UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

|

(Name and address of agent for service) | Copy to: |

| |

J. RICHARD ATWOOD, PRESIDENT FPA NEW INCOME, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

|

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2019 | |

| | | | | | | | | |

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of the Fund's shareholder reports, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the FPA Funds website (fpa.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at fpa.com (for accounts held directly with the Fund).

You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 638-3060. Your election to receive reports in paper will apply to all funds held with the FPA Funds or through your financial intermediary.

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

FPA New Income, Inc. (the "Fund") returned 1.15% in the first quarter of 2019.

As of March 31, the portfolio had a yield-to-worst of 3.29% and an effective duration of 1.69 years1.

Treasury yields declined during the quarter and we saw the Treasury yield curve2 invert for the first time in over 11 years. Specifically, the metric that many market observers watch — the difference between the 2-year Treasury and the 10-year Treasury — stayed positive throughout the quarter, however, the metric that has been a better predictor of recessions — the difference between the 3-month Treasury yield and the 10-year Treasury — inverted briefly before reversing. Concurrently, credit spreads3 in both investment grade and high-yield bonds decreased meaningfully. On an absolute return basis, the combination of lower spreads and lower yields creates expensive bond markets, particularly in credit (which we define as investments rated BBB or lower). While we search and wait for attractive credit investments, we deploy capital into high-quality bonds (rated greater than BBB) that provide interest rate duration for the portfolio. The portfolio's credit-sensitive holdings decreased to 6.6% as of March 31, compared to 7.3% on Dec. 31, 2018.

Portfolio Attribution4

The largest contributors to performance during the first quarter were agency mortgage pools. The portfolio has benefitted from our efforts last year to add duration via agency mortgage pools. These mortgage pools appreciated in price due to declining interest rates and lower spreads.

The second-largest contributors to performance were asset-backed securities (ABS) backed by auto loans (prime or subprime loans) with the return due to coupon payments, in addition to higher prices caused by lower interest rates. The third-largest contributors to performance were collateralized loan obligations (CLO). Our CLO returns were driven mostly by coupon payments and, to a lesser extent, higher prices as a result of lower spreads.

The only detractors from performance in the first quarter were corporate high-yield bonds, predominantly due to a price decline in the bonds of an energy-related company which filed for bankruptcy during the quarter.

1 Yield-to-worst is the lowest possible yield that can be received on a bond without the issuer defaulting. It does not represent the yield that an investor should expect to receive. As of March 31, 2019, the Fund's subsidized/unsubsidized 30-Day SEC Standardized Yield ("SEC Yield") was 3.10%/3.03% respectively. The SEC Yield calculation begins with the Fund's dividend payments for the last 30 days, subtracts Fund expenses and uses this number to estimate returns for a year. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without waivers and/or reimbursements, yields would be reduced. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. The SEC Yield calculation is based on the price of the Fund at the beginning of the month. The SEC yield reflects prospective data and thus assumes payments collected by the Fund may fluctuate. Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates.

2 A yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates.

3 A credit spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality.

4 Top contributors and detractors to the Fund's performance are based on contribution to return for the periods noted. This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every sector's contribution to the overall Fund's performance during the quarter is available by contacting FPA at crm@fpa.com. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com. Past performance is no guarantee, nor is it indicative, of future results. Please see Important Disclosures at the end of this commentary.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

This bankruptcy filing was expected and the holding was 0.6% of the Fund's portfolio as of March 31. We are engaged with the various stakeholders in this process and are actively monitoring the situation. As such, we will reserve further comment for a future date.

Portfolio Activity

The table below shows the portfolio's exposures as of Dec. 31, 2018 and March 31, 2019:

| Sector | | % Portfolio

12/31/2018 | | % Portfolio

3/31/2019 | | Quarter/Quarter

Change (bps)5 | |

ABS | | | 49.9 | % | | | 50.0 | % | | | 10 | | |

Mortgage Backed (CMO6) | | | 12.9 | % | | | 11.2 | % | | | -170 | | |

Stripped Mortgage-backed | | | 4.0 | % | | | 3.6 | % | | | -40 | | |

Corporate | | | 5.7 | % | | | 5.2 | % | | | -50 | | |

CMBS7 | | | 3.7 | % | | | 4.9 | % | | | 120 | | |

Mortgage Pass-through | | | 13.7 | % | | | 14.3 | % | | | 60 | | |

U.S. Treasury | | | 5.0 | % | | | 5.0 | % | | | 0 | | |

Cash and equivalents | | | 5.1 | % | | | 5.8 | % | | | 70 | | |

Total | | | 100.0 | % | | | 100.0 | % | | | | | |

Yield-to-worst | | | 3.79 | % | | | 3.29 | % | | | -49 | | |

Effective Duration (years) | | | 1.85 | | | | 1.69 | | | | -0.19 | | |

Average Life8 (years) | | | 2.42 | | | | 2.15 | | | | -0.26 | | |

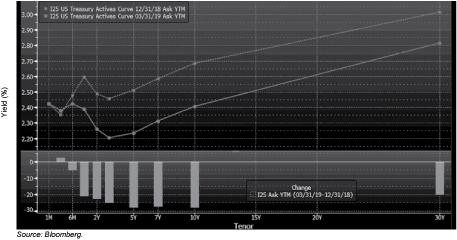

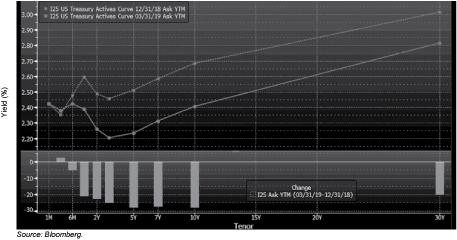

The Treasury market has been on 'Mr. Powell's wild ride' since the end of the year. For the past several months, intermediate and long Treasury yields declined due to recession fears sparked by weak global economic data and weak inflation. Against that backdrop, the U.S. Federal Reserve (Fed) entered 2019 with a stated bias toward tighter monetary policy via higher interest rates and a gradual reduction in the size of the Fed's balance sheet. In late March, Chairman Jerome Powell reversed course toward looser monetary policy with interest rate increases on hold for "some time," and a slower wind down of the balance sheet. These dynamics and the impact on Treasury yields9 are reflected in the graph below, which shows that Treasury rates declined further and the Treasury yield curve became slightly flatter or more inverted, depending on how one measures the shape of the curve.

5 Change in basis points (bps), except for effective duration and average life, which represents the change in years. Portfolio composition will change due to ongoing management of the Fund.

6 Collateralized mortgage obligations ("CMO") are mortgage-backed bonds that separate mortgage pools into different maturity classes.

7 Commercial mortgage-backed securities ("CMBS") are securities backed by commercial mortgages rather than residential mortgages.

8 The average life is the length of time the principal of a debt issue is expected to be outstanding.

9 Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

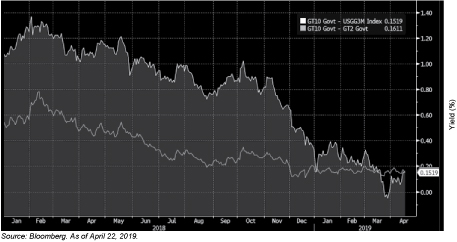

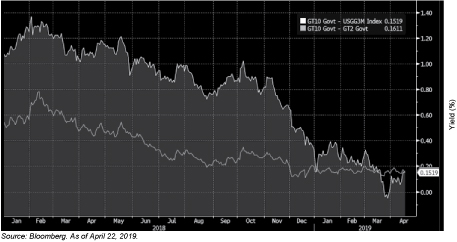

The graph below illustrates what we mentioned earlier. The yield curve, as measured by the difference between the 2-year Treasury and the 10-year Treasury, did not invert whereas the difference between the 3-month Treasury and the 10-year Treasury, the more reliable predictor of future recessions in our view, did briefly invert in late March.

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

A yield curve inversion where the short-term yield is higher than the long-term yield, if it persists, historically has signaled an economic downturn of some magnitude in the near future. Commentators' opinions on this market event ranged from "this time is different, so a recession is not in the cards," to "based on history, the chances of a recession in the next 12 to 18 months is elevated." As described further below, we acknowledge both prospects and invest knowing our limitations, namely that our ability to predict the ultimate outcome and its timing are, at best, an educated guess.

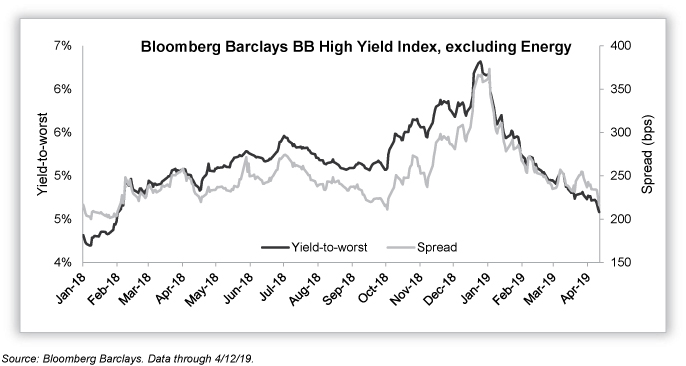

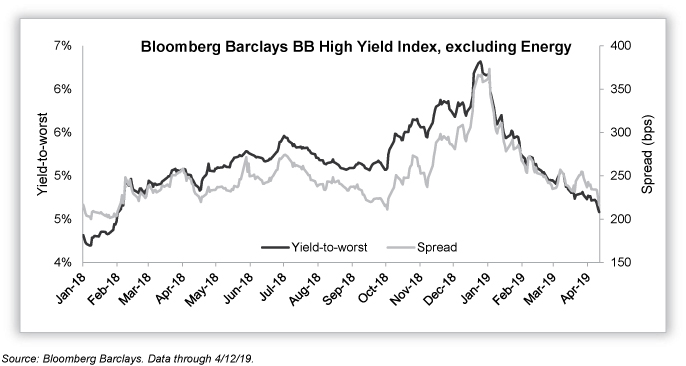

At the same time that the Treasury market expressed recession fears, risk assets appreciated in price. Following a broad sell-off in high-yield bonds and leveraged loans at the end of 2018, we were hopeful that we were seeing the green shoots of a cheaper credit market, ripe with opportunities for us to harvest. That didn't last long. Within the first week of 2019, credit spreads rallied dramatically and credit markets have been "en fuego" ever since, as shown by the significant decline in spreads in the following graph. The graph below shows the decline in spreads on the BB-rated component of the high-yield index (excluding energy), which we focus on because it shows us what the 'fairway' of the market is doing and strips out the effects of the more volatile components of the high-yield index:

While high-yield spreads have not quite reached the low points of 2018, the magnitude of the high-yield market rally feels greater because spreads have declined at the same time that Treasury yields have declined, resulting in lower overall yields than what lower spreads alone would suggest. This market has been doubly painful for us since we focus on absolute return, and we therefore place a lot of value on overall yields, not spread alone.

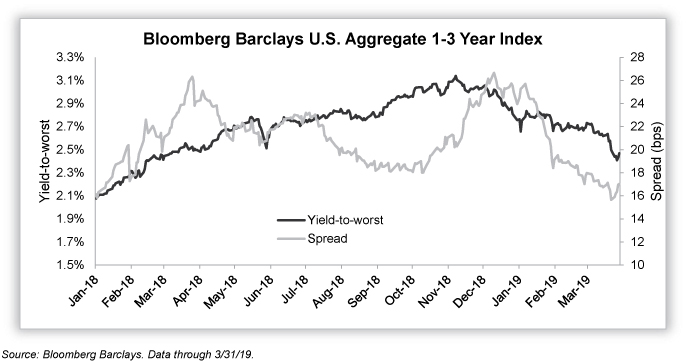

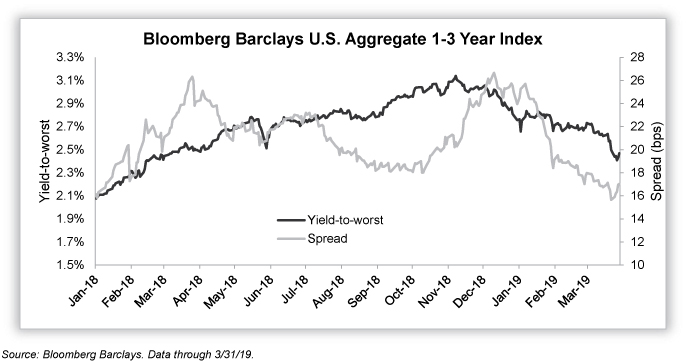

This combination of spread and yield compression appeared in high-quality bonds as well, as shown in the following graph.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

If history is any guide, when the shape of the yield curve looks like it does now, high-yield credit spreads tend to increase because the risk associated with these lower-quality bonds rises in anticipation of an economic slowdown or recession. For the same reason, the spread on high-quality bonds tends to increase too, though not as dramatically.

It is counterintuitive then that one part of the financial markets (Treasury yields) tells us that economic growth is in peril while other parts of the financial markets (spreads and equities) tell us that everything is great. These conditions can exist simultaneously, we would guess, because the Fed's U-turn on monetary policy reinforced, yet again, the notion that the Fed has effectively added financial stability to its mandate. In our opinion, the market therefore believes the Fed would step in to support financial markets and asset prices.

Under these conditions, undisciplined investing that chases returns may benefit. What do disciplined investors like us do? We wait for better buying opportunities at lower prices. Elevated prices for risk assets have steered us toward highly-rated bonds that we believe do not bear a lot of spread-related short-term mark-to-market risk. Within these high-quality bonds, we are trying to buy as much duration as we can within the confines of our duration test. That test limits us to bonds that we expect will produce positive returns over 12 months if yields rise by 100 basis points over that timeframe. One might wonder why it makes sense to extend duration when an inverted yield curve offers better or similar yields for shorter duration bonds. The rationale for our approach is twofold. First, while it is true that one can buy slightly higher yields for shorter duration Treasury bonds, the yield curve for bonds that are not risk-free and offer a spread that is not inverted means that these longer duration bonds with spread offer more yield than shorter duration bonds with spread. Second, historically, Treasury yields have declined when the yield curve is flat or inverted. If history repeats, our long duration bonds offer some price appreciation potential in an environment of declining interest rates. We believe the value in our approach is that the bonds we buy have upside return potential above today's yields in the event that yields decline, while potentially insulating the portfolio from capital losses in the event that yields rise.

Today's portfolio reflects this investment approach. Most of the portfolio's cash was invested in highly-rated agency mortgages, asset-backed securities and commercial mortgage-backed securities with a duration of

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

approximately three years. We were able to find a few attractive credit investments but these opportunities today are rare. The credit exposure in the portfolio (defined as investments rated BBB or lower) stands at 6.6%, reflecting an expensive credit market.

Market Commentary

This quote from Grant's Interest Rate Observer dated March 5, 2019 is a good introduction to this quarter's market commentary.

"Socialists eventually run out of other people's money, as Margaret Thatcher observed, but central banks print their own."

We start there because there has been a lot of discussion in this country about Modern Monetary Theory (MMT). A simplified description of MMT is as follows:

A country with its own currency does not have to worry about accumulating too much debt because it can always print more money to make the interest payments. The only constraint of spending is inflation, which can break out if the public and private sectors spend too much at the same time. As long as there are enough workers and enough equipment to meet growing demand without igniting inflation, the government can spend what it needs to maintain employment and meet its objectives. Think of this theory as government deficits financed by printing money versus the traditional debt-financed deficit.

This is not a new theory. As recently as April 2016, ex-Fed Chairman Ben Bernanke wrote in a Brookings Institute blog post that printing money to finance deficits is an appropriate policy tool. He does not advocate printing money as a primary policy tool for central bankers, but Bernanke thinks it should be considered after zero interest rate policy (ZIRP), negative interest rate policy (NIRP) and quantitative easing (QE) have been implemented and their efficacy has become limited.

MMT attempts to facilitate more aggressive fiscal policy tools as a way to improve an economy in a recession. In addition, some within the political arena view MMT as an elegant solution to a debt problem. For instance, MMT could be used to finance Medicare-for-all, badly needed infrastructure projects and to plug social security deficits. Debt financing of these ideas normally costs money in the form of interest expense and, concomitantly, increased taxes to pay that interest. If that interest cost is greater than nominal growth, or the amount of debt growth outstanding is greater than nominal growth, the result is increased (i.e., worse) government debt ratios. If this increased indebtedness is financed via money printing, the debt issue could go away as long as the printed money is permanently in the system. One means of executing this money printing is for the U.S. Treasury to issue zero coupon perpetual bonds and have the Federal Reserve purchase the bonds. (One could say printing money is similar and simpler.) Voila, political objectives are met without any cost to the taxpayer or the nation, or so say the proponents of MMT.

How did MMT gain mainstream traction? At the exit of the Great Financial Crisis, the Fed implemented ZIRP by pegging the Fed Funds rate at or near zero. Europe and Japan went further and used negative short-term interest rates to provide even more monetary stimulus. Next came QE. The Fed bought long maturity Treasury bonds and agency mortgages. Europe and Japan again went a step further and bought high-quality corporate bonds and Exchange Traded Funds. The idea was to drive up high-quality asset prices, thereby financing corporate capital expenditures. In addition, investors became wealthier from the trickle-down effects of higher prices for risk assets. The expectation was that the increased wealth would spur individuals to spend more, which would then beget greater economic growth (the virtuous cycle).

However, after 10 years of these policies, developed market GDP growth is still sluggish and inflation is still below central bank targets of 2%. In Europe and Japan, economic growth continues to be below expectations

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

after a very aggressive utilization of these new, unconventional monetary policy tools. Granted, in macroeconomic terms, 10 years is not a long time. But these unconventional policies have not produced impressive results thus far, and the ultimate outcome is still to be determined.

The current slowdown in economic growth in Europe, China, Japan and the United States has policy makers concerned that the existing set of monetary tools may not be enough to revive the economy once it goes into a recession. If the old toolkit doesn't work, what's next? MMT.

We are not surprised that the 2020 presidential election is turning into a broad and contentious debate about the merits of MMT since it offers a convenient solution for spendthrift candidates. Wise or not, the specter of MMT creates uncertainties around both monetary and fiscal policy.

We do not pretend to have any analytical advantage in evaluating the efficacy of MMT or its impact on the economy, inflation and fixed income markets. However, we have some idea of how well ZIRP, NIRP, and QE have worked. In our opinion, the results are mixed, with some of the negative implications just starting to surface. We are observers of policy actions and it would appear that each new policy idea is less proven and more extreme then the last. This leads us to have some level of conviction that during the next economic downturn — and there will be one at some point — the debate and potential use of these tools will create increased levels of market volatility along with greater uncertainty regarding the economic impact.

Does any of this affect how we deploy capital? We like to say that such topics are informative but not determinative of our investments. One of the reasons we employ the duration test described earlier is to compensate for these kinds of potential non-consensus policy implementations. In our opinion, what is appropriate is to stay dedicated to an investment discipline. By using this approach, our expectation is that our clients will have confidence in how we will act and visibility on how the portfolio will perform amid changes in the market.

Thank you for your continued trust and support.

Respectfully submitted,

Thomas H. Atteberry

Portfolio Manager

Abhijeet Patwardhan

Portfolio Manager

April 2019

7

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities.

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The funds may purchase foreign securities which are subject to interest rate, currency exchange rate, economic and political risks: this may be enhanced when investing in emerging markets. The securities of smaller, less well-known companies can be more volatile than those of larger companies. The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds. Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; derivatives may increase volatility. High yield securities can be volatile and subject to much higher instances of default.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

8

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

March 31, 2019 (Unaudited)

Common Stocks | | | | | | | 0.0 | %* | |

Industrials | | | 0.0 | %* | | | | | |

Bonds & Debentures | | | | | 99.6 | % | |

Asset-Backed Securities | | | 49.9 | % | | | | | |

Residential Mortgage-Backed Securities | | | 25.5 | % | | | | | |

U.S. Treasuries | | | 10.4 | % | | | | | |

Commercial Mortgage-Backed Securities | | | 8.6 | % | | | | | |

Corporate Bank Debt | | | 2.7 | % | | | | | |

Corporate Bonds & Notes | | | 2.5 | % | | | | | |

Short-term Investments | | | | | 0.1 | % | |

Other Assets And Liabilities, Net | | | | | 0.3 | % | |

Net Assets | | | | | 100.0 | % | |

* Less than 0.05%

9

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

March 31, 2019

(Unaudited)

COMMON STOCK — 0.0% | | Shares or

Principal

Amount | |

Fair Value | |

INDUSTRIALS — 0.0% | |

Boart Longyear Ltd.(a) (Cost $633,546) | | | 262,296,050 | | | $ | 744,973 | | |

BONDS & DEBENTURES | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 8.6% | |

AGENCY — 0.4% | |

Government National Mortgage Association 2013-55 A —

1.317% 5/16/2034 | | $ | 325,002 | | | $ | 320,987 | | |

Government National Mortgage Association 2011-49 A —

2.45% 7/16/2038 | | | 35,170 | | | | 35,095 | | |

Government National Mortgage Association 2015-41 AF, VRN —

3.063% 9/16/2056(b) | | | 20,496,990 | | | | 20,927,121 | | |

Government National Mortgage Association 2011-9 C, VRN —

3.512% 9/16/2041(b) | | | 5,815,787 | | | | 5,856,994 | | |

Government National Mortgage Association 2010-148 AC —

7.00% 12/16/2050(b) | | | 36,230 | | | | 36,476 | | |

| | | $ | 27,176,673 | | |

AGENCY STRIPPED — 4.6% | |

Government National Mortgage Association 2004-10 IO —

0.00% 1/16/2044(b) | | $ | 4,810,629 | | | $ | 5 | | |

Government National Mortgage Association 2012-45 IO —

0.01% 4/16/2053(b) | | | 11,181,611 | | | | 66,422 | | |

Government National Mortgage Association 2002-56 IO —

0.043% 6/16/2042(b) | | | 17,329 | | | | 18 | | |

Government National Mortgage Association 2009-119 IO —

0.105% 12/16/2049(b) | | | 13,637,441 | | | | 99,492 | | |

Government National Mortgage Association 2009-86 IO —

0.109% 10/16/2049(b) | | | 16,045,010 | | | | 83,240 | | |

Government National Mortgage Association 2009-105 IO —

0.166% 11/16/2049(b) | | | 5,005,131 | | | | 21,944 | | |

Government National Mortgage Association 2009-71 IO —

0.262% 7/16/2049(b) | | | 3,206,872 | | | | 25,958 | | |

Government National Mortgage Association 2008-8 IO —

0.29% 11/16/2047(b) | | | 6,624,245 | | | | 52,339 | | |

Government National Mortgage Association 2009-49 IO —

0.357% 6/16/2049(b) | | | 8,013,270 | | | | 73,571 | | |

Government National Mortgage Association 2012-125 IO —

0.385% 2/16/2053(b) | | | 71,187,807 | | | | 1,798,653 | | |

Government National Mortgage Association 2009-4 IO —

0.39% 1/16/2049(b) | | | 2,874,512 | | | | 21,545 | | |

10

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Government National Mortgage Association 2009-60 IO —

0.509% 6/16/2049(b) | | $ | 7,081,302 | | | $ | 65,242 | | |

Government National Mortgage Association 2010-123 IO —

0.517% 9/16/2050(b) | | | 6,316,413 | | | | 103,682 | | |

Government National Mortgage Association 2012-25 IO —

0.545% 8/16/2052(b) | | | 86,480,977 | | | | 1,674,583 | | |

Government National Mortgage Association 2005-9 IO —

0.546% 1/16/2045(b) | | | 1,353,465 | | | | 11,839 | | |

Government National Mortgage Association 2007-77 IO —

0.551% 11/16/2047(b) | | | 21,296,317 | | | | 296,208 | | |

Government National Mortgage Association 2009-30 IO —

0.57% 3/16/2049(b) | | | 5,190,072 | | | | 139,398 | | |

Government National Mortgage Association 2008-24 IO —

0.596% 11/16/2047(b) | | | 386,730 | | | | 2,651 | | |

Government National Mortgage Association 2015-41 IO —

0.628% 9/16/2056(b) | | | 33,717,521 | | | | 1,517,393 | | |

Government National Mortgage Association 2013-45 IO —

0.647% 12/16/2053(b) | | | 69,840,677 | | | | 1,554,584 | | |

Government National Mortgage Association 2014-157 IO —

0.65% 5/16/2055(b) | | | 144,652,813 | | | | 5,779,082 | | |

Government National Mortgage Association 2012-79 IO —

0.674% 3/16/2053(b) | | | 117,096,192 | | | | 3,711,411 | | |

Government National Mortgage Association 2012-58 IO —

0.70% 2/16/2053(b) | | | 216,500,217 | | | | 6,155,058 | | |

Government National Mortgage Association 2012-150 IO —

0.723% 11/16/2052(b) | | | 71,322,143 | | | | 2,740,646 | | |

Government National Mortgage Association 2013-125 IO —

0.723% 10/16/2054(b) | | | 21,291,650 | | | | 736,433 | | |

Government National Mortgage Association 2014-77 IO —

0.726% 12/16/2047(b) | | | 50,607,903 | | | | 1,976,026 | | |

Government National Mortgage Association 2004-43 IO —

0.741% 6/16/2044(b) | | | 11,964,261 | | | | 154,465 | | |

Government National Mortgage Association 2014-138 IO —

0.743% 4/16/2056(b) | | | 29,222,614 | | | | 1,391,987 | | |

Government National Mortgage Association 2015-86 IO —

0.762% 5/16/2052(b) | | | 69,209,727 | | | | 3,414,946 | | |

Government National Mortgage Association 2012-114 IO —

0.766% 1/16/2053(b) | | | 46,120,393 | | | | 2,087,750 | | |

Government National Mortgage Association 2015-19 IO —

0.772% 1/16/2057(b) | | | 91,642,611 | | | | 4,873,343 | | |

Government National Mortgage Association 2014-110 IO —

0.773% 1/16/2057(b) | | | 72,671,237 | | | | 3,762,691 | | |

11

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Government National Mortgage Association 2015-7 IO —

0.789% 1/16/2057(b) | | $ | 58,736,123 | | | $ | 3,176,003 | | |

Government National Mortgage Association 2014-153 IO —

0.79% 4/16/2056(b) | | | 210,177,354 | | | | 10,507,670 | | |

Government National Mortgage Association 2014-175 IO —

0.797% 4/16/2056(b) | | | 207,578,163 | | | | 10,664,826 | | |

Government National Mortgage Association 2014-164 IO —

0.802% 1/16/2056(b) | | | 266,678,457 | | | | 12,159,498 | | |

Government National Mortgage Association 2014-135 IO —

0.82% 1/16/2056(b) | | | 289,960,429 | | | | 14,536,354 | | |

Government National Mortgage Association 2015-101 IO —

0.825% 3/16/2052(b) | | | 153,502,409 | | | | 7,682,519 | | |

Government National Mortgage Association 2008-45 IO —

0.85% 2/16/2048(b) | | | 2,625,280 | | | | 4,921 | | |

Government National Mortgage Association 2015-47 IO —

0.851% 10/16/2056(b) | | | 160,530,816 | | | | 8,405,988 | | |

Government National Mortgage Association 2006-55 IO —

0.872% 8/16/2046(b) | | | 7,541,328 | | | | 84,356 | | |

Government National Mortgage Association 2014-187 IO —

0.881% 5/16/2056(b) | | | 179,482,538 | | | | 9,566,796 | | |

Government National Mortgage Association 2015-169 IO —

0.925% 7/16/2057(b) | | | 223,462,951 | | | | 13,880,826 | | |

Government National Mortgage Association 2012-53 IO —

0.931% 3/16/2047(b) | | | 58,289,663 | | | | 2,135,687 | | |

Government National Mortgage Association 2015-114 IO —

0.937% 3/15/2057(b) | | | 159,293,977 | | | | 9,303,103 | | |

Government National Mortgage Association 2015-128 IO —

0.938% 12/16/2056(b) | | | 198,674,713 | | | | 11,100,453 | | |

Government National Mortgage Association 2015-150 IO —

0.942% 9/16/2057(b) | | | 225,845,008 | | | | 14,665,336 | | |

Government National Mortgage Association 2015-108 IO —

0.946% 10/16/2056(b) | | | 34,494,648 | | | | 1,962,756 | | |

Government National Mortgage Association 2015-160 IO —

0.947% 1/16/2056(b) | | | 251,805,228 | | | | 15,324,514 | | |

Government National Mortgage Association 2008-48 IO —

0.968% 4/16/2048(b) | | | 8,860,805 | | | | 126,262 | | |

Government National Mortgage Association 2016-65 IO —

1.002% 1/16/2058(b) | | | 241,476,794 | | | | 18,134,279 | | |

Government National Mortgage Association 2016-106 IO —

1.031% 9/16/2058(b) | | | 240,049,089 | | | | 17,835,911 | | |

Government National Mortgage Association 2016-125 IO —

1.062% 12/16/2057(b) | | | 137,585,967 | | | | 10,745,519 | | |

12

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Government National Mortgage Association 2008-92 IO —

1.176% 10/16/2048(b) | | $ | 12,421,445 | | | $ | 123,685 | | |

Government National Mortgage Association 2004-108 IO —

1.93% 12/16/2044(b) | | | 399,916 | | | | 3,455 | | |

Government National Mortgage Association 2006-30 IO —

2.391% 5/16/2046(b) | | | 873,174 | | | | 9,547 | | |

Government National Mortgage Association — 3.10% 5/16/2059 | | | 68,607,000 | | | | 68,362,985 | | |

| | | $ | 304,895,854 | | |

NON-AGENCY — 3.6% | |

A10 Term Asset Financing LLC 2017-1A A1FX — 2.34% 3/15/2036(c) | | $ | 5,145,892 | | | $ | 5,143,652 | | |

Aventura Mall Trust M 2013-AVM A — 3.743% 12/5/2032(b)(c) | | | 37,824,000 | | | | 38,462,045 | | |

Bear Stearns Commercial Mortgage Securities Trust 2005-PWR7 B —

5.142% 2/11/2041(b) | | | 4,748,953 | | | | 4,760,901 | | |

Citigroup Commercial Mortgage Trust 2017-C4 A2 — 3.19% 10/12/2050 | | | 18,524,000 | | | | 18,736,079 | | |

COMM Mortgage Trust 2013-LC6 A4 — 2.941% 1/10/2046 | | | 3,497,000 | | | | 3,503,620 | | |

COMM Mortgage Trust 2014-FL5 B, 1M LIBOR + 2.150% —

3.875% 10/15/2031(b)(c) | | | 945,912 | | | | 943,219 | | |

COMM Mortgage Trust 2014-FL5 C, 1M LIBOR + 2.150% —

3.875% 10/15/2031(b)(c) | | | 8,340,000 | | | | 8,299,639 | | |

Credit Suisse Commercial Mortgage Trust Series 2016-MFF E,

1M LIBOR + 6.000% — 8.484% 11/15/2033(b)(c) | | | 34,278,000 | | | | 34,252,110 | | |

DBUBS Mortgage Trust 2011-LC2A A4 — 4.537% 7/10/2044(c) | | | 44,816,836 | | | | 46,135,580 | | |

J.P. Morgan Chase Commercial Mortgage Securities Trust I 2016-WIKI A —

2.798% 10/5/2031(c) | | | 7,922,000 | | | | 7,885,021 | | |

JP Morgan Chase Commercial Mortgage Securities Trust 2010-C1 A3 —

5.058% 6/15/2043(c) | | | 7,277,000 | | | | 7,438,022 | | |

Latitude Management Real Estate Capita 2016-CRE2 A,

1M LIBOR + 1.700% — 4.19% 11/24/2031(b)(c) | | | 14,526,895 | | | | 14,562,181 | | |

OBP Depositor LLC Trust P 2010-OBP A — 4.646% 7/15/2045(c) | | | 4,000,000 | | | | 4,086,289 | | |

Wells Fargo Commercial Mortgage Trust 2015-C26 A2 —

2.663% 2/15/2048 | | | 7,829,941 | | | | 7,801,210 | | |

WFRBS Commercial Mortgage Trust 2013-UBS1 A3 —

3.591% 3/15/2046 | | | 30,588,000 | | | | 30,908,009 | | |

| | | $ | 232,917,577 | | |

TOTAL COMMERICAL MORTGAGE-BACKED SECURITIES

(Cost $611,044,008) | | $ | 564,990,104 | | |

13

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 25.5% | |

AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 4.0% | |

Federal Home Loan Mortgage Corp. 4170 QE — 2.00% 5/15/2032 | | $ | 1,768,914 | | | $ | 1,740,715 | | |

Federal Home Loan Mortgage Corp. 3979 HD — 2.50% 12/15/2026 | | | 2,834,820 | | | | 2,826,748 | | |

Federal Home Loan Mortgage Corp. 4304 DA — 2.50% 1/15/2027 | | | 1,047,633 | | | | 1,044,419 | | |

Federal Home Loan Mortgage Corp. 4010 DE — 2.50% 2/15/2027 | | | 3,336,349 | | | | 3,326,711 | | |

Federal Home Loan Mortgage Corp. 3914 MA — 3.00% 6/15/2026 | | | 2,166,571 | | | | 2,186,729 | | |

Federal Home Loan Mortgage Corp. 4297 CA — 3.00% 12/15/2030 | | | 3,827,965 | | | | 3,849,626 | | |

Federal Home Loan Mortgage Corp. 4664 TA — 3.00% 9/15/2037 | | | 6,108,376 | | | | 6,135,795 | | |

Federal Home Loan Mortgage Corp. 4504 DN — 3.00% 10/15/2040 | | | 12,610,128 | | | | 12,671,153 | | |

Federal Home Loan Mortgage Corp. 3862 MB — 3.50% 5/15/2026 | | | 18,302,683 | | | | 18,696,123 | | |

Federal Home Loan Mortgage Corp. 3828 VE — 4.50% 1/15/2024 | | | 989,258 | | | | 1,032,404 | | |

Federal Home Loan Mortgage Corp. 4395 NT — 4.50% 7/15/2026 | | | 8,811,535 | | | | 9,140,187 | | |

Federal National Mortgage Association 2012-117 DA — 1.50% 12/25/2039 | | | 1,153,313 | | | | 1,059,729 | | |

Federal National Mortgage Association 2014-80 GD — 2.00% 2/25/2042 | | | 18,439,625 | | | | 17,936,465 | | |

Federal National Mortgage Association 2014-21 ED — 2.25% 4/25/2029 | | | 750,717 | | | | 743,878 | | |

Federal National Mortgage Association 2013-135 KM — 2.50% 3/25/2028 | | | 1,630,627 | | | | 1,624,792 | | |

Federal National Mortgage Association 4387 VA — 3.00% 2/15/2026 | | | 496,741 | | | | 501,070 | | |

Federal National Mortgage Association 2017-30 G — 3.00% 7/25/2040 | | | 9,643,870 | | | | 9,642,841 | | |

Federal National Mortgage Association 2013-93 PJ — 3.00% 7/25/2042 | | | 2,013,360 | | | | 2,029,076 | | |

Federal National Mortgage Association 2017-16 JA — 3.00% 2/25/2043 | | | 23,951,803 | | | | 23,932,658 | | |

Federal National Mortgage Association 2018-16 HA — 3.00% 7/25/2043 | | | 24,034,866 | | | | 24,032,311 | | |

Federal National Mortgage Association 2017-15 DA — 3.00% 12/25/2044 | | | 18,061,692 | | | | 18,074,776 | | |

Federal National Mortgage Association 2011-98 VE — 3.50% 6/25/2026 | | | 13,677,000 | | | | 13,848,869 | | |

Federal National Mortgage Association 2011-80 KB — 3.50% 8/25/2026 | | | 13,578,000 | | | | 13,773,409 | | |

Federal National Mortgage Association 2012-144 PD — 3.50% 4/25/2042 | | | 4,284,227 | | | | 4,364,960 | | |

Federal National Mortgage Association 2017-45 KD — 3.50% 2/25/2044 | | | 18,001,409 | | | | 18,184,910 | | |

Federal National Mortgage Association 2017-52 KC — 3.50% 4/25/2044 | | | 18,269,317 | | | | 18,460,539 | | |

Federal National Mortgage Association 2017-59 DC — 3.50% 5/25/2044 | | | 25,243,976 | | | | 25,501,161 | | |

Federal National Mortgage Association 2009-76 MA — 4.00% 9/25/2024 | | | 2,135 | | | | 2,136 | | |

Federal National Mortgage Association 2012-95 AB — 4.00% 11/25/2040 | | | 97,084 | | | | 97,462 | | |

Federal National Mortgage Association 2009-70 NU — 4.25% 8/25/2019 | | | 538 | | | | 539 | | |

Federal National Mortgage Association 2012-40 GC — 4.50% 12/25/2040 | | | 1,100,692 | | | | 1,125,231 | | |

Federal National Mortgage Association 2012-67 PB — 4.50% 12/25/2040 | | | 865,505 | | | | 871,031 | | |

Federal National Mortgage Association 2004-60 LB — 5.00% 4/25/2034 | | | 1,542,359 | | | | 1,579,860 | | |

Federal National Mortgage Association 2010 43 MK — 5.50% 5/25/2040 | | | 1,905,358 | | | | 2,036,810 | | |

| | | $ | 262,075,123 | | |

AGENCY POOL ADJUSTABLE RATE — 0.0% | |

Federal National Mortgage Association 865963,

12M USD LIBOR + 1.705% — 4.429% 3/1/2036(b) | | $ | 721,946 | | | $ | 753,395 | | |

14

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

AGENCY POOL FIXED RATE — 14.3% | |

Federal Home Loan Mortgage Corp. J24941 — 2.00% 8/1/2023 | | $ | 2,079,284 | | | $ | 2,074,248 | | |

Federal Home Loan Mortgage Corp. J21434 — 2.50% 12/1/2027 | | | 19,742,182 | | | | 19,752,622 | | |

Federal Home Loan Mortgage Corp. G16178 — 2.50% 11/1/2028 | | | 22,871,117 | | | | 22,883,211 | | |

Federal Home Loan Mortgage Corp. G16618 — 2.50% 1/1/2030 | | | 37,735,870 | | | | 37,755,825 | | |

Federal Home Loan Mortgage Corp. J16678 — 3.00% 9/1/2026 | | | 4,832,788 | | | | 4,879,137 | | |

Federal Home Loan Mortgage Corp. J17544 — 3.00% 12/1/2026 | | | 6,990,118 | | | | 7,078,443 | | |

Federal Home Loan Mortgage Corp. G16406 — 3.00% 1/1/2028 | | | 21,394,960 | | | | 21,712,104 | | |

Federal Home Loan Mortgage Corp. G16476 — 3.00% 4/1/2028 | | | 30,605,691 | | | | 31,011,547 | | |

Federal Home Loan Mortgage Corp. G16620 — 3.00% 8/1/2028 | | | 9,663,187 | | | | 9,791,328 | | |

Federal Home Loan Mortgage Corp. G16478 — 3.00% 5/1/2030 | | | 30,059,217 | | | | 30,373,284 | | |

Federal Home Loan Mortgage Corp. G16592 — 3.00% 2/1/2032 | | | 17,449,078 | | | | 17,658,655 | | |

Federal Home Loan Mortgage Corp. G16473 — 3.50% 1/1/2028 | | | 35,111,598 | | | | 36,055,577 | | |

Federal Home Loan Mortgage Corp. G16613 — 3.50% 8/1/2028 | | | 9,102,421 | | | | 9,338,607 | | |

Federal Home Loan Mortgage Corp. V62149 — 3.50% 9/1/2028 | | | 6,307,571 | | | | 6,467,295 | | |

Federal Home Loan Mortgage Corp. J26472 — 3.50% 11/1/2028 | | | 7,275,881 | | | | 7,480,588 | | |

Federal Home Loan Mortgage Corp. G15169 — 4.50% 9/1/2026 | | | 1,672,644 | | | | 1,731,657 | | |

Federal Home Loan Mortgage Corp. G15272 — 4.50% 9/1/2026 | | | 1,011,358 | | | | 1,026,784 | | |

Federal Home Loan Mortgage Corp. G15875 — 4.50% 9/1/2026 | | | 2,486,389 | | | | 2,561,415 | | |

Federal Home Loan Mortgage Corp. G15036 — 5.00% 6/1/2024 | | | 994,428 | | | | 1,008,861 | | |

Federal Home Loan Mortgage Corp. G13667 — 5.00% 8/1/2024 | | | 86,064 | | | | 87,904 | | |

Federal Home Loan Mortgage Corp. G15173 — 5.00% 6/1/2026 | | | 754,363 | | | | 767,033 | | |

Federal Home Loan Mortgage Corp. G15407 — 5.00% 6/1/2026 | | | 2,302,087 | | | | 2,376,778 | | |

Federal Home Loan Mortgage Corp. J01270 — 5.50% 2/1/2021 | | | 24,440 | | | | 24,871 | | |

Federal Home Loan Mortgage Corp. G15230 — 5.50% 12/1/2024 | | | 1,837,362 | | | | 1,880,737 | | |

Federal Home Loan Mortgage Corp. G15458 — 5.50% 12/1/2024 | | | 422,858 | | | | 436,617 | | |

Federal Home Loan Mortgage Corp. G14460 — 6.00% 1/1/2024 | | | 163,627 | | | | 168,664 | | |

Federal National Mortgage Association AB6251 — 2.00% 9/1/2022 | | | 384,423 | | | | 383,167 | | |

Federal National Mortgage Association AB7515 — 2.00% 1/1/2023 | | | 234,902 | | | | 234,164 | | |

Federal National Mortgage Association AQ7281 — 2.00% 12/1/2027 | | | 1,149,820 | | | | 1,135,616 | | |

Federal National Mortgage Association BM4743 — 2.00% 8/1/2030 | | | 43,040,387 | | | | 42,508,705 | | |

Federal National Mortgage Association MA1502 — 2.50% 7/1/2023 | | | 20,051,909 | | | | 20,117,094 | | |

Federal National Mortgage Association AB6192 — 2.50% 9/1/2027 | | | 1,977,796 | | | | 1,977,763 | | |

Federal National Mortgage Association AR6882 — 2.50% 2/1/2028 | | | 3,612,819 | | | | 3,612,757 | | |

Federal National Mortgage Association BM4406 — 2.50% 9/1/2028 | | | 15,444,222 | | | | 15,443,959 | | |

Federal National Mortgage Association BM5514 — 2.50% 2/1/2029 | | | 43,659,477 | | | | 43,658,735 | | |

Federal National Mortgage Association BM4386 — 2.50% 8/1/2030 | | | 14,499,641 | | | | 14,499,394 | | |

Federal National Mortgage Association BM1595 — 2.50% 3/1/2031 | | | 2,376,434 | | | | 2,376,394 | | |

Federal National Mortgage Association MA2726 — 3.00% 8/1/2026 | | | 3,444,039 | | | | 3,496,671 | | |

Federal National Mortgage Association AJ6973 — 3.00% 11/1/2026 | | | 1,711,325 | | | | 1,727,852 | | |

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Federal National Mortgage Association AJ9387 — 3.00% 12/1/2026 | | $ | 876,299 | | | $ | 884,761 | | |

Federal National Mortgage Association AU3826 — 3.00% 12/1/2026 | | | 24,605,915 | | | | 24,866,305 | | |

Federal National Mortgage Association AL1345 — 3.00% 2/1/2027 | | | 1,585,349 | | | | 1,600,659 | | |

Federal National Mortgage Association AB4673 — 3.00% 3/1/2027 | | | 1,728,510 | | | | 1,748,984 | | |

Federal National Mortgage Association AK9467 — 3.00% 3/1/2027 | | | 1,826,198 | | | | 1,843,834 | | |

Federal National Mortgage Association AL3458 — 3.00% 5/1/2028 | | | 35,874,426 | | | | 36,276,926 | | |

Federal National Mortgage Association AL4693 — 3.00% 8/1/2028 | | | 1,537,821 | | | | 1,552,672 | | |

Federal National Mortgage Association MA3480 — 3.00% 8/1/2028 | | | 6,621,602 | | | | 6,704,172 | | |

Federal National Mortgage Association AU6681 — 3.00% 9/1/2028 | | | 15,025,594 | | | | 15,203,568 | | |

Federal National Mortgage Association AU6682 — 3.00% 9/1/2028 | | | 76,134,347 | | | | 77,036,135 | | |

Federal National Mortgage Association MA3485 — 3.00% 9/1/2028 | | | 3,337,552 | | | | 3,376,041 | | |

Federal National Mortgage Association 890837 — 3.00% 10/1/2028 | | | 18,161,299 | | | | 18,365,063 | | |

Federal National Mortgage Association BM4485 — 3.00% 9/1/2030 | | | 50,035,026 | | | | 50,596,404 | | |

Federal National Mortgage Association BM3539 — 3.00% 10/1/2030 | | | 36,463,204 | | | | 36,906,495 | | |

Federal National Mortgage Association BM4536 — 3.00% 8/1/2031 | | | 53,655,365 | | | | 54,290,897 | | |

Federal National Mortgage Association BM3973 — 3.00% 4/1/2032 | | | 55,358,971 | | | | 56,014,681 | | |

Federal National Mortgage Association AB1940 — 3.50% 12/1/2025 | | | 1,889,167 | | | | 1,931,725 | | |

Federal National Mortgage Association MA3075 — 3.50% 7/1/2027 | | | 30,604,942 | | | | 31,418,733 | | |

Federal National Mortgage Association MA3132 — 3.50% 9/1/2027 | | | 6,713,157 | | | | 6,887,465 | | |

Federal National Mortgage Association MA3251 — 3.50% 1/1/2028 | | | 8,355,326 | | | | 8,572,274 | | |

Federal National Mortgage Association MA3321 — 3.50% 3/1/2028 | | | 4,874,248 | | | | 5,000,809 | | |

Federal National Mortgage Association CA1631 — 3.50% 10/1/2028 | | | 8,151,181 | | | | 8,350,092 | | |

Federal National Mortgage Association MA3514 — 3.50% 11/1/2028 | | | 21,374,979 | | | | 21,896,586 | | |

Federal National Mortgage Association MA3542 — 3.50% 12/1/2028 | | | 19,685,771 | | | | 20,166,157 | | |

Federal National Mortgage Association BM1231 — 3.50% 11/1/2031 | | | 16,429,770 | | | | 16,851,238 | | |

Federal National Mortgage Association AA4546 — 4.00% 5/1/2024 | | | 696,861 | | | | 717,485 | | |

Federal National Mortgage Association AL5956 — 4.00% 5/1/2027 | | | 783,232 | | | | 806,412 | | |

Federal National Mortgage Association AL4056 — 5.00% 6/1/2026 | | | 1,892,448 | | | | 1,935,597 | | |

Federal National Mortgage Association AL5867 — 5.50% 8/1/2023 | | | 131,246 | | | | 133,552 | | |

Federal National Mortgage Association AL0471 — 5.50% 7/1/2025 | | | 89,720 | | | | 93,209 | | |

Federal National Mortgage Association AL4433 — 5.50% 9/1/2025 | | | 613,666 | | | | 631,095 | | |

Federal National Mortgage Association AL4901 — 5.50% 9/1/2025 | | | 636,912 | | | | 652,785 | | |

Federal National Mortgage Association AD0951 — 6.00% 12/1/2021 | | | 296,321 | | | | 300,295 | | |

Federal National Mortgage Association AL0294 — 6.00% 10/1/2022 | | | 41,182 | | | | 42,523 | | |

Federal National Mortgage Association 890225 — 6.00% 5/1/2023 | | | 385,886 | | | | 395,877 | | |

Government National Mortgage Association 782281 — 6.00% 3/15/2023 | | | 694,142 | | | | 720,220 | | |

| | | $ | 942,327,789 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

AGENCY STRIPPED — 0.0% | |

Federal Home Loan Mortgage Corp. 217 PO — 0.00% 1/1/2032(d) | | $ | 173,252 | | | $ | 155,458 | | |

Federal Home Loan Mortgage Corp. 3763 NI — 3.50% 5/15/2025 | | | 1,130,602 | | | | 55,387 | | |

Federal Home Loan Mortgage Corp. 3917 AI — 4.50% 7/15/2026 | | | 8,956,918 | | | | 648,492 | | |

Federal Home Loan Mortgage Corp. 217 IO — 6.50% 1/1/2032 | | | 166,823 | | | | 38,525 | | |

Federal National Mortgage Association 2010-25 NI — 5.00% 3/25/2025 | | | 53,439 | | | | 1,040 | | |

Federal National Mortgage Association 2003-64 XI — 5.00% 7/25/2033 | | | 483,005 | | | | 90,932 | | |

| | | $ | 989,834 | | |

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 7.2% | |

CIM Trust 2017-7 A, VRN — 3.00% 4/25/2057(b)(c) | | $ | 26,827,653 | | | $ | 26,582,663 | | |

CIM Trust 2018-R3 A1, VRN — 5.00% 12/25/2057(b)(c) | | | 45,559,396 | | | | 47,388,597 | | |

Citicorp Mortgage Securities REMIC Pass-Through

Certificates Trust Series 2005-5 2A3 — 5.00% 8/25/2020 | | | 14,387 | | | | 14,435 | | |

Citigroup Mortgage Loan Trust, Inc. 2014-A A — 4.00% 1/25/2035(b)(c) | | | 8,374,362 | | | | 8,538,289 | | |

Finance of America Structured Securities Trust 2018-HB1 M1, VRN —

3.774% 9/25/2028(b)(c)(e) | | | 15,845,000 | | | | 15,886,197 | | |

Mill City Mortgage Loan Trust 2018-2 A1, VRN — 3.50% 5/25/2058(b)(c) | | | 43,589,479 | | | | 43,651,271 | | |

Mill City Mortgage Loan Trust 2018-3 A1, VRN — 3.50% 8/25/2058(b)(c) | | | 24,567,462 | | | | 24,590,713 | | |

Nationstar HECM Loan Trust 2017-2A M1 — 2.815% 9/25/2027(b)(c) | | | 12,414,000 | | | | 12,317,022 | | |

Nationstar HECM Loan Trust 2018-2A M1, VRN — 3.552% 7/25/2028 | | | 8,381,000 | | | | 8,446,120 | | |

Nomura Resecuritization Trust 2016-1R 3A1 — 5.00% 9/28/2036(b)(c) | | | 4,059,667 | | | | 4,122,990 | | |

Stanwich Mortgage Loan Trust Series 2011-2 A —

0.00% 9/15/2050(b)(c)(e)(f) | | | 177,977 | | | | 95,254 | | |

Stanwich Mortgage Loan Trust Series 2010-2 A —

0.021% 2/28/2057(b)(c)(e)(f) | | | 199,194 | | | | 100,434 | | |

Stanwich Mortgage Loan Trust Series 2011-1 A —

0.668% 8/15/2050(b)(c)(e)(f) | | | 60,246 | | | | 31,775 | | |

Stanwich Mortgage Loan Trust Series 2010-4 A —

1.939% 8/31/2049(b)(c)(e)(f) | | | 11,865 | | | | 5,992 | | |

Towd Point Mortgage Trust 2016-3 A1 — 2.25% 4/25/2056(b)(c) | | | 15,038,710 | | | | 14,768,758 | | |

Towd Point Mortgage Trust 2015-1 AES — 3.00% 10/25/2053(b)(c) | | | 11,630,152 | | | | 11,564,381 | | |

Towd Point Mortgage Trust 2018-1 A1, VRN — 3.00% 1/25/2058(b)(c) | | | 32,010,066 | | | | 31,680,721 | | |

Towd Point Mortgage Trust 2018-2 A1, VRN — 3.25% 3/25/2058(b)(c) | | | 56,272,217 | | | | 56,051,039 | | |

Towd Point Mortgage Trust 2018-5 A1A, VRN — 3.25% 7/25/2058(b)(c) | | | 53,416,073 | | | | 53,212,162 | | |

Towd Point Mortgage Trust 2015-2 1A1 — 3.25% 11/25/2060(b)(c) | | | 21,985,659 | | | | 21,974,998 | | |

Towd Point Mortgage Trust 2015-4 A1 — 3.50% 4/25/2055(b)(c) | | | 21,819,048 | | | | 21,830,850 | | |

Towd Point Mortgage Trust 2015-2 2A1 — 3.75% 11/25/2057(b)(c) | | | 14,705,127 | | | | 14,757,593 | | |

Towd Point Mortgage Trust 2018-6 A1A, VRN — 3.75% 3/25/2058(b)(c) | | | 53,840,176 | | | | 54,303,061 | | |

| | | $ | 471,915,315 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost $1,664,710,158) | | $ | 1,678,061,456 | | |

ASSET-BACKED SECURITIES — 49.9% | |

AUTO — 15.4% | |

Ally Auto Receivables Trust 2017-1 B — 2.35% 3/15/2022 | | $ | 3,758,000 | | | $ | 3,724,592 | | |

Ally Auto Receivables Trust 2017-1 C — 2.48% 5/16/2022 | | | 7,059,000 | | | | 7,006,245 | | |

AmeriCredit Automobile Receivables Trust 2017-4 A3 — 2.04% 7/18/2022 | | | 15,679,000 | | | | 15,585,737 | | |

AmeriCredit Automobile Receivables Trust 2017-1 C — 2.71% 8/18/2022 | | | 7,547,000 | | | | 7,530,289 | | |

Avis Budget Rental Car Funding AESOP LLC 2017-2A A —

2.97% 3/20/2024(c) | | | 8,580,000 | | | | 8,527,184 | | |

Avis Budget Rental Car Funding AESOP LLC 2019-1A A —

3.45% 3/20/2023(c) | | | 13,010,000 | | | | 13,142,140 | | |

BMW Vehicle Lease Trust 2017-1 A4 — 2.18% 6/22/2020 | | | 18,527,000 | | | | 18,477,802 | | |

BMW Vehicle Lease Trust 2017-2 A4 — 2.19% 3/22/2021 | | | 9,585,000 | | | | 9,536,282 | | |

Capital Auto Receivables Asset Trust 2016-1 B — 2.67% 12/21/2020 | | | 4,211,000 | | | | 4,207,523 | | |

CarMax Auto Owner Trust 2017-4 A3 — 2.11% 10/17/2022 | | | 8,714,000 | | | | 8,638,619 | | |

CarMax Auto Owner Trust 2018-1 A3 — 2.48% 11/15/2022 | | | 18,953,000 | | | | 18,939,460 | | |

CarMax Auto Owner Trust 2018-2 A3 — 2.98% 1/17/2023 | | | 22,270,000 | | | | 22,420,182 | | |

Carmax Auto Owner Trust 2019-1 A4 — 3.26% 8/15/2024 | | | 24,353,000 | | | | 24,636,106 | | |

Carmax Auto Owner Trust 2019-1 B — 3.45% 11/15/2024 | | | 13,090,000 | | | | 13,245,716 | | |

Carmax Auto Owner Trust 2018-4 A4 — 3.48% 2/15/2024 | | | 22,031,000 | | | | 22,603,275 | | |

Credit Acceptance Auto Loan Trust 2017-2A A — 2.55% 2/17/2026(c) | | | 50,778,000 | | | | 50,583,495 | | |

Credit Acceptance Auto Loan Trust 2017-3A A — 2.65% 6/15/2026(c) | | | 17,185,000 | | | | 17,127,064 | | |

Credit Acceptance Auto Loan Trust 2016-3A B — 2.94% 10/15/2024(c) | | | 20,876,000 | | | | 20,809,790 | | |

Credit Acceptance Auto Loan Trust 2016-2A B — 3.18% 5/15/2024(c) | | | 22,937,000 | | | | 22,936,982 | | |

Credit Acceptance Auto Loan Trust 2017-3A B — 3.21% 8/17/2026(c) | | | 36,562,000 | | | | 36,513,281 | | |

DT Auto Owner Trust 2017-4A C — 2.86% 7/17/2023(c) | | | 9,173,000 | | | | 9,165,616 | | |

Exeter Automobile Receivables Trust 2018-1A B — 2.75% 4/15/2022(c) | | | 10,910,000 | | | | 10,887,884 | | |

Exeter Automobile Receivables Trust 2017-1A B — 3.00% 12/15/2021(c) | | | 7,644,770 | | | | 7,646,197 | | |

First Investors Auto Owner Trust 2017-1A B — 2.67% 4/17/2023(c) | | | 4,174,000 | | | | 4,158,474 | | |

First Investors Auto Owner Trust 2017-1A C — 2.95% 4/17/2023(c) | | | 8,149,000 | | | | 8,106,768 | | |

GM Financial Automobile Leasing Trust 2017-2 B — 2.43% 6/21/2021 | | | 22,329,000 | | | | 22,228,332 | | |

GM Financial Automobile Leasing Trust 2017-1 B — 2.48% 8/20/2020 | | | 6,143,000 | | | | 6,124,691 | | |

GM Financial Automobile Leasing Trust 2018-1 A4 — 2.68% 12/20/2021 | | | 15,743,000 | | | | 15,712,632 | | |

GM Financial Automobile Leasing Trust 2017-1 C — 2.74% 8/20/2020 | | | 21,903,000 | | | | 21,832,004 | | |

GM Financial Automobile Leasing Trust 2017-2 C — 2.84% 6/21/2021 | | | 3,750,000 | | | | 3,737,533 | | |

GM Financial Automobile Leasing Trust 2019-1 B — 3.37% 12/20/2022 | | | 43,632,000 | | | | 43,878,612 | | |

Great American Auto Leasing, Inc. 2019-1 A4 — 3.21% 2/18/2025(c) | | | 10,720,000 | | | | 10,823,807 | | |

Honda Auto Receivables Owner Trust 2018-1I A4 — 2.78% 5/15/2024 | | | 37,617,000 | | | | 37,726,958 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Honda Auto Receivables Owner Trust 2019-1 A4 — 2.90% 6/18/2024 | | $ | 14,962,000 | | | $ | 15,070,356 | | |

Hyundai Auto Lease Securitization Trust 2016-C B — 1.86% 5/17/2021(c) | | | 13,264,000 | | | | 13,257,491 | | |

Hyundai Auto Lease Securitization Trust 2017-C A4 —

2.21% 9/15/2021(c) | | | 10,394,000 | | | | 10,341,354 | | |

Hyundai Auto Lease Securitization Trust 2018-A A4 —

2.89% 3/15/2022(c) | | | 23,622,000 | | | | 23,633,287 | | |

Hyundai Auto Lease Securitization Trust 2019-A B —

3.25% 10/16/2023(c) | | | 12,636,000 | | | | 12,705,581 | | |

Hyundai Auto Receivables Trust 2018-A A4 — 2.94% 6/17/2024 | | | 27,125,000 | | | | 27,365,336 | | |

Mercedes-Benz Auto Lease Trust 2018-A A4 — 2.51% 10/16/2023 | | | 6,318,000 | | | | 6,306,450 | | |

Mercedes-Benz Auto Receivables Trust 2018-1 A4 — 3.15% 10/15/2024 | | | 24,004,000 | | | | 24,442,618 | | |

Nissan Auto Lease Trust 2017-A A3 — 1.91% 4/15/2020 | | | 18,752,036 | | | | 18,721,389 | | |

Nissan Auto Lease Trust 2017-B A4 — 2.17% 12/15/2021 | | | 11,332,000 | | | | 11,278,051 | | |

Nissan Auto Receivables Owner Trust 2018-A A3 — 2.65% 5/16/2022 | | | 27,120,000 | | | | 27,144,682 | | |

Nissan Auto Receivables Owner Trust 2018-B A4 — 3.16% 12/16/2024 | | | 26,643,000 | | | | 27,046,426 | | |

Prestige Auto Receivables Trust 2016-2A B — 2.19% 11/15/2022(c) | | | 25,223,000 | | | | 25,170,438 | | |

Prestige Auto Receivables Trust 2017-1A B — 2.39% 5/16/2022(c) | | | 12,205,000 | | | | 12,141,390 | | |

Prestige Auto Receivables Trust 2017-1A C — 2.81% 1/17/2023(c) | | | 30,628,000 | | | | 30,400,161 | | |

Prestige Auto Receivables Trust 2016-2A C — 2.88% 11/15/2022(c) | | | 12,327,000 | | | | 12,294,236 | | |

Santander Drive Auto Receivables Trust 2017-3 B — 2.19% 3/15/2022 | | | 30,359,000 | | | | 30,271,089 | | |

Santander Drive Auto Receivables Trust 2017-1 C — 2.58% 5/16/2022 | | | 7,621,000 | | | | 7,601,602 | | |

Santander Drive Auto Receivables Trust 2018-1 B — 2.63% 7/15/2022 | | | 18,533,000 | | | | 18,508,444 | | |

Santander Drive Auto Receivables Trust 2016-2 C — 2.66% 11/15/2021 | | | 4,228,294 | | | | 4,225,892 | | |

Santander Drive Auto Receivables Trust 2017-2 C — 2.79% 8/15/2022 | | | 12,325,000 | | | | 12,327,210 | | |

Westlake Automobile Receivables Trust 2017-1A C —

2.70% 10/17/2022(c) | | | 11,439,000 | | | | 11,417,532 | | |

Westlake Automobile Receivables Trust 2018-1A C —

2.92% 5/15/2023(c) | | | 12,425,000 | | | | 12,415,640 | | |

World Omni Auto Receivables Trust 2018-A A3 — 2.50% 4/17/2023 | | | 31,463,000 | | | | 31,324,582 | | |

World Omni Auto Receivables Trust 2019-A B — 3.34% 6/16/2025 | | | 10,560,000 | | | | 10,700,369 | | |

World Omni Automobile Lease Securitization Trust 2017-A A4 —

2.32% 8/15/2022 | | | 5,495,000 | | | | 5,477,073 | | |

World Omni Automobile Lease Securitization Trust 2017-A B —

2.48% 8/15/2022 | | | 10,143,000 | | | | 10,082,648 | | |

World Omni Automobile Lease Securitization Trust 2018-B B —

3.43% 3/15/2024 | | | 11,060,000 | | | | 11,130,281 | | |

| | | $ | 1,011,022,880 | | |

COLLATERALIZED LOAN OBLIGATION — 11.1% | |

Adams Mill CLO Ltd. 2014-1A B2R — 3.35% 7/15/2026(c) | | $ | 8,136,000 | | | $ | 7,974,557 | | |

B&M CLO Ltd. 2014-1A A2R, FRN — 4.379% 4/16/2026(b)(c) | | | 12,409,000 | | | | 12,413,244 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Black Diamond CLO Ltd. 2014-1A A1R, 3M USD

LIBOR + 1.150% — 3.923% 10/17/2026(b)(c) | | $ | 31,202,290 | | | $ | 31,201,947 | | |

Cerberus Loan Funding XVIII LP 2017-1A A, 3M USD

LIBOR + 1.750% — 4.537% 4/15/2027(b) | | | 43,577,000 | | | | 43,595,172 | | |

Cerberus Loan Funding XXI LP 2017-4A A, FRN —

4.237% 10/15/2027(b)(c) | | | 34,803,000 | | | | 34,802,722 | | |

Elm Trust 2016-1A A2 — 4.163% 6/20/2025(c) | | | 9,043,518 | | | | 9,052,506 | | |

Elm Trust 2018-2A A2 — 4.605% 10/20/2027(c) | | | 22,693,000 | | | | 22,930,450 | | |

Fortress Credit Opportunities IX CLO Ltd. 2017-9A A1T, FRN —

4.234% 11/15/2029(b)(c) | | | 36,720,000 | | | | 36,496,632 | | |

Fortress Credit Opportunities IX CLO Ltd. 2017-9A E, FRN —

9.934% 11/15/2029(b)(c) | | | 12,772,000 | | | | 12,173,095 | | |

Fortress Credit Opportunities VII CLO, Ltd. 2016-7I E, 3M USD

LIBOR + 7.490% — 10.101% 12/15/2028(b) | | | 20,977,000 | | | | 19,014,874 | | |

Halcyon Loan Advisors Funding 2015-3A A1R, 3M USD

LIBOR + 0.90% — 3.68% 10/18/2027(b)(c) | | | 43,913,000 | | | | 43,682,940 | | |

Halcyon Loan Advisors Funding 2015-1A AR, FRN —

3.681% 4/20/2027(b)(c) | | | 50,464,000 | | | | 50,250,083 | | |

Halcyon Loan Advisors Funding 2014-3A AR, 3M USD

LIBOR + 1.100% — 3.861% 10/22/2025(b)(c) | | | 14,512,307 | | | | 14,506,749 | | |

Hercules Capital Funding Trust 2018-1A A — 4.605% 11/22/2027(c) | | | 21,762,000 | | | | 22,243,824 | | |

Hercules Capital Funding Trust 2019-1A A — 4.703% 2/20/2028(c) | | | 47,606,000 | | | | 48,059,804 | | |

Ivy Hill Middle Market Credit Fund VII Ltd. — 4.03% 7/18/2030(b)(c) | | | 26,085,000 | | | | 26,035,360 | | |

Ivy Hill Middle Market Credit Fund VII Ltd. 7A AR, FRN —

4.291% 10/20/2029(b)(c) | | | 7,430,000 | | | | 7,411,351 | | |

Oaktree CLO Ltd. 2014-2A A1BR — 2.953% 10/20/2026(c) | | | 9,492,390 | | | | 9,414,951 | | |

Saranac CLO III Ltd. 2014-3A ALR, FRN — 3.707% 6/22/2030(b)(c) | | | 26,217,000 | | | | 26,326,430 | | |

Senior Credit Fund SPV LLC 2016-1A — 4.83% 12/19/2025(b) | | | 32,776,515 | | | | 32,788,184 | | |

Silvermore CLO Ltd. 2014-1A A1R, 3M USD LIBOR + 1.170% —

3.854% 5/15/2026(b)(c) | | | 18,576,654 | | | | 18,577,193 | | |

Symphony CLO XII Ltd. 2013-12A B2R — 3.389% 10/15/2025(c) | | | 15,800,000 | | | | 15,585,373 | | |

Telos CLO Ltd. 2013-3A AR, 3M USD LIBOR + 1.300% —

4.073% 7/17/2026(b)(c) | | | 23,124,000 | | | | 23,125,064 | | |

Telos CLO Ltd. 2013-3A BR, 3M USD LIBOR + 2.000% —

4.773% 7/17/2026(b)(c) | | | 20,894,000 | | | | 20,854,385 | | |

Telos CLO Ltd. 2014-5A A1R, FRN — 3.723% 4/17/2028(b)(c) | | | 32,022,000 | | | | 31,788,880 | | |

THL Credit Wind River CLO Ltd. 2016-1A AR, FRN —

3.837% 7/15/2028(b) | | | 27,873,000 | | | | 27,738,178 | | |

VCO CLO LLC 2018-1A A, FRN — 4.261% 7/20/2030(b)(c) | | | 26,276,000 | | | | 26,309,502 | | |

Wellfleet CLO Ltd. 2016-1A AR, FRN — 3.671% 4/20/2028(b)(c) | | | 26,029,000 | | | | 25,780,319 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

West CLO Ltd. 2014-2A A1BR — 2.724% 1/16/2027(c) | | $ | 9,227,000 | | | $ | 9,126,250 | | |

West CLO Ltd. 2013-1A A2BR — 3.393% 11/7/2025(c) | | | 12,780,000 | | | | 12,631,445 | | |

Zais CLO 2 Ltd. 2014-2A A1BR — 2.92% 7/25/2026(c) | | | 6,041,263 | | | | 5,991,471 | | |

| | | $ | 727,882,935 | | |

CREDIT CARD — 4.8% | |

American Express Credit Account Master Trust 2017-6 B —

2.20% 5/15/2023 | | $ | 39,998,000 | | | $ | 39,606,956 | | |

Cabela's Credit Card Master Note Trust 2016-1 A1 — 1.78% 6/15/2022 | | | 51,561,000 | | | | 51,454,423 | | |

Capital One Multi-Asset Execution Trust 2016-A6 A6 — 1.82% 9/15/2022 | | | 38,371,000 | | | | 38,182,418 | | |

Capital One Multi-Asset Execution Trust 2017-A1 A1 — 2.00% 1/17/2023 | | | 49,036,000 | | | | 48,760,231 | | |

Discover Card Execution Note Trust 2014-A4 A4 — 2.12% 12/15/2021 | | | 42,672,000 | | | | 42,618,801 | | |

Golden Credit Card Trust 2018-1A A — 2.62% 1/15/2023(c) | | | 32,022,000 | | | | 31,942,627 | | |

Synchrony Card Issuance Trust 2018-A1 A1 — 3.38% 9/15/2024 | | | 56,311,000 | | | | 57,305,368 | | |

Synchrony Credit Card Master Note Trust 2016-3 B — 1.91% 9/15/2022 | | | 3,847,000 | | | | 3,829,690 | | |

| | | $ | 313,700,514 | | |

EQUIPMENT — 12.0% | |

ARI Fleet Lease Trust 2018-A A3 — 2.84% 10/15/2026(c) | | $ | 13,974,000 | | | $ | 13,976,997 | | |

Ascentium Equipment Receivables Trust 2017-2A A3 —

2.31% 12/10/2021(c) | | | 11,172,000 | | | | 11,077,470 | | |

Avis Budget Rental Car Funding AESOP LLC 2014-2A A —

2.50% 2/20/2021(c) | | | 6,184,000 | | | | 6,165,483 | | |

Avis Budget Rental Car Funding AESOP LLC 2015-1A A —

2.50% 7/20/2021(c) | | | 48,657,000 | | | | 48,441,960 | | |

Avis Budget Rental Car Funding AESOP LLC 2015-2A A —

2.63% 12/20/2021(c) | | | 22,666,000 | | | | 22,552,187 | | |

CCG Receivables Trust 2018-1 A2 — 2.50% 6/16/2025(c) | | | 11,729,103 | | | | 11,707,389 | | |

Chesapeake Funding II LLC 2017-4A A1 — 2.12% 11/15/2029(c) | | | 20,516,035 | | | | 20,327,167 | | |

Coinstar Funding LLC Series 2017-1A A2 — 5.216% 4/25/2047(c) | | | 8,310,968 | | | | 8,447,674 | | |

Dell Equipment Finance Trust 2017-2 A3 — 2.19% 10/24/2022(c) | | | 6,988,000 | | | | 6,962,910 | | |

Enterprise Fleet Financing LLC 2017-2 A2 — 1.97% 1/20/2023(c) | | | 8,409,448 | | | | 8,370,429 | | |

Enterprise Fleet Financing LLC 2017-3 A2 — 2.13% 5/22/2023(c) | | | 12,924,838 | | | | 12,855,202 | | |

Enterprise Fleet Financing LLC 2017-2 A3 — 2.22% 1/20/2023(c) | | | 23,511,000 | | | | 23,266,429 | | |

Enterprise Fleet Financing LLC 2017-1 A3 — 2.60% 7/20/2022(c) | | | 9,653,000 | | | | 9,617,861 | | |

GreatAmerica Leasing Receivables Funding LLC Series 2017-1 A4 —

2.36% 1/20/2023(c) | | | 6,662,000 | | | | 6,618,215 | | |

GreatAmerica Leasing Receivables Funding LLC Series 2018-1 A4 —

2.83% 6/17/2024 | | | 8,631,000 | | | | 8,629,654 | | |

GreatAmerica Leasing Receivables Funding LLC Series 2017-1 C —

2.89% 1/22/2024(c) | | | 2,609,000 | | | | 2,600,335 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

GreatAmerica Leasing Receivables Funding LLC Series 2018-1 B —

2.99% 6/17/2024 | | $ | 920,000 | | | $ | 920,700 | | |

Hertz Fleet Lease Funding LP 2017-1 A2 — 2.13% 4/10/2031(c) | | | 13,513,718 | | | | 13,460,470 | | |

Hertz Fleet Lease Funding LP 2018-1 A2 — 3.23% 5/10/2032(c) | | | 16,932,000 | | | | 16,962,984 | | |

John Deere Owner Trust 2018-A A4 — 2.91% 1/15/2025 | | | 24,496,000 | | | | 24,659,134 | | |

John Deere Owner Trust 2018-B A4 — 3.23% 6/16/2025 | | | 26,991,000 | | | | 27,388,278 | | |

John Deere Owner Trust 2019 A A4 — 3.24% 1/15/2026 | | | 13,310,000 | | | | 13,437,266 | | |

Kubota Credit Owner Trust 2018-1A A3 — 3.10% 8/15/2022(c) | | | 41,762,000 | | | | 41,911,704 | | |

MMAF Equipment Finance LLC 2017-B A3 — 2.21% 10/17/2022(c) | | | 19,510,000 | | | | 19,368,800 | | |

MMAF Equipment Finance LLC 2019 A A3 — 3.27% 11/13/2023(c) | | | 23,174,000 | | | | 23,244,076 | | |

NextGear Floorplan Master Owner Trust 2017-1A A2 —

2.54% 4/18/2022(c) | | | 22,933,000 | | | | 22,857,890 | | |

NextGear Floorplan Master Owner Trust 2017-2A B —

3.02% 10/17/2022(c) | | | 20,252,000 | | | | 20,186,693 | | |

NextGear Floorplan Master Owner Trust 2018-1A A2 —

3.22% 2/15/2023(c) | | | 12,191,000 | | | | 12,228,197 | | |

Prop Series 2017-1A — 5.30% 3/15/2042(e) | | | 25,815,390 | | | | 25,393,351 | | |

Verizon Owner Trust 2017-2A A — 1.92% 12/20/2021 | | | 26,475,000 | | | | 26,326,038 | | |

Verizon Owner Trust 2017-3A A1A — 2.06% 4/20/2022(c) | | | 20,678,000 | | | | 20,540,196 | | |

Verizon Owner Trust 2017-2A B — 2.22% 12/20/2021 | | | 24,147,000 | | | | 23,967,102 | | |

Verizon Owner Trust 2017-3A B — 2.38% 4/20/2022(c) | | | 19,491,000 | | | | 19,364,827 | | |

Verizon Owner Trust 2017-1A B — 2.45% 9/20/2021(c) | | | 33,818,000 | | | | 33,640,526 | | |

Verizon Owner Trust 2019 A A1A — 2.93% 9/20/2023 | | | 36,729,000 | | | | 37,011,167 | | |

Verizon Owner Trust 2019 A B — 3.02% 9/20/2023 | | | 16,656,000 | | | | 16,796,030 | | |

Verizon Owner Trust 2018-1A B — 3.05% 9/20/2022(c) | | | 24,278,000 | | | | 24,398,963 | | |

Verizon Owner Trust 2018-A B — 3.38% 4/20/2023 | | | 26,414,000 | | | | 26,872,526 | | |

Volvo Financial Equipment LLC Series 2017-1A A4 —

2.21% 11/15/2021(c) | | | 5,966,000 | | | | 5,921,910 | | |

Volvo Financial Equipment LLC Series 2018-1A A3 —

2.54% 2/15/2022(c) | | | 40,208,000 | | | | 40,136,566 | | |

Volvo Financial Equipment LLC Series 2019-1A A4 —

3.13% 11/15/2023(c) | | | 17,060,000 | | | | 17,215,684 | | |

Wheels SPV 2 LLC 2018-1A A3 — 3.24% 4/20/2027(c) | | | 12,759,000 | | | | 12,889,641 | | |

| | | $ | 788,718,081 | | |

OTHER — 6.6% | |

Conn Funding II LP 2017-B B — 4.52% 4/15/2021(c) | | $ | 4,313,105 | | | $ | 4,326,018 | | |

New Residential Advance Receivables Trust 2016-T4 AT4 —

3.107% 12/15/2050(c) | | | 50,491,000 | | | | 50,543,359 | | |

New Residential Advance Receivables Trust Advance

Receivables Backed Notes 2016-T2 AT2 — 2.575% 10/15/2049(c) | | | 25,417,000 | | | | 25,337,402 | | |

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

New Residential Advance Receivables Trust Advance

Receivables Backed Notes 2017-T1 AT1 — 3.214% 2/15/2051(c) | | $ | 46,976,000 | | | $ | 47,106,729 | | |

New Residential Mortgage LLC 2018-FNT1 A — 3.61% 5/25/2023(c) | | | 27,540,424 | | | | 27,639,110 | | |

New Residential Mortgage LLC 2018-FNT2 A — 3.79% 7/25/2054(c) | | | 33,887,088 | | | | 34,171,801 | | |

NRZ Excess Spread-Collateralized Notes Series 2018-PLS1 A —

3.193% 1/25/2023(c) | | | 13,445,529 | | | | 13,384,226 | | |

NRZ Excess Spread-Collateralized Notes Series 2018-PLS2 A —

3.265% 2/25/2023(c) | | | 15,183,728 | | | | 15,132,160 | | |

Panhandle-Plains Student Finance Corp. 2001-1 A2 —

3.97% 12/1/2031(e) | | | 3,000,000 | | | | 2,981,250 | | |

PFS Financing Corp. 2017-BA A2 — 2.22% 7/15/2022(c) | | | 22,138,000 | | | | 21,878,908 | | |

PFS Financing Corp. 2017-D A — 2.40% 10/17/2022(c) | | | 16,852,000 | | | | 16,745,671 | | |

PFS Financing Corp. 2017-BA B — 2.57% 7/15/2022(c) | | | 7,305,000 | | | | 7,239,828 | | |

PFS Financing Corp. 2017-D B — 2.74% 10/17/2022(c) | | | 7,798,000 | | | | 7,742,799 | | |

PFS Financing Corp. 2018-B A — 2.89% 2/15/2023(c) | | | 28,344,000 | | | | 28,248,089 | | |

PFS Financing Corp. 2018-B B — 3.08% 2/15/2023(c) | | | 7,809,000 | | | | 7,802,992 | | |

PFS Financing Corp. 2018-D A — 3.19% 4/17/2023(c) | | | 35,001,000 | | | | 35,205,189 | | |

PFS Financing Corp. 2018-D B — 3.45% 4/17/2023(c) | | | 17,375,000 | | | | 17,463,607 | | |

PFS Financing Corp. 2018-F A — 3.52% 10/16/2023(c) | | | 31,951,000 | | | | 32,455,168 | | |

PFS Financing Corp. 2018-F B — 3.77% 10/16/2023(c) | | | 5,641,000 | | | | 5,737,867 | | |

PFS Financing Corp. 2016-BA A — 1.87% 10/15/2021(c) | | | 3,481,000 | | | | 3,461,935 | | |

Unison Ground Lease Funding LLC 2013-1 B — 5.78% 3/15/2043(c)(e) | | | 11,146,000 | | | | 11,070,851 | | |

Unison Ground Lease Funding LLC 2013-2 B — 6.268% 3/15/2043(c) | | | 3,768,000 | | | | 3,761,138 | | |

WCP ISSUER LLC 2013-1 B — 6.657% 8/15/2043(c)(e) | | | 15,060,000 | | | | 15,063,228 | | |

| | | $ | 434,499,325 | | |

| TOTAL ASSET-BACKED SECURITIES (Cost $3,275,975,301) | | $ | 3,275,823,735 | | |

CORPORATE BONDS & NOTES — 2.5% | |

BASIC MATERIALS — 0.9% | |

PT Boart Longyear Management Pty Ltd. PIK, 10.00% Cash or

12.00% PIK — 10.00% 12/31/2022 | | $ | 67,602,030 | | | $ | 59,658,791 | | |

COMMUNICATIONS — 0.3% | |

Cisco Systems, Inc. — 2.45% 6/15/2020 | | $ | 19,864,000 | | | $ | 19,826,189 | | |

CONSUMER, CYCLICAL — 0.1% | |

Continental Airlines 2000-1 Class B Pass Through Trust —

8.388% 5/1/2022 | | $ | 2,523 | | | $ | 2,761 | | |

Northwest Airlines 2000-1 Class G Pass Through Trust — 7.15% 4/1/2021 | | | 3,224,132 | | | | 3,204,787 | | |

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Northwest Airlines 1999-2 Class C Pass Through Trust —

8.304% 9/1/2010(e)(f) | | $ | 13,505,171 | | | $ | — | | |

US Airways 1999-1C Pass Through Trust — 7.96% 7/20/2019(e)(f) | | | 3,802,540 | | | | — | | |

| | | $ | 3,207,548 | | |

CONSUMER, NON-CYCLICAL — 0.3% | |

StoneMor Partners LP / Cornerstone Family Services of West Virginia

Subsidiary — 7.875% 6/1/2021 | | $ | 23,042,000 | | | $ | 20,717,638 | | |

ENERGY — 0.7% | |

PHI, Inc. — 5.25% 3/15/2019 | | $ | 58,999,000 | | | $ | 36,726,877 | | |

Bristow Group, Inc. — 8.75% 3/1/2023(c) | | | 14,505,000 | | | | 10,552,388 | | |

| | | $ | 47,279,265 | | |

INDUSTRIAL — 0.2% | |

Manitowoc Co., Inc. (The) — 12.75% 8/15/2021(c) | | $ | 11,397,000 | | | $ | 12,141,885 | | |

Air 2 US — 8.027% 10/1/2020(c) | | | 642,229 | | | | 646,645 | | |

| | | $ | 12,788,530 | | |

TECHNOLOGY — 0.0% | |

Oracle Corp. — 3.875% 7/15/2020 | | $ | 842,000 | | | $ | 855,861 | | |

| TOTAL CORPORATE BONDS & NOTES (Cost $212,981,629) | | $ | 164,333,822 | | |

CORPORATE BANK DEBT — 2.7% | |

ABG Intermediate Holdings 2 LLC, 1M USD

LIBOR + 7.750% — 10.249% 9/29/2025(b)(g) | | $ | 21,567,384 | | | $ | 21,028,199 | | |

Boart Longyear Management Pty Ltd TL, 10.000% Cash or 11.00% PIK —

11.000% 10/23/2020(b)(g) | | | 4,757,758 | | | | 4,703,852 | | |

General Nutrition Centers, Inc., 1M USD LIBOR + 7.000% —

9.500% 12/31/2022(b)(g) | | | 19,406,000 | | | | 19,616,167 | | |

JC Penney Corp., Inc., 1M USD LIBOR + 4.250% —

6.879% 6/23/2023(b)(g) | | | 30,032,034 | | | | 26,428,190 | | |

Logix Holding Co. LLC TL 1L, 1M USD LIBOR + 5.750% —

8.249% 12/22/2024(b)(g) | | | 11,136,915 | | | | 11,006,056 | | |

MB2LTL, 3M USD LIBOR + 9.250% — 11.880% 11/30/2023(b)(e)(g) | | | 6,816,000 | | | | 6,850,080 | | |

OTGTL, 3M USD LIBOR + 7.000% — 9.744% 8/23/2021(b)(e)(g) | | | 25,573,000 | | | | 25,494,747 | | |

SDTL, 11/22/2021(b)(e)(g) | |

1M USD LIBOR + 4.500% — 6.999% | | | 5,814,185 | | | | 5,800,638 | | |

6M USD LIBOR + 4.500% — 7.383% | | | 6,001,000 | | | | 5,987,017 | | |

24

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Transform SR Holdings LLC TL B, 1M USD LIBOR + 7.250% —

9.741% 2/11/2024(b)(g) | | $ | 8,797,000 | | | $ | 8,713,780 | | |

Xplornet Communication, Inc., 3M USD LIBOR + 4.000% —

6.601% 9/9/2021(b)(g) | | | 21,392,595 | | | | 21,482,016 | | |

ZW1L, 1M USD LIBOR + 5.00% — 7.50% 11/16/2022(b)(e)(g) | | | 13,323,325 | | | | 13,339,979 | | |

ZW2L, 1M USD LIBOR + 9.00% — 11.49% 11/16/2023(b)(e)(g) | | | 4,870,000 | | | | 4,894,399 | | |

| TOTAL CORPORATE BANK DEBT (Cost $176,747,567) | | $ | 175,345,120 | | |

U.S. TREASURIES — 10.4% | |

U.S. Treasury Bills — 2.379% 4/4/2019(d) | | $ | 9,723,000 | | | $ | 9,721,088 | | |

U.S. Treasury Bills — 2.446% 4/11/2019(d) | | | 57,765,000 | | | | 57,726,892 | | |

U.S. Treasury Bills — 2.433% 4/18/2019(d) | | | 131,319,000 | | | | 131,170,491 | | |

U.S. Treasury Bills — 2.428% 4/25/2019(d) | | | 156,934,000 | | | | 156,687,629 | | |

U.S. Treasury Bills — 2.445% 5/2/2019(d) | | | 1,000,000 | | | | 997,955 | | |

U.S. Treasury Notes — 2.00% 7/31/2022 | | | 100,607,000 | | | | 99,887,137 | | |

U.S. Treasury Notes — 1.875% 8/31/2022 | | | 119,563,000 | | | | 118,185,228 | | |

U.S. Treasury Notes — 1.875% 9/30/2022 | | | 108,643,000 | | | | 107,395,376 | | |

| TOTAL U.S. TREASURIES (Cost $673,926,513) | | $ | 681,771,796 | | |

| TOTAL BONDS & DEBENTURES — 99.6% (Cost $6,615,385,176) | | $ | 6,540,326,033 | | |

| TOTAL INVESTMENT SECURITIES — 99.6% (Cost $6,616,018,722) | | $ | 6,541,071,006 | | |

SHORT-TERM INVESTMENTS — 0.1% | |

State Street Bank Repurchase Agreement — 0.50% 4/1/2019

(Dated 03/29/2019, repurchase price of $8,661,361, collateralized by

$8,780,000 principal amount U.S. Treasury Notes — 2.375% 2022,

fair value $8,837,290) | | $ | 8,661,000 | | | $ | 8,661,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $8,661,000) | | $ | 8,661,000 | | |

| TOTAL INVESTMENTS — 99.7% (Cost $6,624,679,722) | | $ | 6,549,732,006 | | |

Other assets and liabilities, net — 0.3% | | | 17,360,913 | | |

NET ASSETS — 100.0% | | $ | 6,567,092,919 | | |

25

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2019

(Unaudited)

(a) Non-income producing security.

(b) Variable/Floating Rate Security — The rate shown is based on the latest available information as of March 31, 2019. For Senior Loan Notes, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(d) Zero coupon bond. Coupon amount represents effective yield to maturity.

(e) Investments categorized as a significant unobservable input (Level 3) (See Note 6 of the Notes to Financial Statements).

(f) These securities have been valued in good faith under policies adopted by authority of the Board of Director in accordance with the Fund's fair value procedures. These securities constituted 0.00% of total net assets at March 31, 2019.