As filed with the Securities and Exchange Commission on March 10, 2016.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09114

The Needham Funds, Inc.

(Exact name of registrant as specified in charter)

445 Park Avenue, New York, NY 10022-2606

(Address of principal executive offices) (Zip code)

Mr. George A. Needham, 445 Park Avenue, New York, NY 10022-2606

(Name and address of agent for service)

1-800-625-7071

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2015

Date of reporting period: December 31, 2015

Item 1. Reports to Stockholders.

445 Park Avenue

New York, New York 10022-2606

1-800-625-7071

www.needhamfunds.com

Annual Report

December 31, 2015

Contents

| Letter from the Adviser | 1 |

| | |

| Portfolio Characteristics | |

| Needham Growth Fund | 8 |

| Needham Aggressive Growth Fund | 9 |

| Needham Small Cap Growth Fund | 10 |

| Disclosure of Fund Expenses | 11 |

| | |

| Schedules of Investments | |

| Needham Growth Fund | 12 |

| Needham Aggressive Growth Fund | 15 |

| Needham Small Cap Growth Fund | 18 |

| | |

| Schedule of Securities Sold Short | |

| Needham Growth Fund | 14 |

| Needham Aggressive Growth Fund | 17 |

| Needham Small Cap Growth Fund | 19 |

| | |

| Statements of Assets and Liabilities | 20 |

| | |

| Statements of Operations | 21 |

| | |

| Statements of Changes in Net Assets | 22 |

| | |

| Financial Highlights | |

| Needham Growth Fund | 23 |

| Needham Aggressive Growth Fund | 24 |

| Needham Small Cap Growth Fund | 25 |

| | |

| Notes to Financial Statements | 26 |

| | |

| Report of Independent Registered Public Accounting Firm | 31 |

| | |

| Information about Directors and Officers | 32 |

| | |

| Supplementary Information and Privacy Policy | 33 |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus or summary prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

| Needham Funds | Annual Report 2015 |

| 445 Park Avenue |

| New York, NY 10022 |

| (800) 625-7071 |

| www.needhamfunds.com |

February 2016

Dear Shareholders, Friends of Needham and Prospective Shareholders,

We are reporting results for the fourth quarter and the year ending December 31, 2015 for the Needham Growth Fund, Needham Aggressive Growth Fund, and Needham Small Cap Growth Fund. Our mission is to create wealth for long-term investors. 2015 was a disappointing year and 2016 is off to a disappointing start. We believe there are opportunities in small and mid-cap stocks, even in this difficult market.

Needham Funds’ Fourth Quarter

In the fourth quarter, the Needham Growth Fund (NEEGX) returned 4.39%, the Needham Aggressive Growth Fund (NEAGX) returned 4.73%, and the Needham Small Cap Growth Fund (NESGX) returned 7.63%. The Russell 2000 Total Return Index returned 3.59%, the S&P 500 Total Return Index returned 7.04%, and the NASDAQ Composite Index returned 8.76%.

For the year 2015, the Needham Growth Fund (NEEGX) declined 5.07%, the Needham Aggressive Growth Fund (NEAGX) declined 7.05%, and the Needham Small Cap Growth Fund (NESGX) declined 8.96%. The Russell 2000 Total Return Index declined 4.41%, the S&P 500 Total Return Index returned 1.38%, and the NASDAQ Composite Index returned 7.11%.

Thoughts on Investing in Small Caps in This Difficult Market

Through February 18, 2016, the Russell 2000 Total Return Index has declined 11.42% and the S&P 500 has declined 5.86%. On top of the difficult second half of 2015, these are trying times for investors, financial advisors and fund managers. However, as evidenced by the recent transaction (highlighted below), patient value investing can produce exemplary results.

On January 29, 2016, Berkshire Hathaway, Inc. (BRK.A/BRK.B) closed its acquisition of Precision Castparts Corporation (PCP) for $235 per share in cash. Jim Kloppenburg, the founding Portfolio Manager of NEAGX, bought Precision Cast-parts for $10 per share in November 2002, resulting in a 13-year, 23-bagger, and 27% return CAGR for the Fund. However, the PCP investment was not without its difficult days or years: PCP fell from a high of $154 in 2007 to a low of $47 in the depths of 2008. In the end, a sound business strategy and patient investing on behalf of the Fund produced quite a result.

With Berkshire Hathaway’s acquisition of NEAGX holding Precision Castparts Corporation, we had occasion to reread a number of the books written about Warren Buffett and Charlie Munger. We offer a few of their perspectives:

| 1) | Pay little attention to the macro. Times are never easy. As bad as things may seem today, imagine what it was like investing during World War II or the Cold War. In an August 6, 1979 essay for Forbes, Warren Buffett wrote, “The future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values.” |

And from Robert Hagstrom Jr.’s book, The Warren Buffett Way: Investment Strategies of the World’s Greatest Investor, “Just as people spend fruitless hours worrying about the stock market, so too do they worry needlessly about the economy. If you find yourself discussing and debating whether the economy is poised for growth or tilting toward a recession, whether interest rates are moving up or down, or whether there is inflation or disinflation, STOP.”1

(1) Robert Hagstrom, Jr., The Warren Buffett Way: Investment Strategies of the World’s Greatest Investor (1995), 227.

| | 2) | Focus on the business, not on the stock. “He (Warren Buffett) never forgot that underneath each stock and bond, no matter how arcane, there lay a tangible, ordinary business.2 ... Study prospects—and their competitors— in great detail. Look at raw data, not analysts’ summaries. Trust your own eyes.”3 |

| | | |

| | 3) | Invest in companies or funds that you understand. It’s important to define your circle of competence. If something sounds too complicated or good to be true, it probably is. If Warren Buffett can’t understand an investment opportunity, it goes into the “Too Hard” box on his desk. |

| | | |

| | 4) | Invest with a margin of safety. Once you understand the strategic and operational aspects of a business, it’s important to determine what you believe to be the intrinsic value of the business. What do you think is the company’s growth rate and future cash generation potential? What are the assets on the balance sheet worth? If the stock is too expensive, be patient. |

| | | |

| | 5) | Once you invest, be prepared to stay the course. Buffett says one should be prepared to withstand a 50% drop in an investment and if that happens, one should be prepared to hold for at least two years to let your investment thesis play out. “To the extent that he, or any investor, is not thinking about how and when he will get out, he will be more selective on the way in.”4 |

| | | |

| | 6) | Professors Martijn Cremers and Ankur Pareek found that High Active Share and Low Turnover is an effective strategy for outperforming broad-based indices over the long-term. In writing about Buffett’s view of a concentrated portfolio, Lowenstein wrote, “But when an investor had conviction about a stock, he or she should also show courage—and buy a ton of it.”5 |

| | | |

| | | In “The Education of a Value Investor,” Guy Spier highlighted the importance of low turnover, “Long-term compounding is an investor’s best friend, so why get in its way?”6 |

| | | |

| | | “...what makes sense in business also makes sense in stocks: An investor should ordinarily hold a small piece of an outstanding business with the same tenacity that an owner would exhibit if he owned all of that business.”7 |

| | | |

| | 7) | Make investment decisions away from the noise. Spier described the importance of one’s work environment and the dangers of listening to the pervasive investing noise. As humans, we are inclined to act and respond to stimulus. It takes discipline to ignore the noise and we all have a limited amount of discipline. Rather than try the difficult task of trying to be more disciplined, how about changing the work environment and minimizing the distractions? Get rid of the televisions, Bloomberg terminals and quote screens. |

| | | |

| | 8) | Know yourself and avoid leverage. The 2016 sell-off has caused fear in institutional and retail investors alike; this fear can cause one to sometimes act against well thought out plans and long-term interests. Investing will find and expose your weaknesses. |

| | | |

| | | “As investors, we all have shortcomings; as I came to see it, the key is to accept who we are, understand our differences and limitations and figure out ways to work around them.”8 |

| | | |

| | | At a Capital Cities/ABC management conference Warren Buffett said, “You can have somebody, whose aggregate performance is terrific, but if they have a weakness, maybe it’s alcohol, maybe it’s susceptibility to taking a little easy money, it’s the weak link that snaps you. And frequently in the financial markets, the weak link is borrowed money.”9 |

(2) Roger Lowenstein, Buffett, The Making of an American Capitalist, (1995), xii.

(3) Lowenstein, Buffett, The Making of an American Capitalist, 325.

(4) Lowenstein, Buffett, The Making of an American Capitalist, 272.

(5) Lowenstein, Buffett, The Making of an American Capitalist, 325.

(6) Guy Spier, The Education of a Value Investor, (2014), 48.

(7) Berkshire Hathaway, Annual Report, 1993.

(8) Spier, The Education of a Value Investor, 48.

(9) Lowenstein, Buffett, The Making of an American Capitalist, 273.

Annual Report 2015

| 9) | There’s no hurry to get rich. Disciplined investing, over time, in things you understand, will bring wealth. Spier and his friend, Mohnish Pabrai, won the auction for lunch with Warren Buffett in 2008. Spier quotes Buffett as having said, “If you’re even a slightly above-average investor who spends less than you earn, over a lifetime you can’t help but get very wealthy, if you’re patient.” |

2015 was Dominated by Weak Commodities, the Strong U.S. Dollar, Slowing Growth in China and “FANG” Stocks10

In late January 2015, the European Central Bank announced a massive quantitative easing program that will run through September 2016. Consequently, February 2015 was a very strong month as the Russell 2000 Total Return Index returned 5.9%, the S&P 500 TR returned 5.8%, and the Needham Funds outperformed. In March, the U.S. Federal Reserve dropped the word “patient” from its outlook for interest rates, but made it clear it was in no hurry to normalize rates.

The Funds and the markets declined at the beginning of the second quarter, owing to weak economic results. However, the Funds and markets closed the half year in positive territory.

Then came the third quarter. The Russell 2000 and the Needham Funds were down each month of the quarter. Brent oil fell nearly 24% from $63.59 to $48.37, and companies doing business in the energy sector were hurt badly. China has been a major consumer of commodities to fuel its infrastructure construction, but it hasslowed. Chinese officials made stunning policy moves in July to attempt to counteract the falling stock market. The Shanghai Stock Exchange had been up over 60% in 2015, but then fell over 30% from mid-June into July. China halted trading in many stocks, forbid large holders from selling, and the People’s Bank of China injected over $200 billion to prop up equity prices. On August 7, China announced a surprise devaluation of the Yuan, which could be revalued even lower in 2016. These are extraordinary measures for investors in Chinese securities to consider. We continue to believe that U.S. equities are the most viable asset class.

August brought the ETF “flash crash.” The S&P 500 was down 6% at the open on Monday, August 24. Many stocks had delayed openings, which made it difficult for the ETF market makers to value ETFs. While ETFs provide intraday liquidity, they are dependent on orderly markets, and “quant” trading systems can have an outsized short-term impact. Again, we prefer plain old U.S. equities and mutual funds.

Economic weakness continued through September and the markets remained confused about the Federal Reserve’s message regarding a rate hike. Right until the Fed meeting of September 17, it seemed as if the Fed would raise interest rates for the first time in nine years—to all of 0.25%. Alas, it took until the December meeting for the Fed to raise rates.

The Funds and markets were positive in October and November. December brought a restart of the weakness, which continued through February 18 with the S&P 500 TR declining 5.86% and the Russell 2000 TR declining 11.42% in 2016. The S&P 500 and the NASDAQ Composite indices were dominated by strong performance of the FANG large-cap stocks: Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Alphabet (f/k/a Google) (GOOG). The top 10 largest stocks by market cap in the S&P 500 Index gained nearly 23%, while the other 490 dropped on average 3.5%. Since summer 2015, U.S. stocks have declined, with most stocks down 20% or more and many have fallen 30% or more.

2016 Outlook – Still About Commodities, China and the U.S. Dollar

Brent oil remains at low levels. In mid-January, it traded as low as $26 per barrel. In January, the average price of regular gas in the United States fell to $1.80 from $2.00 per gallon. Consumers will benefit. In January, the Shenzen market fell another 27%. Kenneth Rogoff’s February 2 article, The Great Escape from China, argues that weak commodities and a declining Yuan could lead to continued strength for the dollar, which could lead to additional pressure on our exporters. We believe that the U.S. economy will grow 1.5-2%, which is below the “new normal” of 2-2.5%, which has prevailed for the past seven years. We do not foresee the Federal Reserve raising rates again in 2016. Many international markets have negative interest rates. Bonds with negative interest rates would seem to be full of risk, should monetary affairs normalize.

Acceleration of growth seems unlikely unless Washington shifts focus to a fiscal policy designed to promote business investment and capital formation. Imagine if we had an internationally competitive corporate tax regime, lower regulatory and policy barriers to private sector hiring, lower marginal tax rates, and a lower rate of increase of government spending. Unfortunately, this Presidential Primary election season has been devoid of any discussion of positive fiscal policy. Hopefully, that day will return.

(10) “FANG” refers to Facebook, Inc., Amazon.com, Inc., Netflix, Inc. and Alphabet, Inc. (f/k/a Google, Inc.)

Needham Funds

Big Opportunity in Small Cap Stocks

It’s easy to be concerned about the market and macroeconomic fears. However, when we think of the Needham Funds as having partial ownership in businesses with great new products and services, it’s easier to be excited. Our job is to find companies which we believe have misunderstood growth prospects. We believe our portfolios are full of such companies and many are on sale, having fallen 20-30% since last summer.

Dividing the Russell 3000 stocks by market cap shows that the smaller the market, the more severe the sell-off. The largest companies, with market cap over $25 billion, declined 17.1% from July 1, 2015 thru January 21, 2016, while those under $200 million declined 62%. Those between $200 million and $500 million declined 33.8%.

Russell 3000 Current Valuation & Performance by Market Capitalization

| | 1/21/2016 | 2015 Performance |

| Market Capitalization | EV/Sales | MTD | Q4 | Q3 & Q4 | Year |

| >$25B | 4.4X | -8.4% | -5.6% | -8.4% | 7.9% |

| $1B - $25B | 3.9X | -11.3% | -10.6% | -14.4% | 2.6% |

| $500MM - $1B | 3.0X | -14.2% | -13.3% | -20.6% | -2.4% |

| $200MM - $500MM | 2.7X | -14.5% | -14.6% | -22.6% | -7.3% |

| <$200MM | 2.4X | -24.0% | -35.0% | -50.0% | -36.0% |

(Source: Emancipation Capital)

We see a big opportunity in our small cap equity universe. All three Funds also have substantial small-cap (under $2 billion market cap) and micro-cap (market caps under $250 million) exposure.

2015 and Fourth Quarter Contributors Across All Three Funds:

Photronics, Inc. (PLAB) returned 37.4% in the fourth quarter and 49.8% in 2015. Photronics makes photomasks, which are used to manufacture semiconductors and flat panel displays. Photronics reported a strong fourth quarter ending October 30, with growth from high-end integrated circuits and flat-panel displays. The company significantly exceeded earnings expectations for the year, with actual gross margins of 27% versus 24% estimated at the beginning of FY15.

FormFactor, Inc. (FORM) returned 32.7% in the fourth quarter and 4.7% in 2015. The company makes wafer probe cards used to test a manufactured semiconductor wafer with system-on-chip and memory designs. In 2015, FormFactor introduced a new NAND flash memory product. Additionally, the latest system-on-chip logic designs use copper pillar packaging, which is best tested with FormFactor’s MEMs probe cards. FormFactor grew revenues by 5% and EPS by 16% in 2015. On February 4, 2016, FormFactor announced the acquisition of Cascade Microtech (CSCD) for $350 million cash.

Detractors Across the Needham Funds

Super Micro Computer, Inc. (SMCI) makes servers and storage systems used in cloud data centers by leading Internet companies. We believe Super Micro has an opportunity to gain market share versus Lenovo Group, Ltd. (992-HK) and Hewlett-Packard (HPQ). Lenovo purchased IBM Corporation’s (IBM) server business in 2014. Super Micro’s customers include high-growth, next-generation storage companies such as Nimble Storage, Inc. (NMBL) and Nutanix, Inc., and IBM’s SoftLayer subsidiary.

Super Micro declined 10.1% in the fourth quarter and 29.7% for the year, as investors worried about slowing orders from data center customers and the company’s December quarter. In January 2016, Super Micro reported a very strong fourth quarter, allaying investors’ concerns over the quarter. Super Micro had 26% revenue growth and 12% EPS growth in 2015. However, as of December 31, 2015, Super Micro was valued at just 10x earnings, ex-cash.

KVH Industries, Inc. (KVHI) declined 5.8% in the fourth quarter and 25.5% for the year. On its upcoming fourth quarter earnings announcement, we believe KVH will report progress in 2015, just not as much as first expected. KVH is estimated to grow revenue by 7% and EPS by 11%. Most importantly, we believe KVH is positioned for further growth in 2016.

In our view, KVH is like the combined Netflix, Inc. (NFLX) and Comcast Corporation (CMCSA) of the commercial maritime industry. The company supplies satellite communications equipment, voice and data services and entertainment, news and training content to ships at sea through their IP-Multicast technology. KVH also supplies fiber optic gyroscopes for self-driving cars and military vehicles, including vehicles in the Middle East.

Annual Report 2015

KVH has not traded below $10 per share since June 2012. At $8.67 per share on February 18, KVHI is valued at just 0.8x EV/estimated 2015 revenue and 7x EV/estimated 2015 EBITDA, which gives no credit for the investments made to position the company for faster growth.

Needham Growth Fund

The Needham Growth Fund returned 4.39% in the fourth quarter, but declined 5.07% for the year ending December 31, 2015.

Thermo Fisher Scientific (TMO), the Fund’s second-largest holding at 8.4% of net assets, was the top contributor for the quarter, returning 16.1%, and 13.8% for the year. The Fund bought Thermo Fisher in 2000 and 2002 and as of December 31, 2015, it was an 8-bagger. In October, Thermo Fisher reported 4% organic revenue growth for the fourth quarter, raised guidance for the year and announced a $1 billion share buyback. In January 2016, Thermo Fisher announced an agreement to purchase Affymetrix, Inc. (AFFX) for $1.3 billion. Affymetrix’s microarray products fit with Thermo’s genetic analysis business. The planned 15% of revenue cost synergies make for a high-single-digit return-on-investment capital for the acquisition, which is expected to close in the second quarter of 2016. Other top contributors included FormFactor, Becton Dickinson & Co. (BDX), and Photronics.

Akamai Technologies, Inc. (AKAM) was the leading detractor for the quarter, down 23.8%. Guidance for the fourth quarter fell below expectations; we believe this shortcoming was due to Apple (AAPL) utilizing less of Akamai’s services to deliver the iOS 9 iPhone upgrade and the delayed launch of Apple’s over-the-top TV bundle. Akamai benefits from the long-term prospects for growth in over-the-top video and cloud cyber security. Super Micro Computer, Inc. was the largest detractor for the year, down 29.7%.

During the quarter, we added to positions in Akamai and Super Micro Computer. We exited our long-term holding in II-VI, Inc. We reduced positions in Photronics and FormFactor on the market strength.

On December 31, 2015, the Fund had an Active Share of 103.0% compared to the S&P 500, and trailing twelve-month turnover of 13%. The top ten positions were 54% of net assets.

On December 31, 2015, 50% of Needham Growth Fund’s net assets were invested in companies with market capitalizations of over $8 billion, 14% between $2-8 billion, and 36% under $2 billion. The Fund had a 4% short position and 6% in cash, up from 5% in the September quarter.

Needham Aggressive Growth Fund

The Needham Aggressive Growth Fund returned 4.73% in the fourth quarter, but declined 7.05% for the year ending December 31, 2015.

GSE Systems, Inc. (GVP) was the top contributor for the year, returning 50.9%, and the second leading contributor for the fourth quarter. GSE, featured in our third quarter letter, supplies training simulators for the nuclear and process manufacturing industries. As of December 31, 2015, it had a $44 million market cap with $13 million of net cash, $43 million of revenue for the first three quarters of 2015 and its first quarter with positive adjusted EBITDA since 2013. During the quarter, we saw insider buying from GSE’s new management team.

Oil-Dri Corp. (ODC), another microcap, was the third-leading contributor for the quarter returning 62.0%. Oil-Dri is creating the category for lightweight cat litter and is the leading supplier. Oil-Dri owns the mines and clay reserves necessary to make lightweight cat litter.

LeMaitre Vascular, Inc. (LMAT), yet another microcap, was a leading contributor for the year as it returned 128.8%. LeMaitre is a seven-year holding and a five-bagger for the Fund. LeMaitre makes devices for vascular surgeons and exceeded expectations in 2015.

FormFactor was the top contributor for the fourth quarter. For the quarter, Akamai and Super Micro were the leading detractors.

PDF Solutions, Inc. declined 27.1% and was the leading detractor for 2015. PDF gets paid a gainshare royalty when semiconductor companies such as Qualcomm and AMD manufacture parts at Samsung, Global Foundries or other fabs that utilize PDF’s technology. PDF’s stock price has fallen to $10.35 per share as of February 18, 2016. It has $4 per share in cash and is estimated to earn $0.80 per share in 2016. We believe the company’s big data analytics SaaS revenue could

Needham Funds

grow 100% annually and reach 20% of revenue by the fourth quarter of 2016. We also believe the company’s new electrical design for inspection initiative has the potential to generate royalties in 2017 and a longer-term opportunity to double royalty revenue.

The largest additions to the portfolio in the fourth quarter were to Akamai, CRA International, Inc. (CRAI), GSE Systems and Norsat International (NSAT). We sold positions, including Bruker Corporation (BRKR), Brooks Automation, Inc. (BRKS), and Electro-Scientific Industries, Inc. (ESIO).

On December 31, 2015, the Fund had an Active Share of 111.7% compared to the Russell 2000 and trailing twelve-month turnover of 15%. The top ten positions were 49% of net assets.

The Fund exited the fourth quarter with 27% of net assets invested in companies with over an $8 billion market cap, 7% between $2 and 8 billion, 4% between $250 million and $2 billion and 16% under $250 million. The Fund had a 7% short position and was again fully invested.

Needham Small Cap Growth Fund

The Needham Small Cap Growth Fund returned 7.63% in the fourth quarter, but declined 8.96% for the year ending December 31, 2015.

We are pleased that many of our core holdings recovered in the fourth quarter after suffering a significant downturn in the third quarter. We found liquidity in our holdings during the quarter and took advantage of the opportunity to lighten our investments and raise cash. Shorting was also a contributor to performance.

After a difficult second half in 2015 for semiconductor capital equipment, we are positive on the industry’s trends and outlook later in 2016. The stocks did not see their seasonal December rally, which provides better valuation entry points as the industry begins to see an uptick in orders in 2016. NESGX holding Ultra Clean Holdings (UCTT) engages in the development, manufacture and supply of critical subsystems for the semiconductor capital equipment, flat panel, medical and research industries. Ultra Clean was a top ten position for NESGX at December 31, 2015, and we are excited about the risk/reward after a tough 2015.

TTM Technologies (TTMI), another top-ten holding at December 31, 2015, is another stock we are excited about, as we expect the company to begin to realize greater synergies and return on invested capital following the integration of its acquisition of Viasystems Group last year. The acquisition expanded and diversified its customer base and end markets and should begin to leverage its greater market share as a combined company. The stock has traded down based upon its exposure to the Apple supply chain, although this only represents 17% of its sales. The company should be able to generate substantial cash flow that will help it to deleverage from the acquisition and thereby drive higher return on equity. Again, we believe TTMI exhibits a strong risk/reward after a tough 2015.

Although the macro and geopolitical environment is a headwind to global growth, we believe this is the time for stock pickers. Other than the U.S. Federal Reserve, most central banks around the global are providing increased quantitative easing, which has caused a stronger U.S. Dollar. In general, small cap stocks should not be as impacted by a stronger Dollar as will larger cap companies that are more exposed to international customers and markets. However, the collapse of the high yield market has certainly affected the appetite for small cap stocks, which also points to the importance of stock picking rather than blanket index buying. We remain concentrated in our top holdings, as we feel most comfortable in evaluating their growth prospects and downside risks. Our increased cash position should help in a more volatile market as well as allow us to make investments at better valuations.

Closing

We believe the U.S. is again facing sub-par economic growth, but it remains the best place in the world to be investing and working. Asia and Europe are facing difficult economic times. We believe there’s opportunity in small and mid-cap stocks in this difficult market. We are particularly excited that this market may give us a chance to add to positions already in the portfolio.

To reiterate perspectives from Warren Buffett and Charlie Munger:

| 1) | Pay little attention to the macro. |

| 2) | Focus on the business, not on the stock. |

| 3) | Invest in companies or funds that you understand. |

Annual Report 2015

| 4) | Invest with a margin of safety. |

| 5) | Once you invest, be prepared to stay the course. |

| 6) | Professors Cremers and Pareek found that High Active Share and Low Turnover is an effective strategy to outperform the averages over the long-term. |

| 7) | Make investment decisions away from the noise. |

| 8) | Know yourself and avoid leverage. |

| 9) | There’s no hurry to get rich. |

To reiterate our overall thesis: monetary policy remains accommodative. Most importantly, we see a revolution happening in technology that has created and continues to create investment opportunities.

We see opportunity in our strategy of investing in companies that we know well and that we believe are positioned with secular growth drivers. We believe 2016 will bring a modest rebound for equities. As it already has this year, we believe the markets will experience more volatility and that our ability to short could dampen the possible volatility.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts or concerns, please contact us at (800) 625-7071 or send us an email at cretzler@needhamco.com or jbarr@needhamco.com. For information about the funds, please visit our website at www.needhamfunds.com.

| Sincerely, | |

| | |

|  |

| | |

| Chris Retzler | John O. Barr |

| Portfolio Manager | Portfolio Manager |

Needham Funds

| NEEDHAM GROWTH FUND | TICKER: NEEGX |

Comparative Performance Statistics as of December 31, 2015

| | | | | | | | | | | | | Since | | Gross Expense |

| | | 6 Months(7) | | 1 Year | | 3 Years(8) | | 5 Years(8) | | 10 Years(8) | | Inception(8)(12) | | Ratio(14) |

| Needham Growth Fund(1) | | (8.28)% | | (5.07)% | | 11.69%(9) | | 6.96%(10) | | 6.95%(11) | | 12.96%(13) | | 1.84% |

| S&P 500 Index(2)(3) | | 0.15% | | 1.38% | | 15.13% | | 12.57% | | 7.31% | | 8.19% | | |

| NASDAQ Composite Index(2)(4) | | 1.05% | | 7.11% | | 19.91% | | 15.02% | | 9.79% | | 9.00% | | |

| S&P 400 MidCap Index(2)(5) | | (6.11)% | | (2.18)% | | 12.76% | | 10.68% | | 8.18% | | 11.22% | | |

| Russell 2000 Index(2)(6) | | (8.75)% | | (4.41)% | | 11.65% | | 9.19% | | 6.80% | | 8.03% | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 5. | The S&P 400 MidCap Index is a broad unmanaged measure of the U.S. stock market. |

| 6. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 8. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. |

| 9. | Cumulative return for the three year period was 39.33%, assuming all dividends were reinvested in shares of the Fund. |

| 10. | Cumulative return for the five year period was 39.97%, assuming all dividends were reinvested in shares of the Fund. |

| 11. | Cumulative return for the ten year period was 95.87%, assuming all dividends were reinvested in shares of the Fund. |

| 12. | The inception date of the Fund was 1/1/96. |

| 13. | Cumulative return since inception was 1,044.46%, assuming all dividends were reinvested in shares of the Fund. |

| 14. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2015. Additional information pertaining to the Fund’s expense ratios as of December 31, 2015 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2016. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 1.84%. |

Top Ten Holdings*

(as a % of total investments, as of December 31, 2015)

| | | | | % of Total |

| | | Security | | | | | Investments† |

| 1 Express Scripts Holding Co. | | ESRX | | 9.54% |

| 2 Thermo Fisher Scientific, Inc. | | TMO | | 8.94% |

| 3 Gilead Sciences, Inc. | | GILD | | 8.03% |

| 4 Becton Dickinson and Co. | | BDX | | 5.37% |

| 5 CarMax, Inc. | | KMX | | 5.10% |

| 6 ViaSat, Inc. | | VSAT | | 4.61% |

| 7 FormFactor, Inc. | | FORM | | 4.54% |

| 8 Super Micro Computer, Inc. | | SMCI | | 4.27% |

| 9 KVH Industries, Inc. | | KVHI | | 4.06% |

| 10 Jabil Circuit, Inc. | | JBL | | 2.93% |

Top Ten Holdings = 57.39% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments less cash.

Sector Weightings*

(as a % of total investments, as of December 31, 2015)

| | | Sector | | | Long(1) | | (Short) (1) | | Total(1)(2) |

| Consumer Discretionary | | 9.4% | | — | | 9.4% |

| Energy | | 2.7% | | — | | 2.7% |

| Financials | | 3.2% | | (0.7)% | | 2.5% |

| Health Care | | 36.7% | | — | | 36.7% |

| Industrials | | 3.2% | | — | | 3.2% |

| Information Technology | | 42.9% | | (3.4)% | | 39.5% |

| Cash | | 6.0% | | — | | 6.0% |

* Current portfolio holdings may not be indicative of future portfolio holdings.

| (1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

| (2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Annual Report 2015

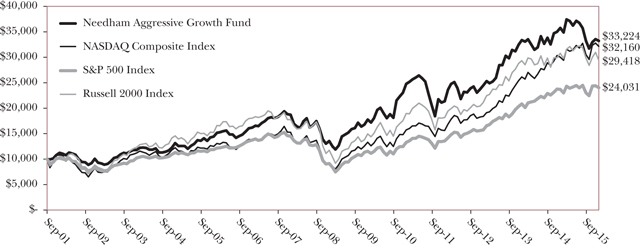

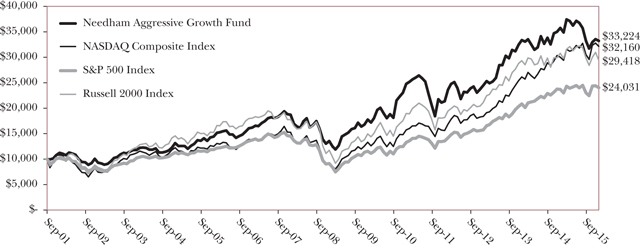

| NEEDHAM AGGRESSIVE GROWTH FUND | TICKER: NEAGX |

Comparative Performance Statistics as of December 31, 2015

| | | | | | | | | | | | | Since | | Gross Expense |

| | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | 10 Years(7) | | Inception(7)(11) | | Ratio(13) |

| Needham Aggressive Growth Fund(1) | | -9.58% | | -7.05% | | 10.71%(8) | | 6.04%(9) | | 8.70%(10) | | 8.74% (12) | | 2.09% |

| S&P 500 Index(2)(3) | | 0.15% | | 1.38% | | 15.13% | | 12.57% | | 7.31% | | 6.31% | | |

| NASDAQ Composite Index(2)(4) | | 1.05% | | 7.11% | | 19.91% | | 15.02% | | 9.79% | | 8.49% | | |

| Russell 2000 Index(2)(5) | | -8.75% | | -4.41% | | 11.65% | | 9.19% | | 6.80% | | 7.82% | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 5. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 7. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. |

| 8. | Cumulative return for the three year period was 35.68%, assuming all dividends were reinvested in shares of the Fund. |

| 9. | Cumulative return for the five year period was 34.09%, assuming all dividends were reinvested in shares of the Fund. |

| 10. | Cumulative return for the ten year period was 130.26%, assuming all dividends were reinvested in shares of the Fund. |

| 11. | The inception date of the Fund was 9/4/2001. |

| 12. | Cumulative return since inception was 232.24% assuming all dividends were reinvested in shares of the Fund. |

| 13. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2015. Additional information pertaining to the Fund’s expense ratios as of December 31, 2015 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2016. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 2.09%. |

Top Ten Holdings*

(as a % of total investments, as of December 31, 2015)

| | | | | | | | % of Total |

| | | Security | | | | | Investments† |

| 1 Akamai Technologies, Inc. | | AKAM | | 6.92% |

| 2 FormFactor, Inc. | | FORM | | 6.03% |

| 3 Entegris, Inc. | | ENTG | | 5.23% |

| 4 PDF Solutions, Inc. | | PDFS | | 5.11% |

| 5 KVH Industries, Inc. | | KVHI | | 5.06% |

| 6 Apple, Inc. | | AAPL | | 4.61% |

| 7 Gilead Sciences, Inc. | | GILD | | 4.58% |

| 8 Reis, Inc. | | REIS | | 4.44% |

| 9 Super Micro Computer, Inc. | | SMCI | | 4.13% |

| 10 GSE Systems, Inc. | | GVP | | 3.14% |

Top Ten Holdings = 49.25% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments less cash.

Sector Weightings*

(as a % of total investments, as of December 31, 2015)

| | | Sector | | | Long(1) | | (Short) (1) | | Total(1)(2) |

| Consumer Discretionary | | 5.1% | | — | | 5.1% |

| Consumer Staples | | 2.7% | | — | | 2.7% |

| Energy | | 1.1% | | — | | 1.1% |

| Financials | | 5.2% | | (2.3)% | | 2.9% |

| Health Care | | 10.8% | | — | | 10.8% |

| Industrials | | 6.9% | | — | | 6.9% |

| Information Technology | | 74.8% | | (4.4)% | | 70.4% |

| Cash | | 0.1% | | — | | 0.1% |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Needham Funds

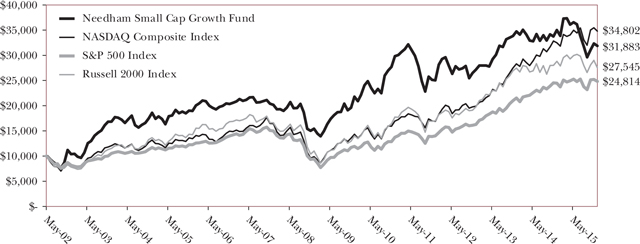

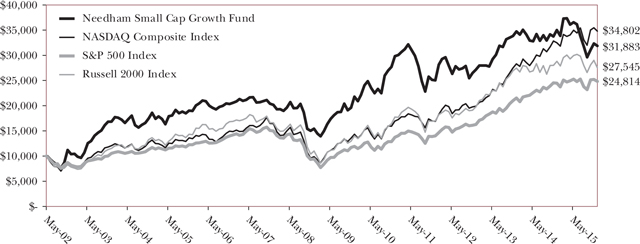

| NEEDHAM SMALL CAP GROWTH FUND | TICKER: NESGX |

Comparative Performance Statistics as of December 31, 2015

| | | | | | | | | | | | | Since | | Gross Expense |

| | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | 10 Years(7) | | Inception(7)(11) | | Ratio(13) |

| Needham Small Cap Growth Fund(1) | | -11.86% | | -8.96% | | 5.48%(8) | | 1.34%(9) | | 5.34%(10) | | 8.89% (12) | | 2.01% |

| S&P 500 Index(2)(3) | | 0.15% | | 1.38% | | 15.13% | | 12.57% | | 7.31% | | 6.91% | | |

| NASDAQ Composite Index(2)(4) | | 1.05% | | 7.11% | | 19.91% | | 15.02% | | 9.79% | | 9.59% | | |

| Russell 2000 Index(2)(5) | | -8.75% | | -4.41% | | 11.65% | | 9.19% | | 6.80% | | 7.73% | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 5. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 7. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. |

| 8. | Cumulative return for the three year period was 17.37%, assuming all dividends were reinvested in shares of the Fund. |

| 9. | Cumulative return for the five year period was 6.88%, assuming all dividends were reinvested in shares of the Fund. |

| 10. | Cumulative return for the ten year period was 68.20%, assuming all dividends were reinvested in shares of the Fund. |

| 11. | The inception date of the Fund was 5/22/02. |

| 12. | Cumulative return since inception was 218.83% assuming all dividends were reinvested in shares of the Fund. |

| 13. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2015. Additional information pertaining to the Fund’s expense ratios as of December 31, 2015 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2016. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 2.01%. |

Top Ten Holdings*

(as a % of total investments, as of December 31, 2015)

| | | | | | % of Total |

| | | Security | | | | | Investments† |

| 1 Newport Corp. | | NEWP | | 7.65% |

| 2 Silicon Graphics International Corp. | | SGI | | 7.54% |

| 3 KVH Industries, Inc. | | KVHI | | 6.88% |

| 4 Ultra Clean Holdings, Inc. | | UCTT | | 6.81% |

| 5 Super Micro Computer, Inc. | | SMCI | | 6.39% |

| 6 FormFactor, Inc. | | FORM | | 6.10% |

| 7 TTM Technologies, Inc. | | TTMI | | 5.94% |

| 8 Reis, Inc. | | REIS | | 5.88% |

| 9 Frequency Electronics, Inc. | | FEIM | | 5.81% |

| 10 Air Lease Corp. | | AL | | 5.67% |

Top Ten Holdings = 64.67% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments less cash.

Sector Weightings*

(as a % of total investments, as of December 31, 2015)

| | | Sector | | | Long(1) | | (Short) (1) | | Total(1)(2) |

| Consumer Staples | | 2.5% | | — | | 2.5% |

| Energy | | 1.1% | | — | | 1.1% |

| Financials | | 0.4% | | — | | 0.4% |

| Health Care | | 1.4% | | — | | 1.4% |

| Industrials | | 5.4% | | — | | 5.4% |

| Information Technology | | 73.0% | | (3.6)% | | 69.4% |

| Cash | | 19.8% | | — | | 19.8% |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| (1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

| (2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Annual Report

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur transactional costs, including redemption fees and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. The expense example table below illustrates your fund’s cost in two ways:

| • | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio under the heading entitled “Expenses Paid During Period”. |

| • | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. It assumes that the Portfolio had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Portfolio’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

For the Period July 1, 2015 to December 31, 2015

Expense Example Table

| | | Beginning | | Ending | | Expenses Paid | | Expense Ratio | |

| | | Account Value | | Account Value | | During Period* | | During Period* | |

| | | 7/1/15 | | 12/31/15 | | 7/1/15 - 12/31/15 | | 7/1/15 - 12/31/15 | |

| Needham Growth Fund | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,035.00 | | | $ | 10.87 | | | | 2.25 | % | |

| Hypothetical Example for Comparison Purposes (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.57 | | | $ | 11.42 | | | | 2.25 | % | |

| | | | | | | | | | | | | | | | | | |

| Needham Aggressive Growth Fund | | | | | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,028.00 | | | $ | 13.53 | | | | 2.82 | % | |

| Hypothetical Example for Comparison Purposes (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.68 | | | $ | 14.29 | | | | 2.82 | % | |

| | | | | | | | | | | | | | | | | | |

| Needham Small Cap Growth Fund | | | | | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,032.80 | | | $ | 10.15 | | | | 2.14 | % | |

| Hypothetical Example for Comparison Purposes (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.98 | | | $ | 10.87 | | | | 2.14 | % | |

| * | Expenses are equal to the average account value times the Portfolio annualized expense ratio multiplied by 184/365 (to reflect the one-half year period). |

Needham Funds

Needham Growth Fund

Schedule of Investments

December 31, 2015

| | | Shares | | | Market Value | |

| Common Stocks (93.6%) | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense (0.6%) | | | | | | | | |

| Honeywell International, Inc. | | | 7,000 | | | $ | 724,990 | |

| | | | | | | | | |

| Air Freight & Logistics (0.2%) | | | | | | | | |

| FedEx Corp. | | | 2,000 | | | | 297,980 | |

| | | | | | | | | |

| Airlines (0.2%) | | | | | | | | |

| United Continental Holdings, Inc.* | | | 5,000 | | | | 286,500 | |

| | | | | | | | | |

| Auto Components (0.2%) | | | | | | | | |

| Sypris Solutions, Inc.* | | | 185,400 | | | | 202,086 | |

| | | | | | | | | |

| Biotechnology (7.6%) | | | | | | | | |

| Foundation Medicine, Inc.* | | | 7,500 | | | | 157,950 | |

| Gilead Sciences, Inc.† | | | 94,500 | | | | 9,562,455 | |

| | | | | | | | 9,720,405 | |

| | | | | | | | | |

| Capital Markets (2.8%) | | | | | | | | |

| Financial Engines, Inc.† | | | 66,500 | | | | 2,239,055 | |

| GSV Capital Corp.* | | | 37,500 | | | | 351,375 | |

| Oaktree Capital Group LLC | | | 20,000 | | | | 954,400 | |

| | | | | | | | 3,544,830 | |

| | | | | | | | | |

| Communications Equipment (8.1%) | | | | | | | | |

| KVH Industries, Inc.* | | | 512,560 | | | | 4,828,315 | |

| ViaSat, Inc.*† | | | 90,000 | | | | 5,490,900 | |

| | | | | | | | 10,319,215 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (8.4%) | | | | | | | | |

| Corning, Inc. | | | 35,000 | | | | 639,800 | |

| Electro Scientific Industries, Inc.* | | | 180,000 | | | | 934,200 | |

| Flir Systems, Inc. | | | 15,000 | | | | 421,050 | |

| Frequency Electronics, Inc.* | | | 33,247 | | | | 353,083 | |

| Jabil Circuit, Inc.† | | | 150,000 | | | | 3,493,500 | |

| National Instruments Corp. | | | 20,000 | | | | 573,800 | |

| Newport Corp.* | | | 210,000 | | | | 3,332,700 | |

| TTM Technologies, Inc.* | | | 30,750 | | | | 200,183 | |

| Vishay Intertechnology, Inc. | | | 62,500 | | | | 753,125 | |

| | | | | | | | 10,701,441 | |

| | | | | | | | | |

| Energy Equipment & Services (0.7%) | | | | | | | | |

| Schlumberger Ltd. | | | 12,500 | | | | 871,875 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (9.3%) | | | | | | | | |

| Analogic Corp. | | | 5,000 | | | | 413,000 | |

| Becton Dickinson and Co. | | | 41,500 | | | | 6,394,735 | |

| CONMED Corp. | | | 30,000 | | | | 1,321,500 | |

| Medtronic PLC | | | 26,290 | | | | 2,022,227 | |

| Varian Medical Systems, Inc.* | | | 20,000 | | | | 1,616,000 | |

| | | | | | | | 11,767,462 | |

| | | | | | | | | |

| Health Care Providers & Services (8.9%) | | | | | | | | |

| Express Scripts Holding Co.*† | | | 130,000 | | | | 11,363,300 | |

| | | | | | | | | |

| Health Care Technology (0.1%) | | | | | | | | |

| Castlight Health, Inc.* | | | 15,000 | | | | 64,050 | |

| | | | | | | | | |

| Internet Software & Services (3.9%) | | | | | | | | |

| Akamai Technologies, Inc.*† | | | 54,250 | | | | 2,855,177 | |

| Amber Road, Inc.* | | | 264,000 | | | | 1,343,760 | |

| Q2 Holdings, Inc.* | | | 20,000 | | | | 527,400 | |

| Reis, Inc. | | | 10,000 | | | | 237,300 | |

| | | | | | | | 4,963,637 | |

| | | | | | | | | |

| Life Sciences Tools & Services (8.8%) | | | | | | | | |

| Bruker Corp.* | | | 25,000 | | | | 606,750 | |

| Thermo Fisher Scientific, Inc.† | | | 75,000 | | | | 10,638,750 | |

| | | | | | | | 11,245,500 | |

| | | | | | | | | |

| Media (3.1%) | | | | | | | | |

| Comcast Corp. | | | 60,000 | | | | 3,385,800 | |

| Twenty-First Century Fox, Inc. | | | 10,000 | | | | 271,600 | |

| World Wrestling Entertainment, Inc. | | | 12,500 | | | | 223,000 | |

| | | | | | | | 3,880,400 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (1.9%) | | | | | | | | |

| Hess Corp.† | | | 49,375 | | | | 2,393,700 | |

| | | | | | | | | |

| Pharmaceuticals (0.3%) | | | | | | | | |

| Corium International, Inc.* | | | 50,000 | | | | 406,000 | |

| | | | | | | | | |

| Professional Services (0.8%) | | | | | | | | |

| WageWorks, Inc.* | | | 23,500 | | | | 1,066,195 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (13.7%) |

| Applied Materials, Inc. | | | 8,000 | | | | 149,360 | |

| Brooks Automation, Inc. | | | 90,000 | | | | 961,200 | |

| Entegris, Inc.* | | | 227,500 | | | | 3,018,925 | |

| FormFactor, Inc.* | | | 600,000 | | | | 5,400,000 | |

| Lam Research Corp. | | | 2,500 | | | | 198,550 | |

| MKS Instruments, Inc. | | | 67,500 | | | | 2,430,000 | |

| Nova Measuring Instruments Ltd.* | | | 130,000 | | | | 1,274,000 | |

| PDF Solutions, Inc.* | | | 202,000 | | | | 2,189,680 | |

| Photronics, Inc.* | | | 147,788 | | | | 1,839,960 | |

| | | | | | | | 17,461,675 | |

| | | | | | | | | |

| Software (0.4%) | | | | | | | | |

| Barracuda Networks, Inc.* | | | 28,023 | | | | 523,470 | |

See accompanying notes to financial statements.

Annual Report 2015

Needham Growth Fund

Schedule of Investments (Continued)

December 31, 2015

| | | Shares | | | Market Value | |

| Common Stocks - Continued | | | | | | | | |

| | | | | | | | | |

| Specialty Retail (5.6%) | | | | | | | | |

| CarMax, Inc.*† | | | 112,500 | | | $ | 6,071,625 | |

| Dick’s Sporting Goods, Inc. | | | 24,000 | | | | 848,400 | |

| Tiffany & Co. | | | 2,500 | | | | 190,725 | |

| | | | | | | | 7,110,750 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (6.4%) | | | | | | | | |

| Electronics For Imaging, Inc.* | | | 64,000 | | | | 2,991,360 | |

| Super Micro Computer, Inc.* | | | 207,500 | | | | 5,085,825 | |

| | | | | | | | 8,077,185 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods (0.1%) | | | | | | | | |

| Under Armour, Inc.* | | | 2,000 | | | | 161,220 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (0.3%) | | | | | | | | |

| Ladder Capital Corp. | | | 31,954 | | | | 396,869 | |

| | | | | | | | | |

| Trading Companies & Distributors (1.2%) | | | | | | | | |

| Air Lease Corp. | | | 45,000 | | | | 1,506,600 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $58,612,546) | | | | | | $ | 119,057,335 | |

| | | | | | | | | |

| Short-Term Investments (5.7%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (5.7%) | | | | | | | | |

| Dreyfus Treasury Prime Cash | | | | | | | | |

| Management - Institutional | | | | | | | | |

| Class 0.01% (a) | | | | | | | | |

| (Cost $7,306,182) | | | 7,306,182 | | | | 7,306,182 | |

| | | | | | | | | |

| Total Investments (99.3%) | | | | | | | | |

| (Cost $65,918,726) | | | | | | | 126,363,517 | |

| Total Securities Sold Short (-3.9%) | | | | | | | | |

| (Proceeds $4,612,182) | | | | | | | (4,943,555 | ) |

| Other Assets in Excess of Liabilities (4.6%) | | | | | | | 5,734,400 | |

| Net Assets (100.0%) | | | | | | $ | 127,154,362 | |

| * | Non-income producing security. |

| | |

| (a) | Rate shown is the seven day yield as of December 31, 2015 |

| | |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $6,079,840. |

| | |

| | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Securities Sold Short

December 31, 2015

| | | Shares | | | Market Value | |

| | | | | | | | | |

| Securities Sold Short (-3.9%) | | | | | | | | |

| | | | | | | | | |

| Capital Markets (-0.6%) | | | | | | | | |

| Medallion Financial Corp. | | | 112,000 | | | $ | 788,480 | |

| | | | | | | | | |

| Communications Equipment (-1.7%) | | | | | | | | |

| Ubiquiti Networks, Inc.* | | | 69,000 | | | | 2,186,610 | |

| | | | | | | | | |

| Internet Software & Services (-0.2%) | | | | | | | | |

| SPS Commerce, Inc.* | | | 2,575 | | | | 180,791 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.3%) | | | | | | | | |

| Advanced Energy Industries, Inc.* | | | 5,000 | | | | 141,150 | |

| Applied Micro Circuits Corp.* | | | 5,000 | | | | 31,850 | |

| Rudolph Technologies, Inc.* | | | 3,000 | | | | 42,660 | |

| Solaredge Technologies, Inc.* | | | 5,000 | | | | 140,850 | |

| | | | | | | | 356,510 | |

| | | | | | | | | |

| Software (-1.1%) | | | | | | | | |

| ANSYS, Inc.* | | | 15,000 | | | | 1,387,500 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (0.0%) | | | | | | | | |

| QLogic Corp.* | | | 3,579 | | | | 43,664 | |

| | | | | | | | | |

| Total Securities Sold Short (-3.9%) | | | | | | | | |

| (Proceeds $4,612,182) | | | | | | $ | 4,943,555 | |

| * | Non-income producing security. | | | |

See accompanying notes to financial statements.

Annual Report 2015

Needham Aggressive Growth Fund

Schedule of Investments

December 31, 2015

| | | Shares | | | Market Value | |

| Common Stocks (99.6%) | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense (2.3%) | | | | | | | | |

| Precision Castparts Corp. | | | 5,000 | | | $ | 1,160,050 | |

| | | | | | | | | |

| Biotechnology (4.7%) | | | | | | | | |

| Foundation Medicine, Inc.* | | | 2,500 | | | | 52,650 | |

| Gilead Sciences, Inc.† | | | 23,000 | | | | 2,327,370 | |

| | | | | | | | 2,380,020 | |

| | | | | | | | | |

| Capital Markets (2.3%) | | | | | | | | |

| Financial Engines, Inc.† | | | 29,000 | | | | 976,430 | |

| GSV Capital Corp.* | | | 18,700 | | | | 175,219 | |

| | | | | | | | 1,151,649 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.2%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 2,400 | | | | 99,960 | |

| | | | | | | | | |

| Communications Equipment (7.9%) | | | | | | | | |

| KVH Industries, Inc.* | | | 272,560 | | | | 2,567,515 | |

| Norsat International, Inc.* | | | 62,500 | | | | 275,000 | |

| ViaSat, Inc.*† | | | 19,500 | | | | 1,189,695 | |

| | | | | | | | 4,032,210 | |

| | | | | | | | | |

| Electrical Equipment (0.8%) | | | | | | | | |

| Vicor Corp.* | | | 45,000 | | | | 410,400 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (6.5%) |

| FEI Co. | | | 14,000 | | | | 1,117,060 | |

| Flir Systems, Inc. | | | 8,500 | | | | 238,595 | |

| Frequency Electronics, Inc.* | | | 51,100 | | | | 542,682 | |

| IPG Photonics Corp.* | | | 4,500 | | | | 401,220 | |

| National Instruments Corp. | | | 9,000 | | | | 258,210 | |

| Newport Corp.*† | | | 22,500 | | | | 357,075 | |

| Vishay Precision Group, Inc.* | | | 33,000 | | | | 373,560 | |

| | | | | | | | 3,288,402 | |

| | | | | | | | | |

| Energy Equipment & Services (0.4%) | | | | | | | | |

| Aspen Aerogels, Inc.* | | | 35,200 | | | | 213,664 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (3.1%) | | | | | | | | |

| Analogic Corp. | | | 5,000 | | | | 413,000 | |

| Becton Dickinson and Co. | | | 4,500 | | | | 693,405 | |

| LeMaitre Vascular, Inc. | | | 28,000 | | | | 483,000 | |

| | | | | | | | 1,589,405 | |

| | | | | | | | | |

| Health Care Providers & Services (1.0%) | | | | | | | | |

| Express Scripts Holding Co.* | | | 6,000 | | | | 524,460 | |

| | | | | | | | | |

| Health Care Technology (0.8%) | | | | | | | | |

| Omnicell, Inc.* | | | 13,000 | | | | 404,040 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure (0.7%) | | | | | | | | |

| Panera Bread Co.* | | | 1,800 | | | | 350,604 | |

| | | | | | | | | |

| Household Durables (0.8%) | | | | | | | | |

| iRobot Corp.* | | | 5,000 | | | | 177,000 | |

| Libbey, Inc. | | | 10,000 | | | | 213,200 | |

| | | | | | | | 390,200 | |

| | | | | | | | | |

| Household Products (2.5%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 34,687 | | | | 1,277,522 | |

| | | | | | | | | |

| Insurance (0.1%) | | | | | | | | |

| Crawford & Co. | | | 13,400 | | | | 67,938 | |

| | | | | | | | | |

| Internet Software & Services (16.5%) | | | | | | | | |

| Akamai Technologies, Inc.*† | | | 66,750 | | | | 3,513,053 | |

| Amber Road, Inc.* | | | 89,000 | | | | 453,010 | |

| ARI Network Services, Inc.* | | | 15,000 | | | | 67,500 | |

| ChannelAdvisor Corp.* | | | 14,117 | | | | 195,520 | |

| Constant Contact, Inc.* | | | 42,000 | | | | 1,228,080 | |

| Q2 Holdings, Inc.* | | | 12,500 | | | | 329,625 | |

| Reis, Inc.† | | | 95,000 | | | | 2,254,350 | |

| TheStreet, Inc. | | | 270,000 | | | | 405,000 | |

| | | | | | | | 8,446,138 | |

| | | | | | | | | |

| Media (0.2%) | | | | | | | | |

| World Wrestling Entertainment, Inc. | | | 6,000 | | | | 107,040 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (0.6%) | | | | | | | | |

| Hess Corp. | | | 6,375 | | | | 309,060 | |

| | | | | | | | | |

| Pharmaceuticals (0.5%) | | | | | | | | |

| Corium International, Inc.* | | | 30,000 | | | | 243,600 | |

| | | | | | | | | |

| Professional Services (2.9%) | | | | | | | | |

| CRA International, Inc.* | | | 12,500 | | | | 233,125 | |

| WageWorks, Inc.*† | | | 28,000 | | | | 1,270,360 | |

| | | | | | | | 1,503,485 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) (2.1%) | | | | | | | | |

| Equinix, Inc. | | | 3,593 | | | | 1,086,523 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (23.4%) | | | | | | | | |

| Entegris, Inc.* | | | 200,000 | | | | 2,654,000 | |

| FormFactor, Inc.* | | | 340,000 | | | | 3,060,000 | |

| MKS Instruments, Inc.† | | | 29,100 | | | | 1,047,600 | |

| Nova Measuring Instruments Ltd.* | | | 94,900 | | | | 930,020 | |

| PDF Solutions, Inc.*† | | | 239,500 | | | | 2,596,180 | |

| Photronics, Inc.* | | | 117,500 | | | | 1,462,875 | |

| Ultra Clean Holdings, Inc.* | | | 20,000 | | | | 102,400 | |

| Xcerra Corp.* | | | 10,000 | | | | 60,500 | |

| | | | | | | | 11,913,575 | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

December 31, 2015

| | | Shares | | | Market Value | |

| Common Stocks - Continued | | | | | | | | |

| | | | | | | | | |

| Software (5.2%) | | | | | | | | |

| Barracuda Networks, Inc.* | | | 13,539 | | | $ | 252,909 | |

| Bottomline Technologies, Inc.* | | | 25,000 | | | | 743,250 | |

| Exa Corp.* | | | 5,000 | | | | 58,050 | |

| GSE Systems, Inc.* | | | 665,000 | | | | 1,596,000 | |

| | | | | | | | 2,650,209 | |

| | | | | | | | | |

| Specialty Retail (3.1%) | | | | | | | | |

| CarMax, Inc.*† | | | 22,500 | | | | 1,214,325 | |

| Dick’s Sporting Goods, Inc. | | | 10,000 | | | | 353,500 | |

| | | | | | | | 1,567,825 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (10.4%) | | | | | | | | |

| Apple, Inc.† | | | 22,250 | | | | 2,342,035 | |

| Avid Technology, Inc.* | | | 13,750 | | | | 100,238 | |

| Electronics For Imaging, Inc.* | | | 16,000 | | | | 747,840 | |

| Super Micro Computer, Inc.*† | | | 85,500 | | | | 2,095,605 | |

| | | | | | | | 5,285,718 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (0.4%) | | | | | | | | |

| Ladder Capital Corp. | | | 14,894 | | | | 184,983 | |

| | | | | | | | | |

| Trading Companies & Distributors (0.2%) | | | | | | | | |

| Air Lease Corp. | | | 3,000 | | | | 100,440 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $27,881,472) | | | | | | $ | 50,739,120 | |

| | | | | | | | | |

| Short-Term Investments (0.1%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (0.1%) | | | | | | | | |

| Dreyfus Treasury Prime Cash | | | | | | | | |

| Management - Institutional | | | | | | | | |

| Class 0.01% (a) | | | | | | | | |

| (Cost $26,486) | | | 26,486 | | | | 26,486 | |

| | | | | | | | | |

| Total Investments (99.7%) | | | | | | | | |

| (Cost $27,907,957) | | | | | | | 50,765,606 | |

| Total Securities Sold Short (-6.2%) | | | | | | | | |

| (Proceeds $3,031,869) | | | | | | | (3,177,382 | ) |

| Other Assets in Excess of Liabilities (6.5%) | | | | | | | 3,317,419 | |

| Net Assets (100.0%) | | | | | | $ | 50,905,643 | |

| * | Non-income producing security. |

| (a) | Rate shown is the seven day yield as of December 31, 2015. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $6,031,110. |

| | |

| | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

See accompanying notes to financial statements.

Annual Report 2015

Needham Aggressive Growth Fund

Schedule of Securities Sold Short

December 31, 2015

| | | Shares | | | Market Value | |

| | | | | | | | | |

| Securities Sold Short (-6.2%) | | | | | | | | |

| | | | | | | | | |

| Capital Markets (-1.7%) | | | | | | | | |

| Medallion Financial Corp. | | | 123,000 | | | $ | 865,920 | |

| | | | | | | | | |

| Communications Equipment (-2.9%) | | | | | | | | |

| Ubiquiti Networks, Inc.* | | | 46,250 | | | | 1,465,662 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.3%) | | | | | | | | |

| Applied Micro Circuits Corp.* | | | 5,000 | | | | 31,850 | |

| Solaredge Technologies, Inc.* | | | 5,000 | | | | 140,850 | |

| | | | | | | | 172,700 | |

| | | | | | | | | |

| Software (-0.9%) | | | | | | | | |

| ANSYS, Inc.* | | | 5,000 | | | | 462,500 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (-0.4%) | | | | | | | | |

| Federal Home Loan Mortgage Corp.* | | | 130,000 | | | | 210,600 | |

| | | | | | | | | |

| Total Securities Sold Short (-6.2%) | | | | | | | | |

| (Proceeds $3,031,869) | | | | | | $ | 3,177,382 | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments

December 31, 2015

| | | Shares | | | Market Value | |

| Common Stocks (81.7%) | | | | | | | | |

| | | | | | | | | |

| Communications Equipment (8.6%) | | | | | | | | |

| KVH Industries, Inc.* | | | 140,000 | | | $ | 1,318,800 | |

| Ruckus Wireless, Inc.*† | | | 65,000 | | | | 696,150 | |

| | | | | | | | 2,014,950 | |

| | | | | | | | | |

| Electrical Equipment (0.6%) | | | | | | | | |

| Generac Holdings, Inc.* | | | 5,000 | | | | 148,850 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (17.5%) |

| Electro Scientific Industries, Inc.* | | | 75,000 | | | | 389,250 | |

| Frequency Electronics, Inc.* | | | 105,000 | | | | 1,115,100 | |

| Newport Corp.*† | | | 92,500 | | | | 1,467,975 | |

| TTM Technologies, Inc.* | | | 175,000 | | | | 1,139,250 | |

| | | | | | | | 4,111,575 | |

| | | | | | | | | |

| Health Care Providers & Services (1.1%) | | | | | | | | |

| Express Scripts Holding Co.* | | | 3,000 | | | | 262,230 | |

| | | | | | | | | |

| Health Care Technology (0.3%) | | | | | | | | |

| Castlight Health, Inc.* | | | 15,000 | | | | 64,050 | |

| | | | | | | | | |

| Household Products (2.4%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 15,404 | | | | 567,329 | |

| | | | | | | | | |

| Internet Software & Services (10.2%) | | | | | | | | |

| Akamai Technologies, Inc.* | | | 1,000 | | | | 52,630 | |

| Amber Road, Inc.* | | | 150,000 | | | | 763,500 | |

| Reis, Inc.† | | | 47,500 | | | | 1,127,175 | |

| TheStreet, Inc. | | | 300,000 | | | | 450,000 | |

| | | | | | | | 2,393,305 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (1.1%) | | | | | | | | |

| Hess Corp. | | | 5,250 | | | | 254,520 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (23.5%) | | | | | | | | |

| Entegris, Inc.* | | | 60,000 | | | | 796,200 | |

| FormFactor, Inc.* | | | 130,000 | | | | 1,170,000 | |

| MKS Instruments, Inc.† | | | 30,000 | | | | 1,080,000 | |

| Nanometrics, Inc.* | | | 1,402 | | | | 21,226 | |

| PDF Solutions, Inc.*† | | | 77,000 | | | | 834,680 | |

| Photronics, Inc.* | | | 24,750 | | | | 308,138 | |

| Ultra Clean Holdings, Inc.* | | | 255,000 | | | | 1,305,600 | |

| | | | | | | | 5,515,844 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (11.4%) | | | | | | | | |

| Silicon Graphics International Corp.* | | | 245,000 | | | | 1,445,500 | |

| Super Micro Computer, Inc.*† | | | 50,000 | | | | 1,225,500 | |

| | | | | | | | 2,671,000 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (0.4%) | | | | | | | | |

| LendingTree, Inc.* | | | 1,000 | | | | 89,280 | |

| | | | | | | | | |

| Trading Companies & Distributors (4.6%) | | | | | | | | |

| Air Lease Corp.† | | | 32,500 | | | | 1,088,100 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $19,649,626) | | | | | | $ | 19,181,033 | |

| | | | | | | | | |

| Short-Term Investments (19.2%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (19.2%) | | | | | | | | |

| Dreyfus Treasury Prime Cash | | | | | | | | |

| Management - Institutional | | | | | | | | |

| Class 0.01% (a) | | | | | | | | |

| (Cost $4,514,166) | | | 4,514,166 | | | | 4,514,166 | |

| | | | | | | | | |

| Total Investments (100.9%) | | | | | | | | |

| (Cost $24,163,793) | | | | | | | 23,695,199 | |

| Total Securities Sold Short (-3.5%) | | | | | | | | |

| (Proceeds $787,829) | | | | | | | (821,003 | ) |

| Other Assets in Excess of | | | | | | | | |

| Liabilities (2.6%) | | | | | | | 599,123 | |

| Net Assets (100.0%) | | | | | | $ | 23,473,319 | |

| * | Non-income producing security. |

| (a) | Rate shown is the seven day yield as of December 31, 2015. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $1,135,650. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

Annual Report 2015

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

December 31, 2015

| | | Shares | | | Market Value | |

| | | | | | | | | |

| Securities Sold Short (-3.5%) | | | | | | | | |

| | | | | | | | | |

| Communications Equipment (-1.1%) | | | | | | | | |

| Ubiquiti Networks, Inc.* | | | 8,000 | | | $ | 253,520 | |

| | | | | | | | | |

| Internet Software & Services (-1.0%) | | | | | | | | |

| SPS Commerce, Inc.* | | | 3,425 | | | | 240,469 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (-1.2%) | | | | | | | | |

| Advanced Energy Industries, Inc.* | | | 5,000 | | | | 141,150 | |

| Rudolph Technologies, Inc.* | | | 10,000 | | | | 142,200 | |

| | | | | | | | 283,350 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (-0.2%) | | | | | | | | |

| QLogic Corp.* | | | 3,579 | | | | 43,664 | |

| | | | | | | | | |

| Total Securities Sold Short (-3.5%) | | | | | | | | |

| (Proceeds $787,829) | | | | | | $ | 821,003 | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

Needham Funds

Statements of Assets and Liabilities

December 31, 2015

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Assets | | | | | | | | | | | | |

| Investments, at Value | | | | | | | | | | | | |

| (Cost $65,918,726, $27,907,957, $24,163,793) | | $ | 126,363,517 | | | $ | 50,765,606 | | | $ | 23,695,199 | |

| Cash | | | 71,996 | | | | 12,741 | | | | 103,674 | |

| Receivables: | | | | | | | | | | | | |

| Deposit with Broker for Securities Sold Short | | | 5,320,554 | �� | | | 3,308,997 | | | | 986,460 | |

| Dividends and Interest | | | 89,521 | | | | 24,427 | | | | 1,649 | |

| Fund Shares Sold | | | 6,292 | | | | 17,733 | | | | 1,722 | |

| Investment Securities Sold | | | 620,429 | | | | 91,119 | | | | 17,243 | |

| Prepaid Expenses | | | 28,237 | | | | 21,802 | | | | 16,489 | |