UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11400 WEST OLYMPIC BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA | | 90064 |

(Address of principal executive offices) | | (Zip code) |

|

J. RICHARD ATWOOD, 11400 WEST OLYMPIC BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA 90064 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 310-473-0225 | |

|

Date of fiscal year end: | SEPTEMBER 30 | |

|

Date of reporting period: | MARCH 31, 2014 | |

| | | | | | | |

Item 1. Report to Stockholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

803 West Michigan Street

Milwaukee, Wisconsin 53233

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Fund Performance

This Semi-Annual Report covers the six-month period ended March 31, 2014. Your Fund's net asset value (NAV) closed at $10.33. Dividends of $0.12 and $0.08 were paid on October 2, 2013 and December 19, 2013, to holders of record on September 30 and December 17, 2013, respectively. There were no capital gains distributions.

The following table shows the average annual total return for several different periods ended on that date for the Fund and its benchmarks.

| | | Periods Ended March 31, 2013 | |

| | | 1 Year | | 5 Years* | | 10 Years* | | 15 Years* | | 20 Years* | | 25 Years* | | Since

6/30/1984*,† | |

FPA New Income, Inc. | | | 0.68 | % | | | 2.14 | % | | | 3.01 | % | | | 4.46 | % | | | 5.13 | % | | | 6.40 | % | | | 7.72 | % | |

Barclays U.S. Aggregate

Bond Index | | | -0.10 | % | | | 4.80 | % | | | 4.46 | % | | | 5.40 | % | | | 5.99 | % | | | 6.86 | % | | | 7.94 | % | |

Consumer Price Index + 100

Basis Points | | | 2.44 | % | | | 3.11 | % | | | 3.36 | % | | | 3.44 | % | | | 3.41 | % | | | 3.69 | % | | | 3.83 | % | |

* Annualized

† Inception for FPA management was July 11, 1984. Return information for period July 1-July 10, 1984 reflects performance by a manager other than FPA. A benchmark comparison is not available based on the Fund's inception date therefore a comparison using July 1, 1984 is used.

A redemption fee of 2.00% will be imposed on redemptions within 90 days. Expense ratio calculated as of the date of the most recent prospectus is 0.58%. As of March 31, 2014, the 30 day SEC yield was 3.54%.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem, your investment may be worth more or less than its original cost. Current month-end performance data may be obtained by calling toll-free, 1-800-982-4372.

Portfolio Commentary

During the past quarter the Fund appreciated 0.58% while the Barclays U.S. Aggregate Bond Index rose 1.84%. The main driver of the Fund's underperformance was the decline in Treasury yields. The 10-year Treasury note declined from 3.04% to 2.73%. This benefited the Index, which continues to have a duration of around 5 years (versus the Fund's duration of less than 2 years).

For the trailing twelve months the Fund gained 0.68% versus a -0.10% loss for the Index. We encourage shareholders interested in a recap of the challenging bond market conditions of 2013 to refer to our last quarterly letter.

From a sector perspective, the Collateralized Mortgage Obligations were the best performer for the quarter followed by the Asset Backed Security holdings, then the corporate bond holdings. Specifically the CMO1 bonds backed by relocation mortgage loans associated with corporate and military relocation programs turned in excellent results. The prepayment speeds started to climb as homeowners were being transferred to another

1 CMO is Collateralized Mortgage Obligation. It is a mortgage-backed bond that separates mortgage pools into different maturity classes.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

location thus causing the existing mortgage loans to be paid off. The worst performing sector for the quarter were our Commercial Mortgage Backed Securities which provided a slightly negative return for the quarter.

Portfolio Activity

The portfolio entered the first quarter 2014 with an elevated level of cash and equivalents, the result of selling assets during the fourth quarter that no longer passed our stress test. By the end of this quarter, we had significantly reduced the level of cash in the portfolio through expanding the portfolio's holdings in Asset Backed Securities (ABS) that are backed by consumer automobile loans and leases. This sector was the largest area of investment during the quarter. The portfolio continued to accumulate Collateralized Mortgages Obligations (CMOs) backed by pools of non-performing residential mortgage loans purchased from commercial banks. Within the high-yield corporate portion of the portfolio, we continued to purchase securities with solid financials and good asset protection, maturities of less than six years, callable in approximately one to two years, and have interest coupons that are so large as to make the prospect of the bond being called very likely. If the bond is not called, we are comfortable owning the security until it matures.

The agency-backed single family mortgage market continues to be very challenging. In general, these bonds do not provide sufficient yield to protect the portfolio in the event interest rates rise by 100 basis points2 over the next year. As we believe this portion of the market offers very limited value at the moment, we continue to sell some of our mortgage holdings. Over the last quarter, several of the portfolio's CMOs backed by very large balance jumbo loans guaranteed by FNMA3 or FHLMC4 were liquidated.

We continue to look across the bond market for investment opportunities to help the portfolio achieve a positive absolute return in any one-year period if interest rates rise 100 basis points and a return that is greater than the Consumer Price Index plus 100 basis points on rolling five-year basis.

Market Commentary

As our fixed income investment team has grown over the past few years, its organization is making adjustments too. Melinda Newman joined the team in January 2013 to head up our corporate credit analysis effort and was instrumental in increasing the portfolio's allocation to high yield corporate credit during the second quarter of 2013. Abhi Patwardhan joined the team in 2010 as a generalist with experience in both structured product and corporate credit and has been the lead analyst in several structured product areas such as our non-agency CMBS investments and non-performing residential loan investments. Starting this year he heads up the structured product investment research segment of the fixed income team.

Both Melinda and Abhi have been key contributors during our quarterly client conference calls. Starting this quarter they will be sharing commentary on their respective areas of market focus in the quarterly client letters.

2 Basis Point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument.

3 FNMA (Federal National Mortgage Association) is a government-sponsored enterprise (GSE) that was created in 1938 to expand the flow of mortgage money by creating a secondary mortgage market. Fannie Mae is a publicly traded company, currently under conservatorship, which operates under a congressional charter that directs Fannie Mae to channel its efforts into increasing the availability and affordability of homeownership for low-, moderate- and middle-income Americans.

4 FHLMC (Federal Home Loan Mortgage Corp) is a stockholder-owned, government-sponsored enterprise (GSE), currently under conservatorship, chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing for middle income Americans.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Does an increase in intermediate and longer-term Treasury rates present an investment opportunity?

We have long used the shape of the Treasury yield curve as an indicator of investors' views toward the future direction of interest rates. Through history we have observed that when the Treasury yield curve is flat (i.e. short-term interest rates are similar to long-term rates), the next directional move in interest rates is down. However, the timing of this move is uncertain. A flat yield curve, such as in June 2006, when two-year, ten-year and thirty-year Treasury yields were around 5%, tells us the investors are not fearful of inflation and do not require higher interest rates to tie up their money for a longer period of time. Over the subsequent several years interest rates declined and by July 24, 2012 the ten-year Treasury yield was 1.39%.

When the difference between short-term and long-term interest rates is quite large, such as today, investors are exhibiting a different concern. The current 230 basis point spread between yields on the two-year and ten-year Treasury is a little more than 2.5 times the median level of the last 37 years5. Today investors do fear inflation and they are requiring a higher return to tie up their money for a longer period of time. Looking at history, we observe that in similar situations the next significant move in interest rates is up. An example of such a time period is the end of 2002, when a two-year Treasury had a yield of 1.6% and a ten-year Treasury had a yield of 3.8%. By mid-2006 both instruments had a yield of approximately 5.15%. As with the flat yield curve scenario, the timing of the increase in the level of interest rates is unknown.

This leads us to the next question — are we being adequately compensated for the outcome of such an event? The chart below compares the level of interest rates at the lowest point of July 24, 2012 and end of first quarter 2014.

Treasury Maturity | | Yield 7/24/2012 | | Yield 3/31/2014 | | Change | |

Two-year | | | 0.22 | % | | | 0.42 | % | | | +0.20% | | |

Three-year | | | 0.28 | % | | | 0.87 | % | | | +0.59% | | |

Five-year | | | 0.54 | % | | | 1.72 | % | | | +1.18% | | |

Seven-year | | | 0.88 | % | | | 2.30 | % | | | +1.42% | | |

Ten-year | | | 1.39 | % | | | 2.72 | % | | | +1.33% | | |

Thirty-year | | | 2.45 | % | | | 3.56 | % | | | +1.11% | | |

Difference between two-year and ten-year | | | 1.17 | % | | | 2.30 | % | | | 1.13 | % | |

Our first observation is that the difference between the yield on the two-year Treasury and the yield on the ten-year Treasury has changed dramatically and the bulk of the changes in Treasury interest rates occurred in those with maturities of five years and longer. So has the increase in longer-term interest rates over the past two years made the Treasuries more attractive investments? One tool we use to answer this question is a stress test which calculates the total return over a one-year period if we purchased one of those maturities and its yield were to increase by 100 basis points. We use this metric because history tells us that a 100 basis point movement in yields is a normal market event. The stress test, performed on July 24, 2012 and March 31, 2014, shows us that despite the recent increase in overall Treasury yields, investments in Treasuries could easily result in negative returns and the recent rise in yields has not greatly diminished risk of loss.

5 Calculated quarterly since March of 1977

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

| Treasury Maturity | | Impact of an increase in yield

by 100 basis points in a 12 month

period 7/24/2012 | | Impact of an increase in yield

by 100 basis points in a 12 month

period 3/31/2014 | |

Two-year | | | -0.70 | % | | | -0.57 | % | |

Three-year | | | -1.67 | % | | | -1.05 | % | |

Five-year | | | -3.27 | % | | | -2.07 | % | |

Seven-year | | | -4.71 | % | | | -3.13 | % | |

Ten-year | | | -6.47 | % | | | -4.80 | % | |

Thirty-year | | | -15.55 | % | | | -12.68 | % | |

While the increase in the level of Treasury rates has been significant, they are still not at a level that makes them attractive enough for us to invest in them. However, this steepening of the yield curve presents us with some investment opportunities in securities outside of the Treasury sector with two to three year maturities. This opportunity is offset by the fact that the spread one can get above a Treasury for investing in various non-Treasury segments of the market has declined since June 2012 as well. While challenging, the team still feels confident that they can uncover opportunities that fit our investment criteria.

As stated in previous commentaries, given the current market environment, we have kept the effective duration in the one to two year range, with an average life of our holdings between two and three years, and a yield-to-worst of 2-2.5%. The following table looks at the portfolio as of the end of second quarter 2012 and first quarter 2014.

Portfolio | | Average Coupon | | Average Life | | Yield-to-Worst6 | | Effective Duration | |

June 30, 2012 | | | 3.20 | % | | | 2.44 years | | | | 2.46 | % | | | 1.33 years | | |

March 31, 2014 | | | 2.89 | % | | | 1.99 years | | | | 2.01 | % | | | 1.51 years | | |

Why is the portfolio's effective duration so similar after such a rise in rates? While Treasury interest rates have increased, little has changed as it relates to valuation that warrants any major changes in the portfolio's interest rate risk exposure. With spreads in some sectors tighter, the ability to find investment opportunities with longer durations is also constrained. The result is that we continue to focus on investment ideas that lean toward preservation of capital and as such are willing to accept slightly less yield. Therefore, we have a portfolio with a lower average coupon, shorter average life and lower yield to worst with only a slightly higher effective duration.

The Federal Reserve Bank finances revisited

At this point corporations have reported 2013 year-end earnings. We thought it would be interesting to look at the Federal Reserve from a profit perspective over last year. For 2013, the Federal Reserve reported a net profit of $79 billion which was remitted to the United States Treasury Department, thus assisting in the reduction of the federal budget deficit. The size of the Fed's bond portfolio increased from about $3 trillion to almost $4 trillion, approximately a 33% increase. However, the interest income of the portfolio increased from $78 billion

6 Yield to worst is the lowest possible yield on a callable bond. As of March 31, 2014, the SEC yield was 3.54%. This calculation begins with the Fund's dividend payments for the last 30 days, subtracts fund expenses and uses this number to estimate your returns for a year. The SEC yield is based on the price of the fund at the beginning of the month. The income yield stated here reflects prospective data and thus assumes payments collected by the fund may fluctuate.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

to $85 billion, a far less significant increase. One can deduce that while the assets went up dramatically, the earnings on those assets were lower than on those previously on the bank's books.

Now we move to the not so good news. If the Federal Reserve Bank marked its assets to market, they would have experienced an unrealized loss of $53 billion with $38 billion coming from its mortgage holdings according to the Financial Times article by Robin Harding dated March 14, 2014, the Federal Reserve Bank's Combined Financial Statements for the years ending December 31, 2013 and 2012 and the Independent Auditors Report. As long as the bank chooses not to sell any assets, it can leave them in a held to maturity classification and not mark them to market. Why is there such a large unreported loss in the mortgage holdings? First, the Federal Reserve owns about $522 billion, at amortized cost, of 3% 30-year amortization mortgage pools which have a weighted average coupon for the borrower of about 3.5%. These pools represent approximately 34% of the total Mortgage Backed Security holdings. Looking at TBA pricing7 for this mortgage pool, the price at the beginning of 2013 was $104.78 compared to $94.97 at year-end resulting in a $9.81 loss before interest payments and prepayment activity. As of the end of 2013, the new market rate for borrowing money for a 30-year fixed rate mortgage guaranteed by FNMA or FHLMC was about 4.55% according to the Bank Rate Monitor. Higher mortgage rates usually equate to slower prepayment speeds as the ability to refinance is curtailed and the assumed average life increases. Coupled with rising interest rates, this could result in a large potential negative impact to the price of the bank's holdings. Overall this does not look good either from the standpoint of profitability or the value of bank's assets, two metrics that a private investor would take into account when looking at the soundness and attractiveness of a private bank.

These unrealized losses have the potential to curtail the options available to the Federal Reserve to control the excess reserves (money) in the monetary system it created by printing the money to purchase these securities. Only time will tell if the Quantitative Easing (QE) program created unintended consequences to the nation's monetary system. In our opinion, it introduced an additional level of complexity and risk to the capital markets of the United States and, to a lesser degree, the global capital markets as well. We address these concerns by taking on slightly less interest rate and credit risk in the portfolio.

Quantitative Easing and the risk-on trade: the music is playing and the punch bowl is flowing

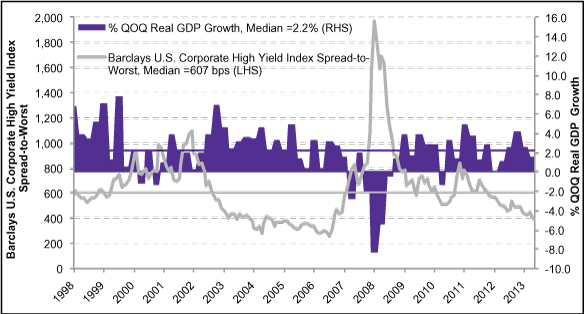

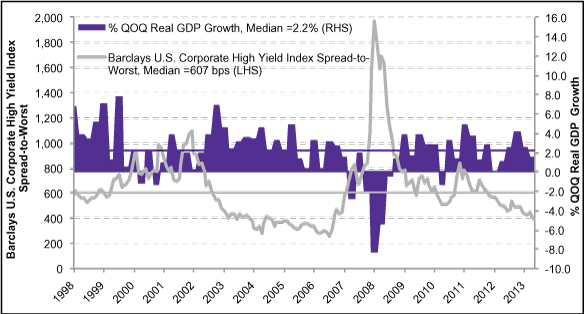

The relationship between credit spreads and real GDP8 growth is a favorite topic among academics seeking to improve fickle macroeconomic models with an infusion of data from allegedly efficient financial markets. We are not economists. However, it seems clear to us that there is a significant relationship between high yield credit spreads and real GDP growth. The correlation coefficient9 of the average spread-to-worst for the Barclays U.S. Corporate High Yield Index and quarter-over-quarter real GDP growth in the U.S.10 is -0.60 for the period from November 1998 through March 201411.

7 TBA pricing is used to term used to describe a forward mortgage-backed securities trade. Pass-through securities issued by Freddie Mac, Fannie Mae and Ginnie Mae trade in the TBA market. The term TBA is derived from the fact that the actual mortgage-backed security that will be delivered to fulfill a TBA trade is not designated at the time the trade is made. The securities are "to be announced" 48 hours prior to the established trade settlement date.

8 GDP (Gross Domestic Product) is the total market value of all final goods and services produced in a country in a given year, equal to total consumer, investment and government spending, plus the value of exports, minus the value of imports.

9 Correlation Coefficient is a measure that determines the degree to which two variable's movements are associated.

10 Using Bloomberg median Q1 2014 quarter-over-quarter real GDP forecast of 1.5% as of 4/22/14

11 Calculated using month-end average spread-to-worst

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Source: Bloomberg, U.S. Bureau of Economic Analysis, Barclays

Note: uses median Q1 2014 quarter-over-quarter (QOQ) real GDP forecast of 1.5% as of 04/22/14; calculated using month-end average spread-to-worst12.

BBB-rated bond spreads, for which we have a longer data set going back to 1953, also have a negative correlation with economic growth. The correlation coefficient for BBB credit spreads13 and quarter-over-quarter real GDP growth was -0.32 for the period from April 1953 through March 2014.

The negative correlation between credit spreads and real GDP growth makes intuitive sense. In periods of strong economic growth, corporate earnings and free cash flow improve, companies de-lever, and the risk of default declines. Risk is lower, and investors demand less compensation for lower risk. Once an economic expansion becomes overheated, complacency sets in, equity and debt valuations become stretched, corporate profits and capital are misallocated, and leverage rises. Then, inflation picks up, and central banks intervene by tightening monetary policy. Earnings decline, leverage increases, and the risk of default rises in the tighter monetary environment. Investors then demand more compensation for greater risk.

QE has disrupted the normal relationship between credit spreads and economic growth. The correlation between high yield spreads and real GDP growth is +0.21 since the November 2010 announcement of QE2, a notable reversal in the relationship from -0.66 for the period from November 1998 through November 2010. The same is true for the correlation between BBB spreads and economic growth, which is +0.13 for the post-QE2

12 Spread-to-Worst: the difference in overall returns between two different classes of securities, or returns from the same class, but different representative securities.

13 BBB credit spreads calculated by subtracting 20-Year Treasury Constant Maturity Rate from the Board of Governors of the Federal Reserve System from Moody's Seasoned Baa Corporate Bond Yield, which includes bonds with maturities between 20 and 30 years. Changes in the 30-Year Constant Maturity Rate were used as a proxy for 20-Year CMT for the January 1987-September 1993 period

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

period vs. -0.32 from April 1953 through November 2010. This means that the worse the economy gets, the more the credit market rallies. There are two possible explanations for this change. The first is that the credit market is correctly forecasting more robust economic growth in the future. The second is that investors are currently too complacent about credit risk. Given deteriorating consensus forecasts for 1Q2014 real GDP growth, declining consensus estimates for 2014 corporate earnings growth, bearish company revenue and earnings guidance, and the generally lackluster track record QE has thus far in stimulating the economy, we believe the latter is the more likely scenario.

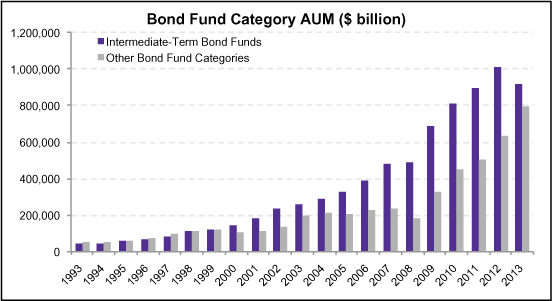

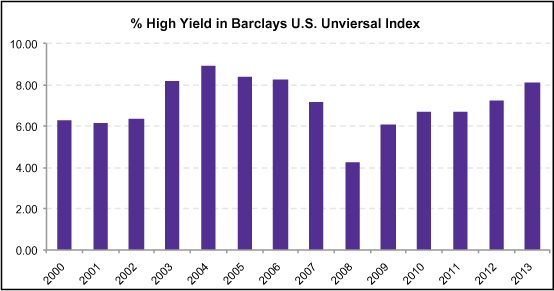

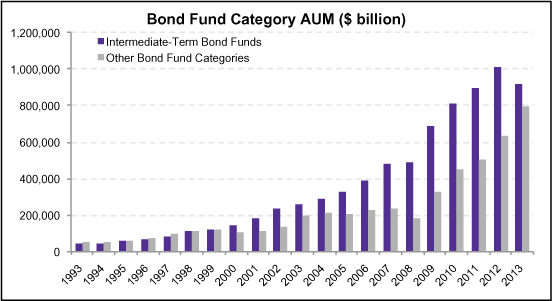

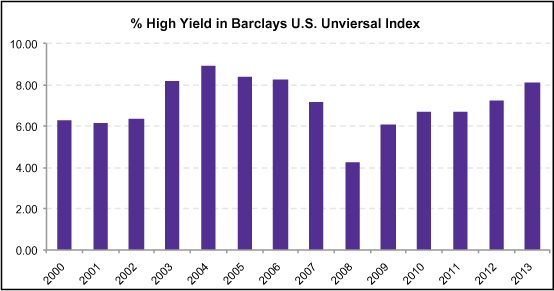

We have commented previously on the increasing amount of capital deployed in fixed income strategies with higher credit risk, such as high yield and leveraged loans, as well as nontraditional bond funds, which can take considerable credit risk given unconstrained guidelines. These three bond fund categories comprised 31% of domestic open-end bond fund assets under management at the end of 2013 according to Morningstar, the highest level since 2000. Bank loan fund assets increased 92% to $137 billion in 2013, and nontraditional bond fund assets grew 79% to $122 billion. While the mutual fund market represents only a portion of the overall domestic fixed income market, we believe this increased exposure to credit has likely been replicated among institutional investors, insurance companies, and other fixed income investors. On a broader scale, this can be seen by the high yield allocation in the Barclays Capital U.S. Universal Bond Index's which now tops 8% — the highest percentage since 2003-2006.

Source: Morningstar

7

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

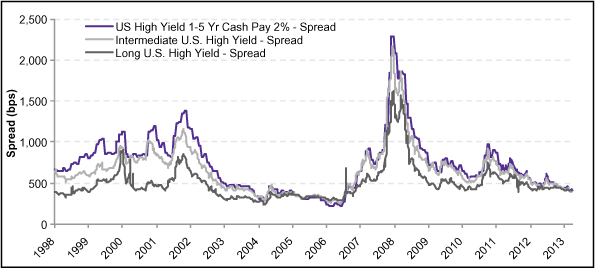

Source: Barclays

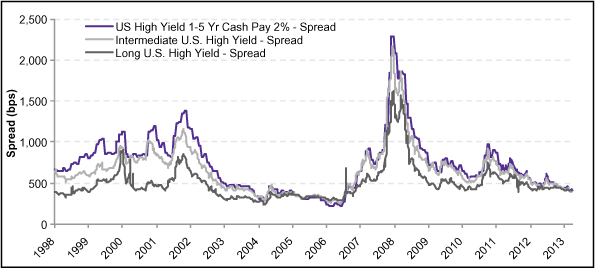

The quest for yield has driven investors further out on the risk spectrum and is likely responsible for the notable decrease in yields of below investment grade debt to an all-time low of 5.5%14. Perhaps investors believe increased demand for risk assets will help to support asset prices regardless of the state of the economy or that the shorter duration of high yield bonds and leveraged loans will afford some degree of insulation from interest rate risk

Given fairly weak real GDP growth, high yield spreads of 387 bps (as represented by Barclays U.S. High-Yield Bond Index), which are almost 200 bps inside long-term averages, seem incongruous with the current economic landscape. We are also concerned with anomalies in the term structure of credit spreads, the relationship between spread-to-worst for short, medium, and long duration high yield indices. The term structure of high yield spread-to-worst is normally inverted, and spread for short duration bonds is normally higher than for long duration bonds. Lately this term structure of spreads has been flat, similar to the August 2005-June 2007 period. In that period, the housing bubble was still building. The flat term structure of spreads raises our concerns over the potential for future financial instability, especially when we take into account that the Fed's monetary policy is even more accommodative now than it was in 2005.

14 BofA Merrill Lynch US High Yield Master II Effective Yield was 5.63 as of 3/31/14. https://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2EY

8

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Source: Barclays

It is our nature as value investors to plan for the worst, but hope for a better outcome. As such, we have deployed capital into credit quite carefully by keeping our duration short, mitigating extension risk, and remaining relatively high in the capital structure of companies we invest in. While we hope that tight credit spreads do portend a return to more robust economic growth, we have planned for an eventual widening of spreads to something more commensurate with a lackluster economic environment and normalization of overly easy monetary policy.

9

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Crowding in short duration bonds

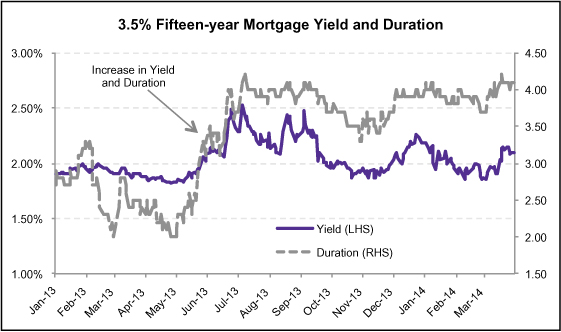

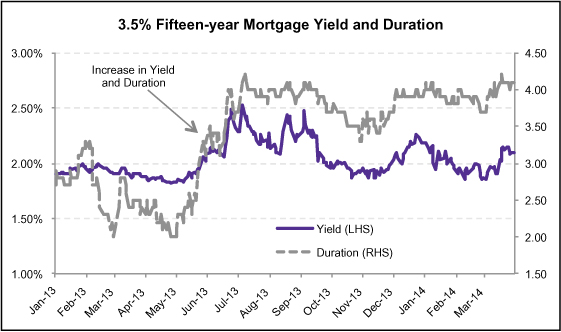

Given the market environment of the past several years, we have maintained a short duration for the portfolio. Unfortunately for us, we are not the only bond investors pursuing this strategy. Having seen last year's sudden increase in interest rates and the losses that such interest rate increases can create for longer duration portfolios, a number of other investment managers have similarly begun buying short duration bonds. Increased demand for short-duration bonds has led to lower risk-adjusted yields for these bonds and has made it more difficult for us to find attractive investment opportunities. This phenomenon can be seen in 15-year amortization agency mortgage pools. We had previously found these mortgages attractive because the 15-year amortization limits the potential duration extension in a rising interest rate environment, a characteristic which has recently led other investors to find these mortgages attractive as well. The increased demand for these mortgages has pushed up pricing resulting in greater risk of negative total returns in an increasing interest rate environment. As an example, the chart below shows the yield and duration for the generic 3.5% coupon, 15-year agency mortgage pool. As shown in the chart, coincident with the May 2013 increase in Treasury yields, the yield on these 15-year mortgages increased. However, the increase in yield is a misleading indicator of the attractiveness of these bonds because the increase in Treasury rates caused an increase in the mortgages' duration too:

Source: Bloomberg

10

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

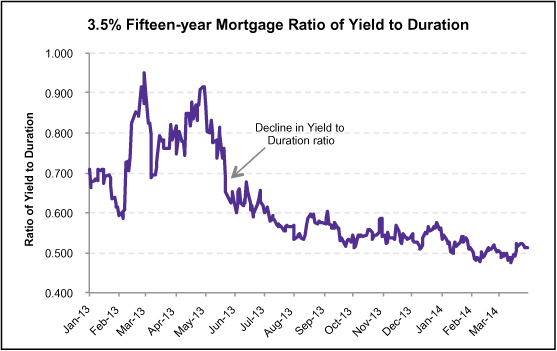

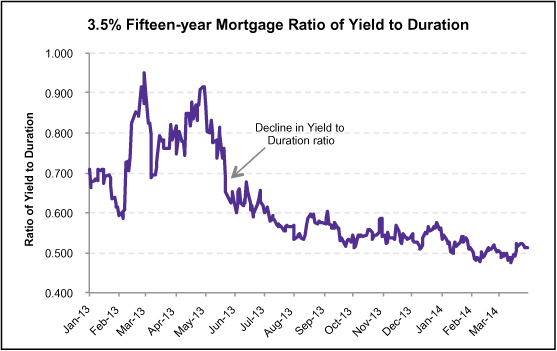

Due to the increase in duration, despite the higher yield, the riskiness of the mortgages actually increased. The chart below highlights this point by plotting the ratio of the yield to the duration, i.e. how much yield investors receive per unit of duration. Since May 2013, 15-year mortgages have become more expensive as reflected by the fact that investors are now receiving less yield per unit of duration.

Source: Bloomberg

Agency mortgages are emblematic of the recent trend in short-duration bonds which have become more expensive thus making an already difficult investing environment even more challenging for us.

Conclusion

There are two consequences of expensive bonds. The first consequence is that we have to look to new sectors within the fixed income universe to find investment opportunities. Historically, we had deployed a significant amount of our capital in agency mortgages because they were the most attractive securities that met our absolute return criteria. As demonstrated above, these days it is difficult to find agency mortgages that meet our investment criteria. In the absence of attractive absolute value in agency mortgages, we have been able to find attractive absolute value in asset-backed securities, which resulted in a significant increase in the portfolio's exposure to asset-backed securities from June 30, 2013 through March 31, 2014.

The second consequence of expensive bonds is that the portfolio carries a higher cash balance. Typically, the portfolio's cash balance is the inverse of attractive investment ideas. Thus, low cash balances mean that there is significant investment opportunity and high cash balances reflect limited investment opportunity. We have not

11

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

been able to find enough attractive asset-backed or other fixed income investments to offset the decrease in our agency mortgage investments, which is reflected in the portfolio's higher cash balance.

Having said that, with yields at such a low absolute level, the opportunity cost of holding cash is very small. In other words, by holding cash instead of investing that cash, the income that we are sacrificing is de minimis. With such a low opportunity cost, we would rather hold cash and wait until the market presents us with opportunities to invest your capital at attractive absolute returns versus making sub-optimum relative investments.

With the prospect of higher rates coming into clearer view, now is not the time to bend our investment discipline. We have been employing a portfolio construction tactic of owning bonds that amortize their principal monthly, mature within two to three years or are callable over the next two years. This allows the portfolio to continuously reinvest the capital at progressively higher interest rates as shorter-term interest rates rise while protecting the principal from a negative absolute return. As we saw last year, the opportunity set can change quickly. For example, when the May 2013 increase in interest rates occurred, we pounced on the opportunity to buy corporate bonds at attractive prices. In anticipation of similar opportunities in the future, we will remain disciplined in investing your money so that we can preserve capital to take advantage of that opportunity the moment it arrives.

Thank you for your continued support.

Respectfully submitted,

Thomas H. Atteberry

Chief Executive Officer and Portfolio Manager

April 22, 2014

The discussion of Fund investments represents the views of the Fund's managers at the time of this report and are subject to change without notice. Portfolio composition will change due to ongoing management of the Fund. References to individual securities are for informational purposes only and should not be construed as recommendations by the Fund, Adviser or Distributor.

The Barclays U.S. Aggregate Bond Index is a broad base index and a market capitalization-weighted index and is often used to represent investment grade bonds being traded in the United States. CPI+100 is a measure of the consumer price index (CPI) plus an additional 100 basis points. The CPI, or a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. The CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them; the goods are weighted according to their importance.

12

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund can purchase foreign securities, which are subject to interest rate, currency exchange rate, economic and political risks. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds. Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; derivatives may increase volatility. High yield securities can be volatile and subject to much higher instances of default.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

13

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

March 31, 2014 (Unaudited)

Bonds & Debentures | | | | | 96.9 | % | |

Commercial Mortgage-Backed | |

Agency Stripped | | | 7.3 | % | | | | | |

Non-Agency | | | 5.9 | % | | | | | |

Agency | | | 2.1 | % | | | | | |

Residential Mortgage-Backed | |

Agency Pool Fixed Rate | | | 4.6 | % | | | | | |

Agency Collateralized Mortgage

Obligation | | | 17.4 | % | | | | | |

Non-Agency Collateralized

Mortgage Obligation | | | 8.8 | % | | | | | |

Agency Stripped | | | 2.2 | % | | | | | |

Agency Pool Adjustable Rate | | | 0.0 | % | | | | | |

Asset-Backed | |

Auto | | | 15.4 | % | | | | | |

Other | | | 10.0 | % | | | | | |

U.S. Treasuries | | | 14.4 | % | | | | | |

Corporate | | | 7.0 | % | | | | | |

Corporate Bank Debt | | | 1.8 | % | | | | | |

Short-Term Investments | | | | | 2.9 | % | |

Other Assets and Liabilities, net | | | | | 0.2 | % | |

Net Assets | | | | | 100.0 | % | |

MAJOR PORTFOLIO CHANGES

For the Six Months Ended March 31, 2014

(Unaudited)

| | | Principal

Amount | |

NET PURCHASES | |

U.S Treasury Note — 2.375% 08/31/14 (1) | | $ | 193,000,000 | | |

U.S Treasury Note — 2.625% 06/30/14 (1) | | $ | 193,000,000 | | |

U.S Treasury Note — 2.625% 07/31/14 (1) | | $ | 168,000,000 | | |

U.S Treasury Note — 1% 05/15/14 | | $ | 110,000,000 | | |

CARDS II TR 2012-4A CL A — 0.605% 9/15/2017 (1) | | $ | 75,000,000 | | |

GE Capital Credit Card Master Note Trust 2010-1 A — 3.69% 3/15/2018 (1) | | $ | 63,545,000 | | |

Federal National Mortgage Association 2013-112 CL WA — 3.5% 02/25/43 (1) | | $ | 52,946,954 | | |

NET SALES | |

U.S Treasury Note — 0.25% 01/31/14 (2) | | $ | 50,000,000 | | |

U.S Treasury Note — 1% 01/15/14 (2) | | $ | 50,000,000 | | |

U.S Treasury Note — 1.75% 03/31/14 (2) | | $ | 50,000,000 | | |

U.S Treasury Note — 1.25% 03/15/14 (2) | | $ | 70,000,000 | | |

U.S Treasury Note — 0.25% 04/30/14 (2) | | $ | 75,000,000 | | |

U.S Treasury Note — 0.75% 12/15/13 (2) | | $ | 75,000,000 | | |

U.S Treasury Note — 1.875% 02/28/14 (2) | | $ | 75,000,000 | | |

U.S Treasury Note — 0.25% 03/31/14 (2) | | $ | 150,000,000 | | |

(1) Indicates new commitment to portfolio

(2) Indicates elimination from portfolio

14

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

March 31, 2014 (Unaudited)

BONDS & DEBENTURES | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

COMMERCIAL MORTGAGE-BACKED

SECURITIES AGENCY STRIPPED — 7.3% | | | |

Government National Mortgage Association | |

2004-10 | | | 0.0351 | | | 1/16/2044 | | $ | 26,531,811 | | | $ | 6,368 | | |

2002-56 | | | 0.0425 | | | 6/16/2042 | | | 218,179 | | | | 345 | | |

2009-119 | | | 0.1896 | | | 12/16/2049 | | | 100,596,653 | | | | 2,599,417 | | |

2010-63 | | | 0.1970 | | | 5/16/2050 | | | 44,355,253 | | | | 1,063,639 | | |

2010-18 | | | 0.2221 | | | 1/16/2050 | | | 56,830,840 | | | | 1,429,296 | | |

2011-10 | | | 0.2739 | | | 12/16/2045 | | | 79,253,420 | | | | 2,381,565 | | |

2008-8 | | | 0.3068 | | | 11/16/2047 | | | 38,591,516 | | | | 911,532 | | |

2008-24 | | | 0.3140 | | | 11/16/2047 | | | 14,427,216 | | | | 341,781 | | |

2008-45 | | | 0.3405 | | | 2/16/2048 | | | 24,093,091 | | | | 558,237 | | |

2007-77 | | | 0.3921 | | | 11/16/2047 | | | 52,224,122 | | | | 1,736,974 | | |

2005-9 | | | 0.4247 | | | 1/16/2045 | | | 6,536,968 | | | | 142,179 | | |

2006-55 | | | 0.4815 | | | 8/16/2046 | | | 28,801,649 | | | | 918,773 | | |

2009-105 | | | 0.4979 | | | 11/16/2049 | | | 35,946,106 | | | | 1,386,801 | | |

2008-48 | | | 0.5186 | | | 4/16/2048 | | | 15,560,652 | | | | 597,840 | | |

2013-72 | | | 0.5266 | | | 11/16/2047 | | | 541,056,061 | | | | 32,783,777 | | |

2004-43 | | | 0.5330 | | | 6/16/2044 | | | 41,741,264 | | | | 1,038,523 | | |

2010-49 | | | 0.5569 | | | 2/16/2050 | | | 79,993,788 | | | | 2,308,621 | | |

2009-71 | | | 0.5652 | | | 7/16/2049 | | | 66,842,826 | | | | 2,073,464 | | |

2004-108 | | | 0.5812 | | | 12/16/2044 | | | 17,991,020 | | | | 448,696 | | |

2009-86 | | | 0.5816 | | | 9/16/2049 | | | 70,569,053 | | | | 2,086,727 | | |

2006-30 | | | 0.5924 | | | 5/16/2046 | | | 6,159,148 | | | | 365,484 | | |

2011-6 | | | 0.6269 | | | 10/16/2052 | | | 198,303,957 | | | | 6,748,284 | | |

2009-49 | | | 0.6375 | | | 6/16/2049 | | | 52,797,954 | | | | 1,933,461 | | |

2013-35 | | | 0.6550 | | | 1/16/2053 | | | 362,176,904 | | | | 22,867,017 | | |

2009-60 | | | 0.6647 | | | 7/16/2049 | | | 64,026,129 | | | | 2,057,159 | | |

2008-92 | | | 0.6691 | | | 10/16/2048 | | | 42,219,476 | | | | 1,883,411 | | |

| 2010-161 IA | | | 0.6744 | | | 12/16/2050 | | | 239,356,343 | | | | 8,310,452 | | |

| 2011-64 IX | | | 0.7034 | | | 10/16/2044 | | | 67,754,667 | | | | 3,574,059 | | |

2010-28 | | | 0.7280 | | | 3/16/2050 | | | 83,309,133 | | | | 2,836,676 | | |

2013-7 | | | 0.7416 | | | 5/16/2053 | | | 131,194,676 | | | | 9,367,523 | | |

2008-78 | | | 0.7481 | | | 7/16/2048 | | | 11,842,315 | | | | 614,735 | | |

2011-16 | | | 0.7711 | | | 9/16/2046 | | | 103,458,101 | | | | 4,779,764 | | |

2009-4 | | | 0.7744 | | | 1/16/2049 | | | 34,679,286 | | | | 1,517,912 | | |

2010-123 | | | 0.8072 | | | 9/16/2050 | | | 61,261,015 | | | | 2,861,502 | | |

2013-29 | | | 0.8295 | | | 5/16/2053 | | | 127,436,257 | | | | 8,984,995 | | |

2013-1 | | | 0.9110 | | | 2/16/2054 | | | 139,757,244 | | | | 11,602,059 | | |

| 2010-148 IX | | | 0.9137 | | | 10/16/2052 | | | 64,932,344 | | | | 3,155,063 | | |

2013-80 | | | 0.9200 | | | 3/16/2052 | | | 64,818,605 | | | | 5,408,341 | | |

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

2009-30 | | | 0.9210 | | | 3/16/2049 | | $ | 14,181,814 | | | $ | 678,316 | | |

2012-131 | | | 0.9293 | | | 2/16/2053 | | | 112,330,910 | | | | 9,136,940 | | |

2013-13 | | | 0.9459 | | | 7/16/2047 | | | 107,369,300 | | | | 7,488,364 | | |

2013-125 | | | 0.9493 | | | 10/16/2054 | | | 26,842,044 | | | | 1,584,424 | | |

2012-150 | | | 0.9557 | | | 11/16/2052 | | | 99,559,667 | | | | 7,791,510 | | |

2013-30 | | | 0.9804 | | | 9/16/2053 | | | 231,691,139 | | | | 17,582,902 | | |

2011-165 | | | 0.9921 | | | 10/16/2051 | | | 232,714,215 | | | | 12,378,069 | | |

2012-9 | | | 0.9945 | | | 11/16/2052 | | | 172,330,744 | | | | 16,955,622 | | |

2011-49 | | | 1.0110 | | | 4/16/2045 | | | 75,096,927 | | | | 3,859,982 | | |

2012-45 | | | 1.0166 | | | 4/16/2053 | | | 34,888,001 | | | | 2,675,132 | | |

2012-58 | | | 1.0292 | | | 1/16/2055 | | | 233,755,521 | | | | 18,415,260 | | |

2012-35 | | | 1.0394 | | | 11/16/2052 | | | 146,550,400 | | | | 10,089,922 | | |

2012-95 | | | 1.0406 | | | 2/16/2053 | | | 145,060,002 | | | | 11,675,502 | | |

2013-61 | | | 1.0466 | | | 5/16/2053 | | | 158,544,807 | | | | 12,268,435 | | |

2012-79 | | | 1.0500 | | | 3/16/2053 | | | 146,291,100 | | | | 11,085,939 | | |

2012-85 | | | 1.0669 | | | 9/16/2052 | | | 122,340,057 | | | | 9,736,874 | | |

2013-45 | | | 1.0754 | | | 12/16/2040 | | | 126,756,319 | | | | 8,417,862 | | |

2012-25 | | | 1.0841 | | | 8/16/2052 | | | 120,133,331 | | | | 8,267,456 | | |

2011-143 | | | 1.0996 | | | 4/16/2053 | | | 95,528,094 | | | | 13,057,735 | | |

2011-120 | | | 1.1237 | | | 12/16/2043 | | | 115,208,758 | | | | 12,816,974 | | |

| 2011-78 IX | | | 1.1927 | | | 8/16/2046 | | | 147,185,394 | | | | 8,791,383 | | |

2011-164 | | | 1.2064 | | | 4/16/2046 | | | 170,659,406 | | | | 11,133,820 | | |

| 2011-92 IX | | | 1.2071 | | | 11/16/2044 | | | 33,113,502 | | | | 2,275,560 | | |

2011-149 | | | 1.2295 | | | 10/16/2046 | | | 114,408,535 | | | | 8,731,659 | | |

2012-4 | | | 1.4742 | | | 5/16/2052 | | | 273,215,235 | | | | 19,100,559 | | |

TOTAL AGENCY STRIPPED | | $ | 399,678,653 | | |

NON-AGENCY — 5.9% | | | |

A10 Securitization 2013-2 A† | | | 2.6000 | | | 11/15/2027 | | $ | 11,610,000 | | | $ | 11,620,903 | | |

Citigroup Commercial Mortgage Trust | |

| 2007-FL3A B† | | | 0.3250 | | | 4/15/2022 | | | 440,933 | | | | 437,292 | | |

| 2007-FL3A C† | | | 0.3650 | | | 4/15/2022 | | | 546,612 | | | | 541,240 | | |

| 2007-FL3A D† | | | 0.4050 | | | 4/15/2022 | | | 361,447 | | | | 357,894 | | |

| 2007-FL3A E† | | | 0.4550 | | | 4/15/2022 | | | 413,082 | | | | 406,983 | | |

Citigroup Mortgage Loan Trust Inc. 2014-A A | | | 4.0000 | | | 1/1/2035 | | | 31,019,106 | | | | 32,024,912 | | |

COMM Mortgage Trust 2013-RIA4 A2† | | | 6.0000 | | | 6/25/2028 | | | 12,099,500 | | | | 11,753,254 | | |

Credit Suisse Mortgage Trust | |

| 2007-TF2A B† | | | 0.5050 | | | 4/15/2022 | | | 401,000 | | | | 388,970 | | |

| 2007-TF2A A3† | | | 0.4250 | | | 4/15/2022 | | | 43,257,311 | | | | 42,564,809 | | |

Del Coronado Trust 2013-HDMZ CL M† | | | 5.1545 | | | 3/15/2018 | | | 9,299,000 | | | | 9,325,541 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Lehman Brothers Floating Rate

Commercial 2007-LLFA F† | | | 1.1550 | | | 6/15/2022 | | $ | 12,924,000 | | | $ | 12,463,518 | | |

LSTAR Commercial Mortgage

Trust 2011-1 A† | | | 3.9129 | | | 7/25/2017 | | | 1,640,302 | | | | 1,671,583 | | |

Monty Parent Issuer LLC | |

| 2013-LTR1 A† | | | 3.4700 | | | 11/20/2028 | | | 9,382,925 | | | | 9,385,740 | | |

| 2013-LTR1 B† | | | 4.2500 | | | 11/20/2028 | | | 19,647,987 | | | | 19,672,547 | | |

Motel 6 Trust | |

| 2012-MTL6 D† | | | 3.7812 | | | 10/5/2017 | | | 37,033,000 | | | | 37,117,254 | | |

| 2012-MTL6 E† | | | 4.2743 | | | 10/5/2017 | | | 10,061,000 | | | | 9,767,321 | | |

Ores NPL LLC | |

| 2014-LV3 CL A† | | | 3.0000 | | | 3/27/2024 | | | 17,822,000 | | | | 17,822,000 | | |

| 2013-LV2 CL A† | | | 3.0810 | | | 9/25/2025 | | | 24,968,347 | | | | 24,984,077 | | |

| 2014-LV3 CL B† | | | 6.0000 | | | 3/27/2024 | | | 47,419,000 | | | | 47,300,452 | | |

RREF 2012 LT1 LLC 2013-LT2 CL A† | | | 2.8331 | | | 5/22/2028 | | | 11,402,556 | | | | 11,402,556 | | |

Starwood Commercial Mortgage Trust

2013-FV1 CL B† | | | 2.1570 | | | 8/11/2028 | | | 18,051,000 | | | | 18,063,275 | | |

TOTAL NON-AGENCY | | $ | 319,072,121 | | |

AGENCY — 2.1% | | | |

Government National Mortgage Association | |

| 2012-22 CL AB | | | 1.6610 | | | 2/1/2026 | | $ | 6,402,229 | | | $ | 6,405,280 | | |

| 2011-49 CL AB | | | 2.8000 | | | 4/16/2034 | | | 25,496,424 | | | | 25,856,434 | | |

| 2009-49 CL B | | | 3.4360 | | | 6/16/2034 | | | 1,133 | | | | 1,133 | | |

| 2011-120 CL A | | | 3.9291 | | | 8/16/2033 | | | 38,167,282 | | | | 39,122,609 | | |

| 2011-143 CL AB | | | 3.9739 | | | 3/16/2033 | | | 41,270,809 | | | | 42,317,849 | | |

TOTAL AGENCY | | $ | 113,703,305 | | |

RESIDENTIAL MORTGAGE-BACKED

SECURITIES AGENCY POOL FIXED

RATE MORTGAGES — 4.6% | | | |

Federal Home Loan Mortgage Corporation | |

J13919 | | | 3.5000 | | | 12/1/2020 | | $ | 20,575,636 | | | $ | 21,593,970 | | |

J11204 | | | 4.5000 | | | 11/1/2019 | | | 5,423,542 | | | | 5,761,266 | | |

P60959 | | | 4.5000 | | | 9/1/2020 | | | 3,116,299 | | | | 3,307,172 | | |

E01322 | | | 5.0000 | | | 3/1/2018 | | | 4,646,431 | | | | 4,948,774 | | |

G13091 | | | 5.0000 | | | 6/1/2018 | | | 2,206,430 | | | | 2,341,486 | | |

E01642 | | | 5.0000 | | | 5/1/2019 | | | 3,525,128 | | | | 3,756,835 | | |

G14987 | | | 5.0000 | | | 1/1/2020 | | | 4,316,960 | | | | 4,617,941 | | |

G13812 | | | 5.0000 | | | 12/1/2020 | | | 7,679,470 | | | | 8,150,759 | | |

G14979 | | | 5.5000 | | | 12/1/2018 | | | 1,780,228 | | | | 1,920,668 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

G14187 | | | 5.5000 | | | 12/1/2020 | | $ | 13,293,372 | | | $ | 14,318,291 | | |

G12139 | | | 6.5000 | | | 9/1/2019 | | | 986,734 | | | | 1,025,473 | | |

A26942 | | | 6.5000 | | | 9/1/2034 | | | 624,103 | | | | 705,012 | | |

G08107 | | | 6.5000 | | | 1/1/2036 | | | 1,990,872 | | | | 2,247,874 | | |

P50543 | | | 6.5000 | | | 4/1/2037 | | | 142,986 | | | | 157,286 | | |

Federal National Mortgage Association | |

AA0905 | | | 4.5000 | | | 1/1/2021 | | | 3,024,437 | | | | 3,211,287 | | |

995756 | | | 5.0000 | | | 12/1/2018 | | | 8,016,437 | | | | 8,564,040 | | |

735453 | | | 5.0000 | | | 12/1/2019 | | | 4,405,993 | | | | 4,712,518 | | |

AE0126 | | | 5.0000 | | | 6/1/2020 | | | 11,118,893 | | | | 11,891,322 | | |

995861 | | | 5.0000 | | | 1/1/2021 | | | 8,815,978 | | | | 9,419,255 | | |

890122 | | | 5.0000 | | | 11/1/2021 | | | 4,152,943 | | | | 4,396,928 | | |

890083 | | | 5.0000 | | | 12/1/2021 | | | 4,476,138 | | | | 4,782,977 | | |

AE0792 | | | 5.0000 | | | 1/1/2026 | | | 8,433,397 | | | | 9,020,361 | | |

AL4056 | | | 5.0000 | | | 6/1/2026 | | | 25,257,433 | | | | 27,068,598 | | |

257100 | | | 5.5000 | | | 1/1/2018 | | | 772,410 | | | | 824,123 | | |

745500 | | | 5.5000 | | | 12/1/2018 | | | 5,784,023 | | | | 6,167,619 | | |

995327 | | | 5.5000 | | | 12/1/2019 | | | 2,078,046 | | | | 2,238,804 | | |

735521 | | | 5.5000 | | | 3/1/2020 | | | 3,734,546 | | | | 4,019,454 | | |

995284 | | | 5.5000 | | | 3/1/2020 | | | 7,033,248 | | | | 7,499,693 | | |

889318 | | | 5.5000 | | | 7/1/2020 | | | 7,522,027 | | | | 8,058,498 | | |

889069 | | | 5.5000 | | | 1/1/2021 | | | 6,970,804 | | | | 7,494,590 | | |

AE0237 | | | 5.5000 | | | 11/1/2023 | | | 8,143,034 | | | | 8,750,830 | | |

AL4901 | | | 5.5000 | | | 9/1/2025 | | | 11,491,785 | | | | 12,317,667 | | |

745832 | | | 6.0000 | | | 4/1/2021 | | | 14,380,038 | | | | 15,466,019 | | |

AD0951 | | | 6.0000 | | | 4/1/2021 | | | 7,794,575 | | | | 8,389,613 | | |

890225 | | | 6.0000 | | | 5/1/2023 | | | 7,364,415 | | | | 7,921,754 | | |

323282 | | | 7.5000 | | | 7/1/2028 | | | 348,466 | | | | 401,558 | | |

Government National Mortgage Association | |

782281 | | | 6.0000 | | | 3/15/2023 | | | 3,718,814 | | | | 4,089,084 | | |

TOTAL AGENCY POOL FIXED RATE

MORTGAGES | | $ | 251,559,399 | | |

AGENCY COLLATERALIZED MORTGAGE

OBLIGATION — 17.4% | | | |

Federal Home Loan Bank | |

00-0986 | | | 5.7390 | | | 7/20/2014 | | $ | 9,959,785 | | | $ | 10,101,015 | | |

Federal Home Loan Mortgage Corporation | |

| 4151 CL YU | | | 2.0000 | | | 1/15/2043 | | | 23,310,719 | | | | 18,754,590 | | |

| 4125 CL NA | | | 2.5000 | | | 4/15/2042 | | | 26,396,148 | | | | 23,055,800 | | |

| 4141 CL CK | | | 2.5000 | | | 12/15/2042 | | | 3,673,963 | | | | 3,113,172 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 4144 CL BY | | | 2.5000 | | | 12/15/2042 | | $ | 23,217,334 | | | $ | 20,233,110 | | |

| 4153 CL KP | | | 2.5000 | | | 1/15/2043 | | | 21,577,497 | | | | 19,017,502 | | |

| 3829 CL CD | | | 3.0000 | | | 8/15/2024 | | | 2,522,904 | | | | 2,584,917 | | |

| 3806 CL AB | | | 4.0000 | | | 2/15/2023 | | | 2,573,260 | | | | 2,594,489 | | |

| 2869 CL JA | | | 4.0000 | | | 4/15/2034 | | | 11,738 | | | | 11,735 | | |

| 3992 CL H | | | 4.0000 | | | 6/15/2036 | | | 186,452 | | | | 191,044 | | |

| 3877 CL EL | | | 4.0000 | | | 8/15/2038 | | | 2,393,052 | | | | 2,409,940 | | |

| 4088 CL LE | | | 4.0000 | | | 10/15/2040 | | | 14,666,157 | | | | 15,115,230 | | |

| 2877 CL WA | | | 4.2500 | | | 10/15/2034 | | | 1,618,302 | | | | 1,633,206 | | |

| 3578 CL AM | | | 4.5000 | | | 9/15/2016 | | | 2,419,728 | | | | 2,500,087 | | |

| 2914 CL JQ | | | 4.5000 | | | 5/15/2019 | | | 298,251 | | | | 298,707 | | |

| 2900 CL PC | | | 4.5000 | | | 12/15/2019 | | | 6,956,626 | | | | 7,389,270 | | |

| 3439 CL AC | | | 4.5000 | | | 4/15/2022 | | | 1,466,758 | | | | 1,476,292 | | |

| 3939 CL D | | | 4.5000 | | | 9/15/2041 | | | 3,079,531 | | | | 3,263,804 | | |

| 2509 CL CB | | | 5.0000 | | | 10/15/2017 | | | 2,579,676 | | | | 2,704,094 | | |

| 2747 CL DX | | | 5.0000 | | | 2/15/2019 | | | 5,056,056 | | | | 5,430,406 | | |

| 3852 CL HA | | | 5.0000 | | | 12/15/2021 | | | 9,034,585 | | | | 9,694,561 | | |

| 2494 CL CF | | | 5.5000 | | | 9/15/2017 | | | 2,727,860 | | | | 2,900,779 | | |

| 2503 CL B | | | 5.5000 | | | 9/15/2017 | | | 2,670,995 | | | | 2,818,274 | | |

| 3808 CL BQ | | | 5.5000 | | | 8/15/2025 | | | 9,623,634 | | | | 10,248,208 | | |

| 3806 CL JB | | | 5.5000 | | | 2/15/2026 | | | 4,668,898 | | | | 5,112,490 | | |

| 3855 CL HQ | | | 5.5000 | | | 2/15/2026 | | | 4,982,308 | | | | 5,345,767 | | |

| 3926 CL GP | | | 6.0000 | | | 8/15/2025 | | | 5,424,990 | | | | 5,710,453 | | |

| 3614 CL DY | | | 6.0000 | | | 1/15/2032 | | | 10,070,913 | | | | 11,193,417 | | |

Federal National Mortgage Association | |

| 2013-64 CL TZ | | | 1.5000 | | | 3/25/2042 | | | 1,881,025 | | | | 1,868,874 | | |

| 2013-6 CL TA | | | 1.5000 | | | 1/25/2043 | | | 46,851,435 | | | | 45,207,334 | | |

| 2013-30 CL CA | | | 1.5000 | | | 4/25/2043 | | | 28,827,253 | | | | 27,612,118 | | |

| 2013-30 CL JA | | | 1.5000 | | | 4/25/2043 | | | 19,623,524 | | | | 18,707,777 | | |

| 2013-66 CL JA | | | 2.2500 | | | 7/25/2043 | | | 78,259,773 | | | | 78,079,932 | | |

| 2011-125 GE | | | 2.5000 | | | 12/25/2041 | | | 56,095,390 | | | | 55,131,234 | | |

| 2011-110 BH | | | 3.0000 | | | 10/25/2041 | | | 3,281,635 | | | | 3,269,164 | | |

| 2012-73 CL JB | | | 3.5000 | | | 1/25/2042 | | | 39,707,245 | | | | 41,496,430 | | |

| 2012-8 CL LE | | | 3.5000 | | | 2/25/2042 | | | 37,427,241 | | | | 39,111,253 | | |

| 2012-26 CL ME | | | 3.5000 | | | 3/25/2042 | | | 50,627,053 | | | | 52,902,010 | | |

| 2012-41 CL LB | | | 3.5000 | | | 4/25/2042 | | | 48,565,151 | | | | 50,788,454 | | |

| 2012-48 CL MB | | | 3.5000 | | | 5/25/2042 | | | 48,220,975 | | | | 50,382,905 | | |

| 2012-117 CL AD | | | 3.5000 | | | 10/25/2042 | | | 67,816,414 | | | | 69,979,276 | | |

| 2013-112 CL WA | | | 3.5000 | | | 2/25/2043 | | | 52,946,954 | | | | 54,597,131 | | |

| 2011-67 CL EA | | | 4.0000 | | | 7/25/2021 | | | 19,166,263 | | | | 20,306,656 | | |

| 2012-95 CL AB | | | 4.0000 | | | 11/25/2040 | | | 8,179,540 | | | | 8,359,523 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2012-78 CL PA | | | 4.0000 | | | 8/25/2041 | | $ | 12,895,513 | | | $ | 13,615,727 | | |

| 2012-97 CL MA | | | 4.0000 | | | 10/25/2041 | | | 11,420,499 | | | | 11,786,797 | | |

| 2012-81 CL Q | | | 4.0000 | | | 8/25/2042 | | | 9,095,406 | | | | 9,500,659 | | |

| 2014-1 CL DA | | | 4.0000 | | | 6/25/2043 | | | 15,078,945 | | | | 15,722,345 | | |

| 2009-70 CL NU | | | 4.2500 | | | 8/25/2019 | | | 6,598,931 | | | | 6,942,273 | | |

| 2004-90 -CL GA | | | 4.3500 | | | 3/25/2034 | | | 1,935,379 | | | | 1,970,429 | | |

| 2012-67 CL PB | | | 4.5000 | | | 6/1/2027 | | | 10,719,139 | | | | 11,175,881 | | |

| 2012-40 CL GC | | | 4.5000 | | | 12/25/2040 | | | 7,236,889 | | | | 7,450,939 | | |

| 2011-148 CL PB | | | 4.5000 | | | 12/25/2041 | | | 8,535,796 | | | | 9,114,063 | | |

| 2003-24 -CL PD | | | 5.0000 | | | 4/25/2018 | | | 3,098,413 | | | | 3,285,743 | | |

| 2008-77 CL DA | | | 5.0000 | | | 4/25/2023 | | | 2,913,205 | | | | 3,034,074 | | |

| 2010-39 CL PL | | | 5.0000 | | | 10/25/2032 | | | 2,767,403 | | | | 2,826,072 | | |

| 2004-60 CL LB | | | 5.0000 | | | 4/25/2034 | | | 8,830,604 | | | | 9,600,809 | | |

| 2014-2 CL MC | | | 5.0000 | | | 3/25/2042 | | | 9,070,416 | | | | 9,574,658 | | |

| 2003-W17 CL 1A5 | | | 5.3500 | | | 8/25/2033 | | | 2,470,613 | | | | 2,491,786 | | |

| 2011-19 CL WB | | | 5.5000 | | | 10/25/2018 | | | 7,237,638 | | | | 7,791,752 | | |

| 2009-116 CL PA | | | 5.5000 | | | 4/25/2024 | | | 4,293,188 | | | | 4,469,681 | | |

| 2002-9 CL PC | | | 6.0000 | | | 3/25/2017 | | | 2,647,114 | | | | 2,803,585 | | |

TOTAL AGENCY COLLATERALIZED

MORTGAGE OBLIGATION | | $ | 945,859,703 | | |

NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATION — 8.8% | | | |

Bayview Opportunity Master Fund Trust | |

| 2013-2RPL CL A† | | | 3.4721 | | | 3/28/2016 | | $ | 5,489,022 | | | $ | 5,447,672 | | |

| 2013-13NP CL A† | | | 3.7210 | | | 6/28/2033 | | | 11,108,208 | | | | 11,021,582 | | |

| 2012-4NR2 CL A† | | | 3.9496 | | | 1/28/2034 | | | 9,015,753 | | | | 9,023,884 | | |

| 2013-14NP CL A† | | | 4.2130 | | | 8/28/2033 | | | 27,432,853 | | | | 27,628,200 | | |

| 2013-4RPL CL A† | | | 4.4583 | | | 7/28/2018 | | | 14,753,935 | | | | 14,946,555 | | |

Citicorp Mortgage Securities Inc.

2005-5 CL 2A3 | | | 5.0000 | | | 8/25/2020 | | | 168,787 | | | | 170,237 | | |

Credit Suisse Mortgage Trust

2013-6 1A1† | | | 2.5000 | | | 8/25/2043 | | | 92,473,135 | | | | 88,432,318 | | |

JP Morgan Mortgage Trust

2013-1 CL 2A2† | | | 2.5000 | | | 3/1/2043 | | | 37,837,917 | | | | 36,999,762 | | |

Normandy Mortgage Loan Trust

2013-NPL3 A† | | | 4.9486 | | | 9/16/2043 | | | 35,732,578 | | | | 35,553,915 | | |

Riverview HECM Trust 2007-1 CL A† | | | 0.6200 | | | 5/25/2047 | | | 35,643,141 | | | | 31,949,799 | | |

Sequoia Mortgage Trust | |

| 2013-2 A1 | | | 1.8740 | | | 2/17/2043 | | | 43,618,780 | | | | 38,263,999 | | |

| 2012-1 1A1 | | | 2.8650 | | | 1/25/2042 | | | 7,674,869 | | | | 7,573,054 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Stanwich Mortgage Loan Trust Series | |

| 2009-2 A†,* | | | 2.1892 | | | 2/15/2049 | | $ | 552,652 | | | $ | 247,146 | | |

| 2010-1 A†,* | | | 1.2897 | | | 9/15/2047 | | | 839,928 | | | | 424,836 | | |

| 2010-2 A†,* | | | 7.5851 | | | 2/28/2057 | | | 3,981,252 | | | | 2,007,347 | | |

| 2010-3 A†,* | | | 1.3103 | | | 7/31/2038 | | | 2,667,316 | | | | 1,334,458 | | |

| 2010-4 A†,* | | | 1.0254 | | | 8/31/2049 | | | 3,059,310 | | | | 1,544,952 | | |

| 2011-1 A†,* | | | 3.8944 | | | 6/30/2039 | | | 5,309,279 | | | | 2,800,268 | | |

| 2011-2 A†,* | | | 2.8890 | | | 9/15/2050 | | | 3,470,445 | | | | 1,857,396 | | |

| 2012-NPL4 CL A† | | | 2.9814 | | | 10/15/2042 | | | 7,145,095 | | | | 7,162,160 | | |

| 2012-NPL5 CL A† | | | 2.9814 | | | 10/16/2042 | | | 10,153,366 | | | | 10,162,890 | | |

| 2013-NPL1 CL A† | | | 2.9814 | | | 2/16/2043 | | | 30,465,639 | | | | 30,744,259 | | |

| 2013-NPL2 CL A† | | | 3.2282 | | | 4/16/2059 | | | 38,559,120 | | | | 38,559,081 | | |

US Residential Opportunity Fund Trust

2014-4A† | | | 3.4656 | | | 3/25/2034 | | | 11,870,000 | | | | 11,910,714 | | |

Vericrest Opportunity Loan Transferee | |

| 2013-3A A† | | | 3.2216 | | | 5/27/2053 | | | 14,638,720 | | | | 14,520,641 | | |

| 2014-NPL1 A1† | | | 3.6250 | | | 10/27/2053 | | | 10,667,159 | | | | 10,691,517 | | |

| 2014-NPL2 A1† | | | 3.6250 | | | 11/25/2053 | | | 13,273,359 | | | | 13,303,699 | | |

| 2014-NPL3 A1† | | | 3.2500 | | | 11/25/2053 | | | 17,375,000 | | | | 17,396,696 | | |

Wells Fargo Mortgage-Backed Securities Trust

2006-5 2A1 | | | 5.2500 | | | 4/25/2021 | | | 6,392,118 | | | | 6,689,352 | | |

TOTAL NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATION | | $ | 478,368,389 | | |

AGENCY STRIPPED — 2.2% | | | |

PRINCIPAL ONLY SECURITIES | | | |

Federal Home Loan Mortgage

Corporation 217 | | | 6.5000 | | | 1/1/2032 | | $ | 493,458 | | | $ | 454,521 | | |

INTEREST ONLY SECURITIES — | | | |

Federal Home Loan Mortgage Corporation | |

| 3714 TI | | | 2.2500 | | | 8/15/2015 | | | 41,938,930 | | | | 1,054,663 | | |

| 3935 LI | | | 3.0000 | | | 10/15/2021 | | | 6,843,766 | | | | 573,403 | | |

| 3948 AI | | | 3.0000 | | | 10/15/2021 | | | 8,544,932 | | | | 725,465 | | |

| 3956 KI | | | 3.0000 | | | 11/15/2021 | | | 18,905,879 | | | | 1,671,062 | | |

| 3968 AI | | | 3.0000 | | | 12/15/2021 | | | 7,123,437 | | | | 626,784 | | |

| 3992 OI | | | 3.0000 | | | 1/15/2022 | | | 5,567,678 | | | | 470,909 | | |

| 3994 EI | | | 3.0000 | | | 2/15/2022 | | | 12,617,388 | | | | 1,134,856 | | |

| 3998 KI | | | 3.0000 | | | 11/15/2026 | | | 21,476,946 | | | | 2,577,092 | | |

| 3994 AI | | | 3.0000 | | | 2/1/2027 | | | 13,118,538 | | | | 1,176,536 | | |

| 4100 EI | | | 3.0000 | | | 8/15/2027 | | | 99,015,932 | | | | 11,926,429 | | |

| 3706 AI | | | 3.5000 | | | 7/15/2020 | | | 9,888,940 | | | | 601,006 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 3722 AI | | | 3.5000 | | | 9/15/2020 | | $ | 12,244,262 | | | $ | 1,046,042 | | |

| 3735 AI | | | 3.5000 | | | 10/15/2020 | | | 5,919,214 | | | | 527,952 | | |

| 3874 DI | | | 3.5000 | | | 10/15/2020 | | | 10,364,410 | | | | 692,271 | | |

| 3893 DI | | | 3.5000 | | | 10/15/2020 | | | 7,526,618 | | | | 509,436 | | |

| 3753 CI | | | 3.5000 | | | 11/15/2020 | | | 2,715,075 | | | | 247,640 | | |

| 3755 AI | | | 3.5000 | | | 11/15/2020 | | | 11,175,888 | | | | 997,326 | | |

| 3760 KI | | | 3.5000 | | | 11/15/2020 | | | 8,883,687 | | | | 730,251 | | |

| 3784 BI | | | 3.5000 | | | 1/15/2021 | | | 7,501,778 | | | | 702,565 | | |

| 3874 BI | | | 3.5000 | | | 6/15/2021 | | | 6,220,078 | | | | 597,937 | | |

| 3893 BI | | | 3.5000 | | | 7/15/2021 | | | 5,236,220 | | | | 485,599 | | |

| 3909 KI | | | 3.5000 | | | 7/15/2021 | | | 4,522,812 | | | | 421,100 | | |

| 3938 IO | | | 3.5000 | | | 10/15/2021 | | | 31,377,815 | | | | 3,072,945 | | |

| 3714 TI | | | 3.5000 | | | 4/25/2024 | | | 11,211,140 | | | | 839,192 | | |

| 3778 GI | | | 3.5000 | | | 6/15/2024 | | | 5,882,968 | | | | 503,788 | | |

| 3854 GI | | | 3.5000 | | | 11/15/2024 | | | 4,363,031 | | | | 280,110 | | |

| 3852 YI | | | 3.5000 | | | 3/15/2025 | | | 14,497,517 | | | | 1,199,822 | | |

| 3763 NI | | | 3.5000 | | | 5/15/2025 | | | 4,843,069 | | | | 487,091 | | |

| 3904 QI | | | 3.5000 | | | 5/15/2025 | | | 5,268,629 | | | | 483,386 | | |

| 3909 UI | | | 3.5000 | | | 8/15/2025 | | | 8,299,407 | | | | 716,670 | | |

| 3904 NI | | | 3.5000 | | | 8/15/2026 | | | 10,977,588 | | | | 1,433,762 | | |

| 3930 AI | | | 3.5000 | | | 9/15/2026 | | | 14,146,788 | | | | 2,042,595 | | |

| 4018 AI | | | 3.5000 | | | 3/15/2027 | | | 24,506,541 | | | | 3,210,161 | | |

| 3684 CI | | | 4.5000 | | | 8/15/2024 | | | 28,523,202 | | | | 2,832,922 | | |

| 3917 AI | | | 4.5000 | | | 7/15/2026 | | | 40,177,007 | | | | 5,589,956 | | |

217 | | | 6.5000 | | | 1/1/2032 | | | 475,148 | | | | 96,737 | | |

Federal National Mortgage Association | |

| 2011-88 BI | | | 3.0000 | | | 11/25/2020 | | | 4,576,533 | | | | 270,050 | | |

| 2011-141 EI | | | 3.0000 | | | 7/25/2021 | | | 19,011,824 | | | | 1,446,026 | | |

| 2012-8 TI | | | 3.0000 | | | 10/25/2021 | | | 8,843,222 | | | | 685,809 | | |

| 2011-113 GI | | | 3.0000 | | | 11/25/2021 | | | 8,499,728 | | | | 659,738 | | |

| 2011-129 AI | | | 3.0000 | | | 12/25/2021 | | | 11,503,375 | | | | 944,785 | | |

| 2012-8 UI | | | 3.0000 | | | 12/25/2021 | | | 28,209,726 | | | | 2,326,278 | | |

| 2011-137 AI | | | 3.0000 | | | 1/25/2022 | | | 15,096,867 | | | | 1,213,790 | | |

| 2011-138 IG | | | 3.0000 | | | 1/25/2022 | | | 17,928,337 | | | | 1,538,149 | | |

| 2011-145 IO | | | 3.0000 | | | 1/25/2022 | | | 23,280,626 | | | | 1,892,848 | | |

| 2012-78 AI | | | 3.0000 | | | 2/25/2022 | | | 14,258,940 | | | | 1,100,264 | | |

| 2012-23 IA | | | 3.0000 | | | 3/25/2022 | | | 10,650,643 | | | | 920,855 | | |

| 2012-32 AI | | | 3.0000 | | | 4/25/2022 | | | 17,290,582 | | | | 1,520,522 | | |

| 2012-53 CI | | | 3.0000 | | | 5/25/2022 | | | 26,496,701 | | | | 2,353,238 | | |

| 2012-147 AI | | | 3.0000 | | | 10/25/2027 | | | 36,551,441 | | | | 4,770,800 | | |

| 2012-145 DI | | | 3.0000 | | | 1/25/2028 | | | 20,111,067 | | | | 2,640,983 | | |

| 2012-149 CI | | | 3.0000 | | | 1/25/2028 | | | 53,452,833 | | | | 6,906,523 | | |

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2010-128 LI | | | 3.5000 | | | 11/25/2020 | | $ | 14,209,831 | | | $ | 1,183,611 | | |

| 2011-75 BI | | | 3.5000 | | | 11/25/2020 | | | 7,770,073 | | | | 528,176 | | |

| 2011-78 LI | | | 3.5000 | | | 11/25/2020 | | | 20,115,023 | | | | 1,253,824 | | |

| 2010-145 BI | | | 3.5000 | | | 12/25/2020 | | | 7,074,840 | | | | 620,187 | | |

| 2011-61 BI | | | 3.5000 | | | 7/25/2021 | | | 6,058,861 | | | | 589,568 | | |

| 2011-66 QI | | | 3.5000 | | | 7/25/2021 | | | 10,702,780 | | | | 990,554 | | |

| 2010-104 CI | | | 3.5000 | | | 10/25/2021 | | | 18,112,254 | | | | 1,692,500 | | |

| 2011-104 DI | | | 3.5000 | | | 10/25/2021 | | | 30,287,677 | | | | 2,719,467 | | |

| 2011-110 AI | | | 3.5000 | | | 11/25/2021 | | | 12,816,629 | | | | 1,179,741 | | |

| 2011-118 IC | | | 3.5000 | | | 11/25/2021 | | | 33,544,476 | | | | 3,180,033 | | |

| 2011-125 DI | | | 3.5000 | | | 12/25/2021 | | | 23,461,511 | | | | 2,287,636 | | |

| 2011-143 MI | | | 3.5000 | | | 1/25/2022 | | | 9,789,698 | | | | 850,835 | | |

| 2012-2 MI | | | 3.5000 | | | 2/25/2022 | | | 14,469,451 | | | | 1,428,463 | | |

| 2010-137 BI | | | 3.5000 | | | 2/25/2024 | | | 5,359,479 | | | | 356,500 | | |

| 2011-75 AI | | | 3.5000 | | | 1/25/2025 | | | 20,867,588 | | | | 1,723,853 | | |

| 2011-66 BI | | | 3.5000 | | | 3/25/2025 | | | 2,615,448 | | | | 196,845 | | |

| 2011-80 KI | | | 3.5000 | | | 4/25/2025 | | | 10,756,604 | | | | 961,239 | | |

| 2011-67 CI | | | 3.5000 | | | 8/25/2025 | | | 5,206,986 | | | | 523,197 | | |

| 2011-22 IC | | | 3.5000 | | | 12/25/2025 | | | 10,148,229 | | | | 1,113,996 | | |

| 2011-101 EI | | | 3.5000 | | | 10/25/2026 | | | 22,610,236 | | | | 3,076,141 | | |

| 2011-69 TI | | | 4.0000 | | | 5/25/2020 | | | 7,245,873 | | | | 486,457 | | |

| 2010-89 LI | | | 4.0000 | | | 8/25/2020 | | | 11,196,626 | | | | 976,579 | | |

| 2010-104 CI | | | 4.0000 | | | 9/25/2020 | | | 4,997,035 | | | | 440,651 | | |

| 2011-67 EI | | | 4.0000 | | | 7/25/2021 | | | 12,496,661 | | | | 1,025,976 | | |

| 2010-110 IH | | | 4.5000 | | | 10/25/2018 | | | 13,729,897 | | | | 1,061,531 | | |

| 2009-70 IN | | | 4.5000 | | | 8/25/2019 | | | 19,760,289 | | | | 1,353,084 | | |

| 2008-15 JI | | | 4.5000 | | | 6/25/2022 | | | 4,075,270 | | | | 152,539 | | |

| 2010-114 CI | | | 5.0000 | | | 4/25/2018 | | | 17,932,838 | | | | 1,370,585 | | |

2010-30 | | | 5.0000 | | | 5/25/2018 | | | 7,358,099 | | | | 575,715 | | |

| 2003-64 XI | | | 5.0000 | | | 7/25/2033 | | | 1,323,833 | | | | 199,294 | | |

TOTAL RMBS AGENCY STRIPPED | | $ | 118,029,417 | | |

AGENCY POOL ADJUSTABLE RATE

MORTGAGES — 0.0% | | | |

Federal National Mortgage Association 865963 | | | 2.2980 | | | 3/1/2036 | | $ | 2,086,776 | | | $ | 2,199,274 | | |

ASSET-BACKED — AUTO — 15.4% | | | |

American Credit Acceptance Receivables

2014-1 A† | | | 1.1400 | | | 3/12/2018 | | $ | 5,443,637 | | | $ | 5,444,307 | | |

AmeriCredit Automobile Receivables Trust | |

| 2014-1 A1 | | | 0.2100 | | | 3/9/2015 | | | 25,145,000 | | | | 25,145,302 | | |

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2013-5 A1† | | | 0.2500 | | | 4/8/2014 | | $ | 16,461,245 | | | $ | 16,461,782 | | |

| 2013-2 A2 | | | 0.5300 | | | 11/8/2016 | | | 28,096,815 | | | | 28,106,669 | | |

| 2014-1 A2 | | | 0.5700 | | | 6/8/2017 | | | 36,935,000 | | | | 36,934,018 | | |

| 2013-1 A2† | | | 0.6300 | | | 6/8/2016 | | | 15,754,324 | | | | 15,752,588 | | |

| 2013-4 A2 | | | 0.7400 | | | 11/8/2016 | | | 47,905,095 | | | | 47,934,193 | | |

| 2011-1 B | | | 2.1900 | | | 2/8/2016 | | | 2,745,297 | | | | 2,748,197 | | |

| 2011-4 B | | | 2.2600 | | | 9/8/2016 | | | 7,952,000 | | | | 8,008,384 | | |

| 2011-2 C | | | 3.1900 | | | 10/8/2016 | | | 8,580,000 | | | | 8,710,673 | | |

| 2010-3 C | | | 3.3400 | | | 4/8/2016 | | | 4,989,604 | | | | 5,040,175 | | |

| 2010-3 D | | | 4.9800 | | | 1/8/2018 | | | 13,735,000 | | | | 14,440,567 | | |

| 2010-1 C | | | 5.1900 | | | 8/17/2015 | | | 954,224 | | | | 962,717 | | |

| 2010-2 D | | | 6.2400 | | | 6/8/2016 | | | 6,990,000 | | | | 7,265,895 | | |

Credit Acceptance Auto Loan Trust

2012-1A B† | | | 3.1200 | | | 3/16/2020 | | | 4,500,000 | | | | 4,527,668 | | |

Carmax Auto Owner Trust 2014-1 A2 | |

| 2014-1 A1 | | | 0.1900 | | | 2/17/2015 | | | 19,778,296 | | | | 19,775,050 | | |

| 2014-1 A2 | | | 0.4700 | | | 2/15/2017 | | | 40,000,000 | | | | 39,843,452 | | |

DT Auto Owner Trust | |

| 2014-1A B† | | | 1.4300 | | | 3/15/2018 | | | 5,730,000 | | | | 5,719,363 | | |

| 2012-2A B† | | | 1.7800 | | | 6/15/2017 | | | 9,548,000 | | | | 9,591,761 | | |

| 2012-2A B† | | | 1.8500 | | | 4/17/2017 | | | 5,545,587 | | | | 5,549,489 | | |

Exeter Automobile Receivables Trust 2013-2A A | |

| 2013-2A A† | | | 1.4960 | | | 11/15/2017 | | | 24,887,755 | | | | 24,971,667 | | |

| 2014-1A A† | | | 1.2900 | | | 5/15/2018 | | | 40,830,261 | | | | 40,938,792 | | |

Fifth Third Auto Trust | |

| 2014-1 A1 | | | 0.2000 | | | 3/16/2015 | | | 18,444,878 | | | | 18,445,523 | | |

| 2014-1 A2 | | | 0.4600 | | | 8/15/2016 | | | 42,380,000 | | | | 42,380,347 | | |

First Investors Auto Owner Trust | |

| 2013-3A A1† | | | 0.3300 | | | 11/17/2014 | | | 1,057,885 | | | | 1,057,977 | | |

| 2013-3A A2† | | | 0.8900 | | | 9/15/2017 | | | 6,856,000 | | | | 6,859,060 | | |

Ford Credit Auto Owner Trust 2014-A A1† | | | 0.2300 | | | 1/15/15 | | | 10,469,214 | | | | 10,469,475 | | |

Honda Auto Receivables Owner Trust | |

| 2014-1 A1 | | | 0.1900 | | | 3/23/2015 | | | 29,265,088 | | | | 29,265,088 | | |

| 2014-1 A2 | | | 0.4100 | | | 8/22/2016 | | | 42,000,000 | | | | 41,996,825 | | |

Hyundai Auto Receivables Trust | | | 0.2400 | | | 2/17/2015 | | | 12,761,932 | | | | 12,761,303 | | |

Mercedes-Benz Auto Lease | |

| 2012 A A4 | | | 1.0700 | | | 11/15/2017 | | | 3,960,000 | | | | 3,961,076 | | |

| 2013 A A3 | | | 0.5900 | | | 2/15/2016 | | | 37,803,000 | | | | 37,840,115 | | |

Nissan Auto Lease Trust 2012 A A3 | | | 0.9800 | | | 5/15/2015 | | | 20,949,090 | | | | 20,968,344 | | |

Nissan Auto Receivables Owner Trust 2013-C A1 | |

| 2013-C CL A1 | | | 0.2300 | | | 12/15/2014 | | | 3,329,846 | | | | 3,329,618 | | |

| 2014-A CL A1 | | | 0.1900 | | | 2/17/2015 | | | 16,705,545 | | | | 16,706,130 | | |

24

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Prestige Automobile Receivables Trust | |

| 2014-1A A2† | | | 0.9700 | | | 3/15/2018 | | $ | 16,390,000 | | | $ | 16,387,838 | | |

| 2013-1A A2† | | | 1.0900 | | | 2/15/2018 | | | 16,363,341 | | | | 16,393,886 | | |

| 2014-1A A3† | | | 1.5200 | | | 4/15/2020 | | | 17,250,000 | | | | 17,246,452 | | |

Santander Drive Auto Receivables Trust | |

| 2013-5 A1 | | | 0.2600 | | | 11/17/2014 | | | 5,913,001 | | | | 5,913,170 | | |

| 2014-1 1 A1 | | | 0.2700 | | | 1/15/2015 | | | 16,778,661 | | | | 16,779,742 | | |

| 2013-1 A2 | | | 0.4800 | | | 2/16/2016 | | | 3,659,302 | | | | 3,659,588 | | |

| 2013-3 A2 | | | 0.5500 | | | 9/15/2016 | | | 20,794,073 | | | | 20,802,565 | | |

| 2013-1 A3 | | | 0.6200 | | | 6/15/2017 | | | 28,000,000 | | | | 28,010,528 | | |

| 2014-1 A2A | | | 0.6600 | | | 7/17/2017 | | | 24,276,000 | | | | 24,279,459 | | |

| 2012-6 A2 | | | 0.8300 | | | 9/15/2015 | | | 1,928,564 | | | | 1,928,702 | | |

| 2014-1 A3 | | | 0.8700 | | | 1/16/2018 | | | 19,425,000 | | | | 19,434,652 | | |

| 2013-4 A2 | | | 0.8900 | | | 9/15/2016 | | | 2,634,049 | | | | 2,637,776 | | |

| 2012-4 A3 | | | 1.0400 | | | 8/15/2016 | | | 5,435,103 | | | | 5,444,898 | | |

| 2012-3 A3 | | | 1.0800 | | | 4/15/2016 | | | 7,204,161 | | | | 7,212,579 | | |

Volkswagen Auto Loan Enhanced Trust

2013-2 A1 | | | 0.3500 | | | 11/20/2014 | | | 7,512,412 | | | | 7,512,142 | | |

Volkswagen Auto Lease Trust 2014-A A1 | | | 0.2000 | | | 2/20/2015 | | | 17,236,727 | | | | 17,235,138 | | |

Westlake Automobile Receivables Trust

2013-1A A1† | | | 0.5500 | | | 10/15/2014 | | | 5,472,131 | | | | 5,474,152 | | |

TOTAL ASSET-BACKED — AUTO | | $ | 836,266,857 | | |

ASSET-BACKED — OTHER — 10.0% | | | |

CARDS II TR 2012-4A A† | | | 0.6050 | | | 9/15/2017 | | $ | 75,000,000 | | | $ | 75,074,303 | | |

CLI Funding LLC 2012-1A† | | | 4.2100 | | | 12/18/2022 | | | 40,841,585 | | | | 41,006,993 | | |

Chesapeake Funding LLC† | | | 0.5756 | | | 3/7/2026 | | | 29,025,000 | | | | 29,025,348 | | |

GE Capital Credit Card Master Note Trust

2010-1 A | | | 3.6900 | | | 3/15/2018 | | | 63,545,000 | | | | 65,411,456 | | |

Global Tower Partners Acquisition Partners† | | | 4.7040 | | | 5/15/2018 | | | 15,981,000 | | | | 16,212,405 | | |

HFG HEALTHCO-4 LLC 2011-1A A† | | | 2.4053 | | | 6/2/2017 | | | 16,552,000 | | | | 16,806,024 | | |

HLSS Servicer Advance Receivables Back | |

| 2013-T4 AT4† | | | 1.1830 | | | 8/15/2044 | | | 1,095,000 | | | | 1,092,810 | | |

| 2014-T1 AT1† | | | 1.3104 | | | 1/17/2045 | | | 19,425,000 | | | | 19,432,207 | | |

| 2013-T2 B2† | | | 1.4953 | | | 5/16/2044 | | | 8,050,000 | | | | 8,010,025 | | |

| 2013-T1 A2† | | | 1.4953 | | | 1/16/2046 | | | 24,512,000 | | | | 24,450,720 | | |

| 2013-T1 B2† | | | 1.7436 | | | 1/16/2046 | | | 5,750,000 | | | | 5,728,869 | | |

| 2013-T5 BT5† | | | 2.2761 | | | 8/15/2046 | | | 9,300,000 | | | | 9,310,230 | | |

| 2012-T2 B2† | | | 2.4800 | | | 10/15/2045 | | | 14,078,000 | | | | 14,289,339 | | |

Insite Issuer LLC† | | | 8.5950 | | | 8/15/2043 | | | 11,613,000 | | | | 12,059,116 | | |

MMAF Equipment Finance LLC 2013-AA A2† | | | 0.6900 | | | 5/9/2016 | | | 20,656,000 | | | | 20,667,053 | | |

25

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

PFS Financing Corpation | |

| 2013-B A† | | | 0.6550 | | | 4/17/2017 | | $ | 4,000,000 | | | $ | 4,002,083 | | |

| 2014-AA A† | | | 0.7545 | | | 2/15/2019 | | | 26,000,000 | | | | 25,999,969 | | |

| 2012-BA B† | | | 0.8550 | | | 10/17/2016 | | | 18,795,000 | | | | 18,835,644 | | |

| 2011-BA A† | | | 1.6550 | | | 10/17/2016 | | | 4,710,000 | | | | 4,737,017 | | |

| 2011-BA B† | | | 2.4050 | | | 10/17/2016 | | | 4,000,000 | | | | 4,013,896 | | |

Panhandle-Plains Student Finance Corp

2001-1 CL A2 | | | 1.6560 | | | 12/1/2031 | | | 5,900,000 | | | | 5,811,500 | | |

Progresso Receivables Funding I LLC

2013-A CL A† | | | 4.0000 | | | 7/9/2018 | | | 14,984,000 | | | | 15,021,460 | | |

Global SC Finance SRL 2012-1A CL A† | | | 4.1100 | | | 7/17/2027 | | | 8,945,834 | | | | 9,048,174 | | |

Store Master Funding LLC 2012-1A CLA† | | | 5.7700 | | | 8/20/2042 | | | 16,865,287 | | | | 18,181,623 | | |

TAL Advantage LLC 2006-1A† | | | 0.3440 | | | 4/20/2021 | | | 9,583,335 | | | | 9,419,843 | | |

Textainer Marine Containers Ltd 2012-1A A† | | | 4.2100 | | | 4/15/2027 | | | 14,017,310 | | | | 14,031,840 | | |

Triton Container Finance LLC 2006-1A† | | | 4.2100 | | | 5/14/2027 | | | 6,344,681 | | | | 6,368,220 | | |

Unison Ground Lease Fund† | | | 5.7800 | | | 3/16/2020 | | | 10,932,000 | | | | 10,953,918 | | |

Unison Ground Lease Fund† | | | 6.2680 | | | 3/16/2020 | | | 3,768,000 | | | | 3,686,574 | | |

Unison Ground Lease Fund† | | | 9.5220 | | | 4/15/2020 | | | 19,600,000 | | | | 21,988,064 | | |

WCP Issuer LLC 2013-1 CL B† | | | 6.6570 | | | 8/15/2020 | | | 15,347,000 | | | | 16,115,546 | | |

TOTAL ASSET-BACKED — OTHER | | $ | 546,792,269 | | |

U.S. TREASURY NOTES — 14.4% | | | |

U.S Treasury Note | | | 0.1250 | | | 7/31/2014 | | $ | 38,000,000 | | | $ | 38,007,421 | | |

U.S Treasury Note | | | 0.2500 | | | 5/31/2014 | | | 36,000,000 | | | | 36,011,250 | | |

U.S Treasury Note | | | 0.2500 | | | 6/30/2014 | | | 3,000,000 | | | | 3,001,392 | | |

U.S Treasury Note | | | 0.5000 | | | 8/15/2014 | | | 18,000,000 | | | | 18,028,741 | | |

U.S Treasury Note | | | 1.0000 | | | 5/15/2014 | | | 110,000,000 | | | | 110,124,608 | | |

U.S Treasury Note | | | 2.3750 | | | 8/31/2014 | | | 193,000,000 | | | | 194,815,030 | | |

U.S Treasury Note | | | 2.6250 | | | 6/30/2014 | | | 193,000,000 | | | | 194,226,978 | | |

U.S Treasury Note | | | 2.6250 | | | 7/31/2014 | | | 168,000,000 | | | | 169,424,069 | | |

U.S Treasury Note | | | 4.7500 | | | 5/15/2014 | | | 18,000,000 | | | | 18,100,987 | | |

TOTAL U.S. TREASURY NOTES | | $ | 781,740,476 | | |

CORPORATE BONDS & DEBENTURES — 7.0% | | | |

Boart Longyear Management Pty Ltd† | | | 10.0000 | | | 10/1/2018 | | $ | 21,104,000 | | | $ | 21,895,400 | | |

British Airways plc† | | | 5.6250 | | | 6/20/2020 | | | 8,375,000 | | | | 8,909,325 | | |

Colgate Palmolive Co. | | | 1.2500 | | | 5/1/2014 | | | 1,084,000 | | | | 1,084,849 | | |

Colgate Palmolive Co. | | | 0.6000 | | | 11/15/2014 | | | 4,968,000 | | | | 4,976,243 | | |

26

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2014 (Unaudited)

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Continental Airlines Company | |

| 1997-1 1A | | | 7.4610 | | | 4/1/2015 | | $ | 796,692 | | | $ | 804,659 | | |