UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08085 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios, Inc. 10 |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2011 |

| |

| Date of reporting period: | | 10/31/2011 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

PRUDENTIAL JENNISON EQUITY INCOME FUND

ANNUAL REPORT · OCTOBER 31, 2011

Fund Type

Equity income

Objective

Income and capital appreciation

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Prudential Investments, Prudential, Jennison, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

December 15, 2011

Dear Shareholder:

After leading Prudential Investments for the past eight years, I have decided to retire at the end of 2011 from my positions as President of Prudential Investments and President and Director of the Prudential Jennison Equity Income Fund (the Fund). Effective January 1, 2012, I will become Chairman of Prudential Investments and act as an advisor to the business during 2012 to help facilitate a smooth transition to my successor, Stuart Parker.

Stuart, who will become President of Prudential Investments and President and Director of the Fund on January 1, 2012, previously served as the Executive Vice President of Retail Mutual Fund Distribution at Prudential Investments. With more than 20 years of investment industry experience, Stuart brings a deep understanding of the needs and challenges facing today’s investors.

We hope you find the annual report for the Fund informative. We recognize that ongoing market volatility may make it a difficult time to be an investor. We continue to believe a prudent response to uncertainty is to maintain a diversified portfolio, including stock and bond mutual funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial professional can help you create a diversified investment plan that reflects your personal investor profile and risk tolerance. Keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets. We encourage you to call your financial professional before making any investment decision.

Prudential Investments provides a wide range of mutual funds to choose from that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of Prudential Financial’s affiliated asset managers.

Finally, I’ve been privileged to have had the opportunity to help you address your investment needs, and I thank you for choosing the Prudential Investments family of mutual funds.

Sincerely,

Judy A. Rice, President

Prudential Jennison Equity Income Fund

| | | | |

| Prudential Jennison Equity Income Fund | | | 1 | |

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.27%; Class B, 1.97%; Class C, 1.97%; Class L, 1.46%; Class M, 1.95%; Class Q, 0.89%; Class R, 1.76%; Class X, 1.95%; Class Z, 0.98%. Net operating expenses: Class A, 1.22%; Class B, 1.97%; Class C, 1.97%; Class L, 1.46%; Class M, 1.95%; Class Q, 0.89%; Class R, 1.51%; Class X, 1.95%; Class Z, 0.98%, after contractual reduction through 2/29/2013.

| | | | | | | | | | | | | | | | |

Cumulative Total Returns (Without Sales Charges) as of 10/31/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | 4.16 | % | | | 24.09 | % | | | N/A | | | | 55.37% (4/12/04) | |

Class B | | | 3.45 | | | | 19.55 | | | | N/A | | | | 46.48 (4/12/04) | |

Class C | | | 3.37 | | | | 19.60 | | | | 60.77 | % | | | — | |

Class L | | | 3.93 | | | | 22.49 | | | | 68.86 | | | | — | |

Class M | | | 3.45 | | | | 19.47 | | | | 60.76 | | | | — | |

Class Q | | | N/A | | | | N/A | | | | N/A | | | | –1.06 (1/18/11) | |

Class R | | | N/A | | | | N/A | | | | N/A | | | | –1.50 (1/18/11) | |

Class X | | | 3.37 | | | | 19.78 | | | | 61.15 | | | | — | |

Class Z | | | 4.42 | | | | N/A | | | | N/A | | | | 21.53 (8/25/08) | |

Lipper Equity Income Funds Index | | | 7.08 | | | | –1.87 | | | | 50.57 | | | | — | |

S&P 500 Index | | | 8.07 | | | | 1.25 | | | | 43.67 | | | | — | |

Lipper Average | | | 7.13 | | | | 4.61 | | | | 63.17 | | | | — | |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 9/30/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | –6.67 | % | | | 2.03 | % | | | N/A | | | | 4.01% (4/12/04) | |

Class B | | | –6.78 | | | | 2.28 | | | | N/A | | | | 3.98 (4/12/04) | |

Class C | | | –2.99 | | | | 2.40 | | | | 4.25 | % | | | — | |

Class L | | | –7.16 | | | | 1.69 | | | | 4.15 | | | | — | |

Class M | | | –7.73 | | | | 2.13 | | | | 4.25 | | | | — | |

Class Q | | | N/A | | | | N/A | | | | N/A | | | | N/A (1/18/11) | |

Class R | | | N/A | | | | N/A | | | | N/A | | | | N/A (1/18/11) | |

Class X | | | –7.82 | | | | 2.03 | | | | 4.28 | | | | — | |

Class Z | | | –1.07 | | | | N/A | | | | N/A | | | | 3.44 (8/25/08) | |

Lipper Equity Income Funds Index | | | 0.27 | | | | –1.64 | | | | 3.24 | | | | — | |

S&P 500 Index | | | 1.13 | | | | –1.18 | | | | 2.82 | | | | — | |

Lipper Average | | | 0.54 | | | | –0.48 | | | | 3.94 | | | | — | |

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 10/31/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | –1.57 | % | | | 3.24 | % | | | N/A | | | | 5.22% (4/12/04) | |

Class B | | | –1.55 | | | | 3.50 | | | | N/A | | | | 5.18 (4/12/04) | |

Class C | | | 2.37 | | | | 3.64 | | | | 4.86 | % | | | — | |

Class L | | | –2.05 | | | | 2.91 | | | | 4.76 | | | | — | |

Class M | | | –2.55 | | | | 3.35 | | | | 4.86 | | | | — | |

Class Q | | | N/A | | | | N/A | | | | N/A | | | | N/A (1/18/11) | |

Class R | | | N/A | | | | N/A | | | | N/A | | | | N/A (1/18/11) | |

Class X | | | –2.63 | | | | 3.27 | | | | 4.89 | | | | — | |

Class Z | | | 4.42 | | | | N/A | | | | N/A | | | | 6.32 (8/25/08) | |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (Without Sales Charges) as of 10/31/11 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | 4.16 | % | | | 4.41 | % | | | N/A | | | | 6.01% (4/12/04) | |

Class B | | | 3.45 | | | | 3.64 | | | | N/A | | | | 5.18 (4/12/04) | |

Class C | | | 3.37 | | | | 3.64 | | | | 4.86 | % | | | — | |

Class L | | | 3.93 | | | | 4.14 | | | | 5.38 | | | | — | |

Class M | | | 3.45 | | | | 3.62 | | | | 4.86 | | | | — | |

Class Q | | | N/A | | | | N/A | | | | N/A | | | | N/A (1/18/11) | |

Class R | | | N/A | | | | N/A | | | | N/A | | | | N/A (1/18/11) | |

Class X | | | 3.37 | | | | 3.68 | | | | 4.89 | | | | — | |

Class Z | | | 4.42 | | | | N/A | | | | N/A | | | | 6.32 (8/25/08) | |

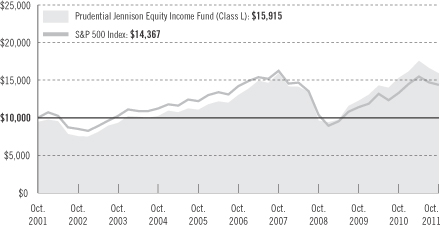

Growth of a $10,000 Investment

| | | | |

| Prudential Jennison Equity Income Fund | | | 3 | |

Your Fund’s Performance (continued)

The graph compares a $10,000 investment in the Prudential Jennison Equity Income Fund (Class L shares) with a similar investment in the S&P 500 Index by portraying the initial account values at the beginning of the 10-year period for Class L shares (October 31, 2001) and the account values at the end of the current fiscal year (October 31, 2011) as measured on a quarterly basis. The data are measured from the closest month-end to inception date, and not from the Fund’s actual inception date. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class L shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class L shares only. As indicated in the tables above, performance for Class A, Class B, Class C, Class M, Class Q, Class R, Class X, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs).

Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Inception returns are provided for any share class with less than 10 calendar years of returns.

The average annual total returns take into account applicable sales charges. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively. Under certain limited circumstances, an exchange may be made from Class A to Class Z shares of the Fund. Class L, Class M, and Class X shares are closed to most new purchases (with the exception of reinvested dividends). Under certain circumstances, Class A and Class L shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 6%, and 6%, respectively. Class Q, Class R, and Class Z shares are not subject to a sales charge. Class A shares are subject to a 12b-1 fee of up to 0.30% annually. Class B, Class C, Class M, and Class X shares are subject to a 12b-1 fee of 1%. Class L shares are subject to a 12b-1 fee of 0.50%. Class R shares are subject to a 12b-1 fee of up to 0.75%. Class Q and Class Z shares are not subject to a 12b-1 fee. Prior to April 12, 2004, Class L shares were known as Class A shares. On April 12, 2004, Class A shares were redesignated as Class L shares and a new Class A was opened. Prior to April 12, 2004, Class M shares were known as Class B shares. On April 12, 2004, Class B shares were redesignated as Class M shares and a new Class B was opened. The returns in the tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Without a distribution and service (12b-1) fee waiver of 0.05% and 0.25% for Class A and Class R shares, respectively, the returns shown in the tables would have been lower.

Benchmark Definitions

Standard & Poor’s 500 Composite Stock Price Index

The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of 500 stocks of large U.S. public companies. It gives a broad look at how U.S. stock prices have performed. S&P 500 Index

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

Closest Month-End to Inception cumulative total returns as of 10/31/11 are 29.76% for Class A and Class B; –1.06% for Class Q and Class R; and 4.82% for Class Z. S&P 500 Index Closest Month-End to Inception average annual total returns as of 9/30/11 are 2.11% for Class A and Class B; and –1.82% for Class Z. Class Q and Class R shares have been in existence for less than one year and have no average annual total return performance information available.

Lipper Equity Income Funds Index

Funds in the Lipper Equity Income Funds Index seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend-paying equity securities. These funds’ gross or net yield must be at least 125% of the average gross or net yield of the U.S. diversified equity fund universe. Lipper Equity Income Funds Index Closest Month-End to Inception cumulative total returns as of 10/31/11 are 30.81% for Class A and Class B; –1.55% for Class Q and Class R; and 4.24% for Class Z. Lipper Equity Income Funds Index Closest Month-End to Inception average annual total returns as of 9/30/11 are 2.34% for Class A and Class B; and –1.72% for Class Z. Class Q and Class R shares have been in existence for less than one year and have no average annual total return performance information available.

Lipper Equity Income Funds Average

Funds in the Lipper Equity Income Funds Average (Lipper Average) seek relatively high current income and growth of income through investing 60% or more of their portfolio in dividend-paying equity securities. Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/11 are 39.50% for Class A and Class B; –0.50% for Class Q and Class R; and 6.52% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/11 are 3.10% for Class A and Class B; and –1.10% for Class Z. Class Q and Class R shares have been in existence for less than one year and have no average annual total return performance information available.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

Five Largest Holdings expressed as a percentage of net assets as of 10/31/11 | | | | |

Citigroup, Inc., CVT, 7.50%, Diversified Financial Services | | | 2.4 | % |

National Grid PLC, ADR (United Kingdom), Multi-Utilities | | | 2.3 | |

Oracle Corp., Software | | | 2.3 | |

Philip Morris International, Inc., Tobacco | | | 2.2 | |

Frontier Communications Corp., Diversified Telecommunication Services | | | 2.2 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

| Prudential Jennison Equity Income Fund | | | 5 | |

Strategy and Performance Overview

How did the Fund perform?

Prudential Jennison Equity Income Fund Class L shares returned 3.93% for the 12-month reporting period ended October 31, 2011. The Class L shares underperformed the 7.08% gain of the Lipper Equity Income Funds Index, the 7.13% gain of the Lipper Equity Income Funds Average, and the 8.07% gain of the S&P 500 Index.

How is the Fund managed?

Jennison Associates manages the Fund with an investment objective of income and capital appreciation. The Fund seeks companies with the ability to sustain and grow their dividends. It employs a value strategy to identify firms Jennison believes are fundamentally sound but valued at a discount to their true worth, as defined by the value of their earnings, free cash flow, the value of their assets, their private market value, or a combination of these factors.

How did the U.S. stock market perform?

The U.S. equity market, as measured by the S&P 500 Index, returned 8.07% for the period. However, the market was exceptionally volatile, buffeted by political turmoil in the Middle East and North Africa (MENA) region, a devastating earthquake and tsunami in Japan, heightened anxiety over government debt in the euro zone and United States, and prospects for a global economic slowdown.

| | • | | The market continued an uptrend through April 2011, then declined for five consecutive months, with the largest losses in August and September. Investors grew increasingly worried about a prolonged European government-debt crisis and slowing global economic growth. Stock prices rebounded sharply in October, however, with signs that the economies of the United States and China could prove more resilient than originally thought, despite continued uncertainty in Europe. |

| | • | | Solid gains in corporate earnings and continued corporate and personal spending provided tailwinds that allowed the U.S. economy to continue expanding, although at a generally lackluster rate. Business production and housing measures were mixed, and overall job growth remained anemic. |

| | • | | Stock prices were also pressured during the summer by acrimony and political gamesmanship in the Congressional debate over raising the U.S. debt ceiling. A last-minute accord averted an immediate crisis, but the lack of a longer-term solution highlighted the scope of Washington’s fiscal problems. The subsequent downgrade by Standard & Poor’s of the U.S. long-term sovereign credit rating to AA+ from AAA fueled additional anxiety. |

| | • | | Estimates of the impact of falling confidence across the globe led to reductions in forecasts of gross domestic product (GDP) growth and corporate earnings. |

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

| | Commodity prices moved broadly lower, as oil and copper, two widely regarded barometers of economic health, finished the summer with steep declines (although they posted noteworthy comebacks in October). |

Which holdings made the largest positive contribution to the Fund’s return?

Holdings in the consumer staples, information technology, and utilities sectors made the largest contributions to the Fund’s return.

| | • | | B&G Foods drove the consumer staples contribution. It manufactures and distributes shelf-stable food products in the United States, Canada, and Puerto Rico. During the year, its sales grew and gross profit margins increased as it shifted its product mix to new higher-margin products. Jennison continues to like this holding for its strong portfolio of products and attractive dividend yield. Its prospects remain good as it follows consumer spending trends away from traditional channels such as grocery stores to non-traditional channels such as Wal-Mart, pharmacies, and dollar stores. |

| | • | | Rackspace Hosting, a technology firm, also was a leading contributor. It provides a range of web-hosting and managed-network services to more than 100,000 enterprise customers around the world. Primarily offering traditional hosting services with dedicated servers, Rackspace is expanding into cloud hosting, which lets customers use pooled server resources on an on-demand basis. Rackspace may continue to benefit from the trend among corporations of all sizes toward outsourcing their data-warehousing and software application needs in order to get better returns on investment. |

| | • | | ONEOK, a diversified energy company engaged in the gathering, processing, storage, and transportation of natural gas in the U.S., boosted performance in the utilities sector. Jennison likes its solid earnings growth and attractive dividend yield, supported by strong free cash flow and an expanding midstream business (in between downstream production and upstream delivery) in liquid natural gas. In addition, ONEOK is the general partner of ONEOK Partners, a master limited partnership, where most of its midstream natural gas business is housed. Jennison expects this midstream exposure to yield significant growth opportunities from shale gas and oil drilling in the United States. |

Which holdings subtracted most from the Fund’s return?

A Paris-based media conglomerate and a French auto equipment supplier, which both suffered from the heightened anxiety over European sovereign debt, were significant detractors.

| | • | | Lagardere was in the midst of a major restructuring when it was added to the portfolio. It planned to sell its non-core assets and refocus on sports marketing |

| | | | |

| Prudential Jennison Equity Income Fund | | | 7 | |

Strategy and Performance Overview (continued)

| | and core media retail distribution. With its shares trading at a 50% discount to the sum of its parts, Jennison saw it as a value opportunity potentially able to return capital to shareholders. Lagardere sold its magazine business to Hearst in July, but the worsening European sovereign debt crisis hurt its plans to divest other key assets. The Fund eliminated the position in September. |

| | • | | Faurecia supplies most of the world’s major carmakers with parts, ranging from seats and doors to exhaust systems. Earlier in the year, there was some uncertainty about how the Japanese earthquake might affect production. Management, however, maintained its earnings estimates for the year. As auto sales and manufacturing rates rebounded, Faurecia shares performed well. However, as the European financial crisis in August and September intensified, the automotive industry appeared vulnerable to a downturn. In October, Jennison exited the position in favor of other investment candidates. |

| | • | | Frontier Communications was a notable performer for most of the first half of the period. It posted solid first-quarter financial results, and improved revenue and expense trends were possible indications of further cost savings after it acquired select Verizon access lines in July 2010. Around mid-2011, concerns over increasing competition and uncertainties over costs linked to its acquisitions raised questions about the company’s free cash flow projections. Jennison continues to believe the acquisition will help drive longer-term growth and remains confident the company’s free cash flow will support its above-average dividend yield. |

Were there significant changes to the Fund?

Jennison did not make any strategic changes to the portfolio during the period. However, the Fund added or eliminated positions because of company fundamentals and risk-reward characteristics of certain stocks.

| | • | | Significant new positions were established including Boeing, Williams Companies, International Power, and Sara Lee. |

| | • | | Positions in other securities, including AT&T, CenterPoint Energy, International Business Machines (IBM), and NiSource were eliminated. |

During the reporting period, the Fund’s use of derivatives was limited, with no meaningful impact on performance.

The Portfolio of Investments following this report shows the size of the Fund’s positions at period-end.

| | |

| 8 | | Visit our website at www.prudentialfunds.com |

Comments on the Fund’s Five Largest Holdings

| 2.4% | Citigroup, Inc., CVT, 7.50%, Diversified Financial Services |

Jennison believes Citigroup has made great strides since the financial crisis by reducing its riskier assets and selling non-core, poorly performing business units. Like financial firms generally, Citigroup came under pressure during the summer owing to concerns about slower economic growth, investors’ reduced appetite for risk, and the ever-changing regulatory environment of the financial services industry. (All were reflected in the company’s poor third-quarter 2011 results.) Nevertheless, Jennison continues to like Citigroup’s fundamentals. Its balance sheet is dramatically improved, and with its ample cash, Jennison believes the company is well positioned for a resumption of more normal returns. These preferred shares are convertible into common stock on December 15, 2012. And in the interim, the Fund benefits from the security’s coupon (7.90% on an annualized basis, based on the closing price on October 31, 2011).

| 2.3% | National Grid PLC, ADR (United Kingdom), Multi-Utilities |

National Grid owns and operates the electricity transmission network in England and Wales as well as Britain’s high pressure natural gas transmission system. In the United States, National Grid’s transmission networks are concentrated in the Northeast, where the company distributes electricity and natural gas to customers in Massachusetts, New Hampshire, Rhode Island, and New York. Jennison continues to like National Grid for its attractive combination of earnings growth, driven by electric grid investment in the United Kingdom and earnings recovery among its U.S. utilities, as well as for its above-average dividend yield.

| 2.3% | Oracle Corp., Software |

Oracle provides a range of tools for managing business data, supporting business operations, and facilitating collaboration and software application development. Jennison believes the company is positioned for continued earnings growth and market share gains through product upgrades and cross-selling to its well-diversified customer base. Oracle can also benefit from new product cycles and offerings with superior technological integration and open standards.

| 2.2% | Philip Morris International Inc., Tobacco |

Philip Morris manufactures and markets many leading brands of cigarettes and tobacco products in more than 160 countries. Its products and market share produce considerable pricing power and some degree of insulation from economic fluctuations. Jennison expects its rising free cash flow to support continued dividend growth and an above-average dividend yield.

| 2.2% | Frontier Communications Corp., Diversified Telecommunication Services |

Please see comments on largest detractors from Fund’s return.

| | | | |

| Prudential Jennison Equity Income Fund | | | 9 | |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2011, at the beginning of the period, and held through the six-month period ended October 31, 2011. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

| | |

| 10 | | Visit our website at www.prudentialfunds.com |

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential Jennison

Equity Income Fund | | Beginning Account

Value

May 1, 2011 | | | Ending Account

Value

October 31, 2011 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | | | | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 906.70 | | | | 1.23 | % | | $ | 5.91 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.00 | | | | 1.23 | % | | $ | 6.26 | |

| | | | | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 903.40 | | | | 1.98 | % | | $ | 9.50 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.22 | | | | 1.98 | % | | $ | 10.06 | |

| | | | | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 903.10 | | | | 1.98 | % | | $ | 9.50 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.22 | | | | 1.98 | % | | $ | 10.06 | |

| | | | | | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | | $ | 905.50 | | | | 1.48 | % | | $ | 7.11 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,017.74 | | | | 1.48 | % | | $ | 7.53 | |

| | | | | | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | | $ | 903.30 | | | | 1.96 | % | | $ | 9.40 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.32 | | | | 1.96 | % | | $ | 9.96 | |

| | | | | | | | | | | | | | | | | | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 908.80 | | | | 0.89 | % | | $ | 4.28 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.72 | | | | 0.89 | % | | $ | 4.53 | |

| | | | | | | | | | | | | | | | | | |

| Class R | | Actual | | $ | 1,000.00 | | | $ | 905.50 | | | | 1.50 | % | | $ | 7.20 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,017.64 | | | | 1.50 | % | | $ | 7.63 | |

| | | | | | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | | $ | 903.10 | | | | 1.97 | % | | $ | 9.45 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.27 | | | | 1.97 | % | | $ | 10.01 | |

| | | | | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 907.20 | | | | 0.99 | % | | $ | 4.76 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.21 | | | | 0.99 | % | | $ | 5.04 | |

| | | | |

| Prudential Jennison Equity Income Fund | | | 11 | |

Fees and Expenses (continued)

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2011, and divided by 365 days. Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 12 | | Visit our website at www.prudentialfunds.com |

Portfolio of Investments

as of October 31, 2011

| | | | | | |

| Shares | | Description | | Value (Note 2) | |

| | | | | | |

LONG-TERM INVESTMENTS 99.1% | | | | |

COMMON STOCKS 87.0% | | | | |

| |

Aerospace & Defense 1.4% | | | | |

| 433,970 | | Boeing Co. (The) | | $ | 28,550,886 | |

| |

Air Freight & Logistics 1.4% | | | | |

| 406,280 | | United Parcel Service, Inc. (Class B Stock) | | | 28,537,107 | |

| |

Automobiles 0.8% | | | | |

| 203,611 | | Bayerische Motoren Werke AG (Germany) | | | 16,540,163 | |

| |

Beverages 0.7% | | | | |

| 214,591 | | Coca-Cola Co. (The)(a) | | | 14,660,857 | |

| |

Capital Markets 0.5% | | | | |

| 611,905 | | Morgan Stanley | | | 10,794,004 | |

| |

Chemicals 1.9% | | | | |

| 541,543 | | Monsanto Co. | | | 39,397,253 | |

| |

Communications Equipment 3.2% | | | | |

| 1,305,195 | | Finisar Corp.*(a) | | | 26,743,446 | |

| 764,270 | | QUALCOMM, Inc. | | | 39,436,332 | |

| | | | | | |

| | | | | 66,179,778 | |

| |

Computers & Peripherals 1.0% | | | | |

| 49,033 | | Apple, Inc.* | | | 19,847,578 | |

| |

Diversified Financial Services 0.6% | | | | |

| 100,000 | | Gateway Energy & Resource Holdings LLC, 144A

(original cost $2,000,000; purchased 12/14/07)*(b)(c) | | | 1,782,043 | |

| 309,225 | | JPMorgan Chase & Co. | | | 10,748,661 | |

| | | | | | |

| | | | | 12,530,704 | |

| |

Diversified Telecommunication Services 7.2% | | | | |

| 1,375,823 | | Alaska Communications Systems Group, Inc.(a) | | | 9,727,068 | |

| 451,866 | | BCE, Inc. (Canada) | | | 17,911,438 | |

| 1,149,646 | | CenturyLink, Inc. | | | 40,536,518 | |

| 1,683,138 | | City Telecom HK Ltd., ADR (Hong Kong) | | | 16,124,462 | |

| 1,257,741 | | Deutsche Telekom AG (Germany) | | | 15,978,511 | |

| 7,251,318 | | Frontier Communications Corp.(a) | | | 45,393,251 | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Equity Income Fund | | | 13 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 2) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Diversified Telecommunication Services (cont’d.) | | | | |

| 202,498 | | Otelco, Inc. (One Share of Class A Common Stock and $7.50 Principal amount of 13% senior subordinated notes due 2019), IDS | | $ | 3,369,567 | |

| | | | | | |

| | | | | 149,040,815 | |

| |

Electric Utilities 4.2% | | | | |

| 583,112 | | Exelon Corp. | | | 25,884,342 | |

| 668,176 | | FirstEnergy Corp. | | | 30,041,193 | |

| 1,417,412 | | Scottish & Southern Energy PLC (United Kingdom) | | | 30,624,814 | |

| | | | | | |

| | | | | 86,550,349 | |

| |

Electrical Equipment 0.8% | | | | |

| 501,941 | | Woodward, Inc. | | | 17,005,761 | |

| |

Food Products 8.4% | | | | |

| 1,617,781 | | B&G Foods, Inc. | | | 34,329,313 | |

| 289,220 | | Bunge Ltd. (Bermuda) | | | 17,865,119 | |

| 291,602 | | J.M. Smucker Co. (The)(a) | | | 22,459,186 | |

| 534,480 | | Kraft Foods, Inc. (Class A Stock) | | | 18,803,007 | |

| 2,393,959 | | Sara Lee Corp. | | | 42,612,470 | |

| 3,622,554 | | Tate & Lyle PLC (United Kingdom) | | | 37,900,502 | |

| | | | | | |

| | | | | 173,969,597 | |

| |

Independent Power Producers & Energy Traders 2.8% | | | | |

| 900,000 | | Atlantic Power Corp. (Canada) | | | 12,150,000 | |

| 3,706,450 | | International Power PLC (United Kingdom) | | | 20,106,310 | |

| 1,539,151 | | Northland Power, Inc. (Canada) | | | 25,540,564 | |

| | | | | | |

| | | | | 57,796,874 | |

| |

Internet Software & Services 1.1% | | | | |

| 553,582 | | Rackspace Hosting, Inc.* | | | 22,912,759 | |

| |

Media 5.6% | | | | |

| 2,642,630 | | British Sky Broadcasting Group PLC (United Kingdom) | | | 29,796,882 | |

| 1,486,860 | | Cinemark Holdings, Inc.(a) | | | 30,733,396 | |

| 1,316,009 | | Comcast Corp. (Class A Stock) | | | 30,860,411 | |

| 1,427,084 | | News Corp. (Class A Stock) | | | 25,002,512 | |

| | | | | | |

| | | | | 116,393,201 | |

| |

Multi-Utilities 2.3% | | | | |

| 953,291 | | National Grid PLC, ADR (United Kingdom) | | | 47,731,280 | |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.prudentialfunds.com |

| | | | | | |

| Shares | | Description | | Value (Note 2) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Oil, Gas & Consumable Fuels 12.4% | | | | |

| 454,774 | | Baytex Energy Corp. (Canada) | | $ | 24,040,173 | |

| 526,346 | | Bonavista Energy Corp., UTS (Canada) | | | 13,550,076 | |

| 335,378 | | CONSOL Energy, Inc. | | | 14,340,763 | |

| 645,287 | | Crescent Point Energy Corp. (Canada) | | | 27,559,436 | |

| 217,200 | | Crescent Point Energy Corp., 144A (Canada) | | | 9,276,352 | |

| 508,637 | | Marathon Petroleum Corp. | | | 18,260,068 | |

| 1,650,973 | | NAL Energy Corp. (Canada)(b) | | | 14,625,625 | |

| 170,000 | | NAL Energy Corp., 144A, UTS (Canada)(b) | | | 1,505,994 | |

| 981,353 | | Peyto Exploration & Development Corp. (Canada)(b) | | | 21,414,023 | |

| 156,000 | | Peyto Exploration & Development Corp., 144A (Canada)(b) | | | 3,404,063 | |

| 2,174,215 | | Provident Energy Ltd. (Canada) | | | 19,698,388 | |

| 1,281,257 | | Targa Resources Corp. | | | 43,229,611 | |

| 134,630 | | Whiting Petroleum Corp.* | | | 6,267,027 | |

| 1,298,897 | | Williams Cos., Inc. (The) | | | 39,109,789 | |

| | | | | | |

| | | | | 256,281,388 | |

| |

Pharmaceuticals 5.3% | | | | |

| 1,097,679 | | Bristol-Myers Squibb Co. | | | 34,675,680 | |

| 603,731 | | Johnson & Johnson | | | 38,874,239 | |

| 1,875,127 | | Pfizer, Inc. | | | 36,114,946 | |

| | | | | | |

| | | | | 109,664,865 | |

| |

Real Estate Investment Trusts 5.5% | | | | |

| 695,884 | | Digital Realty Trust, Inc.(a) | | | 43,374,450 | |

| 2,241,384 | | First Potomac Realty Trust | | | 31,850,067 | |

| 206,128 | | Health Care REIT, Inc.(a) | | | 10,860,884 | |

| 4,171,779 | | MFA Financial, Inc. | | | 28,159,508 | |

| | | | | | |

| | | | | 114,244,909 | |

| |

Real Estate Management & Development 0.5% | | | | |

| 927,666 | | Direcional Engenharia SA (Brazil) | | | 4,862,972 | |

| 1,114,076 | | Direcional Engenharia SA, 144A (Brazil)(b) | | | 5,840,163 | |

| | | | | | |

| | | | | 10,703,135 | |

| |

Road & Rail 1.2% | | | | |

| 596,409 | | J.B. Hunt Transport Services, Inc. | | | 25,234,065 | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Equity Income Fund | | | 15 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 2) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Semiconductors & Semiconductor Equipment 3.9% | | | | |

| 1,772,809 | | Intel Corp. | | $ | 43,504,733 | |

| 1,113,382 | | Xilinx, Inc.(a) | | | 37,253,762 | |

| | | | | | |

| | | | | 80,758,495 | |

| |

Software 3.6% | | | | |

| 2,086,256 | | Activision Blizzard, Inc.(a) | | | 27,934,968 | |

| 1,425,681 | | Oracle Corp. | | | 46,719,566 | |

| | | | | | |

| | | | | 74,654,534 | |

| |

Tobacco 5.0% | | | | |

| 804,990 | | Altria Group, Inc. | | | 22,177,475 | |

| 655,748 | | Philip Morris International, Inc. | | | 45,817,113 | |

| 901,533 | | Reynolds American, Inc. | | | 34,871,296 | |

| | | | | | |

| | | | | 102,865,884 | |

| |

Transportation Infrastructure 0.7% | | | | |

| 553,566 | | CCR SA (Brazil) | | | 15,257,444 | |

| |

Wireless Telecommunication Services 5.0% | | | | |

| 813,805 | | NII Holdings, Inc.* | | | 19,148,832 | |

| 985,944 | | Rogers Communications, Inc. (Class B Stock) (Canada) | | | 35,955,921 | |

| 786,378 | | Tim Participacoes SA, ADR (Brazil)(a) | | | 20,477,283 | |

| 1,025,633 | | Vodafone Group PLC, ADR (United Kingdom) | | | 28,553,623 | |

| | | | | | |

| | | | | 104,135,659 | |

| | | | | | |

| | TOTAL COMMON STOCKS

(cost $1,765,820,141) | | | 1,802,239,344 | |

| | | | | | |

| |

PREFERRED STOCKS 7.3% | | | | |

| |

Airlines 0.5% | | | | |

| 364,902 | | Continental Airlines Finance Trust II, CVT, 6.00% | | | 11,038,286 | |

| |

Diversified Financial Services 2.4% | | | | |

| 524,602 | | Citigroup, Inc., CVT, 7.50% | | | 49,858,174 | |

| |

Electric Utilities 1.7% | | | | |

| 310,733 | | Great Plains Energy, Inc., CVT, 12.00% | | | 20,011,205 | |

| 275,000 | | PPL Corp., CVT, 8.75%(b) | | | 15,012,250 | |

| | | | | | |

| | | | | 35,023,455 | |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | | | | | |

| Shares | | Description | | | | | | | | Value (Note 2) | |

| | | | | | | | | | | | |

PREFERRED STOCKS (Continued) | | | | | | | | | | |

| | | | |

Insurance 1.8% | | | | | | | | | | |

| 537,800 | | Metlife, Inc., CVT, 5.00%(b) | | | | | | | | $ | 36,521,998 | |

| | | | |

Leisure Equipment & Products 0.5% | | | | | | | | | | |

| 46,500 | | Callaway Golf Co., Series B,

144A, CVT, 7.50%(b) | | | | | | | | | 4,632,563 | |

| 55,120 | | Callaway Golf Co., Series B,

CVT, 7.50%(b) | | | | | | | | | 5,491,330 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,123,893 | |

| | | | |

Oil, Gas & Consumable Fuels 0.3% | | | | | | | | | | |

| 28,902 | | Whiting Petroleum Corp.,

CVT, 6.25% | | | | | | | | | 6,529,251 | |

| | | | |

Real Estate Investment Trusts 0.1% | | | | | | | | | | |

| 104,534 | | DuPont Fabros Redeemable Perpetual, 7.875% | | | | | | | | | 2,571,536 | |

| | | | | | | | | | | | |

| | TOTAL PREFERRED STOCKS

(cost $171,980,883) | | | | | | | | | 151,666,593 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | |

Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | | |

| | | | | | | | | | | | | | | | |

CONVERTIBLE BONDS 4.8% | | | | | | | | | | | | | | | | |

| | | | | |

Airlines 0.9% | | | | | | | | | | | | | | | | |

United Continental Holdings, Inc. Unsec’d. Notes | | CCC+(d) | | 6.00% | | | 10/15/29 | | | $ | 7,750 | | | | 18,270,625 | |

| | | |

Investment Banking & Brokerage 3.9% | | | | | | | | | | | | |

CS Equity Linked Notes, Sr. Unsec’d. Notes (Switzerland)(b) | | NR | | 11.50 | | | 03/22/12 | | | | 26,000 | | | | 27,944,800 | |

GS Apple, Inc.,

Sr. Unsec’d. Notes, 144A(b) | | NR | | 7.90 | | | 02/29/12 | | | | 72,912 | | | | 29,211,761 | |

GS NetApp, Inc.,

Sr. Unsec’d. Notes, 144A(b) | | NR | | 4.50 | | | 12/06/11 | | | | 54,350 | | | | 22,469,975 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 79,626,536 | |

| | | | | | | | | | | | | | | | |

TOTAL CONVERTIBLE BONDS

(cost $107,957,286) | | | | | | | | | | | 97,897,161 | |

| | | | | | | | | | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $2,045,758,310) | | | | | | | | | | | 2,051,803,098 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Equity Income Fund | | | 17 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | | | |

| Shares | | Description | | Value (Note 2) | |

SHORT-TERM INVESTMENT 7.7% | |

|

AFFILIATED MONEY MARKET MUTUAL FUND | |

| 159,986,065 | | Prudential Investment Portfolios 2 - Prudential Core Taxable Money Market Fund

(cost $159,986,065; includes $131,178,596 of cash collateral for securities on loan)(e)(f) | | $ | 159,986,065 | |

| | | | | | |

| | TOTAL INVESTMENTS 106.8%

(cost $2,205,744,375; Note 5) | | | 2,211,789,163 | |

| | Liabilities in excess of other assets (6.8)% | | | (140,850,597 | ) |

| | | | | | |

| | NET ASSETS 100.0% | | $ | 2,070,938,566 | |

| | | | | | |

The following abbreviations are used in the Portfolio descriptions:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

ADR—American Depositary Receipt

CVT—Convertible Security

IDS—Income Depositary Receipt

NR—Not Rated by Moody’s or Standard & Poor’s

REIT—Real Estate Investment Trust

UTS—Unit Trust Security

| † | The ratings reflected are as of October 31, 2011. Ratings of certain bonds may have changed subsequent to that date. |

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $125,637,742; cash collateral of $131,178,596 (included with liabilities) was received with which the Portfolio purchased highly liquid short-term investments. |

| (b) | Indicates a security or securities that have been deemed illiquid. |

| (c) | Private Placement restricted as to resale and does not have a readily available market. The aggregate original cost of such securities is $2,000,000. The aggregate value of $1,782,043 is approximately 0.1% of net assets. |

| (d) | Standard & Poor’s rating. |

| (e) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (f) | Prudential Investments LLC, the manager of the Fund also serves as manager of the Prudential Investment Portfolio 2 - Prudential Core Taxable Money Market Fund. |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.prudentialfunds.com |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally for securities actively traded on a regulated securities exchange and for open-end mutual funds which trade at daily net asset value.

Level 2—other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, foreign currency exchange rates, and amortized cost) generally for debt securities, swaps, forward foreign currency contracts and for foreign stocks priced using vendor modeling tools.

Level 3—significant unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2011 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | $ | 1,649,510,119 | | | $ | 150,947,182 | | | $ | 1,782,043 | |

Preferred Stocks | | | 151,666,593 | | | | — | | | | — | |

Convertible Bonds | | | — | | | | 97,897,161 | | | | — | |

Affiliated Money Market Mutual Fund | | | 159,986,065 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 1,961,162,777 | | | $ | 248,844,343 | | | $ | 1,782,043 | |

| | | | | | | | | | | | |

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2011 were as follows:

| | | | |

Oil, Gas & Consumable Fuels | | | 12.7 | % |

Food Products | | | 8.4 | |

Affiliated Money Market Mutual Fund (6.3% represents investments purchased with collateral from securities on loan) | | | 7.7 | |

Diversified Telecommunication Services | | | 7.2 | |

Electric Utilities | | | 5.9 | |

Real Estate Investment Trusts | | | 5.6 | |

Media | | | 5.6 | |

Pharmaceuticals | | | 5.3 | |

Wireless Telecommunication Services | | | 5.0 | |

Tobacco | | | 5.0 | % |

Semiconductors & Semiconductor Equipment | | | 3.9 | |

Investment Banking & Brokerage | | | 3.9 | |

Software | | | 3.6 | |

Communications Equipment | | | 3.2 | |

Diversified Financial Services | | | 3.0 | |

Independent Power Producers & Energy Traders | | | 2.8 | |

Multi-Utilities | | | 2.3 | |

Chemicals | | | 1.9 | |

Insurance | | | 1.8 | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Equity Income Fund | | | 19 | |

Portfolio of Investments

as of October 31, 2011 continued

| | | | |

Industry (cont’d.) | | | |

Airlines | | | 1.4 | % |

Aerospace & Defense | | | 1.4 | |

Air Freight & Logistics | | | 1.4 | |

Road & Rail | | | 1.2 | |

Internet Software & Services | | | 1.1 | |

Computers & Peripherals | | | 1.0 | |

Electrical Equipment | | | 0.8 | |

Automobiles | | | 0.8 | |

Transportation Infrastructure | | | 0.7 | % |

Beverages | | | 0.7 | |

Capital Markets | | | 0.5 | |

Real Estate Management & Development | | | 0.5 | |

Leisure Equipment & Products | | | 0.5 | |

| | | | |

| | | 106.8 | |

Liabilities in excess of other assets | | | (6.8 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

The Fund invested in various derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity risk.

The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Operations is presented in the summary below. The Fund did not hold any derivative instruments as of October 31, 2011, accordingly, no derivative positions were presented in the Statements of Assets and Liabilities.

The effects of derivative instruments on the Statement of Operations for the year ended October 31, 2011 are as follows:

| | | | |

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging

instruments, carried at fair value | | Options

Written | |

Equity contracts | | $ | 266,395 | |

| | | | |

For the year ended October 31, 2011, the Fund did not have any unrealized appreciation or (depreciation) on derivatives recognized in income.

For the year ended October 31, 2011, the average premium received for written options was $34,829.

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.prudentialfunds.com |

Financial Statements

| | |

| OCTOBER 31, 2011 | | ANNUAL REPORT |

Prudential Jennison Equity Income Fund

Statement of Assets and Liabilities

as of October 31, 2011

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $125,637,742: | | | | |

Unaffiliated Investments (cost $2,045,758,310) | | $ | 2,051,803,098 | |

Affiliated Investments (cost $159,986,065) | | | 159,986,065 | |

Foreign currency, at value (cost $497,358) | | | 531,585 | |

Receivable for investments sold | | | 45,999,541 | |

Receivable for Fund shares sold | | | 13,794,147 | |

Dividends and interest receivable | | | 3,895,347 | |

Prepaid expenses | | | 31,296 | |

| | | | |

Total assets | | | 2,276,041,079 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 131,178,596 | |

Payable for investments purchased | | | 56,714,876 | |

Payable for Fund shares reacquired | | | 8,506,104 | |

Payable to custodian | | | 6,242,226 | |

Advisory fee payable | | | 1,312,458 | |

Distribution fee payable | | | 645,595 | |

Accrued expenses | | | 430,067 | |

Affiliated transfer agent fee payable | | | 72,591 | |

| | | | |

Total liabilities | | | 205,102,513 | |

| | | | |

| |

Net Assets | | $ | 2,070,938,566 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at $.001 par value | | $ | 162,043 | |

Paid-in capital in excess of par | | | 2,129,705,491 | |

| | | | |

| | | 2,129,867,534 | |

Undistributed net investment income | | | 2,902,093 | |

Accumulated net realized loss on investment and foreign currency transactions | | | (67,919,298 | ) |

Net unrealized appreciation (depreciation) on investments and foreign currencies | | | 6,088,237 | |

| | | | |

Net assets, October 31, 2011 | | $ | 2,070,938,566 | |

| | | | |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.prudentialfunds.com |

| | | | |

Class A | | | | |

Net asset value and redemption price per share

($934,995,521 ÷ 72,040,576 shares of common stock issued and outstanding) | | $ | 12.98 | |

Maximum sales charge (5.5% of offering price) | | | 0.76 | |

| | | | |

Maximum offering price to public | | $ | 13.74 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share

($58,827,207 ÷ 4,780,492 shares of common stock issued and outstanding) | | $ | 12.31 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share

($499,092,401 ÷ 40,645,511 shares of common stock issued and outstanding) | | $ | 12.28 | |

| | | | |

| |

Class L | | | | |

Net asset value, offering price and redemption price per share

($16,578,374 ÷ 1,287,218 shares of common stock issued and outstanding) | | $ | 12.88 | |

| | | | |

| |

Class M | | | | |

Net asset value, offering price and redemption price per share

($1,311,928 ÷ 106,703 shares of common stock issued and outstanding) | | $ | 12.30 | |

| | | | |

| |

Class Q | | | | |

Net asset value, offering price and redemption price per share

($980,969 ÷ 75,528 shares of common stock issued and outstanding) | | $ | 12.99 | |

| | | | |

| |

Class R | | | | |

Net asset value, offering price and redemption price per share

($3,014,194 ÷ 232,246 shares of common stock issued and outstanding) | | $ | 12.98 | |

| | | | |

| |

Class X | | | | |

Net asset value, offering price and redemption price per share

($2,693,868 ÷ 219,552 shares of common stock issued and outstanding) | | $ | 12.27 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share

($553,444,104 ÷ 42,655,591 shares of common stock issued and outstanding) | | $ | 12.97 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Equity Income Fund | | | 23 | |

Statement of Operations

Year Ended October 31, 2011

| | | | |

Net Investment Income | | | | |

Investment Income | | | | |

Unaffiliated dividend income (net of foreign withholding tax of $1,824,521) | | $ | 72,767,601 | |

Unaffiliated interest income | | | 2,196,926 | |

Affiliated income from securities lending, net | | | 518,366 | |

Affiliated dividend income | | | 103,557 | |

| | | | |

Total income | | | 75,586,450 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 11,956,892 | |

Distribution fee—Class A | | | 1,803,327 | |

Distribution fee—Class B | | | 420,143 | |

Distribution fee—Class C | | | 3,560,906 | |

Distribution fee—Class L | | | 89,574 | |

Distribution fee—Class M | | | 28,966 | |

Distribution fee—Class R | | | 5,859 | |

Distribution fee—Class X | | | 38,187 | |

Transfer agent’s fee and expenses (including affiliated expense of $327,000) | | | 1,623,000 | |

Registration fees | | | 339,000 | |

Custodian’s fees and expenses | | | 326,000 | |

Reports to shareholders | | | 156,000 | |

Legal fees and expenses | | | 41,000 | |

Directors’ fees | | | 33,000 | |

Audit fees | | | 25,000 | |

Insurance fees | | | 12,000 | |

Miscellaneous | | | 21,059 | |

| | | | |

Total expenses | | | 20,479,913 | |

| | | | |

Net investment income | | | 55,106,537 | |

| | | | |

|

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | (25,040,766 | ) |

Options written | | | 266,395 | |

Foreign currency transactions | | | (2,054,979 | ) |

| | | | |

| | | (26,829,350 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (43,036,164 | ) |

Foreign currencies | | | 43,223 | |

| | | | |

| | | (42,992,941 | ) |

| | | | |

Net loss on investments and foreign currencies | | | (69,822,291 | ) |

| | | | |

Net Decrease In Net Assets Resulting From Operations | | $ | (14,715,754 | ) |

| | | | |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.prudentialfunds.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2011 | | | 2010 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 55,106,537 | | | $ | 8,317,494 | |

Net realized gain (loss) on investment and foreign currency transactions | | | (26,829,350 | ) | | | 4,675,578 | |

Net change in unrealized appreciation on investments and foreign currencies | | | (42,992,941 | ) | | | 44,593,040 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | (14,715,754 | ) | | | 57,586,112 | |

| | | | | | | | |

| | |

Dividends and Distributions (Note 1) | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (25,624,158 | ) | | | (6,563,049 | ) |

Class B | | | (1,266,725 | ) | | | (317,393 | ) |

Class C | | | (10,814,696 | ) | | | (1,906,319 | ) |

Class L | | | (600,499 | ) | | | (844,391 | ) |

Class M | | | (85,574 | ) | | | (362,623 | ) |

Class Q | | | (6,607 | ) | | | — | |

Class R | | | (38,789 | ) | | | — | |

Class X | | | (114,795 | ) | | | (278,862 | ) |

Class Z | | | (13,357,666 | ) | | | (575,619 | ) |

| | | | | | | | |

Total dividends | | | (51,909,509 | ) | | | (10,848,256 | ) |

| | | | | | | | |

| | |

Fund share transactions (Note 4) | | | | | | | | |

Net proceeds from shares sold | | | 1,940,207,862 | | | | 394,173,232 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 38,231,007 | | | | 9,674,929 | |

Cost of shares redeemed | | | (376,903,828 | ) | | | (59,552,099 | ) |

| | | | | | | | |

Increase in net assets from Fund share transactions | | | 1,601,535,041 | | | | 344,296,062 | |

| | | | | | | | |

| | |

Capital Contributions (Note 5) | | | | | | | | |

Proceeds from regulatory settlement | | | — | | | | 5,611 | |

| | | | | | | | |

Total increase in net assets | | | 1,534,909,778 | | | | 391,039,529 | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 536,028,788 | | | | 144,989,259 | |

| | | | | | | | |

End of year(a) | | $ | 2,070,938,566 | | | $ | 536,028,788 | |

| | | | | | | | |

(a) Includes undistributed net investment income of | | $ | 2,902,093 | | | $ | 1,722,027 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Equity Income Fund | | | 25 | |

Notes to Financial Statements

1. Organization

Prudential Investment Portfolios, Inc. 10 (the “Company”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended, (“1940 Act”). The Company was organized on March 5, 1997, as a Maryland Corporation. The Company operates as a series company. At October 31, 2011, the Company consisted of two diversified investment portfolios (each a “Fund” and collectively the “Funds”). The information presented in these financial statements pertains to Prudential Jennison Equity Income Fund (the “Fund”). The investment objective of the Fund is long term capital growth and income by investing primarily in common stocks that are believed to be selling at reasonable valuation in relation to their fundamental business prospects.

2. Significant Accounting Policies

The following accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Company and the Funds in the preparation of their financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded via NASDAQ are valued at the official closing price as provided by NASDAQ. Securities that are actively traded in the over-the-counter market, including listed securities for which primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to

| | |

| 26 | | Visit our website at www.prudentialfunds.com |

investments or securities with similar characteristics. Securities for which reliable market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset value.

Investments in open-end, non-exchange traded mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Foreign Currency Translation: Fund securities and other assets and liabilities denominated in foreign currencies are translated each business day into U.S. dollars based on the current rates of exchange. Purchases and sales of Fund securities and income and expenses are translated into U.S. dollars on the respective dates of such transactions. Gains and losses resulting from changes in exchange rates applicable to long-term foreign securities are not reported separately from gains and losses arising from movements in securities prices. Net realized foreign exchange gains and losses include gains and losses from sales and maturities of foreign currency exchange contracts, gains and losses realized between the trade and settlement dates of foreign securities transactions, and the difference between the amount of net investment income accrued on foreign securities and the U.S. dollar amount actually received. Net unrealized foreign exchange gains and losses include gains and losses from changes in the value of assets and liabilities other than Fund securities, resulting from changes in exchange rates.

Options: The Fund may either purchase or write options in order to hedge against adverse market movements or fluctuations in value caused by changes in prevailing interest rates or foreign currency exchange rates with respect to securities or financial instruments which the Fund currently owns or intends to purchase. The Fund’s principal reason for writing options is to realize, through receipt of premiums, a greater current return than would be realized on the underlying security alone. When the Fund purchases an option, it pays a premium and an amount equal to that

| | | | |

| Prudential Jennison Equity Income Fund | | | 27 | |

Notes to Financial Statements

continued

premium is recorded as an asset. When the Fund writes an option, it receives a premium and an amount equal to that premium is recorded as a liability. The asset or liability is adjusted daily to reflect the current market value of the option.

If an option expires unexercised, the Fund realizes a gain or loss to the extent of the premium received or paid. If an option is exercised, the premium received or paid is recorded as an adjustment to the proceeds from the sale or the cost basis of the purchase. The difference between the premium and the amount received or paid on at a closing purchase or sale transaction is also treated as a realized gain or loss. Gain or loss on purchased options is included in net realized gain or loss on investment transactions. Gain or loss on written options is presented separately as net realized gain or loss on written options transactions.

The Fund, as writer of an option, may have no control over whether the underlying securities or financial instruments may be sold (called) or purchased (put). As a result, the Fund bears the market risk of an unfavorable change in the price of the security or financial instrument underlying the written option. Over-the-counter options involve the risk of the potential inability of the counterparties to meet the terms of their contracts.

Securities Lending: The Funds may lend their portfolio securities to broker-dealers. The loans are secured by collateral at least equal at all times to the market value of the securities loaned. Loans are subject to termination at the option of the borrower or the Funds. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially, the Funds have the right to repurchase the securities using the collateral in the open market. The Funds recognize income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The Funds also continue to receive interest and dividends or amounts equivalent thereto, on the securities loaned and recognize any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Securities Transactions and Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of investments and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The

| | |

| 28 | | Visit our website at www.prudentialfunds.com |

Fund amortizes premiums and discounts on portfolio securities as adjustments to interest income. Expenses are recorded on the accrual basis which may require the use of certain estimates by management.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions to Shareholders: Dividends and distributions to shareholders are recorded on the ex-divided date. Dividends, if any, from net investment income are declared and paid at least quarterly. These dividends and distributions are determined in accordance with federal income tax regulations and may differ from accounting principles generally accepted in the United States of America.

Net realized gains from investment transactions, if any are distributed at least annually. Permanent book/tax differences relating to income and gains are reclassified to paid-in capital when they arise.

Taxes: For federal income tax purposes, each Fund in the Company is treated as a separate tax paying entity. It is the Funds’ policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal tax provision is required. Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

3. Agreements

The Fund has entered into investment management agreements with PI which provides that the Manager will furnish the Fund with investment advice and investment management and administrative services. The Manager has entered into a subadvisory agreement with Jennison Associates LLC.

Advisory Fees and Expense Limitations: The Manager receives a fee, computed daily and paid monthly, based on an annual rate of the average net assets. The Manager

| | | | |

| Prudential Jennison Equity Income Fund | | | 29 | |

Notes to Financial Statements

continued

pays the subadvisor a fee as compensation for advisory services provided to the Fund. The Manager has voluntarily agreed through February 29, 2012 to waive expenses in accordance with limitation expense policies as noted in the table below. The Manager will reimburse the Fund for its operating expenses, exclusive of taxes, interest, brokerage commissions, distribution fees and extraordinary expenses, but inclusive of the advisory fee, which in the aggregate exceed specified percentages of the Fund’s average net assets while retaining their ability to be reimbursed for such fee waivers prior to the end of the fiscal year. The advisory fee and expense limitation are summarized as follows:

| | | | |

Advisory Expense | | Effective Advisory Fees | | Fees

Limitation |

| 0.85% to $500 million; | | 0.80% | | 1.15% |

| 0.80% next $500 million; | | | | |

| 0.75% in excess of $1 billion | | | | |

Such contractual fee waivers or reductions have been calculated prior to any fee reimbursements with respect to the expense limitations, and may be rescinded at any time and without notice to investors. All reimbursements by the Manager are reflected in the Statements of Operations.

Certain officers and directors of the Fund are officers or directors of the Manager. The Fund pays no compensation directly to its officers or interested directors.

The Fund has distribution agreements with Prudential Investment Management Services LLC (“PIMS”) and Prudential Annuities Distributors, Inc. (“PAD”). PIMS and PAD are both affiliates of PI and indirect, wholly-owned subsidiaries of Prudential. PIMS serves as the distributor of the Fund’s Class A, Class B, Class C, Class Q, Class R and Class Z shares. PIMS, together with PAD, serves as co-distributor of the Fund’s Class L, Class M, and Class X shares.

The Company has adopted a separate Distribution and Service plan (each a “Plan” and collectively the “Plans”) for the Class A, Class B, Class C, Class L, Class M, Class R, and Class X shares of the Fund in accordance with Rule 12b-1 of the 1940 Act, as amended. No distribution or service fees are paid to PIMS as distributor for the Fund’s Class Q or Class Z shares.

| | |

| 30 | | Visit our website at www.prudentialfunds.com |

Under the Plans, the Fund compensates PIMS and PAD a distribution and service fee at the annual rate of 0.30%, 1.00%, 1.00%, 0.50%, 1.00%, 0.75% and 1.00% of the average daily net assets of the Class A, B, C, L, M, R and X shares, respectively. Through February 28, 2013, PIMS has contractually agreed to limit such fees to 0.25% and 0.50% of the average daily net assets of the Class A shares and Class R shares, respectively.

During the year ended October 31, 2011, PIMS has advised the Fund, front-end sales charges (“FESC”) and gross contingent deferred sales charges (“CDSC”) were as follows:

| | | | | | | | | | |

Class A

FESC | | Class A

CDSC | | Class B

CDSC | | Class C

CDSC | | Class M

CDSC | | Class X

CDSC |

| $6,643,102 | | $134,616 | | $70,414 | | $121,033 | | $633 | | $396 |

4. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of Prudential Investments LLC and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent fees and expenses are shown in the Statements of Operations.

The Fund invests in the Prudential Core Taxable Money Market Fund (the “Core Fund”), a series of the Prudential Investment Portfolios 2, registered under the 1940 Act, as amended, and managed by PI. Earnings from the Core Fund are disclosed on the Statement of Operations as affiliated dividend income.

Prudential Investment Management, Inc. (“PIM”), an indirect, wholly-owned subsidiary of Prudential, served as the Fund’s securities lending agent. For the year ended October 31, 2011, PIM has been compensated approximately $154,700 for these services.

5. Shares of Capital Stock

Class A shares are sold with a front-end sales charge of up to 5.50%. Purchases of $1 million or more are subject to a contingent deferred sales charge (“CDSC”) if shares are redeemed within 12 months of their purchase. The Class A shares CDSC is waived for purchases by certain retirement and/or benefit plans. Class B shares are sold with a CDSC which declines from 5% to zero depending upon the period of time the shares are held. Class B shares will automatically convert to Class A shares approximately seven years after purchase. Class M shares will automatically convert to Class A

| | | | |

| Prudential Jennison Equity Income Fund | | | 31 | |

Notes to Financial Statements

continued