UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09114 |

|

The Needham Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

445 Park Avenue, New York, NY | | 10022-2606 |

(Address of principal executive offices) | | (Zip code) |

|

Citi Fund Services Ohio, Inc., 3435 Stelzer Road, Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-625-7071 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2009 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Semiannual

Report

Needham Funds

Seeking to build wealth for long-term investors.

Six Months Ended June 30, 2009 (unaudited)

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

445 Park Avenue

New York, New York 10022-2606

1-800-625-7071

www.needhamfunds.com

Semiannual Report

For the Six Months Ended June 30, 2009

(Unaudited)

Contents

| Letter from the Adviser | | | 1 | | |

|

| Portfolio Characteristics | |

|

| Needham Growth Fund | | | 5 | | |

|

| Needham Aggressive Growth Fund | | | 6 | | |

|

| Needham Small Cap Growth Fund | | | 7 | | |

|

| Disclosure of Fund Expenses | | | 8 | | |

|

| Schedule of Investments | |

|

| Needham Growth Fund | | | 9 | | |

|

| Needham Aggressive Growth Fund | | | 12 | | |

|

| Needham Small Cap Growth Fund | | | 14 | | |

|

| Schedule of Securities Sold Short | |

|

| Needham Growth Fund | | | 11 | | |

|

| Needham Aggressive Growth Fund | | | 13 | | |

|

| Needham Small Cap Growth Fund | | | 15 | | |

|

| Statements of Assets and Liabilities | | | 16 | | |

|

| Statements of Operations | | | 17 | | |

|

| Statements of Changes in Net Assets | | | 18 | | |

|

| Financial Highlights | |

|

| Needham Growth Fund | | | 19 | | |

|

| Needham Aggressive Growth Fund | | | 20 | | |

|

| Needham Small Cap Growth Fund | | | 21 | | |

|

| Notes to Financial Statements | | | 22 | | |

|

| Supplemental Data | | | 27 | | |

|

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

• Are NOT FDIC insured

• Have no bank guarantee

• May lose value

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

Needham Funds Semiannual Report 2009

Dear Shareholders,

The first half of 2009 presented spectacular challenges and opportunities. The world at large continued to fall apart through mid-March, as the financial and economic crisis continued its relentless course. It seemed that all news was bleak: massive destocking, rising unemployment, bankruptcies of the weak (including the U.S. auto industry), distrust of the U.S. Government's program and the recession in Asia combined to generate a further 25% loss for investors, after the 40% punishment experienced in 2008. However, a very sharp turn occurred in late March. The U.S. stimulus program took shape, the world financial systems started to function again (with kudos to the U.S. Treasury and the Federal Reserve for unprecedented and creative interventions), and restocking and quick "shovels" in China helped restore some confidence. Optimism, short covering and trickling cash inflows into equity boosted the market over 40% from its lows, to close the first half in the black, yet still about a third below the fall 2007 highs. The NASDAQ was more swift at bouncing back, outperforming the Dow and the S&P 500, which registered modest gains.

We at The Needham Funds, Inc. focus on buying growth stocks at reasonable prices. In the six-month period ended June 30, 2009, the Growth Fund was up 16.63%, the Aggressive Growth Fund was up 12.28% and the Small Cap Growth Fund was up 17.35%. By comparison, the S&P 500 Index was up 3.16%, the NASDAQ Composite Index was up 16.98% and the Russell 2000 Index was up 2.64%.

The Needham Growth Fund (the "Growth Fund") seeks to create long-term, tax-efficient capital appreciation for its investors. To this end, the Growth Fund targets companies with products or services that are selling or marketing into growth markets. These companies normally have earnings growth of at least 10-15%, product and market dominance, and the ability to consolidate their market positions. They may also have a competitive advantage by acquiring and retaining more customers or driving costs down and profits up. The Growth Fund also looks for seasoned and motivated managements with records of building shareholder value. Companies with these characteristics sometimes find themselves in a temporary earnings shortfall or may be in a product transition. This often causes aggressive growth or momentum investors to sell. At this point, the Growth Fund may deem the stock to be reasonably priced and purchase it for long-term capita l appreciation. Hence, the discipline called "Growth At a Reasonable Price," or "GARP."

As of June 30, 2009, the Growth Fund was down 20.28% for the 1 year period, down 7.85% for the 3 years, down 0.05% for the 5 years, up 6.50% for the 10 years, and up 12.57% since inception, compounded annually. The Growth Fund received a four-star MorningstarTM Rating for the Ten-Year Period in the U.S.-domiciled Mid-Cap Growth Funds category as of June 30, 2009, based on Risk-Adjusted Return, when rated against 331 Mid-Cap Growth Funds. We ended the six-month period with approximately 9.5% of total investments in cash and 4.2% as our short position. Our best contributing stocks were CarMax (+86.5%), Express Scripts (+25.0%), Seagate (+136.1%), Morgan Stanley (+77.7%), 3Com (+107.5%) and Schering-Plough (+47.5%). Our worst detracting stocks were CONMED (-35.2%), Brooks Automation (-22.9%), EMS Technologies (-19.2%) and our short positions. We benefited from our exposure to healthcare services, consumer discretionary, storage, and energy; our medical technology and semi-cap equipment stocks hurt the Growth Fund. We expect the latter to rebound. We initiated a few positions such as Becton Dickinson, Entegris, Hologic, Iconix Brands, IPG Photonics, TomoTherapy and Xyratex. The fact that we kept our short position small throughout the quarter helped the fund in an overall rising market.

The Needham Aggressive Growth Fund (the "Aggressive Growth Fund") seeks to create long-term, tax-efficient capital appreciation for its investors. To this end, the Aggressive Growth Fund targets the equities of

1

Needham Funds

companies with strong, above-average prospective growth rates. The Aggressive Growth Fund invests, in general, in markets and industries with strong growth rates, focusing on the market leaders in these areas. These market leaders, especially as they break away from their competitors, tend to garner a disproportionate share of the positive financial returns. Also important is the long-term sustainability of the companies' leadership positions. Thus, the Aggressive Growth Fund looks for companies with strong management teams, superior balance sheets, above-average margins that can generate excess cash, and strong R&D and brand spending in industries with high barriers to entry.

As of June 30, 2009, the Aggressive Growth Fund was down 6.10% for the 1 year period, up 0.85% for the 3 years, up 4.68% for the 5 years, and up 5.51% since inception, compounded annually. The Aggressive Growth Fund received a five-star MorningstarTM Rating (Morningstar's highest rating) Overall and for the Three-Year and Five-Year Periods in the U.S.-domiciled Mid-Cap Growth Funds category as of June 30, 2009, based on Risk-Adjusted Return, when rated against 794, 794 and 658 Mid-Cap Growth Funds, respectively. In April, the Aggressive Growth Fund was honored by Lipper for being the 2009 top performer in the Mid-Cap Growth — United States category over a three-year period when ranked against 529 funds. The Wall Street Journal listed the fund as the top performer in that category for the 12-month period ending June 30, 2009 among 521 funds, significantly outperforming the average comparable fund, which lost about 31% during the period. Throughout the quarter, we maintained in excess of 35% of cash in the Aggressive Growth Fund, which protected our shareholders last year, but contributed to some underperformance so far this year. Our best contributing stocks were Apple (+66.9%), Solta Medical (which more than doubled after we bought it during the first half), Express Scripts (+25.0%) and Morgan Stanley (+77.7%). Our worst detracting stocks were Alliance Healthcare (-8.0%), Gilead Sciences (-8.4%), Cavium Networks (-23.3%), Brooks Automation (-22.9%) and our short positions. We benefited from our exposure to consumer discretionary, healthcare services and technology stocks; our medical technology stocks hurt the Aggressive Growth Fund. We initiated a few positions such as Daktronics, Gentiva, Iconix Brands and Powerwave. The fact that we kept our short position small throughout the quarter was of help to the fund in an overall rising market.

The Needham Small Cap Growth Fund (the "Small Cap Growth Fund") seeks long-term, tax-efficient capital appreciation by investing primarily in equity securities of smaller growth companies that the Small Cap Growth Fund believes are trading at a discount to their underlying value, yet have the potential for superior long-term growth. Under normal conditions, the Small Cap Growth Fund invests at least 80% of its net assets in equity securities of domestic issuers listed on a nationally recognized securities exchange or traded on the NASDAQ System that have market capitalizations not exceeding $2 billion or the highest market capitalization in the Russell 2000 Index, if greater. As of June 30, 2009, the highest market capitalization in the Russell 2000 Index was $2.284 billion. Due to the abnormal market conditions that we have faced over the past year, we have maintained, and continue to maintain, a higher than usual cash position until we observe a more normal investment environment.

Central to the Small Cap Growth Fund's investment strategy is a sound valuation discipline that seeks to acquire growth companies at reasonable prices. The Small Cap Growth Fund seeks tax efficiency by holding securities for a period of 12 months or more to obtain long-term capital gain treatment and by offsetting capital gains on the sale of securities with capital losses.

As of June 30, 2009, the Small Cap Growth Fund was down 7.09% for the 1 year period, down 2.57% for the 3 years, up 0.10% for the 5 years, and up 8.72% since inception, compounded annually. The Small Cap Growth Fund received a five-star MorningstarTM Rating (Morningstar's highest rating) Overall and for the Three-Year

2

Semiannual Report 2009

and Five-Year Periods in the U.S.-domiciled Small-Cap Growth Funds category as of June 30, 2009, based on Risk-Adjusted Return, when rated against 687, 687 and 573 Small-Cap Growth Funds, respectively. Many of our investments at the end of 2008 and early 2009 performed very well relative to the market and helped the fund to outperform its comparative indices both in the second quarter and on a year-to-date basis. Our cautious stance during the early part of the first quarter allowed us the opportunity to minimize a significant market slide and deploy cash at very attractive entry levels. We continued to invest cash throughout the second quarter as well as harvest some investments that had made substantial gains off their lows. We continue to maintain a significant exposure to the semiconductor and semiconductor equipment industries and do not expect that we have seen the end of the early cycle movement in these names. That being said, we also believe that the early success experienced to date was the result of an inventory refresh rather than the start of a new bull cycle. During 2008, many of the semiconductor names were relatively ignored by the market and we were able to successfully purchase specific names that are well managed and have great product opportunities. These names include MKS Instruments, Semitool and Entegris.

The portfolio turnover rates were 13% for the Growth Fund, 51% for the Aggressive Growth Fund and 82% for the Small Cap Growth Fund for the six months ended June 30, 2009. The expense ratios were 2.03% for the Growth Fund, 2.50% for the Aggressive Growth Fund and 2.58% for the Small Cap Growth Fund for the six months ended June 30, 2009.

As we write this letter in late July 2009, the market is testing new highs buoyed by improving housing and confidence statistics. It appears likely that the U.S. GDP will grow in the third quarter after four consecutive quarters of decline. Volatility remains elevated but has declined somewhat from its peaks of 2008. Investors remain by and large cautious, both from fear of a bear rally and elevated valuations. Our guiding light in our investing decisions remains unchanged: sound management teams with sustainable, value-added strategies and execution skills; outperforming growth prospects; and bargain valuation. Overall, as we reflect on this extraordinary first half of 2009, it seems extremely likely that we will not return to the mid-March lows anytime soon. The period was marked by a disproportionate pessimism of investors in relation to the then actual reality. Investors feared Depression 2.0 at the time when in fact all was in place for a recovery of the financial system. Corporate earnings were assumed to be obliterated, when, in fact, second quarter earnings exceeded all expectations as massive cost savings measures such as reducing supplier and employee costs were a significant boost. So we ask, "Is optimism vs. the future disconnected from the current reality?" Fears are less profound now that the green shoots have turned into a low rising tide. Unemployment statistics will continue to rise, putting a significant brake on the economy and on confidence. Earnings gains will come more from true growth than from cost savings. Overall, the market seems relatively fairly valued, and it is up to us to identify the outperforming companies as we expect less correlation among stocks. Stock picking is our skill. We are glad to have an opportunity to practice it again.

Sincerely,

| |  | |

|

| Bernard Lirola | | Chris Retzler | |

|

| Portfolio Manager | | Portfolio Manager | |

|

3

Needham Funds

Mr. Bernard Lirola is the Co-Portfolio Manager of the Growth Fund and the Portfolio Manager of the Aggressive Growth Fund. Mr. Lirola has an extensive 31-year career on Wall Street covering investment banking, research and now asset management. He graduated from École Polytechnique in Paris, France in 1973 and received an MBA from Harvard Business School in 1976. Prior to joining Needham in 1994, he worked at Smith Barney, Harris Upham & Co. (1976-1978), at CS First Boston (1978-1990) and at Swiss Bank Corporation (1990-1994). Mr. Lirola was an early member of CS First Boston's M&A group (1978), recruited by Joseph Perella and Bruce Wasserstein and headed First Boston's M&A healthcare group (1985-1990). At Swiss Bank Corporation, he was Head of U.S. M&A activities (1990-1994). Mr. Lirola joined Needham & Company, Inc. (predecessor to The Needham Group, Inc.) on the investment banking side in 1994 and w as successively a Co-Head of Health Care, Co-Head of Investment Banking and a member of its Operating Committee. Between 1996 and 1999, he was also an equity research analyst covering the health care services industry. Mr. Lirola joined the Adviser in 2007, where he provided sourcing and assessing of investment opportunities for the Needham Funds both in the U.S. and overseas. He also serves as Executive Vice President of the Growth Fund and the Aggressive Growth Fund. Mr. Lirola became Portfolio Manager of the Growth Fund and the Aggressive Growth Fund in January 2008. He engages in a variety of portfolio management-related activities, including stock selection, research, company visits and market analysis.

Mr. Chris Retzler is the Co-Portfolio Manager of the Growth Fund and the Portfolio Manager of the Small Cap Growth Fund. Mr. Retzler has been with Needham Asset Management, LLC since 2005. Mr. Retzler is a graduate of the Columbia Business School and was a Fulbright Scholar. He began his career in 1994 with Merrill Lynch Investment Banking. When he left Merrill Lynch in 2002, Mr. Retzler was an associate in Mergers and Acquisitions where he participated in numerous stock and asset transactions across a wide range of domestic and global industries. From 2002 until he joined Needham, he was in charge of Winterkorn, a privately owned company. Prior to becoming the sole Portfolio Manager of the Small Cap Growth Fund, Mr. Retzler's responsibilities at Needham included examining and conducting due diligence on both existing and new investment opportunities for the Needham Funds. He also serves as Executive Vice President of the Growth Fund and the Small Cap Growth Fund. Mr. Retzler became Co-Portfolio Manager of the Growth Fund in January 2009 and Portfolio Manager of the Small Cap Growth Fund in January 2008. He engages in a variety of portfolio management-related activities, including stock selection, research, company visits and market analysis.

4

Semiannual Report 2009

NEEDHAM GROWTH FUND (Unaudited) TICKER: NEEGX

Comparative Performance Statistics as of June 30, 2009

| | | 6 Months(7) | | 1 Year | | 3 Years(8) | | 5 Years(8) | | 10 Years(8) | | Since Inception(8)(12) | | Gross Expense

Ratio(14) | |

| Needham Growth Fund(1) | | | 16.63 | % | | | (20.28 | )% | | | (7.85 | )%(9) | | | (0.05 | )%(10) | | | 6.50 | %(11) | | | 12.57 | %(13) | | | 2.06 | % | |

| S&P 500 Index(2)(3) | | | 3.16 | % | | | (26.21 | )% | | | (8.21 | )% | | | (2.24 | )% | | | (2.22 | )% | | | 4.83 | % | | | |

| NASDAQ Composite Index(2)(4) | | | 16.98 | % | | | (19.13 | )% | | | (4.64 | )% | | | (1.37 | )% | | | (3.17 | )% | | | 4.75 | % | | | |

| S&P 400 MidCap Index(2)(5) | | | 8.47 | % | | | (28.02 | )% | | | (7.54 | )% | | | 0.36 | % | | | 4.60 | % | | | 8.86 | % | | | |

| Russell 2000® Index(2)(6) | | | 2.64 | % | | | (25.01 | )% | | | (9.88 | )% | | | (1.67 | )% | | | 2.43 | % | | | 5.01 | % | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

1. Investment results calculated after reinvestment of dividends.

2. It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees.

3. The S&P 500 Index is a broad unmanaged measure of the U.S. stock market.

4. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks.

5. The S&P 400 MidCap Index is a broad unmanaged measure of the U.S. stock market.

6. The Russell 2000® Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000® Index.

7. Not annualized.

8. Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund.

9. Cumulative return for the three year period was (21.75)%, assuming all dividends were reinvested in shares of the Fund.

10. Cumulative return for the five year period was (0.24)%, assuming all dividends were reinvested in shares of the Fund.

11. Cumulative return for the ten year period was 87.74%, assuming all dividends were reinvested in shares of the Fund.

12. The inception date of the Fund was 1/1/96.

13. Cumulative return since inception was 394.22%, assuming all dividends were reinvested in shares of the Fund.

14. The above expense ratio is from the Funds' prospectus dated May 1, 2009. Additional information pertaining to the Funds' expense ratios as of June 30, 2009 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on December 31, 2009. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total net fund operating expenses would be 2.04%.

Top Ten Holdings*

(as a % of total investments, as of June 30, 2009)

| Security | | | | % of Total

Investments† | |

| 1) Express Scripts, Inc. | | ESRX | | | 8.84 | % | |

| 2) Iron Mountain, Inc. | | IRM | | | 5.47 | % | |

| 3) Thermo Fisher Scientific, Inc. | | TMO | | | 5.24 | % | |

| 4) Varian Medical Systems, Inc. | | VAR | | | 4.52 | % | |

| 5) CarMax, Inc. | | KMX | | | 4.36 | % | |

| 6) ViaSat, Inc. | | VSAT | | | 4.30 | % | |

| 7) Luxottica Group Spa | | LUX | | | 3.83 | % | |

| 8) EMS Technologies, Inc. | | ELMG | | | 2.92 | % | |

| 9) Brooks Automation, Inc. | | BRKS | | | 2.67 | % | |

| 10) National Semiconductor Corp. | | NSM | | | 2.53 | % | |

Top Ten Holdings = 44.68% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments includes all stocks, plus cash minus all short positions.

Sector Weightings*

(as a % of total investments, as of June 30, 2009)

| Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| Business Services | | | 11.2 | % | | | — | | | | 11.2 | % | |

| Consumer | | | 12.3 | % | | | (1.7 | )% | | | 10.6 | % | |

| Energy | | | 3.5 | % | | | — | | | | 3.5 | % | |

| Financial Services | | | 2.3 | % | | | (1.3 | )% | | | 1.0 | % | |

| Healthcare | | | 28.5 | % | | | (0.4 | )% | | | 28.1 | % | |

| Industrial | | | 1.3 | % | | | (0.4 | )% | | | 0.9 | % | |

| Technology | | | 24.6 | % | | | (0.3 | )% | | | 24.3 | % | |

| Telecommunications/Cable | | | 11.0 | % | | | (0.1 | )% | | | 10.9 | % | |

| Cash | | | 9.5 | % | | | — | | | | 9.5 | % | |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

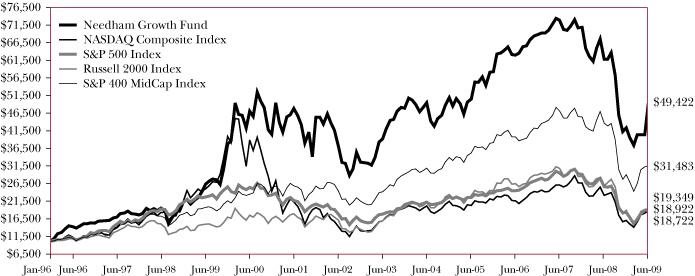

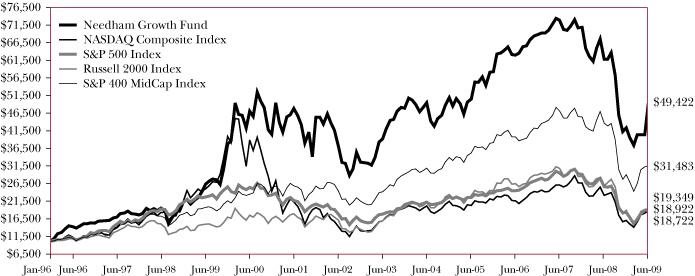

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

5

Needham Funds

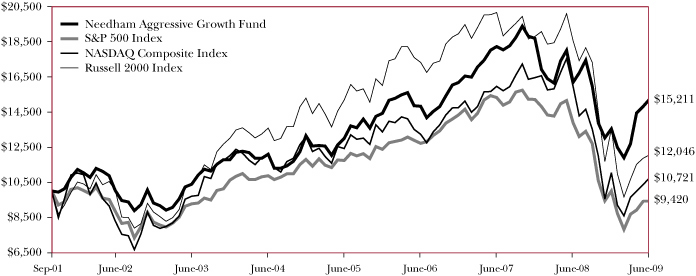

NEEDHAM AGGRESSIVE GROWTH FUND (Unaudited) TICKER: NEAGX

Comparative Performance Statistics as of June 30, 2009

| | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | Since Inception(7)(10) | | Gross Expense

Ratio(12) | |

| Needham Aggressive Growth Fund(1) | | | 12.28 | % | | | (6.10 | )% | | | 0.85 | %(8) | | | 4.68 | %(9) | | | 5.51 | %(11) | | | 2.65 | % | |

| S&P 500 Index(2)(3) | | | 3.16 | % | | | (26.21 | )% | | | (8.21 | )% | | | (2.24 | )% | | | (0.76 | )% | | | |

| NASDAQ Composite Index(2)(4) | | | 16.98 | % | | | (19.13 | )% | | | (4.64 | )% | | | (1.37 | )% | | | 0.89 | % | | | |

| Russell 2000® Index(2)(5) | | | 2.64 | % | | | (25.01 | )% | | | (9.88 | )% | | | (1.67 | )% | | | 2.40 | % | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

1. Investment results calculated after reinvestment of dividends.

2. It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees.

3. The S&P 500 Index is a broad unmanaged measure of the U.S. stock market.

4. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks.

5. The Russell 2000® Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000® Index.

6. Not annualized.

7. Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund.

8. Cumulative return for the three year period was 2.58%, assuming all dividends were reinvested in shares of the Fund.

9. Cumulative return for the five year period was 25.72%, assuming all dividends were reinvested in shares of the Fund.

10. The inception date of the Fund was 9/4/01.

11. Cumulative return since inception was 52.11%, assuming all dividends were reinvested in shares of the Fund.

12. The above expense ratio is from the Funds' prospectus dated May 1, 2009. Additional information pertaining to the Funds' expense ratios as of June 30, 2009 can be found in the financial highlights. Since inception, the investment performance reflects contractually agreed upon fee waivers which shall continue in effect from year to year only upon mutual agreement of the Funds and the Adviser. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total net fund operating expenses would be 2.51%.

Top Ten Holdings*

(as a % of total investments, as of June 30, 2009)

| Security | | | | % of Total

Investments† | |

| 1) Gilead Sciences, Inc. | | GILD | | | 7.13 | % | |

| 2) Express Scripts, Inc. | | ESRX | | | 6.28 | % | |

| 3) Iron Mountain, Inc. | | IRM | | | 5.84 | % | |

| 4) Varian Medical Systems, Inc. | | VAR | | | 5.35 | % | |

| 5) Precision Castparts Corp. | | PCP | | | 4.45 | % | |

| 6) Apple, Inc. | | AAPL | | | 4.34 | % | |

| 7) ViaSat, Inc. | | VSAT | | | 3.91 | % | |

| 8) Dick's Sporting Goods, Inc. | | DKS | | | 3.75 | % | |

| 9) Eclypsys Corp. | | ECLP | | | 3.71 | % | |

| 10) Resources Connection, Inc. | | RECN | | | 3.70 | % | |

Top Ten Holdings = 48.46% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments includes all stocks, plus cash minus all short positions.

Sector Weightings*

(as a % of total investments, as of June 30, 2009)

| Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| Business Services | | | 10.4 | % | | | — | | | | 10.4 | % | |

| Consumer | | | 7.2 | % | | | — | | | | 7.2 | % | |

| Financial Services | | | 1.4 | % | | | — | | | | 1.4 | % | |

| Healthcare | | | 27.5 | % | | | (0.4 | )% | | | 27.1 | % | |

| Industrial | | | 3.2 | % | | | — | | | | 3.2 | % | |

| Technology | | | 11.5 | % | | | (0.4 | )% | | | 11.1 | % | |

| Telecommunications/Cable | | | 5.9 | % | | | — | | | | 5.9 | % | |

| Cash | | | 32.0 | % | | | — | | | | 32.0 | % | |

| Exchange Traded Funds | | | 1.7 | % | | | — | | | | 1.7 | % | |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

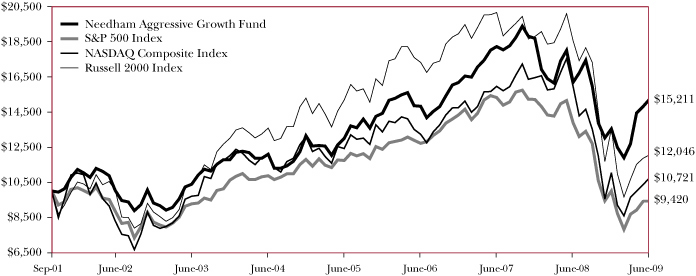

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

6

Semiannual Report 2009

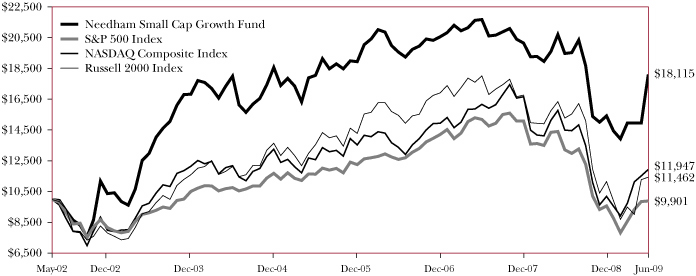

NEEDHAM SMALL CAP GROWTH FUND (Unaudited) TICKER: NESGX

Comparative Performance Statistics as of June 30, 2009

| | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | Since Inception(7)(10) | | Gross Expense

Ratio(12) | |

| Needham Small Cap Growth Fund(1) | | | 17.35 | % | | | (7.09 | )% | | | (2.57 | )%(8) | | | 0.10 | %(9) | | | 8.72 | %(11) | | | 3.62 | % | |

| S&P 500 Index(2)(3) | | | 3.16 | % | | | (26.21 | )% | | | (8.21 | )% | | | (2.24 | )% | | | (0.14 | )% | | | |

| NASDAQ Composite Index(2)(4) | | | 16.98 | % | | | (19.13 | )% | | | (4.64 | )% | | | (1.37 | )% | | | 2.54 | % | | | |

| Russell 2000® Index(2)(5) | | | 2.64 | % | | | (25.01 | )% | | | (9.88 | )% | | | (1.67 | )% | | | 1.94 | % | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

1. Investment results calculated after reinvestment of dividends.

2. It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees.

3. The S&P 500 Index is a broad unmanaged measure of the U.S. stock market.

4. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks.

5. The Russell 2000® Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000® Index.

6. Not annualized.

7. Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund.

8. Cumulative return for the three year period was (7.52)%, assuming all dividends were reinvested in shares of the Fund.

9. Cumulative return for the five year period was 0.53%, assuming all dividends were reinvested in shares of the Fund.

10. The inception date of the Fund was 5/22/02.

11. Cumulative return since inception was 81.15%, assuming all dividends were reinvested in shares of the Fund.

12. The above expense ratio is from the Funds' prospectus dated May 1, 2009. Additional information pertaining to the Funds' expense ratios as of June 30, 2009 can be found in the financial highlights. Since inception, the investment performance reflects contractually agreed upon fee waivers which shall continue in effect from year to year only upon mutual agreement of the Funds and the Adviser. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total net fund operating expenses would be 2.51%.

Top Ten Holdings*

(as a % of total investments, as of June 30, 2009)

| Security | | | | % of Total

Investments† | |

| 1) Express Scripts, Inc. | | ESRX | | | 4.90 | % | |

| 2) CONMED Corp. | | CNMD | | | 4.15 | % | |

| 3) MKS Instruments, Inc. | | MKSI | | | 4.00 | % | |

| 4) Aruba Networks, Inc. | | ARUN | | | 3.90 | % | |

| 5) ICx Technologies, Inc. | | ICXT | | | 3.75 | % | |

| 6) Cognex Corp. | | CGNX | | | 3.53 | % | |

| 7) iRobot Corp. | | IRBT | | | 3.47 | % | |

| 8) Airvana, Inc. | | AIRV | | | 3.41 | % | |

| 9) Eclipsys Corp. | | ECLP | | | 3.26 | % | |

| 10) Varian Medical Systems, Inc. | | VAR | | | 3.13 | % | |

Top Ten Holdings = 37.50% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments includes all stocks, plus cash minus all short positions.

Sector Weightings*

(as a % of total investments, as of June 30, 2009)

| Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| Business Services | | | 2.8 | % | | | — | | | | 2.8 | % | |

| Consumer | | | — | | | | (3.6 | )% | | | (3.6 | )% | |

| Energy | | | 5.0 | % | | | — | | | | 5.0 | % | |

| Financial Services | | | — | | | | (0.6 | )% | | | (0.6 | )% | |

| Healthcare | | | 15.7 | % | | | (0.4 | )% | | | 15.3 | % | |

| Industral | | | 5.1 | % | | | — | | | | 5.1 | % | |

| Technology | | | 26.6 | % | | | (2.5 | )% | | | 24.1 | % | |

| Telecommunications/Cable | | | 15.2 | % | | | (0.3 | )% | | | 14.9 | % | |

| Cash | | | 37.0 | % | | | — | | | | 37.0 | % | |

* Current portfolio holdings may not be indicative of future portfolio holdings.

(1) Percentage of total investments includes all stocks, plus cash minus all short positions.

(2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure.

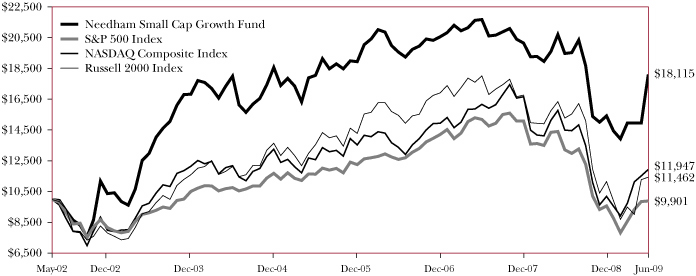

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund's Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

7

Needham Funds

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur transactional costs, including redemption fees and exchange fees, and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A fund's expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The expense example table below illustrates your fund's cost in two ways:

• Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The "Ending Account Value" shown is derived from the fund's actual return, and "Expenses Paid During Period" shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled "Expenses Paid During Period".

• Hypothetical Expenses on a 5% Return. This section is intended to help you compare your fund's costs with those of other mutual funds. It assumes that the fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the fund's actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund's cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

For the Period January 1, 2009 to June 30, 2009

Expense Example Table

| | | Beginning

Account

Value

1/1/09 | | Ending

Account

Value

6/30/09 | | Expenses

Paid During

Period*

1/1/09-

6/30/09 | | Expense Ratio

During

Period

1/1/09-

6/30/09 | |

| Needham Growth Fund | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,166.30 | | | $ | 10.90 | | | | 2.03 | % | |

Hypothetical Example for Comparison Purposes

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.73 | | | $ | 10.14 | | | | 2.03 | % | |

| Needham Aggressive Growth Fund | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,122.80 | | | $ | 13.16 | | | | 2.50 | % | |

Hypothetical Example for Comparison Purposes

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,012.40 | | | $ | 12.47 | | | | 2.50 | % | |

| Needham Small Cap Growth Fund | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,173.50 | | | $ | 13.90 | | | | 2.58 | % | |

Hypothetical Example for Comparison Purposes

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,012.00 | | | $ | 12.87 | | | | 2.58 | % | |

* Expenses are equal to the average account value times the Fund's annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.

8

Semiannual Report 2009

Needham Growth Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Common Stocks (90.7%) | |

| Business Services (7.0%) | |

| Dice Holdings, Inc.* | | | 115,300 | | | $ | 536,145 | | |

| Iconix Brand Group, Inc.* | | | 42,000 | | | | 645,960 | | |

| Iron Mountain, Inc.* | | | 170,000 | | | | 4,887,500 | | |

| Resources Connection, Inc.* | | | 50,000 | | | | 858,500 | | |

| | | | 6,928,105 | | |

| Consumer Services (11.7%) | |

| Avis Budget Group, Inc.*† | | | 50,000 | | | | 282,500 | | |

| CarMax, Inc.* | | | 265,000 | | | | 3,895,500 | | |

| Dick's Sporting Goods, Inc.* | | | 115,000 | | | | 1,978,000 | | |

| Luxottica Group SpA - ADR*† | | | 165,000 | | | | 3,428,700 | | |

| Morton's Restaurant Group* | | | 247,200 | | | | 741,600 | | |

| Whole Foods Market, Inc. | | | 65,000 | | | | 1,233,700 | | |

| | | | 11,560,000 | | |

| Energy (1.8%) | |

| Chesapeake Energy Corp. | | | 90,000 | | | | 1,784,700 | | |

| Financial Services (2.2%) | |

| Morgan Stanley | | | 75,000 | | | | 2,138,250 | | |

| Healthcare Services (27.4%) | |

| Becton, Dickinson & Co. | | | 25,000 | | | | 1,782,750 | | |

| Cardiac Science Corp.* | | | 50,000 | | | | 201,000 | | |

| CONMED Corp.* | | | 135,000 | | | | 2,095,200 | | |

| Covidien Ltd. | | | 43,750 | | | | 1,638,000 | | |

| Express Scripts, Inc.*† | | | 115,000 | | | | 7,906,250 | | |

| Healthways, Inc.* | | | 20,000 | | | | 269,000 | | |

| Hologic, Inc.* | | | 50,000 | | | | 711,500 | | |

| Merck & Co., Inc. | | | 50,000 | | | | 1,398,000 | | |

| Omnicell, Inc.* | | | 39,800 | | | | 427,850 | | |

Palomar Medical

Technologies, Inc.* | | | 8,000 | | | | 117,280 | | |

| Thermo Fisher Scientific, Inc.* | | | 115,000 | | | | 4,688,550 | | |

| TomoTherapy, Inc.* | | | 210,000 | | | | 577,500 | | |

| UnitedHealth Group, Inc. | | | 44,500 | | | | 1,111,610 | | |

| Varian Medical Systems, Inc.*† | | | 115,000 | | | | 4,041,100 | | |

| | | | 26,965,590 | | |

| Industrial (1.2%) | |

| Southwall Technologies, Inc.*† | | | 728,000 | | | | 691,600 | | |

| Sypris Solutions, Inc. | | | 418,700 | | | | 506,627 | | |

| | | | 1,198,227 | | |

| Oil & Gas — Exploration & Production (1.5%) | |

| Transocean, Ltd* | | | 20,000 | | | | 1,485,800 | | |

| | | Shares | | Value | |

| Common Stocks — Continued | |

| Software (3.7%) | |

| Actuate Corp.* | | | 321,854 | | | $ | 1,538,462 | | |

| Aspen Technology, Inc.* | | | 250,000 | | | | 2,132,500 | | |

| | | | 3,670,962 | | |

| Technology (23.6%) | |

| 3Com Corp.* | | | 475,000 | | | | 2,237,250 | | |

| Barco Industries NV | | | 25,000 | | | | 855,298 | | |

| Brooks Automation, Inc.* | | | 531,911 | | | | 2,382,961 | | |

| Cognex Corp. | | | 20,000 | | | | 282,600 | | |

| Eclipsys Corp.* | | | 102,700 | | | | 1,826,006 | | |

Electro Scientific

Industries, Inc.* | | | 175,000 | | | | 1,956,500 | | |

| Entegris, Inc.* | | | 100,000 | | | | 272,000 | | |

| FSI International, Inc.* | | | 558,500 | | | | 228,985 | | |

| Intuit, Inc.* | | | 20,000 | | | | 563,200 | | |

| LogMeIn, Inc.* | | | 811 | | | | 12,976 | | |

| Mattson Technology, Inc.* | | | 91,000 | | | | 107,380 | | |

| MKS Instruments, Inc.* | | | 100,000 | | | | 1,319,000 | | |

| National Semiconductor Corp. | | | 180,000 | | | | 2,259,000 | | |

| Newport Corp.* | | | 237,600 | | | | 1,375,704 | | |

| Orbotech Ltd.* | | | 148,600 | | | | 1,285,390 | | |

| Parametric Technology Corp.* | | | 175,000 | | | | 2,045,750 | | |

| Quantel, SA | | | 20,905 | | | | 101,166 | | |

| Seagate Technology | | | 200,000 | | | | 2,092,000 | | |

| Semitool, Inc.*† | | | 100,000 | | | | 462,000 | | |

| Super Micro Computer, Inc.* | | | 100,000 | | | | 766,000 | | |

| Vishay Intertechnology, Inc.*† | | | 100,000 | | | | 679,000 | | |

| Xyratex, Ltd.* | | | 33,900 | | | | 169,161 | | |

| | | | 23,279,327 | | |

| Telecommunications/Cable (10.6%) | |

| Airvana, Inc.*† | | | 350,000 | | | | 2,229,500 | | |

| Comcast Corp., Class A | | | 75,000 | | | | 1,086,750 | | |

| EMS Technologies, Inc.* | | | 124,800 | | | | 2,608,320 | | |

| IPG Photonics Corp.* | | | 35,000 | | | | 383,950 | | |

SoundBite

Communications, Inc.* | | | 100,000 | | | | 237,000 | | |

| ViaSat, Inc.* | | | 150,000 | | | | 3,846,000 | | |

| | | | 10,391,520 | | |

Total Common Stocks

(Cost $95,326,049) | | | | | | | 89,402,481 | | |

See accompanying notes to financial statements.

9

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Short-Term Investments (9.1%) | |

| Money Market Fund (9.1%) | |

Dreyfus Treasury Prime Cash

Management, 0.00%(a)

(Cost $8,945,152) | | | 8,945,152 | | | $ | 8,945,152 | | |

| Warrants (0.0%) | |

| Technology (0.0%) | |

Quantel, SA, Strike Price

10.00, Expires 6/30/10

(Cost $0) | | | 20,905 | | | | 4,545 | | |

Total Investments (99.8%)

(Cost $104,271,201) | | | | | 98,352,178 | | |

Total Securities Sold Short (-4.1%)

(Proceeds $3,446,238) | | | | | (4,021,575 | ) | |

Other Assets in Excess

of Liabilities (4.3%) | | | | | 4,217,000 | | |

| Net Assets (100.0%) | | | | $ | 98,547,603 | | |

(a) Rate disclosed is the seven day yield as of June 30, 2009.

* Non-income producing security.

† Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $4,202,816.

ADR American Depositary Receipt.

NV Naamloze Vennootschap (Dutch corporation)

SA Société Anonyme (French corporation)

SpA Società per Azìonì (Italian corporation)

See accompanying notes to financial statements.

10

Semiannual Report 2009

Needham Growth Fund

Schedule of Securities Sold Short

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Securities Sold Short (-4.1%) | |

| Airline (-0.8%) | |

| Allegiant Travel Co.* | | | 20,000 | | | $ | 792,800 | | |

| Commercial Services (-0.4%) | |

| HMS Holdings Corp.* | | | 10,000 | | | | 407,200 | | |

| Financial Services (-1.2%) | |

| Stifel Financial Corp.* | | | 25,000 | | | | 1,202,250 | | |

| Healthcare Services (-0.5%) | |

Bio-Reference

Laboratories, Inc.* | | | 5,000 | | | | 158,050 | | |

Valeant Pharmaceuticals

International* | | | 10,000 | | | | 257,200 | | |

| | | | 415,250 | | |

| Retail (-0.8%) | |

| Buffalo Wild Wings, Inc.* | | | 25,000 | | | | 813,000 | | |

| Technology (-0.3%) | |

Varian Semiconductor

Equipment Associates, Inc.* | | | 12,500 | | | | 299,875 | | |

| Telecommunications/Cable (-0.1%) | |

| Arris Group, Inc.* | | | 7,500 | | | | 91,200 | | |

Total Securities Sold Short

(Proceeds $3,446,238) | | | | | | | 4,021,575 | | |

| Total Securities Sold Short (-4.1%) | | | | | | | (4,021,575 | ) | |

| Total Investments (99.8%) | | | | | | | 98,352,178 | | |

Other Assets in Excess

of Liabilities (4.3%) | | | | | | | 4,217,000 | | |

| Net Assets (100.0%) | | | | | | $ | 98,547,603 | | |

* Non-income producing security.

See accompanying notes to financial statements.

11

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Common Stocks (66.2%) | |

| Business Services (8.6%) | |

| Dice Holdings, Inc.* | | | 17,300 | | | $ | 80,445 | | |

| Iconix Brand Group, Inc.* | | | 15,000 | | | | 230,700 | | |

| Iron Mountain, Inc.*† | | | 20,000 | | | | 575,000 | | |

| Resources Connection, Inc.*† | | | 21,250 | | | | 364,862 | | |

| | | | 1,251,007 | | |

| Consumer Services (7.1%) | |

| CarMax, Inc.* | | | 15,000 | | | | 220,500 | | |

| Dick's Sporting Goods, Inc.*† | | | 21,500 | | | | 369,800 | | |

| Luxottica Group SpA - ADR* | | | 12,500 | | | | 259,750 | | |

| Morton's Restaurant Group* | | | 45,000 | | | | 135,000 | | |

| Whole Foods Market, Inc. | | | 2,500 | | | | 47,450 | | |

| | | | 1,032,500 | | |

| Financial Services (1.4%) | |

| FCStone Group, Inc.* | | | 35,000 | | | | 138,250 | | |

| Morgan Stanley | | | 2,000 | | | | 57,020 | | |

Oppenheimer Holdings,

Inc., Class A | | | 300 | | | | 6,351 | | |

| | | | 201,621 | | |

| Healthcare Services (27.0%) | |

| Abaxis, Inc.* | | | 2,000 | | | | 41,080 | | |

Alliance HealthCare

Services, Inc.* | | | 10,000 | | | | 73,300 | | |

| Becton, Dickinson & Co. | | | 2,500 | | | | 178,275 | | |

| Cardiac Science Corp.* | | | 30,000 | | | | 120,600 | | |

| CONMED Corp.* | | | 5,000 | | | | 77,600 | | |

| Express Scripts, Inc.*† | | | 9,000 | | | | 618,750 | | |

| Gentiva Health Services, Inc.* | | | 3,000 | | | | 49,380 | | |

| Gilead Sciences, Inc.* | | | 15,000 | | | | 702,600 | | |

| LeMaitre Vascular, Inc.*† | | | 85,700 | | | | 270,812 | | |

| Masimo Corp.* | | | 12,500 | | | | 301,375 | | |

| Natus Medical, Inc.* | | | 10,000 | | | | 115,400 | | |

| Omnicell, Inc.* | | | 18,700 | | | | 201,025 | | |

Palomar Medical

Technologies, Inc.* | | | 7,500 | | | | 109,950 | | |

| Solta Medical, Inc.* | | | 150,000 | | | | 234,000 | | |

| TomoTherapy, Inc.* | | | 20,000 | | | | 55,000 | | |

| Varian Medical Systems, Inc.* | | | 15,000 | | | | 527,100 | | |

| Volcano Corp.* | | | 18,000 | | | | 251,640 | | |

| | | | 3,927,887 | | |

| Industrial (3.2%) | |

| Precision Castparts Corp. | | | 6,000 | | | | 438,180 | | |

| Quixote Corp.* | | | 7,538 | | | | 21,333 | | |

| | | | 459,513 | | |

| Software (1.7%) | |

| Actuate Corp.*† | | | 50,000 | | | | 239,000 | | |

| | | Shares | | Value | |

| Common Stocks — Continued | |

| Technology (11.4%) | |

| Apple, Inc.* † | | | 3,000 | | | $ | 427,290 | | |

| Autodesk, Inc.*† | | | 10,000 | | | | 189,800 | | |

| Brooks Automation, Inc.* | | | 40,000 | | | | 179,200 | | |

| Daktronics, Inc. | | | 5,000 | | | | 38,500 | | |

| Eclipsys Corp.* | | | 20,530 | | | | 365,023 | | |

| Linear Technology Corp. | | | 2,500 | | | | 58,375 | | |

| LogMeIn, Inc.* | | | 119 | | | | 1,904 | | |

| Mattson Technology, Inc.* | | | 9,000 | | | | 10,620 | | |

| Parametric Technology Corp.* | | | 25,000 | | | | 292,250 | | |

| Quantel, SA | | | 10,210 | | | | 49,410 | | |

| Super Micro Computer, Inc.* | | | 5,000 | | | | 38,300 | | |

| | | | 1,650,672 | | |

| Telecommunications/Cable (5.8%) | |

| Airvana, Inc.*† | | | 50,000 | | | | 318,500 | | |

| Powerwave Technologies, Inc.* | | | 90,000 | | | | 144,900 | | |

| ViaSat, Inc.* | | | 15,000 | | | | 384,600 | | |

| | | | 848,000 | | |

Total Common Stocks

(Cost $7,682,718) | | | | | | | 9,610,200 | | |

| Exchange Traded Funds (1.6%) | |

PowerShares QQQ

(Cost $229,895) | | | 6,500 | | | | 236,470 | | |

| Short-Term Investments (31.5%) | |

| Money Market Fund (31.5%) | |

Dreyfus Treasury Prime Cash

Management, 0.00%(a)

(Cost $4,574,119) | | | 4,574,119 | | | | 4,574,119 | | |

| Warrants (0.0%) | |

| Technology (0.0%) | |

Quantel, SA, Strike Price

10.00, Expires 6/30/10

(Cost $0) | | | 10,210 | | | | 2,220 | | |

Total Investments (99.3%)

(Cost $12,486,732) | | | | | | | 14,423,009 | | |

Total Securities Sold Short (-0.7%)

(Proceeds $93,431) | | | | | | | (105,580 | ) | |

Other Assets in Excess

of Liabilities (1.4%) | | | | | | | 207,868 | | |

| Net Assets (100.0%) | | | | | | $ | 14,525,297 | | |

(a) Rate disclosed is the seven day yield as of June 30, 2009.

* Non-income producing security.

† Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $1,886,441.

ADR American Depositary Receipt.

SA Société Anonyme (French corporation)

SpA Società per Azìonì (Italian corporation)

See accompanying notes to financial statements.

12

Semiannual Report 2009

Needham Aggressive Growth Fund

Schedule of Securities Sold Short

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Securities Sold Short (-0.7%) | |

| Healthcare Services (-0.3%) | |

Valeant Pharmaceuticals

International* | | | 2,000 | | | $ | 51,440 | | |

| Technology (-0.4%) | |

| DTS, Inc.* | | | 2,000 | | | | 54,140 | | |

Total Securities Sold Short

(Proceeds $93,431) | | | | | 105,580 | | |

| Total Securities Sold Short (-0.7%) | | | | | (105,580 | ) | |

| Total Investments (99.3%) | | | | | 14,423,009 | | |

Other Assets in Excess

of Liabilities (1.4%) | | | | | 207,868 | | |

| Net Assets (100.0%) | | | | $ | 14,525,297 | | |

* Non-income producing security.

See accompanying notes to financial statements.

13

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Common Stocks (62.3%) | |

| Defense (4.5%) | |

| ICx Technologies Inc.* | | | 35,000 | | | $ | 210,000 | | |

| iRobot Corp.*† | | | 15,000 | | | | 194,700 | | |

| | | | 404,700 | | |

| Healthcare Services (13.9%) | |

Alliance HealthCare

Services, Inc.*† | | | 15,000 | | | | 109,950 | | |

| Cardiac Science Corp.*† | | | 15,000 | | | | 60,300 | | |

| CONMED Corp.*† | | | 15,000 | | | | 232,800 | | |

| Express Scripts, Inc.*† | | | 4,000 | | | | 275,000 | | |

| Hologic, Inc.* | | | 5,000 | | | | 71,150 | | |

| Phase Forward, Inc.*† | | | 10,000 | | | | 151,100 | | |

| Solta Medical, Inc.*† | | | 42,000 | | | | 65,520 | | |

| TomoTherapy, Inc.*† | | | 40,000 | | | | 110,000 | | |

| Varian Medical Systems, Inc.* | | | 5,000 | | | | 175,700 | | |

| | | | 1,251,520 | | |

| Oil & Gas — Exploration & Production (4.4%) | |

| ATP Oil & Gas Corp.*† | | | 10,000 | | | | 69,600 | | |

| BPZ Resources, Inc.* | | | 15,000 | | | | 73,350 | | |

| Carrizo Oil & Gas, Inc.* | | | 5,000 | | | | 85,750 | | |

| Compton Petroleum Corp.* | | | 75,000 | | | | 87,750 | | |

| GMX Resources, Inc.* | | | 7,500 | | | | 79,800 | | |

| | | | 396,250 | | |

| Software (2.4%) | |

| Aspen Technology, Inc.*† | | | 20,000 | | | | 170,600 | | |

| PDF Solutions, Inc.*† | | | 20,000 | | | | 51,000 | | |

| | | | 221,600 | | |

| Technology (23.6%) | |

| 3Com Corp.* | | | 15,000 | | | | 70,650 | | |

| ATMI, Inc.*† | | | 2,000 | | | | 31,060 | | |

| BigBand Networks, Inc.*† | | | 15,000 | | | | 77,550 | | |

| Brooks Automation, Inc.* | | | 20,000 | | | | 89,600 | | |

| Cognex Corp. | | | 14,000 | | | | 197,820 | | |

| Eclipsys Corp.*† | | | 10,270 | | | | 182,600 | | |

Electro Scientific

Industries, Inc.* | | | 5,000 | | | | 55,900 | | |

| Entegris, Inc.* | | | 50,000 | | | | 136,000 | | |

| Linear Technology Corp. | | | 2,500 | | | | 58,375 | | |

| LogMeIn, Inc.* | | | 70 | | | | 1,120 | | |

| Mattson Technology, Inc.* | | | 30,000 | | | | 35,400 | | |

| MKS Instruments, Inc.*† | | | 17,000 | | | | 224,230 | | |

| | | Shares | | Value | |

| Common Stocks — Continued | |

| Technology — Continued | |

| Netezza Corp.*† | | | 20,000 | | | $ | 166,400 | | |

| Newport Corp.* | | | 10,000 | | | | 57,900 | | |

| PLX Technology, Inc* | | | 30,000 | | | | 113,100 | | |

| Seagate Technology | | | 12,500 | | | | 130,750 | | |

| Semitool, Inc.*† | | | 31,000 | | | | 143,220 | | |

| STEC, Inc.*† | | | 5,000 | | | | 115,950 | | |

| Super Micro Computer, Inc.*† | | | 20,000 | | | | 153,200 | | |

| Xyratex, Ltd.*† | | | 15,900 | | | | 79,341 | | |

| | | | 2,120,166 | | |

| Telecommunications/Cable (13.5%) | |

| Acme Packet, Inc.* | | | 15,000 | | | | 151,800 | | |

| Airvana, Inc.*† | | | 30,000 | | | | 191,100 | | |

| Anaren, Inc.*† | | | 8,500 | | | | 150,280 | | |

| Aruba Networks, Inc.* | | | 25,000 | | | | 218,500 | | |

| EMS Technologies, Inc.* | | | 7,500 | | | | 156,750 | | |

| Harmonic, Inc.* | | | 10,000 | | | | 58,900 | | |

| IPG Photonics Corp.* | | | 10,000 | | | | 109,700 | | |

| Powerwave Technologies, Inc.* | | | 10,000 | | | | 16,100 | | |

SoundBite

Communications, Inc.*† | | | 40,000 | | | | 94,800 | | |

| ViaSat, Inc.*† | | | 2,500 | | | | 64,100 | | |

| | | | 1,212,030 | | |

Total Common Stocks

(Cost $4,456,675) | | | | | | | 5,606,266 | | |

| Short-Term Investments (32.8%) | |

| Money Market Fund (32.8%) | |

Dreyfus Treasury Prime Cash

Management, 0.00%(a)

(Cost $2,951,987) | | | 2,951,987 | | | | 2,951,987 | | |

Total Investments (95.1%)

(Cost $7,408,662) | | | | | | | 8,558,253 | | |

Total Securities Sold Short (-6.6%)

(Proceeds $555,555) | | | | | | | (589,700 | ) | |

Other Assets in Excess

of Liabilities (11.5%) | | | | | | | 1,032,911 | | |

| Net Assets (100.0%) | | | | | | $ | 9,001,464 | | |

(a) Rate disclosed is the seven day yield as of June 30, 2009.

* Non-income producing security.

† Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $2,800,458.

See accompanying notes to financial statements.

14

Semiannual Report 2009

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

June 30, 2009 (Unaudited)

| | | Shares | | Value | |

| Securities Sold Short (-6.6%) | |

| Airline (-0.9%) | |

| Allegiant Travel Co.* | | | 2,000 | | | $ | 79,280 | | |

| Consumer Products (-1.6%) | |

| The Scotts Miracle-Gro Co. | | | 4,000 | | | | 140,200 | | |

| Financial Services (-0.5%) | |

| Stifel Financial Corp.* | | | 1,000 | | | | 48,090 | | |

| Healthcare Services (-0.4%) | |

| Bio-Reference Laboratories, Inc.* | | | 1,000 | | | | 31,610 | | |

| Retail (-0.7%) | |

| Buffalo Wild Wings, Inc.* | | | 2,000 | | | | 65,040 | | |

| Technology (-2.2%) | |

| DTS, Inc.* | | | 3,000 | | | | 81,210 | | |

Varian Semiconductor

Equipment Associates, Inc.* | | | 5,000 | | | | 119,950 | | |

| | | | 201,160 | | |

| Telecommunications/Cable (-0.3%) | |

| Arris Group, Inc.* | | | 2,000 | | | | 24,320 | | |

Total Securities Sold Short

(Proceeds $555,555) | | | | | | | 589,700 | | |

| Total Securities Sold Short (-6.6%) | | | | | | | (589,700 | ) | |

| Total Investments (95.1%) | | | | | | | 8,558,253 | | |

Other Assets in Excess

of Liabilities (11.5%) | | | | | | | 1,032,911 | | |

| Net Assets (100.0%) | | | | | | $ | 9,001,464 | | |

* Non-income producing security.

See accompanying notes to financial statements.

15

Needham Funds

Statements of Assets and Liabilities

June 30, 2009 (Unaudited)

| | | Needham

Growth Fund | | Needham

Aggressive

Growth Fund | | Needham

Small Cap

Growth Fund | |

| Assets | |

Investments, at Value (Cost $104,271,201, $12,486,732 and

$7,408,662, respectively) | | $ | 98,352,178 | | | $ | 14,423,009 | | | $ | 8,558,253 | | |

| Receivables: | |

| Deposit with Broker for Securities Sold Short | | | 4,729,931 | | | | 156,165 | | | | 566,388 | | |

| Dividends and Interest | | | 40,220 | | | | 160 | | | | 23 | | |

| Fund Shares Sold | | | 21,164 | | | | 95,556 | | | | 500,979 | | |

| Prepaid Expenses | | | 25,817 | | | | 14,201 | | | | 10,232 | | |

| Total Assets | | | 103,169,310 | | | | 14,689,091 | | | | 9,635,875 | | |

| Liabilities | |

Securities Sold Short, at Value (Proceeds $3,446,238,

$93,431 and $555,555, respectively) | | | 4,021,575 | | | | 105,580 | | | | 589,700 | | |

| Payables: | |

| Investment Securities Purchased | | | 12,976 | | | | 1,904 | | | | 1,120 | | |

| Fund Shares Redeemed | | | 334,728 | | | | — | | | | — | | |

| Due to Adviser | | | 102,783 | | | | 16,921 | | | | 6,672 | | |

| Distribution Fees | | | 20,557 | | | | 2,920 | | | | 1,747 | | |

| Directors' Fees | | | 8,249 | | | | 979 | | | | 561 | | |

| Chief Compliance Officer Fees | | | 15,423 | | | | 1,104 | | | | 654 | | |

| Accrued Expenses and Other Liabilities | | | 105,416 | | | | 34,386 | | | | 33,957 | | |

| Total Liabilities | | | 4,621,707 | | | | 163,794 | | | | 634,411 | | |

| Net Assets | | $ | 98,547,603 | | | $ | 14,525,297 | | | $ | 9,001,464 | | |

Shares Issued and Outstanding $.001 Par Value

(Authorized 800,000,000, 100,000,000 and 100,000,000,

respectively) | | | 4,169,539 | | | | 1,369,731 | | | | 1,007,781 | | |

| Net Asset Value, Offering and Redemption Price Per Share(a) | | $ | 23.64 | | | $ | 10.60 | | | $ | 8.93 | | |

| Components of Net Assets | |

| Paid-in Capital | | | 111,293,901 | | | | 12,767,573 | | | | 7,848,523 | | |

| Accumulated Net Investment Loss | | | (734,945 | ) | | | (131,374 | ) | | | (77,772 | ) | |

Accumulated Net Realized Gains (Losses) from Investment

Transactions, Securities Sold Short, Foreign Currency

Transactions, and Written Options | | | (5,516,993 | ) | | | (35,030 | ) | | | 115,267 | | |

Net Unrealized Appreciation (Depreciation) of Investment

Securities and Securities Sold Short | | | (6,494,360 | ) | | | 1,924,128 | | | | 1,115,446 | | |

| Total Net Assets | | $ | 98,547,603 | | | $ | 14,525,297 | | | $ | 9,001,464 | | |

(a) Subject to certain exceptions, a 2% redemption fee is imposed upon shares redeemed within 60 days of their purchase. See Note 2 of the notes to financial statements.

See accompanying notes to financial statements.

16

Semiannual Report 2009

Statements of Operations

For the Six Months Ended June 30, 2009 (Unaudited)

| | | Needham

Growth Fund | | Needham

Aggressive

Growth Fund | | Needham

Small Cap

Growth Fund | |

| Investment Income | |

| Dividends | | $ | 171,721 | | | $ | 3,210 | | | $ | 3,497 | | |

| Interest | | | 2,584 | | | | 973 | | | | 798 | | |

| Total Investment Income | | | 174,305 | | | | 4,183 | | | | 4,295 | | |

| Expenses | |

| Investment Advisory Fees | | | 559,143 | | | | 67,614 | | | | 39,701 | | |

| Distribution Fees | | | 111,828 | | | | 13,523 | | | | 7,940 | | |

| Administration and Accounting Fees | | | 35,882 | | | | 8,739 | | | | 6,880 | | |

| Chief Compliance Officer Fees | | | 15,438 | | | | 2,119 | | | | 1,124 | | |

| Audit Fees | | | 15,121 | | | | 15,121 | | | | 15,120 | | |

| Custodian Fees | | | 11,484 | | | | 1,822 | | | | 1,910 | | |

| Dividend Expense on Securities Sold Short | | | — | | | | — | | | | 625 | | |

| Interest Expense* | | | 14,817 | | | | 251 | | | | 1,818 | | |

| Legal Fees | | | 34,169 | | | | 7,881 | | | | 8,448 | | |

| Filing Fees | | | 11,909 | | | | 6,708 | | | | 5,978 | | |

| Transfer Agent Fees | | | 47,607 | | | | 10,211 | | | | 9,848 | | |

| Directors' Fees | | | 20,278 | | | | 2,287 | | | | 1,352 | | |

| Printing Fees | | | 32,512 | | | | 3,736 | | | | 2,515 | | |

| Other Expenses | | | 57,163 | | | | 5,879 | | | | 4,284 | | |

| Total Expenses | | | 967,351 | | | | 145,891 | | | | 107,543 | | |

| Fees Waived by Investment Adviser | | | (58,101 | ) | | | (10,334 | ) | | | (25,476 | ) | |

| Net Expenses | | | 909,250 | | | | 135,557 | | | | 82,067 | | |

| Net Investment Loss | | | (734,945 | ) | | | (131,374 | ) | | | (77,772 | ) | |

Net Realized/Unrealized Gain (Loss) from

Investment Securities, Securities Sold Short, Foreign

Currency Transactions and Written Options | |

| Net Realized Gain (Loss) from Investment Securities | | | (2,848,738 | ) | | | 98,579 | | | | 141,320 | | |

| Net Realized Gain (Loss) from Securities Sold Short | | | (28,454 | ) | | | 4,577 | | | | 4,330 | | |

| Net Realized Gain (Loss) from Foreign Currency Transactions | | | (1,377 | ) | | | 277 | | | | — | | |

| Net Realized Gain from Written Options | | | 70,275 | | | | 2,115 | | | | — | | |

Change in Unrealized Appreciation/Depreciation of

Investment Securities and Securities Sold Short | | | 17,623,996 | | | | 1,405,163 | | | | 1,177,704 | | |

Net Realized/Unrealized Gain (Loss) from

Investment Securities, Securities Sold Short, Foreign

Currency Transactions and Written Options | | | 14,815,702 | | | | 1,510,711 | | | | 1,323,354 | | |

| Change in Net Assets Resulting from Operations | | $ | 14,080,757 | | | $ | 1,379,337 | | | $ | 1,245,582 | | |

* Expense consists of interest expense on temporary borrowings and/or interest expense related to Securities Sold Short.

See accompanying notes to financial statements.

17

Needham Funds

Statements of Changes in Net Assets

| | | Needham Growth Fund | | Needham Aggressive

Growth Fund | | Needham

Small Cap

Growth Fund | |

| | | Six Months

Ended June 30,

2009

(Unaudited) | | Year Ended

December 31,

2008 | | Six Months

Ended June 30,

2009

(Unaudited) | | Year Ended

December 31,

2008 | | Six Months

Ended June 30,

2009

(Unaudited) | | Year Ended

December 31,

2008 | |

| Change in Net Assets | |

| Operations: | |

| Net Investment Loss | | $ | (734,945 | ) | | $ | (2,055,416 | ) | | $ | (131,374 | ) | | $ | (283,040 | ) | | $ | (77,772 | ) | | $ | (131,472 | ) | |

Net Realized Gain (Loss) from

Investment Securities, Securities

Sold Short, Foreign Currency

Transactions, and Written Options | | | (2,808,294 | ) | | | (1,031,882 | ) | | | 105,548 | | | | 55,219 | | | | 145,650 | | | | 33,520 | | |

Change in Unrealized Appreciation/

Depreciation on Investment

Securities and Securities Sold Short | | | 17,623,996 | | | | (69,741,872 | ) | | | 1,405,163 | | | | (4,436,033 | ) | | | 1,177,704 | | | | (1,564,399 | ) | |

Change in Net Assets Resulting

from Operations | | | 14,080,757 | | | | (72,829,170 | ) | | | 1,379,337 | | | | (4,663,854 | ) | | | 1,245,582 | | | | (1,662,351 | ) | |

| Distributions to Shareholders from: | |

| Long-term Gains | | | — | | | | (5,577,950 | ) | | | — | | | | (715,222 | ) | | | — | | | | (506,898 | ) | |

| Return of Capital | | | — | | | | — | | | | — | | | | — | | | | — | | | | (107,987 | ) | |

| Total Distributions to Shareholders | | | — | | | | (5,577,950 | ) | | | — | | | | (715,222 | ) | | | — | | | | (614,885 | ) | |

| Capital Transactions: | |

| Shares Issued | | | 2,257,495 | | | | 9,876,082 | | | | 4,114,251 | | | | 1,426,700 | | | | 3,514,915 | | | | 1,300,515 | | |

Shares Issued in Reinvestment

of Distributions | | | — | | | | 5,390,946 | | | | — | | | | 714,754 | | | | — | | | | 604,759 | | |

| Shares Redeemed | | | (10,608,886 | ) | | | (53,438,178 | ) | | | (1,170,438 | ) | | | (7,077,777 | ) | | | (1,068,422 | ) | | | (2,044,919 | ) | |

Change in Net Assets from

Capital Transactions | | | (8,351,391 | ) | | | (38,171,150 | ) | | | 2,943,813 | | | | (4,936,323 | ) | | | 2,446,493 | | | | (139,645 | ) | |

| Change in Net Assets | | | 5,729,366 | | | | (116,578,270 | ) | | | 4,323,150 | | | | (10,315,399 | ) | | | 3,692,075 | | | | (2,416,881 | ) | |

| Net Assets | |

| Beginning of Period | | | 92,818,237 | | | | 209,396,507 | | | | 10,202,147 | | | | 20,517,546 | | | | 5,309,389 | | | | 7,726,270 | | |

| End of Period | | $ | 98,547,603 | | | $ | 92,818,237 | | | $ | 14,525,297 | | | $ | 10,202,147 | | | $ | 9,001,464 | | | $ | 5,309,389 | | |

| Accumulated Net Investment Loss | | $ | (734,945 | ) | | $ | — | | | $ | (131,374 | ) | | $ | — | | | $ | (77,772 | ) | | $ | — | | |

| Share Transactions: | |

| Number of Shares Issued | | | 110,881 | | | | 334,933 | | | | 411,625 | | | | 147,044 | | | | 440,355 | | | | 125,527 | | |

| Number of Shares Reinvested | | | — | | | | 262,845 | | | | — | | | | 76,444 | | | | — | | | | 82,618 | | |

| Number of Shares Redeemed | | | (521,012 | ) | | | (1,826,860 | ) | | | (121,950 | ) | | | (594,769 | ) | | | (129,971 | ) | | | (195,029 | ) | |

| Change in Shares | | | (410,131 | ) | | | (1,229,082 | ) | | | 289,675 | | | | (371,281 | ) | | | 310,384 | | | | 13,116 | | |

See accompanying notes to financial statements.

18

Semiannual Report 2009

Needham Growth Fund

Financial Highlights

(For a Share Outstanding | | Six Months

Ended

June 30, | | Year Ended December 31, | |

| Throughout each Period) | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 20.27 | | | $ | 36.05 | | | $ | 39.01 | | | $ | 35.69 | | | $ | 31.17 | | | $ | 29.35 | | |

| Investment Operations | |

| Net Investment Income (Loss) | | | (0.17 | ) | | | (0.45 | ) | | | (0.25 | ) | | | 0.10 | | | | (0.38 | ) | | | (0.84 | ) | |

Net Realized and Unrealized Gains (Losses)

on Investments | | | 3.54 | | | | (14.10 | ) | | | 1.45 | | | | 6.29 | | | | 4.90 | | | | 2.62 | | |

| Total from Investment Operations | | | 3.37 | | | | (14.55 | ) | | | 1.20 | | | | 6.39 | | | | 4.52 | | | | 1.78 | | |

| Less Distributions | |

| Net Investment Income | | | — | | | | — | | | | (0.01 | ) | | | (0.09 | ) | | | — | | | | — | | |

| Net Realized Gains | | | — | | | | (1.23 | ) | | | (4.15 | ) | | | (3.00 | ) | | | — | | | | — | | |

| Total Distributions | | | — | | | | (1.23 | ) | | | (4.16 | ) | | | (3.09 | ) | | | — | | | | — | | |

| Contribution by Adviser | | | — | | | | — | | | | — | | | | 0.02 | (a) | | | — | | | | 0.04 | (b) | |

| Net Asset Value, End of Period | | $ | 23.64 | | | $ | 20.27 | | | $ | 36.05 | | | $ | 39.01 | | | $ | 35.69 | | | $ | 31.17 | | |

| Total Return | | | 16.63 | %(c) | | | (40.41 | )% | | | 3.09 | % | | | 18.05 | %(a) | | | 14.50 | % | | | 6.20 | %(b) | |

| Net Assets, End of Period (000's) | | $ | 98,548 | | | $ | 92,818 | | | $ | 209,397 | | | $ | 308,693 | | | $ | 204,624 | | | $ | 287,372 | | |

| Ratios/Supplemental Data | |

| Ratio of Net Expenses to Average Net Assets | | | 2.03 | %(d) | | | 2.04 | % | | | 1.86 | % | | | 1.79 | % | | | 1.94 | % | | | 2.21 | % | |

Ratio of Net Expenses to Average Net Assets

(excluding interest and dividend expense) | | | 2.00 | %(d) | | | 2.03 | % | | | 1.85 | % | | | 1.78 | % | | | 1.91 | % | | | 1.78 | % | |

Ratio of Net Expenses to Average Net Assets

(excluding waivers and reimbursement

of expenses) | | | 2.16 | %(d) | | | 2.04 | % | | | 1.86 | % | | | 1.79 | % | | | 1.94 | % | | | 2.21 | % | |

Ratio of Net Investment Income (Loss)

to Average Net Assets | | | (1.64 | )%(d) | | | (1.37 | )% | | | (0.61 | )% | | | 0.31 | % | | | (1.01 | )% | | | (1.51 | )% | |

Ratio of Net Investment Income (Loss)

to Average Net Assets (excluding waivers

and reimbursement of expenses) | | | (1.77 | )%(d) | | | (1.37 | )% | | | (0.61 | )% | | | 0.31 | % | | | (1.01 | )% | | | (1.51 | )% | |

| Portfolio Turnover Rate | | | 13 | %(c) | | | 41 | % | | | 41 | % | | | 48 | % | | | 16 | % | | | 15 | % | |

(a) In May 2006, the Adviser made a payment to the Growth Fund which increased the total return by 0.06%.

(b) In October 2004, the Adviser made a payment to the Growth Fund which increased the total return by 0.14%.

(c) Not annualized for periods less than one year.

(d) Annualized for periods less than one year.

See accompanying notes to financial statements.

19

Needham Funds

Needham Aggressive Growth Fund

Financial Highlights

(For a Share Outstanding | | Six Months

Ended

June 30, | | Year Ended December 31, | |

| Throughout each Period) | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 9.45 | | | $ | 14.14 | | | $ | 13.96 | | | $ | 13.73 | | | $ | 12.85 | | | $ | 11.51 | | |

| Investment Operations | |

| Net Investment Loss | | | (0.11 | ) | | | (0.26 | ) | | | (0.16 | ) | | | (0.19 | ) | | | (0.26 | ) | | | (0.36 | ) | |

Net Realized and Unrealized Gains (Losses)

on Investments | | | 1.26 | | | | (3.65 | ) | | | 2.34 | | | | 1.83 | | | | 1.49 | | | | 1.70 | | |

| Total from Investment Operations | | | 1.15 | | | | (3.91 | ) | | | 2.18 | | | | 1.64 | | | | 1.23 | | | | 1.34 | | |

| Less Distributions | |

| Net Realized Gains | | | — | | | | (0.78 | ) | | | (2.00 | ) | | | (1.42 | ) | | | (0.35 | ) | | | — | | |

| Total Distributions | | | — | | | | (0.78 | ) | | | (2.00 | ) | | | (1.42 | ) | | | (0.35 | ) | | | — | | |

| Contribution by Adviser | | | — | | | | — | | | | — | | | | 0.01 | (a) | | | — | | | | — | | |

| Net Asset Value, End of Period | | $ | 10.60 | | | $ | 9.45 | | | $ | 14.14 | | | $ | 13.96 | | | $ | 13.73 | | | $ | 12.85 | | |

| Total Return | | | 12.28 | %(b) | | | (27.60 | )% | | | 15.58 | % | | | 12.22 | %(a) | | | 9.70 | % | | | 11.64 | % | |

| Net Assets, End of Period (000's) | | $ | 14,525 | | | $ | 10,202 | | | $ | 20,518 | | | $ | 18,051 | | | $ | 18,125 | | | $ | 17,000 | | |

| Ratios/Supplemental Data | |

| Ratio of Net Expenses to Average Net Assets | | | 2.50 | %(c) | | | 2.51 | % | | | 2.18 | % | | | 2.24 | % | | | 2.50 | % | | | 2.61 | % | |

Ratio of Net Expenses to Average Net Assets

(excluding interest and dividend expense) | | | 2.50 | %(c) | | | 2.50 | % | | | 2.18 | % | | | 2.23 | % | | | 2.50 | % | | | 2.50 | % | |

Ratio of Net Expenses to Average Net Assets

(excluding waivers and reimbursement

of expenses) | | | 2.69 | %(c) | | | 2.63 | % | | | 2.18 | % | | | 2.24 | % | | | 2.78 | % | | | 3.15 | % | |

Ratio of Net Investment Loss to

Average Net Assets | | | (2.42 | )%(c) | | | (2.04 | )% | | | (1.18 | )% | | | (1.35 | )% | | | (2.01 | )% | | | (2.25 | )% | |

Ratio of Net Investment Loss to

Average Net Assets (excluding waivers

and reimbursement of expenses) | | | (2.61 | )%(c) | | | (2.15 | )% | | | (1.18 | )% | | | (1.35 | )% | | | (2.29 | )% | | | (2.79 | )% | |

| Portfolio Turnover Rate | | | 51 | %(b) | | | 45 | % | | | 64 | % | | | 55 | % | | | 69 | % | | | 64 | % | |

(a) In May 2006, the Adviser made a payment to the Aggressive Growth Fund which increased the total return by 0.08%.

(b) Not annualized for periods less than one year.

(c) Annualized for periods less than one year.

See accompanying notes to financial statements.

20

Semiannual Report 2009

Needham Small Cap Growth Fund

Financial Highlights

(For a Share Outstanding | | Six Months

Ended

June 30, | | Year Ended December 31, | |

| Throughout each Period) | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| | | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 7.61 | | | $ | 11.29 | | | $ | 14.32 | | | $ | 17.09 | | | $ | 18.53 | | | $ | 16.84 | | |

| Investment Operations | |

| Net Investment Loss | | | (0.09 | ) | | | (0.19 | ) | | | (0.26 | ) | | | (0.26 | ) | | | (0.31 | ) | | | (0.37 | ) | |

Net Realized and Unrealized Gains (Losses)

on Investments | | | 1.41 | | | | (2.49 | ) | | | (0.02 | ) | | | 1.61 | | | | 0.66 | | | | 2.11 | | |

| Total from Investment Operations | | | 1.32 | | | | (2.68 | ) | | | (0.28 | ) | | | 1.35 | | | | 0.35 | | | | 1.74 | | |

| Less Distributions | |

| Net Realized Gains | | | — | | | | (0.82 | ) | | | (2.75 | ) | | | (4.18 | ) | | | (1.79 | ) | | | (0.05 | ) | |

| Return of Capital | | | — | | | | (0.18 | ) | | | — | | | | — | | | | — | | | | — | | |

| Total Distributions | | | — | | | | (1.00 | ) | | | (2.75 | ) | | | (4.18 | ) | | | (1.79 | ) | | | (0.05 | ) | |

| Contribution by Adviser | | | — | | | | — | | | | — | | | | 0.06 | (a) | | | — | | | | — | | |

| Net Asset Value, End of Period | | $ | 8.93 | | | $ | 7.61 | | | $ | 11.29 | | | $ | 14.32 | | | $ | 17.09 | | | $ | 18.53 | | |

| Total Return | | | 17.35 | %(b) | | | (23.42 | )% | | | (2.01 | )% | | | 8.52 | %(a) | | | 2.01 | % | | | 10.34 | % | |

| Net Assets, End of Period (000's) | | $ | 9,001 | | | $ | 5,309 | | | $ | 7,726 | | | $ | 15,248 | | | $ | 18,789 | | | $ | 25,895 | | |

| Ratios/Supplemental Data | |

| Ratio of Net Expenses to Average Net Assets | | | 2.58 | %(c) | | | 2.51 | % | | | 2.50 | % | | | 2.36 | % | | | 2.44 | % | | | 2.52 | % | |

Ratio of Net Expenses to Average Net Assets

(excluding interest and dividend expense) | | | 2.50 | %(c) | | | 2.50 | % | | | 2.50 | % | | | 2.36 | % | | | 2.44 | % | | | 2.50 | % | |

Ratio of Net Expenses to Average Net Assets

(excluding waivers and reimbursement

of expenses) | | | 3.38 | %(c) | | | 3.57 | % | | | 2.64 | % | | | 2.36 | % | | | 2.58 | % | | | 2.63 | % | |

Ratio of Net Investment Loss to

Average Net Assets | | | (2.44 | )%(c) | | | (2.02 | )% | | | (1.54 | )% | | | (1.61 | )% | | | (1.64 | )% | | | (1.91 | )% | |

Ratio of Net Investment Loss to