UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

Name and address of agent for service: | John E. Denneen, Esquire |

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2011 – June 30, 2011

Item 1. Reports to Shareholders.

| ||||||

| Royce Capital Fund– Micro-Cap Portfolio Royce Capital Fund– Small-Cap Portfolio | SEMIANNUAL | |||||

REVIEW AND REPORT | ||||||

TO SHAREHOLDERS | ||||||

| ||||||

| www.roycefunds.com | ||||||

|

|

|

| Through June 30, 2011 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

| Average Annual Total Returns |

| Annual | |||||||||||||||||||||||

|

|

| |||||||||||||||||||||||||

Fund |

|

| Year-to-Date1 |

| 1-Year |

| 5-Year |

| 10-Year |

| Since Inception (Date) |

| |||||||||||||||

Royce Capital Fund–Micro-Cap Portfolio |

|

| 2.79 | % |

| 35.87 | % |

| 6.25 | % |

| 9.87 | % |

| 13.40 | % |

| (12/27/96 | ) |

| 1.37 | % | |||||

Royce Capital Fund–Small-Cap Portfolio |

|

| 5.26 |

|

| 27.01 |

|

| 6.18 |

|

| 8.99 |

|

| 12.09 |

|

| (12/27/96 | ) |

| 1.06 |

| |||||

Russell Microcap Index |

|

| 3.08 |

|

| 32.70 |

|

| 0.55 |

|

| 5.59 |

|

| n.a.2 |

|

|

|

|

| n.a. |

| |||||

Russell 2000 Index |

|

| 6.21 |

|

| 37.41 |

|

| 4.08 |

|

| 6.27 |

|

| 7.303 |

|

|

|

|

| n.a. |

| |||||

1 Not annualized

2 Data for the Russell Microcap Index goes back only to 2000.

3 Since Royce Capital Fund’s inception on 12/27/96.

Important Performance, Expense and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts or retirement plans investing in the Fund. All performance and expense information reflects results for each Fund’s Investment Class Shares. Service Class Shares bear an annual distribution expense that is not borne by the Investment Class. Operating expenses reflect the Fund’s total annual operating expenses for the Investment Class as of the Fund’s most current prospectus and include management fees, other expenses and, in the case of Royce Capital Fund–Micro-Cap Portfolio, acquired fund fees and expenses. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds and other investment companies.

Series of Royce Capital Fund invest primarily in securities of small-cap and micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Royce Capital Fund—Micro-Cap Portfolio may invest up to 35% of its net assets in foreign securities and Royce Capital Fund—Small-Cap Portfolio may invest up to 25% of its net assets in foreign securities. Investments in foreign securities may involve political, economic, currency and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1000 of the smallest securities in the small-cap Russell 2000 Index. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index.

This page is not part of the 2011 Semiannual Report to Shareholders

|

|

Table of Contents |

|

Semiannual Review |

|

|

|

Inside Cover | |

|

|

2 | |

|

|

7 | |

|

|

This page is not part of the 2011 Semiannual Report to Shareholders | 1

| |

| Charles M. Royce, President | |

We have spent a lot of time talking about dividends lately, but they have been important to us as an investment theme since Chuck Royce assumed full investment control of Royce Pennsylvania Mutual Fund in November 1972. However, our work with dividend- paying small-cap stocks became particularly focused in 1979, when we agreed to create a portfolio for an institutional client who informed us at the last minute that every stock in the portfolio had to pay a dividend. | |

Our long history of finding what we think are undervalued, fundamentally strong dividend payers in the small- cap world makes us a bit bemused as to why so many other investors ignore small-cap dividend-paying companies; they simply do not associate the small-cap asset class with dividends. However, we have long maintained that dividends can be an integral part of a successful long-term investment strategy in the small-cap asset class. Our experience suggests that including dividend-paying smaller companies in an equity portfolio potentially offers both an effective cushion against market volatility and a strong component of | |

| Continued on page 4... | |

| |

Déjà vu All Over Again? Some have suggested that the first half of 2011 looked uncannily like that of 2010. We admit that there are some striking similarities. As 2010 began, the stock market briefly stumbled out of the gate before regaining its feet, and the highly charged rally that began early in March of 2009 resumed its brisk pace. However, the month of April brought a more serious correction that lingered into early July, precipitated by fears of sovereign debt crises in Europe, anxiety over the U.S. and Chinese economies and an environmental disaster. In 2011, a sluggish January quickly yielded to an extension of the dynamic market that had characterized 2010 as a whole. This segment of the bull run then quickly reversed direction in April—truly the cruelest month for equity investors over the last two years—as renewed concerns over European fiscal solvency, another round of hand-wringing over the rate of growth in the U.S. and China, and a series of catastrophic events in Japan combined to rouse the bear. However superficially close, the parallels between the first halves of 2010 and 2011 were never quite as neat as some observers suggested. Any resemblance began to break down decisively in the middle of June, when the market shook off its doldrums with a rally that lasted through most of July. Unlike the first six months of 2010, the market bore only slightly ill effects by the end of 2011's first half, despite the relentless flow of negative news and pervasive feeling of economic anxiety that have distinguished both years. The stock market's greater resilience thus far through 2011 can be seen by measuring each year's respective spring-summer downturn. June 2010 ended in the midst of a correction that would ultimately drop small-cap stock prices by more than 20% by early July, while 2011's first down period, which |

| 2 | This page is not part of the 2011 Semiannual Report to Shareholders |

|

|

|

|

| |

|

|

|

All of this makes the question of what may happen next perplexing. What bemuses us as we look back on both periods is that the first half of 2011 was arguably, if not worse, then at least more uncertain, in terms of headline-making developments. For example, in addition to those events already mentioned, we have been through a series of natural disasters here in the States, brinkmanship in Washington over raising the debt ceiling, and ongoing debates about how to deal with deficits and jobs, the latter two made worse because the beckoning election year has been encouraging even larger doses of partisanship than usual. So while the correction was not at all surprising—bull market interruptions have been very common historically—we are concerned about what looks like an almost casual shrugging off of significant events by large numbers of investors, some of whom are likely the same people who sold at the first sign of trouble. On the one hand, then, our contrarian perspective makes us skeptical of the rally that closed out the first half. On the other hand, our long-term view of both the equity market and the economy remains reasonably bright. We still believe that stocks can generate positive returns over the next two or three years, though we are not anticipating a rally in the second half of 2011 like the very dynamic run that ushered out 2010. In all, we remain modestly bullish and cautiously optimistic about the years ahead. |

| We still believe that stocks can generate positive returns over the next two or three years, though we are not anticipating a rally in the second half of 2011 like the very dynamic run that ushered out 2010. |

|

|

|

Seen It All Before |

|

|

Year-to-date results for the major stock indexes were positive, though they were muted by the second quarter's higher volatility. From our perspective, the most notable development in the first half of 2011 was seeing small-cap's seemingly unassailable market leadership contested. For the year-to-date period ended June 30, 2011, the small-cap Russell 2000 Index gained 6.2%, while the large-cap S&P 500 Index was up 6.0%, the Russell 1000 Index climbed 6.4%, and the more tech-oriented Nasdaq Composite returned 4.6%. These results were the combined effect of the year's very different quarters. The first, while it saw numerous shifts in market leadership, was a pleasant, placid bull period compared to what followed. Small-cap companies edged out their larger counterparts between January and March, with the Russell 2000 up 7.9% compared to respective gains of 5.9% and 6.2% for the large-cap S&P 500 and Russell 1000, and 4.8% for the Nasdaq. |

| It should be kept in mind that growth in both the stock market and the economy seldom takes place in uninterrupted straight lines or in lock stepped tandem. The recent pauses in both are very much in the range of what we consider normal. |

The second quarter, while offering a distinctly mixed bag for equities, saw small-caps cede leadership to their large-cap siblings. The Russell 2000 fell 1.6% in the second quarter versus a slender gain of 0.1% for both the S&P 500 and Russell 1000, and a loss of 0.3% for the Nasdaq Composite. One-year returns remained very strong for all four domestic indexes, and were led by small-caps. The Russell 2000 climbed 37.4%, the S&P 500 rose 30.7%, the Russell 1000 was up |

|

This page is not part of the 2011 Semiannual Report to Shareholders | 3

an investment’s total return, especially during lower-return periods. | |

We also believe that a company’s practice of paying dividends is an excellent measure of its underlying quality and an intelligent form of corporate governance. From our perspective within the small- cap world, where the words “dividend” and “quality” are often considered synonymous, adopting a dividend- paying investment strategy could be a key to long-term outperformance. We believe that this is more than usually relevant today, as we believe a shift to higher quality companies may be at hand. | |

Understanding a company’s capital allocation decisions is a critical element in our investment process. This is especially important in a market when corporate balance sheets are generally in excellent condition and, in many cases, flush with cash. Dividends are by nature the byproduct of healthy free cash flow generation. Of the more than 4,140 domestic small-cap companies (those with market capitalizations up to $2.5 billion), 1,181 were dividend payers as of the end of the first half of 2011; of these dividend-paying companies, 757 had a dividend yield of at least 2%. | |

Not surprisingly, the number of dividend- paying companies located outside of the United States is even larger. In many foreign public markets, there is typically | |

| Continued on page 6... | |

Letter to Our Shareholders | |

31.9%, and the Nasdaq Composite gained 31.5%. Small-caps also led over longer-term periods, as the Russell 2000 outperformed each of its large-cap counterparts, the S&P 500 and Russell 1000, for the trailing three-, five-, 10-, 15- and 20-year periods ended June 30, 2011. Year-to-date results for non-U.S. equity indexes were somewhat in line with their domestic cousins, with the Russell Global ex-U.S. Small Cap Index finishing further behind its large-cap counterpart, the Russell Global ex-U.S. Large Cap Index, up 0.8% versus a gain of 4.1%. The lower year-to-date results relative to U.S. indexes were attributable to significantly lower first-quarter returns, with the Russell Global ex-U.S. Large Cap gaining 3.6%, while its non-U.S. small-cap equivalent gained 1.0%. While non-U.S. indexes generally enjoyed slightly better performance than the domestic indexes in the second quarter, it was not enough to overcome the first quarter’s relative disadvantage. For the second quarter, the Russell Global ex-U.S. Large Cap was up 0.4%, while the Russell Global ex-U.S. Small Cap declined 0.2%. Arguably the market’s unsung heroes, domestic mid-cap stocks, as measured by the Russell Midcap Index, outpaced their small-cap and large-cap equivalents for the year-to-date period ended June 30, 2011, up 8.1%. Micro-caps, as measured by the Russell Microcap Index, were the worst performers along the market cap spectrum, up 3.1% for the six months ended June 30, 2011. Within small-cap, value, as measured by the Russell 2000 Value Index, fell behind growth, as measured by the Russell 2000 Growth Index for the year-to-date period (+3.8% versus +8.6%). In addition, small-cap growth led its value sibling in the trailing one-, three- and five-year periods, while trailing 10-, 15-, 20-, and 25-year returns belonged to small-cap value. Seeing Things All in all, the first six months were a curious time, befitting a period in which the mood of investors seemed to shift violently from composed to panic and back again. While these mood swings were the top story in equities during the first half, the return of volatility was not a development that struck us as unusual, especially considering that the market had previously been on a very dynamic run from the interim small-cap low on July 6, 2010. Some retreat from its recent highs was therefore to be expected at some point. The correction has so far been fairly modest and mostly painless, particularly in the wider context of the bull market that began following the bottom on March 9, 2009. Our thought is that, for all the surface similarities to last year’s first half, there are cyclical forces at work that are as much a factor as investors’ unease with the U.S. or global economies. It is also worth remembering that, though growth has decelerated, the economy is still growing. In addition, it should be kept in mind that growth in both the stock market and the economy seldom takes place in uninterrupted straight lines or in lock-stepped tandem. The recent pauses in both are very much in the range of what we consider normal. |

| 4 | This page is not part of the 2011 Semiannual Report to Shareholders |

|

|

|

|

| |

|

|

|

In addition, as contrarian, bargain-hunting value investors, we see opportunity when the markets correct. Our discipline entails thinking about the present and about the years ahead when positioning our portfolios. So while we never look forward to corrections, we accept them as a fact of investment life, and then some. We see downturns as vital opportunities to re-evaluate and re-stock our portfolios. Even a brief reversal in the market can create ample chances to find what we see as well-managed, financially strong businesses with attractively low share prices. |

|

|

|

|

|

Sights Unseen |

|

|

The issues of unemployment and housing continue to dominate the headlines, though we still maintain that there is far more good news about the economy on a company by company basis. In fact, from the standpoint of balance sheets, cash flows, revenues and profits, corporations have seldom been in better shape. However, as long as unemployment remains high and housing continues to correct, the focus will remain on those two. The latter is, we think, less of a problem. Real estate cycles tend to unwind very slowly, and this one shows no signs of being any different. It may actually take years because the run-up in housing prices was so extreme. Any expectation that a correction would be quick was entirely misplaced. Unemployment is a more significant issue, and we have no good answer as to why the much-discussed and hoped-for pick-up in employment has not yet materialized. Certainly any increase in jobs would be a huge benefit to the economy and society as a whole. Yet companies seem much more focused on continuing to improve revenues and profits than they are on hiring, at least here in the U.S., something that we do not necessarily see changing in the intermediate future. |

| We believe that the fortunes of quality companies in all asset classes will resemble the growth in the economy—slow and steady, not very dramatic, but in retrospect more than satisfying. |

So the economy is by no means out of the woods yet. This observation can be balanced, however, by our contention that it is closer to recovery than it has been since the recession began in 2007. Clearly, it has been a long, unhappy ride for many. And there have been numerous instances in history when the market was either ahead of the economy or, as we think is currently the case, when headlines are fixated on bad news while many individual companies have been doing well. Ultimately, we are throwing our lot in with companies, and the message |

|

This page is not part of the 2011 Semiannual Report to Shareholders | 5

Letter to Our Shareholders | ||||||

| ||||||

that we have been receiving lately in our meetings with management is far more optimistic than what we see in the headlines. Still, we would not be surprised if the coming months brought another downturn. We did not become too excited by the rally that closed out June, which, though welcome, did little to convince us that the downturn was over. While we continue to believe that stocks can generate positive returns over the next two or three years, we are not anticipating a rally in the second half of 2011 such as the one we had in the final six months of 2010. As stated, our bullishness and optimism are real, but low key. We believe that the fortunes of quality companies in all asset classes will resemble the growth in the economy—slow and steady, not very dramatic, but in retrospect more than satisfying. Sincerely, | ||||||

|  |  | ||||

| Charles M. Royce President | W. Whitney George Vice President | Jack E. Fockler, Jr. Vice President | ||||

| ||||||

| 6 | This page is not part of the 2011 Semiannual Report to Shareholders |

|

|

Table of Contents |

|

|

|

| |

|

|

Managers’ Discussions of Fund Performance |

|

|

|

8 | |

|

|

10 | |

|

|

12 | |

|

|

22 | |

|

|

25 | |

|

|

26 | |

|

|

27 | |

|

|

28 |

|

|

Royce Capital Fund 2011 Semiannual Report to Shareholders | 7

AVERAGE ANNUAL TOTAL RETURNS Through 6/30/11 | |||||||||||

| Jan-June 20111 | 2.79 | % | |||||||||

| One-Year | 35.87 | ||||||||||

| Three-Year | 8.82 | ||||||||||

| Five-Year | 6.25 | ||||||||||

| 10-Year | 9.87 | ||||||||||

| Since Inception (12/27/96) | 13.40 | ||||||||||

| ANNUAL EXPENSE RATIO | |||||||||||

| Operating Expenses | 1.37 | % | |||||||||

| 1Not annualized | |||||||||||

CALENDAR YEAR TOTAL RETURNS | |||||||||||

| Year | RCM | Year | RCM | ||||||||

| 2010 | 30.1 | % | 2003 | 49.2 | % | ||||||

| 2009 | 57.9 | 2002 | -12.9 | ||||||||

| 2008 | -43.3 | 2001 | 29.7 | ||||||||

| 2007 | 4.0 | 2000 | 18.5 | ||||||||

| 2006 | 21.1 | 1999 | 28.1 | ||||||||

| 2005 | 11.6 | 1998 | 4.1 | ||||||||

| 2004 | 13.8 | 1997 | 21.2 | ||||||||

| TOP 10 POSITIONS % of Net Assets | |||||||||||

| GP Strategies | 1.1 | % | |||||||||

| Anaren | 1.1 | ||||||||||

| Universal Stainless & Alloy Products | 1.0 | ||||||||||

| Allied Nevada Gold | 1.0 | ||||||||||

| Marten Transport | 1.0 | ||||||||||

| Total Energy Services | 0.9 | ||||||||||

| Lincoln Educational Services | 0.9 | ||||||||||

| Lamprell | 0.9 | ||||||||||

| Cavco Industries | 0.9 | ||||||||||

| Horsehead Holding Corporation | 0.9 | ||||||||||

| PORTFOLIO SECTOR BREAKDOWN | |||||||||||

| % of Net Assets | |||||||||||

| Industrials | 17.8 | % | |||||||||

| Materials | 13.5 | ||||||||||

| Information Technology | 13.1 | ||||||||||

| Consumer Discretionary | 11.4 | ||||||||||

| Health Care | 10.2 | ||||||||||

| Energy | 7.6 | ||||||||||

| Financials | 6.5 | ||||||||||

| Consumer Staples | 2.8 | ||||||||||

| Telecommunication Services | 1.3 | ||||||||||

| Utilities | 0.1 | ||||||||||

| Miscellaneous | 4.6 | ||||||||||

| Cash and Cash Equivalents | 11.1 | ||||||||||

Manager’s Discussion Manager’s DiscussionMicro-cap stocks struggled through the first six months of 2011, and the diversified portfolio of Royce Capital Fund–Micro-Cap Portfolio (RCM) was unfortunately no exception to this rule. The Fund was up 2.8% for the year-to-date period ended June 30, 2011 versus a gain of 6.2% for the small-cap Russell 2000 Index and a 3.1% result for the Russell Microcap Index, the Fund’s new benchmark. (We chose the Fund’s new benchmark because it better reflects the Fund’s security selection universe.) During the mostly bullish first quarter, RCM gained 7.3%, behind the Russell 2000 Index, which was up 7.9%, but ahead of the Russell Microcap Index, which climbed 6.8%. This pattern held through April, but when share prices began to plummet following the interim small-cap high on April 29, the Fund lost ground against both indexes. (The Fund was down 6.3% from small-cap high on April 29 through June 30, 2011, versus respective losses of 4.1% and 4.9% for the Russell 2000 and Russell Microcap Indexes.) For the second quarter as a whole, RCM fell 4.2% versus a decline of 1.6% for the small-cap index and a loss of 3.5% for its micro-cap benchmark. Following stellar years in 2009 and 2010, some give-back was not surprising, particularly for this more volatile segment of the small-cap asset class during a period in which volatility made a highly visible comeback. We were therefore only mildly disappointed by the Fund’s results through the first six months of 2011. | |||||

| However, longer-term market cycle results were far more encouraging. RCM rose 172.0% from the market low on March 9, 2009 through June 30, 2011 compared to a gain of 148.6% for the Russell 2000 Index and 147.1% for the Russell Microcap Index. From the interim small-cap peak on July 6, 2010 through the end of June 2011, the Fund gained 39.4% versus gains of 41.9% and 37.4%, for the small-cap and micro-cap indexes, respectively. | |||||

| GOOD IDEAS THAT WORKED | |||||

| Top Contributors to Performance Year-to-Date through 6/30/111 | |||||

| Heritage-Crystal Clean | 0.48 | % | |||

| SMART Modular Technologies (WWH) | 0.46 | ||||

| Universal Stainless & Alloy Products | 0.37 | ||||

| Fronteer Gold | 0.34 | ||||

| TGC Industries | 0.33 | ||||

| 1Includes dividends | |||||

Strong market cycle performances played a pivotal role in the Fund’s average annual total returns through the end of June. RCM outpaced the Russell Microcap Index—for which returns date back only as far as 2000—for the one-, three-, five- and 10-year periods ended June 30, 2011, while also beating the small-cap index for the three-, five-, 10-year and since inception (12/27/96) periods. The Fund’s average annual total return since inception was 13.4%. Following the heady results of the previous two calendar years, many portfolio positions were sold or trimmed after reaching or, in some cases, exceeding our price targets as we Important Performance and Expense Information All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts of retirement plans investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information for RCM reflects Investment Class results. Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class. Operating expenses reflect the Fund’s total annual operating expenses for the Investment Class as of the Fund’s most current prospectus and include management fees, other expenses, and acquired fund fees and expenses. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds and other investment companies. Regarding the two “Good Ideas” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2011. | |||||

| 8 | Royce Capital Fund 2011 Semiannual Report to Shareholders |

Performance and Portfolio Review actively sought to better position the portfolio for the years ahead. When this activity was accompanied by a volatile market, it made the necessity of re-stocking painful. However, it also opened up numerous opportunities, as valuations in the first half looked highly encouraging to us, whether in existing holdings or newer positions. We were very pleased with the state of the portfolio at the end of June, its recent performance notwithstanding. Smith Micro Software provides software and services for laptops, tablets and other devices. We liked its balance sheet and have high regard for its core business, though it is also highly cyclical. Its stock performance has often been tied to the success of new product launches that utilize its technology, which has made for considerable volatility. The stock began to underperform Wall Street’s expectations early in 2011 and failed to recover any value during the June rally as it continued to move more of its business to tablet software at a pace most investors deemed too slow. We held a modest position at the end of June, though we built our stake in the first half. We also had confidence in the prospects for Sigma Designs, which makes integrated system-on-chip solutions for IPTV (Internet protocol television). It has suffered the typical fits and starts of many new, highly | |||||||

| niche-based tech businesses, which kept investors away during the first half. It too failed to participate in the late rally, which kept its stock attractively cheap through the first half, allowing us to increase our position in March, May and June. Xyratex‘s stock price revived a bit in June, though not nearly enough to keep it from being a detractor to first-half performance. The company makes hard disks for large-scale data storage needs. High expectations for its business led its share price to rise in the second half of last year, and helped lead to a vicious sell-off when middling results were announced earlier this year. Its disappointing stock performance led us to add a bit to our position in January. A steadily rising stock price led us to take gains in Heritage-Crystal Clean, which performs industrial and hazardous waste services for small and mid-sized businesses. Our initial attraction was to its interesting business, pristine balance sheet and very attractive valuation. We sold our shares of SMART Modular Technologies in June following the announcement of its acquisition in May, which helped to boost its share price. Although we made modest trims late in the first half, we otherwise substantially increased our position in top-ten holding and strong performer Universal Stainless & Alloy Products during the first half. The company, which manufactures specialty steel products, saw its stock get very cheap in the downturn. New management helped to make the company more efficient and its subsequent improved results attracted other investors. | |||||||

GOOD IDEAS AT THE TIME | |||||||

| Smith Micro Software | -0.61% | ||||||

| Sigma Designs | -0.32 | ||||||

| Xyratex | -0.26 | ||||||

| Patriot Transportation Holding | -0.24 | ||||||

| PDI | -0.23 | ||||||

| 1 Net of dividends | |||||||

| | |||||||

| | |||||||

| | |||||||

| | |||||||

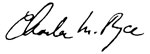

ROYCE CAPITAL—MICRO-CAP VS. RUSSELL MICROCAP AND RUSSELL 2000 Value of $10,000 Invested on 12/27/96 | |||||||

| |||||||

| Includes reinvestment of distributions. | |||||||

| FUND INFORMATION AND PORTFOLIO DIAGNOSTICS | |||||||

| Average Market Capitalization 1 | $407 million | ||||||

| Weighted Average P/E Ratio 2 | 16.8x | ||||||

| Weighted Average P/B Ratio | 1.7x | ||||||

| U.S. Investments (% of Net Assets) | 56.5% | ||||||

| Non-U.S. Investments (% of Net Assets) | 32.4% | ||||||

| Fund Net Assets | $730 million | ||||||

| Turnover Rate | 18% | ||||||

| Number of Holdings | 224 | ||||||

| Symbol | |||||||

| Investment Class | RCMCX | ||||||

| Service Class | RCMSX | ||||||

| 1 Geometrically calculated | |||||||

2 The Fund’s P/E calculation excludes companies with zero or negative earnings (15% of portfolio holdings as of 6/30/11). | |||||||

| RISK/RETURN COMPARISON | |||||||

| Five-Year Period Ended 6/30/11 | |||||||

| Average Annual Total Return | Standard Deviation | Return Efficiency 1 | |||||

| RCM | 6.25% | 22.29 | 0.28 | ||||

| Russell Microcap | 0.55 | 23.79 | 0.02 | ||||

1 Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. Please read the prospectus for a more complete discussion of risk. | |||||||

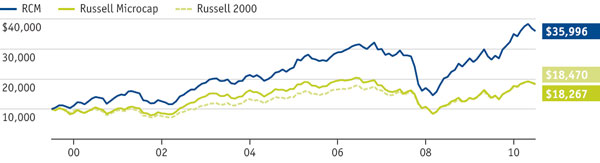

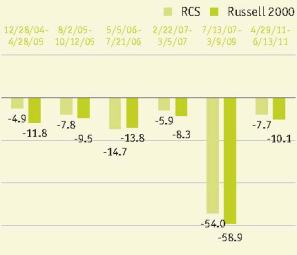

| DOWN MARKET PERFORMANCE COMPARISON All Down Periods of 7.5% or Greater Over the Last 7 Years, in Percentages (%) | |||||||

| |||||||

Royce Capital Fund 2011 Semiannual Report to Shareholders | 9

| AVERAGE ANNUAL TOTAL RETURNS Through 6/30/11 | ||||||||||||

| Jan-June 2011 1 | 5.26 | % | ||||||||||

| One-Year | 27.01 | |||||||||||

| Three-Year | 7.02 | |||||||||||

| Five-Year | 6.18 | |||||||||||

| 10-Year | 8.99 | |||||||||||

| Since Inception (12/27/96) | 12.09 | |||||||||||

| ANNUAL EXPENSE RATIO | ||||||||||||

| Operating Expenses | 1.06 | % | ||||||||||

| 1 Not annualized | ||||||||||||

| CALENDAR YEAR TOTAL RETURNS | ||||||||||||

| Year | RCS | Year | RCS | |||||||||

| 2010 | 20.5 | % | 2003 | 41.1 | % | |||||||

| 2009 | 35.2 | 2002 | -13.8 | |||||||||

| 2008 | -27.2 | 2001 | 21.0 | |||||||||

| 2007 | -2.1 | 2000 | 33.3 | |||||||||

| 2006 | 15.6 | 1999 | 8.2 | |||||||||

| 2005 | 8.6 | 1998 | 8.9 | |||||||||

| 2004 | 25.0 | 1997 | 17.1 | |||||||||

| TOP 10 POSITIONS % of Net Assets | ||||||||||||

| Jos. A. Bank Clothiers | 2.9 | % | ||||||||||

| Steven Madden | 2.9 | |||||||||||

| Ascena Retail Group | 2.9 | |||||||||||

| Buckle (The) | 2.8 | |||||||||||

| Allied World Assurance Company Holdings | 2.7 | |||||||||||

| ManTech International Cl. A | 2.6 | |||||||||||

| MEDNAX | 2.4 | |||||||||||

| MAXIMUS | 2.2 | |||||||||||

| Federated Investors Cl. B | 2.0 | |||||||||||

| Wolverine World Wide | 1.9 | |||||||||||

| �� | PORTFOLIO SECTOR BREAKDOWN % of Net Assets | |||||||||||

| Consumer Discretionary | 21.3 | % | ||||||||||

| Financials | 16.2 | |||||||||||

| Information Technology | 15.3 | |||||||||||

| Health Care | 12.5 | |||||||||||

| Energy | 6.4 | |||||||||||

| Industrials | 6.1 | |||||||||||

| Consumer Staples | 5.8 | |||||||||||

| Materials | 1.2 | |||||||||||

| Miscellaneous | 2.6 | |||||||||||

| Cash and Cash Equivalents | 12.6 | |||||||||||

Manager's Discussion Manager's DiscussionRoyce Capital Fund–Small-Cap Portfolio (RCS) managed to effectively roll with the punches as the equity markets grew more volatile later in the first half of 2011. RCS gained 5.3% for the year-to-date period ended June 30, 2011, trailing its small-cap benchmark, the Russell 2000 Index, which was up 6.2% for the same period. During the more bullish first quarter, RCS rose 7.7% versus a 7.9% gain for the small-cap index. After hitting an interim high on April 29, small-caps plummeted before the mid-June rally helped to shore up gains. The Fund performed respectably through this period, although its 2.2% drop in the second quarter was behind the 1.6% decline for the Russell 2000 Index. Recent market cycle results were strong on an absolute basis, though more mixed on a relative basis. In the more bearish peak-to-current period from the small-cap peak on July 13, 2007 through June 30, 2011, RCS was up 8.1% versus a 2.2% gain for the Russell 2000. From the small-cap trough on March 9, 2009 through June 30, 2011, the Fund rose 134.8% compared to a gain of 148.6% for its benchmark. Finally, RCS gained 30.0% from the interim small-cap low on July 6, 2010 through the end of June 2011 versus a 41.9% return for the small-cap index. We were also pleased with the Fund’s longer-term average annual total returns. RCS outperformed the Russell 2000 for the five-year, 10-year and since inception (12/27/96) periods ended June 30, 2011. The Fund’s average annual total return since inception was 12.1%. | ||||||

| Each of the Fund’s consumer sectors was a source of net gains during the first half, with the Consumer Discretionary sector making the largest positive contribution to performance by a comfortable margin. Consumer stocks have been an area of focus since the recession began. Our strategy was based on two related factors: First, these companies were among the hardest hit, especially during the worst days of the bear market between September 2008 and early March 2009. Second, we believed that, while the recession would | GOOD IDEAS THAT WORKED Top Contributors to Performance Year-to-Date through 6/30/111 | |||||

| Steven Madden | 0.94% | |||||

| Ascena Retail Group | 0.81 | |||||

| Jos. A. Bank Clothiers | 0.71 | |||||

| Wolverine World Wide | 0.60 | |||||

| MAXIMUS | 0.52 | |||||

| 1 Includes dividends | ||||||

undoubtedly hurt results for many consumer stocks, the best-managed businesses would find ways to survive or even thrive through challenging times. We simply could not see Americans giving up shopping to the degree that many analysts were forecasting a few years ago. Our search therefore centered on those small-cap companies that we thought were best positioned to succeed, typically those with strong balance sheets, good management and a history of success through different business and economic cycles. Important Performance and Expense Information All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts of retirement plans investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information for RCS reflects Investment Class results. Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class. Operating expenses reflect the Fund’s total annual operating expenses for the Investment Class as of the Fund’s most current prospectus and include management fees and other expenses. Regarding the two “Good Ideas” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2011. | ||||||

10 | Royce Capital Fund 2011 Semiannual Report to Shareholders

Performance and Portfolio Review Four of the Fund’s top five performers came from the Consumer Discretionary sector, and each was a top-three holding at the end of June. Steven Madden, which designs and sells footwear, handbags and accessories, first drew our attention with its strong balance sheet, steady earnings and positive cash flow from operations. The company has successfully added new brands to its own well-known name over the last few years by introducing its own or by purchasing others. Its core business in shoes has continued to produce strong results. After buying through much of the first quarter, we took some gains in the second. Long-time Royce favorite The Dress Barn, which reorganized under the name Ascena Retail Group in January 2011, enjoyed strong sales and thus gained the attention of other investors. We trimmed our position in the specialty retailer for women’s apparel late in the second quarter. We acted in a similar fashion during the first half with menswear retailer and tailor Jos. A. Bank Clothiers, while we made a relatively larger reduction to our position in footwear, apparel, and accessories maker Wolverine World Wide. First building a position in late 2009, we have | |||

| long regarded Jos. A. Bank Clothiers as the kind of poorly understood business that intrigues us. Although well-known as a business with a reputation for quality and value, its discount-driven business model seemed to keep interest in the company low. Wolverine World Wide derives a benefit from having several established brands, including Merrell, Patagonia Footwear, Harley-Davidson Footwear, Hush Puppies, and Sebago. MAXIMUS provides outsourcing and consulting services for governments across the globe. Its recent success came from running welfare-to-work-type programs in Australia and the UK. Although we trimmed our stake in the first half, we think that the company remains well-positioned to potentially benefit from the Affordable Care Act putting more people on Medicaid. As for those holdings that did not enjoy rising prices through the end of June, two—Almost Family and LHC Group—are in the business of providing home healthcare. We saw both as well-managed businesses in an attractive niche that were trading cheaply because of uncertainty about how the Affordable Care Act would affect their industry. They now face the likely prospect of increased regulatory hurdles that could hurt margins for their industry. We are closely watching each stock—both could potentially benefit from the wave of industry consolidation that could result once new home healthcare rules are in place, provided that new regulations do not depress margins too significantly. | |||

GOOD IDEAS AT THE TIME | |||

| Almost Family | -0.55% | ||

| LHC Group | -0.39 | ||

| World Wrestling Entertainment Cl. A | -0.30 | ||

| Multi-Fineline Electronix | -0.26 | ||

| Knight Capital Group Cl. A | -0.24 | ||

| 1 Net of dividends | |||

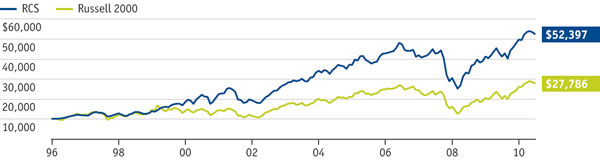

| ROYCE CAPITAL—SMALL-CAP VS. RUSSELL 2000 Value of $10,000 Invested on 12/27/96 | |||

| |||

| Includes reinvestment of distributions. | |||

| FUND INFORMATION AND PORTFOLIO DIAGNOSTICS | ||||||||

| Average Market Capitalization1 | $1,245 million | |||||||

| Weighted Average P/E Ratio 2 | 13.6x | |||||||

| Weighted Average P/B Ratio | 1.8x | |||||||

| U.S. Investments (% of Net Assets) | 79.5% | |||||||

| Non-U.S. Investments (% of Net Assets) | 7.9% | |||||||

| Fund Net Assets | $774 million | |||||||

| Turnover Rate | 19% | |||||||

| Number of Holdings | 81 | |||||||

| Symbol | ||||||||

| Investment Class | RCPFX | |||||||

| Service Class | RCSSX | |||||||

| 1 Geometrically calculated | ||||||||

2 The Fund’s P/E calculation excludes companies with zero or negative earnings (0% of portfolio holdings as of 6/30/11). | ||||||||

| RISK/RETURN COMPARISON Five-Year Period Ended 6/30/11 | ||||||||

| Average Annual Total Return | Standard Deviation | Return Efficiency 1 | ||||||

| RCS | 6.18% | 20.17 | 0.31 | |||||

| Russell 2000 | 4.08 | 22.76 | 0.18 | |||||

1 Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. Please read the prospectus for a more complete discussion of risk. | ||||||||

| DOWN MARKET PERFORMANCE COMPARISON All Down Periods of 7.5% or Greater Over the Last 7 Years, in Percentages (%) | ||||||||

| ||||||||

Royce Capital Fund 2011 Semiannual Report to Shareholders | 11

|

|

Royce Capital Fund–Micro-Cap Portfolio |

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

COMMON STOCKS – 88.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Discretionary – 11.4% |

|

|

|

|

|

|

|

Auto Components - 1.6% |

|

|

|

|

|

|

|

Drew Industries |

|

| 244,633 |

| $ | 6,047,328 |

|

|

| 94,500 |

|

| 2,357,775 |

| |

Motorcar Parts of America 2 |

|

| 227,081 |

|

| 3,408,486 |

|

|

|

|

|

| |||

|

|

|

|

|

| 11,813,589 |

|

|

|

|

|

| |||

Diversified Consumer Services - 1.3% |

|

|

|

|

|

|

|

|

| 511,500 |

|

| 2,649,570 |

| |

Lincoln Educational Services |

|

| 395,313 |

|

| 6,779,618 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,429,188 |

|

|

|

|

|

| |||

Hotels, Restaurants & Leisure - 0.3% |

|

|

|

|

|

|

|

McCormick & Schmick's Seafood Restaurants 2 |

|

| 167,500 |

|

| 1,438,825 |

|

Multimedia Games Holding Company 2 |

|

| 175,882 |

|

| 800,263 |

|

|

|

|

|

| |||

|

|

|

|

|

| 2,239,088 |

|

|

|

|

|

| |||

Household Durables - 1.4% |

|

|

|

|

|

|

|

AS Creation Tapeten |

|

| 32,400 |

|

| 1,376,343 |

|

Cavco Industries 2 |

|

| 148,704 |

|

| 6,691,680 |

|

CSS Industries |

|

| 84,300 |

|

| 1,764,399 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,832,422 |

|

|

|

|

|

| |||

Internet & Catalog Retail - 0.9% |

|

|

|

|

|

|

|

GS Home Shopping |

|

| 24,200 |

|

| 3,097,574 |

|

Manutan International |

|

| 35,900 |

|

| 2,769,891 |

|

|

| 177,100 |

|

| 857,164 |

| |

|

|

|

|

| |||

|

|

|

|

|

| 6,724,629 |

|

|

|

|

|

| |||

Leisure Equipment & Products - 0.7% |

|

|

|

|

|

|

|

Arctic Cat 2 |

|

| 198,644 |

|

| 2,667,789 |

|

Piscines Desjoyaux |

|

| 210,000 |

|

| 2,223,022 |

|

|

|

|

|

| |||

|

|

|

|

|

| 4,890,811 |

|

|

|

|

|

| |||

Media - 0.2% |

|

|

|

|

|

|

|

Rentrak Corporation 2 |

|

| 53,440 |

|

| 948,025 |

|

Saraiva SA Livreiros Editores |

|

| 27,000 |

|

| 528,011 |

|

|

|

|

|

| |||

|

|

|

|

|

| 1,476,036 |

|

|

|

|

|

| |||

Specialty Retail - 3.9% |

|

|

|

|

|

|

|

Buckle (The) |

|

| 76,025 |

|

| 3,246,267 |

|

Cato Corporation (The) Cl. A |

|

| 124,300 |

|

| 3,579,840 |

|

Jos. A. Bank Clothiers 2 |

|

| 67,170 |

|

| 3,359,172 |

|

Kirkland's 2 |

|

| 469,877 |

|

| 5,647,922 |

|

Lewis Group |

|

| 231,000 |

|

| 2,891,179 |

|

Luk Fook Holdings (International) |

|

| 1,028,900 |

|

| 4,996,032 |

|

Shoe Carnival 2 |

|

| 55,900 |

|

| 1,685,385 |

|

Stein Mart |

|

| 328,310 |

|

| 3,164,908 |

|

|

|

|

|

| |||

|

|

|

|

|

| 28,570,705 |

|

|

|

|

|

| |||

Textiles, Apparel & Luxury Goods - 1.1% |

|

|

|

|

|

|

|

LaCrosse Footwear |

|

| 253,531 |

|

| 3,660,987 |

|

True Religion Apparel 2 |

|

| 98,000 |

|

| 2,849,840 |

|

Van De Velde |

|

| 29,550 |

|

| 1,679,112 |

|

|

|

|

|

| |||

|

|

|

|

|

| 8,189,939 |

|

|

|

|

|

| |||

Total (Cost $61,926,644) |

|

|

|

|

| 83,166,407 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

Consumer Staples – 2.8% |

|

|

|

|

|

|

|

Food Products - 1.8% |

|

|

|

|

|

|

|

Asian Citrus Holdings |

|

| 3,500,000 |

| $ | 3,197,658 |

|

Binggrae |

|

| 44,000 |

|

| 2,546,022 |

|

BioExx Specialty Proteins 2 |

|

| 571,300 |

|

| 592,358 |

|

Sipef |

|

| 38,000 |

|

| 3,843,695 |

|

Super Group |

|

| 2,538,000 |

|

| 2,959,385 |

|

|

|

|

|

| |||

|

|

|

|

|

| 13,139,118 |

|

|

|

|

|

| |||

Household Products - 0.1% |

|

|

|

|

|

|

|

Jyothy Laboratories |

|

| 221,900 |

|

| 1,083,485 |

|

|

|

|

|

| |||

Personal Products - 0.9% |

|

|

|

|

|

|

|

Nutraceutical International 2 |

|

| 104,500 |

|

| 1,607,210 |

|

|

| 150,000 |

|

| 4,692,000 |

| |

|

|

|

|

| |||

|

|

|

|

|

| 6,299,210 |

|

|

|

|

|

| |||

Total (Cost $14,152,943) |

|

|

|

|

| 20,521,813 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Energy – 7.6% |

|

|

|

|

|

|

|

Energy Equipment & Services - 6.8% |

|

|

|

|

|

|

|

Cal Dive International 2 |

|

| 277,230 |

|

| 1,657,835 |

|

Canadian Energy Services & Technology |

|

| 190,700 |

|

| 6,179,040 |

|

Dawson Geophysical 2 |

|

| 120,729 |

|

| 4,122,895 |

|

Gasfrac Energy Services 2 |

|

| 193,300 |

|

| 1,763,741 |

|

Geodrill 2 |

|

| 614,600 |

|

| 1,484,803 |

|

Gulf Island Fabrication |

|

| 172,746 |

|

| 5,576,241 |

|

Lamprell |

|

| 1,118,300 |

|

| 6,774,202 |

|

OYO Geospace 2 |

|

| 43,161 |

|

| 4,316,100 |

|

Tesco Corporation 2 |

|

| 266,980 |

|

| 5,182,082 |

|

TGC Industries 2 |

|

| 522,007 |

|

| 3,335,625 |

|

Total Energy Services |

|

| 456,300 |

|

| 6,793,994 |

|

Union Drilling 2 |

|

| 207,569 |

|

| 2,135,885 |

|

|

|

|

|

| |||

|

|

|

|

|

| 49,322,443 |

|

|

|

|

|

| |||

Oil, Gas & Consumable Fuels - 0.8% |

|

|

|

|

|

|

|

Gran Tierra Energy 2 |

|

| 444,100 |

|

| 2,935,501 |

|

Triangle Petroleum 2 |

|

| 350,563 |

|

| 2,264,637 |

|

|

| 551,225 |

|

| 920,546 |

| |

|

|

|

|

| |||

|

|

|

|

|

| 6,120,684 |

|

|

|

|

|

| |||

Total (Cost $31,567,916) |

|

|

|

|

| 55,443,127 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Financials – 6.5% |

|

|

|

|

|

|

|

Capital Markets - 2.7% |

|

|

|

|

|

|

|

CapMan Cl. B |

|

| 687,000 |

|

| 1,344,227 |

|

Edelman Financial Group (The) |

|

| 420,000 |

|

| 3,313,800 |

|

FBR & Company 2 |

|

| 636,215 |

|

| 2,163,131 |

|

Gluskin Sheff + Associates |

|

| 173,900 |

|

| 3,389,828 |

|

GMP Capital |

|

| 193,600 |

|

| 2,567,415 |

|

INTL FCStone 2 |

|

| 188,194 |

|

| 4,556,177 |

|

U.S. Global Investors Cl. A |

|

| 112,300 |

|

| 808,560 |

|

Westwood Holdings Group |

|

| 44,427 |

|

| 1,692,669 |

|

|

|

|

|

| |||

|

|

|

|

|

| 19,835,807 |

|

|

|

|

|

| |||

Commercial Banks - 0.7% |

|

|

|

|

|

|

|

Bancorp (The) 2 |

|

| 202,528 |

|

| 2,116,417 |

|

BCB Holdings 2 |

|

| 1,303,907 |

|

| 1,130,062 |

|

|

|

12 | Royce Capital Fund 2011 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

Financials (continued) |

|

|

|

|

|

|

|

Commercial Banks (continued) |

|

|

|

|

|

|

|

Pacific Continental |

|

| 178,800 |

| $ | 1,636,020 |

|

|

|

|

|

| |||

|

|

|

|

|

| 4,882,499 |

|

|

|

|

|

| |||

Diversified Financial Services - 0.3% |

|

|

|

|

|

|

|

Hellenic Exchanges |

|

| 325,000 |

|

| 2,318,251 |

|

|

|

|

|

| |||

Insurance - 1.7% |

|

|

|

|

|

|

|

American Safety Insurance Holdings 2 |

|

| 140,900 |

|

| 2,696,826 |

|

Argo Group International Holdings |

|

| 50,027 |

|

| 1,486,802 |

|

|

| 407,482 |

|

| 5,443,960 |

| |

Navigators Group 2 |

|

| 42,500 |

|

| 1,997,500 |

|

United Fire & Casualty |

|

| 43,730 |

|

| 759,590 |

|

|

|

|

|

| |||

|

|

|

|

|

| 12,384,678 |

|

|

|

|

|

| |||

Real Estate Management & Development - 1.1% |

|

|

|

|

|

|

|

Kennedy-Wilson Holdings |

|

| 524,814 |

|

| 6,428,972 |

|

Syswin ADR 2 |

|

| 522,868 |

|

| 1,547,689 |

|

|

|

|

|

| |||

|

|

|

|

|

| 7,976,661 |

|

|

|

|

|

| |||

Total (Cost $50,330,632) |

|

|

|

|

| 47,397,896 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Health Care – 10.2% |

|

|

|

|

|

|

|

Biotechnology - 1.0% |

|

|

|

|

|

|

|

Dyax Corporation 2 |

|

| 717,416 |

|

| 1,420,484 |

|

Lexicon Pharmaceuticals 2 |

|

| 1,266,686 |

|

| 2,229,367 |

|

Sinovac Biotech 2 |

|

| 434,700 |

|

| 1,391,040 |

|

Zogenix 2 |

|

| 460,268 |

|

| 1,845,675 |

|

|

|

|

|

| |||

|

|

|

|

|

| 6,886,566 |

|

|

|

|

|

| |||

Health Care Equipment & Supplies - 4.4% |

|

|

|

|

|

|

|

Anika Therapeutics 2 |

|

| 170,678 |

|

| 1,215,227 |

|

Cerus Corporation 2 |

|

| 490,257 |

|

| 1,470,771 |

|

CryoLife 2 |

|

| 271,605 |

|

| 1,520,988 |

|

Cynosure Cl. A 2 |

|

| 222,800 |

|

| 2,695,880 |

|

Exactech 2 |

|

| 208,568 |

|

| 3,756,310 |

|

Kensey Nash 2 |

|

| 127,614 |

|

| 3,219,701 |

|

Merit Medical Systems 2 |

|

| 225,135 |

|

| 4,045,676 |

|

Neogen Corporation 2 |

|

| 39,739 |

|

| 1,796,600 |

|

Solta Medical 2 |

|

| 571,323 |

|

| 1,576,851 |

|

STRATEC Biomedical Systems |

|

| 30,000 |

|

| 1,332,934 |

|

SurModics 2 |

|

| 227,846 |

|

| 2,529,091 |

|

Syneron Medical 2 |

|

| 398,885 |

|

| 4,838,475 |

|

Young Innovations |

|

| 82,053 |

|

| 2,340,152 |

|

|

|

|

|

| |||

|

|

|

|

|

| 32,338,656 |

|

|

|

|

|

| |||

Health Care Providers & Services - 1.6% |

|

|

|

|

|

|

|

CorVel Corporation 2 |

|

| 61,423 |

|

| 2,880,738 |

|

IPC The Hospitalist 2 |

|

| 46,500 |

|

| 2,155,275 |

|

PDI 2 |

|

| 478,720 |

|

| 3,394,125 |

|

U.S. Physical Therapy |

|

| 141,960 |

|

| 3,510,671 |

|

|

|

|

|

| |||

|

|

|

|

|

| 11,940,809 |

|

|

|

|

|

| |||

Health Care Technology - 0.7% |

|

|

|

|

|

|

|

Transcend Services 2 |

|

| 164,134 |

|

| 4,823,898 |

|

|

|

|

|

| |||

Life Sciences Tools & Services - 1.2% |

|

|

|

|

|

|

|

BioClinica 2 |

|

| 292,123 |

|

| 1,454,773 |

|

EPS |

|

| 2,000 |

|

| 4,708,933 |

|

Furiex Pharmaceuticals 2 |

|

| 135,944 |

|

| 2,418,444 |

|

|

|

|

|

| |||

|

|

|

|

|

| 8,582,150 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

Health Care (continued) |

|

|

|

|

|

|

|

Pharmaceuticals - 1.3% |

|

|

|

|

|

|

|

Bukwang Pharmaceutical |

|

| 240,000 |

| $ | 2,662,231 |

|

Daewoong Pharmaceutical |

|

| 30,000 |

|

| 1,078,642 |

|

Unichem Laboratories |

|

| 302,400 |

|

| 1,013,613 |

|

Vetoquinol |

|

| 112,888 |

|

| 4,909,615 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,664,101 |

|

|

|

|

|

| |||

Total (Cost $65,507,954) |

|

|

|

|

| 74,236,180 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Industrials – 17.8% |

|

|

|

|

|

|

|

Aerospace & Defense - 0.3% |

|

|

|

|

|

|

|

Ducommun |

|

| 125,873 |

|

| 2,589,208 |

|

|

|

|

|

| |||

Building Products - 1.3% |

|

|

|

|

|

|

|

AAON |

|

| 194,556 |

|

| 4,249,103 |

|

Sung Kwang Bend |

|

| 185,000 |

|

| 3,820,342 |

|

WaterFurnace Renewable Energy |

|

| 56,000 |

|

| 1,289,025 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,358,470 |

|

|

|

|

|

| |||

Commercial Services & Supplies - 1.4% |

|

|

|

|

|

|

|

Courier Corporation |

|

| 125,518 |

|

| 1,386,974 |

|

Ennis |

|

| 228,549 |

|

| 3,976,752 |

|

Heritage-Crystal Clean 2 |

|

| 242,500 |

|

| 4,651,150 |

|

|

|

|

|

| |||

|

|

|

|

|

| 10,014,876 |

|

|

|

|

|

| |||

Construction & Engineering - 1.3% |

|

|

|

|

|

|

|

Layne Christensen 2 |

|

| 83,200 |

|

| 2,524,288 |

|

Raubex Group |

|

| 695,000 |

|

| 1,657,476 |

|

Severfield-Rowen |

|

| 365,000 |

|

| 1,272,708 |

|

Sterling Construction 2 |

|

| 303,372 |

|

| 4,177,432 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,631,904 |

|

|

|

|

|

| |||

Electrical Equipment - 2.5% |

|

|

|

|

|

|

|

Fushi Copperweld 2 |

|

| 522,339 |

|

| 2,993,002 |

|

Global Power Equipment Group 2 |

|

| 208,829 |

|

| 5,538,145 |

|

Graphite India |

|

| 1,381,400 |

|

| 2,796,171 |

|

LSI Industries |

|

| 476,713 |

|

| 3,785,101 |

|

Voltamp Transformers |

|

| 254,000 |

|

| 2,928,123 |

|

|

|

|

|

| |||

|

|

|

|

|

| 18,040,542 |

|

|

|

|

|

| |||

Machinery - 5.8% |

|

|

|

|

|

|

|

Burckhardt Compression Holding |

|

| 14,000 |

|

| 4,272,039 |

|

Foster (L.B.) Company Cl. A |

|

| 116,576 |

|

| 3,836,516 |

|

FreightCar America 2 |

|

| 181,191 |

|

| 4,591,380 |

|

Gorman-Rupp Company |

|

| 46,870 |

|

| 1,543,898 |

|

Graham Corporation |

|

| 310,003 |

|

| 6,324,061 |

|

Kadant 2 |

|

| 132,531 |

|

| 4,176,052 |

|

Key Technology 2 |

|

| 216,129 |

|

| 3,494,806 |

|

Pfeiffer Vacuum Technology |

|

| 32,400 |

|

| 4,062,686 |

|

RBC Bearings 2 |

|

| 102,544 |

|

| 3,872,061 |

|

Semperit AG Holding |

|

| 127,713 |

|

| 6,370,319 |

|

|

|

|

|

| |||

|

|

|

|

|

| 42,543,818 |

|

|

|

|

|

| |||

Marine - 0.6% |

|

|

|

|

|

|

|

Baltic Trading |

|

| 235,100 |

|

| 1,349,474 |

|

Euroseas |

|

| 711,757 |

|

| 3,103,261 |

|

|

|

|

|

| |||

|

|

|

|

|

| 4,452,735 |

|

|

|

|

|

| |||

Professional Services - 2.7% |

|

|

|

|

|

|

|

Begbies Traynor |

|

| 947,000 |

|

| 657,478 |

|

CRA International 2 |

|

| 176,706 |

|

| 4,786,965 |

|

eClerx Services |

|

| 83,000 |

|

| 1,562,158 |

|

|

|

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. | Royce Capital Fund 2011 Semiannual Report to Shareholders | 13 |

|

Schedules of Investments |

|

Royce Capital Fund–Micro-Cap Portfolio (continued) |

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

Industrials (continued) |

|

|

|

|

|

|

|

Professional Services (continued) |

|

|

|

|

|

|

|

Exponent 2 |

|

| 115,829 |

| $ | 5,039,720 |

|

GP Strategies 2 |

|

| 579,560 |

|

| 7,916,790 |

|

|

|

|

|

| |||

|

|

|

|

|

| 19,963,111 |

|

|

|

|

|

| |||

Road & Rail - 1.6% |

|

|

|

|

|

|

|

Marten Transport |

|

| 322,180 |

|

| 6,959,088 |

|

Patriot Transportation Holding 2 |

|

| 196,440 |

|

| 4,394,363 |

|

|

|

|

|

| |||

|

|

|

|

|

| 11,353,451 |

|

|

|

|

|

| |||

Trading Companies & Distributors - 0.3% |

|

|

|

|

|

|

|

Houston Wire & Cable |

|

| 133,400 |

|

| 2,074,370 |

|

|

|

|

|

| |||

Total (Cost $107,617,677) |

|

|

|

|

| 130,022,485 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Information Technology – 13.1% |

|

|

|

|

|

|

|

Communications Equipment - 2.6% |

|

|

|

|

|

|

|

Anaren 2 |

|

| 363,236 |

|

| 7,718,765 |

|

BigBand Networks 2 |

|

| 659,221 |

|

| 1,430,509 |

|

Digi International 2 |

|

| 332,900 |

|

| 4,327,700 |

|

KVH Industries 2 |

|

| 264,400 |

|

| 2,810,572 |

|

Parrot 2 |

|

| 62,115 |

|

| 2,517,779 |

|

|

|

|

|

| |||

|

|

|

|

|

| 18,805,325 |

|

|

|

|

|

| |||

Computers & Peripherals - 1.1% |

|

|

|

|

|

|

|

Novatel Wireless 2 |

|

| 369,300 |

|

| 2,023,764 |

|

Super Micro Computer 2 |

|

| 172,511 |

|

| 2,775,702 |

|

Xyratex 2 |

|

| 305,500 |

|

| 3,134,430 |

|

|

|

|

|

| |||

|

|

|

|

|

| 7,933,896 |

|

|

|

|

|

| |||

Electronic Equipment, Instruments & Components - 2.2% |

|

|

|

|

|

|

|

Diploma |

|

| 516,500 |

|

| 3,110,418 |

|

Domino Printing Sciences |

|

| 154,852 |

|

| 1,695,020 |

|

Electro Rent |

|

| 127,600 |

|

| 2,184,512 |

|

Fabrinet 2 |

|

| 131,669 |

|

| 3,196,923 |

|

Inficon Holding |

|

| 10,300 |

|

| 2,151,390 |

|

Nice |

|

| 63,511 |

|

| 276,387 |

|

Vaisala Cl. A |

|

| 100,000 |

|

| 3,239,476 |

|

|

|

|

|

| |||

|

|

|

|

|

| 15,854,126 |

|

|

|

|

|

| |||

Internet Software & Services - 1.3% |

|

|

|

|

|

|

|

Envestnet 2 |

|

| 139,700 |

|

| 2,074,545 |

|

Meetic 2 |

|

| 165,000 |

|

| 3,580,011 |

|

Neurones |

|

| 170,000 |

|

| 2,120,248 |

|

World Energy Solutions 2 |

|

| 358,700 |

|

| 1,506,540 |

|

|

|

|

|

| |||

|

|

|

|

|

| 9,281,344 |

|

|

|

|

|

| |||

IT Services - 0.2% |

|

|

|

|

|

|

|

Forrester Research |

|

| 44,200 |

|

| 1,456,832 |

|

|

|

|

|

| |||

Semiconductors & Semiconductor Equipment - 4.8% |

|

|

|

|

|

|

|

Advanced Energy Industries 2 |

|

| 121,300 |

|

| 1,794,027 |

|

|

| 618,700 |

|

| 1,986,027 |

| |

ATMI 2 |

|

| 252,000 |

|

| 5,148,360 |

|

AXT 2 |

|

| 676,147 |

|

| 5,733,727 |

|

GSI Technology 2 |

|

| 300,157 |

|

| 2,161,130 |

|

Integrated Silicon Solution 2 |

|

| 463,700 |

|

| 4,483,979 |

|

|

| 224,900 |

|

| 1,799,200 |

| |

Rudolph Technologies 2 |

|

| 523,941 |

|

| 5,611,408 |

|

Sigma Designs 2 |

|

| 481,364 |

|

| 3,677,621 |

|

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

Information Technology (continued) |

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment (continued) |

|

|

|

|

|

|

|

Supertex 2 |

|

| 127,700 |

| $ | 2,860,480 |

|

|

|

|

|

| |||

|

|

|

|

|

| 35,255,959 |

|

|

|

|

|

| |||

Software - 0.9% |

|

|

|

|

|

|

|

PROS Holdings 2 |

|

| 78,723 |

|

| 1,376,865 |

|

Smith Micro Software 2 |

|

| 644,876 |

|

| 2,714,928 |

|

VASCO Data Security International 2 |

|

| 236,930 |

|

| 2,949,779 |

|

|

|

|

|

| |||

|

|

|

|

|

| 7,041,572 |

|

|

|

|

|

| |||

Total (Cost $82,525,540) |

|

|

|

|

| 95,629,054 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Materials – 13.5% |

|

|

|

|

|

|

|

Chemicals - 1.0% |

|

|

|

|

|

|

|

Huchems Fine Chemical |

|

| 145,000 |

|

| 3,509,395 |

|

Societe Internationale de Plantations |

|

|

|

|

|

|

|

d'Heveas |

|

| 16,700 |

|

| 2,184,433 |

|

Victrex |

|

| 73,000 |

|

| 1,757,449 |

|

|

|

|

|

| |||

|

|

|

|

|

| 7,451,277 |

|

|

|

|

|

| |||

Construction Materials - 0.1% |

|

|

|

|

|

|

|

Polaris Minerals 2 |

|

| 547,900 |

|

| 482,881 |

|

|

|

|

|

| |||

Metals & Mining - 12.4% |

|

|

|

|

|

|

|

Alamos Gold |

|

| 240,200 |

|

| 3,977,390 |

|

Allied Nevada Gold 2 |

|

| 203,429 |

|

| 7,195,284 |

|

AuRico Gold 2 |

|

| 195,547 |

|

| 2,149,061 |

|

Bear Creek Mining 2 |

|

| 317,800 |

|

| 1,268,630 |

|

Castle (A.M.) & Co. 2 |

|

| 229,663 |

|

| 3,814,702 |

|

Eldorado Gold |

|

| 140,800 |

|

| 2,075,392 |

|

Endeavour Mining 2 |

|

| 1,472,900 |

|

| 3,527,813 |

|

Endeavour Silver 2 |

|

| 619,000 |

|

| 5,199,600 |

|

Entree Gold 2 |

|

| 873,700 |

|

| 1,869,718 |

|

Great Basin Gold 2 |

|

| 1,288,675 |

|

| 2,645,629 |

|

Horsehead Holding Corporation 2 |

|

| 502,200 |

|

| 6,689,304 |

|

Imdex |

|

| 1,555,892 |

|

| 3,591,756 |

|

International Tower Hill Mines 2 |

|

| 277,000 |

|

| 2,088,580 |

|

Keegan Resources 2 |

|

| 376,600 |

|

| 2,920,803 |

|

Lumina Copper 2 |

|

| 674,700 |

|

| 4,162,440 |

|

|

| 674,700 |

|

| 477,806 |

| |

Olympic Steel |

|

| 238,600 |

|

| 6,568,658 |

|

Quaterra Resources 2 |

|

| 895,000 |

|

| 1,085,748 |

|

|

| 133,341 |

|

| 601,368 |

| |

Richmont Mines 2 |

|

| 382,500 |

|

| 2,719,575 |

|

Silvercorp Metals |

|

| 475,000 |

|

| 4,455,500 |

|

Sprott Resource 2 |

|

| 982,100 |

|

| 4,673,999 |

|

Synalloy Corporation 2 |

|

| 8,052 |

|

| 109,266 |

|

Torex Gold Resources 2 |

|

| 1,009,000 |

|

| 1,820,374 |

|

Universal Stainless & Alloy Products 2 |

|

| 161,757 |

|

| 7,563,757 |

|

US Gold 2 |

|

| 804,196 |

|

| 4,849,302 |

|

Western Copper 2 |

|

| 720,000 |

|

| 2,304,000 |

|

|

|

|

|

| |||

|

|

|

|

|

| 90,405,455 |

|

|

|

|

|

| |||

Total (Cost $56,264,258) |

|

|

|

|

| 98,339,613 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Telecommunication Services – 1.3% |

|

|

|

|

|

|

|

Diversified Telecommunication Services - 1.3% |

|

|

|

|

|

|

|

Atlantic Tele-Network |

|

| 139,650 |

|

| 5,356,974 |

|

|

|

14 | Royce Capital Fund 2011 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS. |

|

June 30, 2011 (unaudited) |

|

|

|

Royce Capital Fund–Small-Cap Portfolio |

|

|

|

|

|

|

|

|

|

| SHARES |

| VALUE |

| ||

Telecommunication Services (continued) |

|

|

|

|

|

|

|

Diversified Telecommunication Services (continued) |

|

|

|

|

|

|

|

Neutral Tandem 2 |

|

| 247,030 |

| $ | 4,303,263 |

|

|

|

|

|

| |||

Total (Cost $5,416,841) |

|

|

|

|

| 9,660,237 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Utilities – 0.1% |

|

|

|

|

|

|

|

Independent Power Producers & Energy Traders - 0.1% |

|

|

|

|

|

|

|

Alterra Power 2 |

|

| 1,352,300 |

|

| 995,524 |

|

|

|

|

|

| |||

Total (Cost $1,759,433) |

|

|

|

|

| 995,524 |

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

Miscellaneous 4 – 4.6% |

|

|

|

|

|

|

|

Total (Cost $36,609,713) |

|

|

|

|

| 33,602,437 |

|

|

|

|

|

| |||

|

|

|

|

|