UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09114

The Needham Funds, Inc.

(Exact name of registrant as specified in charter)

250 Park Avenue, New York, NY 10177-1099

(Address of principal executive offices) (Zip code)

Mr. George A. Needham, 250 Park Avenue, New York, NY 10177-1099

(Name and address of agent for service)

1-800-625-7071

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2017

Date of reporting period: December 31, 2017

Item 1. Reports to Stockholders.

Annual

Report

Needham Funds

Seeking to build wealth for long-term investors.

December 31, 2017

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

250 Park Avenue, 10th Floor

New York, New York 10177

1-800-625-7071

www.needhamfunds.com

Annual Report

December 31, 2017

| Contents | |

| Letter from the Adviser | 1 |

| Portfolio Characteristics | |

| Needham Growth Fund | 14 |

| Needham Aggressive Growth Fund | 16 |

| Needham Small Cap Growth Fund | 18 |

| Disclosure of Fund Expenses | 20 |

| Schedules of Investments | |

| Needham Growth Fund | 22 |

| Needham Aggressive Growth Fund | 28 |

| Needham Small Cap Growth Fund | 33 |

| Schedules of Securities Sold Short | |

| Needham Growth Fund | 27 |

| Needham Aggressive Growth Fund | 32 |

| Needham Small Cap Growth Fund | 36 |

| Statements of Assets and Liabilities | 38 |

| Statements of Operations | 40 |

| Statements of Changes in Net Assets | 41 |

| Financial Highlights | |

| Needham Growth Fund | 44 |

| Needham Aggressive Growth Fund | 46 |

| Needham Small Cap Growth Fund | 48 |

| Notes to Financial Statements | 50 |

| Report of Independent Registered Public Accounting Firm | 59 |

| Information about Directors and Officers | 60 |

| Supplementary Information and Privacy Policy | 62 |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus or summary prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

| | • | Are NOT FDIC insured |

| | • | Have no bank guarantee |

| | • | May lose value |

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

Annual Report 2017

250 Park Avenue, 10th Floor

New York, NY 10177

(800) 625-7071

www.needhamfunds.com

February 2018

Dear Shareholders, Friends of Needham and Prospective Shareholders,

We are reporting results for the quarter and year ending December 31, 2017 for the Needham Growth Fund, Needham Aggressive Growth Fund, and Needham Small Cap Growth Fund. Our mission is to create wealth for long-term investors.

Needham Funds’ Fourth Quarter and Year-End 2017 Results

In the fourth quarter, the Needham Growth Fund Institutional and Retail classes were down -2.40% and -2.55%, respectively; the Needham Aggressive Growth Fund Institutional and Retail classes were down -2.84% and -2.98%, respectively; and the Needham Small Cap Growth Fund Institutional and Retail classes were down -1.13% and -1.27%, respectively. The Russell 2000 Total Return Index returned 3.34%, the S&P 500 Total Return Index returned 6.64%, and the NASDAQ Composite Index returned 6.57%. We are disappointed with the fourth quarter results.

In 2017, the Needham Growth Fund Institutional and Retail classes returned 8.89% and 8.32%, respectively; the Needham Aggressive Growth Institutional and Retail classes returned 9.36% and 8.73%, respectively, and the Needham Small Cap Growth Fund Institutional and Retail classes returned 12.48% and 11.88%, respectively. The Russell 2000 Total Return Index returned 14.65%, the S&P 500 Total Return Index returned 21.83%, and the NASDAQ Composite Index returned 29.73%. The Funds’ absolute returns were good, but disappointing relative to the averages.

Start to 2018

Before we review 2017, a word on the start to 2018. The first few weeks were a continuation of the dream market of the last three years. Through January 23, the S&P 500 returned 6.19%, the Russell 2000 returned 4.90% and the Needham Funds were positive. The Tax Cut and Jobs Act of 2017 became law and established an internationally competitive corporate tax structure with the first sweeping overhaul to the U.S. tax code in over 30 years. The market and the Needham Funds responded positively.

Regarding the new tax law, many of our portfolio holdings should benefit from a reduction in the corporate tax rate from 35% to 22%. However, some of our companies are in investment mode and not yet generating enough taxable earnings to benefit. Companies that have been investing for many years could be long-term beneficiaries of the tax change; they were investing, thus not generating earnings that would have been taxed at the higher rate. Future earnings that may result from these past investments will be taxed at the new, lower corporate tax rate. What brilliant tax planning!

The beginning of February brought a different story. On Friday, February 2, the Dow Jones Industrial Average fell 666 points and the decline continued through the following week. As of February 8, the S&P 500 was down 3.46%, the Russell 2000 was down 4.67% and

Needham Funds

the Needham Funds were also down for 2018. We point to two factors. First, the Federal Reserve is raising interest rates, as it views the economy at full employment and inflation at its 2% target.

Second, there is $1.5 trillion in “risk parity” trades, which are short the market’s volatility. Grant’s Interest Rate Observer did a great write-up on risk parity in its March 10, 2017 issue. This second week of February will have served a good result, if the risk volatility traders realize this trade is over. According to Barron’s, the Credit Suisse Velocity Shares Daily Inverse VIX Short-Term ETN (XIV) and ProShares Short VIX Short-Term Futures ETF (SVXY) fell from $3 billion to $150 million of net asset value, creating significant losses for retail investors. Credit Suisse is liquidating its fund. As market pundit Ed Borgato wrote on Twitter, “How … are people supposed to save for retirement without a reliable way to short vol?” I facetiously said, “It’s too bad there weren’t triple-levered volatility ETFs…”

Trading volatility is so far from our investment philosophy. We look to create wealth for long-term investors by investing in companies with strong management teams and attractive valuations.

Review of 2017 – “Reward and Patience”

Well, the world didn’t end in 2017, as it appeared it might at the beginning of the year. In fact, it was a robust year for the economy and equities. The U.S. started 2017 with the inauguration of President Trump and fear about everything.

In 2017, the Needham Funds were rewarded by our patience in semiconductor capital equipment holdings, some of which were started eight years ago. On the other hand, some of our long-term holdings suffered owing to lack of perceived progress and a few company stumbles. These will require additional patience, and we believe many of these holdings are poised for outperformance in 2018. The short positions hurt the overall performance of the Needham Growth and Aggressive Growth Funds as well.

In January, the market rallied on the presidential inauguration and proposals of pro-growth tax reform, infrastructure spending, and reduced regulatory burden. In February, President Trump promised a “phenomenal tax plan” and to streamline the new drug regulatory process. Failure to repeal the Affordable Care Act and introduce new healthcare legislation brought worries that tax reform would be delayed. The indices rallied for each month of the first quarter.

In April, the market remained positive. Preliminary GDP showed just 0.7% economic growth, although that number was later revised to a still low 1.2%. The Atlanta Fed’s GDPNow showed preliminary second quarter GDP growth at a slightly higher 2.5%, making the first half of 2017 consistent with the growth of the last 8 years.

In May, we had the firing of FBI Director James Comey and North Korea’s third missile launch. June saw the market rally and there was a sell-off in the FAANG stocks (Facebook, Amazon, Apple, Netflix, Google/Alphabet), which lasted about one week.

July was another positive month for the markets and the Funds. The preliminary 2Q17 GDP came in at 2.6%. The Core Consumer Price Index showed a 1.7% year-over-year increase, which remained below the Federal Reserve’s 2% target. Both of these indicated a goldilocks economy – not too hot and not too cold.

August saw the S&P 500 eke out a small gain and the Russell 2000 decline. The Funds were down and slightly underperformed. August brought terrorism in Barcelona, violence in Charlottesville, a troubling North Korean situation, stalled healthcare and tax reform policy, and disappointing earnings from Cisco Systems, Inc. (CSCO) and retail companies.

September was a good month for the Funds and for the markets. The second quarter GDP estimate was revised higher to 3.1%—the strongest growth in over two years. As expected, the Federal Reserve left the target federal funds rate unchanged at 1-1.25% and announced its intention to begin normalizing its balance sheet by reducing holdings of Treasuries and mortgage-backed securities by $10 billion per month in the October quarter. With $4.2 trillion of holdings, this will take time. In September, Applied Materials (AMAT) reinforced our positive thesis on the long-term, secular growth opportunity in semiconductor capital equipment at its investor day.

October was another positive month for the markets. The third quarter preliminary GDP reading was 2.1% and the Core Consumer Price Index showed a 2.0% year-over-year increase, in-line with the Fed’s 2% target. Again, both of these indicated a goldilocks economy.

The markets showed continued strength in November. We learned that GDP grew 3.3% in the third quarter, the fastest pace since 2014. We also saw progress on the tax bill, which would be a generational change in favor of an internationally competitive corporate tax structure.

December was a mostly flat month for the averages, but a down month for all three Needham Funds. December saw the passage of the tax bill. Sectors including financials, energy, industrials and consumer all outperformed. Many of the companies in these sectors will have a greater short-term benefit from a lower corporate tax rate than some of our small cap companies, which are not yet taxpayers.

Our outlook for 2018 is positive, with the possibilities of stronger economic growth and reward of value recognition in our small cap companies that lagged in 2017. We look forward to a year of patience rewarded.

John Barr’s Commentary – Reward and Patience with Compounders

I believe that finding and holding investments in compounding stocks is the path to long-term wealth creation.

There are a wide variety of options for one looking to generate wealth. Some masquerade as investments, others are known openly as gambling. People can buy and sell baseball cards, fine wines, or they could have traded volatility with the Velocity Shares Daily Inverse VIX Short-Term ETN (XIV).1 Gamblers can play the lottery, bet on sports, and play the tables in Las Vegas.2 Gambling primarily requires luck, although a few are able to win through skill. Buying and selling stuff requires many right decisions. Many things that one trades won’t capture the relentless move forward by the American economy and its worldwide trade partners. It also leaves one at risk of being uninvested at the wrong time.

____________

1 ETF is sponsored by Credit Suisse and fell spectacularly on February 5 during the volatility traders induced sell-off. CSFB will close this ETF.

2 Molly’s Game is a great movie showing the addiction of gambling and how lack of skill can be disastrous in “playing” games of chance.

Needham Funds

In the 2016 Berkshire Hathaway Annual Letter, Warren Buffett wrote “American business—and consequently a basket of stocks—is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that. Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle. Many companies, of course, will fall behind, and some will fail.”

3

By owning common stocks in the right companies, we have the opportunity to be the financial partner with great entrepreneurs and CEOs. Our investments represent partial ownership of businesses that provide value to customers, invest in new products and plants, employ engineers, marketers and operations people, and may grow and generate cash for their owners. Imagine how our predecessors a few generations back would have viewed this opportunity to be a business owner. An ownership mentality matches the investment duration of investors in the Needham Funds looking to create wealth over the long term.

I look to make investments in companies with great management, which, to me, generally means founders, family, or long-tenured managers, with high return or the potential for a high return on capital and the opportunity to be 5-10x larger. These are potential compounders. I look for companies available at an attractive valuation that may be in an investment stage, operating near break-even, and below potential operating margin. When I purchase a new investment, I believe that financial results could come within 6-12 months. However, investment phases may last longer than expected while the companies are making progress behind the scenes. It’s impossible for a quantitative or passive investor to see this progress.

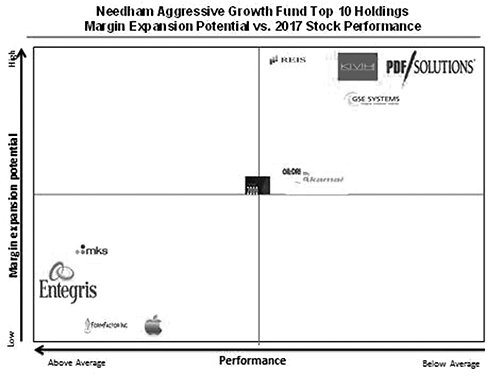

The adjacent chart shows the 2017 performance of Needham Aggressive Growth Fund’s top 10 holdings and their potential for margin expansion. The other Needham Funds have some of these same top 10 holdings.

____________

3 http://www.berkshirehathaway.com/letters/2016ltr.pdf, p. 6

Reward – The Needham Aggressive Growth Fund’s 2017 outperformers were Entegris (ENTG), MKS Instruments (MKSI), FormFactor (FORM), and Apple (AAPL). All of these companies are operating close to their peak margins. They are also seeing strong revenue growth. These winners are clustered in the lower left quadrant of the chart.

Patience is required for companies still in investment mode that have yet to show financial results. The investments may be in operating expenses or capital equipment to open a new office, expand capacity or bring a new product to market. The level of investment can be measured by looking at a company’s potential operating margin and its current level. It may also be seen by comparing capex spending with the historical level of depreciation and amortization.

Reis (REIS), KVH Industries (KVHI), PDF Solutions (PDFS) and GSE Systems (GVP) are clustered in the upper right of the chart; they all remain in investment mode and detracted from the Fund’s performance in 2017. I expected more visible progress, but these companies made progress behind the scenes. All four are small or micro-cap companies, where there is less investor focus and a less efficient market. In all four cases, I believe 2018 may be a year of reward, but the timing may remain uncertain.

The Needham Funds Are Very Different from an Index

At Needham, we view our Funds’ public investments the same way venture capital investors view theirs. Months, quarters or even years can pass without markets recognizing progress behind the scenes that may lead to an above-market, compounding return. Consequently, the Needham Funds are not correlated with the averages, as shown by an R-Squared of 79.58 relative to the Russell 20004 for the Needham Aggressive Growth Fund; 68.63 relative to the Russell 2000 for the Needham Small Cap Growth Fund; and 59.63 relative to the S&P 5005 for the Needham Growth Fund.

As of December 31, 2017, Needham Aggressive Growth Fund owned stakes in 57 companies. The Fund’s top 10 holdings represent 57% of net assets. Therefore, the Fund has a very different constitution than the indices, as shown by its high Active Share6 of 112.7% versus the Russell 2000 Total Return Index. The other Needham Funds also have high Active Share—Needham Growth Fund is 107.4% versus the S&P 500 TR Index, and Needham Small Cap Growth Fund is 100.4% versus the Russell 2000. The bottom line is that I don’t try to rotate sectors to match or beat an index. I look to invest in companies that might earn an above market, compounding long-term return.

Needham Growth Fund (NEEGX/NEEIX)

The Needham Growth Fund Institutional class was down -2.40% and the Retail class was down -2.55% in the fourth quarter, underperforming the S&P 500, which returned 6.64%. For the year, Needham Growth Fund Institutional class returned 8.89% and the Retail class returned 8.32%, compared to the S&P 500’s return of 21.83%.

____________

4 Since inception on 9/4/01.

5 Since inception on 1/1/96.

6 Active Share represents the proportion of portfolio holdings that differ from those in the benchmark index.

Needham Funds

For the fourth quarter, ViaSat, Inc. (VSAT) was the top contributor and returned 16.4%. The ViaSat 2 high-throughput satellite launched and is prepared to go in service in early February. This satellite has twice the capacity of the next previous generation of High-throughput Satellite (HTS).

Akamai Technologies, Inc. (AKAM) was the second best contributor for the quarter and returned 33.5%. On December 15, activist investor Elliott Management announced a stake in Akamai. Elliott seeks to speak with Akamai about maximizing shareholder value. On January 9, 2018, Bloomberg reported that Akamai was working with Morgan Stanley on a strategic review. Our patience was rewarded.

Long-time holding Becton Dickinson and Co. (BDX) returned 9.6% and was the third leading contributor, as it closed the accretive acquisition of healthcare company C.R. Bard.

CarMax, Inc. (KMX) was the leading detractor in the fourth quarter, as comparable used car sales were up slightly less than Wall Street expectations, amid much ado about an upcoming peak in used car sales. CarMax is the nation’s leading seller of used cars. It offers a great dealership experience with professional salespeople and no price negotiation. With our long-term view, CarMax has the opportunity to grow from single-digit national market share. CarMax has barriers to entry from its scale. It knows the logistics of moving cars, and it knows more about what cars are worth than any other company. Consequently, CarMax can offer a fair price to the car seller and to the car buyer.

Short positions in Ubiquiti Networks, Inc. (UBNT) and Medallion Financial Corp. (MFIN) were detractors in the fourth quarter. Medallion Financial remains in default on a bank loan that we believe it will have difficulty repaying. Its bank sued in 2016, and they are due in court in February for a summary judgment hearing. This is a basic case of, “They didn’t pay and the bank wants its money back.” The stock was up 62.6% in the fourth quarter due to short-covering and as the momentum traders seized control.

KVH Industries, Inc. (KVHI) was the third-largest detractor, down -13.4%, despite a good earnings report, progress on its strategic plan, and an activist becoming its largest investor. KVH is a case of additional patience required. The company’s new AgilePlans offering bundles communications hardware, airtime, entertainment and operational content on a new high-throughput satellite network. KVH continued its work on a low-cost fiber optic gyroscope (FOG) for the autonomous vehicle market. These vehicles depend on many sensors, including FOGs, to know where they are. We estimate KVH is on almost all of the autonomous cars manufactured to date. Vintage Capital filed a 13G with the SEC to disclose it had acquired 1.5 million shares of KVH, or about 9% of KVH’s outstanding shares. Vintage has made successful investments in a number of small defense electronics companies, some of which were acquired.

For the year the Fund’s largest position, Thermo Fisher Scientific, Inc. (TMO), was the top performer and returned 35.0%. Thermo Fisher has a record of mid-single-digit revenue growth and mid-teens earnings growth. We see continued organic growth and acquisition opportunities in life science tools. Thermo Fisher is an 18-year holding of the Fund and has compounded at a near 18% annual rate.

Entegris, Inc. (ENTG) was the second top contributor in 2017, returning 70.5%. Entering 2017, we thought Entegris might generate $1.24 billion of revenue with $1.06 per share of earnings. Exiting 2017, we believe the year will be $1.33 billion of revenue and $1.40 per share of earnings.

FormFactor, Inc. (FORM) was the third top contributor in 2017, returning 39.7%. It provides wafer probe cards used to test integrated circuits. FormFactor benefitted from strong business across its customer base, including mobile phone customers, DRAM, logic (Intel [INTC] is their largest customer) and foundry with new business at Taiwan Semiconductor (TSM). Taiwan Semiconductor manufactures processors for Apple’s (AAPL) iPhones. FormFactor sees growing demand from the automotive market and from the RF (radio frequency) market.

As I wrote last quarter, the debate in semiconductor industry circles revolves around cyclical versus secular growth. Consensus is that the semiconductor equipment stocks will soon suffer in unison, owing to an overbuild in capacity. It is always dangerous to say, “This time is different.” However, among other market drivers, NAND memory is replacing disk drives in storage systems. Given the growth in data storage and the early stage of this replacement cycle, we believe the NAND memory and equipment makers could see growth for a number of years. Nonetheless, the stocks will have days or weeks when the “top is in” argument will rule. Entegris, FormFactor, MKS Instruments (MKSI) and Nova Measuring Instruments Ltd. (NVMI) all contributed to Needham Growth Fund’s performance in 2017.

The largest detractor in 2017 was PDF Solutions (PDFS), which was down -30.38%. Super Micro Computer, Inc. (SMCI) was the second largest detractor, down -25.4%. Super Micro supplies servers and network equipment and has many leading storage and data center companies as customers. It supplies a critical part of the web infrastructure. In August, Super Micro announced that it was unable to file its 10K for the June 2017 fiscal year. As of February 2018, it has yet to file and recently announced management changes, including the appointment of a new CFO, Kevin Bauer, whom we’ve known from previous companies. Apart from the accounting, Super Micro’s business is strong. We believe growth in fiscal year 2018 could reach 12% with expanding gross margins. The Fund has owned Super Micro for over eight years, and we believe in the company’s long-term vision to reach $5 billion of server and network equipment sales, up from $500 million when we first invested.

Electronics For Imaging (EFII) was the fourth largest detractor in 2017, down -32.7%. It also stumbled on accounting and delayed an earnings report, as it analyzed some revenue transactions. The company did not miss a filing date. However, EFI, did not grow revenue in 2017, after many years of double-digit growth.

In 2017, Needham Growth Fund nearly completed the exit of its long-term, successful holding of Express Scripts, Inc. (ESRX), which started the year as the Fund’s second-largest holding. We previously saw Express Scripts contributing to lowering costs in the U.S. healthcare system. Throughout 2017, that view became murkier and it appeared that Express Scripts was acting more as a rent-seeking middleman than an efficient delivery mechanism for prescription drugs.

Needham Funds

In 2017, the Fund did not add any positions of over 0.75%. The Fund added to PDF Solutions and Super Micro on price weaknesses. The Fund exited Varian Medical Systems, Inc. (VAR), Jabil Circuits, Inc. (JBL) and Brooks Automation, Inc. (BRKS) on valuation, and Financial Engines, Inc. (FNGN) and Dick’s Sporting Goods (DKS) over concern for their businesses.

As of December 31, 2017, the top 10 positions were 52.49% of net assets. The Fund had trailing 12-month turnover of just 9% and Active Share of 107.4% vs. the S&P 500.

Needham Aggressive Growth Fund (NEAGX/NEAIX)

Needham Aggressive Growth Fund Institutional class was down -2.84% in the fourth quarter and the Retail class was down -2.98%, compared to a 3.34% return for the Russell 2000. In 2017, the Needham Aggressive Growth Fund Institutional class returned 9.36% and the Retail class returned 8.73%.

Akamai was the Fund’s top contributor for the fourth quarter. Reis, Inc. (REIS) returned 15.7% and was the second leading contributor for the quarter. Reis licenses information to real estate investors, and its revenue growth returned to 5% in the third quarter, after several years of subpar growth. This return to growth has taken six months longer than I anticipated. I believe the new products and the additional sales resources could help Reis return to long-term, double-digit revenue growth and 40% operating margins in 2018.

Apple was the third leading contributor in the fourth quarter at 48.5%. iPhones and services exceeded expectations. Apple was purchased by my predecessor on the Fund in 2006, before the iPhone was introduced. I continue to believe Apple represents a compelling value with long-term growth opportunities, thus it stays in the Fund.

The short positions in Ubiquiti and Medallion Financial were top detractors in the fourth quarter.

2017 saw a mixture of stock performance from the Fund’s holdings. Of the Needham Aggressive Growth Fund’s top 10 holdings at the beginning of 2017, only three were major contributors. Seven were down and underperformed in 2017. The top contributor was Entegris, now the largest position in the Fund. Entegris supplies filters and chemicals used in advanced manufacturing processes, particularly for semiconductors. Semiconductor manufacturing plants require filters capable of capturing one contaminated drop of water in a day’s worth of water flowing over Niagara Falls, which is filtering one part in a quadrillion. Over 80% of Entegris’ revenue is from consumables used in the manufacturing process. Entegris reported strong March and June quarter results after a strong 2016. In October, Entegris announced that it would be paying its first dividend.

Apple was the second-largest contributor, and MKS Instruments, which returned 60.5%, was third. MKS provides instruments and subsystems that measure, control and power advanced processes, with semiconductor manufacturing being its largest market. MKS reported strong June quarter results and is benefitting from the strength of its customers, including Lam Research Corp. (LRCX) and Applied Materials. MKS also saw strong results from its Light and Motion segment, most of which it acquired last year as Newport Corporation.

Like the Needham Growth Fund, PDF Solutions, Super Micro, and KVH were top detractors for 2017.

PDF Solutions benefits from the need for low power semiconductors to provide longer battery lives for mobile phones and other devices. The company made very good progress with its new Design-for-Inspection offering, but its current business was below expectations throughout 2017. The company receives Gainshare royalties from semiconductors manufactured on lines where its technology has been used, and Solutions revenue from software and services. Royalties and Solutions revenues are largely irrelevant to the reasons I remain invested in PDF. I am enthusiastic about the Design-for-Inspection and Exensio Big Data analytics offerings, as well as the opportunity in China.

Design-for-Inspection (DFI) is sold to semiconductor design and manufacturing companies to determine whether leading edge semiconductors can be manufactured with high yield. Today, semiconductor manufacturing companies use light-based inspection systems to find problem areas on semiconductors. Today’s most advanced semiconductors have feature sizes that are about 20 atoms, and these features are very difficult to see with light. DFI software inserts billions of tiny test instruments on a semiconductor wafer. The wafer can then be analyzed electrically by a PDF-designed electron-beam microscope, called an eProbe. DFI may perform 10 billion electrical measurements on a single wafer, which produces a great deal of data. PDF’s Exensio Big Data analytics software is then used for analysis. DFI allows a manufacturing engineer to inspect a wafer to “detect the undetectables.” PDF’s business model for DFI is two-fold.

During its July 27 conference call, PDF mentioned that John Chen of NVIDIA Corporation (NVDA) was the keynote speaker at PDF’s User Meeting. This is the first confirmation that NVIDIA, a leader in computer graphics and artificial intelligence, with a $100 billion market cap, is interested in Design-for-Inspection. Importantly, the first eProbe 150 system, which was shipped to a customer in mid-2016, is being used in production by a leading semiconductor fab on programs from leading fabless semiconductor companies, including what we believe to be Apple for the processors on their latest phones. PDF originally intended the eProbe 150 to be used exclusively in engineering testing. On the third quarter 2017 conference call, the Gen-2 DFI customer demo was delayed into early 2018. I believe it is important for PDF to really understand how its customers can use DFI and fine-tune the applications. I believe they made good progress in 2017; it just wasn’t visible, nor expected to be visible, on the income statement. We are hopeful that visibility will improve in 2018. These investments take patience.

In 2017, we added positions in CyroPort (CYRX), Appian (APPN), DIRTT Environmental (DRT.TSE) and Markel Corporation (MKL). We also added a position in comScore (SCOR), thinking that its inability to file financials would be resolved in the summer of 2017. It has yet to file and its business growth has decreased. It’s hard to imagine comScore as a compounder; nonetheless, we bought the stock at an attractive price and believe there’s value yet to be recognized.

We exited our position in Norsat International, as the company was acquired. We also exited long-time holdings Bottomline Technologies (EPAY), Financial Engines, and Dick’s Sporting Goods.

At December 31, 2017, the Fund’s top 10 positions were 57.64% of net assets. The Fund had an Active Share of 112.7% versus the Russell 2000 and had trailing 12-month turnover of 15%.

Needham Funds

Needham Small Cap Growth Fund (NESGX/NESIX)

The Needham Small Cap Growth Fund Institutional class returned -1.13% and the Retail class returned -1.27% in the quarter ended December 31, 2017. For the year, the Fund’s Institutional class returned 12.48% and the Retail class returned 11.88%.

We were pleased with the Fund’s performance up until the last three weeks of 2017. Throughout the year, the Fund performed very well, with many of our concentrated positions outperforming the broader markets. However, in the last few weeks of December, we saw some of these positions decline due to some company-specific news items and an overall “sell the winners” trend in small cap stocks. Thankfully, some of this correction was regained in the early part of 2018. The market for small cap companies continues to offer good value; however, large cap stocks continue to outperform this asset category. The Fund continued its lean toward a concentrated portfolio of stocks, with the top 10 holdings representing 54.04% of net assets at December 31, 2017.

With the exception of the last three weeks of December, the Fund continued to show strength in the fourth quarter. Fear of an economic slowdown, along with geopolitical headline risks, quickly subsided by October, and the portfolio recovered from the summer lows. The Trump reflation trade returned as attention toward tax reform accelerated. While tax reform took longer than the markets had anticipated last December, we believe the full benefits of reforms have yet to be priced into the market completely.

Top holdings at December 31, 2017 included PDF Solutions, Pure Storage (PSTG), Amber Road (AMBR), Super Micro Computers (SMCI), and Invuity (IVTY). The Fund’s top fourth quarter contributors included Nutanix (NTNX), NeoPhotonics (NPTN), Reis (REIS), Aspen Aerogels (ASPN), and Air Lease Corporation (AL). The Fund’s largest fourth quarter detractors were Invuity, Agile Therapeutics (AGRX), FireEye (FEYE), KVH Industries, and Corium (CORI). With regard to Invuity’s poor performance throughout the quarter, we learned that a significant institutional shareholder of the stock has been facing redemptions, thereby forcing the sale of stock. We do not believe that the fundamental story of the company has changed, and we remain excited about its new product launches and future growth trajectory.

Agile Therapeutics was another disappointment, as the FDA did not give final approval for the company’s patch contraceptive product. The stock had been a strong contributor throughout the year and it was a big disappointment and surprise when approval was not received at the end of December. We believe the company has a good plan of action to continue to seek FDA approval, and we will monitor its progress throughout 2018. Corium was also affected by the Agile news, as it is the production partner for the new product. Corium’s stock reacted negatively with the FDA news, but has since recovered in 2018. There were no significant additions or deletions from the portfolio, but we trimmed some of our holdings as they achieved our price targets after significant appreciation. The Fund ended the quarter with a cash position of 8.8%. We remain excited about the composition of the portfolio as we enter 2018, and we look forward to learning about new small cap prospects this year.

We continue to believe that a good environment remains for investment in equities. Three themes we are focused on include: 1) continuation of the growth in the semiconductor capital equipment industry; 2) cyber-security; and 3) military and defense modernization. These three areas of investment impact much of our portfolio, and we believe that long term, they should create shareholder value.

We expect increased volatility in 2018, as we have already seen in the first week of February. The Federal Reserve continues to raise short-term interest rates, but at a gradual pace. We expect one more rate increase this year, in December. The expectation of pro-growth policies has boosted confidence for both individuals and corporations, and this should ultimately translate into higher economic activity for many of our portfolio companies. The high-yield markets remain strong, which is also supportive of the small cap asset class valuations. We reiterate from our last quarterly letter that mergers and acquisitions continued in the small cap universe, but have slowed since 2016. We believe this trend is a pause, and we expect to see increased M&A activity in 2018. We expect economic growth to improve and benefit our portfolio of stocks in 2018.

Closing

We believe the U.S. remains the best place in the world to be investing, and we continue to see an opportunity to invest in small and mid-cap stocks. Most importantly, we see a revolution happening in technology that has created and continues to create investment opportunities. We see opportunity in our strategy of investing in companies that we know well and that we believe are positioned with secular growth drivers.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts or concerns, please contact us at (800) 625-7071 or at cretzler@needhamco.com or jbarr@needhamco.com. For information about the funds, please visit our website at www.needhamfunds.com.

Sincerely,

| | |

|  |

| Chris Retzler | John O. Barr |

| Portfolio Manager | Portfolio Manager |

Needham Funds Fact Sheet Links:

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

Needham Funds

The information presented in this commentary is not intended as personalized investment advice and does not constitute a recommendation to buy or sell a particular security or other investments. Past performance is no guarantee of future results. Not all investments have been profitable.

This message is not an offer of the Needham Growth Fund, the Needham Aggressive Growth Fund or the Needham Small Cap Growth Fund. Shares are sold only through the currently effective prospectus. Please read the prospectus carefully and consider the investment objectives, risks, and charges and expenses of the Fund carefully before you invest. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at www.needhamfunds.com or by contacting the Fund’s transfer agent, U.S. Bancorp Fund Services, LLC at 1-800-625-7071.

All three of the Needham Funds have substantial exposure to small and micro capitalized companies. Funds holding smaller capitalized companies are subject to greater price fluctuation than those of larger companies.

Needham & Company, LLC, member FINRA/SIPC, is the distributor of The Needham Funds, Inc.

Portfolio holdings are subject to change. The Needham Funds ownership as a percentage of net assets in the stated securities as of 12/31/17:

| Security | Growth | Aggressive | Small Cap | | Security | Growth | Aggressive | Small Cap |

| AAPL | 0.41% | 5.84% | 0.00% | | IJR | -0.14% | 0.00% | 0.00% |

| AGRX | 0.30% | 0.25% | 2.10% | | IJS | -0.14% | 0.00% | 0.00% |

| AKAM | 2.94% | 6.34% | 0.22% | | INTC | 0.00% | 0.00% | 0.00% |

| AL | 2.07% | 0.00% | 1.83% | | IPGP | 1.16% | 2.61% | 0.00% |

| ALNA | 0.05% | 0.00% | 0.00% | | IRBT | 0.00% | 0.06% | 0.00% |

| ALTR | 0.06% | 0.06% | 0.06% | | IVTY | 0.65% | 0.46% | 4.71% |

| AMAT | 0.35% | 0.00% | 0.00% | | JBL | 0.00% | 0.00% | 0.00% |

| AMBR | 2.99% | 2.05% | 6.69% | | KMX | 5.19% | 2.24% | 0.00% |

| APPN | 0.28% | 0.38% | 0.27% | | KVHI | 4.96% | 6.31% | 3.39% |

| AQ | 0.41% | 0.37% | 0.76% | | LCRX | 0.00% | 0.00% | 0.00% |

| ASPN | 0.74% | 1.06% | 4.51% | | LMAT | 0.00% | 1.45% | 0.00% |

| BDX | 4.84% | 1.22% | 0.00% | | LRCX | 0.42% | 0.00% | 0.00% |

| BKRS | 0.00% | 0.00% | 0.00% | | MDT | 1.92% | 0.00% | 0.00% |

| BRKR | 0.23% | 0.00% | 0.00% | | MDXG | -0.06% | -0.10% | 0.00% |

| CASA | 0.12% | 0.00% | 0.11% | | MFIN | -0.81% | -1.59% | 0.00% |

| CLB | 0.05% | 0.00% | 0.00% | | MKL | 0.15% | 0.28% | 0.00% |

| CLH | 0.05% | 0.00% | 0.00% | | MKSI | 2.48% | 4.15% | 0.00% |

| CMCSA | 4.17% | 0.00% | 0.00% | | NATI | 0.78% | 0.61% | 0.00% |

| CNMD | 0.55% | 0.00% | 0.00% | | NPTN | 0.00% | 0.00% | 4.66% |

| CORI | 1.65% | 1.01% | 3.06% | | NTNX | 0.60% | 0.00% | 4.13% |

| COUP | 0.16% | 0.16% | 0.00% | | NVGS | 0.04% | 0.00% | 0.33% |

| CRAI | 0.00% | 0.37% | 0.00% | | NVMI | 1.50% | 2.93% | 0.00% |

| CSCO | 0.00% | 0.00% | 0.00% | | OAK | 0.76% | 0.00% | 0.00% |

Annual Report 2017

| Security | Growth | Aggressive | Small Cap | | Security | Growth | Aggressive | Small Cap |

| CSLT | 0.05% | 0.00% | 0.76% | | ODC | 0.67% | 3.03% | 0.00% |

| CUTR | -0.21% | 0.00% | -0.76% | | OMCL | 0.00% | 1.02% | 0.00% |

| CYRX | 0.00% | 1.01% | 0.00% | | PDFS | 4.97% | 8.35% | 8.47% |

| DKS | 0.52% | 0.47% | 0.00% | | PLAB | 1.16% | 1.35% | 2.44% |

| DRTTF | 0.00% | 0.87% | 0.00% | | PSTG | 0.63% | 0.00% | 6.96% |

| ECOM | 0.00% | 0.21% | 2.13% | | QTWO | 0.67% | 0.75% | 0.00% |

| EEI | 0.00% | 0.53% | 0.00% | | RDFN | 0.08% | 0.08% | 0.26% |

| EFII | 1.71% | 0.77% | 1.99% | | REIS | 1.53% | 4.02% | 4.53% |

| EGOV | 0.02% | 0.03% | 0.00% | | RHT | 0.98% | 0.00% | 0.00% |

| ENTG | 4.27% | 9.30% | 0.00% | | ROKU | 0.10% | 0.04% | 0.09% |

| EPAY | 0.00% | 0.00% | 0.00% | | SCOR | 1.81% | 1.85% | 3.17% |

| EQIX | 0.00% | 1.47% | 0.00% | | SLB | 0.30% | 0.00% | 0.00% |

| ESRX | 0.68% | 0.00% | 0.00% | | SMCI | 3.84% | 2.92% | 4.94% |

| EVBG | 0.07% | 0.07% | 0.00% | | SYPR | 0.09% | 0.00% | 0.00% |

| EXAS | 0.00% | 0.00% | 0.09% | | TMO | 7.73% | 0.00% | 0.00% |

| FEIM | 0.42% | 0.27% | 4.26% | | TREE | 0.00% | 0.00% | 0.57% |

| FEYE | 0.00% | 0.00% | 4.31% | | TSM | 0.00% | 0.00% | 0.00% |

| FLIR | 0.63% | 0.57% | 0.00% | | TTD | 0.41% | 0.30% | 0.00% |

| FNGN | 0.55% | 0.00% | 0.00% | | TWLO | 0.00% | 0.00% | 0.60% |

| FNKO | 0.05% | 0.04% | 0.00% | | TWOU | 0.23% | 0.21% | 0.44% |

| FORM | 5.03% | 4.39% | 0.96% | | UA | 0.09% | 0.00% | 0.00% |

| GILD | 5.67% | 1.69% | 0.00% | | UAL | 0.31% | 0.00% | 0.00% |

| GLW | 1.01% | 0.00% | 0.00% | | UBNT | -4.08% | -4.59% | 0.00% |

| GNMK | 0.08% | 0.00% | 0.84% | | VAR | 0.00% | 0.00% | 0.00% |

| GVP | 0.00% | 5.91% | 0.00% | | VICR | 0.38% | 2.38% | 0.00% |

| HES | 0.43% | 0.00% | 1.12% | | VPG | 0.00% | 0.33% | 1.70% |

| HIIQ | -0.19% | -0.33% | 0.00% | | VSAT | 5.66% | 2.07% | 0.51% |

| HON | 0.35% | 0.00% | 0.00% | | VSH | 1.13% | 0.00% | 0.00% |

| HQH | 0.00% | 0.00% | 2.09% | | WAGE | 1.26% | 2.82% | 0.00% |

| HQL | 0.00% | 0.00% | 2.15% | | WWE | 0.28% | 0.30% | 0.00% |

| ICHR | 0.00% | 0.00% | 0.50% | | XCRA | 0.00% | 0.08% | 0.00% |

| NEEDHAM GROWTH FUND | Retail Class |

| | Ticker Symbol: NEEGX |

| | Institutional Class |

| | Ticker Symbol: NEEIX |

Comparative Performance Statistics as of December 31, 2017

| | | | | | | | Gross |

| | 6 | 1 | 3 | 5 | 10 | Since | Expense |

| | Months(9) | Year | Years(10) | Years(10) | Years(10) | Inception(9) | Ratio(16) |

| Needham Growth Fund | | | | | | | |

Retail Class(1)(2) | 4.12% | 8.32% | 4.37%(11) | 10.79%(12) | 6.78%(13) | 12.64%(14) | 2.18% |

| Needham Growth Fund | | | | | | | |

Institutional Class(1)(3) | 4.41% | 8.89% | n/a | n/a | n/a | 8.86% | 1.74% |

S&P 500 Index(4)(5) | 11.42% | 21.83% | 11.41% | 15.79% | 8.50% | 8.94%(15) | |

NASDAQ Composite Index(4)(6) | 13.04% | 29.73% | 14.81% | 19.49% | 11.35% | 9.87%(15) | |

S&P 400 MidCap Index(4)(7) | 9.68% | 16.24% | 11.14% | 15.01% | 9.97% | 11.86%(15) | |

Russell 2000 Index(4)(8) | 9.20% | 14.65% | 9.96% | 14.12% | 8.71% | 8.89%(15) | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 1/1/96. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index is a broad unmanaged measure of the U.S.stock market. |

| 6. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 7. | The S&P 400 MidCap Index is a broad unmanaged measure of the U.S. stock market. |

| 8. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 9. | Not annualized. |

| 10. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Retail Class. |

| 11. | Cumulative return for the three year period was 13.70%, assuming all dividends were reinvested in shares of the Retail Class. |

| 12. | Cumulative return for the five year period was 66.88%, assuming all dividends were reinvested in shares of the Retail Class. |

| 13. | Cumulative return for the ten year period was 92.77%, assuming all dividends were reinvested in shares of the Retail Class. |

| 14. | Cumulative return since inception was 1,270.77%, assuming all dividends were reinvested in shares of the Retail Class. |

| 15. | The return shown for the Index is from the Inception date of the Retail Class. |

| 16. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2017. Additional information pertaining to the Fund’s expense ratios as of December 31, 2017 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2018. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total class operating expenses would be 2.17% and 1.73% for the Retail Class and Institutional Class, respectively. |

Annual Report 2017

| Top Ten Holdings* |

| (as a % of total investments, |

| as of December 31, 2017) |

| | | % of Total |

Security | | Investments |

| Thermo Fisher Scientific, Inc. | TMO | 7.82% |

| Gilead Sciences, Inc. | GILD | 5.74% |

| ViaSat, Inc. | VSAT | 5.72% |

| CarMax, Inc. | KMX | 5.25% |

| FormFactor, Inc. | FORM | 5.08% |

| PDF Solutions, Inc. | PDFS | 5.03% |

| KVH Industries, Inc. | KVHI | 5.01% |

| Becton Dickinson and Co. | BDX | 4.90% |

| Entegris, Inc. | ENTG | 4.32% |

| Comcast Corp., Class A | CMCSA | 4.21% |

Top Ten Holdings = 53.08% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash and short-term investments. |

| Sector Weightings* |

| (as a % of net investments, |

| as of December 31, 2017) |

Sector | Long(1)* | (Short)(1)* | Total(2) |

| Consumer Discretionary | 11.1% | — | 11.1% |

| Consumer Staples | 0.7% | — | 0.7% |

| Energy | 1.7% | — | 1.7% |

| Exchange Traded Funds | — | (0.3)% | (0.3)% |

| Finance and Insurance | — | (0.3)% | (0.3)% |

| Financials | 1.6% | (1.1)% | 0.5% |

| Health Care | 25.8% | (0.3)% | 25.5% |

| Industrials | 4.7% | — | 4.7% |

| Information Technology | 59.1% | (4.3)% | 54.8% |

| Real Estate | 0.1% | — | 0.1% |

| Cash | 1.5% | — | 1.5% |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

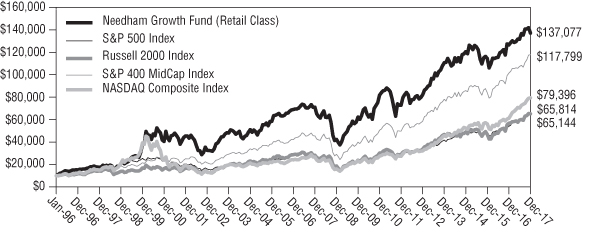

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| NEEDHAM AGGRESSIVE GROWTH FUND | Retail Class |

| | Ticker Symbol: NEAGX |

| | Institutional Class |

| | Ticker Symbol: NEAIX |

Comparative Performance Statistics as of December 31, 2017

| | | | | | | | Gross |

| | 6 | 1 | 3 | 5 | 10 | Since | Expense |

| | Months(8) | Year | Years(9) | Years(9) | Years(9) | Inception(9) | Ratio(15) |

| Needham Aggressive Growth | | | | | | | |

Fund Retail Class(1)(2) | 7.48% | 8.73% | 7.27%(10) | 12.51%(11) | 8.96%(12) | 9.52%(13) | 2.71% |

| Needham Aggressive Growth | | | | | | | |

Fund Institutional Class(1)(3) | 7.77% | 9.36% | n/a | n/a | n/a | 9.34% | 2.16% |

S&P 500 Index(4)(5) | 11.42% | 21.83% | 11.41% | 15.79% | 8.50% | 7.54%(14) | |

NASDAQ Composite Index(4)(6) | 13.04% | 29.73% | 14.81% | 19.49% | 11.35% | 9.71%(14) | |

Russell 2000 Index(4)(7) | 9.20% | 14.65% | 9.96% | 14.12% | 8.71% | 9.01%(14) | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 9/4/01. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 6. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 7. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 8. | Not annualized. |

| 9. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Retail Class. |

| 10. | Cumulative return for the three year period was 23.43%, assuming all dividends were reinvested in shares of the Retail Class. |

| 11. | Cumulative return for the five year period was 80.26%, assuming all dividends were reinvested in shares of the Retail Class. |

| 12. | Cumulative return for the ten year period was 135.87%, assuming all dividends were reinvested in shares of the Retail Class. |

| 13. | Cumulative return since inception was 341.39% assuming all dividends were reinvested in shares of the Retail Class. |

| 14. | The return shown for the Index is from the Inception date of the Retail Class. |

| 15. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2017. Additional information pertaining to the Fund’s expense ratios as of December 31, 2017 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2018. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total class operating expenses would be 2.71% and 2.16% for the Retail Class and Institutional Class, respectively. |

| Top Ten Holdings* |

| (as a % of total investments, |

| as of December 31, 2017) |

| | | % of Total |

Security | | Investments |

| Entegris, Inc. | ENTG | 9.33% |

| PDF Solutions, Inc. | PDFS | 8.38% |

| Akamai Technologies, Inc. | AKAM | 6.36% |

| KVH Industries, Inc. | KVHI | 6.33% |

| GSE Systems, Inc. | GVP | 5.93% |

| Apple, Inc. | AAPL | 5.86% |

| FormFactor, Inc. | FORM | 4.40% |

| MKS Instruments, Inc. | MKSI | 4.16% |

| Reis, Inc. | REIS | 4.03% |

| Oil-Dri Corp. of America | ODC | 3.04% |

Top Ten Holdings = 57.82% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash and short-term investments. |

| Sector Weightings* |

| (as a % of net investments, |

| as of December 31, 2017) |

Sector | Long(1)* | (Short)(1)* | Total(2) |

| Consumer Discretionary | 3.4% | — | 3.4% |

| Consumer Staples | 3.2% | — | 3.2% |

| Energy | 1.1% | — | 1.1% |

| Financials | 0.3% | (2.1)% | (1.8)% |

| Health Care | 8.7% | (0.1)% | 8.6% |

| Industrials | 7.5% | — | 7.5% |

| Information Technology | 80.9% | (4.9)% | 76.0% |

| Real Estate | 1.8% | — | 1.8% |

| Cash | 0.2% | — | 0.2% |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

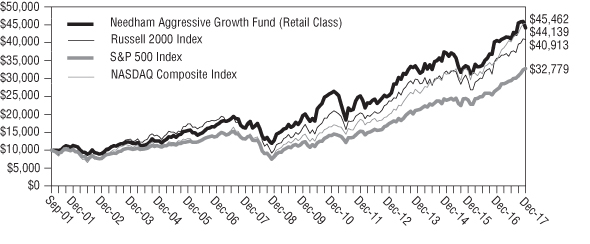

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| NEEDHAM SMALL CAP GROWTH FUND | Retail Class |

| | Ticker Symbol: NESGX |

| | Institutional Class |

| | Ticker Symbol: NESIX |

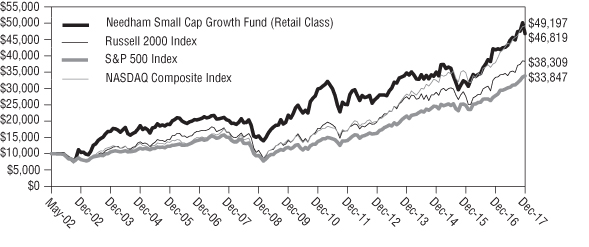

Comparative Performance Statistics as of December 31, 2017

| | | | | | | | Gross |

| | 6 | 1 | 3 | 5 | 10 | Since | Expense |

| | Months(8) | Year | Years(9) | Years(9) | Years(9) | Inception(9) | Ratio(15) |

| Needham Small Cap Growth | | | | | | | |

Fund Retail Class(1)(2) | 4.48% | 11.81% | 10.14%(10) | 11.49%(11) | 8.79%(12) | 10.39%(13) | 2.15% |

| Needham Small Cap Growth | | | | | | | |

Fund Institutional Class(1)(3) | 4.78% | 12.41% | n/a | n/a | n/a | 12.37% | 1.60% |

S&P 500 Index(4)(5) | 11.42% | 21.83% | 11.41% | 15.79% | 8.50% | 8.12%(14) | |

NASDAQ Composite Index(4)(6) | 13.04% | 29.73% | 14.81% | 19.49% | 11.35% | 10.73%(14) | |

Russell 2000 Index(4)(7) | 9.20% | 14.65% | 9.96% | 14.12% | 8.71% | 8.98%(14) | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 5/22/02. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 6. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 7. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 8. | Not annualized. |

| 9. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Retail Class. |

| 10. | Cumulative return for the three year period was 33.68%, assuming all dividends were reinvested in shares of the Retail Class. |

| 11. | Cumulative return for the five year period was 72.36%, assuming all dividends were reinvested in shares of the Retail Class. |

| 12. | Cumulative return for the ten year period was 132.27%, assuming all dividends were reinvested in shares of the Retail Class. |

| 13. | Cumulative return since inception was 368.19% assuming all dividends were reinvested in shares of the Retail Class. |

| 14. | The return shown for the Index is from the Inception date of the Retail Class. |

| 15. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2017. Additional information pertaining to the Fund’s expense ratios as of December 31, 2017 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2018. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total class operating expenses would be 2.09% and 1.54% for the Retail Class and Institutional Class, respectively. |

| Top Ten Holdings* |

| (as a % of total investments, |

| as of December 31, 2017) |

| | | % of Total |

Security | | Investments |

| PDF Solutions, Inc. | PDFS | 9.14% |

| Pure Storage, Inc., Class A | PSTG | 7.50% |

| Amber Road, Inc. | AMBR | 7.21% |

| Super Micro Computer, Inc. | SMCI | 5.33% |

| Invuity, Inc. | IVTY | 5.08% |

| NeoPhotonics Corp. | NPTN | 5.03% |

| Reis, Inc. | REIS | 4.88% |

| Aspen Aerogels, Inc. | ASPN | 4.86% |

| FireEye, Inc. | FEYE | 4.65% |

| Frequency Electronics, Inc. | FEIM | 4.60% |

Top Ten Holdings = 61.09% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash and short-term investments. |

| Sector Weightings* |

| (as a % of net investments, |

| as of December 31, 2017) |

Sector | Long(1)* | (Short)(1)* | Total(2) |

| Closed-End Funds | 4.2% | — | 4.2% |

| Consumer Discretionary | 0.1% | — | 0.1% |

| Energy | 6.0% | — | 6.0% |

| Financials | 0.6% | — | 0.6% |

| Health Care | 11.5% | (0.8)% | 10.7% |

| Industrials | 1.8% | — | 1.8% |

| Information Technology | 67.6% | — | 67.6% |

| Real Estate | 0.3% | — | 0.3% |

| Cash | 8.7% | — | 8.7% |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Needham Funds

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur transactional costs, including redemption fees and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. The expense example table below illustrates your fund’s cost in two ways:

| • | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio under the heading entitled “Expenses Paid During Period”. |

| • | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. It assumes that the Portfolio had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Portfolio’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report 2017

For the Period July 1, 2017 to December 31, 2017

Expense Example Table

| | Beginning | Ending | Expenses Paid | Expense Ratio |

| | Account | Account | During Period* | During Period* |

| | Value | Value | 7/1/17 – | 7/1/17 – |

| | 7/1/17 | 12/31/17 | 12/31/17 | 12/31/17 |

| Needham Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,041.20 | $13.63 | 2.65% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,011.85 | $13.43 | 2.65% |

| Institutional Class Actual Expenses | $1,000.00 | $1,044.10 | $10.97 | 2.13% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,014.47 | $10.81 | 2.13% |

| | | | | |

| Needham Aggressive Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,074.80 | $15.73 | 3.01% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,010.04 | $15.24 | 3.01% |

| Institutional Class Actual Expenses | $1,000.00 | $1,077.70 | $12.95 | 2.47% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,012.74 | $12.54 | 2.47% |

| | | | | |

| Needham Small Cap Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,045.40 | $10.05 | 1.95% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,015.38 | $ 9.90 | 1.95% |

| Institutional Class Actual Expenses | $1,000.00 | $1,048.50 | $ 7.22 | 1.40% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,018.15 | $ 7.11 | 1.40% |

| * | Expenses are equal to the average account value times the Portfolio’s annualized expense ratio multiplied 184/365 (to reflect the one-half-year period). |

Needham Funds

Needham Growth Fund

Schedule of Investments

December 31, 2017

| | | Shares | | | Value | |

| (Percentage of Net Assets) | | | | | | |

| | | | | | | |

| Common Stocks (98.9%) | | | | | | |

| | | | | | | |

| Airlines (0.3%) | | | | | | |

| United Continental Holdings, Inc.* | | | 5,000 | | | $ | 337,000 | |

| | | | | | | | | |

| Auto Components (0.1%) | | | | | | | | |

| Sypris Solutions, Inc.* | | | 76,000 | | | | 104,120 | |

| | | | | | | | | |

| Biotechnology (5.7%) | | | | | | | | |

| Allena Pharmaceuticals, Inc.* | | | 5,020 | | | | 50,501 | |

| Gilead Sciences, Inc.† | | | 87,500 | | | | 6,268,500 | |

| | | | | | | | 6,319,001 | |

| Capital Markets (1.3%) | | | | | | | | |

| Financial Engines, Inc.† | | | 20,000 | | | | 606,000 | |

| Oaktree Capital Group LLC, Class A | | | 20,000 | | | | 842,000 | |

| | | | | | | | 1,448,000 | |

| Commercial Services & Supplies (0.0%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 1,000 | | | | 54,200 | |

| | | | | | | | | |

| Communications Equipment (10.7%) | | | | | | | | |

| Casa Systems, Inc.* | | | 7,354 | | | | 130,607 | |

| KVH Industries, Inc.* | | | 529,375 | | | | 5,479,031 | |

| ViaSat, Inc.*† | | | 83,500 | | | | 6,249,975 | |

| | | | | | | | 11,859,613 | |

| Distributors (0.0%) | | | | | | | | |

| Funko, Inc., Class A* | | | 7,497 | | | | 49,855 | |

| | | | | | | | | |

| Electrical Equipment (0.4%) | | | | | | | | |

| Vicor Corp.* | | | 20,000 | | | | 418,000 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (5.1%) | | | | | | | | |

| Corning, Inc. | | | 35,000 | | | | 1,119,650 | |

| FLIR Systems, Inc. | | | 15,000 | | | | 699,300 | |

| Frequency Electronics, Inc.* | | | 50,000 | | | | 468,000 | |

| IPG Photonics Corp.* | | | 6,000 | | | | 1,284,780 | |

| National Instruments Corp. | | | 20,800 | | | | 865,904 | |

| Vishay Intertechnology, Inc. | | | 60,000 | | | | 1,245,000 | |

| | | | | | | | 5,682,634 | |

See accompanying notes to financial statements.

Annual Report 2017

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2017

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Energy Equipment & Services (1.1%) | | | | | | |

| Aspen Aerogels, Inc.* | | | 167,600 | | | $ | 817,888 | |

| Core Laboratories NV (Netherlands) | | | 500 | | | | 54,775 | |

| Schlumberger Ltd. (Netherlands) | | | 5,000 | | | | 336,950 | |

| | | | | | | | 1,209,613 | |

| Health Care Equipment & Supplies (8.0%) | | | | | | | | |

| Becton Dickinson and Co. | | | 25,000 | | | | 5,351,500 | |

| CONMED Corp. | | | 12,000 | | | | 611,640 | |

| GenMark Diagnostics, Inc.* | | | 20,000 | | | | 83,400 | |

| Invuity, Inc.* | | | 115,000 | | | | 713,000 | |

| Medtronic PLC (Ireland) | | | 26,290 | | | | 2,122,918 | |

| | | | | | | | 8,882,458 | |

| Health Care Providers & Services (0.7%) | | | | | | | | |

| Express Scripts Holding Co.*† | | | 10,000 | | | | 746,400 | |

| | | | | | | | | |

| Health Care Technology (0.1%) | | | | | | | | |

| Castlight Health, Inc., Class B* | | | 15,000 | | | | 56,250 | |

| | | | | | | | | |

| Household Durables (0.1%) | | | | | | | | |

| Roku, Inc., Class A* | | | 2,085 | | | | 107,961 | |

| | | | | | | | | |

| Household Products (0.7%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 17,800 | | | | 738,700 | |

| | | | | | | | | |

| Industrial Conglomerates (0.3%) | | | | | | | | |

| Honeywell International, Inc. | | | 2,500 | | | | 383,400 | |

| | | | | | | | | |

| Insurance (0.2%) | | | | | | | | |

| Markel Corp.* | | | 150 | | | | 170,870 | |

| | | | | | | | | |

| Internet Software & Services (11.4%) | | | | | | | | |

| The Trade Desk, Inc., Class A* | | | 10,000 | | | | 457,300 | |

| 2U, Inc.* | | | 4,000 | | | | 258,040 | |

| Akamai Technologies, Inc.*† | | | 50,000 | | | | 3,252,000 | |

| Amber Road, Inc.* | | | 450,000 | | | | 3,303,000 | |

| comScore, Inc.* | | | 70,200 | | | | 2,000,700 | |

| Coupa Software, Inc.* | | | 5,700 | | | | 177,954 | |

| NIC, Inc. | | | 1,500 | | | | 24,900 | |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2017

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Internet Software & Services – Continued | | | | | | |

| Nutanix, Inc.* | | | 18,800 | | | $ | 663,264 | |

| Q2 Holdings, Inc.* | | | 20,000 | | | | 737,000 | |

| Reis, Inc. | | | 82,000 | | | | 1,693,300 | |

| | | | | | | | 12,567,458 | |

| Life Sciences Tools & Services (8.0%) | | | | | | | | |

| Bruker Corp. | | | 7,500 | | | | 257,400 | |

| Thermo Fisher Scientific, Inc.† | | | 45,000 | | | | 8,544,600 | |

| | | | | | | | 8,802,000 | |

| Media (4.4%) | | | | | | | | |

| Comcast Corp., Class A | | | 115,000 | | | | 4,605,750 | |

| World Wrestling Entertainment, Inc., Class A | | | 10,000 | | | | 305,800 | |

| | | | | | | | 4,911,550 | |

| Oil, Gas & Consumable Fuels (0.5%) | | | | | | | | |

| Hess Corp. | | | 10,000 | | | | 474,700 | |

| Navigator Holdings Ltd.* (United Kingdom) | | | 5,000 | | | | 49,250 | |

| | | | | | | | 523,950 | |

| Pharmaceuticals (1.9%) | | | | | | | | |

| Agile Therapeutics, Inc.* | | | 121,294 | | | | 326,281 | |

| Corium International, Inc.* | | | 190,000 | | | | 1,825,900 | |

| | | | | | | | 2,152,181 | |

| Professional Services (1.3%) | | | | | | | | |

| WageWorks, Inc.* | | | 22,500 | | | | 1,395,000 | |

| | | | | | | | | |

| Real Estate Management & Development (0.1%) | | | | | | | | |

| Redfin Corp.* | | | 2,993 | | | | 93,741 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (20.6%) | | | | | | | | |

| Applied Materials, Inc. | | | 7,500 | | | | 383,400 | |

| Aquantia Corp.* | | | 40,000 | | | | 453,200 | |

| Entegris, Inc. | | | 155,000 | | | | 4,719,750 | |

| FormFactor, Inc.* | | | 355,000 | | | | 5,555,750 | |

| Lam Research Corp. | | | 2,500 | | | | 460,175 | |

| MKS Instruments, Inc. | | | 29,000 | | | | 2,740,500 | |

See accompanying notes to financial statements.

Annual Report 2017

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2017

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment – Continued | | | | | | |

| Nova Measuring Instruments Ltd.* (Israel) | | | 64,000 | | | $ | 1,658,240 | |

| PDF Solutions, Inc.* | | | 350,000 | | | | 5,495,000 | |

| Photronics, Inc.* | | | 150,000 | | | | 1,278,750 | |

| | | | | | | | 22,744,765 | |

| Software (1.4%) | | | | | | | | |

| Altair Engineering, Inc., Class A* | | | 2,996 | | | | 71,664 | |

| Appian Corp., Class A* | | | 10,000 | | | | 314,800 | |

| Everbridge, Inc.* | | | 2,500 | | | | 74,300 | |

| Red Hat, Inc.* | | | 9,000 | | | | 1,080,900 | |

| | | | | | | | 1,541,664 | |

| Specialty Retail (5.7%) | | | | | | | | |

| CarMax, Inc.*† | | | 89,500 | | | | 5,739,635 | |

| Dick’s Sporting Goods, Inc. | | | 20,000 | | | | 574,800 | |

| | | | | | | | 6,314,435 | |

| Technology Hardware, Storage & Peripherals (6.6%) | | | | | | | | |

| Apple, Inc. | | | 2,700 | | | | 456,921 | |

| Electronics For Imaging, Inc.* | | | 64,000 | | | | 1,889,920 | |

| Pure Storage, Inc., Class A* | | | 44,000 | | | | 697,840 | |

| Super Micro Computer, Inc.* | | | 202,900 | | | | 4,245,682 | |

| | | | | | | | 7,290,363 | |

| Textiles, Apparel & Luxury Goods (0.1%) | | | | | | | | |

| Under Armour, Inc., Class C* | | | 7,483 | | | | 99,674 | |

| | | | | | | | | |

| Trading Companies & Distributors (2.1%) | | | | | | | | |

| Air Lease Corp., Class A | | | 47,500 | | | | 2,284,275 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $49,393,998) | | | | | | $ | 109,289,131 | |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2017

| | | Shares | | | Value | |

| Short-Term Investments (1.1%) | | | | | | |

| | | | | | | |

| Money Market Fund (1.1%) | | | | | | |

| Dreyfus Treasury Securities Cash Management – | | | | | | |

| Institutional Class 1.11% (a) | | | | | | |

| (Cost $1,262,813) | | | 1,262,813 | | | $ | 1,262,813 | |

| | | | | | | | | |

| Total Investments (100.0%) | | | | | | | | |

| (Cost $50,656,811) | | | | | | | 110,551,944 | |

| Total Securities Sold Short (-5.6%) | | | | | | | (6,202,598 | ) |

| (Proceeds $3,424,005) | | | | | | | | |

| Other Assets in Excess of Liabilities (5.6%) | | | | | | | 6,140,497 | |

| Net Assets (100.0%) | | | | | | $ | 110,489,843 | |

| * | Non-income producing security. |

| (a) | Rate shown is the seven-day yield as of December 31, 2017. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $5,621,050. |

| | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

See accompanying notes to financial statements.

Annual Report 2017

Needham Growth Fund

Schedule of Securities Sold Short

December 31, 2017

| | | Shares | | | Value | |

| Securities Sold Short (-5.3%) | | | | | | |

| | | | | | | |

| Biotechnology (0.0%) | | | | | | |

| MiMedx Group, Inc.* | | | 5,000 | | | $ | 63,050 | |

| | | | | | | | | |

| Capital Markets (-0.8%) | | | | | | | | |

| Medallion Financial Corp.* | | | 250,000 | | | | 890,000 | |

| | | | | | | | | |

| Communications Equipment (-4.1%) | | | | | | | | |

| Ubiquiti Networks, Inc.* | | | 63,500 | | | | 4,509,770 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (-0.2%) | | | | | | | | |

| Cutera, Inc.* | | | 5,000 | | | | 226,750 | |

| | | | | | | | | |

| Insurance (-0.2%) | | | | | | | | |

| Health Insurance Innovations, Inc., Class A* | | | 8,250 | | | | 205,838 | |

| | | | | | | | | |

| Total Securities Sold Short (-5.3%) | | | | | | | | |

| (Proceeds $3,169,401) | | | | | | $ | 5,895,408 | |

| | | | | | | | | |

| Exchange Traded Funds Sold Short (-0.3%) | | | | | | | | |

| iShares Core S&P Small-Cap ETF | | | 2,000 | | | | 153,620 | |

| iShares S&P Small-Cap 600 Value ETF | | | 1,000 | | | | 153,570 | |

| | | | | | | | 307,190 | |

| | | | | | | | | |

| Total Exchange Traded Funds Sold Short (-0.3%) | | | | | | | | |

| (Proceeds $254,604) | | | | | | $ | 307,190 | |

| | | | | | | | | |

| Total Securities & Exchange Traded Funds Sold Short (-5.6%) | | | | | | | | |

| (Proceeds $3,424,005) | | | | | | $ | 6,202,598 | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments

December 31, 2017