UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07239

Name of Registrant: Vanguard Horizon Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2008 – September 30, 2009

Item 1: Reports to Shareholders

|

| Vanguard Strategic Equity Fund |

| Annual Report |

|

|

| September 30, 2009 |

|

|

|

|

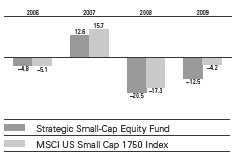

> For the fiscal year ended September 30, 2009, Vanguard Strategic Equity Fund returned –9.66%.

> The fund’s results for the fiscal year covered two very different market environments—a first half of dramatic declines followed by a second half of robust gains.

> For the 12-month period, Strategic Equity Fund substantially lagged both its benchmark return and the average return of peer-group funds.

| |

| Contents | |

| |

| Your Fund’s Total Returns | 1 |

| President’s Letter | 2 |

| Advisor’s Report | 7 |

| Results of Proxy Voting | 9 |

| Fund Profile | 10 |

| Performance Summary | 11 |

| Financial Statements | 12 |

| Your Fund’s After-Tax Returns | 28 |

| About Your Fund’s Expenses | 29 |

| Glossary | 31 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Cover photograph: Veronica Coia.

Your Fund’s Total Returns

| | |

| Fiscal Year Ended September 30, 2009 | | |

| | Ticker | Total |

| | Symbol | Returns |

| Vanguard Strategic Equity Fund | VSEQX | –9.66% |

| MSCI® US Small + Mid Cap 2200 Index | | –3.00 |

| Mid-Cap Core Funds Average1 | | –3.02 |

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| September 30, 2008–September 30, 2009 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Strategic Equity Fund | $16.42 | $14.52 | $0.241 | $0.000 |

1 Derived from data provided by Lipper Inc.

1

President’s Letter

Dear Shareholder,

The results for Vanguard Strategic Equity Fund for the 12 months ended September 30, 2009, were disappointing. However, they masked a dramatic turnaround in market sentiment and fund performance that began midway through the fund’s fiscal year.

Investor confidence abruptly revived in March in both the stock and bond markets, as turmoil in the credit markets began to subside and economic reports began to suggest that the economy was on the mend. The Strategic Equity Fund returned about –37% for the six months ended March 31, 2009, while the fund returned about 43% for the subsequent six months.

Considered together, these almost perfectly inverse results produced a 12-month loss of –9.66%. If you hold the Strategic Equity Fund in a taxable account, you may wish to review our report on the fund’s after-tax returns on page 28.

After a precipitous fall, stock markets rebound

In recent months, the financial markets have performed so strongly that it’s almost hard to remember that less than a year ago the global financial system stood on the brink of collapse. Since then, markets have pulled back from the abyss. Although unemployment remains near generational highs, and the prospects of a robust recovery seem dim, the global economy has begun to grind into gear.

2

Reminders of the markets’ dark days are nevertheless apparent in the index returns for both the past 12 months and the past three years. Over both periods, U.S. stocks recorded negative returns. Global stocks did better over the past 12 months, recouping their late-2008 losses thanks to general strength in developed economies and a powerful rally in emerging markets. Over the past three years, however, international stocks posted a modestly negative return.

The bond market’s turnabout has been equally dramatic

The stock market’s collapse and recovery echo even more dramatic developments in the bond market. At the end of 2008, as the credit markets nearly ceased to function, the difference between the yields of corporate bonds and U.S. Treasury bonds spiked to levels last seen during the Great Depression.

The Federal Reserve and its central bank counterparts around the world responded with aggressive monetary stimulus efforts, while global governments opened the fiscal taps. Investors first tiptoed, then stampeded, back into the market, boosting bond prices and bringing down yields. Over the past 12 months, taxable U.S. bonds returned more than 10%; municipal securities did even better, returning almost 15%, as measured by the Barclays Capital Municipal Bond Index.

The Fed’s rescue campaign has imposed a heavy price on short-term savings vehicles such as money market funds. In December

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended September 30, 2009 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | –6.14% | –5.10% | 1.49% |

| Russell 2000 Index (Small-caps) | –9.55 | –4.57 | 2.41 |

| Dow Jones U.S. Total Stock Market Index | –5.83 | –4.58 | 1.93 |

| MSCI All Country World Index ex USA (International) | 6.43 | –0.78 | 8.59 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad taxable market) | 10.56% | 6.41% | 5.13% |

| Barclays Capital Municipal Bond Index | 14.85 | 5.13 | 4.78 |

| Citigroup 3-Month Treasury Bill Index | 0.39 | 2.63 | 2.96 |

| |

| CPI | | | |

| Consumer Price Index | –1.29% | 2.10% | 2.61% |

3

2008, the Fed reduced its target for the federal funds rate, a benchmark for the interest rates paid by money market instruments and other very short-term securities, to between 0% and 0.25%. The Fed has said it expects to maintain its target at this level “for an extended period.”

Early-in-the-year results weigh on full-year returns

The recent fiscal year has been a historically anomalous period in the financial markets, to say the least. One consequence for stocks has been that the worst-performing stocks in the dizzying market of the first six months of the period were among the best performers during the exceptionally strong rally that characterized the final six months.

| | |

| Expense Ratios1 | | |

| Your Fund Compared With Its Peer Group | | |

| | | Mid-Cap |

| | | Core Funds |

| | Fund | Average |

| Strategic Equity Fund | 0.32% | 1.30% |

The first-half results weighed heavily on the performance of stocks for the full year, so it’s not surprising that the fund posted a negative return. It was disappointing, however, that the fund fell measurably short of its benchmark index—an obvious setback in its effort to capture most of the index’s risk and investment characteristics while producing index-beating returns through superior stock selection.

Although financial-sector stocks, the fund’s largest weighting, were a major negative contributor to return on an absolute basis, good stock selection helped somewhat to minimize the difference between the fund’s returns and its benchmark index.

1 The fund expense ratio shown is from the prospectus dated January 28, 2009, and represents estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the fiscal year ended September 30, 2009, the fund’s expense ratio was 0.30%. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2008.

4

The fund’s information technology and consumer discretionary holdings—which together represented about one-third of the fund’s assets—helped to cushion the effect of the general market downdraft by contributing a total of 7 percentage points to return. Good stock selection among consumer discretionary stocks also benefited the fund on a relative basis.

However, good stock picking in sectors such as financials and consumer discretionary were outweighed by poor choices elsewhere, especially among energy, health care, and industrial stocks.

A long-term view can curb short-term distractions

A stock market rally is always welcome, of course. But not all rallies are alike when you look under the hood.

The stock market rally that characterized the final six months of your fund’s 2009 fiscal year was led, in general, by the stocks of companies whose financial health is suspect. However, the models that Vanguard Quantitative Equity Group uses in managing the fund are designed to sift through thousands of stocks to find those with higher-quality characteristics. We believe those stocks have the potential to produce the strongest results over the long term.

| |

| Total Returns | |

| Ten Years Ended September 30, 2009 | |

| | Average |

| | Annual Return |

| Strategic Equity Fund | 5.69% |

| Spliced Small and Mid Cap Index1 | 5.92 |

| Mid-Cap Core Funds Average2 | 5.93 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 The Spliced Small and Mid Cap Index reflects the returns of the Russell 2800 Index through May 31, 2003, and the MSCI US Small + Mid Cap 2200 Index thereafter.

2 Derived from data provided by Lipper Inc.

5

That is why we maintain confidence in Strategic Equity Fund’s underlying stock-selection methodology, despite the disappointing short-term results and, indeed, its modest shortfall relative to its benchmark over the past decade.

In recent months, the market’s and the fund’s performance have improved. The latest rally reinforces our belief that it’s important to step back (difficult as it may be) from the distraction of short-term results and consider investing as a long-term process—one that’s set in motion after you’ve developed a low-cost portfolio that is balanced and diversified among the major asset classes and aligned with your investing goals.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

October 14, 2009

Advisor’s Report

The financial crisis that began in 2007 continued to influence the stock market during the past fiscal year. The Strategic Equity Fund returned about –10%, compared with a return of about –3% for the MSCI US Small + Mid Cap 2200 Index.

During the panic that ruled the market in the first half of the fiscal year, the fund’s benchmark returned about –34%. The worst-performing stocks during those six months became the best-returning stocks of the second six months. This “junk” rally in stocks, which began after the market’s close brush with financial disaster, led the benchmark to a gain of about 47% in the final half of the period.

Our quantitative fundamental investment-management process led to mixed results for the full 12 months. We use a model that assesses the attractiveness of stocks relative to their peers based on five components: valuation, earnings quality, growth, management decisions, and market sentiment.

Valuation measures the price we will pay for a stock’s earnings or cash flow. By itself, valuation can be a powerful investment tool, but our research leads us to conclude that other components improve upon a valuation signal. Our earnings-quality score separates cheap stocks that deserve their low valuations, because of poor margins, from their more-profitable peers.

Our growth indicator likewise differentiates between companies with low valuations due to poor growth prospects and firms with more attractive prospects. Since actions often speak louder than words, the management-decisions component of our model helps determine the attractiveness of a stock by evaluating the decisions corporate managers make. These include decisions to issue stock, raise debt, and make capital investments. Finally, our market sentiment score measures the market’s overall evaluation of the company’s value. Our logic is that a stock’s performance reflects the news affecting that stock, which helps to verify the results of our other scores.

We combine the five components into an overall score, with each indicator serving as a verification of the others. Our research tells us that the attributes we prefer in stocks—such as low ratios of price/earnings and price/cash flow, as well as higher return on equity compared with other stocks—are likely to be successful in the long term, but may not work in some periods, such as this fiscal year.

The extreme anxiety in the first part of the year drove down all stocks, regardless of individual characteristics, as investors sought to exit the market. In March, once companies that had almost ceased to exist seemed more likely to survive, the stocks of those firms roared back to life. This happened even though the firms had

7

attributes that our model does not favor, such as negative earnings, low margins, and low growth.

Value-oriented stocks, which we prefer, were particularly out of favor during the year. Although we are disappointed that our performance for the year was below that of the benchmark, we are not surprised that we lagged during this period. All investment styles endure periods of underperformance, and there have been earlier periods—such as the dot-com bubble—when our process similarly underperformed.

In contrast to the recent stock-market meltdown, the dot-com bubble that began in the late 1990s was a “melt-up”—stock prices climbed strongly and steeply before plummeting. Nevertheless, just as in the past year, a very few factors dominated performance during that time: For example, it was acceptable for a stock to have little or no earnings if it had an Internet-related story line. Throughout the dot-com bubble, our model rejected many stocks that did not pass the test of our earnings and quality models; thus, our portfolios underperformed.

Last year, the dominating factor was the credit crisis. In an environment such as 2008 or the late 1990s, when one or two factors prevail in investor decision-making, our process suffers. We continue to maintain our commitment to a portfolio with lower price/earnings and price/cash flow ratios, growth rates near the market’s overall rate, and a slightly higher return on equity. Such a portfolio offers an attractive profile that we expect the market will reward over the long term.

We thank you for your investment, and we look forward to the upcoming year.

James D. Troyer, CFA, Principal and Portfolio Manager

Joel M. Dickson,

Prinicipal and Head,

Vanguard Active Quantitative Equity

Management

October 16, 2009

8

Results of Proxy Voting

At a special meeting of shareholders on July 2, 2009, fund shareholders approved the following two proposals:

Proposal 1—Elect trustees for each fund.*

The individuals listed in the table below were elected as trustees for each fund. All trustees with the exception of Messrs. McNabb and Volanakis (both of whom already served as directors of The Vanguard Group, Inc.) served as trustees to the funds prior to the shareholder meeting.

| | | |

| | | | Percentage |

| Trustee | For | Withheld | For |

| John J. Brennan | 517,264,433 | 14,297,196 | 97.3% |

| Charles D. Ellis | 501,913,782 | 29,647,847 | 94.4% |

| Emerson U. Fullwood | 507,851,847 | 23,709,782 | 95.5% |

| Rajiv L. Gupta | 515,891,359 | 15,670,270 | 97.1% |

| Amy Gutmann | 517,356,594 | 14,205,035 | 97.3% |

| JoAnn Heffernan Heisen | 516,532,227 | 15,029,403 | 97.2% |

| F. William McNabb III | 516,660,098 | 14,901,531 | 97.2% |

| André F. Perold | 507,715,282 | 23,846,348 | 95.5% |

| Alfred M. Rankin, Jr. | 516,327,018 | 15,234,611 | 97.1% |

| Peter F. Volanakis | 516,503,576 | 15,058,053 | 97.2% |

| * Results are for all funds within the same trust. | | | |

Proposal 2—Update and standardize the funds’ fundamental policies regarding:

(a) Purchasing and selling real estate.

(b) Issuing senior securities.

(c) Borrowing money.

(d) Making loans.

(e) Purchasing and selling commodities.

(f) Concentrating investments in a particular industry or group of industries.

(g) Eliminating outdated fundamental investment policies not required by law.

The revised fundamental policies are clearly stated and simple, yet comprehensive, making oversight and compliance more efficient than under the former policies. The revised fundamental policies will allow the funds to respond more quickly to regulatory and market changes, while avoiding the costs and delays associated with successive shareholder meetings.

| | | | | |

| | | | | Broker | Percentage |

| Vanguard Fund | For | Abstain | Against | Non-Votes | For |

| Strategic Equity Fund | | | | | |

| 2a | 178,164,129 | 3,534,815 | 10,024,312 | 5,730,570 | 90.2% |

| 2b | 177,486,762 | 3,801,136 | 10,435,358 | 5,730,570 | 89.9% |

| 2c | 176,246,489 | 3,646,003 | 11,830,765 | 5,730,570 | 89.3% |

| 2d | 176,671,295 | 3,691,730 | 11,360,235 | 5,730,566 | 89.5% |

| 2e | 176,761,443 | 3,516,471 | 11,445,346 | 5,730,566 | 89.5% |

| 2f | 177,545,769 | 3,665,294 | 10,512,194 | 5,730,570 | 89.9% |

| 2g | 178,712,026 | 3,657,543 | 9,353,685 | 5,730,572 | 90.5% |

9

Strategic Equity Fund

Fund Profile

As of September 30, 2009

| | | |

| Portfolio Characteristics | | |

| | | Comparative | Broad |

| | Fund | Index1 | Index2 |

| Number of Stocks | 706 | 2,197 | 4,324 |

| Median Market Cap | $2.7B | $3.0B | $29.0B |

| Price/Earnings Ratio | 21.0x | 105.6x | 27.9x |

| Price/Book Ratio | 2.0x | 1.8x | 2.1x |

| Yield3 | 1.3% | 1.4% | 1.9% |

| Return on Equity | 15.8% | 13.2% | 19.1% |

| Earnings Growth Rate | 17.5% | 9.2% | 9.6% |

| Foreign Holdings | 0.1% | 0.0% | 0.0% |

| Turnover Rate | 60% | — | — |

| Expense Ratio4 | 0.32% | — | — |

| Short-Term Reserves | 0.3% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | Comparative | Broad |

| | Fund | Index1 | Index2 |

| Consumer Discretionary | 15.4% | 14.9% | 10.1% |

| Consumer Staples | 3.2 | 4.0 | 9.9 |

| Energy | 7.7 | 7.3 | 11.0 |

| Financials | 18.7 | 18.8 | 16.7 |

| Health Care | 11.0 | 11.3 | 12.9 |

| Industrials | 13.5 | 13.9 | 10.6 |

| Information Technology | 17.8 | 17.1 | 18.2 |

| Materials | 6.6 | 6.1 | 3.9 |

| Telecommunication | | | |

| Services | 1.2 | 1.2 | 2.9 |

| Utilities | 4.9 | 5.4 | 3.8 |

| | |

| Volatility Measures5 | |

| | Fund Versus | Fund Versus |

| | Comparative Index1 | Broad Index2 |

| R-Squared | 0.99 | 0.95 |

| Beta | 1.00 | 1.18 |

| | |

| Ten Largest Holdings6 (% of total net assets) |

| |

| Marvell Technology | | |

| Group Ltd. | semiconductors | 1.1% |

| Western Digital Corp. | computer storage | |

| | and peripherals | 1.1 |

| AmerisourceBergen | health care | |

| Corp. Class A | distributors | 1.1 |

| NRG Energy Inc. | independent power | |

| | producers and | |

| | energy traders | 1.1 |

| Dr Pepper Snapple | | |

| Group Inc. | soft drinks | 1.1 |

| priceline.com Inc. | Internet retail | 1.0 |

| Cooper Industries PLC | electrical components | |

| Class A | and equipment | 1.0 |

| Unum Group | life and health | |

| | insurance | 1.0 |

| Goodrich Corp. | aerospace and | |

| | defense | 1.0 |

| Owens-Illinois Inc. | metal and glass | |

| | containers | 1.0 |

| Top Ten | | 10.5% |

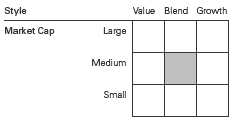

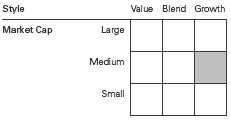

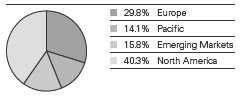

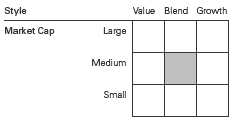

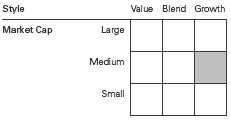

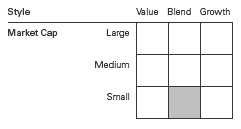

Investment Focus

1 MSCI US Small + Mid Cap 2200 Index.

2 Dow Jones U.S. Total Stock Market Index.

3 30-day SEC yield for the fund; annualized dividend yield for the indexes. See the Glossary.

4 The expense ratio shown is from the prospectus dated January 28, 2009, and represents estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the fiscal year ended September 30, 2009, the expense ratio was 0.30%.

5 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

6 The holdings listed exclude any temporary cash investments and equity index products.

10

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

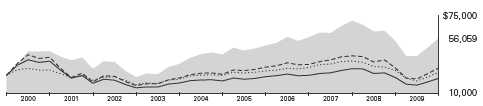

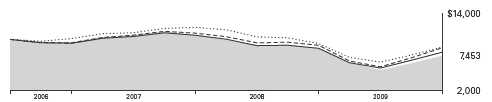

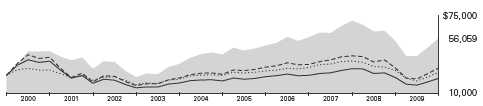

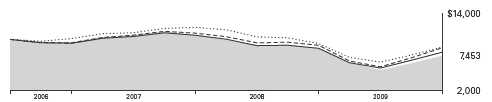

Cumulative Performance: September 30, 1999–September 30, 2009

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | Final Value |

| | Periods Ended September 30, 2009 | of a $10,000 |

| | One Year | Five Years | Ten Years | Investment |

| Strategic Equity Fund1 | –9.66% | 0.31% | 5.69% | $17,385 |

| Dow Jones U.S. Total Stock Market Index | –5.83 | 1.93 | 0.94 | 10,978 |

| Spliced Small and Mid Cap Index2 | –3.00 | 3.77 | 5.92 | 17,777 |

| Mid-Cap Core Funds Average3 | –3.02 | 2.99 | 5.93 | 17,795 |

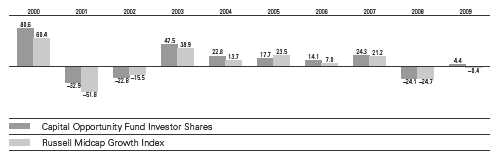

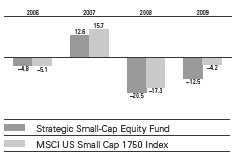

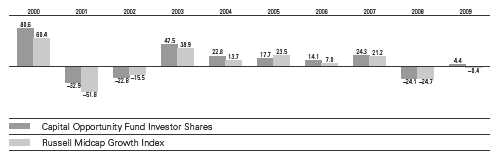

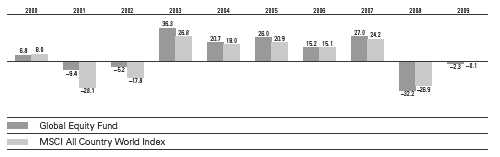

Fiscal-Year Total Returns (%): September 30, 1999–September 30, 2009

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 The Spliced Small and Mid Cap Index reflects the returns of the Russell 2800 Index through May 31, 2003, and the MSCI US Small + Mid Cap 2200 Index thereafter.

3 Derived from data provided by Lipper Inc.

Note: See Financial Highlights table for dividend and capital gains information.

11

Strategic Equity Fund

Financial Statements

Statement of Net Assets

As of September 30, 2009

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Common Stocks (99.5%)1 | | |

| Consumer Discretionary (15.3%) | |

| * | priceline.com Inc. | 224,200 | 37,177 |

| | Whirlpool Corp. | 505,711 | 35,380 |

| * | Dollar Tree Inc. | 671,747 | 32,701 |

| | H&R Block Inc. | 1,636,150 | 30,072 |

| | Ross Stores Inc. | 502,262 | 23,993 |

| * | Aeropostale Inc. | 549,650 | 23,893 |

| * | AutoZone Inc. | 154,400 | 22,576 |

| | DR Horton Inc. | 1,671,902 | 19,076 |

| | Wyndham Worldwide Corp. | 1,050,183 | 17,139 |

| | Darden Restaurants Inc. | 435,032 | 14,848 |

| * | Big Lots Inc. | 480,385 | 12,019 |

| * | ITT Educational | | |

| | Services Inc. | 107,000 | 11,814 |

| | Jarden Corp. | 412,528 | 11,580 |

| | RadioShack Corp. | 662,778 | 10,982 |

| * | Tempur-Pedic | | |

| | International Inc. | 578,399 | 10,955 |

| | Cablevision Systems | | |

| | Corp. Class A | 445,400 | 10,578 |

| | Autoliv Inc. | 281,014 | 9,442 |

| * | Valassis | | |

| | Communications Inc. | 514,780 | 9,204 |

| | Bob Evans Farms Inc. | 312,617 | 9,085 |

| * | Warnaco Group Inc. | 186,459 | 8,178 |

| * | True Religion Apparel Inc. | 310,939 | 8,063 |

| * | WMS Industries Inc. | 173,407 | 7,727 |

| | Meredith Corp. | 253,620 | 7,593 |

| | Polaris Industries Inc. | 175,178 | 7,144 |

| * | Rent-A-Center Inc. | 346,198 | 6,536 |

| | Scripps Networks | | |

| | Interactive Inc. Class A | 165,437 | 6,113 |

| * | Panera Bread Co. Class A | 102,157 | 5,619 |

| * | Denny’s Corp. | 2,039,080 | 5,424 |

| | DeVry Inc. | 93,500 | 5,172 |

| | Unifirst Corp. | 115,203 | 5,121 |

| * | CEC Entertainment Inc. | 191,451 | 4,951 |

| * | Helen of Troy Ltd. | 249,900 | 4,856 |

| | Tupperware Brands Corp. | 120,328 | 4,804 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | JOS A Bank Clothiers Inc. | 106,600 | 4,773 |

| * | Dana Holding Corp. | 608,958 | 4,147 |

| * | Jo-Ann Stores Inc. | 148,238 | 3,977 |

| * | Pre-Paid Legal Services Inc. | 70,812 | 3,597 |

| * | Carter’s Inc. | 132,900 | 3,548 |

| * | Marvel Entertainment Inc. | 66,400 | 3,295 |

| | Cooper Tire & Rubber Co. | 183,621 | 3,228 |

| * | Bally Technologies Inc. | 81,090 | 3,111 |

| * | Steiner Leisure Ltd. | 82,209 | 2,940 |

| | Scholastic Corp. | 120,574 | 2,935 |

| * | NVR Inc. | 4,400 | 2,804 |

| * | Lincoln Educational | | |

| | Services Corp. | 112,018 | 2,563 |

| | Interactive Data Corp. | 95,734 | 2,509 |

| ^ | Buckle Inc. | 71,150 | 2,429 |

| *,^ | Fuel Systems Solutions Inc. | 67,393 | 2,426 |

| * | Isle of Capri Casinos Inc. | 195,000 | 2,299 |

| * | PF Chang’s China Bistro Inc. | 65,702 | 2,232 |

| * | Timberland Co. Class A | 154,661 | 2,153 |

| | La-Z-Boy Inc. | 248,035 | 2,146 |

| | Regal Entertainment | | |

| | Group Class A | 172,925 | 2,130 |

| | Brinker International Inc. | 126,900 | 1,996 |

| * | Sally Beauty Holdings Inc. | 265,724 | 1,889 |

| | Advance Auto Parts Inc. | 46,900 | 1,842 |

| | Burger King Holdings Inc. | 102,600 | 1,805 |

| | Fred’s Inc. Class A | 141,500 | 1,801 |

| * | Steven Madden Ltd. | 47,578 | 1,751 |

| * | Mediacom Communications | | |

| | Corp. Class A | 283,456 | 1,633 |

| | CSS Industries Inc. | 70,397 | 1,392 |

| * | Tenneco Inc. | 103,900 | 1,355 |

| | KB Home | 78,954 | 1,311 |

| * | Papa John’s International Inc. | 52,300 | 1,285 |

| | Limited Brands Inc. | 59,200 | 1,006 |

| * | Career Education Corp. | 39,200 | 956 |

| | Aaron’s Inc. | 33,956 | 896 |

| * | Corinthian Colleges Inc. | 47,900 | 889 |

| ^ | Sturm Ruger & Co. Inc. | 67,650 | 875 |

| * | AFC Enterprises Inc. | 103,426 | 871 |

12

Strategic Equity Fund

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Cracker Barrel Old | | |

| | Country Store Inc. | 24,823 | 854 |

| * | Beazer Homes USA Inc. | 152,475 | 852 |

| | Regis Corp. | 51,100 | 792 |

| * | EW Scripps Co. Class A | 104,622 | 785 |

| | MDC Holdings Inc. | 21,700 | 754 |

| | Family Dollar Stores Inc. | 28,500 | 752 |

| | Barnes & Noble Inc. | 33,800 | 751 |

| * | Stein Mart Inc. | 54,545 | 693 |

| * | Knology Inc. | 70,900 | 691 |

| * | Meritage Homes Corp. | 33,200 | 674 |

| * | Dorman Products Inc. | 44,649 | 671 |

| | Cato Corp. Class A | 31,694 | 643 |

| | Weight Watchers | | |

| | International Inc. | 23,422 | 643 |

| | American Axle & | | |

| | Manufacturing Holdings Inc. | 86,900 | 615 |

| * | Domino’s Pizza Inc. | 68,400 | 605 |

| | CKE Restaurants Inc. | 55,500 | 582 |

| * | NetFlix Inc. | 12,300 | 568 |

| | Stage Stores Inc. | 42,500 | 551 |

| * | Pier 1 Imports Inc. | 142,300 | 551 |

| | Service Corp. International | 74,207 | 520 |

| *,^ | Chipotle Mexican | | |

| | Grill Inc. Class A | 5,200 | 505 |

| | Pulte Homes Inc. | 43,900 | 482 |

| | Leggett & Platt Inc. | 21,800 | 423 |

| * | Steak N Shake Co. | 31,700 | 373 |

| | National Presto Industries Inc. | 4,300 | 372 |

| | Newell Rubbermaid Inc. | 23,400 | 367 |

| | Finish Line Inc. Class A | 35,300 | 359 |

| * | Smith & Wesson | | |

| | Holding Corp. | 63,445 | 332 |

| | John Wiley & Sons Inc. | | |

| | Class A | 9,400 | 327 |

| * | CKX Inc. | 45,868 | 308 |

| * | HSN Inc. | 17,900 | 291 |

| | Harte-Hanks Inc. | 19,800 | 274 |

| * | Penn National Gaming Inc. | 8,208 | 227 |

| * | Dolan Media Co. | 18,300 | 219 |

| * | Capella Education Co. | 3,200 | 216 |

| | Cinemark Holdings Inc. | 17,300 | 179 |

| | Mattel Inc. | 9,200 | 170 |

| | Big 5 Sporting Goods Corp. | 11,100 | 168 |

| | Jones Apparel Group Inc. | 8,700 | 156 |

| * | Warner Music Group Corp. | 28,074 | 155 |

| | PetMed Express Inc. | 5,284 | 100 |

| * | California Pizza Kitchen Inc. | 5,700 | 89 |

| | World Wrestling | | |

| | Entertainment Inc. Class A | 5,600 | 78 |

| * | Blockbuster Inc. Class B | 66,881 | 40 |

| | | | 542,367 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Consumer Staples (3.2%) | | |

| * | Dr Pepper Snapple | | |

| | Group Inc. | 1,299,008 | 37,346 |

| | Del Monte Foods Co. | 1,565,761 | 18,132 |

| | Mead Johnson Nutrition | | |

| | Co. Class A | 200,260 | 9,034 |

| | Herbalife Ltd. | 200,929 | 6,578 |

| | Lancaster Colony Corp. | 107,918 | 5,533 |

| * | Central Garden and Pet | | |

| | Co. Class A | 495,079 | 5,411 |

| | Universal Corp. | 115,936 | 4,848 |

| | Nash Finch Co. | 144,986 | 3,964 |

| | Andersons Inc. | 87,445 | 3,078 |

| * | Revlon Inc. Class A | 547,726 | 2,662 |

| | Molson Coors Brewing | | |

| | Co. Class B | 49,398 | 2,405 |

| | PepsiAmericas Inc. | 69,805 | 1,994 |

| * | Chiquita Brands | | |

| | International Inc. | 118,611 | 1,917 |

| * | Pantry Inc. | 122,219 | 1,916 |

| * | Central Garden and Pet Co. | 144,451 | 1,697 |

| * | Prestige Brands | | |

| | Holdings Inc. | 238,903 | 1,682 |

| * | Alliance One | | |

| | International Inc. | 270,200 | 1,211 |

| | Village Super Market Inc. | | |

| | Class A | 39,202 | 1,155 |

| | Coca-Cola Bottling Co. | | |

| | Consolidated | 11,608 | 562 |

| * | American Italian Pasta Co. | 19,168 | 521 |

| | Bunge Ltd. | 7,500 | 470 |

| | Pepsi Bottling Group Inc. | 11,140 | 406 |

| | Alberto-Culver Co. Class B | 14,100 | 390 |

| | J&J Snack Foods Corp. | 6,500 | 281 |

| * | TreeHouse Foods Inc. | 7,400 | 264 |

| | Sanderson Farms Inc. | 6,100 | 230 |

| | Weis Markets Inc. | 6,400 | 204 |

| * | National Beverage Corp. | 16,746 | 193 |

| * | BJ’s Wholesale Club Inc. | 4,500 | 163 |

| | Calavo Growers Inc. | 8,124 | 154 |

| | | | 114,401 |

| Energy (7.7%) | | |

| | ENSCO International Inc. | 803,609 | 34,186 |

| | Helmerich & Payne Inc. | 753,542 | 29,788 |

| | Tidewater Inc. | 483,683 | 22,777 |

| * | FMC Technologies Inc. | 390,100 | 20,379 |

| * | Cameron International Corp. | 509,400 | 19,265 |

| | Murphy Oil Corp. | 327,696 | 18,865 |

| | El Paso Corp. | 1,723,154 | 17,783 |

| | Tesoro Corp. | 1,163,000 | 17,422 |

| * | Alpha Natural | | |

| | Resources Inc. | 274,725 | 9,643 |

| * | SEACOR Holdings Inc. | 114,469 | 9,344 |

13

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Oil States International Inc. | 234,728 | 8,246 |

| | World Fuel Services Corp. | 164,312 | 7,898 |

| * | Newfield Exploration Co. | 183,851 | 7,825 |

| * | Dresser-Rand Group Inc. | 217,160 | 6,747 |

| * | USEC Inc. | 1,106,734 | 5,191 |

| * | Oceaneering | | |

| | International Inc. | 82,910 | 4,705 |

| | Massey Energy Co. | 126,312 | 3,523 |

| | CARBO Ceramics Inc. | 58,566 | 3,019 |

| * | Matrix Service Co. | 236,915 | 2,575 |

| | Rowan Cos. Inc. | 105,000 | 2,422 |

| * | Contango Oil & Gas Co. | 41,605 | 2,124 |

| * | Pride International Inc. | 65,600 | 1,997 |

| | Overseas Shipholding | | |

| | Group Inc. | 51,309 | 1,917 |

| * | Nabors Industries Ltd. | 90,662 | 1,895 |

| | Southern Union Co. | 83,242 | 1,731 |

| | Holly Corp. | 67,400 | 1,727 |

| * | CVR Energy Inc. | 135,212 | 1,682 |

| * | Bristow Group Inc. | 52,699 | 1,565 |

| * | Gulfmark Offshore Inc. | 39,900 | 1,306 |

| | Frontier Oil Corp. | 84,400 | 1,175 |

| * | James River Coal Co. | 42,865 | 819 |

| * | Superior Energy Services Inc. | 26,809 | 604 |

| | Consol Energy Inc. | 12,000 | 541 |

| * | Cal Dive International Inc. | 40,852 | 404 |

| * | Concho Resources Inc. | 10,277 | 373 |

| * | McMoRan Exploration Co. | 42,400 | 320 |

| * | Endeavour International | | |

| | Corp. | 217,500 | 263 |

| * | Global Industries Ltd. | 22,400 | 213 |

| | | | 272,259 |

| Financials (18.5%) | | |

| | Unum Group | 1,724,135 | 36,965 |

| * | TD Ameritrade | | |

| | Holding Corp. | 1,468,347 | 28,809 |

| | Cullen/Frost Bankers Inc. | 547,053 | 28,250 |

| | Bank of Hawaii Corp. | 677,564 | 28,146 |

| | Axis Capital Holdings Ltd. | 808,872 | 24,412 |

| | Torchmark Corp. | 454,947 | 19,758 |

| | Platinum Underwriters | | |

| | Holdings Ltd. | 491,800 | 17,626 |

| | FirstMerit Corp. | 890,366 | 16,944 |

| | Host Hotels & Resorts Inc. | 1,117,400 | 13,152 |

| * | Arch Capital Group Ltd. | 193,292 | 13,055 |

| | Aspen Insurance | | |

| | Holdings Ltd. | 443,300 | 11,734 |

| * | Ezcorp Inc. Class A | 675,417 | 9,226 |

| | PartnerRe Ltd. | 114,419 | 8,803 |

| * | Knight Capital Group Inc. | | |

| | Class A | 398,776 | 8,673 |

| | Plum Creek Timber Co. Inc. | 271,900 | 8,331 |

| | UMB Financial Corp. | 205,888 | 8,326 |

| | HRPT Properties Trust | 1,080,800 | 8,128 |

| | NBT Bancorp Inc. | 352,499 | 7,945 |

| | Everest Re Group Ltd. | 88,600 | 7,770 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Nationwide Health | | |

| | Properties Inc. | 249,300 | 7,726 |

| | Odyssey Re Holdings Corp. | 118,571 | 7,685 |

| | Highwoods Properties Inc. | 238,346 | 7,496 |

| | Oriental Financial | | |

| | Group Inc. | 587,694 | 7,464 |

| *,^ | St Joe Co. | 255,300 | 7,434 |

| | Hospitality Properties Trust | 362,800 | 7,390 |

| | Federated Investors Inc. | | |

| | Class B | 278,530 | 7,345 |

| | Senior Housing | | |

| | Properties Trust | 379,600 | 7,254 |

| | American Financial | | |

| | Group Inc. | 280,244 | 7,146 |

| | BOK Financial Corp. | 153,521 | 7,111 |

| | Washington Real Estate | | |

| | Investment Trust | 232,316 | 6,691 |

| | National Retail | | |

| | Properties Inc. | 295,500 | 6,344 |

| | Entertainment | | |

| | Properties Trust | 177,800 | 6,070 |

| | Mack-Cali Realty Corp. | 185,600 | 6,000 |

| | Rayonier Inc. | 141,450 | 5,787 |

| | Mid-America Apartment | | |

| | Communities Inc. | 124,508 | 5,619 |

| | Jones Lang LaSalle Inc. | 117,800 | 5,580 |

| | Home Properties Inc. | 127,456 | 5,492 |

| | Sun Communities Inc. | 251,668 | 5,416 |

| | Kilroy Realty Corp. | 189,447 | 5,255 |

| | Parkway Properties Inc. | 261,775 | 5,157 |

| | HCP Inc. | 176,059 | 5,060 |

| | Sovran Self Storage Inc. | 166,124 | 5,055 |

| | PS Business Parks Inc. | 97,632 | 5,011 |

| | City Holding Co. | 166,255 | 4,956 |

| | Equity Lifestyle | | |

| | Properties Inc. | 115,683 | 4,950 |

| | EastGroup Properties Inc. | 128,800 | 4,923 |

| * | MBIA Inc. | 633,049 | 4,912 |

| * | CB Richard Ellis Group Inc. | | |

| | Class A | 413,600 | 4,856 |

| * | Ocwen Financial Corp. | 399,981 | 4,528 |

| | Alexandria Real Estate | | |

| | Equities Inc. | 82,600 | 4,489 |

| | LTC Properties Inc. | 186,494 | 4,483 |

| | Allied World Assurance Co. | | |

| | Holdings Ltd. | 92,973 | 4,456 |

| | Bank of the Ozarks Inc. | 166,987 | 4,430 |

| * | Conseco Inc. | 826,700 | 4,348 |

| * | Nelnet Inc. Class A | 323,399 | 4,023 |

| | Ventas Inc. | 103,000 | 3,966 |

| | Saul Centers Inc. | 122,855 | 3,944 |

| | First Financial | | |

| | Bankshares Inc. | 79,722 | 3,943 |

| * | Jefferies Group Inc. | 137,200 | 3,736 |

| | AvalonBay Communities Inc. | 48,114 | 3,499 |

14

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | American Physicians | | |

| | Capital Inc. | 118,676 | 3,419 |

| | Getty Realty Corp. | 135,564 | 3,327 |

| | Republic Bancorp Inc. | | |

| | Class A | 163,411 | 3,262 |

| | Healthcare Realty Trust Inc. | 151,954 | 3,211 |

| | Reinsurance Group of | | |

| | America Inc. Class A | 70,007 | 3,122 |

| * | AMERISAFE Inc. | 179,960 | 3,104 |

| | Provident Financial | | |

| | Services Inc. | 298,225 | 3,069 |

| | Health Care REIT Inc. | 71,800 | 2,988 |

| * | PHH Corp. | 149,900 | 2,974 |

| | Ares Capital Corp. | 264,812 | 2,918 |

| | International | | |

| | Bancshares Corp. | 174,425 | 2,845 |

| | Colonial Properties Trust | 286,560 | 2,788 |

| * | World Acceptance Corp. | 109,735 | 2,766 |

| | Westamerica | | |

| | Bancorporation | 52,819 | 2,747 |

| | Douglas Emmett Inc. | 205,300 | 2,521 |

| | Bancfirst Corp. | 67,922 | 2,508 |

| | Extra Space Storage Inc. | 236,200 | 2,492 |

| | Community Bank | | |

| | System Inc. | 129,761 | 2,371 |

| | Employers Holdings Inc. | 143,582 | 2,223 |

| | Cash America | | |

| | International Inc. | 72,200 | 2,178 |

| | Kimco Realty Corp. | 165,173 | 2,154 |

| | ProLogis | 175,900 | 2,097 |

| ^ | Pennsylvania Real Estate | | |

| | Investment Trust | 264,600 | 2,014 |

| | Advance America Cash | | |

| | Advance Centers Inc. | 357,325 | 2,001 |

| | Arrow Financial Corp. | 70,009 | 1,911 |

| | Provident New York Bancorp | 198,119 | 1,892 |

| | Tompkins Financial Corp. | 42,569 | 1,860 |

| * | CNA Surety Corp. | 110,533 | 1,791 |

| | Potlatch Corp. | 62,100 | 1,767 |

| | Suffolk Bancorp | 58,893 | 1,744 |

| | Prosperity Bancshares Inc. | 49,100 | 1,708 |

| | Financial Federal Corp. | 68,237 | 1,684 |

| * | First Cash Financial | | |

| | Services Inc. | 97,984 | 1,679 |

| * | FPIC Insurance Group Inc. | 49,984 | 1,677 |

| * | Credit Acceptance Corp. | 50,500 | 1,626 |

| | Capitol Federal Financial | 48,427 | 1,594 |

| | Lakeland Financial Corp. | 76,707 | 1,584 |

| | New York Community | | |

| | Bancorp Inc. | 135,400 | 1,546 |

| | Endurance Specialty | | |

| | Holdings Ltd. | 42,026 | 1,533 |

| ^ | Life Partners Holdings Inc. | 84,077 | 1,505 |

| | Bank Mutual Corp. | 142,345 | 1,258 |

| * | Altisource Portfolio | | |

| | Solutions SA | 80,286 | 1,159 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | HCC Insurance Holdings Inc. | 42,000 | 1,149 |

| | LaSalle Hotel Properties | 57,800 | 1,136 |

| | Southside Bancshares Inc. | 48,848 | 1,100 |

| | Trico Bancshares | 66,041 | 1,083 |

| * | ProAssurance Corp. | 19,917 | 1,040 |

| | Montpelier Re Holdings Ltd. | 61,500 | 1,004 |

| | Corporate Office Properties | | |

| | Trust SBI | 26,320 | 971 |

| | Safety Insurance Group Inc. | 28,553 | 940 |

| | Heartland Financial USA Inc. | 62,162 | 917 |

| ^ | United Bankshares Inc. | 46,547 | 912 |

| | TFS Financial Corp. | 76,185 | 907 |

| | Validus Holdings Ltd. | 34,191 | 882 |

| | Hudson City Bancorp Inc. | 66,600 | 876 |

| | Federal Realty | | |

| | Investment Trust | 13,900 | 853 |

| * | First Horizon National Corp. | 63,669 | 842 |

| | Simmons First National Corp. | | |

| | Class A | 29,009 | 836 |

| * | LaBranche & Co. Inc. | 240,329 | 817 |

| | Hanover Insurance | | |

| | Group Inc. | 17,900 | 740 |

| | Digital Realty Trust Inc. | 15,000 | 686 |

| | Anworth Mortgage | | |

| | Asset Corp. | 85,700 | 675 |

| | NewAlliance Bancshares Inc. | 59,004 | 631 |

| | GAMCO Investors Inc. | 13,400 | 612 |

| | Clifton Savings Bancorp Inc. | 60,281 | 591 |

| | Camden National Corp. | 16,945 | 560 |

| | Park National Corp. | 9,500 | 554 |

| | MFA Financial Inc. | 68,100 | 542 |

| * | Cardtronics Inc. | 68,900 | 539 |

| | Omega Healthcare | | |

| | Investors Inc. | 32,200 | 516 |

| | 1st Source Corp. | 31,054 | 506 |

| | Commerce Bancshares Inc. | 12,701 | 473 |

| | Infinity Property & | | |

| | Casualty Corp. | 10,900 | 463 |

| | Baldwin & Lyons Inc. | 15,991 | 375 |

| | Trustco Bank Corp. NY | 53,400 | 334 |

| | NASB Financial Inc. | 12,604 | 332 |

| | Danvers Bancorp Inc. | 24,172 | 329 |

| | Kearny Financial Corp. | 29,400 | 306 |

| | Calamos Asset | | |

| | Management Inc. Class A | 23,400 | 306 |

| | Trustmark Corp. | 13,200 | 251 |

| | Amtrust Financial | | |

| | Services Inc. | 22,000 | 251 |

| | U-Store-It Trust | 37,477 | 234 |

| | Flagstone Reinsurance | | |

| | Holdings Ltd. | 20,200 | 228 |

| | First Bancorp | 12,200 | 220 |

| | Wilshire Bancorp Inc. | 27,800 | 204 |

| | Radian Group Inc. | 19,200 | 203 |

| * | Greenlight Capital Re Ltd. | | |

| | Class A | 10,300 | 194 |

15

| | | | |

| Strategic Equity Fund | | | |

| |

| |

| |

| | | | | Market |

| | | | | Value• |

| | | | Shares | ($000) |

| | Brandywine Realty Trust | | 17,500 | 193 |

| | SY Bancorp Inc. | | 8,300 | 192 |

| | Great Southern Bancorp Inc. | | 7,500 | 178 |

| | Fifth Street Finance Corp. | | 16,200 | 177 |

| * | American International | | | |

| | Group Inc. | | 3,900 | 172 |

| | Walter Investment | | | |

| | Management Corp. | | 9,795 | 157 |

| | First Financial Holdings Inc. | | 9,200 | 147 |

| | BGC Partners Inc. Class A | | 33,500 | 143 |

| * | Meridian Interstate | | | |

| | Bancorp Inc. | | 16,500 | 140 |

| | DCT Industrial Trust Inc. | | 26,900 | 137 |

| | Ames National Corp. | | 3,494 | 84 |

| | National Interstate Corp. | | 1,600 | 28 |

| * | Interactive Brokers Group Inc. | 13 | — |

| | | | | 657,568 |

| Health Care (10.9%) | | | |

| | AmerisourceBergen Corp. | | | |

| | Class A | 1,704,204 | 38,140 |

| * | Lincare Holdings Inc. | 1,003,471 | 31,359 |

| | STERIS Corp. | | 793,143 | 24,151 |

| * | Isis Pharmaceuticals Inc. | 1,549,602 | 22,578 |

| * | Cephalon Inc. | | 383,300 | 22,323 |

| * | Warner Chilcott PLC | | | |

| | Class A | 1,020,250 | 22,058 |

| | Universal Health Services | | | |

| | Inc. Class B | | 316,106 | 19,576 |

| * | Watson | | | |

| | Pharmaceuticals Inc. | | 384,700 | 14,095 |

| * | Emergency Medical | | | |

| | Services Corp. Class A | | 254,973 | 11,856 |

| * | Valeant Pharmaceuticals | | | |

| | International | | 366,638 | 10,288 |

| * | Mylan Inc. | | 561,638 | 8,992 |

| * | Human Genome | | | |

| | Sciences Inc. | | 470,810 | 8,861 |

| | Invacare Corp. | | 373,954 | 8,332 |

| * | Emergent Biosolutions Inc. | | 451,708 | 7,977 |

| * | Dendreon Corp. | | 253,524 | 7,096 |

| | Cooper Cos. Inc. | | 230,515 | 6,853 |

| * | Myriad Genetics Inc. | | 241,600 | 6,620 |

| * | PharMerica Corp. | | 352,573 | 6,547 |

| * | Gentiva Health | | | |

| | Services Inc. | | 249,756 | 6,246 |

| * | Cubist Pharmaceuticals Inc. | | 287,985 | 5,817 |

| | PDL BioPharma Inc. | | 577,149 | 4,548 |

| * | Questcor | | | |

| | Pharmaceuticals Inc. | | 811,144 | 4,478 |

| * | Psychiatric Solutions Inc. | | 162,000 | 4,335 |

| * | AMERIGROUP Corp. | | 193,027 | 4,279 |

| | Martek Biosciences Corp. | | 182,800 | 4,129 |

| | Beckman Coulter Inc. | | 57,900 | 3,992 |

| * | LifePoint Hospitals Inc. | | 144,835 | 3,919 |

| * | Hospira Inc. | | 86,190 | 3,844 |

| * | Cyberonics Inc. | | 239,984 | 3,825 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Sirona Dental Systems Inc. | 127,900 | 3,805 |

| * | RehabCare Group Inc. | 164,364 | 3,565 |

| * | Bio-Rad Laboratories Inc. | | |

| | Class A | 38,700 | 3,556 |

| * | Endo Pharmaceuticals | | |

| | Holdings Inc. | 155,300 | 3,514 |

| * | Skilled Healthcare | | |

| | Group Inc. | 436,383 | 3,504 |

| * | Kensey Nash Corp. | 115,475 | 3,343 |

| * | American Medical Systems | | |

| | Holdings Inc. | 188,989 | 3,198 |

| * | LHC Group Inc. | 93,121 | 2,787 |

| * | Millipore Corp. | 35,000 | 2,462 |

| * | Centene Corp. | 128,466 | 2,433 |

| * | DaVita Inc. | 40,991 | 2,322 |

| * | Dionex Corp. | 31,755 | 2,063 |

| * | Cambrex Corp. | 326,503 | 2,057 |

| * | Healthsouth Corp. | 115,700 | 1,810 |

| | Chemed Corp. | 40,500 | 1,778 |

| * | Amsurg Corp. Class A | 77,520 | 1,646 |

| | IMS Health Inc. | 80,800 | 1,240 |

| * | Health Management | | |

| | Associates Inc. Class A | 116,848 | 875 |

| * | Mettler-Toledo | | |

| | International Inc. | 9,451 | 856 |

| * | Kindred Healthcare Inc. | 50,600 | 821 |

| * | ResMed Inc. | 18,000 | 814 |

| * | Henry Schein Inc. | 14,400 | 791 |

| * | Immunogen Inc. | 95,880 | 778 |

| * | Merit Medical Systems Inc. | 43,858 | 760 |

| * | Nektar Therapeutics | 65,872 | 642 |

| * | Medivation Inc. | 23,400 | 635 |

| * | Micromet Inc. | 90,242 | 601 |

| * | Odyssey HealthCare Inc. | 47,397 | 593 |

| * | Corvel Corp. | 20,825 | 591 |

| * | Cantel Medical Corp. | 32,700 | 492 |

| | Atrion Corp. | 3,200 | 462 |

| * | Maxygen Inc. | 65,200 | 436 |

| * | HMS Holdings Corp. | 11,400 | 436 |

| * | Par Pharmaceutical Cos. Inc. | 18,804 | 405 |

| * | eResearchTechnology Inc. | 53,700 | 376 |

| * | PSS World Medical Inc. | 16,195 | 354 |

| * | Auxilium | | |

| | Pharmaceuticals Inc. | 10,068 | 344 |

| * | Greatbatch Inc. | 14,900 | 335 |

| | Ensign Group Inc. | 23,299 | 327 |

| * | Affymetrix Inc. | 31,200 | 274 |

| * | Tenet Healthcare Corp. | 45,700 | 269 |

| * | Hanger Orthopedic | | |

| | Group Inc. | 17,600 | 244 |

| * | Kinetic Concepts Inc. | 6,300 | 233 |

| * | Symmetry Medical Inc. | 22,200 | 230 |

| * | Catalyst Health Solutions Inc. | 7,600 | 222 |

| * | Triple-S Management Corp. | | |

| | Class B | 10,800 | 181 |

| * | ICU Medical Inc. | 2,800 | 103 |

16

| | | | |

| Strategic Equity Fund | | | |

| |

| |

| |

| | | | | Market |

| | | | | Value• |

| | | | Shares | ($000) |

| * | Cadence Pharmaceuticals Inc. | | 7,360 | 81 |

| * | Air Methods Corp. | | 2,100 | 68 |

| *,^ | Osiris Therapeutics Inc. | | 10,100 | 67 |

| | | | | 386,893 |

| Industrials (13.4%) | | | |

| * | Cooper Industries PLC | | | |

| | Class A | | 987,900 | 37,115 |

| | Goodrich Corp. | | 671,676 | 36,499 |

| | Pitney Bowes Inc. | 1,191,600 | 29,611 |

| * | EMCOR Group Inc. | 1,004,867 | 25,443 |

| | Ryder System Inc. | | 607,400 | 23,725 |

| | Hubbell Inc. Class B | | 552,300 | 23,197 |

| * | Hertz Global Holdings Inc. | 1,839,332 | 19,920 |

| | Fluor Corp. | | 378,727 | 19,258 |

| | Flowserve Corp. | | 184,594 | 18,190 |

| | Manpower Inc. | | 288,403 | 16,355 |

| * | United Stationers Inc. | | 240,961 | 11,472 |

| | Watson Wyatt | | | |

| | Worldwide Inc. Class A | | 215,400 | 9,383 |

| | Joy Global Inc. | | 190,917 | 9,344 |

| * | SYKES Enterprises Inc. | | 412,790 | 8,594 |

| | Comfort Systems USA Inc. | | 690,178 | 7,999 |

| * | TransDigm Group Inc. | | 144,900 | 7,217 |

| * | Alliant Techsystems Inc. | | 86,669 | 6,747 |

| * | GrafTech International Ltd. | | 437,864 | 6,437 |

| * | URS Corp. | | 137,500 | 6,002 |

| | Dun & Bradstreet Corp. | | 76,799 | 5,785 |

| | Knoll Inc. | | 537,404 | 5,605 |

| | Triumph Group Inc. | | 114,783 | 5,508 |

| | GATX Corp. | | 186,635 | 5,216 |

| | Robbins & Myers Inc. | | 220,800 | 5,184 |

| * | Force Protection Inc. | | 866,200 | 4,729 |

| | Briggs & Stratton Corp. | | 240,243 | 4,663 |

| | Bucyrus International Inc. | | | |

| | Class A | | 129,200 | 4,602 |

| * | Iron Mountain Inc. | | 161,572 | 4,308 |

| | Cubic Corp. | | 103,133 | 4,071 |

| | Stanley Works | | 93,300 | 3,983 |

| | Carlisle Cos. Inc. | | 107,900 | 3,659 |

| * | ATC Technology Corp. | | 180,700 | 3,571 |

| *,^ | Allegiant Travel Co. Class A | | 85,973 | 3,275 |

| | Trinity Industries Inc. | | 185,234 | 3,184 |

| * | School Specialty Inc. | | 130,688 | 3,100 |

| | SPX Corp. | | 50,300 | 3,082 |

| * | Esterline Technologies Corp. | 77,150 | 3,025 |

| * | Beacon Roofing Supply Inc. | | 189,210 | 3,024 |

| | Werner Enterprises Inc. | | 157,437 | 2,933 |

| | Apogee Enterprises Inc. | | 179,676 | 2,699 |

| * | Hawaiian Holdings Inc. | | 303,725 | 2,509 |

| * | Marten Transport Ltd. | | 143,274 | 2,444 |

| * | EnerSys | | 106,157 | 2,348 |

| | Textainer Group | | | |

| | Holdings Ltd. | | 143,576 | 2,299 |

| | AAON Inc. | | 112,465 | 2,258 |

| | Lincoln Electric Holdings Inc. | 47,536 | 2,256* |

| | Powell Industries Inc. | | 58,727 | 2,255 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Chart Industries Inc. | 99,400 | 2,146 |

| * | Kirby Corp. | 53,600 | 1,974 |

| | Federal Signal Corp. | 269,706 | 1,939 |

| * | DynCorp International Inc. | | |

| | Class A | 105,941 | 1,907 |

| * | Cornell Cos. Inc. | 84,716 | 1,901 |

| | Granite Construction Inc. | 59,277 | 1,834 |

| | ABM Industries Inc. | 84,942 | 1,787 |

| | Kaman Corp. | 81,141 | 1,784 |

| | Encore Wire Corp. | 75,707 | 1,691 |

| | Universal Forest | | |

| | Products Inc. | 42,200 | 1,665 |

| * | CBIZ Inc. | 215,186 | 1,605 |

| * | Pike Electric Corp. | 124,699 | 1,494 |

| * | First Advantage Corp. | | |

| | Class A | 74,600 | 1,384 |

| | AO Smith Corp. | 35,700 | 1,360 |

| * | EnPro Industries Inc. | 55,402 | 1,267 |

| | John Bean | | |

| | Technologies Corp. | 67,077 | 1,219 |

| | TAL International Group Inc. | 82,400 | 1,172 |

| | American Science & | | |

| | Engineering Inc. | 17,200 | 1,170 |

| * | Blount International Inc. | 118,582 | 1,123 |

| * | Airtran Holdings Inc. | 178,800 | 1,118 |

| * | Thomas & Betts Corp. | 33,500 | 1,008 |

| | Interface Inc. Class A | 119,445 | 991 |

| | Standard Register Co. | 151,253 | 889 |

| | RR Donnelley & Sons Co. | 41,800 | 889 |

| | Mcgrath Rentcorp | 37,600 | 800 |

| * | American Reprographics Co. | 82,000 | 781 |

| * | Alaska Air Group Inc. | 27,765 | 744 |

| * | General Cable Corp. | 18,600 | 728 |

| * | Orion Marine Group Inc. | 35,300 | 725 |

| * | Navistar International Corp. | 18,900 | 707 |

| * | Waste Services Inc. | 144,201 | 666 |

| * | AZZ Inc. | 15,000 | 603 |

| * | GenCorp Inc. | 110,600 | 593 |

| | Applied Signal | | |

| | Technology Inc. | 24,254 | 564 |

| | Tredegar Corp. | 36,320 | 527 |

| * | Avis Budget Group Inc. | 39,400 | 526 |

| * | Geo Group Inc. | 24,600 | 496 |

| * | M&F Worldwide Corp. | 24,500 | 496 |

| | Kimball International Inc. | | |

| | Class B | 62,690 | 478 |

| * | WESCO International Inc. | 16,200 | 467 |

| | CIRCOR International Inc. | 16,128 | 456 |

| | Brink’s Co. | 16,288 | 438 |

| * | Armstrong World | | |

| | Industries Inc. | 12,400 | 427 |

| * | Exponent Inc. | 14,527 | 409 |

| | Ennis Inc. | 25,300 | 408 |

| * | Sterling Construction Co. Inc. | 21,480 | 385 |

| * | Michael Baker Corp. | 10,342 | 376 |

17

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | APAC Customer | | |

| | Services Inc. | 62,710 | 371 |

| * | Standard Parking Corp. | 21,068 | 369 |

| * | MasTec Inc. | 30,300 | 368 |

| * | Republic Airways | | |

| | Holdings Inc. | 34,310 | 320 |

| | Macquarie Infrastructure | | |

| | Co. LLC | 32,200 | 290 |

| | Lennox International Inc. | 7,204 | 260 |

| * | Owens Corning | 11,500 | 258 |

| | Deluxe Corp. | 12,513 | 214 |

| | Aceto Corp. | 26,100 | 172 |

| | Toro Co. | 4,100 | 163 |

| | Timken Co. | 6,931 | 162 |

| | Lawson Products Inc. | 8,632 | 150 |

| | Great Lakes Dredge & | | |

| | Dock Corp. | 21,300 | 149 |

| * | Metalico Inc. | 32,238 | 134 |

| | Raven Industries Inc. | 4,902 | 131 |

| | Ampco-Pittsburgh Corp. | 4,374 | 116 |

| * | Colfax Corp. | 8,679 | 92 |

| * | Builders FirstSource Inc. | 13,836 | 60 |

| | | | 475,979 |

| Information Technology (17.8%) | |

| * | Marvell Technology | | |

| | Group Ltd. | 2,467,819 | 39,954 |

| * | Western Digital Corp. | 1,083,400 | 39,577 |

| * | Sybase Inc. | 853,585 | 33,204 |

| * | Hewitt Associates Inc. | | |

| | Class A | 875,623 | 31,899 |

| | Xilinx Inc. | 1,334,812 | 31,261 |

| * | Skyworks Solutions Inc. | 2,356,616 | 31,202 |

| * | Computer Sciences Corp. | 589,692 | 31,083 |

| * | Sohu.com Inc. | 444,186 | 30,551 |

| * | Avnet Inc. | 1,159,500 | 30,112 |

| | Earthlink Inc. | 2,426,105 | 20,404 |

| * | Dolby Laboratories Inc. | | |

| | Class A | 493,400 | 18,843 |

| * | CSG Systems | | |

| | International Inc. | 1,122,136 | 17,965 |

| * | QLogic Corp. | 994,628 | 17,108 |

| * | ON Semiconductor Corp. | 1,916,994 | 15,815 |

| *,^ | Alliance Data Systems Corp. | 240,981 | 14,719 |

| * | Plexus Corp. | 556,466 | 14,657 |

| * | Anixter International Inc. | 298,868 | 11,988 |

| * | Mantech International Corp. | |

| | Class A | 232,680 | 10,973 |

| * | JDA Software Group Inc. | 459,275 | 10,076 |

| * | PMC - Sierra Inc. | 1,051,825 | 10,055 |

| * | Multi-Fineline | | |

| | Electronix Inc. | 347,697 | 9,982 |

| | Solera Holdings Inc. | 297,880 | 9,267 |

| * | LSI Corp. | 1,503,400 | 8,254 |

| * | RF Micro Devices Inc. | 1,376,200 | 7,473 |

| * | NCR Corp. | 497,362 | 6,874 |

| * | Teradata Corp. | 201,302 | 5,540 |

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | SAIC Inc. | 310,700 | 5,450 |

| | Syntel Inc. | 108,723 | 5,189 |

| * | SYNNEX Corp. | 166,974 | 5,089 |

| * | Starent Networks Corp. | 199,192 | 5,063 |

| * | TNS Inc. | 180,300 | 4,940 |

| * | S1 Corp. | 721,980 | 4,462 |

| | Shares | Market | |

| | Diebold Inc. | 129,861 | 4,276 |

| * | TIBCO Software Inc.�� | 386,069 | 3,664 |

| * | Synopsys Inc. | 140,470 | 3,149 |

| * | Lawson Software Inc. | 494,813 | 3,088 |

| | iGate Corp. | 356,314 | 3,057 |

| *,^ | STEC Inc. | 103,879 | 3,053 |

| * | j2 Global | | |

| | Communications Inc. | 131,165 | 3,018 |

| * | Acxiom Corp. | 313,696 | 2,968 |

| * | Genpact Ltd. | 240,157 | 2,954 |

| * | Netscout Systems Inc. | 208,405 | 2,816 |

| | Broadridge Financial | | |

| | Solutions Inc. | 138,779 | 2,789 |

| * | Gartner Inc. | 145,300 | 2,655 |

| | Black Box Corp. | 105,541 | 2,648 |

| | Adtran Inc. | 105,200 | 2,583 |

| * | 3Com Corp. | 488,900 | 2,557 |

| * | Semtech Corp. | 130,513 | 2,220 |

| * | Cogent Inc. | 215,974 | 2,181 |

| * | Micron Technology Inc. | 258,900 | 2,123 |

| * | Affiliated Computer | | |

| | Services Inc. Class A | 33,000 | 1,788 |

| * | BMC Software Inc. | 44,200 | 1,659 |

| * | Sapient Corp. | 197,761 | 1,590 |

| * | Tessera Technologies Inc. | 54,189 | 1,511 |

| * | Tech Data Corp. | 36,000 | 1,498 |

| | CTS Corp. | 157,015 | 1,460 |

| * | NCI Inc. Class A | 47,906 | 1,373 |

| *,^ | Synaptics Inc. | 48,400 | 1,220 |

| * | Scansource Inc. | 43,000 | 1,218 |

| * | SPSS Inc. | 24,116 | 1,205 |

| * | VistaPrint NV | 23,700 | 1,203 |

| * | Netlogic Microsystems Inc. | 23,657 | 1,065 |

| * | Hittite Microwave Corp. | 27,603 | 1,015 |

| * | Ingram Micro Inc. | 60,200 | 1,014 |

| | Linear Technology Corp. | 36,500 | 1,008 |

| | Pegasystems Inc. | 29,100 | 1,005 |

| * | OSI Systems Inc. | 52,695 | 964 |

| * | Cirrus Logic Inc. | 172,296 | 958 |

| * | BigBand Networks Inc. | 227,042 | 910 |

| * | Art Technology Group Inc. | 232,200 | 896 |

| * | Global Cash Access | | |

| | Holdings Inc. | 122,600 | 896 |

| * | Wright Express Corp. | 30,000 | 885 |

| * | DTS Inc. | 29,200 | 799 |

| * | Arris Group Inc. | 61,400 | 799 |

| * | Benchmark Electronics Inc. | 42,908 | 772 |

| * | Tekelec | 43,200 | 710 |

| | MAXIMUS Inc. | 14,700 | 685 |

18

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| * | Ariba Inc. | 58,100 | 674 |

| * | Avocent Corp. | 29,551 | 599 |

| * | Kopin Corp. | 122,122 | 586 |

| * | Monotype Imaging | | |

| | Holdings Inc. | 59,800 | 503 |

| * | Polycom Inc. | 18,500 | 495 |

| * | InterDigital Inc. | 20,700 | 479 |

| | Lender Processing | | |

| | Services Inc. | 12,200 | 466 |

| * | Compuware Corp. | 62,500 | 458 |

| * | NeuStar Inc. Class A | 19,600 | 443 |

| * | Ebix Inc. | 8,000 | 443 |

| * | Applied Micro Circuits Corp. | 33,700 | 337 |

| * | TeleTech Holdings Inc. | 17,500 | 299 |

| * | Riverbed Technology Inc. | 12,600 | 277 |

| * | Interactive Intelligence Inc. | 14,200 | 271 |

| * | Insight Enterprises Inc. | 18,200 | 222 |

| * | Unisys Corp. | 81,700 | 218 |

| * | Loral Space & | | |

| | Communications Inc. | 7,800 | 214 |

| * | Volterra Semiconductor Corp. | 11,500 | 211 |

| * | Quantum Corp. | 165,200 | 208 |

| * | Blue Coat Systems Inc. | 9,000 | 203 |

| * | Acme Packet Inc. | 20,104 | 201 |

| * | TriQuint Semiconductor Inc. | 24,100 | 186 |

| * | Conexant Systems Inc. | 66,800 | 183 |

| * | Manhattan Associates Inc. | 8,100 | 164 |

| * | CACI International Inc. | | |

| | Class A | 3,300 | 156 |

| * | Smith Micro Software Inc. | 11,907 | 147 |

| * | SonicWALL Inc. | 17,100 | 144 |

| * | Ciber Inc. | 35,486 | 142 |

| * | Aruba Networks Inc. | 15,800 | 140 |

| * | Euronet Worldwide Inc. | 2,855 | 69 |

| * | Brightpoint Inc. | 6,011 | 53 |

| | | | 630,125 |

| Materials (6.6%) | | |

| * | Owens-Illinois Inc. | 977,000 | 36,051 |

| | Eastman Chemical Co. | 594,728 | 31,842 |

| | Celanese Corp. Class A | 1,202,100 | 30,052 |

| | Greif Inc. Class A | 447,400 | 24,629 |

| | FMC Corp. | 264,741 | 14,892 |

| | Rock-Tenn Co. Class A | 233,458 | 10,998 |

| | Compass Minerals | | |

| | International Inc. | 174,275 | 10,739 |

| | Schnitzer Steel | | |

| | Industries Inc. | 153,000 | 8,147 |

| | Silgan Holdings Inc. | 131,186 | 6,917 |

| * | Pactiv Corp. | 247,618 | 6,450 |

| | Glatfelter | 551,883 | 6,336 |

| | Terra Industries Inc. | 164,199 | 5,693 |

| | Koppers Holdings Inc. | 171,338 | 5,080 |

| | Walter Energy Inc. | 83,400 | 5,009 |

| | Schweitzer-Mauduit | | |

| | International Inc. | 84,639 | 4,601 |

| | Ball Corp. | 85,000 | 4,182 |

| | | | |

| | | | | Market |

| | | | | Value• |

| | | | Shares | ($000) |

| | Innophos Holdings Inc. | | 201,584�� | 3,729 |

| * | Crown Holdings Inc. | | 112,200 | 3,052 |

| | NewMarket Corp. | | 32,722 | 3,044 |

| * | Buckeye Technologies Inc. | | 240,158 | 2,577 |

| | CF Industries Holdings Inc. | | 28,007 | 2,415 |

| | Stepan Co. | | 28,538 | 1,715 |

| | A Schulman Inc. | | 75,709 | 1,509 |

| * | Clearwater Paper Corp. | | 32,271 | 1,334 |

| | Bemis Co. Inc. | | 41,900 | 1,086 |

| | Sonoco Products Co. | | 36,603 | 1,008 |

| * | Graphic Packaging | | | |

| | Holding Co. | | 248,729 | 575 |

| | Sensient Technologies Corp. | 19,272 | 535 |

| * | Bway Holding Co. | | 26,368 | 488 |

| * | LSB Industries Inc. | | 15,600 | 243 |

| | | | | 234,928 |

| Telecommunication Services (1.2%) | |

| * | Syniverse Holdings Inc. | 1,166,403 | 20,412 |

| * | Cincinnati Bell Inc. | 3,873,500 | 13,557 |

| | Windstream Corp. | | 306,200 | 3,102 |

| | NTELOS Holdings Corp. | | 152,027 | 2,685 |

| | USA Mobility Inc. | | 105,215 | 1,355 |

| * | Premiere Global | | | |

| | Services Inc. | | 148,562 | 1,235 |

| | Consolidated | | | |

| | Communications | | | |

| | Holdings Inc. | | 34,800 | 557 |

| * | Centennial | | | |

| | Communications Corp. | | 69,400 | 554 |

| * | iPCS Inc. | | 14,100 | 245 |

| * | Neutral Tandem Inc. | | 9,300 | 212 |

| | | | | 43,914 |

| Utilities (4.9%) | | | |

| * | NRG Energy Inc. | 1,337,100 | 37,693 |

| | CMS Energy Corp. | 2,023,269 | 27,112 |

| | Centerpoint Energy Inc. | 2,014,308 | 25,038 |

| | SCANA Corp. | | 488,356 | 17,044 |

| * | Mirant Corp. | | 793,452 | 13,036 |

| | Atmos Energy Corp. | | 355,211 | 10,010 |

| | UGI Corp. | | 236,700 | 5,932 |

| | DPL Inc. | | 174,900 | 4,565 |

| | NSTAR | | 136,155 | 4,332 |

| | IDACORP Inc. | | 144,444 | 4,159 |

| | AGL Resources Inc. | | 114,790 | 4,049 |

| | NorthWestern Corp. | | 133,497 | 3,261 |

| | Avista Corp. | | 151,929 | 3,072 |

| | WGL Holdings Inc. | | 82,603 | 2,737 |

| | NiSource Inc. | | 131,300 | 1,824 |

| | PNM Resources Inc. | | 151,735 | 1,772 |

| | Vectren Corp. | | 76,367 | 1,759 |

| | Unisource Energy Corp. | | 31,800 | 978 |

| | Southwest Gas Corp. | | 37,400 | 957 |

| | New Jersey Resources Corp. | 22,000 | 799 |

| | CH Energy Group Inc. | | 13,300 | 589 |

| * | El Paso Electric Co. | | 29,100 | 514 |

| | South Jersey Industries Inc. | 13,890 | 490 |

19

| | | |

| Strategic Equity Fund | | |

| |

| |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | Central Vermont Public | | |

| | Service Corp. | 6,900 | 133 |

| | Chesapeake Utilities Corp. | 3,800 | 118 |

| | | | 171,973 |

| Total Common Stocks | | |

| (Cost $3,292,283) | | 3,530,407 |

| Temporary Cash Investments (1.2%)1 | |

| Money Market Fund (1.0%) | | |

| 2,3 | Vanguard Market Liquidity | | |

| | Fund, 0.267% | 36,073,853 | 36,074 |

| |

| | | Face | |

| | | Amount | |

| | | ($000) | |

| U.S. Government and Agency Obligations (0.2%) |

| 4,5 | Freddie Mac Discount Notes, | |

| | 0.351% 11/23/09 | 2,000 | 2,000 |

| 4,5 | Freddie Mac Discount Notes, | |

| | 0.260% 2/22/10 | 4,000 | 3,997 |

| | | | 5,997 |

| Total Temporary Cash Investments | |

| (Cost $42,069) | | 42,071 |

| Total Investments (100.7%) | | |

| (Cost $3,334,352) | | 3,572,478 |

| Other Assets and Liabilities (–0.7%) | |

| Other Assets | | 90,425 |

| Liabilities3 | | (114,169) |

| | | | (23,744) |

| Net Assets (100%) | | |

| Applicable to 244,480,810 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,548,734 |

| Net Asset Value Per Share | | $14.52 |

| |

| At September 30, 2009, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 5,233,220 |

| Undistributed Net Investment Income | 17,851 |

| Accumulated Net Realized Losses | (1,940,388) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 238,126 |

| Futures Contracts | (75) |

| Net Assets | 3,548,734 |

• See Note A in Notes to Financial Statements. * Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $14,307,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 0.7%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $14,993,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government. 5 Securities with a value of $5,997,000 have been segregated as initial margin for open futures contracts.

REIT–Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

20

| |

| Strategic Equity Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | September 30, 2009 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 50,755 |

| Interest1 | 4,778 |

| Security Lending | 1,706 |

| Total Income | 57,239 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 683 |

| Management and Administrative | 7,436 |

| Marketing and Distribution | 1,026 |

| Custodian Fees | 99 |

| Auditing Fees | 24 |

| Shareholders’ Reports and Proxies | 373 |

| Trustees’ Fees and Expenses | 8 |

| Total Expenses | 9,649 |

| Net Investment Income | 47,590 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold1 | (1,457,352) |

| Futures Contracts | (112,066) |

| Realized Net Gain (Loss) | (1,569,418) |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 921,718 |

| Futures Contracts | 821 |

| Change in Unrealized Appreciation (Depreciation) | 922,539 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (599,289) |

1 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $0, $619,000, and ($21,261,000), respectively.

See accompanying Notes, which are an integral part of the Financial Statements.

21

| | |

| Strategic Equity Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended September 30, |

| | 2009 | 2008 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 47,590 | 65,953 |

| Realized Net Gain (Loss) | (1,569,418) | (331,389) |

| Change in Unrealized Appreciation (Depreciation) | 922,539 | (1,492,805) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | (599,289) | (1,758,241) |

| Distributions | | |

| Net Investment Income | (67,840) | (69,137) |

| Realized Capital Gain1 | — | (700,017) |

| Total Distributions | (67,840) | (769,154) |

| Capital Share Transactions | | |

| Issued | 436,608 | 774,976 |

| Issued in Lieu of Cash Distributions | 63,748 | 726,971 |

| Redeemed | (1,106,155) | (1,851,818) |

| Net Increase (Decrease) from Capital Share Transactions | (605,799) | (349,871) |

| Total Increase (Decrease) | (1,272,928) | (2,877,266) |

| Net Assets | | |

| Beginning of Period | 4,821,662 | 7,698,928 |

| End of Period2 | 3,548,734 | 4,821,662 |

1 Includes fiscal 2008 short-term gain distributions totaling $83,541,000. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed net investment income of $17,851,000 and $38,101,000.

See accompanying Notes, which are an integral part of the Financial Statements.

22

| | | | | |

| Strategic Equity Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| For a Share Outstanding | | | Year Ended September 30, |

| Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $16.42 | $24.94 | $23.07 | $23.28 | $19.70 |

| Investment Operations | | | | | |

| Net Investment Income | .184 | .240 | .270 | .270 | .190 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | (1.843) | (6.090) | 2.840 | 1.170 | 4.490 |

| Total from Investment Operations | (1.659) | (5.850) | 3.110 | 1.440 | 4.680 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.241) | (.240) | (.260) | (.210) | (.140) |

| Distributions from Realized Capital Gains | — | (2.430) | (.980) | (1.440) | (.960) |

| Total Distributions | (.241) | (2.670) | (1.240) | (1.650) | (1.100) |

| Net Asset Value, End of Period | $14.52 | $16.42 | $24.94 | $23.07 | $23.28 |

| |

| Total Return1 | –9.66% | –25.37% | 13.76% | 6.49% | 24.32% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $3,549 | $4,822 | $7,699 | $6,755 | $5,183 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets | 0.30% | 0.25% | 0.30% | 0.35% | 0.40% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.47% | 1.09% | 1.03% | 1.18% | 0.99% |

| Portfolio Turnover Rate | 60% | 79% | 75% | 80% | 75% |

| 1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

23

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2006–2009), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

24

Strategic Equity Fund

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At September 30, 2009, the fund had contributed capital of $755,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.30% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of September 30, 2009, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |