UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-08085 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios, Inc. 10 |

| |

| Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2010 |

| |

| Date of reporting period: | | 10/31/2010 |

Item 1 – Reports to Stockholders

| | |

| ANNUAL REPORT | | OCTOBER 31, 2010 |

Prudential Mid-Cap Value Fund

| | | | |

Fund Type Mid-cap stock Objective Capital growth | | | | This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter. Prudential Investments, Prudential, the Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide. |

| | |

| | To enroll in e-delivery, go to www.prudentialfunds.com/edelivery |

December 15, 2010

Dear Shareholder:

We hope you find the annual report for the Prudential Mid-Cap Value Fund informative and useful. Because of ongoing market volatility, we understand that this is a difficult time to be an investor. While it is impossible to predict what the future holds, we continue to believe a prudent response to uncertainty is to maintain a diversified portfolio, including stock and bond mutual funds consistent with your tolerance for risk, time horizon, and financial goals.

A diversified asset allocation offers two potential advantages: It limits your exposure to any particular asset class; plus it provides a better opportunity to invest some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. Keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Prudential Investments® provides a wide range of mutual funds to choose from that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of Prudential Financial’s affiliated asset managers. Most of Prudential Investments’ equity funds are advised by Jennison Associates LLC, Quantitative Management Associates LLC (QMA), or Prudential Real Estate Investors. Prudential Investment Management, Inc. (PIM) advises the Prudential Investments fixed income and money market funds through its Prudential Fixed Income unit. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies. Prudential Real Estate Investors is a unit of PIM.

Thank you for choosing the Prudential Investments family of mutual funds.

Sincerely,

Judy A. Rice, President

Prudential Mid-Cap Value Fund

| | | | |

| Prudential Mid-Cap Value Fund | | | 1 | |

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.66%; Class B, 2.36%; Class C, 2.36%; Class L, 1.86%; Class M, 2.36%; Class X, 2.36%; Class Z, 1.36%. Net operating expenses: Class A, 1.61%; Class B, 2.36%; Class C, 2.36%; Class L, 1.86%; Class M, 1.61%; Class X, 1.61%; Class Z, 1.36%, after contractual reduction for Class A through 2/29/2012.

| | | | | | | | | | | | | | | | |

Cumulative Total Returns (Without Sales Charges) as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | 24.14 | % | | | 17.16 | % | | | N/A | | | | 39.74% (4/12/04) | |

Class B | | | 23.20 | | | | 12.93 | | | | N/A | | | | 33.03 (4/12/04) | |

Class C | | | 23.27 | | | | 12.93 | | | | 72.16 | % | | | — | |

Class L | | | 23.75 | | | | 15.60 | | | | 80.71 | | | | — | |

Class M | | | 24.19 | | | | 15.96 | | | | 76.78 | | | | — | |

Class X | | | 24.15 | | | | 17.89 | | | | 79.60 | | | | — | |

Class Z | | | 24.43 | | | | N/A | | | | N/A | | | | 13.17 (11/28/05) | |

Russell Midcap Value Index | | | 27.49 | | | | 18.11 | | | | 115.86 | | | | — | |

Russell Midcap Index | | | 27.71 | | | | 21.73 | | | | 69.51 | | | | — | |

S&P MidCap 400 Index | | | 27.64 | | | | 27.21 | | | | 81.12 | | | | — | |

Lipper Average | | | 22.77 | | | | 17.27 | | | | 99.25 | | | | — | |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 9/30/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | 8.29 | % | | | 0.08 | % | | | N/A | | | | 3.74% (4/12/04) | |

Class B | | | 8.83 | | | | 0.38 | | | | N/A | | | | 3.87 (4/12/04) | |

Class C | | | 12.76 | | | | 0.48 | | | | 5.24 | % | | | — | |

Class L | | | 7.78 | | | | –0.22 | | | | 5.13 | | | | — | |

Class M | | | 8.72 | | | | 0.79 | | | | 5.51 | | | | — | |

Class X | | | 8.73 | | | | 1.01 | | | | 5.68 | | | | — | |

Class Z | | | 14.92 | | | | N/A | | | | N/A | | | | 1.74 (11/28/05) | |

Russell Midcap Value Index | | | 16.93 | | | | 1.97 | | | | 7.80 | | | | — | |

Russell Midcap Index | | | 17.54 | | | | 2.60 | | | | 4.86 | | | | — | |

S&P MidCap 400 Index | | | 17.78 | | | | 3.77 | | | | 5.40 | | | | — | |

Lipper Average | | | 13.96 | | | | 1.83 | | | | 6.82 | | | | — | |

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 10/31/10 | |

| | | One Year | | | Five Year | | | Ten Years | | | Since Inception | |

Class A | | | 17.31 | % | | | 2.06 | % | | | N/A | | | | 4.33% (4/12/04) | |

Class B | | | 18.20 | | | | 2.35 | | | | N/A | | | | 4.45 (4/12/04) | |

Class C | | | 22.27 | | | | 2.46 | | | | 5.58 | % | | | — | |

Class L | | | 16.64 | | | | 1.73 | | | | 5.47 | | | | — | |

Class M | | | 18.19 | | | | 2.78 | | | | 5.86 | | | | — | |

Class X | | | 18.15 | | | | 3.01 | | | | 6.03 | | | | — | |

Class Z | | | 24.43 | | | | N/A | | | | N/A | | | | 2.55 (11/28/05) | |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns (Without Sales Charges) as of 10/31/10 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception | |

Class A | | | 24.14 | % | | | 3.22 | % | | | N/A | | | | 5.24% (4/12/04) | |

Class B | | | 23.20 | | | | 2.46 | | | | N/A | | | | 4.45 (4/12/04) | |

Class C | | | 23.27 | | | | 2.46 | | | | 5.58 | % | | | — | |

Class L | | | 23.75 | | |

| 2.94

|

| | | 6.10 | | | | — | |

Class M | | | 24.19 | | | | 3.01 | | | | 5.86 | | | | — | |

Class X | | | 24.15 | | | | 3.35 | | | | 6.03 | | | | — | |

Class Z | | | 24.43 | | | | N/A | | | | N/A | | | | 2.55 (11/28/05) | |

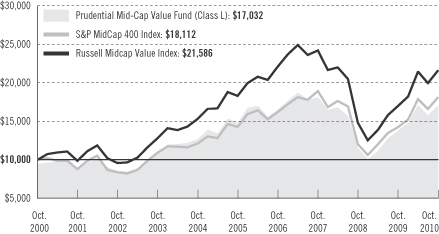

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential Mid-Cap Value Fund (Class L shares) with a similar investment in the S&P MidCap 400 Index and Russell Midcap Value Index by portraying the initial account values

| | | | |

| Prudential Mid-Cap Value Fund | | | 3 | |

Your Fund’s Performance (continued)

at the beginning of the 10-year period for Class L shares (October 31, 2000) and the account values at the end of the current fiscal year (October 31, 2010) as measured on a quarterly basis. The Russell Midcap Value Index data is measured from the closest month-end to inception date and not from the Fund’s actual inception date. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class L shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class L shares only. As indicated in the tables above, performance for Class A, Class B, Class C, Class M, Class X, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs).

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

Inception returns are provided for any share class with less than 10 calendar years of returns.

The average annual total returns take into account applicable sales charges. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively. Class L, Class M, and Class X shares are closed to most new purchases (with the exception of reinvested dividends and purchases by certain college savings plans). Under certain circumstances, Class A and Class L shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 6%, and 6%, respectively. Class A shares are subject to a 12b-1 fee of up to 0.30% annually. Class B, Class C, Class M, and Class X shares are subject to a 12b-1 fee of 1%. Class L shares are subject to a 12b-1 fee of 0.50%. Class Z shares are not subject to a 12b-1 fee. Prior to April 12, 2004, Class L shares were known as Class A shares. On April 12, 2004, Class A shares were redesignated as Class L shares and a new Class A was opened. Prior to April 12, 2004, Class M shares were known as Class B shares. On April 12, 2004, Class B shares were redesignated as Class M shares and a new Class B was opened. The returns in the graph and the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Without a distribution and service (12b-1) fee waiver of 0.05% for Class A shares, the returns would have been lower.

Benchmark Definitions

Russell Midcap Value

The Russell Midcap Value Index is an unmanaged index which measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000 Value Index. Russell Midcap Value Index Closest Month-End to Inception cumulative total returns as of 10/31/10 are 49.95% for Class A and Class B; and 14.08% for Class Z. Russell Midcap Value Index Closest Month-End to Inception average annual total returns as of 9/30/10 are 5.76% for Class A and Class B; and 1.97% for Class Z.

Russell Midcap Index

The Russell Midcap Index is an unmanaged index which measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000 Index. Russell Midcap Index Closest Month-End to Inception cumulative total returns as of 10/31/10 are 48.60% for Class A and Class B; and 16.56% for Class Z. Russell Midcap Index Closest Month-End to Inception average annual total returns as of 9/30/10 are 5.66% for Class A and Class B; and 2.41% for Class Z.

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

Standard & Poor’s MidCap 400 Stock Index

The Standard & Poor’s MidCap 400 Stock Index (S&P MidCap 400 Index) is an unmanaged index of 400 domestic stocks chosen for market capitalization, liquidity, and industry group representation. It gives a broad look at how U.S. mid-cap stock prices have performed. S&P MidCap 400 Index Closest Month-End to Inception cumulative total returns as of 10/31/10 are 50.31% for Class A and Class B; and 21.28% for Class Z. S&P MidCap 400 Index Closest Month-End to Inception average annual total returns as of 9/30/10 are 5.92% for Class A and Class B; and 3.35% for Class Z.

Lipper Mid-Cap Value Funds Average

Funds in the Lipper Mid-Cap Value Funds Average (Lipper Average), by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Mid-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the companies in the S&P MidCap 400 Index. Lipper Average Closest Month-End to Inception cumulative total returns as of 10/31/10 are 40.34% for Class A and Class B; and 12.40% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/10 are 4.79% for Class A and Class B; and 1.71% for Class Z.

Investors cannot invest directly in an index or average. The returns for the Russell Midcap Value Index, the Russell Midcap Index, and the S&P MidCap 400 Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

Five Largest Holdings expressed as a percentage of net assets as of 10/31/10 | | | | |

Xerox Corp., Office Electronics | | | 1.2 | % |

Century Link, Inc., Diversified Telecommunication Services | | | 1.1 | |

Edison International, Electric Utilities | | | 1.1 | |

Murphy Oil Corp., Oil, Gas & Consumable Fuels | | | 1.0 | |

Host Hotels & Resorts, Inc., Real Estate Investment Trusts | | | 1.0 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

| Prudential Mid-Cap Value Fund | | | 5 | |

Strategy and Performance Overview

How did the Fund perform?

The Prudential Mid-Cap Value Fund Class A shares gained 24.14% for the 12-month reporting period ended October 31, 2010, underperforming the 27.49% gain of the Russell Midcap® Value Index (the Index) but outperforming the 22.77% gain of the Lipper Mid-Cap Value Funds Average.

How is the Fund managed?

Quantitative Management Associates LLC (QMA) manages the Fund, which invests in a diversified portfolio of stocks that are out of favor and inexpensive based on price-to-earnings ratios and other value measures. Historically, value stocks have outperformed broad stock market averages. Constraints are placed on the portfolio with regard to sector, industry, and individual security weighting to reduce risk relative to the Index.

What were conditions like in the mid-cap segment of the U.S. stock market?

Stocks of medium-size companies significantly outperformed stocks of large companies for the reporting period as measured by Russell U.S. indexes. This occurred as increased activity in mergers and acquisitions helped shares of small and medium-size companies (both of which are often takeover targets) gain more than shares of large companies. Also, earnings growth for small- and mid-cap stocks is typically stronger than that of large-cap stocks as the U.S. economy climbs out of recessions. The most recent recession in the United States ended in June 2009, though the economy continues to battle high unemployment.

How did the various sectors perform?

All 10 sectors of the Index posted double-digit gains for the reporting period. The telecommunications, consumer discretionary, and materials sectors outperformed the Index. The remaining seven sectors—industrials, information technology, utilities, consumer staples, healthcare, energy, and financials—scored gains that ranged from 22.90% to 26.22%.

What aspects of sector allocation and stock selection contributed most to performance?

The primary contributors to the Fund’s performance were its strong stock selection in the healthcare and materials sectors. Within healthcare, Hill-Rom Holdings, a manufacturer of hospital beds, was a standout. Despite a challenging environment for spending on healthcare capital equipment, Hill-Rom’s earnings continued to beat expectations, driven by the benefits of its restructuring initiatives. Among pharmaceutical companies, an overweight in Endo Pharmaceuticals, a drug company specializing in pain management, also helped performance. Endo’s stock gained strongly as investors reacted favorably to recent strategic acquisitions that have strengthened the company’s longer-term growth prospects.

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

Among healthcare providers, the Fund’s timely sale of Lincare Holdings, a leading player in the in-home oxygen business, contributed to its performance. As the reporting period progressed, Lincare stock began to trend lower due to growing investor concern about the effect on earnings growth of potential reimbursement cuts and the introduction of competitive bidding.

Favorable security selection among stocks in the materials sector also helped the Fund’s performance. Within the metals industry, the Fund benefited from the timely sale of its shares of U.S. Steel. After a strong performance in late 2009, U. S. Steel and other steel-company stocks weakened in early 2010 as an expected recovery in earnings growth failed to materialize due to sluggish demand and rising materials costs.

The Fund had a larger exposure than the Index to Carpenter Technology, which helped its results as the manufacturer of specialty metals turned in above-consensus earnings. Carpenter’s major markets, which are commercial aerospace and energy, have been more robust, despite the muted economic recovery. The Fund also benefited from avoiding shares of Vulcan Materials, whose earnings were hurt by the delayed turn in the residential and commercial construction markets.

What aspects of sector allocation and stock selection subtracted most from performance?

The Fund’s performance was penalized by adverse selection within the industrials, utilities, and energy sectors. In industrials, the Fund was hurt by having a larger exposure than the Index to R.R. Donnelley and Pitney Bowes, two commercial services stocks that declined during the reporting period. Earnings of Donnelley, a global printer heavily sensitive to business and consumer spending, have been depressed by unfavorable developments in the foreign exchange markets and weak end markets. Earnings expectations have also been reduced for Pitney Bowes, a provider of mail-processing equipment, reflecting ongoing weakness in the small business and international markets. In the machinery industry, not holding Cummins, an engine manufacturer whose stock more than doubled in price during the reporting period, penalized the Fund’s performance.

��

In the utilities sector, having a larger exposure than the Index to independent power producers hurt the Fund’s performance. Holdings in Mirant Corp. and AES Corp. were the primary detractors as earnings of both companies were pressured by falling natural gas prices.

In the energy sector, the Fund had a larger exposure to the equipment and services industry than to the stronger-performing exploration and production segment. This hurt the Fund’s results.

The Portfolio of Investments following this report shows the size of the Fund’s positions at period-end.

| | | | |

| Prudential Mid-Cap Value Fund | | | 7 | |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2010, at the beginning of the period, and held through the six-month period ended October 31, 2010. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and

| | |

| 8 | | Visit our website at www.prudentialfunds.com |

expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential Mid-Cap

Value Fund | | Beginning Account

Value

May 1, 2010 | | | Ending Account

Value

October 31, 2010 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | | | | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,001.50 | | | | 1.65 | % | | $ | 8.32 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.89 | | | | 1.65 | % | | $ | 8.39 | |

| | | | | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 997.50 | | | | 2.40 | % | | $ | 12.08 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.11 | | | | 2.40 | % | | $ | 12.18 | |

| | | | | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 997.50 | | | | 2.40 | % | | $ | 12.08 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,013.11 | | | | 2.40 | % | | $ | 12.18 | |

| | | | | | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | | $ | 999.20 | | | | 1.90 | % | | $ | 9.57 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.63 | | | | 1.90 | % | | $ | 9.65 | |

| | | | | | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | | $ | 1,000.80 | | | | 1.65 | % | | $ | 8.32 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.89 | | | | 1.65 | % | | $ | 8.39 | |

| | | | | | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | | $ | 1,000.80 | | | | 1.65 | % | | $ | 8.32 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.89 | | | | 1.65 | % | | $ | 8.39 | |

| | | | | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,002.30 | | | | 1.40 | % | | $ | 7.07 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.15 | | | | 1.40 | % | | $ | 7.12 | |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2010, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2010 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

| Prudential Mid-Cap Value Fund | | | 9 | |

Portfolio of Investments

as of October 31, 2010

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

LONG-TERM INVESTMENTS 98.4% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Aerospace & Defense 1.1% | | | | | | | | |

Alliant Techsystems, Inc.* | | | 500 | | | $ | 38,120 | |

ITT Corp. | | | 11,400 | | | | 537,966 | |

L-3 Communications Holdings, Inc. | | | 14,200 | | | | 1,025,098 | |

| | | | | | | | |

| | | | | | | 1,601,184 | |

| | | | | | | | |

| | |

Auto Components 0.7% | | | | | | | | |

Autoliv, Inc. | | | 12,000 | | | | 855,600 | |

Goodyear Tire & Rubber Co. (The)* | | | 21,600 | | | | 220,752 | |

| | | | | | | | |

| | | | | | | 1,076,352 | |

| | | | | | | | |

| | |

Beverages 1.0% | | | | | | | | |

Coca-Cola Enterprises, Inc. | | | 25,100 | | | | 602,651 | |

Constellation Brands, Inc. (Class A Stock)* | | | 45,000 | | | | 887,850 | |

| | | | | | | | |

| | | | | | | 1,490,501 | |

| | | | | | | | |

| | |

Biotechnology 0.4% | | | | | | | | |

Cephalon, Inc.* | | | 8,200 | | | | 544,808 | |

| | | | | | | | |

| | |

Capital Markets 1.5% | | | | | | | | |

Ameriprise Financial, Inc. | | | 25,800 | | | | 1,333,602 | |

Raymond James Financial, Inc. | | | 28,000 | | | | 790,160 | |

| | | | | | | | |

| | | | | | | 2,123,762 | |

| | | | | | | | |

| | |

Chemicals 2.5% | | | | | | | | |

Ashland, Inc. | | | 17,700 | | | | 913,851 | |

Celanese Corp. (Class A Stock) | | | 14,600 | | | | 520,490 | |

Cytec Industries, Inc. | | | 15,900 | | | | 787,368 | |

Eastman Chemical Co. | | | 3,200 | | | | 251,424 | |

PPG Industries, Inc. | | | 13,800 | | | | 1,058,460 | |

| | | | | | | | |

| | | | | | | 3,531,593 | |

| | | | | | | | |

| | |

Commercial Banks 2.4% | | | | | | | | |

Bank of Hawaii Corp. | | | 13,600 | | | | 587,384 | |

City National Corp. | | | 3,400 | | | | 175,338 | |

Comerica, Inc. | | | 7,700 | | | | 275,506 | |

Commerce Bancshares, Inc. | | | 16,900 | | | | 622,596 | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 11 | |

Portfolio of Investments

as of October 31, 2010 continued

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Commercial Banks (cont’d.) | | | | | | | | |

Fifth Third Bancorp | | | 30,700 | | | $ | 385,592 | |

M&T Bank Corp.(a) | | | 11,800 | | | | 882,050 | |

TCF Financial Corp. | | | 44,800 | | | | 589,568 | |

| | | | | | | | |

| | | | | | | 3,518,034 | |

| | | | | | | | |

| | |

Commercial Services & Supplies 2.0% | | | | | | | | |

Avery Dennison Corp. | | | 23,400 | | | | 850,590 | |

Cintas Corp.(a) | | | 27,200 | | | | 747,184 | |

Pitney Bowes, Inc.(a) | | | 25,200 | | | | 552,888 | |

RR Donnelley & Sons Co. | | | 38,900 | | | | 717,705 | |

| | | | | | | | |

| | | | | | | 2,868,367 | |

| | | | | | | | |

| | |

Communications Equipment 0.6% | | | | | | | | |

CommScope, Inc.*(a) | | | 19,400 | | | | 614,204 | |

Harris Corp. | | | 6,000 | | | | 271,140 | |

| | | | | | | | |

| | | | | | | 885,344 | |

| | | | | | | | |

| | |

Computers & Peripherals 1.6% | | | | | | | | |

Diebold, Inc.(a) | | | 5,100 | | | | 156,315 | |

Lexmark International, Inc. (Class A Stock)* | | | 21,700 | | | | 825,251 | |

NCR Corp.* | | | 24,900 | | | | 341,628 | |

Seagate Technology PLC (Ireland)* | | | 29,500 | | | | 432,175 | |

Western Digital Corp.* | | | 16,800 | | | | 537,936 | |

| | | | | | | | |

| | | | | | | 2,293,305 | |

| | | | | | | | |

| | |

Construction & Engineering 0.2% | | | | | | | | |

Chicago Bridge & Iron Co. NV (Netherlands)* | | | 12,600 | | | | 317,646 | |

| | | | | | | | |

| | |

Consumer Finance 1.2% | | | | | | | | |

Discover Financial Services | | | 46,700 | | | | 824,255 | |

SLM Corp.* | | | 73,300 | | | | 872,270 | |

| | | | | | | | |

| | | | | | | 1,696,525 | |

| | | | | | | | |

| | |

Containers & Packaging 1.2% | | | | | | | | |

Owens-Illinois, Inc.* | | | 21,300 | | | | 597,039 | |

Sealed Air Corp. | | | 40,400 | | | | 935,260 | |

Sonoco Products Co. | | | 6,700 | | | | 224,450 | |

| | | | | | | | |

| | | | | | | 1,756,749 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Diversified Consumer Services 1.0% | | | | | | | | |

H&R Block, Inc. | | | 44,000 | | | $ | 518,760 | |

Service Corp. International | | | 59,700 | | | | 494,316 | |

Weight Watchers International, Inc. | | | 14,300 | | | | 478,907 | |

| | | | | | | | |

| | | | | | | 1,491,983 | |

| | | | | | | | |

| | |

Diversified Financial Services 0.6% | | | | | | | | |

NASDAQ OMX Group, Inc. (The)* | | | 43,600 | | | | 916,472 | |

| | | | | | | | |

| | |

Diversified Telecommunication Services 2.3% | | | | | | | | |

CenturyLink, Inc.(a) | | | 39,891 | | | | 1,650,689 | |

Frontier Communications Corp. | | | 91,600 | | | | 804,248 | |

Windstream Corp. | | | 67,800 | | | | 858,348 | |

| | | | | | | | |

| | | | | | | 3,313,285 | |

| | | | | | | | |

| | |

Electric Utilities 4.5% | | | | | | | | |

Allegheny Energy, Inc. | | | 22,700 | | | | 526,640 | |

American Electric Power Co., Inc. | | | 8,000 | | | | 299,520 | |

Edison International | | | 42,000 | | | | 1,549,800 | |

FirstEnergy Corp.(a) | | | 21,100 | | | | 766,352 | |

Northeast Utilities | | | 11,000 | | | | 344,080 | |

NV Energy, Inc. | | | 28,000 | | | | 382,480 | |

Pepco Holdings, Inc.(a) | | | 22,100 | | | | 425,646 | |

Pinnacle West Capital Corp. | | | 8,800 | | | | 362,208 | |

PPL Corp. | | | 42,900 | | | | 1,154,010 | |

Progress Energy, Inc. | | | 13,900 | | | | 625,500 | |

| | | | | | | | |

| | | | | | | 6,436,236 | |

| | | | | | | | |

| | |

Electrical Equipment 1.1% | | | | | | | | |

General Cable Corp.* | | | 5,200 | | | | 145,288 | |

Hubbell, Inc. (Class B Stock) | | | 13,000 | | | | 702,260 | |

Thomas & Betts Corp.* | | | 16,100 | | | | 701,155 | |

| | | | | | | | |

| | | | | | | 1,548,703 | |

| | | | | | | | |

| | |

Electronic Equipment & Instruments 1.6% | | | | | | | | |

Arrow Electronics, Inc.* | | | 23,200 | | | | 686,952 | |

Avnet, Inc.* | | | 26,800 | | | | 798,104 | |

Jabil Circuit, Inc. | | | 30,700 | | | | 470,938 | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 13 | |

Portfolio of Investments

as of October 31, 2010 continued

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Electronic Equipment & Instruments (cont’d.) | | | | | | | | |

Vishay Intertechnology, Inc.* | | | 27,200 | | | $ | 307,360 | |

| | | | | | | | |

| | | | | | | 2,263,354 | |

| | | | | | | | |

| | |

Energy Equipment & Services 4.1% | | | | | | | | |

Atwood Oceanics, Inc.* | | | 7,300 | | | | 237,323 | |

Diamond Offshore Drilling, Inc. | | | 6,000 | | | | 396,960 | |

Helmerich & Payne, Inc.(a) | | | 8,900 | | | | 380,742 | |

McDermott International, Inc. (Panama)* | | | 15,400 | | | | 237,622 | |

Nabors Industries Ltd. (Bermuda)* | | | 43,300 | | | | 904,970 | |

Oil States International, Inc.* | | | 8,100 | | | | 414,072 | |

Patterson-UTI Energy, Inc. | | | 19,600 | | | | 380,436 | |

Pride International, Inc.* | | | 10,000 | | | | 303,200 | |

Rowan Cos., Inc.*(a) | | | 22,000 | | | | 723,800 | |

SEACOR Holdings, Inc.* | | | 7,700 | | | | 729,575 | |

Superior Energy Services, Inc.* | | | 23,600 | | | | 651,832 | |

Tidewater, Inc. | | | 12,900 | | | | 595,077 | |

| | | | | | | | |

| | | | | | | 5,955,609 | |

| | | | | | | | |

| | |

Exchange Traded Fund 0.7% | | | | | | | | |

iShares Russell Midcap Value Index Fund | | | 23,300 | | | | 976,969 | |

| | | | | | | | |

| | |

Food & Staples Retailing 1.5% | | | | | | | | |

Kroger Co. (The) | | | 14,300 | | | | 314,600 | |

Safeway, Inc. | | | 54,300 | | | | 1,243,470 | |

SUPERVALU, Inc.(a) | | | 58,100 | | | | 626,899 | |

| | | | | | | | |

| | | | | | | 2,184,969 | |

| | | | | | | | |

| | |

Food Products 3.2% | | | | | | | | |

ConAgra Foods, Inc. | | | 47,800 | | | | 1,075,022 | |

Corn Products International, Inc. | | | 20,900 | | | | 889,295 | |

Dean Foods Co.* | | | 33,700 | | | | 350,480 | |

Del Monte Foods Co. | | | 56,500 | | | | 810,210 | |

Sara Lee Corp. | | | 61,500 | | | | 881,295 | |

Tyson Foods, Inc. (Class A Stock) | | | 43,600 | | | | 677,980 | |

| | | | | | | | |

| | | | | | | 4,684,282 | |

| | | | | | | | |

| | |

Gas Utilities 2.2% | | | | | | | | |

Atmos Energy Corp. | | | 23,000 | | | | 677,350 | |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Gas Utilities (cont’d.) | | | | | | | | |

Energen Corp. | | | 15,500 | | | $ | 691,920 | |

ONEOK, Inc. | | | 13,700 | | | | 682,534 | |

Questar Corp. | | | 32,800 | | | | 556,616 | |

UGI Corp. | | | 18,500 | | | | 556,665 | |

| | | | | | | | |

| | | | | | | 3,165,085 | |

| | | | | | | | |

| | |

Healthcare Equipment & Supplies 1.1% | | | | | | | | |

Beckman Coulter, Inc. | | | 6,500 | | | | 346,060 | |

Cooper Cos., Inc. (The)(a) | | | 7,900 | | | | 389,786 | |

Kinetic Concepts, Inc.* | | | 17,300 | | | | 657,919 | |

Teleflex, Inc.(a) | | | 3,900 | | | | 217,425 | |

| | | | | | | | |

| | | | | | | 1,611,190 | |

| | | | | | | | |

| | |

Healthcare Providers & Services 4.0% | | | | | | | | |

Aetna, Inc. | | | 14,700 | | | | 438,942 | |

CIGNA Corp. | | | 35,300 | | | | 1,242,207 | |

Community Health Systems, Inc.* | | | 14,800 | | | | 445,184 | |

Coventry Health Care, Inc.* | | | 32,600 | | | | 763,492 | |

Health Net, Inc.* | | | 23,200 | | | | 623,848 | |

Humana, Inc.* | | | 19,100 | | | | 1,113,339 | |

LifePoint Hospitals, Inc.* | | | 15,100 | | | | 512,192 | |

Omnicare, Inc.(a) | | | 23,300 | | | | 561,996 | |

| | | | | | | | |

| | | | | | | 5,701,200 | |

| | | | | | | | |

| | |

Hotels, Restaurants & Leisure 1.6% | | | | | | | | |

Brinker International, Inc.(a) | | | 23,200 | | | | 430,128 | |

Darden Restaurants, Inc. | | | 9,600 | | | | 438,816 | |

Royal Caribbean Cruises Ltd. (Liberia)*(a) | | | 19,000 | | | | 751,260 | |

Wyndham Worldwide Corp.(a) | | | 21,800 | | | | 626,750 | |

| | | | | | | | |

| | | | | | | 2,246,954 | |

| | | | | | | | |

| | |

Household Durables 2.9% | | | | | | | | |

Fortune Brands, Inc.(a) | | | 19,500 | | | | 1,053,975 | |

Garmin Ltd. (Switzerland)(a) | | | 22,100 | | | | 725,764 | |

Jarden Corp. | | | 18,900 | | | | 605,934 | |

Mohawk Industries, Inc.* | | | 9,600 | | | | 550,464 | |

Newell Rubbermaid, Inc. | | | 43,900 | | | | 774,835 | |

Whirlpool Corp.(a) | | | 6,800 | | | | 515,644 | |

| | | | | | | | |

| | | | | | | 4,226,616 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 15 | |

Portfolio of Investments

as of October 31, 2010 continued

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Household Products 0.6% | | | | | | | | |

Energizer Holdings, Inc.* | | | 11,400 | | | $ | 852,492 | |

| | | | | | | | |

| | |

Independent Power Producers & Energy Traders 1.7% | | | | | | | | |

AES Corp. (The)* | | | 51,800 | | | | 618,492 | |

Constellation Energy Group, Inc. | | | 15,900 | | | | 480,816 | |

Mirant Corp.* | | | 39,400 | | | | 418,034 | |

NRG Energy, Inc.* | | | 46,100 | | | | 917,851 | |

| | | | | | | | |

| | | | | | | 2,435,193 | |

| | | | | | | | |

| | |

Industrial Conglomerates 0.9% | | | | | | | | |

Carlisle Cos., Inc.(a) | | | 17,700 | | | | 620,739 | |

Textron, Inc.(a) | | | 34,800 | | | | 724,536 | |

| | | | | | | | |

| | | | | | | 1,345,275 | |

| | | | | | | | |

| | |

Insurance 9.8% | | | | | | | | |

Allied World Assurance Co. Holdings Ltd. (Bermuda) | | | 15,100 | | | | 863,871 | |

American Financial Group, Inc. | | | 29,000 | | | | 886,820 | |

AON Corp. | | | 11,000 | | | | 437,250 | |

Arch Capital Group Ltd. (Bermuda)* | | | 11,200 | | | | 967,568 | |

Aspen Insurance Holdings Ltd. (Bermuda) | | | 14,100 | | | | 400,017 | |

AXIS Capital Holdings Ltd. (Bermuda) | | | 21,400 | | | | 727,814 | |

Cincinnati Financial Corp. | | | 34,300 | | | | 1,009,792 | |

Endurance Specialty Holdings Ltd. (Bermuda) | | | 14,000 | | | | 579,600 | |

First American Financial Corp. | | | 27,700 | | | | 388,908 | |

Hartford Financial Services Group, Inc. (The)(a) | | | 42,100 | | | | 1,009,558 | |

HCC Insurance Holdings, Inc. | | | 27,600 | | | | 730,848 | |

Lincoln National Corp. | | | 35,000 | | | | 856,800 | |

PartnerRe Ltd. (Bermuda) | | | 13,500 | | | | 1,070,820 | |

Principal Financial Group, Inc.(a) | | | 20,900 | | | | 560,956 | |

Progressive Corp. (The) | | | 29,600 | | | | 626,336 | |

Protective Life Corp. | | | 37,000 | | | | 886,890 | |

RenaissanceRe Holdings Ltd. (Bermuda) | | | 8,600 | | | | 518,236 | |

StanCorp Financial Group, Inc. | | | 15,900 | | | | 682,110 | |

Unitrin, Inc. | | | 19,100 | | | | 464,130 | |

Unum Group | | | 24,100 | | | | 540,322 | |

| | | | | | | | |

| | | | | | | 14,208,646 | |

| | | | | | | | |

| | |

IT Services 1.9% | | | | | | | | |

Computer Sciences Corp. | | | 25,800 | | | | 1,265,490 | |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

IT Services (cont’d.) | | | | | | | | |

Convergys Corp.* | | | 24,500 | | | $ | 277,340 | |

CoreLogic, Inc. | | | 27,700 | | | | 486,689 | |

DST Systems, Inc. | | | 9,600 | | | | 415,392 | |

Total System Services, Inc. | | | 16,900 | | | | 263,809 | |

| | | | | | | | |

| | | | | | | 2,708,720 | |

| | | | | | | | |

| | |

Machinery 3.6% | | | | | | | | |

Crane Co. | | | 17,900 | | | | 684,854 | |

Eaton Corp. | | | 13,300 | | | | 1,181,439 | |

Harsco Corp. | | | 16,700 | | | | 387,106 | |

Oshkosh Corp.* | | | 16,200 | | | | 478,062 | |

SPX Corp. | | | 10,600 | | | | 710,836 | |

Timken Co. | | | 11,900 | | | | 492,898 | |

Toro Co. (The) | | | 8,500 | | | | 482,460 | |

Trinity Industries, Inc. | | | 32,900 | | | | 747,817 | |

| | | | | | | | |

| | | | | | | 5,165,472 | |

| | | | | | | | |

| | |

Media 2.4% | | | | | | | | |

CBS Corp. (Class B Stock) | | | 67,000 | | | | 1,134,310 | |

DISH Network Corp. (Class A Stock) | | | 42,800 | | | | 850,008 | |

Gannett Co., Inc. | | | 43,600 | | | | 516,660 | |

McGraw-Hill Cos., Inc. (The) | | | 17,100 | | | | 643,815 | |

Meredith Corp. | | | 10,600 | | | | 359,870 | |

| | | | | | | | |

| | | | | | | 3,504,663 | |

| | | | | | | | |

| | |

Metals & Mining 0.7% | | | | | | | | |

Carpenter Technology Corp. | | | 8,600 | | | | 306,676 | |

Reliance Steel & Aluminum Co. | | | 16,100 | | | | 673,785 | |

| | | | | | | | |

| | | | | | | 980,461 | |

| | | | | | | | |

| | |

Multi-Line Retail 1.5% | | | | | | | | |

JC Penney Co., Inc.(a) | | | 27,400 | | | | 854,332 | |

Macy’s, Inc. | | | 46,800 | | | | 1,106,352 | |

Nordstrom, Inc. | | | 6,400 | | | | 246,464 | |

| | | | | | | | |

| | | | | | | 2,207,148 | |

| | | | | | | | |

| | |

Multi-Utilities 6.8% | | | | | | | | |

Alliant Energy Corp. | | | 5,500 | | | | 200,915 | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 17 | |

Portfolio of Investments

as of October 31, 2010 continued

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Multi-Utilities (cont’d.) | | | | | | | | |

Ameren Corp. | | | 38,400 | | | $ | 1,112,832 | |

CenterPoint Energy, Inc. | | | 47,100 | | | | 779,976 | |

CMS Energy Corp.(a) | | | 28,100 | | | | 516,478 | |

Consolidated Edison, Inc. | | | 9,800 | | | | 487,256 | |

DTE Energy Co. | | | 24,400 | | | | 1,140,944 | |

MDU Resources Group, Inc. | | | 28,900 | | | | 575,977 | |

NiSource, Inc. | | | 52,900 | | | | 915,699 | |

OGE Energy Corp. | | | 17,000 | | | | 750,720 | |

SCANA Corp. | | | 10,700 | | | | 436,988 | |

Sempra Energy | | | 19,500 | | | | 1,042,860 | |

TECO Energy, Inc. | | | 11,100 | | | | 195,249 | |

Vectren Corp. | | | 18,000 | | | | 492,840 | |

Xcel Energy, Inc. | | | 46,200 | | | | 1,102,332 | |

| | | | | | | | |

| | | | | | | 9,751,066 | |

| | | | | | | | |

| | |

Office Electronics 1.2% | | | | | | | | |

Xerox Corp. | | | 144,300 | | | | 1,688,310 | |

| | | | | | | | |

| | |

Oil, Gas & Consumable Fuels 5.4% | | | | | | | | |

El Paso Corp. | | | 78,200 | | | | 1,036,932 | |

Frontline Ltd. (Bermuda) | | | 9,000 | | | | 258,750 | |

Holly Corp. | | | 10,600 | | | | 346,938 | |

Murphy Oil Corp. | | | 22,500 | | | | 1,466,100 | |

Noble Energy, Inc.(a) | | | 5,800 | | | | 472,584 | |

Southern Union Co. | | | 30,600 | | | | 768,978 | |

Spectra Energy Corp. | | | 23,500 | | | | 558,595 | |

Sunoco, Inc. | | | 20,900 | | | | 783,123 | |

Talisman Energy, Inc. (Canada) | | | 12,900 | | | | 234,006 | |

Teekay Corp. (Marshall Island) | | | 14,400 | | | | 457,920 | |

Tesoro Corp. | | | 41,400 | | | | 536,544 | |

Valero Energy Corp. | | | 50,700 | | | | 910,065 | |

| | | | | | | | |

| | | | | | | 7,830,535 | |

| | | | | | | | |

| | |

Paper & Forest Products 0.9% | | | | | | | | |

Domtar Corp. (Canada) | | | 4,500 | | | | 357,120 | |

International Paper Co. | | | 35,100 | | | | 887,328 | |

| | | | | | | | |

| | | | | | | 1,244,448 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Personal Products 0.4% | | | | | | | | |

Herbalife Ltd. (Cayman Islands) | | | 8,600 | | | $ | 549,196 | |

| | | | | | | | |

| | |

Pharmaceuticals 1.9% | | | | | | | | |

Endo Pharmaceuticals Holdings, Inc.* | | | 25,800 | | | | 947,892 | |

Forest Laboratories, Inc.* | | | 39,300 | | | | 1,298,865 | |

King Pharmaceuticals, Inc.* | | | 38,900 | | | | 550,046 | |

| | | | | | | | |

| | | | | | | 2,796,803 | |

| | | | | | | | |

| | |

Real Estate Investment Trusts 4.7% | | | | | | | | |

Annaly Capital Management, Inc. | | | 57,800 | | | | 1,023,638 | |

Brandywine Realty Trust | | | 21,900 | | | | 262,143 | |

Duke Realty Corp. | | | 56,100 | | | | 699,567 | |

Hospitality Properties Trust | | | 35,500 | | | | 809,755 | |

Host Hotels & Resorts, Inc. | | | 89,249 | | | | 1,418,167 | |

Mack-Cali Realty Corp. | | | 13,300 | | | | 446,614 | |

ProLogis(a) | | | 79,100 | | | | 1,079,715 | |

SL Green Realty Corp.(a) | | | 16,900 | | | | 1,110,668 | |

| | | | | | | | |

| | | | | | | 6,850,267 | |

| | | | | | | | |

| | |

Real Estate Management & Development 1.0% | | | | | | | | |

Forest City Enterprises, Inc. (Class A Stock)*(a) | | | 49,300 | | | | 719,287 | |

Jones Lang LaSalle, Inc.(a) | | | 8,600 | | | | 671,316 | |

| | | | | | | | |

| | | | | | | 1,390,603 | |

| | | | | | | | |

| | |

Road & Rail 0.4% | | | | | | | | |

Ryder System, Inc. | | | 12,700 | | | | 555,625 | |

| | | | | | | | |

| | |

Semiconductors 0.3% | | | | | | | | |

Micron Technology, Inc.*(a) | | | 56,000 | | | | 463,120 | |

| | | | | | | | |

| | |

Specialty Retail 1.4% | | | | | | | | |

Foot Locker, Inc. | | | 9,600 | | | | 152,928 | |

GameStop Corp. (Class A Stock)*(a) | | | 31,500 | | | | 619,290 | |

Limited Brands, Inc. | | | 15,300 | | | | 449,667 | |

RadioShack Corp.(a) | | | 6,600 | | | | 132,858 | |

Signet Jewelers Ltd. (Bermuda)*(a) | | | 17,600 | | | | 619,168 | |

| | | | | | | | |

| | | | | | | 1,973,911 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 19 | |

Portfolio of Investments

as of October 31, 2010 continued

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| | | | | | | | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Thrifts & Mortgage Finance 0.3% | | | | | | | | |

Astoria Financial Corp. | | | 13,100 | | | $ | 162,702 | |

New York Community Bancorp, Inc.(a) | | | 17,500 | | | | 296,275 | |

| | | | | | | | |

| | | | | | | 458,977 | |

| | | | | | | | |

| | |

Tobacco 0.3% | | | | | | | | |

Lorillard, Inc. | | | 5,800 | | | | 494,972 | |

| | | | | | | | |

| | |

Trading Companies & Distributors 0.9% | | | | | | | | |

GATX Corp. | | | 18,600 | | | | 588,876 | |

WESCO International, Inc.*(a) | | | 17,800 | | | | 762,196 | |

| | | | | | | | |

| | | | | | | 1,351,072 | |

| | | | | | | | |

| | |

Wireless Telecommunication Services 0.6% | | | | | | | | |

NII Holdings, Inc.* | | | 19,000 | | | | 794,390 | |

Telephone & Data Systems, Inc.(a) | | | 2,600 | | | | 90,558 | |

| | | | | | | | |

| | | | | | | 884,948 | |

| | | | | | | | |

Total long-term investments

(cost $127,737,461) | | | | | | | 142,119,000 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT 16.6% | | | | | | | | |

| | |

AFFILIATED MONEY MARKET MUTUAL FUND | | | | | | | | |

Prudential Investment Portfolios 2 - Prudential Core Taxable Money Market Fund (cost $23,973,761; includes $22,415,948 of cash collateral for securities on loan)(b)(c) | | | 23,973,761 | | | | 23,973,761 | |

| | | | | | | | |

TOTAL INVESTMENTS 115.0%

(cost $151,711,222; Note 6) | | | | | | | 166,092,761 | |

Liabilities in excess of other assets (15.0)% | | | | | | | (21,718,778 | ) |

| | | | | | | | |

NET ASSETS 100.0% | | | | | | $ | 144,373,983 | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $21,758,830; cash collateral of $22,415,948 (included with liabilities) was received with which the Portfolio purchased highly liquid short-term investments. |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.prudentialfunds.com |

| (b) | Represents security, or a portion thereof, purchased with cash collateral received for securities on loan. |

| (c) | Prudential Investments LLC, the manager of the Fund also serves as manager of the Prudential Investment Portfolios 2—Prudential Core Taxable Money Market Fund. |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices in active markets for identical securities, generally for stocks and mutual funds with daily NAVs

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, repayment speeds, credit risk, etc. and amortized cost), generally for foreign stocks priced through vendor modeling tools and debt securities

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The following is a summary of the inputs used as of October 31, 2010 in valuing the Fund’s assets carried at fair value:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | $ | 142,119,000 | | | $ | — | | | $ | — | |

Affiliated Money Market Mutual Fund | | | 23,973,761 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 166,092,761 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2010 were as follows:

| | | | |

Affiliated Money Market Mutual Fund (15.5% represents investments purchased with collateral from securities on loan) | | | 16.6 | % |

Insurance | | | 9.8 | |

Multi-Utilities | | | 6.8 | |

Oil, Gas & Consumable Fuels | | | 5.4 | |

Real Estate Investment Trusts | | | 4.7 | |

Electric Utilities | | | 4.5 | |

Energy Equipment & Services | | | 4.1 | |

Healthcare Providers & Services | | | 4.0 | |

Machinery | | | 3.6 | |

Food Products | | | 3.2 | |

Household Durables | | | 2.9 | |

Chemicals | | | 2.5 | |

Commercial Banks | | | 2.4 | |

Media | | | 2.4 | |

Diversified Telecommunication Services | | | 2.3 | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 21 | |

Portfolio of Investments

as of October 31, 2010 continued

| | | | |

| Industry (cont’d.) | | | | |

Gas Utilities | | | 2.2 | % |

Commercial Services & Supplies | | | 2.0 | |

Pharmaceuticals | | | 1.9 | |

IT Services | | | 1.9 | |

Independent Power Producers & Energy Traders | | | 1.7 | |

Computers & Peripherals | | | 1.6 | |

Electronic Equipment & Instruments | | | 1.6 | |

Hotels, Restaurants & Leisure | | | 1.6 | |

Multi-Line Retail | | | 1.5 | |

Food & Staples Retailing | | | 1.5 | |

Capital Markets | | | 1.5 | |

Specialty Retail | | | 1.4 | |

Containers & Packaging | | | 1.2 | |

Consumer Finance | | | 1.2 | |

Office Electronics | | | 1.2 | |

Healthcare Equipment & Supplies | | | 1.1 | |

Aerospace & Defense | | | 1.1 | |

Electrical Equipment | | | 1.1 | |

Diversified Consumer Services | | | 1.0 | |

Beverages | | | 1.0 | |

Real Estate Management & Development | | | 1.0 | |

Trading Companies & Distributors | | | 0.9 | |

Industrial Conglomerates | | | 0.9 | |

Paper & Forest Products | | | 0.9 | |

Auto Components | | | 0.7 | |

Metals & Mining | | | 0.7 | |

Exchange Traded Fund | | | 0.7 | |

Diversified Financial Services | | | 0.6 | |

Communications Equipment | | | 0.6 | |

Wireless Telecommunication Services | | | 0.6 | |

Household Products | | | 0.6 | |

Road & Rail | | | 0.4 | |

Personal Products | | | 0.4 | |

Biotechnology | | | 0.4 | |

Tobacco | | | 0.3 | |

Semiconductors | | | 0.3 | |

Thrifts & Mortgage Finance | | | 0.3 | |

Construction & Engineering | | | 0.2 | |

| | | | |

| | | 115.0 | |

Liabilities in excess of other assets | | | (15.0 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.prudentialfunds.com |

Financial Statements

| | |

| OCTOBER 31, 2010 | | ANNUAL REPORT |

Prudential Mid-Cap Value Fund

Statement of Assets and Liabilities

as of October 31, 2010

| | | | |

Assets | |

Investments at value, including securities on loan of $21,758,830: | | | | |

Unaffiliated Investments (cost $127,737,461) | | $ | 142,119,000 | |

Affiliated Investments (cost $23,973,761) | | | 23,973,761 | |

Receivable for investments sold | | | 1,233,091 | |

Dividends receivable | | | 113,189 | |

Receivable for Fund shares sold | | | 84,684 | |

Prepaid expenses | | | 2,650 | |

| | | | |

Total assets | | | 167,526,375 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 22,415,948 | |

Payable for Fund shares redeemed | | | 382,232 | |

Accrued expenses | | | 128,516 | |

Advisory fee payable | | | 109,900 | |

Distribution fee payable | | | 50,914 | |

Payable to custodian | | | 38,049 | |

Affiliated transfer agent fee payable | | | 22,190 | |

Deferred directors’ fee | | | 4,643 | |

| | | | |

Total liabilities | | | 23,152,392 | |

| | | | |

| |

Net Assets | | $ | 144,373,983 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at $.001 par value | | $ | 11,350 | |

Paid-in capital in excess of par | | | 151,277,376 | |

| | | | |

| | | 151,288,726 | |

Undistributed net investment income | | | 26,306 | |

Accumulated net realized loss on investment transactions | | | (21,322,588 | ) |

Net unrealized appreciation on investments | | | 14,381,539 | |

| | | | |

Net assets, October 31, 2010 | | $ | 144,373,983 | |

| | | | |

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.prudentialfunds.com |

| | | | |

Class A: | | | | |

Net asset value and redemption price per share

($73,637,981 ÷ 5,614,090 shares of common stock issued and outstanding) | | $ | 13.12 | |

Maximum sales charge (5.5% of offering price) | | | 0.76 | |

| | | | |

Offering price per share | | $ | 13.88 | |

| | | | |

| |

Class B: | | | | |

Net asset value, offering price and redemption price per share

($4,091,700 ÷ 344,670 shares of common stock issued and outstanding) | | $ | 11.87 | |

| | | | |

| |

Class C: | | | | |

Net asset value, offering price and redemption price per share

($29,900,106 ÷ 2,526,225 shares of common stock issued and outstanding) | | $ | 11.84 | |

| | | | |

| |

Class L: | | | | |

Net asset value, offering price and redemption price per share

($11,863,340 ÷ 921,465 shares of common stock issued and outstanding) | | $ | 12.87 | |

| | | | |

| |

Class M: | | | | |

Net asset value, offering price and redemption price per share

($3,986,609 ÷ 332,719 shares of common stock issued and outstanding) | | $ | 11.98 | |

| | | | |

| |

Class X: | | | | |

Net asset value, offering price and redemption price per share

($4,061,417 ÷ 336,938 shares of common stock issued and outstanding) | | $ | 12.05 | |

| | | | |

| |

Class Z: | | | | |

Net asset value, offering price and redemption price per share

($16,832,830 ÷ 1,274,185 shares of common stock issued and outstanding) | | $ | 13.21 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 25 | |

Statement of Operations

Year Ended October 31, 2010

| | | | |

Net Investment Income | | | | |

Investment Income | | | | |

Unaffiliated dividend income (net of foreign withholding tax of $434) | | $ | 3,183,347 | |

Affiliated income from securities lending, net | | | 77,772 | |

Affiliated dividend income | | | 4,261 | |

| | | | |

Total income | | | 3,265,380 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 1,293,490 | |

Distribution fee—Class A | | | 174,607 | |

Distribution fee—Class B | | | 42,249 | |

Distribution fee—Class C | | | 295,203 | |

Distribution fee—Class L | | | 59,421 | |

Distribution fee—Class M | | | 16,350 | |

Distribution fee—Class X | | | 11,766 | |

Transfer agent’s fee and expenses (including affiliated expenses of $124,200) | | | 371,000 | |

Registration fees | | | 77,000 | |

Reports to shareholders | | | 77,000 | |

Custodian’s fees and expenses | | | 66,000 | |

Legal fees and expenses | | | 23,000 | |

Audit fees | | | 22,000 | |

Directors’ fees | | | 14,000 | |

Miscellaneous | | | 18,033 | |

| | | | |

Total expenses | | | 2,561,119 | |

| | | | |

Net investment income | | | 704,261 | |

| | | | |

| |

Realized And Unrealized Gain On Investments | | | | |

Net realized gain on investments | | | 2,239,324 | |

Net change in unrealized appreciation (depreciation) on investments | | | 28,203,715 | |

| | | | |

Net gain on investments | | | 30,443,039 | |

| | | | |

Net Increase In Net Assets Resulting From Operations | | $ | 31,147,300 | |

| | | | |

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.prudentialfunds.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2010 | | | 2009 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 704,261 | | | $ | 1,083,818 | |

Net realized gain (loss) on investment transactions | | | 2,239,324 | | | | (22,282,267 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 28,203,715 | | | | 42,721,972 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 31,147,300 | | | | 21,523,523 | |

| | | | | | | | |

| | |

Dividends (Note 2) | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (504,714 | ) | | | (769,488 | ) |

Class B | | | (11,609 | ) | | | (227,132 | ) |

Class C | | | (76,553 | ) | | | (382,279 | ) |

Class L | | | (69,526 | ) | | | (217,883 | ) |

Class M | | | (80,304 | ) | | | (399,054 | ) |

Class X | | | (46,515 | ) | | | (163,017 | ) |

Class Z | | | (166,991 | ) | | | (193,661 | ) |

| | | | | | | | |

Total dividends | | | (956,212 | ) | | | (2,352,514 | ) |

| | | | | | | | |

| | |

Fund share transactions (Note 5) | | | | | | | | |

Net proceeds from shares sold | | | 10,102,227 | | | | 15,630,053 | |

Net asset value of shares issued in reinvestment of dividends | | | 919,643 | | | | 2,214,203 | |

Cost of shares redeemed | | | (33,817,992 | ) | | | (29,885,755 | ) |

| | | | | | | | |

Decrease in net assets from fund share transactions | | | (22,796,122 | ) | | | (12,041,499 | ) |

| | | | | | | | |

| | |

Capital Contributions | | | | | | | | |

Class M (Note 3) | | | 4,414 | | | | 40,553 | |

Class X (Note 3) | | | 2,295 | | | | 6,801 | |

Proceeds from regulatory settlement (Note 5) | | | 9,456 | | | | — | |

| | | | | | | | |

| | | 16,165 | | | | 47,354 | |

| | | | | | | | |

Total increase in net assets | | | 7,411,131 | | | | 7,176,864 | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 136,962,852 | | | | 129,785,988 | |

| | | | | | | | |

End of year(a) | | $ | 144,373,983 | | | $ | 136,962,852 | |

| | | | | | | | |

(a) Includes undistributed net investment income of: | | $ | 26,306 | | | $ | 278,257 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Mid-Cap Value Fund | | | 27 | |

Notes to Financial Statements

1. Organization

Prudential Investments Portfolios, Inc. 10 (the “Company”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended. The Company was organized on March 5, 1997, as a Maryland Corporation. The Company operates as a series company. At October 31, 2010, the Company consisted of two diversified investment portfolios (each a “Fund” and collectively the “Funds”). The information presented in these financial statements pertains to Prudential Mid-Cap Value Fund (the “Fund”). The investment objective of the Fund is capital growth by investing primarily in common stocks of medium capitalization companies.

2. Significant Accounting Policies

The following accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Company and the Fund in the preparation of their financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded via NASDAQ are valued at the official closing price as provided by NASDAQ. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Securities for which reliable market quotations are not readily available, or whose values have been affected by

| | |

| 28 | | Visit our website at www.prudentialfunds.com |

events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset value.

Investments in open end, non exchange-traded mutual funds are valued at the net asset value as of the close of the New York Stock Exchange on the date of valuation.

Foreign Currency Translation: Fund securities and other assets and liabilities denominated in foreign currencies are translated each business day into U.S. dollars based on the current rates of exchange. Purchases and sales of Fund securities and income and expenses are translated into U.S. dollars on the respective dates of such transactions. Gains and losses resulting from changes in exchange rates applicable to long-term foreign securities are not reported separately from gains and losses arising from movements in securities prices. Net realized foreign exchange gains and losses include gains and losses from sales and maturities of foreign currency exchange contracts, gains and losses realized between the trade and settlement dates of foreign securities transactions, and the difference between the amount of net investment income accrued on foreign securities and the U.S. dollar amount actually received. Net unrealized foreign exchange gains and losses include gains and losses from changes in the value of assets and liabilities other than Fund securities, resulting from changes in exchange rates.

Securities Lending: The Funds may lend their portfolio securities to broker-dealers. The loans are secured by collateral at least equal at all times to the market value of the securities loaned. Loans are subject to termination at the option of the borrower or the Funds. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially, the Funds have the right to repurchase the securities using the collateral in the open market. The Funds recognize income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The Funds also continue to receive

| | | | |

| Prudential Mid-Cap Value Fund | | | 29 | |

Notes to Financial Statements

continued

interest and dividends or amounts equivalent thereto, on the securities loaned and recognize any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of investments and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. The Fund amortizes premiums and discounts on portfolio securities as adjustments to interest income. Expenses are recorded on the accrual basis which may require the use of certain estimates by management.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions to Shareholders: Distributions to shareholders are recorded on the ex-dividend date. Dividends, if any, from net investment income are declared and paid at least annually. These dividends and distributions are determined in accordance with federal income tax regulations and may differ from accounting principles generally accepted in the United States of America.

Net realized gains from investment transactions, if any, are distributed at least annually. Permanent book/tax differences relating to income and gains are reclassified to paid-in capital when they arise.

Taxes: For federal income tax purposes, each Fund in the Company is treated as a separate tax paying entity. It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal tax provision is required.

Withholding taxes on foreign dividends are recorded net of reclaimable amounts, at the time the related income is earned.

| | |

| 30 | | Visit our website at www.prudentialfunds.com |

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

3. Agreements

The Fund has entered into an investment management agreement with PI which provides that the Manager will furnish the Fund with investment advice and investment management and administrative services. The Manager has entered into a subadvisory agreement with Quantitative Management Associates LLC (“QMA”). The subadvisory agreement provides that QMA furnishes investment advisory services in connection with the management of the Fund. PI pays for the services of QMA, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The advisory fee paid to PI is computed daily and payable monthly at an annual rate of 0.90% of the average daily net assets of the Fund up to $500 million, 0.85% of the next $500 million and 0.80% of the average daily net assets in excess of $1 billion. The effective management fee rate was 0.90% for the year ended October 31, 2010.

Certain officers and directors of the Fund are officers or directors of the Manager. The Fund pays no compensation directly to their officers or interested directors.

Prudential Investment Management Services LLC (“PIMS”) and Prudential Annuities Distributors, Inc. (“PAD”) both affiliates of the Manager and an indirect, wholly owned subsidiary of Prudential, serve as the distributors of the Fund. The Company has adopted a separate Distribution and Service plan (each a “Plan” and collectively the “Plans”) for Class A, B, C, L, M, X and Z shares of each Fund in accordance with the requirements of Rule 12b-1 of the Investment Company Act of 1940. No distribution or service fees are paid to PIMS as distributor for Class Z shares.

Under the Plans, the Fund compensates PIMS and PAD distribution and service fees at an annual rate up to 0.30%, 1.00%, 1.00%, 0.50%, 1.00% and 1.00% of the average daily net assets of the Class A, B, C, L, M and X shares, respectively. Through February 29, 2012, PIMS has contractually agreed to limit such fees to 0.25% of the average daily net assets of Class A shares.

Management has received the maximum allowable amount of sales charges for Class M and X in accordance with regulatory limits. As such, any contingent deferred sales charges received by the Manager are contributed back into the Fund and included

| | | | |

| Prudential Mid-Cap Value Fund | | | 31 | |

Notes to Financial Statements

continued

in the Statement of Changes in Net Assets and Financial Highlights as a contribution to capital.

During the year ended October 31, 2008, management determined that Class M and Class X shareholders had been charged sales charges in excess of regulatory limits. The Manager has paid these classes for the overcharge which is reflected in the Financial Highlights for Class M for the years ended October 31, 2008 and 2007 and for Class X for the years ended October 31, 2008, 2007, and 2006.

During the year ended October 31, 2010, PIMS has advised the Fund, front-end sales charges (“FESC”) and contingent deferred sales charges (“CDSC”) were as follows:

| | | | | | | | |

Class A

FESC | | Class A

CDSC | | Class B

CDSC | | Class C

CDSC | | Class L

CDSC |

| $38,588 | | $25 | | $5,214 | | $541 | | $42 |

4. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent fees and expenses shown in the Statements of Operations include certain out-of pocket expenses paid to non-affiliates, where applicable.

The Fund pays networking fees to affiliated and unaffiliated broker/dealers, including fees relating to the services of Wells Fargo, LLC (“Wells Fargo”), an affiliate of PI through December 31, 2009. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the year ended October 31, 2010, the Fund incurred approximately $77,300 in total networking fees, of which approximately $5,700 was paid to Wells Fargo through December 31, 2009. These amounts are included in transfer agent’s fees and expenses on the Statement of Operations.

The Fund invests in the Prudential Core Taxable Money Market Fund (the “Core Fund”), a portfolio of Prudential Investment Portfolios 2 registered under the Investment Company Act of 1940, as amended, and managed by PI. Earnings from the Core Fund are disclosed on the Statement of Operations as affiliated dividend income.

| | |

| 32 | | Visit our website at www.prudentialfunds.com |

Prudential Investment Management, Inc. (“PIM”), an indirect, wholly-owned subsidiary of Prudential, served as the Fund’s securities lending agent. For the year ended October 31, 2010, PIM has been compensated approximately $27,400 for these services.

5. Shares of Capital Stock