UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 1414 Avenue of the Americas

New York, NY 10019

| Name and address of agent for service: | John E. Denneen, Esquire | |

| 1414 Avenue of the Americas | ||

| New York, NY 10019 |

Registrant’s telephone number, including area code: (212) 486-1445

Date of fiscal year end: December 31

Date of reporting period: January 1, 2007 - June 30, 2007

Item 1. Reports to Shareholders

| |||||||||

Royce Capital Fund — Micro-Cap Portfolio Royce Capital Fund — Small-Cap Portfolio | SEMIANNUAL REVIEW AND REPORT TO SHAREHOLDERS | ||||||||

| | |||||||||

| | |||||||||

| | |||||||||

www.roycefunds.com |  | ||||||||

| Table of Contents | ||

| Semiannual Review | ||

| Performance and Expenses | 2 | |

| Letter to Our Shareholders | 3 | |

| Semiannual Report to Shareholders | 10 | |

| This page is not part of the 2007 Semiannual Report to Shareholders | 1 | ||||||

| Performance and Expenses | Through June 30, 2007 | |

| Average Annual Total Returns | ||||||||||||||||||||

| Since | Annual Operating | |||||||||||||||||||

| Fund | 1-Year | 5-Year | 10-Year | Inception | Expenses | |||||||||||||||

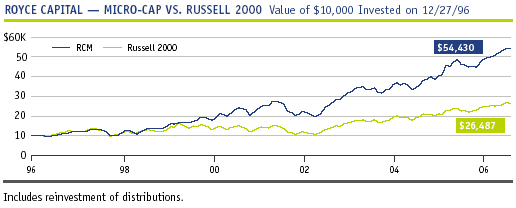

| Royce Capital Fund — Micro-Cap Portfolio | 18.82 | % | 15.64 | % | 17.98% | 17.50 | % | (12/27/96) | 1.31 | % | ||||||||||

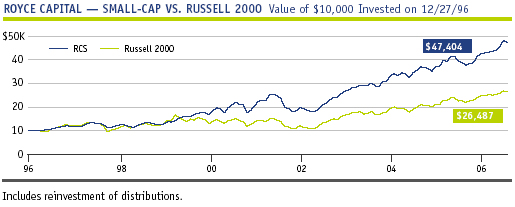

| Royce Capital Fund — Small-Cap Portfolio | 22.12 | 14.91 | 15.54 | 15.96 | (12/27/96) | 1.08 | % | |||||||||||||

| Russell 2000 | 16.43 | 13.88 | 9.06 | n/a | n/a | |||||||||||||||

| Important Performance, Expense and Risk Information | |||||||||||||||||

All performance information in this Review reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for changes or expenses of the variable contracts of retirement plans investing in the Fund. Current month-end performance may be obtained at www.roycefunds.com. All performance, risk and expense information reflects results of each Fund’s Investment Class. Shares of the Funds’ Service Class bear an annual distribution expense that is not borne by the Funds’ Investment Class. Annual operating expenses reflect the Fund’s total annual operating expenses for the Investment Class of the Fund’s most current prospectus and include management fees and other expenses. The Royce Funds invest primarily in securities of mid-, small- and/or micro-cap companies that may involve considerably more risk than investments in securities of larger-cap companies (see “Primary Risks for Fund Investors” in the respective Prospectus). Please read the Prospectus carefully before investing or sending money. The Russell 2000 Index is an unmanaged index of domestic small capitalization stocks. | |||||||||||||||||

| 2 | This page is not part of the 2007 Semiannual Report to Shareholders |

| Letter to Our Shareholders | |

| ||

| Rolling Stone Blues | ||

At first blush, the mid-point of 2007 looked very similar to the end of 2006. The economy’s condition was mostly positive, interest rates remained low and global liquidity levels remained flush following some vexing signs of contraction earlier in the year. The stock market kept moving mostly upwards, and the long bull market for small-caps in particular showed few signs of slowing down prior to July of this year. What’s new for 2007 is that larger companies have emerged in the short run as market leaders, though the margin of outperformance versus small-cap both year-to-date and for the one-year period ended June 30 was not enormous. Within small-cap, there has been a move toward larger, arguably higher-quality companies that’s distinct from the generally better returns achieved by more speculative issues in 2006. The overall direction remained positive for smaller companies, as it did for stocks as a whole. Equity investors continued to benefit from a remarkable run that included more of the overall market than is usually thought, small-cap having long since stolen the headlines from its larger peers as “The Only Asset Class Worth Owning” in some quarters. | ||

One of the advantages of employing an all-weather strategy to select smaller company stocks is that we continue to do what we have always done regardless of the market’s behavior. When smaller company stock prices were on the rise, it was more challenging to find the compelling values that have always been our stock in trade, but the search goes on whether the overall small-cap market is moving up or down. | ||

| This page is not part of the 2007 Semiannual Report to Shareholders | 3 | ||

| Letter to Our Shareholders | |||||||

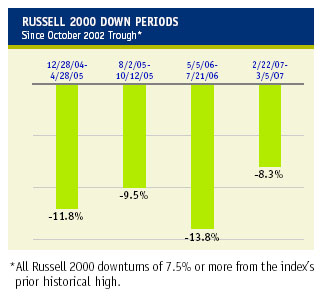

that a more historically typical correction of 15% or better is in the near future for smaller companies. The positive-performance phase that began in the fall of 2002 was interrupted by only two corrections in the 10%-14% range—one in 2004-5 and another in 2006—and a handful of others that were shy of double digits. To paraphrase the poet, the course of true market cycles never did run smooth. At least not as smooth as this current cycle. And to us, this was a warning. As we saw in July, when stock prices fell harder than they did during any other month this year, things can change very quickly. Along with our belief in regression to the mean, our conviction that markets are inherently cyclical is too firm to counter any temptation to abandon the lessons of history. | ||||||||

| Over the past decade or so the growth in the number and variety of equity market indices has been explosive. Russell, Standard & Poor’s (“S&P”), Wilshire, and Barra have all become accepted names in the equity world with stables of various indices. Considering the burgeoning number and scope of equity market indices, it is critical that investors better under- stand the composition, attribution and construction methodology among similar equity market indices. As the Standard & Poor’s 500 index recently celebrated its 50th anniversary, we thought that it might be helpful to delve into the particulars of the more prominent small-cap indices, and how we at The Royce Funds view them. Two of the most prominent are the Russell 2000 and the S&P SmallCap 600, both widely accepted benchmarks for small-cap equities. Yet each is differ- ent in composition, attribution and construction methodology. | As active small-cap managers with large stakes throughout the small-cap universe, perhaps we should be more consistently happy with a market that before July had been gathering no moss and few, if any bears. Maybe we should try a little harder to relax and simply enjoy the good times. Make no mistake, we are mostly very pleased—and more than happy to reap the benefits of the robust returns that smaller stocks have been providing since the most recent small-cap market trough in October 2002. However, as the small-cap bull stampeded its way toward a fifth full year, we were also in the midst of our own 19th Nervous Breakdown (and at least as many bear market predictions) as we awaited what seemed to us an inevitable small-cap downturn. Even as the market was swaying to higher and higher levels, we could not escape the nagging and persistent reality that historically strong bull markets often give way to serious corrections, and the longer the good times last, the more likely it seems that the bear’s bite will be deep. Of course, one of the advantages of employing an all-weather strategy to select smaller company stocks is that we |  | ||||||

| The Russell 2000 index is the oldest— dating back to 1979—and broadest of the two small-cap indices. It meas- ures the performance of the 2,000 smallest companies in the Russell 3000 Index (which represents 99% of the Continued on page 6... | continue to do what we have always done regardless of the market’s behavior. When smaller company stock prices were on the rise, it was more challenging to find the compelling values that have always been our stock in trade, but the search goes on whether the overall small-cap market is moving up or down. It’s All Over Now If our call for overall lower returns has not yet panned out, and our prediction of a small-cap correction has thus far proved at best premature, we can take a small measure of comfort for | |||||||

| 4 | This page is not part of the 2007 Semiannual Report to Shareholders | ||||||||

| our forecasting acumen in the emergence of large-cap as a market leader, a development we thought first looked likely by the beginning of 2006. As usually happens, the case for large-cap leadership took on a certain inevitability only with the gift of hindsight. In 2005, the large-cap S&P 500 and the small-cap Russell 2000 finished the year with near-identical | |||||

| results—the S&P 500 was up 4.9% while the Russell 2000 gained 4.6%. The large-cap index relinquished the performance crown in 2006 (+15.8% versus 18.4%), but small-cap regained its edge mostly through the courtesy of a torrid first quarter and a strong fourth quarter. In both 2006’s bearish second quarter and flat-to-down third quarter, the S&P 500 beat the Russell 2000, events we regarded as especially telling of a shift to large-cap leadership. That third-quarter outperformance (+5.7% versus +0.4%) was the key to giving the large-cap index an edge for the second half of 2006; it also contributed to large-cap outgaining small-cap for the one-year period ended 6/30/07, up 20.6% versus 16.4%. | We have been less focused on the leadership issue within small-cap than we are in the wider worlds of small- and large-cap in part because we do not limit ourselves in the broad small-cap universe by attaching labels to stocks such as “value” or “growth.” | ||||

Two thousand seven has been different in terms of its first-half performance patterns, yet the end result through the end of June showed the S&P 500 ahead of its small-cap counterpart. During this year’s first quarter, a period that was positive for almost every segment of the stock market save certain small-cap growth companies and many micro-cap stocks, the S&P 500 gained a paltry 0.6% versus 2.0% for the Russell 2000. (The Nasdaq Composite, meanwhile, managed a 0.3% gain.) The second quarter saw higher returns spread more consistently throughout the market. Large-cap led small-cap, with the S&P 500 up 6.3% versus 4.4% for its small-cap sibling, while the Nasdaq Composite led both indices with a gain of 7.5%. For the year-to-date period ended 6/30/07, the Nasdaq Composite actually led, its 7.8% gain ahead of the S&P 500’s 7.0% return and the Russell 2000’s 6.5% showing. These first-half results, as well as the large- and small-cap indices’ one-year returns, were consistent with our thought that when large-cap stocks did finally assume a leadership role, the margin of outperformance would be slight. We remain committed to the idea that large-cap’s stay at the top should be brief, as frequent leadership rotation seems likely to roll on. Considering the recent status of large-cap’s leadership, it should come as no surprise that the long-term performance edge remained with smaller companies. The Russell 2000 outpaced the S&P 500 for the three-, five-, 10- and 15-year periods ended 6/30/07. In addition, the small-cap index outgained its large-cap counterpart in two-thirds of the S&P 500’s positive quarters in each three-, five- and 10-year period ended 6/30/07. Not Fade Away During the first half, a similar shift in leadership arrived via a different route between value and growth within small-cap. The Russell 2000 Value index had maintained a near- | |||||

| This page is not part of the 2007 Semiannual Report to Shareholders | 5 |

| U.S. equity market) and accounts for approximately 8% of the total market capitalization of the larger Russell index. As of the end of June 2007, the median market cap of the Russell 2000 was $695 million. The largest company by market cap in the index was $3.3 billion and the smallest was $125 million. Companies with market capitalizations in excess of $2.5 billion represented 6% of the index, while micro-caps, which Royce defines as companies with market capital- izations less than $500 million, comprised roughly 13% of the index. In terms of attribution, Financial Services represented the largest sector weight in the index at the end of June 2007, at 22.6%. Industrials (autos and transportation, materials and processing and producer durable) and Consumer Discretionary followed, with weightings of 21.5% and 19.2%, respectively. Introduced in 1994, the S&P SmallCap 600 is more concentrated than the Russell 2000, consisting of 600 names that cover approximately 3% of the domestic equity market. The median market cap of the S&P SmallCap 600 was $820 million as of the end of June 2007. The largest company by market cap in the index was $5.0 billion and the smallest was $70 million. Companies with more than $2.5 billion in market cap comprised approximately 7%, while micro-caps represented 20% of the overall index. Industrials (materials and processing and producer durable) represented the largest sector weighting in the index at 19.1%, Continued on page 8... | Letter to Our Shareholders | |||||||

stranglehold on small-cap leadership until the first quarter of 2007, when it slipped under the thumb of its small-cap growth sibling. During both the first quarter (+1.5% versus +2.5%) and second quarter (+2.3% versus +6.7%), the Russell 2000 Value index lost ground to the Russell 2000 Growth index. Interestingly for us, value also underperformed growth from the interim small-cap peak on 2/22/07 through 6/30/07, down 0.8% compared to a gain of 2.9%. This consistent underperformance, even during the year’s more volatile periods, not only put small-cap value in second place for the year-to-date period ended 6/30/07 (+3.8% versus +9.3%), it also cost small-cap value the performance edge for the most recent 12-month period. For the one-year period ended 6/30/07, the Russell 2000 Value index was up 16.1% versus 16.8% for the Russell 2000 Growth index. Paralleling the performance patterns of small-cap versus large-cap, the Russell 2000 Value index maintained its lead over the Russell 2000 Growth index for longer-term periods. It bested small-cap growth for the three-, five-, 10-,15-, 20- and 25-year periods ended 6/30/07. A critical element in this performance edge came from small-cap value’s better performance during the nearly five-year bull-market period following the small-cap market trough in October 2002, and from its superior results from the previous small-cap market peak on 3/9/00 through 6/30/07. What gives us some pause about the current period is the relative strength of small-cap growth in the more volatile period from that February 2007 interim peak. This is in stark contrast to 2006, a period in which small-cap value beat small-cap growth in up, down and more mixed quarters. However, we have been less focused on the leadership issue within small-cap than we are in the wider worlds of small- and large-cap in part because we do not limit ourselves in the broad small-cap universe by attaching labels to stocks such as “value” or “growth.” You Can’t Always Get What You Want Indeed, the reality of small-cap’s status as a permanent, professional asset class—something that we are happy to report does not seem likely to change, even in the event of a correction more severe than what we think is probable—cuts both ways for us. The popularity of ETF’s and other index-based investments has played an important role in helping small-cap to be taken more seriously as an asset class. We also think that the related success of small-cap value approaches has been a factor in this growing esteem because a large number of investors saw that you could invest in small-cap stocks or indices with attractively low volatility scores. However, this has also created new tests for our purchase habits, in which we seek high-quality companies selling for bargain prices. Unquestionably, in our view, the major player in the extension of the small-cap bull market has been the vast amount of global liquidity. The world has been awash with capital looking for a profitable home, and that’s been an enormous factor in keeping stock prices afloat. | ||||||||

| 6 | This page is not part of the 2007 Semiannual Report to Shareholders | ||||||||

Many of the investment vehicles that have become increasingly better known—not just ETFs, but hedge funds, as well as merger and acquisition (M&A) and private equity activity—have been fueled to some degree by the large amounts of cash circling the globe. Global liquidity has worked to make M&A’s, leveraged buyouts and privatizations increasingly commonplace in the financial marketplace. The United States is in the midst of a mega-merger wave, with the number and size of the transactions exploding. During the first half of 2007, 15 companies in the S&P 500 announced takeovers, while 111 companies in the Russell 2000 had deals pending. Equally important, the trend has shown no signs of slowing down within the small-cap world. However mindful of the significance of these figures, we still do not believe that the extraordinary amount of global liquidity changes the rules of the road in the U.S. equity market, at least over the long run. Cyclicality remains the norm. Today’s small-cap market is no different than large-cap was during the ’90s. Global liquidity has |  | ||||||||||

| extended a wonderful bull market, but it cannot save the market from history, which means that sooner or later, the good times will end. Smaller companies have been, and will continue to be, the target of private equity funds | |||||||||||

and larger companies flush with cash. Although it’s clear that M&A activity is not the primary driver of long-term performance, it has already had a hand in the extended run for a small-cap bull market. Yet once the bull market for acquisitions ends, the softening in demand could precipitate a more widespread correction in the very market whose bullish phase it helped to extend in the first place. Time Is On Our Side As we look forward, we almost find ourselves wishing for a serious, though short-lived, correction for smaller stocks. We are still buying mostly on short-term dips, which typically do not yield the sort of | We have never allowed our thoughts on the short- or intermediate-term forecasts for the market to cloud our stock selection process. Regardless of where we think the market may be headed next, the search for great values in smaller stocks goes on... | ||||||||||

| absolute value that we would ideally prefer. Our goal is to be fully invested, but with purchase decisions becoming harder and harder, it has not been easy. Yet that is the reality of the current market (at least as of this writing), so we make | |||||||||||

| This page is not part of the 2007 Semiannual Report to Shareholders | 7 |

followed by Information Technology at 17.1%, and Financial Services at 15.8% at the end of June 2007. | Letter to Our Shareholders | |||||||

| Another important difference between the two indices is the respective construction methodology. The S&P SmallCap 600 is designed to be an “efficient portfolio of companies that meet specific inclusion criteria to ensure that they are investable and financially viable.” Inclusion in the index is determined subjectively by the S&P Index Committee, which adds new stocks to the index based not only on size, but also on financial viability, liquidity, adequate float size and other trading requirements. In contrast, the Russell 2000 is more objective in nature; it has no committee to determine membership and stresses the need to accurately represent the market as it is. Kelly Haughton, strategic director for the Russell Indices, believes that “the market should decide which stocks belong in an index, especially if the index is to provide an unbiased benchmark for measuring the results of money managers’ investment decisions.” With differing composition, attribution and construction, performance can also vary dramatically. In fact, examining the annual performance of the two indices over the past 10 years shows that the spread has been as wide as 1400 basis points in a single calendar year. Still, we think that the Russell 2000 and the Standard & Poor’s SmallCap 600 Index are reasonable proxies of the small capitalization world. |  our adjustments and deal with what we have on a daily basis. And even as we remain highly concerned about a correction for smaller companies, we are also confident about the long-term prospects for our chosen asset class. Whether or not a decidedly bearish July marked the beginning of a correction, we are managing our portfolios with a long-term outlook and an absolute return bias. We have never allowed our thoughts on the short- or intermediate-term forecasts for the market to cloud our stock selection process. Regardless of where we think the market may be headed next, the search for great values in smaller stocks goes on, with the thought that our Funds can provide the kind of terrific long-term absolute returns that help our shareholders to build wealth. Sincerely,    Charles M. Royce W. Whitney George Jack E. Fockler, Jr. President Vice President Vice President | |||||||

| July 31, 2007 | ||||||||

| 8 | This page is not part of the 2007 Semiannual Report to Shareholders | ||||||||

[This page intentionally left blank.]

| This page is not part of the 2007 Semiannual Report to Shareholders | 9 |

| Table of Contents | |

| Semiannual Report to Shareholders | |

| Trustees and Officers | 11 |

| Managers’ Discussions of Fund Performance | |

| Royce Capital Fund — Micro-Cap Portfolio | 12 |

| Royce Capital Fund — Small-Cap Portfolio | 14 |

| Financial Statements | 17 |

| Notes to Financial Statements | 26 |

| Understanding Your Fund’s Expenses | 29 |

| Board Approval of Investment Advisory Agreements | 30 |

| Notes to Performance and Other Important Information | 32 |

10 | Royce Capital Fund 2007 Semiannual Report to Shareholders

| Trustees and Officers |

| All Trustees and Officers may be reached c/o The Royce Funds, 1414 Avenue of the Americas, New York, NY 10019 |

| Charles M. Royce, Trustee*, President |

| Age: 67 | Number of Funds Overseen: 25 | Tenure: Since 1996 |

| Non-Royce Directorships: Director of Technology Investment Capital Corp. |

| Principal Occupation(s) During Past Five Years: President, Chief Investment Officer and Member of Board of Managers of Royce & Associates, LLC (“Royce”), the Trust’s investment adviser. |

| Mark R. Fetting, Trustee* |

| Age: 52 | Number of Funds Overseen: 41 | Tenure: Since 2001 |

| Non-Royce Directorships: Director/Trustee of registered investment companies constituting the 16 Legg Mason Funds. |

| Principal Occupation(s) During Past Five Years: Senior Executive Vice President of Legg Mason, Inc.; Member of Board of Managers of Royce. Mr. Fetting’s prior business experience includes having served as Division President and Senior Officer, Prudential Financial Group, Inc. and related companies; Partner, Greenwich Associates and Vice President, T. Rowe Price Group, Inc. |

| Donald R. Dwight, Trustee |

| Age: 76 | Number of Funds Overseen: 25 | Tenure: Since 1998 |

| Non-Royce Directorships: None |

| Principal Occupation(s) During Past Five Years: President of Dwight Partners, Inc., corporate communications consultant; Chairman (from 1982 to March 1998) and Chairman Emeritus (since March 1998) of Newspapers of New England, Inc. Mr. Dwight’s prior experience includes having served as Lieutenant Governor of the Commonwealth of Massachusetts, as President and Publisher of Minneapolis Star and Tribune Company and as a Trustee of the registered investment companies constituting the Eaton Vance Funds. |

| Richard M. Galkin, Trustee |

| Age: 69 | Number of Funds Overseen: 25 | Tenure: Since 1996 |

| Non-Royce Directorships: None |

| Principal Occupation(s) During Past Five Years: Private investor. Mr. Galkin’s prior business experience includes having served as President of Richard M. Galkin Associates, Inc., telecommunications consultants, President of Manhattan Cable Television (a subsidiary of Time, Inc.), President of Haverhills Inc. (another Time, Inc. subsidiary), President of Rhode Island Cable Television and Senior Vice President of Satellite Television Corp. (a subsidiary of Comsat). |

| Stephen L. Isaacs, Trustee |

| Age: 67 | Number of Funds Overseen: 25 | Tenure: Since 1996 |

| Non-Royce Directorships: None |

| Principal Occupation(s) During Past Five Years: President of The Center for Health and Social Policy (since September 1996); Attorney and President of Health Policy Associates, Inc., consultants. Mr. Isaacs’s prior business experience includes having served as Director of Columbia University Development Law and Policy Program and Professor at Columbia University (until August 1996). |

| William L. Koke, Trustee |

| Age: 72 | Number of Funds Overseen: 25 | Tenure: Since 1996 |

| Non-Royce Directorships: None |

| Principal Occupation(s) During Past Five Years: Private investor. Mr. Koke’s prior business experience includes having served as President of Shoreline Financial Consultants, Director of Financial Relations of SONAT, Inc., Treasurer of Ward Foods, Inc. and President of CFC, Inc. |

| Arthur S. Mehlman, Trustee |

| Age: 65 | Number of Funds Overseen: 41 | Tenure: Since 2004 |

| Non-Royce Directorships: Director/Trustee of registered investment companies constituting the 16 Legg Mason Funds and Director of Municipal Mortgage & Equity, LLC. |

| Principal Occupation(s) During Past Five Years: Director of The League for People with Disabilities, Inc.; Director of University of Maryland Foundation (non-profits). Formerly: Director of University of Maryland College Park Foundation (non-profit) (from 1998 to 2005); Partner, KPMG LLP (international accounting firm) (from 1972 to 2002); Director of Maryland Business Roundtable for Education (from July 1984 to June 2002). |

| Royce Capital Fund 2007 Semiannual Report to Shareholders | 11 |

| AVERAGE ANNUAL TOTAL RETURNS Through 6/30/07 | |||||||||

| Jan-June 2007* | 9.31 | % | |||||||

| One-Year | 18.82 | ||||||||

| Three-Year | 16.67 | ||||||||

| Five-Year | 15.64 | ||||||||

| 10-Year | 17.98 | ||||||||

| Since Inception (12/27/96) | 17.50 | ||||||||

| EXPENSE RATIO | |||||||||

| Annual Operating Expenses | 1.31 | % | |||||||

| * Not annualized. | |||||||||

| CALENDAR YEAR TOTAL RETURNS | |||||||||

| Year | RCM | Year | RCM | ||||||

| 2006 | 21.1 | % | 2001 | 29.7 | % | ||||

| 2005 | 11.6 | 2000 | 18.6 | ||||||

| 2004 | 13.9 | 1999 | 28.1 | ||||||

| 2003 | 49.2 | 1998 | 4.1 | ||||||

| 2002 | -12.9 | 1997 | 21.2 | ||||||

| TOP 10 POSITIONS % of Net Assets | |||||||||

| Novamerican Steel | 1.4 | % | |||||||

| Exponent | 1.2 | ||||||||

| TTM Technologies | 1.2 | ||||||||

| Bronco Drilling Company | 1.1 | ||||||||

| Edge Petroleum | 1.1 | ||||||||

| Tesco Corporation | 1.1 | ||||||||

| Cavco Industries | 1.0 | ||||||||

| True Religion Apparel | 1.0 | ||||||||

| Gulf Island Fabrication | 1.0 | ||||||||

| Dynamic Materials | 0.9 | ||||||||

| PORTFOLIO SECTOR BREAKDOWN % of Net Assets | |||||||||

| Technology | 16.8 | % | |||||||

| Natural Resources | 16.0 | ||||||||

| Industrial Services | 11.8 | ||||||||

| Health | 11.1 | ||||||||

| Industrial Products | 10.5 | ||||||||

| Consumer Services | 5.2 | ||||||||

| Financial Intermediaries | 4.2 | ||||||||

| Consumer Products | 4.5 | ||||||||

| Financial Services | 0.5 | ||||||||

| Miscellaneous | 4.8 | ||||||||

| Cash and Cash Equivalents | 14.6 | ||||||||

12 | Royce Capital Fund 2007 Semiannual Report to Shareholders

| PORTFOLIO DIAGNOSTICS | ||||||||||||||

| Average Market Capitalization | $305 million | |||||||||||||

| Weighted Average P/E Ratio | 18.2x* | |||||||||||||

| Weighted Average P/B Ratio | 2.1x | |||||||||||||

| Weighted Average Yield | 0.5% | |||||||||||||

| Fund Net Assets | $672 million | |||||||||||||

| Number of Holdings | 210 | |||||||||||||

| Symbol | ||||||||||||||

Investment Class | RCMCX | |||||||||||||

Service Class | RCMSX | |||||||||||||

| RISK/RETURN COMPARISON Five-Year Period Ended 6/30/07 | ||||||||||||||

| Average Annual | Standard | Return | ||||||||||||

| Total Return | Deviation | Efficiency* | ||||||||||||

| RCM | 15.64 | % | 16.22 | 0.96 | ||||||||||

| Russell 2000 | 13.88 | 16.47 | 0.84 | |||||||||||

| ||||||||||||||

Royce Capital Fund 2007 Semiannual Report to Shareholders | 13

| AVERAGE ANNUAL TOTAL RETURNS Through 6/30/07 | |||||||||

| Jan-June 2007* | 10.59 | % | |||||||

| One-Year | 22.12 | ||||||||

| Three-Year | 16.23 | ||||||||

| Five-Year | 14.91 | ||||||||

| 10-Year | 15.54 | ||||||||

| Since Inception (12/27/96) | 15.96 | ||||||||

| EXPENSE RATIO | |||||||||

| Annual Operating Expenses | 1.08 | % | |||||||

| * Not annualized. | |||||||||

| CALENDAR YEAR TOTAL RETURNS | |||||||||

| Year | RCS | Year | RCS | ||||||

| 2006 | 15.6 | % | 2001 | 21.0 | % | ||||

| 2005 | 8.6 | 2000 | 33.3 | ||||||

| 2004 | 25.0 | 1999 | 8.2 | ||||||

| 2003 | 41.1 | 1998 | 8.9 | ||||||

| 2002 | -13.8 | 1997 | 17.1 | ||||||

| TOP 10 POSITIONS % of Net Assets | |||||||||

| Unit Corporation | 2.4 | % | |||||||

| Oil States International | 2.1 | ||||||||

| Knight Capital Group Cl. A | 2.0 | ||||||||

| RC2 Corporation | 1.9 | ||||||||

| St. Mary Land & Exploration | 1.7 | ||||||||

| Chaparral Steel | 1.6 | ||||||||

| Heidrick & Struggles International | 1.6 | ||||||||

| Korn/Ferry International | 1.6 | ||||||||

| Thor Industries | 1.5 | ||||||||

| Mariner Energy | 1.5 | ||||||||

| PORTFOLIO SECTOR BREAKDOWN % of Net Assets | |||||||||

| Industrial Products | 19.9 | % | |||||||

| Natural Resources | 14.4 | ||||||||

| Industrial Services | 13.4 | ||||||||

| Consumer Products | 10.5 | ||||||||

| Technology | 10.0 | ||||||||

| Consumer Services | 9.2 | ||||||||

| Financial Intermediaries | 4.5 | ||||||||

| Health | 4.0 | ||||||||

| Financial Services | 1.2 | ||||||||

| Cash and Cash Equivalents | 12.9 | ||||||||

14 | Royce Capital Fund 2007 Semiannual Report to Shareholders

| PORTFOLIO DIAGNOSTICS | ||||||||||||||

| Average Market Capitalization | $1,066 million | |||||||||||||

| Weighted Average P/E Ratio | 15.6x | |||||||||||||

| Weighted Average P/B Ratio | 2.4x | |||||||||||||

| Weighted Average Yield | 0.6% | |||||||||||||

| Fund Net Assets | $354 million | |||||||||||||

| Number of Holdings | 93 | |||||||||||||

| Symbol | ||||||||||||||

Investment Class | RCPFX | |||||||||||||

Service Class | RCSSX | |||||||||||||

| The Funds’ P/E calculation excludes companies with zero or negative earnings. | ||||||||||||||

| RISK/RETURN COMPARISON Five-Year Period Ended 6/30/07 | ||||||||||||||

| Average Annual | Standard | Return | ||||||||||||

| Total Return | Deviation | Efficiency* | ||||||||||||

| RCS | 14.91 | % | 15.07 | 0.99 | ||||||||||

| Russell 2000 | 13.88 | 16.47 | 0.84 | |||||||||||

| ||||||||||||||

Royce Capital Fund 2007 Semiannual Report to Shareholders | 15

[This page intentionally left blank.]

16 | Royce Capital Fund 2007 Semiannual Report to Shareholders

Schedules of Investments | June 30, 2007 (unaudited) |

Royce Capital Fund – Micro-Cap Portfolio |

| SHARES | VALUE | |||||

COMMON STOCKS – 85.4% | ||||||

Consumer Products – 4.5% | ||||||

Apparel and Shoes - 2.8% | ||||||

| 107,900 | $ | 4,474,613 | ||||

LaCrosse Footwear | 213,208 | 3,852,669 | ||||

Stride Rite | 197,600 | 4,003,376 | ||||

| 315,900 | 6,422,247 | |||||

| 18,752,905 | ||||||

Food/Beverage/Tobacco - 1.0% | ||||||

| 34,400 | 1,353,640 | |||||

Jones Soda a | 140,000 | 1,962,800 | ||||

Monterey Gourmet Foods a | 331,600 | 1,415,932 | ||||

Reliv International | 181,000 | 1,900,500 | ||||

| 6,632,872 | ||||||

Sports and Recreation - 0.3% | ||||||

Arctic Cat | 103,000 | 2,039,400 | ||||

Other Consumer Products - 0.4% | ||||||

| 74,800 | 2,992,748 | |||||

Total (Cost $20,866,013) | 30,417,925 | |||||

Consumer Services – 5.2% | ||||||

Direct Marketing - 0.1% | ||||||

| 120,065 | 857,264 | |||||

Leisure and Entertainment - 1.2% | ||||||

| 138,200 | 1,394,438 | |||||

| 113,000 | 1,695,000 | |||||

New Frontier Media | 566,600 | 4,940,752 | ||||

| 8,030,190 | ||||||

Restaurants and Lodgings - 0.3% | ||||||

Benihana Cl. A a | 97,930 | 1,958,600 | ||||

Retail Stores - 2.3% | ||||||

| 205,500 | 4,029,855 | |||||

Buckle (The) | 79,350 | 3,126,390 | ||||

| 60,000 | 1,568,400 | |||||

| 308,800 | 4,097,776 | |||||

Cato Corporation Cl. A | 124,500 | 2,731,530 | ||||

| 15,553,951 | ||||||

Other Consumer Services - 1.3% | ||||||

Collectors Universe | 261,807 | 4,003,029 | ||||

| 220,304 | 3,273,717 | |||||

Renaissance Learning | 111,700 | 1,468,855 | ||||

| 8,745,601 | ||||||

Total (Cost $29,524,249) | 35,145,606 | |||||

Financial Intermediaries – 4.2% | ||||||

Banking - 1.0% | ||||||

| 127,528 | 2,851,526 | |||||

Canadian Western Bank | 150,800 | 3,997,740 | ||||

| 6,849,266 | ||||||

Insurance - 2.2% | ||||||

| 197,400 | 1,924,650 | |||||

American Safety Insurance Holdings a | 163,200 | 3,889,056 | ||||

Argonaut Group b | 108,000 | 3,370,680 | ||||

| 56,300 | 3,034,570 | |||||

United Fire & Casualty | 78,630 | 2,781,929 | ||||

| 15,000,885 | ||||||

| SHARES | VALUE | |||||

Securities Brokers - 1.0% | ||||||

| 196,900 | $ | 3,526,479 | ||||

Sanders Morris Harris Group | 255,400 | 2,972,856 | ||||

| 6,499,335 | ||||||

Total (Cost $17,581,362) | 28,349,486 | |||||

Financial Services – 0.5% | ||||||

Investment Management - 0.5% | ||||||

ADDENDA Capital | 163,100 | 3,467,932 | ||||

Total (Cost $3,535,767) | 3,467,932 | |||||

Health – 11.1% | ||||||

Drugs and Biotech - 4.9% | ||||||

| 186,400 | 1,211,600 | |||||

| 285,500 | 956,425 | |||||

| 398,000 | 2,690,480 | |||||

| 444,849 | 1,370,135 | |||||

| 622,316 | 2,607,504 | |||||

| 311,000 | 1,200,460 | |||||

| 368,200 | 3,398,486 | |||||

| 229,500 | 1,354,050 | |||||

| 116,925 | 1,272,144 | |||||

| 612,600 | 1,966,446 | |||||

| 183,000 | 1,568,310 | |||||

| 116,700 | 3,356,292 | |||||

Orchid Cellmark a | 1,009,200 | 4,682,688 | ||||

| 694,800 | 3,265,560 | |||||

| 1,419,500 | 1,973,105 | |||||

| 32,873,685 | ||||||

Health Services - 0.9% | ||||||

Bio-Imaging Technologies a | 303,823 | 2,075,111 | ||||

Hooper Holmes a | 585,700 | 1,962,095 | ||||

U.S. Physical Therapy a | 136,400 | 1,837,308 | ||||

| 5,874,514 | ||||||

Medical Products and Devices - 5.0% | ||||||

Anika Therapeutics a | 123,252 | 1,872,198 | ||||

Bruker BioSciences a | 506,543 | 4,563,952 | ||||

| 321,000 | 1,505,490 | |||||

| 149,000 | 2,395,920 | |||||

| 110,000 | 2,949,100 | |||||

Langer a | 360,300 | 1,974,444 | ||||

| 176,600 | 2,112,136 | |||||

| 293,400 | 1,739,862 | |||||

| 174,000 | 2,067,120 | |||||

| 156,200 | 1,699,456 | |||||

| 145,700 | 1,433,688 | |||||

| 69,700 | 1,739,015 | |||||

Synovis Life Technologies a | 92,800 | 1,336,320 | ||||

Thermage a | 222,200 | 1,857,592 | ||||

Young Innovations | 141,200 | 4,120,216 | ||||

| 33,366,509 | ||||||

Personal Care - 0.3% | ||||||

Nutraceutical International a | 146,500 | 2,427,505 | ||||

Total (Cost $69,173,693) | 74,542,213 | |||||

Industrial Products – 10.5% | ||||||

Automotive - 0.5% | ||||||

Aftermarket Technology a | 108,900 | 3,232,152 | ||||

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | Royce Capital Fund 2007 Semiannual Report to Shareholders | 17 |

Schedules of Investments |

|

Royce Capital Fund – Micro-Cap Portfolio (continued) |

| SHARES | VALUE | |||||

Industrial Products (continued) | ||||||

Building Systems and Components - 2.3% | ||||||

AAON | 141,450 | $ | 4,505,183 | |||

| 160,600 | 5,322,284 | |||||

| 195,334 | 1,504,072 | |||||

LSI Industries | 218,750 | 3,915,625 | ||||

| 15,247,164 | ||||||

Industrial Components - 0.4% | ||||||

Powell Industries a | 76,200 | 2,420,112 | ||||

Machinery - 2.0% | ||||||

Eagle Test Systems a | 367,100 | 5,895,626 | ||||

Key Technology a | 153,200 | 3,431,680 | ||||

T-3 Energy Services a | 116,297 | 3,890,135 | ||||

| 13,217,441 | ||||||

Metal Fabrication and Distribution - 4.1% | ||||||

Dynamic Materials | 168,600 | 6,322,500 | ||||

Metal Management | 125,600 | 5,535,192 | ||||

| 172,047 | 9,175,267 | |||||

Olympic Steel | 207,600 | 5,949,816 | ||||

Samuel Manu-Tech | 78,800 | 915,049 | ||||

| 27,897,824 | ||||||

Specialty Chemicals and Materials - 0.5% | ||||||

American Vanguard | 111,033 | 1,589,993 | ||||

Hawkins | 128,300 | 1,982,235 | ||||

| 3,572,228 | ||||||

Other Industrial Products - 0.7% | ||||||

Electro Rent | 95,100 | 1,382,754 | ||||

| 156,600 | 3,230,658 | |||||

| 4,613,412 | ||||||

Total (Cost $47,751,644) | 70,200,333 | |||||

Industrial Services – 11.8% | ||||||

Commercial Services - 4.0% | ||||||

Barrett Business Services | 84,099 | 2,172,277 | ||||

BB Holdings a | 693,924 | 3,657,857 | ||||

| 78,225 | 2,044,802 | |||||

GP Strategies a | 336,100 | 3,656,768 | ||||

Intersections a | 301,042 | 3,010,420 | ||||

| 384,259 | 5,806,154 | |||||

| 158,500 | 1,260,075 | |||||

OneSource Services a | 48,631 | 627,439 | ||||

| 149,387 | 1,695,542 | |||||

Willdan Group a | 258,300 | 2,531,340 | ||||

| 26,462,674 | ||||||

Engineering and Construction - 3.0% | ||||||

Cavalier Homes a | 405,700 | 1,983,873 | ||||

| 171,481 | 6,433,967 | |||||

Exponent a | 354,500 | 7,930,165 | ||||

| 187,000 | 3,955,050 | |||||

| 20,303,055 | ||||||

Food and Tobacco Processors - 0.9% | ||||||

| 340,300 | 3,151,178 | |||||

Zapata Corporation a | 369,300 | 2,492,775 | ||||

| 5,643,953 | ||||||

Printing - 1.1% | ||||||

CSS Industries | 64,000 | 2,535,040 | ||||

Courier Corporation | 76,718 | 3,068,720 | ||||

Ennis | 81,500 | 1,916,880 | ||||

| 7,520,640 | ||||||

| SHARES | VALUE | |||||

Transportation and Logistics - 2.8% | ||||||

†Euroseas | 332,100 | $ | 4,735,746 | |||

| 228,949 | 4,123,372 | |||||

| 54,409 | 4,717,260 | |||||

Vitran Corporation Cl. A a | 251,050 | 5,357,407 | ||||

| 18,933,785 | ||||||

Total (Cost $62,266,598) | 78,864,107 | |||||

Natural Resources – 16.0% | ||||||

Energy Services - 4.6% | ||||||

Dawson Geophysical a | 21,900 | 1,345,974 | ||||

| 69,500 | 4,166,525 | |||||

Gulf Island Fabrication | 184,200 | 6,391,740 | ||||

TGC Industries a | 361,588 | 3,941,309 | ||||

Tesco Corporation a | 224,400 | 7,079,820 | ||||

Total Energy Services Trust | 513,900 | 5,403,126 | ||||

World Energy Solutions a | 1,913,200 | 2,783,816 | ||||

| 31,112,310 | ||||||

Oil and Gas - 3.5% | ||||||

Bronco Drilling a | 458,200 | 7,519,062 | ||||

| 507,200 | 7,105,872 | |||||

| 332,200 | 730,840 | |||||

| 163,200 | 0 | |||||

Pioneer Drilling a | 152,500 | 2,273,775 | ||||

Savanna Energy Services a | 166,084 | 3,118,216 | ||||

| 50,800 | 1,290,828 | |||||

| 149,900 | 1,540,972 | |||||

| 23,579,565 | ||||||

Precious Metals and Mining - 7.9% | ||||||

Alamos Gold a | 429,200 | 2,216,006 | ||||

| 218,609 | 942,205 | |||||

Central African Gold a | 1,151,500 | 1,260,219 | ||||

Central African Gold (Warrants) a | 2,099,131 | 421,527 | ||||

| 200,000 | 1,166,000 | |||||

Endeavour Mining Capital | 694,900 | 6,249,371 | ||||

Endeavour Silver a | 428,100 | 1,930,731 | ||||

| 988,700 | 2,422,315 | |||||

| 775,800 | 3,291,824 | |||||

| 350,447 | 4,422,641 | |||||

Greystar Resources a | 305,300 | 2,006,196 | ||||

| 320,500 | 2,737,070 | |||||

Kingsgate Consolidated | 742,975 | 3,495,914 | ||||

| 658,500 | 2,963,250 | |||||

Midway Gold a | 782,900 | 2,021,098 | ||||

| 338,000 | 1,450,020 | |||||

Northern Orion Resources a | 976,800 | 5,557,992 | ||||

Quaterra Resources a | 542,500 | 1,919,948 | ||||

Silvercorp Metals a | 105,800 | 1,792,715 | ||||

U.S. Gold a | 498,600 | 2,742,300 | ||||

| 1,252,500 | 1,940,038 | |||||

| 52,949,380 | ||||||

Total (Cost $72,149,579) | 107,641,255 | |||||

Technology – 16.8% | ||||||

Aerospace and Defense - 2.3% | ||||||

| 118,970 | 2,451,972 | |||||

| 50,500 | 2,870,925 | |||||

| 163,600 | 3,499,404 | |||||

Ducommun a | 132,900 | 3,419,517 | ||||

18 | Royce Capital Fund 2007 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

| June 30, 2007 (unaudited) |

| SHARES | VALUE | |||||

Technology (continued) | ||||||

Aerospace and Defense (continued) | ||||||

Integral Systems | 105,000 | $ | 2,552,550 | |||

| 1,332,490 | 772,844 | |||||

| 15,567,212 | ||||||

Components and Systems - 2.7% | ||||||

Digi International a | 256,200 | 3,776,388 | ||||

Excel Technology a | 143,200 | 4,001,008 | ||||

Perceptron a | 106,708 | 1,055,342 | ||||

Performance Technologies a | 369,000 | 1,667,880 | ||||

| 606,200 | 7,880,600 | |||||

| 18,381,218 | ||||||

Internet Software and Services - 1.9% | ||||||

| 144,100 | 1,779,635 | |||||

CryptoLogic | 106,000 | 2,586,400 | ||||

| 337,000 | 909,900 | |||||

| 458,207 | 3,335,747 | |||||

| 226,300 | 1,767,403 | |||||

SupportSoft a | 372,100 | 2,031,666 | ||||

| 12,410,751 | ||||||

IT Services - 0.8% | ||||||

| 471,600 | 1,914,696 | |||||

MAXIMUS | 81,000 | 3,513,780 | ||||

| 5,428,476 | ||||||

Semiconductors and Equipment - 5.3% | ||||||

Advanced Energy Industries a | 141,100 | 3,197,326 | ||||

Cascade Microtech a | 184,763 | 2,215,308 | ||||

CEVA a | 436,500 | 3,710,250 | ||||

| 310,000 | 2,901,600 | |||||

| 261,900 | 1,993,059 | |||||

| 459,824 | 2,896,891 | |||||

MIPS Technologies a | 25,000 | 219,750 | ||||

| 641,800 | 2,246,300 | |||||

| 393,500 | 5,379,145 | |||||

| 340,900 | 4,032,847 | |||||

QuickLogic Corporation a | 287,800 | 768,426 | ||||

| 198,000 | 1,273,140 | |||||

| 253,500 | 2,436,135 | |||||

| 664,900 | 2,613,057 | |||||

| 35,883,234 | ||||||

Software - 1.9% | ||||||

Descartes Systems Group (The) a | 240,000 | 988,800 | ||||

Fundtech a | 128,100 | 1,856,169 | ||||

| 471,500 | 2,555,530 | |||||

Moldflow Corporation a | 77,300 | 1,699,054 | ||||

| 311,500 | 2,700,705 | |||||

Pervasive Software a | 168,505 | 775,123 | ||||

| 425,978 | 1,959,499 | |||||

| 12,534,880 | ||||||

Telecommunications - 1.9% | ||||||

| 198,100 | 3,488,541 | |||||

Atlantic Tele-Network | 160,250 | 4,589,560 | ||||

| 200,000 | 1,078,000 | |||||

Hurray! Holding Company ADR a | 202,000 | 909,000 | ||||

| 181,900 | 1,595,263 | |||||

PC-Tel a | 125,000 | 1,093,750 | ||||

| 12,754,114 | ||||||

Total (Cost $103,274,933) | 112,959,885 | |||||

| VALUE | ||||||

Miscellaneous d– 4.8% | ||||||

Total (Cost $30,222,770) | $ | 31,927,401 | ||||

TOTAL COMMON STOCKS | ||||||

(Cost $456,346,608) | 573,516,143 | |||||

REPURCHASE AGREEMENTS – 16.4% | ||||||

State Street Bank & Trust Company, | ||||||

5.10% dated 6/29/07, due 7/2/07, | ||||||

maturity value $45,070,147 (collateralized | ||||||

by obligations of various U.S. Government | ||||||

Agencies, valued at $46,181,013) | ||||||

(Cost $45,051,000) | 45,051,000 | |||||

Lehman Brothers (Tri-Party), | ||||||

5.05% dated 6/29/07, due 7/2/07, | ||||||

maturity value $65,027,354 (collateralized | ||||||

by obligations of various U.S. Government | ||||||

Agencies, valued at $66,328,151) | ||||||

(Cost $65,000,000) | 65,000,000 | |||||

TOTAL REPURCHASE AGREEMENTS | ||||||

(Cost $110,051,000) | 110,051,000 | |||||

| PRINCIPAL | ||||||

| AMOUNT | ||||||

COLLATERAL RECEIVED FOR SECURITIES | ||||||

LOANED – 15.3% | ||||||

U.S. Treasury Bonds 6.25%-8.875% | ||||||

due 2/15/19-8/15/23 | $146 | 149 | ||||

U.S. Treasury Notes 4.75% | ||||||

due 2/15/10 | 254 | 259 | ||||

U.S. Treasury Strip-Principal | ||||||

due 5/15/17-11/15/21 | 31 | 31 | ||||

U.S. Treasury Strip-Interest | ||||||

due 8/15/23 | 2 | 2 | ||||

Money Market Funds | ||||||

State Street Navigator Securities Lending | ||||||

Prime Portfolio (7 day yield-5.27%) | 102,917,723 | |||||

TOTAL COLLATERAL RECEIVED FOR SECURITIES LOANED (Cost $102,918,164) | 102,918,164 | |||||

TOTAL INVESTMENTS – 117.1% | ||||||

(Cost $669,315,772) | 786,485,307 | |||||

LIABILITIES LESS CASH | ||||||

AND OTHER ASSETS – (17.1)% | (114,783,040 | ) | ||||

NET ASSETS – 100.0% | $ | 671,702,267 | ||||

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | Royce Capital Fund 2007 Semiannual Report to Shareholders | 19 |

Schedules of Investments |

|

Royce Capital Fund — Small-Cap Portfolio |

| SHARES | VALUE | |||||

COMMON STOCKS – 87.1% | ||||||

Consumer Products – 10.5% | ||||||

Apparel and Shoes - 3.6% | ||||||

K-Swiss Cl. A b | 102,400 | $ | 2,900,992 | |||

Stride Rite b | 240,100 | 4,864,426 | ||||

| 24,600 | 619,674 | |||||

| 96,700 | 4,312,820 | |||||

| 12,697,912 | ||||||

Home Furnishing and Appliances - 1.8% | ||||||

Ethan Allen Interiors b | 108,900 | 3,729,825 | ||||

Stanley Furniture b | 134,800 | 2,768,792 | ||||

| 6,498,617 | ||||||

Sports and Recreation - 2.2% | ||||||

Thor Industries b | 120,600 | 5,443,884 | ||||

Winnebago Industries b | 76,000 | 2,243,520 | ||||

| 7,687,404 | ||||||

Other Consumer Products - 2.9% | ||||||

| 169,220 | 6,770,492 | |||||

| 287,000 | 3,619,070 | |||||

| 10,389,562 | ||||||

Total (Cost $32,606,410) | 37,273,495 | |||||

Consumer Services – 9.2% | ||||||

Direct Marketing - 1.3% | ||||||

Nu Skin Enterprises Cl. A b | 274,000 | 4,521,000 | ||||

Leisure and Entertainment - 0.8% | ||||||

International Speedway Cl. A b | 56,100 | 2,957,031 | ||||

Media and Broadcasting - 1.0% | ||||||

Westwood One b | 470,000 | 3,379,300 | ||||

Restaurants and Lodgings - 1.2% | ||||||

| 125,700 | 4,424,640 | |||||

Retail Stores - 4.9% | ||||||

Buckle (The) b | 124,400 | 4,901,360 | ||||

Cato Corporation Cl. A b | 204,000 | 4,475,760 | ||||

Deb Shops | 95,000 | 2,626,750 | ||||

| 179,200 | 3,677,184 | |||||

Finish Line (The) Cl. A b | 164,800 | 1,501,328 | ||||

| 17,182,382 | ||||||

Total (Cost $32,012,540) | 32,464,353 | |||||

Financial Intermediaries – 4.5% | ||||||

Insurance - 2.5% | ||||||

Assured Guaranty b | 134,800 | 3,984,688 | ||||

| 110,103 | 3,115,915 | |||||

| 14,100 | 784,947 | |||||

Security Capital Assurance b | 34,200 | 1,055,754 | ||||

| 8,941,304 | ||||||

Securities Brokers - 2.0% | ||||||

| 417,700 | 6,933,820 | |||||

Total (Cost $14,123,737) | 15,875,124 | |||||

Financial Services – 1.2% | ||||||

Information and Processing - 1.2% | ||||||

| 116,800 | 4,121,872 | |||||

Total (Cost $1,537,914) | 4,121,872 | |||||

| SHARES | VALUE | |||||

Health – 4.0% | ||||||

Drugs and Biotech - 0.2% | ||||||

| 28,300 | $ | 736,083 | ||||

Health Services - 0.8% | ||||||

U.S. Physical Therapy a | 201,200 | 2,710,164 | ||||

Medical Products and Devices - 0.7% | ||||||

Vital Signs b | 47,300 | 2,627,515 | ||||

Personal Care - 2.3% | ||||||

Inter Parfums b | 188,000 | 5,004,560 | ||||

Nutraceutical International a | 184,104 | 3,050,603 | ||||

| 8,055,163 | ||||||

Total (Cost $11,836,294) | 14,128,925 | |||||

Industrial Products – 19.9% | ||||||

Automotive - 0.8% | ||||||

| 120,459 | 1,664,743 | |||||

| 52,800 | 1,325,280 | |||||

| 2,990,023 | ||||||

Building Systems and Components - 2.3% | ||||||

| 123,200 | 4,082,848 | |||||

Simpson Manufacturing b | 118,800 | 4,008,312 | ||||

| 8,091,160 | ||||||

Construction Materials - 1.3% | ||||||

Eagle Materials b | 94,400 | 4,630,320 | ||||

Industrial Components - 0.8% | ||||||

| 8,466 | 313,073 | |||||

Bel Fuse Cl. B b | 69,388 | 2,361,274 | ||||

| 2,674,347 | ||||||

Machinery - 7.6% | ||||||

Applied Industrial Technologies b | 142,900 | 4,215,550 | ||||

| 170,169 | 2,732,914 | |||||

Graco b | 53,500 | 2,154,980 | ||||

Lincoln Electric Holdings b | 50,500 | 3,749,120 | ||||

MTS Systems b | 97,509 | 4,355,727 | ||||

| 65,300 | 4,505,700 | |||||

| 9,900 | 331,155 | |||||

Woodward Governor b | 91,200 | 4,894,704 | ||||

| 26,939,850 | ||||||

Metal Fabrication and Distribution - 5.8% | ||||||

Chaparral Steel | 80,714 | 5,800,915 | ||||

Metal Management b | 103,800 | 4,574,466 | ||||

| 76,100 | 3,706,070 | |||||

| 60,300 | 2,890,782 | |||||

| 104,117 | 3,668,042 | |||||

| 20,640,275 | ||||||

Specialty Chemicals and Materials - 1.3% | ||||||

Westlake Chemical b | 161,700 | 4,547,004 | ||||

Total (Cost $53,198,693) | 70,512,979 | |||||

Industrial Services – 13.4% | ||||||

Commercial Services - 9.3% | ||||||

Barrett Business Services b | 165,226 | 4,267,788 | ||||

| 112,000 | 5,738,880 | |||||

| 212,500 | 3,395,750 | |||||

| 213,400 | 5,603,884 | |||||

| 223,800 | 5,172,018 | |||||

| 343,191 | 5,185,616 | |||||

20 | Royce Capital Fund 2007 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

| June 30, 2007 (unaudited) |

| SHARES | VALUE | |||||

Industrial Services (continued) | ||||||

Commercial Services (continued) | ||||||

| 139,200 | $ | 2,583,552 | ||||

| 116,934 | 819,707 | |||||

| 32,767,195 | ||||||

Engineering and Construction - 0.5% | ||||||

Exponent a | 78,616 | 1,758,640 | ||||

Transportation and Logistics - 3.6% | ||||||

Arkansas Best b | 96,300 | 3,752,811 | ||||

| 243,800 | 3,973,940 | |||||

| 39,300 | 1,605,012 | |||||

| 148,900 | 3,502,128 | |||||

| 12,833,891 | ||||||

Total (Cost $42,691,239) | 47,359,726 | |||||

Natural Resources – 14.4% | ||||||

Energy Services - 4.6% | ||||||

Ensign Energy Services | 208,900 | 3,725,980 | ||||

| 179,900 | 7,437,066 | |||||

Patterson-UTI Energy | 35,400 | 927,834 | ||||

RPC b | 241,000 | 4,106,640 | ||||

| 16,197,520 | ||||||

Oil and Gas - 8.2% | ||||||

Cimarex Energy b | 58,518 | 2,306,194 | ||||

| 209,000 | 1,722,160 | |||||

| 223,200 | 5,412,600 | |||||

St. Mary Land & Exploration b | 165,100 | 6,045,962 | ||||

| 201,769 | 5,126,950 | |||||

| 134,000 | 8,429,940 | |||||

| 29,043,806 | ||||||

Precious Metals and Mining - 1.6% | ||||||

Agnico-Eagle Mines | 105,000 | 3,832,500 | ||||

| 77,500 | 2,040,575 | |||||

| 5,873,075 | ||||||

Total (Cost $37,161,664) | 51,114,401 | |||||

Technology – 10.0% | ||||||

Components and Systems - 1.9% | ||||||

| 168,200 | 2,479,268 | |||||

| 92,897 | 2,934,616 | |||||

Tektronix b | 41,400 | 1,396,836 | ||||

| 6,810,720 | ||||||

Distribution - 0.8% | ||||||

| 120,600 | 2,721,942 | |||||

IT Services - 1.0% | ||||||

| 220,500 | 3,757,320 | |||||

| SHARES | VALUE | |||||

Semiconductors and Equipment - 4.0% | ||||||

| 224,718 | $ | 1,865,160 | ||||

| 242,400 | 2,879,712 | |||||

Fairchild Semiconductor International a | 89,300 | 1,725,276 | ||||

| 164,700 | 1,375,245 | |||||

| 85,600 | 2,371,120 | |||||

Nextest Systems a | 164,500 | 2,248,715 | ||||

| 181,889 | 1,747,953 | |||||

| 14,213,181 | ||||||

Software - 2.1% | ||||||

| 316,280 | 1,714,238 | |||||

| 118,300 | 3,647,189 | |||||

| 42,300 | 359,973 | |||||

Pervasive Software a | 379,372 | 1,745,111 | ||||

| 7,466,511 | ||||||

Telecommunications - 0.2% | ||||||

ADTRAN b | 30,600 | 794,682 | ||||

Total (Cost $30,688,907) | 35,764,356 | |||||

TOTAL COMMON STOCKS | ||||||

(Cost $255,857,398) | 308,615,231 | |||||

REPURCHASE AGREEMENT – 13.0% | ||||||

State Street Bank & Trust Company, | ||||||

5.10% dated 6/29/07, due 7/2/07, | ||||||

maturity value $45,899,499 (collateralized | ||||||

by obligations of various U.S. Government | ||||||

Agencies, valued at $47,030,100) | ||||||

(Cost $45,880,000) | 45,880,000 | |||||

COLLATERAL RECEIVED FOR SECURITIES | ||||||

LOANED – 22.6% | ||||||

Money Market Funds | ||||||

State Street Navigator Securities Lending | ||||||

Prime Portfolio (7 day yield-5.27%) | ||||||

(Cost $80,228,788) | 80,228,788 | |||||

TOTAL INVESTMENTS – 122.7% | ||||||

(Cost $381,966,186) | 434,724,019 | |||||

LIABILITIES LESS CASH | ||||||

AND OTHER ASSETS – (22.7)% | (80,426,452 | ) | ||||

NET ASSETS – 100.0% | $ | 354,297,567 | ||||

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | Royce Capital Fund 2007 Semiannual Report to Shareholders | 21 |

Statements of Assets and Liabilities | June 30, 2007 (unaudited) |

| Micro-Cap | Small-Cap | |||||||

| Portfolio | Portfolio | |||||||

ASSETS: | ||||||||

Investments at value (including collateral on loaned securities) * | $ | 676,434,307 | $ | 388,844,019 | ||||

Repurchase agreements (at cost and value) | 110,051,000 | 45,880,000 | ||||||

Cash | 33,383 | 358 | ||||||

Receivable for investments sold | 1,567,561 | 654,052 | ||||||

Receivable for capital shares sold | 562,082 | 392,654 | ||||||

Receivable for dividends and interest | 436,098 | 107,675 | ||||||

Prepaid expenses and other assets | 3,260 | 1,614 | ||||||

Total Assets | 789,087,691 | 435,880,372 | ||||||

LIABILITIES: | ||||||||

Payable for collateral on loaned securities | 102,918,164 | 80,228,788 | ||||||

Payable for investments purchased | 12,786,791 | 948,731 | ||||||

Payable for capital shares redeemed | 858,906 | 42,439 | ||||||

Payable for investment advisory fees | 685,502 | 291,085 | ||||||

Accrued expenses | 136,061 | 71,762 | ||||||

Total Liabilities | 117,385,424 | 81,582,805 | ||||||

Net Assets | $ | 671,702,267 | $ | 354,297,567 | ||||

ANALYSIS OF NET ASSETS: | ||||||||

Paid-in capital | $ | 456,404,922 | $ | 266,715,469 | ||||

Undistributed net investment income (loss) | 2,042,846 | 1,723,466 | ||||||

Accumulated net realized gain (loss) on investments and foreign currency | 96,084,909 | 33,100,711 | ||||||

Net unrealized appreciation (depreciation) on investments and foreign currency | 117,169,590 | 52,757,921 | ||||||

Net Assets | $ | 671,702,267 | $ | 354,297,567 | ||||

Investment Class | $ | 669,616,944 | $ | 352,214,036 | ||||

Service Class | 2,085,323 | 2,083,531 | ||||||

SHARES OUTSTANDING: | ||||||||

(unlimited number of $.001 par value shares authorized for each Fund) | ||||||||

Investment Class | 42,528,891 | 29,846,127 | ||||||

Service Class | 132,737 | 176,881 | ||||||

NET ASSET VALUES: | ||||||||

(Net Assets ÷ Shares Outstanding) (offering and redemption price per share) | ||||||||

Investment Class | $15.74 | $11.80 | ||||||

Service Class | 15.71 | 11.78 | ||||||

| $ | 559,264,772 | $ | 336,086,186 | |||||

Market value of loaned securities | 98,643,889 | 77,666,184 | ||||||

22 | Royce Capital Fund 2007 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

Statements of Changes in Net Assets |

|

| Micro-Cap Portfolio | Small-Cap Portfolio | |||||||||||||||

| Six months ended | Six months ended | |||||||||||||||

| 6/30/07 | Year ended | 6/30/07 | Year ended | |||||||||||||

| (unaudited) | 12/31/06 | (unaudited) | 12/31/06 | |||||||||||||

INVESTMENT OPERATIONS: | ||||||||||||||||

Net investment income (loss) | $ | 837,485 | $ | (438,651 | ) | $ | 1,543,636 | $ | 180,298 | |||||||

Net realized gain (loss) on investments and foreign currency | 42,637,250 | 61,308,861 | 17,278,053 | 15,832,811 | ||||||||||||

Net change in unrealized appreciation (depreciation) on investments and foreign currency | 12,117,141 | 27,296,223 | 13,051,835 | 16,638,306 | ||||||||||||

Net increase (decrease) in net assets from investment operations | 55,591,876 | 88,166,433 | 31,873,524 | 32,651,415 | ||||||||||||

DISTRIBUTIONS: | ||||||||||||||||

Net investment income | ||||||||||||||||

Investment Class | – | (947,018 | ) | – | (160,670 | ) | ||||||||||

Service Class | – | (1,059 | ) | – | – | |||||||||||

Net realized gain on investments and foreign currency | ||||||||||||||||

Investment Class | – | (28,847,326 | ) | – | (11,959,081 | ) | ||||||||||

Service Class | – | (35,126 | ) | – | (4,597 | ) | ||||||||||

Total distributions | – | (29,830,529 | ) | – | (12,124,348 | ) | ||||||||||

CAPITAL SHARE TRANSACTIONS: | ||||||||||||||||

Value of shares sold | ||||||||||||||||

Investment Class | 99,628,805 | 168,827,134 | 62,769,454 | 99,650,121 | ||||||||||||

Service Class | 785,455 | 1,242,229 | 2,076,698 | 100,000 | ||||||||||||

Distributions reinvested | ||||||||||||||||

Investment Class | – | 29,794,340 | – | 12,119,749 | ||||||||||||

Service Class | – | 36,184 | – | 4,596 | ||||||||||||

Value of shares redeemed | ||||||||||||||||

Investment Class | (46,714,883 | ) | (79,785,472 | ) | (16,366,650 | ) | (45,248,435 | ) | ||||||||

Service Class | (107,465 | ) | (1,273 | ) | (247,109 | ) | – | |||||||||

Net increase (decrease) in net assets from capital share transactions | 53,591,912 | 120,113,142 | 48,232,393 | 66,626,031 | ||||||||||||

NET INCREASE (DECREASE) IN NET ASSETS | 109,183,788 | 178,449,046 | 80,105,917 | 87,153,098 | ||||||||||||

NET ASSETS: | ||||||||||||||||

Beginning of period | 562,518,479 | 384,069,433 | 274,191,650 | 187,038,552 | ||||||||||||

End of period | $ | 671,702,267 | $ | 562,518,479 | $ | 354,297,567 | $ | 274,191,650 | ||||||||

UNDISTRIBUTED NET INVESTMENT INCOME (LOSS) AT END OF PERIOD | $ | 2,042,846 | $ | 1,205,361 | $ | 1,723,466 | $ | 179,830 | ||||||||

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | Royce Capital Fund 2007 Semiannual Report to Shareholders | 23 |

Statements of Operations | Six Months Ended June 30, 2007 (unaudited) |

| Micro-Cap | Small-Cap | |||||||

| Portfolio | Portfolio | |||||||

INVESTMENT INCOME: | ||||||||

Income: | ||||||||

Dividends | $ | 2,074,437 | $ | 2,249,559 | ||||

Interest | 2,532,679 | 930,452 | ||||||

Securities lending | 219,695 | – | ||||||

Total income | 4,826,811 | 3,180,011 | ||||||

Expenses: | ||||||||

Investment advisory fees | 3,833,099 | 1,558,636 | ||||||

Distribution fees | 2,012 | 1,525 | ||||||

Shareholder reports | 47,946 | 14,499 | ||||||

Custody | 34,217 | 17,641 | ||||||

Administrative and office facilities | 23,128 | 11,469 | ||||||

Trustees’ fees | 23,067 | 11,595 | ||||||

Shareholder servicing | 13,231 | 11,628 | ||||||

Audit | 12,776 | 12,636 | ||||||

Legal | 2,833 | 1,404 | ||||||

Registration | 2,588 | 1,882 | ||||||

Other expenses | 21,647 | 5,793 | ||||||

Total expenses | 4,016,544 | 1,648,708 | ||||||

Compensating balance credits | (21,901 | ) | (7,094 | ) | ||||

Fees waived by distributor | (2,012 | ) | (1,525 | ) | ||||

Expenses reimbursed by investment adviser-Service Class | (3,305 | ) | (3,714 | ) | ||||

Net expenses | 3,989,326 | 1,636,375 | ||||||

Net investment income (loss) | 837,485 | 1,543,636 | ||||||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | ||||||||

Net realized gain (loss) on investments and foreign currency | ||||||||

Non-Affiliates | 42,743,379 | 17,278,053 | ||||||

Affiliated Companies | (106,129 | ) | – | |||||

Net change in unrealized appreciation (depreciation) on investments and foreign currency | 12,117,141 | 13,051,835 | ||||||

Net realized and unrealized gain (loss) on investments and foreign currency | 54,754,391 | 30,329,888 | ||||||

NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | $ | 55,591,876 | $ | 31,873,524 | ||||

24 | Royce Capital Fund 2007 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

| This table is presented to show selected data for a share outstanding throughout each period, and to assist shareholders in evaluating a Fund’s performance for the periods presented. Per share amounts have been determined on the basis of the weighted average number of shares outstanding during the period. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net | Net | Net Realized and Unrealized | Distributions | Distributions from Net | Ratio of Expenses to Average Net Assets | Ratio of Net Investment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset Value, Beginning of Period | Investment Income (Loss) | Gain (Loss) on Investments and Foreign Currency | Total from Investment Operations | from Net Investment Income | Realized Gain on Investments and Foreign Currency | Total Distributions | Net Asset Value, End of Period | Total Return | Net Assets, End of Period (in thousands) | Prior to Fee Waivers and Balance Credits | Prior to Fee Waivers | Net of Fee Waivers | Income (Loss) to Average Net Assets | Portfolio Turnover Rate | ||||||||||||||||||||||||||||||||||||||||||||||

| Micro-Cap Portfolio – Investment Class | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| †2007 | $ | 14.40 | $ | 0.02 | $ | 1.32 | $ | 1.34 | $ | – | $ | – | $ | – | $ | 15.74 | 9.31 | %** | $ | 669,617 | 1.31 | %* | 1.30 | %* | 1.30 | %* | 0.27 | %* | 24 | % | ||||||||||||||||||||||||||||||

| 2006 | 12.57 | 0.01 | 2.63 | 2.64 | (0.03 | ) | (0.78 | ) | (0.81 | ) | 14.40 | 21.07 | 561,257 | 1.32 | 1.31 | 1.31 | (0.09 | ) | 41 | |||||||||||||||||||||||||||||||||||||||||

| 2005 | 11.50 | (0.05 | ) | 1.38 | 1.33 | (0.06 | ) | (0.20 | ) | (0.26 | ) | 12.57 | 11.61 | 384,069 | 1.33 | 1.33 | 1.33 | (0.51 | ) | 38 | ||||||||||||||||||||||||||||||||||||||||

| 2004 | 10.90 | (0.09 | ) | 1.58 | 1.49 | – | (0.89 | ) | (0.89 | ) | 11.50 | 13.85 | 345,499 | 1.34 | 1.34 | 1.34 | (0.78 | ) | 38 | |||||||||||||||||||||||||||||||||||||||||

| 2003 | 7.60 | (0.08 | ) | 3.80 | 3.72 | – | (0.42 | ) | (0.42 | ) | 10.90 | 49.16 | 249,652 | 1.36 | 1.36 | 1.35 | (0.84 | ) | 41 | |||||||||||||||||||||||||||||||||||||||||

| 2002 | 9.00 | (0.08 | ) | (1.08 | ) | (1.16 | ) | – | (0.24 | ) | (0.24 | ) | 7.60 | (12.87 | ) | 133,944 | 1.38 | 1.38 | 1.35 | (0.88 | ) | 27 | ||||||||||||||||||||||||||||||||||||||

| Micro-Cap Portfolio – Service Class(a) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| †2007 | $ | 14.39 | $ | 0.00 | $ | 1.32 | $ | 1.32 | $ | – | $ | – | $ | – | $ | 15.71 | 9.17 | %** | $ | 2,085 | 2.25 | %* | 2.24 | %* | 1.58 | %* | 0.02 | %* | 24 | % | ||||||||||||||||||||||||||||||

| 2006 | 14.90 | (0.04 | ) | 0.34 | 0.30 | (0.02 | ) | (0.79 | ) | (0.81 | ) | 14.39 | 2.06 | ** | 1,262 | 8.67 | * | 8.67 | * | 1.58 | * | 0.16 | * | 41 | ||||||||||||||||||||||||||||||||||||

| Small-Cap Portfolio – Investment Class | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| †2007 | $ | 10.67 | $ | 0.06 | $ | 1.07 | $ | 1.13 | $ | – | $ | – | $ | – | $ | 11.80 | 10.59 | %** | $ | 352,214 | 1.05 | %* | 1.05 | %* | 1.05 | %* | 0.99 | %* | 35 | % | ||||||||||||||||||||||||||||||

| 2006 | 9.67 | 0.00 | 1.51 | 1.51 | (0.01 | ) | (0.50 | ) | (0.51 | ) | 10.67 | 15.57 | 274,089 | 1.08 | 1.08 | 1.08 | 0.08 | ) | 54 | |||||||||||||||||||||||||||||||||||||||||

| 2005 | 9.00 | 0.01 | 0.76 | 0.77 | – | (0.10 | ) | (0.10 | ) | 9.67 | 8.56 | 187,039 | 1.11 | 1.11 | 1.11 | 0.11 | 45 | |||||||||||||||||||||||||||||||||||||||||||

| 2004 | 7.59 | (0.05 | ) | 1.93 | 1.88 | – | (0.47 | ) | (0.47 | ) | 9.00 | 24.95 | 110,911 | 1.14 | 1.14 | 1.14 | (0.62 | ) | 47 | |||||||||||||||||||||||||||||||||||||||||

| 2003 | 5.71 | (0.04 | ) | 2.38 | 2.34 | – | (0.46 | ) | (0.46 | ) | 7.59 | 41.10 | 57,391 | 1.21 | 1.21 | 1.21 | (0.55 | ) | 70 | |||||||||||||||||||||||||||||||||||||||||

| 2002 | 6.66 | (0.05 | ) | (0.87 | ) | (0.92 | ) | – | (0.03 | ) | (0.03 | ) | 5.71 | (13.81 | ) | 18,190 | 1.87 | 1.87 | 1.35 | (0.80 | ) | 53 | ||||||||||||||||||||||||||||||||||||||

| Small-Cap Portfolio – Service Class(a) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| †2007 | $ | 10.67 | $ | 0.03 | $ | 1.08 | $ | 1.11 | $ | – | $ | – | $ | – | $ | 11.78 | 10.40 | %** | $ | 2,084 | 2.23 | %* | 2.22 | %* | 1.36 | %* | 0.58 | %* | 35 | % | ||||||||||||||||||||||||||||||

| 2006 | 10.85 | (0.01 | ) | 0.33 | 0.32 | – | (0.50 | ) | (0.50 | ) | 10.67 | 2.94 | ** | 103 | 15.77 | * | 15.77 | * | 1.36 | * | (0.12 | )* | 54 | |||||||||||||||||||||||||||||||||||||

| (a) | The Class commenced operations on May 2, 2006. | |

| * | Annualized. | |

| ** | Not annualized. | |

| † | Six months ended June 30, 2007 (unaudited). |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | Royce Capital Fund 2007 Semiannual Report to Shareholders | 25 |

Notes to Financial Statements (unaudited) |

|

Summary of Significant Accounting Policies: Royce Micro-Cap Portfolio and Royce Small-Cap Portfolio (the “Fund” or “Funds”) are the two series of Royce Capital Fund (the “Trust”), a diversified open-end management investment company organized as a Delaware business trust. Shares of the Funds are offered to life insurance companies for allocation to certain separate accounts established for the purpose of funding qualified and non-qualified variable annuity contracts and variable life insurance contracts, and may also be offered directly to certain pension plans and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis. Micro-Cap Portfolio and Small-Cap Portfolio commenced operations on December 27, 1996. Classes of shares have equal rights as to earnings and assets, except that each class may bear different fees and expenses for distribution, shareholder servicing, registration, shareholder reports, compensating balance credits and different expense reimbursements. Investment income, realized and unrealized capital gains or losses on investments and foreign currency, and expenses other than those attributable to a specific class are allocated to each class of shares based on its relative net assets. The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. Valuation of Investments: Securities are valued as of the close of trading on the New York Stock Exchange (NYSE) (generally 4:00 p.m. Eastern time) on the valuation date. Securities that trade on an exchange, and securities traded on Nasdaq’s Electronic Bulletin Board, are valued at their last reported sales price or Nasdaq official closing price taken from the primary market in which each security trades or, if no sale is reported for such day, at their bid price. Other over-the-counter securities for which market quotations are readily available are valued at their highest bid price. Securities for which market quotations are not readily available are valued at their fair value under procedures established by the Board of Trustees. In addition, if, between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that are significant and may make the closing price unreliable, the Fund may fair value the security. The Funds use an independent pricing service to provide fair value estimates for relevant non-U.S. equity securities on days when the U.S. market volatility exceeds a certain threshold. This pricing service uses proprietary correlations it has developed between the movement of prices of non-U.S. equity securities and indices of U.S.-traded securities, futures contracts and other indications to estimate the fair value of relevant non-U.S. securities. Bonds and other fixed income securities may be valued by reference to other securities with comparable ratings, interest rates and maturities, using established independent pricing services. Investments in money market funds are valued at net asset value per share. Foreign Currency: The Funds value their non-U.S. securities in U.S. dollars on the basis of foreign currency exchange rates provided to the Funds by their custodian, State Street Bank and Trust Company. The effects of changes in foreign exchange rates on investments and other assets and liabilities are | included with net realized and unrealized gains and losses on investments. Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, expiration of currency forward contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, including investments in securities at the end of the reporting period, as a result of changes in foreign currency exchange rates. Investment Transactions and Related Investment Income: Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Non-cash dividend income is recorded at the fair market value of the securities received. Interest income is recorded on an accrual basis. Realized gains and losses from investment transactions are determined on the basis of identified cost for book and tax purposes. Expenses: The Funds incur direct and indirect expenses. Expenses directly attributable to a Fund are charged to the Fund’s operations, while expenses applicable to more than one series of the Trust are allocated equitably. Allocated personnel and occupancy costs related to the Royce Funds are included in administrative and office facilities expenses. The Fund has adopted a deferred fee agreement that allows the Trustees to defer the receipt of all or a portion of Trustees Fees otherwise payable. The deferred fees are invested in certain Royce Funds until distribution in accordance with the agreement. Compensating Balance Credits: The Fund has arrangements with its custodian bank and transfer agent, whereby a portion of the custodian’s fee and transfer agent’s fee is paid indirectly by credits earned on the Fund’s cash on deposit with the bank and transfer agent. These deposit arrangements are an alternative to purchasing overnight investments. Distributions and Taxes: As qualified regulated investment companies under Subchapter M of the Internal Revenue Code, the Funds are not subject to income taxes to the extent that each Fund distributes substantially all of its taxable income for its fiscal year. The Funds pay any dividends and capital gain distributions annually in December. Because federal income tax regulations differ from generally accepted accounting principles, income and capital gain distributions determined in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes. Accordingly, the character of distributions and composition of net assets for tax purposes differ from those reflected in the accompanying financial statements. Repurchase Agreements: The Funds may enter into repurchase agreements with institutions that the Funds’ investment adviser has determined are creditworthy. Each Fund restricts repurchase agreements to maturities of no more than seven days. |

26 | Royce Capital Fund 2007 Semiannual Report to Shareholders |

|

|

Securities pledged as collateral for repurchase agreements, which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability of each Fund to dispose of its underlying securities. Securities Lending: The Funds loan securities to qualified institutional investors for the purpose of realizing additional income. Collateral on all securities loaned for the Funds is accepted in cash and cash equivalents and invested temporarily by the custodian. The collateral is equal to at least 100% of the current market value of the loaned securities. The market value of the loaned securities is determined at the close of business of the Funds and any additional required collateral is delivered to the Funds on the next business day. Line of Credit: The Funds, along with certain other Royce Funds, participate in a $75 million line of credit (“Credit Agreement”) to be used for temporary or emergency purposes. Pursuant to the Credit Agreement, each participating Fund is liable only for principal and interest payments related to borrowings made by that Fund. Borrowings under the Credit Agreement bear interest at a rate equal to the prevailing federal funds rate plus the federal funds rate margin. The Funds did not utilize the line of credit during the six months ended June 30, 2007. | Recent Accounting Pronouncements: Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”) provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. FIN 48 was adopted for the Funds on June 29, 2007. There was no material impact to the financial statements or disclosures thereto as a result of the adoption of this pronouncement. FASB Statement of Financial Accounting Standard No. 157, “Fair Value Measurement” (“FAS 157”), provides enhanced guidance for using fair value to measure assets and liabilities. The standard requires companies to provide expanded information about the assets and liabilities measured at fair value and the potential effect of these fair valuations on an entity’s financial performance. The standard does not expand the use of fair value in any new circumstances, but provides clarification on acceptable fair valuation methods and applications. Adoption of FAS 157 is required for fiscal years beginning after November 15, 2007. The standard is not expected to materially impact the Fund’s financial statements. |

| Capital Share Transactions (in shares): | ||||||||||||||||||||||||||||||||

| Shares issued for reinvestment | Shares | Net increase (decrease) in | ||||||||||||||||||||||||||||||

| Shares sold | of distributions | redeemed | shares outstanding | |||||||||||||||||||||||||||||

| Period ended | Period ended | Period ended | Period ended | |||||||||||||||||||||||||||||

| 6/30/07 | Period ended | 6/30/07 | Period ended | 6/30/07 | Period ended | 6/30/07 | Period ended | |||||||||||||||||||||||||

| (unaudited) | 12/31/06 | (unaudited) | 12/31/06 | (unaudited) | 12/31/06 | (unaudited) | 12/31/06 | |||||||||||||||||||||||||

| Micro-Cap Portfolio | ||||||||||||||||||||||||||||||||