UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07883

ICON Funds

(Exact name of registrant as specified in charter)

5299 DTC Blvd. Suite 1200 Greenwood Village, CO 80111

(Address of principal executive offices) (Zip code)

Brian Harding

5299 DTC Blvd. Suite 1200 Greenwood Village, CO 80111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-790-1600

Date of fiscal year end: September 30, 2018

Date of reporting period: September 30, 2018

Item 1. | Reports to Stockholders. |

| ANNUAL REPORT |

| |

| September 30, 2018 |

Diversified Funds

ICON Equity Income Fund (IOEZX, IOECX, IEQAX)

ICON Flexible Bond Fund (IOBZX, IOBCX, IOBAX)

ICON Fund (ICNZX, ICNCX, ICNAX)

ICON Long/Short Fund (IOLZX, IOLCX, ISTAX)

ICON Opportunities Fund (ICONX)

ICON Risk-Managed Balanced Fund (IOCZX, IOCCX, IOCAX)

You can now sign up for electronic delivery of ICON Fund shareholder reports, including prospectuses, annual reports, semiannual reports and proxy statements.

When these materials are available, you will receive an email from ICON with instructions on how to view the documents. Statements, transaction confirmations and other documents that are not available online will continue to be sent to you by U.S. mail.

Visit ICON’s website at www.iconfunds.com to learn more and sign up.

You may change or cancel your participation in eDelivery by visiting www.iconfunds.com, or you can request a hard copy of any of the materials free of charge by calling ICON Funds at 1-800-764-0442.

| 1-800-764-0442 • www.iconfunds.com |

ICON Diversified Funds | About this Report |

September 30, 2018 (Unaudited)

Historical Returns

All total returns mentioned in this Report account for the change in a Fund’s per-share price and the reinvestment of any dividends, capital gain distributions and adjustments for financial statement purposes. If your account is set up to receive Fund distributions in cash rather than to reinvest them, your actual return may differ from these figures. The Funds’ performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Adviser may have reimbursed certain fees or expenses of some of the Funds. If not for these reimbursements, performance would have been lower. Fund results shown, unless otherwise indicated, are at net asset value. If a sales charge (maximum 5.75%) had been deducted, results would have been lower.

Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results represent past performance, and current performance may be higher or lower. Please call 1-800-764-0442 or visit www.iconfunds.com for performance results current to the most recent month-end.

Portfolio Data

This Report reflects ICON’s portfolio holdings as of September 30, 2018, the end of the reporting period. The information is not a complete analysis of every aspect of any sector, industry, security or the Funds.

There are risks associated with mutual fund investing, including the loss of principal. The likelihood of loss may be greater if you invest for a shorter period of time. There is no assurance that the investment process will consistently lead to successful results.

There are risks associated with selling short, including the risk that the ICON Long/Short Fund may have to cover its short position at a higher price than the short price, resulting in a loss. The ICON Long/Short Fund’s loss on a short sale is potentially unlimited as a loss occurs when the value of a security sold short increases. Call options involve certain risks, such as limited gains and lack of liquidity in the underlying securities, and are not suitable for all investors.

Investing in fixed income securities such as bonds involves interest rate risk. When interest rates rise, the value of fixed income securities generally decreases. The ICON Equity Income Fund and ICON Flexible Bond Fund may invest up to 25% and 35% of its assets in high-yield bonds that are below investment grade, respectively. ICON Risk-Managed Balanced Fund may invest up to 10% of its assets in high-yield bonds that are below investment grade. High-yield bonds involve a greater risk of default and price volatility than U.S. Government and other higher-quality bonds.

An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

Investments in foreign securities may entail unique risks, including political, market, and currency risks. Financial statements of foreign companies are governed by different accounting, auditing, and financial standards than U.S. companies and may be less transparent and uniform than in the United States. Many corporate governance standards, which help ensure the integrity of public information in the United States, do not exist in foreign countries. In general, there may be less governmental supervision of foreign stock exchanges and securities brokers and issuers. The ICON system relies on the integrity of the financial statements released to the market as part of our analysis.

Investments in other mutual fund companies may entail certain risks. For example, the Fund’s performance depends on the underlying funds in which it invests, and it is subject to the risks of the underlying funds. Additionally, an investment by the Fund or underlying fund in exchange-traded funds generally presents the same primary risks as an investment in a mutual fund.

The prospectus and statement of additional information contain this and other information about the Funds and are available by visiting www.iconfunds.com or calling 1-800-764-0442. Please read the prospectus and statement of additional information carefully.

Financial Intermediary

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may influence the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| ICON Equity Income Fund | Management Overview |

| | September 30, 2018 (Unaudited) |

Q. How did the Fund perform relative to its benchmarks?

A. The ICON Equity Income Fund (the Fund) Class S shares returned 5.19% for the fiscal year ending September 30, 2018, lagging its benchmark, the S&P Composite 1500 Index, which returned 17.69% during the fiscal year. Total returns for other periods and additional Class shares as of September 30, 2018, appear in the subsequent pages of this Fund’s Management Overview.

Q. What primary factors were behind the Fund’s relative performance?

A. As the fiscal year began, our valuation methodology calculated an overall average value-to-price (V/P) ratio for the equity market of 1.00, meaning we believed the equity market as a whole was trading at fair value. While we anticipated flat performance, the market exceeded our expectations with the S&P 1500 returning in excess of 17%. However, stocks with higher dividend yields (that is, yields greater than 3%), did not do particularly well over this 12-month period. During fiscal year 2018, S&P 1500 stocks with dividend yields between 0% and 3% returned approximately 20%, while stocks with a dividend yield greater than 3% returned roughly 6%. This performance difference reflects, in part, the improvement in treasury yield over the course of the year. For example, the yield on the 10-year U.S. Treasury Note increased throughout the year -- from 2.33% on September 30, 2017 to 3.06% on September 30, 2018. As fixed income yields improved, the demand for high dividend yielding stocks as an alternative to fixed income investments in a low interest rate environment decreased. With the Fund’s tilt toward stocks with higher dividend yields, the Fund lagged its broad benchmark. The Fund’s fixed income positions during the fiscal year likewise adversely affected relative performance. As interest rates increased, the value of these fixed income positions decreased, creating an additional headwind compared to its equity only index.

Q. How did the Fund’s composition affect performance?

A. The Fund’s stock selection within the Consumer Discretionary sector was the largest detractor to Fund performance. The Fund’s Consumer Discretionary holdings returned approximately -14.7% while the Consumer Discretionary Sector benchmark enjoyed a 30.55% return during fiscal year 2018. In total this sector accounted for more than one third of the Fund’s underperformance. The Fund’s performance was adversely impacted by its lack of exposure to the internet & direct marketing retail industry and, specifically, the Fund’s lack of a position in Amazon. Amazon shares more than doubled in price over the course of the fiscal year, and its absence in the Fund accounts for nearly 10% of the Fund’s underperformance. An additional headwind came from the Fund’s overweight position in the Financials sector. The S&P 1500 Financials Index returned 8.56% over the year, well below the 17.68% return for the broader market. Because we calculated a V/P of 1.13 for the Financials sector as fiscal year 2018 began (well above our estimated V/P of 1.00 for the overall market), we believed the Fund’s Financials holdings would perform better than they did.

Similarly, the Fund’s fixed income allocation dragged on performance. We watched as the overall market V/P at times fell below 1.00 during the fiscal year. Because this suggested to us the market was overvalued, we increased our fixed income holdings and defensive index put options. As interest rates increased, however, the value of our fixed income positions decreased. Furthermore, as the market moved higher during the year, the defensive put options lost value and negatively impacted the Fund.

Q. What is the outlook for the ICON Equity Income Fund?

A. As of September 30, 2018, we believe the market has an overall average V/P of 1.02, meaning stocks are generally priced only slightly below their fair value under our system. Accordingly, we do not anticipate the same strong returns in the equity market in fiscal year 2019 as we saw in the last two fiscal years. Fifteen percent of the Fund is allocated to fixed income holdings, with the remaining 85% comprised of equities. We nonetheless still see sector opportunities based on our valuation readings. The Financials sector has a V/P of 1.19, for example and, as fiscal year 2018 ends, the Fund is invested in an effort to take advantage of potential sector gains. We will continue to monitor the equity market to find the best combination of value and dividend for our investors.

| Annual Report | September 30, 2018 | 3 |

| ICON Equity Income Fund | Management Overview |

| | September 30, 2018 (Unaudited) |

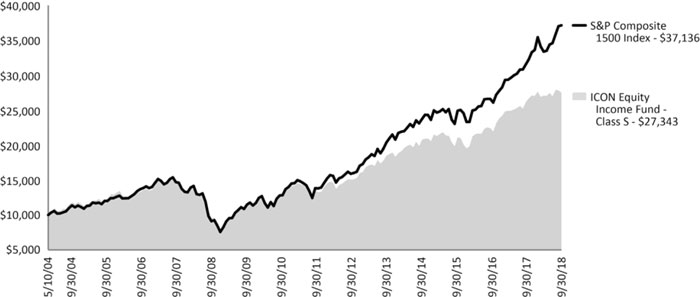

Average Annual Total Return (as of September 30, 2018)

| | Inception Date | 1 Year | 5 Years | 10 Years | Since

Inception | Gross Expense

Ratio* | Net Expense Ratio* |

| ICON Equity Income Fund - Class S | 5/10/04 | 5.19% | 9.08% | 8.33% | 7.24% | 1.26% | 1.10% |

| ICON Equity Income Fund - Class C | 11/8/02 | 4.21% | 8.00% | 7.26% | 7.25% | 2.31% | 2.10% |

| ICON Equity Income Fund - Class A | 5/31/06 | 4.98% | 8.80% | 8.06% | 6.19% | 1.56% | 1.35% |

| ICON Equity Income Fund - Class A | | | | | | | |

| (including maximum sales charge of 5.75%) | 5/31/06 | -1.05% | 7.52% | 7.42% | 5.68% | 1.56% | 1.35% |

| S&P Composite 1500 Index | | 17.69% | 13.77% | 12.04% | 9.54% | N/A | N/A |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

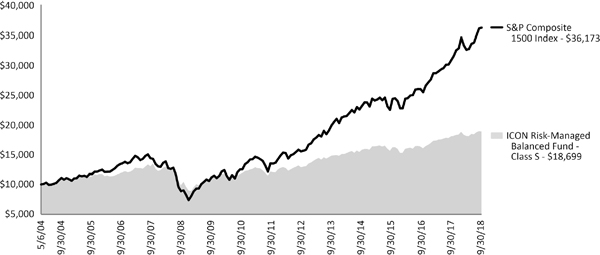

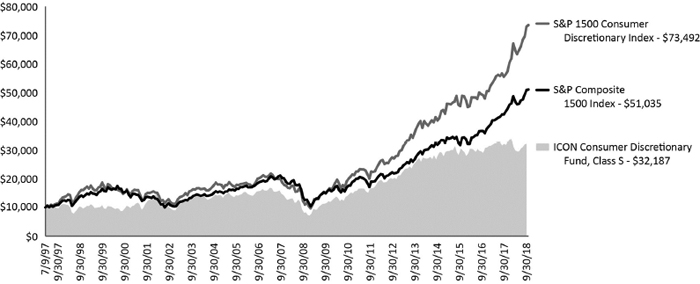

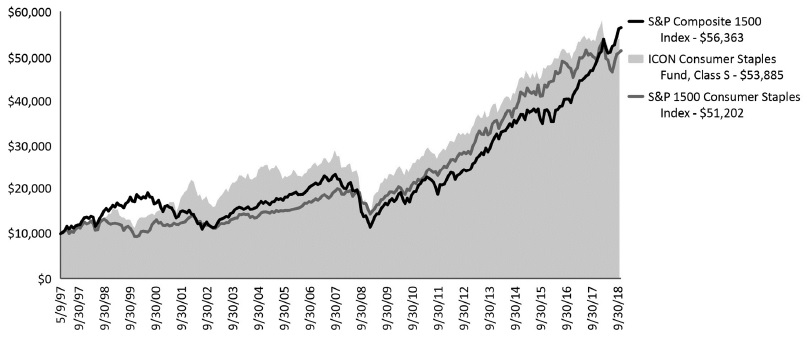

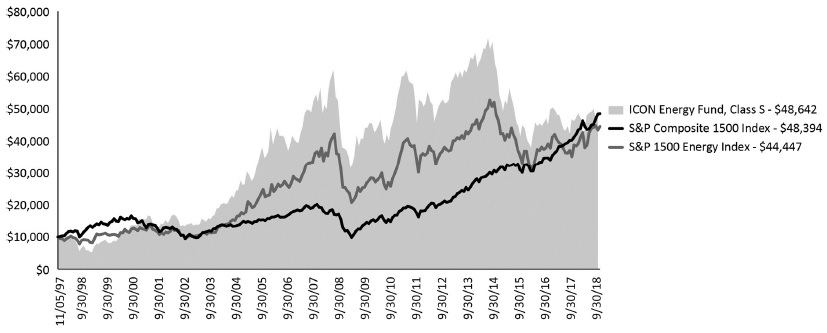

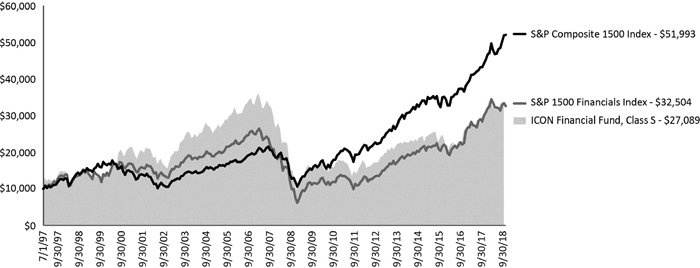

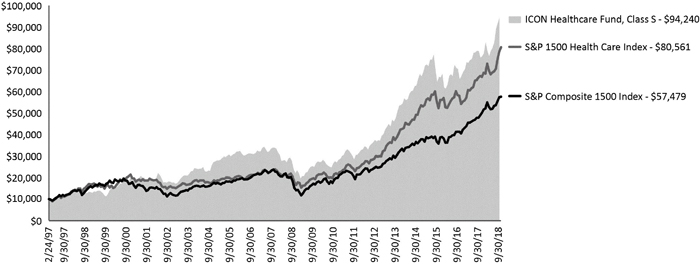

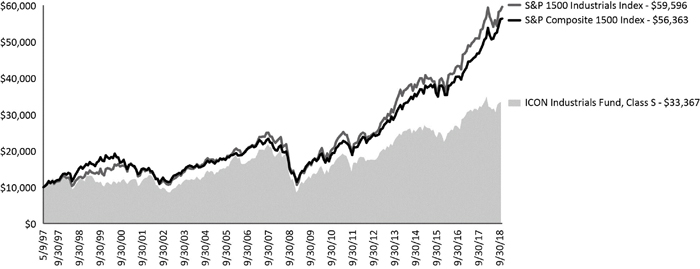

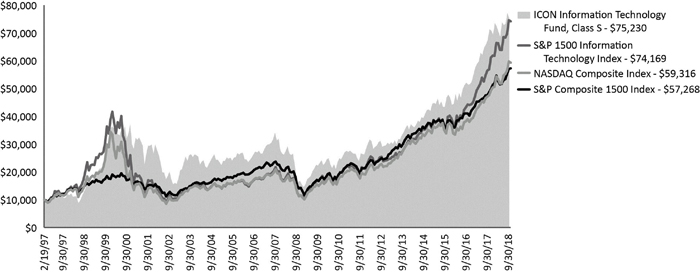

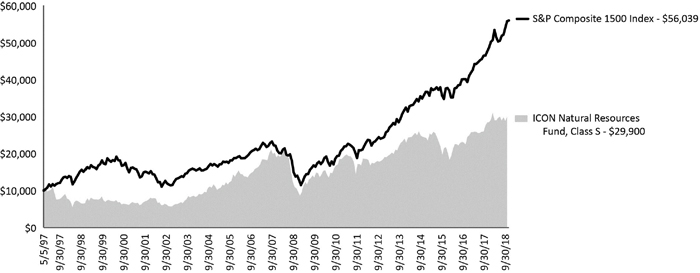

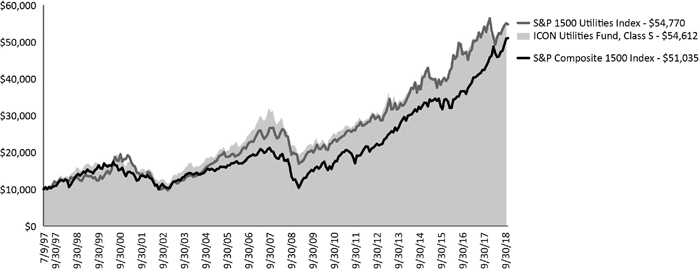

Value of a $10,000 Investment (through September 30, 2018)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Equity Income Fund’s Class S shares on the Class’ inception date of 5/10/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Equity Income Fund’s other share classes will vary due to differences in charges and expenses. The Equity Income Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| ICON Equity Income Fund | Schedule of Investments |

| | September 30, 2018 |

| | | Shares or

Principal

Amount | | | Value | |

| Corporate Bonds (7.03%) | | | | | | | | |

| Communication Services (0.33%) | | | | | | | | |

| Lee Enterprises, Inc. | | | | | | | | |

| 9.50%, 03/15/22(a)(b) | | $ | 250,000 | | | $ | 260,313 | |

| | | | | | | | | |

| Consumer Discretionary (1.98%) | | | | | | | | |

| Foot Locker, Inc. | | | | | | | | |

| 8.50%, 01/15/22 | | | 300,000 | | | | 338,250 | |

| M/I Homes, Inc. | | | | | | | | |

| 6.75%, 01/15/21 | | | 200,000 | | | | 203,990 | |

| Reliance Intermediate Holdings LP | | | | | | | | |

| 6.50%, 04/01/23(a) | | | 650,000 | | | | 675,187 | |

| William Lyon Homes, Inc. | | | | | | | | |

| 7.00%, 08/15/22 | | | 350,000 | | | | 356,563 | |

| | | | | | | | 1,573,990 | |

| Consumer Staples (1.10%) | | | | | | | | |

| Central Garden & Pet Co. | | | | | | | | |

| 6.13%, 11/15/23 | | | 600,000 | | | | 618,750 | |

| Kraft Heinz Foods Co. | | | | | | | | |

| 4.88%, 02/15/25(a) | | | 250,000 | | | | 254,032 | |

| | | | | | | | 872,782 | |

| Energy (0.64%) | | | | | | | | |

| MPLX LP | | | | | | | | |

| 5.50%, 02/15/23 | | | 500,000 | | | | 510,066 | |

| | | | | | | | | |

| Financial (0.33%) | | | | | | | | |

| Enova International, Inc. | | | | | | | | |

| 9.75%, 06/01/21 | | | 250,000 | | | | 262,187 | |

| | | | | | | | | |

| Health Care (0.26%) | | | | | | | | |

| Molina Healthcare, Inc. | | | | | | | | |

| 5.38%, 11/15/22 | | | 200,000 | | | | 203,250 | |

| | | | | | | | | |

| Industrials (0.80%) | | | | | | | | |

| RR Donnelley & Sons Co. | | | | | | | | |

| 7.88%, 03/15/21 | | | 500,000 | | | | 530,625 | |

| USG Corp. | | | | | | | | |

| 5.50%, 03/01/25(a) | | | 100,000 | | | | 102,000 | |

| | | | | | | | 632,625 | |

| Information Technology (0.32%) | | | | | | | | |

| NXP BV / NXP Funding LLC | | | | | | | | |

| 4.63%, 06/01/23(a) | | | 250,000 | | | | 253,800 | |

| | | | | | | | | |

| Materials (0.73%) | | | | | | | | |

| Freeport-McMoRan, Inc. | | | | | | | | |

| 6.88%, 02/15/23 | | | 244,000 | | | | 259,860 | |

| Teck Resources, Ltd. | | | | | | | | |

| 8.50%, 06/01/24(a) | | | 292,000 | | | | 319,229 | |

| | | | | | | | 579,089 | |

| Real Estate (0.12%) | | | | | | | | |

| Iron Mountain, Inc. | | | | | | | | |

| 5.75%, 08/15/24(b) | | | 100,000 | | | | 98,950 | |

| | | Shares or

Principal

Amount | | | Value | |

| Telecommunication Services (0.26%) | | | | | | | | |

| Level 3 Parent LLC | | | | | | | | |

| 5.75%, 12/01/22 | | $ | 200,000 | | | $ | 202,290 | |

| | | | | | | | | |

| Utilities (0.16%) | | | | | | | | |

| DPL, Inc. | | | | | | | | |

| 6.75%, 10/01/19 | | | 124,000 | | | | 127,100 | |

| | | | | | | | | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $5,641,572) | | | | | | | 5,576,442 | |

| | | | | | | | | |

| Common Stocks (82.57%) | | | | | | | | |

| Aerospace & Defense (1.92%) | | | | | | | | |

| Boeing Co. | | | 4,100 | | | | 1,524,790 | |

| | | | | | | | | |

| Auto Parts & Equipment (3.04%) | | | | | | | | |

| Autoliv, Inc.(b) | | | 13,400 | | | | 1,161,512 | |

| Magna International, Inc. | | | 23,800 | | | | 1,250,214 | |

| | | | | | | | 2,411,726 | |

| Automobile Manufacturers (1.79%) | | | | | | | | |

| Nissan Motor Co., Ltd., Sponsored ADR(b) | | | 76,000 | | | | 1,421,580 | |

| | | | | | | | | |

| Biotechnology (1.08%) | | | | | | | | |

| AbbVie, Inc. | | | 9,100 | | | | 860,678 | |

| | | | | | | | | |

| Building Products (1.87%) | | | | | | | | |

| Johnson Controls International PLC | | | 42,400 | | | | 1,484,000 | |

| | | | | | | | | |

| Construction Machinery & Heavy Trucks (1.79%) | | | | | | | | |

| Cummins, Inc. | | | 9,700 | | | | 1,416,879 | |

| | | | | | | | | |

| Diversified Banks (5.95%) | | | | | | | | |

| Bank of America Corp. | | | 65,500 | | | | 1,929,630 | |

| JPMorgan Chase & Co. | | | 18,000 | | | | 2,031,120 | |

| US Bancorp | | | 14,400 | | | | 760,464 | |

| | | | | | | | 4,721,214 | |

| Diversified Chemicals (3.12%) | | | | | | | | |

| Eastman Chemical Co. | | | 14,100 | | | | 1,349,652 | |

| Huntsman Corp. | | | 41,400 | | | | 1,127,322 | |

| | | | | | | | 2,476,974 | |

| Electric Utilities (3.21%) | | | | | | | | |

| Avangrid, Inc. | | | 26,900 | | | | 1,289,317 | |

| PPL Corp. | | | 42,800 | | | | 1,252,328 | |

| | | | | | | | 2,541,645 | |

| Homebuilding (3.23%) | | | | | | | | |

| MDC Holdings, Inc. | | | 48,100 | | | | 1,422,798 | |

| PulteGroup, Inc. | | | 46,100 | | | | 1,141,897 | |

| | | | | | | | 2,564,695 | |

| Hotels, Resorts & Cruise Lines (1.33%) | | | | | | | | |

| Royal Caribbean Cruises, Ltd. | | | 8,100 | | | | 1,052,514 | |

| The accompanying notes are an integral part of the financial statements. | |

| Annual Report | September 30, 2018 | 5 |

| ICON Equity Income Fund | Schedule of Investments |

| | September 30, 2018 |

| | | Shares or

Principal

Amount | | | Value | |

| Integrated Oil & Gas (2.35%) | | | | | | | | |

| TOTAL SA, Sponsored ADR | | | 28,900 | | | $ | 1,860,871 | |

| | | | | | | | | |

| Integrated Telecommunication Services (4.35%) | | | | | | | | |

| AT&T, Inc. | | | 61,500 | | | | 2,065,170 | |

| Verizon Communications, Inc. | | | 26,000 | | | | 1,388,140 | |

| | | | | | | | 3,453,310 | |

| Investment Banking & Brokerage (3.51%) | | | | | | | | |

| BGC Partners, Inc., Class A | | | 92,000 | | | | 1,087,440 | |

| Morgan Stanley | | | 36,400 | | | | 1,695,148 | |

| | | | | | | | 2,782,588 | |

| IT Consulting & Other Services (3.29%) | | | | | | | | |

| Booz Allen Hamilton Holding Corp. | | | 29,800 | | | | 1,478,974 | |

| International Business Machines Corp. | | | 7,500 | | | | 1,134,075 | |

| | | | | | | | 2,613,049 | |

| Life & Health Insurance (5.38%) | | | | | | | | |

| CNO Financial Group, Inc. | | | 65,100 | | | | 1,381,422 | |

| Principal Financial Group, Inc. | | | 25,600 | | | | 1,499,904 | |

| Prudential Financial, Inc. | | | 13,700 | | | | 1,388,084 | |

| | | | | | | | 4,269,410 | |

| Multi-Utilities (3.79%) | | | | | | | | |

| CenterPoint Energy, Inc. | | | 58,200 | | | | 1,609,230 | |

| DTE Energy Co. | | | 12,800 | | | | 1,396,864 | |

| | | | | | | | 3,006,094 | |

| Oil & Gas Exploration & Production (3.00%) | | | | | | | | |

| Cimarex Energy Co. | | | 8,900 | | | | 827,166 | |

| Diamondback Energy, Inc.(b) | | | 11,500 | | | | 1,554,685 | |

| | | | | | | | 2,381,851 | |

| Oil & Gas Refining & Marketing (3.48%) | | | | | | | | |

| Marathon Petroleum Corp. | | | 19,800 | | | | 1,583,406 | |

| Phillips 66 | | | 10,400 | | | | 1,172,288 | |

| | | | | | | | 2,755,694 | |

| Oil & Gas Storage & Transportation (1.69%) | | | | | | | | |

| TransCanada Corp. | | | 33,200 | | | | 1,343,272 | |

| | | | | | | | | |

| | | | | | | | | |

| Paper Packaging (2.63%) | | | | | | | | |

| International Paper Co. | | | 18,400 | | | | 904,360 | |

| Packaging Corp. of America | | | 10,800 | | | | 1,184,652 | |

| | | | | | | | 2,089,012 | |

| Pharmaceuticals (1.06%) | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 13,500 | | | | 838,080 | |

| | | | | | | | | |

| Regional Banks (5.06%) | | | | | | | | |

| Fifth Third Bancorp | | | 58,400 | | | | 1,630,528 | |

| KeyCorp | | | 38,300 | | | | 761,787 | |

| Valley National Bancorp | | | 67,600 | | | | 760,500 | |

| Webster Financial Corp. | | | 14,600 | | | | 860,816 | |

| | | | | | | | 4,013,631 | |

| Restaurants (1.37%) | | | | | | | | |

| Dine Brands Global, Inc.(b) | | | 13,400 | | | | 1,089,554 | |

| | | Shares or

Principal

Amount | | | Value | |

| Semiconductors (3.64%) | | | | | | |

| Broadcom, Inc. | | | 5,851 | | | $ | 1,443,617 | |

| Intel Corp. | | | 30,600 | | | | 1,447,074 | |

| | | | | | | | 2,890,691 | |

| Soft Drinks (2.09%) | | | | | | | | |

| Coca-Cola Co. | | | 35,900 | | | | 1,658,221 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (3.59%) | | | | | | | | |

| Apple, Inc. | | | 12,600 | | | | 2,844,324 | |

| | | | | | | | | |

| Tobacco (3.96%) | | | | | | | | |

| Altria Group, Inc. | | | 29,700 | | | | 1,791,207 | |

| Philip Morris International, Inc. | | | 16,500 | | | | 1,345,410 | |

| | | | | | | | 3,136,617 | |

| Total Common Stocks | | | | | | | | |

| (Cost $60,954,995) | | | | | | | 65,502,964 | |

| | | | | | | | | |

| Preferred Stocks (3.73%) | | | | | | | | |

| Financial Services (0.34%) | | | | | | | | |

| Cabco Series 2004-101 Trust Goldman Sachs Capital I, Series GS 3M US L + 0.85%, 02/15/34(c) | | | 12,107 | | | | 267,928 | |

| | | | | | | | | |

| Industrial REITs (1.92%) | | | | | | | | |

| Gramercy Property Trust, Series A 7.13%(d)(e) | | | | | | | | |

| | | | 60,923 | | | | 1,521,857 | |

| | | | | | | | | |

| Property & Casualty Insurance (1.47%) | | | | | | | | |

| Argo Group US, Inc. | | | | | | | | |

| 6.50%, 09/15/42 | | | 46,594 | | | | 1,171,839 | |

| | | | | | | | | |

| Total Preferred Stocks | | | | | | | | |

| (Cost $3,028,566) | | | | | | | 2,961,624 | |

| | | | | | | | | |

| Convertible Preferred Stocks (1.92%) | | | | | | | | |

| Diversified Banks (0.81%) | | | | | | | | |

| Wells Fargo & Co., Series L 7.50%(b)(d) | | | | | | | | |

| | | | 500 | | | | 645,440 | |

| | | | | | | | | |

| Office REITs (1.11%) | | | | | | | | |

| Equity Commonwealth, Series D 6.50%(d) | | | | | | | | |

| | | | 33,473 | | | | 876,993 | |

| | | | | | | | | |

| Total Convertible Preferred Stocks | | | | | | | | |

| (Cost $1,458,671) | | | | | | | 1,522,433 | |

| | | | | | | | | |

| Closed-End Mutual Funds (3.10%) | | | | | | | | |

| BlackRock Income Trust, Inc. | | | 82,681 | | | | 472,935 | |

| The accompanying notes are an integral part of the financial statements. | |

| 6 | www.iconfunds.com |

| ICON Equity Income Fund | Schedule of Investments |

| | September 30, 2018 |

| | | Shares or

Principal

Amount | | | Value | |

| Closed-End Mutual Funds (continued) | | | | | | | | |

| Deutsche Multi-Market Income Trust | | | 122,811 | | | $ | 1,102,843 | |

| Deutsche Strategic Income Trust | | | 9,700 | | | | 122,220 | |

| Duff & Phelps Utility and Corporate Bond Trust, Inc. | | | 13,791 | | | | 115,706 | |

| Eaton Vance High Income 2021 Target Term Trust | | | 7,791 | | | | 75,573 | |

| Nuveen Build America Bond Fund | | | 26,879 | | | | 537,580 | |

| Nuveen Build America Bond Opportunity Fund | | | 1,301 | | | | 28,323 | |

| | | | | | | | | |

| Total Closed-End Mutual Funds | | | | | | | | |

| (Cost $2,412,056) | | | | | | | 2,455,180 | |

| Underlying Security/Expiration | | | | | | |

| Date/Exercise Price/ Notional Amount | | Contracts | | | Value | |

| Purchased Put Options (0.02%) | | | | | | | | |

| S&P 500 Index | | | | | | | | |

| 10/19/18, 2,660, $23,311,840 | | | 80 | | | | 19,200 | |

| | | | | | | | | |

| Total Purchased Put Options | | | | | | | | |

| (Cost $162,115) | | | | | | | 19,200 | |

| | | Shares or

Principal

Amount | | | Value | |

| Collateral for Securities on Loan (1.73%) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 7-Day Yield 2.19% | | | 1,373,225 | | | | 1,373,225 | |

| | | | | | | | | |

| Total Collateral for Securities on Loan | | | | | | | | |

| (Cost $1,373,225) | | | | | | | 1,373,225 | |

| | | | | | | | | |

| Total Investments (100.10%) | | | | | | | | |

| (Cost $75,031,200) | | | | | | $ | 79,411,068 | |

| | | | | | | | | |

| Liabilities Less Other Assets (-0.10%) | | | | | | | (80,903 | ) |

| | | | | | | | | |

| Net Assets (100.00%) | | | | | | $ | 79,330,165 | |

Investment Abbreviations:

ADR - American Depositary Receipt

LIBOR - London Interbank Offered Rate

REIT - Real Estate Investment Trust

LIBOR Rates:

3M US L - 3 Month LIBOR as of September 30, 2018 was 2.40%

| (a) | Security was purchased pursuant to Rule 144A or Section 4(a)(2) under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. As of September 30, 2018, these securities had a total aggregate market value of $1,864,561. |

| (b) | All or a portion of the security was on loan as of September 30, 2018. |

| (c) | Floating or variable rate security. The reference rate is described above. The rate in effect as of September 30, 2018 is based on the reference rate plus the displayed spread as of the security’s last reset date. |

| (d) | This security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

| (e) | These securities are considered, by management, to be illiquid. The aggregate value of these securities at September 30, 2018 was $1,521,857, which represent 1.92% of the Fund’s net assets. |

| Sector Composition (September 30, 2018) | | | | |

| | | | | |

| Financials | | | 22.85 | % |

| Consumer Discretionary | | | 12.74 | % |

| Energy | | | 11.16 | % |

| Information Technology | | | 10.84 | % |

| Utilities | | | 7.16 | % |

| Consumer Staples | | | 7.15 | % |

| Materials | | | 6.48 | % |

| Industrials | | | 6.38 | % |

| Communication Services | | | 4.68 | % |

| Real Estate | | | 3.15 | % |

| Health Care | | | 2.40 | % |

| Telecommunication Services | | | 0.26 | % |

| | | | 95.25 | % |

Percentages are based upon corporate bonds, common stocks, preferred stocks and convertible preferred stocks as a percentage of net assets.

| The accompanying notes are an integral part of the financial statements. | |

| Annual Report | September 30, 2018 | 7 |

| ICON Equity Income Fund | Schedule of Investments |

| | September 30, 2018 |

| Industry Composition (September 30, 2018) | | | | |

| | | | | |

| Diversified Banks | | | 6.76 | % |

| Life & Health Insurance | | | 5.38 | % |

| Regional Banks | | | 5.06 | % |

| Integrated Telecommunication Services | | | 4.35 | % |

| Tobacco | | | 3.96 | % |

| Semiconductors | | | 3.96 | % |

| Multi-Utilities | | | 3.79 | % |

| Technology Hardware, Storage & Peripherals | | | 3.59 | % |

| Investment Banking & Brokerage | | | 3.51 | % |

| Homebuilding | | | 3.49 | % |

| Oil & Gas Refining & Marketing | | | 3.48 | % |

| IT Consulting & Other Services | | | 3.29 | % |

| Electric Utilities | | | 3.21 | % |

| Diversified Chemicals | | | 3.12 | % |

| Auto Parts & Equipment | | | 3.04 | % |

| Oil & Gas Exploration & Production | | | 3.00 | % |

| Paper Packaging | | | 2.63 | % |

| Integrated Oil & Gas | | | 2.35 | % |

| Oil & Gas Storage & Transportation | | | 2.33 | % |

| Soft Drinks | | | 2.09 | % |

| Building Products | | | 2.00 | % |

| Aerospace & Defense | | | 1.92 | % |

| Industrial REITs | | | 1.92 | % |

| Construction Machinery & Heavy Trucks | | | 1.79 | % |

| Automobile Manufacturers | | | 1.79 | % |

| Property & Casualty Insurance | | | 1.47 | % |

| Restaurants | | | 1.37 | % |

| Hotels, Resorts & Cruise Lines | | | 1.33 | % |

| Office REITs | | | 1.11 | % |

| Biotechnology | | | 1.08 | % |

| Pharmaceuticals | | | 1.06 | % |

| Other Industries (each less than 1%) | | | 6.02 | % |

| | | | 95.25 | % |

Percentages are based upon corporate bonds, common stocks, preferred stocks and convertible preferred stocks as a percentage of net assets.

| The accompanying notes are an integral part of the financial statements. | |

| 8 | www.iconfunds.com |

| ICON Flexible Bond Fund | Management Overview |

| | September 30, 2018 (Unaudited) |

Q. How did the Fund perform relative to its benchmark?

A. For the fiscal year ended September 30, 2018, the ICON Flexible Bond Fund (the Fund) Class S shares outperformed its benchmark, the Barclays Capital U.S. Universal Index (ex-MBS). The Fund returned 1.89% while the Barclays Capital U.S. Universal Index (ex-MBS) returned -1.03%. Total returns for other periods and additional Class shares as of September 30, 2018, appear in the subsequent pages of this Fund’s Management Overview.

Q. What primary factors were behind the Fund’s relative performance?

A. Rising interest rates made fiscal year 2018 difficult for fixed income investors. As interest rates rose over the course of the year, bond prices generally declined, resulting in negative total returns for many bond funds.

Still, the ICON Flexible Bond Fund fared relatively well during this decline in bond values. The Fund’s shorter overall duration, corporate credit orientation and special situation/event-driven focus capitalized on opportunities that others may have missed, and partially offset some of the declining bond values that might have otherwise been the consequence of an interest rate increase.

Q. How did the Fund’s composition affect performance?

A. As stated above, the Fund outperformed its benchmark during the fiscal year. The outperformance largely stemmed from the Fund’s positions in corporate credit and the preferred share segment of the market, both of which produced strong relative returns during the 12-month period. Closed-end fund (CEF) positions also produced strong returns relative to the benchmark, contributing positively to the Fund’s performance.

The Fund looks to purchase CEFs at discounts to their net asset value (NAV). In particular, we look for CEFs that we believe may be converted to an open-end fund or which may liquidate and capitalize upon the discount. Our efforts to find these opportunities led to purchases in which one of the Fund’s CEF holdings liquidated at NAV and another open-ended. As a result, we were able to capture the original discount to net asset value at which each CEF had been acquired.

The Fund benefitted also from our high coupon yield to call purchases, which helped offset some of the Fund’s interest rate sensitivity due to the holdings’ short duration and attractive yields.

Finally, we increased our allocation to preferred stocks after interest rates had risen. We believed preferred stocks experienced more severe price declines than were warranted and several of the Fund’s preferred holdings resulted in attractive yields.

Q. What is your investment outlook for the bond market?

A. At the end of fiscal year 2018, investment-grade and high yield corporate bond spreads continue to trade at levels we regard as excessively tight and overvalued. With spreads at these levels, we have been focused on positions in defensively structured fixed income and are utilizing our bottom up approach to find this type of issue-specific opportunity. While we do not anticipate a substantial upward movement in interest rates over the course of the next 12 months, the Fund is positioned in the lower portion of its duration range as we move into fiscal year 2019. We continue to evaluate CEF opportunities. While future bond market volatility remains a possibility, we believe our bottom up investment methodology will help the Fund navigate the changing market.

| Annual Report | September 30, 2018 | 9 |

| ICON Flexible Bond Fund | Management Overview |

| | September 30, 2018 (Unaudited) |

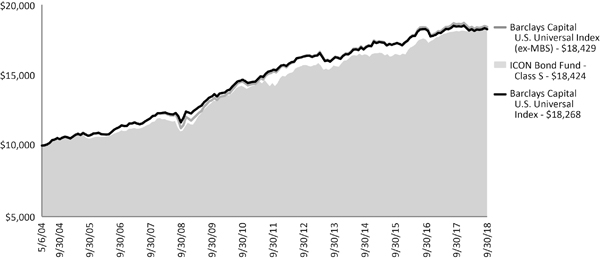

Average Annual Total Return (as of September 30, 2018)

| | | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception | | Gross Expense Ratio* | | Net Expense Ratio* |

| ICON Bond Fund - Class S | | 5/6/04 | | 1.89% | | 3.56% | | 5.03% | | 4.33% | | 1.08% | | 0.92% |

| ICON Bond Fund - Class C | | 10/21/02 | | 0.92% | | 2.67% | | 4.14% | | 3.79% | | 2.30% | | 1.77% |

| ICON Bond Fund - Class A | | 9/30/10 | | 1.55% | | 3.28% | | N/A | | 3.08% | | 1.58% | | 1.17% |

ICON Bond Fund - Class A

(including maximum sales charge of 4.75%) | | 9/30/10 | | -3.29% | | 2.29% | | N/A | | 2.45% | | 1.58% | | 1.17% |

| Barclays Capital U.S. Universal Index | | | | -1.00% | | 2.53% | | 4.22% | | 4.27% | | N/A | | N/A |

Barclays Capital U.S. Universal Index

(ex-MBS) | | | | -1.03% | | 2.69% | | 4.55% | | 4.34% | | N/A | | N/A |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

Value of a $10,000 Investment (through September 30, 2018)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Bond Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Bond Fund’s other share classes will vary due to differences in charges and expenses. The Bond Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| ICON Flexible Bond Fund | Schedule of Investments |

| | September 30, 2018 |

| | | Shares or

Principal

Amount | | | Value | |

| Corporate Bonds (59.50%) | | | | | | | | |

| Communication Services (1.65%) | | | | | | | | |

| Lee Enterprises, Inc. | | | | | | | | |

| 9.50%, 03/15/22(a)(b) | | $ | 1,650,000 | | | $ | 1,718,062 | |

| | | | | | | | | |

| Consumer Discretionary (13.24%) | | | | | | | | |

| Brookfield Residential Properties, Inc. | | | | | | | | |

| 6.50%, 12/15/20(a) | | | 100,000 | | | | 100,375 | |

| Foot Locker, Inc. | | | | | | | | |

| 8.50%, 01/15/22 | | | 2,950,000 | | | | 3,326,125 | |

| Lear Corp. | | | | | | | | |

| 5.38%, 03/15/24 | | | 1,500,000 | | | | 1,541,965 | |

| M/I Homes, Inc. | | | | | | | | |

| 6.75%, 01/15/21 | | | 1,316,000 | | | | 1,342,254 | |

| Nexteer Automotive Group, Ltd. | | | | | | | | |

| 5.88%, 11/15/21(a) | | | 200,000 | | | | 204,583 | |

| Reliance Intermediate Holdings LP | | | | | | | | |

| 6.50%, 04/01/23(a) | | | 4,150,000 | | | | 4,310,812 | |

| Silversea Cruise Finance, Ltd. | | | | | | | | |

| 7.25%, 02/01/25(a) | | | 350,000 | | | | 380,748 | |

| William Lyon Homes, Inc. | | | | | | | | |

| 7.00%, 08/15/22 | | | 2,550,000 | | | | 2,597,813 | |

| | | | | | | | 13,804,675 | |

| Consumer Staples (6.77%) | | | | | | | | |

| Central Garden & Pet Co. | | | | | | | | |

| 6.13%, 11/15/23 | | | 2,550,000 | | | | 2,629,687 | |

| Darling Ingredients, Inc. | | | | | | | | |

| 5.38%, 01/15/22 | | | 1,369,000 | | | | 1,382,690 | |

| Kraft Heinz Foods Co. | | | | | | | | |

| 4.88%, 02/15/25(a) | | | 3,000,000 | | | | 3,048,383 | |

| | | | | | | | 7,060,760 | |

| Energy (10.74%) | | | | | | | | |

| Andeavor Logistics LP / Tesoro Logistics Finance Corp. | | | | | | | | |

| 6.25%, 10/15/22 | | | 2,522,000 | | | | 2,591,355 | |

| 6.38%, 05/01/24 | | | 1,645,000 | | | | 1,743,700 | |

| Continental Resources, Inc. | | | | | | | | |

| 5.00%, 09/15/22 | | | 4,300,000 | | | | 4,362,350 | |

| MPLX LP | | | | | | | | |

| 5.50%, 02/15/23 | | | 2,450,000 | | | | 2,499,325 | |

| | | | | | | | 11,196,730 | |

| Financial (7.29%) | | | | | | | | |

| Catlin Insurance Co., Ltd. | | | | | | | | |

| 3M US L + 2.975%(a)(c)(d) | | | 850,000 | | | | 841,500 | |

| Delphi Financial Group, Inc. | | | | | | | | |

| 7.88%, 01/31/20 | | | 800,000 | | | | 844,731 | |

| Enova International, Inc. | | | | | | | | |

| 9.75%, 06/01/21 | | | 500,000 | | | | 524,375 | |

| International Lease Finance Corp. | | | | | | | | |

| 8.25%, 12/15/20 | | | 1,113,000 | | | | 1,216,203 | |

| Jefferies Finance LLC / JFIN Co.- Issuer Corp. | | | | | | | | |

| 7.38%, 04/01/20(a) | | | 350,000 | | | | 355,687 | |

| | | Shares or

Principal

Amount | | | Value | |

| Financial (continued) | | | | | | | | |

| Nationwide Mutual Insurance Co. | | | | | | | | |

| 7.88%, 04/01/33(a) | | $ | 1,000,000 | | | $ | 1,321,670 | |

| NewBridge Bancorp, Series AI | | | | | | | | |

| 7.25%, 03/14/24(a)(e) | | | 500,000 | | | | 504,095 | |

| Prudential Financial, Inc. | | | | | | | | |

| 3M US L + 4.175%, 09/15/42(c) | | | 1,100,000 | | | | 1,163,250 | |

| Willis North America, Inc. | | | | | | | | |

| 7.00%, 09/29/19 | | | 800,000 | | | | 827,376 | |

| | | | | | | | 7,598,887 | |

| Health Care (3.59%) | | | | | | | | |

| Catholic Health Initiatives | | | | | | | | |

| 2.95%, 11/01/22 | | | 1,000,000 | | | | 964,330 | |

| Hill-Rom Holdings, Inc. | | | | | | | | |

| 5.75%, 09/01/23(a) | | | 1,200,000 | | | | 1,230,000 | |

| Horizon Pharma, Inc. / Horizon Pharma USA, Inc. | | | | | | | | |

| 8.75%, 11/01/24(a) | | | 500,000 | | | | 533,750 | |

| Molina Healthcare, Inc. | | | | | | | | |

| 5.38%, 11/15/22 | | | 1,000,000 | | | | 1,016,250 | |

| | | | | | | | 3,744,330 | |

| Industrials (4.99%) | | | | | | | | |

| Air Canada | | | | | | | | |

| 7.75%, 04/15/21(a) | | | 100,000 | | | | 108,500 | |

| Covanta Holding Corp. | | | | | | | | |

| 6.38%, 10/01/22 | | | 1,747,000 | | | | 1,784,124 | |

| EnPro Industries, Inc. | | | | | | | | |

| 5.88%, 09/15/22 | | | 722,000 | | | | 735,537 | |

| RR Donnelley & Sons Co. | | | | | | | | |

| 7.88%, 03/15/21 | | | 1,000,000 | | | | 1,061,250 | |

| USG Corp. | | | | | | | | |

| 5.50%, 03/01/25(a) | | | 800,000 | | | | 816,000 | |

| XPO Logistics, Inc. | | | | | | | | |

| 6.50%, 06/15/22(a) | | | 675,000 | | | | 696,938 | |

| | | | | | | | 5,202,349 | |

| Information Technology (5.58%) | | | | | | | | |

| Amkor Technology, Inc. | | | | | | | | |

| 6.38%, 10/01/22 | | | 1,280,000 | | | | 1,304,154 | |

| Dell International LLC / EMC Corp. | | | | | | | | |

| 7.13%, 06/15/24(a) | | | 852,000 | | | | 915,133 | |

| Nielsen Co. Luxembourg SARL | | | | | | | | |

| 5.50%, 10/01/21(a) | | | 500,000 | | | | 502,875 | |

| NXP BV / NXP Funding LLC | | | | | | | | |

| 4.63%, 06/01/23(a) | | | 3,050,000 | | | | 3,096,360 | |

| | | | | | | | 5,818,522 | |

| Materials (2.69%) | | | | | | | | |

| Hecla Mining Co. | | | | | | | | |

| 6.88%, 05/01/21 | | | 500,000 | | | | 501,250 | |

| Teck Resources, Ltd. | | | | | | | | |

| 8.50%, 06/01/24(a) | | | 2,105,000 | | | | 2,301,291 | |

| | | | | | | | 2,802,541 | |

| Utilities (2.96%) | | | | | | | | |

| DPL, Inc. | | | | | | | | |

| 6.75%, 10/01/19 | | | 619,000 | | | | 634,475 | |

The accompanying notes are an integral part of the financial statements.

| Annual Report | September 30, 2018 | 11 |

| ICON Flexible Bond Fund | Schedule of Investments |

| | September 30, 2018 |

| | | Shares or

Principal

Amount | | | Value | |

| Utilities (continued) | | | | | | | | |

| Vistra Energy Corp. | | | | | | | | |

| 7.38%, 11/01/22 | | $ | 750,000 | | | $ | 780,135 | |

| 7.63%, 11/01/24 | | | 1,560,000 | | | | 1,678,950 | |

| | | | | | | | 3,093,560 | |

| | | | | | | | | |

Total Corporate Bonds

(Cost $62,987,018) | | | | | | | 62,040,416 | |

| | | | | | | | | |

| Asset-Backed Securities (3.22%) | | | | | | | | |

| SMB Private Education Loan Trust 2014-A | | | | | | | | |

| Series 2014-A, Class C | | | | | | | | |

| 4.50%, 11/15/25(a)(e) | | | 3,500,000 | | | | 3,357,602 | |

| | | | | | | | | |

Total Asset-Backed Securities

(Cost $3,378,658) | | | | | | | 3,357,602 | |

| | | | | | | | | |

| U.S. Treasury Obligations (8.03%) | | | | | | | | |

| U.S. Treasury Bond | | | | | | | | |

| 2.88%, 08/15/28 | | | 8,500,000 | | | | 8,371,172 | |

| | | | | | | | | |

Total U.S. Treasury Obligations

(Cost $8,424,759) | | | | | | | 8,371,172 | |

| | | | | | | | | |

| Common Stocks (3.14%) | | | | | | | | |

| Industrial REITs (3.14%) | | | | | | | | |

| Gramercy Property Trust(b) | | | 119,294 | | | | 3,273,427 | |

| | | | | | | | | |

Total Common Stocks

(Cost $3,266,371) | | | | | | | 3,273,427 | |

| | | | | | | | | |

| Preferred Stocks (12.23%) | | | | | | | | |

| Diversified Banks (0.25%) | | | | | | | | |

| Wells Fargo & Co., Series L 7.50%(b)(d) | | | 200 | | | | 258,176 | |

| | | | | | | | | |

| Financial Services (2.01%) | | | | | | | | |

| Cabco Series 2004-101 Trust Goldman Sachs Capital I, Series GS | | | | | | | | |

| 3M US L + 0.85%, 02/15/34(c) | | | 94,496 | | | | 2,091,196 | |

| | | | | | | | | |

| Industrial REITs (4.16%) | | | | | | | | |

| Gramercy Property Trust, Series A 7.13%(d)(e) | | | 173,861 | | | | 4,343,048 | |

| | | | | | | | | |

| Life & Health Insurance (0.74%) | | | | | | | | |

| Prudential Financial, Inc.(b) | | | | | | | | |

| 5.75%, 12/15/52 | | | 30,696 | | | | 768,014 | |

| | | Shares or

Principal

Amount | | | Value | |

| Property & Casualty Insurance (5.07%) | | | | | | | | |

| Argo Group US, Inc.(b) | | | | | | | | |

| 6.50%, 09/15/42 | | | 210,258 | | | $ | 5,287,989 | |

| | | | | | | | | |

Total Preferred Stocks

(Cost $12,917,497) | | | | | | | 12,748,423 | |

| | | | | | | | | |

| Convertible Preferred Stocks (2.72%) | | | | | | | | |

| Office REITs (2.72%) | | | | | | | | |

| Equity Commonwealth, Series D 6.50%(d) | | | 108,118 | | | | 2,832,692 | |

| | | | | | | | | |

Total Convertible Preferred Stocks

(Cost $2,722,510) | | | | | | | 2,832,692 | |

| | | | | | | | | |

| Closed-End Mutual Funds (9.87%) | | | | | | | | |

| BlackRock Income Trust, Inc.(b) | | | 134,663 | | | | 770,272 | |

| Deutsche Multi-Market Income Trust | | | 299,859 | | | | 2,692,734 | |

| Deutsche Strategic Income Trust | | | 43,770 | | | | 551,502 | |

| Duff & Phelps Utility and Corporate Bond Trust, Inc.(b) | | | 48,797 | | | | 409,407 | |

| High Income Securities Fund | | | 110,616 | | | | 1,048,640 | |

| Nuveen Build America Bond Fund | | | 147,666 | | | | 2,953,320 | |

| Nuveen Build America Bond Opportunity Fund | | | 85,558 | | | | 1,862,597 | |

| | | | | | | | | |

Total Closed-End Mutual Funds

(Cost $10,323,218) | | | | | | | 10,288,472 | |

| | | | | | | | | |

| Collateral for Securities on Loan (2.40%) | | | | | | | | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 7-Day Yield 2.19% | | | 2,503,136 | | | | 2,503,136 | |

| | | | | | | | | |

Total Collateral for Securities on Loan

(Cost $2,503,136) | | | | | | | 2,503,136 | |

| | | | | | | | | |

Total Investments (101.11%)

(Cost $106,523,167) | | | | | | $ | 105,415,340 | |

| | | | | | | | | |

| Liabilities Less Other Assets (-1.11%) | | | | | | | (1,154,990 | ) |

| | | | | | | | | |

| Net Assets (100.00%) | | | | | | $ | 104,260,350 | |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

REIT - Real Estate Investment Trust

The accompanying notes are an integral part of the financial statements.

| ICON Flexible Bond Fund | Schedule of Investments |

| | September 30, 2018 |

LIBOR Rates:

3M US L - 3 Month LIBOR as of September 30, 2018 was 2.40%

| (a) | Security was purchased pursuant to Rule 144A or Section 4(a)(2) under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. As of September 30, 2018, these securities had a total aggregate market value of $26,344,364. |

| (b) | All or a portion of the security was on loan as of September 30, 2018. |

| (c) | Floating or variable rate security. The reference rate is described above. The rate in effect as of September 30, 2018 is based on the reference rate plus the displayed spread as of the security’s last reset date. |

| (d) | This security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

| (e) | These securities are considered, by management, to be illiquid. The aggregate value of these securities at September 30, 2018 was $8,204,745, which represent 7.87% of the Fund’s net assets. |

| Credit Diversification (September 30, 2018) | | | |

| | | | |

| Ba2 | | 12.38 | % |

| B1 | | 9.07 | % |

| Ba1 | | 8.52 | % |

| Baa3 | | 8.25 | % |

| Aaa | | 8.03 | % |

| Ba3 | | 4.97 | % |

| B2 | | 4.51 | % |

| Baa2 | | 4.04 | % |

| NR* | | 3.69 | % |

| B3 | | 3.48 | % |

| A3 | | 1.27 | % |

| Baa1 | | 0.92 | % |

| BBB | | 0.81 | % |

| BBB+ | | 0.81 | % |

| Total: | | 70.75 | % |

Percentages are based upon corporate bond, asset-backed securities and U.S. Treasury obligations investments as a percentage of net assets. Ratings based on Moody’s Investors Service, Inc where available, otherwise on Standard & Poor’s Financial Services LLC.

The accompanying notes are an integral part of the financial statements.

| Annual Report | September 30, 2018 | 13 |

| ICON Fund | Management Overview |

September 30, 2018 (Unaudited)

Q. How did the Fund perform relative to its benchmark?

A. The ICON Fund (the Fund) Class S returned 6.53% for the fiscal year ended September 30, 2018, while its benchmark, the S&P Composite 1500 Index, returned 17.69%. Total returns for other periods and additional Class shares as of September 30, 2018, appear in the subsequent pages of this Fund’s Management Overview.

Q. What primary factors were behind the Fund’s relative performance?

A. Much of the Fund’s underperformance relative to the S&P Composite 1500 Index occurred between late June and September 30, 2018. The market experienced a sector theme change during the fourth fiscal quarter. The Fund’s large weightings in the Financials, Consumer Discretionary and Information Technology sectors were a drag on performance in the last months of the fiscal year, while lesser weighted sectors like Communication Services, Utilities and Consumer Staples were among the leaders.

Q. How did the Fund’s composition affect performance?

A. The five biggest contributors to Fund performance were Adobe Inc., SVB Financial Group, Bank of America Corp., Home Depot Inc. and Total Systems Services Inc. Bank of America and SVB Financial Group are in the Financials sector and repeated as top five contributors from the previous fiscal year. Adobe and Total Systems are in the Information Technology sector while Home Depot is categorized as a home improvement retail industry which is included in the Consumer Discretionary sector. All five remained in the portfolio as of September 30, 2018.

The five stocks that detracted the most from Fund performance were Celgene Corp., Whirlpool Corp., Applied Materials Inc., Skyworks Solutions Inc. and Martin Marietta Materials Inc. Whirlpool and Applied Materials were sold during fiscal year 2018. The other three remain in the Fund.

Q. What is your investment outlook for the overall market?

A. As of September 30, 2018, ICON’s valuation model shows a value-to-price (V/P) ratio of 1.02 for the overall market. In other words, we believe stock prices, on average, are slightly below our estimate of fair value. We are not seeing overpricing and other indications or behaviors typical of market peaks. In terms of upside potential we do not expect the excess returns available when the broad market is priced at a discount to fair value.

| ICON Fund | Management Overview |

September 30, 2018 (Unaudited)

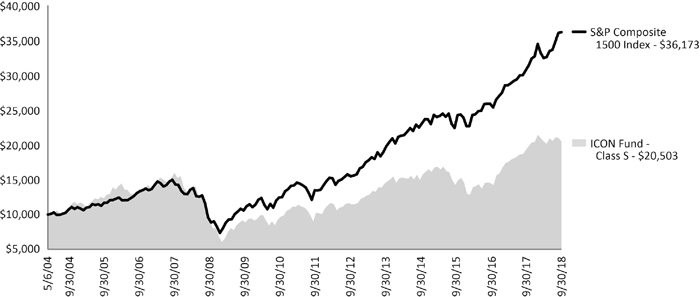

Average Annual Total Return (as of September 30, 2018)

| | | | | | Since | Gross Expense | Net Expense |

| | Inception Date | 1 Year | 5 Years | 10 Years | Inception | Ratio* | Ratio* |

| ICON Fund - Class S | 5/6/04 | 6.53% | 7.29% | 6.10% | 5.11% | 1.10% | 1.10% |

| ICON Fund - Class C | 11/28/00 | 5.32% | 6.07% | 5.21% | 4.14% | 2.31% | 2.25% |

| ICON Fund - Class A | 5/31/06 | 6.08% | 6.87% | 5.65% | 2.82% | 1.66% | 1.50% |

| ICON Fund - Class A (including maximum sales charge of 5.75%) | 5/31/06 | 0.00% | 5.61% | 5.02% | 2.33% | 1.66% | 1.50% |

| S&P Composite 1500 Index | | 17.69% | 13.77% | 12.04% | 9.34% | N/A | N/A |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Since Inception performance results for Class C shares include returns for certain time periods that were restarted as of June 8, 2004.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

Value of a $10,000 Investment (through September 30, 2018)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the ICON Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the ICON Fund’s other share classes will vary due to differences in charges and expenses. The ICON Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2018 | 15 |

| ICON Fund | Schedule of Investments |

September 30, 2018

| | | Shares or

Principal

Amount | | | Value | |

| Common Stocks (99.95%) | | | | | | | | |

| Application Software (7.10%) | | | | | | | | |

| Adobe Systems, Inc.(a) | | | 13,000 | | | $ | 3,509,350 | |

| | | | | | | | | |

| Auto Parts & Equipment (2.36%) | | | | | | | | |

| Magna International, Inc. | | | 22,200 | | | | 1,166,166 | |

| | | | | | | | | |

| Biotechnology (6.70%) | | | | | | | | |

| Celgene Corp.(a) | | | 18,500 | | | | 1,655,565 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 8,600 | | | | 1,657,564 | |

| | | | | | | | 3,313,129 | |

| | | | | | | | | |

| Building Products (2.89%) | | | | | | | | |

| Masco Corp. | | | 39,000 | | | | 1,427,400 | |

| | | | | | | | | |

| Construction Materials (4.61%) | | | | | | | | |

| Eagle Materials, Inc. | | | 7,700 | | | | 656,348 | |

| Martin Marietta Materials, Inc. | | | 8,900 | | | | 1,619,355 | |

| | | | | | | | 2,275,703 | |

| | |

| Data Processing & Outsourced Services (4.05%) | |

| Total System Services, Inc. | | | 20,300 | | | | 2,004,422 | |

| | | | | | | | | |

| Diversified Banks (13.62%) | | | | | | | | |

| Bank of America Corp. | | | 182,000 | | | | 5,361,720 | |

| JPMorgan Chase & Co. | | | 12,200 | | | | 1,376,648 | |

| | | | | | | | 6,738,368 | |

| | |

| General Merchandise Stores (2.86%) | |

| Dollar General Corp. | | | 4,800 | | | | 524,640 | |

| Dollar Tree, Inc.(a) | | | 10,900 | | | | 888,895 | |

| | | | | | | | 1,413,535 | |

| | | | | | | | | |

| Health Care Equipment (1.51%) | | | | | | | | |

| Teleflex, Inc. | | | 2,800 | | | | 745,052 | |

| | | | | | | | | |

| Health Care Services (1.51%) | | | | | | | | |

| DaVita, Inc.(a) | | | 10,400 | | | | 744,952 | |

| | | | | | | | | |

| Home Improvement Retail (3.73%) | |

| Home Depot, Inc. | | | 8,900 | | | | 1,843,635 | |

| | | | | | | | | |

| Homebuilding (3.71%) | | | | | | | | |

| PulteGroup, Inc. | | | 74,100 | | | | 1,835,457 | |

| | | | | | | | | |

| Hotels, Resorts & Cruise Lines (3.02%) | |

| Royal Caribbean Cruises, Ltd. | | | 11,500 | | | | 1,494,310 | |

| | | | | | | | | |

| Interactive Media & Services (2.03%) | |

| Facebook, Inc., Class A(a) | | | 6,100 | | | | 1,003,206 | |

| | | | | | | | | |

| Leisure Products (1.78%) | | | | | | | | |

| Polaris Industries, Inc.(b) | | | 8,700 | | | | 878,265 | |

| | | | | | | | | |

| Oil & Gas Exploration & Production (6.88%) | |

| Cabot Oil & Gas Corp. | | | 37,000 | | | | 833,240 | |

| Diamondback Energy, Inc.(b) | | | 8,600 | | | | 1,162,634 | |

| | | Shares or

Principal

Amount | | | Value | |

| Oil & Gas Exploration & Production (continued) | |

| Parsley Energy, Inc., Class A(a) | | | 48,100 | | | $ | 1,406,925 | |

| | | | | | | | 3,402,799 | |

| Oil & Gas Refining & Marketing (2.81%) | |

| Marathon Petroleum Corp. | | | 17,400 | | | | 1,391,478 | |

| | | | | | | | | |

| Pharmaceuticals (3.43%) | | | | | | | | |

| Jazz Pharmaceuticals PLC(a) | | | 10,100 | | | | 1,698,113 | |

| | | | | | | | | |

| Regional Banks (14.14%) | | | | | | | | |

| KeyCorp | | | 58,000 | | | | 1,153,620 | |

| PNC Financial Services Group, Inc. | | | 8,300 | | | | 1,130,377 | |

| Signature Bank | | | 16,600 | | | | 1,906,344 | |

| SVB Financial Group(a) | | | 9,000 | | | | 2,797,470 | |

| | | | | | | | 6,987,811 | |

| | | | | | | | | |

| Semiconductor Equipment (1.74%) | |

| Applied Materials, Inc. | | | 22,300 | | | | 861,895 | |

| | | | | | | | | |

| Semiconductors (9.47%) | | | | | | | | |

| Broadcom, Inc. | | | 1,800 | | | | 444,114 | |

| Qorvo, Inc.(a) | | | 20,300 | | | | 1,560,867 | |

| Skyworks Solutions, Inc. | | | 29,500 | | | | 2,675,945 | |

| | | | | | | | 4,680,926 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $36,233,307) | | | | | | | 49,415,972 | |

| | | | | | | | | |

| Total Investments (99.95%) | | | | | | | | |

| (Cost $36,233,307) | | | | | | $ | 49,415,972 | |

| | | | | | | | | |

| Other Assets Less Liabilities (0.05%) | | | | | | | 22,484 | |

| | | | | | | | | |

| Net Assets (100.00%) | | | | | | $ | 49,438,456 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security was on loan as of September 30, 2018. |

The accompanying notes are an integral part of the financial statements.

| ICON Fund | Schedule of Investments |

September 30, 2018

| Sector Composition (September 30, 2018) | | | | |

| | | | | |

| Financials | | | 27.76 | % |

| Information Technology | | | 22.36 | % |

| Consumer Discretionary | | | 17.46 | % |

| Health Care | | | 13.15 | % |

| Energy | | | 9.69 | % |

| Materials | | | 4.61 | % |

| Industrials | | | 2.89 | % |

| Communication Services | | | 2.03 | % |

| | | | 99.95 | % |

Percentages are based upon common stocks as a percentage of net assets.

| Industry Composition (September 30, 2018) | | | |

| | | | |

| Regional Banks | | | 14.14 | % |

| Diversified Banks | | | 13.62 | % |

| Semiconductors | | | 9.47 | % |

| Application Software | | | 7.10 | % |

| Oil & Gas Exploration & Production | | | 6.88 | % |

| Biotechnology | | | 6.70 | % |

| Construction Materials | | | 4.61 | % |

| Data Processing & Outsourced Services | | | 4.05 | % |

| Home Improvement Retail | | | 3.73 | % |

| Homebuilding | | | 3.71 | % |

| Pharmaceuticals | | | 3.43 | % |

| Hotels, Resorts & Cruise Lines | | | 3.02 | % |

| Building Products | | | 2.89 | % |

| General Merchandise Stores | | | 2.86 | % |

| Oil & Gas Refining & Marketing | | | 2.81 | % |

| Auto Parts & Equipment | | | 2.36 | % |

| Interactive Media & Services | | | 2.03 | % |

| Leisure Products | | | 1.78 | % |

| Semiconductor Equipment | | | 1.74 | % |

| Health Care Services | | | 1.51 | % |

| Health Care Equipment | | | 1.51 | % |

| | | | 99.95 | % |

Percentages are based upon common stocks as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

| Annual Report | September 30, 2018 | 17 |

ICON Long/Short Fund | Management Overview |

September 30, 2018 (Unaudited)

Q. How did the Fund perform relative to its benchmark?

| A. | The ICON Long-Short Fund (the Fund) Class S returned 7.88% for the fiscal year ended September 30, 2018, while its benchmark, the S&P Composite 1500 Index, returned 17.69%. Total returns for other periods and additional Class shares as of September 30, 2018, appear in the subsequent pages of this Fund’s Management Overview. |

Q. What primary factors were behind the Fund’s relative performance?

| A. | The Fund’s underperformance relative to the S&P 1500 Index occurred between late June and September 30, 2018. The market experienced a sector theme change during the fourth fiscal quarter. The Fund’s large weightings in the Financials, Consumer Discretionary and Information Technology sectors were a drag on performance in the last months of the fiscal year, while lesser weighted sectors like Communication Services, Utilities and Consumer Staples were among the market leaders. |

Q. How did the Fund’s composition affect performance?

| A. | The five biggest contributors to Fund performance were MasterCard Inc., SVB Financial Group, Adobe Inc., Bank of America Corp. and CSX Corp. Bank of America and SVB Financial Group are in the Financials sector and repeated as two of the top five contributors from the previous fiscal year. Master Card and Adobe are in the Information Technology sector while CSX, a railroad, is in the Industrials sector. All five remained in the portfolio as of September 30, 2018. |

| The five stocks that detracted the most from Fund performance were Celgene Corp., Installed Building Products Inc., SINA Corp., Applied Materials Inc., and Whirlpool Corp. The Fund sold its positions in Whirlpool, SINA and Applied Materials during the fiscal year. The other two companies remain in the Fund. |

Q. What is your investment outlook for the overall market?

| A. | As of September 30, 2018, ICON’s valuation model shows a value-to-price (V/P) ratio of 1.02 for the overall market. In other words, we believe stock prices, on average, are slightly below our estimate of fair value. We are not seeing overpricing and other indications or behaviors typical of market peaks. In terms of upside potential we do not expect the excess returns available when the broad market is priced at a discount to fair value. |

ICON Long/Short Fund | Management Overview |

September 30, 2018 (Unaudited)

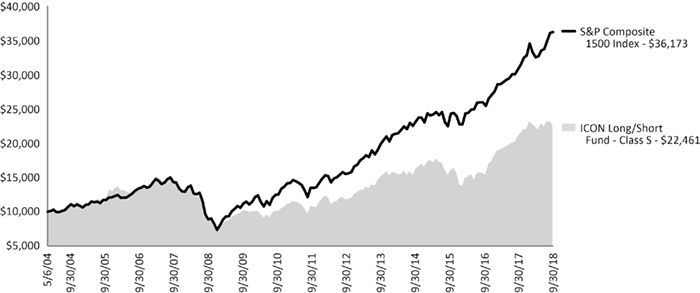

Average Annual Total Return (as of September 30, 2018)

| | Inception Date | | 1 Year | | 5 Years | | 10 Years | | Since Inception | | Gross Expense Ratio* | | Net Expense Ratio* |

| ICON Long/Short Fund - Class S | | 5/6/04 | | 7.88 | % | | 9.16 | % | | 7.47 | % | | 5.78 | % | | 1.50% | | 1.25% |

| ICON Long/Short Fund - Class C | | 10/17/02 | | 6.78 | % | | 8.02 | % | | 6.34 | % | | 6.08 | % | | 2.74% | | 2.30% |

| ICON Long/Short Fund - Class A | | 5/31/06 | | 7.52 | % | | 8.83 | % | | 7.14 | % | | 4.25 | % | | 1.93% | | 1.55% |

| ICON Long/Short Fund - Class A | | | | | | | | | | | | | | | | | | |

| (including maximum sales charge of 5.75%) | | 5/31/06 | | 1.39 | % | | 7.55 | % | | 6.51 | % | | 3.75 | % | | 1.93% | | 1.55% |

| S&P Composite 1500 Index | | | | 17.69 | % | | 13.77 | % | | 12.04 | % | | 9.34 | % | | N/A | | N/A |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

Value of a $10,000 Investment (through September 30, 2018)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Long/Short Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Long/Short Fund’s other share classes will vary due to differences in charges and expenses. The Long/Short Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2018 | 19 |

ICON Long/Short Fund | Schedule of Investments |

September 30, 2018

| | | Shares or

Principal

Amount | | | Value | |

| Common Stocks (99.39%) | | | | | | | | |

| Air Freight & Logistics (3.41%) | | | | | | | | |

| FedEx Corp. | | | 4,100 | | | $ | 987,239 | |

| | | | | | | | | |

| Application Software (2.24%) | | | | | | | | |

| Adobe Systems, Inc.(a) | | | 2,400 | | | | 647,880 | |

| | | | | | | | | |

| Auto Parts & Equipment (1.36%) | | | | | | | | |

| Magna International, Inc. | | | 7,500 | | | | 393,975 | |

| | | | | | | | | |

| Biotechnology (9.18%) | | | | | | | | |

| Alexion Pharmaceuticals, Inc.(a) | | | 7,200 | | | | 1,000,872 | |

| Celgene Corp.(a) | | | 9,500 | | | | 850,155 | |

| Vertex Pharmaceuticals, Inc.(a) | | | 4,200 | | | | 809,508 | |

| | | | | | | | 2,660,535 | |

| Building Products (2.67%) | | | | | | | | |

| Masco Corp. | | | 21,100 | | | | 772,260 | |

| | | | | | | | | |

| Construction Materials (3.48%) | | | | | | | | |

| Eagle Materials, Inc. | | | 6,700 | | | | 571,108 | |

| Martin Marietta Materials, Inc. | | | 2,400 | | | | 436,680 | |

| | | | | | | | 1,007,788 | |

| Data Processing & Outsourced Services (6.15%) | | | | | | | | |

| Mastercard, Inc., Class A | | | 8,000 | | | | 1,780,880 | |

| | | | | | | | | |

| Diversified Banks (9.06%) | | | | | | | | |

| Bank of America Corp. | | | 70,700 | | | | 2,082,822 | |

| JPMorgan Chase & Co. | | | 4,800 | | | | 541,632 | |

| | | | | | | | 2,624,454 | |

| General Merchandise Stores (4.53%) | | | | | | | | |

| Dollar General Corp. | | | 5,500 | | | | 601,150 | |

| Dollar Tree, Inc.(a) | | | 8,700 | | | | 709,485 | |

| | | | | | | | 1,310,635 | |

| Health Care Equipment (1.56%) | | | | | | | | |

| Teleflex, Inc. | | | 1,700 | | | | 452,353 | |

| | | | | | | | | |

| Health Care Facilities (1.54%) | | | | | | | | |

| Universal Health Services, Inc., Class B | | | 3,500 | | | | 447,440 | |

| | | | | | | | | |

| Health Care Services (1.61%) | | | | | | | | |

| DaVita, Inc.(a) | | | 6,500 | | | | 465,595 | |

| | | | | | | | | |

| Home Improvement Retail (2.29%) | | | | | | | | |

| Home Depot, Inc. | | | 3,200 | | | | 662,880 | |

| | | | | | | | | |

| Homebuilding (4.68%) | | | | | | | | |

| Installed Building Products, Inc.(a) | | | 10,300 | | | | 401,700 | |

| PulteGroup, Inc. | | | 38,500 | | | | 953,645 | |

| | | | | | | | 1,355,345 | |

| Hotels, Resorts & Cruise Lines (3.18%) | | | | | | | | |

| Royal Caribbean Cruises, Ltd. | | | 7,100 | | | | 922,574 | |

| | | Shares or

Principal

Amount | | | Value | |

| Insurance Brokers (3.01%) | | | | | | | | |

| Arthur J Gallagher & Co. | | | 11,700 | | | $ | 870,948 | |

| | | | | | | | | |

| Leisure Products (2.33%) | | | | | | | | |

| Polaris Industries, Inc. | | | 6,700 | | | | 676,365 | |

| | | | | | | | | |

| Oil & Gas Exploration & Production (4.95%) | | | | | | | | |

| Cabot Oil & Gas Corp. | | | 17,500 | | | | 394,100 | |

| Diamondback Energy, Inc.(b) | | | 2,400 | | | | 324,456 | |

| Parsley Energy, Inc., Class A(a) | | | 24,500 | | | | 716,625 | |

| | | | | | | | 1,435,181 | |

| Oil & Gas Refining & Marketing (2.93%) | | | | | | | | |

| Marathon Petroleum Corp. | | | 10,600 | | | | 847,682 | |

| | | | | | | | | |

| Pharmaceuticals (2.84%) | | | | | | | | |

| Jazz Pharmaceuticals PLC(a) | | | 4,900 | | | | 823,837 | |

| | | | | | | | | |

| Railroads (5.52%) | | | | | | | | |

| CSX Corp. | | | 12,700 | | | | 940,435 | |

| Kansas City Southern | | | 5,800 | | | | 657,024 | |

| | | | | | | | 1,597,459 | |

| Regional Banks (11.67%) | | | | | | | | |

| KeyCorp | | | 28,500 | | | | 566,865 | |

| PNC Financial Services Group, Inc. | | | 4,000 | | | | 544,760 | |

| Signature Bank | | | 9,200 | | | | 1,056,528 | |

| SVB Financial Group(a) | | | 3,900 | | | | 1,212,237 | |

| | | | | | | | 3,380,390 | |

| Semiconductor Equipment (1.61%) | | | | | | | | |

| Applied Materials, Inc. | | | 12,100 | | | | 467,665 | |

| | | | | | | | | |

| Semiconductors (7.59%) | | | | | | | | |

| Cypress Semiconductor Corp.(b) | | | 48,800 | | | | 707,112 | |

| Qorvo, Inc.(a) | | | 6,300 | | | | 484,407 | |

| Skyworks Solutions, Inc. | | | 11,100 | | | | 1,006,881 | |

| | | | | | | | 2,198,400 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $23,154,065) | | | | | | | 28,789,760 | |

| | | | | | | | | |

| Total Investments (99.39%) | | | | | | | | |

| (Cost $23,154,065) | | | | | | $ | 28,789,760 | |

| | | | | | | | | |

| Other Assets Less Liabilities (0.61%) | | | | | | | 177,413 | |

| | | | | | | | | |

| Net Assets (100.00%) | | | | | | $ | 28,967,173 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security was on loan as of September 30, 2018. |

| The accompanying notes are an integral part of the financial statements. | |

| 20 | www.iconfunds.com |

| ICON Long/Short Fund | Schedule of Investments |

| | September 30, 2018 |

| Sector Composition (September 30, 2018) | | | | |

| | | | | |

| Financials | | | 23.74 | % |

| Consumer Discretionary | | | 18.37 | % |

| Information Technology | | | 17.59 | % |

| Health Care | | | 16.73 | % |

| Industrials | | | 11.60 | % |

| Energy | | | 7.88 | % |

| Materials | | | 3.48 | % |

| | | | 99.39 | % |

Percentages are based upon common stocks as a percentage of net assets.

| Industry Composition (September 30, 2018) | | | | |

| | | | | |

| Regional Banks | | | 11.67 | % |

| Biotechnology | | | 9.18 | % |

| Diversified Banks | | | 9.06 | % |

| Semiconductors | | | 7.59 | % |

| Data Processing & Outsourced Services | | | 6.15 | % |

| Railroads | | | 5.52 | % |

| Oil & Gas Exploration & Production | | | 4.95 | % |

| Homebuilding | | | 4.68 | % |

| General Merchandise Stores | | | 4.53 | % |

| Construction Materials | | | 3.48 | % |

| Air Freight & Logistics | | | 3.41 | % |

| Hotels, Resorts & Cruise Lines | | | 3.18 | % |

| Insurance Brokers | | | 3.01 | % |

| Oil & Gas Refining & Marketing | | | 2.93 | % |

| Pharmaceuticals | | | 2.84 | % |

| Building Products | | | 2.67 | % |

| Leisure Products | | | 2.33 | % |

| Home Improvement Retail | | | 2.29 | % |

| Application Software | | | 2.24 | % |

| Health Care Services | | | 1.61 | % |

| Semiconductor Equipment | | | 1.61 | % |

| Health Care Equipment | | | 1.56 | % |

| Health Care Facilities | | | 1.54 | % |

| Auto Parts & Equipment | | | 1.36 | % |

| | | | 99.39 | % |

Percentages are based upon common stocks as a percentage of net assets.

| The accompanying notes are an integral part of the financial statements. | |

| Annual Report | September 30, 2018 | 21 |

ICON Opportunities Fund | Management Overview |

September 30, 2018 (Unaudited)

| Q. | How did the Fund perform relative to its benchmark? |

| A. | The ICON Opportunities Fund (the Fund) returned 4.88% for the fiscal year ended September 30, 2018, while its benchmark, the S&P Small-Cap 600 Total Return Index, returned 19.08%. Total returns for other periods as of September 2018, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | An attribution analysis suggests stock selection in the Consumer Discretionary and Information Technology sectors is responsible for most of the Fund’s underperformance. Rather than reflecting value, it appears prices were event-driven, with stocks responding to trade tariffs and Federal Reserve behavior, among other things. Although stocks in both sectors posted impressive gains, the event-driven market proved a challenge to the ICON system. As a result, many stocks we believed were underpriced failed to meet our estimation of value, while other stocks we thought were overpriced continued moving higher. |

| Q. | How did the Fund’s composition affect performance? |

| A. | The five stocks contributing the most to returns were Ligand Pharmaceuticals Inc., PGT Innovations Inc., Five Below Inc., Nanometrics Inc. and NuVasive Inc. Ligand and NuVasive are in the Healthcare sector. PGT Innovations, Five Below and Nanometrics are in the Industrials, Consumer Discretionary and Information Technology sectors respectively. |

The following stocks with negative returns detracted the most from Fund performance: Extreme Networks Inc., Nutrisystem Inc., MACOM Technology Solutions Inc., LGI Homes Inc. and Coherent Inc. Extreme Networks, MACOM Technology Solutions and Coherent are in the Information Technology sector while Nutrisystem and LGI Homes are in Consumer Discretionary. The Fund liquidated its positions in Nutrisystem and MACOM during the fiscal year. We continue to hold Extreme Networks, LGI Homes and Coherent in the portfolio.

| Q. | What is your investment outlook for the overall market? |

| A. | As of September 30, 2018, ICON’s valuation model shows a value-to-price (V/P) ratio of 1.02 for the overall market. In other words, we believe stock prices, on average, are about 2% below our estimate of fair value. We are not seeing overpricing and other indications or behaviors typical of market peaks. In terms of upside potential, however, we do not expect the excess returns available when the broad market is priced at a discount to fair value. |

ICON Opportunities Fund | Management Overview |

September 30, 2018 (Unaudited)

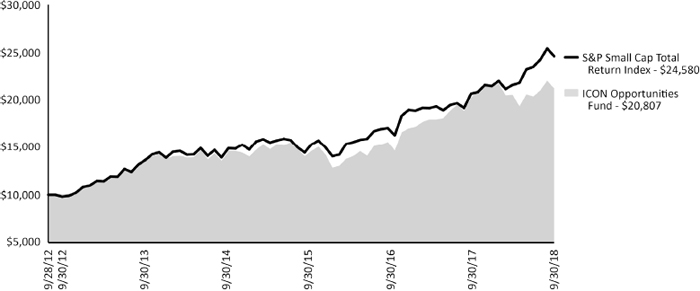

Average Annual Total Return (as of September 30, 2018) | | | |

| | Inception Date | 1 Year | 5 Year | Since Inception | Gross Expense Ratio* | Net Expense Ratio* |

| ICON Opportunities Fund | 9/28/12 | 4.88% | 9.83% | 12.98% | 1.47% | 1.30% |

| S&P Small Cap Total Return Index | | 19.08% | 13.32% | 16.15% | N/A | N/A |

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Value of a $10,000 Investment (through September 30, 2018)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Opportunities Fund on the inception date of 9/28/12 to a $10,000 investment made in an unmanaged securities index on that date. The Opportunities Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2018 | 23 |

ICON Opportunities Fund | Schedule of Investments |

September 30, 2018

| | | Shares or

Principal

Amount | | | Value | |

| Common Stocks (99.86%) | | | | | | | | |

| Air Freight & Logistics (2.41%) | | | | | | | | |

| Forward Air Corp. | | | 7,100 | | | $ | 509,070 | |

| | | | | | | | | |

| Biotechnology (0.98%) | | | | | | | | |

| Ligand Pharmaceuticals, Inc.(a) | | | 751 | | | | 206,142 | |

| | | | | | | | | |

| Building Products (11.38%) | | | | | | | | |

| Armstrong World Industries, Inc.(a) | | | 9,600 | | | | 668,160 | |

| Continental Building Products, Inc.(a) | | | 18,400 | | | | 690,920 | |

| Patrick Industries, Inc.(a) | | | 9,200 | | | | 544,640 | |

| PGT Innovations, Inc.(a) | | | 22,900 | | | | 494,640 | |

| | | | | | | | 2,398,360 | |

| Communications Equipment (1.23%) | | | | | | | | |

| Extreme Networks, Inc.(a) | | | 47,300 | | | | 259,204 | |

| | | | | | | | | |

| Construction Machinery & Heavy Trucks (2.95%) | | | | | | | | |

| Terex Corp. | | | 15,600 | | | | 622,596 | |

| | | | | | | | | |

| Electronic Equipment & Instruments (3.72%) | | | | | | | | |

| Coherent, Inc.(a)(b) | | | 4,562 | | | | 785,531 | |

| | | | | | | | | |

| Electronic Manufacturing Services (3.33%) | | | | | | | | |

| Methode Electronics, Inc. | | | 19,400 | | | | 702,280 | |

| | | | | | | | | |

| Health Care Equipment (2.52%) | | | | | | | | |

| NuVasive, Inc.(a) | | | 7,500 | | | | 532,350 | |

| | | | | | | | | |

| Health Care Services (2.69%) | | | | | | | | |

| LHC Group, Inc.(a) | | | 5,500 | | | | 566,445 | |

| | | | | | | | | |

| Homebuilding (7.54%) | | | | | | | | |

| KB Home | | | 21,100 | | | | 504,501 | |

| LGI Homes, Inc.(a)(b) | | | 14,300 | | | | 678,392 | |

| M/I Homes, Inc.(a) | | | 17,000 | | | | 406,810 | |

| | | | | | | | 1,589,703 | |

| Homefurnishing Retail (2.38%) | | | | | | | | |

| Aaron’s, Inc. | | | 9,200 | | | | 501,032 | |

| | | | | | | | | |

| Leisure Products (4.10%) | | | | | | | | |

| Brunswick Corp. | | | 12,900 | | | | 864,558 | |

| | | | | | | | | |

| Oil & Gas Exploration & Production (5.51%) | | | | | | | | |

| Matador Resources Co.(a) | | | 10,800 | | | | 356,940 | |

| Ring Energy, Inc.(a) | | | 24,400 | | | | 241,804 | |

| SM Energy Co. | | | 8,200 | | | | 258,546 | |

| SRC Energy, Inc.(a) | | | 34,189 | | | | 303,940 | |

| | | | | | | | 1,161,230 | |

| Oil & Gas Refining & Marketing (1.81%) | | | | | | | | |

| CVR Energy, Inc. | | | 9,500 | | | | 382,090 | |

| | | | | | | | | |

| Pharmaceuticals (9.12%) | | | | | | | | |

| Amneal Pharmaceuticals, Inc.(a) | | | 32,500 | | | | 721,175 | |

| | | Shares or

Principal

Amount | | | Value | |

| Pharmaceuticals (continued) | | | | | | | | |

| Corcept Therapeutics, Inc.(a)(b) | | | 39,700 | | | $ | 556,594 | |

| Supernus Pharmaceuticals, Inc.(a) | | | 12,800 | | | | 644,480 | |

| | | | | | | | 1,922,249 | |

| Property & Casualty Insurance (2.81%) | | | | | | | | |

| United Insurance Holdings Corp. | | | 26,500 | | | | 593,070 | |

| | | | | | | | | |