| | | | | | | | | | | | | | Since | | Gross Expense | |

| | | | 6 Months(7) | | 1 Year | | 3 Years(8) | | 5 Years(8) | | 10 Years(8) | | Inception(8)(12) | | Ratio(14) | |

| | Needham Growth Fund(1) | 0.10% | | 26.06% | | -5.22%(9) | | 4.21%(10) | | 2.82%(11) | | 13.45%(13) | | 2.05% | |

| | S&P 500 Index(2)(3) | -6.65% | | 14.43% | | -9.81% | | -0.79% | | -1.59% | | 5.48% | | | |

| | NASDAQ Composite Index(2)(4) | -6.62% | | 16.04% | | -5.89% | | 1.38% | | -5.50% | | 5.49% | | | |

| | S&P 400 MidCap Index(2)(5) | -1.36% | | 24.93% | | -5.90% | | 2.21% | | 5.31% | | 9.91% | | | |

| | Russell 2000 Index(2)(6) | -1.95% | | 21.48% | | -8.60% | | 0.37% | | 3.00% | | 6.02% | | | |

| | | |

| | Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset | |

| | value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please | |

| | visit www.needhamfunds.com. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder | |

| | would have paid on Fund distributions or on the redemption of Fund shares. | |

| | 1. | Investment results calculated after reinvestment of dividends. | |

| | 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. | |

| | 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. | |

| | 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. | |

| | 5. | The S&P 400 MidCap Index is a broad unmanaged measure of the U.S. stock market. | |

| | 6. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. | |

| | 7. | Not annualized. | |

| | 8. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. | |

| | 9. | Cumulative return for the three year period was (14.85)%, assuming all dividends were reinvested in shares of the Fund. | |

| | 10. | Cumulative return for the five year period was 22.91%, assuming all dividends were reinvested in shares of the Fund. | |

| | 11. | Cumulative return for the ten year period was 32.07%, assuming all dividends were reinvested in shares of the Fund. | |

| | 12. | The inception date of the Fund was 1/1/96. | |

| | 13. | Cumulative return since inception was 523.00%, assuming all dividends were reinvested in shares of the Fund. | |

| | 14. | The above expense ratio is from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Funds’ expense ratios as of June 30, 2010 can be found in the | |

| | | financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on May 1, 2011. Without these | |

| | | fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total net fund operating expenses would be 2.03%. | | | |

| | Top Ten Holdings* | | | | | Sector Weightings* | |

| | (as a % of total investments, as of June 30, 2010) | | | | | (as a % of total investments, as of June 30, 2010) | |

| | | | | | | | | | | | | | | |

| | | | % of Total | | | | | Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| | | Security | | | Investments† | | | | Consumer Discretionary | 11.0% | | (0.7)% | | 10.3% | |

| | 1) Express Scripts, Inc. | ESRX | 9.63% | | | | Energy | 2.1% | | — | | 2.1% | |

| | 2) Thermo Fisher Scientific, Inc. | TMO | 5.02% | | | | Financials | 1.6% | | — | | 1.6% | |

| | 3) Viasat, Inc. | VSAT | 4.35% | | | | Health Care | 29.4% | | (0.2)% | | 29.2% | |

| | 4) CarMax, Inc. | KMX | 3.99% | | | | Industrials | 2.5% | | (1.1)% | | 1.4% | |

| | 5) Varian Medical Systems, Inc. | VAR | 3.96% | | | | Information Technology | 50.3% | | (1.2)% | | 49.1% | |

| | 6) Brooks Automation, Inc. | BRKS | 3.43% | | | | Materials | 1.0% | | (1.0)% | | 0% | |

| | 7) Becton Dickinson & Co. | BDX | 2.83% | | | | Cash | 6.3% | | — | | 6.3% | |

| | 8) Electro Scientific Industries, Inc. | ESIO | 2.58% | | | | * Current portfolio holdings may not be indicative of future portfolio | | | |

| | 9) Dick’s Sporting Goods, Inc. | DKS | 2.55% | | | | holdings. | |

| | 10) Parametric Technology Corp. | | | | | | (1) Percentage of total investments includes all stocks, plus cash minus all short | | | |

| | Top Ten Holdings = 40.78% of Total Investments† | | | | positions. | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | | | (2) Total represents the difference between the long exposure and the short | | | |

| | † Percentage of total investments less cash. | | | | exposure, which produces the net exposure. | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

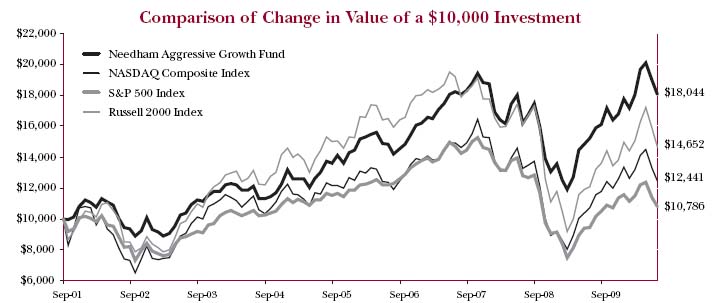

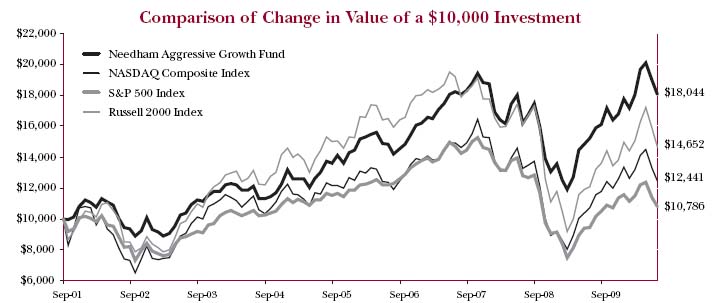

| NEEDHAM AGGRESSIVE GROWTH FUND (Unaudited) | TICKER: NEAGX |

Comparative Performance Statistics as of June 30, 2010

| | | | | | | | | | | | Since | | Gross Expense | |

| | | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | Inception(7)(10) | | Ratio(12) | |

| | Needham Aggressive Growth Fund(1) | 1.53% | | 18.63% | | -0.35%(8) | | 6.78%(9) | | 6.92%(11) | | 2.57% | |

| | S&P 500 Index(2)(3) | -6.65% | | 14.43% | | -9.81% | | -0.79% | | 0.86% | | | |

| | NASDAQ Composite Index(2)(4) | -6.62% | | 16.04% | | -5.89% | | 1.38% | | 2.50% | | | |

| | Russell 2000 Index(2)(5) | -1.95% | | 21.48% | | -8.60% | | 0.37% | | 4.43% | | | |

| | | |

| | Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset | |

| | value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please | |

| | visit www.needhamfunds.com. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder | |

| | would have paid on Fund distributions or on the redemption of Fund shares. | |

| | 1. | Investment results calculated after reinvestment of dividends. |

| | 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. | |

| | 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. | |

| | 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| | 5. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| | 6. | Not annualized. |

| | 7. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. | |

| | 8. | Cumulative return for the three year period was (1.03)%, assuming all dividends were reinvested in shares of the Fund. |

| | 9. | Cumulative return for the five year period was 38.81%, assuming all dividends were reinvested in shares of the Fund. |

| | 10. | The inception date of the Fund was 9/4/2001. |

| | 11. | Cumulative return since inception was 80.44%, assuming all dividends were reinvested in shares of the Fund. |

| | 12. | The above expense ratio is from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Funds’ expense ratios as of June 30, 2010 can be found in the financial highlights. Since inception, | |

| | | the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on May 1, 2011. Without these fee waivers, the performance would have been lower. Excluding the | |

| | | indirect costs of investing in acquired funds, total net fund operating expenses would be 2.50%. | |

| | Top Ten Holdings* | | | | | Sector Weightings* | | |

| | (as a % of total investments, as of June 30, 2010) | | | | | (as a % of total investments, as of June 30, 2010) | |

| | | | | | | | | | | | | | | |

| | | | % of Total | | | | | Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| | | Security | | | Investments† | | | | Consumer Discretionary | 7.3% | | (0.9)% | | 6.4% | |

| | 1) Apple, Inc. | AAPL | 3.36% | | | | Financials | 0.4% | | — | | 0.4% | |

| | 2) Express Scripts, Inc. | ESRX | 3.23% | | | | Health Care | 23.3% | | (0.7)% | | 22.6% | |

| | 3) Varian Medical Systems, Inc. | VAR | 3.19% | | | | Industrials | 5.2% | | (0.7)% | | 4.5% | |

| | 4) Entropic Communications, Inc. | ENTR | 3.03% | | | | Information Technology | 50.0% | | (1.8)% | | 48.2% | |

| | 5) Volcano Corp. | VOLC | 2.92% | | | | Materials | | | (0.4)% | | (0.4)% | |

| | 6) Netezza Corp. | NZ | 2.87% | | | | Cash | 18.3% | | — | | 18.3% | |

| | 7) Super Micro Computer, Inc. | SMCI | 2.84% | | | | | | | | | | | |

| | 8) hhgregg, Inc. | HGG | 2.67% | | | | * Current portfolio holdings may not be indicative of future portfolio | |

| | | | | | | | holdings. | | | | | | |

| | 10) Viasat, Inc. | VSAT | 2.49% | | | | (1) Percentage of total investments includes all stocks, plus cash minus all short | |

| | Top Ten Holdings = 29.22% of Total Investments† | | | | positions. | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | | | (2) Total represents the difference between the long exposure and the short | | |

| | † Percentage of total investments less cash. | | | | | | exposure, which produces the net exposure. | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

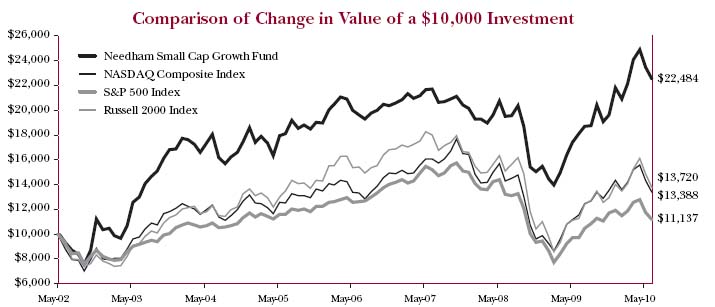

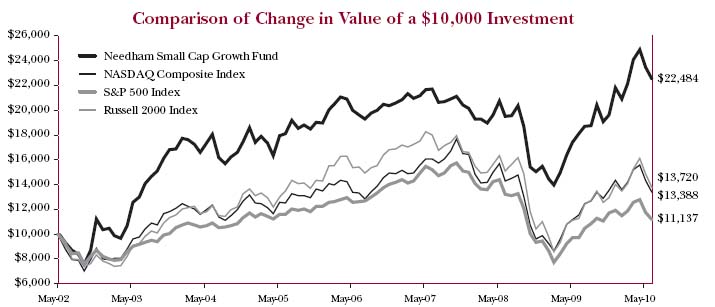

| NEEDHAM SMALL CAP GROWTH FUND (Unaudited) | TICKER: NESGX |

Comparative Performance Statistics as of June 30, 2010

| | | | | | | | |

| | | | | | | | | | | | Since | | Gross Expense | |

| | | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | Inception(7)(10) | | Ratio(12) | |

| | Needham Small Cap Growth Fund(1) | 3.17% | | 24.12% | | 1.20%(8) | | 4.47%(9) | | 10.51%(11) | | 2.64% | |

| | S&P 500 Index(2)(3) | -6.65% | | 14.43% | | -9.81% | | -0.79% | | 1.34% | | | |

| | NASDAQ Composite Index(2)(4) | -6.62% | | 16.04% | | -5.89% | | 1.38% | | 3.73% | | | |

| | Russell 2000 Index(2)(5) | -1.95% | | 21.48% | | -8.60% | | 0.37% | | 3.98% | | | |

| | | |

| | Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset | |

| | value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please | |

| | visit www.needhamfunds.com. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder | |

| | would have paid on Fund distributions or on the redemption of Fund shares. | |

| | 1. | Investment results calculated after reinvestment of dividends. | |

| | 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. | |

| | 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. | |

| | 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. | |

| | 5. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. | |

| | 6. | Not annualized. | |

| | 7. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. | |

| | 8. | Cumulative return for the three year period was (3.65)%, assuming all dividends were reinvested in shares of the Fund. | |

| | 9. | Cumulative return for the five year period was 24.42%, assuming all dividends were reinvested in shares of the Fund. | |

| | 10. | The inception date of the Fund was 5/22/02. | |

| | 11. | Cumulative return since inception was 124.84%, assuming all dividends were reinvested in shares of the Fund. | |

| | 12. | The above expense ratio is from the Funds’ prospectus dated May 1, 2010. Additional information pertaining to the Funds’ expense ratios as of June 30, 2010 can be found in the financial highlights. Since inception, | |

| | | the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on May 1, 2011. Without these fee waivers, the performance would have been lower. Excluding the | |

| | | indirect costs of investing in acquired funds, total net fund operating expenses would be 2.57%. | |

| | | Top Ten Holdings* | | | | | Sector Weightings* | |

| | | (as a % of total investments, as of June 30, 2010) | | | | | (as a % of total investments, as of June 30, 2010) | |

| | | | % of Total | | | | | | | | | | | | |

| | | | Security | | Investments† | | | | | Sector | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| | 1) MKS Instrument, Inc. | 3.33% | | | | Consumer Discretionary | 1.0% | | (0.9)% | | 0.1% | |

| | 2) Entropic Communications, Inc. | 3.01% | | | | Energy | 3.4% | | — | | 3.4% | |

| | | | | | | Financials | 0.3% | | — | | 0.3% | |

| | 4) ATMI, Inc. | 2.61% | | | | | | | | | | |

| | 5) Electronics for Imaging, Inc. | | | | | Industrials | 3.5% | | (0.2)% | | 3.3% | |

| | 6) Conmed Corp. | 2.49% | | | | | | | | | | |

| | | | | | | Cash | 23.2% | | — | | 23.2% | |

| | 8) Compellent Technologies, Inc. | 2.45% | | | | * Current portfolio holdings may not be indicative of future portfolio | | |

| | | | | | | holdings. | | | | | | |

| | 10) Super Micro Computer, Inc. | 2.40% | | | | (1) Percentage of total investments includes all stocks, plus cash minus all short | | |

| | Top Ten Holdings = 26.55% of Total Investments† | | | | | positions. | | | | | | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | | | | (2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure. | | |

| | † Percentage of total investments less cash. | | | | | | | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s Adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’).GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur transactional costs, including redemption fees and exchange fees, and ongoing costs, which include costs for portfolio management, administrative services, distribution (12b-1) fees, and shareholder reports, among others. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each fund and to compare these costs with those of investing in other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The expense example table below illustrates your fund’s cost in two ways:

| ● | Actual Expenses. This section helps you to estimate the actual account value and actual expenses after fee waivers that you paid over the period. The ‘‘Ending Account Value’’ shown is derived from the fund’s actual return, and ‘‘Expenses Paid During Period’’ shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled ‘‘Expenses Paid During Period’’. |

| ● | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your fund’s hypothetical account value and hypothetical expenses with those of other mutual funds. It assumes that the fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

For the Period January 1, 2010 to June 30, 2010

Expense Example Table

| | | | | Expenses | Expense |

| | | Beginning | Ending | Paid During | Ratio During |

| | | Account | Account | Period* | Period* |

| | | Value | Value | 1/1/10- | 1/1/10- |

| | | 1/1/10 | 6/30/10 | 6/30/10 | 6/30/10 |

| Needham Growth Fund | | | | |

| Actual Expenses | $1,000.00 | $1,001.00 | $ 9.92 | 2.00% |

| Hypothetical Example for Comparison Purposes | | | | |

| | (5% return before expenses) | $1,000.00 | $1,014.88 | $ 9.99 | 2.00% |

| | | | | | |

| Needham Aggressive Growth Fund | | | | |

| Actual Expenses | $1,000.00 | $1,015.30 | $11.09 | 2.22% |

| Hypothetical Example for Comparison Purposes | | | | |

| | (5% return before expenses) | $1,000.00 | $1,013.79 | $11.08 | 2.22% |

| | | | | | |

| Needham Small Cap Growth Fund | | | | |

| Actual Expenses | $1,000.00 | $1,031.70 | $12.59 | 2.50% |

| Hypothetical Example for Comparison Purposes | | | | |

| | (5% return before expenses) | $1,000.00 | $1,012.40 | $12.47 | 2.50% |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio of 2.00%, 2.22% and 2.50%. respectively, multiplied by 181/365 (to reflect the one-half year period). |

| Needham Growth Fund | | | | |

| Schedule of Investments | | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Common Stocks (92.5%) | | | | |

| Aerospace & Defense (1.8%) | | | | |

| Honeywell International, Inc. | 20,000 | | $ | 780,600 |

| Sypris Solutions, Inc.* | 356,200 | | | 1,428,362 |

| | | | | 2,208,962 |

| Biotechnology (0.7%) | | | | |

| Gilead Sciences, Inc.* | 25,000 | | | 857,000 |

| | | | | |

| Capital Markets (1.5%) | | | | |

| Financial Engines, Inc.* | 50,000 | | | 680,000 |

| Morgan Stanley | 50,000 | | | 1,160,500 |

| | | | | 1,840,500 |

| Chemicals (0.9%) | | | | |

| Southwall Technologies, Inc.*† | 728,000 | | | 1,142,960 |

| | | | | |

| Communications Equipment (7.1%) | | | | |

| Anaren, Inc.* | 12,500 | | | 186,750 |

| EMS Technologies, Inc.* | 124,800 | | | 1,874,496 |

| Emulex Corp.* | 50,000 | | | 459,000 |

| Oclaro, Inc.* | 105,000 | | | 1,164,450 |

| Viasat, Inc.* | 150,000 | | | 4,884,000 |

| | | | | 8,568,696 |

| Computers & Peripherals (10.5%) | | | | |

| 3PAR, Inc.* | 26,775 | | | 249,275 |

| Compellent Technologies, Inc.* | 140,000 | | | 1,696,800 |

| Electronics for Imaging, Inc.* | 160,000 | | | 1,560,000 |

| Immersion Corp.* | 300,000 | | | 1,518,000 |

| Netezza Corp.* | 175,000 | | | 2,394,000 |

| Seagate Technology* | 200,000 | | | 2,608,000 |

| Super Micro Computer, Inc.* | 200,000 | | | 2,700,000 |

| | | | | 12,726,075 |

| Electronic Equipment, Instruments & Components (8.7%) |

| Electro Scientific Industries, Inc.* | 217,000 | | | 2,899,120 |

| ICx Technologies, Inc.* | 150,000 | | | 1,095,000 |

| IPG Photonics Corp.* | 60,000 | | | 913,800 |

| Jabil Circuit, Inc. | 150,000 | | | 1,995,000 |

| Newport Corp.* | 185,000 | | | 1,676,100 |

| Orbotech, Ltd.* | 110,000 | | | 1,190,200 |

| Vishay Intertechnology, Inc.*† | 100,000 | | | 774,000 |

| | | | | 10,543,220 |

| Energy Equipment & Services (0.5%) | | | | |

| Schlumberger, Ltd. | 10,000 | | | 553,400 |

| | | | | |

| Health Care Equipment & Supplies (12.4%) | | | |

| Becton Dickinson & Co. | 47,000 | | | 3,178,140 |

| Conmed Corp.* | 100,000 | | | 1,863,000 |

| Covidien PLC | 43,750 | | | 1,757,875 |

| Hansen Medical, Inc.* | 246,775 | | | 525,631 |

Palomar Medical Technologies, Inc.* | 60,000 | | | 671,400 |

| Health Care Equipment & Supplies - Continued | | | |

| TomoTherapy, Inc.* | 300,000 | | | 954,000 |

| Varian Medical Systems, Inc.* | 85,000 | | | 4,443,800 |

| Volcano Corporation* | 75,000 | | | 1,636,500 |

| | | | | 15,030,346 |

| Health Care Providers & Services (8.9%) | | | | |

| Express Scripts, Inc.* | 230,000 | | | 10,814,600 |

| | | | | |

| Health Care Technology (1.1%) | | | | |

| Eclipsys Corp.* | 77,900 | | | 1,389,736 |

| | | | | |

| Hotels, Restaurants & Leisure (0.9%) | | | | |

| Morton’s Restaurant Group, Inc.* | 222,200 | | | 1,150,996 |

| | | | | |

| Internet Software & Services (1.6%) | | | | |

| QuinStreet, Inc.* | 125,000 | | | 1,438,750 |

| Soundbite Communications, Inc.* | 170,700 | | | 490,763 |

| | | | | 1,929,513 |

| IT Services (1.4%) | | | | |

| SAIC, Inc.* | 100,000 | | | 1,674,000 |

| | | | | |

| Life Sciences Tools & Services (4.6%) | | | | |

| Thermo Fisher Scientific, Inc.* | 115,000 | | | 5,640,750 |

| | | | | |

| Media (1.1%) | | | | |

| Comcast Corp. | 75,000 | | | 1,302,750 |

| | | | | |

| Oil, Gas & Consumable Fuels (1.6%) | | | | |

| Chesapeake Energy Corp. | 90,000 | | | 1,885,500 |

| | | | | |

| Professional Services (0.6%) | | | | |

| Resources Connection, Inc.* | 50,000 | | | 680,000 |

| | | | | |

| Semiconductors & Semiconductor Equipment (13.4%) | |

| Advanced Analogic Technologies | | | | |

| Co.* | 100,000 | | | 319,000 |

| Anadigics, Inc.* | 210,000 | | | 915,600 |

| Brooks Automation, Inc.* | 498,512 | | | 3,853,497 |

| Entegris, Inc.* | 200,000 | | | 794,000 |

| Entropic Communications, Inc.* | 300,000 | | | 1,902,000 |

| Formfactor, Inc.* | 62,500 | | | 675,000 |

| Ikanos Communications* | 100,000 | | | 161,000 |

| Lattice Semiconductor Corp.* | 200,000 | | | 868,000 |

| Mattson Technology, Inc.* | 19,950 | | | 75,611 |

| MIPS Technologies, Inc.* | 150,000 | | | 766,500 |

| MKS Instrument, Inc.* | 100,000 | | | 1,872,000 |

| National Semiconductor Corp. | 100,000 | | | 1,346,000 |

| Nova Measuring Instruments, Ltd.* | 200,000 | | | 834,000 |

| PDF Solutions, Inc.* | 242,600 | | | 1,164,480 |

| TriQuint Semiconductor, Inc.*† | 125,000 | | | 763,750 |

| | | | | 16,310,438 |

See accompanying notes to financial statements.

| Needham Growth Fund | | | | |

| Schedule of Investments (Continued) | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Common Stocks - Continued | | | | |

| Software (4.8%) | | | | |

| Actuate Corp.*† | 500,000 | | $ | 2,225,000 |

| Aspen Technology, Inc.* | 75,000 | | | 816,750 |

| BroadSoft, Inc.* | 10,543 | | | 90,143 |

| Parametric Technology Corp.* | 175,000 | | | 2,742,250 |

| | | | | 5,874,143 |

| Specialty Retail (6.8%) | | | | |

| CarMax, Inc.* | 225,000 | | | 4,477,500 |

| Dick’s Sporting Goods, Inc.*† | 115,000 | | | 2,862,350 |

| hhgregg, Inc.* | 40,000 | | | 932,800 |

| | | | | 8,272,650 |

| Textiles, Apparel & Luxury Goods (1.6%) | | | |

| Luxottica Group SpA - ADR | 80,000 | | | 1,927,200 |

| Total Common Stocks | | | | |

| (Cost $96,157,889) | | | | 112,323,435 |

| | | | | |

| Short-Term Investment (6.0%) | | | | |

| Money Market Fund (6.0%) | | | | |

| Dreyfus Treasury Prime Cash | | | | |

| Management, 0.00% (a) | | | | |

| (Cost $7,273,376) | 7,273,376 | | $ | 7,273,376 |

| | | | | |

| Total Investments (98.5%) | | | | |

| (Cost $103,431,265) | | | | 119,596,811 |

| Total Securities Sold Short (-4.0%) | | | | |

| (Proceeds $5,115,936) | | | | (4,878,798) |

| Other Assets in Excess of Liabilities | | | | |

| (5.5%) | | | | 6,681,683 |

| Net Assets (100.0%) | | | $ | 121,399,696 |

| (a) | Rate shown is the seven day yield as of June 30, 2010. |

| * | Non-income producing security. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $4,160,189. |

| ADR | American Depositary Receipt. |

| SpA | Societa per Azioni (Italian corporation) |

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’).GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| Needham Growth Fund | | | | |

| Schedule of Securities Sold Short | | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Securities Sold Short (-4.0%) | | | | |

| | | | | |

| Airlines (-0.9%) | | | | |

| Allegiant Travel Co.* | 25,000 | | $ | 1,067,250 |

| | | | | |

| Auto Components (-0.1%) | | | | |

| Drew Industries, Inc.* | 6,725 | | | 135,845 |

| | | | | |

| Chemicals (-0.9%) | | | | |

| Balchem Corp. | 45,000 | | | 1,125,000 |

| | | | | |

| Electronic Equipment, Instruments & | | | | |

| Components (-0.2%) | | | | |

| DTS, Inc.* | 7,500 | | | 246,525 |

| | | | | |

| Health Care Technology (-0.2%) | | | | |

| Computer Programs & Systems, Inc. | 7,000 | | | 286,440 |

| | | | | |

| Professional Services (-0.3%) | | | | |

| Advisory Board Co.* | 7,175 | | | 308,238 |

| | | | | |

| Semiconductors & Semiconductor | | | | |

| Equipment (-0.2%) | | | | |

| Spreadtrum Communications, | | | | |

| Inc. - ADR* | 25,000 | | | 206,000 |

| | | | | |

| Software (-1.0%) | | | | |

| Ansys, Inc.* | 30,000 | | | 1,217,100 |

| | | | | |

| Specialty Retail (-0.2%) | | | | |

| Aeropostale* | 10,000 | | | 286,400 |

| | | | | |

| Total Securities Sold Short | | | | |

| (Proceeds $5,115,936) | | | | 4,878,798 |

| | | | | |

| Total Securities Sold Short (-4.0%) | | | | (4,878,798) |

| | | | | |

| Total Investments (98.5%) | | | | 119,596,811 |

| | | | | |

| Other Assets in Excess of Liabilities | | | | |

| (5.5%) | | | | 6,681,683 |

| Net Assets (100.0%) | | | $ | 121,399,696 |

| * | Non-income producing security. |

| ADR | American Depositary Receipt. |

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| Needham Aggressive Growth Fund | | | |

| Schedule of Investments | | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Common Stocks (83.5%) | | | | |

| Aerospace & Defense (1.8%) | | | | |

| Precision Castparts Corp. | 5,500 | | $ | 566,060 |

| | | | | |

| Biotechnology (2.2%) | | | | |

| Gilead Sciences, Inc.* | 20,000 | | | 685,600 |

| | | | | |

| Capital Markets (0.4%) | | | | |

| Financial Engines, Inc.* | 10,000 | | | 136,000 |

| | | | | |

| Commercial Services & Supplies (2.4%) | | | | |

| Iron Mountain, Inc. | 28,000 | | | 628,880 |

| Ritchie Bros Auctioneers | 6,000 | | | 109,320 |

| | | | | 738,200 |

| | | | | |

| Communications Equipment (5.9%) | | | | |

| Anaren, Inc.* | 5,000 | | | 74,700 |

| Emulex Corp.* | 35,000 | | | 321,300 |

| Oclaro, Inc.* | 52,500 | | | 582,225 |

| Powerwave Technologies, Inc.* | 145,000 | | | 223,300 |

| Viasat, Inc.* | 20,000 | | | 651,200 |

| | | | | 1,852,725 |

| Computers & Peripherals (13.6%) | | | | |

| 3PAR, Inc.* | 11,425 | | | 106,366 |

| Apple, Inc.* | 3,500 | | | 880,355 |

| Compellent Technologies, Inc.* | 50,000 | | | 606,000 |

| Electronics for Imaging, Inc.* | 60,000 | | | 585,000 |

| Immersion Corp.* | 100,000 | | | 506,000 |

| Netezza Corp.* | 55,000 | | | 752,400 |

| Seagate Technology* | 7,500 | | | 97,800 |

| Super Micro Computer, Inc.* | 55,000 | | | 742,500 |

| | | | | 4,276,421 |

| Electronic Equipment, Instruments & Components (5.7%) |

| Electro Scientific Industries, Inc.* | 10,000 | | | 133,600 |

| ICx Technologies, Inc.* | 35,000 | | | 255,500 |

| IPG Photonics Corp.* | 6,660 | | | 101,432 |

| Jabil Circuit, Inc. | 37,500 | | | 498,750 |

| LeCroy Corp.* | 30,000 | | | 143,700 |

| Trimble Navigation, Ltd.* | 17,500 | | | 490,000 |

| Vishay Intertechnology, Inc.*† | 20,000 | | | 154,800 |

| | | | | 1,777,782 |

| Health Care Equipment & Supplies (12.7%) | | | |

| Becton Dickinson & Co. | 8,000 | | | 540,960 |

| Gen-Probe, Inc.* | 10,000 | | | 454,200 |

| Hansen Medical, Inc.* | 11,100 | | | 23,643 |

| LeMaitre Vascular, Inc.* | 53,480 | | | 299,488 |

| NuVasive, Inc.* | 11,500 | | | 407,790 |

| Palomar Medical Technologies, | | | | |

| Inc.* | 25,000 | | | 279,750 |

| Solta Medical, Inc.*† | 163,279 | | | 310,230 |

| Health Care Equipment & Supplies - Continued | | | |

| TomoTherapy, Inc.*† | 20,000 | | | 63,600 |

| Varian Medical Systems, Inc.* | 16,000 | | | 836,480 |

| Volcano Corp. * | 35,000 | | | 763,700 |

| | | | | 3,979,841 |

| Health Care Providers & Services (4.3%) | | | | |

| Alliance Healthcare Services, Inc.* | 55,000 | | | 222,200 |

| Express Scripts, Inc.* | 18,000 | | | 846,360 |

| Gentiva Health Services, Inc.* | 10,000 | | | 270,100 |

| | | | | 1,338,660 |

| Health Care Technology (2.6%) | | | | |

| Eclipsys Corp.* | 20,530 | | | 366,255 |

| Omnicell, Inc.* | 24,200 | | | 282,898 |

| Phase Forward, Inc.* | 10,000 | | | 166,800 |

| | | | | 815,953 |

| Hotels, Restaurants & Leisure (1.0%) | | | | |

| Morton’s Restaurant Group, Inc.* | 61,800 | | | 320,124 |

| | | | | |

| Internet Software & Services (1.7%) | | | | |

| QuinStreet, Inc.* | 25,000 | | | 287,750 |

| Soundbite Communications, Inc.* | 85,300 | | | 245,238 |

| | | | | 532,988 |

| Pharmaceuticals (0.8%) | | | | |

| ISTA Pharmaceuticals, Inc.* | 112,500 | | | 246,375 |

| | | | | |

| Professional Services (0.9%) | | | | |

| Resources Connection, Inc.* | 21,250 | | | 289,000 |

| | | | | |

| Semiconductors & Semiconductor Equipment (17.1%) | |

| Advanced Analogic Technologies, | | | | |

| Inc.* | 50,000 | | | 159,500 |

| Anadigics, Inc.*† | 117,500 | | | 512,300 |

| Brooks Automation, Inc.* | 55,000 | | | 425,150 |

| Entegris, Inc.* | 100,000 | | | 397,000 |

| Entropic Communications, Inc.* | 125,000 | | | 792,499 |

| Fairchild Semiconductor | | | | |

| International, Inc.* | 10,000 | | | 84,100 |

| Formfactor, Inc.* | 25,000 | | | 270,000 |

| Ikanos Communications* | 125,000 | | | 201,250 |

| Lattice Semiconductor Corp.* | 110,000 | | | 477,400 |

| Linear Technology Corp. | 2,500 | | | 69,525 |

| MIPS Technologies, Inc.* | 85,000 | | | 434,350 |

| MKS Instrument, Inc.* | 6,000 | | | 112,320 |

| Nova Measuring Instruments, Ltd.* | 90,000 | | | 375,300 |

| PDF Solutions, Inc.* | 125,600 | | | 602,881 |

| Supertex, Inc.* | 5,000 | | | 123,300 |

| Triquint Semiconductor, Inc.*† | 55,000 | | | 336,050 |

| | | | | 5,372,925 |

See accompanying notes to financial statements.

| Needham Aggressive Growth Fund | | | |

| Schedule of Investments (Continued) | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Common Stocks - Continued | | | | |

| Software (4.4%) | | | | |

| Actuate Corp.*† | 120,000 | | $ | 534,000 |

| Bottomline Technologies, Inc.* | 30,000 | | | 390,900 |

| BroadSoft, Inc.* | 2,688 | | | 22,982 |

| Parametric Technology Corp.* | 27,000 | | | 423,090 |

| | | | | 1,370,972 |

| Specialty Retail (5.2%) | | | | |

| CarMax, Inc.* | 22,500 | | | 447,750 |

| Dick’s Sporting Goods, Inc.*† | 20,000 | | | 497,800 |

| hhgregg, Inc.* | 30,000 | | | 699,600 |

| | | | | 1,645,150 |

| Textiles, Apparel & Luxury Goods (0.8%) | | | |

| Luxottica Group SpA - ADR | 10,000 | | | 240,900 |

| Total Common Stocks | | | | |

| (Cost $22,286,735) | | | | 26,185,676 |

| | | | | |

| Short-Term Investment (17.7%) | | | | |

| Money Market Fund (17.7%) | | | | |

| Dreyfus Treasury Prime Cash | | | | |

| Management, 0.00% (a) | | | | |

| (Cost $5,567,723) | 5,567,723 | | $ | 5,567,723 |

| | | | | |

| Total Investments (101.2%) | | | | |

| (Cost $27,854,458) | | | | 31,753,399 |

| Total Securities Sold Short (-4.3%) | | | | |

| (Proceeds $1,398,112) | | | | (1,364,254) |

| Other Assets in | | | | |

| Excess of Liabilities (3.1%) | | | | 989,366 |

| Net Assets (100.0%) | | | $ | 31,378,511 |

| (a) | Rate shown is the seven day yield as of June 30, 2010. |

* | Non-income producing security. |

† | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $1,944,738. |

| ADR | American Depositary Receipt. |

| SpA | Societa per Azioni (Italian corporation) |

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’).GICS is a service mark of MSCI and S&P and has been licens ed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| Needham Aggressive Growth Fund | | | |

| Schedule of Securities Sold Short | | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Securities Sold Short (-4.3%) | | | | |

| Airlines (-0.5%) | | | | |

| Allegiant Travel Co.* | 3,500 | | $ | 149,415 |

| | | | | |

| Auto Components (-0.2%) | | | | |

| Drew Industries, Inc.* | 2,700 | | | 54,540 |

| | | | | |

| Chemicals (-0.4%) | | | | |

| Balchem Corp. | 4,500 | | | 112,500 |

| | | | | |

| Electronic Equipment, Instruments & Components (-0.2%) |

| DTS, Inc.* | 2,500 | | | 82,175 |

| | | | | |

| Health Care Technology (-0.6%) | | | | |

| Computer Programs & Sys, Inc. | 5,000 | | | 204,600 |

| | | | | |

| Professional Services (-0.3%) | | | | |

| Advisory Board Co.* | 2,400 | | | 103,104 |

| | | | | |

| Semiconductors & Semiconductor Equipment (-0.5%) | |

| KLA-Tencor Corp. | 1,500 | | | 41,820 |

| Spreadtrum Communications, | | | | |

| Inc. - ADR* | 12,500 | | | 103,000 |

| | | | | 144,820 |

| Software (-1.3%) | | | | |

| Ansys, Inc.* | 10,000 | | | 405,700 |

| | | | | |

| Specialty Retail (-0.3%) | | | | |

| Aeropostale, Inc.* | 3,750 | | | 107,400 |

| | | | | |

| Total Securities Sold Short | | | | |

| (Proceeds $1,398,112) | | | | 1,364,254 |

| Total Securities Sold Short (-4.3%) | | | | (1,364,254) |

| Total Investments (101.2%) | | | | 31,753,399 |

| | | | | |

| Other Assets in | | | | |

| Excess of Liabilities (3.1%) | | | | 989,366 |

| Net Assets (100.0%) | | | $ | 31,378,511 |

| * | Non-income producing security. |

| ADR | American Depositary Receipt. |

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’). GICS is a service mark of MSCI and S&P and has been licen sed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| Needham Small Cap Growth Fund | | | |

| Schedule of Investments | | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Common Stocks (78.8%) | | | | |

| Aerospace & Defense (1.8%) | | | | |

| Applied Signal Technology, Inc. | 20,000 | | $ | 393,000 |

| Capital Markets (0.3%) | | | | |

| Financial Engines, Inc.* | 5,000 | | | 68,000 |

| Communications Equipment (3.9%) | | | | |

| Anaren, Inc.* | 7,500 | | | 112,050 |

| Aruba Networks, Inc.* | 5,000 | | | 71,200 |

| EMS Technologies, Inc.* | 17,500 | | | 262,850 |

| Emulex Corp.* | 25,000 | | | 229,500 |

| Viasat, Inc.* | 5,000 | | | 162,800 |

| | | | | 838,400 |

| Computers & Peripherals (10.9%) | | | | |

| 3PAR, Inc.* | 10,700 | | | 99,617 |

| Compellent Technologies, Inc.* | 34,000 | | | 412,080 |

| Electronics for Imaging, Inc.* | 45,000 | | | 438,750 |

| Immersion Corp.* | 60,000 | | | 303,600 |

| Netezza Corp.* | 30,000 | | | 410,400 |

| Seagate Technology* | 20,000 | | | 260,800 |

| Super Micro Computer, Inc.* | 30,000 | | | 405,000 |

| | | | | 2,330,247 |

| Electronic Equipment, Instruments & Components (8.9%) |

| Cognex Corp. | 10,000 | | | 175,800 |

| Cyberoptics Corp.* | 15,000 | | | 145,050 |

| Electro Scientific Industries, Inc.* | 28,650 | | | 382,764 |

| ICx Technologies, Inc.* | 45,000 | | | 328,500 |

| IPG Photonics Corp.* | 25,000 | | | 380,750 |

| Newport Corp.*† | 35,000 | | | 317,100 |

| X-Rite, Inc.*† | 50,000 | | | 184,500 |

| | | | | 1,914,464 |

| Energy Equipment & Services (0.3%) | | | | |

| CE Franklin, Ltd.* | 10,200 | | | 65,586 |

| Health Care Equipment & Supplies (10.2%) | | | |

| Conmed Corp.* | 22,500 | | | 419,175 |

| Hansen Medical, Inc.* | 117,299 | | | 249,847 |

| NuVasive, Inc.* | 10,000 | | | 354,600 |

| Palomar Medical Technologies, | | | | |

| Inc.*† | 25,000 | | | 279,750 |

| Solta Medical, Inc.*† | 125,000 | | | 237,500 |

| TomoTherapy, Inc.*† | 90,000 | | | 286,200 |

| Varian Medical Systems, Inc.* | 2,500 | | | 130,700 |

| Volcano Corporation* | 10,000 | | | 218,200 |

| | | | | 2,175,972 |

| Health Care Providers & Services (2.5%) | | | | |

| Alliance Healthcare Services, | | | | |

| Inc.*† | 40,000 | | | 161,600 |

| Express Scripts, Inc.* | 8,000 | | | 376,160 |

| | | | | 537,760 |

| Health Care Technology (6.3%) | | | | |

| Allscript-Misys Healtcare Solutions, | | | | |

| Inc..* | 22,500 | | | 362,250 |

| athenahealth, Inc.* | 10,000 | | | 261,300 |

| Eclipsys Corp.* | 15,000 | | | 267,600 |

| Omnicell, Inc.* | 10,000 | | | 116,900 |

| Phase Forward, Inc.*† | 20,000 | | | 333,600 |

| | | | | 1,341,650 |

| Internet Software & Services (3.1%) | | | | |

| QuinStreet, Inc.* | 40,000 | | | 460,400 |

| Soundbite Communications, Inc.*† | 68,300 | | | 196,363 |

| | | | | 656,763 |

| IT Services (0.9%) | | | | |

| Euronet Worldwide, Inc.* | 15,000 | | | 191,850 |

| Oil, Gas & Consumable Fuels (3.1%) | | | | |

| ATP Oil & Gas Corp.* | 20,000 | | | 211,800 |

| BPZ Resources, Inc.* | 60,000 | | | 249,000 |

| Carrizo Oil & Gas, Inc.* | 10,000 | | | 155,300 |

| Compton Petroleum Corp.* | 75,000 | | | 42,000 |

| | | | | 658,100 |

| Professional Services (1.6%) | | | | |

| Resources Connection, Inc.* | 25,000 | | | 340,000 |

| Semiconductors & Semiconductor Equipment (21.7%) | |

| Anadigics, Inc.*† | 70,000 | | | 305,200 |

| ATMI, Inc.*† | 30,000 | | �� | 439,200 |

| Brooks Automation, Inc.*† | 45,000 | | | 347,850 |

| Entegris, Inc.*† | 60,000 | | | 238,200 |

| Entropic Communications, Inc.* | 80,000 | | | 507,200 |

| Ikanos Communications* | 100,000 | | | 161,000 |

| Lattice Semiconductor Corp.* | 60,000 | | | 260,400 |

| Mattson Technology, Inc.*† | 50,000 | | | 189,500 |

| MKS Instrument, Inc.*† | 30,000 | | | 561,599 |

| Nova Measuring Instruments, Ltd.* | 65,000 | | | 271,050 |

| PDF Solutions, Inc.*† | 60,000 | | | 288,000 |

| PLX Technology, Inc.*† | 100,000 | | | 419,000 |

| Supertex, Inc.* | 5,000 | | | 123,300 |

| Tessera Technologies, Inc.* | 20,000 | | | 321,000 |

| Triquint Semiconductor, Inc.* | 35,000 | | | 213,850 |

| | | | | 4,646,349 |

| Software (2.3%) | | | | |

| Aspen Technology, Inc.*† | 12,500 | | | 136,125 |

| BroadSoft, Inc.* | 1,769 | | | 15,125 |

| Callidus Software, Inc.* | 100,000 | | | 331,000 |

| | | | | 482,250 |

| Specialty Retail (0.5%) | | | | |

| CarMax, Inc.* | 5,000 | | | 99,500 |

See accompanying notes to financial statements.

| Needham Small Cap Growth Fund | | | |

| Schedule of Investments (Continued) | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Common Stocks - Continued | | | | |

| Textiles, Apparel & Luxury Goods (0.5%) | | | |

| True Religion Apparel, Inc.* | 5,000 | | $ | 110,350 |

| | | | | |

| Total Common Stocks | | | | |

| (Cost $15,310,545) | | | | 16,850,241 |

| | | | | |

| Short-Term Investment (23.0%) | | | | |

| Money Market Fund (23.0%) | | | | |

| Dreyfus Treasury Prime Cash | | | | |

| Management, 0.00% (a) | | | | |

| (Cost $4,915,990) | 4,915,990 | | $ | 4,915,990 |

| | | | | |

| Total Investments (101.8%) | | | | |

| (Cost $20,226,535) | | | | 21,766,231 |

| Total Securities Sold Short (-2.6%) | | | | |

| (Proceeds $560,611) | | | | (548,942) |

| Other Assets in | | | | |

| Excess of Liabilities (0.8%) | | | | 157,615 |

| Net Assets (100.0%) | | | $ | 21,374,904 |

| (a) | Rate shown is the seven day yield as of June 30, 2010. |

| * | Non-income producing security. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $3,078,049. |

| ADR | American Depositary Receipt. |

| SpA | Societa per Azioni (Italian corporation) |

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘‘S&P’’). GI CS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| Needham Small Cap Growth Fund | | | |

| Schedule of Securities Sold Short | | | | |

| June 30, 2010 (Unaudited) | | | | |

| | Shares | | | Value |

| | | | | |

| Securities Sold Short (-2.6%) | | | | |

| | | | | |

| Auto Components (-0.2%) | | | | |

| Drew Industries, Inc.* | 2,005 | | $ | 40,501 |

| | | | | |

| Electronic Equipment, Instruments & | | | | |

| Components (-0.3%) | | | | |

| DTS, Inc.* | 2,000 | | | 65,740 |

| | | | | |

| Professional Services (-0.3%) | | | | |

| Advisory Board Co.* | 1,426 | | | 61,261 |

| | | | | |

| Semiconductors & Semiconductor | | | | |

| Equipment (-0.6%) | | | | |

| Cavium Networks, Inc.* | 2,500 | | | 65,475 |

| Spreadtrum Communications, | | | | |

| Inc. - ADR* | 7,500 | | | 61,800 |

| | | | | 127,275 |

| | | | | |

| Software (-0.9%) | | | | |

| ANSYS, Inc.* | 4,500 | | | 182,565 |

| | | | | |

| Specialty Retail (-0.3%) | | | | |

| Aeropostale* | 2,500 | | | 71,600 |

| | | | | |

| Total Securities Sold Short | | | | |

| (Proceeds $560,611) | | | | 548,942 |

| | | | | |

| Total Securities Sold Short (-2.6%) | | | | (548,942) |

| | | | | |

| Total Investments (101.8%) | | | | 21,766,231 |

| | | | | |

| Other Assets in | | | | |

| Excess of Liabilities (0.8%) | | | | 157,615 |

| Net Assets (100.0%) | | | $ | 21,374,904 |

| * | Non-income producing security. |

| ADR | American Depositary Receipt. |

The Global Industry Classification Standard (GICS3) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (‘ ;‘S&P’’). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| Statements of Assets and Liabilities | | | | | | | | |

| June 30, 2010 (Unaudited) | | | | | | | | |

| | | | | | Needham | | | Needham |

| | | Needham | | | Aggressive | | | Small Cap |

| | | Growth Fund | | | Growth Fund | | | Growth Fund |

| Assets | | | | | | | | |

| Investments, at Value | | | | | | | | |

| (Cost $103,431,265, $27,854,458, $20,226,535) | $ | 119,596,811 | | $ | 31,753,399 | | $ | 21,766,231 |

| Cash | | 173,241 | | | 82,816 | | | — |

| Receivables: | | | | | | | | |

| Deposit with Broker for Securities Sold Short | | 4,876,961 | | | 979,941 | | | 398,869 |

| Dividends and Interest | | 16,850 | | | 1,750 | | | — |

| Fund Shares Sold | | — | | | 11,319 | | | — |

| Investment Securities Sold | | 2,530,012 | | | 492,618 | | | 768,053 |

| Prepaid Expenses | | 51,894 | | | 17,535 | | | 22,798 |

| Total Assets | | 127,245,769 | | | 33,339,378 | | | 22,955,951 |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Securities Sold Short, at Value | | | | | | | | |

| (Proceeds $5,115,936, $1,398,112, $560,611) | | 4,878,798 | | | 1,364,254 | | | 548,942 |

| Payables: | | | | | | | | |

| Investment Securities Purchased | | 453,184 | | | 517,423 | | | 801,509 |

| Fund Shares Redeemed | | 279,152 | | | — | | | 169,082 |

| Due to Adviser | | 128,267 | | | 33,142 | | | 21,809 |

| Distribution Fees | | 25,653 | | | 6,628 | | | 4,362 |

| Administration and Accounting Fees | | 8,813 | | | 2,985 | | | 2,320 |

| Transfer Agent Fees | | 24,360 | | | 7,320 | | | 6,340 |

| Directors’ Fees | | 12,890 | | | 2,610 | | | 1,500 |

| Accrued Expenses and Other Liabilities | | 34,956 | | | 26,505 | | | 25,183 |

| Total Liabilities | | 5,846,073 | | | 1,960,867 | | | 1,581,047 |

| | | | | | | | | |

| Net Assets | $ | 121,399,696 | | $ | 31,378,511 | | $ | 21,374,904 |

| Shares Issued and Outstanding $0.001 Par Value | | | | | | | | |

| (Authorized 800,000,000, 100,000,000 and 100,000,000 respectively) | | 4,073,722 | | | 2,495,679 | | | 1,930,409 |

Net Asset Value, Offering and Redemption Price Per Share(a) | $ | 29.80 | | $ | 12.57 | | $ | 11.07 |

| | | | | | | | | |

| Components of Net Assets | | | | | | | | |

| Paid-in Capital | | 106,984,989 | | | 27,073,486 | | | 18,535,362 |

| Accumulated Net Investment Loss | | (1,133,446) | | | (245,743) | | | (205,298) |

| Accumulated Net Realized Gain (Loss) from Investments, Securities Sold | | | | | | | | |

| Short, Foreign Currency Transactions and Written Options | | (854,531) | | | 617,969 | | | 1,493,475 |

| Net Unrealized Appreciation on Investment Securities and Securities Sold | | | | | | | | |

| Short | | 16,402,684 | | | 3,932,799 | | | 1,551,365 |

| Total Net Assets | $ | 121,399,696 | | $ | 31,378,511 | | $ | 21,374,904 |

| (a) | Subject to certain exceptions, a 2% redemption fee is imposed upon shares redeemed within 60 days of their purchase. See Note 2 to the financial statements. |

See accompanying notes to financial statements.

| Statements of Operations | | | | | | | | |

| For the Six Months Ended June 30, 2010 (Unaudited) | | | | | | | | |

| | | | | | | | | |

| | | | | | Needham | | | Needham |

| | | Needham | | | Aggressive | | | Small Cap |

| | | Growth Fund | | | Growth Fund | | | Growth Fund |

| Investment Income | | | | | | | | |

| Dividends | $ | 165,769 | | $ | 68,796 | | $ | 1,209 |

| Interest | | 616 | | | — | | | 4 |

| Less: Foreign Taxes Withheld | | (10,810) | | | (1,335) | | | — |

| Total Investment Income | | 155,575 | | | 67,461 | | | 1,213 |

| | | | | | | | | |

| | | | | | | | | |

| Expenses | | | | | | | | |

| Investment Advisory Fees | | 806,564 | | | 175,666 | | | 102,815 |

| Distribution Fees | | 161,312 | | | 35,133 | | | 20,563 |

| Administration and Accounting Fees | | 47,301 | | | 13,540 | | | 8,589 |

| Chief Compliance Officer Fees | | 14,694 | | | 2,719 | | | 1,337 |

| Audit Fees | | 15,043 | | | 16,517 | | | 15,645 |

| Custodian Fees | | 13,836 | | | 5,235 | | | 3,708 |

Dividend Expense(1) | | 34,322 | | | 3,913 | | | 5,301 |

Interest Expense(2) | | 20,874 | | | 2,369 | | | 3,587 |

| Legal Fees | | 29,363 | | | 10,911 | | | 9,886 |

| Filing Fees | | 16,594 | | | 11,150 | | | 9,871 |

| Transfer Agent Fees | | 47,207 | | | 14,934 | | | 12,134 |

| Directors’ Fees | | 23,665 | | | 5,297 | | | 2,854 |

| Printing Fees | | 23,354 | | | 6,303 | | | 3,849 |

| Other Expenses | | 34,892 | | | 8,505 | | | 6,372 |

| Total Expenses | | 1,289,021 | | | 312,192 | | | 206,511 |

| | | | | | | | | |

| Fees Waived by Investment Adviser | | — | | | — | | | — |

| | | | | | | | | |

| Net Expenses | | 1,289,021 | | | 312,192 | | | 206,511 |

| | | | | | | | | |

| Net Investment Loss | | (1,133,446) | | | (244,731) | | | (205,298) |

| | | | | | | | | |

| Net Realized/Unrealized Gain (Loss) from Investments, Securities Sold Short, | | | | | | | | |

| Foreign Currency Transactions and Written Options | | | | | | | | |

| Net Realized Gain (Loss) from Investments | | 5,825,357 | | | 562,761 | | | 1,292,719 |

| Net Realized Gain (Loss) from Securities Sold Short | | (334,236) | | | 43,326 | | | 129,240 |

| Net Realized Gain (Loss) from Foreign Currency Transactions | | (3,949) | | | — | | | — |

| Net Realized Gain (Loss) from Currency | | (4,758) | | | — | | | — |

| Change in Unrealized Appreciation/Depreciation on | | | | | | | | |

| Investments and Securities Sold Short | | (4,218,888) | | | (680,643) | | | (1,398,293) |

| Net Realized/Unrealized Gain (Loss) from Investments, Securities Sold Short, | | | | | | | | |

| Foreign Currency Transactions and Currency | | 1,263,526 | | | (74,556) | | | 23,666 |

| Change in Net Assets Resulting from Operations | $ | 130,080 | | $ | (319,287) | | $ | (181,632) |

(1) | Expense related to dividends on securities sold short. |

(2) | Expense related to securities sold short. |

See accompanying notes to financial statements.

| Statements of Changes in Net Assets | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | Needham Aggressive | | | Needham Small Cap |

| | | Needham Growth Fund | | | Growth Fund | | | Growth Fund |

| | | Six Months | | | Year Ended | | | Six Months | | | Year Ended | | | Six Months | | | Year Ended |

| | | Ended June 30, | | | December 31, | | | Ended June 30, | | | December 31, | | | Ended June 30, | | | December 31, |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | | | 2010 | | | 2009 |

| | | (Unaudited) | | | | | | (Unaudited) | | | | | | (Unaudited) | | | |

| Change in Net Assets | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | |

| Net Investment Loss | $ | (1,133,446) | | $ | (1,724,454) | | $ | (244,731) | | $ | (357,615) | | $ | (205,298) | | $ | (213,544) |

| Net Realized Gain (Loss) from | | | | | | | | | | | | | | | | | |

| Investments, Securities Sold | | | | | | | | | | | | | | | | | |

| Short, Foreign Currency | | | | | | | | | | | | | | | | | |

| Transactions, Written Options | | | | | | | | | | | | | | | | | |

| and Distributions from | | | | | | | | | | | | | | | | | |

| Underlying Funds | | 5,482,414 | | | (3,626,998) | | | 606,087 | | | 456,475 | | | 1,421,959 | | | 328,186 |

| Change in Unrealized | | | | | | | | | | | | | | | | | |

| Appreciation/ Depreciation | | | | | | | | | | | | | | | | | |

| on Investments and Securities | | | | | | | | | | | | | | | | | |

| Sold Short | | (4,218,888) | | | 44,739,928 | | | (680,643) | | | 4,094,477 | | | (1,398,293) | | | 3,011,916 |

| Change in Net Assets Resulting | | | | | | | | | | | | | | | | | |

| from Operations | | 130,080 | | | 39,388,476 | | | (319,287) | | | 4,193,337 | | | (181,632) | | | 3,126,558 |

| | | | | | | | | | | | | | | | | | |

| Distributions to | | | | | | | | | | | | | | | | | |

| Shareholders from: | | | | | | | | | | | | | | | | | |

| Long-Term Gains | | — | | | — | | | — | | | (27,272) | | | — | | | (12,743) |

| Return of Capital | | — | | | — | | | — | | | — | | | — | | | — |

| Total Distributions to | | | | | | | | | | | | | | | | | |

| Shareholders | | — | | | — | | | — | | | (27,272) | | | — | | | (12,743) |

| | | | | | | | | | | | | | | | | | |

| Capital Transactions: | | | | | | | | | | | | | | | | | |

| Shares Issued | | 18,888,483 | | | 7,669,908 | | | 12,337,654 | | | 11,511,837 | | | 13,300,724 | | | 7,000,284 |

| Shares Issued in Reinvestment | | | | | | | | | | | | | | | | | |

| of Distribution | | — | | | — | | | — | | | 27,145 | | | — | | | 12,633 |

| Shares Redeemed | | (16,802,921) | | | (20,703,762) | | | (3,459,674) | | | (3,097,732) | | | (3,048,526) | | | (4,135,121) |

| Redemption Fees | | 9,229 | | | 1,966 | | | 858 | | | 9,498 | | | 1,160 | | | 2,178 |

| Change in Net Assets from | | | | | | | | | | | | | | | | | |

| Capital Transactions | | 2,094,791 | | | (13,031,888) | | | 8,878,838 | | | 8,450,748 | | | 10,253,358 | | | 2,879,974 |

| | | | | | | | | | | | | | | | | | |

| Change in Net Assets | | 2,224,871 | | | 26,356,588 | | | 8,559,551 | | | 12,616,813 | | | 10,071,726 | | | 5,993,789 |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net Assets | | | | | | | | | | | | | | | | | |

| Beginning of Period | | 119,174,825 | | | 92,818,237 | | | 22,818,960 | | | 10,202,147 | | | 11,303,178 | | | 5,309,389 |

| End of Period | $ | 121,399,696 | | $ | 119,174,825 | | $ | 31,378,511 | | $ | 22,818,960 | | $ | 21,374,904 | | $ | 11,303,178 |

| Accumulated Net | | | | | | | | | | | | | | | | | |

| Investment Loss | $ | (1,133,446) | | $ | — | | $ | (245,743) | | $ | (1,012) | | $ | (205,298) | | $ | — |

| | | | | | | | | | | | | | | | | | |

| Share Transaction: | | | | | | | | | | | | | | | | | |

| Number of Shares Issued | | 601,495 | | | 314,682 | | | 917,441 | | | 1,047,553 | | | 1,141,496 | | | 805,863 |

| Number of Shares Reinvested | | — | | | — | | | — | | | 2,299 | | | — | | | 1,308 |

| Number of Shares Redeemed | | (530,619) | | | (891,506) | | | (264,317) | | | (287,353) | | | (264,085) | | | (451,580) |

| Change in Shares | | 70,876 | | | (576,824) | | | 653,124 | | | 762,499 | | | 877,411 | | | 355,591 |

See accompanying notes to financial statements.

| Needham Growth Fund | | | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | |

| | | Ended June 30, | | | |

| (For a Share Outstanding | | 2010 | | Year Ended December 31, |

| Throughout each Period) | | (Unaudited) | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 |

| Net Asset Value, Beginning of Period | $ | 29.77 | | $ | 20.27 | | $ | 36.05 | | $ | 39.01 | | $ | 35.69 | | $ | 31.17 |

| Investment Operations | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss) | | (0.28) | | | (0.43) | | | (0.45) | | | (0.25) | | | 0.10 | | | (0.38) |

| Net Realized and Unrealized Gain (Loss) on | | | | | | | | | | | | | | | | | |

| Investments | | 0.31 | | | 9.93 | | | (14.10) | | | 1.45 | | | 6.29 | | | 4.90 |

| Total from Investment Operations | | 0.03 | | | 9.50 | | | (14.55) | | | 1.20 | | | 6.39 | | | 4.52 |

| | | | | | | | | | | | | | | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | |

| Net Investment Income | | — | | | — | | | — | | | (0.01) | | | (0.09) | | | — |

| Net Realized Gains | | — | | | — | | | (1.23) | | | (4.15) | | | (3.00) | | | — |

| Total Distributions | | — | | | — | | | (1.23) | | | (4.16) | | | (3.09) | | | — |

| | | | | | | | | | | | | | | | | | |

| Capital Contributions | | | | | | | | | | | | | | | | | |

| Redemption Fees | | — | | | —(a) | | | — | | | — | | | — | | | — |

| Contribution by Adviser | | — | | | — | | | — | | | — | | | 0.02(b) | | | — |

| Total Capital Contributions | | — | | | —(a) | | | — | | | — | | | 0.02 | | | — |

| Net Asset Value, End of Period | $ | 29.80 | | $ | 29.77 | | $ | 20.27 | | $ | 36.05 | | $ | 39.01 | | $ | 35.69 |

| | | | | | | | | | | | | | | | | | |

| Total Return | | 0.10% | | | 46.87% | | | (40.41%) | | | 3.09% | | | 18.05% | | | 14.50% |

| Net Assets, End of Period (000’s) | $ | 121,400 | | $ | 119,175 | | $ | 928,818 | | $ | 209,397 | | $ | 308,693 | | $ | 204,624 |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | |

| Ratio of Net Expenses to Average Net Assets | | 2.00% | (d) | | 2.03% | | | 2.04% | | | 1.86% | | | 1.79% | | | 1.94% |

| Ratio of Net Expenses to Average Net Assets | | | | | | | | | | | | | | | | | |

| (excluding interest and dividend | | | | | | | | | | | | | | | | | |

| expense) | | 1.91% | (d) | | 2.00% | | | 2.03% | | | 1.85% | | | 1.78% | | | 1.91% |

| Ratio of Net Expenses to Average Net Assets | | | | | | | | | | | | | | | | | |

| (excluding waiver and reimbursement of | | | | | | | | | | | | | | | | | |

| expenses) | | 2.00% | (d) | | 2.08% | | | 2.04% | | | 1.86% | | | 1.79% | | | 1.94% |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | |

| Average Net Assets | | (1.76%) | (d) | | (1.71%) | | | (1.37%) | | | (0.61%) | | | 0.31% | | | (1.01%) |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | |

| Average Net Assets (excluding waivers and | | | | | | | | | | | | | | | | | |

| reimbursements of expenses) | | (1.76%) | (d) | | (1.76%) | | | (1.37%) | | | (0.61%) | | | 0.31% | | | (1.01%) |

| Portfolio turnover rate | | 32% | (c) | | 29% | | | 41% | | | 41% | | | 48% | | | 16% |

| (a) | Value is less than $0.005 per share. |

| (b) | In May 2006, the Adviser made a payment to the Growth Fund which increased the total return by 0.06%. |

| (c) | Not annualized for periods less than one year. |

| (d) | Annualized for periods less than one year. |

See accompanying notes to financial statements.

| Needham Aggressive Growth Fund | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | |

| | | Ended June 30, | | | Year Ended December 31, |

| (For a Share Outstanding | | 2010 | | | | | | | | | | | | | | |

| Throughout each Period) | | (Unaudited) | | | 2009 | | | 2008 | | 2007 | | | 2006 | | | 2005 |

| Net Asset Value, Beginning of Period | $ | 12.38 | | $ | 9.45 | | $ | 14.14 | $ | 13.96 | | $ | 13.73 | | $ | 12.85 |

| Investment Operations | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss) | | (0.10) | | | (0.19) | | | (0.26) | | (0.16) | | | (0.19) | | | (0.26) |

| Net Realized and Unrealized Gain (Loss) on | | | | | | | | | | | | | | | | |

| Investments | | 0.29 | | | 3.13 | | | (3.65) | | 2.34 | | | 1.83 | | | 1.49 |

| Total from Investment Operations | | 0.19 | | | 2.94 | | | (3.91) | | 2.18 | | | 1.64 | | | 1.23 |

| | | | | | | | | | | | | | | | | |

| Less Distributions | | | | | | | | | | | | | | | | |

| Net Realized Gains | | — | | | (0.02) | | | (0.78) | | (2.00) | | | (1.42) | | | (0.35) |

| Total Distributions | | — | | | (0.02) | | | (0.78) | | (2.00) | | | (1.42) | | | (0.35) |

| | | | | | | | | | | | | | | | | |

| Capital Contributions | | | | | | | | | | | | | | | | |

| Redemption Fees | | — | | | 0.01 | | | — | | — | | | — | | | — |

| Contribution by Adviser | | — | | | — | | | — | | — | | | 0.01 | (a) | | — |

| Total Capital Contributions | | — | | | 0.01 | | | — | | — | | | 0.01 | | | — |

| Net Asset Value, End of Period | $ | 12.57 | | $ | 12.38 | | $ | 9.45 | $ | 14.14 | | $ | 13.96 | | $ | 13.73 |

| | | | | | | | | | | | | | | | | |

| Total Return | | 1.53% | (b) | | 31.18% | | (27.60%) | | 15.58% | | | 12.22% | | | 9.70% |

| Net Assets, End of Period (000’s) | $ | 31,379 | | $ | 22,819 | | $ | 10,202 | $ | 20,518 | | $ | 18,051 | | $ | 18,125 |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

| Ratio of Net Expenses to Average Net Assets | | 2.22% | (c) | | 2.50% | | | 2.51% | | 2.18% | | | 2.24% | | | 2.50% |

| Ratio of Net Expenses to Average Net Assets | | | | | | | | | | | | | | | | |

| (excluding interest and dividend | | | | | | | | | | | | | | | | |

| expense) | | 2.18% | (c) | | 2.49% | | | 2.50% | | 2.18% | | | 2.23% | | | 2.50% |

| Ratio of Net Expenses to Average Net Assets | | | | | | | | | | | | | | | | |

| (excluding waiver and reimbursement of | | | | | | | | | | | | | | | | |

| expenses) | | 2.22% | (c) | | 2.50% | | | 2.63% | | 2.18% | | | 2.24% | | | 2.78% |

| Ratio of Net Investment Loss to Average Net | | | | | | | | | | | | | | | | |

| Assets | | (1.74%) | (c) | | (2.39%) | | | (2.04%) | | (1.18%) | | | (1.35%) | | | (2.01%) |

| Ratio of Net Investment Loss to Average Net | | | | | | | | | | | | | | | | |

| Assets (excluding waiver and | | | | | | | | | | | | | | | | |

| reimbursement of expenses) | | (1.74%) | (c) | | (2.39%) | | | (2.15%) | | (1.18%) | | | (1.35%) | | | (2.29%) |

| Portfolio turnover rate | | 35% | (b) | | 70% | | | 45% | | 64% | | | 55% | | | 69% |

| (a) | In May 2006, the Adviser made a payment to the Aggressive Growth Fund which increased the total return by 0.08%. |

| (b) | Not annualized for periods less than one year. |

| (c) | Annualized for periods less than one year. |

See accompanying notes to financial statements.

| Needham Small Cap Growth Fund | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | |

| | | Ended June 30, | | | Year Ended December 31, |

| (For a Share Outstanding | | 2010 | | | | | | | | | | | | | | | |

| Throughout each Period) | | (Unaudited) | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 |

| Net Asset Value, Beginning of Period | $ | 10.73 | | $ | 7.61 | | $ | 11.29 | | $ | 14.32 | | $ | 17.09 | | $ | 18.53 |

| Investment Operations | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss) | | (0.11) | | | (0.20) | | | (0.19) | | | (0.26) | | | (0.26) | | | (0.31) |

| Net Realized and Unrealized Gain (Loss) on | | | | | | | | | | | | | | | | | |

| Investments | | 0.45 | | | 3.33 | | | (2.49) | | | (0.02) | | | 1.61 | | | 0.66 |

| Total from Investment Operations | | 0.34 | | | 3.13 | | | (2.68) | | | (0.28) | | | 1.35 | | | 0.35 |

| | | | | | | | | | | | | | | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | |

| Net Realized Gains | | — | | | (0.01) | | | (0.82) | | | (2.75) | | | (4.18) | | | (1.79) |

| Return of Capital | | — | | | — | | | (0.18) | | | — | | | — | | | — |

| Total Distributions | | — | | | (0.01) | | | (1.00) | | | (2.75) | | | (4.18) | | | (1.79) |

| | | | | | | | | | | | | | | | | | |

| Capital Contributions | | | | | | | | | | | | | | | | | |

| Redemption Fees | | — | | | —(a) | | | — | | | — | | | — | | | — |

| Contribution by Adviser | | — | | | — | | | — | | | — | | | 0.06(b) | | | — |

| Total Capital Contributions | | — | | | —(a) | | | — | | | — | | | 0.06 | | | — |

| Net Asset Value, End of Period | $ | 11.07 | | $ | 10.73 | | $ | 7.61 | | $ | 11.29 | | $ | 14.32 | | $ | 17.09 |

| | | | | | | | | | | | | | | | | | |

| Total Return | | 3.17% | (c) | | 41.18% | | | (23.42%) | | | (2.01%) | | | 8.52% | | | 2.01% |

| Net Assets, End of Period (000’s) | $ | 21,375 | | $ | 11,303 | | $ | 5,309 | | $ | 7,726 | | $ | 15,248 | | $ | 18,789 |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | |

| Ratio of Net Expenses to Average Net Assets | | 2.50% | (d) | | 2.57% | | | 2.51% | | | 2.50% | | | 2.36% | | | 2.44% |

| Ratio of Net Expenses to Average Net Assets | | | | | | | | | | | | | | | | | |

| (excluding interest and dividend | | | | | | | | | | | | | | | | | |

| expense) | | 2.39% | (d) | | 2.50% | | | 2.50% | | | 2.50% | | | 2.36% | | | 2.44% |

| Ratio of Net Expenses to Average Net Assets | | | | | | | | | | | | | | | | | |

| (excluding waiver and reimbursement of | | | | | | | | | | | | | | | | | |

| expenses) | | 2.50% | (d) | | 3.02% | | | 3.57% | | | 2.64% | | | 2.36% | | | 2.58% |

| Ratio of Net Investment Loss to Average Net | | | | | | | | | | | | | | | | | |

| Assets | | (2.49%) | (d) | | (2.50%) | | | (2.02%) | | | (1.54%) | | | (1.61%) | | | (1.64%) |

| Ratio of Net Investment Loss to Average Net | | | | | | | | | | | | | | | | | |

| Assets (excluding waivers and | | | | | | | | | | | | | | | | | |

| reimbursements of expenses) | | (2.49%) | (d) | | (2.95%) | | | (3.09%) | | | (1.68%) | | | (1.61%) | | | (1.78%) |

| Portfolio turnover rate | | 47% | (c) | | 154% | | | 219% | | | 38% | | | 115% | | | 104% |

(a) | Value is less than $0.005 per share. |

| (b) | In May 2006, the Adviser made a payment to the Small Cap Growth Fund which increased the total return by 0.35%. |

| (c) | Not annualized for periods less than one year. |

| (d) | Annualized for periods less than one year. |

See accompanying notes to financial statements

Notes to Financial Statements (Unaudited)

Needham Growth Fund (‘‘NGF’’), Needham Aggressive Growth Fund (‘‘NAGF’’) and Needham Small Cap Growth Fund (‘‘NSCGF’’) (each, a ‘‘Portfolio’’ and collectively, the ‘‘Portfolios’’), are portfolios of The Needham Funds, Inc. (the ‘‘Company’’), which is registered under the Investment Company Act of 1940, as amended (the ‘‘1940 Act’’) as a non-diversified, open-end management investment company. The Company was organized as a Maryland corporation on October 12, 1995.

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Company in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (‘‘GAAP’’).

Security Valuation: Investments in securities (including options) listed or traded on a nationally recognized securities exchange are valued at the last quoted sales price on the date the valuations are made. Portfolio securities and options positions for which market quotations are readily available are stated at the NASDAQ Official Closing Price or the last sale price reported by the principal exchange for each such security as of the exchange’s close of business, as applicable. Securities and options for which no sale has taken place during the day and securities which are not listed on an exchange are valued at the mean of the current closing bid and asked prices. All other securities for which market prices are not readily available are valu ed at their fair value in accordance with Fair Value Procedures established by the Board of Directors (the ‘‘Board’’). The Company’s Fair Value Procedures are implemented and monitored by a Fair Value Committee (the ‘‘Committee’’) designated by the Board. When a security is valued in accordance with the Fair Value Procedures, the Committee determines a value after taking into consideration any relevant information that is reasonably available to the Committee. Some of the more common reasons that may necessitate that a security be valued pursuant to these Fair Value Procedures include, but are not limited to: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; or the security’s primary pricing source is not able or willing to provide a price. ; The assets of each Portfolio may also be valued on the basis of valuations provided by a pricing service approved by, or on behalf of, the Board.

Investment Transactions: Changes in holdings of portfolio securities for the Portfolios shall be reflected no later than in the first calculation on the first business day following the trade date for purposes of calculating each Portfolio’s daily net asset value per share. However, for financial reporting purposes, portfolio security transactions are reported on the trade date of the last business day of the reporting period. The cost (proceeds) of investments sold (bought to cover) is determined on a specific identification basis for the purpose of determining gains or losses on sales and buys to cover short positions. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income is recorded on an accrual basis.

Foreign Currency: Foreign currency amounts are translated into U.S. dollars as follows: (i) assets and liabilities at the rate of exchange at the end of the respective period; and (ii) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments. Principal risks associated with such transactions include the movement in value of the foreign currency relative to the U.S. dollar and the ability of the counterparty t o perform.

The Portfolios may also invest in forward currency contracts. Fluctuations in the value of such forward currency transactions are recorded daily as unrealized gain or loss; realized gain or loss includes net gain or loss on transactions that have terminated by settlement or by the Portfolios entering into offsetting commitments. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the statement of assets and liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates. The Portfolios did not enter into forward currency contracts during the six months ended June 30, 2010.

Allocation of Expenses: Expenses directly attributable to a Portfolio are charged directly to that Portfolio, while expenses which are attributable to more than one Portfolio are allocated among the respective Portfolios based upon relative net assets or some other reasonable method.

Use of Estimates: The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates and those differences could be material.

Distributions to Shareholders: Dividends from net investment income, if any, are declared and paid annually for the Portfolios. Distributable net realized gains, if any, are declared and distributed at least annually.

Redemption Fees: The Portfolios reserve the right to assess a redemption fee for shares redeemed within 60 days of purchase. The shareholder will be charged a fee equal to 2.00% of the value of the shares redeemed. The redemption fee is intended to offset excess brokerage commissions and other costs associated with fluctuations in asset levels and cash flows caused by frequent trading by shareholders. The applicability of the redemption fee will be calculated using a first-in first-out method, which means the oldest shares will be redeemed first, followed by the redemption of more recently acquired shares. For the six months ending June 30, 2010, NGF, NAGF and NSCGF had contributions to capital due to redemption fees in the amounts of $9,229, $858 and $1,160, respectively.

Notes to Financial Statements (Unaudited) (Continued)

Federal Income Taxes: It is the policy of each Portfolio to continue to qualify as a regulated investment company, as defined in the Internal Revenue Code, by complying with the provisions available to certain investment companies and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for income taxes has been made in the Portfolios’ financial statements.