UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07537

Name of Registrant: Royce Capital Fund

Address of Registrant: 745 Fifth Avenue

New York, NY 10151

| Name and address of agent for service: | John E. Denneen, Esq. 745 Fifth Avenue New York, NY 10151 |

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31, 2018

Date of reporting period: January 1, 2018 – June 30, 2018

Item 1. Reports to Shareholders.

| JUNE 30, 2018 | ||

| 2018 Semiannual | ||

| Review and Report to Shareholders | ||

| Royce Capital Fund– | |||

| Micro-Cap Portfolio | |||

| Royce Capital Fund– | |||

| Small-Cap Portfolio | |||

| roycefunds.com |  | ||

| Table of Contents | |||

| Semiannual Review | |||

| Letter to Our Shareholders | 1 | ||

| Performance and Expenses | 5 | ||

| Semiannual Report to Shareholders | |||

| Managers’ Discussions of Fund Performance and Schedules of Investments | |||

Royce Capital Fund–Micro-Cap Portfolio | 6 | ||

Royce Capital Fund–Small-Cap Portfolio | 12 | ||

| Financial Statements | 16 | ||

| Notes to Financial Statements | 20 | ||

| Understanding Your Fund’s Expenses | 24 | ||

| Trustees and Officers | 25 | ||

| Board Approval of Investment Advisory Agreement | 26 | ||

| Notes to Performance and Other Important Information | 27 |

| This page is not part of the Royce Capital Fund 2018 Semiannual Report to Shareholders |

Letter to Our Shareholders

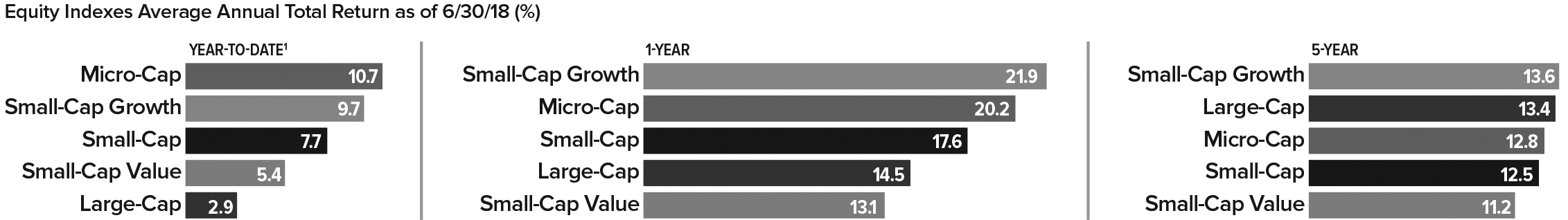

| During the first six months of 2018, small-cap stocks enjoyed the good times bred by a bull market that at this writing has not yet slowed down. Although the first half began with higher volatility and stalled equities prices—and ended with a series of wild days that made the bullish second quarter feel more tumultuous than it was—the overall direction of U.S. markets has remained positive, particularly for smaller stocks. For the year-to-date period ended June 30, 2018, the small-cap Russell 2000 Index gained 7.7%, well ahead of both the large-cap Russell 1000 (+2.9%) and S&P 500 (+2.6%) Indexes, while making a new historical high on June 20. Returns were even higher for micro-cap stocks—the Russell Microcap Index advanced 10.7% for the same period. This mostly welcome absolute and relative performance took place against the backdrop of an accelerating U.S. economy, a strong job |

| market, and, in many cases, sterling corporate profit growth while at the same time global economic progress slowed, most notably in China and other large emerging markets. The major non-U.S. indexes slipped deeper into negative territory during the first half, as the combination of slower international growth, rising emerging market instability, a stronger dollar, and heightened trade war worries led investors to prefer all things domestic. (In fact, 35 of the 45 non-U.S. small-cap markets that we follow had declines in the first half of 2018, though only 26 were negative when measured in local currencies.) Still, growth continued to skew positive outside the U.S., with the important economies of Japan and Germany continuing to look solid. In this context, then, you would expect a small-cap specialist to be quite content, if not happy. This might especially be the case considering that small-caps—as well as micro-caps—have been true to their historical habit of outpacing larger companies through an economic expansion. Yet as much as we were pleased with first-half |

|

| Small-Cap is represented by Russell 2000; Small-Cap Value is represented by Russell 2000 Value, Small-Cap Growth is represented by Russell 2000 Growth, Large-Cap is represented by Russell 1000, Micro-Cap is represented by Russell Microcap. For details on The Royce Funds’ performance in the period, please turn to the Managers’ Discussions that begin on page 8. Past performance is no guarantee of future results. |

| 1 Not annualized. |

| This page is not part of the Royce Capital Fund 2018 Semiannual Report to Shareholders | 1 |

LETTER TO OUR SHAREHOLDERS

| results, we find ourselves far from blissful. A closer look at small-cap performance in the first half reveals some genuine historical oddities in spite of all looking well on the surface. Our main concern is the disconnect between the confidence of the management teams we’ve been meeting with and the relatively underwhelming performance for many cyclical industries. We anticipated that stocks in these industries would do better owing to their recent earnings strength and ongoing prospects as well as to the healthy state of the U.S. economy (each, of course, being related to the other). OBSTACLE ON THE TRACK The Troublesome 10-Year Treasury Yield |

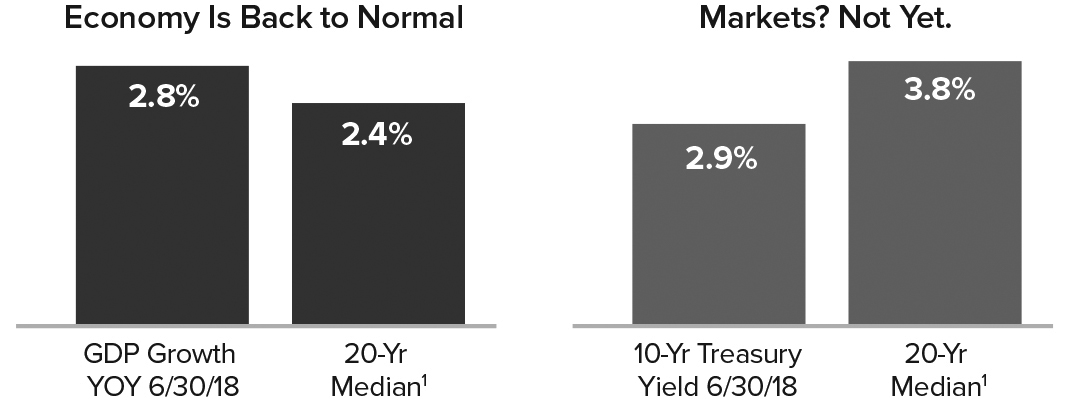

| Road to Normalization: Economy vs Markets |

| 1 Quarterly data Source: Bloomberg |

| We invite you to consider the following five points: through the end of June, the U.S. economy had grown for 109 consecutive months, GDP growth has converged with its long-term average, unemployment reached an 18-year low in June, personal consumption expenditure inflation hit the Fed’s 2% target in May, and short rates were rising. Additionally, we’re also seeing the early signs of inflation. Most are registering in increased commodity, raw material, and other input costs, which is historically familiar economic territory. History also shows, however, that these developments are also typically coincident with rising interest rates. So far, though, the 10-year Treasury yield has stubbornly refused to acquiesce to history—making the 10-year the major obstacle on the path back to normal in our view. |

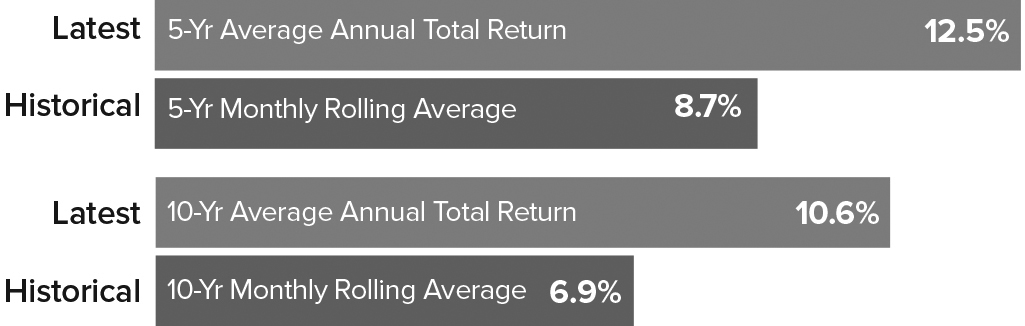

| From our perspective as highly active, valuation-sensitive small-cap specialists, the most frustrating have been those periods when the 10-year yield has fallen back. It seems to us that nearly every time it has declined over the last 18 months, the market has witnessed a subsequent flight to high yielding or growth stocks while value and economically sensitive issues struggled to keep pace. It almost seems as if investors became temporarily convinced that we had slipped back into the 2010-2015 era of quantitative easing and zero interest rates. We think it bears emphasizing that, for all its uncertainty, the current environment could not be more different. Yet the disconnect persisted into June. The critical question, then, is, what happens next? More pertinently for our investors, the question can be phrased in a more specific way as, are we likely to see a shift in small-cap style and sector leadership? We believe that we will. The second quarter saw an admittedly short-term sign when the Russell 2000 Value Index shook off five straight quarters of underperformance to outpace its small-cap growth counterpart, up 8.3% versus 7.2%. But exactly when, and under what conditions, a longer-running shift materializes remains to be seen, of course. To be sure, the kind of leadership change that we expect—from growth to value and from defensives to cyclicals—seldom occurs without a fair bit of volatility. SMALL-CAP HIGHS Returns, Valuations–and Risks Putting the issue of market turbulence aside for a moment, the timing does seem apt to us for a change. First, the two-year cumulative return at the end of June for the Russell 2000 was 46.5%—which is a wonderful, but sadly not a sustainable, pace. Second, the one-, five-, and 10-year average annual total returns for the small-cap index for the period ended June 30, 2018 were all comfortably ahead of their long-term monthly rolling averages. |

| Recent Small-Cap Returns Higher Than History Russell 2000 through 6/30/18 |

| 2 | This page is not part of the Royce Capital Fund 2018 Semiannual Report to Shareholders |

LETTER TO OUR SHAREHOLDERS

| When we look at the same information for the Russell 2000 Growth Index, the contrast is even more stark, with its latest five-year return significantly in excess of its historical rolling average (+13.6% vs +8.6%). This is one important reason why we expect a leadership shift in the form of a reversion to the mean that would favor small-cap value outperforming small-cap growth over the next five years. |

| The state of small-cap valuations also looks unsustainably high to us, particularly if we see a continued, and more consistent, rise in the 10-year yield. While the P/E ratio for the Russell 2000 did not look especially rich at the end of June, another valuation metric, the last twelve months enterprise value to earnings before interest and taxes (EV/EBIT)—which we use most frequently when examining companies—tells a different story, one that reveals higher-than-average historical valuations. The currently elevated state of returns and valuations could mean that we are entering a longish period of multiple compression, which is one reason why we prefer select small-caps with strong earnings prospects and/or modest valuations. If we see increased volatility over the balance of the year, these types of stocks look better positioned to cope with it effectively. |

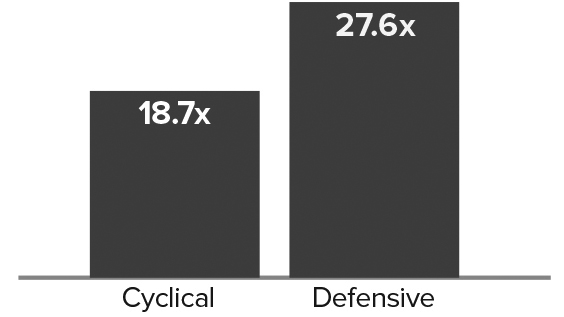

| Cyclicals Cheaper than Defensives Median LTM EV/EBIT1 Ex. Negative EBIT for Russell 2000 as of 6/30/18 |

| Based on earnings and cash flow quality—as well as confident management teams—we are seeing superior fundamentals in selected cyclical areas that other investors are avoiding. For example, the supply/demand dynamics in a number of industries, such as semiconductors & semiconductor equipment, transportation, and chemicals, look favorable to us and do not appear to us to be fully reflected in their current valuations. Many cyclical companies appear much better positioned for intermediate-term growth than defensive and/or growth stocks. While many cyclical stocks have lagged the field over the last 18 months, they are also more reasonably priced than defensives based on EV to EBIT. We remain convinced that fundamentally strong small-cap companies, especially those with attractive-to-reasonable valuations, will become more appealing to investors as confidence in the U.S. economy continues to build. |

| 1 Last Twelve Months Enterprise Value/Earnings Before Interest and Taxes |

| Many Small-Caps Sell at a Significant Discount Bottom Three Deciles in Russell 2000 Median LTM EV/EBIT1 Ex. Negative EBIT as of 6/30/18 |

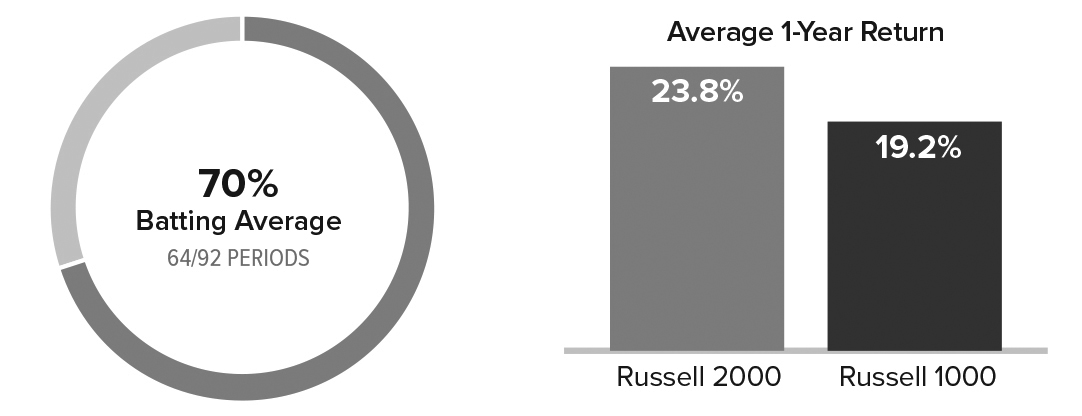

| There’s a related point that may be equally important when considering valuations: The sheer size and diversity of the small-cap asset class means that there are almost always opportunities to find what we think are promising or quality businesses trading at attractive discounts. Based on EV/EBIT, the bottom three deciles of the Russell 2000 were trading at sizable discounts compared to the median for the index as a whole at the end of June. VOLATILITY AND INTEREST RATES Both On the Rise During the first quarter, the Russell 2000 moved 1% or more in 33% of its trading days compared to 18% in all of 2017. Another volatility measure, the CBOE Russell 2000 Volatility Index (“RVX”), measures market expectations of near-term volatility conveyed by Russell 2000 stock index option prices. The RVX has averaged 24.1% per year since its inception on January 2, 2004 through June 30, 2018. Its average in 2017 was 15.9%, and its year-to-date average through the end of June 2018 was 17.5%. Eighteen months of lower volatility suggests—strongly to us—that increased volatility is likely. We also believe that the upward trend in rates is under way—and suspect that the 10-year yield will begin to move up more consistently over the next year. We see both rising rates and increased volatility as healthy. In fact, looking once more at history, we find that periods of rising rates have been favorable for small-cap stocks on both an absolute and relative basis. When the 10-Year Treasury yield was rising, the Russell 2000 outperformed the large-cap Russell 1000 in 70% of monthly rolling one-year periods for the 20-year period ended June 30, 2018 with an average one-year return of 23.8% versus 19.2% for large-cap. Our expectations for small-cap returns are more modest, though we do expect this historical relative return spread pattern to hold up. |

| This page is not part of the Royce Capital Fund 2018 Semiannual Report to Shareholders | 3 |

LETTER TO OUR SHAREHOLDERS

| How Have Small-Caps Performed When Rates Were Rising? Russell 2000 vs Russell 1000 Trailing Monthly Rolling 1-Year Returns When 10-Year Treasury Yield was Rising From 6/30/98 through 6/30/18 |

| 10-Year Treasury Yield rose in 92 of 229 periods |

| More specifically, we see rising rates as a phenomenon that should also be helpful to risk-conscious active managers in the small-cap space—primarily because it fosters an environment where better balance sheet companies are likely to be rewarded for their fiscal prudence. In other words, risk management matters. This is relevant today because of the increased leverage—specifically financial leverage—within the Russell 2000. And as rates continue to move up, the overall small-cap index looks increasingly risky. As active managers, we have the ability to screen and scrutinize small-cap businesses with better balance sheets and shy away from those that we see as having excess financial leverage. (It is worth mentioning that the market has largely ignored better balance sheet companies for much of the last 10 years.) Most of our strategies gravitate toward companies with low debt. We would rather focus on companies that have great operating leverage—but not financial leverage. With rising rates, inflation, and economic growth becoming established, the market seems to be transitioning into an environment that will favor similar qualities. REASONS TO BE CHEERFUL We are therefore of two minds about the current cycle. On the one hand, we think that we could see some consolidation or a correction—the latter certainly seems more probable now than it did |

| a year ago. Yet we remain optimistic about small-cap earnings growth and like the fundamentals of our holdings across our strategies in terms of balance sheets, cash flows, and earnings strength. It is in cyclical areas, including Industrials, the more cyclical precincts of technology, and Materials, and that we have most often uncovered what we judge to be the best combination of value, quality, and/or growth prospects. And this has always been a function of our bottom-up process rather than a top down view of the economy. This is why many of our portfolios have had perennially higher weightings in those sectors (and while others we manage have had high weightings in Financials and Consumer Discretionary). We also long ago developed the practice of leaning into those areas of the asset class where we see excess pessimism. Investments in industries that the rest of the market is abandoning have often borne fruit, though we have learned through decades of small-cap asset management that it usually requires a great deal of patience—measured in years in many cases—before the arrival of a bountiful harvest. We think it’s worth noting that the three changes in the market environment that we expect—lower returns, higher volatility, and value/cyclical leadership—have all historically been coincident with leadership for active management. We see signs of progress that in our view place us squarely on the road to normalization, which was evident in the modest increases in bond yields and the reemergence of value’s leadership in 2018’s second quarter. We saw other equally positive signs in July, including stabilizing macro indicators from outside the U.S., a welcome rebound in the performance of many industrial companies, and ongoing earnings strength for several cyclical areas. We expect to see more signs of normalizing markets to emerge as the year goes on. |

| Sincerely, |

|  |  | ||

| Charles M. Royce | Christopher D. Clark | Francis D. Gannon | ||

| Chairman, | Chief Executive Officer, and | Co-Chief Investment Officer, | ||

| Royce & Associates, LP | Co-Chief Investment Officer, | Royce & Associates, LP | ||

| Royce & Associates, LP | ||||

| July 30, 2018 |

| 4 | This page is not part of the Royce Capital Fund 2018 Semiannual Report to Shareholders |

Performance and Expenses

| Performance and Expenses |

| As of June 30, 2018 |

| YTD1 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | SINCE INCEPTION (12/27/96) | ANNUAL OPERATING EXPENSES (%) | ||||||||||||||

| Royce Capital Fund–Micro-Cap Portfolio | 10.31 | 14.08 | 7.11 | 6.55 | 5.34 | 8.04 | 9.63 | 10.21 | 1.42 | |||||||||||||

| Royce Capital Fund–Small-Cap Portfolio | 7.06 | 17.72 | 6.48 | 8.29 | 7.81 | 10.00 | 10.13 | 10.80 | 1.08 | |||||||||||||

INDEX | ||||||||||||||||||||||

| Russell Microcap Index | 10.71 | 20.21 | 10.49 | 12.78 | 10.63 | 9.44 | N/A | N/A | N/A | |||||||||||||

| Russell 2000 Index | 7.66 | 17.57 | 10.96 | 12.46 | 10.60 | 10.50 | 8.03 | N/A | N/A | |||||||||||||

| 1 Not annualized. | ||||||||||||||||||||||

Important Performance, Expense, and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. The Funds’ total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Funds. All performance and expense information reflects the result for each Fund’s Investment Class Shares. Gross annual operating expenses reflect each Fund’s gross total annual operating expenses and include management fees, operating expenses, and any applicable acquired fund fees and expenses. Net annual operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of each fund’s most current prospectus. Royce & Associates has contractually agreed to waive fees and/or reimburse operating expenses, excluding brokerage commissions, taxes, interest litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary cost of business, to the extent necessary to maintain net operating expenses at or below 1.33% for Royce Capital Fund–Micro-Cap Portfolio, and at or below 1.08% for Royce Capital Fund–Small-Cap Portfolio through April 30, 2019. Acquired fund fees and expenses reflect the estimated amount of fees and expenses incurred indirectly by the Fund through its investment in mutual funds, hedge funds, private equity funds, and other investment companies.

Service Class Shares bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Royce Micro-Cap Portfolio invests primarily in micro-cap companies while Royce Small-Cap Portfolio invests primarily in small-cap companies. Investments in micro-cap and small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. (Please see “Primary Risks for Fund Investors” in the prospectus.) Each series of Royce Capital Fund may invest up to 25% of its net assets in foreign securities. Investments in foreign securities may involve political, economic, currency, and other risks not encountered in U.S. investments. (Please see “Investing in Foreign Securities” in the prospectus.) As of 6/30/18, Royce Small-Cap Portfolio invested a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than a more broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Portfolio’s overall value to decline to a greater degree. Royce Micro-Cap Portfolio’s broadly diversified portfolio does not ensure a profit or guarantee against loss. (Please see “Primary Risks for Fund Investors” in the prospectus.) This Review and Report must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index along with the next smallest eligible securities as determined by Russell. The Russell 2000 Index is an unmanaged, capitalization-weighted index of domestic small-cap stocks. It measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Distributor: Royce Fund Services, LLC.

| This page is not part of the Royce Capital Fund 2018 Semiannual Report to Shareholders | 5 |

| MANAGERS’ DISCUSSION |

| Royce Capital Fund–Micro-Cap Portfolio (RCM) |

|

| Jim Stoeffel Brendan Hartman |

| FUND PERFORMANCE |

| Royce Capital Fund–Micro Cap Portfolio increased 10.3% for the year-to-date period ended June 30, 2018, ahead of the small-cap Russell 2000 Index, which was up 7.7%, but narrowly behind its benchmark, the Russell Microcap Index, which increased 10.7% for the same period. Micro-cap stocks were the top-performing U.S. asset class in the first half of the year, as the greater reliance on U.S. growth left small- and micro-cap stocks better positioned for superior performance relative to large-caps in the first half of the year. |

| WHAT WORKED... AND WHAT DIDN’T |

| The Fund boasted strong sector contributions from Information Technology, Health Care, and Consumer Discretionary, while two healthcare companies made strong positive impacts at the position level. Tactile Systems, which makes medical devices used to treat lymphedema, grew its sales force and introduced new products, such as its new system targeted at head and neck lymphedema. Seeing low market penetration and a favorable competitive environment, we continued to hold shares after making modest trims as its stock price rose. Medical device company Surmodics, which specializes in coronary stents and catheters, was another notable pick for the portfolio. A recent agreement gave Abbot Laboratories exclusive global commercialization rights for the company’s SurVeil drug. We saw an extended pipeline of interesting products and therefore maintained our position in the company’s shares. |

| We reduced our stake in Profire Energy, an oilfield technology specialist in burner management systems that was the portfolio’s top contributor overall. It benefited from the resurgence in oil field activity fueled by higher oil prices. We held our stock in Attunity, a leading provider of data management software, because we saw an increased adoption of its core software platform across an ever increasing number of enterprises. The company’s software addresses new paradigms in data management, which we believed were in the very early stages of adoption. Stoneridge, which supplies electrical components to cars and trucks, was winning new business across several product lines, such as its MirrorEye camera system that offers safety and fuel economy benefits by replacing side mirrors on trucks. We sold a portion of our shares as its share price rose steadily. We also saw positive contributions to return on these positions in relation to the Russell Microcap. |

| Thanks to effective stock selection, Consumer Discretionary and Information Technology were the areas that contributed most to performance versus the benchmark, while Energy and Financials were the largest detractors—both due to poor stock picking. One position significantly detracted from performance on both an absolute and relative basis: Basic Energy Services, a leading provider of well site services in the oil and gas industry, saw increased pricing pressure as well as project delays in certain markets. We increased our stake slightly within the first six months of the year based on the belief that these pressures were transitory given ongoing strength in underlying energy prices. Gulf Island Fabrication makes specialized structures and marine vessels used in the energy sector. Its shares have been pressured as its off-shore oil well platform business remained sluggish while it also experienced cost overruns on a major marine vessel contract. |

| Atlas Financial, which provides insurance for taxis, limos, ride share services, and paratransit transportation firms, was another impactful detractor on an absolute and relative basis. For a second year in a row, Atlas recorded a surprise fourth-quarter loss due to an increase in loss reserves for prior year accidents. Our belief that the first surprise loss was an anomaly and that the company’s market niche could provide high returns on equity was proven incorrect. We sold all of our shares as a result. Shares of Paratek Pharmaceuticals fell due to concerns over incremental FDA approval scrutiny, the potential for a slow commercial ramp up, and a capital raise in April. We increased our position in the first half because of the large market opportunity for a new antibiotic associated with the increased human resistance to older varieties. We chose to trim our position in U.S. Concrete, which saw its shares pressured as poor weather impacted certain large markets and the company had some early execution shortfalls digesting a large acquisition. |

| Top Contributors to Performance | ||||

| Year-to-Date Through 6/30/18 (%)1 | ||||

| Profire Energy | 0.60 | |||

| Tactile Systems Technology | 0.58 | |||

| Surmodics | 0.58 | |||

| Attunity | 0.54 | |||

| Stoneridge | 0.49 | |||

| 1 Includes dividends | ||||

| Top Detractors from Performance | ||||

| Year-to-Date Through 6/30/18 (%)2 | ||||

| Atlas Financial Holdings | -0.46 | |||

| Basic Energy Services | -0.40 | |||

| U.S. Concrete | -0.29 | |||

| Paratek Pharmaceuticals | -0.27 | |||

| Gulf Island Fabrication | -0.24 | |||

| 2 Net of dividends | ||||

| CURRENT POSITIONING AND OUTLOOK |

| We did not make any major changes to portfolio positioning in the first half of 2018. Despite the increasing uncertainty around trade, we remained generally constructive on the U.S. economy, which supported underlying growth and valuations in our overweight sectors, such as Information Technology, Industrials, and Consumer Discretionary. These sectors were also our largest overweights relative to the Russell Microcap. Health Care, particularly biotechnology, continued to be among our largest underweights by nearly 50%. We remained optimistic about micro-cap stocks in anticipation of an increasingly less restrictive regulatory environment. Considering the accelerated pace of U.S. economic growth, lower corporate tax rates, and the slower pace of global economic growth, we were particularly focused on micro-cap companies that had a disproportionate exposure to the U.S. economy. |

| 6 | Royce Capital Fund 2018 Semiannual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | TICKER SYMBOLS RCMCX RCMSX |

| Performance and Expenses | ||||||||||||||||

| Average Annual Total Return (%) Through 6/30/18 | ||||||||||||||||

| JAN-JUN 20181 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | SINCE INCEPTION (12/27/96) | |||||||||

| RCM | 10.31 | 14.08 | 7.11 | 6.55 | 5.34 | 8.04 | 9.63 | 10.21 | ||||||||

| Annual Gross Operating Expenses: 1.47% Annual Net Operating Expenses: 1.42% | ||||||||||||||||

| 1 Not annualized | ||||||||||||||||

Relative Returns: Monthly Rolling Average Annual Return Periods

| On a monthly rolling basis, the Fund outperformed the Russell Microcap in 57% of all 10-year periods; 58% of all 5-year periods; and 48% of all 1-year periods. |

| PERIODS BEATING THE INDEX | FUND AVG (%)1 | INDEX AVG (%)1 | ||||||||||

| 10-year | 55/97 | 57% | 6.8 | 6.4 | ||||||||

| 5-year | 91/157 | 58% | 7.7 | 8.3 | ||||||||

| 1-year | 99/205 | 48% | 10.4 | 10.8 | ||||||||

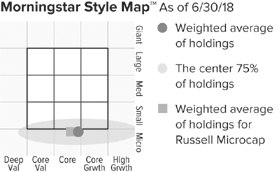

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund's ownership zone may vary. See page 27 for additional information. |

Value of $10,000

as of 6/30/18 ($)

Includes reinvestment of distributions.

| Top 10 Positions | ||

| % of Net Assets | ||

| AtriCure | 1.2 | |

| Attunity | 1.1 | |

| Stoneridge | 1.1 | |

| Shoe Carnival | 1.1 | |

| Surmodics | 1.1 | |

| CryoLife | 1.1 | |

| PC Connection | 1.0 | |

| Red Lion Hotels | 1.0 | |

| QAD Cl. A | 1.0 | |

| Vishay Precision Group | 1.0 | |

| Portfolio Sector Breakdown | ||

| % of Net Assets | ||

| Information Technology | 19.6 | |

| Industrials | 19.2 | |

| Financials | 15.2 | |

| Consumer Discretionary | 14.3 | |

| Health Care | 11.4 | |

| Energy | 6.3 | |

| Materials | 4.5 | |

| Consumer Staples | 2.4 | |

| Real Estate | 2.4 | |

| Telecommunication Services | 0.6 | |

| Cash and Cash Equivalents | 4.1 | |

| Calendar Year Total Returns (%) | ||

| YEAR | RCM | |

| 2017 | 5.2 | |

| 2016 | 19.7 | |

| 2015 | -12.5 | |

| 2014 | -3.6 | |

| 2013 | 21.0 | |

| 2012 | 7.6 | |

| 2011 | -12.1 | |

| 2010 | 30.1 | |

| 2009 | 57.9 | |

| 2008 | -43.3 | |

| 2007 | 4.0 | |

| 2006 | 21.1 | |

| 2005 | 11.6 | |

| 2004 | 13.8 | |

| 2003 | 49.2 | |

| Upside/Downside Capture Ratios | ||||

| Periods Ended 6/30/18 (%) | ||||

| UPSIDE | DOWNSIDE | |||

| 10-Year | 76 | 99 | ||

| From 6/30/00 (Russell Microcap Inception) | 88 | 77 | ||

| Portfolio Diagnostics | ||

| Fund Net Assets | $195 million | |

| Number of Holdings | 145 | |

| Turnover Rate | 14% | |

| Average Market Capitalization1 | $485 million | |

| Weighted Average P/E Ratio2,3 | 23.6x | |

| Weighted Average P/B Ratio2 | 2.1x | |

| Active Share4 | 90% | |

| U.S. Investments (% of Net Assets) | 84.2% | |

| Non-U.S. Investments (% of Net Assets) | 11.7% | |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (27% of portfolio holdings as of 6/30/18). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCM’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Certain immaterial adjustments were made to the net assets of Royce Capital Fund-Micro-Cap Portfolio at 12/31/17 for financial reporting purposes, and as a result the calendar year total returns based on those net assets values differ from the adjusted net values and calendar year total returns reported in the Financial Highlights. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Gross operating expenses reflect the Fund’s total gross operating expenses for the Investment Class and include management fees, other expenses, and acquired fund fees and expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.33% through April 30, 2019. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2018. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark (Russell Microcap). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters. |

| Royce Capital Fund 2018 Semiannual Report to Shareholders | 7 |

Schedule of Investments

| Royce Capital Fund - Micro-Cap Portfolio | |||||||

| Common Stocks – 95.9% | |||||||

| SHARES | VALUE | ||||||

| CONSUMER DISCRETIONARY – 14.3% | |||||||

| AUTO COMPONENTS - 3.4% | |||||||

Fox Factory Holding 1 | 33,800 | $ | 1,573,390 | ||||

Standard Motor Products | 31,100 | 1,503,374 | |||||

Stoneridge 1 | 62,100 | 2,182,194 | |||||

Unique Fabricating | 153,300 | 1,339,842 | |||||

| 6,598,800 | |||||||

| HOTELS, RESTAURANTS & LEISURE - 1.9% | |||||||

Del Taco Restaurants 1 | 121,400 | 1,721,452 | |||||

| 13,400 | 177,550 | ||||||

Red Lion Hotels 1 | 161,800 | 1,884,970 | |||||

| 3,783,972 | |||||||

| HOUSEHOLD DURABLES - 1.1% | |||||||

Cavco Industries 1 | 6,404 | 1,329,791 | |||||

| 39,000 | 809,250 | ||||||

| 2,139,041 | |||||||

| INTERNET & DIRECT MARKETING RETAIL - 0.7% | |||||||

Gaia Cl. A 1 | 62,100 | 1,257,525 | |||||

| LEISURE PRODUCTS - 1.7% | |||||||

MCBC Holdings 1 | 59,117 | 1,711,437 | |||||

Nautilus 1 | 106,900 | 1,678,330 | |||||

| 3,389,767 | |||||||

| SPECIALTY RETAIL - 4.2% | |||||||

Build-A-Bear Workshop 1 | 132,500 | 1,007,000 | |||||

Citi Trends | 55,886 | 1,533,512 | |||||

Francesca’s Holdings 1 | 101,400 | 765,570 | |||||

Haverty Furniture | 66,300 | 1,432,080 | |||||

Kirkland’s 1 | 103,000 | 1,198,920 | |||||

Shoe Carnival | 66,700 | 2,164,415 | |||||

| 8,101,497 | |||||||

| TEXTILES, APPAREL & LUXURY GOODS - 1.3% | |||||||

Culp | 30,649 | 752,433 | |||||

Vera Bradley 1 | 129,300 | 1,815,372 | |||||

| 2,567,805 | |||||||

| Total (Cost $19,207,817) | 27,838,407 | ||||||

| CONSUMER STAPLES – 2.4% | |||||||

| BEVERAGES - 0.9% | |||||||

Primo Water 1 | 100,500 | 1,757,745 | |||||

| FOOD PRODUCTS - 1.5% | |||||||

Farmer Bros. 1 | 47,800 | 1,460,290 | |||||

John B. Sanfilippo & Son | 20,900 | 1,556,005 | |||||

| 3,016,295 | |||||||

| Total (Cost $3,811,088) | 4,774,040 | ||||||

| ENERGY – 6.3% | |||||||

| ENERGY EQUIPMENT & SERVICES - 4.9% | |||||||

Basic Energy Services 1 | 72,000 | 799,920 | |||||

Computer Modelling Group | 133,400 | 1,024,866 | |||||

Gulf Island Fabrication | 92,634 | 833,706 | |||||

Independence Contract Drilling 1 | 316,500 | 1,303,980 | |||||

Natural Gas Services Group 1 | 60,800 | 1,434,880 | |||||

Newpark Resources 1 | 158,400 | 1,718,640 | |||||

Profire Energy 1 | 423,729 | 1,432,204 | |||||

Total Energy Services | 123,500 | 1,091,598 | |||||

| 9,639,794 | |||||||

| OIL, GAS & CONSUMABLE FUELS - 1.4% | |||||||

Ardmore Shipping 1 | 205,800 | 1,687,560 | |||||

Panhandle Oil and Gas Cl. A | 53,800 | 1,027,580 | |||||

| 2,715,140 | |||||||

| Total (Cost $11,425,618) | 12,354,934 | ||||||

| FINANCIALS – 15.2% | |||||||

| BANKS - 6.5% | |||||||

Allegiance Bancshares 1 | 31,200 | 1,352,520 | |||||

| 8,782 | 217,354 | ||||||

Blue Hills Bancorp | 76,400 | 1,696,080 | |||||

Brookline Bancorp | 64,200 | 1,194,120 | |||||

Caribbean Investment Holdings 1 | 1,751,547 | 404,531 | |||||

County Bancorp | 50,200 | 1,380,500 | |||||

HarborOne Bancorp 1 | 77,200 | 1,462,168 | |||||

| 7,500 | 211,125 | ||||||

†Investar Holding | 27,500 | 760,375 | |||||

| 1,751,577 | 0 | ||||||

Stewardship Financial | 92,000 | 1,071,800 | |||||

TriState Capital Holdings 1 | 56,072 | 1,463,479 | |||||

Two River Bancorp | 72,400 | 1,385,012 | |||||

| 12,599,064 | |||||||

| CAPITAL MARKETS - 4.4% | |||||||

B. Riley Financial | 57,800 | 1,303,390 | |||||

Canaccord Genuity Group | 291,800 | 1,611,431 | |||||

GAIN Capital Holdings | 141,600 | 1,069,080 | |||||

Gluskin Sheff + Associates | 117,300 | 1,465,079 | |||||

Silvercrest Asset Management Group Cl. A | 103,900 | 1,693,570 | |||||

Westwood Holdings Group | 25,727 | 1,531,786 | |||||

| 8,674,336 | |||||||

| DIVERSIFIED FINANCIAL SERVICES - 0.2% | |||||||

| 1,302,000 | 390,600 | ||||||

| INSURANCE - 1.0% | |||||||

Blue Capital Reinsurance Holdings | 75,292 | 831,977 | |||||

| 34,900 | 1,129,015 | ||||||

| 1,960,992 | |||||||

| THRIFTS & MORTGAGE FINANCE - 3.1% | |||||||

Federal Agricultural Mortgage | 17,700 | 1,583,796 | |||||

PCSB Financial | 70,400 | 1,398,848 | |||||

Territorial Bancorp | 45,900 | 1,422,900 | |||||

Western New England Bancorp | 139,954 | 1,539,494 | |||||

| 5,945,038 | |||||||

| Total (Cost $26,988,927) | 29,570,030 | ||||||

| HEALTH CARE – 11.4% | |||||||

| BIOTECHNOLOGY - 2.1% | |||||||

BioSpecifics Technologies 1 | 31,500 | 1,413,090 | |||||

Progenics Pharmaceuticals 1 | 173,800 | 1,397,352 | |||||

Zealand Pharma 1 | 92,658 | 1,219,958 | |||||

| 4,030,400 | |||||||

| HEALTH CARE EQUIPMENT & SUPPLIES - 5.6% | |||||||

AtriCure 1 | 84,600 | 2,288,430 | |||||

| 132,900 | 1,475,190 | ||||||

CryoLife 1 | 74,889 | 2,085,659 | |||||

OrthoPediatrics Corporation 1 | 41,200 | 1,097,568 | |||||

Surmodics 1 | 38,078 | 2,101,905 | |||||

| 34,800 | 1,809,600 | ||||||

| 10,858,352 | |||||||

| LIFE SCIENCES TOOLS & SERVICES - 2.0% | |||||||

Harvard Bioscience 1 | 321,568 | 1,720,389 | |||||

| 8 | Royce Capital Fund 2018 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| June 30, 2018 (unaudited) |

| Royce Capital Fund - Micro-Cap Portfolio (continued) | |||||||

| SHARES | VALUE | ||||||

| HEALTH CARE (continued) | |||||||

| LIFE SCIENCES TOOLS & SERVICES (continued) | |||||||

NeoGenomics 1 | 99,400 | $ | 1,303,134 | ||||

| 67,800 | 973,608 | ||||||

| 3,997,131 | |||||||

| PHARMACEUTICALS - 1.7% | |||||||

BioDelivery Sciences International 1 | 411,700 | 1,214,515 | |||||

| 134,400 | 1,076,544 | ||||||

Paratek Pharmaceuticals 1 | 78,600 | 801,720 | |||||

| 246,900 | 0 | ||||||

| 75,800 | 270,606 | ||||||

| 3,363,385 | |||||||

| Total (Cost $14,554,300) | 22,249,268 | ||||||

| INDUSTRIALS – 19.2% | |||||||

| AEROSPACE & DEFENSE - 1.5% | |||||||

Astronics Corporation 1 | 28,545 | 1,026,764 | |||||

CPI Aerostructures 1 | 174,344 | 1,830,612 | |||||

| 2,857,376 | |||||||

| COMMERCIAL SERVICES & SUPPLIES - 1.7% | |||||||

Acme United | 45,065 | 935,099 | |||||

Heritage-Crystal Clean 1 | 48,834 | 981,563 | |||||

Viad Corporation | 24,100 | 1,307,425 | |||||

| 3,224,087 | |||||||

| CONSTRUCTION & ENGINEERING - 1.2% | |||||||

| 50,000 | 658,500 | ||||||

Northwest Pipe 1 | 86,700 | 1,679,379 | |||||

| 2,337,879 | |||||||

| ELECTRICAL EQUIPMENT - 1.3% | |||||||

| 169,500 | 1,186,500 | ||||||

Encore Wire | 30,100 | 1,428,245 | |||||

| 2,614,745 | |||||||

| INDUSTRIAL CONGLOMERATES - 0.6% | |||||||

Raven Industries | 32,900 | 1,265,005 | |||||

| MACHINERY - 7.8% | |||||||

Alimak Group | 84,600 | 1,295,908 | |||||

Exco Technologies | 156,700 | 1,059,645 | |||||

FreightCar America 1 | 79,691 | 1,338,012 | |||||

Global Brass and Copper Holdings | 39,900 | 1,250,865 | |||||

Graham Corporation | 67,020 | 1,729,786 | |||||

Greenbrier Companies (The) | 21,600 | 1,139,400 | |||||

Kadant | 16,331 | 1,570,226 | |||||

| 97,600 | 1,737,280 | ||||||

Lindsay Corporation | 16,700 | 1,619,733 | |||||

Lydall 1 | 33,300 | 1,453,545 | |||||

Sun Hydraulics | 21,100 | 1,016,809 | |||||

| 15,211,209 | |||||||

| MARINE - 0.6% | |||||||

Clarkson | 38,100 | 1,156,497 | |||||

| PROFESSIONAL SERVICES - 3.7% | |||||||

CRA International | 23,006 | 1,170,775 | |||||

GP Strategies 1 | 72,908 | 1,283,181 | |||||

Heidrick & Struggles International | 34,800 | 1,218,000 | |||||

Kforce | 51,800 | 1,776,740 | |||||

Resources Connection | 103,954 | 1,756,823 | |||||

| 7,205,519 | |||||||

| ROAD & RAIL - 0.8% | |||||||

Marten Transport | 66,341 | 1,555,696 | |||||

| Total (Cost $24,880,905) | 37,428,013 | ||||||

| INFORMATION TECHNOLOGY – 19.6% | |||||||

| COMMUNICATIONS EQUIPMENT - 1.0% | |||||||

Digi International 1 | 91,500 | 1,207,800 | |||||

EMCORE Corporation 1 | 134,300 | 678,215 | |||||

| 1,886,015 | |||||||

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 6.5% | |||||||

| 63,500 | 583,565 | ||||||

CUI Global 1 | 298,762 | 887,323 | |||||

| 48,400 | 763,268 | ||||||

ePlus 1 | 14,692 | 1,382,517 | |||||

Fabrinet 1 | 45,569 | 1,681,041 | |||||

Mesa Laboratories | 8,600 | 1,815,288 | |||||

| 14,800 | 489,288 | ||||||

Novanta 1 | 21,400 | 1,333,220 | |||||

PC Connection | 56,900 | 1,889,080 | |||||

Vishay Precision Group 1 | 48,700 | 1,857,905 | |||||

| 12,682,495 | |||||||

| INTERNET SOFTWARE & SERVICES - 1.5% | |||||||

Amber Road 1 | 153,900 | 1,448,199 | |||||

QuinStreet 1 | 122,500 | 1,555,750 | |||||

| 3,003,949 | |||||||

| IT SERVICES - 1.4% | |||||||

Cass Information Systems | 23,540 | 1,620,023 | |||||

Computer Task Group 1 | 137,342 | 1,063,027 | |||||

| 2,683,050 | |||||||

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 5.3% | |||||||

Brooks Automation | 41,000 | 1,337,420 | |||||

| 92,500 | 825,100 | ||||||

NeoPhotonics Corporation 1 | 218,600 | 1,361,878 | |||||

| 46,300 | 1,261,675 | ||||||

Photronics 1 | 185,500 | 1,479,362 | |||||

Rudolph Technologies 1 | 43,093 | 1,275,553 | |||||

Silicon Motion Technology ADR | 26,900 | 1,422,741 | |||||

Ultra Clean Holdings 1 | 81,000 | 1,344,600 | |||||

| 10,308,329 | |||||||

| SOFTWARE - 3.0% | |||||||

Agilysys 1 | 45,200 | 700,600 | |||||

Attunity 1 | 188,100 | 2,183,841 | |||||

QAD Cl. A | 37,100 | 1,860,565 | |||||

SeaChange International 1 | 312,900 | 1,070,118 | |||||

| 5,815,124 | |||||||

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 0.9% | |||||||

†AstroNova | 29,400 | 554,190 | |||||

Super Micro Computer 1 | 53,611 | 1,267,900 | |||||

| 1,822,090 | |||||||

| Total (Cost $28,288,657) | 38,201,052 | ||||||

| MATERIALS – 4.5% | |||||||

| CHEMICALS - 1.9% | |||||||

FutureFuel Corporation | 62,400 | 874,224 | |||||

Quaker Chemical | 7,588 | 1,175,154 | |||||

Trecora Resources 1 | 116,100 | 1,724,085 | |||||

| 3,773,463 | |||||||

| CONSTRUCTION MATERIALS - 0.5% | |||||||

U.S. Concrete 1 | 16,600 | 871,500 | |||||

| METALS & MINING - 2.1% | |||||||

Haynes International | 41,970 | 1,541,978 | |||||

Major Drilling Group International 1 | 240,900 | 1,271,704 | |||||

Schnitzer Steel Industries Cl. A | 37,500 | 1,263,750 | |||||

| 4,077,432 | |||||||

| Total (Cost $6,791,092) | 8,722,395 | ||||||

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2018 Semiannual Report to Shareholders | 9 |

| Schedule of Investments | June 30, 2018 (unaudited) |

| Royce Capital Fund - Micro-Cap Portfolio (continued) | |||||||

| SHARES | VALUE | ||||||

| REAL ESTATE – 2.4% | |||||||

| EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) - 0.8% | |||||||

Community Healthcare Trust | 53,100 | $ | 1,586,097 | ||||

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.6% | |||||||

FRP Holdings 1 | 23,440 | 1,517,740 | |||||

Marcus & Millichap 1 | 41,600 | 1,622,816 | |||||

| 3,140,556 | |||||||

| Total (Cost $2,956,700) | 4,726,653 | ||||||

| TELECOMMUNICATION SERVICES – 0.6% | |||||||

| DIVERSIFIED TELECOMMUNICATION SERVICES - 0.6% | |||||||

ORBCOMM 1 | 117,500 | 1,186,750 | |||||

| Total (Cost $736,738) | 1,186,750 | ||||||

| TOTAL COMMON STOCKS | |||||||

| (Cost $139,641,842) | 187,051,542 | ||||||

| REPURCHASE AGREEMENT – 4.3% | |||||||

| Fixed Income Clearing Corporation, 0.35% dated 6/29/18, due 7/2/18, maturity value $8,427,246 (collateralized by obligations of various U.S. Government Agencies, 1.375% due 10/07/21, valued at $8,599,601) | |||||||

| (Cost $8,427,000) | 8,427,000 | ||||||

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 1.4% | |||||||

| Money Market Funds | |||||||

Federated Government Obligations Fund (7 day yield-1.7400%) | |||||||

| (Cost $2,783,561) | 2,783,561 | ||||||

| TOTAL INVESTMENTS – 101.6% | |||||||

| (Cost $150,852,403) | 198,262,103 | ||||||

| LIABILITIES LESS CASH AND OTHER ASSETS – (1.6)% | (3,205,195 | ) | |||||

| NET ASSETS – 100.0% | $ | 195,056,908 | |||||

| † | New additions in 2018. | |

| 1 | Non-income producing. | |

| 2 | All or a portion of these securities were on loan at June 30, 2018. | |

| 3 | Securities for which market quotations are not readily available represent 0.2% of net assets. These securities have been valued at their fair value under procedures approved by the Fund’s Board of Trustees. These securities are defined as Level 3 securities due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. | |

| Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2018, market value. | ||

| 10 | Royce Capital Fund 2018 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| This page is intentionally left blank. |

| Royce Capital Fund 2018 Semiannual Report to Shareholders | 11 |

| MANAGER’S DISCUSSION |

| Royce Capital Fund–Small-Cap Portfolio (RCS) |

|

| Jay Kaplan, CFA |

| FUND PERFORMANCE |

| Royce Capital Fund–Small-Cap Portfolio rose 7.1% for the year-to-date period ended June 30, 2018, trailing its small-cap benchmark, the Russell 2000 Index, which was up 7.7% for the same period. The Fund narrowly outpaced the small-cap index, however, for the one-year period ended June 30, 2018, up 17.7% versus 17.6%. |

| WHAT WORKED... AND WHAT DIDN’T |

| Information Technology and Consumer Discretionary were the top-contributing sectors by a wide margin, while Utilities, where we typically have very little exposure, detracted modestly. The portfolio’s two leading industry groups—electronic equipment, instruments & components and specialty retail—came from its two top-contributing sectors. The airlines group detracted most at the industry level, followed by commercial services & supplies—both groups are in the Industrials sector. |

| Three of the portfolio’s top five positive contributors came from the electronic instruments & components industry. Two more top-10 holdings from this same group—Vishay Intertechnology, which makes semiconductor and passive component equipment, and Celestica, a contract manufacturer that offers manufacturing, hardware platform, and supply chain solutions—were also strong performers. Another contract manufacturer, Fabrinet, specializes mostly in optical components. Its shares tend to be highly volatile, so we always try to trade effectively around its occasionally extreme moves. The company’s recent growth has been strong, spurred by the ongoing adoption of cloud storage solutions, which require optical components. Insight Enterprises and PC Connection are value-add distributors that provide a wide range of IT products and solutions. Global demand has been on the rise, which has kept revenues and earnings for both companies healthy. |

| Moving from tech to transportation, the portfolio also saw a strong contribution from Stoneridge, a manufacturer of highly engineered electrical and electronic components, modules, and systems for the commercial vehicle, automotive, and agricultural vehicle markets. New management, which joined the firm a few years ago, has rolled out new products, including MirrorEye, a camera monitor system that replaces the rear- and side-view mirrors on trucks. In May, the company reported increased 2018 guidance for sales and adjusted earnings per share while also reaffirming previous margin estimates. All of this combined to keep its shares rolling. |

| Asset management business Federated Investors detracted most at the position level, as outflows from a large equity mutual fund combined with increased competition in money market funds to keep investors selling. We chose to hold our shares in the expectation that the firm will be able to rebound. We built our position in low-cost carrier Spirit Airlines, one of three holdings in the airline industry that disappointed in the first half. Spirit saw weakness in fares, to which its stock has historically been vulnerable, through much of 2018’s first six months. We like its profitability and long-term prospects and were encouraged by a recent reversal in the direction of fares. Thor Industries is another long-time Royce favorite and a leading manufacturer of RVs (recreational vehicles) that has emerged as an innovative industry leader over the last several years. The firm announced record fiscal second-quarter sales in March, but also reported higher raw material and commodity costs. Along with concerns that its industry may have hit a sales peak, this was enough to drive investors away. Ever contrarian, we chose to hold our position. First-half performance versus the benchmark suffered most from sector allocation—stock selection was a strength against the Russell 2000. The portfolio’s much lower weighting in Health Care, the top performer in the benchmark, hurt most, while our greater exposure to Industrials also detracted, largely due to our overweight in airlines, where, in addition to Spirit, Allegiant Travel and Hawaiian Holdings also disappointed. Stock picking in Financials also had a negative impact. Stock selection strength could be seen in a number of sectors, with the largest positive impact coming from holdings in Consumer Discretionary, with notable outperformance in the auto components and specialty retail industries. Holdings in Consumer Staples and Real Estate also contributed positively to relative results in the first half, with our lower weighting in the latter sector also helping. |

| Top Contributors to Performance | ||||

| Year-to-Date Through 6/30/18 (%)1 | ||||

| Fabrinet | 0.74 | |||

| Stoneridge | 0.73 | |||

| Insight Enterprises | 0.63 | |||

| PC Connection | 0.62 | |||

| Village Super Market Cl. A | 0.59 | |||

| 1 Includes dividends | ||||

| Top Detractors from Performance | ||||

| Year-to-Date Through 6/30/18 (%)2 | ||||

| Federated Investors Cl. B | -0.75 | |||

| Spirit Airlines | -0.39 | |||

| Thor Industries | -0.31 | |||

| Wabash National | -0.29 | |||

| Electro Scientific Industries | -0.26 | |||

| 2 Net of dividends | ||||

| CURRENT POSITIONING AND OUTLOOK |

| As interest rates continue to rise—and rise more consistently—valuations become more and more important. Most looked high to us at the end of June, especially with current and imminent challenges, some of which investors may be overlooking. In addition to a flattened yield curve and trade war noise, we have a more challenging climate for earnings growth now that the tax cuts have been reflected and a lack of quality in earnings can be discerned in many cases throughout the small-cap market. The approaching mid-term elections could generate a great deal of noise—and market volatility—all on their own. So while in general, we see more that is worth selling than buying, we have also seen pockets of value within technology in semiconductor and capital equipment makers, distributors, and contract manufacturers, as well as in banks. Moreover, with the expectation of increased volatility, we see a reasonable environment for our contrarian value approach taking shape. |

| 12 | Royce Capital Fund 2018 Semiannual Report to Shareholders |

| PERFORMANCE AND PORTFOLIO REVIEW | TICKER SYMBOLS RCPFX RCSSX |

| Performance and Expenses | ||||||||||||||||

| Average Annual Total Return (%) Through 6/30/18 | ||||||||||||||||

| JAN-JUN 20181 | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | SINCE INCEPTION (12/27/96) | |||||||||

| RCS | 7.06 | 17.72 | 6.48 | 8.29 | 7.81 | 10.00 | 10.13 | 10.80 | ||||||||

| Annual Gross Operating Expenses: 1.11% Annual Net Operating Expenses: 1.08% | ||||||||||||||||

| 1 Not annualized | ||||||||||||||||

Relative Returns: Monthly Rolling Average Annual Return Periods

| On a monthly rolling basis, the Fund outperformed the Russell 2000 in 69% of all 10-year periods; 64% of all 5-year periods; and 49% of all 1-year periods. |

| PERIODS BEATING THE INDEX | FUND AVG (%)1 | INDEX AVG (%)1 | ||||||||||

| 10-year | 83/121 | 69% | 8.9 | 6.9 | ||||||||

| 5-year | 116/181 | 64% | 10.5 | 8.7 | ||||||||

| 1-year | 112/229 | 49% | 12.1 | 10.4 | ||||||||

The Morningstar Style Map is the Morningstar Style BoxTM with the center 75% of fund holdings plotted as the Morningstar Ownership ZoneTM. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund’s ownership zone may vary. See page 27 for additional information. |

Value of $10,000

Includes reinvestment of distributions.

| Top 10 Positions | ||

| % of Net Assets | ||

| PC Connection | 2.5 | |

| Insight Enterprises | 2.5 | |

| Kulicke & Soffa Industries | 2.5 | |

| Genworth MI Canada | 2.4 | |

| Village Super Market Cl. A | 2.3 | |

| Spirit Airlines | 2.3 | |

| Vishay Intertechnology | 2.2 | |

| Celestica | 2.2 | |

| Fabrinet | 2.0 | |

| Hawaiian Holdings | 2.0 | |

| Portfolio Sector Breakdown | ||

| % of Net Assets | ||

| Information Technology | 25.6 | |

| Industrials | 22.3 | |

| Financials | 21.3 | |

| Consumer Discretionary | 14.1 | |

| Consumer Staples | 2.3 | |

| Energy | 2.1 | |

| Real Estate | 1.5 | |

| Health Care | 1.4 | |

| Utilities | 0.4 | |

| Cash and Cash Equivalents | 9.0 | |

| Calendar Year Total Returns (%) | ||

| YEAR | RCS | |

| 2017 | 5.4 | |

| 2016 | 21.0 | |

| 2015 | -11.8 | |

| 2014 | 3.2 | |

| 2013 | 34.8 | |

| 2012 | 12.5 | |

| 2011 | -3.3 | |

| 2010 | 20.5 | |

| 2009 | 35.2 | |

| 2008 | -27.2 | |

| 2007 | -2.1 | |

| 2006 | 15.6 | |

| 2005 | 8.6 | |

| 2004 | 25.0 | |

| 2003 | 41.1 | |

| Upside/Downside Capture Ratios | ||||

| Periods Ended 6/30/18 (%) | ||||

| UPSIDE | DOWNSIDE | |||

| 10-Year | 77 | 82 | ||

| From 12/31/96 (Start of Fund’s First Full Quarter) | 94 | 76 | ||

| Portfolio Diagnostics | ||

| Fund Net Assets | $478 million | |

| Number of Holdings | 79 | |

| Turnover Rate | 23% | |

| Average Market Capitalization1 | $1,295 million | |

| Weighted Average P/E Ratio2,3 | 15.2x | |

| Weighted Average P/B Ratio2 | 2.0x | |

| Active Share4 | 96% | |

| U.S. Investments (% of Net Assets) | 79.4% | |

| Non-U.S. Investments (% of Net Assets) | 11.6% | |

| 1 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 2 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 3 | The Fund’s P/E ratio calculation excludes companies with zero or negative earnings (6% of portfolio holdings as of 6/30/18). |

| 4 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

| Important Performance and Expense Information All performance information in this Report reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current performance may be higher or lower than performance quoted. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Returns as of the most recent month-end may be obtained at www.roycefunds.com. All performance and risk information reflects the result of the Investment Class (its oldest class). Shares of RCS’s Service Class bear an annual distribution expense that is not borne by the Investment Class; if those expenses were reflected, total returns would have been lower. Certain immaterial adjustments were made to the net assets of Royce Capital Fund-Small-Cap Portfolio at 12/31/17 for financial reporting purposes, and as a result the calendar year total returns based on those net assets values differ from the adjusted net values and calendar year total returns reported in the Financial Highlights. All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. The Fund’s total returns do not reflect any deduction for charges or expenses of the variable contracts investing in the Fund. Gross operating expenses reflect the Fund’s total gross operating expenses for the Investment Class and include management fees and other expenses. Net operating expenses reflect contractual fee waivers and/or expense reimbursements. All expense information is reported as of the Fund’s most current prospectus. Royce & Associates has contractually agreed, without right of termination, to waive fees and/or reimburse expenses to the extent necessary to maintain the Investment Class’s net annual operating expenses (excluding brokerage commissions, taxes, interest, litigation expenses, acquired fund fees and expenses, and other expenses not borne in the ordinary course of business) at or below 1.08% through April 30, 2019. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2018. Upside Capture Ratio measures a manager’s performance in up markets relative to the Fund’s benchmark. It is calculated by measuring the Fund’s performance in quarters when the benchmark went up and dividing it by the benchmark’s return in those quarters. Downside Capture Ratio measures a manager’s performance in down markets relative to the Fund’s benchmark (Russell 2000). It is calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters. |

| Royce Capital Fund 2018 Semiannual Report to Shareholders | 13 |

| Schedule of Investments |

| Royce Capital Fund - Small-Cap Portfolio | |||||||

| Common Stocks – 91.0% | |||||||

| SHARES | VALUE | ||||||

| CONSUMER DISCRETIONARY – 14.1% | |||||||

| AUTO COMPONENTS - 2.5% | |||||||

Gentex Corporation | 289,616 | $ | 6,666,960 | ||||

Stoneridge 1 | 143,161 | 5,030,678 | |||||

| 11,697,638 | |||||||

| AUTOMOBILES - 0.5% | |||||||

Thor Industries | 26,600 | 2,590,574 | |||||

| HOTELS, RESTAURANTS & LEISURE - 0.5% | |||||||

Cheesecake Factory | 41,415 | 2,280,310 | |||||

| HOUSEHOLD DURABLES - 2.7% | |||||||

Bassett Furniture Industries | 58,122 | 1,601,261 | |||||

Flexsteel Industries | 105,743 | 4,219,146 | |||||

La-Z-Boy | 231,786 | 7,092,651 | |||||

| 12,913,058 | |||||||

| INTERNET & DIRECT MARKETING RETAIL - 1.1% | |||||||

†Nutrisystem | 139,900 | 5,386,150 | |||||

| MEDIA - 1.5% | |||||||

Saga Communications Cl. A | 191,107 | 7,357,620 | |||||

| SPECIALTY RETAIL - 4.3% | |||||||

American Eagle Outfitters | 286,765 | 6,667,286 | |||||

DSW Cl. A | 273,593 | 7,064,171 | |||||

Shoe Carnival | 206,346 | 6,695,928 | |||||

| 20,427,385 | |||||||

| TEXTILES, APPAREL & LUXURY GOODS - 1.0% | |||||||

Steven Madden | 89,071 | 4,729,670 | |||||

| Total (Cost $51,876,364) | 67,382,405 | ||||||

| CONSUMER STAPLES – 2.3% | |||||||

| FOOD & STAPLES RETAILING - 2.3% | |||||||

Village Super Market Cl. A | 369,177 | 10,875,955 | |||||

| Total (Cost $10,540,057) | 10,875,955 | ||||||

| ENERGY – 2.1% | |||||||

| ENERGY EQUIPMENT & SERVICES - 2.1% | |||||||

Helmerich & Payne | 82,700 | 5,272,952 | |||||

Unit Corporation 1 | 183,013 | 4,677,812 | |||||

| Total (Cost $7,325,817) | 9,950,764 | ||||||

| FINANCIALS – 21.3% | |||||||

| BANKS - 10.0% | |||||||

Ames National | 148,534 | 4,582,274 | |||||

†Bar Harbor Bankshares | 90,658 | 2,746,031 | |||||

Camden National | 153,882 | 7,033,946 | |||||

City Holding Company | 65,567 | 4,932,605 | |||||

CNB Financial | 186,126 | 5,594,948 | |||||

Codorus Valley Bancorp | 51,400 | 1,576,952 | |||||

Landmark Bancorp | 40,017 | 1,140,484 | |||||

MidWestOne Financial Group | 213,023 | 7,195,917 | |||||

National Bankshares | 128,639 | 5,968,850 | |||||

Northrim BanCorp | 127,481 | 5,041,873 | |||||

Unity Bancorp | 92,521 | 2,104,853 | |||||

| 47,918,733 | |||||||

| CAPITAL MARKETS - 3.2% | |||||||

Federated Investors Cl. B | 270,786 | 6,314,730 | |||||

Houlihan Lokey Cl. A | 92,269 | 4,726,018 | |||||

Moelis & Company Cl. A | 74,920 | 4,394,058 | |||||

| 15,434,806 | |||||||

| INSURANCE - 2.9% | |||||||

James River Group Holdings | 176,101 | 6,919,009 | |||||

Kingstone Companies | 119,288 | 2,015,967 | |||||

Reinsurance Group of America | 37,236 | 4,970,261 | |||||

| 13,905,237 | |||||||

| THRIFTS & MORTGAGE FINANCE - 5.2% | |||||||

Genworth MI Canada | 352,550 | 11,472,322 | |||||

Southern Missouri Bancorp | 40,987 | 1,599,313 | |||||

Timberland Bancorp | 119,932 | 4,478,261 | |||||

TrustCo Bank Corp. NY | 783,082 | 6,969,430 | |||||

| 24,519,326 | |||||||

| Total (Cost $73,329,150) | 101,778,102 | ||||||

| HEALTH CARE – 1.4% | |||||||

| HEALTH CARE PROVIDERS & SERVICES - 1.4% | |||||||

| 39,741 | 2,328,823 | ||||||

Ensign Group (The) | 126,314 | 4,524,567 | |||||

| Total (Cost $4,295,287) | 6,853,390 | ||||||

| INDUSTRIALS – 22.3% | |||||||

| AIRLINES - 5.8% | |||||||

Allegiant Travel | 51,899 | 7,211,366 | |||||

Hawaiian Holdings | 265,955 | 9,561,082 | |||||

| 298,953 | 10,866,942 | ||||||

| 27,639,390 | |||||||

| BUILDING PRODUCTS - 2.0% | |||||||

American Woodmark 1 | 22,543 | 2,063,812 | |||||

Apogee Enterprises | 156,017 | 7,515,339 | |||||

| 9,579,151 | |||||||

| COMMERCIAL SERVICES & SUPPLIES - 2.7% | |||||||

Herman Miller | 198,603 | 6,732,642 | |||||

Kimball International Cl. B | 392,482 | 6,342,509 | |||||

| 13,075,151 | |||||||

| CONSTRUCTION & ENGINEERING - 0.5% | |||||||

Comfort Systems USA | 49,969 | 2,288,580 | |||||

| ELECTRICAL EQUIPMENT - 1.2% | |||||||

EnerSys | 77,200 | 5,762,208 | |||||

| MACHINERY - 4.9% | |||||||

Alamo Group | 32,728 | 2,957,302 | |||||

Federal Signal | 96,841 | 2,255,427 | |||||

Miller Industries | 346,682 | 8,857,725 | |||||

Wabash National | 508,303 | 9,484,934 | |||||

| 23,555,388 | |||||||

| PROFESSIONAL SERVICES - 3.9% | |||||||

Heidrick & Struggles International | 63,162 | 2,210,670 | |||||

Kforce | 135,467 | 4,646,518 | |||||

Korn/Ferry International | 76,372 | 4,729,718 | |||||

Robert Half International | 69,100 | 4,498,410 | |||||

TrueBlue 1 | 85,271 | 2,298,053 | |||||

| 18,383,369 | |||||||

| ROAD & RAIL - 1.3% | |||||||

Old Dominion Freight Line | 14,704 | 2,190,308 | |||||

Saia 1 | 28,361 | 2,292,987 | |||||

Werner Enterprises | 47,961 | 1,800,935 | |||||

| 6,284,230 | |||||||

| Total (Cost $89,754,862) | 106,567,467 | ||||||

| INFORMATION TECHNOLOGY – 25.6% | |||||||

| COMMUNICATIONS EQUIPMENT - 0.4% | |||||||

NETGEAR 1 | 34,271 | 2,141,938 | |||||

| 14 | Royce Capital Fund 2018 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| June 30, 2018 (unaudited) |

| Royce Capital Fund - Small-Cap Portfolio (continued) | |||||||

| SHARES | VALUE | ||||||

| INFORMATION TECHNOLOGY (continued) | |||||||

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 16.4% | |||||||

Benchmark Electronics | 240,435 | $ | 7,008,680 | ||||

Celestica 1 | 894,672 | 10,619,757 | |||||

| 446,309 | 7,038,293 | ||||||

Fabrinet 1 | 264,760 | 9,766,996 | |||||

Insight Enterprises 1 | 240,902 | 11,787,335 | |||||

Methode Electronics | 177,353 | 7,147,326 | |||||

PC Connection | 362,317 | 12,028,924 | |||||

Sanmina Corporation 1 | 76,044 | 2,228,089 | |||||

Vishay Intertechnology | 458,299 | 10,632,537 | |||||

| 78,257,937 | |||||||

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 7.9% | |||||||

Advanced Energy Industries 1 | 125,850 | 7,310,626 | |||||

†Cohu | 154,115 | 3,777,359 | |||||

Kulicke & Soffa Industries | 491,726 | 11,712,913 | |||||

MKS Instruments | 38,391 | 3,674,019 | |||||

Silicon Motion Technology ADR | 89,800 | 4,749,522 | |||||

| 458,600 | 6,406,642 | ||||||

| 37,631,081 | |||||||

| TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 0.9% | |||||||

Super Micro Computer 1 | 179,883 | 4,254,233 | |||||

| Total (Cost $105,036,104) | 122,285,189 | ||||||

| REAL ESTATE – 1.5% | |||||||

| REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.5% | |||||||

Marcus & Millichap 1 | 181,284 | 7,071,889 | |||||

| Total (Cost $4,644,978) | 7,071,889 | ||||||

| UTILITIES – 0.4% | |||||||

| GAS UTILITIES - 0.4% | |||||||

Star Group L.P. | 230,460 | 2,258,508 | |||||

| Total (Cost $2,158,098) | 2,258,508 | ||||||

| TOTAL COMMON STOCKS | |||||||

| (Cost $348,960,717) | 435,023,669 | ||||||

| REPURCHASE AGREEMENT– 8.4% | |||||||

| Fixed Income Clearing Corporation, 0.35% dated 6/29/18, due 7/2/18, maturity value $40,227,173 (collateralized by obligations of various U.S. Government Agencies, 1.375% due 10/07/21, valued at $41,030,868) | |||||||

| (Cost $40,226,000) | 40,226,000 | ||||||

| COLLATERAL RECEIVED FOR SECURITIES LOANED – 0.6% | |||||||

| Money Market Funds | |||||||

Federated Government Obligations Fund (7 day yield-1.7400%) | |||||||

| (Cost $2,957,094) | 2,957,094 | ||||||

| TOTAL INVESTMENTS – 100.0% | |||||||

| (Cost $392,143,811) | 478,206,763 | ||||||

| LIABILITIES LESS CASH AND OTHER ASSETS – (0.0)% | (133,940 | ) | |||||

| NET ASSETS – 100.0% | $ | 478,072,823 | |||||

| † | New additions in 2018. | |

| 1 | Non-income producing. | |

| 2 | All or a portion of these securities were on loan at June 30, 2018. | |

| Bold indicates the Fund’s 20 largest equity holdings in terms of June 30, 2018, market value. |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2018 Semiannual Report to Shareholders | 15 |

| Statements of Assets and Liabilities | June 30, 2018 (unaudited) |

| Micro-Cap | Small-Cap | |||||||

| Portfolio | Portfolio | |||||||

| ASSETS: | ||||||||

| Investments at value (including collateral on loaned securities) 1 | $ | 189,835,103 | $ | 437,980,763 | ||||

| Repurchase agreements (at cost and value) | 8,427,000 | 40,226,000 | ||||||

| Cash and foreign currency | 43,366 | – | ||||||

| Receivable for investments sold | – | 4,386,362 | ||||||

| Receivable for capital shares sold | 215,227 | 157,672 | ||||||

| Receivable for dividends and interest | 142,621 | 373,932 | ||||||

| Receivable for securities lending income | 4,773 | 1,219 | ||||||

| Prepaid expenses and other assets | 640 | 7,722 | ||||||

| Total Assets | 198,668,730 | 483,133,670 | ||||||

| LIABILITIES: | ||||||||

| Payable for collateral on loaned securities | 2,783,561 | 2,957,094 | ||||||

| Payable to custodian for cash and foreign currency overdrawn | – | 33,430 | ||||||

| Payable for investments purchased | 338,917 | 1,248,244 | ||||||

| Payable for capital shares redeemed | 214,701 | 264,093 | ||||||

| Payable for investment advisory fees | 204,342 | 401,654 | ||||||

| Payable for trustees’ fees | 11,711 | 27,916 | ||||||

| Accrued expenses | 58,590 | 128,416 | ||||||

| Total Liabilities | 3,611,822 | 5,060,847 | ||||||

| Net Assets | $ | 195,056,908 | $ | 478,072,823 | ||||

| ANALYSIS OF NET ASSETS: | ||||||||

| Paid-in capital | $ | 132,447,821 | $ | 364,622,003 | ||||

| Undistributed net investment income (loss) | (170,679 | ) | 2,815,674 | |||||

| Accumulated net realized gain (loss) on investments and foreign currency | 15,370,047 | 24,572,194 | ||||||

| Net unrealized appreciation (depreciation) on investments and foreign currency | 47,409,719 | 86,062,952 | ||||||

| Net Assets | $ | 195,056,908 | $ | 478,072,823 | ||||

Investment Class | $ | 162,857,359 | $ | 217,616,068 | ||||

Service Class | 32,199,549 | 260,456,755 | ||||||

| SHARES OUTSTANDING (unlimited number of $.001 par value): | ||||||||

Investment Class | 14,222,520 | 23,151,857 | ||||||

Service Class | 2,863,102 | 28,459,700 | ||||||

| NET ASSET VALUES (Net Assets ÷ Shares Outstanding): | ||||||||

(offering and redemption price per share) | ||||||||

Investment Class | $11.45 | $9.40 | ||||||

Service Class | 11.25 | 9.15 | ||||||

| Investments at identified cost | $ | 142,425,403 | $ | 351,917,811 | ||||

| Market value of loaned securities 2 | 3,241,193 | 12,873,326 | ||||||

| 1 | See Notes to Financial Statements for additional collateral on loaned securities. |

| 2 | Market value of loaned securities backed by non-cash collateral is as of prior business day. |

| 16 | Royce Capital Fund 2018 Semiannual Report to Shareholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Statements of Changes in Net Assets |

| Micro-Cap Portfolio | Small-Cap Portfolio | ||||||||||||||||

| Six Months Ended 6/30/18 (unaudited) | Year Ended 12/31/17 | Six Months Ended 6/30/18 (unaudited) | Year Ended 12/31/17 | ||||||||||||||

| INVESTMENT OPERATIONS: | |||||||||||||||||

| Net investment income (loss) | $ | (208,623 | ) | $ | (507,803 | ) | $ | 957,604 | $ | 1,986,132 | |||||||

| Net realized gain (loss) on investments and foreign currency | 8,016,787 | 8,353,077 | 21,982,524 | 7,868,418 | |||||||||||||

Net change in unrealized appreciation (depreciation) on investments and foreign currency | 10,668,687 | 1,752,552 | 9,524,788 | 2,459,022 | |||||||||||||

| Net increase (decrease) in net assets from investment operations | 18,476,851 | 9,597,826 | 32,464,916 | 12,313,572 | |||||||||||||

| DISTRIBUTIONS: | |||||||||||||||||

| Net investment income | |||||||||||||||||

Investment Class | – | (1,090,893 | ) | – | (2,075,505 | ) | |||||||||||

Service Class | – | (170,672 | ) | – | (2,047,296 | ) | |||||||||||

| Net realized gain on investments and foreign currency | |||||||||||||||||

Investment Class | – | (17,091,597 | ) | – | – | ||||||||||||

Service Class | – | (3,298,738 | ) | – | – | ||||||||||||

| Total distributions | – | (21,651,900 | ) | – | (4,122,801 | ) | |||||||||||

| CAPITAL SHARE TRANSACTIONS: | |||||||||||||||||

| Value of shares sold | |||||||||||||||||

Investment Class | 6,453,325 | 19,985,987 | 10,346,375 | 27,113,319 | |||||||||||||

Service Class | 6,728,550 | 8,994,660 | 896,650 | 193,204,040 | |||||||||||||

| Distributions reinvested | |||||||||||||||||

Investment Class | – | 18,182,489 | – | 2,075,505 | |||||||||||||

Service Class | – | 3,469,410 | – | 2,047,296 | |||||||||||||

| Value of shares redeemed | |||||||||||||||||

Investment Class | (23,927,751 | ) | (41,333,398 | ) | (36,176,977 | ) | (57,799,564 | ) | |||||||||

Service Class | (9,397,534 | ) | (12,640,986 | ) | (21,627,251 | ) | (198,351,118 | ) | |||||||||

Net increase (decrease) in net assets from capital share transactions | (20,143,410 | ) | (3,341,838 | ) | (46,561,203 | ) | (31,710,522 | ) | |||||||||

| Net Increase (Decrease) in Net Assets | (1,666,559 | ) | (15,395,912 | ) | (14,096,287 | ) | (23,519,751 | ) | |||||||||

| NET ASSETS: | |||||||||||||||||

| Beginning of period | 196,723,467 | 212,119,379 | 492,169,110 | 515,688,861 | |||||||||||||

| End of period | $ | 195,056,908 | $ | 196,723,467 | $ | 478,072,823 | $ | 492,169,110 | |||||||||

| Undistributed Net Investment Income (Loss) at End of Period | $ | (170,679 | ) | $ | 37,944 | $ | 2,815,674 | $ | 1,858,071 | ||||||||

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | Royce Capital Fund 2018 Semiannual Report to Shareholders | 17 |

| Statements of Operations | Six Months Ended June 30, 2018 (unaudited) |

| Micro-Cap | Small-Cap | |||||||

| Portfolio | Portfolio | |||||||

| INVESTMENT INCOME: | ||||||||

| INCOME: | ||||||||

| Dividends | $ | 995,907 | $ | 3,834,220 | ||||

| Foreign withholding tax | (30,582 | ) | (39,296 | ) | ||||

| Interest | 11,974 | 38,028 | ||||||

| Securities lending | 108,169 | 7,361 | ||||||

| Total income | 1,085,468 | 3,840,313 | ||||||

| EXPENSES: | ||||||||