UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08071

Lazard Retirement Series, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

| (Address of principal executive offices) | | (Zip code) |

Nathan A. Paul, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | (212) 632-6000 |

| | |

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 6/30/16 |

ITEM 1. REPORTS TO STOCKHOLDERS.

Lazard Retirement Series

Semi-Annual Report

June 30, 2016

| | US Equity | | Emerging Markets |

| | Lazard Retirement US Strategic Equity Portfolio | | Lazard Retirement Emerging Markets Equity Portfolio |

| | Lazard Retirement US Small-Mid Cap Equity Portfolio | | |

| | | | Asset Allocation |

| | International Equity | | Lazard Retirement Global Dynamic Multi Asset Portfolio |

| | Lazard Retirement International Equity Portfolio | | |

Lazard Retirement Series, Inc. Table of Contents

Shares of the Portfolios are currently offered only to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. Portfolio shares may also be offered to certain qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis.

Please consider a Portfolio’s investment objective, risks, charges and expenses carefully before investing. For more complete information about Lazard Retirement Series, Inc. (the “Fund”), you may obtain a prospectus or summary prospectus by calling 800-823-6300, or online, at www.LazardNet.com. Read the prospectus or each Portfolio’s summary prospectus carefully before you invest. The prospectus and summary prospectus contain the investment objective, risks, charges, expenses and other information about Portfolios of the Fund, which is not detailed in this report.

Distributed by Lazard Asset Management Securities LLC.

Lazard Retirement Series, Inc. A Message from Lazard

Dear Shareholder,

In the first half of 2016, global equity markets stood firm despite significant bouts of volatility. Concerns about the Chinese economy, commodity price declines, and a series of disappointing earnings announcements pressured equity markets in the early months of 2016. However, they rallied in the latter half of the first quarter and into the second as the US Federal Reserve lowered its forecast for 2016 interest rate increases. Although global equity markets fell again in late-June due to the uncertainty caused by the United Kingdom’s vote to leave the European Union, certain regions rebounded by the end of the period. In addition, signs of some stability in commodity prices helped emerging markets assets during the period.

Volatility also played a role in global bond markets as investors traded largely on risk assessment of macro events. In Europe, the 10-year German bund yield fell below zero for the first time, following Swiss and Japanese 10-year government bonds, which have been in negative territory for some time. The surprising outcome of the UK referendum triggered another rally in safe haven assets, pushing some government bond yields even further into negative territory. The low yield, but still positive, environment continued in the United States.

At Lazard Asset Management, we remain focused on active management and are committed to responsibly pursuing the Portfolios’ investment objectives. We appreciate your continued confidence in our investment management capabilities, and we feel privileged that you have turned to Lazard for your investment needs.

Sincerely,

Lazard Asset Management LLC

Lazard Retirement Series, Inc. Investment Overviews

US Equities

The S&P 500® Index rose 3.8% in the first half of 2016. Markets were down as much as 10% in the beginning of the period, on concerns about the Chinese economy, commodity price declines, and a series of disappointing corporate earnings announcements. However, shares rallied in the latter half of the first quarter and into the second, as the US Federal Reserve lowered its forecast for 2016 interest rate increases. Economic data were mixed during the period, as the economy capped its largest two-year private payroll gain since 1999 in March, but followed it with a spate of disappointing jobs growth reports to finish the period. GDP growth in the first half of 2016 generally exceeded expectations, however. Although US markets fell sharply in late-June due to the uncertainty caused by the United Kingdom’s affirmative vote to leave the European Union (the so-called “Brexit”), they had largely rebounded by the end of the period. Amid the continuingly uncertain economic and geopolitical backdrop, the Federal Open Market Committee elected not to raise interest rates at its June meeting, and expectations for a rate increase in the summer of 2016 fell sharply.

International Equities

International equities fell slightly in a volatile first half of 2016. Initial concerns centered around faltering Chinese growth and low oil prices, with resultant impacts on credit. This was calmed by evidence of a state-led investment recovery in China, falling US oil supply, and reassurance from the US Federal Reserve that US interest rates would remain low. The resulting weakness in the US dollar, and rise in many commodity prices, supported emerging markets assets alongside sectors such as energy and mining. On the other hand, ventures into negative interest rates in Japan and Europe put extreme pressure on the valuations of financial institutions, while the surprise Brexit vote result put pressure on assumptions for domestic demand growth in Europe. The banking and consumer discretionary sectors were weak as a result, alongside Italy, which has a particularly weak banking sector and upcoming political risk. UK domestic stocks inevitably fell on recession fears, though the UK index overall held up well even in US dollars, as the index is dominated by global multinationals. Sectors seen as sta-

ble, such as consumer staples and utilities, also benefited from very low interest rates.

Emerging Markets Equities

Emerging markets equities experienced somewhat of a changed environment in the first half of 2016. Some of the more defensive sector companies, which had led markets for a long time, underperformed while more economy-sensitive industries were relatively strong. Additionally, regions which had been very weak performers, like Latin America, performed very strongly while Asia, which had performed relatively well, finished the period virtually unchanged. The MSCI Emerging Markets® Index (the “EM Index”) rose by 6.4%, as measured in US dollar terms, during the six-month period with Asian markets declining marginally while eastern European markets rose by 10% and Latin American markets increased by 25%. The period included important events such as the Brexit referendum in the UK, attempts at renminbi devaluation in China, and a presidential impeachment in Brazil.

Signs of some stability in commodity prices helped shares in Peru and Brazil over the period. The dramatic political events in Brazil during the period, which brought about the successful impeachment votes against President Dilma Rousseff, caused both the Brazilian real and the market to rise. Peru’s market was helped towards the end of the period by the narrow election victory of market-friendly presidential candidate Pedro Pablo Kuczynski. Mexican shares were adversely affected by a weak peso.

Returns were highly diverse across Eastern Europe. The bottoming and then rising crude oil price helped Russian equities while the United Kingdom’s Brexit referendum vote to leave the European Union undermined shares in several European countries, including Greece and Poland. Turkish equities initially performed well but suffered after Prime Minister Ahmet Davutoglu’s resignation, an event which appeared to signal President Recep Tayyip Erdogan’s political dominance.

Although most Asian emerging markets generated positive returns over the six-month period, China’s attempt to devalue the renminbi at the beginning of 2016 destabilized global markets. In addition, MSCI’s

decision not to include Chinese mainland shares or A-shares in its Emerging Markets Index also hurt the Chinese market. These factors resulted in a negative return for China over the period. Indian stocks also did not progress much in the second quarter as investors became concerned by resistance to Prime Minister Narendra Modi’s policies. Conversely, strong performance was recorded in Thailand, the Philippines, and Indonesia as economies performed in line with expectations and President-elect Rodrigo Duterte outlined his program for the Philippines.

From a sector perspective, the energy, materials, and consumer staples sectors performed well, while the industrials, consumer discretionary, and health care sectors underperformed the EM Index.

Lazard Retirement US Strategic Equity Portfolio

For the six months ended June 30, 2016, the Lazard Retirement US Strategic Equity Portfolio’s Service Shares posted a total return of 0.56%, as compared with the 3.84% return for the S&P 500 Index.

Stock selection in the health care sector contributed to performance. Shares of pharmaceutical company Pfizer rose after the company reported strong quarterly earnings and management raised its guidance for 2016, driven by foreign exchange tailwinds and stronger revenues. Shares also rose after the company announced that it had terminated its proposed $160 billion acquisition of specialty-drug maker Allergan. Stock selection in the industrials sector also helped returns. Shares of salvage vehicle auction holder Copart rose after the company reported quarterly earnings above expectations, due to higher volume growth stemming from market share gains and overall scrap metal industry tailwinds.

In contrast, stock selection in the consumer discretionary sector detracted from performance. Shares of Norwegian Cruise Line Holdings fell in response to disappointing management guidance and macroeconomic instability, as management said it expected slower bookings in the second quarter. Stock selection and an overweight position in the information technology sector also detracted from performance.

Shares of Google parent Alphabet fell after the company reported disappointing second quarter results, which were hurt by greater holiday seasonality.

Lazard Retirement US Small-Mid Cap Equity Portfolio

For the six months ended June 30, 2016, the Lazard Retirement US Small-Mid Cap Equity Portfolio’s Service Shares posted a total return of -0.14%, as compared with the 3.98% return for the Russell 2500® Index.

Stock selection in the information technology sector contributed to performance. Shares of NCR rose after the payment technology maker reported quarterly earnings above expectations, driven by strong margins. Stock selection and an overweight position in the energy sector also helped returns. Shares of New-field rose after the exploration and production company reported strong quarterly earnings, driven by strong production and expenses.

In contrast, stock selection in the financials sector detracted from performance. Shares of OneMain fell amid continued concerns about the consumer financial services provider’s funding costs in a rising interest rate environment, and as many investors moved away from shares of companies with subprime loan exposure. We exited our position in OneMain in May in pursuit of better opportunities elsewhere. Stock selection and an underweight position in the materials sector also hurt performance. Shares of KapStone Paper and Packaging fell after the pulp and paper company reported quarterly earnings below expectations and management gave a cautious outlook, citing difficult market conditions. We exited our position after the announcement in February in pursuit of better opportunities elsewhere.

Lazard Retirement International Equity Portfolio

For the six months ended June 30, 2016, the Lazard Retirement International Equity Portfolio’s Service Shares posted a total return of -2.52%, as compared with the -4.42% return for the MSCI EAFE® Index (the “EAFE Index”).

Stock selection in the consumer discretionary sector was the largest driver of relative returns as shares of

Dutch business information services provider Wolters Kluwer performed well on accelerating growth, while shares of Japanese shoe retailer ABC Mart rose on revenue that is growing faster than expectations and from an increasing dividend. Japanese consumer electronics and media company Sony also rose in the weak market, supported by yen strength. The preceding stocks more than compensated for weakness in jewelry retailer Signet, which was hurt by slowing consumer spending, concerns about the company’s credit portfolio, and some negative publicity. Elsewhere, Japanese telecoms SoftBank and KDDI both rose as investors expect higher revenues and benefited from the previously mentioned yen strength. Lastly, positioning in emerging markets had a positive impact on relative performance as shares of Taiwan Semiconductor and Brazilian insurance broker BB Seguridade both performed well.

In contrast, stock selection in the health care sector detracted from relative returns where shares of German pharmaceutical company Bayer (which was sold during the period) declined as investors reacted negatively to the proposed acquisition of Monsanto. Shares of Israeli pharmaceutical company Teva also declined during the period. The stock fell as revenues from their multiple sclerosis treatment Copaxone declined and management announced that the company’s acquisition of Allergan’s generic drug unit might be delayed. Stock selection in the United Kingdom detracted from relative returns as shares of British bank Lloyds (also sold during the period) declined following the Brexit referendum result. Elsewhere in the United Kingdom, shares of personal credit company Provident and grocer Sainsbury fell, while companies with global revenues, such as tobacco company British American Tobacco and health insurance exchange provider Aon, provided a partial offset. Lastly, low exposure to the strong performing materials and utilities sectors hurt the Portfolio’s relative returns.

Lazard Retirement Emerging Markets Equity Portfolio

For the six months ended June 30, 2016, the Lazard Retirement Emerging Markets Equity Portfolio’s Investor Shares posted a total return of 14.44%, while

Service Shares posted a total return of 14.27%, as compared with the 6.41% return for the EM Index.

During the period, Sberbank, a Russian bank, announced strong earnings and upgraded its guidance for return-on-equity. Telekomunikasi Indonesia, an Indonesian telecom services company, experienced strong growth in data usage leading to improving average revenue per user. Shares of Taiwan Semiconductor Manufacturing, a Taiwanese manufacturer of semiconductors, performed well on expectations of a strong third-quarter ramp up from sales of Apple’s new iPhone 7. Shares of Cielo, a Brazilian credit card processor, rose on the back of reduced regulatory concerns and improved market sentiment following the impeachment proceedings brought against President Dilma Rousseff. Shares of CCR, a Brazilian toll road operator, rose on expectations for lower interest rates in Brazil after the initiation of impeachment proceedings. Stock selection in the financials, consumer discretionary, industrials, and telecom services sectors, and in China helped performance. A higher-than-index exposure to Brazil and a lower-than-index exposure to China also added value.

In contrast, shares of Baidu, a Chinese search engine, declined after company management guided down expectations on continued weakness in its healthcare vertical after the government clampdown. Shares of Hanwha Life Insurance, a Korean insurance company, fell on expectations for a continued environment of low interest rates in Korea. Punjab National Bank, an Indian bank, experienced share declines after the bank increased provisioning for non-performing loans post a regulatory review of the loan book. Bharat Heavy Electricals, an Indian manufacturer of power plant equipment, posted poor earnings on the back of increased competition. Shares of Commercial International Bank, an Egyptian bank, fell early in the second quarter as Egyptian stocks and the Egyptian pound sold off on the back of macroeconomic concerns.

Lazard Retirement Global Dynamic Multi Asset Portfolio

For the six months ended June 30, 2016, the Lazard Retirement Global Dynamic Multi Asset Portfolio’s

Service Shares posted a total return of 2.52%, as compared with the 4.85% return of the blended benchmark, which is a 50/50 blend of the MSCI World® Index and Barclays Capital Global Aggregate Bond® Index (the “GDMA Index”).

The Portfolio is managed using a combination of Lazard Asset Management LLC’s (the “Investment Manager”) domestic and foreign equity and fixed income strategies. The Investment Manager considers a market forecast based on four categories pertinent to allocation decisions among the strategies: Economy, Valuation, Liquidity, and Sentiment.

Changes made to the market forecast during 2016 reflected a consideration of many factors, including monetary policies of central banks around the globe; global macro data readings (particularly the Purchasing Managers Index, which measures economic activity) in China, the United States, the euro zone, and Japan; fiscal policy in developed and emerging markets; geopolitical events and risks; and equity and fixed income valuations, along with other data.

For the six months ended June 30, 2016, stock selection in the health care, consumer discretionary, tele-

com services, and financials sectors, an underweight position in the financials sector and an overweight position in the telecom services sector added value within the equity allocation, as did stock selection in Norway, China, and Italy. Within fixed income, performance was helped by overweight exposure to Australia, New Zealand, Canada, and Singapore, security selection in the United States, and overweight exposure to the New Zealand dollar and tactical management of the euro implemented via derivative instruments (forward currency contracts for long or short exposure to foreign currencies). In contrast, stock selection in the industrials, consumer staples, and materials sectors, and underweight exposures to energy and materials detracted from performance, as did stock selection in the United Kingdom, Canada, and Japan, and within equities, an underweight to Canada and an overweight to Israel. Within fixed income, performance was negatively impacted by underweight exposure to core Europe and Japan, underweight positions in long maturity government bonds from core markets, and small overweight exposure to the Swedish krona, Australian dollar, and Mexican peso (also implemented via derivative instruments comprised of forward currency contracts for long or short exposure to foreign currencies).

| Notes to Investment Overviews: | |

Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of a Portfolio may have been waived or reimbursed by the Investment Manager, State Street Bank and Trust Company, the Fund’s administrator (“State Street”), or Boston Financial Data Services, Inc., the Fund’s transfer and dividend disbursing agent (“BFDS”); without such waiver/reimbursement of expenses, such Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Past performance is not indicative, or a guarantee, of future results. Return for a period of less than one year is not annualized.

The performance data of the indices and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. These indices are unmanaged, have no fees or costs and are not available for investment.

The views of the Investment Manager and the securities described in this report are as of June 30, 2016; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in a Portfolio at the time you receive this report, or that securities sold will not have been repurchased. The specific securities discussed may, in aggregate, represent only a small percentage of a Portfolio’s holdings. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of any outlooks for markets, sectors and securities as discussed herein. You should read the Fund’s prospectus or each Portfolio’s summary prospectus for a more detailed discussion of each Portfolio’s investment objective, strategies, risks and fees.

Lazard Retirement Series, Inc. Performance Overviews (unaudited)

Lazard Retirement US Strategic Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement US Strategic Equity Portfolio and S&P 500® Index*

Average Annual Total Returns*

Periods Ended June 30, 2016

| | One | Five | Ten | |

| | Year | Years | Years | |

| Service Shares | -4.44% | 9.00% | 5.48% | |

| S&P 500 Index | 3.99% | 12.10% | 7.42% | |

| | |

| * | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or State Street; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and may differ from amounts reported in the financial highlights. |

| | |

| | The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| | |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The S&P 500 Index is a market capitalization-weighted index of 500 common stocks, designed to measure performance of the broad domestic economy through changes in the aggregate market value of these stocks, which represent all major industries. The index is unmanaged, has no fees or costs and is not available for investment. |

| | |

| | Before May 1, 2007, the Portfolio was known as Lazard Retirement Equity Portfolio and had a different investment strategy. |

| | |

Lazard Retirement US Small-Mid Cap Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement US Small-Mid Cap Equity Portfolio, Russell 2500® Index and Russell 2000/2500 Linked Index*

Average Annual Total Returns*

Periods Ended June 30, 2016

| | One | Five | Ten | |

| | Year | Years | Years | |

| Service Shares | -8.24% | 6.78% | 5.96% | |

| Russell 2500 Index | -3.67% | 9.48% | 7.32% | |

| Russell 2000/2500 Linked Index | -3.67% | 9.48% | 7.08% | |

| | |

| * | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with GAAP and may differ from amounts reported in the financial highlights. |

| | |

| | The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| | |

| | The Portfolio was previously known as Lazard Retirement U.S. Small Cap Equity Portfolio. As of June 1, 2009, the Portfolio changed its name to Lazard Retirement U.S. Small-Mid Cap Equity Portfolio and changed its investment strategy to invest in equity securities of small-mid cap US companies. |

| | |

| | The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The Russell 2500 Index is comprised of the 2,500 smallest US companies included in the Russell 3000® Index (which consists of the 3,000 largest US companies by capitalization). The Russell 2000/2500 Linked Index is an index created by the Portfolio’s Investment Manager, which links the performance of the Russell 2000® Index for all periods through May 31, 2009 and the Russell 2500 Index for all periods thereafter. The Russell 2000 Index is comprised of the 2,000 smallest US companies included in the Russell 3000 Index. The indices are unmanaged, have no fees or costs and are not available for investment. |

| | |

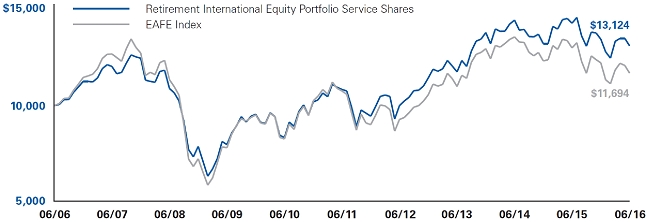

Lazard Retirement International Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement International Equity Portfolio and EAFE Index*

Average Annual Total Returns*

Periods Ended June 30, 2016

| | One | Five | Ten | |

| | Year | Years | Years | |

| Service Shares | -8.24% | 3.90% | 2.76% | |

| EAFE Index | -10.16% | 1.68% | 1.58% | |

| | |

| * | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with GAAP and may differ from amounts reported in the financial highlights. |

| | |

| | The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| | |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The EAFE Index is a broadly diversified international index comprised of equity securities of approximately 1,000 companies located in developed countries outside the United States. The index is unmanaged, has no fees or costs and is not available for investment. |

| | |

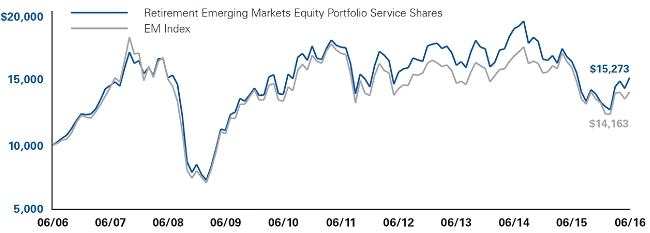

Lazard Retirement Emerging Markets Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Emerging Markets Equity Portfolio and EM Index*

Average Annual Total Returns*

Periods Ended June 30, 2016

| | One | Five | Ten | |

| | Year | Years | Years | |

| Service Shares** | -7.72% | -2.85% | 4.33% | |

| Investor Shares** | -7.49% | -2.61% | 4.59% | |

| EM Index | -12.05% | -3.78% | 3.54% | |

| | |

| * | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with GAAP and may differ from amounts reported in the financial highlights. |

| | |

| | The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| | |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The EM Index is comprised of emerging market securities in countries open to non-local investors. The index is unmanaged, has no fees or costs and is not available for investment. |

| | |

| ** | The performance of Service Shares and Investor Shares may vary, primarily based on the differences in fees borne by shareholders investing in different classes. |

| | |

Lazard Retirement Global Dynamic Multi Asset Portfolio

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement Global Dynamic Multi Asset Portfolio, GDMA Index and MSCI World® Index*

Average Annual Total Returns*

Periods Ended June 30, 2016

| | One | Since | |

| | Year | Inception | † |

| Service Shares | 0.62% | 6.97% | |

| GDMA Index | 3.17% | 4.91% | |

| MSCI World Index | -2.78% | 8.28% | |

| | |

| * | Total returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager, State Street or BFDS; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| | |

| | Performance results do not include adjustments made for financial reporting purposes in accordance with GAAP and may differ from amounts reported in the financial highlights. |

| | |

| | The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| | |

| | The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The GDMA Index is a 50/50 blend of the MSCI World Index and the Barclays Capital Global Aggregate Bond® Index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Barclays Capital Global Aggregate Bond Index provides a broad-based measure of global investment-grade fixed-income debt markets, including government-related debt, corporate debt, securitized debt and global Treasury, with maturities of no less than one year. The indices are unmanaged, have no fees or costs and are not available for investment. |

| | |

| | Before April 30, 2014, the Portfolio was known as Lazard Retirement Multi-Asset Targeted Volatility Portfolio. |

| | |

| † | The inception date for the Portfolio was April 30, 2012. |

| | |

Lazard Retirement Series, Inc. Information About Your Portfolio’s Expenses (unaudited)

Expense Example

As a shareholder in a Portfolio of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Service Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from January 1, 2016 through June 30, 2016 and held for the entire period.

Actual Expenses

For each Share class of the Portfolios, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Share class of the Portfolios, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other mutual funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the insurance companies. Such charges will have the effect of reducing account value.

| | | Beginning | | Ending | | Expenses Paid | | Annualized Expense |

| | | Account Value | | Account Value | | During Period* | | Ratio During Period |

| Portfolio | | 1/1/16 | | 6/30/16 | | 1/1/16 - 6/30/16 | | 1/1/16 - 6/30/16 |

| | | | | | | | | | | | | | | | | |

| US Strategic Equity | | | | | | | | | | | | | | | | |

| Service Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,005.60 | | | $ | 4.99 | | | | 1.00 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.89 | | | $ | 5.02 | | | | 1.00 | % |

| | | | | | | | | | | | | | | | | |

| US Small-Mid Cap Equity | | | | | | | | | | | | | | | | |

| Service Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 998.60 | | | $ | 6.21 | | | | 1.25 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.65 | | | $ | 6.27 | | | | 1.25 | % |

| | | | | | | | | | | | | | | | | |

| International Equity | | | | | | | | | | | | | | | | |

| Service Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 974.80 | | | $ | 5.40 | | | | 1.10 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.39 | | | $ | 5.52 | | | | 1.10 | % |

| | | | | | | | | | | | | | | | | |

| Emerging Markets Equity | | | | | | | | | | �� | | | | | | |

| Service Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,142.70 | | | $ | 7.41 | | | | 1.39 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.95 | | | $ | 6.97 | | | | 1.39 | % |

| | | | | | | | | | | | | | | | | |

| Investor Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,144.40 | | | $ | 6.13 | | | | 1.15 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.14 | | | $ | 5.77 | | | | 1.15 | % |

| | | | | | | | | | | | | | | | | |

| Global Dynamic Multi Asset | | | | | | | | | | | | | | | | |

| Service Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,025.20 | | | $ | 5.29 | | | | 1.05 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.64 | | | $ | 5.27 | | | | 1.05 | % |

| * | Expenses are equal to the annualized expense ratio of each Share class multiplied by the average account value over the period, multiplied by 182/366 (to reflect one-half year period). |

Lazard Retirement Series, Inc. Portfolio Holdings Presented by Sector June 30, 2016 (unaudited)

| | | Lazard | | Lazard | | Lazard | | Lazard |

| | | Retirement | | Retirement | | Retirement | | Retirement |

| | | US Strategic | | US Small-Mid Cap | | International | | Emerging Markets |

| Sector* | | Equity Portfolio | | Equity Portfolio | | Equity Portfolio | | Equity Portfolio |

| | | | | | | | | | | | | | | | | | |

| Consumer Discretionary | | | 8.9 | % | | | 13.5 | % | | | 17.2 | % | | | 8.7 | % | |

| Consumer Staples | | | 11.4 | | | | — | | | | 13.8 | | | | 7.1 | | |

| Energy | | | 5.9 | | | | 3.1 | | | | 7.2 | | | | 8.4 | | |

| Financials | | | 14.2 | | | | 28.1 | | | | 18.4 | | | | 27.8 | | |

| Health Care | | | 16.6 | | | | 9.7 | | | | 9.7 | | | | 0.2 | | |

| Industrials | | | 11.1 | | | | 14.1 | | | | 11.2 | | | | 5.0 | | |

| Information Technology | | | 25.6 | | | | 18.4 | | | | 4.1 | | | | 23.6 | | |

| Materials | | | 0.8 | | | | 4.2 | | | | 2.7 | | | | 3.6 | | |

| Telecommunication Services | | | 1.0 | | | | — | | | | 8.8 | | | | 11.5 | | |

| Utilities | | | — | | | | 5.0 | | | | 1.1 | | | | — | | |

| Short-Term Investments | | | 4.5 | | | | 3.9 | | | | 5.8 | | | | 4.1 | | |

| Total Investments | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | |

| |

| | Lazard Retirement | | | | | | | | | | | | |

| | | Global Dynamic | | | | | | | | | | | | | |

| | | Multi Asset | | | | | | | | | | | | | |

| Sector* | | Portfolio | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Consumer Discretionary | | | 10.9 | % | | | | | | | | | | | | | |

| Consumer Staples | | | 8.1 | | | | | | | | | | | | | | |

| Energy | | | 3.8 | | | | | | | | | | | | | | |

| Financials | | | 16.9 | | | | | | | | | | | | | | |

| Health Care | | | 8.7 | | | | | | | | | | | | | | |

| Industrials | | | 8.1 | | | | | | | | | | | | | | |

| Information Technology | | | 8.3 | | | | | | | | | | | | | | |

| Materials | | | 2.9 | | | | | | | | | | | | | | |

| Telecommunication Services | | | 4.8 | | | | | | | | | | | | | | |

| Utilities | | | 4.6 | | | | | | | | | | | | | | |

| Municipal | | | 0.5 | | | | | | | | | | | | | | |

| Sovereign Debt | | | 17.3 | | | | | | | | | | | | | | |

| US Treasury Securities | | | 1.5 | | | | | | | | | | | | | | |

| Short-Term Investment | | | 3.6 | | | | | | | | | | | | | | |

| Total Investments | | | 100.0 | % | | | | | | | | | | | | | |

* Represents percentage of total investments.

Lazard Retirement Series, Inc. Portfolios of Investments June 30, 2016 (unaudited)

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Lazard Retirement US Strategic Equity Portfolio | | | |

| |

| Common Stocks | 95.5% | | | | | | |

| |

| Aerospace & Defense | 3.4% | | | | | | | | |

| Honeywell International, Inc. | | | 1,775 | | | $ | 206,468 | |

| United Technologies Corp. | | | 1,280 | | | | 131,264 | |

| | | | | | | | 337,732 | |

| Auto Components | 1.7% | | | | | | | | |

| Delphi Automotive PLC | | | 2,620 | | | | 164,012 | |

| |

| Banks | 4.5% | | | | | | | | |

| Bank of America Corp. | | | 20,460 | | | | 271,504 | |

| Wells Fargo & Co. | | | 3,720 | | | | 176,068 | |

| | | | | | | | 447,572 | |

| Beverages | 3.0% | | | | | | | | |

| Molson Coors Brewing Co., Class B | | | 2,925 | | | | 295,805 | |

| |

| Capital Markets | 1.1% | | | | | | | | |

| The Charles Schwab Corp. | | | 4,410 | | | | 111,617 | |

| |

| Commercial Services & Supplies | 2.1% | | | | | | | | |

| Copart, Inc. (a) | | | 2,085 | | | | 102,186 | |

| Tyco International PLC | | | 2,485 | | | | 105,861 | |

| | | | | | | | 208,047 | |

| Communications Equipment | 3.7% | | | | | | | | |

| Cisco Systems, Inc. | | | 12,795 | | | | 367,089 | |

| |

| Containers & Packaging | 0.8% | | | | | | | | |

| Crown Holdings, Inc. (a) | | | 1,500 | | | | 76,005 | |

| |

| Diversified Financial Services | 3.2% | | | | | | | | |

| CBOE Holdings, Inc. | | | 1,560 | | | | 103,927 | |

| Intercontinental Exchange, Inc. | | | 820 | | | | 209,887 | |

| | | | | | | | 313,814 | |

| Diversified Telecommunication Services | 1.0% | | | | | | | | |

| AT&T, Inc. | | | 2,335 | | | | 100,895 | |

| |

| Electrical Equipment | 2.9% | | | | | | | | |

| Eaton Corp. PLC | | | 2,115 | | | | 126,329 | |

| Rockwell Automation, Inc. | | | 1,360 | | | | 156,155 | |

| | | | | | | | 282,484 | |

| Energy Equipment & Services | 1.3% | | | | | | | | |

| Schlumberger, Ltd. | | | 1,665 | | | | 131,668 | |

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Food & Staples Retailing | 2.7% | | | | | | | | |

| CVS Health Corp. | | | 1,650 | | | $ | 157,971 | |

| Walgreens Boots Alliance, Inc. | | | 1,260 | | | | 104,920 | |

| | | | | | | | 262,891 | |

| Food Products | 2.0% | | | | | | | | |

| Kellogg Co. | | | 2,465 | | | | 201,267 | |

| |

| Health Care Equipment & Supplies | 1.3% | | | | | | | | |

| Stryker Corp. | | | 1,070 | | | | 128,218 | |

| |

| Health Care Providers & Services | 1.6% | | | | | | | | |

| Aetna, Inc. | | | 1,255 | | | | 153,273 | |

| |

| Hotels, Restaurants & Leisure | 0.9% | | | | | | | | |

| Norwegian Cruise Line Holdings, Ltd. (a) | | | 2,245 | | | | 89,441 | |

| |

| Household Products | 3.8% | | | | | | | | |

| The Procter & Gamble Co. | | | 4,380 | | | | 370,855 | |

| |

| Insurance | 3.5% | | | | | | | | |

| Aon PLC | | | 1,675 | | | | 182,960 | |

| The Hartford Financial Services Group, Inc. | | | 3,675 | | | | 163,097 | |

| | | | | | | | 346,057 | |

| Internet Software & Services | 6.8% | | | | | | | | |

| Alphabet, Inc., Class A (a) | | | 610 | | | | 429,153 | |

| Alphabet, Inc., Class C (a) | | | 93 | | | | 64,365 | |

| eBay, Inc. (a) | | | 7,435 | | | | 174,054 | |

| | | | | | | | 667,572 | |

| IT Services | 3.5% | | | | | | | | |

| Fidelity National Information Services, Inc. | | | 1,650 | | | | 121,572 | |

| Visa, Inc., Class A | | | 3,070 | | | | 227,702 | |

| | | | | | | | 349,274 | |

| Life Sciences Tools & Services | 0.1% | | | | | | | | |

| Quintiles Transnational Holdings, Inc. (a) | | | 100 | | | | 6,532 | |

| |

| Machinery | 1.1% | | | | | | | | |

| Deere & Co. | | | 885 | | | | 71,720 | |

| Parker Hannifin Corp. | | | 315 | | | | 34,036 | |

| | | | | | | | 105,756 | |

| Media | 1.6% | | | | | | | | |

| The Madison Square Garden Co. Class A (a) | | | 920 | | | | 158,709 | |

| |

| Multiline Retail | 1.1% | | | | | | | | |

| J.C. Penney Co., Inc. (a) | | | 12,450 | | | | 110,556 | |

The accompanying notes are an integral part of these financial statements.

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Lazard Retirement US Strategic Equity Portfolio (concluded) |

| |

| Oil, Gas & Consumable Fuels | 4.5% | | | | | | | | |

| Chevron Corp. | | | 2,120 | | | $ | 222,240 | |

| EOG Resources, Inc. | | | 1,445 | | | | 120,542 | |

| Pioneer Natural Resources Co. | | | 695 | | | | 105,091 | |

| | | | | | | | 447,873 | |

| Pharmaceuticals | 13.7% | | | | | | | | |

| Allergan PLC (a) | | | 1,045 | | | | 241,489 | |

| Eli Lilly & Co. | | | 2,275 | | | | 179,156 | |

| Mallinckrodt PLC (a) | | | 1,945 | | | | 118,217 | |

| Pfizer, Inc. | | | 9,990 | | | | 351,748 | |

| Zoetis, Inc. | | | 9,658 | | | | 458,369 | |

| | | | | | | | 1,348,979 | |

| Real Estate Investment Trusts (REITs) | 1.8% | | | | | | | | |

| Corrections Corp. of America | | | 3,198 | | | | 111,994 | |

| Host Hotels & Resorts, Inc. | | | 4,205 | | | | 68,163 | |

| | | | | | | | 180,157 | |

| Road & Rail | 1.6% | | | | | | | | |

| Union Pacific Corp. | | | 1,815 | | | | 158,359 | |

| |

| Semiconductors & Semiconductor Equipment | 4.9% | | | | | | | | |

| Applied Materials, Inc. | | | 4,575 | | | | 109,663 | |

| NXP Semiconductors NV (a) | | | 1,835 | | | | 143,754 | |

| Skyworks Solutions, Inc. | | | 2,435 | | | | 154,087 | |

| Teradyne, Inc. | | | 3,735 | | | | 73,542 | |

| | | | | | | | 481,046 | |

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Software | 3.4% | | | | | | | | |

| Microsoft Corp. | | | 6,655 | | | $ | 340,536 | |

| |

| Specialty Retail | 3.1% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 1,868 | | | | 301,925 | |

| |

| Technology Hardware, Storage & Peripherals | 3.2% | | | | | | | | |

| Apple, Inc. | | | 3,324 | | | | 317,774 | |

| |

| Textiles, Apparel & Luxury Goods | 0.6% | | | | | | | | |

| Deckers Outdoor Corp. (a) | | | 1,005 | | | | 57,808 | |

| |

Total Common Stocks

(Cost $9,029,655) | | | | | | | 9,421,598 | |

| |

| Short-Term Investment | 4.5% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 0.14% (7 day yield)

(Cost $440,410) | | | 440,410 | | | | 440,410 | |

| | | | | | | | | |

Total Investments | 100.0%

(Cost $9,470,065) (b) | | | | | | $ | 9,862,008 | |

| |

| Cash and Other Assets in Excess of Liabilities | 0.0% | | | | | | | 83 | |

| |

| Net Assets | 100.0% | | | | | | $ | 9,862,091 | |

The accompanying notes are an integral part of these financial statements.

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Lazard Retirement US Small-Mid Cap Equity Portfolio | | | |

| |

| Common Stocks | 96.5% | | | | | | |

| |

| Aerospace & Defense | 0.8% | | | | | | | | |

| B/E Aerospace, Inc. | | | 9,195 | | | $ | 424,579 | |

| |

| Air Freight & Logistics | 1.1% | | | | | | | | |

| Echo Global Logistics, Inc. (a) | | | 28,390 | | | | 636,504 | |

| |

| Airlines | 1.3% | | | | | | | | |

| Alaska Air Group, Inc. | | | 12,325 | | | | 718,424 | |

| |

| Auto Components | 3.1% | | | | | | | | |

| Fox Factory Holding Corp. (a) | | | 45,655 | | | | 793,028 | |

| Gentherm, Inc. (a) | | | 15,245 | | | | 522,141 | |

| Modine Manufacturing Co. (a) | | | 45,225 | | | | 397,980 | |

| | | | | | | | 1,713,149 | |

| Banks | 8.2% | | | | | | | | |

| Comerica, Inc. | | | 22,100 | | | | 908,973 | |

| Home Bancshares, Inc. | | | 43,050 | | | | 851,960 | |

| PacWest Bancorp | | | 22,495 | | | | 894,851 | |

| Signature Bank (a) | | | 5,780 | | | | 722,038 | |

| SVB Financial Group (a) | | | 4,490 | | | | 427,268 | |

| Webster Financial Corp. | | | 23,335 | | | | 792,223 | |

| | | | | | | | 4,597,313 | |

| Biotechnology | 2.1% | | | | | | | | |

| Cellectis SA ADR (a) | | | 21,265 | | | | 565,436 | |

| United Therapeutics Corp. (a) | | | 5,890 | | | | 623,869 | |

| | | | | | | | 1,189,305 | |

| Building Products | 3.0% | | | | | | | | |

| Continental Building Products, Inc. (a) | | | 22,565 | | | | 501,620 | |

| Owens Corning | | | 11,600 | | | | 597,632 | |

| PGT, Inc. (a) | | | 54,990 | | | | 566,397 | |

| | | | | | | | 1,665,649 | |

| Chemicals | 4.2% | | | | | | | | |

| Calgon Carbon Corp. | | | 57,295 | | | | 753,429 | |

| Eastman Chemical Co. | | | 9,545 | | | | 648,106 | |

| Ingevity Corp. (a) | | | 27,950 | | | | 951,418 | |

| | | | | | | | 2,352,953 | |

| Communications Equipment | 1.1% | | | | | | | | |

| Ciena Corp. (a) | | | 33,075 | | | | 620,156 | |

| |

| Construction & Engineering | 0.8% | | | | | | | | |

| EMCOR Group, Inc. | | | 8,765 | | | | 431,764 | |

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Diversified Financial Services | 2.9% | | | | | | | | |

| CBOE Holdings, Inc. | | | 10,200 | | | $ | 679,524 | |

| Morningstar, Inc. | | | 11,330 | | | | 926,567 | |

| | | | | | | | 1,606,091 | |

| Electric Utilities | 1.8% | | | | | | | | |

| PNM Resources, Inc. | | | 28,940 | | | | 1,025,634 | |

| |

| Electrical Equipment | 2.2% | | | | | | | | |

| Generac Holdings, Inc. (a) | | | 15,425 | | | | 539,258 | |

| Regal-Beloit Corp. | | | 12,165 | | | | 669,683 | |

| | | | | | | | 1,208,941 | |

| Electronic Equipment, Instruments & Components | 2.9% | | | | | | | | |

| FLIR Systems, Inc. | | | 27,085 | | | | 838,281 | |

| Littelfuse, Inc. | | | 6,520 | | | | 770,599 | |

| | | | | | | | 1,608,880 | |

| Gas Utilities | 1.2% | | | | | | | | |

| New Jersey Resources Corp. | | | 17,990 | | | | 693,515 | |

| |

| Health Care Equipment & Supplies | 3.1% | | | | | | | | |

| DENTSPLY SIRONA, Inc. | | | 14,627 | | | | 907,459 | |

| STERIS PLC | | | 11,910 | | | | 818,813 | |

| | | | | | | | 1,726,272 | |

| Health Care Providers & Services | 1.2% | | | | | | | | |

| Team Health Holdings, Inc. (a) | | | 17,125 | | | | 696,474 | |

| |

| Hotels, Restaurants & Leisure | 1.0% | | | | | | | | |

| Bloomin’ Brands, Inc. | | | 30,945 | | | | 552,987 | |

| |

| Insurance | 8.3% | | | | | | | | |

| Arch Capital Group, Ltd. (a) | | | 15,045 | | | | 1,083,240 | |

| Argo Group International Holdings, Ltd. | | | 17,879 | | | | 927,920 | |

| Brown & Brown, Inc. | | | 15,860 | | | | 594,274 | |

| Reinsurance Group of America, Inc. | | | 11,120 | | | | 1,078,529 | |

| Validus Holdings, Ltd. | | | 19,130 | | | | 929,527 | |

| | | | | | | | 4,613,490 | |

| Internet Software & Services | 1.3% | | | | | | | | |

| j2 Global, Inc. | | | 11,255 | | | | 710,978 | |

| |

| IT Services | 2.9% | | | | | | | | |

| Leidos Holdings, Inc. | | | 17,445 | | | | 835,092 | |

| Vantiv, Inc., Class A (a) | | | 14,160 | | | | 801,456 | |

| | | | | | | | 1,636,548 | |

The accompanying notes are an integral part of these financial statements.

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Lazard Retirement US Small-Mid Cap Equity Portfolio (concluded) |

| |

| Life Sciences Tools & Services | 3.2% | | | | | | | | |

| Quintiles Transnational Holdings, Inc. (a) | | | 14,140 | | | $ | 923,625 | |

| VWR Corp. (a) | | | 30,735 | | | | 888,241 | |

| | | | | | | | 1,811,866 | |

| Machinery | 3.7% | | | | | | | | |

| Altra Industrial Motion Corp. | | | 24,345 | | | | 656,828 | |

| Tennant Co. | | | 5,100 | | | | 274,737 | |

| TriMas Corp. (a) | | | 33,805 | | | | 608,490 | |

| Woodward, Inc. | | | 9,510 | | | | 548,156 | |

| | | | | | | | 2,088,211 | |

| Media | 3.9% | | | | | | | | |

| AMC Networks, Inc., Class A (a) | | | 12,440 | | | | 751,625 | |

| Cable One, Inc. | | | 920 | | | | 470,497 | |

| Scholastic Corp. | | | 24,265 | | | | 961,137 | |

| | | | | | | | 2,183,259 | |

| Multi-Utilities | 1.9% | | | | | | | | |

| CMS Energy Corp. | | | 23,600 | | | | 1,082,296 | |

| |

| Oil, Gas & Consumable Fuels | 3.2% | | | | | | | | |

| Matador Resources Co. (a) | | | 24,415 | | | | 483,417 | |

| Memorial Resource Development Corp. (a) | | | 41,105 | | | | 652,747 | |

| Newfield Exploration Co. (a) | | | 14,195 | | | | 627,135 | |

| | | | | | | | 1,763,299 | |

| Real Estate Investment Trusts (REITs) | 7.9% | | | | | | | | |

| American Campus Communities, Inc. | | | 18,680 | | | | 987,611 | |

| DCT Industrial Trust, Inc. | | | 23,095 | | | | 1,109,484 | |

| Extra Space Storage, Inc. | | | 6,305 | | | | 583,465 | |

| Kilroy Realty Corp. | | | 10,535 | | | | 698,365 | |

| Tanger Factory Outlet Centers, Inc. | | | 25,500 | | | | 1,024,590 | |

| | | | | | | | 4,403,515 | |

| Real Estate Management & Development | 1.0% | | | | | | | | |

| Jones Lang LaSalle, Inc. | | | 5,715 | | | | 556,927 | |

| |

| Semiconductors & Semiconductor Equipment | 4.4% | | | | | | | | |

| Brooks Automation, Inc. | | | 20,400 | | | | 228,888 | |

| Cypress Semiconductor Corp. | | | 78,700 | | | | 830,285 | |

| MACOM Technology Solutions Holdings, Inc. (a) | | | 16,890 | | | | 557,032 | |

| Microsemi Corp. (a) | | | 25,655 | | | | 838,406 | |

| | | | | | | | 2,454,611 | |

| | | | | |

Fair | |

| Description | | Shares | | | Value | |

| |

| Software | 4.5% | | | | | | | | |

| BroadSoft, Inc. (a) | | | 15,015 | | | $ | 616,065 | |

| Pegasystems, Inc. | | | 13,725 | | | | 369,889 | |

| RealPage, Inc. (a) | | | 40,860 | | | | 912,404 | |

| Red Hat, Inc. (a) | | | 8,795 | | | | 638,517 | |

| | | | | | | | 2,536,875 | |

| Specialty Retail | 4.4% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 2,660 | | | | 429,936 | |

| Chico’s FAS, Inc. | | | 64,985 | | | | 695,989 | |

| Foot Locker, Inc. | | | 11,425 | | | | 626,776 | |

| Sally Beauty Holdings, Inc. (a) | | | 23,850 | | | | 701,428 | |

| | | | | | | | 2,454,129 | |

| Technology Hardware, Storage & Peripherals | 1.4% | | | | | | | | |

| NCR Corp. (a) | | | 27,230 | | | | 756,177 | |

| |

| Textiles, Apparel & Luxury Goods | 1.2% | | | | | | | | |

| Steven Madden, Ltd. (a) | | | 19,650 | | | | 671,637 | |

| |

| Trading Companies & Distributors | 1.3% | | | | | | | | |

| Beacon Roofing Supply, Inc. (a) | | | 16,160 | | | | 734,795 | |

| |

Total Common Stocks

(Cost $51,223,621) | | | | | | | 53,927,203 | |

| |

| Short-Term Investment | 4.0% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 0.14% (7 day yield)

(Cost $2,212,382) | | | 2,212,382 | | | | 2,212,382 | |

| |

Total Investments | 100.5%

(Cost $53,436,003) (b) | | | | | | $ | 56,139,585 | |

| |

| Liabilities in Excess of Cash and Other Assets | (0.5)% | | | | | | | (252,427 | ) |

| |

| Net Assets | 100.0% | | | | | | $ | 55,887,158 | |

The accompanying notes are an integral part of these financial statements.

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement International Equity Portfolio | | | | | | | | |

| | | | | | | | | |

| Common Stocks | 90.5% | | | | | | | | |

| | | | | | | | | |

| Australia | 3.1% | | | | | | | | |

| BHP Billiton PLC | | | 832,000 | | | $ | 10,465,379 | |

| Caltex Australia, Ltd. | | | 444,036 | | | | 10,608,640 | |

| | | | | | | | 21,074,019 | |

| Belgium | 4.1% | | | | | | | | |

| Anheuser-Busch InBev SA/NV | | | 170,212 | | | | 22,374,303 | |

| KBC Group NV (a) | | | 115,221 | | | | 5,648,732 | |

| | | | | | | | 28,023,035 | |

| Brazil | 1.1% | | | | | | | | |

| BB Seguridade Participacoes SA | | | 835,100 | | | | 7,307,742 | |

| | | | | | | | | |

| Canada | 3.8% | | | | | | | | |

| MacDonald Dettwiler & Associates, Ltd. | | | 91,985 | | | | 5,999,904 | |

| National Bank of Canada | | | 255,300 | | | | 8,732,309 | |

| Suncor Energy, Inc. | | | 403,840 | | | | 11,202,930 | |

| | | | | | | | 25,935,143 | |

| Denmark | 1.2% | | | | | | | | |

| Carlsberg A/S, Class B | | | 83,458 | | | | 7,920,197 | |

| | | | | | | | | |

| Finland | 1.6% | | | | | | | | |

| Sampo Oyj, A Shares | | | 270,670 | | | | 11,058,464 | |

| | | | | | | | | |

| France | 7.4% | | | | | | | | |

| Capgemini SA | | | 149,006 | | | | 13,004,022 | |

| Iliad SA | | | 26,200 | | | | 5,325,822 | |

| TOTAL SA | | | 143,744 | | | | 6,931,577 | |

| Valeo SA | | | 266,022 | | | | 11,881,213 | |

| Vinci SA | | | 177,615 | | | | 12,650,047 | |

| | | | | | | | 49,792,681 | |

| Germany | 0.7% | | | | | | | | |

| GEA Group AG | | | 105,708 | | | | 4,968,446 | |

| | | | | | | | | |

| Ireland | 4.6% | | | | | | | | |

| James Hardie Industries PLC | | | 455,879 | | | | 6,982,967 | |

| Ryanair Holdings PLC Sponsored ADR | | | 78,423 | | | | 5,453,536 | |

| Shire PLC | | | 304,290 | | | | 18,738,015 | |

| | | | | | | | 31,174,518 | |

| Israel | 2.4% | | | | | | | | |

| Teva Pharmaceutical Industries, Ltd. | | | | | | | | |

| Sponsored ADR | | | 329,550 | | | | 16,553,297 | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Italy | 1.6% | | | | | | | | |

| Azimut Holding SpA | | | 301,232 | | | $ | 4,909,103 | |

| Mediaset SpA | | | 1,765,247 | | | | 6,213,632 | |

| | | | | | | | 11,122,735 | |

| Japan | 20.7% | | | | | | | | |

| ABC-Mart, Inc. | | | 117,600 | | | | 7,826,597 | |

| Daiwa House Industry Co., Ltd. | | | 685,700 | | | | 20,008,604 | |

| Don Quijote Holdings Co., Ltd. | | | 403,500 | | | | 14,907,375 | |

| Isuzu Motors, Ltd. | | | 845,600 | | | | 10,349,748 | |

| Japan Tobacco, Inc. | | | 262,500 | | | | 10,515,908 | |

| KDDI Corp. | | | 575,200 | | | | 17,509,848 | |

| Makita Corp. | | | 142,500 | | | | 9,396,291 | |

| Seven & I Holdings Co., Ltd. | | | 277,400 | | | | 11,581,254 | |

| SoftBank Group Corp. | | | 190,600 | | | | 10,783,186 | |

| Sony Corp. | | | 395,000 | | | | 11,560,113 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 394,300 | | | | 11,304,686 | |

| United Arrows, Ltd. | | | 146,300 | | | | 4,232,953 | |

| | | | | | | | 139,976,563 | |

| Luxembourg | 0.7% | | | | | | | | |

| RTL Group SA | | | 58,968 | | | | 4,809,467 | |

| | | | | | | | | |

| Netherlands | 5.6% | | | | | | | | |

| Koninklijke KPN NV | | | 1,807,647 | | | | 6,556,594 | |

| Royal Dutch Shell PLC, A Shares | | | 661,985 | | | | 18,074,439 | |

| Wolters Kluwer NV | | | 322,434 | | | | 13,176,416 | |

| | | | | | | | 37,807,449 | |

| Norway | 1.4% | | | | | | | | |

| Telenor ASA | | | 584,522 | | | | 9,654,712 | |

| | | | | | | | | |

| Philippines | 0.5% | | | | | | | | |

| Alliance Global Group, Inc. | | | 9,970,300 | | | | 3,146,319 | |

| | | | | | | | | |

| Spain | 1.1% | | | | | | | | |

| Red Electrica Corporacion SA | | | 81,689 | | | | 7,282,942 | |

| | | | | | | | | |

| Sweden | 3.4% | | | | | | | | |

| Assa Abloy AB, Class B | | | 678,061 | | | | 13,898,162 | |

| Swedbank AB, A Shares | | | 440,122 | | | | 9,206,285 | |

| | | | | | | | 23,104,447 | |

| Switzerland | 5.9% | | | | | | | | |

| Novartis AG | | | 336,063 | | | | 27,645,811 | |

| Wolseley PLC | | | 238,805 | | | | 12,376,111 | |

| | | | | | | | 40,021,922 | |

| Taiwan | 2.0% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR | | | 509,400 | | | | 13,361,562 | |

The accompanying notes are an integral part of these financial statements.

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement International Equity Portfolio (concluded) | |

| | | | | | | | | |

| Thailand | 0.6% | | | | | | | | |

| Krung Thai Bank Public Co. Ltd. (c) | | | 8,002,400 | | | $ | 3,711,984 | |

| | | | | | | | | |

| Turkey | 1.1% | | | | | | | | |

| Turkcell Iletisim Hizmetleri AS (a) | | | 2,084,109 | | | | 7,676,082 | |

| | | | | | | | | |

| United Kingdom | 12.8% | | | | | | | | |

| British American Tobacco PLC | | | 322,509 | | | | 20,985,808 | |

| Direct Line Insurance Group PLC | | | 1,019,511 | | | | 4,714,692 | |

| Howden Joinery Group PLC | | | 957,463 | | | | 4,993,828 | |

| Informa PLC | | | 666,172 | | | | 6,524,041 | |

| J Sainsbury PLC | | | 2,069,882 | | | | 6,419,163 | |

| Provident Financial PLC | | | 184,746 | | | | 5,710,496 | |

| Prudential PLC | | | 844,538 | | | | 14,387,380 | |

| RELX PLC | | | 678,674 | | | | 12,505,020 | |

| Unilever PLC | | | 208,960 | | | | 10,023,200 | |

| | | | | | | | 86,263,628 | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| United States | 3.1% | | | | | | | | |

| Aon PLC | | | 117,875 | | | $ | 12,875,486 | |

| Signet Jewelers, Ltd. | | | 95,341 | | | | 7,857,052 | |

| | | | | | | | 20,732,538 | |

Total Common Stocks

(Cost $543,283,343) | | | | | | | 612,479,892 | |

| | | | | | | | | |

| Short-Term Investment | 5.5% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 0.14% (7 day yield)

(Cost $37,473,652) | | | 37,473,652 | | | | 37,473,652 | |

| | | | | | | | | |

Total Investments | 96.0%

(Cost $580,756,995) (b) | | | | | | $ | 649,953,544 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 4.0% | | | | | | | 26,837,535 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 676,791,079 | |

The accompanying notes are an integral part of these financial statements.

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio | |

| | | | | | | | | |

| Common Stocks | 95.7% | | | | | | | | |

| | | | | | | | | |

| Argentina | 1.1% | | | | | | | | |

| YPF SA Sponsored ADR | | | 605,034 | | | $ | 11,616,653 | |

| | | | | | | | | |

| Brazil | 10.5% | | | | | | | | |

| Ambev SA ADR | | | 2,924,400 | | | | 17,283,204 | |

| Banco do Brasil SA | | | 3,365,266 | | | | 17,998,092 | |

| BB Seguridade Participacoes SA | | | 2,125,600 | | | | 18,600,572 | |

| CCR SA | | | 3,218,100 | | | | 16,830,333 | |

| Cielo SA | | | 2,387,054 | | | | 25,161,301 | |

| Localiza Rent a Car SA | | | 781,115 | | | | 8,389,150 | |

| Natura Cosmeticos SA | | | 396,100 | | | | 3,144,336 | |

| Via Varejo SA | | | 227,000 | | | | 526,461 | |

| | | | | | | | 107,933,449 | |

| China | 16.0% | | | | | | | | |

| AAC Technologies Holdings, Inc. | | | 1,185,000 | | | | 10,192,198 | |

| Baidu, Inc. Sponsored ADR (a) | | | 169,700 | | | | 28,025,955 | |

| China Construction Bank Corp., Class H | | | 57,111,390 | | | | 38,027,502 | |

| China Mobile, Ltd. Sponsored ADR | | | 519,049 | | | | 30,052,937 | |

| China Shenhua Energy Co., Ltd., Class H | | | 4,516,829 | | | | 8,349,096 | |

| CNOOC, Ltd. | | | 7,902,000 | | | | 9,865,285 | |

| NetEase, Inc. ADR | | | 170,400 | | | | 32,924,688 | |

| Weichai Power Co., Ltd., Class H | | | 7,060,932 | | | | 7,305,811 | |

| | | | | | | | 164,743,472 | |

| Egypt | 0.9% | | | | | | | | |

| Commercial International Bank Egypt SAE GDR | | | 2,503,291 | | | | 8,916,296 | |

| | | | | | | | | |

| Hong Kong | 0.4% | | | | | | | | |

| Huabao International Holdings, Ltd. (a) | | | 11,723,000 | | | | 4,159,665 | |

| | | | | | | | | |

| Hungary | 1.5% | | | | | | | | |

| OTP Bank Nyrt. | | | 682,606 | | | | 15,304,421 | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| India | 9.8% | | | | | | | | |

| Axis Bank, Ltd. | | | 2,743,029 | | | $ | 21,820,458 | |

| Bajaj Auto, Ltd. | | | 231,398 | | | | 9,261,755 | |

| Bharat Heavy Electricals, Ltd. | | | 2,506,622 | | | | 4,783,163 | |

| HCL Technologies, Ltd. | | | 1,086,435 | | | | 11,787,919 | |

| Hero MotoCorp, Ltd. | | | 346,621 | | | | 16,228,679 | |

| Punjab National Bank (a) | | | 5,875,030 | | | | 9,307,249 | |

| Tata Consultancy Services, Ltd. | | | 752,872 | | | | 28,437,364 | |

| | | | | | | | 101,626,587 | |

| Indonesia | 7.2% | | | | | | | | |

| PT Astra International Tbk | | | 22,998,900 | | | | 12,964,337 | |

| PT Bank Mandiri (Persero) Tbk | | | 24,016,429 | | | | 17,410,321 | |

| PT Semen Indonesia (Persero) Tbk | | | 10,198,200 | | | | 7,247,130 | |

| PT Telekomunikasi Indonesia (Persero) Tbk Sponsored ADR | | | 502,400 | | | | 30,877,504 | |

| PT United Tractors Tbk | | | 4,815,740 | | | | 5,422,861 | |

| | | | | | | | 73,922,153 | |

| Macau | 0.3% | | | | | | | | |

| Wynn Macau, Ltd. | | | 2,116,000 | | | | 3,083,255 | |

| | | | | | | | | |

| Malaysia | 0.6% | | | | | | | | |

| British American Tobacco Malaysia Berhad | | | 517,700 | | | | 6,772,540 | |

| | | | | | | | | |

| Mexico | 2.8% | | | | | | | | |

| America Movil SAB de CV, Class L Sponsored ADR | | | 744,448 | | | | 9,126,933 | |

| Grupo Mexico SAB de CV, Series B | | | 4,114,197 | | | | 9,640,460 | |

| Kimberly-Clark de Mexico SAB de CV, Series A | | | 4,271,362 | | | | 10,090,503 | |

| | | | | | | | 28,857,896 | |

| Pakistan | 2.0% | | | | | | | | |

| Habib Bank, Ltd. | | | 4,359,600 | | | | 8,225,461 | |

| Oil & Gas Development Co., Ltd. | | | 3,279,300 | | | | 4,355,724 | |

| Pakistan Petroleum, Ltd. | | | 5,144,402 | | | | 7,624,437 | |

| | | | | | | | 20,205,622 | |

| Philippines | 1.3% | | | | | | | | |

| Philippine Long Distance Telephone Co. Sponsored ADR | | | 306,900 | | | | 13,678,533 | |

The accompanying notes are an integral part of these financial statements.

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Emerging Markets Equity Portfolio (concluded) | |

| | | | | | | | | |

| Russia | 9.1% | | | | | | | | |

| ALROSA PAO (a) | | | 6,613,700 | | | $ | 7,123,980 | |

| Gazprom PJSC Sponsored ADR | | | 3,402,719 | | | | 14,695,152 | |

| Lukoil PJSC Sponsored ADR | | | 423,337 | | | | 17,717,515 | |

| Magnit PJSC Sponsored GDR (c), (d) | | | 108,375 | | | | 3,600,218 | |

| Magnit PJSC Sponsored GDR | | | 57,639 | | | | 1,917,301 | |

| Mobile TeleSystems PJSC Sponsored ADR | | | 1,805,420 | | | | 14,948,878 | |

| Sberbank of Russia PJSC (a) | | | 16,162,500 | | | | 33,686,691 | |

| | | | | | | | 93,689,735 | |

| South Africa | 7.8% | | | | | | | | |

| Bid Corp., Ltd. (a) | | | 403,334 | | | | 7,558,405 | |

| Imperial Holdings, Ltd. | | | 817,112 | | | | 8,391,608 | |

| Life Healthcare Group Holdings, Ltd. | | | 1,035,590 | | | | 2,550,354 | |

| Nedbank Group, Ltd. | | | 590,682 | | | | 7,510,247 | |

| PPC, Ltd. | | | 3,297,837 | | | | 1,799,404 | |

| Sanlam, Ltd. | | | 2,031,224 | | | | 8,354,866 | |

| Shoprite Holdings, Ltd. | | | 1,233,255 | | | | 13,958,360 | |

| Standard Bank Group, Ltd. | | | 983,441 | | | | 8,620,696 | |

| The Bidvest Group, Ltd. | | | 403,334 | | | | 3,799,823 | |

| Vodacom Group, Ltd. | | | 754,698 | | | | 8,631,388 | |

| Woolworths Holdings, Ltd. | | | 1,627,632 | | | | 9,313,231 | |

| | | | | | | | 80,488,382 | |

| South Korea | 12.5% | | | | | | | | |

| Coway Co., Ltd. | | | 151,043 | | | | 13,728,902 | |

| Hanwha Life Insurance Co., Ltd. | | | 1,875,601 | | | | 9,434,582 | |

| Hyundai Mobis Co., Ltd. | | | 74,708 | | | | 16,356,500 | |

| KB Financial Group, Inc. | | | 326,393 | | | | 9,311,037 | |

| KT&G Corp. | | | 72,977 | | | | 8,650,181 | |

| Samsung Electronics Co., Ltd. | | | 27,862 | | | | 34,684,255 | |

| Shinhan Financial Group Co., Ltd. | | | 646,348 | | | | 21,340,129 | |

| SK Hynix, Inc. | | | 538,610 | | | | 15,308,352 | |

| | | | | | | | 128,813,938 | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Taiwan | 5.4% | | | | | | | | |

| Hon Hai Precision Industry Co., Ltd. | | | 4,240,138 | | | $ | 10,910,300 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | | 8,920,642 | | | | 45,107,819 | |

| | | | | | | | 56,018,119 | |

| Thailand | 2.1% | | | | | | | | |

| Kasikornbank Public Co. Ltd. | | | 1,618,436 | | | | 7,958,241 | |

| PTT Exploration & Production Public Co. Ltd. | | | 2,742,135 | | | | 6,476,870 | |

| The Siam Cement Public Co. Ltd. | | | 551,650 | | | | 7,512,879 | |

| | | | | | | | 21,947,990 | |

| Turkey | 4.4% | | | | | | | | |

| Akbank TAS | | | 4,823,787 | | | | 13,971,599 | |

| KOC Holding AS | | | 2,217,366 | | | | 10,133,852 | |

| Turk Telekomunikasyon AS | | | 555,430 | | | | 1,175,791 | |

| Turkcell Iletisim Hizmetleri AS (a) | | | 2,738,913 | | | | 10,087,822 | |

| Turkiye Is Bankasi AS, C Shares | | | 6,153,624 | | | | 9,864,972 | |

| | | | | | | | 45,234,036 | |

Total Common Stocks

(Cost $1,068,453,550) | | | | | | | 987,012,742 | |

| | | | | | | | | |

| Short-Term Investment | 4.1% | | | | | | | | |

State Street Institutional Treasury Money Market Fund, Premier Class, 0.14% (7 day yield)

(Cost $41,909,918) | | | 41,909,918 | | | | 41,909,918 | |

| | | | | | | | | |

Total Investments | 99.8%

(Cost $1,110,363,468) (b) | | | | | | $ | 1,028,922,660 | |

| | | | | | | | | |

| Cash and Other Assets in Excess of Liabilities | 0.2% | | | | | | | 1,890,529 | |

| | | | | | | | | |

| Net Assets | 100.0% | | | | | | $ | 1,030,813,189 | |

The accompanying notes are an integral part of these financial statements.

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Lazard Retirement Global Dynamic Multi Asset Portfolio | |

| | | | | | | | | |

| Common Stocks | 64.6% | | | | | | | | |

| | | | | | | | | |

| Australia | 2.4% | | | | | | | | |

| Amcor, Ltd. | | | 95,659 | | | $ | 1,069,824 | |

| Blackmores, Ltd. | | | 2,422 | | | | 239,310 | |

| BlueScope Steel, Ltd. | | | 20,630 | | | | 98,923 | |

| Cochlear, Ltd. | | | 1,316 | | | | 119,363 | |

| CSL, Ltd. | | | 18,636 | | | | 1,566,952 | |

| Evolution Mining, Ltd. | | | 68,873 | | | | 120,064 | |

| Harvey Norman Holdings, Ltd. | | | 36,052 | | | | 124,992 | |

| Investa Office Fund REIT | | | 44,743 | | | | 143,148 | |

| JB Hi-Fi, Ltd. | | | 7,008 | | | | 126,711 | |

| Magellan Financial Group, Ltd. | | | 14,817 | | | | 248,394 | |

| Mirvac Group REIT | | | 182,634 | | | | 276,301 | |

| Northern Star Resources, Ltd. | | | 45,169 | | | | 166,789 | |

| REA Group, Ltd. | | | 5,988 | | | | 266,610 | |

| Regis Resources, Ltd. | | | 207,725 | | | | 530,800 | |

| Sandfire Resources NL | | | 31,406 | | | | 124,044 | |

| Telstra Corp., Ltd. | | | 170,830 | | | | 710,935 | |

| Wesfarmers, Ltd. | | | 6,540 | | | | 196,972 | |

| | | | | | | | 6,130,132 | |

| Austria | 0.1% | | | | | | | | |

| Erste Group Bank AG | | | 8,887 | | | | 203,231 | |

| | | | | | | | | |

| Belgium | 0.6% | | | | | | | | |

| Anheuser-Busch InBev SA/NV Sponsored ADR | | | 10,145 | | | | 1,335,894 | |

| Telenet Group Holding NV (a) | | | 3,930 | | | | 179,383 | |

| | | | | | | | 1,515,277 | |

| Canada | 3.0% | | | | | | | | |

| Alamos Gold, Inc., Class A | | | 19,867 | | | | 170,844 | |

| BCE, Inc. | | | 11,176 | | | | 528,891 | |

| Canadian Imperial Bank of Commerce | | | 6,121 | | | | 459,756 | |

| Canadian National Railway Co. | | | 22,135 | | | | 1,307,181 | |

| CGI Group, Inc., Class A (a) | | | 12,629 | | | | 539,490 | |

| CI Financial Corp. | | | 7,060 | | | | 147,271 | |

| Colliers International Group, Inc. | | | 3,471 | | | | 118,535 | |

| Constellation Software, Inc. | | | 317 | | | | 122,685 | |

| Corus Entertainment, Inc., B Shares | | | 11,396 | | | | 117,493 | |

| Dollarama, Inc. | | | 4,321 | | | | 301,679 | |

| Emera, Inc. | | | 2,982 | | | | 112,222 | |

| Enbridge, Inc. | | | 5,354 | | | | 226,808 | |

| Description | | Shares | | | Fair

Value | |

| | | | | | | | | |

| Genworth MI Canada, Inc. | | | 8,424 | | | $ | 216,085 | |

| Imperial Oil, Ltd. | | | 5,350 | | | | 169,285 | |

| Intact Financial Corp. | | | 7,313 | | | | 522,402 | |

| Lundin Mining Corp. (a) | | | 62,217 | | | | 209,967 | |

| Magna International, Inc. | | | 20,064 | | | | 704,286 | |

| Manulife Financial Corp. | | | 15,318 | | | | 209,504 | |

| Metro, Inc. | | | 9,068 | | | | 315,918 | |

| Open Text Corp. | | | 6,461 | | | | 382,024 | |

| Quebecor, Inc., Class B | | | 5,875 | | | | 168,344 | |

| Suncor Energy, Inc. | | | 12,020 | | | | 333,447 | |

| Transcontinental, Inc. Class A | | | 8,034 | | | | 108,886 | |

| Uni-Select, Inc. | | | 4,220 | | | | 107,007 | |

| | | | | | | | 7,600,010 | |

| Denmark | 0.7% | | | | | | | | |

| Carlsberg A/S Class B Sponsored ADR | | | 27,285 | | | | 519,779 | |

| Coloplast A/S, Class B | | | 3,303 | | | | 246,561 | |

| Novo Nordisk A/S Sponsored ADR | | | 10,295 | | | | 553,665 | |

| Novo Nordisk A/S, Class B | | | 5,539 | | | | 297,871 | |

| Vestas Wind Systems A/S | | | 2,411 | | | | 163,621 | |

| | | | | | | | 1,781,497 | |

| Finland | 0.6% | | | | | | | | |

| Kone Oyj, Class B | | | 12,783 | | | | 590,223 | |

| Sampo Oyj, A Shares ADR | | | 42,795 | | | | 870,664 | |

| | | | | | | | 1,460,887 | |

| France | 0.5% | | | | | | | | |

| Airbus Group SE | | | 7,264 | | | | 421,809 | |

| BNP Paribas SA | | | 3,087 | | | | 138,785 | |

| Electricite de France SA | | | 6,734 | | | | 82,775 | |

| Engie SA | | | 10,747 | | | | 173,440 | |

| Orange SA | | | 12,446 | | | | 203,293 | |

| Sopra Steria Group | | | 1,064 | | | | 110,429 | |

| TOTAL SA | | | 3,406 | | | | 164,243 | |

| | | | | | | | 1,294,774 | |

| Germany | 1.0% | | | | | | | | |

| Bayer AG | | | 1,940 | | | | 195,188 | |

| Continental AG Sponsored ADR | | | 13,455 | | | | 511,290 | |

| Daimler AG | | | 1,242 | | | | 74,068 | |

| Deutsche Lufthansa AG | | | 6,493 | | | | 75,593 | |

| GEA Group AG Sponsored ADR | | | 11,035 | | | | 520,962 | |

| Muenchener Rueckversicherungs AG | | | 631 | | | | 105,458 | |

| ProSiebenSat.1 Media SE | | | 3,573 | | | | 156,017 | |

| Rheinmetall AG | | | 1,347 | | | | 79,552 | |

| Symrise AG ADR | | | 46,910 | | | | 802,395 | |

| | | | | | | | 2,520,523 | |

The accompanying notes are an integral part of these financial statements.

| Description | | Shares | | | Fair

Value | |