UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07443

Name of Registrant: Vanguard Whitehall Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2009 – October 31, 2010

Item 1: Reports to Shareholders

|

|

| Vanguard Selected Value Fund |

| Annual Report |

|

|

| October 31, 2010 |

|

> Vanguard Selected Value Fund returned nearly 22% for the 12 months ended October 31, 2010, but fell short of its comparative standards.

> All sectors in the fund’s portfolio posted strong gains, with consumer discretionary stocks leading the way.

> The fund’s long-term performance remains ahead of the comparable return of the Russell Midcap Value Index and the average result for peer funds.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 7 |

| Fund Profile. | 10 |

| Performance Summary. | 11 |

| Financial Statements. | 13 |

| Your Fund’s After-Tax Returns. | 23 |

| About Your Fund’s Expenses. | 24 |

| Glossary. | 26 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Cover photograph: Jean Maher.

Your Fund’s Total Returns

Fiscal Year Ended October 31, 2010

| |

| | Total |

| | Returns |

| Vanguard Selected Value Fund | 21.75% |

| Russell Midcap Value Index | 27.49 |

| Mid-Cap Value Funds Average | 23.06 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper Inc. |

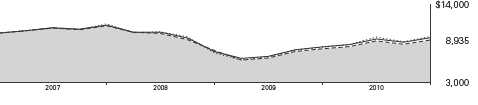

Your Fund’s Performance at a Glance

October 31, 2009, Through October 31, 2010

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Selected Value Fund | $14.78 | $17.73 | $0.241 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

Vanguard Selected Value Fund returned 21.75% for the 12 months ended October 31, 2010, coming close to matching last year’s strong performance. However, the fund lagged the 27.49% return of its index benchmark and the 23.06% average return of peer funds for the period.

The advisors’ selections in the consumer discretionary sector had the largest role in the fund’s return. However, in other sectors the advisors favored stocks that didn’t keep pace with those that the market deemed to have better prospects, particularly in the health care and information technology sectors. Consequently, the fund didn’t gain as much as the Russell Midcap Value Index or the average return of peer funds.

If you hold shares in a taxable account, you may wish to review the information about after-tax returns for the fiscal year that appears later in this report.

Stock market performance was better than it felt

Global stock prices rallied at the start of the period, but struggled through the spring and summer, weighed down by Europe’s sovereign debt crisis and the slow pace of economic recovery in the United States. In the fiscal year’s final months, the mood

2

turned. Stock prices climbed on continued strength in corporate earnings. In the United States, stocks also seemed to get a boost from the Federal Reserve Board’s hints that it would try to stimulate the economy with a second round of U.S. Treasury bond purchases. (In early November, the Fed announced that it would buy as much as $600 billion in Treasuries.)

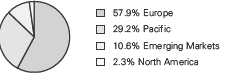

For the 12 months, the broad U.S. stock market returned about 19%, a performance that was better than it felt in a year of ups and downs. Small-capitalization stocks did even better. International stocks returned about 13% on the strength of a powerful rally in emerging markets and solid single-digit gains in developed markets in Europe and the Pacific region.

Despite shrinking yields, bonds attracted investor dollars

Although fixed income yields have fallen to generational lows, investors continued to bid up bond prices. The broad U.S. bond market produced a 12-month return of about 8% as the yield of the 10-year U.S. Treasury note fell from 3.39% at the start of the period to 2.61% at the close. Tax-exempt municipal bonds also rallied. Bond prices and yields move in opposite directions, of course, so abundant returns built on rising prices could mean leaner pickings in the years ahead.

The yields of money market securities hovered near 0%, consistent with the Federal Reserve Board’s target for short-term rates.

Market Barometer

| | | |

| | | Average Annual Total Returns |

| | | Periods Ended October 31, 2010 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 17.67% | -6.14% | 1.99% |

| Russell 2000 Index (Small-caps) | 26.58 | -3.91 | 3.07 |

| Dow Jones U.S. Total Stock Market Index | 19.04 | -5.55 | 2.52 |

| MSCI All Country World Index ex USA (International) | 13.08 | -7.62 | 6.21 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 8.01% | 7.23% | 6.45% |

| Barclays Capital Municipal Bond Index (Broad | | | |

| tax-exempt market) | 7.78 | 5.79 | 5.20 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.12 | 0.89 | 2.41 |

| |

| CPI | | | |

| Consumer Price Index | 1.17% | 1.54% | 1.89% |

3

The fund didn’t capture all of the market’s gains

In seeking midsized U.S. companies that have the best potential to provide investors with long-term capital appreciation and dividend income, the fund’s two advisors lean toward stable firms with strong fundamentals. Although the fund’s portfolio performed well on an absolute basis, its relative performance lagged as mid-cap investors preferred companies that were less financially sound but were viewed as having more promise.

The fund achieved nearly all of its advance in the first six months of the period, gave back a portion in the late spring and summer, then regained that lost ground by the end of October. As occurred in the previous fiscal year, every stock sector in the fund advanced. In fact, every sector’s percentage gains were in double digits. Also as in the previous year, the two largest sectors by weighting—financials and consumer discretionary—accounted for more than half of the fund’s return. This time, however, the advisors’ selections outperformed the index in only one of the two sectors rather than both, as before.

In the consumer discretionary sector, the advisors’ selections among stocks of department stores, apparel stores, and household appliance makers provided a measure of outperformance.

Expense Ratios

Your Fund Compared With Its Peer Group

| | |

| | | Peer Group |

| | Fund | Average |

| Selected Value Fund | 0.52% | 1.42% |

The fund expense ratio shown is from the prospectus dated February 25, 2010, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2010, the fund’s expense ratio was 0.47%. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2009.

Peer group: Mid-Cap Value Funds.

4

However, the fund’s financial holdings trailed the performance of the financial stocks in the benchmark. One key reason: Investors bid up the prices of real estate investment trusts, while the advisors deemphasized REITs and mostly missed out on their sizable gains. On the plus side, the fund’s holdings in midsize banks and asset managers did particularly well.

The industrial sector also contributed notably to the fund’s performance. Relative performance suffered most in the health care arena, where the advisors’ selections gained 13% but the benchmark’s stocks advanced about twice as much. The fund’s information technology holdings also trailed the performance of those in the index’s IT segment.

You can find more information on the fund’s positioning and performance during the year in the Advisors’ Report that follows this letter.

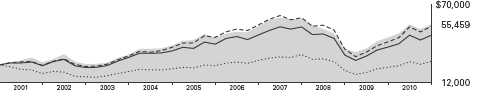

Over the past ten years, the fund’s track record is solid

Although the Selected Value Fund underperformed the average return of peer funds in the 2010 fiscal year, the fund’s long-term performance record continues to outpace the competition. For the ten years ended October 31, the fund’s 8.29% average annual return not only topped its benchmark’s 8.00% return but outdistanced the 6.58% average return from similar funds.

Total Returns

Ten Years Ended October 31, 2010

| |

| | Average |

| | Annual Return |

| Selected Value Fund | 8.29% |

| Russell Midcap Value Index | 8.00 |

| Mid-Cap Value Funds Average | 6.58 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper Inc. |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

The past decade included two major bear markets that limited the Dow Jones U.S. Total Stock Market Index to an average return of about 1% per year. The fund’s much stronger performance over the ten years should be kept in perspective. The advisors’ focus on a relatively small number of out-of-favor, medium-sized companies can result in noticeable underperformance as well as superior results from time to time. In other words, active stock investing in one segment of the market means accepting higher risk along with the potential for higher returns. Fortunately, your advisors have had the advantages of their skill, their patience, and Vanguard’s low operating costs to aid their pursuit of market-beating returns.

During volatile markets, stick to a time-tested approach

The volatility of recent years has certainly tested the fortitude of long-term investors. Although the markets gave more than they took in the past year, periodic bouts of volatility can be expected as the global economy mends from the financial crisis and adjusts to new forces.

But when change seems to accelerate around us, it’s crucial to remember what doesn’t change—and for investors, that means sticking with time-tested principles, notably diversification across and within asset classes, long-term perspective, and low costs. These practices have proven to be effective over longer periods of time. Investors who followed this approach and didn’t alter their basic strategy amid the dramatic swings of recent years were partly insulated from the deepest losses and participated in the recovery.

Whether returns continue to be positive or not, the Selected Value Fund, with its disciplined focus on out-of-favor midsized companies and its low costs, can play a useful role as part of a well-diversified portfolio that also includes a variety of other large- and small-cap stock funds, bond funds, and short-term investments. This balanced approach has proven its mettle over time.

As always, we appreciate your confidence in Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 15, 2010

6

Advisors’ Report

For the fiscal year ended October 31, 2010, Vanguard Selected Value Fund returned 21.75%. Your fund is managed by two independent advisors. This provides exposure to distinct, yet complementary, investment approaches, enhancing the fund’s diversification. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the percentage and amount of fund assets each manages, and a brief description of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the fiscal year and of how portfolio positioning reflects this assessment. These comments were prepared on November 19, 2010.

Vanguard Selected Value Fund Investment Advisors

| | | |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Barrow, Hanley, Mewhinney & | 73 | 2,654 | Conducts fundamental research on individual stocks |

| Strauss, LLC | | | exhibiting traditional value characteristics: |

| | | | price/earnings and price/book ratios below the market |

| | | | average and dividend yields above the market average. |

| Donald Smith & Co., Inc. | 24 | 889 | Conducts fundamental research on the lowest |

| | | | price-to-tangible-book-value companies. Research |

| | | | focuses on underlying quality of book value and assets, |

| | | | and on long-term earnings potential. |

| Cash Investments | 3 | 96 | These short-term reserves are invested by Vanguard in |

| | | | equity index products to simulate investment in stocks. |

| | | | Each advisor may also maintain a modest cash |

| | | | position. |

7

Barrow, Hanley, Mewhinney & Strauss, LLC

Portfolio Managers: James P. Barrow, Executive Director

Mark Giambrone, Managing Director

The past year in the market has seen a strong, although volatile, recovery with substantial returns. Unfortunately, the year was dominated by what we call a “low-quality rally,” led by companies without meaningful earnings and often without dividends. Therefore, while absolute returns have been satisfactory, we have lagged our benchmark. Fortunately, toward the end of the fiscal year, the market began to focus more on fundamentals and lifted our portfolio in advance of the recent market climb. As we enter the new fiscal year, we are encouraged to see much of the political and macroeconomic focus subsiding and a focus on fundamentals increasing. The portfolio is well positioned with quality companies that have good earnings and cash-flow prospects, pay an above-market yield, and have below-market valuations.

Relative to our benchmark index, we continue to be overweighted in the industrial, consumer discretionary, and health care sectors—all areas that have tremendous valuation potential and should see earnings stabilize or improve as the economy mends. Our overweighting in health care was the largest detractor to performance during the fiscal year because of concerns that continue to surround the health care reform legislation. As these concerns are addressed over time, we expect valuations to improve. Although we have been underweighted in financials, we continue to find some opportunities there and our weighting is steadily increasing.

We also are finding unique opportunities in the information technology area, and have been adding to our stake in it. Xerox gives us exposure to a cheap technology company, with predictable cash flow, that now offers an improved growth profile and more diversified profit stream owing to the acquisition of Affiliated Computer Services, a business outsourcing provider. In Molex we own an attractively valued global manufacturer of electronic connectors, which are necessary for thousands of products in various end-markets such as consumer electronics, the automotive industry, telecommunications, and industrial companies.

We remain underweighted in materials, telecommunication services, consumer staples, and utilities. These are areas in which the current economic environment does not seem to favor valuations, or in which company fundamentals do not match our investment parameters.

8

Donald Smith & Co., Inc.

Portfolio Managers: Donald G. Smith, Chief Investment Officer

Richard L. Greenberg, CFA, Senior Vice President

Our portfolio at the end of October 2010 continued to be concentrated in low price-to-tangible-book-value stocks with attractive long-term earnings potential. In aggregate, the portfolio’s holdings were selling at 86% of tangible book value and 8.7 times our estimate of “normalized earnings.” In contrast, the S&P 500 Index sells at more than 400% of tangible book value and about 14 times normalized earnings.

During the year we maintained a substantial cash position, which weighed on our portfolio’s results in a strongly rising market. In general, companies that would benefit from a recovering economy, such as paper producers, retailers, and airlines, did well. With interest rates falling, insurance companies and utilities also outperformed. Top performers among our holdings included Domtar, Dillard’s, and Semiconductor Manufacturing International. Companies in industries suffering from overcapacity—RRI Energy, Overseas Shipholding Group, and Tesoro—declined most over the past year.

During the period, we initiated positions in Constellation Energy, Everest Re, Hyatt, Ingram Micro, JetBlue, Montpelier Re, and Noble Corporation. All of these stocks were purchased below tangible book value. We also increased our existing holdings in Air France, American National Insurance, Yamana Gold, CNA Financial, Micron Technology, RRI Energy, and Tesoro, and scaled back holdings in Dillard’s, Domtar, NV Energy, Pinnacle West, Semiconductor Manufacturing, and Unum. We eliminated positions in five stocks, all of which had appreciated substantially: Aspen Insurance Holdings, Hyatt (recently acquired, as noted above), Royal Caribbean Cruises, Southwest Airlines, and Validus Holdings.

At the fiscal year-end, our two largest industry weightings were insurance and technology. The insurance companies, all of which sell below book value, have seen strong growth in their equity as investment portfolio values have risen with declining interest rates. Some of them (Everest Re, Unum, Montpelier Re) have been aggressively buying back stock below book value. The two largest technology holdings, Micron and Ingram Micro, have generated strong cash flow over the past year that will enable them to either grow more rapidly in the future, reduce debt, or buy back stock. Other large positions include a gold company (Yamana), airlines (Air France and JetBlue), a retailer (Dillard’s), a refiner (Tesoro), and an electricity provider (Constellation).

9

Selected Value Fund

Fund Profile

As of October 31, 2010

| | | |

| Portfolio Characteristics | | |

| | | Russell | DJ |

| | | Midcap | U.S. Total |

| | | Value | Market |

| | Fund | Index | Index |

| Number of Stocks | 67 | 541 | 3,920 |

| Median Market Cap | $7.5B | $6.3B | $28.5B |

| Price/Earnings Ratio | 13.3x | 19.1x | 16.9x |

| Price/Book Ratio | 1.4x | 1.5x | 2.2x |

| Return on Equity | 13.3% | 10.9% | 19.2% |

| Earnings Growth Rate | -3.2% | 0.6% | 6.5% |

| Dividend Yield | 2.1% | 2.1% | 1.8% |

| Foreign Holdings | 5.9% | 0.0% | 0.0% |

| Turnover Rate | 22% | — | — |

| Ticker Symbol | VASVX | — | — |

| Expense Ratio1 | 0.52% | — | — |

| 30-Day SEC Yield | 1.27% | — | — |

| Short-Term Reserves | 7.8% | — | — |

| |

| Sector Diversification (% of equity exposure) |

| | | Russell | DJ |

| | | Midcap | U.S. Total |

| | | Value | Market |

| | Fund | Index | Index |

| Consumer | | | |

| Discretionary | 18.8% | 10.9% | 11.8% |

| Consumer Staples | 5.1 | 7.1 | 10.0 |

| Energy | 8.6 | 10.5 | 9.8 |

| Financials | 22.7 | 29.4 | 16.3 |

| Health Care | 9.0 | 5.3 | 11.0 |

| Industrials | 14.5 | 10.2 | 11.1 |

| Information | | | |

| Technology | 9.2 | 6.6 | 19.4 |

| Materials | 2.9 | 5.2 | 4.4 |

| Telecommunication | | | |

| Services | 0.1 | 2.1 | 2.8 |

| Utilities | 9.1 | 12.7 | 3.4 |

| | | |

| Volatility Measures | | | |

| | Russell | | |

| | Midcap | U.S. Total |

| | Value | | Market |

| | Index | | Index |

| R-Squared | 0.95 | | 0. |

| Beta | 0.84 | | 1. |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| |

| |

| Ten Largest Holdings (% of total net assets) |

| Goodrich Corp. | Aerospace & | | |

| | Defense | | 2.5% |

| Stanley Black & Decker | Household | | |

| Inc. | Appliances | | 2.3 |

| Yamana Gold Inc. | Gold | | 2.2 |

| Murphy Oil Corp. | Integrated Oil & | |

| | Gas | | 2.2 |

| Newell Rubbermaid Inc. | Housewares & | |

| | Specialties | | 2.1 |

| Coventry Health Care | Managed Health | |

| Inc. | Care | | 2.1 |

| Family Dollar Stores Inc. | General | | |

| | Merchandise Stores | 2.0 |

| Ryder System Inc. | Trucking | | 2.0 |

| Willis Group Holdings plc | Insurance Brokers | 1.9 |

| CNA Financial Corp. | Property & Casualty | |

| | Insurance | | 1.9 |

| Top Ten | | | 21.2 |

| The holdings listed exclude any temporary cash investments and equity index products. |

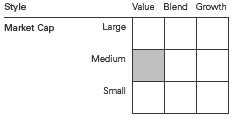

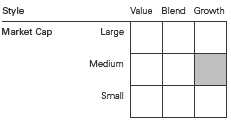

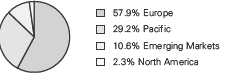

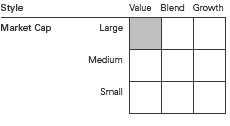

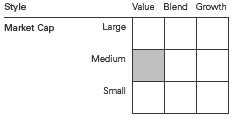

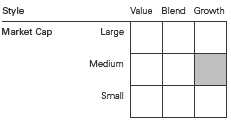

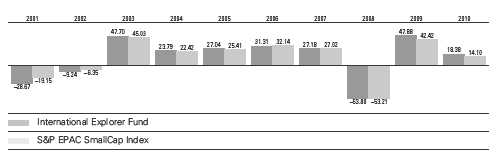

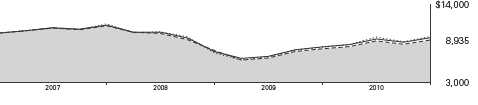

Investment Focus

1 The expense ratio shown is from the prospectus dated February 25, 2010, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2010, the expense ratio was 0.47%.

10

Selected Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

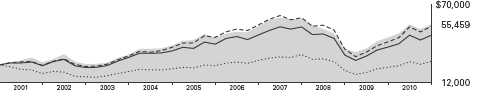

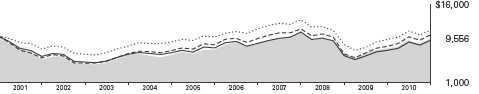

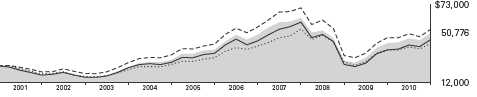

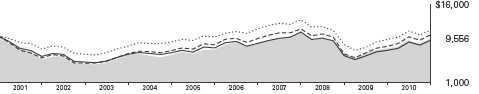

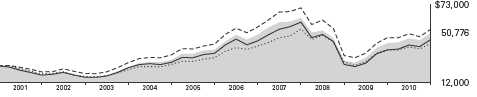

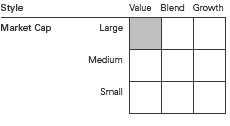

Cumulative Performance: October 31, 2000, Through October 31, 2010

Initial Investment of $25,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2010 | |

| | | | | Final Value |

| | One | Five | Ten | of a $25,000 |

| | Year | Years | Years | Investment |

| Selected Value Fund | 21.75% | 4.11% | 8.29% | $55,459 |

| Dow Jones U.S. Total Stock Market | | | | |

| Index | 19.04 | 2.52 | 1.02 | 27,683 |

| Russell Midcap Value Index | 27.49 | 3.38 | 8.00 | 53,964 |

| Mid-Cap Value Funds Average | 23.06 | 3.09 | 6.58 | 47,293 |

Mid-Cap Value Funds Average: Derived from data provided by Lipper Inc.

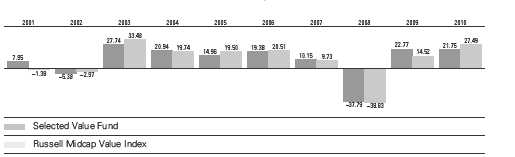

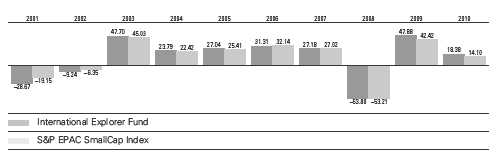

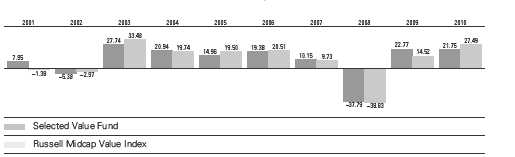

Fiscal-Year Total Returns (%): October 31, 2000, Through October 31, 2010

Vanguard fund returns do not reflect the 1% fee on redemptions of shares held for less than one year.

See Financial Highlights for dividend and capital gains information.

11

Selected Value Fund

Average Annual Total Returns: Periods Ended September 30, 2010

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Selected Value Fund | 2/15/1996 | 14.44% | 2.66% | 8.30% |

Vanguard fund returns do not reflect the 1% fee on redemptions of shares held for less than one year.

12

Selected Value Fund

Financial Statements

Statement of Net Assets

As of October 31, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (89.5%)1 | | |

| Consumer Discretionary (17.1%) | |

| | Stanley Black & | | |

| | Decker Inc. | 1,349,800 | 83,647 |

| | Newell Rubbermaid Inc. | 4,354,400 | 76,855 |

| | Family Dollar Stores Inc. | 1,560,300 | 72,039 |

| | Limited Brands Inc. | 2,342,900 | 68,858 |

| * | Royal Caribbean | | |

| | Cruises Ltd. | 1,693,700 | 66,969 |

| * | Hanesbrands Inc. | 2,447,500 | 60,698 |

| | Dillard’s Inc. Class A | 2,301,900 | 58,721 |

| | Advance Auto Parts Inc. | 872,600 | 56,702 |

| | International Game | | |

| | Technology | 3,507,000 | 54,674 |

| | Service Corp. | | |

| | International | 2,627,000 | 21,752 |

| | | | 620,915 |

| Consumer Staples (4.4%) | | |

| | Reynolds American Inc. | 839,000 | 54,451 |

| | Lorillard Inc. | 633,800 | 54,089 |

| | Sysco Corp. | 1,741,700 | 51,310 |

| | | | 159,850 |

| Energy (7.6%) | | |

| | Murphy Oil Corp. | 1,231,800 | 80,264 |

| *,^ | Seadrill Ltd. | 1,759,300 | 53,536 |

| | Tesoro Corp. | 3,421,000 | 44,336 |

| | Spectra Energy Corp. | 1,664,900 | 39,575 |

| | El Paso Corp. | 2,777,400 | 36,828 |

| | Overseas Shipholding | | |

| | Group Inc. | 472,900 | 15,809 |

| | Noble Corp. | 174,597 | 6,029 |

| | | | 276,377 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Financials (20.4%) | | |

| | Willis Group Holdings plc | 2,194,400 | 69,782 |

| * | CNA Financial Corp. | 2,513,182 | 69,665 |

| | Capital One | | |

| | Financial Corp. | 1,793,900 | 66,859 |

| | PNC Financial | | |

| | Services Group Inc. | 1,174,312 | 63,295 |

| * | SLM Corp. | 5,239,600 | 62,351 |

| | New York Community | | |

| | Bancorp Inc. | 3,526,600 | 59,705 |

| | Ameriprise Financial Inc. | 1,106,400 | 57,190 |

| | Fifth Third Bancorp | 4,240,400 | 53,259 |

| | Annaly Capital | | |

| | Management Inc. | 2,433,800 | 43,103 |

| | XL Group PLC Class A | 1,997,200 | 42,241 |

| | Axis Capital Holdings Ltd. | 1,188,200 | 40,411 |

| | Chubb Corp. | 682,200 | 39,581 |

| | Unum Group | 1,324,490 | 29,695 |

| | Everest Re Group Ltd. | 300,000 | 25,284 |

| | American National | | |

| | Insurance Co. | 164,858 | 12,932 |

| | Fidelity National | | |

| | Financial Inc. Class A | 347,100 | 4,648 |

| | Montpelier Re | | |

| | Holdings Ltd. | 245,863 | 4,504 |

| | | | 744,505 |

| Health Care (8.0%) | | |

| * | Coventry Health Care Inc. | 3,190,700 | 74,726 |

| | Omnicare Inc. | 2,513,600 | 60,628 |

| | Cardinal Health Inc. | 1,679,100 | 58,248 |

| | CIGNA Corp. | 1,510,700 | 53,161 |

| | Quest Diagnostics Inc. | 920,000 | 45,209 |

| | | | 291,972 |

13

Selected Value Fund

| | | | |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| Industrials (13.1%) | | | |

| | Goodrich Corp. | | 1,088,400 | 89,325 |

| | Ryder System Inc. | | 1,638,500 | 71,684 |

| | Eaton Corp. | | 776,100 | 68,941 |

| * | Air France-KLM ADR | 3,744,954 | 68,402 |

| | L-3 Communications | | |

| | Holdings Inc. | | 691,800 | 49,941 |

| | ITT Corp. | | 972,000 | 45,869 |

| | SPX Corp. | | 571,000 | 38,291 |

| | Dun & Bradstreet Corp. | 337,900 | 25,143 |

| * | JetBlue Airways Corp. | 2,715,765 | 18,956 |

| | | | | 476,552 |

| Information Technology (8.0%) | |

| * | Micron Technology Inc. | 7,729,916 | 63,926 |

| | Molex Inc. | | 3,062,300 | 62,165 |

| * | Ingram Micro Inc. | | 3,290,648 | 58,113 |

| | Xerox Corp. | | 3,445,600 | 40,313 |

| | Computer Sciences Corp. | 784,200 | 38,465 |

| * | Flextronics | | | |

| | International Ltd. | | 1,978,613 | 14,167 |

| * | Semiconductor | | | |

| | Manufacturing International | |

| | Corp. ADR | | 3,062,588 | 12,618 |

| | | | | 289,767 |

| Materials (2.6%) | | | |

| | Yamana Gold Inc. | | 7,338,300 | 80,648 |

| | Domtar Corp. | | 185,279 | 14,704 |

| | | | | 95,352 |

| Utilities (8.3%) | | | |

| | CenterPoint Energy Inc. | 3,839,300 | 63,579 |

| | Pinnacle West | | | |

| | Capital Corp. | | 1,523,259 | 62,697 |

| | Xcel Energy Inc. | | 2,535,300 | 60,492 |

| | MDU Resources | | | |

| | Group Inc. | | 2,962,300 | 59,039 |

| | Constellation Energy | | |

| | Group Inc. | | 1,151,737 | 34,829 |

| * | RRI Energy Inc. | | 3,095,218 | 11,638 |

| | NV Energy Inc. | | 668,340 | 9,129 |

| | | | | 301,403 |

| Total Common Stocks | | | |

| (Cost $2,716,595) | | | 3,256,693 |

| Temporary Cash Investments (10.6%)1 | |

| Money Market Fund (10.2%) | | |

| 2,3 | Vanguard Market Liquidity | | |

| | Fund, 0.237% | 370,202,509 | 370,203 |

| | | |

| | | Face | Market |

| | | Amount | Value |

| | | ($000) | ($000) |

| U.S. Government and Agency Obligations (0.4%) |

| 4,5 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.200%, 12/22/10 | 500 | 500 |

| 4 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.180%, 12/29/10 | 1,000 | 1,000 |

| 4,5 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.341%, 3/1/11 | 10,000 | 9,993 |

| 4,5 | Freddie Mac | | |

| | Discount Notes, | | |

| | 0.250%, 3/21/11 | 3,000 | 2,997 |

| 4,5 | Freddie Mac | | |

| | Discount Notes, | | |

| | 0.281%, 6/21/11 | 2,500 | 2,496 |

| | | | 16,986 |

| Total Temporary Cash Investments | |

| (Cost $387,183) | | 387,189 |

| Total Investments (100.1%) | | |

| (Cost $3,103,778) | | 3,643,882 |

| Other Assets and Liabilities (-0.1%) | |

| Other Assets | | 35,941 |

| Liabilities3 | | (40,591) |

| | | | (4,650) |

| Net Assets (100%) | | |

| Applicable to 205,256,066 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,639,232 |

| Net Asset Value Per Share | | $17.73 |

14

Selected Value Fund

At October 31, 2010, net assets consisted of:

| |

| | Amount |

| | ($000) |

| Paid-in Capital | 3,532,748 |

| Undistributed Net | |

| Investment Income | 33,329 |

| Accumulated Net | |

| Realized Losses | (470,944) |

| Unrealized Appreciation | |

| (Depreciation) | |

| Investment Securities | 540,104 |

| Futures Contracts | 3,995 |

| Net Assets | 3,639,232 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $7,769,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 92.0% and 8.1%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $7,914,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

5 Securities with a value of $15,986,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

15

Selected Value Fund

Statement of Operations

| |

| | Year Ended |

| | October 31, 2010 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 64,993 |

| Interest2 | 911 |

| Security Lending | 24 |

| Total Income | 65,928 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 7,682 |

| Performance Adjustment | 1,512 |

| The Vanguard Group—Note C | |

| Management and Administrative | 5,444 |

| Marketing and Distribution | 721 |

| Custodian Fees | 48 |

| Auditing Fees | 27 |

| Shareholders’ Reports | 45 |

| Trustees’ Fees and Expenses | 6 |

| Total Expenses | 15,485 |

| Expenses Paid Indirectly | (154) |

| Net Expenses | 15,331 |

| Net Investment Income | 50,597 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | (40,345) |

| Futures Contracts | 13,833 |

| Realized Net Gain (Loss) | (26,512) |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 600,476 |

| Futures Contracts | 4,018 |

| Change in Unrealized Appreciation (Depreciation) | 604,494 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 628,579 |

| 1 Dividends are net of foreign withholding taxes of $55,000. |

| 2 Interest income from an affiliated company of the fund was $875,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

16

Selected Value Fund

Statement of Changes in Net Assets

| | |

| | 2010 | 2009 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 50,597 | 46,351 |

| Realized Net Gain (Loss) | (26,512) | (247,106) |

| Change in Unrealized Appreciation (Depreciation) | 604,494 | 703,886 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 628,579 | 503,131 |

| Distributions | | |

| Net Investment Income | (46,869) | (78,192) |

| Realized Capital Gain | — | — |

| Total Distributions | (46,869) | (78,192) |

| Capital Share Transactions | | |

| Issued | 628,925 | 465,114 |

| Issued in Lieu of Cash Distributions | 41,576 | 69,913 |

| Redeemed1 | (464,396) | (531,001) |

| Net Increase (Decrease) from Capital Share Transactions | 206,105 | 4,026 |

| Total Increase (Decrease) | 787,815 | 428,965 |

| Net Assets | | |

| Beginning of Period | 2,851,417 | 2,422,452 |

| End of Period2 | 3,639,232 | 2,851,417 |

1 Net of redemption fees for fiscal 2010 and 2009 of $459,000 and $297,000, respectively.

2 Net Assets—End of Period includes undistributed net investment income of $33,329,000 and $29,601,000.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Selected Value Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | | | Year Ended October 31, |

| Throughout Each Period | 2010 | 2009 | 2008 | 2007 | 2006 |

| Net Asset Value, Beginning of Period | $14.78 | $12.48 | $22.11 | $21.38 | $18.99 |

| Investment Operations | | | | | |

| Net Investment Income | .250 | .254 | .3901 | .400 | .350 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 2.941 | 2.463 | (8.100) | 1.700 | 3.180 |

| Total from Investment Operations | 3.191 | 2.717 | (7.710) | 2.100 | 3.530 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.241) | (.417) | (.370) | (.320) | (.290) |

| Distributions from Realized Capital Gains | — | — | (1.550) | (1.050) | (.850) |

| Total Distributions | (.241) | (.417) | (1.920) | (1.370) | (1.140) |

| Net Asset Value, End of Period | $17.73 | $14.78 | $12.48 | $22.11 | $21.38 |

| |

| Total Return2 | 21.75% | 22.77% | -37.79% | 10.15% | 19.38% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $3,639 | $2,851 | $2,422 | $4,991 | $4,326 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets3 | 0.47% | 0.52% | 0.38% | 0.42% | 0.45% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.52% | 1.93% | 2.21% | 1.74% | 1.75% |

| Portfolio Turnover Rate | 22% | 30% | 23% | 33% | 37% |

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable transaction and account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of 0.05%, 0.05%, (0.03%), (0.02%), and (0.05%).

See accompanying Notes, which are an integral part of the Financial Statements.

18

Selected Value Fund

Notes to Financial Statements

Vanguard Selected Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, A DRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund��s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2007–2010), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents fees charged to borrowers plus income earned on investing cash collateral, less expenses associated with the loan.

19

Selected Value Fund

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

B. Barrow, Hanley, Mewhinney & Strauss, LLC, and Donald Smith & Co., Inc., each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee of Barrow, Hanley, Mewhinney & Strauss, LLC, is subject to quarterly adjustments based on performance for the preceding three years relative to the Russell Midcap Value Index. The basic fee of Donald Smith & Co., Inc., is subject to quarterly adjustments based on performance for the preceding five years relative to the MSCI Investable Market 2500 Index.

The Vanguard Group manages the cash reserves of the fund on an at-cost basis.

For the year ended October 31, 2010, the aggregate investment advisory fee represented an effective annual basic rate of 0.23% of the fund’s average net assets, before an increase of $1,512,000 (0.05%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At October 31, 2010, the fund had contributed capital of $635,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.25% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the fund’s investments as of October 31, 2010, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 3,256,693 | — | — |

| Temporary Cash Investments | 370,203 | 16,986 | — |

| Futures Contracts—Assets1 | 32 | — | — |

| Total | 3,626,928 | 16,986 | — |

| 1 Represents variation margin on the last day of the reporting period. |

20

Selected Value Fund

E. At October 31, 2010, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| S&P 500 Index | December 2010 | 215 | 63,409 | 3,433 |

| E-mini S&P 500 Index | December 2010 | 531 | 31,321 | 562 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

F. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

For tax purposes, at October 31, 2010, the fund had $39,705,000 of ordinary income available for distribution. The fund had available capital loss carryforwards totaling $466,345,000 to offset future net capital gains of $194,512,000 through October 31, 2016, $249,339,000 through October 31, 2017, and $22,494,000 through October 31, 2018.

At October 31, 2010, the cost of investment securities for tax purposes was $3,103,778,000. Net unrealized appreciation of investment securities for tax purposes was $540,104,000, consisting of unrealized gains of $703,764,000 on securities that had risen in value since their purchase and $163,660,000 in unrealized losses on securities that had fallen in value since their purchase.

G. During the year ended October 31, 2010, the fund purchased $835,806,000 of investment securities and sold $630,691,000 of investment securities, other than temporary cash investments.

H. Capital shares issued and redeemed were:

| | |

| | Year Ended October 31, |

| | 2010 | 2009 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 37,789 | 36,852 |

| Issued in Lieu of Cash Distributions | 2,571 | 6,144 |

| Redeemed | (28,069) | (44,143) |

| Net Increase (Decrease) in Shares Outstanding | 12,291 | (1,147) |

I. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. For the year ended October 31, 2010, these arrangements reduced the fund’s expenses by $154,000 (an annual rate of 0.00% of average net assets).

J. In preparing the financial statements as of October 31, 2010, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

21

Report of Independent Registered

Public Accounting Firm

To the Trustees of Vanguard Whitehall Funds and the Shareholders of Vanguard Selected Value Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Selected Value Fund (constituting a separate portfolio of Vanguard Whitehall Funds, hereafter referred to as the “Fund”) at October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits o f these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2010 by correspondence with the custodian and broker and by agreement to the underlying ownership records of Vanguard Market Liquidity Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 14, 2010

|

| Special 2010 tax information (unaudited) for Vanguard Selected Value Fund |

This information for the fiscal year ended October 31, 2010, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $46,869,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 100% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

22

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income , using actual prior-year figures and estimates for 2010. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.) Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

Average Annual Total Returns: Selected Value Fund

Periods Ended October 31, 2010

| | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 21.75% | 4.11% | 8.29% |

| Returns After Taxes on Distributions | 21.48 | 3.14 | 7.51 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 14.45 | 3.33 | 7.06 |

Returns do not reflect the 1% fee on redemptions of shares held for less than one year.

23

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include the 1% fee on redemptions of shares held for less than one year, nor do they include the account service fee described in the prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

24

Six Months Ended October 31, 2010

| | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Selected Value Fund | 4/30/2010 | 10/31/2010 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,001.69 | $2.22 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,022.99 | 2.24 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.44%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

25

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (in the case of bonds) or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

26

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

27

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 178 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

| |

| Interested Trustee1 | Amy Gutmann |

| | Born 1949. Trustee Since June 2006. Principal |

| F. William McNabb III | Occupation(s) During the Past Five Years: President |

| Born 1957. Trustee Since July 2009. Chairman of the | of the University of Pennsylvania; Christopher H. |

| Board. Principal Occupation(s) During the Past Five | Browne Distinguished Professor of Political Science |

| Years: Chairman of the Board of The Vanguard Group, | in the School of Arts and Sciences with secondary |

| Inc., and of each of the investment companies served | appointments at the Annenberg School for Commu- |

| by The Vanguard Group, since January 2010; Director | nication and the Graduate School of Education |

| of The Vanguard Group since 2008; Chief Executive | of the University of Pennsylvania; Director of |

| Officer and President of The Vanguard Group and of | Carnegie Corporation of New York, Schuylkill River |

| each of the investment companies served by The | Development Corporation, and Greater Philadelphia |

| Vanguard Group since 2008; Director of Vanguard | Chamber of Commerce; Trustee of the National |

| Marketing Corporation; Managing Director of The | Constitution Center; Chair of the Presidential |

| Vanguard Group (1995–2008). | Commission for the Study of Bioethical Issues. |

| |

| | JoAnn Heffernan Heisen |

| Independent Trustees | Born 1950. Trustee Since July 1998. Principal |

| | Occupation(s) During the Past Five Years: Corporate |

| Emerson U. Fullwood | Vice President and Chief Global Diversity Officer |

| Born 1948. Trustee Since January 2008. Principal | since 2006 (retired 2008) and Member of the |

| Occupation(s) During the Past Five Years: Executive | Executive Committee (retired 2008) of Johnson & |

| Chief Staff and Marketing Officer for North America | Johnson (pharmaceuticals/consumer products); Vice |

| and Corporate Vice President (retired 2008) of Xerox | President and Chief Information Officer of Johnson & |

| Corporation (document management products and | Johnson (1997–2005); Director of the University |

| services); Director of SPX Corporation (multi-industry | Medical Center at Princeton and Women’s Research |

| manufacturing), the United Way of Rochester, | and Education Institute; Member of the Advisory |

| Amerigroup Corporation (managed health care), | Board of the Maxwell School of Citizenship and Public |

| the University of Rochester Medical Center, and | Affairs at Syracuse University. |

| Monroe Community College Foundation. | |

| | F. Joseph Loughrey |

| Rajiv L. Gupta | Born 1949. Trustee Since October 2009. Principal |

| Born 1945. Trustee Since December 2001.2 | Occupation(s) During the Past Five Years: President |

| Principal Occupation(s) During the Past Five Years: | and Chief Operating Officer since 2005 (retired 2009) |

| Chairman and Chief Executive Officer (retired 2009) | and Vice Chairman of the Board (2008–2009) of |

| and President (2006–2008) of Rohm and Haas Co. | Cummins Inc. (industrial machinery); Director of |

| (chemicals); Director of Tyco International, Ltd. | SKF AB (industrial machinery), Hillenbrand, Inc. |

| (diversified manufacturing and services) and Hewlett- | (specialized consumer services), Sauer-Danfoss Inc. |

| Packard Co. (electronic computer manufacturing); | (machinery), the Lumina Foundation for Education, |

| Trustee of The Conference Board; Member of the | and Oxfam America; Chairman of the Advisory |

| Board of Managers of Delphi Automotive LLP | Council for the College of Arts and Letters at the |

| (automotive components). | University of Notre Dame. |

| | |

| André F. Perold | Kathryn J. Hyatt | |

| Born 1952. Trustee Since December 2004. Principal | Born 1955. Treasurer Since November 2008. Principal |

| Occupation(s) During the Past Five Years: George | Occupation(s) During the Past Five Years: Principal |

| Gund Professor of Finance and Banking at the Harvard | of The Vanguard Group, Inc.; Treasurer of each of |

| Business School; Chair of the Investment Committee | the investment companies served by The Vanguard |

| of HighVista Strategies LLC (private investment firm). | Group since 2008; Assistant Treasurer of each of the |

| | investment companies served by The Vanguard Group |

| Alfred M. Rankin, Jr. | (1988–2008). | |

| Born 1941. Trustee Since January 1993. Principal | | |

| Occupation(s) During the Past Five Years: Chairman, | Heidi Stam | |

| President, and Chief Executive Officer of NACCO | Born 1956. Secretary Since July 2005. Principal |

| Industries, Inc. (forklift trucks/housewares/lignite); | Occupation(s) During the Past Five Years: Managing |

| Director of Goodrich Corporation (industrial products/ | Director of The Vanguard Group, Inc., since 2006; |

| aircraft systems and services); Chairman of the | General Counsel of The Vanguard Group since 2005; |

| Federal Reserve Bank of Cleveland; Trustee of The | Secretary of The Vanguard Group and of each of the |

| Cleveland Museum of Art. | investment companies served by The Vanguard Group |

| | since 2005; Director and Senior Vice President of |

| Peter F. Volanakis | Vanguard Marketing Corporation since 2005; |

| Born 1955. Trustee Since July 2009. Principal | Principal of The Vanguard Group (1997–2006). |

| Occupation(s) During the Past Five Years: President | | |

| since 2007 and Chief Operating Officer since 2005 | | |

| of Corning Incorporated (communications equipment); | Vanguard Senior Management Team |

| President of Corning Technologies (2001–2005); | | |

| Director of Corning Incorporated and Dow Corning; | R. Gregory Barton | Michael S. Miller |

| Trustee of the Corning Incorporated Foundation and | Mortimer J. Buckley | James M. Norris |

| the Corning Museum of Glass; Overseer of the | Kathleen C. Gubanich | Glenn W. Reed |

| Amos Tuck School of Business Administration at | Paul A. Heller | George U. Sauter |

| Dartmouth College. | | |

| |

| | Chairman Emeritus and Senior Advisor |

| Executive Officers | | |

| | John J. Brennan | |

| Glenn Booraem | Chairman, 1996–2009 | |

| Born 1967. Controller Since July 2010. Principal | Chief Executive Officer and President, 1996–2008 |

| Occupation(s) During the Past Five Years: Principal | | |

| of The Vanguard Group, Inc.; Controller of each of | | |

| the investment companies served by The Vanguard | Founder | |

| Group since 2010; Assistant Controller of each of | | |

| the investment companies served by The Vanguard | John C. Bogle | |

| Group (2001–2010). | Chairman and Chief Executive Officer, 1974–1996 |

| |

| Thomas J. Higgins | | |

| Born 1957. Chief Financial Officer Since September | | |

| 2008. Principal Occupation(s) During the Past Five | | |

| Years: Principal of The Vanguard Group, Inc.; Chief | | |

| Financial Officer of each of the investment companies | | |

| served by The Vanguard Group since 2008; Treasurer | | |

| of each of the investment companies served by The | | |

| Vanguard Group (1998–2008). | | |

1 Mr. McNabb is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

| |  |

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > vanguard.com

| |

| Fund Information > 800-662-7447 | CFA® is a trademark owned by CFA Institute. |

| Direct Investor Account Services > 800-662-2739 | |

| Institutional Investor Services > 800-523-1036 | |

| Text Telephone for People | |

| With Hearing Impairment > 800-749-7273 | |

| |

| This material may be used in conjunction | |

| with the offering of shares of any Vanguard | |

| fund only if preceded or accompanied by | |

| the fund’s current prospectus. | |

| |

| All comparative mutual fund data are from Lipper Inc. or | |

| Morningstar, Inc., unless otherwise noted. | |

| |

| You can obtain a free copy of Vanguard’s proxy voting | |

| guidelines by visiting vanguard.com/proxyreporting or by | |

| calling Vanguard at 800-662-2739. The guidelines are | |

| also available from the SEC’s website, sec.gov. In | |

| addition, you may obtain a free report on how your fund | |

| voted the proxies for securities it owned during the 12 | |

| months ended June 30. To get the report, visit either | |

| vanguard.com/proxyreporting or sec.gov. | |

| |

| You can review and copy information about your fund at | |

| the SEC’s Public Reference Room in Washington, D.C. To | |

| find out more about this public service, call the SEC at | |

| 202-551-8090. Information about your fund is also | |

| available on the SEC’s website, and you can receive | |

| copies of this information, for a fee, by sending a | |

| request in either of two ways: via e-mail addressed to | |

| publicinfo@sec.gov or via regular mail addressed to the | |

| Public Reference Section, Securities and Exchange | |

| Commission, Washington, DC 20549-1520. | |

| |

| |

| | © 2010 The Vanguard Group, Inc. |

| | All rights reserved. |

| | Vanguard Marketing Corporation, Distributor. |

| |

| | Q9340 122010 |

|

|

| Vanguard Mid-Cap Growth Fund |

| Annual Report |

|

| October 31, 2010 |

|

|

> Vanguard Mid-Cap Growth Fund returned about 27% for the 12 months ended October 31, 2010.

> The fund’s return trailed that of its benchmark, the Russell Midcap Growth Index, but was in line with the average return of mid-cap growth funds.

> Holdings in the information technology and industrial sectors were among the fund’s strongest performers. Stock selection in the consumer discretionary and financial areas hurt the fund’s performance relative to the index.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 7 |

| Fund Profile. | 10 |

| Performance Summary. | 11 |

| Financial Statements. | 13 |

| Your Fund’s After-Tax Returns. | 23 |

| About Your Fund’s Expenses. | 24 |

| Glossary. | 26 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Cover photograph: Jean Maher.

Your Fund’s Total Returns

Fiscal Year Ended October 31, 2010

| |

| | Total |

| | Returns |

| Vanguard Mid-Cap Growth Fund | 26.70% |

| Russell Midcap Growth Index | 28.03 |

| Mid-Cap Growth Funds Average | 27.16 |

| Mid-Cap Growth Funds Average: Derived from data provided by Lipper Inc. | |

Your Fund’s Performance at a Glance

October 31, 2009, Through October 31, 2010

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Mid-Cap Growth Fund | $13.86 | $17.54 | $0.018 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

Vanguard Mid-Cap Growth Fund returned 26.70% for the fiscal year ended October 31, 2010. The fund was a step behind its benchmark, the Russell Midcap Growth Index, which returned 28.03% for the period, and the average return of its peer funds.

Despite a few bumps during the fiscal year, the fund’s mid-capitalization holdings placed it among the best-performing segments of the market. Mid-cap stocks overall outperformed shares of larger and smaller companies during the period. The fund further benefited from its focus on growth, as growth stocks in general beat their value counterparts.

For the 12 months, the fund’s information technology and industrial sectors were standout performers. The fund’s consumer discretionary and financial holdings weighed on its performance relative to its comparative standards.

If you own shares of the fund in a taxable account, you may wish to review information about the fund’s after-tax returns presented later in this report.

Stock market performance was better than it felt

Global stock prices rallied at the start of the period, but struggled through the spring and summer, weighed down by Europe’s sovereign debt crisis and the slow pace of economic recovery in the United States. In the fiscal year’s final months, the mood turned. Stock prices

2

climbed on continued strength in corporate earnings. In the United States, stocks also seemed to get a boost from the Federal Reserve Board’s hints that it would try to stimulate the economy with a second round of U.S. Treasury bond purchases. (In early November, the Fed announced that it would buy as much as $600 billion in Treasuries.)

For the 12 months, the broad U.S. stock market returned about 19%, a performance that was better than it felt in a year of ups and downs. Small-capitalization stocks did even better. International stocks returned about 13% on the strength of a powerful rally in emerging markets and solid single-digit gains in developed markets in Europe and the Pacific region.

Despite shrinking yields, bonds attracted investor dollars

Although fixed income yields have fallen to generational lows, investors continued to bid up bond prices. The broad U.S. bond market produced a 12-month return of about 8% as the yield of the 10-year U.S. Treasury note fell from 3.39% at the start of the period to 2.61% at the close. Tax-exempt municipal bonds also rallied. Bond prices and yields move in opposite directions, of course, so abundant returns built on rising prices could mean leaner pickings in the years ahead.

The yields of money market securities hovered near 0%, consistent with the Federal Reserve Board’s target for short-term rates.

Market Barometer

| | | |

| | | Average Annual Total Returns |

| | | Periods Ended October 31, 2010 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 17.67% | -6.14% | 1.99% |

| Russell 2000 Index (Small-caps) | 26.58 | -3.91 | 3.07 |

| Dow Jones U.S. Total Stock Market Index | 19.04 | -5.55 | 2.52 |

| MSCI All Country World Index ex USA (International) | 13.08 | -7.62 | 6.21 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 8.01% | 7.23% | 6.45% |

| Barclays Capital Municipal Bond Index (Broad | | | |

| tax-exempt market) | 7.78 | 5.79 | 5.20 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.12 | 0.89 | 2.41 |

| |

| CPI | | | |

| Consumer Price Index | 1.17% | 1.54% | 1.89% |

3

IT and industrial holdings propelled the fund’s return

The Mid-Cap Growth Fund’s advisors aim to invest in a broad range of high- quality midsized companies with strong growth prospects. The fund has focused on a handful of sectors—information technology, consumer discretionary, industrials, and health care—which together made up more than 75% of its assets, on average, during the fiscal year.