UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08085 |

| |

| Exact name of registrant as specified in charter: | | Strategic Partners Mutual |

| | Funds, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2007 |

| |

| Date of reporting period: | | 10/31/2007 |

Item 1 – Reports to Stockholders

(Formerly known as Strategic Partners Mid Cap Value Fund)

| | |

| OCTOBER 31, 2007 | | ANNUAL REPORT |

Dryden Mid Cap Value Fund

FUND TYPE

Small/Mid-Cap stock

OBJECTIVE

Capital growth

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden, Dryden, Prudential Financial and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

December 14, 2007

Dear Shareholder:

We hope you find the annual report for the Dryden Mid Cap Value Fund informative and useful. As a JennisonDryden mutual fund shareholder, you may be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

Instead, we believe it is better to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two potential advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and tolerance for risk.

JennisonDryden Mutual Funds gives you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of four leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC, Quantitative Management Associates LLC (QMA), or Prudential Real Estate Investors (PREI). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies. PREI is a registered investment adviser and a unit of PIM.

Thank you for choosing JennisonDryden Mutual Funds.

Sincerely,

Judy A. Rice, President

Dryden Mid Cap Value Fund

| | |

| Dryden Mid Cap Value Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Dryden Mid Cap Value Fund is to seek capital growth. There can be no assurance that the Fund will achieve its investment objective.

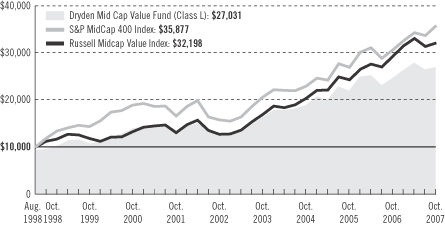

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.53%; Class B, 2.23%; Class C, 2.23%; Class L, 1.73%; Class M, 2.23%; Class X, 1.23%; Class Z, 1.23%. Net operating expenses apply to: Class A, 1.48%; Class B, 2.23%; Class C, 2.23%; Class L, 1.73%; Class M, 2.23%; Class X, 1.23%; Class Z, 1.23%, after contractual reduction through 2/28/2008.

| | | | | | | | | |

Cumulative Total Returns as of 10/31/07 | | | | | | | | | |

| | | One Year | | | Five Years | | | Since Inception1 | |

Class A2 | | 9.78 | % | | N/A | | | 46.96 | % |

Class B3 | | 8.99 | | | N/A | | | 42.97 | |

Class C | | 9.00 | | | 106.92 | % | | 174.24 | |

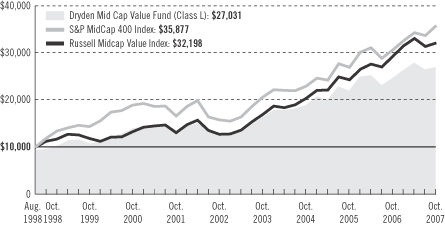

Class L2 | | 9.54 | | | 112.08 | | | 186.80 | |

Class M3 | | 8.95 | | | 106.85 | | | 173.94 | |

Class X | | 10.04 | | | 110.46 | | | 178.30 | |

Class Z | | 10.24 | | | N/A | | | 18.18 | |

S&P MidCap 400 Index4 | | 17.02 | | | 126.69 | | | * | |

Russell Midcap Index5 | | 15.24 | | | 149.85 | | | ** | |

Russell Midcap Value Index6 | | 9.73 | | | 152.56 | | | *** | |

Lipper Mid-Cap Value Funds Avg.7 | | 12.87 | | | 141.01 | | | **** | |

| | | | | | | | | |

Average Annual Total Returns8 as of 9/30/07 | | | | | | | |

| | | One Year | | | Five Years | | | Since Inception1 | |

Class A2 | | 8.85 | % | | N/A | | | 9.72 | % |

Class B3 | | 9.41 | | | N/A | | | 10.25 | |

Class C | | 13.43 | | | 16.16 | % | | 11.63 | |

Class L2 | | 8.31 | | | 15.36 | | | 11.44 | |

Class M3 | | 8.37 | | | 15.93 | | | 11.62 | |

Class X | | 9.72 | | | 16.22 | | | 11.80 | |

Class Z | | 15.72 | | | N/A | | | 9.10 | |

S&P MidCap 400 Index4 | | 18.76 | | | 18.17 | | | * | |

Russell Midcap Index5 | | 17.87 | | | 20.90 | | | ** | |

Russell Midcap Value Index6 | | 13.75 | | | 21.02 | | | *** | |

Lipper Mid-Cap Value Funds Avg.7 | | 16.04 | | | 19.40 | | | **** | |

| | |

| 2 | | Visit our website at www.jennisondryden.com |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total return performance quoted. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively. Class L shares are closed to most new purchases (with the exception of reinvested dividends and purchases by certain college savings plans). Class M and Class X shares are also closed to most new purchases (with the exception of reinvested dividends). Class L, Class M, and Class X shares are exchangeable only with Class L, Class M, and Class X shares, respectively, offered by the other JennisonDryden Funds. Under certain circumstances, Class A and Class L shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 6%, and 6%, respectively.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Inception dates: Class A and Class B, 4/12/04; Class C, Class L, Class M, Class X, 8/19/98, and Class Z, 11/28/05.

2Prior to April 12, 2004, Class L shares were known as Class A shares. On April 12, 2004, Class A shares were redesignated as Class L shares and a new Class A was opened.

3Prior to April 12, 2004, Class M shares were known as Class B shares. On April 12, 2004, Class B shares were redesignated as Class M shares and a new Class B was opened.

4The Standard & Poor’s MidCap 400 Stock Index (S&P MidCap 400 Index) is an unmanaged index of 400 domestic stocks chosen for market size, liquidity, and industry group representation. It gives a broad look at how U.S. mid-cap stock prices have performed.

5The Russell MidCap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000 Index.

6The Russell MidCap Value Index measures the performance of those Russell MidCap companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000 Value Index.

7Funds in the Lipper Mid-Cap Value Funds Average, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Mid-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the companies in the S&P MidCap 400 Index.

8The average annual total returns take into account applicable sales charges. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Without a distribution and service (12b-1) fee waiver of 0.05% for Class A shares, the returns would have been lower. Class A shares are subject to a 12b-1 fee of up to 0.30% annually. Class B, Class C, Class M, and Class X shares are subject to a 12b-1 fee of 1.00%. Class L shares are subject to a 12b-1 fee of 0.50%.

*S&P MidCap 400 Index Closest Month-End to Inception cumulative total returns as of 10/31/07 are 56.84% for Class A and Class B; and 258.77% for Class C, Class L, Class M, and Class X; and 26.55% for Class Z. S&P MidCap 400 Index Closest Month-End to Inception average annual total returns as of 9/30/07 are 12.88% for Class A and Class B; and 14.77% for Class C, Class L, Class M, and Class X; and 12.11% for Class Z.

| | |

| Dryden Mid Cap Value Fund | | 3 |

Your Fund’s Performance (continued)

**Russell Midcap Index Closest Month-End to Inception cumulative total returns as of 10/31/07 are 65.16% for Class A and Class B; and 210.50% for Class C, Class L, Class M, and Class X; and 29.55% for Class Z. Russell Midcap Index Closest Month-End to Inception average annual total returns as of 9/30/07 are 14.89% for Class A and Class B; and 13.09% for Class C, Class L, Class M, and Class X; and 14.17% for Class Z.

***Russell Midcap Value Index Closest Month-End to Inception cumulative total returns as of 10/31/07 are 67.33% for Class A and Class B; and 221.98% for Class C, Class L, Class M, and Class X; and 27.73% for Class Z. Russell Midcap Value Index Closest Month-End to Inception average annual total returns as of 9/30/07 are 15.72% for Class A and Class B; and 13.69% for Class C, Class L, Class M, and Class X; and 14.05% for Class Z.

****Lipper Mid-Cap Value Funds Average Closest Month-End to Inception cumulative total returns as of 10/31/07 are 58.28% for Class A and Class B; and 229.38% for Class C, Class L, Class M, and Class X; and 26.99% for Class Z. Lipper Mid-Cap Value Funds Average Closest Month-End to Inception average annual total returns as of 9/30/07 are 13.51% for Class A and Class B; and 13.62% for Class C, Class L, Class M, and Class X; and 13.17% for Class Z.

Investors cannot invest directly in an index. The returns for the Russell 2500 Index and the S&P SmallCap 600 Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

Returns for the Lipper Average reflect the deduction of operating expenses, but sales charges or taxes.

| | | |

| Five Largest Holdings expressed as a percentage of net assets as of 10/31/07 | | | |

iShares Russell Midcap Value Index Fund, Exchange Traded Fund | | 1.8 | % |

Edison International, Electric Utilities | | 1.4 | |

American Electric Power Co., Inc., Electric Utilities | | 1.3 | |

Hess Corp., Oil, Gas, & Consumable Fuels | | 1.3 | |

PG&E Corp., Multi-Utilities | | 1.2 | |

Holdings reflect only long-term investments and are subject to change.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Strategy and Performance Overview

How did the Fund perform?

The Dryden Mid Cap Value Fund’s Class A shares returned 9.78% for the 12 months ended October 31, 2007, in line with the 9.73% return of the Russell Midcap Value Index (the Index) but trailing the 12.87% return of the Lipper Mid-Cap Value Funds Average (the Lipper Average).

Were there changes in investment personnel relevant to the Fund’s performance?

On January 29, 2007, the name of the Fund was changed to the Dryden Mid Cap Value Fund and shareholders approved the appointment of Quantitative Management Associates LLC (QMA) as the Fund’s manager responsible for its day-to-day management.

Were there changes to the Fund’s investment objectives and the way it is managed?

Although the Fund’s investment objective remained capital appreciation, the way the Fund is managed changed. In the first three months of its fiscal year, Neuberger Berman Management Inc. managed the Fund after which QMA, which employs its quantitative value equity strategy, became the Fund’s manager. QMA invests in a diversified portfolio of stocks that are out of favor and inexpensive based on price-to-earnings ratios and other value measures. Historically, value stocks have outperformed broad stock market averages. Sector, industry, and individual security weighting constraints are placed on the portfolio to reduce risk relative to its benchmark.

What were stock market conditions like during the first three months of the period?

The period from November 1, 2006 through January 31, 2007 recorded attractive stock market returns. Robust corporate earnings growth and relatively low interest rates and inflation helped boost merger-and-acquisition activity which benefited stocks as investors were willing to pay more for shares of companies that were potential takeover targets. Stock prices also benefited as some corporations increased dividends or bought back shares at attractive prices. Stocks of medium-sized companies outperformed both large and small companies as measured by market capitalization.

How did the Fund perform before the change in asset managers?

For the three months, the Fund’s Class A shares returned 6.92%, lagging the 7.49% return of the Index and the 7.0% return of the Lipper Average. The Fund’s holdings in the specialty retail, medical services, defense and aerospace, and financial services industries were the primary detractors from its performance relative to the Index. However, this was partially offset by the positive impact of its holdings in the metals and mining and drug industries.

| | |

| Dryden Mid Cap Value Fund | | 5 |

Strategy and Performance Overview (continued)

The Neuberger Berman strategy involves investing in stocks with low price-to-earnings ratios and other characteristics typical of the value style of investing, but it also incorporated some factors associated with growth stocks. For example, compared with the Index, the Fund had an overweight exposure to some stocks with high price volatility, which detracted from its relative performance. To a lesser extent, the Fund was also hurt by its overweight exposure to stocks with above-market rates of earnings growth as these types of stocks were largely out of favor. However, this was partially offset by the positive impact of the Fund’s underweight exposure to companies that pay out most of their earnings in the form of dividends to shareholders.

What were stock market conditions like during the last nine months of the period?

Stock prices advanced at a much slower pace from February 1, 2007, through October 31, 2007. Corporate earnings growth slowed but the impact on the equity market was mitigated by strength in consumer spending and the job market. Growth in U.S. exports, which were made more competitive by the nation’s weak currency, also helped.

Slower economic growth and market turbulence early on led to style, capitalization, and sector rotations. After a large decline in the Shanghai Composite Index in China at the end of February prompted a global stock sell-off, investors began to reevaluate their appetite for risk and searched for companies with more resilient growth prospects. During the summer, stocks experienced another setback after a crisis in debt securities backed by subprime mortgages (home loans made to borrowers with poor credit histories) spread abroad from the United States. Citing risks to the U.S. economy from increasing financial market turbulence, the Federal Reserve aggressively lowered its target for the rate banks charge each other on overnight loans by a half point in late September and by a quarter point in October, helping stocks recover most of their summer losses.

Unlike recent years when the value-style of investing dominated growth investing, growth stocks outperformed value stocks across every U.S. market capitalization by period end. A decreasing appetite for risk affected small-cap stocks as investors moved to the relative safety of larger companies, which are often viewed as better able to weather an economic slowdown. Small-cap stocks, which had outperformed their larger brethren in 2006 across all styles, gave way to larger issues.

| | |

| 6 | | Visit our website at www.jennisondryden.com |

How did the Fund perform after the change in asset managers?

For the nine months, the Fund’s Class A shares returned 2.68%, outperforming the 2.08% return of the Index but underperforming the 5.64% return of the Lipper Average. Primary contributors to the Fund’s performance were its overweight exposure to the energy sector versus the Index and good stock selection in the materials and industrials sectors.

Strong global demand for petroleum products supported the Fund’s holdings in the energy sector. Notable performers include Frontline, an oil tanker operator whose stock increased 76%, and Denbury Resources (+104%) and Canadian Natural Resources (+67%), two oil exploration and production companies. Among the energy equipment companies, Oil States International (+50%) and Noble Corp. (+42%) were two solid performers. In the materials sector, the Fund benefited from having a larger exposure to mining stocks than the Index, which included Cleveland Cliffs (+76%), a producer of iron ore, and copper companies Freeport-McMoRan (+107%) and Southern Copper Corp. (+137%). In the industrials sector, the Fund benefited from its overweight position in Cummins (+80%) whose expertise in manufacturing diesel engines is enabling it to gain market share as global regulations for diesel emissions become more stringent. The Fund’s overweighting positions in Terex (+30%) and AGCO Corp. (+76%) also contributed to its performance.

Partially offsetting these positives were adverse stock selection in the consumer discretionary and information technology sectors. In consumer discretionary, the key detractor from the Fund’s return was its larger exposure than the Index to household durables, primarily homebuilders. The weak housing market, combined with tightened lending standards and disruptions in the credit markets, penalized homebuilders and other housing-related stocks. In information technology, the Fund’s overweight position in Lexmark International (–33%) detracted from its return. Higher spending on research and development and marketing has depressed profitability as Lexmark tries to improve its competitive position in inkjet and laser printers. Finally, the Fund’s performance relative to the Index was hurt since it did not hold Juniper Networks (+99%), a top-performing provider of secure networking solutions.

| | |

| Dryden Mid Cap Value Fund | | 7 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2007, at the beginning of the period, and held through the six-month period ended October 31, 2007. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| 8 | | Visit our website at www.jennisondryden.com |

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Dryden Mid-Cap

Value Fund | | Beginning Account

Value

May 1, 2007 | | Ending Account

Value

October 31, 2007 | | Annualized

Expense Ratio

Based on the Six-

Month Period | | | Expenses Paid

During the Six-

Month Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 968.40 | | 1.49 | % | | $ | 7.39 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.69 | | 1.49 | % | | $ | 7.58 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 965.00 | | 2.24 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,013.91 | | 2.24 | % | | $ | 11.37 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 964.90 | | 2.24 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,013.91 | | 2.24 | % | | $ | 11.37 |

| | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | $ | 967.40 | | 1.74 | % | | $ | 8.63 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,016.43 | | 1.74 | % | | $ | 8.84 |

| | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | $ | 964.90 | | 2.24 | % | | $ | 11.09 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,013.91 | | 2.24 | % | | $ | 11.37 |

| | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | $ | 969.70 | | 1.24 | % | | $ | 6.16 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.95 | | 1.24 | % | | $ | 6.31 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 971.60 | | 1.24 | % | | $ | 6.16 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.95 | | 1.24 | % | | $ | 6.31 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2007, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2007 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| Dryden Mid Cap Value Fund | | 9 |

Portfolio of Investments

October 31, 2007

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

LONG-TERM INVESTMENTS 99.7% | | | |

COMMON STOCKS | | | | | |

| | |

Aerospace & Defense 1.0% | | | | | |

L-3 Communications Holdings, Inc. | | 26,700 | | $ | 2,927,388 |

| | |

Auto Components 1.8% | | | | | |

Advance Auto Parts, Inc. | | 32,900 | | | 1,122,548 |

Autoliv, Inc. (Sweden) | | 23,600 | | | 1,491,048 |

BorgWarner, Inc. | | 17,400 | | | 1,839,354 |

TRW Automotive Holdings Corp.* | | 28,800 | | | 855,072 |

| | | | | |

| | | | | 5,308,022 |

| | |

Automobiles 1.3% | | | | | |

Ford Motor Co.* | | 198,900 | | | 1,764,243 |

Harley-Davidson, Inc. | | 28,300 | | | 1,457,450 |

Penske Auto Group, Inc.(a) | | 28,626 | | | 637,787 |

| | | �� | | |

| | | | | 3,859,480 |

| | |

Beverages 2.5% | | | | | |

Coca-Cola Enterprises, Inc. | | 80,300 | | | 2,072,543 |

Constellation Brands, Inc. (Class A Stock)*(a) | | 81,700 | | | 2,052,304 |

Pepsi Bottling Group, Inc. | | 38,100 | | | 1,641,348 |

PepsiAmericas, Inc. | | 43,400 | | | 1,550,248 |

| | | | | |

| | | | | 7,316,443 |

| | |

Building Products 0.4% | | | | | |

Masco Corp. | | 45,500 | | | 1,095,640 |

| | |

Capital Markets 0.1% | | | | | |

Bear Stearns Cos., Inc. (The) | | 2,300 | | | 261,280 |

| | |

Chemicals 4.0% | | | | | |

Ashland, Inc. | | 18,300 | | | 1,074,576 |

Celanese Corp. | | 27,300 | | | 1,145,508 |

Eastman Chemical Co. | | 24,400 | | | 1,624,796 |

FMC Corp. | | 28,200 | | | 1,621,500 |

Huntsman Corp. | | 30,200 | | | 795,770 |

Lyondell Chemical Co. | | 53,000 | | | 2,514,850 |

PPG Industries, Inc.(a) | | 34,200 | | | 2,556,108 |

Westlake Chemical Corp.(a) | | 14,700 | | | 360,738 |

| | | | | |

| | | | | 11,693,846 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 11 |

Portfolio of Investments

October 31, 2007 continued

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Commercial Banks 6.8% | | | | | |

Associated Banc-Corp | | 39,600 | | $ | 1,142,856 |

BancorpSouth, Inc.(a) | | 36,300 | | | 880,638 |

Bank of Hawaii Corp. | | 9,700 | | | 515,652 |

City National Corp. | | 15,600 | | | 1,054,560 |

Colonial BancGroup, Inc. (The) | | 50,100 | | | 960,918 |

Comerica, Inc.(a) | | 36,200 | | | 1,689,816 |

Commerce Bancshares, Inc.(a) | | 14,600 | | | 688,682 |

First Horizon National Corp.(a) | | 35,100 | | | 915,408 |

Huntington Bancshares, Inc. | | 66,500 | | | 1,191,015 |

KeyCorp | | 85,000 | | | 2,418,250 |

M&T Bank Corp.(a) | | 11,100 | | | 1,104,228 |

Marshall & Ilsley Corp. | | 55,900 | | | 2,386,930 |

Popular, Inc. (Puerto Rico)(a) | | 79,600 | | | 839,780 |

Synovus Financial Corp. | | 31,700 | | | 835,612 |

TCF Financial Corp. | | 36,300 | | | 826,551 |

UnionBanCal Corp. | | 17,900 | | | 966,779 |

Wilmington Trust Corp. | | 11,900 | | | 432,803 |

Zions Bancorp | | 17,000 | | | 1,004,870 |

| | | | | |

| | | | | 19,855,348 |

| | |

Commercial Services & Supplies 0.7% | | | | | |

R.R. Donnelley & Sons Co. | | 52,400 | | | 2,111,196 |

| | |

Communication Equipment 0.3% | | | | | |

Arris Group, Inc.*(a) | | 78,700 | | | 905,050 |

| | |

Computer Services & Software 0.4% | | | | | |

Tech Data Corp.* | | 28,500 | | | 1,120,905 |

| | |

Computers & Peripherals 1.1% | | | | | |

Lexmark International, Inc. (Class A Stock)* | | 44,000 | | | 1,847,560 |

Western Digital Corp.* | | 47,100 | | | 1,220,832 |

| | | | | |

| | | | | 3,068,392 |

| | |

Construction 0.6% | | | | | |

Centex Corp. | | 17,400 | | | 436,044 |

Lennar Corp. (Class A Stock) | | 30,900 | | | 706,065 |

NVR, Inc.*(a) | | 800 | | | 380,600 |

Ryland Group, Inc.(a) | | 8,700 | | | 247,341 |

| | | | | |

| | | | | 1,770,050 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Construction & Engineering 0.4% | | | | | |

Chicago Bridge & Iron Co. N.V. (Netherlands) | | 22,400 | | $ | 1,120,000 |

| | |

Consumer Finance 0.2% | | | | | |

AmeriCredit Corp.* | | 31,300 | | | 441,643 |

| | |

Containers & Packaging 0.2% | | | | | |

Sonoco Products Co. | | 22,900 | | | 708,068 |

| | |

Diversified Consumer Services 0.2% | | | | | |

Career Education Corp.* | | 19,900 | | | 711,226 |

| | |

Diversified Financial Services 0.6% | | | | | |

CIT Group, Inc. | | 42,800 | | | 1,508,272 |

Thornburg Mortgage, Inc.(a) | | 18,900 | | | 198,450 |

| | | | | |

| | | | | 1,706,722 |

| | |

Diversified Telecommunication Services 0.5% | | | | | |

CenturyTel, Inc. | | 32,600 | | | 1,436,030 |

| | |

Electric Utilities 6.3% | | | | | |

American Electric Power Co., Inc. | | 80,800 | | | 3,895,368 |

DPL, Inc. | | 55,700 | | | 1,617,528 |

Edison International | | 68,600 | | | 3,989,090 |

Great Plains Energy, Inc.(a) | | 31,600 | | | 942,944 |

Pepco Holdings, Inc. | | 54,700 | | | 1,558,403 |

Pinnacle West Capital Corp. | | 28,500 | | | 1,151,400 |

PPL Corp. | | 45,500 | | | 2,352,350 |

Progress Energy, Inc. | | 56,000 | | | 2,688,000 |

| | | | | |

| | | | | 18,195,083 |

| | |

Electronic Components 0.6% | | | | | |

Integrys Energy Group, Inc.(a) | | 24,300 | | | 1,307,583 |

Vishay Intertechnology, Inc.* | | 38,200 | | | 480,938 |

| | | | | |

| | | | | 1,788,521 |

| | |

Electronic Equipment & Instruments 1.0% | | | | | |

Avnet, Inc.* | | 44,100 | | | 1,839,852 |

Ingram Micro, Inc. (Class A Stock)* | | 47,000 | | | 998,280 |

| | | | | |

| | | | | 2,838,132 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 13 |

Portfolio of Investments

October 31, 2007 continued

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Energy Equipment & Services 2.2% | | | | | |

BJ Services Co. | | 40,600 | | $ | 1,022,714 |

Noble Corp. (Cayman Islands) | | 20,600 | | | 1,090,770 |

Oil States International, Inc.*(a) | | 25,000 | | | 1,079,750 |

Patterson-UTI Energy, Inc.(a) | | 37,100 | | | 739,774 |

SEACOR Holdings, Inc.*(a) | | 9,500 | | | 870,675 |

Tidewater, Inc.(a) | | 16,100 | | | 880,187 |

Unit Corp.* | | 11,700 | | | 558,909 |

| | | | | |

| | | | | 6,242,779 |

| | |

Exchange Traded Fund 1.8% | | | | | |

iShares Russell Midcap Value Index Fund | | 34,100 | | | 5,175,357 |

| | |

Financial Services 0.2% | | | | | |

Fulton Financial Corp.(a) | | 45,500 | | | 596,505 |

| | |

Food & Staples Retailing 1.2% | | | | | |

Kroger Co. (The) | | 67,500 | | | 1,983,825 |

Safeway, Inc. | | 45,000 | | | 1,530,000 |

| | | | | |

| | | | | 3,513,825 |

| | |

Food Products 1.6% | | | | | |

ConAgra Foods, Inc. | | 41,900 | | | 994,287 |

Dean Foods Co.(a) | | 48,300 | | | 1,341,291 |

Del Monte Foods Co. | | 113,400 | | | 1,172,556 |

Smithfield Foods, Inc.* | | 44,600 | | | 1,278,682 |

| | | | | |

| | | | | 4,786,816 |

| | |

Gas Utilities 2.0% | | | | | |

AGL Resources, Inc.(a) | | 27,900 | | | 1,102,887 |

Atmos Energy Corp. | | 33,300 | | | 934,065 |

National Fuel Gas Co. | | 43,400 | | | 2,104,466 |

ONEOK, Inc. | | 32,000 | | | 1,598,080 |

| | | | | |

| | | | | 5,739,498 |

| | |

Healthcare Equipment & Supplies 0.1% | | | | | |

Cooper Cos., Inc. (The)(a) | | 6,000 | | | 252,000 |

| | |

Healthcare Providers & Services 2.4% | | | | | |

Aetna, Inc. | | 22,200 | | | 1,246,974 |

CIGNA Corp. | | 20,000 | | | 1,049,800 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Healthcare Providers & Services (cont’d.) | | | | | |

Coventry Health Care, Inc.* | | 26,200 | | $ | 1,580,122 |

LifePoint Hospitals, Inc.* | | 57,200 | | | 1,745,744 |

Omnicare, Inc. | | 42,900 | | | 1,265,550 |

| | | | | |

| | | | | 6,888,190 |

| | |

Hotels, Restaurants & Leisure 1.0% | | | | | |

Brinker International, Inc.(a) | | 17,600 | | | 446,864 |

Carnival Corp. (Panama)(a) | | 25,600 | | | 1,228,288 |

International Speedway Corp. (Class A Stock) | | 16,600 | | | 737,538 |

Yum! Brands, Inc. | | 11,600 | | | 467,132 |

| | | | | |

| | | | | 2,879,822 |

| | |

Household Durables 2.0% | | | | | |

Black & Decker Corp. (The)(a) | | 7,700 | | | 692,307 |

Fortune Brands, Inc. | | 12,300 | | | 1,030,371 |

Leggett & Platt, Inc.(a) | | 37,700 | | | 732,511 |

Mohawk Industries, Inc.*(a) | | 15,200 | | | 1,297,168 |

Stanley Works (The)(a) | | 13,900 | | | 799,945 |

Whirlpool Corp. | | 17,200 | | | 1,361,896 |

| | | | | |

| | | | | 5,914,198 |

| | |

Independent Power Producers & Energy Traders 1.4% | | | | | |

Mirant Corp.* | | 40,600 | | | 1,719,816 |

NRG Energy, Inc.*(a) | | 49,400 | | | 2,255,604 |

| | | | | |

| | | | | 3,975,420 |

| | |

Industrial Conglomerates 1.0% | | | | | |

Teleflex, Inc. | | 15,600 | | | 1,142,076 |

Walter Industries, Inc. | | 61,100 | | | 1,872,104 |

| | | | | |

| | | | | 3,014,180 |

| | |

Insurance 9.1% | | | | | |

Ambac Financial Group, Inc.(a) | | 18,900 | | | 696,087 |

American Financial Group, Inc. | | 30,000 | | | 897,000 |

Cincinnati Financial Corp. | | 39,500 | | | 1,571,310 |

CNA Financial Corp. | | 6,200 | | | 245,706 |

Conseco, Inc.* | | 17,200 | | | 271,588 |

Endurance Specialty Holdings Ltd. (Bermuda)(a) | | 40,800 | | | 1,599,768 |

Fidelity National Financial, Inc. | | 61,300 | | | 943,407 |

First American Corp. | | 27,700 | | | 833,770 |

Genworth Financial, Inc. | | 34,700 | | | 947,310 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 15 |

Portfolio of Investments

October 31, 2007 continued

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Insurance (cont’d.) | | | | | |

HCC Insurance Holdings, Inc. | | 27,200 | | $ | 813,008 |

MBIA, Inc.(a) | | 31,200 | | | 1,342,848 |

Mercury General Corp. | | 15,300 | | | 785,043 |

Nationwide Financial Services, Inc. (Class A Stock) | | 19,100 | | | 1,024,715 |

Old Republic International Corp. | | 65,200 | | | 999,516 |

Philadelphia Consolidated Holding Co.* | | 13,700 | | | 558,960 |

Principal Financial Group, Inc. | | 22,400 | | | 1,515,808 |

Protective Life Corp. | | 23,800 | | | 1,020,306 |

Reinsurance Group of America, Inc. | | 15,000 | | | 856,950 |

RenaissanceRe Holdings Ltd. | | 12,000 | | | 700,080 |

Safeco Corp.(a) | | 29,800 | | | 1,725,420 |

StanCorp Financial Group, Inc. | | 21,700 | | | 1,196,321 |

Torchmark Corp.(a) | | 23,800 | | | 1,550,808 |

Transatlantic Holdings, Inc. | | 9,700 | | | 722,941 |

Unitrin, Inc. | | 19,100 | | | 884,521 |

Unum Group | | 76,200 | | | 1,778,508 |

W.R. Berkely Corp. | | 34,100 | | | 1,026,069 |

| | | | | |

| | | | | 26,507,768 |

| | |

Internet Services 0.8% | | | | | |

Computer Sciences Corp.* | | 39,600 | | | 2,312,244 |

| | |

Leisure Equipment & Products 0.9% | | | | | |

Brunswick Corp.(a) | | 28,800 | | | 642,528 |

Eastman Kodak Co. | | 69,700 | | | 1,997,602 |

| | | | | |

| | | | | 2,640,130 |

| | |

Machinery 5.0% | | | | | |

AGCO Corp.*(a) | | 20,300 | | | 1,211,504 |

Cummins, Inc.(a) | | 9,300 | | | 1,115,628 |

Eaton Corp. | | 34,800 | | | 3,221,784 |

Ingersoll-Rand Co. Ltd. (Class A Stock)(a) | | 40,000 | | | 2,014,000 |

Paccar, Inc. | | 26,250 | | | 1,458,450 |

Parker Hannifin Corp. | | 33,600 | | | 2,700,432 |

Terex Corp.* | | 11,600 | | | 860,952 |

Timken Co. | | 58,600 | | | 1,949,036 |

| | | | | |

| | | | | 14,531,786 |

| | |

Media 1.9% | | | | | |

Cablevision Systems Corp. (Class A Stock)* | | 48,500 | | | 1,422,505 |

EchoStar Communications Corp. (Class A Stock)* | | 13,800 | | | 675,648 |

Gannett Co., Inc. | | 52,600 | | | 2,230,766 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Media (cont’d) | | | | | |

McClatchy Co. (Class A Stock)(a) | | 7,800 | | $ | 129,402 |

New York Times Co. (The) (Class A Stock)(a) | | 48,300 | | | 944,748 |

| | | | | |

| | | | | 5,403,069 |

| | |

Metals & Mining 3.5% | | | | | |

Cleveland-Cliffs, Inc. | | 21,000 | | | 2,008,650 |

Freeport-McMoRan Copper & Gold, Inc. (Class B Stock) | | 17,433 | | | 2,051,516 |

Southern Copper Corp. | | 7,800 | | | 1,089,660 |

Steel Dynamics, Inc. | | 29,800 | | | 1,585,956 |

United States Steel Corp. | | 33,000 | | | 3,560,700 |

| | | | | |

| | | | | 10,296,482 |

| | |

Multi-Line Retail 0.5% | | | | | |

Dollar Tree Stores, Inc.* | | 34,800 | | | 1,332,840 |

| | |

Multi-Utilities 8.9% | | | | | |

CenterPoint Energy, Inc. | | 84,900 | | | 1,422,924 |

Consolidated Edison, Inc.(a) | | 54,600 | | | 2,571,114 |

DTE Energy Co. | | 42,900 | | | 2,127,840 |

Duke Energy Corp. | | 28,900 | | | 554,013 |

Energy East Corp. | | 48,800 | | | 1,360,544 |

NiSource, Inc. | | 68,700 | | | 1,404,915 |

NSTAR | | 35,200 | | | 1,237,632 |

PG&E Corp. | | 73,000 | | | 3,571,890 |

Puget Energy, Inc. | | 42,200 | | | 1,192,150 |

SCANA Corp. | | 33,600 | | | 1,363,824 |

Sempra Energy | | 54,800 | | | 3,370,748 |

TECO Energy, Inc.(a) | | 69,600 | | | 1,171,368 |

Vectren Corp. | | 33,400 | | | 936,536 |

Wisconsin Energy Corp. | | 32,300 | | | 1,546,524 |

Xcel Energy, Inc.(a) | | 93,900 | | | 2,117,445 |

| | | | | |

| | | | | 25,949,467 |

| | |

Office Electronics 1.2% | | | | | |

Xerox Corp.*(a) | | 196,000 | | | 3,418,240 |

| | |

Oil, Gas & Consumable Fuels 10.4% | | | | �� | |

Cabot Oil & Gas Corp. | | 26,642 | | | 1,057,421 |

Canadian Natural Resources Ltd. | | 12,300 | | | 1,023,360 |

Chesapeake Energy Corp.(a) | | 66,400 | | | 2,621,472 |

Cimarex Energy Co.(a) | | 29,500 | | | 1,195,045 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 17 |

Portfolio of Investments

October 31, 2007 continued

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (continued) | | | | | |

| | |

Oil, Gas, Consumable Fuels (cont’d.) | | | | | |

| | | | | |

Denbury Resources, Inc.* | | 14,900 | | $ | 843,340 |

Forest Oil Corp.*(a) | | 27,300 | | | 1,326,507 |

Frontline Ltd. (Bermuda)(a) | | 28,900 | | | 1,312,060 |

Hess Corp. | | 52,600 | | | 3,766,686 |

Murphy Oil Corp. | | 39,700 | | | 2,923,111 |

Newfield Exploration Co.* | | 35,600 | | | 1,916,704 |

Noble Energy, Inc. | | 42,400 | | | 3,245,296 |

Overseas Shipholding Group | | 14,400 | | | 1,071,360 |

Pogo Producing Co. | | 21,700 | | | 1,292,452 |

Ship Finance International Ltd.(a) | | 43,257 | | | 1,184,377 |

Sunoco, Inc. | | 16,800 | | | 1,236,480 |

Talisman Energy, Inc. (Canada) | | 56,000 | | | 1,217,440 |

Tesoro Corp.(a) | | 29,900 | | | 1,809,847 |

XTO Energy, Inc. | | 18,800 | | | 1,247,944 |

| | | | | |

| | | | | 30,290,902 |

| | |

Paper & Forest Products 0.2% | | | | | |

Louisiana-Pacific Corp. | | 43,000 | | | 707,780 |

| | |

Personal Products 0.4% | | | | | |

NBTY, Inc.* | | 32,700 | | | 1,164,120 |

| | |

Pharmaceuticals 1.0% | | | | | |

Endo Pharmaceuticals Holdings, Inc.*(a) | | 37,100 | | | 1,087,030 |

King Pharmaceuticals, Inc.* | | 72,400 | | | 767,440 |

Watson Pharmaceuticals, Inc.* | | 38,200 | | | 1,167,392 |

| | | | | |

| | | | | 3,021,862 |

| | |

Real Estate Investment Trusts 1.3% | | | | | |

Annaly Capital Management, Inc.(a) | | 105,500 | | | 1,802,995 |

Colonial Properties Trust(a) | | 8,700 | | | 272,571 |

iStar Financial, Inc.(a) | | 51,600 | | | 1,574,316 |

| | | | | |

| | | | | 3,649,882 |

| | |

Road & Rail 1.0% | | | | | |

Avis Budget Group, Inc.* | | 22,500 | | | 469,575 |

Con-Way, Inc. | | 18,800 | | | 801,068 |

Ryder System, Inc. | | 21,300 | | | 1,019,205 |

YRC Worldwide, Inc.*(a) | | 23,600 | | | 580,088 |

| | | | | |

| | | | | 2,869,936 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

| | | | | |

COMMON STOCKS (continued) | | | | | |

| | |

Semiconductors & Semiconductor Equipment 0.5% | | | | | |

International Rectifier Corp.* | | 28,700 | | $ | 958,006 |

Teradyne, Inc.*(a) | | 43,200 | | | 533,088 |

| | | | | |

| | | | | 1,491,094 |

| | |

Software 1.1% | | | | | |

BEA Systems, Inc.* | | 31,200 | | | 527,280 |

Check Point Software Technologies Ltd. (Israel)* | | 66,500 | | | 1,679,790 |

McAfee, Inc.* | | 26,500 | | | 1,095,775 |

| | | | | |

| | | | | 3,302,845 |

| | |

Specialty Retail 2.0% | | | | | |

Aeropostale, Inc.*(a) | | 41,450 | | | 949,205 |

AutoNation, Inc.*(a) | | 26,800 | | | 474,092 |

AutoZone, Inc.* | | 4,400 | | | 547,404 |

Circuit City Stores, Inc. | | 46,100 | | | 365,573 |

Foot Locker, Inc. | | 28,500 | | | 424,365 |

Hot Topic, Inc.*(a) | | 55,300 | | | 423,598 |

RadioShack Corp.(a) | | 32,700 | | | 674,274 |

Ross Stores, Inc. | | 37,400 | | | 1,010,548 |

TJX Cos., Inc. | | 35,400 | | | 1,024,122 |

| | | | | |

| | | | | 5,893,181 |

| | |

Textiles, Apparel & Luxury Goods 0.6% | | | | | |

Jones Apparel Group, Inc.(a) | | 35,000 | | | 732,900 |

Liz Claiborne, Inc.(a) | | 31,200 | | | 888,264 |

| | | | | |

| | | | | 1,621,164 |

| | |

Thrifts & Mortgage Finance 0.8% | | | | | |

Astoria Financial Corp.(a) | | 13,100 | | | 340,469 |

MGIC Investment Corp. | | 9,600 | | | 185,856 |

PMI Group, Inc. (The) | | 25,200 | | | 403,956 |

Washington Federal, Inc. | | 20,900 | | | 504,944 |

Washington Mutual, Inc. | | 18,200 | | | 507,416 |

Webster Financial Corp. | | 11,700 | | | 424,008 |

| | | | | |

| | | | | 2,366,649 |

| | |

Trading Companies & Distributors 0.5% | | | | | |

United Rentals, Inc.* | | 46,300 | | | 1,582,997 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 19 |

Portfolio of Investments

October 31, 2007 continued

| | | | | | |

| | | Shares | | Value (Note 2) | |

| | | | | | |

COMMON STOCKS (continued) | | | | | | |

| | |

Wireless Telecommunication Services 0.2% | | | | | | |

Telephone & Data Systems, Inc. | | 8,400 | | $ | 586,320 | |

| | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $261,844,350) | | | | | 290,157,813 | |

| | | | | | |

SHORT-TERM INVESTMENT 21.3% | | | | | | |

| | |

AFFILIATED MONEY MARKET MUTUAL FUND | | | | | | |

Dryden Core Investment Fund - Taxable Money Market Series

(cost $61,876,127; includes $59,132,515 of cash collateral for securities on loan)(b)(c) | | 61,876,127 | | | 61,876,127 | |

| | | | | | |

TOTAL INVESTMENTS 121.0%

(cost $323,720,477; Note 5) | | | | | 352,033,940 | |

Liabilities in excess of other assets (21.0%) | | | (61,090,449 | ) |

| | | | | | |

NET ASSETS 100.0% | | | | $ | 290,943,491 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities is $57,417,954; cash collateral of $59,132,515 (included with liabilities) was received with which the portfolio purchased highly liquid short-term investments. |

| (b) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (c) | Prudential Investments LLC, the manager of the Fund also serves as manager of the Dryden Core Investment Fund-Taxable Money Market Series. |

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2007 were as follows:

| | | |

Affiliated Money Market Mutual Fund (20.3% represents investments purchased with collateral from securities on loan) | | 21.3 | % |

Oil, Gas & Consumable Fuels | | 10.4 | |

Insurance | | 9.1 | |

Multi-utilities | | 8.9 | |

Commercial Banks | | 6.8 | |

Electric Utilities | | 6.3 | |

Machinery | | 5.0 | |

Chemicals | | 4.0 | |

Metals & Mining | | 3.5 | |

Beverages | | 2.5 | |

Healthcare Providers & Services | | 2.4 | |

Energy Equipment & Services | | 2.2 | |

Household Durables | | 2.0 | |

Specialty Retail | | 2.0 | |

Gas Utilities | | 2.0 | |

Media | | 1.9 | |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | |

Industry (cont’d) | | | |

Auto Components | | 1.8 | % |

Exchange Traded Fund | | 1.8 | |

Food Products | | 1.6 | |

Independent Power Producers & Energy Traders | | 1.4 | |

Automobiles | | 1.3 | |

Real Estate Investment Trusts | | 1.3 | |

Food & Staples Retailing | | 1.2 | |

Office Electronics | | 1.2 | |

Software | | 1.1 | |

Computers & Peripherals | | 1.1 | |

Pharmaceuticals | | 1.0 | |

Industrial Conglomerates | | 1.0 | |

Aerospace & Defense | | 1.0 | |

Hotels, Restaurants & Leisure | | 1.0 | |

Road & Rail | | 1.0 | |

Electronic Equipment & Instruments | | 1.0 | |

Leisure Equipment & Products | | 0.9 | |

Thrifts & Mortgage Finance | | 0.8 | |

Internet Services | | 0.8 | |

Commercial Services & Supplies | | 0.7 | |

Electronic Components | | 0.6 | |

Construction | | 0.6 | |

Diversified Financial Services | | 0.6 | |

Textiles, Apparel & Luxury Goods | | 0.6 | |

Trading Companies & Distributors | | 0.5 | |

Semiconductors & Semiconductor Equipment | | 0.5 | |

Diversified Telecommunication Services | | 0.5 | |

Multi-line Retail | | 0.5 | |

Personal Products | | 0.4 | |

Computer Services & Software | | 0.4 | |

Construction & Engineering | | 0.4 | |

Building Products | | 0.4 | |

Communication Equipment | | 0.3 | |

Diversified Consumer Services | | 0.2 | |

Containers & Packaging | | 0.2 | |

Paper & Forest Products | | 0.2 | |

Financial Services | | 0.2 | |

Wireless Telecommunication Services | | 0.2 | |

Consumer Finance | | 0.2 | |

Capital Markets | | 0.1 | |

Healthcare Equipment & Supplies | | 0.1 | |

| | | |

| | 121.0 | |

Liabilities in excess of other assets | | (21.0 | ) |

| | | |

| | 100.0 | % |

| | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 21 |

Statement of Assets and Liabilities

as of October 31, 2007

| | | | |

ASSETS | | | | |

Investments at value: Unaffiliated investments(a) including securities on loan(c) | | $ | 290,157,813 | |

Affiliated investments(b) | | | 61,876,127 | |

Fund shares sold | | | 279,972 | |

Dividends and interest receivable | | | 250,168 | |

Prepaid expenses | | | 5,348 | |

| | | | |

Total assets | | | 352,569,428 | |

| | | | |

| |

LIABILITIES | | | | |

Payable to broker for collateral for securities on loan | | | 59,132,515 | |

Payable for fund shares redeemed | | | 1,279,889 | |

Payable to investment manager | | | 396,697 | |

Payable to custodian | | | 359,249 | |

Distribution fees | | | 259,931 | |

Transfer agents’ fees(d) | | | 108,525 | |

Accrued expenses | | | 83,337 | |

Deferred directors’ fees | | | 4,833 | |

Withholding tax payable | | | 961 | |

| | | | |

Total liabilities | | | 61,625,937 | |

| | | | |

| |

NET ASSETS | | $ | 290,943,491 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at $.001 par value | | $ | 16,657 | |

Paid-in capital in excess of par | | | 202,006,296 | |

| | | | |

| | | 202,022,953 | |

Accumulated net investment loss | | | (4,834 | ) |

Accumulated net realized gain on investments transactions | | | 60,611,909 | |

Net unrealized appreciation (depreciation) on investments | | | 28,313,463 | |

| | | | |

Net assets, October 31, 2007 | | $ | 290,943,491 | |

| | | | |

(a) Unaffiliated investments at cost | | $ | 261,844,350 | |

| | | | |

(b) Affiliated investments at cost | | $ | 61,876,127 | |

| | | | |

(c) Securities on loan at value | | $ | 57,417,954 | |

| | | | |

(d) Affiliated transfer agent fees | | $ | 30,000 | |

| | | | |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| | | |

Class A: | | | |

Net asset value and redemption price per share | | | |

($54,832,649 ÷ 2,983,307 shares of common stock issued and outstanding) | | $ | 18.38 |

Maximum sales charge (5.5% of offering price) | | | 1.07 |

| | | |

Offering price per share | | $ | 19.45 |

| | | |

| |

Class B: | | | |

Net asset value, offering and redemption price per share | | | |

($40,564,684 ÷ 2,376,666 shares of common stock issued and outstanding) | | $ | 17.07 |

| | | |

| |

Class C: | | | |

Net asset value, offering and redemption price per share | | | |

($67,296,709 ÷ 3,947,958 shares of common stock issued and outstanding) | | $ | 17.05 |

| | | |

| |

Class L: | | | |

Net asset value, offering and redemption price per share | | | |

($29,119,247 ÷ 1,607,232 shares of common stock issued and outstanding) | | $ | 18.12 |

| | | |

| |

Class M: | | | |

Net asset value, offering and redemption price per share | | | |

($69,620,534 ÷ 4,087,060 shares of common stock issued and outstanding) | | $ | 17.03 |

| | | |

| |

Class X: | | | |

Net asset value, offering and redemption price per share | | | |

($15,661,434 ÷ 905,692 shares of common stock issued and outstanding) | | $ | 17.29 |

| | | |

| |

Class Z: | | | |

Net asset value, offering and redemption price per share | | | |

($13,848,234 ÷ 748,590 shares of common stock issued and outstanding) | | $ | 18.50 |

| | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 23 |

Statement of Operations

Year Ended October 31, 2007

| | | | |

NET INVESTMENT LOSS | | | | |

Investment income | | | | |

Unaffiliated dividend income | | $ | 5,642,618 | |

Affiliated income from securities loaned, net | | | 211,770 | |

Affiliated dividend income | | | 139,056 | |

Foreign taxes withheld | | | (13,588 | ) |

| | | | |

Total income | | | 5,979,856 | |

| | | | |

| |

Expenses | | | | |

Advisory fees | | | 2,977,475 | |

Distribution fees—Class A | | | 130,965 | |

Distribution fees—Class B | | | 460,945 | |

Distribution fees—Class C | | | 760,459 | |

Distribution fees—Class L | | | 171,669 | |

Distribution fees—Class M | | | 910,665 | |

Transfer agent’s fees and expenses (including affiliated expenses of $509,000) | | | 786,000 | |

Custodian’s fees and expenses | | | 96,000 | |

Registration fees | | | 64,000 | |

Reports to shareholders | | | 50,000 | |

Audit and legal fees | | | 40,000 | |

Directors’ fees | | | 17,000 | |

Insurance fees | | | 5,000 | |

Commitment fees | | | 1,000 | |

Miscellaneous | | | 16,489 | |

| | | | |

Total expenses | | | 6,487,667 | |

| | | | |

Net investment loss | | | (507,811 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

Net realized gain on investments | | | 62,242,943 | |

Net change in unrealized appreciation (depreciation) on investments | | | (30,270,234 | ) |

| | | | |

Net gain on investments | | | 31,972,709 | |

| | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 31,464,898 | |

| | | | |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Dryden Mid Cap Value Fund | |

| | | Year

Ended

October 31, 2007 | | | Year

Ended

October 31, 2006 | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

Operations | | | | | | | | |

Net investment loss | | $ | (507,811 | ) | | $ | (1,326,650 | ) |

Net realized gain on investments transactions | | | 62,242,943 | | | | 34,996,112 | |

Net change in unrealized appreciation (depreciation) on investments | | | (30,270,234 | ) | | | 2,312,993 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 31,464,898 | | | | 35,982,455 | |

| | | | | | | | |

Distributions (Note 1) | | | | | | | | |

Distributions from net realized gains | | | | | | | | |

Class A | | | (4,018,906 | ) | | | (4,078,457 | ) |

Class B | | | (4,412,263 | ) | | | (711,922 | ) |

Class C | | | (7,318,251 | ) | | | (11,460,673 | ) |

Class L | | | (3,312,131 | ) | | | (9,783,292 | ) |

Class M | | | (9,716,121 | ) | | | (28,302,102 | ) |

Class X | | | (1,780,127 | ) | | | (5,113,048 | ) |

Class Z | | | (1,066,903 | ) | | | — | |

| | | | | | | | |

Total distributions | | | (31,624,702 | ) | | | (59,449,494 | ) |

| | | | | | | | |

| | |

Fund share transactions (Note 4) | | | | | | | | |

Net proceeds from shares sold | | | 17,548,970 | | | | 30,469,415 | |

Net asset value of shares issued in connection with merger (Note 8) | | | — | | | | 129,015,263 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 27,210,201 | | | | 49,920,779 | |

Cost of shares redeemed | | | (104,920,347 | ) | | | (126,610,843 | ) |

| | | | | | | | |

Increase (decrease) in net assets from Fund share transactions | | | (60,161,176 | ) | | | 82,794,614 | |

| | | | | | | | |

Net increase (decrease) in net assets | | | (60,320,980 | ) | | | 59,327,575 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 351,264,471 | | | | 291,936,896 | |

| | | | | | | | |

End of year | | $ | 290,943,491 | | | $ | 351,264,471 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 25 |

Notes to Financial Statements

1. Organization

Strategic Partners Mutual Funds, Inc., formerly known as American Skandia Advisor Funds, Inc., (the “Company”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended. The Company was organized on March 5, 1997, as a Maryland Corporation. The Company operates as a series company and effective April 12, 2004, the name of the Company was changed to Strategic Partners Mutual Funds, Inc. At October 31, 2007, the Company consisted of four diversified investment portfolios (each a “Fund” and collectively the “Funds”). The information presented in these financial statements pertains to Dryden Mid Cap Value (formerly known as Strategic Partners Mid Cap Value Fund) (“Mid Cap Value”). The investment objective of the Fund is capital growth by investing primarily in common stocks of medium capitalization companies.

2. Significant Accounting Policies

The following accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Company and the Fund in the preparation of their financial statements.

Securities Valuation

Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded via Nasdaq are valued at the official closing price as provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or

| | |

| 26 | | Visit our website at www.jennisondryden.com |

estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Securities for which reliable market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset value. As of October 31, 2007, there were no securities valued in accordance with such procedure.

Investments in mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Foreign Currency Translation

Fund securities and other assets and liabilities denominated in foreign currencies are translated each business day into U.S. dollars based on the current rates of exchange. Purchases and sales of Fund securities and income and expenses are translated into U.S. dollars on the respective dates of such transactions. Gains and losses resulting from changes in exchange rates applicable to long-term foreign securities are not reported separately from gains and losses arising from movements in securities prices. Net realized foreign exchange gains and losses include gains and losses from sales and maturities of foreign currency exchange contracts, gains and losses realized between the trade and settlement dates of foreign securities transactions, and the difference between the amount of net investment income accrued on foreign securities and the U.S. dollar amount actually received. Net unrealized foreign exchange gains and losses include gains and losses from changes in the value of assets and liabilities other than Fund securities, resulting from changes in exchange rates.

Securities Lending

The Fund may lend its portfolio securities to broker-dealers. The loans are secured by collateral at least equal at all times to the market value of the securities loaned.

| | |

| Dryden Mid Cap Value Fund | | 27 |

Notes to Financial Statements

continued

Loans are subject to termination at the option of the borrower or the Funds. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially, the Funds have the right to repurchase the securities using the collateral in the open market. The Funds recognize income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The Fund also continues to receive interest and dividends or amounts equivalent thereto, on the securities loaned and recognize any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Cash collateral received in connection with securities lending is invested in short-term investments by the lending agent. These may include the Prudential Core Money Market Series or Institutional Money Market Trust, advised by BlackRock Capital Management, Inc., or directly in high-quality, short-term instruments with a maturity date not to exceed 60 days.

Investment Transactions and Investment Income

Securities transactions are recorded on the trade date. Realized gains or losses on sales of investments and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The Fund amortizes premiums and discounts on portfolio securities as adjustments to interest income. Expenses are recorded on the accrual basis which may require the use of certain estimates by management.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Distributions to Shareholders

Distributions to shareholders are recorded on the ex-divided date. Dividends, if any, from net investment income are declared and paid at least annually by the Mid Cap Value Fund. These dividends and distributions are determined in accordance with federal income tax regulations and may differ from accounting principles generally accepted in the United States of America.

| | |

| 28 | | Visit our website at www.jennisondryden.com |

Net realized gains from investment transactions, if any, are distributed at least annually. Permanent book/tax differences relating to income and gains are reclassified to paid-in capital when they arise.

Taxes

For federal income tax purposes, each Fund in the Company is treated as a separate tax paying entity. It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal tax provision is required. Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

Estimates

The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

3. Agreements and Other Transactions with Affiliates

The Funds have entered into investment management agreements with Prudential Investments LLC (“Investment Manager”) which provide that the Investment Manager will furnish each Fund with investment advice and investment management and administrative services. The Investment Manager has engaged Quantitative Management Associates LLC as Sub-Advisor of the Fund, as of October 31, 2007.

Advisory Fees and Expense Limitations

The Investment Manager receives a fee, computed daily and paid monthly, based on an annual rate of the average net assets. The Investment Manager pays each Sub-advisor a fee as compensation for advisory services provided to the Funds. The Investment Manager has voluntarily agreed to waive expenses in accordance with limitation expense policies as noted in the table below. The Investment Manager will reimburse each Fund for its respective operating expenses, exclusive of taxes, interest, brokerage commissions, distribution fees and extraordinary expenses, but inclusive of the advisory fee, which in the aggregate exceed specified percentages of the Funds’ average net assets while retaining their ability to be reimbursed for such fee waivers

| | |

| Dryden Mid Cap Value Fund | | 29 |

Notes to Financial Statements

continued

prior to the end of the fiscal year. The advisory fees and expense limitations are summarized as follows:

| | | | | | | | |

| | | Advisory Expense | | Effective Advisory Fees

Net of Waiver | | | Fees

Limitations | |

Mid Cap Value Fund | | 0.90% to $500 million; | | 0.90 | % | | 1.35 | % |

| | 0.85% next $500 million; | | | | | | |

| | 0.80% in excess of $1 billion | | | | | | |

Such voluntary fee waivers or reductions have been calculated prior to any fee reimbursements with respect to the expense limitations, and may be rescinded at any time and without notice to investors. All reimbursements by the Investment Manager are reflected in the Statements of Operations.

Management of the Company

Certain officers and directors of the Funds are officers or directors of the Investment Manager. The Funds pay no compensation directly to their officers or interested directors.

Distributor

Prudential Investment Management Services LLC (“PIMS”) and American Skandia Marketing, Incorporated (“ASMI”), both affiliates of Prudential Investments LLC and an indirect, wholly-owned subsidiary of Prudential serves as the distributor for the Funds. The Company has adopted a separate Distribution and Service plan (each a “Plan” and collectively the “Plans”) for Class A, B, C, L, M, X and Z shares of each Fund in accordance with the requirements of Rule 12b-1 of the Investment Company Act of 1940. No distribution or service fees are paid to PIMS as distributor for Class Z shares.

Under the Plans, the Fund compensate PIMS and ASMI a distribution and service fee at an annual rate up to 0.30%, 1.00%, 1.00%, 0.50%, 1.00% and 1.00% of the average daily net assets of the Class A, B, C, L, M and X shares, respectively. For the year ended October 31, 2007, PIMS has contractually agreed to limit such fees to 0.25 of 1% of the average daily net assets of the Class A shares. The effective distribution fee rate for Class X shares was 0.00% for the year ended October 31, 2007.

| | |

| 30 | | Visit our website at www.jennisondryden.com |

During the year ended October 31, 2007, PIMS has advised the Fund, front-end sales charges (“FESC”) and gross contingent deferred sales charges (“CDSC”) were approximately as follows:

| | | | | | | | | | | | | | | |

| | | Class A

FESC | | Class B

CDSC | | Class C

CDSC | | Class M

CDSC | | Class X

CDSC |

Mid Cap Value | | $ | 50,700 | | $ | 69,000 | | $ | 2,100 | | $ | 153,600 | | $ | 30,300 |

Transfer Agent

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of Prudential Investments LLC and an indirect, wholly-owned subsidiary of Prudential, serves as the Funds’ transfer agent. Transfer agent fees and expenses in the Statements of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund pays networking fees to affiliated and unaffiliated broker/dealers including fees relating to the services of Wachovia Securities, LLC (“Wachovia”) and First Clearing LLC (“First Clearing”) affiliates of PI. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the years ended October 31, 2007 and October 31, 2006, the Fund incurred approximately $97,000 and $160,000, respectively, in total networking fees of which approximately $37,000 and $46,000, respectively, was paid to First Clearing. These amounts are included in transfer agents’ fees and expenses in the Statement of Operations.

Cash Sweep

The Fund invests in the Taxable Money Market Series (the “Series”), a portfolio of Dryden Core Investment Fund, pursuant to an exemptive order received from the Securities and Exchange Commission. The Series is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI.

Securities Lending Agent

Prudential Investment Management, Inc. (“PIM”), an indirect, wholly-owned subsidiary of Prudential, served as the Fund’s securities lending agent. For the year ended October 31, 2007, PIM was compensated $90,767 for these services by the Fund.

| | |

| Dryden Mid Cap Value Fund | | 31 |

Notes to Financial Statements

continued

Broker

For the year ended October 31, 2007, Prudential Equity Group, LLC earned $200 in brokerage commissions from transactions executed on behalf of the Fund.

4. Shares of Capital Stock

Class A shares are sold with a front-end sales charge of up to 5.50%. Purchases of $1 million or more are subject to a contingent deferred sales charge (“CDSC”) if shares are redeemed within 12 months of their purchase. Class B shares are sold with a CDSC which declines from 5% to zero depending upon the period of time the shares are held. Class B shares will automatically convert to Class A shares approximately seven years after purchase. Class M shares will automatically convert to Class A shares approximately eight years after purchase. Class C shares are sold with a CDSC of 1% during the first 12 months. Class L shares are closed to most new purchases (with the exception of reinvested dividends and purchases by certain college savings

plans). Class M shares are also closed to most new purchases (with the exception of reinvested dividends). Class L shares and Class M shares are only exchangeable with Class L shares and Class M shares, respectively, offered by the other Strategic Partners Funds. Class X shares are closed to new purchases. The authorized capital stock of the Funds is 5.5 billion shares, with a par value of $.001 per share. Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

| | |

| 32 | | Visit our website at www.jennisondryden.com |

Transactions in shares of capital stock were as follows:

| | | | | | | |

Class A | | Shares | | | Amount | |

Year ended October 31, 2007: | | | | | | | |

Shares sold | | 360,615 | | | $ | 6,583,935 | |

Shares issued in reinvestment of dividends and distributions | | 172,072 | | | | 3,052,550 | |

Shares reacquired | | (911,833 | ) | | | (16,746,058 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | (379,146 | ) | | | (7,109,573 | ) |

Shares issued upon conversion from Class B, Class M and Class X | | 887,793 | | | | 16,434,741 | |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 508,647 | | | $ | 9,325,168 | |

| | | | | | | |

Year ended October 31, 2006: | | | | | | | |

Shares sold | | 1,807,136 | | | $ | 31,681,312 | |

Shares issued in reinvestment of dividends and distributions | | 149,137 | | | | 2,514,438 | |

Shares reacquired | | (700,787 | ) | | | (12,404,100 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | 1,255,486 | | | | 21,791,650 | |

Shares issued upon conversion from Class B, Class M and Class X into Class A | | 215,609 | | | | 3,785,068 | |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 1,471,095 | | | $ | 25,576,718 | |

| | | | | | | |

Class B | | | | | | |

Year ended October 31, 2007: | | | | | | | |

Shares sold | | 68,383 | | | $ | 1,173,907 | |

Shares issued in reinvestment of dividends and distributions | | 230,121 | | | | 3,817,707 | |

Shares reacquired | | (653,000 | ) | | | (11,197,496 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | (354,496 | ) | | | (6,205,882 | ) |

Shares reacquired upon conversion into Class A | | (45,391 | ) | | | (775,070 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (399,887 | ) | | $ | (6,980,952 | ) |

| | | | | | | |

Year ended October 31, 2006: | | | | | | | |

Shares sold | | 3,328,648 | | | $ | 55,040,516 | |

Shares issued in reinvestment of dividends and distributions | | 42,509 | | | | 679,292 | |

Shares reacquired | | (744,053 | ) | | | (12,456,689 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | 2,627,104 | | | | 43,263,119 | |

Shares reacquired upon conversion into Class A | | (29,508 | ) | | | (482,512 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 2,597,596 | | | $ | 42,780,607 | |

| | | | | | | |

| | |

| Dryden Mid Cap Value Fund | | 33 |

Notes to Financial Statements

continued

| | | | | | | |

Class C | | Shares | | | Amount | |

Year ended October 31, 2007: | | | | | | | |

Shares sold | | 150,475 | | | $ | 2,576,572 | |

Shares issued in reinvestment of dividends and distributions | | 383,382 | | | | 6,352,634 | |

Shares reacquired | | (1,255,578 | ) | | | (21,482,279 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (721,721 | ) | | $ | (12,553,073 | ) |

| | | | | | | |

Year ended October 31, 2006: | | | | | | | |

Shares sold | | 2,756,378 | | | $ | 45,607,381 | |

Shares issued in reinvestment of dividends and distributions | | 593,277 | | | | 9,462,775 | |

Shares reacquired | | (1,589,867 | ) | | | (26,655,615 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 1,759,788 | | | $ | 28,414,541 | |

| | | | | | | |

Class L | | | | | | |

Year ended October 31, 2007: | | | | | | | |

Shares sold | | 29,758 | | | $ | 530,301 | |