UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA | |

90025

|

(Address of principal executive offices) | | (Zip code) |

|

J. RICHARD ATWOOD, PRESIDENT FPA NEW INCOME, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | Copy to: MARK D. PERLOW, ESQ. K&L GATES LLP FOUR EMBARCADERO CENTER SAN FRANCISCO, CA 94111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2015 | |

| | | | | | | | | |

Item 1: Report to Shareholders.

FPA New Income, Inc.

Semi-Annual Report

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Fund Performance

This Semi-Annual Report covers the six-month period ended March 31, 2015. Your Fund's net asset value (NAV) closed at $10.18. Dividends of $0.05 and $0.075 were paid on October 2, 2014 and December 23, 2014, to holders of record on September 30 and December 19, 2014, respectively. There were no capital gains distributions.

The following table shows the average annual total return for several different periods ended on that date for the Fund and its benchmarks.

| | | Periods Ended March 31, 2015 | |

| | | 1 Year | | 5 Years* | | 10 Years* | | 15 Years* | | 20 Years* | | 7/11/1984

Inception | |

FPA New Income, Inc. | | | 1.33 | % | | | 1.79 | % | | | 2.96 | % | | | 4.21 | % | | | 4.94 | % | | | 7.44 | % | |

Barclays U.S. Aggregate Bond Index | | | 5.72 | % | | | 4.41 | % | | | 4.93 | % | | | 5.66 | % | | | 6.03 | % | | | 7.87 | % | |

Consumer Price Index + 100 Basis Points | | | 0.98 | % | | | 2.66 | % | | | 3.04 | % | | | 3.19 | % | | | 3.27 | % | | | N/A | | |

* Annualized

Portfolio Commentary

FPA New Income appreciated 0.59% during the first quarter of 2015 and rose 1.33% over the past twelve months. While we are pleased to have grown shareholder wealth in real terms (or after inflation), as we have discussed in previous commentaries, for the time being we continue to expect it to be challenging to meet our rolling five-year goal of outpacing CPI + 1% given the current low yield environment. Inflation over the past twelve months ending March 31, 2015 was -0.02%.

Looking back longer-term, we think one appropriate way to think about the Fund's performance is to consider it alongside a passive, index-based alternative that performs the best under our stress test. As longtime shareholders know, we are continually stress testing the portfolio to position it to achieve a positive return should interest rates rise by 100 basis points (or one percentage point) over a twelve-month period (the Stress Test). The Barclays U.S. Aggregate Bond Index would have produced at least -1% returns at all points in time over the last five years under the Stress Test. Over the last three years, the broad-based index that would have performed the best (though still producing a slightly negative return) under that same stress test at the beginning of each calendar year would have been the Barclays U.S. Aggregate 1-3 year Index.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

As the table below shows, the same holds true as of March 31, 2015.

As of 3/31/15 | | Duration1 | | Yield-to-worst2 | | YTW/Duration | | Stress Test Return | |

| FPA New Income | | | 1.40 | | | | 2.32 | | | | 1.66 | | | | 1.42 | | |

| BC U.S. Aggregate Bond Index | | | 5.45 | | | | 2.06 | | | | 0.38 | | | | -2.89 | | |

| BC U.S. Aggregate 1-3 Year Index | | | 1.89 | | | | 0.83 | | | | 0.44 | | | | -0.56 | | |

| BC U.S. Aggregate 3-5 Year Index | | | 3.44 | | | | 1.71 | | | | 0.50 | | | | -1.21 | | |

| BC U.S. Aggregate 5-7 Year Index | | | 4.27 | | | | 2.29 | | | | 0.54 | | | | -1.48 | | |

Source: Barclays, Morningstar

It is important to note that the Stress Test Returns do not reflect the actual performance of the Fund and are shown for illustrative, informational purposes only. They do not represent performance that the Fund or any investor actually attained but rather a depiction of what the returns of the Fund might have been assuming interest rates rose 100 basis points for the one year period ending March 31, 2015. The Stress Test Return also assumes that the Fund's portfolio managers would have made the same investment decisions for the Fund over the same one year period notwithstanding the assumed rise in interest rates. The assumptions have been made strictly for the purposes of presenting the Stress Test Return and are unlikely to be realized. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in calculating the Stress Test Returns have been stated or fully considered. The Stress Test Returns have many inherent limitations and do not reflect the impact that material economic and market factors may have had on the decision-making process including, for example, if interest rates had in fact risen by 100 basis points over the period. Actual performance may have differed substantially from the Stress Test Returns presented and, faced with a similar rise in interest rates in the future, the Fund's performance may be materially different from that stated. Changes in the assumptions would have a material impact on the Stress Test Returns presented. Other periods selected may have different results, including losses. There can be no assurance that Fund will achieve profits or avoid incurring substantial losses.

Stress Test calculation: [Yield + (1+Yield)]/2 - Duration

The table below shows our results versus various indices:

Three years ended 3/31/15 | | Three-year return | | Duration (average) | |

| FPA New Income | | | 1.43 | | | | 1.54 | | |

| BC U.S. Aggregate 1-3 Year Index | | | 0.99 | | | | 1.88 | | |

| BC U.S. Aggregate Bond Index | | | 3.10 | | | | 5.39 | | |

| CPI | | | 0.99 | | | | N/A | | |

Source: Barclays, Morningstar

Past performance is no guarantee of future results and the index performance is not representative of the FPA New Income. As of March 31, 2015, the SEC yield was 3.27%. This calculation begins with the Fund's dividend payments for the last 30 days, subtracts fund expenses and uses this number to estimate your returns for a year. The SEC yield is based on the price of the fund at the beginning of the month. The income yield stated here reflects prospective data and thus assumes payments collected by the fund may fluctuate.

Over the past three years, FPA New Income returned 1.43% net of fees versus 0.99% gross of fees for the Barclays U.S. Aggregate 1-3 Year Index. Our risk-adjusted results were even more compelling: over the past three years the Fund took on about 20% less interest rate as measured by duration.

1 Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates.

2 Yield-to-worst is the lowest possible yield on a callable bond. As of March 31, 2015, the SEC yield was 3.27%. This calculation begins with the Fund's dividend payments for the last 30 days, subtracts Fund expenses and uses this number to estimate your returns for a year. The SEC yield is based on the price of the Fund at the beginning of the month. The income yield stated here reflects prospective data and thus assumes payments collected by the Fund may fluctuate.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

To earn our fees, we believe we must outpace a cheap, passive index-based alternative on a risk-adjusted basis. Importantly, this won't always be the Barclays U.S. Aggregate 1-3 Year Index as interest rates rise and fall in the future. An advantage to investing alongside us is that as interest rates and credit spreads move up and down, we have the flexibility to reposition the portfolio accordingly to take advantage of what we believe are the best risk-adjusted opportunities.

Over the past year we have committed significant resources to enhancing our portfolio management tools. As previously discussed, this resulted in changing our portfolio analytics system. The new system is far more robust and as an example has enabled us to highlight each security by its investment idea and thus sort the portfolio by these ideas instead of the traditional sector sorting. The top ideas represent over 75% of the portfolio's assets broken down as follows by order of their size allocation to the portfolio.

1. Asset Backed Securities (ABS)3 — Sub-prime automobile loans

2. Treasury notes — Two-year maturity floating rate notes and less than one year to maturity fixed rate notes

3. Commercial Mortgage Backed Security (CMBS)4 — GNMA Project Loan Interest Only (IO) Securities

4. Corporate High Yield loans and bonds

5. Collateralized Mortgage Obligation (CMO)5 — Agency backed relocation loans

6. High coupon seasoned 15-year agency mortgages

7. Collateralized Mortgage Obligation (CMO) — Non-performing single family mortgages

8. Commercial Mortgage Backed Security (CMBS) — Non-agency mortgages

Leaders and Laggards

The sectors contributing the most to performance during the quarter were the corporate high yield bonds and bank loans. It was followed by CMOs backed by agency relocation loans and the GNMA Project Loan IO securities. This was driven by the decline in longer maturity treasury yields and a decline in high yield credit spreads. While producing a modest absolute positive return, the weakest performers were the seasoned 15-year agency mortgages and Treasury notes.

Looking back over the previous twelve months, the main contributors were corporate high yield loans and bonds, CMOs backed by agency relocation mortgage pools, and CMOs backed by non-performing single family mortgages. With the weakest performance coming from the Treasury notes and the 15-year seasoned agency mortgages.

Portfolio Activity

For the first quarter of 2015 we continued to find opportunities that met our goals of producing an absolute positive return over rolling twelve-month periods and positive real returns (outperform inflation plus 100 basis points) over five-year periods as well as competitive returns versus the bond market universe.

3 Asset backed securities are bonds or notes backed by assets

4 Commercial mortgage backed securities are securities backed by commercial mortgages rather than residential mortgages

5 Collateralized mortgage obligations are mortgage-backed bonds that separate mortgage pools into different maturity classes.

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

The largest amount of purchasing activity during the quarter was concentrated in the sub-prime automobile loan ABS segment followed by the CMOs backed by non-performing single family mortgages, GNMA Project Loan IOs, and ABS bonds backed by prime automobile loans. We also continued to add to existing high yield bonds and loans positions. A new area that was introduced in the portfolio during the quarter was fixed rate credit card receivables. We found an asset-backed issuer that met our credit quality requirements and has attractive yield-to-worst versus effective duration metrics.

We continue to cull through the portfolio looking for holdings that, after subjecting them to multiple stress tests, do not perform in an acceptable fashion. Once identified, these holdings are eliminated from the portfolio. During the quarter a few names did surface from this review and were sold. In addition, several holdings were called away.

The portfolio continues to be constructed with a defensive posture. Both the effective duration and yield-to-worst declined slightly during the quarter. While we did find some investment opportunities during the past three months, the buildup in the cash component to more normal levels impacted the duration and yield.

Market Commentary

The undertaking of Quantitative Easing (QE) by yet another developed economy central bank was a significant event this quarter. While the Fed has concluded its current expansionary QE program, they do continue to reinvest about $20 billion per month in the mortgage area alone from bond maturities and mortgage principal pay-downs. Japan continues to roll along targeting to purchase upwards of $1.4 trillion in sovereign debt. The newest player joining at the table is the European Central Bank (ECB) that announced the intent to purchase about $50 billion of securities per month between now and September 2016 for a total of around $1.3 trillion. Both Japan and Europe are attempting to boost inflation to their target levels and are comfortable with the added benefit of a lower currency value that, in their view, will stimulate exports and thus increase economic activity. That activity however is not internally demand-driven but predicated on an increase in consumer and business spending by the U.S.

Europe is now experiencing a growing class of negative sovereign and high quality bond interest rates. Today approximately 30% of the outstanding sovereign debt in Europe trades with a negative yield. A negative yield means that someone is willing to lend someone else their money for a period of time and pay them to take the money, hardly a good long-term strategy. This is not just short maturity bonds, as an example seven eurozone countries have negative rates for their five-year maturities including "A" rated Slovakia. Eighteen European countries have ten-year bond yields that are lower than the U.S. ten-year Treasury.

There are several reasons why the yields went negative. First, over the next two years, with the purchases by the ECB, there will be a negative net issuance of sovereign debt in the eurozone. Secondly, certain institutions such as banks, insurance companies, and pension plans by regulation have to hold a certain amount of high quality assets against their liabilities. These institutions may tend to hoard their holdings realizing they are not replaceable. Longer-term, these negative or negligibly positive yields on high quality bonds may have a negative impact on profitability for these institutions which in turn could impact their ability to deliver on the promised obligations. Suffice it to say, this is an unhealthy long-term situation. The illustration below shows the change in German government bond yields over the past year.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Date | | Two-Year Yield | | Ten-Year Yield | | Slope (difference) | |

March 31, 2014 | | | 0.158 | % | | | 1.565 | % | | 141 basis points | |

March 31, 2015 | | | -0.255 | % | | | 0.180 | % | | 44 basis points | |

Change | | | -0.413 | % | | | -1.385 | % | | -97 basis points | |

Source: Bloomberg

Past performance is no guarantee of future results

The German government yield curve not only went to a noticeable negative yield on the front end of the curve, the long end of the curve declined by an even greater amount. The result is a significant flattening of the yield curve during a period of slowing economic growth.

Below is a table showing the change in the yield curve of lower credit quality eurozone country, Italy.

Date | | Two-Year Yield | | Ten-Year Yield | | Slope (difference) | |

March 31, 2014 | | | 0.834 | % | | | 3.291 | % | | 246 basis points | |

March 31, 2015 | | | 0.188 | % | | | 1.239 | % | | 105 basis points | |

Change | | | -0.646 | % | | | -2.052 | % | | -141 basis points | |

Source: Bloomberg

Past performance is no guarantee of future results

The decline in the overall level of yields and the flattening of the yield curve is more pervasive in this case. In both cases economic growth may be difficult to achieve through increased lending if the yield curve remains flat. Also, in our view, a decline in the long end of the yield curve to a greater extent than the short end in both cases reflects a rather cavalier view towards inflation.

Throw in about a 50% decline in the price of oil, the resulting headline CPI6 at "0" in the U.S., the appreciation of the dollar versus major world currencies by about 18% and how all this may impact the domestic bond market, and the result is a market place with much uncertainty. If the price of oil stays at these levels through the rest of the year, the consumer will have more money to either spend or save. Should they choose to spend it, imported goods will look cheaper due to the rise in the dollar. This activity could result in an uneven benefit to our GDP growth. The service sector may benefit more than the goods producing sector. A "0" CPI or very low CPI will result in higher real interest rates. This has the effect of making even low nominal interest rates more difficult to repay. An increase in the value of the dollar in combination with a rise in real interest rates has a similar effect to the Fed raising short term interest rates. Finally, whether the yield curve flattens due to a decline in long-term rates or a rise in short-term rates, or a combination of both, the impact is the same — diminishing availability of credit because the ability to borrow short and lend long at a profit declines.

As a fixed income portfolio manager we face two potential outcomes: deflation and central bank bond buying that drive longer rates down and suppress short rates on high quality assets or inflation (perhaps due to wage pressures or increased consumer spending) that results in rising short rates from a change in the Fed interest rate policy (the exit of zero interest rate policy) and creates the potential for inflation-driven increases in longer-term rates. Which event prevails is uncertain and one event might be followed by the other such as deflation first and inflation second.

6 Headline CPI is the raw inflation figure as reported through the Consumer Price Index (CPI) that is released monthly by the Bureau of Labor Statistics.

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Our solution has been and continues to be constructing a portfolio that we believe survives both worlds with our capital intact. We favor bonds that self-liquidate through amortization (reduce market illiquidity risk), bonds backed by critical assets for the borrower (minimize deflation default risk), assets where the borrower has equity in the collateral (minimize default risk), assets that can be valued accurately and can be obtained in the event of default (increase odds of getting money back in liquidation), and five-year or less to maturity (minimize inflation risk).

In June 2003, Bob Rodriguez and I penned a memo called "Buyers' Strike," where we stated that we see little value in high quality long-term bonds and as such will not commit our clients' capital to them. We revisited the thesis in June 2008 and continued that assessment. The decline in longer-term high quality interest rates today due to central bank purchases and fears of deflation, while a tempting trade to some, is not of interest to us as we continue to view the long end of the high quality bond market devoid of fundamental value for the investor.

We consider this investment discipline and strive to consistently apply the same research and analytical approach every day. If we are consistent in that application, our clients will be comfortable in how this portfolio will act as the bond market vacillates between the fear of inflation and the fear of deflation. It is this consistency that results in our fixed income investment management strategy being an anchor in clients' overall portfolio allocations as they seek to achieve their long-term investment goals.

Illiquidity in Liquidity's Clothing

"Risk like energy, tends to be conserved not dissipated, to change its composition but not its quantum" Andrew Haldane, Chief Economist Bank of England, August 5, 2014

Much has been written about the decrease in liquidity in today's fixed income markets. We share those concerns, which we have expressed in the past so we will not repeat them here. However, amidst all of this discussion, one particular topic has come to the fore which we find particularly troublesome, namely the use of exchange-traded funds (ETFs) by mutual fund managers as a source of liquidity. Specifically, some mutual fund managers have been using ETFs to manage inflows and outflows of cash into their funds.

This phenomenon came to our attention specifically in the high yield sector. Imagine a high yield mutual fund manager receives a large inflow. Suppose that this manager wants to be fully invested at all times (and ignore whether it is wise to be fully invested at all times). Rather than taking the time to buy individual bonds with the newly contributed cash, the manager will simply buy a high yield ETF which allows the fund to be fully invested in a matter of hours versus the days or weeks it would take if the manager were to buy specific bonds. On the flip side, if this fund experiences a large redemption, rather than sell bonds to create the necessary liquidity, the manager would sell the ETF, again turning what should be a multi-day process into a multi-minute process. This approach sounds like a great solution to the problem of managing inflows and outflows in a fully invested fund that has daily liquidity. The problem is that this approach is based on the false premise that ETFs are liquid. Despite what the glossy marketing materials will tell you, some ETFs are in fact illiquidity in liquidity's clothing.

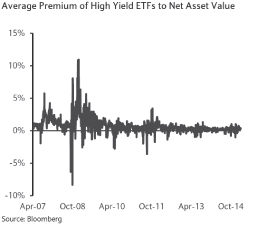

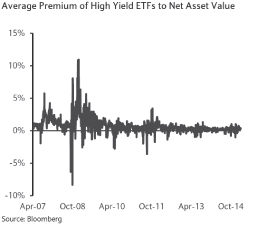

The risk is that ETF investors (including mutual fund managers) get lulled into the liquidity of the ETF shares while failing to respect the illiquidity of the bonds underlying the ETF. Liquidity is not only the ability to sell but rather it is the ability to sell at a price that reflects the value one would get in a functioning market (i.e., not a market with one buyer who is willing to pay a steeply discounted price). As it is, even in today's environment with low volatility, it is not clear that a high yield ETF closely tracks the market value of the underlying bonds. Fixed income markets, and high yield in particular, are special in that they are often quoted but are not necessarily executable at the quoted price. ETFs are designed to track a net asset value (NAV) which is based on market quotes but the market quote may not reflect the price at which bonds could actually be bought or sold. While, on paper, the discount or premium to NAV for a high yield ETF is small, in reality the discount or premium to the true market value may be meaningfully larger. This is a phenomenon which some refer to as the "fuzzy NAV".

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

Also consider that the mechanism which causes the price of a high yield ETF to hew closely to the market value of the underlying bonds requires that an "authorized participant," typically a large broker-dealer, buy or sell the bonds. Recall that the large broker-dealers were also supposed to serve as the back-stop bid on auction rate securities and yet they failed to fulfill that obligation during the financial crisis. What happens in a crisis when the authorized participant does not have balance sheet capacity or willingness to engage in ETF bond transactions? What is the ETF worth in that situation?

In declining high yield markets, bond prices tend to experience multiple point movements as their illiquidity leaves them in search of an equilibrium price level. Oftentimes, a market-clearing price can be hard to ascertain. Lest anyone think we are being alarmists, consider the case of a notable energy-focused hedge fund which had trouble valuing its fund at the end of 2014 because the turmoil in the energy high yield market made it difficult to accurately price its bond holdings. This hedge fund was subsequently forced to restate and mark down the value of its holdings following an auditor's review.

Selling in the high yield market plus the impact of the fuzzy NAV plus the potential absence of the authorized participants could lead to violent movements in the price of a high yield ETF as it experiences waves of liquidity selling while the underlying bonds are trying to discover their price. In situations like these, high yield ETF holders may face a precipitously falling price which dissociates from the value of the underlying bonds. The following chart shows the premium and discount of high yield ETFs versus the NAV and demonstrates how a high yield ETF puts its holders in a position of additional losses on top of the losses which the high yield market experiences. Note that the discount rose to nearly 10% during the financial crisis. Also note that this chart does not capture the difference between the quoted fuzzy NAV value and the true market value of the bonds.

There is no magic — despite the protestations of ETF issuers, it is not possible to decouple the liquidity of the ETF from the liquidity of the high yield market which is to say that you may be able to sell your ETF but at what price? Will that price reflect market value? As a holder of a high yield ETF, your ability to avoid extra

7

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

losses beyond the losses on the underlying bonds depends on whether you can sell before everyone else. Given the erroneous perception of liquidity, there will be a lot of sellers trying to sell very quickly. Do you feel lucky?

We bring this to your attention because, as a fixed income investor, you should be aware of practices in the fixed income industry. We would be remiss in not advising our investors of the risks they could face. Rest assured we do not use ETFs to manage our liquidity. Notwithstanding that we do not feel that fixed income ETFs are a good investment today, using ETFs to manage liquidity is simply not prudent.

Rather than rely on an illusory instrument of liquidity like an ETF, we express our liquidity concerns by owning a large amount of structured products whose monthly amortization organically creates liquidity and by maintaining significant holdings in short duration bonds whose prices should be less susceptible to market illiquidity. Also, we manage exposures in the strategy using cash so that we are not faced with the prospect of selling into a declining market to meet redemptions. We want to be buyers when others are sellers.

Conclusion

Given the uncertainty of continued quantitative easing and its impact on inflation, coupled with the declining oil price and pressuring deflation, further complicated by an illusion of liquidity in portions of the credit market, our team continues to focus on investment opportunities that minimize these risks to the portfolio and go towards achieving both our long-term and short-term investment objectives.

Finally, on April 1, 2015 Prakash Gopinath joined the team as Vice President and Research Analyst. He has over eight years of experience working in the areas of mid-market direct lending, private equity research, and fixed income credit research for a hedge fund. He will be working alongside Joe Choi covering the corporate credit portion of the portfolio. In conjunction with this addition to the team, Abhi Patwardhan has assumed the role of Director of Research.

We thank you for continued support and continue to work diligently to maintain your trust.

Respectfully submitted,

Thomas H. Atteberry

Portfolio Manager

April 24, 2015

The discussion of Fund investments represents the views of the Fund's managers at the time of this report and is subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities.

8

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Continued

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund can purchase foreign securities, which are subject to interest rate, currency exchange rate, economic and political risks. The securities of smaller, less well-known companies can be more volatile than those of larger companies. The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds. Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; derivatives may increase volatility. High yield securities can be volatile and subject to much higher instances of default.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

March 31, 2015 (Unaudited)

Bonds & Debentures | | | 99.2 | % | |

Asset-Backed Securities | | | 33.3 | % | |

Residential Mortgage-Backed

Securities | | | 25.9 | % | |

Commercial Mortgage-Backed

Securities | | | 15.1 | % | |

U.S. Treasury & Government

Agencies | | | 11.8 | % | |

Corporate Bonds & Notes | | | 10.2 | % | |

Corporate Bank Debt | | | 2.8 | % | |

Repurchase Agreements | | | 1.3 | % | |

Municipals | | | 0.1 | % | |

Short-Term Investments | | | 1.3 | % | |

Other Assets & Liabilities, Net | | | (0.5 | )% | |

Net Assets | | | 100.0 | % | |

9

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 15.1% | |

AGENCY — 1.7% | |

Government National Mortgage Association | |

| 2013-55 A — 1.317% 5/16/2034 | | $ | 992,083 | | | $ | 987,049 | | |

| 2012-22 AB — 1.661% 3/16/2033 | | | 4,236,679 | | | | 4,260,704 | | |

| 2012-2 A — 1.862% 6/16/2031 | | | 6,446,252 | | | | 6,475,120 | | |

| 2011-49 A — 2.45% 7/16/2038 | | | 3,367,644 | | | | 3,391,138 | | |

| 2010-155 B — 2.525% 6/16/2039 | | | 2,825,000 | | | | 2,874,797 | | |

| 2011-49 AB — 2.80% 1/16/2034 | | | 16,275,636 | | | | 16,454,506 | | |

| 2011-120 A — 3.856% 8/16/2033 | | | 26,800,789 | | | | 27,333,052 | | |

| 2011-143 AB — 3.928% 3/16/2033 | | | 34,603,488 | | | | 35,473,420 | | |

| 2006-63 B — 5.005% 3/16/2038 | | | 354,029 | | | | 361,159 | | |

| 2010-148 AC — 7.00% 12/16/2050 | | | 265,558 | | | | 290,575 | | |

| | | $ | 97,901,520 | | |

AGENCY STRIPPED — 10.1% | |

Government National Mortgage Association | |

| 2004-10 — 0.00% 1/16/2044 | | | 15,800,628 | | | | 158 | | |

| 2002-56 — 0.043% 6/16/2042 | | | 210,969 | | | | 329 | | |

| 2010-49 — 0.091% 2/16/2050 | | | 47,681,805 | | | | 869,239 | | |

| 2009-119 — 0.106% 12/16/2049 | | | 76,575,256 | | | | 1,398,264 | | |

| 2010-63 — 0.106% 5/16/2050 | | | 38,115,803 | | | | 641,108 | | |

| 2011-10 — 0.109% 12/16/2045 | | | 59,637,163 | | | | 1,297,705 | | |

| 2010-18 — 0.12% 1/16/2050 | | | 51,570,480 | | | | 1,079,370 | | |

| 2011-6 — 0.188% 10/16/2052 | | | 148,779,940 | | | | 3,154,135 | | |

| 2011-64 IX — 0.193% 10/16/2044 | | | 47,571,187 | | | | 2,005,601 | | |

| 2009-60 — 0.205% 6/16/2049 | | | 37,518,318 | | | | 730,482 | | |

| 2008-8 — 0.272% 11/16/2047 | | | 25,487,017 | | | | 464,373 | | |

| 2007-77 — 0.284% 11/16/2047 | | | 38,125,885 | | | | 1,146,445 | | |

| 2009-86 — 0.289% 10/16/2049 | | | 54,724,266 | | | | 1,114,733 | | |

| 2008-24 — 0.292% 11/16/2047 | | | 9,936,594 | | | | 181,939 | | |

| 2009-71 — 0.366% 7/16/2049 | | | 22,934,368 | | | | 561,204 | | |

| 2010-148 IX — 0.377% 10/16/2052 | | | 44,085,024 | | | | 1,412,925 | | |

| 2010-28 — 0.468% 3/16/2050 | | | 49,840,337 | | | | 1,327,747 | | |

| 2009-49 — 0.478% 6/16/2049 | | | 23,950,074 | | | | 700,779 | | |

| 2004-108 — 0.482% 12/16/2044 | | | 12,919,328 | | | | 242,367 | | |

| 2011-16 — 0.488% 9/16/2046 | | | 87,829,155 | | | | 3,164,484 | | |

| 2005-9 — 0.521% 1/16/2045 | | | 4,480,017 | | | | 103,623 | | |

| 2013-72 — 0.527% 11/16/2047 | | | 530,351,714 | | | | 29,420,519 | | |

| 2009-105 — 0.53% 11/16/2049 | | | 26,286,247 | | | | 1,018,592 | | |

| 2004-43 — 0.563% 6/16/2044 | | | 36,942,648 | | | | 876,280 | | |

| 2010-161 IA — 0.57% 12/16/2050 | | | 205,181,216 | | | | 5,439,354 | | |

10

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 2008-45 — 0.599% 2/16/2048 | | $ | 10,381,354 | | | $ | 338,744 | | |

| 2013-35 — 0.623% 1/16/2053 | | | 348,910,761 | | | | 19,530,699 | | |

| 2008-92 — 0.663% 10/16/2048 | | | 34,244,035 | | | | 1,538,242 | | |

| 2006-55 — 0.687% 8/16/2046 | | | 22,025,434 | | | | 809,875 | | |

| 2013-29 — 0.689% 5/16/2053 | | | 115,702,942 | | | | 6,893,315 | | |

| 2008-48 — 0.704% 4/16/2048 | | | 12,653,712 | | | | 505,895 | | |

| 2012-35 — 0.728% 11/16/2052 | | | 118,658,116 | | | | 5,960,411 | | |

| 2013-7 — 0.748% 5/16/2053 | | | 362,836,530 | | | | 23,881,247 | | |

| 2010-123 — 0.758% 9/16/2050 | | | 54,244,765 | | | | 2,143,753 | | |

| 2012-44 — 0.759% 3/16/2049 | | | 53,172,529 | | | | 2,332,434 | | |

| 2014-120 — 0.781% 4/16/2056 | | | 70,692,125 | | | | 4,508,348 | | |

| 2008-78 — 0.792% 7/16/2048 | | | 10,821,021 | | | | 529,148 | | |

| 2012-9 — 0.793% 11/16/2052 | | | 148,767,490 | | | | 11,602,377 | | |

2011-49 IX — 0.813% 4/16/2045 | | | 62,932,975 | | | | 2,511,026 | | |

| 2009-30 — 0.859% 3/16/2049 | | | 12,555,136 | | | | 517,899 | | |

| 2014-88 IE — 0.863% 3/16/2055 | | | 207,111,307 | | | | 13,969,098 | | |

| 2009-4 — 0.874% 1/16/2049 | | | 22,029,386 | | | | 1,032,958 | | |

| 2012-95 — 0.877% 2/16/2053 | | | 142,376,321 | | | | 9,986,574 | | |

| 2012-131 — 0.883% 2/16/2053 | | | 107,862,199 | | | | 8,161,199 | | |

| 2012-45 — 0.89% 4/16/2053 | | | 32,289,228 | | | | 2,130,530 | | |

| 2014-157 — 0.89% 5/16/2055 | | | 190,008,100 | | | | 13,696,715 | | |

| 2011-78 IX — 0.897% 8/16/2046 | | | 112,200,674 | | | | 5,326,166 | | |

| 2011-164 — 0.902% 4/16/2046 | | | 116,647,073 | | | | 6,107,641 | | |

| 2013-80 — 0.907% 3/16/2052 | | | 63,218,412 | | | | 4,945,956 | | |

| 2013-1 — 0.914% 2/16/2054 | | | 137,148,338 | | | | 10,522,295 | | |

| 2014-138 — 0.914% 4/16/2056 | | | 37,344,006 | | | | 2,825,201 | | |

| 2012-150 — 0.919% 11/16/2052 | | | 93,770,480 | | | | 6,801,576 | | |

| 2011-92 IX — 0.927% 11/16/2044 | | | 26,231,600 | | | | 1,475,790 | | |

| 2013-125 — 0.934% 10/16/2054 | | | 26,420,766 | | | | 1,519,390 | | |

| 2014-164 — 0.94% 1/16/2056 | | | 376,936,124 | | | | 27,289,422 | | |

| 2013-13 — 0.946% 7/16/2047 | | | 105,478,457 | | | | 6,892,986 | | |

| 2012-58 — 0.946% 2/16/2053 | | | 292,533,483 | | | | 19,743,085 | | |

| 2012-25 — 0.956% 8/16/2052 | | | 178,595,272 | | | | 10,098,991 | | |

| 2014-135 — 0.961% 1/16/2056 | | | 389,813,112 | | | | 29,199,536 | | |

| 2012-79 — 0.963% 3/16/2053 | | | 175,722,494 | | | | 11,404,390 | | |

| 2011-165 — 0.968% 10/16/2051 | | | 223,191,184 | | | | 10,402,941 | | |

| 2013-30 — 0.977% 9/16/2053 | | | 225,728,314 | | | | 15,740,396 | | |

| 2012-85 — 0.983% 9/16/2052 | | | 187,098,501 | | | | 13,258,623 | | |

| 2011-120 — 1.005% 12/16/2043 | | | 103,783,044 | | | | 9,428,689 | | |

| 2013-61 — 1.007% 5/16/2053 | | | 152,344,053 | | | | 10,711,112 | | |

| 2014-110 — 1.009% 1/16/2057 | | | 57,640,328 | | | | 5,204,339 | | |

11

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 2014-153 — 1.015% 4/16/2056 | | $ | 302,564,252 | | | $ | 26,119,585 | | |

| 2011-143 — 1.034% 4/16/2053 | | | 90,202,893 | | | | 10,405,806 | | |

| 2015-19 — 1.034% 1/16/2057 | | | 116,646,253 | | | | 10,592,530 | | |

| 2014-187 — 1.036% 5/16/2056 | | | 260,175,987 | | | | 22,536,600 | | |

| 2014-175 — 1.04% 4/16/2056 | | | 309,246,190 | | | | 26,413,583 | | |

| 2013-45 — 1.045% 12/16/2053 | | | 119,862,975 | | | | 7,359,371 | | |

| 2006-30 — 1.046% 5/16/2046 | | | 4,060,009 | | | | 290,534 | | |

| 2011-149 — 1.061% 10/16/2046 | | | 54,075,965 | | | | 3,985,939 | | |

| 2015-41 — 1.083% 9/16/2056 | | | 105,598,000 | | | | 9,341,717 | | |

| 2012-4 — 1.097% 5/16/2052 | | | 216,931,261 | | | | 10,927,934 | | |

| 2012-33 — 1.138% 6/16/2052 | | | 273,415,940 | | | | 13,318,911 | | |

| 2014-28 — 1.197% 10/16/2054 | | | 112,362,868 | | | | 9,680,218 | | |

| 2014-49 — 1.358% 8/16/2054 | | | 172,179,188 | | | | 15,741,586 | | |

| | | $ | 566,545,081 | | |

NON-AGENCY — 3.3% | |

| A10 Term Asset Financing LLC 2013-2 A — 2.62% 11/15/2027** | | $ | 10,328,825 | | | $ | 10,363,842 | | |

Citigroup Commercial Mortgage Trust | |

| 2007-FL3A B — 0.345% 4/15/2022** | | | 114,156 | | | | 114,144 | | |

| 2007-FL3A C — 0.385% 4/15/2022** | | | 546,612 | | | | 546,480 | | |

Credit Suisse Commercial Mortgage Trust

Series 2006-C5 A3 — 5.311% 12/15/2039 | | | 32,486,193 | | | | 33,904,950 | | |

Del Coronado Trust 2013-DEL MZ

2013-HDMZ M — 5.175% 3/15/2018** | | | 9,488,000 | | | | 9,512,637 | | |

| Monty Parent Issuer 1 LLC 2013-LTR1 B — 4.25% 11/20/2028** | | | 10,704,380 | | | | 10,704,825 | | |

Morgan Stanley Capital I Trust 2006-TOP23

2006-T23 A4 — 5.877% 8/12/2041 | | | 19,508,262 | | | | 20,379,445 | | |

| Ores NPL LLC 2014-LV3 B — 6.00% 3/27/2024** | | | 49,969,000 | | | | 49,968,825 | | |

Rialto Capital Management LLC | |

| 2014-LT5 B — 5.00% 5/15/2024**†† | | | 7,412,000 | | | | 7,374,940 | | |

| 2014-LT6 B — 5.486% 9/15/2024** | | | 10,040,000 | | | | 10,043,796 | | |

| 2013-RIA4 A2 — 6.00% 11/27/2028**†† | | | 12,099,500 | | | | 11,753,501 | | |

| Starwood Property Mortgage Trust 2013-FV1 B — 2.177% 8/11/2028** | | | 18,051,000 | | | | 18,047,316 | | |

| VFC LLC 2014-2 B — 5.50% 7/20/2030** | | | 6,185,000 | | | | 6,183,868 | | |

| | | $ | 188,898,569 | | |

| TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES | | $ | 850,834,144 | | |

12

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 25.9% | |

AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 17.0% | |

| Banc of America Large Loan Ball 2009 FDG C** | | $ | 22,008,000 | | | $ | 23,927,120 | | |

Federal Home Loan Mortgage Corporation | |

| 3818 HA — 1.50% 1/15/2018 | | | 4,566,951 | | | | 4,606,998 | | |

| 4350 CA — 2.00% 10/15/2019 | | | 32,418,935 | | | | 32,884,069 | | |

| 4351 GA — 2.00% 11/15/2019 | | | 23,466,865 | | | | 23,781,774 | | |

| 4383 JC — 2.00% 5/15/2023 | | | 34,036,514 | | | | 34,536,527 | | |

| 3711 AD — 2.50% 8/15/2023 | | | 180,373 | | | | 182,042 | | |

| 4399 A — 2.50% 7/15/2024 | | | 106,755,758 | | | | 108,979,737 | | |

| 3825 AB — 3.00% 8/15/2020 | | | 2,913,952 | | | | 3,001,472 | | |

| 2634 PA — 3.00% 2/15/2023 | | | 31,265 | | | | 31,588 | | |

| 3829 CD — 3.00% 8/15/2024 | | | 1,148,829 | | | | 1,160,502 | | |

| 2809 UC — 4.00% 6/15/2019 | | | 500,724 | | | | 524,540 | | |

| 3625 AJ — 4.00% 3/15/2023 | | | 18,297 | | | | 18,298 | | |

| 2990 TD — 4.00% 5/15/2035 | | | 69,341 | | | | 71,908 | | |

| 3992 H — 4.00% 6/15/2036 | | | 157,831 | | | | 160,892 | | |

| 3986 P — 4.00% 3/15/2039 | | | 347,139 | | | | 357,379 | | |

| 3578 AM — 4.50% 9/15/2016 | | | 957,949 | | | | 973,631 | | |

| 2614 BY — 4.50% 5/15/2018 | | | 1,328,593 | | | | 1,391,179 | | |

| 2625 JK — 4.50% 6/15/2018 | | | 3,226,784 | | | | 3,378,041 | | |

| 2645 BY — 4.50% 7/15/2018 | | | 269,784 | | | | 281,914 | | |

| 2649 AN — 4.50% 7/15/2018 | | | 2,437,768 | | | | 2,557,146 | | |

| 2656 PE — 4.50% 7/15/2018 | | | 533,880 | | | | 559,801 | | |

| 2885 DX — 4.50% 11/15/2019 | | | 8,012,643 | | | | 8,449,622 | | |

| 2900 PC — 4.50% 12/15/2019 | | | 4,634,678 | | | | 4,888,047 | | |

| 2930 KT — 4.50% 2/15/2020 | | | 1,302,324 | | | | 1,374,822 | | |

| 2933 AD — 4.50% 2/15/2020 | | | 3,289,594 | | | | 3,480,395 | | |

| 2995 JK — 4.50% 6/15/2020 | | | 1,672,127 | | | | 1,755,569 | | |

| 3271 TB — 4.50% 2/15/2022 | | | 4,716,096 | | | | 4,973,765 | | |

| 3969 MP — 4.50% 4/15/2039 | | | 124,225 | | | | 129,608 | | |

| 3939 D — 4.50% 9/15/2041 | | | 2,156,671 | | | | 2,288,409 | | |

| 2509 CB — 5.00% 10/15/2017 | | | 1,508,534 | | | | 1,565,874 | | |

| 2568 XD — 5.00% 2/15/2018 | | | 381,884 | | | | 400,407 | | |

| 2747 DX — 5.00% 2/15/2019 | | | 3,243,173 | | | | 3,414,705 | | |

| 3852 HA — 5.00% 12/15/2021 | | | 6,379,096 | | | | 6,760,247 | | |

| 2494 CF — 5.50% 9/15/2017 | | | 1,502,130 | | | | 1,564,303 | | |

| 2503 B — 5.50% 9/15/2017 | | | 1,474,639 | | | | 1,534,200 | | |

| 3808 BQ — 5.50% 8/15/2025 | | | 6,641,493 | | | | 7,000,864 | | |

| 3806 JB — 5.50% 2/15/2026 | | | 3,622,568 | | | | 3,973,087 | | |

| 3855 HQ — 5.50% 2/15/2026 | | | 3,583,296 | | | | 3,816,568 | | |

13

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 2453 BD — 6.00% 5/15/2017 | | $ | 438,481 | | | $ | 457,856 | | |

| 3926 GP — 6.00% 8/15/2025 | | | 3,640,747 | | | | 3,878,378 | | |

| 3614 DY — 6.00% 1/15/2032 | | | 8,085,165 | | | | 9,006,146 | | |

Federal National Mortgage Association | |

| 2012-117 DA — 1.50% 12/25/2039 | | | 7,994,756 | | | | 8,048,131 | | |

| 2013-64 TZ — 1.50% 3/25/2042 | | | 1,546,095 | | | | 1,528,773 | | |

| 2013-30 CA — 1.50% 4/25/2043 | | | 23,679,936 | | | | 23,239,352 | | |

| 2013-30 JA — 1.50% 4/25/2043 | | | 16,580,264 | | | | 16,264,144 | | |

| 2014-80 GD — 2.00% 2/25/2042 | | | 45,455,905 | | | | 45,544,575 | | |

| 2013-66 JA — 2.25% 7/25/2043 | | | 70,076,678 | | | | 70,349,346 | | |

| 2010-83 AH — 2.50% 11/25/2018 | | | 1,460,468 | | | | 1,495,368 | | |

| 2011-125 GE — 2.50% 12/25/2041 | | | 48,051,175 | | | | 48,626,929 | | |

| 2011-23 AB — 2.75% 6/25/2020 | | | 1,584,369 | | | | 1,628,915 | | |

| 2011-25 AH — 2.75% 6/25/2021 | | | 3,717,802 | | | | 3,821,118 | | |

| 2012-73 JB — 3.50% 1/25/2042 | | | 33,156,657 | | | | 34,866,260 | | |

| 2012-8 LE — 3.50% 2/25/2042 | | | 31,806,955 | | | | 33,448,214 | | |

| 2012-26 ME — 3.50% 3/25/2042 | | | 42,397,893 | | | | 44,585,751 | | |

| 2012-41 LB — 3.50% 4/25/2042 | | | 39,963,443 | | | | 41,981,993 | | |

| 2012-48 MB — 3.50% 5/25/2042 | | | 39,446,349 | | | | 41,483,520 | | |

| 2012-117 AD — 3.50% 10/25/2042 | | | 62,269,889 | | | | 65,485,724 | | |

| 2013-112 WA — 3.50% 2/25/2043 | | | 24,417,579 | | | | 25,376,997 | | |

| 2010-32 CL — 3.75% 8/25/2018 | | | 601,501 | | | | 625,577 | | |

| 2003-128 NG — 4.00% 1/25/2019 | | | 319,931 | | | | 334,555 | | |

| 2004-7 JK — 4.00% 2/25/2019 | | | 2,717,285 | | | | 2,838,066 | | |

| 2008-15 JM — 4.00% 2/25/2019 | | | 20,834 | | | | 20,904 | | |

| 2008-18 MD — 4.00% 3/25/2019 | | | 656,993 | | | | 685,147 | | |

| 2004-76 CL — 4.00% 10/25/2019 | | | 716,689 | | | | 749,598 | | |

| 2011-67 EA — 4.00% 7/25/2021 | | | 13,216,470 | | | | 13,919,719 | | |

| 2009-31 A — 4.00% 2/25/2024 | | | 320,285 | | | | 333,362 | | |

| 2009-76 MA — 4.00% 9/25/2024 | | | 814,509 | | | | 842,428 | | |

| 2012-95 AB — 4.00% 11/25/2040 | | | 5,749,293 | | | | 5,864,539 | | |

| 2009-70 NU — 4.25% 8/25/2019 | | | 4,159,397 | | | | 4,315,666 | | |

| 2004-90 GA — 4.35% 3/25/2034 | | | 361,605 | | | | 363,319 | | |

| 2003-30 HW — 4.50% 4/25/2018 | | | 519,252 | | | | 542,941 | | |

| 2003-92 HP — 4.50% 9/25/2018 | | | 6,907,049 | | | | 7,267,156 | | |

| 2008-40 KA — 4.50% 10/25/2018 | | | 872,645 | | | | 901,737 | | |

| 2008-18 NB — 4.50% 5/25/2020 | | | 1,619,248 | | | | 1,690,618 | | |

| 2005-47 HK — 4.50% 6/25/2020 | | | 9,435,264 | | | | 9,900,086 | | |

| 2008-15 JN — 4.50% 2/25/2023 | | | 34,414,308 | | | | 36,622,241 | | |

| 2008-59 KB — 4.50% 7/25/2023 | | | 3,332,378 | | | | 3,502,696 | | |

| 2011-7 PA — 4.50% 10/25/2039 | | | 377,931 | | | | 389,800 | | |

14

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 2012-67 PB — 4.50% 12/25/2040 | | $ | 8,191,287 | | | $ | 8,465,039 | | |

| 2011-148 PB — 4.50% 12/25/2041 | | | 6,372,001 | | | | 6,824,514 | | |

| 2002-74 PE — 5.00% 11/25/2017 | | | 502,322 | | | | 524,205 | | |

| 2003-24 PD — 5.00% 4/25/2018 | | | 1,883,316 | | | | 1,964,393 | | |

| 2003-46 BG — 5.00% 6/25/2018 | | | 1,603,240 | | | | 1,684,557 | | |

| 2003-97 CA — 5.00% 10/25/2018 | | | 12,389,875 | | | | 13,072,513 | | |

| 2008-77 DA — 5.00% 4/25/2023 | | | 1,400,210 | | | | 1,428,746 | | |

| 2010-39 PL — 5.00% 10/25/2032 | | | 677,151 | | | | 680,042 | | |

| 2004-60 LB — 5.00% 4/25/2034 | | | 6,613,747 | | | | 7,142,648 | | |

| 2003-W17 1A5 — 5.35% 8/25/2033 | | | 288,106 | | | | 288,048 | | |

| 2011-19 WB — 5.50% 10/25/2018 | | | 4,621,804 | | | | 4,871,890 | | |

| 2009-116 A — 5.50% 4/25/2024 | | | 2,291,993 | | | | 2,352,479 | | |

| 2002-9 PC — 6.00% 3/25/2017 | | | 1,286,746 | | | | 1,332,464 | | |

| | | $ | 964,196,233 | | |

AGENCY POOL ADJUSTABLE RATE — 0.0% | |

| Federal National Mortgage Association 865963 — 2.298% 3/1/2036 | | $ | 1,926,835 | | | $ | 2,051,886 | | |

AGENCY POOL FIXED RATE — 6.5% | |

Federal Home Loan Mortgage Corporation | |

| —4.50% 6/1/2019 | | $ | 756,656 | | | $ | 795,517 | | |

| —5.00% 11/1/2019 | | | 3,512,317 | | | | 3,745,088 | | |

| —5.00% 7/1/2020 | | | 259,367 | | | | 276,562 | | |

Federal National Mortgage Association | |

| —4.50% 12/25/2040 | | | 5,432,539 | | | | 5,581,005 | | |

| —6.00% 4/1/2021 | | | 11,645,401 | | | | 12,358,565 | | |

Federal Home Loan Mortgage Corporation | |

| P60959 — 4.50% 9/1/2020 | | | 1,951,033 | | | | 2,055,726 | | |

| G15169 — 4.50% 9/1/2026 | | | 13,400,667 | | | | 14,273,479 | | |

| G15272 — 4.50% 9/1/2026 | | | 16,628,076 | | | | 17,574,037 | | |

| B11858 — 5.00% 1/1/2019 | | | 1,786,515 | | | | 1,888,091 | | |

| B17433 — 5.00% 12/1/2019 | | | 2,511,243 | | | | 2,680,022 | | |

| G12131 — 5.00% 12/1/2019 | | | 949,979 | | | | 1,006,793 | | |

| G18026 — 5.00% 12/1/2019 | | | 980,820 | | | | 1,046,677 | | |

| B17562 — 5.00% 1/1/2020 | | | 1,981,584 | | | | 2,116,393 | | |

| G18033 — 5.00% 1/1/2020 | | | 2,716,023 | | | | 2,898,396 | | |

| G13812 — 5.00% 12/1/2020 | | | 4,931,523 | | | | 5,185,299 | | |

| J05860 — 5.00% 1/1/2021 | | | 1,202,579 | | | | 1,288,138 | | |

| G12358 — 5.00% 5/1/2021 | | | 1,393,321 | | | | 1,492,422 | | |

| G13670 — 5.00% 12/1/2021 | | | 3,010,158 | | | | 3,214,700 | | |

| J10227 — 5.00% 5/1/2022 | | | 1,525,196 | | | | 1,631,317 | | |

| G13674 — 5.00% 6/1/2022 | | | 2,777,460 | | | | 2,966,064 | | |

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| G15036 — 5.00% 6/1/2024 | | $ | 19,571,388 | | | $ | 20,704,050 | | |

| G13667 — 5.00% 8/1/2024 | | | 1,961,884 | | | | 2,120,839 | | |

| G15173 — 5.00% 6/1/2026 | | | 13,001,630 | | | | 13,828,750 | | |

| G12400 — 5.50% 11/1/2016 | | | 99,342 | | | | 102,052 | | |

| G12730 — 5.50% 7/1/2017 | | | 16,672 | | | | 17,344 | | |

| G12829 — 5.50% 10/1/2017 | | | 17,370 | | | | 18,150 | | |

| G14187 — 5.50% 12/1/2020 | | | 9,160,432 | | | | 9,713,355 | | |

| J01270 — 5.50% 2/1/2021 | | | 161,181 | | | | 174,917 | | |

| G15230 — 5.50% 12/1/2024 | | | 20,331,534 | | | | 21,919,916 | | |

| G12139 — 6.50% 9/1/2019 | | | 493,755 | | | | 511,071 | | |

| A26942 — 6.50% 9/1/2034 | | | 606,568 | | | | 696,843 | | |

| G08107 — 6.50% 1/1/2036 | | | 1,463,349 | | | | 1,681,139 | | |

| P50543 — 6.50% 4/1/2037 | | | 140,553 | | | | 154,928 | | |

Federal National Mortgage Association | |

| MA0323 — 4.50% 2/1/2020 | | | 629,692 | | | | 659,599 | | |

| MA0358 — 4.50% 3/1/2020 | | | 368,576 | | | | 386,081 | | |

| MA0419 — 4.50% 5/1/2020 | | | 598,653 | | | | 627,086 | | |

| 889531 — 4.50% 5/1/2022 | | | 95,789 | | | | 101,446 | | |

| AL6212 — 4.50% 1/1/2027 | | | 19,418,784 | | | | 20,398,860 | | |

| 720396 — 5.00% 7/1/2018 | | | 1,466,313 | | | | 1,538,956 | | |

| 254907 — 5.00% 10/1/2018 | | | 1,179,379 | | | | 1,240,350 | | |

| 995565 — 5.00% 12/1/2018 | | | 894,979 | | | | 941,251 | | |

| 995756 — 5.00% 12/1/2018 | | | 5,002,753 | | | | 5,286,009 | | |

| 745387 — 5.00% 4/1/2019 | | | 410,977 | | | | 433,488 | | |

| AL5252 — 5.00% 4/1/2019 | | | 1,561,449 | | | | 1,633,675 | | |

| 735660 — 5.00% 6/1/2020 | | | 229,159 | | | | 244,444 | | |

| AE0126 — 5.00% 6/1/2020 | | | 17,438,957 | | | | 18,445,708 | | |

| 310097 — 5.00% 10/1/2020 | | | 1,730,029 | | | | 1,810,034 | | |

| AE0792 — 5.00% 12/1/2020 | | | 5,720,538 | | | | 6,053,588 | | |

| 995861 — 5.00% 1/1/2021 | | | 5,618,308 | | | | 5,936,417 | | |

| 888104 — 5.00% 5/1/2021 | | | 133,448 | | | | 141,765 | | |

| AE0314 — 5.00% 8/1/2021 | | | 30,281,699 | | | | 31,940,158 | | |

| 890185 — 5.00% 10/1/2021 | | | 1,735,996 | | | | 1,863,107 | | |

| 890083 — 5.00% 12/1/2021 | | | 2,859,333 | | | | 3,021,572 | | |

| 889738 — 5.00% 9/1/2022 | | | 719,908 | | | | 773,187 | | |

| AL5656 — 5.00% 9/1/2025 | | | 2,098,641 | | | | 2,234,815 | | |

| AL5764 — 5.00% 9/1/2025 | | | 15,216,337 | | | | 16,164,985 | | |

| AL4056 — 5.00% 6/1/2026 | | | 17,298,200 | | | | 18,479,422 | | |

| 257100 — 5.50% 1/1/2018 | | | 500,254 | | | | 528,253 | | |

| 745500 — 5.50% 12/1/2018 | | | 3,388,407 | | | | 3,541,680 | | |

| 995284 — 5.50% 3/1/2020 | | | 3,736,608 | | | | 3,863,578 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 745190 — 5.50% 6/1/2020 | | $ | 547,118 | | | $ | 572,574 | | |

| 889318 — 5.50% 7/1/2020 | | | 4,839,047 | | | | 5,156,682 | | |

| AL5867 — 5.50% 8/1/2023 | | | 3,762,194 | | | | 3,994,482 | | |

| AE0237 — 5.50% 11/1/2023 | | | 4,736,583 | | | | 5,041,288 | | |

| AL5812 — 5.50% 5/1/2025 | | | 14,803,056 | | | | 15,732,759 | | |

| AL0471 — 5.50% 7/1/2025 | | | 460,200 | | | | 502,159 | | |

| AL4433 — 5.50% 9/1/2025 | | | 4,202,368 | | | | 4,539,353 | | |

| AL4901 — 5.50% 9/1/2025 | | | 7,243,937 | | | | 7,735,832 | | |

| 735439 — 6.00% 9/1/2019 | | | 862,910 | | | | 905,891 | | |

| 745238 — 6.00% 12/1/2020 | | | 2,334,583 | | | | 2,460,832 | | |

| AD0951 — 6.00% 12/1/2021 | | | 4,707,284 | | | | 5,024,885 | | |

| AL0294 — 6.00% 10/1/2022 | | | 254,311 | | | | 277,385 | | |

| 890225 — 6.00% 5/1/2023 | | | 4,085,746 | | | | 4,375,915 | | |

| 890403 — 6.00% 5/1/2023 | | | 4,911,735 | | | | 5,184,133 | | |

| 725951 — 7.50% 8/1/2017 | | | 34,753 | | | | 36,214 | | |

| 323282 — 7.50% 7/1/2028 | | | 301,734 | | | | 341,493 | | |

| Government National Mortgage Association 782281 — 6.00% 3/15/2023 | | | 2,533,816 | | | | 2,763,606 | | |

| | | $ | 368,652,642 | | |

AGENCY STRIPPED — 1.3% | |

Federal Home Loan Mortgage Corporation | |

| 217 PO — 0.00% 1/1/2032 | | | 400,626 | | | | 367,658 | | |

| 3714 TI — 2.25% 8/15/2015 | | | 27,633,524 | | | | 196,300 | | |

| 4138 AI — 2.50% 11/15/2022 | | | 4,889,770 | | | | 291,710 | | |

| 3935 LI — 3.00% 10/15/2021 | | | 5,261,918 | | | | 349,660 | | |

| 3948 AI — 3.00% 10/15/2021 | | | 6,553,531 | | | | 446,558 | | |

| 3956 KI — 3.00% 11/15/2021 | | | 14,365,603 | | | | 1,009,639 | | |

| 3968 AI — 3.00% 12/15/2021 | | | 5,423,439 | | | | 377,119 | | |

| 3992 OI — 3.00% 1/15/2022 | | | 4,123,381 | | | | 290,143 | | |

| 3994 AI — 3.00% 2/15/2022 | | | 10,274,528 | | | | 740,263 | | |

| 3994 EI — 3.00% 2/15/2022 | | | 9,785,590 | | | | 713,595 | | |

| 3998 KI — 3.00% 11/15/2026 | | | 18,336,499 | | | | 1,854,575 | | |

| 4100 EI — 3.00% 8/15/2027 | | | 84,934,405 | | | | 9,329,051 | | |

| 3706 AI — 3.50% 7/15/2020 | | | 6,056,796 | | | | 231,098 | | |

| 3722 AI — 3.50% 9/15/2020 | | | 8,711,309 | | | | 578,429 | | |

| 3735 AI — 3.50% 10/15/2020 | | | 4,160,837 | | | | 276,156 | | |

| 3874 DI — 3.50% 10/15/2020 | | | 7,097,350 | | | | 361,460 | | |

| 3893 DI — 3.50% 10/15/2020 | | | 5,170,267 | | | | 261,315 | | |

| 3753 CI — 3.50% 11/15/2020 | | | 2,028,681 | | | | 142,063 | | |

| 3755 AI — 3.50% 11/15/2020 | | | 8,000,313 | | | | 560,529 | | |

| 3760 KI — 3.50% 11/15/2020 | | | 6,273,680 | | | | 432,034 | | |

| 3784 BI — 3.50% 1/15/2021 | | | 5,477,727 | | | | 393,966 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 3874 BI — 3.50% 6/15/2021 | | $ | 4,644,719 | | | $ | 348,791 | | |

| 3893 BI — 3.50% 7/15/2021 | | | 3,963,675 | | | | 300,066 | | |

| 3909 KI — 3.50% 7/15/2021 | | | 3,483,921 | | | | 266,146 | | |

| 3938 IO — 3.50% 10/15/2021 | | | 23,515,069 | | | | 1,825,534 | | |

| 3778 GI — 3.50% 6/15/2024 | | | 4,456,748 | | | | 271,021 | | |

| 3854 GI — 3.50% 11/15/2024 | | | 2,902,447 | | | | 119,710 | | |

| 3852 YI — 3.50% 3/15/2025 | | | 10,122,683 | | | | 541,838 | | |

| 3763 NI — 3.50% 5/15/2025 | | | 3,907,822 | | | | 342,598 | | |

| 3904 QI — 3.50% 5/15/2025 | | | 4,068,765 | | | | 277,572 | | |

| 3909 UI — 3.50% 8/15/2025 | | | 6,321,080 | | | | 393,872 | | |

| 3904 NI — 3.50% 8/15/2026 | | | 9,060,799 | | | | 1,034,268 | | |

| 3930 AI — 3.50% 9/15/2026 | | | 11,574,483 | | | | 1,324,973 | | |

| 4018 AI — 3.50% 3/15/2027 | | | 19,859,604 | | | | 2,172,361 | | |

| 3684 CI — 4.50% 8/15/2024 | | | 20,380,693 | | | | 1,745,881 | | |

| 3917 AI — 4.50% 7/15/2026 | | | 31,656,007 | | | | 4,116,433 | | |

| 3636 IO — 5.00% 11/15/2018 | | | 17,562,318 | | | | 998,052 | | |

| 217 IO — 6.50% 1/1/2032 | | | 385,760 | | | | 89,488 | | |

Federal National Mortgage Association | |

| 2011-88 BI — 3.00% 11/25/2020 | | | 3,143,743 | | | | 143,341 | | |

| 2011-141 EI — 3.00% 7/25/2021 | | | 14,017,597 | | | | 817,386 | | |

| 2012-8 TI — 3.00% 10/25/2021 | | | 6,655,427 | | | | 453,654 | | |

| 2011-113 GI — 3.00% 11/25/2021 | | | 6,396,912 | | | | 436,033 | | |

| 2011-129 AI — 3.00% 12/25/2021 | | | 8,822,149 | | | | 611,972 | | |

| 2012-8 UI — 3.00% 12/25/2021 | | | 21,686,997 | | | | 1,504,577 | | |

| 2011-137 AI — 3.00% 1/25/2022 | | | 11,347,268 | | | | 792,383 | | |

| 2011-138 IG — 3.00% 1/25/2022 | | | 14,122,615 | | | | 1,014,523 | | |

| 2011-145 IO — 3.00% 1/25/2022 | | | 17,862,217 | | | | 1,239,113 | | |

| 2012-78 AI — 3.00% 2/25/2022 | | | 10,594,345 | | | | 625,611 | | |

| 2012-23 IA — 3.00% 3/25/2022 | | | 8,207,775 | | | | 579,654 | | |

| 2012-32 AI — 3.00% 4/25/2022 | | | 13,592,524 | | | | 976,808 | | |

| 2012-53 CI — 3.00% 5/25/2022 | | | 20,879,728 | | | | 1,513,419 | | |

| 2012-147 AI — 3.00% 10/25/2027 | | | 31,424,886 | | | | 3,575,153 | | |

| 2012-145 DI — 3.00% 1/25/2028 | | | 17,203,431 | | | | 1,984,913 | | |

| 2012-149 CI — 3.00% 1/25/2028 | | | 46,663,223 | | | | 5,321,992 | | |

| 2010-128 LI — 3.50% 11/25/2020 | | | 10,181,273 | | | | 694,500 | | |

| 2011-75 BI — 3.50% 11/25/2020 | | | 5,166,990 | | | | 258,230 | | |

| 2011-78 IA — 3.50% 11/25/2020 | | | 13,687,549 | | | | 653,771 | | |

| 2010-145 BI — 3.50% 12/25/2020 | | | 5,167,210 | | | | 362,169 | | |

| 2011-61 BI — 3.50% 7/25/2021 | | | 4,549,135 | | | | 352,701 | | |

| 2011-66 QI — 3.50% 7/25/2021 | | | 7,918,169 | | | | 618,969 | | |

| 2011-104 CI — 3.50% 10/25/2021 | | | 13,487,250 | | | | 1,031,652 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 2011-104 DI — 3.50% 10/25/2021 | | $ | 22,613,335 | | | $ | 1,655,748 | | |

| 2011-110 AI — 3.50% 11/25/2021 | | | 9,460,915 | | | | 704,968 | | |

| 2011-118 IC — 3.50% 11/25/2021 | | | 25,480,576 | | | | 1,993,348 | | |

| 2011-125 DI — 3.50% 12/25/2021 | | | 17,985,844 | | | | 1,452,042 | | |

| 2011-143 MI — 3.50% 1/25/2022 | | | 7,180,166 | | | | 507,742 | | |

| 2012-2 MI — 3.50% 2/25/2022 | | | 10,846,791 | | | | 876,534 | | |

| 2010-137 BI — 3.50% 2/25/2024 | | | 3,718,593 | | | | 158,993 | | |

| 2010-135 DI — 3.50% 4/25/2024 | | | 8,063,741 | | | | 389,507 | | |

| 2011-75 AI — 3.50% 1/25/2025 | | | 15,432,500 | | | | 822,453 | | |

| 2011-66 BI — 3.50% 3/25/2025 | | | 1,839,465 | | | | 93,129 | | |

| 2011-80 KI — 3.50% 4/25/2025 | | | 7,857,093 | | | | 467,023 | | |

| 2011-67 CI — 3.50% 8/25/2025 | | | 4,056,311 | | | | 310,877 | | |

| 2011-22 IC — 3.50% 12/25/2025 | | | 7,995,228 | | | | 819,732 | | |

| 2011-101 EI — 3.50% 10/25/2026 | | | 18,322,697 | | | | 2,091,756 | | |

| 2011-69 TI — 4.00% 5/25/2020 | | | 4,777,864 | | | | 251,797 | | |

| 2010-89 LI — 4.00% 8/25/2020 | | | 7,773,062 | | | | 528,990 | | |

| 2010-104 CI — 4.00% 9/25/2020 | | | 3,435,272 | | | | 240,800 | | |

| 2011-67 EI — 4.00% 7/25/2021 | | | 8,596,629 | | | | 576,346 | | |

| 2010-110 IH — 4.50% 10/25/2018 | | | 9,000,364 | | | | 550,633 | | |

| 2009-70 IN — 4.50% 8/25/2019 | | | 12,455,179 | | | | 674,813 | | |

| 2008-15 JI — 4.50% 6/25/2022 | | | 1,568,398 | | | | 33,164 | | |

| 2010-114 CI — 5.00% 4/25/2018 | | | 10,900,163 | | | | 628,474 | | |

| 2010-30 IO — 5.00% 8/25/2018 | | | 4,620,915 | | | | 284,159 | | |

| 2003-64 XI — 5.00% 7/25/2033 | | | 1,088,188 | | | | 172,547 | | |

| | | $ | 77,220,024 | | |

NON-AGENCY COLLATERALIZED MORTGAGE

OBLIGATION — 1.1% | |

Citicorp Mortgage Securities REMIC Pass-Through Certificates

Trust Series 2005-5 2A3 — 5.00% 8/25/2020 | | $ | 112,701 | | | $ | 115,488 | | |

| Citigroup Mortgage Loan Trust 2014-A A — 4.00% 1/1/2035** | �� | | 22,415,251 | | | | 23,151,834 | | |

| RiverView HECM Trust 2007-1 A — 0.61% 5/25/2047** | | | 33,198,156 | | | | 28,994,937 | | |

| Sequoia Mortgage Trust 2012-1 1A1 — 2.865% 1/25/2042 | | | 5,259,507 | | | | 5,279,482 | | |

Wells Fargo Mortgage Backed Securities

Trust 2006-5 2A1 — 5.25% 4/25/2021 | | | 4,325,151 | | | | 4,413,730 | | |

| | | $ | 61,955,471 | | |

| TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES | | $ | 1,476,587,282 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

ASSET-BACKED SECURITIES — 33.3% | |

AUTO — 20.1% | |

Ally Auto Receivables Trust | |

| 2013-SN1 A3 — 0.72% 5/20/2016 | | $ | 2,150,254 | | | $ | 2,151,453 | | |

| 2012-1 B — 1.84% 11/15/2016** | | | 8,666,000 | | | | 8,674,910 | | |

American Credit Acceptance Receivables Trust | |

| 2014-2 A — 0.99% 10/10/2017** | | | 4,769,654 | | | | 4,767,869 | | |

| 2014-1 A — 1.14% 3/12/2018** | | | 1,639,134 | | | | 1,639,782 | | |

| 2013-2 A — 1.32% 2/15/2017** | | | 188,490 | | | | 188,571 | | |

AmeriCredit Automobile Receivables Trust | |

| 2014-1 A2 — 0.57% 7/10/2017 | | | 22,944,186 | | | | 22,957,255 | | |

| 2013-1 A3 — 0.61% 10/10/2017 | | | 885,854 | | | | 885,642 | | |

| 2012-5 A3 — 0.62% 6/8/2017 | | | 331,067 | | | | 331,103 | | |

| 2014-3 A2A — 0.64% 4/9/2018 | | | 42,091,390 | | | | 42,044,505 | | |

| 2013-2 A3 — 0.65% 12/8/2017 | | | 16,422,673 | | | | 16,412,240 | | |

| 2012-4 A3 — 0.67% 6/8/2017 | | | 24,407,356 | | | | 24,408,122 | | |

| 2013-4 A2 — 0.74% 11/8/2016 | | | 4,384,734 | | | | 4,384,993 | | |

| 2013-4 A3 — 0.96% 4/9/2018 | | | 8,314,000 | | | | 8,319,476 | | |

| 2013-3 B — 1.58% 9/10/2018 | | | 5,024,000 | | | | 5,045,373 | | |

| 2013-4 B — 1.66% 9/10/2018 | | | 90,000 | | | | 90,284 | | |

| 2012-5 C — 1.69% 11/8/2018 | | | 14,140,000 | | | | 14,287,284 | | |

| 2012-1 B — 1.73% 2/8/2017 | | | 418,981 | | | | 419,131 | | |

| 2012-4 C — 1.93% 8/8/2018 | | | 3,665,700 | | | | 3,690,173 | | |

| 2012-3 C — 2.42% 5/8/2018 | | | 1,650,000 | | | | 1,665,253 | | |

| 2012-2 C — 2.64% 10/10/2017 | | | 4,893,000 | | | | 4,948,966 | | |

| 2012-1 C — 2.67% 1/8/2018 | | | 2,371,000 | | | | 2,391,887 | | |

| 2011-3 C — 2.86% 1/9/2017 | | | 1,476,642 | | | | 1,482,536 | | |

| 2012-3 D — 3.03% 7/9/2018 | | | 24,856,000 | | | | 25,383,646 | | |

| 2011-4 C — 3.08% 7/10/2017 | | | 191,202 | | | | 192,626 | | |

| 2010-3 C — 3.34% 4/8/2016 | | | 141,063 | | | | 141,084 | | |

| 2012-1 D — 4.72% 3/8/2018 | | | 8,891,000 | | | | 9,220,502 | | |

| 2010-3 D — 4.98% 1/8/2018 | | | 13,735,000 | | | | 13,745,576 | | |

| BMW Vehicle Lease Trust 2014-1 A2 — 0.45% 3/21/2016 | | | 13,265,863 | | | | 13,267,675 | | |

California Republic Auto Receivables Trust

2013-2 A2 — 1.23% 3/15/2019 | | | 12,399,733 | | | | 12,438,763 | | |

Capital Auto Receivables Asset Trust | |

| 2013-1 A3 — 0.79% 6/20/2017 | | | 3,345,000 | | | | 3,346,523 | | |

| 2013-4 A2 — 0.85% 2/21/2017 | | | 6,750,000 | | | | 6,753,729 | | |

CarMax Auto Owner Trust | |

| 2014-2 A2 — 0.46% 4/17/2017 | | | 27,762,704 | | | | 27,761,347 | | |

| 2014-1 A2 — 0.47% 2/15/2017 | | | 18,593,579 | | | | 18,597,504 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| 2012-3 A3 — 0.52% 7/17/2017 | | $ | 13,437,784 | | | $ | 13,436,018 | | |

| Chesapeake Funding LLC 2014-1A A — 0.595% 3/7/2026** | | | 29,025,000 | | | | 29,026,219 | | |

Credit Acceptance Auto Loan Trust | |

| 2014-2A A — 1.88% 3/15/2022** | | | 16,243,000 | | | | 16,269,520 | | |

| 2014-2A B — 2.67% 9/15/2022** | | | 8,639,000 | | | | 8,681,652 | | |

DT Auto Owner Trust | |

| 2014-1A A — 0.66% 7/17/2017** | | | 618,554 | | | | 618,444 | | |

| 2014-2A A — 0.68% 8/15/2017** | | | 5,432,703 | | | | 5,431,055 | | |

| 2014-2A B — 1.34% 4/16/2018** | | | 8,474,000 | | | | 8,483,204 | | |

| 2014-1A B — 1.43% 3/15/2018** | | | 5,730,000 | | | | 5,735,344 | | |

| 2013-2A B — 1.78% 6/15/2017** | | | 7,313,750 | | | | 7,323,223 | | |

Enterprise Fleet Financing LLC | |

| 2012-2 A2 — 0.72% 4/20/2018** | | | 2,507,945 | | | | 2,508,316 | | |

| 2014-2 A2 — 1.05% 3/20/2020** | | | 5,941,000 | | | | 5,943,722 | | |

Exeter Automobile Receivables Trust | |

| 2014-2A A — 1.06% 8/15/2018** | | | 5,771,045 | | | | 5,756,122 | | |

| 2014-1A A — 1.29% 5/15/2018** | | | 18,967,428 | | | | 19,003,859 | | |

| 2013-2A A — 1.49% 11/15/2017** | | | 7,720,820 | | | | 7,736,016 | | |

| Fifth Third Auto Trust 2014-1 A2 — 0.46% 8/15/2016 | | | 17,095,682 | | | | 17,098,026 | | |

First Investors Auto Owner Trust | |

| 2014-1A A2 — 0.80% 2/15/2018** | | | 2,757,520 | | | | 2,757,341 | | |

| 2014-2A A2 — 0.86% 8/15/2018** | | | 20,524,606 | | | | 20,511,819 | | |

| 2013-3A A2 — 0.89% 9/15/2017** | | | 1,655,563 | | | | 1,655,909 | | |

| 2014-1A A3 — 1.49% 1/15/2020** | | | 9,500,000 | | | | 9,522,087 | | |

| Ford Credit Auto Lease Trust 2013-A A3 — 0.60% 3/15/2016 | | | 13,814,274 | | | | 13,818,460 | | |

| Ford Credit Auto Owner Trust 2013-A A3 — 0.55% 7/15/2017 | | | 31,869,873 | | | | 31,878,252 | | |

Honda Auto Receivables Owner Trust | |

| 2014-2 A2 — 0.39% 9/19/2016 | | | 20,569,824 | | | | 20,569,314 | | |

| 2014-1 A2 — 0.41% 9/21/2016 | | | 26,450,392 | | | | 26,451,312 | | |

Hyundai Auto Lease Securitization Trust

2015-A A2 — 1.00% 10/16/2017** | | | 29,432,000 | | | | 29,432,889 | | |

Hyundai Auto Receivables Trust | |

| 2014-B A2 — 0.44% 2/15/2017 | | | 30,428,709 | | | | 30,422,690 | | |

| 2012-C A4 — 0.73% 6/15/2018 | | | 500,000 | | | | 500,242 | | |

| Mercedes Benz Auto Lease Trust 2014-A A2A — 0.48% 6/15/2016 | | | 30,725,047 | | | | 30,731,293 | | |

| Mercedes-Benz Auto Lease Trust 2013-A A3 — 0.59% 2/15/2016 | | | 4,073,863 | | | | 4,074,156 | | |

| Nissan Auto Lease 2013-A A3 — 0.61% 4/15/2016 | | | 44,800,413 | | | | 44,819,009 | | |

Porsche Financial Auto Securitization Trust

2014-1 A2 — 0.38% 9/23/2016** | | | 19,593,516 | | | | 19,592,544 | | |

| Porsche Innovative Lease Owner Trust 2014-1 A4 — 1.26% 9/21/2020** | | | 15,253,000 | | | | 15,271,819 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

Prestige Auto Receivables Trust | |

| 2014-1A A2 — 0.97% 3/15/2018** | | $ | 10,335,469 | | | $ | 10,334,550 | | |

| 2013-1A A2 — 1.09% 2/15/2018** | | | 4,663,030 | | | | 4,670,490 | | |

| 2013-1A A3 — 1.33% 5/15/2019** | | | 4,625,000 | | | | 4,633,399 | | |

| 2014-1A A3 — 1.52% 4/15/2020** | | | 17,250,000 | | | | 17,257,048 | | |

| 2015-1 A3 — 1.53% 2/15/2021** | | | 16,433,000 | | | | 16,433,656 | | |

| 2015-1 B — 2.04% 4/15/2021** | | | 10,395,000 | | | | 10,394,789 | | |

| 2012-1A B — 2.49% 4/16/2018** | | | 3,855,000 | | | | 3,892,382 | | |

Santander Drive Auto Receivables Trust | |

| 2014-2 A2A — 0.54% 7/17/2017 | | | 16,523,729 | | | | 16,520,811 | | |

| 2014-3 A2A — 0.54% 8/15/2017 | | | 11,682,624 | | | | 11,680,472 | | |

| 2013-1 A3 — 0.62% 6/15/2017 | | | 8,600,293 | | | | 8,600,846 | | |

| 2013-5 A2A — 0.64% 4/17/2017 | | | 769,231 | | | | 769,269 | | |

| 2014-1 A2A — 0.66% 6/15/2017 | | | 8,565,268 | | | | 8,566,600 | | |

| 2014-4 A2A — 0.67% 1/16/2018 | | | 39,021,268 | | | | 39,018,400 | | |

| 2013-2 A3 — 0.70% 9/15/2017 | | | 23,085,550 | | | | 23,084,451 | | |

| 2013-3 A3 — 0.70% 10/16/2017 | | | 3,683,278 | | | | 3,682,367 | | |

| 2014-1 A3 — 0.87% 1/16/2018 | | | 19,425,000 | | | | 19,436,391 | | |

| 2013-1 B — 1.16% 1/15/2019 | | | 3,570,000 | | | | 3,572,710 | | |

| 2012-AA B — 1.21% 10/16/2017** | | | 17,943,000 | | | | 17,957,064 | | |

| 2012-6 B — 1.33% 5/15/2017 | | | 6,646,909 | | | | 6,651,525 | | |

| 2013-5 B — 1.55% 10/15/2018 | | | 17,165,000 | | | | 17,243,341 | | |

| 2014-1 B — 1.59% 10/15/2018 | | | 11,705,000 | | | | 11,753,440 | | |

| 2012-3 B — 1.94% 12/15/2016 | | | 394,799 | | | | 394,938 | | |

| 2013-4 B — 2.16% 1/15/2020 | | | 4,218,000 | | | | 4,254,870 | | |

| 2012-3 D — 3.64% 5/15/2018 | | | 32,352,000 | | | | 33,523,411 | | |

| Toyota Auto Receivables Owner Trust 2014-A A3 — 0.67% 12/15/2017 | | | 35,000,000 | | | | 34,980,648 | | |

Westlake Automobile Receivables Trust | |

| 2014-1A A2 — 0.70% 5/15/2017** | | | 1,484,432 | | | | 1,482,960 | | |

| 2015-1A A2 — 1.17% 3/15/2018** | | | 15,449,000 | | | | 15,448,863 | | |

| 2014-1A B — 1.24% 11/15/2019** | | | 4,500,000 | | | | 4,498,997 | | |

| 2015-1A B — 1.68% 11/16/2020** | | | 11,721,000 | | | | 11,719,616 | | |

| 2014-1A C — 1.70% 11/15/2019** | | | 500,000 | | | | 499,570 | | |

| 2015-1A C — 2.29% 11/16/2020** | | | 550,000 | | | | 549,926 | | |

| Wheels SPV 2 LLC 2014-1A A2 — 0.84% 3/20/2023** | | | 17,039,418 | | | | 17,019,927 | | |

| | | $ | 1,137,623,386 | | |

OTHER — 13.2% | |

Bayview Opportunity Master Fund IIa Trust PL

2014-20NP A — 3.721% 8/28/2044** | | $ | 193,915 | | | $ | 194,040 | | |

| Beacon Container Finance LLC 2012-1A A — 3.72% 9/20/2027** | | | 469,525 | | | | 480,068 | | |

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

Cabela's Credit Card Master Note Trust | |

| 2012-2A A1 — 1.45% 6/15/2020** | | $ | 30,268,000 | | | $ | 30,423,408 | | |

| 2012-1A A1 — 1.63% 2/18/2020** | | | 8,983,000 | | | | 9,070,251 | | |

| 2011-4A A1 — 1.90% 10/15/2019** | | | 31,487,000 | | | | 31,928,725 | | |

| 2010-2A A1 — 2.29% 9/17/2018** | | | 7,560,000 | | | | 7,616,409 | | |

| CCG Receivables Trust 2014-1 A2 — 1.06% 11/15/2021** | | | 9,603,473 | | | | 9,598,959 | | |

Cerberus Onshore II CLO-2 LLC | |

| 2014-1A A — 2.176% 10/15/2023** | | | 9,499,000 | | | | 9,499,902 | | |

| 2014-1A B — 2.976% 10/15/2023** | | | 6,612,000 | | | | 6,568,599 | | |

| HFG Healthco-4 LLC 2011-1A A — 2.422% 6/2/2017** | | | 17,140,000 | | | | 17,404,110 | | |

HLSS Servicer Advance Receivables Backed Notes Series | |

| 2013-T2 B2 — 1.495% 5/16/2044** | | | 8,050,000 | | | | 8,011,078 | | |

| 2013-T5 BT5 — 2.276% 8/15/2046** | | | 9,300,000 | | | | 9,190,790 | | |

HLSS Servicer Advance Receivables Trust | |

| 2013-T1 A2 — 1.495% 1/16/2046** | | | 24,512,000 | | | | 24,436,430 | | |

| 2013-T1 B2 — 1.744% 1/16/2046** | | | 5,750,000 | | | | 5,707,191 | | |

| 2012-T2 B2 — 2.48% 10/15/2045** | | | 14,078,000 | | | | 14,043,396 | | |

| Kubota Credit Owner Trust 2014-1A A2 — 0.58% 2/15/2017** | | | 5,215,488 | | | | 5,213,943 | | |

MMAF Equipment Finance LLC | |

| 2013-AA A2 — 0.69% 5/9/2016** | | | 7,980,619 | | | | 7,981,848 | | |

| 2012-AA A3 — 0.94% 8/10/2016** | | | 6,082,826 | | | | 6,086,427 | | |

| 2013-AA A3 — 1.03% 12/11/2017** | | | 2,419,000 | | | | 2,423,969 | | |

| Nationstar HECM Loan Trust A 2014-1A A — 4.50% 11/25/2017** | | | 27,981,148 | | | | 27,977,637 | | |

Normandy Mortgage Loan Co. LLC

2013-NPL3 A — 4.949% 9/16/2043** | | | 24,859,269 | | | | 24,824,713 | | |

PFS Financing Corp. | |

| 2013-BA A — 0.675% 4/17/2017** | | | 35,160,000 | | | | 35,163,583 | | |

| 2014-AA A — 0.775% 2/15/2019** | | | 26,000,000 | | | | 25,973,293 | | |

| 2014-BA A — 0.775% 10/15/2019** | | | 14,121,000 | | | | 14,114,469 | | |

| Progreso Receivables Funding I LLC 2013-A A — 4.00% 7/9/2018**†† | | | 15,371,000 | | | | 15,467,069 | | |

| Progreso Receivables Funding II LLC 2014-A A — 3.50% 7/8/2019**†† | | | 9,735,000 | | | | 9,741,084 | | |

| Stanwich Mortgage Loan Co. LLC 2013-NPL2 A — 3.228% 4/16/2059** | | | 28,049,068 | | | | 28,042,620 | | |

| Stanwich Mortgage Loan Trust 2013-NPL1 A — 2.981% 2/16/2043** | | | 6,977,612 | | | | 6,989,861 | | |

Stanwich Mortgage Loan Trust Series | |

| 2010-2 A — 1.00% 2/28/2057**†† | | | 2,704,325 | | | | 1,363,521 | | |

| 2010-4 A — 1.183% 8/31/2049**†† | | | 1,802,684 | | | | 910,355 | | |

| 2011-1 A — 1.187% 8/15/2050**†† | | | 3,032,164 | | | | 1,599,251 | | |

| 2011-2 A — 1.967% 9/15/2050**†† | | | 2,611,528 | | | | 1,397,700 | | |

| 2010-3 A — 3.434% 7/31/2038**†† | | | 1,737,623 | | | | 869,333 | | |

| 2010-1 A — 4.083% 9/30/2047**†† | | | 572,126 | | | | 289,381 | | |

| 2009-2 A — 4.218% 2/15/2049**†† | | | 305,711 | | | | 136,714 | | |

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

| STORE Master Funding LLC 2012-1A A — 5.77% 8/20/2042** | | $ | 481,814 | | | $ | 522,479 | | |

Sunset Mortgage Loan Co. LLC | |

| 2014-NPL1 A — 3.228% 8/16/2044** | | | 43,405,646 | | | | 43,514,334 | | |

| 2014-NPL2 A — 3.721% 11/16/2044** | | | 50,676,959 | | | | 50,851,090 | | |

| Synchrony Credit Card Master Note Trust 2012-6 A — 1.36% 8/17/2020 | | | 57,527,000 | | | | 57,578,556 | | |

Truman Capital Mortgage Loan Trust | |

| 2014-NPL3 A1 — 3.125% 4/25/2053** | | | 5,763,191 | | | | 5,729,132 | | |

| 2014-NPL2 A1 — 3.125% 6/25/2054** | | | 6,476,193 | | | | 6,438,578 | | |

Vericrest Opportunity Loan Transferee LLC

2014-NPL4 A1 — 3.125% 4/27/2054** | | | 32,936,077 | | | | 32,907,633 | | |

| VOLT XXVII LLC 2014-NPL7 A1 — 3.375% 8/27/2057** | | | 55,898,948 | | | | 55,787,525 | | |

| VOLT XXXIII LLC 2015-NPL5 A1 — 3.50% 3/25/2055** | | | 56,903,000 | | | | 56,905,276 | | |

Volvo Financial Equipment LLC Series A

2015-1A A2 — 0.95% 11/15/2017** | | | 40,215,000 | | | | 40,236,326 | | |

| | | $ | 751,211,056 | | |

| TOTAL ASSET-BACKED SECURITIES | | $ | 1,888,834,442 | | |

CORPORATE BONDS & NOTES — 10.2% | |

BASIC MATERIALS — 0.9% | |

| Thompson Creek Metals Co., Inc. — 9.75% 12/1/2017 | | $ | 49,274,000 | | | $ | 50,752,220 | | |

COMMUNICATIONS — 1.9% | |

| GTP Acquisition Partners I LLC — 4.704% 5/15/2043** | | $ | 16,569,000 | | | $ | 16,782,574 | | |

Unison Ground Lease Funding LLC | |

| —9.522% 4/15/2040** | | | 20,699,000 | | | | 23,372,276 | | |

| —5.78% 3/15/2043**†† | | | 12,545,000 | | | | 12,519,408 | | |

| —6.268% 3/15/2043** | | | 3,843,000 | | | | 3,823,016 | | |

| WCP ISSUER LLC — 6.657% 8/15/2043**†† | | | 15,711,000 | | | | 16,644,705 | | |

| Zayo Group LLC / Zayo Capital, Inc. — 8.125% 1/1/2020 | | | 34,514,000 | | | | 36,529,618 | | |

| | | $ | 109,671,597 | | |

CONSUMER, CYCLICAL — 2.9% | |

| Algeco Scotsman Global Finance plc — 8.50% 10/15/2018** | | $ | 56,846,000 | | | $ | 56,351,440 | | |

Continental Airlines 1997-1 Class A

Pass Through Trust — 7.461% 10/1/2016 | | | 220,678 | | | | 220,678 | | |

Continental Airlines 2000-1 Class B

Pass Through Trust — 8.388% 5/1/2022 | | | 5,242,493 | | | | 5,337,487 | | |

| HD Supply, Inc. — 11.00% 4/15/2020 | | | 37,556,000 | | | | 42,626,060 | | |

24

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2015 (Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair

Value | |

Northwest Airlines 1999-2 Class C

Pass Through Trust — 8.304% 9/1/2010†† | | $ | 23,450,793 | | | $ | 15,477,523 | | |

Northwest Airlines 2000-1 Class G

Pass Through Trust — 7.15% 4/1/2021 | | | 13,966,906 | | | | 14,665,251 | | |

| US Airways 1998-1B Pass Through Trust — 7.35% 7/30/2019 | | | 5,963,399 | | | | 6,201,935 | | |

| US Airways 1998-1C Pass Through Trust — 6.82% 1/30/2019 | | | 9,381,579 | | | | 9,287,763 | | |

| US Airways 1999-1C Pass Through Trust — 7.96% 7/20/2019 | | | 15,022,669 | | | | 13,370,176 | | |

| Wal-Mart Stores, Inc. — 2.875% 4/1/2015 | | | 1,875,000 | | | | 1,874,995 | | |

| | | $ | 165,413,308 | | |

CONSUMER, NON-CYCLICAL — 0.2% | |

| InSite Issuer LLC — 8.595% 8/15/2043**†† | | $ | 11,901,000 | | | $ | 12,613,275 | | |

DIVERSIFIED — 1.0% | |

| PT Boart Longyear Management Pty Ltd. — 10.00% 10/1/2018** | | $ | 51,802,000 | | | $ | 52,967,545 | | |

ENERGY — 1.3% | |

| EP Energy LLC / Everest Acquisition Finance, Inc. — 6.875% 5/1/2019 | | $ | 69,367,000 | | | $ | 71,101,175 | | |

| Atwood Oceanics, Inc. — 6.50% 2/1/2020 | | | 4,318,000 | | | | 4,156,075 | | |

| | | $ | 75,257,250 | | |

FINANCIAL — 0.3% | |

| N671US Trust — 7.50% 9/15/2020**†† | | $ | 15,228,136 | | | $ | 15,266,206 | | |

INDUSTRIAL — 1.7% | |

| Air 2 US — 10.127% 10/1/2020**†† | | $ | 39,258,228 | | | $ | 9,421,975 | | |

Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC / Reynolds

Group Issuer Lu — 7.875% 8/15/2019 | | | 71,693,000 | | | | 75,815,347 | | |

| Air 2 US — 8.027% 10/1/2020** | | | 8,580,276 | | | | 9,154,082 | | |