| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | |

| FORM N-CSR |

| | | | |

| CERTIFIED SHAREHOLDER REPORT |

| OF |

| REGISTERED MANAGEMENT INVESTMENT COMPANIES |

| | | | |

| Investment Company Act file number: 811-07537 |

| | | | |

| Name of Registrant: Royce Capital Fund |

| | | | |

| Address of Registrant: 745 Fifth Avenue |

| New York, NY 10151 |

| | | | |

| Name and address of agent for service: | | John E. Denneen, Esq. | |

| | | 745 Fifth Avenue | |

| | | New York, NY 10151 | |

| | | | |

| Registrant’s telephone number, including area code: (212) 508-4500 |

| Date of fiscal year end: December 31, 2015 |

| Date of reporting period: January 1, 2015 – June 30, 2015 |

Item 1. Reports to Shareholders.

| | | JUNE 30, 2015 |

| | | |

| | | |

| | | |

| | | 2015 Semiannual |

| | | Review and Report to Shareholders |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | Royce Capital Fund– |

| | | Micro-Cap Portfolio |

| | | | |

| | | Royce Capital Fund– |

| | | Small-Cap Portfolio |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | roycefunds.com |  |

| | | | |

| | | | |

| | | | |

| Table of Contents | | | |

| | | | |

| | | | |

| Semiannual Review | | | |

| | | | |

| Letter to Our Shareholders | | 1 | |

| | | | |

| Performance and Expenses | | 5 | |

| | | | |

| | | | |

| Semiannual Report to Shareholders | | | |

| | | | |

| Managers’ Discussions of Fund Performance | | | |

| | | | |

Royce Capital Fund–Micro-Cap Portfolio | | 6 | |

| | | | |

Royce Capital Fund–Small-Cap Portfolio | | 8 | |

| | | | |

| Schedules of Investments and Financial Statements | | 10 | |

| | | | |

| Notes to Financial Statements | | 19 | |

| | | | |

| Understanding Your Fund’s Expenses | | 23 | |

| | | | |

| Trustees and Officers | | 24 | |

| | | | |

| Board Approval of Investment Advisory Agreements | | 25 | |

| | | | |

| Notes to Performance and Other Important Information | | 27 | |

| This page is not part of the Royce Capital Fund 2015 Semiannual Report to Shareholders |

Letter to Our Shareholders

“THE TIME IS OUT OF JOINT”

Anyone reestablishing contact with the wider world at the end of June would no doubt be pleased by the numbers that guide the financial and economic parts of our lives. The economy, following a first-quarter stumble in which GDP is estimated to have grown by 0.6%, appears once again to be growing at a faster clip. One could argue that its pace could be livelier, but healthy employment numbers, improving wages, and robust housing and auto markets would seem to promise a quickening in the coming months. Inflation is, for now, not a matter of great concern. Interest rates remain low—and will remain that way on an absolute basis, even with an increase (or two) in short-term rates likely before the end of 2015. And a Fed-led increase in short rates may cause long-term rates to back up as well, which would be bad news for the bond markets, though perhaps not for stocks.

One could find positive developments in the equity markets through the first half of the year—or so it would seem. Returns for each of the major domestic indexes were in the black through the end of June, while a welcome recovery finally arrived for many non-U.S. stocks in the year’s first six months. Three- and five-year average annualized returns for the small-cap Russell 2000 |

Index, the Nasdaq Composite, and the large-cap Russell 1000 and S&P 500 Indexes all topped 17%, well above the rolling three- and five-year historical averages for each index. It would appear that we are living through good times for the economy and possibly great ones for equities.

Why, then, have we purloined a line from Hamlet to introduce our own take on stocks in the first half, one in which the titular protagonist warns of a troubling dislocation in the world around him? Some of the reasons are clear enough: Positive results for the first half notwithstanding, global equities were rocked by the highly publicized Greek default late in June. On the second-to-last trading day of the first half, many stocks gave away most, if not all, of their second-quarter gains. Markets in China faced arguably even more significant problems, considering how much larger and more important that nation’s economy is to the world compared to that of Greece. Chinese stocks plummeted 30% in the three weeks leading up to our Independence Day, making what seemed like a typical correction in June far more worrisome. A cut in interest rates and more relaxed rules for margin trading—both hastily put in place late in June—did little to stem the tide of selling. |

| This page is not part of the Royce Capital Fund 2015 Semiannual Report to Shareholders | 1 |

LETTER TO OUR SHAREHOLDERS

The small-cap market has thus moved from the tightly correlated markets of 2011-2013 into a new phase of wide divergence and constricted leadership. From our perspective, then, the market is indeed out of joint.

Closer to home, there is the matter of how thoroughly disjointed results were for domestic equities. Large-cap returns, for example, were paltry—as can be seen from the table below—brought even lower by the Greek drama that ushered out the month of June. Performance for small-caps and the Nasdaq looked appreciably better, but in each case looks are almost assuredly deceiving. Health Care was by far the dominant sector in every market cap range, from micro to large, that Russell Investments tracks. Yet the rule in the first half seemed to be the smaller—and more growth-driven—the company, the loftier the results, especially if it was involved in biotech, the industry that has reigned supreme within the Russell 2000 over much of the last two years. This has had the effect of creating decidedly narrow market leadership within the small-cap space. Outside of biotech, strong first-half performances were mostly limited to a handful of other Health Care industries, software companies, and a few outliers such as construction materials and tobacco. The small-cap market has thus moved from the tightly correlated markets of 2011-2013 into a new phase of wide divergence and constricted leadership. From our perspective, then, the market is indeed out of joint. |

“MORE THINGS IN HEAVEN AND EARTH...”

We have actually been arguing that the market has been disjointed for some time now. Fed policies designed to keep the economy and capital markets above water, which included multiple rounds of QE and keeping interest rates at or near zero, had other, unintended consequences that had an outsized effect on the small-cap market. For example, it became both easy and affordable for businesses to add debt, essentially eroding the risk differential between lower- and higher-quality businesses. Lower-quality and more highly levered companies then began a historically atypical period of outperformance in which our funds mostly did not participate. The Fed’s zero-interest-rate policy (“ZIRP”) also stoked an intense hunger for yield, which drove up values for bond-proxy equities such as REITs and Utilities, regardless of their underlying quality or profitability, that have only recently begun to correct. These actions also boosted stock correlations and reduced volatility, making it harder to find the kind of mispriced opportunities that have always been our stock in trade.

Finally, there were significant runs for high-growth, non-earning, and more speculative businesses, many with negative EBIT. This continues into the present day with the recent contraction of small-cap leadership, which represents more of a bet on long-duration assets than current profitability. In each of these cases, our more qualitative, risk-conscious approaches have in general kept us away from these areas. While we are confident |

|

| Equity Indexes |

| As of June 30, 2015 (%) |

| | | |

| • | | Greek Drama Creates Underwhelming Results—The Greek default late in June eroded gains—giving equities second-quarter results that more closely hugged the flat line. The tech-oriented Nasdaq Composite was the leader, up 1.8%, followed by the small-cap Russell 2000 Index, which finished the quarter with a gain of 0.4%. The large-cap S&P 500 and Russell 1000 Indexes rose 0.3% and 0.1%, respectively. |

| | | |

| • | | Long-Term Returns in Excess—Both large-cap and small-cap indexes’ three- and five-year average annual total returns for the periods ended 6/30/15 were above 17%, well in excess of each index’s historical average. |

| | | |

| • | | Healthy and Informed—Health Care and Information Technology were the best performing sectors in the Russell 2000 year-to-date through 6/30/15—the former led by a wide margin—while Utilities and Materials were the worst performers in the year’s first half. |

| | | |

| |

| | | YTD1 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | |

| |

| Russell 2000 | | 4.75 | | 6.49 | | 17.81 | | 17.08 | | 8.40 | |

| |

| S&P 500 | | 1.23 | | 7.42 | | 17.31 | | 17.34 | | 7.89 | |

| |

| Russell 1000 | | 1.71 | | 7.37 | | 17.73 | | 17.58 | | 8.13 | |

| |

| Nasdaq Composite | | 5.30 | | 13.13 | | 19.33 | | 18.78 | | 9.26 | |

| |

| Russell Midcap | | 2.35 | | 6.63 | | 19.26 | | 18.23 | | 9.40 | |

| |

| Russell Microcap | | 6.03 | | 8.21 | | 19.25 | | 17.48 | | 7.07 | |

| |

| Russell Global ex-U.S. Small Cap | | 7.74 | | -3.46 | | 11.35 | | 8.99 | | 7.07 | |

| |

| Russell Global ex-U.S. Large Cap | | 4.23 | | -5.02 | | 9.96 | | 8.13 | | 5.80 | |

| |

| |

| 1Not annualized |

| For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 6. |

| 2 | This page is not part of the Royce Capital Fund 2015 Semiannual Report to Shareholders |

LETTER TO OUR SHAREHOLDERS

that this trend will fade and that speculative bubbles will burst, we also understand the frustrations that have built over the last few years as active managers such as ourselves have continued to lag our respective benchmarks.

We have seen enough signs, both economically and in the market, which suggest that stocks are slowly moving back to what we would call their historical norm—lower overall returns, higher volatility, and long-term advantages for companies with consistent profits and high returns on invested capital.

So do these challenges mean that something is rotten in the state of small-cap, if only in some of its actively managed precincts? That is the question, more or less, that we have been wrestling with of late. To be sure, we ran the gamut in the first half from disappointment to optimism to frustration as investor preferences moved around. They first showed favor to long-duration assets, then looked, if only briefly, toward consistently profitable and/or conservatively capitalized companies before shifting back again. However, we have seen enough signs, both economically and in the market, which suggest that stocks are slowly moving back to what we would call their historical norm—lower overall returns, higher volatility, and long-term advantages for companies with consistent profits and high returns on invested capital.

Most notably, there was a positive directional trend dating from the first-half low for the 10-year Treasury on January 30 through the end of the first half. During this period, which included the bearish month of April, we were pleased with the way many of our portfolios either outperformed their benchmarks or began to narrow the gap. This was very clear during the growth scare engendered by (at the time) negative first-quarter GDP numbers, which led many companies to begin revising their earnings expectations downward. Of course, when it became clear that much of what put a drag on first-quarter numbers was temporary, including such factors as the awful winter weather, the West Coast port strike, and the plunge in oil prices, things began to pick up again fairly quickly, at least for the more speculative areas within Health Care and a few other narrow equity locales. |

“THE READINESS IS ALL”

Yet this period also offered a potential preview of how the landscape for stocks will look when short-term interest rates begin to rise—which is likely to be later this year. We see higher rates breeding more uncertainty, be it about inflation, the cost of capital, or a number of other issues. This in turn typically leads to more mispricing in the short run, which creates precisely the opportunities that we crave as risk-conscious bargain hunters. To us, high rates are synonymous with higher risk. A higher-risk environment also tends to benefit quality companies (by which we mean conservatively capitalized, profitable businesses with high returns on invested capital and effective, shareholder-friendly management). So we have no worries about rising rates or greater volatility in the markets. In fact, we welcome both.

High rates are synonymous with higher risk. A higher-risk environment also tends to benefit quality companies (by which we mean conservatively capitalized, profitable businesses with high returns on invested capital and effective, shareholder-friendly management). So we have no worries about rising rates or greater volatility in the markets. In fact, we welcome both.

We see quality differentiating itself when risk premiums rise because quality businesses are better businesses—as profitable, financially sound enterprises, they are purpose-built and run to survive periods of higher risk and/or greater uncertainty, which helps to explain why the market of the last several years has seen many of these companies disadvantaged in the easy-money, ZIRP environment. In a phase in which few if any of the traditional penalties were paid for larding leverage onto corporate balance sheets, there were also scant advantages that have historically accrued to higher-quality, more conservatively capitalized companies.

We feel confident that this era is over. Our expectation is for lower returns for stocks as a whole, but relatively better returns for both high-quality companies and more cyclical, less defensive sectors. We suspect that in a few years market observers will look back at 2015—and perhaps the longer |

| This page is not part of the Royce Capital Fund 2015 Semiannual Report to Shareholders | 3 |

LETTER TO OUR SHAREHOLDERS

| span covering 2013-2015—as a hinge period in which the gradual sun-setting of interventionist Fed policies, coupled with the steady growth of the economy, restored the capital markets to something closer to more familiar historical patterns of performance and volatility. This is why we have been patiently holding so many companies in cyclical sectors, such as Industrials, Materials, and, more recently, Energy—they boast many attractive characteristics that the market has not yet fully recognized, a phenomenon we expect will change as the economy heats up. In our estimation their profitability, growth prospects, and reasonable to attractive valuations make them coiled springs. Until then, we wait. |

| To be sure, it has been a cycle of, at times, seemingly endless challenges for our active and risk-conscious approaches. Our collective patience has been sorely tested as we have waited (and waited) for many of our highest-confidence holdings to turn around. Of course, transitions are never easy, and the turn we have been anticipating has taken longer, after a few false starts, than any of us initially anticipated. Change, however, can take time—and we are often aware that a dramatic turn has occurred only in retrospect. We are content, then, to continue investing in the same way that we have for more than four decades—with a close eye on risk as we look for the intersection of attractive valuation and organic growth potential. |

| |  | |  |

| Charles M. Royce | | Christopher D. Clark | | Francis D. Gannon |

| Chief Executive Officer, | | President and Co-Chief Investment Officer, | | Co-Chief Investment Officer, |

| Royce & Associates, LLC | | Royce & Associates, LLC | | Royce & Associates, LLC |

| | | | | |

| July 31, 2015 | | | | |

| 4 | This page is not part of the Royce Capital Fund 2015 Semiannual Report to Shareholders |

Performance and Expenses

| |

| |

| Performance and Expenses |

| As of June 30, 2015 |

| | | | AVERAGE ANNUAL TOTAL RETURNS (%) | | |

| | | | | | | | | | | | | | | | SINCE INCEPTION | | ANNUAL OPERATING |

| | | | YTD1 | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | (12/27/96) | | EXPENSES (%) |

| |

| Royce Capital Fund–Micro-Cap Portfolio | | -1.06 | | -5.55 | | 6.65 | | 7.61 | | 6.30 | | 9.35 | | 10.72 | | 1.31 |

| |

| Royce Capital Fund–Small-Cap Portfolio | | -0.32 | | 0.95 | | 14.05 | | 12.73 | | 7.75 | | 10.89 | | 11.51 | | 1.05 |

| |

INDEX | | | | | | | | | | | | | | | | |

| |

| Russell Microcap Index2 | | 6.03 | | 8.21 | | 19.25 | | 17.48 | | 7.07 | | 7.79 | | n.a. | | n.a. |

| |

| Russell 2000 Index | | 4.75 | | 6.49 | | 17.81 | | 17.08 | | 8.40 | | 7.50 | | 8.40 | | n.a. |

| |

1 Not annualized

2 Data for the Russell Microcap Index goes back only to 6/30/00.

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. The Funds’ total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Funds. All performance and expense information reflects the result for each Fund’s Investment Class Shares. Service Class Shares bear an annual distribution expense that is not borne by the Investment Class; if the expenses were reflected, total returns would have been lower. Operating expenses reflect the Funds’ total annual operating expenses for the Investment Class as of the Funds’ most current prospectus and include management fees, other expenses, and, in the case of Royce Capital Fund–Micro-Cap Portfolio, acquired fund fees and expenses. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies.

Royce Micro-Cap Portfolio invests primarily in micro-cap companies while Royce Small-Cap Portfolio invests primarily in small-cap companies. Investments in micro-cap and small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Each series of Royce Capital Fund may invest up to 25% of its respective net assets in foreign securities. Investments in foreign securities may involve political, economic, currency, and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) As of 6/30/15, Royce Small-Cap Portfolio invested a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than more broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Portfolio’s overall value to decline to a greater degree. (Please see “Primary Risks for Fund Investors” in the prospectus.) Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Distributor: Royce Fund Services, Inc.

This page is not part of the Royce Capital Fund 2015 Semiannual Report to Shareholders | 5

| MANAGERS’ DISCUSSION |

| Royce Capital Fund–Micro-Cap Portfolio (RCM) |

|

| Jenifer Taylor and Jim Stoeffel |

| |

FUND PERFORMANCE

Royce Capital Fund–Micro-Cap Portfolio fell 1.1% for the year-to-date period ended June 30, 2015, lagging both its benchmark, the Russell Microcap Index, and the small-cap Russell 2000 Index, which advanced 6.0% and 4.8%, respectively, for the same period. The Fund was again challenged by its lack of participation in a bullish period for both micro-cap and small-cap stocks. However, it should be noted that returns within each asset class were narrower than the pleasing year-to-date results for the respective indexes might suggest, with biotech remaining a primary driver of returns during the first half of 2015.

In the first quarter, Royce Micro-Cap Portfolio fell 0.2%, a disappointing result that was mostly due to a dismal and bearish January. Positive returns for the Fund in both February and March could not push the portfolio into the black for the quarter. By contrast, the Russell Microcap gained 3.1% for the first quarter while the Russell 2000 rose 4.3% for that same period. The Fund’s performance worsened in the second quarter, especially hurt by the wave of volatility that the Greek default sent through the markets at the end of June. The Fund lost 0.9% for the second quarter while the micro-cap index and small-cap index increased 2.8% and 0.4%, respectively. Longer-term relative results were better. Royce Micro-Cap Portfolio outperformed the Russell Microcap for the 15-year period ended June 30, 2015 and beat the Russell 2000 for the 15-year and since inception (12/27/96) periods ended June 30, 2015. (Data for the Russell Microcap only goes back to June 30, 2000.) The Fund’s average annual total return since inception was 10.7%. We are very proud of the Fund’s long-term performance history. |

| WHAT WORKED... AND WHAT DIDN’T |

Health Care was something of a double-edged sword for the portfolio. The sector comfortably led both the Fund and the Russell Microcap in the first half. Returns for the index, however, were dominated by stratospheric results for biotech stocks as well as hearty returns for pharmaceuticals companies. Most of these businesses lack either the conservative capitalization or earnings profile that we look for when building our portfolio. The Fund was therefore significantly underweight in Health Care during the first half and had little exposure to biotech and pharmaceuticals. Net gains came primarily from companies in the health care equipment & supplies and the health care providers & services industries. So while the sector was by far the portfolio’s top contributor in the first half, its net gains were not as vigorous as were those for the sector within the Russell Microcap.

Firearms maker Smith & Wesson Holding Corporation was the Fund’s best-performing position in the first half. The company continued to gain market share while recent sizable investments in R&D have been driving significant product innovation. Its shares also benefited from effective cash flow allocation into strategic acquisitions that are providing vertical manufacturing integration as well as adjacent product offerings. The stock of financial services business INTL FCStone began to climb in February. It has a growing niche in automated international currency settlements and was thus rewarded in an increasingly volatile global currency market. |

| |

| Of the Fund’s five sectors that finished the semiannual period in the red, only Energy and Materials posted sizable net losses. Gulf Island Fabrication fabricates offshore drilling and production platforms, as well as other steel structures for the oil and gas and marine industries. Recent results have been hurt by the decline in commodity prices, which has led to a slowdown in its business. Still, we like how this low-debt, asset-strong firm has been executing through a highly challenging phase for its industry. We held a good-sized position at the end of June. Exposure to the energy industry also played a role in poor results for Global Power Equipment Group, which makes gas turbine generation equipment. Other factors contributing to the decline in its stock price were the resignation of its CEO in March and the announcement in May that it would need to restate financial statements. While this was a clearly disappointing turn of events, we chose to hold our position, at least for the short term. The company’s highly attractive valuation and strong balance sheet offered enough interest for us to allow the dust to settle around a business that we like for the long-term. Two for-profit education businesses were also among the portfolio’s top detractors in the first half—American Public Education and Capella Education. The industry has been under fire of late and is enduring a round of new, more stringent federal regulations. We think each of these companies has the management talent and fundamental strength to survive these challenges. |

| | | | | |

| | Top Contributors to Performance

Year-to-Date Through 6/30/15 (%)1 | | | |

| | | | | |

| | Smith & Wesson Holding | | | |

| | Corporation | | 0.54 | |

| | | |

| | INTL FCStone | | 0.45 | |

| | | |

| | LSI Industries | | 0.38 | |

| | | |

| | Culp | | 0.32 | |

| | | |

| | Ennis | | 0.29 | |

| | | |

| | 1 Includes dividends | | | |

| | | | | |

| | | | | |

| | Top Detractors from Performance

Year-to-Date Through 6/30/15 (%)2 | | | |

| | | | | |

| | Gulf Island Fabrication | | -0.54 | |

| | | |

| | American Public Education | | -0.34 | |

| | | |

| | Capella Education | | -0.33 | |

| | | |

| | Global Power Equipment Group | | -0.33 | |

| | | |

| | Graham Corporation | | -0.29 | |

| | | |

| | 2 Net of dividends | | | |

| | | | | |

| CURRENT POSITIONING AND OUTLOOK |

| Sector weightings at the end of June were relatively unchanged from where they have stood over the last 18-24 months. This is due to our ongoing preference for more economically sensitive sectors, such as the Fund’s three largest at the end of the period—Industrials, Information Technology, and Consumer Discretionary. We maintain the belief that many portfolio holdings in these (and other) sectors should benefit from a faster-growing economy that also could reward disciplined approaches that focus on fundamentals. So while the Fund’s recent performances have fallen below our expectations, we remain confident about its prospects going forward. We are also pleased to announce that on May 1, 2015, Royce veteran Jim Stoeffel joined Jenifer Taylor as the Fund’s co-portfolio manager. Jen has been involved in the Fund’s management for more than 12 years while Jim joined Royce in 2007 as a portfolio manager. |

| 6 | Royce Capital Fund 2015 Semiannual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | | TICKER SYMBOLS RCMCX RCMSX |

| Performance and Expenses |

| Average Annual Total Return (%) Through 6/30/15 |

| | | JAN-JUN 2015* | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | SINCE INCEPTION (12/27/96) |

| |

| RCM | | -1.06 | | -5.55 | | 6.65 | | 7.61 | | 6.30 | | 9.35 | | 10.72 |

| |

| Annual Operating Expenses: 1.31% | | | | | | | | | |

| |

| * Not Annualized | | | | | | | | | | | | | | |

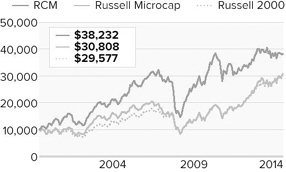

Relative Returns: Monthly Rolling Average Annual Return PeriodsSince Russell Microcap’s Inception (6/30/00) Through 6/30/15

| On a monthly rolling basis, the Fund outperformed the Russell Microcap in 90% of all 10-year periods; 75% of all 5-year periods; and 55% of all 1-year periods. |

| |

| | | PERIODS BEATING THE INDEX | | | | FUND AVG (%)* | | INDEX AVG (%)* |

| |

| 10-year | | 55/61 | | | | | 90% | | 8.8 | | 6.7 |

| |

| 5-year | | 91/121 | | | | | 75% | | 9.0 | | 7.1 |

| |

| 1-year | | 93/169 | | | | | 55% | | 11.6 | | 10.9 |

| |

*Average of monthly rolling average annual total returns over the specified periods.

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 27 for additional information. |

Value of $10,000Invested on 6/30/00 (Russell Microcap Inception) as of 6/30/15 ($)

Includes reinvestment of distributions.

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Total Energy Services | | 1.0 |

| |

| Resources Connection | | 1.0 |

| |

| Shoe Carnival | | 1.0 |

| |

| Haynes International | | 0.9 |

| |

| Kirkland’s | | 0.9 |

| |

| ORBCOMM | | 0.9 |

| |

| Key Technology | | 0.9 |

| |

| Culp | | 0.9 |

| |

| Photronics | | 0.9 |

| |

| Smith & Wesson Holding Corporation | | 0.9 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Industrials | | 21.6 |

| |

| Information Technology | | 18.2 |

| |

| Consumer Discretionary | | 13.2 |

| |

| Health Care | | 10.8 |

| |

| Financials | | 9.1 |

| |

| Materials | | 6.2 |

| |

| Energy | | 5.5 |

| |

| Consumer Staples | | 1.4 |

| |

| Telecommunication Services | | 1.2 |

| |

| Miscellaneous | | 5.0 |

| |

| Cash and Cash Equivalents | | 7.8 |

| |

|

| Calendar Year Total Returns (%) | | |

| | | |

| YEAR | | RCM |

| |

| 2014 | | -3.6 |

| |

| 2013 | | 21.0 |

| |

| 2012 | | 7.6 |

| |

| 2011 | | -12.1 |

| |

| 2010 | | 30.1 |

| |

| 2009 | | 57.9 |

| |

| 2008 | | -43.3 |

| |

| 2007 | | 4.0 |

| |

| 2006 | | 21.1 |

| |

| 2005 | | 11.6 |

| |

| 2004 | | 13.8 |

| |

| 2003 | | 49.2 |

| |

| 2002 | | -12.9 |

| |

| 2001 | | 29.7 |

| |

| 2000 | | 18.5 |

| |

|

| Upside/Downside Capture Ratios | | | | |

| Periods Ended 6/30/15 (%) | | | | |

| | | UPSIDE | | DOWNSIDE |

| |

| 10-Year | | 88 | | 88 |

| |

From 6/30/00 (Russell

Microcap Inception) | | 90 | | 77 |

| |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $476 million |

| |

| Number of Holdings | | 218 |

| |

| Turnover Rate | | 26% |

| |

| Average Market Capitalization1 | | $412 million |

| |

| Weighted Average P/E Ratio2,3 | | 22.7x |

| |

| Weighted Average P/B Ratio2 | | 2.1x |

| |

| Holdings ≥ 75% of Total Investments | | 115 |

| |

| Active Share4 | | 89% |

| |

| U.S. Investments (% of Net Assets) | | 79.1% |

| |

| Non-U.S. Investments (% of Net Assets) | | 13.1% |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (24% of portfolio holdings as of 6/30/15). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class. Operating expenses reflect the Fund’s total annual operating expenses for the Investment Class as of the Fund’s most current prospectus and include management fees, other expenses, and acquired fund fees and expenses. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2015. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a Manager’s performance in down markets relative to the Fund’s benchmark (Russell Microcap). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters. |

| Royce Capital Fund 2015 Semiannual Report to Shareholders | 7 |

| | | MANAGER’S DISCUSSION |

| Royce Capital Fund–Small-Cap Portfolio (RCS) | | |

|

| Jay Kaplan, CFA |

FUND PERFORMANCE

It was a difficult first half for Royce Capital Fund–Small-Cap Portfolio. The Fund was down 0.3% for the year-to-date period ended June 30, 2015, well behind its small-cap benchmark, the Russell 2000 Index, which advanced 4.8% for the same period. This was particularly frustrating in light of the fact that the Fund, while behind, had been much closer to the small-cap index in four of the last five calendar years while also posting strong absolute returns during a market cycle that has been largely inhospitable to our valuation-focused, quality-centric, and highly disciplined approach. |

| |

| As was the case in 2014, the first half of the year looked quietly bullish. The key differences were both more volatility and narrower market leadership through the first six months of 2015. The second of these developments played a large role in the Fund’s first-half underperformance. The year began with most stocks trending down, though small-cap growth stocks generally—and uncharacteristically—fared better than their value counterparts. This short-term anomaly can be added to a growing list of the historical deviations that have marked the current small-cap cycle. |

| |

For the first quarter Royce Small-Cap Portfolio rose 3.0% versus a 4.3% gain for its benchmark. The second quarter was less bullish and, at least through the fourth week of June, somewhat less volatile. Small-cap shares stumbled in April. They were recovering nicely through May and into the last days of June before the second-to-last trading day of the quarter brought a wave of volatility from the Greek default that washed over the market and plunged many stock prices into the red for the quarter. The Fund fell 3.2% for the second quarter versus a gain of 0.4% for the Russell 2000. Longer time spans saw better relative results for the Fund. Royce Small-Cap Portfolio outpaced the Russell 2000 for the 15-year and since inception (12/27/96) periods ended June 30, 2015. The Fund’s average annual total return since inception was 11.5%, a long-term record that gives us great pride. |

| |

| WHAT WORKED... AND WHAT DIDN’T |

| The Fund’s worst-performing sector in the first half was Energy, just as it was in 2014 when the price of oil collapsed. The lion’s share of the sector’s net losses in the first half of this year occurred in the first quarter as the arrival of spring saw some recovery in commodity prices. Our own long-term outlook for the sector remains positive. One of the portfolio’s larger detractors was long-time holding Unit Corporation, which operates several energy businesses. Primarily a contract driller, Unit also explores for and produces oil and natural gas while engaging in midstream activities. The decline in energy prices badly hurt its stock, which was beginning to show signs of life early in 2015’s second quarter until May, when the company announced a first-quarter loss that depressed its shares. We were more focused on its record oil production, improved dayrates, and other positive developments. |

| |

| Two technology companies were the Fund’s two largest detractors in the first half. Top-five position Vishay Intertechnology makes semiconductors and components. It’s a conservatively capitalized, cash-rich business with a long history of successful and profitable execution. Its stock began to slip in March in the context of an uncertain and more volatile market for many tech issues. The firm’s good-sized exposure to an equally uncertain Europe appears to have been a factor. TESSCO Technologies distributes specialized equipment for cell phone towers. The decision of one of its major customers to curtail spending had a chilling effect on its shares, which plummeted further in early May when the firm announced fiscal fourth-quarter and 2015 earnings that were not to Wall Street’s liking. |

| |

| Top-ten position Genesco, another detractor, is a specialty footwear retailer that also sells licensed and branded headwear and licensed sports apparel. The company lowered its fiscal year earnings outlook late in May, leading its stock to slump. The firm has a number of attractive businesses but has recently struggled to turn around business at its Lids hat and Locker Room stores. Shares of Genworth MI Canada bottomed out in April though its subsequent second-quarter recovery was not robust enough to lift it out of the red for the first half. This Canadian mortgage insurer was a top-10 holding at the end of June. |

| |

| The Fund’s best performer in the first half was Steven Madden, which designs and sells name brand and private label shoes for women, men, and children. The rising price of its shares seems to have been influenced by the perception that consumers were turning toward more fashionable footwear. Call-center specialist Convergys Corporation benefited from steadily improving execution, which spurred earnings improvement. Long-time holding Nu Skin Enterprises, which makes and markets personal care products, saw its shares rise through much of the first half as the firm won back investor confidence after it settled issues with the Chinese government—Asia is its largest market—and restructured its debt covenants. Its stock pulled back in the second quarter on an earnings miss and concerns over currency headwinds. |

| | Top Contributors to Performance

Year-to-Date Through 6/30/15 (%)1 | | | |

| | | |

| Steven Madden | | 0.67 |

| |

| Convergys Corporation | | 0.47 |

| |

| Nu Skin Enterprises Cl. A | | 0.46 |

| |

| Ascena Retail Group | | 0.36 |

| |

| MYR Group | | 0.31 |

| |

| 1 Includes dividends | | |

| | Top Detractors from Performance

Year-to-Date Through 6/30/15 (%)2 | | | |

| | | |

| Vishay Intertechnology | | -0.54 |

| |

| TESSCO Technologies | | -0.49 |

| |

| Genesco | | -0.45 |

| |

| Genworth MI Canada | | -0.43 |

| |

| Unit Corporation | | -0.42 |

| |

| 2 Net of dividends | | |

| CURRENT POSITIONING AND OUTLOOK |

| At the end of June, the portfolio remained heavily overweight in the Consumer Discretionary, Information Technology, and Energy sectors, though its exposure to the latter in the portfolio was relatively low. These weightings reflected our expectation for slow but mostly steady economic growth. We also anticipate a possible increase in interest rates. However, even in the event of an increase rates will remain historically low. The portfolio is positioned for a market that more consistently rewards quality companies with low leverage and high returns on invested capital. |

| 8 | Royce Capital Fund 2015 Semiannual Report to Shareholders | |

| PERFORMANCE AND PORTFOLIO REVIEW | TICKER SYMBOLS RCPFX RCSSX |

|

| Performance and Expenses | | | | | | | | | | | | | | |

| Average Annual Total Return (%) Through 6/30/15 | | | | | | | | | | |

| | | JAN-JUN 2015* | | 1-YR | | 3-YR | | 5-YR | | 10-YR | | 15-YR | | SINCE INCEPTION (12/27/96) |

|

| RCS | | -0.32 | | 0.95 | | 14.05 | | 12.73 | | 7.75 | | 10.89 | | 11.51 |

| |

| Annual Operating Expenses: 1.05% | | | | | | | | | | | |

| |

| * Not Annualized | | | | | | | | | | | | | | |

Relative Returns: Monthly Rolling Average Annual Return PeriodsSince Inception Through 6/30/15

| On a monthly rolling basis, the Fund outperformed the Russell 2000 in 95% of all 10-year periods; 82% of all 5-year periods; and 57% of all 1-year periods. |

| |

| | | PERIODS BEATING THE INDEX | | | | | FUND AVG (%)* | | INDEX AVG (%)* |

| |

| 10-year | | 98/103 | | | | | | 95% | | 10.7 | | 6.9 |

| |

| 5-year | | 134/163 | | | | | | 82% | | 11.3 | | 7.2 |

| |

| 1-year | | 120/211 | | | | | | 57% | | 13.0 | | 9.9 |

| |

*Average of monthly rolling average annual total returns over the specified periods.

| The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 27 for additional information. |

Value of $10,000Invested on 12/31/96 as of 6/30/15 ($)

Includes reinvestment of distributions.

|

| Top 10 Positions | | |

| % of Net Assets | | |

| | | |

| Buckle (The) | | 3.0 |

| |

| Reinsurance Group of America | | 3.0 |

| |

| PC Connection | | 3.0 |

| |

| MKS Instruments | | 2.9 |

| |

| Vishay Intertechnology | | 2.9 |

| |

| Fabrinet | | 2.9 |

| |

| Genesco | | 2.9 |

| |

| Genworth MI Canada | | 2.8 |

| |

| Cato Corporation (The) Cl. A | | 2.8 |

| |

| Shoe Carnival | | 2.7 |

| |

|

| Portfolio Sector Breakdown | | |

| % of Net Assets | | |

| | | |

| Consumer Discretionary | | 27.7 |

| |

| Information Technology | | 26.1 |

| |

| Financials | | 14.1 |

| |

| Industrials | | 13.1 |

| |

| Energy | | 6.7 |

| |

| Consumer Staples | | 3.7 |

| |

| Health Care | | 2.9 |

| |

| Materials | | 2.5 |

| |

| Miscellaneous | | 0.5 |

| |

| Cash and Cash Equivalents | | 2.7 |

| |

|

| Calendar Year Total Returns (%) | |

| | | |

| YEAR | | RCS |

| |

| 2014 | | 3.2 |

| |

| 2013 | | 34.8 |

| |

| 2012 | | 12.5 |

| |

| 2011 | | -3.3 |

| |

| 2010 | | 20.5 |

| |

| 2009 | | 35.2 |

| |

| 2008 | | -27.2 |

| |

| 2007 | | -2.1 |

| |

| 2006 | | 15.6 |

| |

| 2005 | | 8.6 |

| |

| 2004 | | 25.0 |

| |

| 2003 | | 41.1 |

| |

| 2002 | | -13.8 |

| |

| 2001 | | 21.0 |

| |

| 2000 | | 33.3 |

| |

|

| Upside/Downside Capture Ratios | | | | |

| Periods Ended 6/30/15 (%) | | | | |

| | | UPSIDE | | DOWNSIDE |

| |

| 10-Year | | 90 | | 89 |

| |

From 12/31/96 (Start of Fund’s

First Full Quarter) | | 99 | | 79 |

| |

|

| Portfolio Diagnostics | | |

| | | |

| Fund Net Assets | | $788 million |

| |

| Number of Holdings | | 72 |

| |

| Turnover Rate | | 26% |

| |

| Average Market Capitalization1 | | $1,305 million |

| |

| Weighted Average P/E Ratio2,3 | | 15.4x |

| |

| Weighted Average P/B Ratio2 | | 2.0x |

| |

| Holdings ≥ 75% of Total Investments | | 36 |

| |

| Active Share4 | | 97% |

| |

| U.S. Investments (% of Net Assets) | | 89.8% |

| |

| Non-U.S. Investments (% of Net Assets) | | 7.5% |

| |

| |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (0% of portfolio holdings as of 6/30/15). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Expense Information

All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class. Operating expenses reflect the Fund’s total annual operating expenses for the Investment Class as of the Fund’s most current prospectus and include management fees and other expenses. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2015. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a Manager’s performance in down markets relative to the Fund’s benchmark (Russell 2000). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters. |

| | | Royce Capital Fund 2015 Semiannual Report to Shareholders | 9 |

Schedules of Investments

Royce Capital Fund - Micro-Cap Portfolio

Common Stocks – 92.2%| | | SHARES | | | | VALUE |

| |

| | | | | | | |

| CONSUMER DISCRETIONARY – 13.2% | | | | | | |

| AUTO COMPONENTS - 0.7% | | | | | | |

Drew Industries | | 35,379 | | | $ | 2,052,689 |

†Superior Industries International | | 81,900 | | | | 1,499,589 |

| | | | | | |

| | | | | | | 3,552,278 |

| | | | | | |

| DISTRIBUTORS - 0.3% | | | | | | |

†Fenix Parts 1 | | 163,800 | | | | 1,641,276 |

| | | | | | |

| DIVERSIFIED CONSUMER SERVICES - 2.4% | | | | | | |

American Public Education 1 | | 130,230 | | | | 3,349,516 |

Capella Education | | 74,872 | | | | 4,018,380 |

Liberty Tax Cl. A | | 89,848 | | | | 2,223,738 |

Lincoln Educational Services 1 | | 894,693 | | | | 1,807,280 |

| | | | | | |

| | | | | | | 11,398,914 |

| | | | | | |

| HOUSEHOLD DURABLES - 0.8% | | | | | | |

Cavco Industries 1 | | 50,504 | | | | 3,810,022 |

| | | | | | |

| INTERNET & CATALOG RETAIL - 0.5% | | | | | | |

FTD Companies 1 | | 30,000 | | | | 845,700 |

Gaiam Cl. A 1 | | 240,500 | | | | 1,572,870 |

| | | | | | |

| | | | | | | 2,418,570 |

| | | | | | |

| LEISURE PRODUCTS - 1.6% | | | | | | |

Malibu Boats Cl. A 1 | | 163,600 | | | | 3,286,724 |

Smith & Wesson Holding Corporation 1,2 | | 246,100 | | | | 4,082,799 |

| | | | | | |

| | | | | | | 7,369,523 |

| | | | | | |

| MEDIA - 0.8% | | | | | | |

†New Media Investment Group | | 107,600 | | | | 1,929,268 |

Rentrak Corporation 1,2 | | 24,300 | | | | 1,696,140 |

| | | | | | |

| | | | | | | 3,625,408 |

| | | | | | |

| SPECIALTY RETAIL - 5.2% | | | | | | |

Boot Barn Holdings 1 | | 32,000 | | | | 1,024,000 |

Buckle (The) | | 68,225 | | | | 3,122,658 |

Build-A-Bear Workshop 1 | | 45,100 | | | | 721,149 |

Cato Corporation (The) Cl. A | | 47,800 | | | | 1,852,728 |

Citi Trends 1 | | 91,186 | | | | 2,206,701 |

†Container Store Group (The) 1,2 | | 41,400 | | | | 698,418 |

Destination Maternity | | 194,900 | | | | 2,272,534 |

Kirkland’s | | 152,380 | | | | 4,246,831 |

Shoe Carnival | | 161,800 | | | | 4,669,548 |

Stein Mart | | 267,078 | | | | 2,796,307 |

Zumiez 1 | | 39,300 | | | | 1,046,559 |

| | | | | | |

| | | | | | | 24,657,433 |

| | | | | | |

| TEXTILES, APPAREL & LUXURY GOODS - 0.9% | | | | | | |

Culp | | 133,849 | | | | 4,149,319 |

| |

| Total (Cost $53,206,161) | | | | | | 62,622,743 |

| |

| | | | | | | |

| CONSUMER STAPLES – 1.4% | | | | | | |

| FOOD PRODUCTS - 1.4% | | | | | | |

Limoneira Company | | 105,300 | | | | 2,340,819 |

Sipef | | 28,400 | | | | 1,513,905 |

†SunOpta 1 | | 209,100 | | | | 2,243,643 |

Waterloo Investment Holdings 1,3 | | 1,303,907 | | | | 495,485 |

| |

| Total (Cost $6,885,205) | | | | | | 6,593,852 |

| |

| | | | | | | |

| ENERGY – 5.5% | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 4.5% | | | | | | |

Canadian Energy Services & Technology | | 142,200 | | | | 819,728 |

Dawson Geophysical 1 | | 437,692 | | | | 2,057,152 |

Geospace Technologies 1,2 | | 113,812 | | | | 2,623,367 |

Gulf Island Fabrication | | 341,134 | | | | 3,810,467 |

Natural Gas Services Group 1 | | 156,500 | | | | 3,571,330 |

Newpark Resources 1 | | 92,200 | | | | 749,586 |

Profire Energy 1,2 | | 467,129 | | | | 523,184 |

Tesco Corporation | | 223,280 | | | | 2,433,752 |

Total Energy Services | | 401,000 | | | | 4,896,117 |

| | | | | | |

| | | | | | | 21,484,683 |

| | | | | | |

| OIL, GAS & CONSUMABLE FUELS - 1.0% | | | | | | |

Ardmore Shipping | | 118,600 | | | | 1,436,246 |

Sprott Resource 1 | | 1,345,600 | | | | 1,012,701 |

Synergy Resources 1 | | 175,600 | | | | 2,007,108 |

| | | | | | |

| | | | | | | 4,456,055 |

| |

| Total (Cost $33,842,269) | | | | | | 25,940,738 |

| |

| | | | | | | |

| FINANCIALS – 9.1% | | | | | | |

| BANKS - 0.8% | | | | | | |

BCB Holdings 1 | | 1,849,707 | | | | 247,040 |

John Marshall Bank 1,4 | | 65,520 | | | | 1,048,975 |

TriState Capital Holdings 1 | | 192,772 | | | | 2,492,542 |

| | | | | | |

| | | | | | | 3,788,557 |

| | | | | | |

| CAPITAL MARKETS - 4.1% | | | | | | |

ASA Gold and Precious Metals | | 52,200 | | | | 506,862 |

FBR & Co. 1 | | 135,575 | | | | 3,137,205 |

Gluskin Sheff + Associates | | 76,000 | | | | 1,527,302 |

GMP Capital | | 362,700 | | | | 1,489,713 |

INTL FCStone 1 | | 105,069 | | | | 3,492,494 |

JMP Group | | 293,751 | | | | 2,291,258 |

Silvercrest Asset Management Group Cl. A | | 234,700 | | | | 3,299,882 |

U.S. Global Investors Cl. A | | 262,700 | | | | 730,306 |

Westwood Holdings Group | | 53,827 | | | | 3,206,474 |

| | | | | | |

| | | | | | | 19,681,496 |

| | | | | | |

| DIVERSIFIED FINANCIAL SERVICES - 0.5% | | | | | | |

GAIN Capital Holdings | | 248,700 | | | | 2,377,572 |

| | | | | | |

| INSURANCE - 0.9% | | | | | | |

Blue Capital Reinsurance Holdings | | 97,500 | | | | 1,752,075 |

eHealth 1 | | 87,100 | | | | 1,105,299 |

Navigators Group 1 | | 16,536 | | | | 1,282,532 |

| | | | | | |

| | | | | | | 4,139,906 |

| | | | | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 2.1% | | | | | | |

AV Homes 1 | | 158,700 | | | | 2,280,519 |

FRP Holdings 1 | | 72,840 | | | | 2,362,201 |

Kennedy-Wilson Holdings | | 137,430 | | | | 3,379,404 |

Midland Holdings 1 | | 4,983,000 | | | | 2,256,366 |

| | | | | | |

| | | | | | | 10,278,490 |

| | | | | | |

| THRIFTS & MORTGAGE FINANCE - 0.7% | | | | | | |

†Beneficial Bancorp 1 | | 117,140 | | | | 1,463,078 |

†Westfield Financial | | 244,954 | | | | 1,790,614 |

| | | | | | |

| | | | | | | 3,253,692 |

| |

| Total (Cost $41,037,986) | | | | | | 43,519,713 |

| |

| | | | | | | |

| HEALTH CARE – 10.8% | | | | | | |

| BIOTECHNOLOGY - 1.4% | | | | | | |

BioSpecifics Technologies 1 | | 26,300 | | | | 1,357,080 |

Dyax Corporation 1 | | 36,716 | | | | 972,974 |

Lexicon Pharmaceuticals 1,2 | | 88,068 | | | | 708,947 |

†Progenics Pharmaceuticals 1 | | 492,700 | | | | 3,675,542 |

| | | | | | |

| | | | | | | 6,714,543 |

| | | | | | |

| HEALTH CARE EQUIPMENT & SUPPLIES - 5.5% | | | | | | |

†Avinger 1 | | 83,100 | | | | 1,072,821 |

Cerus Corporation 1,2 | | 444,357 | | | | 2,306,213 |

CryoLife | | 238,289 | | | | 2,687,900 |

| 10 | Royce Capital Fund 2015 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| June 30, 2015 (unaudited) |

|

| Royce Capital Fund - Micro-Cap Portfolio (continued) |

| | | SHARES | | | | VALUE |

| |

| | | | | | | |

| HEALTH CARE (continued) | | | | | | |

| HEALTH CARE EQUIPMENT & SUPPLIES (continued) | | | | | | |

Cynosure Cl. A 1 | | 55,500 | | | $ | 2,141,190 |

Exactech 1 | | 52,610 | | | | 1,095,866 |

Neovasc 1 | | 159,300 | | | | 1,034,366 |

Novadaq Technologies 1,2 | | 84,979 | | | | 1,029,095 |

Orthofix International 1 | | 52,700 | | | | 1,745,424 |

RTI Surgical 1 | | 353,500 | | | | 2,283,610 |

SurModics 1 | | 131,678 | | | | 3,083,899 |

Synergetics USA 1 | | 404,900 | | | | 1,903,030 |

Syneron Medical 1 | | 196,985 | | | | 2,091,981 |

Trinity Biotech ADR Cl. A | | 89,170 | | | | 1,610,410 |

Vascular Solutions 1 | | 59,600 | | | | 2,069,312 |

| | | | | | |

| | | | | | | 26,155,117 |

| | | | | | |

| HEALTH CARE PROVIDERS & SERVICES - 1.7% | | | | | | |

Bio-Reference Laboratories 1 | | 29,200 | | | | 1,204,500 |

CorVel Corporation 1 | | 85,121 | | | | 2,725,574 |

U.S. Physical Therapy | | 72,560 | | | | 3,973,386 |

| | | | | | |

| | | | | | | 7,903,460 |

| | | | | | |

| HEALTH CARE TECHNOLOGY - 0.7% | | | | | | |

†Castlight Health Cl. B 1,2 | | 187,300 | | | | 1,524,622 |

Computer Programs and Systems | | 2,600 | | | | 138,892 |

Vocera Communications 1 | | 149,300 | | | | 1,709,485 |

| | | | | | |

| | | | | | | 3,372,999 |

| | | | | | |

| LIFE SCIENCES TOOLS & SERVICES - 0.6% | | | | | | |

Harvard Bioscience 1 | | 464,468 | | | | 2,647,468 |

| | | | | | |

| PHARMACEUTICALS - 0.9% | | | | | | |

Agile Therapeutics 1,2 | | 115,000 | | | | 987,850 |

Theravance Biopharma 1,2 | | 177,800 | | | | 2,314,956 |

Vetoquinol | | 28,008 | | | | 1,161,559 |

| | | | | | |

| | | | | | | 4,464,365 |

| |

| Total (Cost $34,083,113) | | | | | | 51,257,952 |

| |

| | | | | | | |

| INDUSTRIALS – 21.6% | | | | | | |

| AEROSPACE & DEFENSE - 1.3% | | | | | | |

AeroVironment 1 | | 66,800 | | | | 1,742,144 |

American Science and Engineering | | 17,800 | | | | 779,818 |

CPI Aerostructures 1 | | 151,344 | | | | 1,514,953 |

†Vectrus 1 | | 88,100 | | | | 2,191,047 |

| | | | | | |

| | | | | | | 6,227,962 |

| | | | | | |

| BUILDING PRODUCTS - 0.6% | | | | | | |

AAON | | 114,262 | | | | 2,573,180 |

| | | | | | |

| COMMERCIAL SERVICES & SUPPLIES - 3.1% | | | | | | |

Black Diamond Group | | 267,300 | | | | 3,747,336 |

Ennis | | 185,049 | | | | 3,440,061 |

Heritage-Crystal Clean 1 | | 111,234 | | | | 1,635,140 |

Horizon North Logistics | | 708,700 | | | | 2,184,544 |

Hudson Technologies 1 | | 398,700 | | | | 1,391,463 |

Performant Financial 1,2 | | 319,600 | | | | 1,035,504 |

US Ecology | | 27,100 | | | | 1,320,312 |

| | | | | | |

| | | | | | | 14,754,360 |

| | | | | | |

| CONSTRUCTION & ENGINEERING - 1.1% | | | | | | |

MYR Group 1 | | 112,238 | | | | 3,474,889 |

†Northwest Pipe 1 | | 80,000 | | | | 1,629,600 |

Severfield 1 | | 244,200 | | | | 262,834 |

| | | | | | |

| | | | | | | 5,367,323 |

| | | | | | |

| ELECTRICAL EQUIPMENT - 2.2% | | | | | | |

Global Power Equipment Group | | 254,288 | | | | 1,973,275 |

Graphite India | | 1,516,809 | | | | 1,980,570 |

LSI Industries | | 424,313 | | | | 3,963,083 |

Powell Industries | | 54,900 | | | | 1,930,833 |

†Power Solutions International 1,2 | | 13,800 | | | | 745,476 |

| | | | | | |

| | | | | | | 10,593,237 |

| | | | | | |

| INDUSTRIAL CONGLOMERATES - 0.2% | | | | | | |

Raven Industries | | 38,000 | | | | 772,540 |

| | | | | | |

| MACHINERY - 6.8% | | | | | | |

CIRCOR International | | 74,000 | | | | 4,035,220 |

FreightCar America | | 87,791 | | | | 1,833,076 |

Gorman-Rupp Company (The) | | 55,837 | | | | 1,567,903 |

Graham Corporation | | 183,320 | | | | 3,756,227 |

Kadant | | 58,631 | | | | 2,767,383 |

Key Technology 1,5 | | 315,129 | | | | 4,159,703 |

†Lindsay Corporation | | 20,800 | | | | 1,828,528 |

†Lydall 1 | | 88,700 | | | | 2,621,972 |

†NN | | 129,700 | | | | 3,309,944 |

RBC Bearings 1 | | 39,522 | | | | 2,836,098 |

Semperit AG Holding | | 70,242 | | | | 2,897,443 |

Sun Hydraulics | | 19,400 | | | | 739,334 |

| | | | | | |

| | | | | | | 32,352,831 |

| | | | | | |

| MARINE - 0.5% | | | | | | |

Clarkson | | 52,200 | | | | 2,244,867 |

| | | | | | |

| PROFESSIONAL SERVICES - 4.2% | | | | | | |

CRA International 1 | | 131,906 | | | | 3,676,220 |

Exponent | | 53,994 | | | | 2,417,851 |

GP Strategies 1 | | 74,508 | | | | 2,476,646 |

Heidrick & Struggles International | | 114,200 | | | | 2,978,336 |

Kforce | | 141,100 | | | | 3,226,957 |

†Marathon Patent Group 1,2 | | 166,330 | | | | 482,357 |

Resources Connection | | 300,254 | | | | 4,831,087 |

| | | | | | |

| | | | | | | 20,089,454 |

| | | | | | |

| ROAD & RAIL - 1.2% | | | | | | |

Marten Transport | | 174,785 | | | | 3,792,834 |

†Patriot Transportation Holding 1,2 | | 80,589 | | | | 1,986,519 |

| | | | | | |

| | | | | | | 5,779,353 |

| | | | | | |

| TRADING COMPANIES & DISTRIBUTORS - 0.4% | | | | | | |

Houston Wire & Cable | | 203,900 | | | | 2,022,688 |

| |

| Total (Cost $83,651,845) | | | | | | 102,777,795 |

| |

| | | | | | | |

| INFORMATION TECHNOLOGY – 18.2% | | | | | | |

| COMMUNICATIONS EQUIPMENT - 3.0% | | | | | | |

CalAmp Corporation 1 | | 135,000 | | | | 2,465,100 |

COM DEV International | | 434,500 | | | | 2,007,258 |

Digi International 1 | | 340,984 | | | | 3,256,397 |

†Harmonic 1 | | 315,700 | | | | 2,156,231 |

KVH Industries 1,2 | | 257,100 | | | | 3,457,995 |

Numerex Corporation Cl. A 1 | | 88,900 | | | | 759,206 |

| | | | | | |

| | | | | | | 14,102,187 |

| | | | | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 3.4% | | | | | | |

CUI Global 1,2 | | 312,062 | | | | 1,579,034 |

DTS 1 | | 76,600 | | | | 2,335,534 |

Fabrinet 1 | | 185,369 | | | | 3,471,961 |

GSI Group 1,2 | | 203,300 | | | | 3,055,599 |

Neonode 1,2 | | 493,465 | | | | 1,455,722 |

Newport Corporation 1 | | 55,700 | | | | 1,056,072 |

Pure Technologies | | 88,800 | | | | 515,452 |

Vishay Precision Group 1,2 | | 167,400 | | | | 2,521,044 |

| | | | | | |

| | | | | | | 15,990,418 |

| | | | | | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | | Royce Capital Fund 2015 Semiannual Report to Shareholders | 11 |

Schedules of Investments

| |

| Royce Capital Fund - Micro-Cap Portfolio (continued) |

| | | SHARES | | | VALUE |

| |

| | | | | | |

| INFORMATION TECHNOLOGY (continued) | | | | | |

| INTERNET SOFTWARE & SERVICES - 1.0% | | | | | |

Care.com 1,2 | | 166,200 | | $ | 983,904 |

QuinStreet 1,2 | | 370,500 | | | 2,389,725 |

Stamps.com 1 | | 10,300 | | | 757,771 |

United Online 1 | | 34,100 | | | 534,347 |

| | | | | |

| | | | | | 4,665,747 |

| | | | | |

| IT SERVICES - 0.5% | | | | | |

Computer Task Group | | 319,942 | | | 2,469,952 |

| | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 5.5% | | | | | |

Amtech Systems 1 | | 138,000 | | | 1,433,820 |

Brooks Automation | | 281,600 | | | 3,224,320 |

Cascade Microtech 1 | | 192,900 | | | 2,936,903 |

GSI Technology 1 | | 347,461 | | | 1,810,272 |

PDF Solutions 1 | | 122,400 | | | 1,958,400 |

Photronics 1 | | 430,300 | | | 4,092,153 |

Rudolph Technologies 1 | | 187,093 | | | 2,246,987 |

Ultra Clean Holdings 1 | | 327,000 | | | 2,037,210 |

Ultratech 1 | | 147,900 | | | 2,745,024 |

Xcerra Corporation 1 | | 524,100 | | | 3,967,437 |

| | | | | |

| | | | | | 26,452,526 |

| | | | | |

| SOFTWARE - 3.8% | | | | | |

†Computer Modelling Group | | 142,100 | | | 1,440,341 |

ePlus 1 | | 44,396 | | | 3,402,953 |

Monotype Imaging Holdings | | 116,142 | | | 2,800,184 |

†QAD | | 60,500 | | | 1,599,015 |

Rubicon Project 1 | | 153,400 | | | 2,294,864 |

SeaChange International 1 | | 406,700 | | | 2,850,967 |

TeleNav 1 | | 223,300 | | | 1,797,565 |

Zix Corporation 1 | | 364,600 | | | 1,884,982 |

| | | | | |

| | | | | | 18,070,871 |

| | | | | |

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 1.0% | | | | | |

Avid Technology 1 | | 157,593 | | | 2,102,291 |

Super Micro Computer 1 | | 99,211 | | | 2,934,661 |

| | | | | |

| | | | | | 5,036,952 |

| |

| Total (Cost $79,936,554) | | | | | 86,788,653 |

| |

| | | | | | |

| MATERIALS – 6.2% | | | | | |

| CHEMICALS - 2.0% | | | | | |

BioAmber 1,2 | | 295,979 | | | 2,545,419 |

FutureFuel Corporation | | 267,500 | | | 3,442,725 |

Quaker Chemical | | 31,488 | | | 2,797,394 |

Societe Internationale de Plantations

d’Heveas 1 | | 21,585 | | | 819,140 |

| | | | | |

| | | | | | 9,604,678 |

| | | | | |

| METALS & MINING - 4.2% | | | | | |

Alamos Gold | | 162,900 | | | 922,100 |

Argonaut Gold 1 | | 361,700 | | | 486,514 |

Endeavour Silver 1 | | 445,300 | | | 886,147 |

Geodrill 1 | | 1,460,700 | | | 877,122 |

Gold Standard Ventures 1 | | 771,600 | | | 365,739 |

Haynes International | | 91,370 | | | 4,506,368 |

Horsehead Holding Corporation 1,2 | | 269,003 | | | 3,152,715 |

Imdex 1 | | 2,184,592 | | | 505,657 |

McEwen Mining 1,2 | | 1,119,096 | | | 1,073,101 |

Olympic Steel | | 180,570 | | | 3,149,141 |

Pilot Gold 1 | | 1,669,325 | | | 828,648 |

Universal Stainless & Alloy Products 1 | | 171,188 | | | 3,363,844 |

| | | | | |

| | | | | | 20,117,096 |

| |

| Total (Cost $37,980,245) | | | | | 29,721,774 |

| |

| | | | | | |

| TELECOMMUNICATION SERVICES – 1.2% | | | | | |

| DIVERSIFIED TELECOMMUNICATION SERVICES - 0.9% | | | | | |

ORBCOMM 1 | | 616,400 | | | 4,160,700 |

| | | | | |

| WIRELESS TELECOMMUNICATION SERVICES - 0.3% | | | | | |

Spok Holdings | | 93,800 | | | 1,579,592 |

| |

| Total (Cost $5,230,445) | | | | | 5,740,292 |

| |

| | | | | | |

| MISCELLANEOUS6 – 5.0% | | | | | |

| |

| Total (Cost $23,323,465) | | | | | 23,733,606 |

| |

| | | | | | |

| TOTAL COMMON STOCKS | | | | | |

| |

| (Cost $399,177,288) | | | | | 438,697,118 |

| |

| | | | | | |

| REPURCHASE AGREEMENT– 8.0% | | | | | |

Fixed Income Clearing Corporation, 0.00% dated 6/30/15, due 7/1/15, maturity value

$38,242,000 (collateralized by obligations of various U.S. Government Agencies, 2.625%

due 8/15/20, valued at $39,008,625) |

| |

| (Cost $38,242,000) | | | | | 38,242,000 |

| |

| | | | | | |

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 2.7% | | | | | |

| Money Market Funds | | | | | |

Federated Government Obligations Fund (7 day yield-0.0099%) | | | | | |

| |

| (Cost $12,718,398) | | | | | 12,718,398 |

| |

| | | | | | |

| | | | | | |

| TOTAL INVESTMENTS – 102.9% | | | | | |

| |

| (Cost $450,137,686) | | | | | 489,657,516 |

| |

| | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (2.9)% | | | | | (13,966,802) |

| | | | | |

| | | | | | |

| |

| NET ASSETS – 100.0% | | | | $ | 475,690,714 |

| |

| 12 | Royce Capital Fund 2015 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| June 30, 2015 (unaudited) |

| |

| |

Royce Capital Fund - Small-Cap Portfolio

Common Stocks – 97.3% |

| | | SHARES | | | | VALUE |

| |

| | | | | | | |

| CONSUMER DISCRETIONARY – 27.7% | | | | | | |

| AUTO COMPONENTS - 2.0% | | | | | | |

Dorman Products 1 | | 201,669 | | | $ | 9,611,545 |

STRATTEC SECURITY | | 94,219 | | | | 6,472,845 |

| | | | | | |

| | | | | | | 16,084,390 |

| | | | | | |

| AUTOMOBILES - 0.9% | | | | | | |

Thor Industries | | 125,385 | | | | 7,056,668 |

| | | | | | |

| MEDIA - 1.1% | | | | | | |

Saga Communications Cl. A | | 229,782 | | | | 8,697,249 |

| | | | | | |

| SPECIALTY RETAIL - 18.6% | | | | | | |

American Eagle Outfitters | | 752,485 | | | | 12,957,792 |

Ascena Retail Group 1 | | 644,280 | | | | 10,730,483 |

Buckle (The) | | 517,902 | | | | 23,704,374 |

Cato Corporation (The) Cl. A | | 575,191 | | | | 22,294,403 |

DSW Cl. A | | 466,227 | | | | 15,557,995 |

GameStop Corporation Cl. A | | 185,072 | | | | 7,950,693 |

Genesco 1 | | 344,518 | | | | 22,748,524 |

Shoe Carnival | | 749,401 | | | | 21,627,713 |

Stein Mart | | 816,770 | | | | 8,551,582 |

| | | | | | |

| | | | | | | 146,123,559 |

| | | | | | |

| TEXTILES, APPAREL & LUXURY GOODS - 5.1% | | | | | | |

Deckers Outdoor 1 | | 200,986 | | | | 14,464,962 |

G-III Apparel Group 1 | | 53,358 | | | | 3,753,735 |

Movado Group | | 296,629 | | | | 8,056,444 |

Steven Madden 1 | | 280,182 | | | | 11,986,186 |

Vera Bradley 1 | | 147,110 | | | | 1,657,930 |

| | | | | | |

| | | | | | | 39,919,257 |

| |

| Total (Cost $173,603,805) | | | | | | 217,881,123 |

| |

| | | | | | | |

| CONSUMER STAPLES – 3.7% | | | | | | |

| FOOD & STAPLES RETAILING - 1.2% | | | | | | |

Village Super Market Cl. A | | 292,936 | | | | 9,283,142 |

| | | | | | |

| PERSONAL PRODUCTS - 2.5% | | | | | | |

Nu Skin Enterprises Cl. A | | 419,473 | | | | 19,769,762 |

| |

| Total (Cost $26,179,952) | | | | | | 29,052,904 |

| |

| | | | | | | |

| ENERGY – 6.7% | | | | | | |

| ENERGY EQUIPMENT & SERVICES - 5.9% | | | | | | |

Atwood Oceanics | | 470,029 | | | | 12,427,567 |

Helmerich & Payne | | 78,000 | | | | 5,492,760 |

Matrix Service 1 | | 807,450 | | | | 14,760,186 |

Total Energy Services | | 84,750 | | | | 1,034,778 |

Unit Corporation 1 | | 461,640 | | | | 12,519,677 |

| | | | | | |

| | | | | | | 46,234,968 |

| | | | | | |

| OIL, GAS & CONSUMABLE FUELS - 0.8% | | | | | | |

Cimarex Energy | | 61,188 | | | | 6,749,648 |

| |

| Total (Cost $54,829,232) | | | | | | 52,984,616 |

| |

| | | | | | | |

| FINANCIALS – 14.1% | | | | | | |

| BANKS - 4.0% | | | | | | |

Ames National | | 239,150 | | | | 6,002,665 |

Camden National | | 245,948 | | | | 9,518,188 |

City Holding Company | | 320,674 | | | | 15,793,194 |

| | | | | | |

| | | | | | | 31,314,047 |

| | | | | | |

| CAPITAL MARKETS - 0.6% | | | | | | |

Federated Investors Cl. B | | 136,796 | | | | 4,581,298 |

| | | | | | |

| INSURANCE - 4.5% | | | | | | |

Allied World Assurance Company Holdings | | 142,265 | | | | 6,148,693 |

Aspen Insurance Holdings | | 115,666 | | | | 5,540,402 |

Reinsurance Group of America | | 248,100 | | | | 23,537,247 |

| | | | | | |

| | | | | | | 35,226,342 |

| | | | | | |

| THRIFTS & MORTGAGE FINANCE - 5.0% | | | | | | |

Genworth MI Canada | | 853,800 | | | | 22,421,649 |

TrustCo Bank Corp. NY | | 2,449,286 | | | | 17,218,481 |

| | | | | | |

| | | | | | | 39,640,130 |

| |

| Total (Cost $76,268,267) | | | | | | 110,761,817 |

| |

| | | | | | | |

| HEALTH CARE – 2.9% | | | | | | |

| HEALTH CARE PROVIDERS & SERVICES - 2.9% | | | | | | |

Aceto Corporation | | 279,278 | | | | 6,878,617 |

Chemed Corporation | | 27,896 | | | | 3,657,165 |

MEDNAX 1 | | 109,170 | | | | 8,090,589 |

U.S. Physical Therapy | | 82,896 | | | | 4,539,385 |

| |

| Total (Cost $8,698,934) | | | | | | 23,165,756 |

| |

| | | | | | | |

| INDUSTRIALS – 13.1% | | | | | | |

| COMMERCIAL SERVICES & SUPPLIES - 1.9% | | | | | | |

UniFirst Corporation | | 133,450 | | | | 14,926,383 |

| | | | | | |

| CONSTRUCTION & ENGINEERING - 2.0% | | | | | | |

MYR Group 1 | | 522,623 | | | | 16,180,408 |

| | | | | | |

| MACHINERY - 4.9% | | | | | | |

Alamo Group | | 258,452 | | | | 14,121,817 |

Federal Signal | | 576,042 | | | | 8,588,786 |

Kennametal | | 91,195 | | | | 3,111,574 |

Miller Industries 5 | | 663,445 | | | | 13,235,728 |

| | | | | | |

| | | | | | | 39,057,905 |

| | | | | | |

| ROAD & RAIL - 2.4% | | | | | | |

Knight Transportation | | 35,389 | | | | 946,302 |

†Saia 1 | | 269,419 | | | | 10,585,472 |

†Werner Enterprises | | 270,600 | | | | 7,103,250 |

| | | | | | |

| | | | | | | 18,635,024 |

| | | | | | |

| TRADING COMPANIES & DISTRIBUTORS - 1.9% | | | | | | |

Applied Industrial Technologies | | 370,074 | | | | 14,673,434 |

| |

| Total (Cost $91,443,852) | | | | | | 103,473,154 |

| |

| | | | | | | |

| INFORMATION TECHNOLOGY – 26.1% | | | | | | |

| COMMUNICATIONS EQUIPMENT - 5.0% | | | | | | |

†Brocade Communications Systems | | 1,129,400 | | | | 13,417,272 |

NETGEAR 1 | | 450,150 | | | | 13,513,503 |

Plantronics | | 82,534 | | | | 4,647,489 |

TESSCO Technologies 5 | | 417,695 | | | | 8,274,538 |

| | | | | | |

| | | | | | | 39,852,802 |

| | | | | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 15.2% | | | | | | |

Benchmark Electronics 1 | | 833,617 | | | | 18,156,178 |

Fabrinet 1 | | 1,220,322 | | | | 22,856,631 |

Key Tronic 1,5 | | 600,081 | | | | 6,522,881 |

PC Connection | | 942,794 | | | | 23,324,724 |

Rofin-Sinar Technologies 1 | | 522,982 | | | | 14,434,303 |

ScanSource 1 | | 297,982 | | | | 11,341,195 |

Vishay Intertechnology | | 1,969,899 | | | | 23,008,420 |

| | | | | | |

| | | | | | | 119,644,332 |

| | | | | | |

| IT SERVICES - 2.7% | | | | | | |

Calian Technologies | | 75,900 | | | | 1,124,219 |

Convergys Corporation | | 434,542 | | | | 11,076,476 |

ManTech International Cl. A | | 304,015 | | | | 8,816,435 |

| | | | | | |

| | | | | | | 21,017,130 |

| | | | | | |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2015 Semiannual Report to Shareholders | 13 |

| June 30, 2015 (unaudited) |

| Schedules of Investments |

| |

| |

| Royce Capital Fund - Small-Cap Portfolio (continued) |

| | | SHARES | | | | VALUE |

| |

| | | | | | | |

| INFORMATION TECHNOLOGY (continued) | | | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.2% | | | | | | |

MKS Instruments | | 609,398 | | | $ | 23,120,560 |

Teradyne | | 117,500 | | | | 2,266,575 |

| | | | | | |

| | | | | | | 25,387,135 |

| |

| Total (Cost $190,732,380) | | | | | | 205,901,399 |

| |

| | | | | | | |

| MATERIALS – 2.5% | | | | | | |

| CHEMICALS - 0.8% | | | | | | |

Innospec | | 138,721 | | | | 6,247,994 |

| | | | | | |

| METALS & MINING - 0.3% | | | | | | |

Reliance Steel & Aluminum | | 36,400 | | | | 2,201,472 |

| | | | | | |

| PAPER & FOREST PRODUCTS - 1.4% | | | | | | |

Schweitzer-Mauduit International | | 284,005 | | | | 11,326,119 |

| |

| Total (Cost $21,268,038) | | | | | | 19,775,585 |

| |

| | | | | | | |

| MISCELLANEOUS6 – 0.5% | | | | | | |

| |

| Total (Cost $3,614,106) | | | | | | 3,590,724 |

| |

| | | | | | | |

| TOTAL COMMON STOCKS | | | | | | |

| |

| (Cost $646,638,566) | | | | | | 766,587,078 |

| |

| | | | | | | |

| REPURCHASE AGREEMENT–2.5% | | | | | | |

Fixed Income Clearing Corporation, 0.00% dated 6/30/15, due 7/1/15, maturity value

$19,731,000 (collateralized by obligations of various U.S. Government Agencies, 2.625%

due 8/15/20, valued at $20,129,400) |

| |

| (Cost $19,731,000) | | | | | | 19,731,000 |

| |

| | | | | | | |

| TOTAL INVESTMENTS – 99.8% | | | | | | |

| |

| (Cost $666,369,566) | | | | | | 786,318,078 |

| |

| | | | | | | |

| | | | | | | |

| CASH AND OTHER ASSETS LESS LIABILITIES – 0.2% | | | | | | 1,613,068 |

| | | | | | |

| | | | | | | |

| |

| NET ASSETS – 100.0% | | | | | $ | 787,931,146 |

| |

| |

| † | New additions in 2015. |

| 1 | Non-income producing. |

| 2 | All or a portion of these securities were on loan at June 30, 2015. |