177,100 | 7,068 |

| | Genuine Parts Co. | 85,000 | 6,876 |

| * | LeapFrog Enterprises Inc. | 702,400 | 6,617 |

| | Lear Corp. | 86,400 | 6,184 |

| | Delphi Automotive plc | 99,000 | 5,784 |

| * | Red Robin Gourmet | | |

| | Burgers Inc. | 81,100 | 5,766 |

| | Service Corp. International | 302,600 | 5,634 |

| | Abercrombie & Fitch Co. | 154,800 | 5,475 |

| | H&R Block Inc. | 200,900 | 5,356 |

| | Cracker Barrel Old | | |

| | Country Store Inc. | 50,400 | 5,203 |

| * | Bloomin’ Brands Inc. | 217,100 | 5,126 |

| * | MGM Resorts International | 244,500 | 4,998 |

| * | AMC Networks Inc. Class A | 68,200 | 4,670 |

| | Regal Entertainment Group | | |

| | Class A | 234,400 | 4,449 |

| | Tupperware Brands Corp. | 48,800 | 4,215 |

| * | Visteon Corp. | 52,600 | 3,979 |

| | Rent-A-Center Inc. | 103,400 | 3,940 |

| | Leggett & Platt Inc. | 118,200 | 3,564 |

| * | Overstock.com Inc. | 113,800 | 3,376 |

| | Meredith Corp. | 68,200 | 3,248 |

| | Mattel Inc. | 76,800 | 3,215 |

| * | News Corp. Class A | 196,700 | 3,159 |

| | BorgWarner Inc. | 29,900 | 3,032 |

| * | Fossil Group Inc. | 24,600 | 2,859 |

| * | Bally Technologies Inc. | 36,300 | 2,616 |

| * | Lamar Advertising Co. | | |

| | Class A | 53,300 | 2,507 |

| * | Liberty Interactive Corp. | | |

| | Class A | 104,300 | 2,448 |

| * | Lumber Liquidators | | |

| | Holdings Inc. | 22,100 | 2,357 |

14

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | International Game | | |

| | Technology | 115,000 | 2,177 |

| * | Madison Square | | |

| | Garden Co. Class A | 37,400 | 2,172 |

| | Gentex Corp. | 84,400 | 2,160 |

| | Washington Post Co. | | |

| | Class B | 3,500 | 2,140 |

| * | Tower International Inc. | 102,600 | 2,051 |

| | NACCO Industries Inc. | | |

| | Class A | 34,000 | 1,884 |

| * | Journal Communications | | |

| | Inc. Class A | 215,261 | 1,840 |

| * | Marriott Vacations | | |

| | Worldwide Corp. | 41,500 | 1,826 |

| | OfficeMax Inc. | 69,750 | 892 |

| | | | 675,182 |

| Consumer Staples (5.3%) | | |

| | JM Smucker Co. | 338,200 | 35,525 |

| | Ingredion Inc. | 328,600 | 21,743 |

| * | Rite Aid Corp. | 3,880,900 | 18,473 |

| | Clorox Co. | 193,200 | 15,788 |

| | Dean Foods Co. | 761,852 | 14,704 |

| | Tyson Foods Inc. Class A | 436,100 | 12,333 |

| | Energizer Holdings Inc. | 134,900 | 12,296 |

| * | SUPERVALU Inc. | 1,331,700 | 10,960 |

| | Herbalife Ltd. | 143,178 | 9,990 |

| | Coca-Cola Enterprises Inc. | 246,700 | 9,920 |

| | Lancaster Colony Corp. | 108,519 | 8,496 |

| | Universal Corp. | 157,800 | 8,037 |

| | Nu Skin Enterprises Inc. | | |

| | Class A | 80,300 | 7,688 |

| | Sanderson Farms Inc. | 116,800 | 7,620 |

| * | Green Mountain Coffee | | |

| | Roasters Inc. | 88,400 | 6,659 |

| * | USANA Health | | |

| | Sciences Inc. | 65,700 | 5,702 |

| * | Pilgrim’s Pride Corp. | 299,200 | 5,024 |

| | Molson Coors Brewing | | |

| | Co. Class B | 80,600 | 4,040 |

| | Safeway Inc. | 125,300 | 4,008 |

| | Dr Pepper Snapple | | |

| | Group Inc. | 84,700 | 3,796 |

| * | WhiteWave Foods Co. | | |

| | Class A | 154,906 | 3,093 |

| | | | 225,895 |

| Energy (6.0%) | | |

| ^ | Core Laboratories NV | 224,800 | 38,038 |

| | Helmerich & Payne Inc. | 501,192 | 34,557 |

| ^ | Western Refining Inc. | 841,400 | 25,276 |

| | Cabot Oil & Gas Corp. | 572,800 | 21,377 |

| * | Ultra Petroleum Corp. | 875,100 | 18,001 |

| | Delek US Holdings Inc. | 595,000 | 12,548 |

| | HollyFrontier Corp. | 284,100 | 11,963 |

| * | Exterran Holdings Inc. | 393,800 | 10,857 |

| | | |

| * | Stone Energy Corp. | 323,212 | 10,482 |

| * | EPL Oil & Gas Inc. | 280,200 | 10,398 |

| | CVR Energy Inc. | 208,400 | 8,028 |

| | Cimarex Energy Co. | 75,000 | 7,230 |

| * | Denbury Resources Inc. | 369,800 | 6,808 |

| | EXCO Resources Inc. | 799,900 | 5,391 |

| | Bristow Group Inc. | 57,500 | 4,184 |

| * | Matador Resources Co. | 238,400 | 3,893 |

| * | Hornbeck Offshore | | |

| | Services Inc. | 52,900 | 3,039 |

| | Oceaneering | | |

| | International Inc. | 37,000 | 3,006 |

| * | Oasis Petroleum Inc. | 55,000 | 2,702 |

| ^ | PBF Energy Inc. Class A | 111,800 | 2,510 |

| * | Hercules Offshore Inc. | 326,000 | 2,403 |

| | SM Energy Co. | 28,700 | 2,215 |

| | Alon USA Energy Inc. | 204,900 | 2,092 |

| | RPC Inc. | 129,400 | 2,002 |

| | Diamond Offshore | | |

| | Drilling Inc. | 29,300 | 1,826 |

| | Patterson-UTI Energy Inc. | 78,200 | 1,672 |

| | Berry Petroleum Co. | | |

| | Class A | 18,800 | 811 |

| | | | 253,309 |

| Financials (19.6%) | | |

| | Huntington | | |

| | Bancshares Inc. | 4,332,800 | 35,789 |

| | Torchmark Corp. | 443,795 | 32,109 |

| | Regions Financial Corp. | 3,239,100 | 29,994 |

| | KeyCorp | 2,599,930 | 29,639 |

| | Discover Financial | | |

| | Services | 569,925 | 28,804 |

| * | Portfolio Recovery | | |

| | Associates Inc. | 455,000 | 27,273 |

| * | World Acceptance Corp. | 257,019 | 23,111 |

| | Comerica Inc. | 572,300 | 22,497 |

| | XL Group plc Class A | 729,400 | 22,480 |

| * | Arch Capital Group Ltd. | 409,826 | 22,184 |

| | Host Hotels & | | |

| | Resorts Inc. | 1,142,900 | 20,195 |

| | Moody’s Corp. | 261,900 | 18,419 |

| | East West Bancorp Inc. | 540,100 | 17,256 |

| | Plum Creek | | |

| | Timber Co. Inc. | 363,200 | 17,009 |

| | Protective Life Corp. | 378,900 | 16,122 |

| | Kimco Realty Corp. | 759,500 | 15,327 |

| | Extra Space Storage Inc. | 313,540 | 14,344 |

| | Corrections Corp. of | | |

| | America | 408,532 | 14,115 |

| | Platinum Underwriters | | |

| | Holdings Ltd. | 231,400 | 13,822 |

| | Allied World Assurance | | |

| | Co. Holdings AG | 135,200 | 13,438 |

| | PartnerRe Ltd. | 141,000 | 12,907 |

15

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Retail Properties of | | |

| | America Inc. | 900,500 | 12,382 |

| * | Popular Inc. | 459,300 | 12,047 |

| | Geo Group Inc. | 357,100 | 11,874 |

| | Omega Healthcare | | |

| | Investors Inc. | 388,900 | 11,616 |

| | Sunstone Hotel | | |

| | Investors Inc. | 881,000 | 11,224 |

| | Weingarten Realty | | |

| | Investors | 374,500 | 10,984 |

| | National Retail | | |

| | Properties Inc. | 340,000 | 10,819 |

| | EPR Properties | 215,200 | 10,489 |

| ^ | Lexington Realty Trust | 912,700 | 10,250 |

| | Brandywine Realty Trust | 757,032 | 9,978 |

| * | Credit Acceptance Corp. | 89,022 | 9,865 |

| | Regency Centers Corp. | 202,700 | 9,801 |

| | Everest Re Group Ltd. | 67,000 | 9,742 |

| | Apartment Investment & | | |

| | Management Co. Class A | 338,700 | 9,463 |

| | Pennsylvania REIT | 482,400 | 9,021 |

| | American Financial | | |

| | Group Inc. | 164,689 | 8,903 |

| | Medical Properties | | |

| | Trust Inc. | 683,200 | 8,315 |

| | Ryman Hospitality | | |

| | Properties Inc. | 240,500 | 8,300 |

| | Post Properties Inc. | 181,700 | 8,180 |

| | Lincoln National Corp. | 187,000 | 7,852 |

| | Nelnet Inc. Class A | 203,912 | 7,840 |

| | Unum Group | 256,300 | 7,802 |

| | Associated Banc-Corp | 464,200 | 7,190 |

| | Primerica Inc. | 166,100 | 6,700 |

| * | Howard Hughes Corp. | 58,800 | 6,607 |

| | Montpelier Re | | |

| | Holdings Ltd. | 244,300 | 6,364 |

| | HCC Insurance | | |

| | Holdings Inc. | 140,200 | 6,144 |

| | CoreSite Realty Corp. | 164,300 | 5,576 |

| | Umpqua Holdings Corp. | 338,000 | 5,482 |

| * | St. Joe Co. | 243,900 | 4,785 |

| | Provident Financial | | |

| | Services Inc. | 293,425 | 4,756 |

| | Washington Federal Inc. | 225,400 | 4,661 |

| | RLJ Lodging Trust | 196,100 | 4,606 |

| | Sovran Self Storage Inc. | 59,800 | 4,526 |

| | Cathay General Bancorp | 185,510 | 4,335 |

| | Realty Income Corp. | 105,600 | 4,198 |

| | Susquehanna | | |

| | Bancshares Inc. | 324,800 | 4,076 |

| | CNO Financial Group Inc. | 277,200 | 3,992 |

| | Axis Capital Holdings Ltd. | 91,400 | 3,959 |

| | StanCorp Financial | | |

| | Group Inc. | 65,800 | 3,620 |

| | Inland Real Estate Corp. | 342,300 | 3,502 |

| | | |

| | PrivateBancorp Inc. | 152,500 | 3,263 |

| | RenaissanceRe | | |

| | Holdings Ltd. | 35,500 | 3,214 |

| | Home Properties Inc. | 55,500 | 3,205 |

| | Principal Financial Group Inc. | 70,900 | 3,036 |

| | Zions Bancorporation | 103,800 | 2,846 |

| | UDR Inc. | 120,000 | 2,844 |

| | CBOE Holdings Inc. | 61,900 | 2,800 |

| | Stewart Information | | |

| | Services Corp. | 77,400 | 2,476 |

| | Spirit Realty Capital Inc. | 259,600 | 2,383 |

| | Flagstar Bancorp Inc. | 157,100 | 2,319 |

| | Webster Financial Corp. | 90,500 | 2,310 |

| | Ramco-Gershenson | | |

| | Properties Trust | 148,300 | 2,285 |

| | Federated Investors Inc. | | |

| | Class B | 83,100 | 2,257 |

| | Sabra Health Care REIT Inc. | 97,500 | 2,243 |

| | Apollo Residential | | |

| | Mortgage Inc. | 153,400 | 2,238 |

| | MB Financial Inc. | 78,700 | 2,222 |

| * | First Cash Financial | | |

| | Services Inc. | 37,300 | 2,162 |

| | Highwoods Properties Inc. | 61,000 | 2,154 |

| | STAG Industrial Inc. | 104,300 | 2,099 |

| | First Niagara Financial | | |

| | Group Inc. | 201,000 | 2,084 |

| | Hancock Holding Co. | 64,400 | 2,021 |

| * | MSCI Inc. Class A | 50,000 | 2,013 |

| | Home Loan Servicing | | |

| | Solutions Ltd. | 90,900 | 2,001 |

| | Equity Lifestyle | | |

| | Properties Inc. | 57,200 | 1,955 |

| | BioMed Realty Trust Inc. | 104,700 | 1,946 |

| | First Horizon National Corp. | 169,900 | 1,867 |

| | Douglas Emmett Inc. | 78,900 | 1,852 |

| | Aspen Insurance | | |

| | Holdings Ltd. | 49,700 | 1,804 |

| | Oritani Financial Corp. | 94,900 | 1,562 |

| | Bancfirst Corp. | 25,783 | 1,394 |

| | Republic Bancorp Inc. | | |

| | Class A | 50,311 | 1,386 |

| | MFA Financial Inc. | 92,300 | 688 |

| | American Capital | | |

| | Agency Corp. | 21,300 | 481 |

| | | | 830,070 |

| Health Care (11.4%) | | |

| ^ | ResMed Inc. | 740,783 | 39,128 |

| * | Mylan Inc. | 986,300 | 37,647 |

| | Omnicare Inc. | 672,100 | 37,302 |

| | AmerisourceBergen Corp. | | |

| | Class A | 434,504 | 26,548 |

| * | Cyberonics Inc. | 370,500 | 18,799 |

| * | Endo Health Solutions Inc. | 408,300 | 18,553 |

| * | Isis Pharmaceuticals Inc. | 486,200 | 18,252 |

16

| | | | |

| Strategic Equity Fund | | | |

| |

| |

| |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| * | Celldex Therapeutics Inc. | 475,600 | 16,850 |

| * | Thoratec Corp. | | 400,200 | 14,923 |

| * | Covance Inc. | | 172,600 | 14,923 |

| * | Magellan Health | | | |

| | Services Inc. | | 237,100 | 14,217 |

| * | Charles River Laboratories | | |

| | International Inc. | | 286,100 | 13,235 |

| | West Pharmaceutical | | | |

| | Services Inc. | | 313,600 | 12,905 |

| * | Sirona Dental Systems Inc. | 171,600 | 11,485 |

| * | Boston Scientific Corp. | 925,000 | 10,859 |

| ^ | PDL BioPharma Inc. | 1,344,400 | 10,715 |

| * | PAREXEL | | | |

| | International Corp. | | 202,200 | 10,156 |

| * | Centene Corp. | | 130,300 | 8,334 |

| * | Santarus Inc. | | 368,800 | 8,324 |

| * | Seattle Genetics Inc. | | 184,900 | 8,104 |

| * | Brookdale Senior Living Inc. | | |

| | Class A | | 304,700 | 8,014 |

| * | United Therapeutics Corp. | 95,600 | 7,538 |

| * | CareFusion Corp. | | 191,100 | 7,052 |

| *,^ | Myriad Genetics Inc. | | 298,600 | 7,017 |

| * | NPS Pharmaceuticals Inc. | 218,700 | 6,957 |

| * | Bruker Corp. | | 323,400 | 6,678 |

| ^ | Chemed Corp. | | 88,700 | 6,342 |

| * | Salix Pharmaceuticals Ltd. | 79,200 | 5,297 |

| *,^ | Bio-Reference Labs Inc. | 170,700 | 5,101 |

| * | Quintiles Transnational | | |

| | Holdings Inc. | | 107,100 | 4,807 |

| * | Life Technologies Corp. | 61,200 | 4,580 |

| * | Medicines Co. | | 125,675 | 4,213 |

| * | Mettler-Toledo | | | |

| | International Inc. | | 16,300 | 3,913 |

| * | Vertex Pharmaceuticals Inc. | 49,400 | 3,746 |

| * | Molina Healthcare Inc. | 94,000 | 3,346 |

| | Universal Health | | | |

| | Services Inc. Class B | 44,000 | 3,300 |

| *,^ | Arena Pharmaceuticals Inc. | 621,200 | 3,274 |

| * | Nektar Therapeutics | | 302,900 | 3,165 |

| * | Alkermes plc | | 92,900 | 3,123 |

| * | Henry Schein Inc. | | 30,000 | 3,111 |

| | Warner Chilcott plc Class A | 132,100 | 3,018 |

| | Ensign Group Inc. | | 67,000 | 2,754 |

| * | MedAssets Inc. | | 97,900 | 2,489 |

| * | Align Technology Inc. | | 48,800 | 2,348 |

| * | VCA Antech Inc. | | 85,400 | 2,345 |

| | HealthSouth Corp. | | 68,260 | 2,354 |

| | Select Medical | | | |

| | Holdings Corp. | | 279,300 | 2,254 |

| * | Health Management | | | |

| | Associates Inc. Class A | 162,800 | 2,084 |

| * | Health Net Inc. | | 64,500 | 2,045 |

| * | Cubist Pharmaceuticals Inc. | 31,800 | 2,021 |

| | Questcor | | | |

| | Pharmaceuticals Inc. | | 30,500 | 1,769 |

| | | |

| * | Auxilium | | |

| | Pharmaceuticals Inc. | 92,500 | 1,686 |

| * | Gentiva Health | | |

| | Services Inc. | 104,400 | 1,257 |

| * | SurModics Inc. | 30,200 | 718 |

| | | | 480,975 |

| Industrials (14.7%) | | |

| | Delta Air Lines Inc. | 2,180,400 | 51,436 |

| | Dun & Bradstreet Corp. | 341,300 | 35,444 |

| | L-3 Communications | | |

| | Holdings Inc. | 356,700 | 33,708 |

| | Huntington Ingalls | | |

| | Industries Inc. | 478,000 | 32,217 |

| | Cintas Corp. | 568,900 | 29,128 |

| * | US Airways Group Inc. | 1,507,900 | 28,590 |

| | EnerSys Inc. | 448,557 | 27,196 |

| | Trinity Industries Inc. | 577,500 | 26,190 |

| | AO Smith Corp. | 568,200 | 25,683 |

| | Towers Watson & Co. | | |

| | Class A | 205,100 | 21,937 |

| | Flowserve Corp. | 340,800 | 21,262 |

| | Alaska Air Group Inc. | 319,490 | 20,006 |

| * | USG Corp. | 679,300 | 19,414 |

| | Alliant Techsystems Inc. | 151,700 | 14,800 |

| | Rockwell Collins Inc. | 177,700 | 12,059 |

| | Lincoln Electric | | |

| | Holdings Inc. | 163,600 | 10,899 |

| | Hyster-Yale Materials | | |

| | Handling Inc. | 105,600 | 9,469 |

| | Deluxe Corp. | 223,013 | 9,291 |

| | Fortune Brands Home & | | |

| | Security Inc. | 213,400 | 8,884 |

| | Steelcase Inc. Class A | 518,400 | 8,616 |

| | AMERCO | 45,740 | 8,422 |

| * | Taser International Inc. | 553,000 | 8,245 |

| | Masco Corp. | 378,900 | 8,063 |

| | Robert Half | | |

| | International Inc. | 179,300 | 6,998 |

| * | AECOM Technology Corp. | 218,900 | 6,845 |

| | Southwest Airlines Co. | 463,600 | 6,750 |

| | Nielsen Holdings NV | 184,700 | 6,732 |

| | Toro Co. | 119,200 | 6,478 |

| | ITT Corp. | 179,300 | 6,446 |

| * | Hertz Global Holdings Inc. | 274,000 | 6,072 |

| | Equifax Inc. | 94,600 | 5,662 |

| * | Oshkosh Corp. | 114,600 | 5,613 |

| | Exelis Inc. | 330,500 | 5,192 |

| * | B/E Aerospace Inc. | 66,800 | 4,931 |

| * | Hexcel Corp. | 125,400 | 4,865 |

| | Generac Holdings Inc. | 114,100 | 4,865 |

| | Standex International Corp. | 76,450 | 4,541 |

| | Lennox International Inc. | 55,000 | 4,139 |

| | Pall Corp. | 51,500 | 3,968 |

| | Manpowergroup Inc. | 53,400 | 3,884 |

| * | MRC Global Inc. | 141,900 | 3,803 |

17

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | RR Donnelley & Sons Co. | 230,000 | 3,634 |

| | Mueller Water | | |

| | Products Inc. Class A | 446,500 | 3,568 |

| * | Trex Co. Inc. | 68,700 | 3,403 |

| | AGCO Corp. | 55,000 | 3,323 |

| | Manitowoc Co. Inc. | 156,800 | 3,070 |

| | GATX Corp. | 61,400 | 2,918 |

| * | Jacobs Engineering | | |

| | Group Inc. | 49,000 | 2,851 |

| | Mueller Industries Inc. | 48,800 | 2,717 |

| * | Spirit Airlines Inc. | 75,000 | 2,570 |

| | ADT Corp. | 63,200 | 2,570 |

| | IDEX Corp. | 36,700 | 2,395 |

| * | Saia Inc. | 76,050 | 2,371 |

| * | United Rentals Inc. | 40,600 | 2,367 |

| | Crane Co. | 37,900 | 2,337 |

| | Apogee Enterprises Inc. | 78,600 | 2,333 |

| * | Terex Corp. | 67,700 | 2,275 |

| | Mine Safety Appliances Co. | 40,500 | 2,090 |

| | Brink’s Co. | 70,800 | 2,004 |

| | Ryder System Inc. | 32,900 | 1,964 |

| | G&K Services Inc. Class A | 31,100 | 1,878 |

| | Valmont Industries Inc. | 13,000 | 1,806 |

| | | | 623,187 |

| Information Technology (15.9%) | |

| | Fidelity National | | |

| | Information Services Inc. | 918,200 | 42,641 |

| | Western Digital Corp. | 668,000 | 42,351 |

| | Seagate Technology plc | 953,750 | 41,717 |

| * | Alliance Data Systems Corp. | 189,800 | 40,137 |

| * | Gartner Inc. | 578,791 | 34,727 |

| *,^ | SunPower Corp. Class A | 1,260,700 | 32,980 |

| | LSI Corp. | 4,211,600 | 32,935 |

| * | Anixter International Inc. | 372,508 | 32,654 |

| * | Micron Technology Inc. | 1,696,100 | 29,631 |

| * | CACI International Inc. | | |

| | Class A | 349,000 | 24,119 |

| | Maxim Integrated | | |

| | Products Inc. | 748,850 | 22,316 |

| * | CommVault Systems Inc. | 225,700 | 19,823 |

| * | CoreLogic Inc. | 626,000 | 16,933 |

| | Jack Henry & | | |

| | Associates Inc. | 307,200 | 15,855 |

| * | Manhattan Associates Inc. | 145,300 | 13,869 |

| * | LinkedIn Corp. Class A | 54,000 | 13,287 |

| | SanDisk Corp. | 194,100 | 11,551 |

| | Avnet Inc. | 269,100 | 11,224 |

| | Heartland Payment | | |

| | Systems Inc. | 268,500 | 10,665 |

| | MAXIMUS Inc. | 227,080 | 10,228 |

| * | Tech Data Corp. | 198,900 | 9,927 |

| * | Freescale | | |

| | Semiconductor Ltd. | 577,000 | 9,607 |

| | Broadridge Financial | | |

| | Solutions Inc. | 301,000 | 9,557 |

| | | |

| * | Electronics For Imaging Inc. | 282,100 | 8,937 |

| * | Fiserv Inc. | 87,000 | 8,791 |

| * | Brocade Communications | | |

| | Systems Inc. | 1,031,700 | 8,305 |

| *,^ | Advanced Micro | | |

| | Devices Inc. | 2,126,635 | 8,081 |

| | DST Systems Inc. | 103,230 | 7,785 |

| | Computer Sciences Corp. | 147,700 | 7,642 |

| * | Electronic Arts Inc. | 287,500 | 7,346 |

| * | Aspen Technology Inc. | 203,000 | 7,014 |

| * | SYNNEX Corp. | 113,274 | 6,961 |

| * | Ingram Micro Inc. | 299,500 | 6,903 |

| | AOL Inc. | 196,900 | 6,809 |

| * | Acxiom Corp. | 223,200 | 6,337 |

| * | ValueClick Inc. | 291,200 | 6,071 |

| * | Kulicke & Soffa | | |

| | Industries Inc. | 456,000 | 5,267 |

| * | Unisys Corp. | 205,900 | 5,187 |

| * | Advanced Energy | | |

| | Industries Inc. | 276,100 | 4,837 |

| * | ON Semiconductor Corp. | 500,000 | 3,650 |

| * | RF Micro Devices Inc. | 630,100 | 3,554 |

| | Mentor Graphics Corp. | 150,000 | 3,505 |

| | Harris Corp. | 53,900 | 3,196 |

| * | Ciena Corp. | 117,000 | 2,923 |

| *,^ | Angie’s List Inc. | 111,000 | 2,497 |

| * | Vantiv Inc. Class A | 86,600 | 2,420 |

| | KLA-Tencor Corp. | 39,100 | 2,379 |

| * | Rambus Inc. | 249,300 | 2,343 |

| | Lexmark International Inc. | | |

| | Class A | 67,600 | 2,231 |

| * | NeuStar Inc. Class A | 41,200 | 2,039 |

| | Lender Processing | | |

| | Services Inc. | 59,400 | 1,976 |

| * | Zebra Technologies Corp. | 40,700 | 1,853 |

| | | | 675,573 |

| Materials (5.8%) | | |

| | CF Industries Holdings Inc. | 170,200 | 35,883 |

| | Valspar Corp. | 389,900 | 24,731 |

| | Eastman Chemical Co. | 262,486 | 20,448 |

| | Westlake Chemical Corp. | 165,386 | 17,309 |

| | Packaging Corp. of America | 260,200 | 14,855 |

| | Avery Dennison Corp. | 333,800 | 14,527 |

| | Schweitzer-Mauduit | | |

| | International Inc. | 237,278 | 14,363 |

| * | Owens-Illinois Inc. | 397,000 | 11,918 |

| * | WR Grace & Co. | 121,800 | 10,645 |

| * | Graphic Packaging | | |

| | Holding Co. | 1,154,119 | 9,879 |

| | NewMarket Corp. | 32,822 | 9,450 |

| | Rock Tenn Co. Class A | 83,900 | 8,497 |

| | KapStone Paper and | | |

| | Packaging Corp. | 154,800 | 6,626 |

| | Worthington Industries Inc. | 120,800 | 4,159 |

| | Neenah Paper Inc. | 93,600 | 3,679 |

18

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| * | Headwaters Inc. | 385,300 | 3,464 |

| * | Louisiana-Pacific Corp. | 190,800 | 3,356 |

| | International Flavors & | | |

| | Fragrances Inc. | 36,600 | 3,012 |

| | Minerals Technologies Inc. | 59,300 | 2,928 |

| | Cytec Industries Inc. | 35,700 | 2,905 |

| * | Chemtura Corp. | 125,500 | 2,885 |

| | Kaiser Aluminum Corp. | 36,600 | 2,608 |

| * | Calgon Carbon Corp. | 129,200 | 2,454 |

| | American Vanguard Corp. | 91,100 | 2,452 |

| | Sealed Air Corp. | 81,700 | 2,221 |

| | Sonoco Products Co. | 54,000 | 2,103 |

| | Steel Dynamics Inc. | 121,500 | 2,030 |

| * | Berry Plastics Group Inc. | 100,200 | 2,001 |

| | Bemis Co. Inc. | 48,200 | 1,880 |

| | | | 243,268 |

| Telecommunication Services (0.3%) | |

| | Frontier | | |

| | Communications Corp. | 2,589,700 | 10,799 |

| | Telephone & Data | | |

| | Systems Inc. | 73,300 | 2,166 |

| | | | 12,965 |

| Utilities (4.7%) | | |

| | Ameren Corp. | 846,800 | 29,503 |

| | Pinnacle West Capital Corp. | 413,500 | 22,635 |

| | DTE Energy Co. | 298,050 | 19,665 |

| | Portland General | | |

| | Electric Co. | 687,500 | 19,408 |

| | AES Corp. | 1,136,300 | 15,101 |

| | Southwest Gas Corp. | 271,640 | 13,582 |

| | CMS Energy Corp. | 421,100 | 11,083 |

| | PNM Resources Inc. | 387,735 | 8,775 |

| | AGL Resources Inc. | 176,300 | 8,115 |

| | Black Hills Corp. | 158,000 | 7,878 |

| | Vectren Corp. | 230,700 | 7,694 |

| | CenterPoint Energy Inc. | 252,400 | 6,050 |

| | Wisconsin Energy Corp. | 134,300 | 5,423 |

| | UGI Corp. | 136,400 | 5,337 |

| | NV Energy Inc. | 158,000 | 3,730 |

| | American States Water Co. | 108,000 | 2,977 |

| | Westar Energy Inc. | | |

| | Class A | 84,700 | 2,596 |

| | Great Plains Energy Inc. | 110,000 | 2,442 |

| | Atmos Energy Corp. | 51,700 | 2,202 |

| | UNS Energy Corp. | 42,900 | 2,000 |

| | IDACORP Inc. | 40,300 | 1,951 |

| | MGE Energy Inc. | 25,000 | 1,364 |

| | | | 199,511 |

| Total Common Stocks | | |

| (Cost $3,243,805) | | 4,219,935 |

| | | | |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| Temporary Cash Investments (1.9%)1 | |

| Money Market Fund (1.9%) | | |

| 2,3 | Vanguard Market Liquidity | | |

| | Fund, 0.112% | 79,934,769 | 79,935 |

| |

| | | | Face | |

| | | | Amount | |

| | | | ($000) | |

| U.S. Government and Agency Obligations (0.0%) |

| 4,5 | Fannie Mae Discount | | |

| | Notes, 0.060%, 3/19/14 | 500 | 499 |

| 5,6 | Federal Home Loan Bank | | |

| | Discount Notes, 0.095%, | | |

| | 10/4/13 | | 500 | 500 |

| 4,5 | Freddie Mac Discount | | |

| | Notes, 0.095%, 11/18/13 | 500 | 500 |

| 4 | Freddie Mac Discount | | |

| | Notes, 0.070%, 3/31/14 | 300 | 300 |

| | | | | 1,799 |

| Total Temporary Cash Investments | |

| (Cost $81,734) | | | 81,734 |

| Total Investments (101.5%) | | |

| (Cost $3,325,539) | | | 4,301,669 |

| Other Assets and Liabilities (-1.5%) | |

| Other Assets | | | 6,721 |

| Liabilities3 | | | (69,380) |

| | | | | (62,659) |

| Net Assets (100%) | | | |

| Applicable to 155,068,536 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 4,239,010 |

| Net Asset Value Per Share | | $27.34 |

19

Strategic Equity Fund

| |

| At September 30, 2013, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 3,752,110 |

| Undistributed Net Investment Income | 32,183 |

| Accumulated Net Realized Losses | (521,453) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 976,130 |

| Futures Contracts | 40 |

| Net Assets | 4,239,010 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $47,927,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.5%, respectively, of

net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

3 Includes $50,336,000 of collateral received for securities on loan.

4 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the

Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange

for senior preferred stock.

5 Securities with a value of $1,000,000 have been segregated as initial margin for open futures contracts.

6 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the

full faith and credit of the U.S. government.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Strategic Equity Fund

Statement of Operations

| |

| | Year Ended |

| | September 30, 2013 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 73,078 |

| Interest1 | 45 |

| Securities Lending | 2,017 |

| Total Income | 75,140 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 1,248 |

| Management and Administrative | 8,457 |

| Marketing and Distribution | 542 |

| Custodian Fees | 42 |

| Auditing Fees | 28 |

| Shareholders’ Reports | 54 |

| Trustees’ Fees and Expenses | 6 |

| Total Expenses | 10,377 |

| Net Investment Income | 64,763 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 460,017 |

| Futures Contracts | 5,326 |

| Realized Net Gain (Loss) | 465,343 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 498,328 |

| Futures Contracts | 480 |

| Change in Unrealized Appreciation (Depreciation) | 498,808 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,028,914 |

| 1 Interest income from an affiliated company of the fund was $43,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

21

Strategic Equity Fund

Statement of Changes in Net Assets

| | |

| | Year Ended September 30, |

| | 2013 | 2012 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 64,763 | 39,685 |

| Realized Net Gain (Loss) | 465,343 | 293,306 |

| Change in Unrealized Appreciation (Depreciation) | 498,808 | 477,419 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,028,914 | 810,410 |

| Distributions | | |

| Net Investment Income | (52,913) | (32,559) |

| Realized Capital Gain | — | — |

| Total Distributions | (52,913) | (32,559) |

| Capital Share Transactions | | |

| Issued | 451,413 | 237,519 |

| Issued in Lieu of Cash Distributions | 49,012 | 30,266 |

| Redeemed | (491,012) | (548,498) |

| Net Increase (Decrease) from Capital Share Transactions | 9,413 | (280,713) |

| Total Increase (Decrease) | 985,414 | 497,138 |

| Net Assets | | |

| Beginning of Period | 3,253,596 | 2,756,458 |

| End of Period1 | 4,239,010 | 3,253,596 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $32,183,000 and $20,089,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

22

Strategic Equity Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | Year Ended September 30, |

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $21.02 | $16.30 | $16.30 | $14.52 | $16.42 |

| Investment Operations | | | | | |

| Net Investment Income | . 4261 | .249 | .210 | .221 | .184 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 6.244 | 4.667 | .017 | 1.759 | (1.843) |

| Total from Investment Operations | 6.670 | 4.916 | . 227 | 1.980 | (1.659) |

| Distributions | | | | | |

| Dividends from Net Investment Income | (. 350) | (.196) | (. 227) | (. 200) | (. 241) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (. 350) | (.196) | (. 227) | (. 200) | (. 241) |

| Net Asset Value, End of Period | $27.34 | $21.02 | $16.30 | $16.30 | $14.52 |

| |

| Total Return2 | 32.23% | 30.32% | 1.23% | 13.71% | -9.66% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $4,239 | $3,254 | $2,756 | $3,103 | $3,549 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets | 0.28% | 0.29% | 0.30% | 0.30% | 0.30% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.75%1 | 1.25% | 1.09% | 1.37% | 1.47% |

| Portfolio Turnover Rate | 64% | 67% | 73% | 60% | 60% |

1 Net investment income per share and the ratio of net investment income to average net assets include $.043 and 0.18%, respectively,

resulting from a special dividend received in connection with a merger between T-Mobile US Inc. and Metro PCS Communications Inc.

in May 2013.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about

any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund may use index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended September 30, 2013, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on quarterly average aggregate settlement values.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2010–2013), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

24

Strategic Equity Fund

5. Securities Lending: To earn additional income, the fund may lend its securities to qualified institutional borrowers. Security loans are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the absence of a default the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At September 30, 2013, the fund had contributed capital of $495,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.20% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

25

Strategic Equity Fund

The following table summarizes the market value of the fund’s investments as of September 30, 2013, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 4,219,935 | — | — |

| Temporary Cash Investments | 79,935 | 1,799 | — |

| Futures Contracts—Assets1 | 1 | — | — |

| Futures Contracts—Liabilities1 | (16) | — | — |

| Total | 4,299,855 | 1,799 | — |

| 1 Represents variation margin on the last day of the reporting period. |

D. At September 30, 2013, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini Russell 2000 Index | December 2013 | 84 | 9,000 | 42 |

| E-mini S&P MidCap 400 Index | December 2013 | 78 | 9,676 | (2) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

Certain of the fund’s investments are in securities considered to be “passive foreign investment companies,” for which any unrealized appreciation and/or realized gains are required to be included in distributable net income for tax purposes. During the year ended September 30, 2013, the fund realized gains on the sale of passive foreign investment companies of $244,000, which have been included in current and prior periods’ taxable income; accordingly, such gains have been reclassified from accumulated net realized losses to undistributed net investment income. Passive foreign investment companies held at September 30, 2013, had unrealized appreciation of $84,000, of which all has been distributed and is reflected in the balance of undistributed net investment income.

26

Strategic Equity Fund

For tax purposes, at September 30, 2013, the fund had $39,685,000 of ordinary income available for distribution. The fund used capital loss carryforwards of $465,579,000 to offset taxable capital gains realized during the year ended September 30, 2013. At September 30, 2013, the fund had available capital losses totaling $521,412,000 to offset future net capital gains through September 30, 2018.

At September 30, 2013, the cost of investment securities for tax purposes was $3,325,623,000. Net unrealized appreciation of investment securities for tax purposes was $976,046,000, consisting of unrealized gains of $1,021,216,000 on securities that had risen in value since their purchase and $45,170,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended September 30, 2013, the fund purchased $2,380,112,000 of investment securities and sold $2,346,920,000 of investment securities, other than temporary cash investments.

G. Capital shares issued and redeemed were:

| | |

| | Year Ended September 30, |

| | 2013 | 2012 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 18,636 | 12,157 |

| Issued in Lieu of Cash Distributions | 2,331 | 1,630 |

| Redeemed | (20,671) | (28,154) |

| Net Increase (Decrease) in Shares Outstanding | 296 | (14,367) |

H. Management has determined that no material events or transactions occurred subsequent to September 30, 2013, that would require recognition or disclosure in these financial statements.

27

Report of Independent Registered

Public Accounting Firm

To the Trustees of Vanguard Horizon Funds and the Shareholders of Vanguard Strategic Equity Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Strategic Equity Fund (constituting a separate portfolio of Vanguard Horizon Funds, hereafter referred to as the “Fund”) at September 30, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2013 by correspondence with the custodian and broker and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 14, 2013

Special 2013 tax information (unaudited) for Vanguard Strategic Equity Fund

This information for the fiscal year ended September 30, 2013, is included pursuant to provisions of

the Internal Revenue Code.

The fund distributed $52,913,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 86.7% of investment income (dividend income plus short-term gains, if

any) qualifies for the dividends-received deduction.

28

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2013. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| | | |

| Average Annual Total Returns: Strategic Equity Fund | | | |

| Periods Ended September 30, 2013 | | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 32.23% | 12.37% | 9.12% |

| Returns After Taxes on Distributions | 31.91 | 12.11 | 8.41 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 18.67 | 9.88 | 7.45 |

29

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

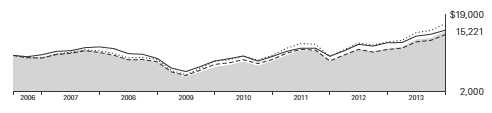

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.