UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08085

Strategic Partners Mutual Funds, Inc.

Exact name of registrant as specified in charter:

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Address of principal executive offices:

Deborah A. Docs

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Name and address of agent for service:

Registrant’s telephone number, including area code: 800-225-1852

Date of fiscal year end: 10/31/2009

Date of reporting period: 10/31/2009

Item 1 – Reports to Stockholders

| | |

| OCTOBER 31, 2009 | | ANNUAL REPORT |

Dryden Mid Cap Value Fund

FUND TYPE

Mid-cap stock

OBJECTIVE

Capital growth

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden, Dryden, Prudential Financial and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

December 15, 2009

Dear Shareholder:

On December 11, 2009, the Board of Directors approved the renaming of JennisonDryden, Prudential Financial’s mutual fund family, to Prudential Investments, effective on or about February 16, 2010. As a result of this change, each of our funds will be renamed to feature “Prudential” as part of its new name. The name of your Fund will change from Dryden Mid-Cap Value Fund to Prudential Mid-Cap Value Fund.

While the name of your Fund will change, its investment objectives and portfolio management team will remain the same. No action is required on your part. If you participate in an automatic investment plan, your account will continue to be invested in the Fund under its new name.

Featuring the Prudential name in our Funds will create an immediate connection to the experience and heritage of Prudential, a name recognized by millions for helping people grow and protect their wealth.

On the following pages, you will find your Fund’s annual report, including an analysis of its performance over the fiscal year in addition to other data. If you have questions about this information or the renaming of our mutual fund family, please contact your financial professional or visit our website at www.jennisondryden.com.

Sincerely,

Judy A. Rice, President

Dryden Mid Cap Value Fund

| | |

| Dryden Mid Cap Value Fund | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Dryden Mid Cap Value Fund is to seek capital growth. There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.77%; Class B, 2.47%; Class C, 2.47%; Class L, 1.97%; Class M, 1.72%; Class X, 1.72%; Class Z, 1.47%. Net operating expenses apply to: Class A, 1.72%; Class B, 2.47%; Class C, 2.47%; Class L, 1.97%; Class M, 1.72%; Class X, 1.72%; Class Z, 1.47%, after contractual reduction through 2/28/2011.

| | | | | | | | | | | |

| Cumulative Total Returns as of 10/31/09 | | | | | | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception1 |

Class A2 | | 20.16 | % | | 10.18 | % | | N/A | | | 12.57% (4/12/04) |

Class B3 | | 19.44 | | | 6.19 | | | N/A | | | 7.98 (4/12/04) |

Class C | | 19.21 | | | 6.04 | | | 81.36 | % | | — |

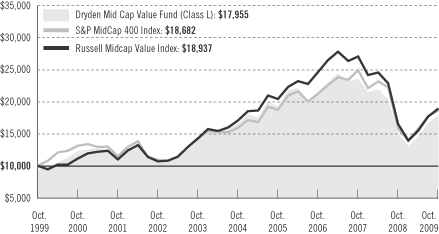

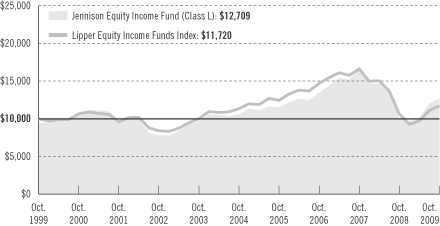

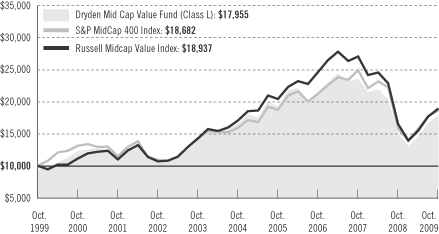

Class L2 | | 19.75 | | | 8.63 | | | 90.51 | | | — |

Class M3 | | 20.42 | | | 8.07 | | | 84.85 | | | — |

Class X | | 20.15 | | | 9.84 | | | 87.81 | | | — |

Class Z | | 20.41 | | | N/A | | | N/A | | | –9.05 (11/28/05) |

Russell Midcap Value Index4 | | 14.52 | | | 10.71 | | | 89.37 | | | * |

Russell Midcap Index5 | | 18.75 | | | 12.56 | | | 64.22 | | | ** |

S&P MidCap 400 Index6 | | 18.18 | | | 17.26 | | | 86.82 | | | *** |

Lipper Average7 | | 18.89 | | | 9.86 | | | 92.45 | | | **** |

| | | | | | | | | | | |

| Average Annual Total Returns8 as of 9/30/09 | | | | | | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception1 |

Class A2 | | –7.15 | % | | 1.73 | % | | N/A | | | 1.87% (4/12/04) |

Class B3 | | –7.27 | | | 2.01 | | | N/A | | | 2.06 (4/12/04) |

Class C | | –3.44 | | | 2.10 | | | 6.81 | % | | — |

Class L2 | | –7.76 | | | 1.38 | | | 6.69 | | | — |

Class M3 | | –7.13 | | | 2.27 | | | 7.00 | | | — |

Class X | | –7.37 | | | 2.50 | | | 7.17 | | | — |

Class Z | | –1.57 | | | N/A | | | N/A | | | –1.44 (11/28/05) |

Russell Midcap Value Index4 | | –7.12 | | | 3.53 | | | 7.43 | | | * |

Russell Midcap Index5 | | –3.55 | | | 3.89 | | | 6.05 | | | ** |

S&P MidCap 400 Index6 | | –3.11 | | | 4.53 | | | 7.48 | | | *** |

Lipper Average7 | | –2.45 | | | 2.98 | | | 7.11 | | | **** |

| | |

| 2 | | Visit our website at www.jennisondryden.com |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total return performance quoted. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively. Class L shares are closed to most new purchases (with the exception of reinvested dividends and purchases by certain college savings plans). Class M and Class X shares are also closed to most new purchases (with the exception of reinvested dividends). Class L, Class M, and Class X shares are exchangeable only with Class L, Class M, and Class X shares, respectively, offered by the other JennisonDryden Funds. Under certain circumstances, Class A and Class L shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 6%, and 6%, respectively.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Inception returns are provided for any share class with less than 10 calendar years of returns.

2Prior to April 12, 2004, Class L shares were known as Class A shares. On April 12, 2004, Class A shares were redesignated as Class L shares and a new Class A was opened.

3Prior to April 12, 2004, Class M shares were known as Class B shares. On April 12, 2004, Class B shares were redesignated as Class M shares and a new Class B was opened.

4The Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000 Value Index.

5The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000 Index.

6The Standard & Poor’s MidCap 400 Stock Index (S&P MidCap 400 Index) is an unmanaged index of 400 domestic stocks chosen for market size, liquidity, and industry group representation. It gives a broad look at how U.S. mid-cap stock prices have performed.

7Funds in the Lipper Mid-Cap Value Funds Average (Lipper Average), by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Mid-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the companies in the S&P MidCap 400 Index.

8The average annual total returns take into account applicable sales charges. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Without a distribution and service (12b-1) fee waiver of 0.05% for Class A shares, the returns would have been lower. Class A shares are subject to a 12b-1 fee of up to 0.30% annually. Class B, Class C, Class M, and Class X shares are subject to a 12b-1 fee of 1.00%. Class L shares are subject to a 12b-1 fee of 0.50%.

*Russell Midcap Value Index Closest Month-End to Inception cumulative total returns as of 10/31/09 are 17.23% for Class A and Class B; and –10.52% for Class Z. Russell Midcap Value Index Closest Month-End to Inception average annual total returns as of 9/30/09 are 3.85% for Class A and Class B; and –1.61% for Class Z.

**Russell Midcap Index Closest Month-End to Inception cumulative total returns as of 10/31/09 are 16.36% for Class A and Class B; and –8.73% for Class Z. Russell Midcap Index Closest Month-End to Inception average annual total returns as of 9/30/09 are 3.64% for Class A and Class B; and –1.20% for Class Z.

| | |

| Dryden Mid Cap Value Fund | | 3 |

Your Fund’s Performance (continued)

***S&P MidCap 400 Index Closest Month-End to Inception cumulative total returns as of 10/31/09 are 17.77% for Class A and Class B; and –4.98% for Class Z. S&P MidCap 400 Index Closest Month-End to Inception average annual total returns as of 9/30/09 are 3.89% for Class A and Class B; and –0.12% for Class Z.

****Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/09 are 13.54% for Class A and Class B; and –8.95% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/09 are 3.05% for Class A and Class B; and –1.42% for Class Z.

Investors cannot invest directly in an index. The returns for the Russell Midcap Value Index, the Russell Midcap Index, and the S&P MidCap 400 Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | |

| Five Largest Holdings expressed as a percentage of net assets as of 10/31/09 | | | |

CenturyTel, Inc., Diversified Telecommunication Services | | 1.3 | % |

Edison International, Electric Utilities | | 1.2 | |

Computer Sciences Corp., IT Services | | 1.1 | |

Safeway, Inc., Foods & Staples Retailing | | 1.1 | |

Xcel Energy, Inc., Multi-Utilities | | 1.0 | |

Holdings reflect only long-term investments and are subject to change.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Strategy and Performance Overview

How did the Fund perform?

The Dryden Mid-Cap Value Fund Class A shares returned 20.16% for the 12-month reporting period ended October 31, 2009, outperforming the 14.52% return of the Russell Midcap® Value Index (the Index) and the 18.89% return of the Lipper Mid-Cap Value Funds Average.

How is the Fund managed?

Quantitative Management Associates LLC (QMA) manages the Fund, which invests in a diversified portfolio of stocks that are out of favor and inexpensive based on price-to-earnings ratios and other value measures. Historically, value stocks have outperformed broad stock market averages. Constraints are placed on the portfolio with regard to sector, industry, and individual security weighting to reduce risk relative to the Index.

What were conditions like in the U.S. stock market?

Conditions in the U.S. stock market deteriorated sharply, then improved markedly during the reporting period that began November 1, 2008. Initially, stock prices repeatedly came under pressure as a bursting housing bubble in the United States kept pushing up foreclosures on residential mortgages, the economy continued to rapidly shed jobs, and businesses and consumers tightened their belts. Many financial institutions in the United States and abroad continued to take write downs and losses on debt securities linked to the troubled home loans.

The Federal Reserve (the Fed) and the U.S. Department of the Treasury took unusual steps to steady the nation’s financial system and stimulate its economy. For example, the Fed, which had tried to boost growth earlier in 2008 by repeatedly easing monetary policy, cut its target for the overnight bank lending rate in December 2008 from 1.00% to a record low range of zero to 0.25%. The Fed also purchased federal agency debt securities, mortgage-backed securities of federal agencies, and U.S. Treasury securities to support mortgage lending, aid housing markets, and improve overall conditions in the private credit markets. The federal government implemented stimulus programs such as “cash for clunkers” to encourage consumers to purchase automobiles and a tax credit for first-time home buyers to help boost home sales.

Stock prices began to rally during March 2009 and continued to soar for most of the remainder of the reporting period as it became clear the U.S. economy was starting to grow again. Government data showed the economy expanded during the July-September period after contracting for the previous four quarters. Not surprisingly, rising sales of houses and autos, along with government spending, accounted for much of that growth.

| | |

| Dryden Mid Cap Value Fund | | 5 |

Strategy and Performance Overview (continued)

Doubts about the economy, among other factors, caused the stock market to post a loss for the month of October 2009, but the Index still scored a double-digit gain for the reporting period. Among small, medium, and large companies, growth stocks (shares of firms expected to continue to generate faster-than-average earnings growth) handily outperformed value stocks, according to the Russell family of U.S. stock indexes.

How did the various sectors of mid-cap value stocks perform?

All sectors of the Index ended the reporting period in positive territory, with the exception of financials, which finished with a single-digit loss. The top four performers—consumer discretionary, information technology, healthcare, and telecommunication services—posted gains of more than 30%. The consumer staples, energy, materials, and industrials sectors scored smaller double-digit gains. The remaining sector, utilities, turned in a single-digit gain for the reporting period.

What aspects of sector allocation and stock selection contributed most to the return?

The Fund outperformed the Index primarily due to prudent stock selection in the troubled financials sector and, to a lesser extent, because it had a smaller exposure to the sector than the Index. Favorable stock selection in the materials, consumer staples, and industrials sectors also aided the Fund’s relative performance. For example, the Fund avoided shares of insurance brokers Marsh & McLennan and Aon Corp., two heavily weighted names in the Index that posted declines for the year ended October 31, 2009. Earnings of insurance brokers were disappointing due to declining demand for consulting services, ongoing pressure on commission rates, and continued erosion in pricing.

In other areas of the financials sector, the performance of real estate investment trusts (REITs) was generally flat for the reporting period. However, two key contributors to the Fund were its purchases of Hospitality Properties, a hotel REIT, and SL Green Realty, an owner and operator of office buildings in New York City. Their shares gained sharply during the time they were held by the Fund. Both benefited from deleveraging their balance sheets. Other notably beneficial decisions included not holding shares of Regions Financial and KeyCorp, both of which declined. The two regional banks are burdened by above-average exposure to commercial real estate and construction loans. Both reported sharply higher credit costs and above-average increases in nonperforming loans during the period.

Strong stock selection in the materials sector also helped the Fund outperform the Index. An overweight exposure to Celanese Corp., a manufacturer of industrial chemicals whose stock nearly doubled during the reporting period, was the single

| | |

| 6 | | Visit our website at www.jennisondryden.com |

largest contributor to the Fund’s performance in this sector. Despite weaker-than-expected revenues, the company’s earnings have exceeded investor expectations due to lower energy and raw material costs and favorable geographic exposure, especially to China. Freeport McMoran, a copper and gold mining firm, was an especially strong performer among metals and mining stocks. Freeport’s stock soared while it was held by the Fund, largely driven by the strength in metals prices, particularly copper.

Favorable selection in consumer staples also aided the Fund’s performance. Among positions in beverage stocks, soft-drink bottlers were stand-out performers, especially Coca-Cola Enterprises, PepsiAmericas, and Pepsi Bottling Group. Although soft-drink volumes declined over the period, strong pricing helped drive earnings growth. Del Monte Foods was another strong performer for the Fund. The company’s earnings, driven largely by price increases and lower energy, soybean, and other input costs, continued to exceed investor expectations.

In the industrials sector, the Fund was helped by strong rebounds in a number of machinery stocks. Some of the more prominent names included Crane, Timken, and Paccar. Each of these stocks was hit hard early in the period, as investors were concerned about the impact of the recession on their operating results.

What aspects of sector allocation and stock selection subtracted most from the return?

Poor issue selection in the consumer discretionary and healthcare sectors was the primary detractor from the Fund’s performance. Among consumer discretionary stocks, the single largest detractor from the Fund’s return was its failure to own Ford Motor shares, which gained dramatically. Ford stock rebounded sharply after investors became more optimistic about the automaker’s competitive position relative to General Motors Corporation and Chrysler Corporation, its successful debt restructuring, and the potential bottoming in the U.S. economy. Among media stocks, not holding Virgin Media and Liberty Media also penalized the Fund’s performance as shares of both firms rose strongly.

In the healthcare sector, the Fund had a larger exposure than the Index to Hill-Rom Holdings, a medical technology and service provider whose stock posted a decline for the reporting period. Failure to own Hospira, a pharmaceutical manufacturer specializing in injectable drugs, also hurt the Fund’s performance. Hospira stock gained sharply during the reporting period, as its earnings consistently exceeded investor expectations.

| | |

| Dryden Mid Cap Value Fund | | 7 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2009, at the beginning of the period, and held through the six-month period ended October 31, 2009. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and

| | |

| 8 | | Visit our website at www.jennisondryden.com |

expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Dryden Mid Cap

Value Fund | | Beginning Account

Value

May 1, 2009 | | Ending Account

Value

October 31, 2009 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,235.50 | | 1.61 | % | | $ | 9.07 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.09 | | 1.61 | % | | $ | 8.19 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,232.10 | | 2.36 | % | | $ | 13.28 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,013.31 | | 2.36 | % | | $ | 11.98 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,229.90 | | 2.36 | % | | $ | 13.26 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,013.31 | | 2.36 | % | | $ | 11.98 |

| | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | $ | 1,234.90 | | 1.86 | % | | $ | 10.48 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.83 | | 1.86 | % | | $ | 9.45 |

| | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | $ | 1,236.30 | | 1.61 | % | | $ | 9.08 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.09 | | 1.61 | % | | $ | 8.19 |

| | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | $ | 1,236.10 | | 1.61 | % | | $ | 9.07 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,017.09 | | 1.61 | % | | $ | 8.19 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,237.90 | | 1.36 | % | | $ | 7.67 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.35 | | 1.36 | % | | $ | 6.92 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2009, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2009 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| Dryden Mid Cap Value Fund | | 9 |

Portfolio of Investments

as of October 31, 2009

| | | | | |

| | | Shares | | Value (Note 2) |

LONG-TERM INVESTMENTS 98.7% | | | | | |

| | |

COMMON STOCKS | | | | | |

Aerospace & Defense 0.4% | | | | | |

L-3 Communications Holdings, Inc. | | 6,700 | | $ | 484,343 |

| | | | | |

Auto Components 0.5% | | | | | |

Autoliv, Inc. | | 19,200 | | | 644,736 |

| | | | | |

Automobiles 0.2% | | | | | |

Harley-Davidson, Inc.(a) | | 9,800 | | | 244,216 |

| | | | | |

Beverages 1.3% | | | | | |

Coca-Cola Enterprises, Inc. | | 44,800 | | | 854,336 |

Constellation Brands, Inc. (Class A Stock)* | | 60,800 | | | 961,856 |

| | | | | |

| | | | | 1,816,192 |

| | | | | |

Building Products 0.2% | | | | | |

Masco Corp.(a) | | 22,500 | | | 264,375 |

| | | | | |

Capital Markets 1.8% | | | | | |

Ameriprise Financial, Inc. | | 38,300 | | | 1,327,861 |

Investment Technology Group, Inc.* | | 23,500 | | | 506,895 |

Raymond James Financial, Inc.(a) | | 24,800 | | | 585,528 |

| | | | | |

| | | | | 2,420,284 |

| | | | | |

Chemicals 2.8% | | | | | |

Ashland, Inc. | | 14,100 | | | 487,014 |

Cabot Corp. | | 17,800 | | | 390,354 |

Celanese Corp. (Class A Stock) | | 14,600 | | | 400,770 |

Cytec Industries, Inc.(a) | | 20,600 | | | 683,302 |

Eastman Chemical Co. | | 21,200 | | | 1,113,212 |

PPG Industries, Inc. | | 13,800 | | | 778,734 |

| | | | | |

| | | | | 3,853,386 |

| | | | | |

Commercial Banks 3.7% | | | | | |

Associated Banc-Corp. | | 47,200 | | | 604,632 |

Bank of Hawaii Corp.(a) | | 13,600 | | | 603,840 |

City National Corp. | | 15,600 | | | 587,652 |

Comerica, Inc.(a) | | 29,500 | | | 818,625 |

Commerce Bancshares, Inc. | | 16,096 | | | 617,443 |

M&T Bank Corp.(a) | | 13,500 | | | 848,475 |

TCF Financial Corp. | | 44,800 | | | 529,984 |

Wilmington Trust Corp. | | 20,300 | | | 244,615 |

Zions Bancorp(a) | | 17,000 | | | 240,720 |

| | | | | |

| | | | | 5,095,986 |

| | | | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 11 |

Portfolio of Investments

as of October 31, 2009 continued

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | | | |

Commercial Services & Supplies 3.0% | | | | | |

Avery Dennison Corp. | | 23,400 | | $ | 834,210 |

Brink’s Co. (The) | | 14,800 | | | 351,204 |

Cintas Corp. | | 27,200 | | | 753,168 |

HNI Corp.(a) | | 17,400 | | | 457,968 |

Pitney Bowes, Inc. | | 37,800 | | | 926,100 |

RR Donnelley & Sons Co. | | 42,100 | | | 845,368 |

| | | | | |

| | | | | 4,168,018 |

| | | | | |

Communications Equipment 0.3% | | | | | |

CommScope, Inc.* | | 17,000 | | | 459,340 |

| | | | | |

Computers & Peripherals 1.8% | | | | | |

Lexmark International, Inc. (Class A Stock)* | | 32,900 | | | 838,950 |

NCR Corp.* | | 24,900 | | | 252,735 |

Seagate Technology (Cayman Islands) | | 38,300 | | | 534,285 |

Western Digital Corp.*(a) | | 25,700 | | | 865,576 |

| | | | | |

| | | | | 2,491,546 |

| | | | | |

Consumer Finance 0.8% | | | | | |

AmeriCredit Corp.*(a) | | 26,400 | | | 465,960 |

Discover Financial Services | | 46,700 | | | 660,338 |

| | | | | |

| | | | | 1,126,298 |

| | | | | |

Containers & Packaging 1.2% | | | | | |

Bemis Co., Inc. | | 7,600 | | | 196,308 |

Sealed Air Corp. | | 40,400 | | | 776,892 |

Sonoco Products Co. | | 22,900 | | | 612,575 |

| | | | | |

| | | | | 1,585,775 |

| | | | | |

Diversified Telecommunication Services 2.0% | | | | | |

CenturyTel, Inc.(a) | | 54,691 | | | 1,775,270 |

Frontier Communications Corp. | | 38,300 | | | 274,611 |

Windstream Corp. | | 67,800 | | | 653,592 |

| | | | | |

| | | | | 2,703,473 |

| | | | | |

Electric Utilities 2.4% | | | | | |

Allegheny Energy, Inc. | | 10,200 | | | 232,764 |

American Electric Power Co., Inc. | | 24,700 | | | 746,434 |

Edison International | | 50,000 | | | 1,591,000 |

Great Plains Energy, Inc. | | 31,600 | | | 546,680 |

NV Energy, Inc. | | 12,700 | | | 145,542 |

| | | | | |

| | | | | 3,262,420 |

| | | | | |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | |

Electrical Equipment 1.7% | | | | | |

General Cable Corp.*(a) | | 13,200 | | $ | 411,048 |

Hubbell, Inc. (Class B Stock) | | 13,000 | | | 552,890 |

Rockwell Automation, Inc.(a) | | 23,200 | | | 950,040 |

Thomas & Betts Corp.* | | 13,500 | | | 461,835 |

| | | | | |

| | | | | 2,375,813 |

| | | | | |

Electronic Equipment & Instruments 2.8% | | | | | |

Arrow Electronics, Inc.* | | 28,800 | | | 729,792 |

Avnet, Inc.* | | 36,500 | | | 904,470 |

Ingram Micro, Inc. (Class A Stock)* | | 47,000 | | | 829,550 |

Jabil Circuit, Inc. | | 46,700 | | | 624,846 |

Tech Data Corp.* | | 15,400 | | | 591,822 |

Vishay Intertechnology, Inc.* | | 27,200 | | | 169,456 |

| | | | | |

| | | | | 3,849,936 |

| | | | | |

Energy Equipment & Services 5.5% | | | | | |

BJ Services Co. | | 48,900 | | | 938,880 |

ENSCO International, Inc. | | 19,700 | | | 902,063 |

Helix Energy Solutions Group, Inc.* | | 35,200 | | | 483,296 |

Helmerich & Payne, Inc.(a) | | 13,700 | | | 520,874 |

Nabors Industries Ltd. (Bermuda)*(a) | | 45,600 | | | 949,848 |

Oil States International, Inc.*(a) | | 8,100 | | | 278,964 |

Patterson-UTI Energy, Inc.(a) | | 34,600 | | | 539,068 |

Pride International, Inc.*(a) | | 10,000 | | | 295,600 |

Rowan Cos., Inc.(a) | | 23,500 | | | 546,375 |

SEACOR Holdings, Inc.*(a) | | 7,700 | | | 625,779 |

Superior Energy Services, Inc.* | | 23,600 | | | 509,996 |

Tidewater, Inc. | | 14,600 | | | 608,382 |

Unit Corp.* | | 7,500 | | | 293,100 |

| | | | | |

| | | | | 7,492,225 |

| | | | | |

Exchange Traded Fund 0.3% | | | | | |

iShares Russell Midcap Value Index Fund | | 12,100 | | | 407,044 |

| | | | | |

Food & Staples Retailing 2.0% | | | | | |

Kroger Co. (The) | | 21,000 | | | 485,730 |

Safeway, Inc. | | 67,800 | | | 1,513,974 |

SUPERVALU, Inc. | | 48,300 | | | 766,521 |

| | | | | |

| | | | | 2,766,225 |

| | | | | |

Food Products 1.9% | | | | | |

Bunge Ltd. (Bermuda)(a) | | 22,300 | | | 1,272,438 |

Dean Foods Co.* | | 2,900 | | | 52,867 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 13 |

Portfolio of Investments

as of October 31, 2009 continued

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | |

Food Products (cont’d.) | | | | | |

Del Monte Foods Co. | | 61,300 | | $ | 662,040 |

Sara Lee Corp. | | 49,600 | | | 559,984 |

| | | | | |

| | | | | 2,547,329 |

| | | | | |

Gas Utilities 2.6% | | | | | |

Atmos Energy Corp. | | 33,300 | | | 927,405 |

Energen Corp. | | 21,500 | | | 943,420 |

ONEOK, Inc. | | 10,100 | | | 365,721 |

Questar Corp. | | 24,600 | | | 980,064 |

UGI Corp. | | 14,100 | | | 336,708 |

| | | | | |

| | | | | 3,553,318 |

| | | | | |

Healthcare Equipment & Supplies 0.8% | | | | | |

Hill-Rom Holdings, Inc.(a) | | 26,200 | | | 513,258 |

Kinetic Concepts, Inc.*(a) | | 19,200 | | | 637,248 |

| | | | | |

| | | | | 1,150,506 |

| | | | | |

Healthcare Providers & Services 4.2% | | | | | |

Aetna, Inc. | | 12,700 | | | 330,581 |

CIGNA Corp. | | 45,500 | | | 1,266,720 |

Community Health Systems, Inc.* | | 20,400 | | | 638,112 |

Coventry Health Care, Inc.* | | 34,800 | | | 690,084 |

Health Net, Inc.* | | 18,800 | | | 280,308 |

Humana, Inc.* | | 10,400 | | | 390,832 |

LifePoint Hospitals, Inc.*(a) | | 26,500 | | | 750,745 |

Lincare Holdings, Inc.*(a) | | 21,400 | | | 672,174 |

Omnicare, Inc.(a) | | 33,900 | | | 734,613 |

| | | | | |

| | | | | 5,754,169 |

| | | | | |

Healthcare Technology 0.5% | | | | | |

IMS Health, Inc. | | 43,600 | | | 714,604 |

| | | | | |

Hotels, Restaurants & Leisure 2.2% | | | | | |

Brinker International, Inc. | | 33,000 | | | 417,120 |

Carnival Corp. (Panama) | | 10,200 | | | 297,024 |

Darden Restaurants, Inc. | | 17,600 | | | 533,456 |

International Speedway Corp. (Class A Stock) | | 17,400 | | | 443,874 |

Royal Caribbean Cruises Ltd. (Liberia)*(a) | | 30,400 | | | 614,992 |

Starwood Hotels & Resorts Worldwide, Inc.(a) | | 17,200 | | | 499,832 |

Wyndham Worldwide Corp. | | 15,300 | | | 260,865 |

| | | | | |

| | | | | 3,067,163 |

| | | | | |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | |

Household Durables 3.9% | | | | | |

Black & Decker Corp. (The) | | 14,700 | | $ | 694,134 |

Fortune Brands, Inc. | | 22,700 | | | 884,165 |

Garmin Ltd. (Cayman Islands) | | 16,800 | | | 508,368 |

Jarden Corp. | | 23,500 | | | 643,665 |

Leggett & Platt, Inc. | | 5,500 | | | 106,315 |

Mohawk Industries, Inc.* | | 15,200 | | | 651,016 |

Newell Rubbermaid, Inc. | | 48,100 | | | 697,931 |

Stanley Works (The)(a) | | 16,900 | | | 764,387 |

Whirlpool Corp.(a) | | 5,100 | | | 365,109 |

| | | | | |

| | | | | 5,315,090 |

| | | | | |

Independent Power Producers & Energy Traders 1.0% | | | | | |

AES Corp. (The)* | | 58,000 | | | 758,060 |

Mirant Corp.*(a) | | 38,200 | | | 534,036 |

| | | | | |

| | | | | 1,292,096 |

| | | | | |

Industrial Conglomerates 1.1% | | | | | |

Carlisle Cos., Inc. | | 17,700 | | | 549,408 |

Textron, Inc.(a) | | 56,600 | | | 1,006,348 |

| | | | | |

| | | | | 1,555,756 |

| | | | | |

Insurance 7.7% | | | | | |

Allied World Assurance Co. Holdings Ltd. (Bermuda) | | 15,100 | | | 675,876 |

American Financial Group, Inc. | | 34,200 | | | 841,320 |

Arch Capital Group Ltd. (Bermuda)* | | 11,200 | | | 754,544 |

AXIS Capital Holdings Ltd. (Bermuda) | | 21,400 | | | 618,246 |

Cincinnati Financial Corp. | | 34,300 | | | 869,848 |

First American Corp.(a) | | 27,700 | | | 841,803 |

Hartford Financial Services Group, Inc. (The)(a) | | 40,300 | | | 988,156 |

HCC Insurance Holdings, Inc. | | 27,600 | | | 728,364 |

Lincoln National Corp. | | 35,000 | | | 834,050 |

PartnerRe Ltd. (Bermuda) | | 13,500 | | | 1,032,480 |

Protective Life Corp. | | 39,500 | | | 760,375 |

StanCorp Financial Group, Inc. | | 21,700 | | | 796,607 |

Unitrin, Inc. | | 19,100 | | | 374,360 |

Unum Group | | 24,100 | | | 480,795 |

| | | | | |

| | | | | 10,596,824 |

| | | | | |

IT Services 2.3% | | | | | |

Affiliated Computer Services, Inc. (Class A Stock)* | | 14,800 | | | 770,932 |

Computer Sciences Corp.* | | 30,100 | | | 1,526,371 |

Convergys Corp.* | | 45,500 | | | 493,675 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 15 |

Portfolio of Investments

as of October 31, 2009 continued

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | |

IT Services (cont’d.) | | | | | |

DST Systems, Inc.* | | 7,700 | | $ | 321,167 |

| | | | | |

| | | | | 3,112,145 |

| | | | | |

Machinery 4.3% | | | | | |

Crane Co. | | 22,800 | | | 634,980 |

Dover Corp. | | 7,700 | | | 290,136 |

Eaton Corp. | | 22,600 | | | 1,366,170 |

Gardner Denver, Inc.* | | 7,700 | | | 276,507 |

Harsco Corp. | | 5,500 | | | 173,195 |

Oshkosh Corp. | | 15,400 | | | 481,404 |

Parker Hannifin Corp. | | 9,500 | | | 503,120 |

Terex Corp.*(a) | | 27,300 | | | 552,006 |

Timken Co. | | 32,400 | | | 713,772 |

Toro Co. (The)(a) | | 8,500 | | | 314,670 |

Trinity Industries, Inc. | | 30,900 | | | 521,592 |

| | | | | |

| | | | | 5,827,552 |

| | | | | |

Media 2.3% | | | | | |

CBS Corp. (Class B Stock) | | 67,000 | | | 788,590 |

DISH Network Corp. (Class A Stock)* | | 42,800 | | | 744,720 |

Gannett Co., Inc.(a) | | 35,800 | | | 351,556 |

McGraw-Hill Cos., Inc. (The) | | 26,600 | | | 765,548 |

Meredith Corp. | | 20,300 | | | 549,318 |

| | | | | |

| | | | | 3,199,732 |

| | | | | |

Metals & Mining 2.7% | | | | | |

Allegheny Technologies, Inc.(a) | | 21,700 | | | 669,662 |

Carpenter Technology Corp. | | 25,200 | | | 529,956 |

Commercial Metals Co. | | 36,400 | | | 540,176 |

Reliance Steel & Aluminum Co. | | 16,100 | | | 587,328 |

Steel Dynamics, Inc. | | 39,800 | | | 532,922 |

United States Steel Corp.(a) | | 22,800 | | | 786,372 |

| | | | | |

| | | | | 3,646,416 |

| | | | | |

Multi-Line Retail 1.7% | | | | | |

JC Penney Co., Inc. | | 33,000 | | | 1,093,290 |

Macy’s, Inc. | | 58,600 | | | 1,029,602 |

Nordstrom, Inc. | | 6,400 | | | 203,392 |

| | | | | |

| | | | | 2,326,284 |

| | | | | |

Multi-Utilities 6.5% | | | | | |

Alliant Energy Corp. | | 14,000 | | | 371,840 |

Ameren Corp. | | 36,700 | | | 893,278 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | |

Multi Utilities (cont’d.) | | | | | |

CenterPoint Energy, Inc. | | 54,900 | | $ | 691,740 |

CMS Energy Corp. | | 28,100 | | | 373,730 |

DTE Energy Co. | | 24,400 | | | 902,312 |

MDU Resources Group, Inc. | | 28,900 | | | 599,675 |

NiSource, Inc. | | 83,300 | | | 1,076,236 |

OGE Energy Corp.(a) | | 17,000 | | | 564,740 |

SCANA Corp. | | 28,100 | | | 950,904 |

Sempra Energy | | 8,800 | | | 452,760 |

TECO Energy, Inc.(a) | | 19,900 | | | 285,366 |

Vectren Corp. | | 18,000 | | | 405,720 |

Xcel Energy, Inc. | | 73,300 | | | 1,382,438 |

| | | | | |

| | | | | 8,950,739 |

| | | | | |

Office Electronics 0.6% | | | | | |

Xerox Corp.(a) | | 104,600 | | | 786,592 |

| | | | | |

Oil, Gas & Consumable Fuels 5.8% | | | | | |

Arch Coal, Inc.(a) | | 16,000 | | | 346,560 |

Cimarex Energy Co. | | 19,800 | | | 775,368 |

El Paso Corp. | | 91,000 | | | 892,710 |

Frontier Oil Corp. | | 33,300 | | | 461,538 |

Frontline Ltd. (Bermuda)(a) | | 23,900 | | | 557,587 |

Holly Corp.(a) | | 10,600 | | | 307,506 |

Murphy Oil Corp. | | 18,700 | | | 1,143,318 |

Noble Energy, Inc.(a) | | 6,800 | | | 446,284 |

Overseas Shipholding Group, Inc.(a) | | 11,800 | | | 463,150 |

Plains Exploration & Production Co.* | | 3,057 | | | 81,010 |

Southern Union Co. | | 30,600 | | | 598,842 |

St. Mary Land & Exploration Co. | | 10,800 | | | 368,280 |

Sunoco, Inc. | | 23,100 | | | 711,480 |

Talisman Energy, Inc. (Canada) | | 12,900 | | | 218,913 |

Tesoro Corp.(a) | | 31,500 | | | 445,410 |

Whiting Petroleum Corp.* | | 2,900 | | | 163,560 |

| | | | | |

| | | | | 7,981,516 |

| | | | | |

Paper & Forest Products 0.9% | | | | | |

International Paper Co. | | 55,300 | | | 1,233,743 |

| | | | | |

Personal Products 0.3% | | | | | |

Herbalife Ltd. (Cayman Islands) | | 11,500 | | | 386,975 |

| | | | | |

Pharmaceuticals 1.6% | | | | | |

Endo Pharmaceuticals Holdings, Inc.*(a) | | 25,800 | | | 577,920 |

Forest Laboratories, Inc.* | | 39,300 | | | 1,087,431 |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 17 |

Portfolio of Investments

as of October 31, 2009 continued

| | | | | |

| | | Shares | | Value (Note 2) |

COMMON STOCKS (Continued) | | | | | |

Pharmaceuticals (cont’d.) | | | | | |

King Pharmaceuticals, Inc.*(a) | | 49,100 | | $ | 497,383 |

| | | | | |

| | | | | 2,162,734 |

| | | | | |

Professional Services 0.5% | | | | | |

Manpower, Inc.(a) | | 15,300 | | | 725,373 |

| | | | | |

Real Estate Investment Trusts 3.4% | | | | | |

Annaly Capital Management, Inc. | | 33,900 | | | 573,249 |

Brandywine Realty Trust | | 21,900 | | | 209,364 |

Hospitality Properties Trust | | 52,500 | | | 1,013,775 |

Host Hotels & Resorts, Inc. | | 106,400 | | | 1,075,704 |

ProLogis | | 79,100 | | | 896,203 |

SL Green Realty Corp.(a) | | 21,300 | | | 825,588 |

| | | | | |

| | | | | 4,593,883 |

| | | | | |

Real Estate Management & Development 0.8% | | | | | |

Forest City Enterprises, Inc. (Class A Stock) | | 49,300 | | | 429,896 |

Jones Lang LaSalle, Inc.(a) | | 15,000 | | | 702,750 |

| | | | | |

| | | | | 1,132,646 |

| | | | | |

Road & Rail 0.9% | | | | | |

Con-Way, Inc. | | 18,800 | | | 620,212 |

Ryder System, Inc. | | 16,300 | | | 660,965 |

| | | | | |

| | | | | 1,281,177 |

| | | | | |

Specialty Retail 2.1% | | | | | |

Abercrombie & Fitch Co. (Class A Stock) | | 8,700 | | | 285,534 |

Barnes & Noble, Inc.(a) | | 23,100 | | | 383,691 |

Foot Locker, Inc. | | 30,300 | | | 317,544 |

Limited Brands, Inc. | | 30,500 | | | 536,800 |

Penske Auto Group, Inc. | | 6,600 | | | 103,356 |

RadioShack Corp.(a) | | 32,700 | | | 552,303 |

Signet Jewelers Ltd. (Bermuda)* | | 17,600 | | | 443,696 |

Williams-Sonoma, Inc. | | 11,100 | | | 208,458 |

| | | | | |

| | | | | 2,831,382 |

| | | | | |

Thrifts & Mortgage Finance 0.1% | | | | | |

Astoria Financial Corp. | | 13,100 | | | 130,738 |

| | | | | |

Trading Companies & Distributors 0.6% | | | | | |

GATX Corp.(a) | | 15,300 | | | 415,854 |

WESCO International, Inc.* | | 17,800 | | | 454,968 |

| | | | | |

| | | | | 870,822 |

| | | | | |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| | | Shares | | Value (Note 2) | |

COMMON STOCKS (Continued) | | | | | | |

Wireless Telecommunication Services 0.7% | | | | | | |

NII Holdings, Inc.*(a) | | 33,600 | | $ | 904,848 | |

Telephone & Data Systems, Inc. | | 2,600 | | | 77,012 | |

| | | | | | |

| | | | | 981,860 | |

| | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $149,042,971) | | | | | 135,220,795 | |

| | | | | | |

| | |

SHORT-TERM INVESTMENT 25.3% | | | | | | |

| | |

AFFILIATED MONEY MARKET MUTUAL FUND | | | | | | |

Dryden Core Investment Fund—Taxable Money Market Series

(cost $34,568,012; includes $32,621,817 of cash collateral for securities on loan)(b)(c) | | 34,568,012 | | | 34,568,012 | |

| | | | | | |

TOTAL INVESTMENTS 124.0%

(cost $183,610,983; Note 6) | | | | | 169,788,807 | |

Liabilities in excess of other assets (24.0)% | | | | | (32,825,955 | ) |

| | | | | | |

NET ASSETS 100.0% | | | | $ | 136,962,852 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities is $30,419,870; cash collateral of $32,621,817 (included with liabilities) was received with which the Portfolio purchased highly liquid short-term investments. |

| (b) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (c) | Prudential Investments LLC, the manager of the Fund also serves as manager of the Dryden Core Investment Fund-Taxable Money Market Series. |

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices in active markets for identical securities

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3—significant unobservable inputs (including the Portfolio's own assumptions in determining the fair value of investments)

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 19 |

Portfolio of Investments

as of October 31, 2009 continued

The following is a summary of the inputs used as of October 31, 2009 in valuing the Fund's assets carried at fair value:

| | | | | | | | | |

Investments in Securities | | Level 1 | | Level 2 | | Level 3 |

| Common Stocks | | $ | 135,220,795 | | $ | — | | $ | — |

| Affiliated Money Market Mutual Fund | | | 34,568,012 | | | — | | | — |

| | | | | | | | | |

| | $ | 169,788,807 | | $ | — | | $ | — |

| Other Financial Instruments* | | | — | | | — | | | — |

| | | | | | | | | |

| Total | | $ | 169,788,807 | | $ | — | | $ | — |

| | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

As of October 31, 2008 and October 31, 2009, the Fund did not use any significant unobservable inputs (Level 3) in determining the value of investments.

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2009 were as follows:

| | | |

Affiliated Money Market Mutual Fund (23.8% represents investments purchased with collateral from securities on loan) | | 25.3 | % |

Insurance | | 7.7 | |

Multi-Utilities | | 6.5 | |

Oil, Gas & Consumable Fuels | | 5.8 | |

Energy Equipment & Services | | 5.5 | |

Machinery | | 4.3 | |

Healthcare Providers & Services | | 4.2 | |

Household Durables | | 3.9 | |

Commercial Banks | | 3.7 | |

Real Estate Investment Trusts | | 3.4 | |

Commercial Services & Supplies | | 3.0 | |

Chemicals | | 2.8 | |

Electronic Equipment & Instruments | | 2.8 | |

Metals & Mining | | 2.7 | |

Gas Utilities | | 2.6 | |

Electric Utilities | | 2.4 | |

Media | | 2.3 | |

IT Services | | 2.3 | |

Hotels, Restaurants & Leisure | | 2.2 | |

Specialty Retail | | 2.1 | |

Food & Staples Retailing | | 2.0 | |

Diversified Telecommunication Services | | 2.0 | |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | |

Industry (cont’d.) | | | |

Food Products | | 1.9 | % |

Computers & Peripherals | | 1.8 | |

Capital Markets | | 1.8 | |

Electrical Equipment | | 1.7 | |

Multi-Line Retail | | 1.7 | |

Pharmaceuticals | | 1.6 | |

Beverages | | 1.3 | |

Containers & Packaging | | 1.2 | |

Industrial Conglomerates | | 1.1 | |

Independent Power Producers & Energy Traders | | 1.0 | |

Road & Rail | | 0.9 | |

Paper & Forest Products | | 0.9 | |

Healthcare Equipment & Supplies | | 0.8 | |

Real Estate Management & Development | | 0.8 | |

Consumer Finance | | 0.8 | |

Wireless Telecommunication Services | | 0.7 | |

Trading Companies & Distributors | | 0.6 | |

Office Electronics | | 0.6 | |

Professional Services | | 0.5 | |

Healthcare Technology | | 0.5 | |

Auto Components | | 0.5 | |

Aerospace & Defense | | 0.4 | |

Communications Equipment | | 0.3 | |

Exchange Traded Funds | | 0.3 | |

Personal Products | | 0.3 | |

Building Products | | 0.2 | |

Automobiles | | 0.2 | |

Thrifts & Mortgage Finance | | 0.1 | |

| | | |

| | 124.0 | |

Liabilities in excess of other assets | | (24.0 | ) |

| | | |

| | 100.0 | % |

| | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 21 |

Statement of Assets and Liabilities

as of October 31, 2009

| | | | |

ASSETS | | | | |

Investments at value, including securities on loan of $30,419,870: | | | | |

Unaffiliated investments (cost $149,042,971) | | $ | 135,220,795 | |

Affiliated investments (cost $34,568,012) | | | 34,568,012 | |

Receivable for Fund shares sold | | | 217,004 | |

Dividends and interest receivable | | | 87,640 | |

Prepaid expenses | | | 2,071 | |

| | | | |

Total Assets | | | 170,095,522 | |

| | | | |

| |

LIABILITIES | | | | |

Payable to broker for collateral for securities on loan | | | 32,621,817 | |

Accrued expenses | | | 142,818 | |

Advisory fee payable | | | 110,653 | |

Payable for Fund shares redeemed | | | 104,282 | |

Payable to custodian | | | 64,051 | |

Distribution fee payable | | | 51,343 | |

Affiliated transfer agent fee payable | | | 32,941 | |

Deferred directors’ fee | | | 4,765 | |

| | | | |

Total Liabilities | | | 33,132,670 | |

| | | | |

| |

NET ASSETS | | $ | 136,962,852 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at $.001 par value | | $ | 13,316 | |

Paid-in capital in excess of par | | | 174,055,367 | |

| | | | |

| | | 174,068,683 | |

Undistributed net investment income | | | 278,257 | |

Accumulated net realized loss on investment transactions | | | (23,561,912 | ) |

Net unrealized depreciation on investments | | | (13,822,176 | ) |

| | | | |

Net Assets, October 31, 2009 | | $ | 136,962,852 | |

| | | | |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| | | |

Class A: | | | |

Net asset value and redemption price per share ($62,425,582 ÷ 5,861,490 shares of common stock issued and outstanding) | | $ | 10.65 |

Maximum sales charge (5.5% of offering price) | | | 0.62 |

| | | |

Offering price per share | | $ | 11.27 |

| | | |

| |

Class B: | | | |

Net asset value, offering price and redemption price per share ($4,233,480 ÷ 438,317 shares of common stock issued and outstanding) | | $ | 9.66 |

| | | |

| |

Class C: | | | |

Net asset value, offering price and redemption price per share ($27,766,219 ÷ 2,882,947 shares of common stock issued and outstanding) | | $ | 9.63 |

| | | |

| |

Class L: | | | |

Net asset value, offering price and redemption price per share ($11,509,844 ÷ 1,100,581 shares of common stock issued and outstanding) | | $ | 10.46 |

| | | |

| |

Class M: | | | |

Net asset value, offering price and redemption price per share ($9,493,247 ÷ 975,570 shares of common stock issued and outstanding) | | $ | 9.73 |

| | | |

| |

Class X: | | | |

Net asset value, offering price and redemption price per share ($5,333,412 ÷ 544,809 shares of common stock issued and outstanding) | | $ | 9.79 |

| | | |

| |

Class Z: | | | |

Net asset value, offering price and redemption price per share ($16,201,068 ÷ 1,511,861 shares of common stock issued and outstanding) | | $ | 10.72 |

| | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 23 |

Statement of Operations

Year Ended October 31, 2009

| | | | |

Net Investment Income | | | | |

Investment income | | | | |

Unaffiliated dividend income (net of foreign withholding tax of $344) | | $ | 3,218,225 | |

Affiliated income from securities lending, net | | | 165,702 | |

Affiliated dividend income | | | 12,996 | |

| | | | |

Total income | | | 3,396,923 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 1,067,350 | |

Distribution fee—Class A | | | 110,880 | |

Distribution fee—Class B | | | 105,901 | |

Distribution fee—Class C | | | 252,369 | |

Distribution fee—Class L | | | 53,253 | |

Distribution fee—Class M | | | 31,306 | |

Distribution fee—Class X | | | 13,620 | |

Transfer agent’s fee and expenses (including affiliated expenses of $158,400) | | | 398,000 | |

Registration fees | | | 77,000 | |

Custodian’s fees and expenses | | | 69,000 | |

Reports to shareholders | | | 57,000 | |

Legal fees and expenses | | | 23,000 | |

Audit fees | | | 21,000 | |

Directors’ fees | | | 17,000 | |

Miscellaneous | | | 16,426 | |

| | | | |

Total expenses | | | 2,313,105 | |

| | | | |

Net investment income | | | 1,083,818 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

Net realized loss on investments | | | (22,282,267 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 42,721,972 | |

| | | | |

Net gain on investments | | | 20,439,705 | |

| | | | |

Net Increase In Net Assets Resulting From Operations | | $ | 21,523,523 | |

| | | | |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2009 | | | 2008 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 1,083,818 | | | $ | 1,931,987 | |

Net realized loss on investments transactions | | | (22,282,267 | ) | | | (846,402 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 42,721,972 | | | | (84,857,611 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 21,523,523 | | | | (83,772,026 | ) |

| | | | | | | | |

| | |

Distributions and Dividends (Note 2) | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (769,488 | ) | | | (189,476 | ) |

Class B | | | (227,132 | ) | | | — | |

Class C | | | (382,279 | ) | | | — | |

Class L | | | (217,883 | ) | | | (31,512 | ) |

Class M | | | (399,054 | ) | | | — | |

Class X | | | (163,017 | ) | | | (92,430 | ) |

Class Z | | | (193,661 | ) | | | (78,231 | ) |

| | | | | | | | |

Total dividends | | | (2,352,514 | ) | | | (391,649 | ) |

| | | | | | | | |

Distributions from net realized gains | | | | | | | | |

Class A | | | — | | | | (11,309,130 | ) |

Class B | | | — | | | | (8,459,871 | ) |

Class C | | | — | | | | (14,447,216 | ) |

Class L | | | — | | | | (5,905,852 | ) |

Class M | | | — | | | | (14,894,261 | ) |

Class X | | | — | | | | (3,280,759 | ) |

Class Z | | | — | | | | (2,776,295 | ) |

| | | | | | | | |

Total distributions | | | — | | | | (61,073,384 | ) |

| | | | | | | | |

| | |

Capital Contributions | | | | | | | | |

Class M | | | 40,553 | | | | 52,049 | |

Class X | | | 6,801 | | | | 1,362 | |

| | | | | | | | |

| | | 47,354 | | | | 53,411 | |

| | | | | | | | |

| | |

Fund share transactions (Note 5) | | | | | | | | |

Net proceeds from shares sold | | | 15,630,053 | | | | 12,570,751 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 2,214,203 | | | | 56,896,231 | |

Cost of shares redeemed | | | (29,885,755 | ) | | | (85,542,769 | ) |

| | | | | | | | |

Decrease in net assets from fund share transactions | | | (12,041,499 | ) | | | (16,075,787 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | 7,176,864 | | | | (161,259,435 | ) |

| | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 129,785,988 | | | | 291,045,423 | |

| | | | | | | | |

End of year (a) | | $ | 136,962,852 | | | $ | 129,785,988 | |

| | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | 278,257 | | | $ | 1,546,953 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Dryden Mid Cap Value Fund | | 25 |

Notes to Financial Statements

1. Organization

Strategic Partners Mutual Funds, Inc., formerly known as American Skandia Advisor Funds, Inc., (the “Company”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended. The Company was organized on March 5, 1997, as a Maryland Corporation. The Company operates as a series company and effective April 12, 2004, the name of the Company was changed to Strategic Partners Mutual Funds, Inc. At October 31, 2009, the Company consisted of two diversified investment portfolios (each a “Fund” and collectively the “Funds”). The information presented in these financial statements pertains to Dryden Mid Cap Value (the “Fund”). The investment objective of the Fund is capital growth by investing primarily in common stocks of medium capitalization companies.

2. Significant Accounting Policies

The following accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Company and the Fund in the preparation of their financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded via Nasdaq are valued at the official closing price as provided by Nasdaq. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Securities for which reliable

| | |

| 26 | | Visit our website at www.jennisondryden.com |

market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset value.

Investments in mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Foreign Currency Translation: Fund securities and other assets and liabilities denominated in foreign currencies are translated each business day into U.S. dollars based on the current rates of exchange. Purchases and sales of Fund securities and income and expenses are translated into U.S. dollars on the respective dates of such transactions. Gains and losses resulting from changes in exchange rates applicable to long-term foreign securities are not reported separately from gains and losses arising from movements in securities prices. Net realized foreign exchange gains and losses include gains and losses from sales and maturities of foreign currency exchange contracts, gains and losses realized between the trade and settlement dates of foreign securities transactions, and the difference between the amount of net investment income accrued on foreign securities and the U.S. dollar amount actually received. Net unrealized foreign exchange gains and losses include gains and losses from changes in the value of assets and liabilities other than Fund securities, resulting from changes in exchange rates.

Securities Lending: The Funds may lend their portfolio securities to broker-dealers. The loans are secured by collateral at least equal at all times to the market value of the securities loaned. Loans are subject to termination at the option of the borrower or the Funds. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially, the Funds have the right to repurchase the securities using the collateral in the open market. The Funds recognize income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the

| | |

| Dryden Mid Cap Value Fund | | 27 |

Notes to Financial Statements

continued

investment of any cash received as collateral. The Funds also continue to receive interest and dividends or amounts equivalent thereto, on the securities loaned and recognize any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Securities Transactions and Net Investment Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of investments and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The Fund amortizes premiums and discounts on portfolio securities as adjustments to interest income. Expenses are recorded on the accrual basis which may require the use of certain estimates by management.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions to Shareholders: Distributions to shareholders are recorded on the ex-dividend date. Dividends, if any, from net investment income are declared and paid at least annually. These dividends and distributions are determined in accordance with federal income tax regulations and may differ from accounting principles generally accepted in the United States of America.

Net realized gains from investment transactions, if any, are distributed at least annually. Permanent book/tax differences relating to income and gains are reclassified to paid-in capital when they arise.

Taxes: For federal income tax purposes, each Fund in the Company is treated as a separate tax paying entity. It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal tax provision is required.

Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

| | |

| 28 | | Visit our website at www.jennisondryden.com |

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

3. Agreements

The Fund has entered into an investment management agreement with PI which provides that the Manager will furnish the Fund with investment advice and investment management and administrative services. The Manager has entered into a subadvisory agreement with Quantitative Management Associates LLC (“QMA”). The subadvisory agreement provides that QMA furnishes investment advisory services in connection with the management of the Fund. PI pays for the services of QMA, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The advisory fee paid to PI is computed daily and payable monthly at an annual rate of .90 of 1% of the average daily net assets of the Fund up to $500 million, .85 of 1% of the next $500 million and .80 of 1% of the average daily net assets in excess of $1 billion. The effective management fee rate was .90 of 1% for the year ended October 31, 2009.

Certain officers and directors of the Fund are officers or directors of the Manager. The Fund pays no compensation directly to their officers or interested directors.

Prudential Investment Management Services LLC (“PIMS”) and Prudential Annuities Distributors, Inc. (“PAD”) both affiliates of the Manager and an indirect, wholly-owned subsidiary of Prudential, serves as the distributor for the Fund. The Company has adopted a separate Distribution and Service plan (each a “Plan” and collectively the “Plans”) for Class A, B, C, L, M, X and Z shares of each Fund in accordance with the requirements of Rule 12b-1 of the Investment Company Act of 1940. No distribution or service fees are paid to PIMS as distributor for Class Z shares.

Under the Plans, the Fund compensates PIMS and PAD distribution and service fees at an annual rate up to .30%, 1.00%, 1.00%, .50%, 1.00% and 1.00% of the average daily net assets of the Class A, B, C, L, M and X shares, respectively. Through February 28, 2011, PIMS has contractually agreed to limit such fees to .25% of 1% of the average daily net assets of Class A shares.

| | |

| Dryden Mid Cap Value Fund | | 29 |

Notes to Financial Statements

continued

Management has received the maximum allowable amount of sales charges for Class M and X in accordance with regulatory limits. As such, any contingent deferred sales charges received by the manager are contributed back into the Fund and included in the Statement of Changes and Financial Highlights as a contribution to capital.

During the year ended October 31, 2008, management determined that Class M and Class X shareholders had been charged sales charges in excess of regulatory limits. The manager has paid these classes for the overcharge which is reflected as an increase in net investment income, an increase in distributions from net investment income related to Class M and X, and capital contributions to Class M and X in the Statement of Changes for the year ended October 31, 2008. The impact is also reflected in the Financial Highlights for Class M for the years ended October 31, 2008 and 2007 and for Class X for the years ended October 31, 2008, 2007, 2006 and 2005.

During the year ended October 31, 2009, PIMS has advised the Fund, front-end sales charges (“FESC”) and contingent deferred sales charges (“CDSC”) were as follows:

| | | | | | |

Class A

FESC | | Class A

CDSC | | Class B

CDSC | | Class C

CDSC |

| $21,633 | | $68 | | $8,726 | | $587 |

The Fund, along with other affiliated registered investment companies (the “Funds”), is a party to a Syndicated Credit Agreement (“SCA”) with two banks. The SCA provides for a commitment of $500 million. Interest on any borrowings under the SCA would be incurred at market rates and a commitment fee for the unused amount is accrued daily and paid quarterly. Effective October 22, 2009, the Funds renewed the SCA with the banks. The commitment under the renewed SCA continues to be $500 million. The Funds pay a commitment fee of .15 of 1% of the unused portion of the renewed SCA. The expiration date of the renewed SCA is October 20, 2010. For the period from October 24, 2008 through October 21, 2009, the Funds paid a commitment fee of .13 of 1% of the unused portion of the agreement. The purpose of the SCA is to provide an alternative source of temporary funding for capital share redemptions. The Fund did not utilize the line of credit during the year ended October 31, 2009.

4. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer

| | |

| 30 | | Visit our website at www.jennisondryden.com |

agent fees and expenses shown in the Statements of Operations include certain out-of pocket expenses paid to non-affiliates, where applicable.

The Fund pays networking fees to affiliated and unaffiliated broker/dealers, including fees relating to the services of Wells Fargo Advisors, LLC (“Wells Fargo”) and First Clearing, LLC (“First Clearing”), affiliates of PI. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the year ended October 31, 2009 the Fund incurred approximately $69,100 in total networking fees of which approximately $24,200 was paid to First Clearing. These amounts are included in transfer agent’s fees and expenses on the Statement of Operations.

The Fund invests in the Taxable Money Market Series (the “Series”), a portfolio of Dryden Core Investment Fund. The Series is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI.

Prudential Investment Management, Inc. (“PIM”), an indirect, wholly-owned subsidiary of Prudential, served as the Fund’s securities lending agent. For the year ended October 31, 2009, PIM has been compensated approximately $67,700 for these services.

5. Shares of Capital Stock

Class A shares are sold with a front-end sales charge of up to 5.50%. Purchases of $1 million or more are subject to a contingent deferred sales charge (“CDSC”) if shares are redeemed within 12 months of their purchase. Class B shares are sold with a CDSC which declines from 5% to zero depending upon the period of time the shares are held. Class B shares will automatically convert to Class A shares approximately seven years after purchase. Class M shares will automatically convert to Class A shares approximately eight years after purchase. Class C shares are sold with a CDSC of 1% during the first 12 months. Class L shares are closed to most new purchases (with the exception of reinvested dividends and purchases by certain college savings plans). Class M shares are also closed to most new purchases (with the exception of reinvested dividends). Class L shares and Class M shares are only exchangeable with Class L shares and Class M shares, respectively, offered by the other Strategic Partners and JennisonDryden Funds. Class X shares are closed to new purchases. The authorized capital stock of the Fund is 5.5 billion shares, with a par value of $.001 per share. Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

| | |

| Dryden Mid Cap Value Fund | | 31 |

Notes to Financial Statements

continued

Transactions in shares of capital stock, during the year ended October 31, 2009, were as follows:

| | | | | | | |

Class A | | Shares | | | Amount | |

Year ended October 31, 2009: | | | | | | | |

Shares sold | | 655,465 | | | $ | 5,625,712 | |

Shares issued in reinvestment of dividends and distributions | | 88,784 | | | | 728,915 | |

Shares reacquired | | (1,251,027 | ) | | | (10,806,289 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | (506,778 | ) | | | (4,451,662 | ) |

Shares issued upon conversion from Class B, Class M and Class X | | 2,384,516 | | | | 21,374,478 | |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 1,877,738 | | | $ | 16,922,816 | |

| | | | | | | |

Year ended October 31, 2008: | | | | | | | |

Shares sold | | 460,650 | | | $ | 5,841,849 | |

Shares issued in reinvestment of dividends and distributions | | 839,400 | | | | 10,962,780 | |

Shares reacquired | | (1,505,353 | ) | | | (18,897,048 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | (205,303 | ) | | | (2,092,419 | ) |

Shares issued upon conversion from Class B, Class M and Class X | | 1,205,748 | | | | 15,508,519 | |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 1,000,445 | | | $ | 13,416,100 | |

| | | | | | | |

Class B | | | | | | |

Year ended October 31, 2009: | | | | | | | |

Shares sold | | 50,125 | | | $ | 398,642 | |

Shares issued in reinvestment of dividends and distributions | | 27,766 | | | | 207,692 | |

Shares reacquired | | (413,066 | ) | | | (3,202,713 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | (335,175 | ) | | | (2,596,379 | ) |

Shares reacquired upon conversion into Class A | | (1,291,085 | ) | | | (10,927,101 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (1,626,260 | ) | | $ | (13,523,480 | ) |

| | | | | | | |

Year ended October 31, 2008: | | | | | | | |

Shares sold | | 71,665 | | | $ | 836,744 | |

Shares issued in reinvestment of dividends and distributions | | 634,097 | | | | 7,552,019 | |

Shares reacquired | | (944,071 | ) | | | (11,396,520 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | (238,309 | ) | | | (3,007,757 | ) |

Shares reacquired upon conversion into Class A | | (73,780 | ) | | | (884,958 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (312,089 | ) | | $ | (3,892,715 | ) |

| | | | | | | |

Class C | | | | | | |

Year ended October 31, 2009: | | | | | | | |

Shares sold | | 86,597 | | | $ | 680,548 | |

Shares issued in reinvestment of dividends and distributions | | 47,364 | | | | 353,811 | |

Shares reacquired | | (760,453 | ) | | | (5,836,852 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (626,492 | ) | | $ | (4,802,493 | ) |

| | | | | | | |

| | |

| 32 | | Visit our website at www.jennisondryden.com |

| | | | | | | |

Class C | | Shares | | | Amount | |

Year ended October 31, 2008: | | | | | | | |

Shares sold | | 93,684 | | | $ | 1,103,017 | |

Shares issued in reinvestment of dividends and distributions | | 1,122,284 | | | | 13,343,962 | |

Shares reacquired | | (1,654,487 | ) | | | (19,618,780 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (438,519 | ) | | $ | (5,171,801 | ) |

| | | | | | | |

Class L | | | | | | |

Year ended October 31, 2009: | | | | | | | |

Shares sold | | 6,301 | | | $ | 53,803 | |

Shares issued in reinvestment of dividends and distributions | | 24,681 | | | | 199,418 | |

Shares reacquired | | (336,075 | ) | | | (2,829,822 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (305,093 | ) | | $ | (2,576,601 | ) |

| | | | | | | |

Year ended October 31, 2008: | | | | | | | |