SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549 USA

FORM 20-F/A

AMENDMENT NO. 2

(Mark One)

o

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

o

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

___________________________

OR

þ

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

o

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

________________________________

For the transition period from May 1, 2007 to May 31, 2008

Commission file number:000-26296

Petaquilla Minerals Ltd.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant's name into English)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 410, 475 West Georgia Street, Vancouver, British Columbia, Canada V6B 4M9

(Address of principal executive offices)

Bassam Moubarak, telephone (604) 694-0021, fax (604) 694-0063,

Suite 410, 475 West Georgia Street,Vancouver, British Columbia, Canada V6B 4M9

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 1 |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | | Name of each exchange on which registered |

None | | Not applicable |

| | |

| | |

| | |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares Without Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

95,958,641

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yesþ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

o Large accelerated filer þ Accelerated filer o Non-accelerated filer

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 2 |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | |

o | U.S. GAAP | o | International Financial reporting Standards as issued by the International Accounting Standards Board | þ | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

þ Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes þ No

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 3 |

Explanatory Note

Petaquilla Minerals Ltd. (the “Company”) has filed this Amendment No. 2 (“Amendment No. 2”) to its Annual Report on Form 20-F for the transition period ended May 31, 2008, to (i) expand the Company’s disclosures concerning the material effects of governmental regulation on the Company’s Molejon gold project in Panama; (ii) update its operating results, liquidity and capital resources to reflect changes to the Company’s amended financial statements included in the Amendment No. 2 and to include additional disclosure regarding the Company’s ability to continue as a going concern; (iii) expand the Company’s disclosure regarding its controls and procedures and how it intends to take remedial actions with respect to identified material weaknesses; (iv) file certain material contracts as exhibits that were not previously filed; (v) update its list of subsidiaries; and (vi) update its presentation of e xploration results. The Company directs the reader of Amendment No. 2 to the following specific Items in this Amendment No. 2 for further details: Item 3.A – Selected Financial Data, Item 3.D. – Key Information – Risk Factors, Item 4.A. – History and Development of Our Company, Item 4.B – Business Overview, Item 4.D.– Property, Plants and Equipment, Item 5.A. – Operating Results, Item 5.B. – Liquidity and Capital Resources, Item 8.A. – Financial Information – Consolidated Statements and Other Financial Information, Item 15 (Controls and Procedures), Item 17 (Financial Statements) and Item 19 (Exhibits). Further, pursuant to Rule 13a-10(g)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which does not permit transition reports to cover periods longer than 12 months, this Amendment No. 2 amends the periods of the Company’s financial disclosures from the 15-month period ended April 30, 2007, and the 13-month period ended May 31, 2008, to the 12-month period ended January 31, 2007, the three-month period ended April 30, 2007, the 12-month period ended April 30, 2008, and the one-month period ended May 31, 2008.

This Amendment No. 2 sets forth the complete text of the above-referenced Items and all amendments thereto as well as updated responses to the other Form 20-F Items, and includes new certifications pursuant to Rules 13a-14(a) and 15d-14(a) and Rules 13a-14(b) and 15d-14(b) under the Exchange Act.

The information set forth in this report on Form 20-F is as at November 6, 2009, unless an earlier or later date is indicated.

Financial information in this Amendment No. 2 is presented in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”). Measurement differences between accounting principles generally accepted in Canada and in the United States, as applicable to the Company are set forth in Item 5 of this Amendment No. 2 and in Note 28 to the accompanying financial statements of the Company.

This Amendment No. 2 contains forward-looking statements within the meaning of applicable securities laws. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Statements in this Amendment No. 2 regarding expected completion dates of feasibility studies, anticipated commencement dates of mining or metal production operations, including when our Molejon project is anticipated to begin production, projected quantities of future metal production and anticipated production rates, operating efficiencies, costs and expenditures are forward-looking statements. Actual results could differ materially depending upon the availability of materials, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, the accuracy of reserve estimates, lower than expected ore grades or the failure of equipment or processes to operate in accordance with specifications. See“Item 3 – Key Information – 3.D. Risk Factors” for other factors that may affect our future financial performance.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 4 |

As used in this report, the terms "we", "us" and "our" mean Petaquilla Minerals Ltd. and its subsidiaries, unless otherwise indicated.

Unless otherwise indicated, all dollar amounts referred to herein are in Canadian dollars.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 5 |

![[petaminerals20fa2may08001.jpg]](https://capedge.com/proxy/20-FA/0001176256-10-000024/petaminerals20fa2may08001.jpg)

PETAQUILLA MINERALS LTD.

SECURITIES AND EXCHANGE COMMISSION

FORM 20-F/A

AMENDMENT NO. 2

TABLE OF CONTENTS

Page No.

| | |

| GLOSSARY OF MINING TERMS | 10 |

| CAUTIONARY NOTE REGARDING RESOURCE AND RESERVE ESTIMATES | 11 |

| | |

PART I | | 12 |

| | |

ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 12 |

| | |

ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 12 |

| | |

ITEM 3 | KEY INFORMATION | 12 |

3.A. | Selected Financial Data | 12 |

3.B. | Capitalization and Indebtedness | 13 |

3.C. | Reasons For The Offer and Use of Proceeds | 13 |

3.D. | Risk Factors | 14 |

| Risks related to our exploration, construction and mining operations could adversely affect our business | 14 |

| Our estimates of reserves, mineral deposits and potential future production costs may be inaccurate, which could impact our results of operations in the future | 14 |

| Our properties may be subject to undetected title defects | 15 |

| Our directors may have conflicts of interest | 15 |

| Exchange rate fluctuations may effectively increase our costs of exploration and production | 15 |

| We are dependent upon additional funding in order to sustain our operations | 15 |

| Our company has a history of losses and there is substantial uncertainty regarding our ability to continue as a going concern | 16 |

| The requirements of the Ley Petaquilla may have an adverse impact on our company | 16 |

| We have a history of net losses, an accumulated deficit and a lack of revenue from operations | 17 |

| We have limited experience with development-stage mining operations | 17 |

| Our common shares are subject to penny stock rules, which could affect trading in our shares | 17 |

| We face strong competition for the acquisition of mining properties. | 18 |

| Mineral prices can fluctuate dramatically and have a material adverse effect on our results of operations | 18 |

| We face risks related to our operations in foreign countries | 18 |

| Our operations are subject to environmental and other regulation | 18 |

| We face political risks in Panama | 19 |

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 6 |

| | |

| We have not paid dividends in the past and do not expect to pay dividends in the foreseeable future | 19 |

| U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling person and officers | 19 |

| If We are Characterized as a Passive Foreign Investment Company (“PFIC”), Our U.S. Shareholders May Be Subject to Adverse U.S. Federal Income Tax Consequences | 20 |

ITEM 4 | INFORMATION ON THE COMPANY | 20 |

4.A. | History and Development of the Company | 20 |

| Molejon Property – Panama | 21 |

| Mineral Properties – Other | 22 |

| Directors and Officers of Our Company | 22 |

| Principal Capital Expenditures/Divestitures Over Last Three Fiscal Years | 23 |

| Current and Planned Capital Expenditures/Divestitures | 23 |

| Public Takeover Offers | 23 |

4.B. | Business Overview | 23 |

4.C. | Organizational Structure | 24 |

4.D. | Property, Plants and Equipment | 26 |

| Cerro Petaquilla Concession, Panama | 26 |

| Introduction | 26 |

| Property Location | 26 |

| Location, Access & Physiography | 27 |

| Plants and Equipment | 28 |

| Title | 29 |

| Exploration History | 30 |

| Outlook – 2010 | 33 |

| Regional and Local Geology | 34 |

| Mineralization | 36 |

| Doing Business in Panama | 37 |

| | |

ITEM 4A | UNRESOLVED STAFF COMMENTS | 40 |

| | |

ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 40 |

5.A. | Operating Results | 40 |

| Restatement of U.S. GAAP Financial Statements | 40 |

| Restatement of January 31, 2007 Interim Financial Statements and May 31, 2008 Balance Sheet | 41 |

| One Month Ended May 31, 2008 Compared to One Month Ended May 31, 2007 | 43 |

| 12 Months Ended April 30, 2008,Compared to 12 Months Ended April 30, 2007 | 44 |

| Three Months Ended April 30, 2008 Compared to Three Months Ended April 30, 2007 | 46 |

| 12 Months Ended January 31, 2007 Compared to Fiscal Year Ended January 31, 2006 | 47 |

5.B. | Liquidity and Capital Resources | 47 |

| May 31, 2008, Compared to April 30, 2008 | 48 |

| April 30, 2008, Compared to April 30, 2007 | 48 |

| April 30, 2007, Compared to January 31, 2007 | 49 |

| January 31, 2007, Compared to January 31, 2006 | 49 |

5.C. | Research and Development, Patents and Licenses, etc. | 50 |

5.D. | Trend Information | 50 |

5.E. | Off-Balance Sheet Arrangements | 50 |

5.F. | Tabular Disclosure of Contractual Obligations | 50 |

| | |

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 7 |

| | |

ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 52 |

6.A. | Directors and Senior Management | 52 |

6.B. | Compensation | 53 |

| Cash and Non-Cash Compensation - Executive Officers and Directors | 53 |

| Option Grants in Last Two Fiscal Periods | 54 |

| Aggregated Option Exercises in Last Two Fiscal Periods | 55 |

| Defined Benefit or Actuarial Plan Disclosure | 55 |

| Termination of Employment, Change in Responsibilities and Employment Contracts | 55 |

| Directors | 55 |

6.C. | Board Practices | 56 |

6.D. | Employees | 57 |

6.E. | Share Ownership | 57 |

| | |

ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 58 |

7.A. | Major Shareholders | 58 |

7.B. | Related Party Transactions | 59 |

7.C. | Interests of Experts and Counsel | 60 |

| | |

ITEM 8 | FINANCIAL INFORMATION | 60 |

8.A. | Consolidated Statements and Other Financial Information | 60 |

8.B. | Significant Changes | 60 |

| | |

ITEM 9 | THE OFFER AND LISTING | 62 |

9.A. | Offer and Listing Details | 62 |

9.B. | Plan of Distribution | 64 |

9.C. | Markets | 64 |

9.D. | Selling Shareholders | 64 |

9.E. | Dilution | 64 |

9.F. | Expenses of the Issue | 64 |

| | |

ITEM 10 | ADDITIONAL INFORMATION | 64 |

10.A. | Share Capital | 64 |

10.B. | Memorandum and Articles of Association | 64 |

10.C. | Material Contracts | 68 |

10.D. | Exchange Controls | 68 |

10.E. | Taxation | 70 |

| Material Canadian Federal Income Tax Consequences | 70 |

| Dividends | 70 |

| Capital Gains | 70 |

| Material United States Federal Income Tax Consequences | 71 |

| U.S. Holders | 71 |

| Distributions on our Common Shares | 71 |

| Disposition of Our Common Shares | 72 |

| Passive Foreign Investment Company | 72 |

| Foreign Tax Credit | 73 |

| Controlled Foreign Corporations | 73 |

| Information Reporting: Backup Withholding | 74 |

10.F. | Dividends and Paying Agents | 74 |

10.G. | Statements by Experts | 74 |

10.H. | Documents on Display | 74 |

10.I. | Subsidiary Information | 74 |

| | |

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 8 |

| | |

ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 74 |

| | |

ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 74 |

| | |

PART II | | 75 |

| | |

ITEM 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 75 |

| | |

ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 75 |

| | |

ITEM 15 | CONTROLS AND PROCEDURES | 77 |

| | |

ITEM 16 | [RESERVED] | 78 |

16.A. | Audit Committee Financial Expert | 78 |

16.B. | Code of Ethics | 78 |

16.C. | Principal Accountant Fees and Services | 79 |

16.D. | Exemptions From the Listing Standards for Audit Committees | 79 |

16.E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 79 |

16.F. | Change in Registrant’s Certifying Accountant | 79 |

16.G. | Corporate Governance | 80 |

| | |

PART III | | 80 |

| | |

ITEM 17 | FINANCIAL STATEMENTS | 80 |

| | |

ITEM 18 | FINANCIAL STATEMENTS | 129 |

| | |

ITEM 19 | EXHIBITS | 129 |

| | |

| SIGNATURES | 131 |

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 9 |

GLOSSARY OF MINING TERMS

The following is a glossary of some of the terms used in the mining industry and referenced herein:

cutoff grade - deemed grade of mineralization, established by reference to economic factors, above which material is included in mineral deposit calculations and below which material is considered waste. May be either an external cutoff grade, which refers to the grade of mineralization used to control the external or design limits of an open pit based upon the expected economic parameters of the operation, or an internal cutoff grade, which refers to the minimum grade required for blocks of mineralization present within the confines of an open pit to be included in mineral deposit estimates.

diamond drill - a machine designed to rotate under pressure an annular diamond-studded cutting tool to produce a more or less continuous solid sample (drill core) of the material that is drilled.

epithermal - a term applied to those mineral deposits formed in and along fissures or other openings in rocks by deposition at shallow depths from ascending hot solutions.

indicated reserves orprobable reserves - reserves for which quantity and grade and/or quality are computed from information similar to that used for measured or proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for measured reserves, is high enough to assume continuity between points of observation.

junior resource company - as used herein means a company whose mineral resource properties are in the exploration phase only and which is wholly or substantially dependent on equity financing or joint ventures to fund its ongoing activities.

measured reserves orproven reserves - reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geological character is so well defined that size, shape, depth and mineral content of reserves are well established.

mineral deposit, deposit ormineralized material - a mineralized body which has been physically delineated by sufficient drilling, trenching and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify under Commission standards as a commercially mineable ore body or as containing ore reserves, until final legal, technical and economic factors have been resolved.

open pit mining - the process of mining an ore body from the surface in progressively deeper steps. Sufficient waste rock adjacent to the ore body is removed to maintain mining access and to maintain the stability of the resulting pit.

ore - a natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit, or from which some part may be profitably separated.

ounces - troy ounces.

oz/tonne - troy ounces per metric ton.

ppb - parts per billion.

ppm - parts per million.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 10 |

porphyry deposit - a disseminated mineral deposit often closely associated with porphyritic intrusive rocks.

reserve - that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of "ore" when dealing with metalliferous minerals.

stockwork - a rock mass so interpenetrated by small veins of ore that the whole must be mined together. Stockworks are distinguished from tabular or sheet deposits, i.e. veins or beds, which have a small thickness in comparison with their extension in the main plane of the deposit.

strike length - the longest horizontal dimensions of a body or zone of mineralization.

stripping ratio - the ratio of waste material to ore that is experienced in mining an ore body.

tonne - metric ton (2,204 pounds).

CAUTIONARY NOTE REGARDING RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) -CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analy sis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the ba sis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Amendment No. 2 contains descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 11 |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

ITEM 3. KEY INFORMATION

3.A. Selected Financial Data

The following tables summarize our selected financial data (stated in Canadian dollars) prepared in accordance with Canadian GAAP and reconciled for measurement differences to United States generally accepted accounting principles (“U.S. GAAP”). The information in the tables was extracted from the more detailed financial statements and related notes included with this filing and should be read in conjunction with these financial statements and with the information appearing under the heading “Item 5 – Operating and Financial Review and Prospects”. Note 28 of our consolidated financial statements , included with this filing , sets forth the material variations in U.S. GAAP. Results for the periods presented are not necessarily indicative of results for future periods.

INFORMATION IN ACCORDANCE WITH CANADIAN GAAP:

| | | | | | | | | |

| 1 Month Ended May 31 | 12 Months

Ended April 30 | 3 Months

Ended April 30 | 12 Months Ended January 31 |

| | 2008 | 2008 | 2007 | 2007 | 2006 | 2005 | 2004 |

(a) | Total revenue | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

(b) | (Loss) before extraordinary items(1) | | | | | | | |

| | Total | ($4,513,145) | ($1,031,155) | ($6,443,991) | ($21,518,459) | ($2,567,758) | ($1,798,273) | ($811,190) |

| | Per Share(1) | ($0.05) | ($0.01) | ($0.07) | ($0.28) | ($0.05) | ($0.04) | ($0.02) |

(c) | Total assets | $106,282,486 | $93,935,092 | $46,581,365 | $42,300,633 | $12,807,172 | $1,989,474 | $2,670,561 |

(d) | Total long-term debt | $30,760,220 | $1,377,094 | $699,185 | $869,990 | $0 | $0 | $0 |

(e) | Total shareholder equity (deficiency) | $50,008,735 | $53,623,536 | $34,837,619 | $37,479,809 | $12,256,076 | $1,886,423 | $2,543,620 |

(f) | Cash dividends declared per share | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

(g) | Capital stock (number of issued and outstanding common shares) | 95,958,641 | 95,958,641 | 89,876,951 | 89,367,031 | 70,246,303 | 51,264,537 | 48,829,542 |

(h) | Net earnings (loss) for the period | | | | | | | |

| | Total | ($4,513,145) | ($1,031,155) | ($6,443,991) | ($21,518,459) | ($2,567,758) | ($1,798,273) | ($811,190) |

| | Per Share(1) | ($0.05) | ($0.01) | ($0.07) | ($0.28) | ($0.05) | ($0.04) | ($0.02) |

|

(1) The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses per share are the same. |

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 12 |

INFORMATION IN ACCORDANCE WITH U.S. GAAP:

| | | | | | | | | |

| 1 Month Ended May 31 | 12 Months Ended April 30 | 3 Months Ended April 30 | 12 Months Ended January 31 |

| | 2008 | 2008 | 2007 | 2007 | 2006 | 2005 | 2004 |

(a) | Total revenue | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

(b) | Loss before extraordinary items | | | | | | | |

| | Total | ($3,280,379) | ($51,227,478) | ($16,408,094) | ($40,967,629) | ($4,979,571) | ($1,798,273) | ($811,190) |

| | Per Share(1) | ($0.04) | ($0.55) | ($0.18) | ($0.53) | ($0.09) | ($0.04) | ($0.02) |

(c) | Total assets | $40,985,357 | $27,428,456 | $17,439,671 | $22,390,538 | $10,432,778 | $2,026,893 | $2,715,567 |

(d) | Total long-term debt | $20,932,559 | $1,377,094 | $699,185 | $869,990 | $0 | $0 | $0 |

(e) | Total shareholder equity (deficiency) | ($5,460,733) | ($12,883,100) | $5,695,925 | $17,569,714 | $9,881,682 | $1,923,842 | $2,588,626 |

(f) | Cash dividends declared per share | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

(g) | Capital stock (number of issued and outstanding common shares) | 95,958,641 | 95,958,641 | 89,876,951 | 89,367,031 | 70,246,303 | 51,264,537 | 48,829,542 |

(h) | Net loss for the period | | | | | | | |

| | Total | ($3,280,379) | ($51,227,478) | ($16,408,094) | ($40,967,629) | ($4,979,571) | ($1,805,860) | (766,184) |

| | Per Share(1) | ($0.04) | ($0.55) | ($0.18) | ($0.53) | ($0.09) | ($0.04) | ($0.02) |

|

(1) The effect of potential share issuances pursuant to the exercise of options and warrants would be anti-dilutive and, therefore, basic and diluted losses are the same. |

We have not declared or paid any dividends in any of our last five financial years.

On November 6, 2009, the exchange rate, based on the noon buying rate published by The Bank of Canada, for the conversion of Canadian dollars into United States dollars (the "Noon Rate of Exchange") was $1.0720 (US$1.00 = $1.0720 ).

The following table sets out the high and low exchange rates for each month during the last six months.

| | | | | | |

| | 2009 |

| | October | September | August | July | June | May |

| High for period | 1.0845 | 1.1065 | 1.1079 | 1.1655 | 1.1625 | 1.1872 |

| Low for period | 1.0292 | 1.0613 | 1.0686 | 1.0790 | 1.0827 | 1.0872 |

The following table sets out the average exchange rates for the five most recent financial years calculated by using the average of the Noon Rate of Exchange on the last day of each month during the period.

| | | | | | | |

| 12 Months

Ended May 31 | 1 Month

Ended May 31 | 12 Months

Ended April 30 | 3 Months

Ended April 30 | 12 Months Ended January 31 |

| 2009 | 2008 | 2008 | 2007 | 2007 | 2006 | 2005 |

Average for the period | 1.1585 | 0.9995 | 1.0225 | 1.1581 | 1.1358 | 1.2060 | 1.2906 |

3.B. Capitalization and Indebtedness

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

3.C. Reasons For The Offer and Use of Proceeds

This Amendment No. 2 is being filed as an annual report under the Exchange Act and, as such, there is no requirement to provide the information called for by this item.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 13 |

3.D. Risk Factors

We operate in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. Investors should carefully consider the risks described below before investing in our securities. The occurrence of any of the following events could harm us. If these events occur, the trading price of our common shares could decline, and investors may lose part or even all of their investment.

Risks related to our exploration, construction and mining operations could adversely affect our business.

We are engaged in the acquisition, exploration, exploration management and sale of mineral properties, with the primary aim of developing them to a stage where they can be exploited at a profit. Our property interests are in the exploration stage and are without a known body of commercial ore. Although an open pit mine is planned and construction of a gold plant for the processing of gold-bearing ores is currently underway at the Molejon gold property, located in the Cerro Petaquilla Concession, for the processing of gold-bearing ores, there is no guarantee we will realize any profits or positive cash flow from this property. Any profitability in the future from our business will be dependent upon locating mineral reserves, which itself is subject to numerous risk factors.

The business of exploring for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. Should our mineral deposits reach the development stage, we will be subjected to an array of complex economic factors and accordingly there is no assurance that a positive feasibility study or any projected results contained in a feasibility study of a mineral deposit will be attained.

Our ability to meet timing and cost estimates for properties cannot be assured. Technical considerations, delays in obtaining governmental approvals, inability to obtain financing or other factors could cause delays in exploring properties and such delays could materially adversely affect our financial performance.

The business of mining is subject to a variety of risks such as cave-ins and other accidents, flooding, environmental hazards, the discharge of toxic chemicals and other hazards. Should our mineral properties reach the production stage, such occurrences may delay production, increase production costs or result in liability. We intend to obtain insurance in amounts that we consider to be adequate to protect ourselves against certain risks of mining and processing. However, we may become subject to liability for hazards against which we cannot insure ourselves or which we may elect not to insure against because of premium costs or other reasons. In particular, we are not insured for environmental liability nor earthquake damage.

In order to further the Molejon gold property located in Panama, it will be necessary to continue construction of electrical, transportation, and other infrastructure facilities, the costs of which could be substantial.

Our estimates of reserves, mineral deposits and potential future production costs may be inaccurate, which could impact our results of operations in the future.

Although the ore reserve and mineral deposit figures included herein, some of which, as noted, are not compliant with National Instrument (“NI”) 43-101, have been carefully prepared by us, or, in some instances have been prepared, reviewed or verified by independent mining experts, these amounts are estimates only and no assurance can be given that any particular level of recovery of minerals from ore reserves will in fact be realized or that an identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Further drilling and engineering analyses are required in order to have any of our resources classified as proven reserves. Estimates of reserves, mineral deposits and potential future production costs can also be affected by such factors as permitting regulations and requirements, weather, environmental facto rs, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short-term factors relating to ore reserves, such as the need for orderly exploration of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. Historical and comparative results should not be relied upon as indicators of potential future performance. There can be no assurance that minerals recovered in small-scale laboratory tests will be duplicated in large-scale tests under on-site conditions. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of projects. Ore reserves are reported as general indicators of mine life. Reserves should not be interpreted as assurances of mine life or of the profitability of current or future operations.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 14 |

Our properties may be subject to undetected title defects.

It is possible there may be undetected title defects affecting our properties. Title insurance generally is not available, and our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Furthermore, we have not conducted surveys of the claims in which we hold interests and, therefore, the precise area and location of such claims may be in doubt. Accordingly, our properties may be subject to prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects which could have a material adverse impact on our operations. In addition, we may be unable to operate our properties as permitted or to enforce our rights with respect to our properties.

Our directors may have conflicts of interest.

As at November 6, 2009, two of our directors, David Levy and Daniel Small, hold positions with Platinum Management (NY) LLC, an investment advising firm to Platinum Partners Value Arbitrage Fund LP, a New York based investment fund. Platinum Partners Value Arbitrage Fund LP holds securities in our company and a portion of our debt. However, none of our directors are directors or officers of Platinum Partners Value Arbitrage Fund LP nor are any of our directors insiders of any other reporting company. While currently none of our directors beneficially owns a 10% or greater interest in the voting power of any other mineral resource companies, they could in the future. To the extent that these other companies may participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such p articipation, which could result in competitive harm to us. In the event that such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In appropriate cases we will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. In accordance with the laws of the Province of British Columbia, our directors are required to act honestly, in good faith and in our best interests. In determining whether or not we will participate in a particular program and the interest therein to be acquired by it, our directors primarily consider the potential benefits to us, the degree of risk to which we may be exposed and our financial position at that time. Other than as indicated, we have no other procedures or mechanisms to prevent conflicts of interest.

Exchange rate fluctuations may effectively increase our costs of exploration and production.

Exchange rate fluctuations may affect the costs that we incur in our operations. The appreciation of non-U.S. dollar currencies against the U.S. dollar can increase the cost of exploration and production in U.S. dollar terms, which could materially and adversely affect our profitability, results of operations and financial condition.

We are dependent upon additional funding in order to sustain our operations.

We have not generated cash flow from operations in the past and, although we are currently commissioning our surface gold processing plant at the Molejon gold property, cash flow to satisfy our operational requirements, debt repayments and cash commitments is not assured from the operations of the Molejon gold plant. In the past, we have relied on sales of equity securities or debt financing to meet most of our cash requirements, together with project management fees, property payments and sales or joint ventures of properties. There can be no assurance that funding from these sources will be sufficient in the future to satisfy our operational requirements and cash commitments.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 15 |

We do not presently have sufficient financial resources to undertake all of our planned exploration programs. Advancement of our properties depends upon our ability to obtain financing through any or all of the joint venturing of projects, debt financing, equity financing or other means. There is no assurance that we will be successful in obtaining the required financing. Failure to obtain additional financing on a timely basis could cause us to forfeit our interest in our properties and reduce or terminate our operations on such properties.

Our company has a history of losses and there is substantial uncertainty regarding our ability to continue as a going concern.

In their report on the consolidated financial statements for the periods ended May 31, 2008, April 30, 2008, April 30, 2007 , January 31, 2007 , and January 31, 2006, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

As at May 31, 2008, we had an accumulated deficit of $85,065,382 and for the one month ended May 31, 2008 and 12 months ended April 30, 2008, incurred a net loss from continuing operations of $4,513,145 and $1,031,155, respectively. Continuing operations are dependent on us achieving profitable operations and being able to raise capital, if and when necessary to meet our obligations and repay liabilities when they come due.

We are executing a business plan to allow us to continue as a going concern, which is to achieve profitability through cost containment and increased revenues. We have reduced our losses and intend to reduce them further, ultimately achieving profitability. There is significant uncertainty that we will be successful in executing this plan. Should we fail to achieve profitability, or if necessary, raise sufficient capital to sustain operations, we may be forced to suspend our operations, and possibly even liquidate our assets and wind-up and dissolve our company.

During May 2007 and January 2008, we completed private placements for gross proceeds of $2,824,305 and $9,421,500, respectively. In May 2008, we raised gross proceeds of $31,801,725 through debt financing.

We did not generate revenue from operations during the one month ended May 31, 2008, 12 months ended April 30, 2008, three months ended April 30, 2007 , twelve months ended January 31, 2007 , or twelve months ended January 31, 2006. Expenses for the one month ended May 31, 2008 were $4,709,927, for the twelve months ended April 30, 2008 were $14,889,731, for the three months ended April 30, 2007 were $4,890,565 , for the twelve months ended January 31, 2007 were $23,951,217 , and for the twelve months ended January 31, 2006 were $2,538,350.

Our consolidated financial statements are prepared on a going concern basis, which assumes that we will be able to realize our assets at the amounts recorded and discharge our liabilities in the normal course of business in the foreseeable future. Should this assumption not be appropriate, adjustments in the carrying amounts of the assets and liabilities to their realizable amounts and the classifications thereof will be required and these adjustments and reclassifications may be material.

The requirements of the Ley Petaquilla may have an adverse impact on our company.

Our operations in Panama are governed primarily by Law No. 9 of the Legislative Assembly of Panama (the “Ley Petaquilla”), a project-specific piece of legislation enacted in February 1997 to deal with the orderly development of the Cerro Petaquilla Concession.

The Ley Petaquilla granted a mineral exploration and exploitation concession to Minera Petaquilla, S.A. (“MPSA”), a Panamanian company formed in 1997 to hold the Cerro Petaquilla Concession covering approximately 136 square kilometers in north-central Panama. Although we no longer hold an interest in MPSA, we continue to hold the rights to the Molejon gold deposit and, as the Cerro Petaquilla Concession encompasses this deposit, the Ley Petaquilla governs our exploration activities.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 16 |

The Ley Petaquilla contains fiscal and legal stability clauses necessary in order to obtain project financing and includes tax exemptions on income, dividends and imports. The Ley Petaquilla also provides for an increase in the annual available infrastructure tax credit, higher depreciation rates for depreciable assets, which cannot be used in the infrastructure tax credit pool, and a favorable depletion allowance.

In order to maintain the Cerro Petaquilla Concession in good standing, MPSA must pay to the Government of Panama an annual rental fee of US$1.00 per hectare during the first five years of the concession, US$2.50 per hectare in the sixth to the tenth years of the concession and US$3.50 per hectare thereafter. Initially, the annual rental was approximately US$13,600 payable by MPSA and was funded pro rata by its shareholders. The current annual rental is approximately US$34,000. The concession was granted for a 20-year term with up to two 20-year extensions permitted subject to the requirement to begin mine development and to make a minimum investment, as described below.

Under the Ley Petaquilla, MPSA was required to begin mine development by May 2001. However, MPSA was able to defer commencing development operations for one month for every month that the price of copper remained below US$1.155 per pound for up to a further five years (i.e., until May 2006 at the latest). The Ley Petaquilla also requires MPSA to (i) make a minimum investment of US$400 million in the development of the Cerro Petaquilla Concession; (ii) deliver an environmental report to the General Direction of Mineral Resources of the Ministry of Commerce and Industiries (“MICI”) for evaluation; (iii) submit, prior to extraction, an environmental feasibility study specific to the project area in which the respective extradition will take place; (iv) submit annually a work plan comprising the projections and approximate costs for the respective year to the MICI; (v) post letters of credit in support of required complia nce and environmental protection guarantees; (vi) annually pay surface canons; (vii) annually pay royalties for extracted minerals; (viii) annually present to the MICI detailed reports covering operations and employment and training; (ix) create and participate in the administration of a scholarship fund to finance studies and training courses or professional training for the inhabitants of the communities neighboring the Cerro Petaquilla Concession in the provinces of Cocle and Colon; and (x) maintain all mining and infrastructure works and services of the project, always complying with the standards and regulations of general application in force that pertain to occupational safety, health and construction.

For reference, a copy of Law No. 9 as passed by the Legislative Assembly of Panama on February 26, 1997, is attached to this Amendment No. 2 as Exhibit 4.V. and an English translation of the law has also been provided as Exhibit 4.W.

We have a history of net losses, an accumulated deficit and a lack of revenue from operations.

We have incurred net losses to date. Our deficit as of May 31, 2008, was $85,065,382. We have not yet had any revenue from the exploration activities on our properties. The Molejon gold property is our most advanced property. Even if we generate future revenue from any of our properties, including the Molejon gold property, we may continue to incur losses beyond the period of commencement of such activity. There is no certainty that we will produce revenue, operate profitably or provide a return on investment in the future and recent significant increases in metal commodity prices may not be sustainable. They may not be reliable as indicators of future consistent realizable values, should any of our mineral deposits reach commercial production.

We have limited experience with development-stage mining operations.

We have limited experience in placing resource properties into production and our ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that we will have available to us the necessary expertise when and if we place our resource properties into production. There also exists significant risk in being able to recruit experienced employees or contractors to allow us to move forward in pursuing development-stage mining operations.

Our common shares are subject to penny stock rules, which could affect trading in our shares.

Our common shares are classified as “penny stock” as defined in Rule 15g-9 promulgated under the Exchange Act. In response to perceived abuse in the penny stock market generally, the Exchange Act was amended in 1990 to add new requirements in connection with penny stocks. In connection with effecting any transaction in a penny stock, a broker or dealer must give the customer a written risk disclosure document that (a) describes the nature and level of risk in the market for penny stocks in both public offerings and secondary trading, (b) describes the broker's or dealer's duties to the customer and the rights and remedies available to such customer with respect to violations of such duties, (c) describes the dealer market, including “bid” and “ask” prices for penny stock and the significance of the spread between the bid and ask prices, (d) contains a toll-free telephone number for inquiries on disciplinary histories of brokers and dealers, and (e) defines significant terms used in the disclosure document or the conduct of trading in penny stocks. In addition, the broker-dealer must provide to a penny stock customer a written monthly account statement that discloses the identity and number of shares of each penny stock held in the customer’s account, and the estimated market value of such shares. The extensive disclosure and other broker-dealer compliance related to penny stocks may result in reducing the level of trading activity in the secondary market for our common shares, thus limiting the ability of our shareholder to sell their shares.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 17 |

We face strong competition for the acquisition of mining properties.

Significant and increasing competition exists for the limited number of mineral property acquisition opportunities available. As a result of this competition, some of which is with large established mining companies with substantial capabilities and greater financial and technical resources than we have, we may be unable to acquire additional attractive mineral properties on terms we consider acceptable. Accordingly, there can be no assurance that our exploration and acquisition programs will yield any new reserves or result in any commercial mining operation.

Mineral prices can fluctuate dramatically and have a material adverse effect on our results of operations.

The mining industry in general is intensely competitive and there is no assurance that, even if commercial quantities of minerals are discovered, a profitable market will exist for the sale of same. Factors beyond our control may affect the marketability of any substances discovered. The prices of minerals such as gold have experienced volatile and significant price movements over short periods of time and are affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the U.S. dollar relative to other currencies), interest rates and global or regional consumption patterns (such as the development of gold coin programs), speculative activities and increased production due to improved mining and production methods. The supply of and demand for minerals such as gold is affected by various factors, including political events, economic conditions and production costs in major producing regions and governmental policies with respect to holdings by a nation or its citizens. There can be no assurance that the price of recovered minerals will be such that our properties can be mined at a profit.

We face risks related to our operations in foreign countries.

Currently our only properties are located in Panama. Consequently, we are subject to certain risks associated with foreign ownership, including currency fluctuations, inflation, political instability and political risk. Mineral exploration and mining activities in foreign countries may be affected in varying degrees by political stability and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, restriction of earnings distribution, taxation laws, expropriation of property, environmental legislation, water use and mine safety. In particular, the status of Panama as a developing country may make it more difficult for us to obtain any required production financing for our properties from senior lending institutions.

Our operations are subject to environmental and other regulation.

Our current or planned operations, including development activities and commencement of production on our properties, require permits from various governmental authorities and such operations are and will be subject to laws and regulations governing prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, community services and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. There can be no assurance that approvals and permits required to commence production on our various properties will be obtained. Additional permits and studies, which may include environmen tal impact studies conducted before permits can be obtained, may be necessary prior to operation of the properties in which we have interests and there can be no assurance that we will be able to obtain or maintain all necessary permits that may be required to commence construction, development or operation of mining facilities at these properties on terms which enable operations to be conducted at economically justifiable costs.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 18 |

Our potential mining and processing operations and exploration activities in Panama are subject to various federal and provincial laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, mine safety, community services and other matters. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that we obtain permits from various governmental agencies. We believe we are in substantial compliance with all material laws and regulations that currently apply to our activities. There can be no assurance, however, that all permits we may require for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that s uch laws and regulations would not have a material adverse effect on any mining project we might undertake.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on us and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or abandonment or delays in development of new mining properties.

To the best of our knowledge, we are currently operating in compliance with all applicable environmental regulations.

We face political risks in Panama.

Mineral exploration and mining activities in Panama may be affected in varying degrees by political conditions and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and mine safety.

We have not paid dividends in the past and do not expect to pay dividends in the foreseeable future.

All of our available funds will be invested to finance the growth of our business and, therefore, investors cannot expect and should not anticipate receiving a dividend on our common shares in the foreseeable future.

U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers.

Our company and our officers and directors are residents of countries other than the United States, and all of our assets are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon such persons or enforce in the United States against such persons judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of United States federal securities laws or state securities laws.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 19 |

We believe that a judgment of a United States court predicated solely upon civil liability under United States securities laws would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that was recognized by a Canadian court for such purposes. However, there is doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon such laws.

If We are Characterized as a Passive Foreign Investment Company (“PFIC”), Our U.S. Shareholders May Be Subject to Adverse U.S. Federal Income Tax Consequences.

We have not made a determination as to whether we are considered a PFIC as such term is defined in the U.S. Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes for the current tax year and any prior tax years. A non-U.S. corporation generally will be considered a PFIC for any tax year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce or are held for the production of passive income.

In general, if we are or become a PFIC, any gain recognized on the sale of our common stock and any “excess distributions” (as specifically defined in the Code) paid on the common stock must be ratably allocated to each day in a U.S. taxpayer’s holding period for the common stock. The amount of any such gain or excess distribution allocated to prior years of such U.S. taxpayer’s holding period for the common stock generally will be subject to U.S. federal income tax at the highest tax applicable to ordinary income in each such prior year, and the U.S. taxpayer will be required to pay interest on the resulting tax liability for each such prior year, calculated as if such tax liability had been due in each such prior year. For more information, see “Material United States Federal Income Tax Consequences-Passive Foreign Investment Company.”

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Our company, Petaquilla Minerals Ltd., is a British Columbia company engaged in the acquisition, exploration and exploration management of mineral properties with the goal of bringing properties to production. Our company was incorporated under the laws of the Province of British Columbia, Canada, on October 10, 1985, by registration of our Memorandum and Articles of Association (the “Articles”) with the British Columbia Registrar of Companies under the name Adrian Resources Ltd. We changed our name to Petaquilla Minerals Ltd. on October 12, 2004.

Our head office and principal office address is Suite 410, 475 West Georgia Street, Vancouver, British Columbia, V6B 4M9 Canada. Our telephone number is (604) 694-0021 and our facsimile number is (604) 694-0063.

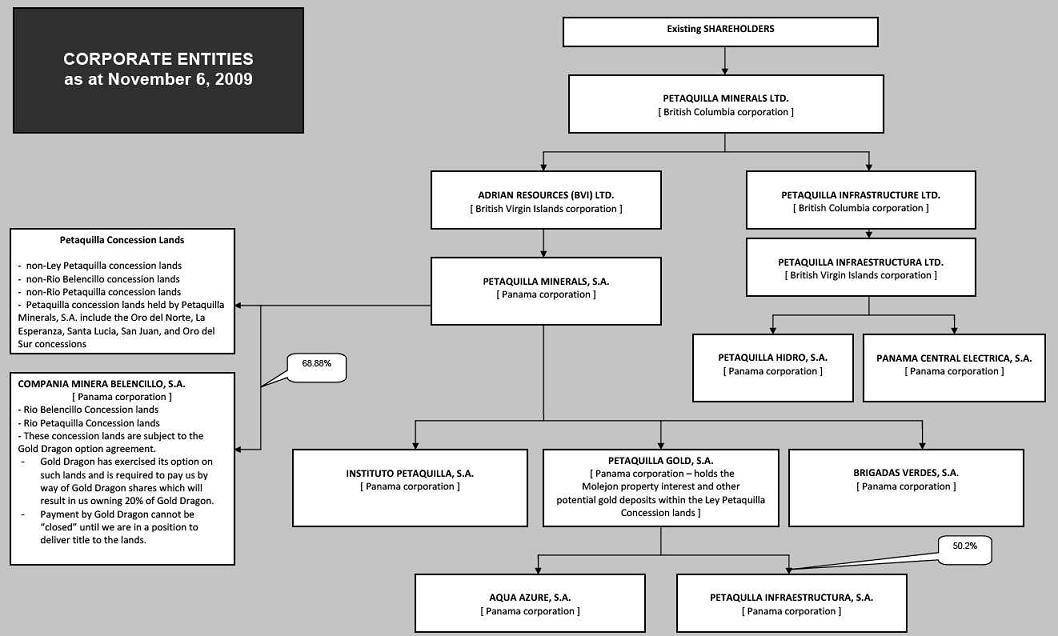

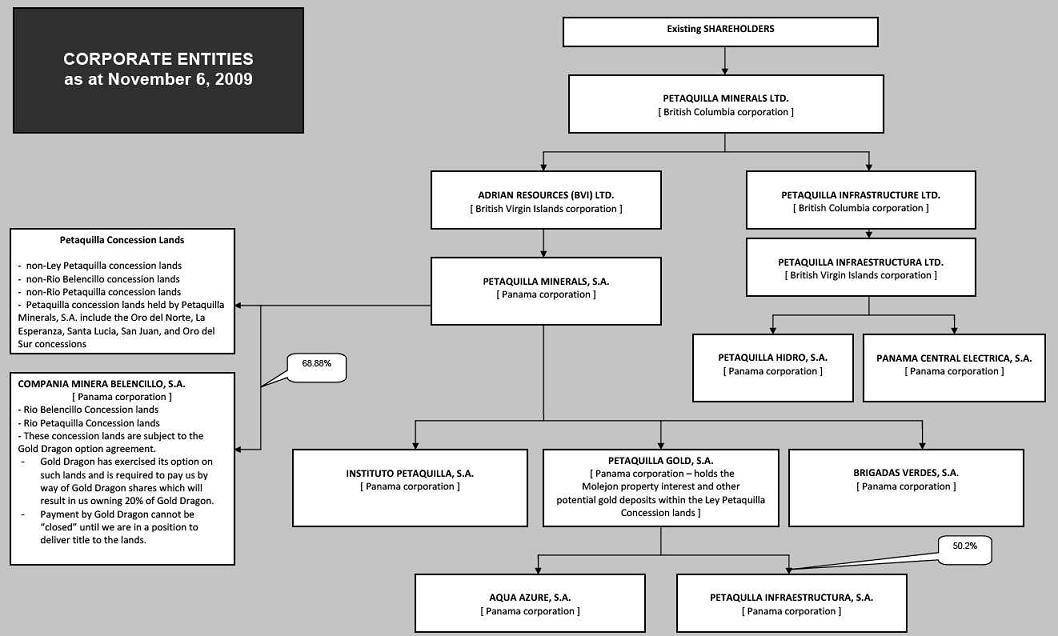

We have eleven subsidiaries and one joint venture interest as detailed below:

(i)

We own all of the issued shares of Adrian Resources (BVI) Ltd., incorporated in the British Virgin Islands on December 17, 1999.

(ii)

Adrian Resources (BVI) Ltd. owns all of the issued shares of Petaquilla Minerals, S.A., incorporated in the Republic of Panama on April 28, 1992, and holding title to certain of our exploration concessions in the Republic of Panama. Although originally incorporated under the name Adrian Resources, S.A., the name of this subsidiary was changed to Petaquilla Minerals, S.A. on February 3, 2005.

(iii)

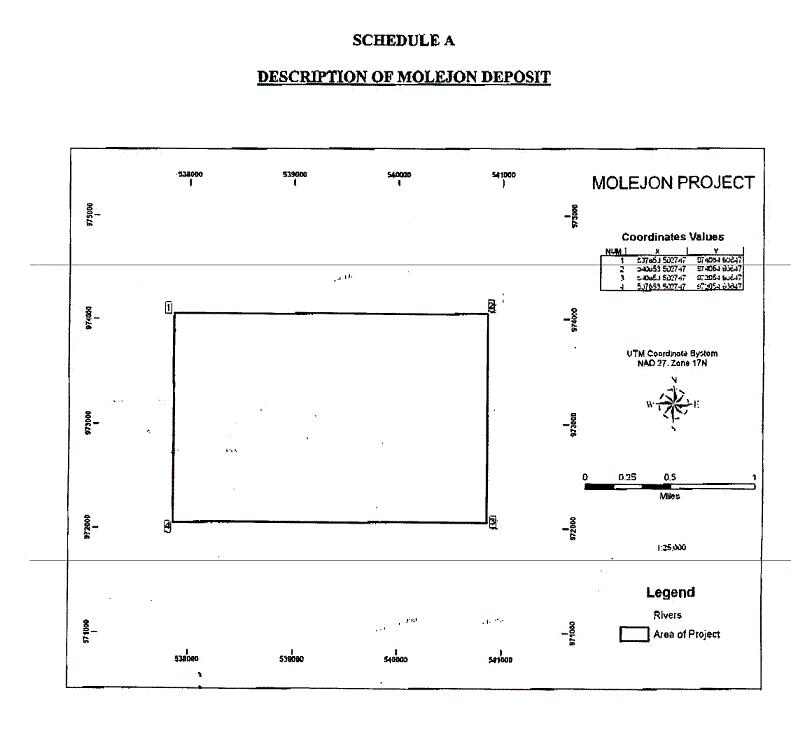

Petaquilla Minerals, S.A. owns all of the issued shares of Petaquilla Gold, S.A., a Panamanian corporation formed on August 11, 2005. Petaquilla Gold, S.A. holds the Molejon gold property interest and other potential gold deposits within the Cerro Petaquilla Concession lands.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 20 |

(iv)

Petaquilla Minerals, S.A. owns all of the issued shares of Instituto Petaquilla, S.A., a Panamanian corporation formed on April 23, 2007, to conduct training and education programs for our personnel.

(v)

Petaquilla Minerals, S.A. owns all of the issued shares of Brigadas Verdes, S.A., a Panamanian corporation formed on March 27, 2007, to coordinate and manage reforestation activities.

(vi)

Compañìa Minera Belencillo, S.A., a Panamanian corporation, was created on September 21, 2005, in accordance with the agreement signed between Petaquilla Minerals, S.A. and Madison Enterprises (Latin American), S.A. Petaquilla Minerals, S.A. owns 68.88% of Compañìa Minera Belencillo, S.A., which in turn holds a 100% interest in Zone 2 of the Rio Belencillo Concession and 68.88% of Zone 1, subject to an option by Madison Enterprises (Latin American), S.A. to earn a 31.12% interest in Zone 1 of the Rio Belencillo Concession. On May 7, 2005, we entered into an option agreement with Gold Dragon Capital Management Ltd. (“Gold Dragon”) whereby Gold Dragon could earn a 100% interest in the concession lands by the expenditure of US $500,000 over two years on mutually agreed upon property expenditures.

(vii)

Petaquilla Gold, S.A. owns 50.2% of the shares of Petaquilla Infraestructura, S.A. (formerly named Petaquilla Power & Water, S.A.), a Panamanian corporation formed on September 21, 2006, to primarily (i) design, construct, operate, maintain and install equipment and networks for the generation, transmission and commercialization of electrical energy; and (ii) to develop projects for the production, distribution and commercialization of potable water.

(viii)

Petaquilla Gold, S.A. also owns all of the issued shares of Aqua Azure, S.A., a Panamanian corporation formed on October 10, 2006, to purchase, sell, lease, manage, commercialize and hold investment in all sorts of moveable goods.

(ix)

We own all of the issued shares of Petaquilla Infrastructure Ltd., incorporated in British Columbia, Canada, on May 29, 2009.

(x)

Petaquilla Infrastructure Ltd. owns all of the issued shares of Petaquilla Infraestructura Ltd. incorporated in the British Virgin Islands on February 21, 2008.

(xi)

Petaquilla Infraestructura Ltd. owns all of the issued shares of Petaquilla Hidro, S.A., a Panamanian corporation formed on October 10, 2008.

(xii)

Petaquilla Infraestructura Ltd. owns all of the issued shares of Panama Central Electrica, S.A., a Panamanian corporation formed on February 16, 2009.

Molejon Property – Panama

Our interest in the Molejon deposit was acquired in 1992 and 1993 through two separate series of transactions and in 2005 by way of an agreement amongst the shareholders of MPSA. Specifically,in June 2005, the shareholders of MPSA agreed to separate the gold deposit and other precious metal mineral deposits that might be developed within the Cerro Petaquilla Concession from the copper mineral deposits within the Cerro Petaquilla Concession. The agreement provided for us, through our subsidiary, Petaquilla Gold, S.A., to own a 100% interest in the Molejon gold deposit, as well as all other gold and precious metal mineral deposits that might be developed within the Cerro Petaquilla Concession, subject to a graduated 1% - 5% Net Smelter Return, based on the future gold price at the time of production, payable to others.

In September 2005, the multi-phase Petaquilla Mine Development Plan (the “Plan”) submitted to the Government of Panama by MPSA was approved by Ministerial Resolution. The Molejon gold mineral deposit forms part of the Cerro Petaquilla Concession lands and the first phase of the Plan focuses on the advancement of the Molejon gold deposit by our company commencing in 2006. Subsequent phases of the plan will be the responsibility of MPSA, the joint venture company in which we no longer hold an interest.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 21 |

As at May 31, 2008, we incurred the following costs related to the Molejon gold deposit (except as noted below for Rio Belencillo). These costs have been capitalized on our audited consolidated balance sheet as mineral property costs:

| | | | |

| Trenching – Molejon | | $ 4,308,854 | |

| Trenching – Rio Belencillo | | 48,872 | |

| Camp costs | | 6,158,386 | |

| Transportation | | 250,126 | |

| Drilling costs | | 11,046,825 | |

| Indirect drilling costs | | 1,106,528 | |

| Geologist | | 1,128,193 | |

| Topography | | 153,571 | |

| Engineering and design | | 517,156 | |

| Engineering and consulting | | 2,807,641 | |

| Technical support | | 120,272 | |

| Property permits | | 408,381 | |

| Water samples | | 3,857 | |

| Environment | | 488,040 | |

| Communications | | 192,370 | |

| Logistics | | 395,581 | |

| Plant equipment | | 3,927,704 | |

| Communications - plant | | 6,179 | |

| Plant – site | | 22,272,755 | |

| Roads | | 1,634,057 | |

| Roads agreements | | 105,939 | |

| Bridges | | 50,261 | |

| Deferred amortization on mining equipment | | 3,938,717 | |

| Reclamation costs | | 4,400,000 | |

| Stock-based compensation | | 723,668 | |

| Accreted interest | | 955,682 | |

| | | $67,149,615 | |

Mineral Properties - Other

We hold various interests in other land concession areas adjacent to the Cerro Petaquilla Concession lands in Panama, including the Rio Belencillo and Rio Petaquilla Concessions.

By an agreement dated May 7, 2005, and amended on June 10, 2005, Gold Dragon Capital Management Ltd. (“Gold Dragon”), had an option to purchase all of our interest in the Rio Belencillo and Rio Petaquilla Concessions by the expenditure of $100,000 in approved exploration costs by May 7, 2007, an additional $400,000 in approved exploration costs by February 7, 2008, and by then paying us $1,152,400. This sum is payable in shares of Gold Dragon.

The payment of $100,000 on account of exploration expenditures has not been made in accordance with the terms and conditions of the May 7, 2005 agreement and we are in the process of amending the agreement with Gold Dragon.

Directors and Officers of Our Company

Effective May 1, 2007, our Board of Directors (the “Board”) consisted of Ralph Ansley, John Cook, Richard Fifer, and Marco Tejeira. Our officers were Richard Fifer as President and Chief Executive Officer, Tony M. Ricci as interim Chief Financial Officer, and Graham Scott as Corporate Secretary. On June 11, 2007, Robert Baxter was appointed to the Board of Directors and on September 10, 2007, Pablo Mauricio Buenano joined our company as VP Finance.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 22 |

At our Annual General Meeting of Shareholders held on November 6, 2007, the following Board members stood for election and were duly re-elected: Ralph Ansley, Robert Baxter, John Cook, Richard Fifer, and Marco Tejeira. Tony M. Ricci, who had been serving as our interim Chief Financial Officer while we conducted our search for a full-time Chief Financial Officer, stepped down when Bassam Moubarak was appointed as Chief Financial Officer on February 11, 2008. On July 7, 2008, Dr. Ralph Ansley resigned from our Board citing medical reasons.

At our Annual General Meeting of Shareholders held on November 18, 2008, the following Board members stood for election and were duly re-elected: Robert Baxter, John Cook, and Richard Fifer. Gaston Araya and John Resing were proposed for election for the first time and were duly elected to the Board. Bassam Moubarak and Graham Scott continued in their roles as Chief Financial Officer and Corporate Secretary, respectively, and on December 1, 2008, Joao Manuel joined the Company in the capacity of Chief Operating Officer.

Principal Capital Expenditures/Divestitures Over Last Three Fiscal Years

At May 31, 2008, we incurred $67,100,743 in Molejon property expenses and $48,872 in Rio Belencillo property expenses for a total of $67,149,615 that has been capitalized as mineral property costs. On February 10, 2005, we sold 500,000 of our own shares on the Toronto Stock Exchange (“TSX”) at a price of $0.65 per share. These shares were previously issued and reacquired by us some years ago pursuant to an issuer bid. Accordingly, there was no change to the number of shares issued and outstanding as a result of this sale. The proceeds of the sale were directed towards general working capital purposes.

Current and Planned Capital Expenditures/Divestitures

We have either ongoing or anticipated capital expenditures during the fiscal year ending May 31, 2010. With respect to the planned exploration and advancement of the Molejon property, we anticipate having capital expenditures of approximately $5,000,000 to $10,000,000 during the fiscal year ending May 31, 2010. However, such expenditures are subject to further consideration and to our ability to obtain external financing. There is no assurance that we will be successful in obtaining such financing.

Public Takeover Offers

During the one-month period ended May 31, 2008, the 12-month period ended April 30, 2008, the three-month period ended April 30, 2007, the 12-month period ended January 31, 2007, and the 12-month period ended January 31, 2006, we did not receive any public takeover offers from third parties nor did we make any such takeover offers.

4.B. Business Overview

Molejon Property – Panama

We currently have no significant properties in Canada and we are not actively exploring, or seeking to acquire interests in, mineral properties in Canada. Our primary focus has been the exploration of the Molejon gold deposit and other mineral properties in the Republic of Panama.

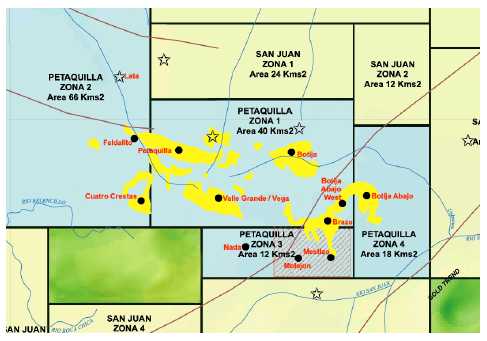

The Republic of Panama, through the Ministry of Commerce and Industry, is the regulatory body overseeing the Cerro Petaquilla Concession and potential future development thereof. Law No. 9, the Ley Petaquilla, passed by the Legislative Assembly of Panama on February 26, 1997, is a project-specific piece of legislation dealing with the orderly development of the Cerro Petaquilla Concession, including the Molejon gold deposit. The Ley Petaquilla could be amended by the government of Panama through the enaction of a subsequent law but no such law has been enacted since the Ley Petaquilla legislation passed in February 1997. At that time, the Ley Petaquilla granted a mineral exploration and exploitation concession to MPSA, a Panamanian company formed in 1997 to hold the 136 square kilometer Cerro Petaquilla Concession. Our Molejon property comprises approximately 10% of the Cerro Petaquilla l ands.

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 23 |

The Ley Petaquilla contains fiscal and legal stability clauses necessary in order to obtain project financing and includes tax exemptions on income, dividends and imports. The Ley Petaquilla also provides for an increase in the annual available infrastructure tax credit, higher depreciation rates for depreciable assets, which cannot be used in the infrastructure tax credit pool, and a favourable depletion allowance.

There were no competing bidders for the concession at the time the Ley Petaquilla was enacted and the concession was granted for an initial 20-year term with two 20-year extensions permissible subject to the requirements to begin mine development and to make a minimum required investment. In 2005, we and our former partners in MPSA delivered the Plan to the Government of Panama and the Plan was approved by Ministerial Resolution in September 2005. Development of the Molejon gold mineral deposit by our company commencing in 2006 forms the first phase of the Plan. Subsequent phases of the Plan will be the responsibility of MPSA.

This government’s approval of the Plan resulted in the extension of the land tenure for an initial 20-year period commencing September 2005, subject to MPSA meeting certain other ongoing development and operational conditions. In addition, pursuant to the Ley Petaquilla, in order to maintain the Cerro Petaquilla Concession in good standing, we and MPSA must continue to meet certain obligations.

The Ley Petaquilla comprises the agreement between the Republic of Panama and the corporation of Minera Petaquilla, S.A. and its affiliates and expresses each party’s rights and obligations. The majority of our obligations require that the Republic of Panama be provided with a variety of reports, studies and work plans, payment of surface canons, access and use of port installations, evidence of bonding, etc. An example of an obligation that requires government approvals concerns the environment and states that an Environmental Feasibility Study specific to the project area in which the respective extradition will take place must be submitted to the General Direction of Mineral Resources of the Ministry of Commerce and Industries. Said study shall be evaluated and its approval, modification or rejection shall be defined within a term of 45 days counted as of the date of its presentation to the General Direction of Mineral Resources. After the end of this term, if there is no statement from the General Direction of Mining Resources, the Environmental Feasibility Study shall be considered approved. For complete disclosure of Panama’s requirements, please refer to Exhibit 4.V., Law No. 9 as passed by the Legislative Assembly of Panama on February 26, 1997, attached to this Amendment No. 2. An English translation of the law has also been provided as Exhibit 4.W. to this Amendment No. 2.

4.C. Organizational Structure

The following chart sets out our corporate structure and the mineral properties owned by each of our subsidiaries:

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 24 |

| |

Form 20-F/A_Amendment No.2_Transition Period Ended 2008 May 31 | Page 25 |

4.D. Property, Plants and Equipment

All our properties are in the exploration stage and are without a known body of commercial ore. Although an open pit mine is planned and a gold processing plant is currently being commissioned at the Molejon gold property, we currently have no mineral producing properties and have not generated any revenue from any mineral producing properties in the one month ended May 31, 2008, the 12 months ended April 30, 2008, the three months ended April 30, 2007, the 12 months ended January 31, 2007, and the 12 months ended January 31, 2006 .

Cerro Petaquilla Concession, Panama

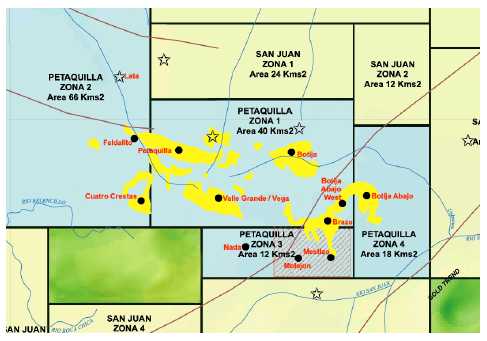

Introduction