UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07443

Name of Registrant: Vanguard Whitehall Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2010 – October 31, 2011

Item 1: Reports to Shareholders

Annual Report | October 31, 2011

Vanguard Selected Value Fund

> For the fiscal year ended October 31, Vanguard Selected Value Fund returned almost 8%.

> The fund outperformed its benchmark index by almost 2 percentage points and the average return of its peer funds by more than 3 percentage points.

> Financial and health care holdings contributed most to the fund’s outperformance.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 7 |

| Fund Profile. | 11 |

| Performance Summary. | 12 |

| Financial Statements. | 14 |

| Your Fund’s After-Tax Returns. | 24 |

| About Your Fund’s Expenses. | 25 |

| Glossary. | 27 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we strive to help clients reach their financial goals.

Your Fund’s Total Returns

| |

| Fiscal Year Ended October 31, 2011 | |

| |

| | Total |

| | Returns |

| Vanguard Selected Value Fund | 7.74% |

| Russell Midcap Value Index | 5.83 |

| Mid-Cap Value Funds Average | 4.09 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper Inc. |

Your Fund’s Performance at a Glance

October 31, 2010 , Through October 31, 2011

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Selected Value Fund | $17.73 | $18.81 | $0.291 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

Despite extreme volatility in the financial markets, Vanguard Selected Value Fund returned 7.74% for the fiscal year ended October 31, 2011, ahead of both the 5.83% return of its benchmark, the Russell Midcap Value Index, and the 4.09% average return of its mid-cap value fund peers.

In large part, the fund’s solid performance was driven by its holdings in financials and health care. Consumer discretionary and utility stocks were also sources of strength; however, reversals among a number of information technology holdings dampened returns.

If you hold shares in a taxable account, you may wish to review the information about after-tax returns for the fiscal year that appears later in this report.

A positive finish

to an anxious 12 months

U.S. stock indexes ended the period with solid returns, though the gains were shadowed by anxiety in a volatile period. This turbulence was so pronounced, in fact, that a one-month change in the start date would have yielded a very different perspective on performance. For the 12 months through October 31, the broad U.S. stock market returned 7.67%. For the 12 months ended September 30, however, the return was a mere 0.31%.

2

Volatility has been a theme in international markets, too. International stock markets returned a combined –4.66% as stock prices retreated in Europe. Prices also fell in the Pacific region’s developed economies and emerging markets, where growth has moderated.

Unsteady yields reflected

fast-changing sentiment

Taxable bonds produced strong return and municipal bonds solid but unspectacular results, though as in the stock market, investor sentiment was volatile. The yield of the 10-year U.S. Treasury note, a benchmark for longer-term interest rates, began the 12 months at 2.61%, drifted higher as the economic expansion seemed to gather steam, then fluttered lower to close the period at 2.17%. The decline in Treasury yields (and rise in prices) was driven by Europe’s sovereign-debt dramas, underwhelming economic reports, and a flight to safety that was prompted, paradoxically, by a rating agency’s decision to downgrade the U.S. government debt. Vanguard’s confidence in the full faith and credit of the U.S. Treasury remains unshaken.

Taxable investment-grade bonds returned 5.00% for the full 12 months. It’s important to note, of course, that as yields decline, the opportunity for similarly strong returns diminishes. The broad municipal market returned 3.78%. The returns on money market instruments hovered near 0%, consistent with the Federal Reserve Board’s target for short-term interest rates.

| | | |

| Market Barometer | | | |

| |

| | | Average Annual Total Returns |

| | | Periods Ended October 31, 2011 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 8.01% | 12.22% | 0.54% |

| Russell 2000 Index (Small-caps) | 6.71 | 12.87 | 0.68 |

| Dow Jones U.S. Total Stock Market Index | 7.67 | 12.58 | 0.90 |

| MSCI All Country World Index ex USA (International) | -4.66 | 12.92 | -0.37 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 5.00% | 8.87% | 6.41% |

| Barclays Capital Municipal Bond Index (Broad | | | |

| tax-exempt market) | 3.78 | 8.31 | 4.80 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.10 | 0.15 | 1.53 |

| |

| CPI | | | |

| Consumer Price Index | 3.53% | 1.49% | 2.33% |

3

Security selection

drives performance

Vanguard Selected Value Fund invests in midsized companies that, in the advisors’ judgment, are significantly undervalued relative to their assets or earnings. When the advisors identify compelling candidates, they invest with conviction, producing a relatively concentrated portfolio. (While the fund’s benchmark index included more than 500 stocks at the end of the period, the fund held just 64.)

More than one-quarter of the fund’s assets were in financial stocks. Though this sector continued to wrestle with bad loans and a tough lending environment, the fund managed to avoid some associated potholes, such as regional banks. It also benefited from its very concentrated insurance company holdings and from credit card company stocks that remained unscathed by some of the problems plaguing the broader banking industry.

Health care was another bright spot for the fund. Its holdings in this sector, all in health care providers and services, boosted returns and outpaced their counterparts in the index. Consumer discretionary and utilities stocks together also added to relative returns. Stock selection in information technology, however, detracted from returns.

You can find more information on the fund’s positioning and performance during the fiscal year in the Advisors’ Report that follows this letter.

Expense Ratios

Your Fund Compared With Its Peer Group

| | |

| | | Peer Group |

| | Fund | Average |

| Selected Value Fund | 0.47% | 1.39% |

The fund expense ratio shown is from the prospectus dated February 24, 2011, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2011, the fund’s expense ratio was 0.45%. The peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2010.Peer group: Mid-Cap Value Funds.4

A decade of returns

attests to the fund’s strategy

The Selected Value Fund’s advisors seek very concentrated investments in midsized companies that are significantly undervalued and have the potential to appreciate substantially. This strategy involves considerable risk: When the advisors’ investment thesis pays off, the positive effect on returns can be significant; on the other hand, weakness in a handful of positions can have an outsized negative impact.

Over time, buying stocks with fundamental value at market discounts should result in good returns, and that has proven to be the case. Over the last ten years, the fund’s average annualized return was 8.27%, almost 4 percentage points more than the broad U.S. stock market. This strong result was less strong relative to the fund’s more finely calibrated comparative standards. The fund’s return trailed that of its benchmark index by a small amount but outpaced that of its mid-cap value fund peers.

A well-balanced portfolio

is your best approach

Diversification is a proven means of reducing risk in a portfolio, protecting it from the market’s inevitable downturns while also capturing its upswings. Investors may feel they are sufficiently diversified if they are invested in a fund pegged to a well-known large-cap index such as the S&P 500. However, by broadening their portfolio’s exposure to include a blend

Total Returns

Ten Years Ended October 31, 2011

| |

| | Average |

| | Annual Return |

| Selected Value Fund | 8.27% |

| Russell Midcap Value Index | 8.76 |

| Mid-Cap Value Funds Average | 7.23 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper Inc. |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

of small-, mid-, and large-cap stocks, they can benefit additionally during those times when one asset class outperforms another.

At Vanguard, we advise investors to hold a balanced portfolio that includes stocks, bonds, and money market funds in a mix that matches their risk tolerance and time horizon. With its skilled advisors’ long experience in identifying attractively valued smaller companies, Vanguard Selected Value Fund can play an important role in such a plan.

As always, we appreciate your confidence in Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 11, 2011

6

Advisors’ Report

For the fiscal year ended October 31, 2011, Vanguard Selected Value Fund returned 7.74%. Your fund is managed by two independent advisors. This provides exposure to distinct, yet complementary, investment approaches, enhancing the fund’s diversification. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the percentage and amount of fund assets each manages, and a brief description of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the fiscal period and of how portfolio positioning reflects this assessment. These comments were prepared on November 19, 2011.

| | | |

| Vanguard Selected Value Fund Investment Advisors | |

| |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Barrow, Hanley, Mewhinney & | 73 | 2,895 | Conducts fundamental research on individual stocks |

| Strauss, LLC | | | exhibiting traditional value characteristics: |

| | | | price/earnings and price/book ratios below the market |

| | | | average and dividend yields above the market average. |

| Donald Smith & Co., Inc. | 25 | 977 | Conducts fundamental research on the lowest |

| | | | price-to-tangible-book-value companies. Research |

| | | | focuses on underlying quality of book value and assets, |

| | | | and on long-term earnings potential. |

| Cash Investments | 2 | 84 | These short-term reserves are invested by Vanguard in |

| | | | equity index products to simulate investment in stocks. |

| | | | Each advisor may also maintain a modest cash |

| | | | position. |

7

Barrow, Hanley, Mewhinney & Strauss, LLC

Portfolio Managers:

James P. Barrow, Executive Director

Mark Giambrone, Managing Director

The past year has been dominated by macro themes leading to dramatic volatility and uncertainty in markets, economies, and politics around the world. Through all of this, the market recorded a modest gain, and we were able to perform meaningfully better than our benchmark. Since we take no macro positions, our general perspective on the business environment is shaped by the many company management teams we meet with regularly. This may sound surprising, but their general theme is, “While the headlines are toxic, business is okay, and better than last year.” Although we pick stocks on a bottom-up basis, we consider this opinion when forecasting future business prospects, and our portfolio reflects that.

Accordingly, we are overweight in industrials, health care, energy, and consumer discretionary, and we have a significant weight in financials. Recently, we have been finding new opportunities in all of these sectors, and over the past year we have established new positions in all but health care. Consistently, we are underweight in consumer staples, utilities, information technology, and materials and are struggling to find value and new opportunities in these areas.

The global uncertainty has caused CEOs and companies to take a very conservative stance toward their balance sheets. While this is certainly understandable, corporate cash as a percent of total assets is at record levels, and management now appears more willing to either deploy excess cash to grow a business or return it to shareholders in the form of dividends and share repurchases. We have seen consistent increases in both dividends and share repurchases across all sectors.

We believe this portfolio is uniquely positioned to benefit from merger-and-acquisition activity; several of our holdings have already done so. We had a large position in Goodrich Corp., which was taken over by United Technologies at a substantial premium. Acquisitions by Stanley Black & Decker and Capital One will add nicely to earnings growth over the next few years and should lead to higher valuations. And ITT Corp. decided to break into three pieces, each of which is an attractive value candidate. Because of our focus on low valuations and high-quality business prospects, our portfolio has a long history of acquisition activity, and with all the cash now on large corporate balance sheets, we expect this to continue.

8

Although headlines are “toxic,” strong, solid companies are doing the right things to try to enhance shareholder value, and we expect to be direct beneficiaries of this. We believe our portfolio is well-positioned, made up of quality holdings with good earnings and cash-flow prospects that pay an above-market yield and have below-market valuations.

Donald Smith & Co., Inc.

Portfolio Managers:

Donald G. Smith, Chief Investment Officer

Richard L. Greenberg, CFA, Senior Vice President

Our portfolio at the end of October 2011 continues to meet our criteria of holding a concentrated group of low price-to-tangible-book-value stocks with attractive long-term earnings potential. The portfolio currently sells at 81% of tangible book value and 7.8 times our estimate of “normalized earnings.” In contrast, the S&P 500 Index sells at more than 400% of tangible book value and about 14 times normalized earnings.

The portfolio’s return over the past year exceeded that of the Russell Midcap Value Index. Dillard’s and Tesoro each appreciated in excess of 100%; both continue to show substantial progress in their turnaround plans. Dillard’s has been very aggressive in its stock buyback program. Yamana Gold (+36.2%) benefited from higher gold prices. Constellation Energy (+31.3%) agreed to merge with Exelon. Royal Caribbean, a recent purchase, rose from its depressed bottom. In general, companies not as subject to the direction of the economy, such as utilities and insurance, outperformed, and those hurt by a weaker economy and/or higher oil prices, such as technology, airlines, and shipping, underperformed. Our two airline stocks, Air France (–57.9%) and JetBlue (–35.8%), and the oil tanker company Overseas Shipholding (–62.7%) were the poorest performers. Micron Technology (–32.3%) has suffered from weak pricing in memory chips and concerns about a pending lawsuit decision.

We eliminated holdings in Flextronics and Semiconductor Manufacturing and added to several others, particularly in August, when the cash position was reduced by 46%. We greatly increased our position in stocks that have underperformed, including airlines and Micron Technology, and added three new stocks over the past year. We recently purchased Royal Caribbean Cruises, which we’d previously owned, at $23.73, or 50% below recent highs. This price was only about 70% of tangible book value and 8 times earnings. We initiated a small position in XL Group, a reinsurance company that sells at 69% of tangible book value. Like many other reinsurance companies, it has wisely been repurchasing stock at a discount to book

9

value. Our final purchase was in Southwest Airlines. The airline industry’s shrinking capacity has allowed for much improved pricing power, and Southwest has the best balance sheet in the industry.

The portfolio’s three largest industry positions are insurance (18.2%), technology (14.7%), and utilities (14.4%). The defensive nature of utilities and insurance helps to offset more cyclically oriented sectors, including technology and transportation. Our insurance firms all sell below book value and are overcapitalized; we are pleased that some have decided to return money to the shareholders through aggressive stock repurchase programs. Our technology holdings—Ingram Micro and Micron—while more sensitive to an economic slowdown, have superior balance sheets that ensure their survival. The portfolio overall is attractively valued at only 81% of tangible book value.

10

Selected Value Fund

Fund Profile

As of October 31, 2011

| | | |

| Portfolio Characteristics | | |

| | | Russell | DJ |

| | | Midcap | U.S. Total |

| | | Value | Market |

| | Fund | Index | Index |

| Number of Stocks | 64 | 528 | 3,749 |

| Median Market Cap | $7.2B | $6.7B | $30.4B |

| Price/Earnings Ratio | 13.2x | 15.3x | 14.9x |

| Price/Book Ratio | 1.3x | 1.4x | 2.1x |

| Return on Equity | 12.0% | 10.5% | 19.1% |

| Earnings Growth Rate | -1.6% | 0.6% | 7.2% |

| Dividend Yield | 2.4% | 2.4% | 2.0% |

| Foreign Holdings | 7.3% | 0.0% | 0.0% |

| Turnover Rate | 25% | — | — |

| Ticker Symbol | VASVX | — | — |

| Expense Ratio1 | 0.47% | — | — |

| 30-Day SEC Yield | 1.80% | — | — |

| Short-Term Reserves | 3.9% | — | — |

| |

| Sector Diversification (% of equity exposure) |

| | | Russell | DJ |

| | | Midcap | U.S. Total |

| | | Value | Market |

| | Fund | Index | Index |

| Consumer | | | |

| Discretionary | 13.5% | 11.2% | 12.4% |

| Consumer Staples | 4.2 | 6.8 | 10.1 |

| Energy | 8.6 | 6.7 | 10.7 |

| Financials | 26.2 | 31.0 | 15.1 |

| Health Care | 8.4 | 6.1 | 11.1 |

| Industrials | 14.9 | 10.5 | 10.9 |

| Information | | | |

| Technology | 9.2 | 8.3 | 19.3 |

| Materials | 3.8 | 4.5 | 4.3 |

| Telecommunication | | | |

| Services | 0.1 | 0.8 | 2.6 |

| Utilities | 11.1 | 14.1 | 3.5 |

| | |

| Volatility Measures | | |

| | Russell | DJ |

| | Midcap | U.S. Total |

| | Value | Market |

| | Index | Index |

| R-Squared | 0.95 | 0.95 |

| Beta | 0.84 | 1.01 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. | |

| |

| |

| Ten Largest Holdings (% of total net assets) |

| Royal Caribbean Cruises | Hotels, Resorts & | |

| Ltd. | Cruise Lines | 3.5% |

| Constellation Energy | Independent Power | |

| Group Inc. | Producers & Energy | |

| | Traders | 2.6 |

| Yamana Gold Inc. | Gold | 2.5 |

| International Game | | |

| Technology | Casinos & Gaming | 2.4 |

| Discover Financial | | |

| Services | Consumer Finance | 2.3 |

| Coventry Health Care | Managed Health | |

| Inc. | Care | 2.3 |

| Capital One Financial | | |

| Corp. | Consumer Finance | 2.2 |

| Stanley Black & Decker | Industrial | |

| Inc. | Machinery | 2.1 |

| Essex Property Trust Inc. | Residential REITs | 2.1 |

| Molex Inc. | Electronic | |

| | Manufacturing | |

| | Services | 2.1 |

| Top Ten | | 24.1% |

| The holdings listed exclude any temporary cash investments and equity index products. |

| | |

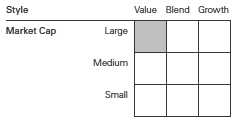

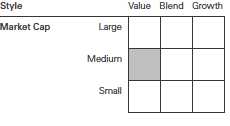

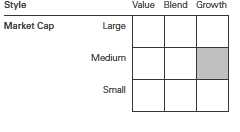

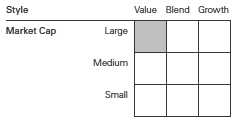

Investment Focus

1 The expense ratio shown is from the prospectus dated February 24, 2011, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2011, the expense ratio was 0.45%.

11

Selected Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

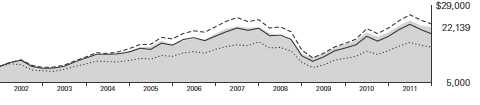

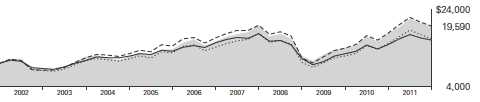

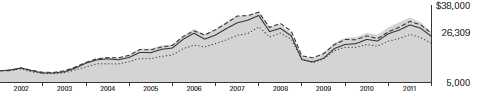

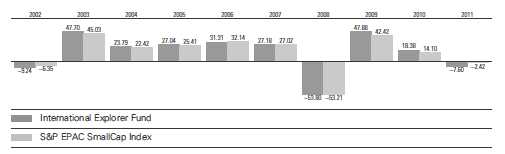

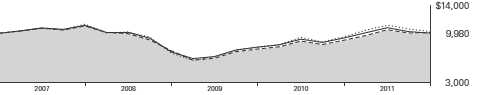

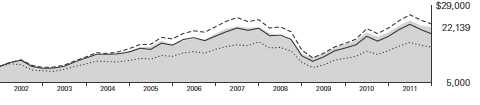

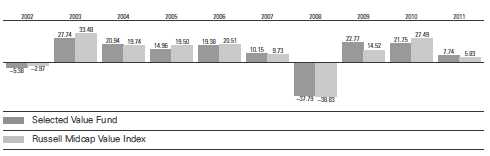

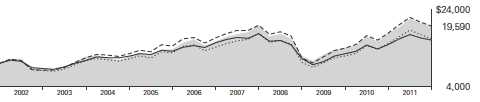

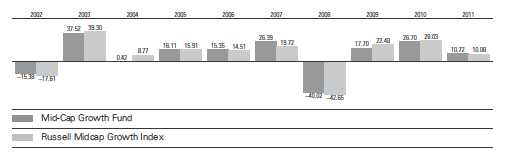

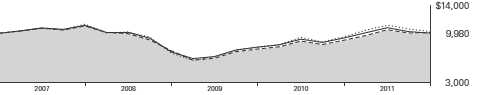

Cumulative Performance: October 31, 2001, Through October 31, 2011

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2011 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| Selected Value Fund | 7.74% | 1.99% | 8.27% | $22,139 |

| Dow Jones U.S. Total Stock Market | | | | |

| Index | 7.67 | 0.90 | 4.82 | 16,011 |

| Russell Midcap Value Index | 5.83 | 0.73 | 8.76 | 23,164 |

| Mid-Cap Value Funds Average | 4.09 | 0.72 | 7.23 | 20,107 |

Mid-Cap Value Funds Average: Derived from data provided by Lipper Inc.

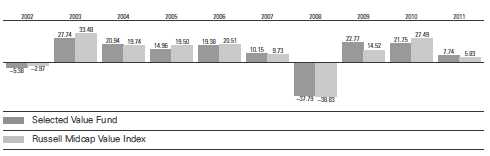

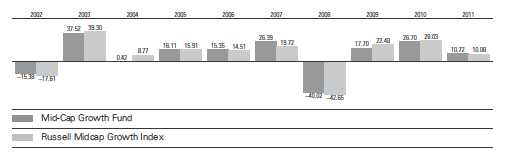

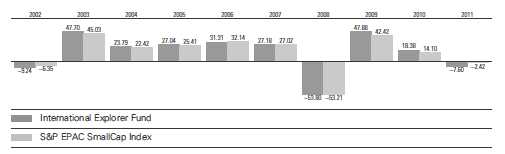

Fiscal-Year Total Returns (%): October 31, 2001, Through October 31, 2011

Vanguard fund returns do not reflect the 1% fee on redemptions of shares held for less than one year.

See Financial Highlights for dividend and capital gains information.

12

Selected Value Fund

Average Annual Total Returns: Periods Ended September 30, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Selected Value Fund | 2/15/1996 | -1.29% | 0.10% | 6.88% |

Vanguard fund returns do not reflect the 1% fee on redemptions of shares held for less than one year.

13

Selected Value Fund

Financial Statements

Statement of Net Assets

As of October 31, 2011

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (94.3%)1 | | |

| Consumer Discretionary (12.7%) | |

| | Royal Caribbean Cruises | | |

| | Ltd. | 4,612,000 | 137,069 |

| | International Game | | |

| | Technology | 5,370,100 | 94,460 |

| | Newell Rubbermaid Inc. | 4,854,400 | 71,845 |

| * | Hanesbrands Inc. | 2,694,900 | 71,064 |

| | Dillard’s Inc. Class A | 1,121,927 | 57,813 |

| | Rent-A-Center Inc. | 1,340,017 | 45,762 |

| | Service Corp. | | |

| | International | 2,627,000 | 26,270 |

| | | | 504,283 |

| Consumer Staples (3.9%) | | |

| | Lorillard Inc. | 733,800 | 81,203 |

| | Reynolds American Inc. | 1,846,800 | 71,434 |

| | | | 152,637 |

| Energy (8.0%) | | |

| ^ | Seadrill Ltd. | 2,467,900 | 81,761 |

| | Golar LNG Ltd. | 1,698,147 | 68,656 |

| | Murphy Oil Corp. | 1,231,800 | 68,205 |

| | Spectra Energy Corp. | 1,664,900 | 47,666 |

| * | Tesoro Corp. | 1,437,184 | 37,281 |

| | Noble Corp. | 224,597 | 8,072 |

| ^ | Overseas Shipholding | | |

| | Group Inc. | 472,900 | 5,902 |

| | | | 317,543 |

| Financials (25.1%) | | |

| | Discover Financial | | |

| | Services | 3,914,600 | 92,228 |

| | Capital One Financial | | |

| | Corp. | 1,889,500 | 86,275 |

| | Essex Property Trust Inc. | 583,600 | 83,315 |

| | Willis Group Holdings plc | 2,242,900 | 81,440 |

| | SLM Corp. | 5,721,200 | 78,209 |

| | CNA Financial Corp. | 2,833,282 | 75,365 |

| | XL Group plc Class A | 3,431,300 | 74,596 |

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Fifth Third Bancorp | 6,025,500 | 72,366 |

| | New York Community | | |

| | Bancorp Inc. | 4,330,300 | 57,636 |

| | PNC Financial Services | | |

| | Group Inc. | 1,055,712 | 56,702 |

| | Ameriprise Financial Inc. | 1,106,400 | 51,647 |

| | Everest Re Group Ltd. | 506,817 | 45,573 |

| | Chubb Corp. | 633,900 | 42,503 |

| | Annaly Capital | | |

| | Management Inc. | 2,320,500 | 39,100 |

| | Unum Group | 1,401,490 | 33,412 |

| | American National | | |

| | Insurance Co. | 164,858 | 11,781 |

| | Montpelier Re Holdings | | |

| | Ltd. | 566,863 | 9,920 |

| | | | 992,068 |

| Health Care (7.9%) | | |

| * | Coventry Health Care Inc. | 2,899,200 | 92,224 |

| | Omnicare Inc. | 2,648,200 | 78,969 |

| | Cardinal Health Inc. | 1,679,100 | 74,334 |

| | CIGNA Corp. | 1,510,700 | 66,984 |

| | | | 312,511 |

| Industrials (14.1%) | | |

| | Stanley Black & Decker | | |

| | Inc. | 1,317,300 | 84,110 |

| | Goodrich Corp. | 615,600 | 75,491 |

| | Eaton Corp. | 1,552,200 | 69,570 |

| | Masco Corp. | 5,836,700 | 56,032 |

| | L-3 Communications | | |

| | Holdings Inc. | 759,300 | 51,465 |

| | SPX Corp. | 871,500 | 47,593 |

| | ITT Corp. | 972,000 | 44,323 |

| * | Air France-KLM ADR | 5,177,864 | 39,326 |

| | Dun & Bradstreet Corp. | 529,500 | 35,402 |

| * | JetBlue Airways Corp. | 7,389,729 | 33,106 |

| | Southwest Airlines Co. | 2,600,000 | 22,230 |

| | | | 558,648 |

14

Selected Value Fund

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Information Technology (8.4%) | |

| | Molex Inc. | 3,364,700 | 83,074 |

| * | Ingram Micro Inc. | 4,190,311 | 74,923 |

| * | Micron Technology Inc. | 12,321,916 | 68,879 |

| | Western Union Co. | 3,087,500 | 53,939 |

| | Xerox Corp. | 6,548,400 | 53,566 |

| | | | 334,381 |

| Materials (3.6%) | | |

| | Yamana Gold Inc. | 6,630,900 | 99,264 |

| | Sonoco Products Co. | 1,033,700 | 32,448 |

| | Domtar Corp. | 112,570 | 9,221 |

| | | | 140,933 |

| Utilities (10.6%) | | |

| | Constellation Energy | | |

| | Group Inc. | 2,568,237 | 101,959 |

| | CenterPoint Energy Inc. | 3,839,300 | 80,011 |

| | Pinnacle West Capital | | |

| | Corp. | 1,513,505 | 68,986 |

| | Xcel Energy Inc. | 2,535,300 | 65,537 |

| | MDU Resources Group | | |

| | Inc. | 1,967,500 | 40,550 |

| | Oneok Inc. | 505,100 | 38,413 |

| | NV Energy Inc. | 788,340 | 12,645 |

| * | GenOn Energy Inc. | 3,553,218 | 10,837 |

| | | | 418,938 |

| Total Common Stocks | | |

| (Cost $3,154,211) | | 3,731,942 |

| Temporary Cash Investments (7.1%)1 | |

| Money Market Fund (6.9%) | | |

| 2,3 | Vanguard Market Liquidity | |

| | Fund, 0.128% | 271,055,290 | 271,055 |

| | | |

| | | Face | Market |

| | Amount | Value |

| | | ($000) | ($000) |

| U.S. Government and Agency Obligations (0.2%) |

| 4 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.080%, 12/19/11 | 850 | 850 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.075%, 11/16/11 | 2,000 | 2,000 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.040%, 12/9/11 | 5,000 | 5,000 |

| | | | 7,850 |

| Total Temporary Cash Investments | |

| (Cost $278,905) | | 278,905 |

| Total Investments (101.4%) | | |

| (Cost $3,433,116) | | 4,010,847 |

| Other Assets and Liabilities (-1.4%) | |

| Other Assets | | 5,775 |

| Liabilities3 | | (60,295) |

| | | | (54,520) |

| Net Assets (100%) | | |

| Applicable to 210,298,299 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | | 3,956,327 |

| Net Asset Value Per Share | | $18.81 |

| |

| |

| At October 31, 2011, net assets consisted of: |

| | | | Amount |

| | | | ($000) |

| Paid-in Capital | | 3,634,781 |

| Undistributed Net | | |

| Investment Income | | 43,027 |

| Accumulated Net Realized Losses | | (302,882) |

| Unrealized Appreciation | | |

| (Depreciation) | | |

| Investment Securities | | 577,731 |

| Futures Contracts | | 3,670 |

| Net Assets | | 3,956,327 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $39,870,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 96.4% and 5.0%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $42,557,000 of collateral received for securities on loan.

4 The issuer is under federal conservatorship and is dependent upon the continued support of the U.S. Treasury to avoid receivership.

5 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

6 Securities with a value of $7,000,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

15

Selected Value Fund

Statement of Operations

| |

| | Year Ended |

| | October 31, 2011 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 87,070 |

| Interest2 | 783 |

| Security Lending | 283 |

| Total Income | 88,136 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 9,077 |

| Performance Adjustment | 1,539 |

| The Vanguard Group—Note C | |

| Management and Administrative | 6,615 |

| Marketing and Distribution | 903 |

| Custodian Fees | 50 |

| Auditing Fees | 29 |

| Shareholders’ Reports | 57 |

| Trustees’ Fees and Expenses | 8 |

| Total Expenses | 18,278 |

| Expenses Paid Indirectly | (250) |

| Net Expenses | 18,028 |

| Net Investment Income | 70,108 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 162,314 |

| Futures Contracts | 5,748 |

| Realized Net Gain (Loss) | 168,062 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 37,627 |

| Futures Contracts | (325) |

| Change in Unrealized Appreciation (Depreciation) | 37,302 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 275,472 |

1 Dividends are net of foreign withholding taxes of $42,000.

2 Interest income from an affiliated company of the fund was $755,000.

See accompanying Notes, which are an integral part of the Financial Statements.

16

Selected Value Fund

Statement of Changes in Net Assets

| | |

| | Year Ended October 31, |

| | 2011 | 2010 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 70,108 | 50,597 |

| Realized Net Gain (Loss) | 168,062 | (26,512) |

| Change in Unrealized Appreciation (Depreciation) | 37,302 | 604,494 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 275,472 | 628,579 |

| Distributions | | |

| Net Investment Income | (60,410) | (46,869) |

| Realized Capital Gain | — | — |

| Total Distributions | (60,410) | (46,869) |

| Capital Share Transactions | | |

| Issued | 636,966 | 628,925 |

| Issued in Lieu of Cash Distributions | 54,298 | 41,576 |

| Redeemed1 | (589,231) | (464,396) |

| Net Increase (Decrease) from Capital Share Transactions | 102,033 | 206,105 |

| Total Increase (Decrease) | 317,095 | 787,815 |

| Net Assets | | |

| Beginning of Period | 3,639,232 | 2,851,417 |

| End of Period2 | 3,956,327 | 3,639,232 |

1 Net of redemption fees for fiscal 2011 and 2010 of $482,000 and $459,000, respectively.

2 Net Assets—End of Period includes undistributed net investment income of $43,027,000 and $33,329,000.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Selected Value Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | | | Year Ended October 31, |

| Throughout Each Period | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $17.73 | $14.78 | $12.48 | $22.11 | $21.38 |

| Investment Operations | | | | | |

| Net Investment Income | . 334 | . 250 | . 254 | . 3901 | .400 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 1.037 | 2.941 | 2.463 | (8.100) | 1.700 |

| Total from Investment Operations | 1.371 | 3.191 | 2.717 | (7.710) | 2.100 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (. 291) | (. 241) | (. 417) | (. 370) | (. 320) |

| Distributions from Realized Capital Gains | — | — | — | (1.550) | (1.050) |

| Total Distributions | (. 291) | (. 241) | (. 417) | (1.920) | (1.370) |

| Net Asset Value, End of Period | $18.81 | $17.73 | $14.78 | $12.48 | $22.11 |

| |

| Total Return2 | 7.74% | 21.75% | 22.77% | -37.79% | 10.15% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $3,956 | $3,639 | $2,851 | $2,422 | $4,991 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets3 | 0.45% | 0.47% | 0.52% | 0.38% | 0.42% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.74% | 1.52% | 1.93% | 2.21% | 1.74% |

| Portfolio Turnover Rate | 25% | 22% | 30% | 23% | 33% |

1 Calculated based on average shares outstanding.

2 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable transaction or account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of 0.04%, 0.05%, 0.05%, (0.03%), and (0.02%).

See accompanying Notes, which are an integral part of the Financial Statements.

18

Selected Value Fund

Notes to Financial Statements

Vanguard Selected Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2008–2011), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents fees charged to borrowers plus income earned on investing cash collateral, less expenses associated with the loan.

19

Selected Value Fund

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

B. Barrow, Hanley, Mewhinney & Strauss, LLC., and Donald Smith & Co., Inc., each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee of Barrow, Hanley, Mewhinney & Strauss, LLC, is subject to quarterly adjustments based on performance for the preceding three years relative to the Russell Midcap Value Index. The basic fee of Donald Smith & Co., Inc., is subject to quarterly adjustments based on performance for the preceding five years relative to the MSCI Investable Market 2500 Index.

The Vanguard Group manages the cash reserves of the fund on an at-cost basis.

For the year ended October 31, 2011, the aggregate investment advisory fee represented an effective annual basic rate of 0.23% of the fund’s average net assets, before an increase of $1,539,000 (0.04%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At October 31, 2011, the fund had contributed capital of $609,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.24% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. For the year ended October 31, 2011, these arrangements reduced the fund’s expenses by $250,000 (an annual rate of 0.01% of average net assets).

E. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

20

Selected Value Fund

The following table summarizes the market value of the fund’s investments as of October 31, 2011, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 3,731,942 | — | — |

| Temporary Cash Investments | 271,055 | 7,850 | — |

| Futures Contracts—Assets1 | 33 | — | — |

| Futures Contracts—Liabilities1 | (2,147) | — | — |

| Total | 4,000,883 | 7,850 | — |

| 1 Represents variation margin on the last day of the reporting period. |

F. At October 31, 2011, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| S&P 500 Index | December 2011 | 260 | 81,205 | 3,697 |

| E-mini S&P 500 Index | December 2011 | 17 | 1,062 | (27) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

G. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

For tax purposes, at October 31, 2011, the fund had $49,735,000 of ordinary income available for distribution. The fund had available capital loss carryforwards totaling $298,609,000 to offset future net capital gains of $26,776,000 through October 31, 2016, $249,339,000 through October 31, 2017, and $22,494,000 through October 31, 2018.

At October 31, 2011, the cost of investment securities for tax purposes was $3,433,116,000. Net unrealized appreciation of investment securities for tax purposes was $577,731,000, consisting of unrealized gains of $793,277,000 on securities that had risen in value since their purchase and $215,546,000 in unrealized losses on securities that had fallen in value since their purchase.

H. During the year ended October 31, 2011, the fund purchased $1,183,534,000 of investment securities and sold $907,830,000 of investment securities, other than temporary cash investments.

21

Selected Value Fund

I. Capital shares issued and redeemed were:

| | |

| | Year Ended October 31, |

| | 2011 | 2010 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 33,349 | 37,789 |

| Issued in Lieu of Cash Distributions | 2,899 | 2,571 |

| Redeemed | (31,206) | (28,069) |

| Net Increase (Decrease) in Shares Outstanding | 5,042 | 12,291 |

J. In preparing the financial statements as of October 31, 2011, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

22

Report of Independent Registered

Public Accounting Firm

To the Trustees of Vanguard Whitehall Funds and the Shareholders of Vanguard Selected Value Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Selected Value Fund (constituting a separate portfolio of Vanguard Whitehall Funds, hereafter referred to as the “Fund”) at October 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2011 by correspondence with the custodian and broker and by agreement to the underlying ownership records of Vanguard Market Liquidity Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 12, 2011

|

| Special 2011 tax information (unaudited) for Vanguard Selected Value Fund |

This information for the fiscal year ended October 31, 2011, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $60,410,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 93.7% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

23

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2011. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

Average Annual Total Returns: Selected Value Fund

Periods Ended October 31, 2011

| | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 7.74% | 1.99% | 8.27% |

| Returns After Taxes on Distributions | 7.49 | 1.23 | 7.55 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 5.36 | 1.54 | 7.08 |

Returns do not reflect the 1% fee on redemptions of shares held for less than one year.

24

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

25

| | | |

| Six Months Ended October 31, 2011 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Selected Value Fund | 4/30/2011 | 10/31/2011 | Period |

| Based on Actual Fund Return | $1,000.00 | $912.66 | $2.17 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,022.94 | 2.29 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.45%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

26

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds; excluding inflation for inflation-protected securities), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

27

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

28

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 180 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

| |

| Interested Trustee1 | and President (2006–2008) of Rohm and Haas Co. |

| | (chemicals); Director of Tyco International, Ltd. |

| F. William McNabb III | (diversified manufacturing and services) and Hewlett- |

| Born 1957. Trustee Since July 2009. Chairman of the | Packard Co. (electronic computer manufacturing); |

| Board. Principal Occupation(s) During the Past Five | Senior Advisor at New Mountain Capital; Trustee |

| Years: Chairman of the Board of The Vanguard Group, | of The Conference Board; Member of the Board of |

| Inc., and of each of the investment companies served | Managers of Delphi Automotive LLP (automotive |

| by The Vanguard Group, since January 2010; Director | components). |

| of The Vanguard Group since 2008; Chief Executive | |

| Officer and President of The Vanguard Group and of | Amy Gutmann |

| each of the investment companies served by The | Born 1949. Trustee Since June 2006. Principal |

| Vanguard Group since 2008; Director of Vanguard | Occupation(s) During the Past Five Years: President |

| Marketing Corporation; Managing Director of The | of the University of Pennsylvania; Christopher H. |

| Vanguard Group (1995–2008). | Browne Distinguished Professor of Political Science |

| | in the School of Arts and Sciences with secondary |

| | appointments at the Annenberg School for Commu- |

| Independent Trustees | nication and the Graduate School of Education |

| | of the University of Pennsylvania; Director of |

| Emerson U. Fullwood | Carnegie Corporation of New York, Schuylkill River |

| Born 1948. Trustee Since January 2008. Principal | Development Corporation, and Greater Philadelphia |

| Occupation(s) During the Past Five Years: Executive | Chamber of Commerce; Trustee of the National |

| Chief Staff and Marketing Officer for North America | Constitution Center; Chair of the Presidential |

| and Corporate Vice President (retired 2008) of Xerox | Commission for the Study of Bioethical Issues. |

| Corporation (document management products and | |

| services); Executive in Residence and 2010 | JoAnn Heffernan Heisen |

| Distinguished Minett Professor at the Rochester | Born 1950. Trustee Since July 1998. Principal |

| Institute of Technology; Director of SPX Corporation | Occupation(s) During the Past Five Years: Corporate |

| (multi-industry manufacturing), the United Way of | Vice President and Chief Global Diversity Officer |

| Rochester, Amerigroup Corporation (managed health | (retired 2008) and Member of the Executive |

| care), the University of Rochester Medical Center, | Committee (1997–2008) of Johnson & Johnson |

| Monroe Community College Foundation, and North | (pharmaceuticals/consumer products); Director of |

| Carolina A&T University. | Skytop Lodge Corporation (hotels), the University |

| | Medical Center at Princeton, the Robert Wood |

| Rajiv L. Gupta | Johnson Foundation, and the Center for Work Life |

| Born 1945. Trustee Since December 2001.2 | Policy; Member of the Advisory Board of the |

| Principal Occupation(s) During the Past Five Years: | Maxwell School of Citizenship and Public Affairs |

| Chairman and Chief Executive Officer (retired 2009) | at Syracuse University. |

| | |

| F. Joseph Loughrey | Thomas J. Higgins | |

| Born 1949. Trustee Since October 2009. Principal | Born 1957. Chief Financial Officer Since September |

| Occupation(s) During the Past Five Years: President | 2008. Principal Occupation(s) During the Past Five |

| and Chief Operating Officer (retired 2009) and Vice | Years: Principal of The Vanguard Group, Inc.; Chief |

| Chairman of the Board (2008–2009) of Cummins Inc. | Financial Officer of each of the investment companies |

| (industrial machinery); Director of SKF AB (industrial | served by The Vanguard Group since 2008; Treasurer |

| machinery), Hillenbrand, Inc. (specialized consumer | of each of the investment companies served by The |

| services), the Lumina Foundation for Education, and | Vanguard Group (1998–2008). |

| Oxfam America; Chairman of the Advisory Council | | |

| for the College of Arts and Letters and Member | Kathryn J. Hyatt | |

| of the Advisory Board to the Kellogg Institute for | Born 1955. Treasurer Since November 2008. Principal |

| International Studies at the University of Notre Dame. | Occupation(s) During the Past Five Years: Principal |

| | of The Vanguard Group, Inc.; Treasurer of each of |

| André F. Perold | the investment companies served by The Vanguard |

| Born 1952. Trustee Since December 2004. Principal | Group since 2008; Assistant Treasurer of each of the |

| Occupation(s) During the Past Five Years: George | investment companies served by The Vanguard Group |

| Gund Professor of Finance and Banking at the Harvard | (1988–2008). | |

| Business School (retired July 2011); Chief Investment | | |

| Officer and co-Managing Partner of HighVista | Heidi Stam | |

| Strategies LLC (private investment firm); Director of | Born 1956. Secretary Since July 2005. Principal |

| Rand Merchant Bank; Overseer of the Museum of | Occupation(s) During the Past Five Years: Managing |

| Fine Arts Boston. | Director of The Vanguard Group, Inc., since 2006; |

| | General Counsel of The Vanguard Group since 2005; |

| Alfred M. Rankin, Jr. | Secretary of The Vanguard Group and of each of the |

| Born 1941. Trustee Since January 1993. Principal | investment companies served by The Vanguard Group |

| Occupation(s) During the Past Five Years: Chairman, | since 2005; Director and Senior Vice President of |

| President, and Chief Executive Officer of NACCO | Vanguard Marketing Corporation since 2005; |

| Industries, Inc. (forklift trucks/housewares/lignite); | Principal of The Vanguard Group (1997–2006). |

| Director of Goodrich Corporation (industrial products/ | | |

| aircraft systems and services) and the National | | |

| Association of Manufacturers; Chairman of the | Vanguard Senior Management Team |

| Federal Reserve Bank of Cleveland; Vice Chairman | | |

| of University Hospitals of Cleveland; President of | R. Gregory Barton | Chris D. McIsaac |

| the Board of The Cleveland Museum of Art. | Mortimer J. Buckley | Michael S. Miller |

| | Kathleen C. Gubanich | James M. Norris |

| Peter F. Volanakis | Paul A. Heller | Glenn W. Reed |

| Born 1955. Trustee Since July 2009. Principal | Martha G. King | George U. Sauter |

| Occupation(s) During the Past Five Years: President | | |

| and Chief Operating Officer (retired 2010) of Corning | | |

| Incorporated (communications equipment); Director of | Chairman Emeritus and Senior Advisor |

| Corning Incorporated (2000–2010) and Dow Corning | | |

| (2001–2010); Overseer of the Amos Tuck School of | John J. Brennan | |

| Business Administration at Dartmouth College. | Chairman, 1996–2009 | |

| | Chief Executive Officer and President, 1996–2008 |

| |

| Executive Officers | | |

| | Founder | |

| Glenn Booraem | | |

| Born 1967. Controller Since July 2010. Principal | John C. Bogle | |

| Occupation(s) During the Past Five Years: Principal | Chairman and Chief Executive Officer, 1974–1996 |

| of The Vanguard Group, Inc.; Controller of each of | | |

| the investment companies served by The Vanguard | | |

| Group since 2010; Assistant Controller of each of | | |

| the investment companies served by The Vanguard | | |

| Group (2001–2010). | | |

1 Mr. McNabb is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

|  |

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > vanguard.com

| |

| Fund Information > 800-662-7447 | CFA® is a trademark owned by CFA Institute. |

| Direct Investor Account Services > 800-662-2739 | |

| Institutional Investor Services > 800-523-1036 | |

| Text Telephone for People | |

| With Hearing Impairment > 800-749-7273 | |

| |

| This material may be used in conjunction | |

| with the offering of shares of any Vanguard | |

| fund only if preceded or accompanied by | |

| the fund’s current prospectus. | |

| |

| All comparative mutual fund data are from Lipper Inc. or | |

| Morningstar, Inc., unless otherwise noted. | |

| |

| You can obtain a free copy of Vanguard’s proxy voting | |

| guidelines by visiting vanguard.com/proxyreporting or by | |

| calling Vanguard at 800-662-2739. The guidelines are | |

| also available from the SEC’s website, sec.gov. In | |

| addition, you may obtain a free report on how your fund | |

| voted the proxies for securities it owned during the 12 | |

| months ended June 30. To get the report, visit either | |

| vanguard.com/proxyreporting or sec.gov. | |

| |

| You can review and copy information about your fund at | |

| the SEC’s Public Reference Room in Washington, D.C. To | |

| find out more about this public service, call the SEC at | |

| 202-551-8090. Information about your fund is also | |

| available on the SEC’s website, and you can receive | |

| copies of this information, for a fee, by sending a | |

| request in either of two ways: via e-mail addressed to | |

| publicinfo@sec.gov or via regular mail addressed to the | |

| Public Reference Section, Securities and Exchange | |

| Commission, Washington, DC 20549-1520. | |

| |

| |

| | © 2011 The Vanguard Group, Inc. |

| | All rights reserved. |

| | Vanguard Marketing Corporation, Distributor. |

| |

| | Q9340 122011 |

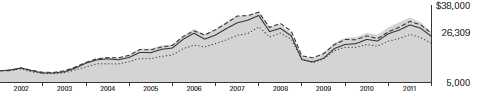

Annual Report | October 31, 2011

Vanguard Mid-Cap Growth Fund

> Vanguard Mid-Cap Growth Fund returned 10.72% for the 12 months ended October 31, 2011.

> The fund outperformed its benchmark, the Russell Midcap Growth Index, and the average return of mid-cap growth funds.

> Strong stock selection in industrials, consumer staples, and materials helped the fund beat its benchmark.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 8 |

| Fund Profile. | 12 |

| Performance Summary. | 13 |

| Financial Statements. | 15 |

| Your Fund’s After-Tax Returns. | 26 |

| About Your Fund’s Expenses. | 27 |

| Glossary. | 29 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we strive to help clients reach their financial goals.

Your Fund’s Total Returns

| |

| Fiscal Year Ended October 31, 2011 | |

| |

| | Total |

| | Returns |

| Vanguard Mid-Cap Growth Fund | 10.72% |

| Russell Midcap Growth Index | 10.08 |

| Mid-Cap Growth Funds Average | 8.00 |

| Mid-Cap Growth Funds Average: Derived from data provided by Lipper Inc. |

Your Fund’s Performance at a Glance

October 31, 2010 , Through October 31, 2011

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Mid-Cap Growth Fund | $17.54 | $19.40 | $0.020 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

For the fiscal year ended October 31, 2011, Vanguard Mid-Cap Growth Fund returned 10.72%, ahead of its benchmark, the Russell Midcap Growth Index, and the average return of its peer funds.

The Mid-Cap Growth Fund benefited from the prevailing trends in the broad U.S. stock market throughout the year. Notably, growth stocks, especially the small- and mid-cap variety, fared considerably better than value stocks. The fund outperformed its market benchmark thanks in part to the advisors’ strong stock selection in the industrial, consumer staples, and materials sectors.

If you own shares of the fund in a taxable account, you may wish to review the information about after-tax returns presented later in this report.

A positive finish

to an anxious 12 months

U.S. stock indexes ended the 12 months with solid returns, though the gains were shadowed by anxiety in a volatile period. This turbulence was so pronounced, in fact, that a one-month change in the start date would have yielded a very different perspective on performance. For the 12months through October 31, the broad U.S. stock market returned 7.67%. For the 12 months ended September 30, however, the return was a mere 0.31%.

2

Volatility has been a theme in international markets, too. Global stock markets returned a combined –4.66% as stock prices retreated in Europe. Prices also fell in the Pacific region’s developed economies and emerging markets, where growth has moderated.

Unsteady yields reflected fast-changing sentiment

Taxable bonds produced strong returns and municipal bonds solid but unspectacular results, though as in the stock market, investor sentiment was volatile. The yield of the 10-year U.S. Treasury note, a benchmark for longer-term interest rates, began the 12 months at 2.61%, drifted higher as the economic expansion seemed to gather steam, then fluttered lower to close the period at 2.17%.

The decline in Treasury yields (and rise in prices) was driven by Europe’s sovereign-debt dramas, underwhelming economic reports, and a flight to safety that was prompted, paradoxically, by a rating agency’s decision to downgrade the U.S. government debt. Vanguard’s confidence in the full faith and credit of the U.S. Treasury remains unshaken.

Taxable investment-grade bonds returned 5.00% for the full 12 months. It’s important to note, of course, that as yields decline, the opportunity for similarly strong returns diminishes. The broad municipal market returned 3.78%. The returns on money market instruments hovered near 0%, consistent with the Federal Reserve Board’s target for short-term interest rates.

| | | |

| Market Barometer | | | |

| |

| | | Average Annual Total Returns |

| | | Periods Ended October 31, 2011 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 8.01% | 12.22% | 0.54% |

| Russell 2000 Index (Small-caps) | 6.71 | 12.87 | 0.68 |

| Dow Jones U.S. Total Stock Market Index | 7.67 | 12.58 | 0.90 |

| MSCI All Country World Index ex USA (International) | -4.66 | 12.92 | -0.37 |

| |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 5.00% | 8.87% | 6.41% |

| Barclays Capital Municipal Bond Index (Broad | | | |

| tax-exempt market) | 3.78 | 8.31 | 4.80 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.10 | 0.15 | 1.53 |

| |

| CPI | | | |

| Consumer Price Index | 3.53% | 1.49% | 2.33% |

3

Smaller sector holdings

drove the fund’s success

Vanguard Mid-Cap Growth Fund posted

strong returns in the first half of the fiscal

year, but then retreated as stock market

volatility spiked in the second half. In

October, markets suddenly surged upward