Annual

Report

Needham Funds

Seeking to build wealth for long-term investors.

December 31, 2020

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

250 Park Avenue, 10th Floor

New York, New York 10177

1-800-625-7071

www.needhamfunds.com

Annual Report

December 31, 2020

| Contents | |

| Letter from the Adviser | 1 |

| Portfolio Characteristics | |

| Needham Growth Fund | 10 |

| Needham Aggressive Growth Fund | 11 |

| Needham Small Cap Growth Fund | 12 |

| Disclosure of Fund Expenses | 14 |

| Schedules of Investments | |

| Needham Growth Fund | 16 |

| Needham Aggressive Growth Fund | 22 |

| Needham Small Cap Growth Fund | 26 |

| Schedules of Securities Sold Short | |

| Needham Growth Fund | 21 |

| Needham Small Cap Growth Fund | 29 |

| Statements of Assets and Liabilities | 30 |

| Statements of Operations | 32 |

| Statements of Changes in Net Assets | 33 |

| Financial Highlights | |

| Needham Growth Fund | 36 |

| Needham Aggressive Growth Fund | 38 |

| Needham Small Cap Growth Fund | 40 |

| Notes to Financial Statements | 42 |

| Report of Independent Registered Public Accounting Firm | 52 |

| Information about Directors and Officers | 53 |

| Supplementary Information | 56 |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus or summary prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

| | • | Are NOT FDIC insured |

| | • | Have no bank guarantee |

| | • | May lose value |

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

Annual Report 2020

| 250 Park Avenue, 10th Floor |

| New York, NY 10177 |

| | (800) 625-7071 |

| | www.needhamfunds.com |

January 2021

Dear Shareholders, Friends of Needham, and Prospective Shareholders,

We are pleased to report Needham Funds’ results for the quarter and year ended December 31, 2020. Our mission is to create wealth for long-term investors and 2020 was a big step forward despite an unprecedented economic and social backdrop. All three Needham Funds significantly outperformed the Russell 2000 Index and the S&P 500 Index for the year.

Once again, the Needham Funds were recognized by Refinitiv Lipper for their top performance. For the one-year period ended December 31, 2020, the Needham Small Cap Growth Fund was ranked as the #2 fund in the Small-Cap Core category and the Needham Growth Fund was ranked as the #2 fund in the Multicap Core category. We are very excited about these recognitions and appreciate the long-term support and patience of our investors.

John’s Barr’s Macroeconomic and Market Commentary

Entering 2020, we anticipated strategic progress and growth from our portfolio companies. That all changed with COVID-19. From late February until March 23, the S&P 500 declined 34%, its largest drop in history. It was one of the worst quarters in the recorded history of the United States’ markets; however, in April 2020, the S&P 500 posted its best month since January 1987.

Along with the stock market performance, the monetary and fiscal policy responses to COVID-19 were unprecedented. The Federal Reserve announced an unlimited bond-buying program. These bonds included high-yield ETFs, bonds rated investment grade before the crisis, small business loans, municipals, asset-backed securities, collateralized loan obligations and commercial mortgage-backed securities. The fiscal response included the CARES Act with over $2 trillion of grants and loans to all kinds of businesses, including airlines, hospitals and small businesses, payments to state and local governments, and a $1,200 direct payment to some individuals. We believe these policy responses contributed to the strong performance of equities.

Company earnings for the March quarter were as expected. Business in the U.S. was strong until shelter-in-place restrictions went into effect in mid-March. Although most companies followed the legalistic path of withdrawing guidance, their commentaries on second quarter revenue and bookings were much better than we expected.

In April, Needham Funds recovered nearly all of their entire first quarter declines. April unemployment was 14.7%, the worst since an estimated 24.9% in the Great Depression.

May was another strong month for Needham Funds and the market. We believe the monetary and fiscal stimulus was a contributor to the positive month. May unemployment improved to 13.3%. June was another positive month for Needham Funds and the markets as more states began to open their economies.

Needham Funds

In early June, the Federal Reserve estimated second quarter GDP might drop a stunning 52.8%, following a 5.0% first quarter decline. In July, the U.S. Bureau of Economic Analysis published its estimate of -32.8% GDP in the second quarter.

Then came a rapid, but far from complete rebound in the third quarter. In late July, estimates for third quarter GDP were for 12% growth. In fact, third quarter GDP growth was 38%. The Federal Reserve maintained interest rates at near 0% and its aggressive purchases of a range of fixed-income securities through its Quantitative Easing program.

Recent commentary indicates even more aggressive accommodative monetary and fiscal policy. In late August the Federal Reserve adopted a new policy framework. Federal Reserve Chair Jerome H. Powell said, “Our revised statement reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities, and that a robust job market can be sustained without causing an unwelcome increase in inflation.” This framework allows for inflation over 2%.1,2 Raphael Bostic, President of the Atlanta Federal Reserve Bank, stated to the Wall Street Journal, “Economists believe that inflation is less of a problem today than it has been in the past.”3

By late September, the Federal Reserve’s balance sheet increased to $7 trillion, up from $4.2 trillion in early March, providing another tailwind to asset prices. After the 2008 financial crisis, it took five years for the Federal Reserve’s balance sheet to expand by $3 trillion.

In December, Congress and the Trump administration passed a $900 billion COVID Relief Bill. The Biden administration plans to quickly pass another $1.9 trillion relief bill.4

A recent Brookings Institute panel featured a draft paper, “Reconsideration of Fiscal Policy in the Era of Low Interest Rates.” Authors Jason Furman and Larry Summers argue that with structural low interest rates, the U.S. government can implement support of public sector spending for health care, education and a host of other programs without raising taxes or systemic risk.5 President Biden recently said, “Every major economist thinks we should be investing in deficit spending in order to generate economic growth.”6 For further information on the theory that governments should spend up to the point of measurable inflation read “The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy” by Prof. Stephanie Kelton of SUNY Stonybrook. Accommodative monetary and fiscal policy may continue to lead to increasing equity prices.

The fourth quarter brought continued strong equity performance led by pandemic recovery stocks in the consumer discretionary, financial services, materials and energy sectors. Low quality and value factors outperformed.

____________

1 | https://www.federalreserve.gov/newsevents/pressreleases/monetary20200827a.htm |

2 | https://www.marketwatch.com/story/fed-unanimously-adopts-new-strategy-widely-seen-as-leading-to-easier-policy-2020-08-27 |

3 | https://www.wsj.com/video/inside-the-feds-plan-to-support-minority-workers/BDF130C8-3B41-4218-BDC7-D43CB3ED8753.html |

4 | https://www.marketwatch.com/story/lifeline-to-workers-why-bidens-call-for-a-19-billion-covid-19-rescue-package-has-not-come-a-moment-too-soon-2021-01-14 |

5 | https://www.brookings.edu/events/fiscal-policy-advice-for-joe-biden-and-congress |

6 | https://www.nbcnews.com/politics/white-house/joe-biden-wants-set-aside-deficit-concerns-invest-ailing-u-n1253638 |

Annual Report 2020

Needham Funds’ Portfolio Overview: The Great Digital Acceleration

2020 brought an unprecedented worldwide economic shutdown to control the spread of COVID-19. The pandemic accelerated trends that were already occurring; we call this the Great Digital Acceleration. As we look into 2021, we see four important themes to consider.

| | 1) | This time is different. The Great Digital Acceleration is here. There will be winners and losers. There will also be those investments, in the words of Warren Buffett and Charlie Munger, which belong in the “too hard” pile. Berkshire Hathaway’s sale of its airline investments in early 2020 is an example of “too hard.” Most commercial real estate investments belong in the “too hard” pile. We believe our areas of expertise – technology, applied technology and life sciences – belong in the winners’ category. |

| | | We see three groups of winners; digital business-to-consumer (B2C), digital business-to-business (B2B) and those that supply the infrastructure, research and development to the B2C and B2B groups. Many of our portfolio companies supply the infrastructure, research and development, equipment and services that enable digital transformation. |

| | 2) | For the winners, today’s valuations may work. Yet, it is important to do your homework and know why the price you are paying makes sense. Buying just any SPAC (Special Purpose Acquisition Company) at a $1-2 billion valuation seems a recipe for disaster. |

| | 3) | Stocks and industries that appear attractive to value investors may be squarely in the losers’ bracket. No matter the attractive valuation, these companies and stocks may be left behind. |

| | 4) | As discussed above, we are in the early stages of a new level of accommodative monetary and fiscal policies. A company trading at 40x earnings has a 2.5% earnings yield with prospects for higher earnings and compares favorably to a bond with a negative or near zero interest rate. |

Needham Growth Fund – John Barr, Chris Retzler, Co-Portfolio Managers

For the year ended December 31, 2020, NEEIX returned 42.24% and NEEGX returned 41.59%, considerably outperforming the S&P 500’s 18.40% and Russell 2000’s 19.96%.

Entegris, Inc. (ENTG) was the Fund’s leading contributor for the year 2020. It was also the Fund’s largest position at year-end. Entegris supplies filters and chemicals used in advanced semiconductor manufacturing processes. The company reported strong third quarter earnings and guidance for the fourth quarter. Demand for leading-edge semiconductors has been robust. Over time, we believe semiconductors will increase as a percentage of industrial output, and that Entegris’ filtration and specialty materials products will grow faster than the semiconductor industry.

Aspen Aerogels Inc. (ASPN) was the second-leading contributor for the year. The company supplies aerogel insulation used primarily in the energy industry to insulate pipelines and refinery pipes. Aspen’s aerogel has superior thermal and cryogenic properties and is lighter than older generation insulation, which was developed 50 years ago. In 2020, Aspen determined its aerogel has the potential to prevent thermal run-away in li-ion batteries, which is a major cause of engine fires in electric vehicles. In late October, Aspen

Needham Funds

announced that it was selected by a major U.S. automotive OEM to supply its new PyroThin™7 thermal barriers for use with electric vehicle batteries. We believe every EV maker has a similar need and that Aspen’s near-20 years of experience with aerogels puts it far ahead of any competitor. This market has the potential to transform Aspen from a $100 million revenue company to over a billion dollars. Of course, these developments may not occur and the company may not succeed with this opportunity.

Vicor Corporation (VICR) was also a leading contributor to the Fund’s performance in 2020. Vicor makes small, modular power converters used in data centers, on servers and in cars and transportation systems. It has invested $400 million in new product development over the last decade. Vicor has worked with Alphabet’s Google (GOOGL) on its Open Compute data centers to distribute DC (direct current) power throughout the data center, rather than go through the inefficient conversions to AC (alternating current) and back again to DC. Many artificial intelligence and machine learning applications require sophisticated power conversion, and Vicor is uniquely positioned to meet these needs. The company had a good year and we anticipate even more widespread adoption of its products in 2021.

Thermo Fisher Scientific, Inc. (TMO) was another top contributor for the year. Thermo Fisher’s PCR-testing, personal protective equipment and broad array of biopharmaceutical services helped the company have a very good year. Thermo Fisher’s mission is “to enable its customers to make the world healthier, cleaner and safer. Whether our customers are accelerating life sciences research, solving complex analytical challenges, improving patient diagnostics and therapies or increasing productivity in their laboratories.” The Fund began investing in the company in 2000. While Thermo Fisher had a great year and was well-positioned to contribute to the COVID-19 response, the company’s strategy positions it as a solution to many of the world’s life science challenges.

There were no material detractors in the year.

For the year, the Fund’s largest new positions included ADTRAN, Inc. (ADTN), AXT, Inc. (AXTI), 8x8, Inc. (EGHT) and Telos Corp. (TLS). The Fund’s largest additions to existing positions were Aspen Aerogels Inc. (ASPN) and Intevac, Inc. (IVAC).

The Fund’s largest complete exits were Brookfield Asset Management, Inc. (BAM), Bill.com (BILL), DIRTT Environmental Solutions (DRT) and Wabtec Corp. (WAB). The Fund also reduced positions in some of the longer-term, larger holdings including Air Lease Corporation (AL), Appian Corporation (APPN), CarMax, Inc. (KMX), Entegris, FormFactor, Inc. (FORM), Gilead Sciences, Inc. (GILD), II-VI, Inc. (IIVI) and Thermo Fisher Scientific, Inc.

At December 31, 2020, the Fund’s top 10 positions were 51.40% of net assets. The Fund had 2.7% of net assets in cash and was short 0.2%. The Fund had an Active Share of 95.2% versus the S&P 500 and trailing 12-month turnover was 15%.

Morningstar categorizes the Fund as Mid Cap Growth. Lipper categorizes it as MultiCap Core. When you hold companies for 10-15 years, and they succeed, they grow to larger market cap categories. Our mission is to find companies that may be compounders over many years, independent of industry or market cap.

____________

7 | https://info.aerogel.com/thermal-runaway |

Annual Report 2020

Needham Aggressive Growth – John Barr, Portfolio Manager

For the year ended December 31, 2020, NEAIX returned 52.36% and NEAGX returned 51.39%, considerably outperforming the S&P 500’s 18.40% and Russell 2000’s 19.96%.

The Fund’s greater-than-benchmark exposure to high quality and low exposure to value factors contributed to the Fund’s outperformance for the year.8,9 Quality factors, including high return on capital and low leverage, helped the Fund’s positions outperform during the COVID-19 crash early in the year. Under the guidance of our investment process, the Fund looks to purchase companies while they are “Hidden Compounders” – companies going through investment periods. As our investment thesis plays out, these companies convert to “Quality Compounders,” with strong return on capital and still below-average leverage. The Fund’s fourth quarter underperformance relative to the Russell 2000 was a result of underexposure to the strong consumer discretionary, financial services, materials, and energy sectors. With just 13% turnover, the Fund does not rotate into or out of sectors, but invests in companies we believe can outperform over the long-term.

Like the Growth Fund, the Fund’s top contributor for 2020 was Entegris, Inc. (ENTG), the Fund’s largest holding at December 31.10 We invested in Entegris in 2009 and 2010, and the company performed well through 2016. In 2016, the company’s business faced a positive inflection – cloud infrastructure spending accelerated, benefitting the leading semiconductor and manufacturing technology companies, including Entegris. We believe Entegris and its peers are in the early stages of secular growth driven by increasing cloud adoption. Previously, the semiconductor industry was cyclical and controlled by seasonal personal computer purchases.

The four other top contributors for the year were the next largest holdings at year end: Apple, Inc. (AAPL), Nova Measuring Instruments, Inc. (NVMI), PDF Solutions Inc. (PDFS) and Vicor Corporation (VICR).

Apple reported a positive 4th quarter with a strong installed base and services revenue. Apple closed the year with talk of a positive 2021, with new 5G iPhones and discussion of an Apple Car by 2024.

In October, Nova Measuring announced a win for its new NovaPRISM optical metrology product with a leading global memory maker and strong results. Nova is well positioned for continued success as leading edge semiconductor manufacturing is metrology intensive.

PDF Solutions’ results showed continued progress establishing Exensio as the semiconductor manufacturing industry’s standard big data platform. On its first quarter conference call, PDF discussed a multi-year, eight-figure Exensio agreement with a major semiconductor company. Exensio is very useful for automotive electronics companies. In July, PDF announced a partnership with Advantest (6857-TKY). Advantest purchased

____________

8 | https://www.morningstar.com/funds/xnas/neagx/portfolio |

9 | https://research.ftserussell.com./products/downloads-research/FTSE_Russell_Monthly_Performance_Report_LCY.pdf#page=5 |

10 | https://www.regions.com/-/media/pdfs/AssetManagement-The-Semiconductor-Cycle.pdf?revision=1da76437-de80-4ebd-96f3-dc8ab8257328&la=en&hash=414BE463A90E72789127F9AB4D334AAA |

Needham Funds

3.3 million shares of PDF, representing 9% of the company for $19.70 per share. Advantest also purchased a 5-year, non-exclusive license for Exensio to be the basis for the Advantest Cloud Solution, which will be sold to Advantest customers. Advantest will also pay PDF to develop a close integration between Exensio and Advantest testers.

None of the Fund’s positions were material detractors in the year ended December 31.

In 2020, the Fund added four positions that each ended the year at over 0.50% of net assets. ADTRAN, Inc. (ADTN) and AXT, Inc. (AXTI) were added earlier in the year and Digimarc Corporation (DMRC) and Telos Corp. (TLS) were added in the fourth quarter. ADTRAN has a contract with British Telecom’s Openreach spin-out to provide communications equipment used to provide high-speed internet in the United Kingdom. AXT manufactures Gallium Arsenide and Indium Phosphide wafers, which are used in communications systems and consumer electronics. Both areas could grow in 2021 and beyond. Digimarc has been investing for many years in a unique watermarking technology that has the potential to replace QR codes. Digimarc is a leader in the European Union’s Holy Grail 2.0 initiative to significantly reduce plastic waste. Telos is a newly public provider of cyber security services to the leading defense and security agencies in the United States. They are looking to sell their incredible technology to commercial customers.

In 2020, the largest addition to an existing holding was to Smith-Midland Corporation (SMID), a micro-cap maker of pre-cast concrete systems for road barriers and construction. We are impressed by the company’s management and the returns from its barrier rental business.

The Fund also added to its Aspen Aerogels Inc (ASPN), Intevac Inc. (IVAC) and Transcat, Inc. (TRNS) positions. Intevac is developing sensors for use with night-vision systems for the U.S. military and allied forces. Transcat has a recurring business model where they maintain and calibrate instruments used in the electronics, life sciences and other industries.

In 2020, the Fund exited its investment in National Instruments Corp. (NATI) over concern for its long-term growth potential. The Fund reduced its positions in some of the longer-term, larger holdings including Apple, Akamai Technologies (AKAM), Entegris and PDF Solutions.

At December 31, 2020, the Fund’s top 10 positions were 63.83% of net assets. The Fund was fully invested and had no short positions. The Fund had an Active Share of 98.2% versus the Russell 2000 and trailing 12-month turnover was 13%. Morningstar and Lipper categorize the Fund as Small Cap Growth.

Needham Small Cap Growth Fund – Chris Retzler, Portfolio Manager

For year ended December 31, 2020, the Needham Small Cap Growth Fund Institutional and Retail classes returned 72.51% and 71.35%, respectively. The Russell 2000 Index returned 19.96% and the S&P 500 Index returned 18.40%.

After a strong first half, we were nimble in our exposure levels entering the fall months as the headline risk and volatility surrounding the U.S. election increased. We harvested many winning positions and deployed capital into new and existing positions during market pullbacks. The results of the election removed some significant unknown risks; markets

Annual Report 2020

improved and small cap stocks outperformed. While value stocks had nice gains, many of our small cap technology investments also rallied in expectation of improved economic growth. Both monetary and fiscal spending has been significantly supportive of risk assets in general, but the rally in small caps is often an early sign of a new economic cycle. We believe this is the case as the world begins to recover from the pandemic to a new normal, we hope by the second half of 2021.

Many of the Fund’s investments are technology-defined companies, however we achieve diversity in the portfolio through the broad array of end markets that our portfolio companies serve. Technology has permeated the entire global economy. End markets with strong secular growth include advanced communications, military modernization, automotive advancement, industrial digitization, medical enhancement, 5G wireless, data center buildouts, infrastructure expansion, security improvements and overall semiconductor processing and power management enhancements. Many of our portfolio companies are at the crossroads of many industries and therefore have multiple opportunities for success. This diverse market positioning inherently gives the portfolio a natural hedge and ultimately helps reduce volatility and risk. Using an old phrase, we like to invest in companies that “sell picks to the miners.”

The Fund benefitted from its concentrated investments in Veeco Instruments (VECO), Cambium Networks (CMBM), FireEye (FEYE), AXT, Inc. (AXTI) and Akoustis Technologies (AKTS).

Veeco Instruments has been a turnaround story for a couple of years after its last large company acquisition. It has significant upside in multiple product offerings in the markets of semiconductor manufacturing, light emitting diodes and hard disk drives. Veeco expects to continue improving its margin profile and balance sheet, and we believe it is well-positioned to drive shareholder value higher.

Cambium Networks became a top holding for the Fund as we believed in management and their ability to drive growth in the business model. Cambium is exposed to the rapidly expanding wireless communications markets and while it had a tough start as a new publicly-traded company in 2019, our patience and conviction paid off in 2020. Management executed through a difficult market and introduced new products that ultimately returned the company to strong financial results.

We have been a long-time believer in the FireEye’s software security solution. Unfortunately for many, there was a substantial hack in late 2020 and FireEye, along with other security stocks, had a substantial stock price move that far exceeded our previous valuation expectations.

AXT was a new investment in early 2020, based upon its technology in the substrate industry for semiconductors and other products such as LiDAR. We accumulated a large position in the stock and remained steadfast in our conviction that the business was improving. We were rewarded as manufacturing and product opportunities improved. Simultaneously, the company announced that it was going to list a subsidiary on the Chinese stock market which would unlock substantial value for shareholders.

Needham Funds

Finally, our investment in Akoustis Technologies also paid off, as filter technology for wireless communications continued to see customer interest and acceptance. As 5G continues to expand, we expect Akoustis to benefit and further broaden their end-market customer base.

Closing

We believe the U.S. remains the best place in the world to be investing, and we continue to see an opportunity to invest in small and mid-cap stocks. Most importantly, we see a revolution happening in technology that has created and continues to create investment opportunities. We see opportunity in our strategy of investing in companies that we know well and that we believe are positioned with secular growth drivers.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts or concerns, please contact us at (800) 625-7071 or jbarr@needhamco.com and cretzler@needhamco.com. For information about the Needham Funds, please visit our website at www.needhamfunds.com.

Sincerely,

|  |

| | |

| Chris Retzler, | John O. Barr, |

| Portfolio Manager | Portfolio Manager |

Fact Sheet Links:

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

The information presented in this commentary is not intended as personalized investment advice and does not constitute a recommendation to buy or sell a particular security or other investments. Past performance is no guarantee of future results. The views of Needham Investment Management L.L.C., the Funds’ investment adviser (the “Adviser”), and the securities described in this report are as of December 31, 2020; these views and portfolio holdings may have changed subsequent to this date. The specific securities discussed may, in aggregate, represent only a small percentage of a Fund’s holdings. If a specific security discussed is not found in a Fund’s Schedule of Investments, it may have been held by the Fund during the period. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein. There can be no guarantee as to the accuracy of any outlooks for markets, sectors and securities as discussed herein.

Annual Report 2020

This message is not an offer of the Needham Growth Fund, the Needham Aggressive Growth Fund or the Needham Small Cap Growth Fund. Shares are sold only through the currently effective prospectus. Please read the prospectus or summary prospectus carefully and consider the investment objectives, risks and charges and expenses of the Funds carefully before you invest. The prospectus and summary prospectus contain this and other information about the Funds and can be obtained on our website, www.needhamfunds.com or by contacting the Funds’ transfer agent U.S. Bancorp Fund Services LLC doing business as U.S. Bank Global Fund Services (“Fund Services”) at 1-800-625-7071.

Investment returns and principal value will fluctuate, and when redeemed, shares may be worth more or less than their original cost. Performance data quoted represents past performance, and does not guarantee future results. Current performance may be higher or lower than these results. Performance current to the most recent month-end may be obtained by calling our transfer agent at 1-800-625-7071. Total return figures include reinvestment of all dividends and capital gains.

All three of the Needham Funds have substantial exposure to small and micro capitalized companies. Funds holding smaller capitalized companies are subject to greater price fluctuation than those of larger companies. The coronavirus disease 2019 (COVID-19) global pandemic and the aggressive responses taken by many governments or voluntarily imposed by private parties, including closing borders, restricting travel and imposing prolonged quarantines or similar restrictions, as well as the closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment. Needham & Company, LLC, member FINRA/SIPC, is the distributor of The Needham Funds, Inc.

The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. The Russell 3000 Index is a market-capitalization-weighted equity index that provides exposure to the entire U.S. stock market. The Russell 3000 Index tracks the performance of the 3,000 largest U.S.-traded stocks. Please see the disclaimer regarding these indexes under “Supplementary Information—Index Disclaimer” on page 57 of this report.

Needham Funds

| NEEDHAM GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NEEGX |

| | Institutional Class |

| | Ticker Symbol: NEEIX |

Comparison of Change in Value of a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on January 1, 1996.

Comparative Performance Statistics as of December 31, 2020

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Growth Fund Retail Class(1)(2) | 41.59% | 16.71% | 11.73% | 13.70% |

Needham Growth Fund Institutional Class(1)(3) | 42.24% | n/a | n/a | 18.89% |

S&P 500 Index(4)(5) | 18.40% | 15.22% | 13.88% | 9.56%(8) |

S&P MidCap 400 Index(4)(6) | 13.66% | 12.35% | 11.51% | 11.45%(8) |

Russell 2000 Index(4)(7) | 19.96% | 13.26% | 11.20% | 9.05%(8) |

Top Ten Holdings*

(as a % of investments†,

as of December 31, 2020)

| | | % of |

Security | | Investments |

| Entegris, Inc. | ENTG | 7.56% |

| Thermo Fisher Scientific, Inc. | TMO | 7.13% |

| PDF Solutions, Inc. | PDFS | 6.92% |

| Aspen Aerogels, Inc. | ASPN | 5.08% |

| CarMax, Inc. | KMX | 4.81% |

| Vicor Corp. | VICR | 4.56% |

| KVH Industries, Inc. | KVHI | 4.14% |

| Comcast Corp. | CMCSA | 4.08% |

| FormFactor, Inc. | FORM | 3.79% |

| Becton Dickinson & Co. | BDX | 3.38% |

| | | |

| Top Ten Holdings = 51.45% of Total Investments | | |

| | |

Sector Weightings*

(as a % of net exposure(12),

as of December 31, 2020)

| | | | Net |

Sector(10) | Long(11) | (Short) | Exposure(12) |

| Cash | 2.7% | — | 2.7% |

| Communication Services | 4.5% | — | 4.5% |

| Consumer Discretionary | 4.8% | — | 4.8% |

| Consumer Staples | 0.4% | — | 0.4% |

| Energy | 5.3% | — | 5.3% |

| Health Care | 17.4% | — | 17.4% |

| Industrials | 6.1% | — | 6.1% |

| Information Technology | 58.7% | (0.2)% | 58.5% |

| Real Estate | 0.3% | — | 0.3% |

| | | | |

Annual Report 2020

| NEEDHAM AGGRESSIVE GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NEAGX |

| | Institutional Class |

| | Ticker Symbol: NEAIX |

Comparison of Change in Value of a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on September 4, 2001.

Comparative Performance Statistics as of December 31, 2020

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Aggressive Growth Fund Retail Class(1)(2) | 51.39% | 19.50% | 12.57% | 11.43% |

Needham Aggressive Growth Fund Institutional Class(1)(3) | 52.36% | n/a | n/a | 19.53% |

S&P 500 Index(4)(5) | 18.40% | 15.22% | 13.88% | 8.55%(8) |

Russell 2000 Index(4)(7) | 19.96% | 13.26% | 11.20% | 9.20%(8) |

| Top Ten Holdings* |

| (as a % of investments†, |

| as of December 31, 2020) |

| | | |

| | | % of |

Security | | Investments |

| Entegris, Inc. | ENTG | 10.46% |

| PDF Solutions, Inc. | PDFS | 9.69% |

| Vicor Corp. | VICR | 9.51% |

| Apple, Inc. | AAPL | 9.36% |

| Nova Measuring | | |

| Instruments, Ltd. (Israel) | NVMI | 5.79% |

| KVH Industries, Inc. | KVHI | 5.63% |

| MKS Instruments, Inc. | MKSI | 4.65% |

| Aspen Aerogels, Inc. | ASPN | 3.28% |

| Super Micro Computer, Inc. | SMCI | 2.96% |

| CarMax, Inc. | KMX | 2.47% |

| | | |

| Top Ten Holdings = 63.80 of Total Investments | | |

Sector Weightings*

(as a % of net exposure(12),

as of December 31, 2020)

| | | | Net |

Sector(10) | Long(11) | (Short) | Exposure(12) |

| Cash | 0.6% | — | 0.6% |

| Communication Services | 0.1% | — | 0.1% |

| Consumer Discretionary | 2.5% | — | 2.5% |

| Consumer Staples | 1.9% | — | 1.9% |

| Energy | 3.3% | — | 3.3% |

| Financials | 1.9% | — | 1.9% |

| Health Care | 5.3% | — | 5.3% |

| Industrials | 13.4% | — | 13.4% |

| Information Technology | 69.1% | — | 69.1% |

| Materials | 1.7% | — | 1.7% |

| Real Estate | 0.2% | — | 0.2% |

Needham Funds

| NEEDHAM SMALL CAP GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NESGX |

| | Institutional Class |

| | Ticker Symbol: NESIX |

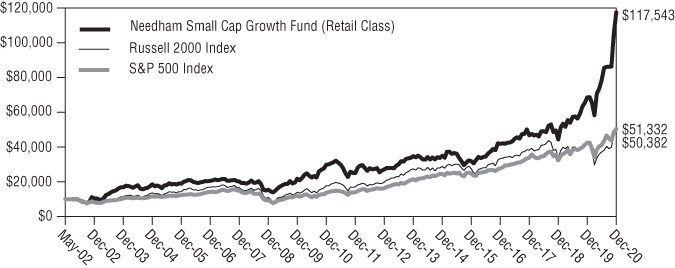

Comparison of Change in Value of a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on May 22, 2002.

Comparative Performance Statistics as of December 31, 2020

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Small Cap Growth Fund Retail Class(1)(2) | 71.35% | 29.82% | 14.70% | 14.16% |

Needham Small Cap Growth Fund Institutional Class(1)(3) | 72.51% | n/a | n/a | 30.20% |

S&P 500 Index(4)(5) | 18.40% | 15.22% | 13.88% | 9.08%(8) |

Russell 2000 Index(4)(7) | 19.96% | 13.26% | 11.20% | 9.19%(8) |

Top Ten Holdings*

(as a % of investments†,

as of December 31, 2020)

| | | % of |

Security | | Investments |

| Photronics, Inc. | PLAB | 6.12% |

| AXT, Inc. | AXTI | 5.49% |

| Limelight Networks, Inc. | LLNW | 4.10% |

| Intevac, Inc. | IVAC | 4.02% |

| Telos Corp. | TLS | 3.83% |

| Veeco Instruments, Inc. | VECO | 3.81% |

| EMCORE Corp. | EMKR | 3.73% |

| Fluidigm Corp. | FLDM | 3.43% |

| Akoustis Technologies, Inc. | AKTS | 3.39% |

| Sumo Logic, Inc. | SUMO | 3.30% |

| | | |

| Top Ten Holdings = 41.22% of Total Investments | | |

Sector Weightings*

(as a % of net exposure(12),

as of December 31, 2020)

| | | | Net |

Sector(10) | Long(11) | (Short) | Exposure(12) |

| Cash | 8.8% | — | 8.8% |

| Communication Services | 4.2% | — | 4.2% |

| Energy | 3.7% | — | 3.7% |

| Financials | 2.8% | — | 2.8% |

| Health Care | 9.3% | — | 9.3% |

| Industrials | 0.5% | — | 0.5% |

| Information Technology | 71.1% | (0.4)% | 70.7% |

Annual Report 2020

Each Fund’s performance figures are for the periods ended December 31, 2020. The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com or call 1-800-625-7071. The returns shown above are net of expenses. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and expense reimbursements, when they are necessary to keep the Fund’s total annual operating expenses at the expense cap currently in effect, total return would be reduced. Performance figures for periods greater than one year are annualized. For information about each index shown above, please see the notes below. The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

(1) | Investment results calculated after reinvestment of dividends. |

(2) | The inception date of the Retail Class of each Fund was as follows: Needham Growth Fund – 1/1/96; Needham Aggressive Growth Fund – 9/4/01; and Needham Small Cap Growth Fund – 5/22/02. |

(3) | The inception date of the Institutional Class of each Fund was 12/30/16. |

(4) | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

(5) | The S&P 500 Index focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also is considered representative of the market. Companies in the S&P 500 are considered leading companies in leading industries. |

(6) | The S&P MidCap 400 Index provides investors with a benchmark for mid-sized companies. The index seeks to remain an accurate measure of mid-sized companies, reflecting the risk and return characteristics of the broader mid-cap universe on an on-going basis. |

(7) | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 8% of the total market capitalization of that index. The Russell 2000 Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

(8) | The return shown for the index is from the inception date of the Retail Class. The returns for the S&P 500 Index, S&P MidCap 400 Index and the Russell 2000 Index from the inception date of the Institutional Class are 16.03%, 10.34%, 11.32%, respectively. |

(9) | The return reflects the actual performance for the year and does not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

(10) | These categories represent broad market sectors. Refer to the Schedule of Investments for a more detailed categorization by industry. |

(11) | Percentage of total investments includes all stocks, plus cash. |

(12) | Net exposure represents the difference between the long exposure and the short exposure, which produces the net investment exposure. |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments. |

Needham Funds

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A Fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of a six-month period and held for the entire period. The expense example table below illustrates your Fund’s cost in two ways:

| • | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading entitled “Expenses Paid During Period”. |

| |

| • | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Fund’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Annual Report 2020

For the Period July 1, 2020 to December 31, 2020

Expense Example Table

| | Beginning | Ending | Expenses Paid | Expense Ratio |

| | Account | Account | During Period* | During Period* |

| | Value | Value | 7/1/20 – | 7/1/20 – |

| | 7/1/20 | 12/31/20 | 12/31/20 | 12/31/20 |

| Needham Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,333.30 | $10.38 | 1.77% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,016.24 | $8.97 | 1.77% |

| Institutional Class Actual Expenses | $1,000.00 | $1,336.00 | $8.22 | 1.40% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,018.10 | $7.10 | 1.40% |

| | | | | |

| Needham Aggressive Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,343.60 | $10.90 | 1.85% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,015.84 | $9.37 | 1.85% |

| Institutional Class Actual Expenses | $1,000.00 | $1,348.80 | $6.97 | 1.18% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,019.20 | $5.99 | 1.18% |

| | | | | |

| Needham Small Cap Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,496.50 | $11.67 | 1.86% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,015.79 | $9.42 | 1.86% |

| Institutional Class Actual Expenses | $1,000.00 | $1,501.90 | $7.48 | 1.19% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,019.15 | $6.04 | 1.19% |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 184/366 (to reflect the one-half-year period). |

Needham Funds

Needham Growth Fund

Schedule of Investments

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks (97.4%) | |

| | |

| Aerospace & Defense (0.6%) | |

| | Parsons Corp. (a) | | | 24,000 | | | $ | 873,840 | |

| | | | | | | | | | |

| Biotechnology (3.0%) | |

| | G1 Therapeutics, Inc. (a) | | | 11,000 | | | | 197,890 | |

| | Gilead Sciences, Inc. | | | 69,000 | | | | 4,019,940 | |

| | Moderna, Inc. (a) | | | 750 | | | | 78,353 | |

| | | | | | | | | 4,296,183 | |

| Building Products (0.1%) | |

| | Alpha Pro Tech, Ltd. (a) | | | 7,500 | | | | 83,625 | |

| | | | | | | | | | |

| Commercial Services & Supplies (0.2%) | |

| | Clean Harbors, Inc. (a) | | | 3,500 | | | | 266,350 | |

| | |

| Communications Equipment (6.6%) | |

| | ADTRAN, Inc. | | | 85,000 | | | | 1,255,450 | |

| | Cambium Networks Corp. (a) | | | 53,450 | | | | 1,340,526 | |

| | Inseego Corp. (a) | | | 11,458 | | | | 177,255 | |

| | KVH Industries, Inc. (a) | | | 513,100 | | | | 5,823,685 | |

| | ViaSat, Inc. (a)(b) | | | 19,500 | | | | 636,675 | |

| | | | | | | | | 9,233,591 | |

| Electrical Equipment (4.6%) | |

| | Vicor Corp. (a) | | | 69,500 | | | | 6,409,290 | |

| | | | | | | | | | |

| Electronic Equipment, Instruments & Components (4.5%) | |

| | Arlo Technologies, Inc. (a) | | | 40,000 | | | | 311,600 | |

| | Corning, Inc. | | | 32,500 | | | | 1,170,000 | |

| | FARO Technologies, Inc. (a) | | | 10,000 | | | | 706,300 | |

| | FLIR Systems, Inc. | | | 5,000 | | | | 219,150 | |

| | II-VI, Inc. (a) | | | 10,000 | | | | 759,600 | |

| | IPG Photonics Corp. (a) | | | 6,250 | | | | 1,398,687 | |

| | TTM Technologies, Inc. (a) | | | 4,000 | | | | 55,180 | |

| | Vishay Intertechnology, Inc. | | | 60,000 | | | | 1,242,600 | |

| | Vishay Precision Group, Inc. (a) | | | 15,000 | | | | 472,200 | |

| | | | | | | | | 6,335,317 | |

| Energy Equipment & Services (5.1%) | |

| | Aspen Aerogels, Inc. (a) | | | 428,000 | | | | 7,143,320 | |

See accompanying notes to financial statements.

Annual Report 2020

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Entertainment (0.1%) | |

| | World Wrestling Entertainment, Inc. – Class A | | | 4,500 | | | $ | 216,225 | |

| | | | | | | | | | |

| Food Products (0.0%) | |

| | Vital Farms, Inc. (a) | | | 1,500 | | | | 37,965 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies (6.5%) | |

| | Becton Dickinson & Co. | | | 19,000 | | | | 4,754,180 | |

| | CryoLife, Inc. (a) | | | 6,000 | | | | 141,660 | |

| | CryoPort, Inc. (a) | | | 42,500 | | | | 1,864,900 | |

| | Medtronic PLC (Ireland) | | | 20,000 | | | | 2,342,800 | |

| | | | | | | | | 9,103,540 | |

| Health Care Providers & Services (0.6%) | |

| | Laboratory Corp. of America Holdings (a) | | | 2,000 | | | | 407,100 | |

| | Quest Diagnostics, Inc. | | | 3,750 | | | | 446,888 | |

| | | | | | | | | 853,988 | |

| Health Care Technology (0.1%) | |

| | American Well Corp. – Class A (a) | | | 6,500 | | | | 164,645 | |

| | | | | | | | | | |

| Household Products (0.4%) | |

| | Oil-Dri Corp. of America | | | 14,500 | | | | 494,160 | |

| | | | | | | | | | |

| Industrial Conglomerates (0.4%) | |

| | Honeywell International, Inc. | | | 2,500 | | | | 531,750 | |

| | | | | | | | | | |

| Interactive Media & Services (0.3%) | |

| | Alphabet, Inc. – Class A (a) | | | 250 | | | | 438,160 | |

| | | | | | | | | | |

| IT Services (3.0%) | |

| | Akamai Technologies, Inc. (a)(b) | | | 33,500 | | | | 3,517,165 | |

| | BigCommerce Holdings, Inc. (a) | | | 11,700 | | | | 750,555 | |

| | | | | | | | | 4,267,720 | |

| Life Sciences Tools & Services (7.2%) | |

| | Bruker Corp. | | | 1,000 | | | | 54,130 | |

| | Thermo Fisher Scientific, Inc. (b) | | | 21,500 | | | | 10,014,270 | |

| | | | | | | | | 10,068,400 | |

| Media (4.1%) | |

| | Comcast Corp. – Class A | | | 109,500 | | | | 5,737,800 | |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Oil, Gas & Consumable Fuels (0.2%) | |

| | Navigator Holdings, Ltd. (Marshall Islands) (a) | | | 27,500 | | | $ | 301,125 | |

| | | | | | | | | | |

| Real Estate Investment Trusts (REITs) (0.3%) | |

| | American Tower Corp. | | | 1,750 | | | | 392,805 | |

| | | | | | | | | | |

| Semiconductors & Semiconductor Equipment (31.1%) (d) | |

| | Allegro MicroSystems, Inc. (a) | | | 10,000 | | | | 266,600 | |

| | Applied Materials, Inc. | | | 9,000 | | | | 776,700 | |

| | AXT, Inc. (a) | | | 380,200 | | | | 3,638,514 | |

| | Entegris, Inc. | | | 110,500 | | | | 10,619,050 | |

| | FormFactor, Inc. (a) | | | 123,850 | | | | 5,328,027 | |

| | Lam Research Corp. | | | 2,500 | | | | 1,180,675 | |

| | MKS Instruments, Inc. | | | 22,000 | | | | 3,309,900 | |

| | NeoPhotonics Corp. (a) | | | 55,000 | | | | 499,950 | |

| | Nova Measuring Instruments, Ltd. (Israel) (a) | | | 48,750 | | | | 3,441,750 | |

| | PDF Solutions, Inc. (a) | | | 450,000 | | | | 9,720,000 | |

| | Photronics, Inc. (a) | | | 150,000 | | | | 1,674,000 | |

| | SiTime Corp. (a) | | | 12,500 | | | | 1,399,125 | |

| | Taiwan Semiconductor Manufacturing | | | | | | | | |

| | Co., Ltd. (Taiwan) – ADR | | | 9,000 | | | | 981,360 | |

| | Veeco Instruments, Inc. (a) | | | 50,650 | | | | 879,284 | |

| | | | | | | | | 43,714,935 | |

| Software (9.1%) | |

| | The Trade Desk, Inc. – Class A (a) | | | 4,750 | | | | 3,804,750 | |

| | 8x8, Inc. (a) | | | 20,000 | | | | 689,400 | |

| | Alteryx, Inc. – Class A (a) | | | 1,000 | | | | 121,790 | |

| | Appian Corp. (a) | | | 4,500 | | | | 729,405 | |

| | ChannelAdvisor Corp. (a) | | | 42,600 | | | | 680,748 | |

| | Coupa Software, Inc. (a) | | | 2,500 | | | | 847,275 | |

| | Datadog, Inc. – Class A (a) | | | 1,500 | | | | 147,660 | |

| | Duck Creek Technologies, Inc. (a) | | | 4,723 | | | | 204,506 | |

| | Everbridge, Inc. (a) | | | 11,500 | | | | 1,714,305 | |

| | FireEye, Inc. (a) | | | 1,250 | | | | 28,825 | |

| | GSE Systems, Inc. (a) | | | 24,029 | | | | 31,718 | |

| | Q2 Holdings, Inc. (a) | | | 16,500 | | | | 2,087,745 | |

| | Sumo Logic, Inc. (a) | | | 20,500 | | | | 585,890 | |

| | Telos Corp. (a) | | | 35,450 | | | | 1,169,141 | |

| | | | | | | | | 12,843,158 | |

See accompanying notes to financial statements.

Annual Report 2020

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Specialty Retail (4.8%) | |

| | CarMax, Inc. (a) | | | 71,500 | | | $ | 6,753,890 | |

| | | | | | | | | | |

| Technology Hardware, Storage & Peripherals (4.2%) | |

| | Apple, Inc. | | | 10,800 | | | | 1,433,052 | |

| | Intevac, Inc. (a) | | | 192,350 | | | | 1,386,843 | |

| | Super Micro Computer, Inc. (a) | | | 94,436 | | | | 2,989,844 | |

| | Western Digital Corp. | | | 2,250 | | | | 124,628 | |

| | | | | | | | | 5,934,367 | |

| Trading Companies & Distributors (0.3%) | |

| | Air Lease Corp. | | | 10,000 | | | | 444,200 | |

| Total Common Stocks | |

| (Cost $42,362,677) | | | $ | 136,940,349 | |

| | |

| Short-Term Investments (2.7%) | |

| | |

| Money Market Fund (2.7%) | |

| | Dreyfus Treasury Securities Cash Management – | | | | | | | | |

| | Institutional Class 0.01% (c) | | | | | | | | |

| Total Short-Term Investments | |

| (Cost $3,791,788) | | | 3,791,788 | | | $ | 3,791,788 | |

| | |

| Total Investments (100.1%) | |

| (Cost $46,154,465) | | | | 140,732,137 | |

| Total Securities Sold Short (-0.2%) | | | | (223,485 | ) |

| (Proceeds $221,612) | | | | | |

| Other Assets in Excess of Liabilities (0.1%) | | | | 164,899 | |

| Net Assets (100.0%) | | | $ | 140,673,551 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $1,963,860. |

| (c) | Rate shown is the seven-day yield as of December 31, 2020. |

| (d) | As of December 31, 2020, the Fund had a significant portion of its assets invested in the Semiconductors & Semiconductor Equipment industry. (unaudited) |

| | |

| ADR | American Depositary Receipt |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2020

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | Long | |

| United States^ | 95.0% | |

| Israel | 2.4% | |

| Ireland | 1.7% | |

| Taiwan | 0.7% | |

| Marshall Islands | 0.2% | |

| Total | 100.0% | |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 2.7%. |

See accompanying notes to financial statements.

Annual Report 2020

Needham Growth Fund

Schedule of Securities Sold Short

December 31, 2020

| | | Shares | | | Value | |

| Securities Sold Short (-0.2%) | |

| | |

| Semiconductors & Semiconductor Equipment (-0.2%) | |

| | Onto Innovation, Inc. (a) | | | 4,700 | | | $ | 223,485 | |

| Total Securities Sold Short (-0.2%) | |

| (Proceeds $221,612) | | | $ | 223,485 | |

| (a) | Non-income producing security. |

Distribution of investments by country or territory of incorporation, as a percentage of Securities Sold Short, is as follows (Unaudited):

| Country | Short | |

| United States | 100.0% | |

| Total | 100.0% | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks (99.4%) | |

| | |

| Aerospace & Defense (0.4%) | |

| | Parsons Corp. (a) | | | 7,550 | | | $ | 274,895 | |

| | | | | | | | | | |

| Biotechnology (0.2%) | |

| | G1 Therapeutics, Inc. (a) | | | 7,000 | | | | 125,930 | |

| | Moderna, Inc. (a) | | | 200 | | | | 20,894 | |

| | | | | | | | | 146,824 | |

| Building Products (1.2%) | |

| | Alpha Pro Tech, Ltd. (a) | | | 75,000 | | | | 836,250 | |

| | Jewett-Cameron Trading Co., Ltd. (Canada) (a) | | | 7,500 | | | | 65,625 | |

| | | | | | | | | 901,875 | |

| Commercial Services & Supplies (0.2%) | |

| | Clean Harbors, Inc. (a) | | | 2,000 | | | | 152,200 | |

| | | | | | | | | | |

| Communications Equipment (7.2%) | |

| | ADTRAN, Inc. | | | 50,000 | | | | 738,500 | |

| | Cambium Networks Corp. (a) | | | 17,500 | | | | 438,900 | |

| | KVH Industries, Inc. (a) | | | 369,400 | | | | 4,192,690 | |

| | | | | | | | | 5,370,090 | |

| Construction Materials (1.7%) | |

| | Smith-Midland Corp. (a) | | | 137,500 | | | | 1,263,625 | |

| | | | | | | | | | |

| Electrical Equipment (9.5%) | |

| | Vicor Corp. (a) | | | 76,750 | | | | 7,077,885 | |

| | | | | | | | | | |

| Electronic Equipment, Instruments & Components (3.1%) | |

| | Arlo Technologies, Inc. (a) | | | 40,000 | | | | 311,600 | |

| | IPG Photonics Corp. (a) | | | 7,000 | | | | 1,566,530 | |

| | Vishay Precision Group, Inc. (a) | | | 12,500 | | | | 393,500 | |

| | | | | | | | | 2,271,630 | |

| Energy Equipment & Services (3.3%) | |

| | Aspen Aerogels, Inc. (a) | | | 146,100 | | | | 2,438,409 | |

| | | | | | | | | | |

| Entertainment (0.1%) | |

| | World Wrestling Entertainment, Inc. – Class A | | | 2,250 | | | | 108,112 | |

| | | | | | | | | | |

| Food Products (0.1%) | |

| | Vital Farms, Inc. (a) | | | 2,000 | | | | 50,620 | |

See accompanying notes to financial statements.

Annual Report 2020

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Health Care Equipment & Supplies (2.9%) | |

| | CryoPort, Inc. (a) | | | 29,500 | | | $ | 1,294,460 | |

| | LeMaitre Vascular, Inc. | | | 22,000 | | | | 891,000 | |

| | | | | | | | | 2,185,460 | |

| Health Care Providers & Services (0.8%) | |

| | Laboratory Corp. of America Holdings (a) | | | 500 | | | | 101,775 | |

| | Quest Diagnostics, Inc. | | | 2,000 | | | | 238,340 | |

| | Sharps Compliance Corp. (a) | | | 27,500 | | | | 259,875 | |

| | | | | | | | | 599,990 | |

| Health Care Technology (0.5%) | |

| | American Well Corp. – Class A (a) | | | 1,155 | | | | 29,256 | |

| | Omnicell, Inc. (a) | | | 3,000 | | | | 360,060 | |

| | | | | | | | | 389,316 | |

| Household Products (1.8%) | |

| | Oil-Dri Corp. of America | | | 39,500 | | | | 1,346,160 | |

| | | | | | | | | | |

| IT Services (2.5%) | |

| | Akamai Technologies, Inc. (a)(b) | | | 14,500 | | | | 1,522,355 | |

| | BigCommerce Holdings, Inc. (a) | | | 5,000 | | | | 320,750 | |

| | | | | | | | | 1,843,105 | |

| Life Sciences Tools & Services (0.8%) | |

| | Bruker Corp. | | | 11,000 | | | | 595,430 | |

| | | | | | | | | | |

| Machinery (0.5%) | |

| | Westinghouse Air Brake Technologies Corp. | | | 5,000 | | | | 366,000 | |

| | | | | | | | | | |

| Professional Services (0.8%) | |

| | CRA International, Inc. | | | 12,000 | | | | 611,160 | |

| | | | | | | | | | |

| Real Estate Investment Trusts (REITs) (2.1%) | |

| | American Tower Corp. | | | 800 | | | | 179,568 | |

| | Equinix, Inc. | | | 2,000 | | | | 1,428,360 | |

| | | | | | | | | 1,607,928 | |

| Semiconductors & Semiconductor Equipment (35.6%) (d) | |

| | Allegro MicroSystems, Inc. (a) | | | 2,373 | | | | 63,264 | |

| | AXT, Inc. (a) | | | 56,750 | | | | 543,098 | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Semiconductors & Semiconductor Equipment – Continued | |

| | Entegris, Inc. | | | 81,000 | | | $ | 7,784,100 | |

| | FormFactor, Inc. (a) | | | 22,750 | | | | 978,705 | |

| | MKS Instruments, Inc. | | | 23,000 | | | | 3,460,350 | |

| | NeoPhotonics Corp. (a) | | | 25,000 | | | | 227,250 | |

| | Nova Measuring Instruments, Ltd. (Israel) (a)(b) | | | 61,000 | | | | 4,306,600 | |

| | PDF Solutions, Inc. (a)(b) | | | 334,000 | | | | 7,214,400 | |

| | Photronics, Inc. (a) | | | 30,000 | | | | 334,800 | |

| | SiTime Corp. (a) | | | 5,000 | | | | 559,650 | |

| | Taiwan Semiconductor Manufacturing | | | | | | | | |

| | Co., Ltd. (Taiwan) – ADR | | | 7,500 | | | | 817,800 | |

| | Veeco Instruments, Inc. (a) | | | 11,000 | | | | 190,960 | |

| | | | | | | | | 26,480,977 | |

| Software (7.6%) | |

| | The Trade Desk, Inc. – Class A (a) | | | 1,200 | | | | 961,200 | |

| | Absolute Software Corp. (Canada) | | | 8,500 | | | | 101,235 | |

| | Altair Engineering, Inc. – Class A (a) | | | 1,750 | | | | 101,815 | |

| | Appian Corp. (a) | | | 1,150 | | | | 186,404 | |

| | ChannelAdvisor Corp. (a) | | | 24,650 | | | | 393,907 | |

| | Digimarc Corp. (a) | | | 10,500 | | | | 496,020 | |

| | Duck Creek Technologies, Inc. (a) | | | 1,440 | | | | 62,352 | |

| | Everbridge, Inc. (a) | | | 2,000 | | | | 298,140 | |

| | fuboTV, Inc. (a) | | | 4,500 | | | | 126,000 | |

| | GSE Systems, Inc. (a)(e) | | | 1,057,625 | | | | 1,396,065 | |

| | Q2 Holdings, Inc. (a) | | | 8,000 | | | | 1,012,240 | |

| | Sumo Logic, Inc. (a) | | | 578 | | | | 16,519 | |

| | Telos Corp. (a) | | | 14,950 | | | | 493,051 | |

| | | | | | | | | 5,644,948 | |

| Specialty Retail (2.5%) | |

| | CarMax, Inc. (a) | | | 19,500 | | | | 1,841,970 | |

| | | | | | | | | | |

| Technology Hardware, Storage & Peripherals (13.2%) | |

| | Apple, Inc. | | | 52,500 | | | | 6,966,225 | |

| | Intevac, Inc. (a) | | | 92,675 | | | | 668,187 | |

| | Super Micro Computer, Inc. (a) | | | 69,500 | | | | 2,200,370 | |

| | | | | | | | | 9,834,782 | |

See accompanying notes to financial statements.

Annual Report 2020

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Trading Companies & Distributors (0.6%) | |

| | Transcat, Inc. (a) | | | 13,500 | | | $ | 468,180 | |

| | | | | | | | | | |

| Transportation Infrastructure (0.2%) | |

| | exactEarth, Ltd. (Canada) (a) | | | 115,000 | | | | 126,483 | |

| Total Common Stocks | |

| (Cost $23,429,526) | | | $ | 73,998,054 | |

| | |

| Short-Term Investments (0.6%) | |

| | |

| Money Market Fund (0.6%) | |

| | Dreyfus Treasury Securities Cash Management – | | | | | | | | |

| | Institutional Class 0.01% (c) | | | | | | | | |

| Total Short-Term Investment | |

| (Cost $425,951) | | | 425,951 | | | $ | 425,951 | |

| | |

| Total Investments (100.0%) | |

| (Cost $23,855,477) | | | | 74,424,005 | |

| Liabilities in Excess of Other Assets (0.0%) | | | | (33,718 | ) |

| Net Assets (100.0%) | | | $ | 74,390,287 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $1,525,097. |

| (c) | Rate shown is the seven-day yield as of December 31, 2020. |

| (d) | As of December 31, 2020, the Fund had a significant portion of its assets invested in the Semiconductors & Semiconductor Equipment industry. (unaudited) |

| (e) | Affiliated security. Please refer to Note 11 of the Financial Statements. |

ADR

| American Depositary Receipt |

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | Long | |

| United States^ | 92.7% | |

| Israel | 5.8% | |

| Taiwan | 1.1% | |

| Canada | 0.4% | |

| Total | 100.0% | |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 0.6%. |

See accompanying notes to financial statements.

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks (92.3%) | |

| | |

| Aerospace & Defense (0.5%) | |

| | Parsons Corp. (a) | | | 30,000 | | | $ | 1,092,300 | |

| | | | | | | | | | |

| Biotechnology (0.5%) | |

| | Voyager Therapeutics, Inc. (a) | | | 141,924 | | | | 1,014,757 | |

| | | | | | | | | | |

| Communications Equipment (15.8%) | |

| | ADTRAN, Inc. | | | 395,000 | | | | 5,834,150 | |

| | Cambium Networks Corp. (a) | | | 183,354 | | | | 4,598,518 | |

| | EMCORE Corp. (a)(e) | | | 1,500,000 | | | | 8,175,000 | |

| | Inseego Corp. (a) | | | 133,600 | | | | 2,066,792 | |

| | KVH Industries, Inc. (a)(b) | | | 568,400 | | | | 6,451,340 | |

| | Lantronix, Inc. (a) | | | 250,000 | | | | 1,110,000 | |

| | ViaSat, Inc. (a)(b) | | | 185,000 | | | | 6,040,250 | |

| | | | | | | | | 34,276,050 | |

| Consumer Finance (2.8%) | |

| | LendingTree, Inc. (a) | | | 22,500 | | | | 6,160,275 | |

| | | | | | | | | | |

| Diversified Telecommunication Services (1.6%) | |

| | Vonage Holdings Corp. (a) | | | 275,000 | | | | 3,540,625 | |

| | | | | | | | | | |

| Electronic Equipment, Instruments & Components (9.0%) | |

| | Akoustis Technologies, Inc. (a) | | | 607,500 | | | | 7,429,725 | |

| | TTM Technologies, Inc. (a) | | | 55,000 | | | | 758,725 | |

| | Vishay Intertechnology, Inc. | | | 225,000 | | | | 4,659,750 | |

| | Vishay Precision Group, Inc. (a)(b) | | | 214,000 | | | | 6,736,720 | |

| | | | | | | | | 19,584,920 | |

| Energy Equipment & Services (2.5%) | |

| | Aspen Aerogels, Inc. (a) | | | 320,000 | | | | 5,340,800 | |

| | | | | | | | | | |

| Entertainment (2.7%) | |

| | World Wrestling Entertainment, Inc. – Class A | | | 120,000 | | | | 5,766,000 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies (4.4%) | |

| | CryoLife, Inc. (a) | | | 80,000 | | | | 1,888,800 | |

| | Sientra, Inc. (a) | | | 1,000,000 | | | | 3,890,000 | |

| | ViewRay, Inc. (a) | | | 1,000,000 | | | | 3,820,000 | |

| | | | | | | | | 9,598,800 | |

See accompanying notes to financial statements.

Annual Report 2020

Needham Small Cap Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Health Care Technology (0.2%) | |

| | American Well Corp. – Class A (a) | | | 20,800 | | | $ | 526,864 | |

| | | | | | | | | | |

| IT Services (5.5%) | |

| | BigCommerce Holdings, Inc. (a) | | | 46,800 | | | | 3,002,220 | |

| | Limelight Networks, Inc. (a)(b) | | | 2,250,000 | | | | 8,977,500 | |

| | | | | | | | | 11,979,720 | |

| Life Sciences Tools & Services (3.4%) | |

| | Fluidigm Corp. (a) | | | 1,250,000 | | | | 7,500,000 | |

| | | | | | | | | | |

| Oil, Gas & Consumable Fuels (1.3%) | |

| | Navigator Holdings, Ltd. (Marshall Islands) (a) | | | 257,044 | | | | 2,814,632 | |

| | |

| Pharmaceuticals (0.8%) | |

| | Agile Therapeutics, Inc. (a) | | | 600,000 | | | | 1,722,000 | |

| | | | | | | | | | |

| Semiconductors & Semiconductor Equipment (17.6%) | |

| | Allegro MicroSystems, Inc. (a) | | | 50,000 | | | | 1,333,000 | |

| | AXT, Inc. (a) | | | 1,255,000 | | | | 12,010,350 | |

| | NeoPhotonics Corp. (a) | | | 200,000 | | | | 1,818,000 | |

| | PDF Solutions, Inc. (a) | | | 60,000 | | | | 1,296,000 | |

| | Photronics, Inc. (a) | | | 1,200,000 | | | | 13,392,000 | |

| | Veeco Instruments, Inc. (a) | | | 480,428 | | | | 8,340,230 | |

| | | | | | | | | 38,189,580 | |

| Software (19.2%) | |

| | 8x8, Inc. (a) | | | 35,000 | | | | 1,206,450 | |

| | Benefitfocus, Inc. (a) | | | 15,000 | | | | 217,200 | |

| | ChannelAdvisor Corp. (a) | | | 90,250 | | | | 1,442,195 | |

| | Cornerstone OnDemand, Inc. (a) | | | 140,000 | | | | 6,165,600 | |

| | Duck Creek Technologies, Inc. (a) | | | 40,000 | | | | 1,732,000 | |

| | FireEye, Inc. (a) | | | 125,000 | | | | 2,882,500 | |

| | New Relic, Inc. (a) | | | 50,000 | | | | 3,270,000 | |

| | Sumo Logic, Inc. (a) | | | 252,500 | | | | 7,216,450 | |

| | Telos Corp. (a) | | | 254,600 | | | | 8,396,708 | |

| | Yext, Inc. (a) | | | 450,000 | | | | 7,074,000 | |

| | Zuora, Inc. – Class A (a) | | | 151,800 | | | | 2,114,574 | |

| | | | | | | | | 41,717,677 | |

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments (Continued)

December 31, 2020

| | | Shares | | | Value | |

| Common Stocks – Continued | |

| | |

| Technology Hardware, Storage & Peripherals (4.5%) | |

| | Intevac, Inc. (a)(e) | | | 1,220,468 | | | $ | 8,799,574 | |

| | Western Digital Corp. | | | 17,500 | | | | 969,325 | |

| | | | | | | | | 9,768,899 | |

| Total Common Stocks | |

| (Cost $159,221,856) | | | $ | 200,593,899 | |

| | |

| Short-Term Investments (8.9%) | |

| | |

| Money Market Fund (8.9%) | |

| | Dreyfus Treasury Securities Cash Management – | | | | | | | | |

| | Institutional Class 0.01% (c) | | | | | | | | |

| Total Short-Term Investments | |

| (Cost $19,254,825) | | | 19,254,825 | | | $ | 19,254,825 | |

| | |

| Total Investments (101.2%) | |

| (Cost $178,476,681) | | | | 219,848,724 | |

| Total Securities Sold Short (-0.4%) | | | | (884,430 | ) |

| (Proceeds $877,019) | | | | | |

| Liabilities in Excess of Other Assets (-0.8%) | | | | (1,814,811 | ) |

| Net Assets (100.0%) | | | $ | 217,149,483 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $2,239,430. |

| (c) | Rate shown is the seven-day yield as of December 31, 2020. |

| (e) | Affiliated security. Please refer to Note 11 of the Financial Statements. |

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | Long | |

| United States^ | 98.7% | |

| Marshall Islands | 1.3% | |

| Total | 100.0% | |

^ United States allocation includes Short-Term Investment-Money Market Fund of 8.90%

See accompanying notes to financial statements.

Annual Report 2020

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

December 31, 2020

| | | Shares | | | Value | |

| Securities Sold Short (-0.4%) | |

| | |

| Semiconductors & Semiconductor Equipment (-0.4%) | |

| | Onto Innovation, Inc. (a) | | | 18,600 | | | $ | 884,430 | |

| Total Securities Sold Short (-0.4%) | |

| (Proceeds $877,019) | | | $ | 884,430 | |

| (a) | Non-income producing security. |

Distribution of investments by country or territory of incorporation, as a percentage of Total Securities Sold Short, is as follows (Unaudited):

| Country | Short | |

| United States | 100.0% | |

| Total | 100.0% | |

See accompanying notes to financial statements.

Needham Funds

Statements of Assets and Liabilities

December 31, 2020

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Assets | | | | | | | | | |

| Investments, at Value: | | | | | | | | | |

| Unaffiliated Securities, | | | | | | | | | |

| (Cost $46,154,465, $21,869,017, $166,703,792) | | $ | 140,732,137 | | | $ | 73,027,940 | | | $ | 202,874,150 | |

| Affiliated securities (Cost $—, $1,986,460, $11,772,889) | | | — | | | | 1,396,065 | | | | 16,974,574 | |

| Receivables: | | | | | | | | | | | | |

| Deposit with Broker for Securities Sold Short | | | 231,715 | | | | — | | | | 981,766 | |

| Dividends and Interest | | | 26,477 | | | | 4,295 | | | | 290 | |

| Fund Shares Sold | | | 115,730 | | | | 132,331 | | | | 1,080,412 | |

| Investment Securities Sold | | | 59,609 | | | | — | | | | 2,452,354 | |

| Prepaid Expenses | | | 43,753 | | | | 30,671 | | | | 64,347 | |

| Total Assets | | | 141,209,421 | | | | 74,591,302 | | | | 224,427,893 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Securities Sold Short, at Value | | | | | | | | | | | | |

| (Proceeds $221,612, $—, $877,019) | | | 223,485 | | | | — | | | | 884,430 | |

| Payables: | | | | | | | | | | | | |

| Investment Securities Purchased | | | 36,244 | | | | 40,830 | | | | 5,682,690 | |

| Fund Shares Redeemed | | | 43,114 | | | | — | | | | 443,552 | |

| Due to Adviser | | | 142,216 | | | | 99,475 | | | | 175,107 | |

| Distribution Fees | | | 17,689 | | | | 8,627 | | | | 15,965 | |

| Administration and Accounting Fees | | | 20,810 | | | | 11,222 | | | | 26,906 | |

| Transfer Agent Fees | | | 3,167 | | | | 1,066 | | | | 5,939 | |

| Directors’ Fees | | | 1,045 | | | | 540 | | | | 1,391 | |

| Audit Fees | | | 20,350 | | | | 24,958 | | | | 20,350 | |

| Accrued Expenses and Other Liabilities | | | 27,750 | | | | 14,297 | | | | 22,080 | |

| Total Liabilities | | | 535,870 | | | | 201,015 | | | | 7,278,410 | |

| Total Net Assets | | $ | 140,673,551 | | | $ | 74,390,287 | | | $ | 217,149,483 | |

See accompanying notes to financial statements.

Annual Report 2020

Statements of Assets and Liabilities (Continued)

December 31, 2020

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Retail Class Shares | | | | | | | | | |

| Net Assets | | $ | 82,627,969 | | | $ | 40,258,236 | | | $ | 89,206,186 | |

| Shares Issued and Outstanding | | | | | | | | | | | | |

| $0.001 Par Value (Authorized | | | | | | | | | | | | |

| 800,000,000,100,000,000 and | | | | | | | | | | | | |

| 100,000,000 respectively) | | | 1,478,523 | | | | 1,274,830 | | | | 3,457,891 | |

| Net Asset Value and | | | | | | | | | | | | |

| Offering Price Per Share | | $ | 55.89 | | | $ | 31.58 | | | $ | 25.80 | |

| | | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | |

| Net Assets | | $ | 58,045,582 | | | $ | 34,132,051 | | | $ | 127,943,297 | |

| Shares Issued and Outstanding | | | | | | | | | | | | |

| $0.001 Par Value (Authorized | | | | | | | | | | | | |

| 800,000,000,100,000,000 and | | | | | | | | | | | | |

| 100,000,000 respectively) | | | 1,012,022 | | | | 1,050,618 | | | | 4,801,916 | |

| Net Asset Value and | | | | | | | | | | | | |

| Offering Price Per Share | | $ | 57.36 | | | $ | 32.49 | | | $ | 26.64 | |

| | | | | | | | | | | | | |

| Components of Net Assets | | | | | | | | | | | | |

| Paid in Capital | | | 40,209,623 | | | | 22,902,189 | | | | 151,931,830 | |

| Distributable Earnings | | | 100,463,928 | | | | 51,488,098 | | | | 65,217,653 | |

| Total Net Assets | | $ | 140,673,551 | | | $ | 74,390,287 | | | $ | 217,149,483 | |

See accompanying notes to financial statements.

Needham Funds

Statements of Operations

For the year ended December 31, 2020

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Investment Income | | | | | | | | | |

| Dividend Income from unaffiliated securities (net of | | | | | | | | | |

| foreign withholding tax of $3,778, $2,783, $—) | | $ | 706,333 | | | $ | 215,756 | | | $ | 89,014 | |

| Interest Income | | | 13,898 | | | | 8,500 | | | | 262,871 | |

| Total Investment Income | | | 720,231 | | | | 224,256 | | | | 351,885 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Investment Advisory Fees | | | 1,441,336 | | | | 721,662 | | | | 2,065,798 | |

| Distribution Fees | | | 166,692 | | | | 79,228 | | | | 273,867 | |

| Administration and Accounting Fees | | | 141,152 | | | | 82,489 | | | | 191,166 | |

| Legal Fees | | | 57,632 | | | | 31,810 | | | | 98,940 | |

| Registration Fees | | | 41,628 | | | | 23,697 | | | | 50,327 | |

| Audit Fees | | | 33,057 | | | | 37,691 | | | | 39,739 | |

| Transfer Agent Fees | | | 29,091 | | | | 12,184 | | | | 44,123 | |

| Directors’ Fees | | | 13,155 | | | | 6,490 | | | | 15,904 | |

| Chief Compliance Officer Fees | | | 13,151 | | | | 6,357 | | | | 17,343 | |

| Custodian Fees | | | 11,842 | | | | 7,388 | | | | 17,697 | |

| Printing Fees | | | 9,349 | | | | 5,606 | | | | 10,439 | |

Dividend Expense(1) | | | 1,725 | | | | 305 | | | | 4,000 | |

Interest Expense(1) | | | 1,385 | | | | 697 | | | | 2,900 | |

| Other Expenses | | | 31,750 | | | | 15,954 | | | | 14,400 | |

| Total Expenses | | | 1,992,945 | | | | 1,068,251 | | | | 2,846,643 | |

| Fees Waived by Adviser | | | (88,423 | ) | | | (104,256 | ) | | | (240,497 | ) |

| Fees Recouped by Adviser | | | 14,374 | | | | — | | | | 84,831 | |

| Net Expenses | | | 1,918,896 | | | | 927,302 | | | | 2,690,977 | |

| Net Investment Loss | | | (1,198,665 | ) | | | (703,046 | ) | | | (2,339,092 | ) |

| | | | | | | | | | | | | |

| Net Realized / Unrealized Gain (Loss) from | | | | | | | | | | | | |

| Affiliated and Unaffiliated Securities, | | | | | | | | | | | | |

| Securities Sold Short (Note 3) | | | | | | | | | | | | |

| Net Realized Gain from Unaffiliated Securities | | | 12,575,169 | | | | 4,822,205 | | | | 54,082,947 | |

| Net Realized Loss from Affiliated Securities | | | — | | | | — | | | | (105,917 | ) |