UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-07343 |

| |

| Exact name of registrant as specified in charter: | | The Prudential Investment Portfolios, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 9/30/2010 |

| |

| Date of reporting period: | | 3/31/2010 |

Item 1 – Reports to Stockholders

| | |

| SEMIANNUAL REPORT | | MARCH 31, 2010 |

Prudential Asset Allocation Fund

(Formerly known as Dryden Asset Allocation Fund)

| | | | |

Fund Type Balanced/allocation Objective Income and long-term growth of capital | | | | This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter. The accompanying financial statements as of March 31, 2010. were not audited and, accordingly, no auditor’s opinion is expressed on them. Prudential Investments, Prudential Financial, and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates. |

| | |

| | To enroll in e-delivery, go to www.prudentialfunds.com/edelivery |

May 14, 2010

Dear Shareholder:

Recently we announced the renaming of JennisonDryden, Prudential Financial’s mutual fund family, to Prudential Investments. As a result of this change, each of our funds has been renamed to feature “Prudential” as part of its new name. The name of your fund has changed from the Dryden Asset Allocation Fund to the Prudential Asset Allocation Fund.

While the name of your fund has changed, its investment objectives and portfolio management team remain the same. No action is required on your part. If you participate in an automatic investment plan, your account continues to be invested in the Fund under its new name.

Featuring the Prudential name in our funds creates an immediate connection to the experience and heritage of Prudential, a name recognized by millions for helping people grow and protect their wealth.

On the following pages, you will find your fund’s semiannual report, including a table showing fund performance over the first half of the fiscal year and for longer periods. The report also contains a listing of the fund’s holdings at period-end. If you have questions about your fund or the renaming of our mutual fund family, please contact your financial professional or visit our website at www.prudentialfunds.com.

Sincerely,

Judy A. Rice, President

Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 1 |

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.24%; Class B, 1.94%; Class C, 1.94%; Class L, 1.44%; Class M, 1.94%; Class R, 1.69%; Class X, 1.94%; Class Z, 0.94%. Net operating expenses apply to: Class A, 1.22%; Class B, 1.92%; Class C, 1.92%; Class L, 1.42%; Class M, 1.92%; Class R, 1.42%; Class X, 1.92%; Class Z, 0.92%, after contractual reduction of management fees and/or distribution fees (Class R only).

| | | | | | | | | | | | | | |

| Cumulative Total Returns (Without Sales Charge) as of 3/31/10 |

| | | Six Months | | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Class A | | 8.26 | % | | 34.14 | % | | 11.12 | % | | 23.29 | % | | — |

Class B | | 7.96 | | | 33.27 | | | 7.22 | | | 14.74 | | | — |

Class C | | 7.96 | | | 33.11 | | | 7.22 | | | 14.74 | | | — |

Class L | | 8.24 | | | 33.90 | | | N/A | | | N/A | | | –8.30% (3/26/07) |

Class M | | 7.96 | | | 33.11 | | | N/A | | | N/A | | | –9.69 (3/26/07) |

Class R | | 8.16 | | | 33.55 | | | 9.63 | | | N/A | | | 9.39 (12/17/04) |

Class X | | 7.96 | | | 33.27 | | | N/A | | | N/A | | | –9.69 (3/26/07) |

Class Z | | 8.40 | | | 34.46 | | | 12.67 | | | 26.89 | | | — |

Customized Blend Index | | 7.53 | | | 32.48 | | | 20.85 | | | 31.58 | | | — |

Prior Customized Blend Index | | 7.60 | | | 30.40 | | | 19.76 | | | 28.11 | | | — |

Barclays Capital U.S. Aggregate Bond Index | | 1.99 | | | 7.69 | | | 30.33 | | | 83.98 | | | — |

S&P 500 Index | | 11.75 | | | 49.73 | | | 9.97 | | | –6.35 | | | — |

Lipper Average | | 8.06 | | | 40.02 | | | 15.93 | | | 22.87 | | | — |

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | | | | |

| Average Annual Total Returns (With Sales Charge) as of 3/31/10 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception |

Class A | | 26.76 | % | | 0.98 | % | | 1.54 | % | | — |

Class B | | 28.27 | | | 1.25 | | | 1.38 | | | — |

Class C | | 32.11 | | | 1.40 | | | 1.38 | | | — |

Class L | | 26.20 | | | N/A | | | N/A | | | –4.72% (3/26/07) |

Class M | | 27.11 | | | N/A | | | N/A | | | –4.18 (3/26/07) |

Class R | | 33.55 | | | 1.86 | | | N/A | | | 1.71 (12/17/04) |

Class X | | 27.27 | | | N/A | | | N/A | | | –4.46 (3/26/07) |

Class Z | | 34.46 | | | 2.41 | | | 2.41 | | | — |

Customized Blend Index | | 32.48 | | | 3.86 | | | 2.78 | | | — |

Prior Customized Blend Index | | 30.40 | | | 3.67 | | | 2.51 | | | — |

Barclays Capital U.S. Aggregate Bond Index | | 7.69 | | | 5.44 | | | 6.29 | | | — |

S&P 500 Index | | 49.73 | | | 1.92 | | | –0.65 | | | — |

Lipper Average | | 40.02 | | | 2.96 | | | 1.92 | | | — |

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Inception returns are provided for any share class with less than 10 calendar years of returns. The Since Inception returns for the Customized Blend Index, Prior Customized Blend Index, Barclays Capital U.S. Aggregate Bond Index, S&P 500 Index, and the Lipper Average are measured from the closest month-end to inception date, and not from the Fund’s actual inception date.

The average annual total returns take into account applicable sales charges. Class A, Class B, Class C, Class L, Class M, Class R, and Class X shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, 1.00%, 0.50%, 1.00%, 0.75%, and 1.00%, respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class L, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 1%, 6%, and 6%, respectively. Class R and Class Z shares are not subject to a sales charge. Class L shares are closed to most new purchasers (with the exception of exchanges from the same class of shares offered by certain other Prudential Investments funds). The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 3 |

Your Fund’s Performance (continued)

Benchmark Definitions

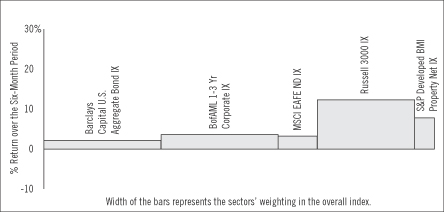

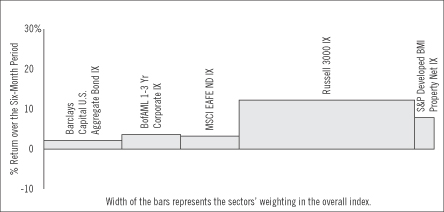

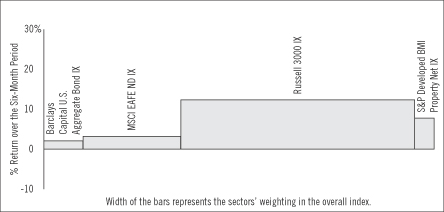

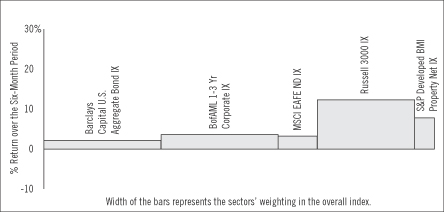

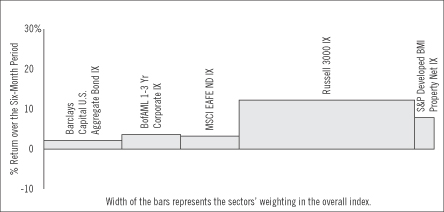

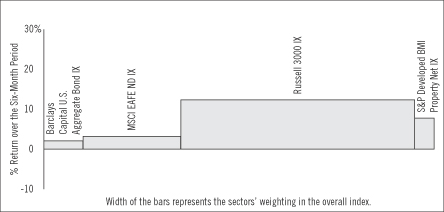

Customized Blend Index

The Customized Blend Index is made up of the S&P 500 Index (50%), the Barclays Capital U.S. Aggregate Bond Index (40%), the Russell 2000 Index (5%), and the MSCI EAFE ND Index (5%). Customized Blend Index Closest Month-End to Inception cumulative total returns are 19.01% for Class R; and 0.72% for Class L, Class M, and Class X. Customized Blend Index Closest Month-End to Inception average annual total returns are 3.37% for Class R; and 0.24% for Class L, Class M, and Class X.

Prior Customized Blend Index

The Prior Customized Blend Index is made up of the S&P 500 Index (57.5%), the Barclays Capital U.S. Aggregate Bond Index (40.0%), and the T-Bill 3-Month Blend (2.5%). Prior Customized Blend Index Closest Month-End to Inception cumulative total returns are 18.08% for Class R; and 1.45% for Class L, Class M, and Class X. Prior Customized Blend Index Closest Month-End to Inception average annual total returns are 3.22% for Class R; and 0.48% for Class L, Class M, and Class X.

Barclays Capital U.S. Aggregate Bond Index

The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade securities issued by the U.S. government and its agencies, and by corporations with between one and 10 years remaining to maturity on the securities. It gives a broad look at how short- and intermediate-term bonds have performed. Barclays Capital U.S. Aggregate Bond Index Closest Month-End to Inception cumulative total returns are 29.71% for Class R; and 19.57% for Class L, Class M, and Class X. Barclays Capital U.S. Aggregate Bond Index Closest Month-End to Inception average annual total returns are 5.08% for Class R; and 6.14% for Class L, Class M, and Class X.

S&P 500 Index

The S&P 500 Index is an unmanaged index of 500 stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed. S&P 500 Index Closest Month-End to Inception cumulative total returns are 7.61% for Class R; and –11.97% for Class L, Class M, and Class X. S&P 500 Index Closest Month-End to Inception average annual total returns are 1.41% for Class R; and –4.16% for Class L, Class M, and Class X.

Lipper Mixed-Asset Target Allocation Growth Funds Average

The Lipper Mixed-Asset Target Allocation Growth Funds Average (Lipper Average) represents returns based on the average return of all funds in the Lipper Mixed-Asset Target Allocation Growth Funds category for the periods noted. Funds in the Lipper Average are funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both stocks and bonds. Typically, the stock:bond ratio ranges around 60%:40%. Lipper Average Closest Month-End to Inception cumulative total returns are 14.16% for Class R; and –4.98% for Class L, Class M, and Class X. Lipper Average Closest Month-End to Inception average annual total returns are 2.51% for Class R; and –1.74% for Class L, Class M, and Class X.

Investors cannot invest directly in an index. The returns for the Customized Blend Index, Prior Customized Blend Index, the Barclays Capital U.S. Aggregate Bond Index, and the S&P 500 Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

| | | |

| Five Largest Equity Holdings expressed as a percentage of net assets as of 3/31/10 | | | |

Exxon Mobil Corp., Oil, Gas & Consumable Fuels | | 1.7 | % |

Microsoft Corp., Software | | 1.4 | |

Bank of America Corp., Diversified Financial Services | | 1.2 | |

Procter & Gamble Co. (The), Household Products | | 1.1 | |

Chevron Corp., Oil, Gas & Consumable Fuels | | 1.0 | |

Holdings reflect only long-term equity investments and are subject to change.

| | |

| Five Largest Equity Industries expressed as a percentage of net assets as of 3/31/10 | | |

Oil, Gas & Consumable Fuels | | 5.3 |

Pharmaceuticals | | 3.5 |

Computers & Peripherals | | 3.1 |

Diversified Financial Services | | 2.8 |

Insurance | | 2.7 |

Industry weightings reflect only long-term equity investments and are subject to change.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 5 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on October 1, 2009, at the beginning of the period, and held through the six-month period ended March 31, 2010. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Prudential Asset

Allocation Fund | | Beginning Account

Value

October 1, 2009 | | Ending Account

Value March 31, 2010 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,082.60 | | 1.22 | % | | $ | 6.33 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.85 | | 1.22 | % | | $ | 6.14 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,079.60 | | 1.92 | % | | $ | 9.95 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.36 | | 1.92 | % | | $ | 9.65 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,079.60 | | 1.92 | % | | $ | 9.95 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.36 | | 1.92 | % | | $ | 9.65 |

| | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | $ | 1,082.40 | | 1.42 | % | | $ | 7.37 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.85 | | 1.42 | % | | $ | 7.14 |

| | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | $ | 1,079.60 | | 1.92 | % | | $ | 9.95 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.36 | | 1.92 | % | | $ | 9.65 |

| | | | | | | | | | | | | | |

| Class R | | Actual | | $ | 1,000.00 | | $ | 1,081.60 | | 1.42 | % | | $ | 7.37 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.85 | | 1.42 | % | | $ | 7.14 |

| | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | $ | 1,079.60 | | 1.92 | % | | $ | 9.95 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.36 | | 1.92 | % | | $ | 9.65 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,084.00 | | 0.92 | % | | $ | 4.78 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.34 | | 0.92 | % | | $ | 4.63 |

| | | | | | | | | | | | | | |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 182 days in the six-month period ended March 31, 2010, and divided by the 365 days in the Fund’s fiscal year ending September 30, 2010 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 7 |

Portfolio of Investments

as of March 31, 2010 (Unaudited)

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

LONG-TERM INVESTMENTS 93.0% | | | |

COMMON STOCKS 60.6% | | | |

| |

Aerospace & Defense 2.0% | | | |

| 600 | | AAR Corp.(a) | | $ | 14,892 |

| 4,300 | | Alliant Techsystems, Inc.(a)(b) | | | 349,590 |

| 7,377 | | BAE Systems PLC (United Kingdom) | | | 41,565 |

| 2,334 | | Cobham PLC (United Kingdom) | | | 9,102 |

| 1,200 | | Cubic Corp. | | | 43,200 |

| 1,500 | | Ducommun, Inc. | | | 31,515 |

| 3,600 | | DynCorp International, Inc. (Class A Stock)(a) | | | 41,364 |

| 1,200 | | Esterline Technologies Corp.(a) | | | 59,316 |

| 830 | | European Aeronautic Defense and Space Co. NV (France) | | | 16,698 |

| 826 | | Finmeccanica SpA (Italy) | | | 11,023 |

| 1,000 | | GenCorp, Inc.(a) | | | 5,760 |

| 23,400 | | General Dynamics Corp. | | | 1,806,480 |

| 6,400 | | ITT Corp. | | | 343,104 |

| 900 | | L-3 Communications Holdings, Inc. (Class 3 Stock) | | | 82,467 |

| 12,300 | | Lockheed Martin Corp. | | | 1,023,606 |

| 23,700 | | Northrop Grumman Corp. | | | 1,554,009 |

| 11,800 | | Raytheon Co. | | | 674,016 |

| 3,778 | | Rolls-Royce Group PLC (United Kingdom) | | | 34,141 |

| 383 | | Safran SA (France) | | | 9,984 |

| 3,000 | | Singapore Technologies Engineering Ltd. (Singapore) | | | 6,841 |

| 10,600 | | TASER International, Inc.(a) | | | 62,116 |

| 1,000 | | Teledyne Technologies, Inc.(a) | | | 41,270 |

| 183 | | Thales SA (France) | | | 7,346 |

| 200 | | Triumph Group, Inc. | | | 14,018 |

| 30,500 | | United Technologies Corp. | | | 2,245,105 |

| | | | | |

| | | | | 8,528,528 |

| |

Air Freight & Logistics 0.7% | | | |

| 700 | | Air Transport Services Group, Inc.(a) | | | 2,359 |

| 1,725 | | Deutsche Post AG (Germany) | | | 29,846 |

| 2,700 | | Dynamex, Inc.(a) | | | 46,440 |

| 10,000 | | FedEx Corp. | | | 934,000 |

| 800 | | Forward Air Corp. | | | 21,040 |

| 756 | | TNT NV (Netherlands) | | | 21,678 |

| 1,349 | | Toll Holdings Ltd. (Australia) | | | 9,185 |

| 30,000 | | United Parcel Service, Inc. (Class B Stock) | | | 1,932,300 |

| 1,000 | | Yamato Holdings Co. Ltd. (Japan) | | | 14,055 |

| | | | | |

| | | | | 3,010,903 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 9 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Airlines 0.1% | | | |

| 276 | | Air France-KLM (France)(a) | | $ | 4,363 |

| 13,900 | | AirTran Holdings, Inc.(a) | | | 70,612 |

| 4,000 | | Alaska Air Group, Inc.(a) | | | 164,920 |

| 2,000 | | All Nippon Airways Co. Ltd. (Japan)(a) | | | 5,712 |

| 1,300 | | Allegiant Travel Co. (Class A Stock)(a) | | | 75,218 |

| 1,178 | | British Airways PLC (United Kingdom)(a) | | | 4,344 |

| 2,000 | | Cathay Pacific Airways Ltd. (Hong Kong)(a) | | | 4,214 |

| 468 | | Deutsche Lufthansa AG (Germany) | | | 7,747 |

| 4,300 | | Hawaiian Holdings, Inc.(a) | | | 31,691 |

| 973 | | Iberia Lineas Aereas de Espana (Spain)(a) | | | 3,401 |

| 2,266 | | Qantas Airways Ltd. (Australia)(a) | | | 5,906 |

| 1,000 | | Singapore Airlines Ltd. (Singapore) | | | 10,865 |

| 2,600 | | Skywest, Inc. | | | 37,128 |

| | | | | |

| | | | | 426,121 |

| |

Auto Components 0.6% | | | |

| 400 | | Aisin Seiki Co. Ltd. (Japan) | | | 11,980 |

| 6,100 | | ArvinMeritor, Inc.(a) | | | 81,435 |

| 1,300 | | Bridgestone Corp. (Japan) | | | 22,193 |

| 297 | | Compagnie Generale des Etablissements Michelin (France) (Class B Stock) | | | 21,886 |

| 6,900 | | Cooper Tire & Rubber Co. | | | 131,238 |

| 1,000 | | Denso Corp. (Japan) | | | 29,789 |

| 700 | | Dorman Products, Inc.(a) | | | 13,293 |

| 1,100 | | Drew Industries, Inc.(a) | | | 24,222 |

| 49,300 | | Johnson Controls, Inc. | | | 1,626,407 |

| 200 | | NOK Corp. (Japan) | | | 3,010 |

| 217 | | Nokian Renkaat OYJ (Finland) | | | 5,636 |

| 5,343 | | Pirelli & C SpA (Italy)(a) | | | 3,284 |

| 1,400 | | Standard Motor Products, Inc. | | | 13,888 |

| 300 | | Stanley Electric Co. Ltd. (Japan) | | | 5,818 |

| 500 | | Sumitomo Rubber Industries Ltd. (Japan) | | | 4,407 |

| 1,700 | | Superior Industries International, Inc. | | | 27,336 |

| 2,700 | | Tenneco, Inc.(a) | | | 63,855 |

| 100 | | Toyoda Gosei Co. Ltd. (Japan) | | | 2,803 |

| 400 | | Toyota Industries Corp. (Japan) | | | 11,424 |

| 17,200 | | TRW Automotive Holdings Corp.(a) | | | 491,576 |

| | | | | |

| | | | | 2,595,480 |

See Notes to Financial Statements.

| | |

| 10 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Automobiles 0.5% | | | |

| 674 | | Bayerische Motoren Werke AG (Germany) | | $ | 31,156 |

| 1,838 | | Daimler AG (Germany) | | | 86,702 |

| 1,558 | | Fiat SpA (Italy)(a) | | | 20,286 |

| 119,800 | | Ford Motor Co.(a)(b) | | | 1,505,886 |

| 1,000 | | Fuji Heavy Industries Ltd. (Japan)(a) | | | 5,177 |

| 3,400 | | Honda Motor Co. Ltd. (Japan) | | | 120,013 |

| 2,000 | | Isuzu Motors Ltd. (Japan) | | | 5,412 |

| 3,000 | | Mazda Motor Corp. (Japan) | | | 8,439 |

| 8,000 | | Mitsubishi Motors Corp. (Japan)(a) | | | 10,867 |

| 5,100 | | Nissan Motor Co. Ltd. (Japan)(a) | | | 43,696 |

| 311 | | Peugeot SA (France)(a) | | | 9,157 |

| 179 | | Porsche Automobil Holding SE (Germany) | | | 10,886 |

| 378 | | Renault SA (France)(a) | | | 17,716 |

| 800 | | Suzuki Motor Corp. (Japan) | | | 17,653 |

| 2,200 | | Thor Industries, Inc. | | | 66,462 |

| 6,000 | | Toyota Motor Corp. (Japan) | | | 240,347 |

| 90 | | Volkswagen AG (Germany) | | | 8,691 |

| 2,200 | | Winnebago Industries(a) | | | 32,142 |

| 500 | | Yamaha Motor Co. Ltd. (Japan)(a) | | | 7,493 |

| | | | | |

| | | | | 2,248,181 |

| |

Beverages 1.4% | | | |

| 800 | | Asahi Breweries Ltd. (Japan) | | | 15,001 |

| 218 | | Carlsberg A/S (Denmark) (Class B Stock) | | | 18,297 |

| 1,136 | | Coca-Cola Amatil Ltd. (Australia) | | | 11,728 |

| 34,620 | | Coca-Cola Co. (The) | | | 1,904,100 |

| 373 | | Coca-Cola Hellenic Bottling Co. SA (Greece) | | | 10,056 |

| 100 | | Coca-Cola West Holdings Co. Ltd. (Japan) | | | 1,635 |

| 17,400 | | Constellation Brands, Inc. (Class A Stock)(a) | | | 286,056 |

| 5,095 | | Diageo PLC (United Kingdom) | | | 85,512 |

| 35,100 | | Dr Pepper Snapple Group, Inc. | | | 1,234,467 |

| 3,936 | | Foster’s Group Ltd. (Australia) | | | 19,107 |

| 225 | | Heineken Holding NV (Netherlands) | | | 10,009 |

| 499 | | Heineken NV (Netherlands) | | | 25,645 |

| 1,470 | | InBev NV (Belgium) | | | 74,048 |

| 200 | | ITO EN Ltd. (Japan) | | | 3,095 |

| 2,000 | | Kirin Holdings Co. Ltd. (Japan) | | | 29,500 |

| 35,000 | | PepsiCo, Inc. | | | 2,315,600 |

| 398 | | Pernod-Ricard SA (France) | | | 33,796 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 11 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Beverages (cont’d.) | | | |

| 1,922 | | SABMiller PLC (United Kingdom) | | $ | 56,349 |

| 1,000 | | Sapporo Holdings Ltd. (Japan) | | | 5,220 |

| | | | | |

| | | | | 6,139,221 |

| |

Biotechnology 1.0% | | | |

| 204 | | Actelion Ltd. (Switzerland)(a) | | | 9,281 |

| 9,700 | | Alkermes, Inc.(a) | | | 125,809 |

| 21,600 | | Amgen, Inc.(a) | | | 1,290,816 |

| 1,900 | | Biogen Idec, Inc.(a) | | | 108,984 |

| 10,700 | | Celera Corp.(a) | | | 75,970 |

| 9,500 | | Celldex Therapeutics, Inc.(a) | | | 58,330 |

| 1,232 | | CSL Ltd. (Australia) | | | 41,186 |

| 4,300 | | Cubist Pharmaceuticals, Inc.(a) | | | 96,922 |

| 1,000 | | Dyax Corp.(a) | | | 3,410 |

| 3,800 | | Genomic Health, Inc.(a) | | | 66,842 |

| 42,600 | | Gilead Sciences, Inc.(a) | | | 1,937,448 |

| 142 | | Grifols SA (Spain) | | | 2,121 |

| 400 | | Human Genome Sciences, Inc.(a) | | | 12,080 |

| 3,400 | | Idenix Pharmaceuticals, Inc.(a) | | | 9,588 |

| 500 | | Idera Pharmaceuticals, Inc.(a) | | | 3,105 |

| 20,100 | | Immunomedics, Inc.(a) | | | 66,732 |

| 400 | | Infinity Pharmaceuticals, Inc.(a) | | | 2,440 |

| 2,100 | | Isis Pharmaceuticals, Inc.(a) | | | 22,932 |

| 200 | | Martek Biosciences Corp.(a) | | | 4,502 |

| 1,400 | | NABI Biopharmaceuticals(a) | | | 7,658 |

| 5,200 | | PDL Biopharma, Inc. | | | 32,292 |

| 12,100 | | Progenics Pharmaceuticals, Inc.(a) | | | 64,493 |

| 2,200 | | SciClone Pharmaceuticals, Inc.(a) | | | 7,766 |

| 3,400 | | Synta Pharmaceuticals Corp.(a) | | | 14,654 |

| 3,900 | | Theravance, Inc.(a) | | | 51,948 |

| | | | | |

| | | | | 4,117,309 |

| |

Building Products 0.1% | | | |

| 1,000 | | AAON, Inc. | | | 22,620 |

| 3,000 | | Asahi Glass Co. Ltd. (Japan) | | | 33,790 |

| 637 | | ASSA Abloy AB (Sweden) (Class B Stock) | | | 12,465 |

| 774 | | CIE de Saint-Gobain (France) | | | 37,216 |

| 500 | | Daikin Industries Ltd. (Japan) | | | 20,457 |

| 79 | | Geberit AG (Switzerland) | | | 14,138 |

| 6,700 | | Gibraltar Industries, Inc.(a) | | | 84,487 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Building Products (cont’d.) | | | |

| 500 | | JS Group Corp. (Japan) | | $ | 10,178 |

| 1,000 | | Nippon Sheet Glass Co. Ltd. (Japan) | | | 2,952 |

| 1,400 | | Quanex Building Products Corp. | | | 23,142 |

| 1,000 | | Toto Ltd. (Japan) | | | 6,814 |

| 100 | | Universal Forest Products, Inc. | | | 3,852 |

| | | | | |

| | | | | 272,111 |

| |

Capital Markets 1.2% | | | |

| 1,967 | | 3i Group PLC (United Kingdom) | | | 8,692 |

| 1,000 | | Affiliated Managers Group, Inc.(a) | | | 79,000 |

| 7,100 | | Ameriprise Financial, Inc. | | | 322,056 |

| 6,300 | | Ares Capital Corp. | | | 93,492 |

| 2,700 | | Bank of New York Mellon Corp. (The)(b) | | | 83,376 |

| 8,300 | | BGC Partners, Inc. (Class A Stock) | | | 50,713 |

| 700 | | BlackRock, Inc. (Class A Stock) | | | 152,432 |

| 3,400 | | Calamos Asset Management, Inc. (Class A Stock) | | | 48,756 |

| 2,324 | | Credit Suisse Group AG (Switzerland) | | | 119,793 |

| 3,000 | | Daiwa Securities Group, Inc. (Japan) | | | 15,788 |

| 1,266 | | Deutsche Bank AG (Germany) | | | 97,637 |

| 100 | | Diamond Hill Investment Group, Inc. | | | 6,860 |

| 400 | | Fifth Street Finance Corp. | | | 4,644 |

| 1,500 | | Franklin Resources, Inc. | | | 166,350 |

| 431 | | GAM Holding Ltd. (Switzerland) | | | 5,294 |

| 1,500 | | GFI Group, Inc. | | | 8,670 |

| 16,915 | | Goldman Sachs Group, Inc. (The) | | | 2,886,206 |

| 1,058 | | ICAP PLC (United Kingdom) | | | 6,001 |

| 881 | | Investec PLC (United Kingdom) | | | 7,206 |

| 100 | | JAFCO Co. Ltd. (Japan) | | | 2,626 |

| 431 | | Julius Baer Group Ltd. (Switzerland) | | | 15,635 |

| 2,700 | | Knight Capital Group, Inc. (Class A Stock)(a) | | | 41,175 |

| 2,800 | | Labranche & Co., Inc.(a) | | | 14,728 |

| 653 | | Macquarie Group Ltd. (Australia) | | | 28,313 |

| 3,488 | | Man Group PLC (United Kingdom) | | | 12,783 |

| 1,297 | | Marfin Investment Group SA (Greece) | | | 2,978 |

| 200 | | Matsui Securities Co. Ltd. (Japan) | | | 1,429 |

| 967 | | Mediobanca SpA (Italy)(a) | | | 10,390 |

| 1,000 | | Mizuho Securities Co. Ltd. (Japan) | | | 3,166 |

| 21,900 | | Morgan Stanley | | | 641,451 |

| 7,300 | | Nomura Holdings, Inc. (Japan) | | | 53,799 |

| 9,900 | | PennantPark Investment Corp. | | | 102,564 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 13 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Capital Markets (cont’d.) | | | |

| 1,300 | | Piper Jaffray Cos.(a) | | $ | 52,390 |

| 198 | | Ratos AB (Sweden) (Class B Stock) | | | 6,568 |

| 34 | | SBI Holdings, Inc. (Japan) | | | 6,710 |

| 251 | | Schroders PLC (United Kingdom) | | | 5,359 |

| 1,700 | | Sws Group, Inc. | | | 19,601 |

| 7,252 | | UBS AG (Switzerland)(a) | | | 117,886 |

| | | | | |

| | | | | 5,302,517 |

| |

Chemicals 0.9% | | | |

| 511 | | Air Liquide SA (France) | | | 61,344 |

| 2,600 | | Air Products & Chemicals, Inc. | | | 192,270 |

| 497 | | AKZO Nobel NV (Netherlands) | | | 28,324 |

| 3,000 | | Asahi Kasei Corp. (Japan) | | | 16,141 |

| 3,700 | | Ashland, Inc. | | | 195,249 |

| 1,902 | | BASF AG (Germany) | | | 118,146 |

| 5,100 | | Calgon Carbon Corp.(a) | | | 87,312 |

| 22,800 | | Celanese Corp. (Class A Stock) | | | 726,180 |

| 1,000 | | Daicel Chemical Industries Ltd. (Japan) | | | 6,878 |

| 1,000 | | Denki Kagaku Kogyo K. K. (Japan) | | | 4,300 |

| 3,400 | | E.I. du Pont de Nemours & Co. | | | 126,616 |

| 8,200 | | Eastman Chemical Co. | | | 522,176 |

| 16 | | Givaudan SA (Switzerland) | | | 14,036 |

| 2,200 | | HB Fuller Co. | | | 51,062 |

| 200 | | Hitachi Chemical Co. Ltd. (Japan) | | | 4,321 |

| 3,266 | | Incitec Pivot Ltd. (Australia) | | | 10,400 |

| 200 | | Innophos Holdings, Inc. | | | 5,580 |

| 438 | | Johnson Matthey PLC (United Kingdom) | | | 11,605 |

| 400 | | JSR Corp. (Japan) | | | 8,356 |

| 352 | | K+S AG (Germany) | | | 21,342 |

| 1,000 | | Kaneka Corp. (Japan) | | | 6,482 |

| 315 | | Koninklijke DSM NV (Netherlands) | | | 14,046 |

| 1,100 | | Koppers Holdings, Inc. | | | 31,152 |

| 1,000 | | Kuraray Co. Ltd. (Japan) | | | 13,456 |

| 309 | | Linde AG (Germany) | | | 36,727 |

| 2,500 | | Mitsubishi Chemical Holdings Corp. (Japan) | | | 12,782 |

| 1,000 | | Mitsubishi Gas Chemical Co., Inc. (Japan) | | | 6,022 |

| 2,000 | | Mitsui Chemicals, Inc. (Japan) | | | 6,054 |

| 27,300 | | Nalco Holding Co. | | | 664,209 |

| 700 | | NewMarket Corp. | | | 72,093 |

| 300 | | Nitto Denko Corp. (Japan) | | | 11,648 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Chemicals (cont’d.) | | | |

| 109 | | Novozymes A/S (Denmark) (Class B Stock) | | $ | 12,063 |

| 350 | | Nufarm Ltd. (Australia) | | | 2,643 |

| 7,800 | | Omnova Solutions, Inc.(a) | | | 61,230 |

| 733 | | Orica Ltd. (Australia) | | | 18,020 |

| 1,200 | | Praxair, Inc. | | | 99,600 |

| 2,400 | | Schulman, Inc. | | | 58,728 |

| 800 | | Shin-Etsu Chemical Co. Ltd. (Japan) | | | 46,465 |

| 3,000 | | Showa Denko K.K. (Japan) | | | 6,771 |

| 4,500 | | Solutia, Inc.(a) | | | 72,495 |

| 121 | | Solvay SA (Belgium) | | | 12,439 |

| 5,300 | | Spartech Corp.(a) | | | 62,010 |

| 1,000 | | Stepan Co. | | | 55,890 |

| 3,000 | | Sumitomo Chemical Co. Ltd. (Japan) | | | 14,665 |

| 193 | | Syngenta AG (Switzerland) | | | 53,595 |

| 1,000 | | Taiyo Nippon Sanso Corp. (Japan) | | | 9,776 |

| 2,000 | | Teijin Ltd. (Japan) | | | 6,717 |

| 1,000 | | Tokuyama Corp. (Japan) | | | 5,541 |

| 3,000 | | Toray Industries, Inc. (Japan) | | | 17,521 |

| 1,000 | | Tosoh Corp. (Japan) | | | 2,546 |

| 2,000 | | UBE Industries Ltd. (Japan) | | | 5,134 |

| 233 | | Umicore (Belgium) | | | 8,137 |

| 32 | | Wacker Chemie AG (Germany) | | | 4,763 |

| 3,400 | | WR Grace & Co.(a) | | | 94,384 |

| 387 | | Yara International ASA (Norway) | | | 16,800 |

| | | | | |

| | | | | 3,834,242 |

| |

Commercial Banks 2.3% | | | |

| 1,000 | | 77 Bank Ltd. (The) (Japan) | | | 5,712 |

| 810 | | Alpha Bank A.E. (Greece)(a) | | | 7,669 |

| 2,000 | | Aozora Bank Ltd. (Japan) | | | 2,824 |

| 5,104 | | Australia & New Zealand Banking Group Ltd. (Australia) | | | 118,778 |

| 1,320 | | Banca Carige SpA (Italy) | | | 3,606 |

| 4,486 | | Banca Monte DEI Paschi DI Siena SpA (Italy) | | | 6,641 |

| 805 | | Banca Popolare Di Milano Scarl (Italy) | | | 4,999 |

| 7,297 | | Banco Bilbao Vizcaya Argentaria SA (Spain) | | | 99,839 |

| 4,793 | | Banco Comercial Portugues SA (Portugal) (Class R Stock) | | | 5,334 |

| 2,050 | | Banco de Sabadell SA (Spain) | | | 11,319 |

| 435 | | Banco de Valencia SA (Spain) | | | 2,773 |

| 1,072 | | Banco Espirito Santo SA (Portugal)(a) | | | 5,792 |

| 1,308 | | Banco Popolare SC (Italy)(a) | | | 9,098 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 15 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Commercial Banks (cont’d.) | | | |

| 1,788 | | Banco Popular Espanol SA (Spain) | | $ | 13,162 |

| 16,823 | | Banco Santander Central Hispano SA (Spain) | | | 223,586 |

| 1,159 | | Bank of Cyprus Public Co. Ltd. (Cyprus) | | | 7,326 |

| 3,000 | | Bank of East Asia Ltd. (Hong Kong) | | | 11,051 |

| 1,000 | | Bank of Kyoto Ltd. (The) (Japan) | | | 9,210 |

| 3,000 | | Bank of Yokohama Ltd. (The) (Japan) | | | 14,697 |

| 580 | | Bankinter SA (Spain) | | | 4,826 |

| 23,233 | | Barclays (United Kingdom) | | | 127,027 |

| 710 | | Bendigo And Adelaide Bank Ltd. (Australia) | | | 6,515 |

| 1,930 | | BNP Paribas (France) | | | 148,221 |

| 9,500 | | BOC Hong Kong Holdings Ltd. (Hong Kong) | | | 22,660 |

| 300 | | Bryn Mawr Bank Corp. | | | 5,445 |

| 900 | | Camden National Corp. | | | 28,899 |

| 600 | | Cardinal Financial Corp. | | | 6,408 |

| 2,000 | | Chiba Bank Ltd. (The) (Japan) | | | 11,958 |

| 2,000 | | Chuo Mitsui Trust Holdings, Inc. (Japan) | | | 7,509 |

| 2,000 | | City Holding Co. | | | 68,580 |

| 1,447 | | Commerzbank AG (Germany)(a) | | | 12,408 |

| 3,194 | | Commonwealth Bank of Australia (Australia) | | | 164,985 |

| 1,300 | | Community Bank System, Inc. | | | 29,614 |

| 1,400 | | Community Trust Bancorp, Inc. | | | 37,926 |

| 2,059 | | Credit Agricole SA (France) | | | 36,042 |

| 924 | | Danske Bank A/S (Denmark)(a) | | | 22,732 |

| 4,000 | | DBS Group Holdings Ltd. (Singapore) | | | 40,888 |

| 129 | | Deutsche Postbank AG (Germany)(a) | | | 4,111 |

| 1,080 | | Dexia SA (Belgium)(a) | | | 6,442 |

| 1,826 | | DnB NOR ASA (Norway)(a) | | | 20,862 |

| 660 | | EFG Eurobank Ergasias SA (Greece)(a) | | | 6,062 |

| 384 | | Erste Group Bank AG (Austria) | | | 16,130 |

| 200 | | Financial Institutions, Inc. | | | 2,924 |

| 3,700 | | First Bancorp, Inc. | | | 8,917 |

| 500 | | First Bancorp, Inc./Maine | | | 7,970 |

| 2,500 | | First Bancorp, Inc./Troy, North Carolina | | | 33,800 |

| 8,200 | | First Commonwealth Financial Corp. | | | 55,022 |

| 2,900 | | First Community Bancshares, Inc. | | | 35,873 |

| 200 | | First Financial Bancorp | | | 3,558 |

| 10,500 | | FNB Corp. | | | 85,155 |

| 2,000 | | Fukuoka Financial Group, Inc. (Japan) | | | 8,493 |

| 1,000 | | Gunma Bank Ltd. (The) (Japan) | | | 5,530 |

| 1,000 | | Hachijuni Bank Ltd. (The) (Japan) | | | 5,690 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Commercial Banks (cont’d.) | | | |

| 1,600 | | Hang Seng Bank Ltd. (Hong Kong) | | $ | 22,297 |

| 1,000 | | Hiroshima Bank Ltd. (The) (Japan) | | | 4,225 |

| 3,000 | | Hokuhoku Financial Group, Inc. (Japan) | | | 6,578 |

| 200 | | Home Bancorp, Inc.(a) | | | 2,800 |

| 35,338 | | HSBC Holdings PLC (United Kingdom) | | | 358,217 |

| 165,300 | | Huntington Bancshares, Inc. | | | 887,661 |

| 3,800 | | International Bancshares Corp. | | | 87,362 |

| 15,898 | | Intesa SanPaolo SpA (Italy)(a) | | | 59,211 |

| 1,904 | | Intesa SanPaolo SpA-RSP (Italy) | | | 5,703 |

| 1,000 | | Iyo Bank Ltd. (The) (Japan) | | | 9,509 |

| 1,000 | | Joyo Bank Ltd. (The) (Japan) | | | 4,460 |

| 329 | | KBC Groep NV (Belgium)(a) | | | 15,933 |

| 28,300 | | KeyCorp | | | 219,325 |

| 1,600 | | Lakeland Bancorp, Inc. | | | 14,160 |

| 77,727 | | Lloyds TSB Group PLC (United Kingdom)(a) | | | 74,037 |

| 2,800 | | MainSource Financial Group, Inc. | | | 18,844 |

| 25,800 | | Mitsubishi UFJ Financial Group, Inc. (Japan) | | | 135,223 |

| 27,000 | | Mizuho Financial Group, Inc. (Japan) | | | 53,428 |

| 3,000 | | Mizuho Trust & Banking Co. Ltd. (Japan) | | | 3,016 |

| 1,000 | | Nara Bancorp, Inc.(a) | | | 8,760 |

| 4,271 | | National Australia Bank Ltd. (Australia) | | | 107,859 |

| 1,280 | | National Bank of Greece SA (Greece)(a) | | | 25,760 |

| 1,781 | | Natixis (France)(a) | | | 9,610 |

| 300 | | NBT Bancorp, Inc. | | | 6,855 |

| 1,000 | | Nishi-Nippon City Bank Ltd. (The) (Japan) | | | 2,952 |

| 6,583 | | Nordea Bank AB (Sweden) | | | 64,958 |

| 900 | | Oriental Financial Group, Inc. | | | 12,150 |

| 5,000 | | Oversea-Chinese Banking Corp. Ltd. (Singapore) | | | 31,130 |

| 700 | | Peoples Bancorp, Inc. | | | 11,536 |

| 618 | | Piraeus Bank SA (Greece)(a) | | | 5,401 |

| 17,200 | | PNC Financial Services Group, Inc. | | | 1,026,840 |

| 2,100 | | Prosperity Bancshares, Inc. | | | 86,100 |

| 113 | | Raiffeisen International Bank Holding AG (Austria) | | | 5,372 |

| 21,200 | | Regions Financial Corp. | | | 166,420 |

| 300 | | Renasant Corp. | | | 4,854 |

| 1,100 | | Republic Bancorp, Inc. (Class A Stock) | | | 20,724 |

| 1,000 | | Resona Holdings, Inc. (Japan) | | | 12,643 |

| 34,526 | | Royal Bank of Scotland Group PLC (United Kingdom)(a) | | | 23,053 |

| 300 | | S&T Bancorp, Inc. | | | 6,270 |

| 900 | | Sapporo Hokuyo Holdings, Inc. (Japan) | | | 4,111 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 17 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Commercial Banks (cont’d.) | | | |

| 1,000 | | Senshu Ikeda Holdings, Inc. (Japan) | | $ | 1,818 |

| 2,000 | | Shinsei Bank Ltd. (Japan) | | | 2,417 |

| 1,000 | | Shizuoka Bank Ltd. (The) (Japan) | | | 8,717 |

| 3,000 | | Signature Bank(a) | | | 111,150 |

| 3,096 | | Skandinaviska Enskilda Banken (Sweden) (Class A Stock)(a) | | | 19,779 |

| 1,282 | | Societe Generale (France) | | | 80,629 |

| 1,400 | | Southside Bancshares, Inc. | | | 30,198 |

| 4,097 | | Standard Chartered PLC (United Kingdom) | | | 111,754 |

| 300 | | State Bancorp, Inc./NY | | | 2,361 |

| 400 | | Suffolk Bancorp | | | 12,284 |

| 2,567 | | Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 84,844 |

| 3,000 | | Sumitomo Trust & Banking Co. Ltd. (The) (Japan) | | | 17,585 |

| 700 | | Sun Bancorp, Inc.(a) | | | 2,758 |

| 2,300 | | SunTrust Banks, Inc. | | | 61,617 |

| 17,100 | | Susquehanna Bancshares, Inc. | | | 167,751 |

| 997 | | Svenska Handelsbanken AB (Sweden) (Class A Stock) | | | 29,217 |

| 1,037 | | Swedbank AB (Sweden) (Class A Stock) | | | 10,642 |

| 400 | | Texas Capital Bancshares, Inc.(a) | | | 7,596 |

| 45,008 | | U.S. Bancorp | | | 1,164,807 |

| 34,186 | | UniCredit SpA (Italy)(a) | | | 101,005 |

| 1,172 | | Unione di Banche Italiane ScpA (Italy) | | | 15,814 |

| 3,000 | | United Overseas Bank Ltd. (Singapore) | | | 41,217 |

| 700 | | Washington Trust Bancorp, Inc. | | | 13,048 |

| 5,700 | | Webster Financial Corp. | | | 99,693 |

| 72,641 | | Wells Fargo & Co. | | | 2,260,588 |

| 3,900 | | WesBanco, Inc. | | | 63,414 |

| 5,994 | | Westpac Banking Corp. (Australia) | | | 153,131 |

| 1,700 | | Wilshire Bancorp, Inc. | | | 18,751 |

| 500 | | Wing Hang Bank Ltd. (Hong Kong) | | | 4,572 |

| 200 | | Wintrust Financial Corp. | | | 7,442 |

| 7,600 | | Zions Bancorporation | | | 165,832 |

| | | | | |

| | | | | 10,150,376 |

| |

Commercial Services & Supplies 0.3% | | | |

| 1,400 | | ABM Industries, Inc. | | | 29,680 |

| 2,200 | | ATC Technology Corp.(a) | | | 37,752 |

| 5,800 | | Avery Dennison Corp. | | | 211,178 |

| 2,862 | | Brambles Ltd. (Australia) | | | 19,330 |

| 100 | | Consolidated Graphics, Inc.(a) | | | 4,141 |

| 1,400 | | Courier Corp. | | | 23,114 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Commercial Services & Supplies (cont’d.) | | | |

| 1,000 | | DAI Nippon Printing Co. Ltd. (Japan) | | $ | 13,509 |

| 5,100 | | Deluxe Corp. | | | 99,042 |

| 3,900 | | Ennis, Inc. | | | 63,453 |

| 2,588 | | G4S PLC (United Kingdom) | | | 10,270 |

| 5,000 | | Herman Miller, Inc. | | | 90,300 |

| 600 | | M & F Worldwide Corp.(a) | | | 18,360 |

| 8,100 | | R.R. Donnelley & Sons Co. | | | 172,935 |

| 8,000 | | Republic Services, Inc. (Class A Stock) | | | 232,160 |

| 4,700 | | Rollins, Inc. | | | 101,896 |

| 4,000 | | Schawk, Inc. (Class A Stock) | | | 72,520 |

| 400 | | Secom Co. Ltd. (Japan) | | | 17,499 |

| 639 | | Securitas AB (Sweden) (Class B Stock) | | | 6,814 |

| 995 | | Serco Group PLC (United Kingdom) | | | 9,074 |

| 54 | | Societe BIC SA (France) | | | 4,135 |

| 1,200 | | Standard Parking Corp.(a) | | | 19,704 |

| 1,000 | | Toppan Printing Co. Ltd. (Japan) | | | 9,028 |

| 1,400 | | United Stationers, Inc.(a) | | | 82,390 |

| 2,700 | | Waste Management, Inc.(b) | | | 92,961 |

| | | | | |

| | | | | 1,441,245 |

| |

Communications Equipment 1.3% | | | |

| 4,733 | | Alcatel-Lucent (France)(a) | | | 14,965 |

| 15,200 | | ARRIS Group, Inc.(a) | | | 182,552 |

| 8,400 | | Aruba Networks, Inc.(a) | | | 114,744 |

| 2,000 | | Black Box Corp. | | | 61,520 |

| 132,166 | | Cisco Systems, Inc.(a) | | | 3,440,281 |

| 2,800 | | Globecomm Systems, Inc.(a) | | | 21,532 |

| 2,300 | | Harris Corp. | | | 109,227 |

| 24,800 | | Juniper Networks, Inc.(a) | | | 760,864 |

| 3,300 | | Loral Space & Communications, Inc.(a) | | | 115,896 |

| 2,500 | | NETGEAR, Inc.(a) | | | 65,250 |

| 2,700 | | Network Equipment Technologies, Inc.(a) | | | 14,877 |

| 7,675 | | Nokia Corp. (Finland) | | | 119,523 |

| 2,800 | | OPLINK Communications, Inc.(a) | | | 51,912 |

| 2,100 | | Plantronics, Inc. | | | 65,688 |

| 8,700 | | QUALCOMM, Inc. | | | 365,313 |

| 4,500 | | Riverbed Technology, Inc.(a) | | | 127,800 |

| 3,300 | | Tekelec(a) | | | 59,928 |

| 6,094 | | Telefonaktiebolaget LM Ericsson (Sweden) (Class B Stock) | | | 64,227 |

| | | | | |

| | | | | 5,756,099 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 19 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Computers & Peripherals 3.1% | | | |

| 14,400 | | Apple, Inc.(a) | | $ | 3,382,992 |

| 70,000 | | EMC Corp.(a) | | | 1,262,800 |

| 4,000 | | Fujitsu Ltd. (Japan) | | | 26,185 |

| 54,911 | | Hewlett-Packard Co. | | | 2,918,520 |

| 33,241 | | International Business Machines Corp. | | | 4,263,158 |

| 372 | | Logitech International SA (Switzerland)(a) | | | 6,121 |

| 4,000 | | NEC Corp. (Japan) | | | 12,023 |

| 5,300 | | Novatel Wireless, Inc.(a) | | | 35,669 |

| 500 | | Rimage Corp.(a) | | | 7,230 |

| 10,600 | | Seagate Technology(a)(b) | | | 193,556 |

| 300 | | Seiko Epson Corp. (Japan) | | | 4,659 |

| 1,400 | | Teradata Corp.(a) | | | 40,446 |

| 8,000 | | Toshiba Corp. (Japan)(a) | | | 41,330 |

| 33,300 | | Western Digital Corp.(a) | | | 1,298,367 |

| | | | | |

| | | | | 13,493,056 |

| |

Construction & Engineering 0.1% | | | |

| 289 | | ACS Actividades de Construccion y Servicios SA (Spain) | | | 13,334 |

| 1,394 | | Balfour Beatty PLC (United Kingdom) | | | 6,181 |

| 456 | | Bouygues SA INH (France) | | | 22,924 |

| 866 | | Cintra Concesiones de Infraestructuras de Transporte SA (Spain) | | | 8,422 |

| 2,100 | | Dycom Industries, Inc.(a) | | | 18,417 |

| 83 | | Eiffage SA (France) | | | 4,293 |

| 3,700 | | EMCOR Group, Inc.(a) | | | 91,131 |

| 78 | | Fomento de Construcciones y Contratas SA (Spain) | | | 2,855 |

| 86 | | Hochtief AG (Germany) | | | 7,266 |

| 1,000 | | JGC Corp. (Japan) | | | 17,841 |

| 2,000 | | Kajima Corp. (Japan) | | | 4,899 |

| 114 | | Koninklijke Boskalis Westminster NV (Netherlands) | | | 4,369 |

| 304 | | Leighton Holdings Ltd. (Australia) | | | 10,880 |

| 1,000 | | Obayashi Corp. (Japan) | | | 4,439 |

| 187 | | Sacyr Vallehermoso SA (Spain)(a) | | | 1,650 |

| 1,000 | | Shimizu Corp. (Japan) | | | 4,171 |

| 815 | | Skanska AB (Sweden) (Class B Stock) | | | 14,809 |

| 2,000 | | Taisei Corp. (Japan) | | | 4,407 |

| 888 | | Vinci SA (France) | | | 52,335 |

| | | | | |

| | | | | 294,623 |

| |

Construction Materials | | | |

| 1,211 | | Boral Ltd. (Australia) | | | 6,234 |

| 480 | | Cimpor Cimentos de Portugal SGPS SA (Portugal) | | | 3,627 |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Construction Materials (cont’d.) | | | |

| 1,413 | | CRH PLC (Ireland) | | $ | 35,288 |

| 1,234 | | Fletcher Building Ltd. (New Zealand) | | | 7,319 |

| 294 | | Heidelbergcement AG (Germany) | | | 16,468 |

| 500 | | Holcim Ltd. (Switzerland)(a) | | | 37,272 |

| 69 | | Imerys SA (France) | | | 4,253 |

| 145 | | Italcementi SpA (Italy) | | | 1,677 |

| 883 | | James Hardie Industries NV (Austria)(a) | | | 5,883 |

| 407 | | Lafarge SA (France) | | | 28,640 |

| 2,000 | | Taiheiyo Cement Corp. (Japan)(a) | | | 2,867 |

| 118 | | Titan Cement Co. SA (Greece) | | | 3,124 |

| | | | | |

| | | | | 152,652 |

| |

Consumer Finance 0.7% | | | |

| 100 | | Acom Co. Ltd. (Japan) | | | 1,636 |

| 5,200 | | Advance America Cash Advance Centers, Inc. | | | 30,264 |

| 200 | | AEON Credit Service Co. Ltd. (Japan) | | | 2,375 |

| 31,400 | | American Express Co. | | | 1,295,564 |

| 3,100 | | Capital One Financial Corp. | | | 128,371 |

| 400 | | Credit Saison Co. Ltd. (Japan) | | | 6,204 |

| 7,800 | | Nelnet, Inc. (Class A Stock) | | | 144,768 |

| 230 | | ORIX Corp. (Japan) | | | 20,395 |

| 96,100 | | SLM Corp.(a) | | | 1,203,172 |

| 1,500 | | World Acceptance Corp.(a) | | | 54,120 |

| | | | | |

| | | | | 2,886,869 |

| |

Containers & Packaging 0.1% | | | |

| 1,500 | | AEP Industries, Inc.(a) | | | 39,030 |

| 2,485 | | Amcor Ltd. (Australia) | | | 14,572 |

| 4,600 | | Boise, Inc.(a) | | | 28,198 |

| 100 | | Bway Holding Co.(a) | | | 2,010 |

| 1,790 | | Rexam PLC (United Kingdom) | | | 7,956 |

| 3,000 | | Rock-Tenn Co. (Class A Stock) | | | 136,710 |

| 900 | | Silgan Holdings, Inc. | | | 54,207 |

| 400 | | Toyo Seikan Kaisha Ltd. (Japan) | | | 7,085 |

| | | | | |

| | | | | 289,768 |

| |

Distributors 0.1% | | | |

| 200 | | Canon Marketing Japan, Inc. (Japan) | | | 2,723 |

| 1,800 | | Core-Mark Holding Co., Inc.(a) | | | 55,098 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 21 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Distributors (cont’d.) | | | |

| 4,000 | | Li & Fung Ltd. (Hong Kong) | | $ | 19,680 |

| 16,900 | | LKQ Corp.(a) | | | 343,070 |

| | | | | |

| | | | | 420,571 |

| |

Diversified Consumer Services 0.2% | | | |

| 200 | | Benesse Holdings, Inc. (Japan) | | | 8,664 |

| 1,200 | | Capella Education Co.(a) | | | 111,408 |

| 900 | | Career Education Corp.(a)(b) | | | 28,476 |

| 2,000 | | Coinstar, Inc.(a) | | | 65,000 |

| 1,600 | | Corinthian Colleges, Inc.(a) | | | 28,144 |

| 3,600 | | DeVry, Inc. | | | 234,720 |

| 10,200 | | Education Management Corp.(a) | | | 223,380 |

| 2,400 | | Universal Technical Institute, Inc.(a) | | | 54,768 |

| | | | | |

| | | | | 754,560 |

| |

Diversified Financial Services 2.8% | | | |

| 350 | | ASX Ltd. (Australia) | | | 10,901 |

| 289,445 | | Bank of America Corp. | | | 5,166,593 |

| 396,800 | | Citigroup, Inc.(a) | | | 1,607,040 |

| 400 | | CME Group, Inc. (Class A Stock) | | | 126,444 |

| 7,600 | | Compass Diversified Holdings | | | 115,976 |

| 1,717 | | Criteria CaixaCorp SA (Spain) | | | 8,509 |

| 398 | | Deutsche Boerse AG (Germany) | | | 29,485 |

| 56 | | Eurazeo (France) | | | 3,890 |

| 147 | | EXOR SpA (Italy) | | | 2,553 |

| 165 | | Groupe Bruxelles Lambert SA (Belgium) | | | 14,579 |

| 2,000 | | Hong Kong Exchanges and Clearing Ltd. (Hong Kong) | | | 33,384 |

| 7,592 | | ING Groep NV (Netherlands)(a) | | | 75,799 |

| 800 | | IntercontinentalExchange, Inc.(a) | | | 89,744 |

| 930 | | Investor AB (Sweden) (Class B Stock) | | | 17,839 |

| 85,330 | | JPMorgan Chase & Co. | | | 3,818,517 |

| 400 | | Kinnevik Investment AB (Sweden) (Class B Stock) | | | 7,368 |

| 304 | | London Stock Exchange Group PLC (United Kingdom) | | | 3,278 |

| 1,700 | | MarketAxess Holdings, Inc. | | | 26,741 |

| 67 | | Nationale a Portefeuille SA (Belgium) | | | 3,511 |

| 29,200 | | NYSE Euronext | | | 864,612 |

| 282 | | OKO Bank PLC (Finland) | | | 3,169 |

| 55 | | Pargesa Holding SA (Switzerland) | | | 4,668 |

| 3,600 | | PHH Corp.(a) | | | 84,852 |

| 2,000 | | Singapore Exchange Ltd. (Singapore) | | | 10,937 |

| | | | | |

| | | | | 12,130,389 |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Diversified Telecommunication Services 1.8% | | | |

| 153,810 | | AT&T, Inc. | | $ | 3,974,450 |

| 1,300 | | Atlantic Tele-Network, Inc. | | | 58,409 |

| 311 | | Belgacom SA (Belgium) | | | 12,148 |

| 17,167 | | BT Group PLC (United Kingdom) (Class A Stock) | | | 32,277 |

| 4,183 | | Cable & Wireless Communications PLC (United Kingdom) | | | 3,514 |

| 4,183 | | Cable & Wireless Worldwide (United Kingdom)(a) | | | 5,840 |

| 5,778 | | Deutsche Telekom AG (Germany) | | | 78,587 |

| 272 | | Elisa OYJ (Finland) | | | 5,610 |

| 3,779 | | France Telecom SA (France) | | | 90,420 |

| 500 | | Hellenic Telecommunications Organization SA (Greece) | | | 6,206 |

| 300 | | HickoryTech Corp. | | | 2,649 |

| 33 | | Iliad SA (France) | | | 3,403 |

| 1,000 | | Inmarsat PLC (United Kingdom) | | | 11,472 |

| 3,406 | | Koninklijke KPN NV (Netherlands) | | | 53,962 |

| 1,100 | | Nippon Telegraph & Telephone Corp. (Japan) | | | 46,358 |

| 8,000 | | PCCW Ltd. (Hong Kong) | | | 2,380 |

| 1,190 | | Portugal Telecom, SGPS SA (Portugal) | | | 13,305 |

| 600 | | Premiere Global Services, Inc.(a) | | | 4,956 |

| 16,000 | | Singapore Telecommunications Ltd. (Singapore) | | | 36,256 |

| 700 | | SureWest Communications(a) | | | 6,013 |

| 53 | | Swisscom AG (Switzerland) | | | 19,342 |

| 840 | | Talktalk Telecom Group PLC (United Kingdom)(a) | | | 1,644 |

| 623 | | Tele2 AB (Sweden) (Class B Stock) | | | 10,397 |

| 3,775 | | Telecom Corp. of New Zealand Ltd. (New Zealand) | | | 5,819 |

| 21,307 | | Telecom Italia SpA (Italy) | | | 30,678 |

| 12,304 | | Telecom Italia SpA-RSP (Italy) | | | 13,877 |

| 8,731 | | Telefonica SA (Spain) | | | 206,842 |

| 657 | | Telekom Austria AG (Austria) | | | 9,184 |

| 1,690 | | Telenor ASA (Norway)(a) | | | 22,919 |

| 4,576 | | Teliasonera AB (Sweden) | | | 32,479 |

| 8,877 | | Telstra Corp. Ltd. (Australia) | | | 24,357 |

| 93,750 | | Verizon Communications, Inc.(b) | | | 2,908,125 |

| �� | | | | |

| | | | | 7,733,878 |

| |

Electric Utilities 1.1% | | | |

| 52 | | Acciona SA (Spain) | | | 5,767 |

| 18,500 | | Allegheny Energy, Inc. | | | 425,500 |

| 2,800 | | American Electric Power Co., Inc. | | | 95,704 |

| 27 | | BKW FMB Energie AG (Switzerland) | | | 2,006 |

| 1,100 | | Central Vermont Public Service Corp. | | | 22,187 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 23 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Electric Utilities (cont’d.) | | | |

| 1,000 | | Cheung Kong Infrastructure Holdings Ltd. (Hong Kong) | | $ | 3,870 |

| 1,400 | | Chubu Electric Power Co., Inc. (Japan) | | | 34,996 |

| 700 | | Chugoku Electric Power Co., Inc. (The) (Japan) | | | 13,912 |

| 4,000 | | CLP Holdings Ltd. (Hong Kong) | | | 28,593 |

| 613 | | Contact Energy Ltd. (New Zealand)(a) | | | 2,787 |

| 1,200 | | DPL, Inc. | | | 32,628 |

| 3,875 | | E.ON AG (Germany) | | | 143,092 |

| 491 | | EDF SA (France) | | | 26,792 |

| 26,400 | | Edison International | | | 902,088 |

| 3,563 | | EDP - Energias de Portugal SA (Portugal) | | | 14,163 |

| 1,500 | | El Paso Electric Co.(a) | | | 30,900 |

| 13,716 | | ENEL SpA (Italy) | | | 76,696 |

| 2,200 | | Entergy Corp. | | | 178,970 |

| 13,800 | | Exelon Corp. | | | 604,578 |

| 8,900 | | FirstEnergy Corp. | | | 347,901 |

| 905 | | Fortum OYJ (Finland) | | | 22,137 |

| 25,100 | | FPL Group, Inc. | | | 1,213,083 |

| 400 | | Hokkaido Electric Power Co., Inc. (Japan) | | | 7,676 |

| 200 | | Hokuriku Electric Power Co. (Japan) | | | 4,398 |

| 3,000 | | Hong Kong Electric Holdings Ltd. (Hong Kong) | | | 17,793 |

| 7,494 | | Iberdrola SA (Spain) | | | 63,515 |

| 1,400 | | IDACORP, Inc. | | | 48,468 |

| 1,600 | | Kansai Electric Power Co., Inc. (The) (Japan) | | | 36,659 |

| 800 | | Kyushu Electric Power Co., Inc. (Japan) | | | 17,414 |

| 2,600 | | PNM Resources, Inc. | | | 32,578 |

| 1,500 | | PPL Corp. | | | 41,565 |

| 237 | | Public Power Corp. SA (Greece)(a) | | | 4,161 |

| 221 | | Red Electrica Corp. SA (Spain) | | | 11,861 |

| 1,856 | | Scottish & Southern Energy PLC (United Kingdom) | | | 31,009 |

| 300 | | Shikoku Electric Power Co. (Japan) | | | 8,500 |

| 2,706 | | SP AusNet (Australia) (Class Miscellaneous Stock) | | | 2,247 |

| 2,656 | | Terna Rete Elettrica Nazionale SpA (Italy) | | | 11,489 |

| 900 | | Tohoku Electric Power Co., Inc. (Japan) | | | 19,022 |

| 2,500 | | Tokyo Electric Power Co., Inc. (The) (Japan) | | | 66,638 |

| 157 | | Verbund - Oesterreichische Elektrizitaetswirtschafts AG (Austria) (Class A Stock) | | | 6,232 |

| | | | | |

| | | | | 4,659,575 |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Electrical Equipment 0.7% | | | |

| 4,506 | | ABB Ltd. (Switzerland) | | $ | 98,419 |

| 700 | | Acuity Brands, Inc. | | | 29,547 |

| 433 | | Alstom SA (France) | | | 27,002 |

| 3,100 | | AO Smith Corp. | | | 162,967 |

| 1,000 | | AZZ, Inc. | | | 33,850 |

| 1,000 | | Brady Corp. (Class A Stock) | | | 31,120 |

| 18,200 | | Emerson Electric Co. | | | 916,188 |

| 2,900 | | EnerSys(a) | | | 71,514 |

| 1,000 | | Fuji Electric Holdings Co. Ltd. (Japan) | | | 2,728 |

| 1,000 | | Furukawa Electric Co. Ltd. (Japan) | | | 5,198 |

| 373 | | Gamesa Corp. Tecnologica SA (Spain) | | | 5,113 |

| 3,600 | | GrafTech International Ltd.(a) | | | 49,212 |

| 1,000 | | GS Yuasa Corp. (Japan) | | | 6,749 |

| 7,500 | | Hubbell, Inc. (Class B Stock) | | | 378,225 |

| 215 | | Legrand SA (France) | | | 6,792 |

| 4,000 | | Mitsubishi Electric Corp. (Japan) | | | 36,753 |

| 1,000 | | Panasonic Electric Works Co. Ltd. (Japan) | | | 12,622 |

| 1,100 | | Powell Industries, Inc.(a) | | | 35,783 |

| 203 | | Prysmian SpA (Italy) | | | 3,989 |

| 700 | | Regal-Beloit Corp. | | | 41,587 |

| 479 | | Renewable Energy Corp. ASA (Norway)(a) | | | 2,241 |

| 16,800 | | Rockwell Automation, Inc. | | | 946,848 |

| 478 | | Schneider Electric SA (France) | | | 56,065 |

| 171 | | Solarworld AG (Germany) | | | 2,597 |

| 1,600 | | Sumitomo Electric Industries Ltd. (Japan) | | | 19,613 |

| 300 | | Ushio, Inc. (Japan) | | | 5,089 |

| 416 | | Vestas Wind Systems A/S (Denmark)(a) | | | 22,605 |

| 1,500 | | Vicor Corp.(a) | | | 20,715 |

| | | | | |

| | | | | 3,031,131 |

| |

Electronic Equipment & Instruments 0.6% | | | |

| 13,800 | | Avnet, Inc.(a) | | | 414,000 |

| 4,100 | | Benchmark Electronics, Inc.(a) | | | 85,034 |

| 16,000 | | Brightpoint, Inc.(a) | | | 120,480 |

| 600 | | Checkpoint Systems, Inc.(a) | | | 13,272 |

| 600 | | Citizen Holdings Co. Ltd. (Japan) | | | 4,101 |

| 37,400 | | Corning, Inc. | | | 755,854 |

| 4,400 | | CTS Corp. | | | 41,448 |

| 4,200 | | Electro Rent Corp. | | | 55,146 |

| 500 | | Electro Scientific Industries, Inc.(a) | | | 6,405 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 25 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Electronic Equipment & Instruments (cont’d.) | | | |

| 4,000 | | Foxconn International Holdings Ltd. (Hong Kong)(a) | | $ | 4,219 |

| 1,000 | | Fujifilm Holdings Corp. (Japan) | | | 34,442 |

| 100 | | Hirose Electric Co. Ltd. (Japan) | | | 11,531 |

| 100 | | Hitachi High-Technologies Corp. (Japan) | | | 2,294 |

| 10,000 | | Hitachi Ltd. (Japan)(a) | | | 37,330 |

| 800 | | Hoya Corp. (Japan) | | | 21,983 |

| 300 | | Ibiden Co. Ltd. (Japan) | | | 10,333 |

| 1,500 | | Insight Enterprises, Inc.(a) | | | 21,540 |

| 33,900 | | Jabil Circuit, Inc. | | | 548,841 |

| 100 | | Keyence Corp. (Japan) | | | 23,896 |

| 300 | | Kyocera Corp. (Japan) | | | 29,233 |

| 100 | | Mabuchi Motor Co. Ltd. (Japan) | | | 5,755 |

| 4,200 | | Mercury Computer Systems, Inc.(a) | | | 57,624 |

| 200 | | Mitsumi Electric Co. Ltd. (Japan) | | | 4,377 |

| 400 | | Murata Manufacturing Co. Ltd. (Japan) | | | 22,719 |

| 300 | | Nidec Corp. (Japan) | | | 32,153 |

| 1,000 | | Nippon Electric Glass Co. Ltd. (Japan) | | | 14,087 |

| 400 | | Omron Corp. (Japan) | | | 9,285 |

| 2,000 | | Park Electrochemical Corp. | | | 57,480 |

| 300 | | Rogers Corp.(a) | | | 8,703 |

| 400 | | ScanSource, Inc.(a) | | | 11,512 |

| 1,000 | | Shimadzu Corp. (Japan) | | | 8,012 |

| 1,400 | | SYNNEX Corp.(a) | | | 41,384 |

| 200 | | TDK Corp. (Japan) | | | 13,306 |

| 1,000 | | Yaskawa Electric Corp. (Japan) | | | 9,145 |

| 500 | | Yokogawa Electric Corp. (Japan) | | | 4,353 |

| | | | | |

| | | | | 2,541,277 |

| |

Energy Equipment & Services 0.6% | | | |

| 679 | | AMEC PLC (United Kingdom) | | | 8,233 |

| 1,600 | | Bristow Group, Inc.(a) | | | 60,368 |

| 7,900 | | Cal Dive International, Inc.(a) | | | 57,907 |

| 600 | | Carbo Ceramics, Inc. | | | 37,404 |

| 293 | | CIE Generale de Geophysique-Veritas (France)(a) | | | 8,312 |

| 2,400 | | Complete Production Services, Inc.(a) | | | 27,720 |

| 6,600 | | FMC Technologies, Inc.(a)(b) | | | 426,558 |

| 133 | | Fugro NV (Netherlands) | | | 8,693 |

| 1,400 | | Gulf Island Fabrication, Inc. | | | 30,450 |

| 12,800 | | Helmerich & Payne, Inc. | | | 487,424 |

| 10,500 | | National Oilwell Varco, Inc. | | | 426,090 |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Energy Equipment & Services (cont’d.) | | | |

| 100 | | OYO Geospace Corp.(a) | | $ | 4,781 |

| 423 | | Petrofac Ltd. (United Kingdom) | | | 7,716 |

| 541 | | Saipem SpA (Italy) | | | 20,935 |

| 306 | | SBM Offshore NV (Netherlands) | | | 6,123 |

| 7,100 | | Schlumberger Ltd. | | | 450,566 |

| 570 | | Seadrill Ltd. (Norway) | | | 13,283 |

| 212 | | Technip SA (France) | | | 17,237 |

| 1,039 | | Tenaris SA (Italy) | | | 22,425 |

| 11,500 | | Unit Corp.(a) | | | 486,220 |

| 335 | | WorleyParsons Ltd. (Australia) | | | 7,824 |

| | | | | |

| | | | | 2,616,269 |

| |

Food & Staples Retailing 1.1% | | | |

| 1,300 | | AEON Co. Ltd. (Japan) | | | 14,753 |

| 1,600 | | Andersons, Inc. (The) | | | 53,568 |

| 1,295 | | Carrefour SA (France) | | | 62,417 |

| 3,000 | | Casey’s General Stores, Inc. | | | 94,200 |

| 113 | | Casino Guichard Perrachon SA (France) | | | 9,562 |

| 31 | | Colruyt SA (Belgium) | | | 7,631 |

| 3,000 | | Costco Wholesale Corp. | | | 179,130 |

| 2,100 | | CVS Caremark Corp. | | | 76,776 |

| 226 | | Delhaize Group SA (Belgium) | | | 18,162 |

| 100 | | FamilyMart Co. Ltd. (Japan) | | | 3,182 |

| 2,424 | | J Sainsbury PLC (United Kingdom) | | | 12,050 |

| 450 | | Jeronimo Martins SGPS SA (Portugal) | | | 4,559 |

| 135 | | Kesko OYJ (Finland) (Class B Stock) | | | 5,313 |

| 2,434 | | Koninklijke Ahold NV (Netherlands) | | | 32,448 |

| 5,600 | | Kroger Co. (The) | | | 121,296 |

| 100 | | Lawson, Inc. (Japan) | | | 4,268 |

| 1,562 | | Metcash Ltd. (Australia) | | | 5,934 |

| 232 | | Metro AG (Germany) | | | 13,762 |

| 2,000 | | Olam International Ltd. (Singapore) | | | 3,703 |

| 1,600 | | Seven & I Holdings Co. Ltd. (Japan) | | | 38,661 |

| 16,400 | | SUPERVALU, Inc. | | | 273,552 |

| 16,171 | | Tesco PLC (United Kingdom) | | | 106,857 |

| 65,600 | | Wal-Mart Stores, Inc. | | | 3,647,360 |

| 200 | | Weis Markets, Inc. | | | 7,272 |

| 2,049 | | Wesfarmers Ltd. (Australia) | | | 59,774 |

| 310 | | Wesfarmers Ltd. (Australia) | | | 9,066 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 27 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Food & Staples Retailing (cont’d.) | | | |

| 4,278 | | WM Morrison Supermarkets PLC (United Kingdom) | | $ | 19,054 |

| 2,557 | | Woolworths Ltd. (Australia) | | | 65,700 |

| | | | | |

| | | | | 4,950,010 |

| |

Food Products 1.4% | | | |

| 1,000 | | Ajinomoto Co., Inc. (Japan) | | | 9,905 |

| 2,200 | | American Italian Pasta Co. (Class A Stock)(a) | | | 85,514 |

| 52,000 | | Archer-Daniels-Midland Co. | | | 1,502,800 |

| 166 | | Aryzta AG (Switzerland) | | | 7,273 |

| 727 | | Associated British Foods PLC (United Kingdom) | | | 10,795 |

| 2,700 | | B & G Foods, Inc. (Class A Stock) | | | 28,296 |

| 4,300 | | Bunge Ltd. | | | 265,009 |

| 3,600 | | Chiquita Brands International, Inc.(a) | | | 56,628 |

| 2,900 | | Darling International, Inc.(a) | | | 25,984 |

| 54,000 | | Dean Foods Co.(a)(b) | | | 847,260 |

| 1,800 | | Dole Food Co., Inc.(a) | | | 21,330 |

| 1,000 | | Fresh Del Monte Produce, Inc.(a) | | | 20,250 |

| 6,500 | | General Mills, Inc. | | | 460,135 |

| 14,000 | | Golden Agri-Resources Ltd. (Singapore)(a) | | | 5,804 |

| 2,628 | | Goodman Fielder Ltd. (Australia) | | | 3,449 |

| 1,121 | | Groupe Danone SA (France) | | | 67,528 |

| 1,100 | | JM Smucker Co. (The) | | | 66,286 |

| 6,100 | | Kellogg Co. | | | 325,923 |

| 286 | | Kerry Group PLC (Ireland) (Class A Stock) | | | 8,885 |

| 13,500 | | Kraft Foods, Inc. (Class A Stock) | | | 408,240 |

| 2,100 | | Lancaster Colony Corp. | | | 123,816 |

| 2 | | Lindt & Spruengli AG (Switzerland) | | | 4,733 |

| 100 | | Meiji Holdings Co. Ltd. (Japan) | | | 3,883 |

| 7,067 | | Nestle SA (Switzerland) | | | 361,929 |

| 500 | | Nisshin Seifun Group, Inc. (Japan) | | | 6,455 |

| 100 | | Nissin Foods Holdings Co. Ltd. (Japan) | | | 3,364 |

| 3,477 | | Parmalat SpA (Italy) | | | 9,522 |

| 9,700 | | Sanderson Farms, Inc. | | | 520,017 |

| 135 | | Suedzucker AG (Germany) | | | 2,986 |

| 22,400 | | Tyson Foods, Inc. (Class A Stock) | | | 428,960 |

| 3,320 | | Unilever NV (Netherlands) | | | 100,423 |

| 2,616 | | Unilever PLC (United Kingdom) | | | 76,815 |

| 3,000 | | Wilmar International Ltd. (Singapore) | | | 14,368 |

| 200 | | Yakult Honsha Co. Ltd. (Japan) | | | 5,395 |

| | | | | |

| | | | | 5,889,960 |

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Gas Utilities 0.1% | | | |

| 800 | | Chesapeake Utilities Corp. | | $ | 23,840 |

| 366 | | Enagas (Spain) | | | 8,021 |

| 2,400 | | Energen Corp. | | | 111,672 |

| 457 | | Gas Natural SDG SA (Spain) | | | 8,438 |

| 9,000 | | Hong Kong & China Gas Co. Ltd. (Hong Kong) | | | 22,441 |

| 200 | | Laclede Group, Inc. (The) | | | 6,744 |

| 800 | | New Jersey Resources Corp. | | | 30,048 |

| 600 | | Nicor, Inc. | | | 25,152 |

| 4,000 | | Osaka Gas Co. Ltd. (Japan) | | | 14,333 |

| 3,063 | | Snam Rete Gas SpA (Italy) | | | 15,524 |

| 2,000 | | Southwest Gas Corp. | | | 59,840 |

| 1,000 | | Toho Gas Co. Ltd. (Japan) | | | 5,455 |

| 5,000 | | Tokyo Gas Co. Ltd. (Japan) | | | 22,035 |

| 2,900 | | WGL Holdings, Inc. | | | 100,485 |

| | | | | |

| | | | | 454,028 |

| |

Healthcare Equipment & Supplies 1.5% | | | |

| 1,100 | | Abaxis, Inc.(a) | | | 29,909 |

| 500 | | Align Technology, Inc.(a) | | | 9,670 |

| 2,100 | | American Medical Systems Holdings, Inc.(a) | | | 39,018 |

| 200 | | Angiodynamics, Inc.(a) | | | 3,124 |

| 200 | | Atrion Corp. | | | 28,608 |

| 18,900 | | Becton Dickinson & Co. | | | 1,487,997 |

| 28 | | BioMerieux (France) | | | 3,216 |

| 2,800 | | C.R. Bard, Inc. | | | 242,536 |

| 1,100 | | Cantel Medical Corp. | | | 21,835 |

| 409 | | CIE Generale D’optique Essilor International SA (France) | | | 26,113 |

| 114 | | Cochlear Ltd. (Australia) | | | 7,620 |

| 46 | | Coloplast A/S (Denmark) (Class B Stock) | | | 5,066 |

| 1,300 | | Cryolife, Inc.(a) | | | 8,411 |

| 1,800 | | Cutera, Inc.(a) | | | 18,666 |

| 2,500 | | DexCom, Inc.(a) | | | 24,325 |

| 2,300 | | ev3, Inc.(a) | | | 36,478 |

| 58 | | Fresenius Se (Germany) | | | 4,265 |

| 409 | | Getinge AB (Sweden) (Class B Stock) | | | 9,805 |

| 1,700 | | Haemonetics Corp.(a) | | | 97,155 |

| 4,000 | | Idexx Laboratories, Inc.(a) | | | 230,200 |

| 400 | | Integra LifeSciences Holdings Corp.(a) | | | 17,532 |

| 4,600 | | Intuitive Surgical, Inc.(a)(b) | | | 1,601,398 |

| 2,800 | | Invacare Corp. | | | 74,312 |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios, Inc./Prudential Asset Allocation Fund | | 29 |

Portfolio of Investments

as of March 31, 2010 (Unaudited) continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Healthcare Equipment & Supplies (cont’d.) | | | |

| 3,600 | | Medical Action Industries, Inc.(a) | | $ | 44,172 |

| 31,600 | | Medtronic, Inc. | | | 1,422,948 |

| 3,200 | | Meridian Bioscience, Inc. | | | 65,184 |

| 600 | | Neogen Corp.(a) | | | 15,060 |

| 254 | | Nobel Biocare Holding AG (Switzerland) | | | 6,793 |

| 300 | | Olympus Corp. (Japan) | | | 9,627 |

| 4,500 | | Quidel Corp.(a) | | | 65,430 |

| 3,300 | | Sirona Dental Systems, Inc.(a) | | | 125,499 |

| 1,805 | | Smith & Nephew PLC (United Kingdom) | | | 17,982 |

| 95 | | Sonova Holding AG (Switzerland) | | | 11,803 |

| 4,300 | | STERIS Corp. | | | 144,738 |

| 16 | | Straumann Holding AG (Switzerland) | | | 3,983 |

| 121 | | Synthes, Inc. (Switzerland) | | | 15,102 |

| 300 | | Terumo Corp. (Japan) | | | 15,980 |

| 48 | | William Demant Holding (Denmark)(a) | | | 3,396 |

| 200 | | Young Innovations, Inc. | | | 5,632 |

| 6,200 | | Zimmer Holdings, Inc.(a) | | | 367,040 |

| | | | | |

| | | | | 6,367,628 |

| |

Healthcare Providers & Services 1.2% | | | |

| 100 | | Alfresa Holdings Corp. (Japan) | | | 4,311 |

| 1,000 | | Allied Healthcare International, Inc.(a) | | | 2,720 |

| 3,000 | | America Service Group, Inc. | | | 48,270 |

| 4,800 | | American Dental Partners, Inc.(a) | | | 62,640 |

| 2,400 | | AmSurg Corp. (Class A Stock)(a) | | | 51,816 |

| 2,400 | | Bio-Reference Labs, Inc.(a) | | | 105,528 |

| 174 | | Celesio AG (Germany) | | | 5,557 |

| 200 | | Chemed Corp. | | | 10,876 |

| 390 | | Fresenius Medical Care AG & Co. KGaA (Germany) | | | 22,005 |

| 2,600 | | Healthsouth Corp.(a) | | | 48,620 |

| 3,000 | | HealthSpring, Inc.(a) | | | 52,800 |

| 1,000 | | Inventiv Health, Inc.(a) | | | 22,460 |

| 2,700 | | IPC The Hospitalist Co., Inc.(a) | | | 94,797 |

| 1,000 | | Laboratory Corp. of America Holdings(a) | | | 75,710 |

| 800 | | LHC Group, Inc.(a) | | | 26,824 |

| 2,000 | | Magellan Health Services, Inc.(a) | | | 86,960 |

| 20,200 | | Medco Health Solutions, Inc.(a) | | | 1,304,112 |

| 300 | | Medipal Holdings Corp. (Japan) | | | 3,552 |

| 200 | | MWI Veterinary Supply, Inc.(a) | | | 8,080 |

| 2,000 | | Owens & Minor, Inc. | | | 92,780 |

See Notes to Financial Statements.

| | |

| 30 | | Visit our website at www.prudentialfunds.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Healthcare Providers & Services (cont’d.) | | | |

| 1,100 | | Psychiatric Solutions, Inc.(a) | | $ | 32,780 |

| 2,900 | | Quest Diagnostics, Inc. | | | 169,041 |

| 745 | | Sonic Healthcare Ltd. (Australia) | | | 9,824 |

| 100 | | Suzuken Co. Ltd. (Japan) | | | 3,525 |

| 3,700 | | Triple-S Management Corp. (Class B Stock)(a) | | | 65,675 |

| 30,900 | | UnitedHealth Group, Inc. | | | 1,009,503 |

| 1,200 | | US Physical Therapy, Inc.(a) | | | 20,880 |

| 24,000 | | WellPoint, Inc.(a) | | | 1,545,120 |

| | | | | |

| | | | | 4,986,766 |

| |

Healthcare Technology 0.1% | | | |

| 18,600 | | Allscripts-Misys Healthcare Solutions, Inc.(a) | | | 363,816 |

|

Hotels, Restaurants & Leisure 0.5% |

| 272 | | Accor SA (France) | | | 15,048 |

| 795 | | Aristocrat Leisure Ltd. (Australia) | | | 3,305 |

| 208 | | Autogrill SpA (Italy)(a) | | | 2,531 |

| 2,100 | | Bob Evans Farms, Inc. | | | 64,911 |

| 331 | | Carnival PLC (United Kingdom) | | | 13,587 |

| 3,800 | | Cheesecake Factory, Inc. (The)(a) | | | 102,828 |

| 3,772 | | Compass Group PLC (United Kingdom) | | | 30,108 |

| 1,000 | | Crown Ltd. (Australia) | | | 7,507 |

| 1,000 | | Denny’s Corp.(a) | | | 3,840 |

| 9,600 | | Genting Singapore PLC (Singapore)(a) | | | 6,073 |