UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08189

J.P. Morgan Fleming Mutual Fund Group, Inc.

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2013 through December 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

J.P. Morgan Mid Cap/Multi-Cap Funds

December 31, 2013 (Unaudited)

JPMorgan Growth Advantage Fund

JPMorgan Mid Cap Core Fund

JPMorgan Mid Cap Equity Fund

JPMorgan Mid Cap Growth Fund

JPMorgan Mid Cap Value Fund

JPMorgan Multi-Cap Market Neutral Fund

JPMorgan Value Advantage Fund

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

January 23, 2014 (Unaudited)

Dear Shareholder,

Equity markets in developed economies performed strongly as the pace of the global economy accelerated during the six months ended December 31, 2013. Healthy corporate earnings and steady improvement in a range of economic indicators provided a positive backdrop for investors seeking returns in the low interest rate environment. While political discord in Washington injected volatility into the market, a bipartisan budget agreement at the end of 2013 relieved much of the political uncertainty created by partisan brinkmanship that led to the partial shutdown of the federal government in October. In December, the U.S. Federal Reserve (the “Fed”) responded to marked improvement in employment and other measures of economic growth by announcing it would trim its $85 billion in monthly asset purchases by $10 billion. The news drove U.S. equities to new highs, with the Standard & Poor’s 500 stock index reaching seven closing highs in December, ending the six-month period with a 16.31% return.

| | |

| | “ While a repeat of the equity performance we experienced during the six month period may be a tall order, we believe stocks in the U.S. and Europe may continue to show gains” |

Overseas, the European Union returned to positive economic growth during the six month period and by the end of the period, Ireland became the first nation to exit from its European Union bailout program. The Fed’s decision to curb its asset purchases also sent equities higher in Europe, as investors viewed the move as a sign of further economic stability. The euro zone’s composite Purchasing Managers Index ended the period at a three-month high. Amid signs of continued economic expansion, it is notable that the European Central Bank cut its benchmark interest rate to a historical low in November in an attempt to counter a drop in the inflation rate.

In Japan, equity markets posted strong gains, benefitting from Prime Minister Shinzo Abe’s efforts to revive the economy. Low returns on bonds and short-term debt instruments also drove investors into stocks in Japan and Europe.

Emerging market equities were weaker overall as China’s economy showed signs of slower growth and political unrest in

Turkey and Thailand shook investor confidence. The Fed’s decision to taper its asset purchase program also set off speculation that the maturation of the emerging markets credit cycle would push yield-seeking investors to rotate into developed markets.

Taper Talk Pressures Bonds

Fixed-income markets generally remained weak during the six month period, with the Barclays Aggregate Index returning 0.43% for the six month period. U.S. Treasury security yields remained low from a historical perspective but peaked in September after the Fed declined to taper its asset purchases at that time. Globally, emerging market debt continued to struggle as stronger developed market growth trends led to declines in the relatively high yields and strong currencies, causing outflows that led to further weakness. The yield for 10-year U.S. Treasury securities ended December 31, 2013 at 3.04%, while the yields for 2- and 30-year U.S. Treasury securities finished the reporting period at 0.38% and 3.96%, respectively.

We welcome the Fed’s move to curb its Quantitative Easing program as a sign that the U.S. economy’s need for artificial stimulus is waning. While a repeat of the equity performance we experienced during the six month period may be a tall order, we believe stocks in the U.S. and Europe may continue to show gains. In the fixed-income market, persistent weakness has led to attractive valuations in some sectors. The reporting period market swings and intermittent volatility underlined the importance of maintaining a long-term view of your investment portfolio and the benefits derived from diversified holdings.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 1 | |

J.P. Morgan Mid Cap/Multi-Cap Funds

MARKET OVERVIEW

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

Overall, the U.S. equity market performed strongly during the six months ended December 31, 2013, as a tepid economic recovery continued to gain strength from healthy corporate earnings, along with improvements in employment, housing and consumer sentiment. Volatility marked the start of the second half of the year amid investor uncertainty about the intent of the U.S. Federal Reserve Board (the “Fed”) to taper off its monthly purchases of $85 billion in U.S. Treasuries and mortgage-backed securities. Partisan brinkmanship in Washington added to the uncertainty, leading to a partial shutdown of the federal government in October. However, a bipartisan budget agreement toward the end of the period dispelled some of the political uncertainty and the Fed followed through by trimming $10 billion from its monthly asset purchases, which sent equities higher. During the six-month period, the U.S. unemployment rate declined from 7.3% in July to 6.7% at year end, with a slight uptick in joblessness in October. Adding to the positive trend were advances in housing prices and auto sales and a rebound in consumer sentiment to a five-month high in December.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

JPMorgan Growth Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class A Shares, without a sales charge)* | | | 25.24% | |

| Russell 3000 Growth Index | | | 19.60% | |

| |

| Net Assets as of 12/31/2013 (In Thousands) | | $ | 2,952,882 | |

INVESTMENT OBJECTIVE**

The JPMorgan Growth Advantage Fund (the “Fund”) seeks to provide long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Class A Shares, without a sales charge) outperformed the Russell 3000 Growth Index (the “Benchmark”) for the six months ended December 31, 2013. The Fund’s stock selection in the technology sector and the health care sector contributed to performance relative to the Benchmark. While the Fund’s underweight position in the consumer discretionary sector and its overweight position in the material & processing sector detracted from relative performance, the impact was not significant.

Individual contributors to relative performance included IBM Corp. and the Fund’s overweight position in Onyx Pharmaceuticals and its underweight position in Microsoft Corp. The Fund had no position in IBM, and the Fund benefited as the stock underperformed on continued deterioration in the company’s hardware business and declining free cash flow generation. Shares of Onyx, a maker of anti-cancer drugs, rose sharply after it agreed to an all-cash takeover offer from Amgen Inc. Shares of Microsoft, a maker of software and computer hardware, came under pressure from declining trends in personal computer growth and problems with the company’s Windows 8 and Surface tablet products.

Individual detractors from relative performance included Lululemon Athletica Inc., Broadcom Corp. and Exact Sciences Corp. Shares of Lululemon, a maker of athletic apparel, fell after the company cut its forecast for its fiscal fourth-quarter results, which indicated lower-than-expected organic retail growth. Shares of Broadcom, a supplier of semiconductors, mainly to the mobile and wireless segment, fell on weak revenue growth. Shares of Exact Sciences, a medical molecular diagnostics company, were weak due to lower-than-expected revenue in its second and third quarters.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies across market capitalizations in an effort to construct portfolios of stocks that have strong fundamentals. The Fund’s portfolio managers sought to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Google, Inc., Class A | | | 4.0 | % |

| | 2. | | | Apple, Inc. | | | 3.0 | |

| | 3. | | | MasterCard, Inc., Class A | | | 2.8 | |

| | 4. | | | Gilead Sciences, Inc. | | | 2.7 | |

| | 5. | | | Harley-Davidson, Inc. | | | 2.2 | |

| | 6. | | | Amazon.com, Inc. | | | 2.1 | |

| | 7. | | | Celgene Corp. | | | 2.1 | |

| | 8. | | | Facebook, Inc., Class A | | | 1.9 | |

| | 9. | | | Biogen Idec, Inc. | | | 1.7 | |

| | 10. | | | Acuity Brands, Inc. | | | 1.6 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Information Technology | | | 28.9 | % |

| Consumer Discretionary | | | 20.0 | |

| Industrials | | | 17.8 | |

| Health Care | | | 14.9 | |

| Financials | | | 8.1 | |

| Energy | | | 4.8 | |

| Materials | | | 2.7 | |

| Short-Term Investment | | | 2.8 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 3 | |

JPMorgan Growth Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | | 10/29/99 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 25.24 | % | | | 44.36 | % | | | 22.16 | % | | | 11.31 | % |

With Sales Charge** | | | | | | | 18.68 | | | | 36.75 | | | | 20.86 | | | | 10.72 | |

CLASS B SHARES | | | 10/29/99 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 24.97 | | | | 43.76 | | | | 21.52 | | | | 10.77 | |

With CDSC*** | | | | | | | 19.97 | | | | 38.76 | | | | 21.34 | | | | 10.77 | |

CLASS C SHARES | | | 5/1/06 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 24.95 | | | | 43.72 | | | | 21.54 | | | | 10.68 | |

With CDSC**** | | | | | | | 23.95 | | | | 42.72 | | | | 21.54 | | | | 10.68 | |

CLASS R5 SHARES | | | 1/8/09 | | | | 25.56 | | | | 44.97 | | | | 22.66 | | | | 11.62 | |

CLASS R6 SHARES | | | 12/23/13 | | | | 25.56 | | | | 44.97 | | | | 22.66 | | | | 11.62 | |

SELECT CLASS SHARES | | | 5/1/06 | | | | 25.37 | | | | 44.74 | | | | 22.42 | | | | 11.51 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| **** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

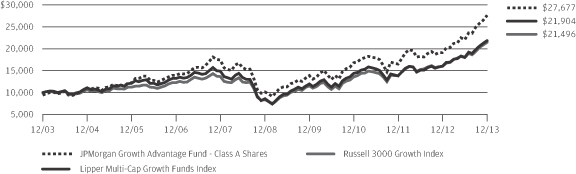

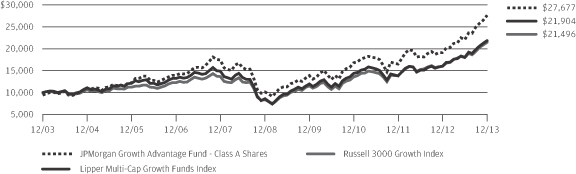

TEN YEAR PERFORMANCE (12/31/03 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

As of August 17, 2005, the Fund changed its name, investment objective, certain investment policies and benchmark. Prior to that time, the Fund operated as JPMorgan Mid Cap Growth Fund. Although past performance is not necessarily an indication of how the Fund will perform in the future, in view of these changes, the Fund’s performance record prior to August 17, 2005 might be less pertinent for investors considering whether to purchase shares of the Fund. Returns for the Class C Shares prior to its inception date are based on the performance of Class B Shares, whose expenses are substantially similar to those of Class C Shares. Returns for the Select Class Shares prior to its inception date are based on the performance of Class A Shares. During this period, the actual returns of Select Class Shares would have been different than those shown because Select Class Shares have different expenses than Class A Shares. Returns for Class R5 Shares prior to its inception date are based on the performance of Select Class Shares from May 1, 2006 to January 8, 2009 and Class A Shares prior to May 1, 2006. The actual returns of Class R5 Shares

would have been different than those shown because Class R5 Shares have different expenses than Select Class and Class A Shares. Returns for Class R6 Shares prior to its inception date are based on the performance of Class R5 Shares from January 9, 2009 to December 23, 2013, Select Class Shares from May 1, 2006 to January 8, 2009 and Class A Shares prior to May 1, 2006. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Growth Advantage Fund, the Russell 3000 Growth Index and the Lipper Multi-Cap Growth Funds Index from December 31, 2003 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Russell 3000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Multi-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 3000 Growth Index is an unmanaged index which measures the performance of those Russell 3000 companies (largest 3000 U.S. companies) with higher price-to-book ratios and higher forecasted growth values. The Lipper Multi-Cap Growth Funds Index is

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also,

performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after 8 years, the 10 year annual average total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 5 | |

JPMorgan Mid Cap Core Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 18.77% | |

| Russell Midcap Index | | | 16.73% | |

| |

| Net Assets as of 12/31/2013 (In Thousands) | | $ | 1,029,301 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Core Fund (the “Fund”) seeks long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the Russell Midcap Index (the “Benchmark”) for the six months ended December 31, 2013. The Fund’s stock selection in the financial services and technology sectors contributed to relative performance, while stock selection in the consumer discretionary and energy sectors detracted from performance, though in the latter case the impact was modest.

Individual contributors to relative performance included the Fund’s positions in Alliance Data Systems Corp., Twitter Inc., and FleetCor Technologies Inc. Shares of Alliance Data, a provider of marketing and customer loyalty programs, rose on strong quarterly earnings and the company’s upward revision of its forecast for 2013 results. Shares of Twitter, a provider of social networking and so-called micro-blogging services, retained their strength following the company’s initial public offering in November. Shares of FleetCor, a manager of commercial vehicle fuel cards, gained from overall growth in its core business line, along with rising earnings and revenue.

Individual detractors from relative performance included Urban Outfitters Inc., MSC Industrial Direct Inc and Gap Inc. Shares of Urban Oufitters, a retail clothing chain, slumped on mistakes in fashion trends both at its namesake stores and at its Anthropologie retail unit. Shares of MSC Industrial, a maker of metalworking tools and related products, had a positive return for the period, but could not keep pace with the overall Benchmark. Shares of The Gap, a retail clothing chain, fell as sales among retailers were weak ahead of the important holiday season.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing a portfolio based on company fundamentals, quantitative screening and proprietary

fundamental analysis. The Fund’s portfolio managers invested in companies that, in their view, had leading competitive advantages, predictable and durable business models, sustainable free cash flow generation and management teams committed to increasing intrinsic value.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Amphenol Corp., Class A | | | 1.6 | % |

| | 2. | | | Carlisle Cos., Inc. | | | 1.3 | |

| | 3. | | | Harley-Davidson, Inc. | | | 1.3 | |

| | 4. | | | Mohawk Industries, Inc. | | | 1.2 | |

| | 5. | | | Xilinx, Inc. | | | 1.2 | |

| | 6. | | | Fortune Brands Home & Security, Inc. | | | 1.1 | |

| | 7. | | | Humana, Inc. | | | 1.0 | |

| | 8. | | | Alliance Data Systems Corp. | | | 1.0 | |

| | 9. | | | KLA-Tencor Corp. | | | 1.0 | |

| | 10. | | | MSC Industrial Direct Co., Inc., Class A | | | 1.0 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Consumer Discretionary | | | 21.9 | % |

| Financials | | | 19.4 | |

| Industrials | | | 16.3 | |

| Information Technology | | | 14.4 | |

| Health Care | | | 9.4 | |

| Materials | | | 4.9 | |

| Energy | | | 4.7 | |

| Utilities | | | 4.5 | |

| Consumer Staples | | | 2.3 | |

| Short-Term Investment | | | 2.2 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 3 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | 11/30/10 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 18.49 | % | | | 36.92 | % | | | 16.19 | % | | | 17.88 | % |

With Sales Charge** | | | | | | | 12.27 | | | | 29.71 | | | | 14.12 | | | | 15.84 | |

CLASS C SHARES | | | 11/30/10 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 18.20 | | | | 36.25 | | | | 15.63 | | | | 17.29 | |

With CDSC*** | | | | | | | 17.20 | | | | 35.25 | | | | 15.63 | | | | 17.29 | |

CLASS R2 SHARES | | | 11/30/10 | | | | 18.38 | | | | 36.55 | | | | 15.90 | | | | 17.58 | |

CLASS R5 SHARES | | | 11/30/10 | | | | 18.76 | | | | 37.47 | | | | 16.71 | | | | 18.40 | |

CLASS R6 SHARES | | | 1/31/11 | | | | 18.82 | | | | 37.61 | | | | 16.77 | | | | 18.46 | |

SELECT CLASS SHARES | | | 11/30/10 | | | | 18.77 | | | | 37.39 | | | | 16.53 | | | | 18.22 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

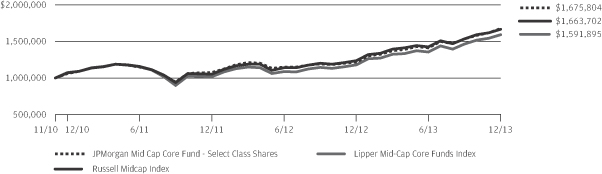

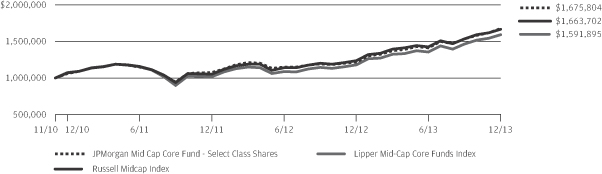

LIFE OF FUND PERFORMANCE (11/30/10 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The fund commenced operations on November 30, 2010.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class R5 Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Mid Cap Core Fund, the Russell Midcap Index and the Lipper Mid-Cap Core Funds Index from November 30, 2010 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain

distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Mid-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Index is an unmanaged index which measures the performance of the 800 smallest companies in the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 7 | |

JPMorgan Mid Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 18.72% | |

| Russell Midcap Index | | | 16.73% | |

| |

| Net Assets as of 12/31/2013 (In Thousands) | | $ | 1,268,665 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Equity Fund (the “Fund”) seeks long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the Russell Midcap Index (the “Benchmark”) for the six months ended December 31, 2013. The Fund’s stock selection in the financial services sector and the technology sector contributed to relative performance. Stock selection in the consumer discretionary sector was the notable detractor, while stock selection in the energy sector detracted from relative performance.

Individual contributors to relative performance included the Fund’s positions in Alliance Data Systems Corp., Twitter Inc., and FleetCor Technologies Inc. Shares of Alliance Data, a provider of marketing and customer loyalty programs, rose on continued strong growth in its private label credit card business. Also driving the stock’s performance was the accelerating growth in the Epsilon marketing business due to secular growth in targeted loyalty-based marketing programs.

We participated in the initial public offering of Twitter, a provider of social networking and so-called micro-blogging services, and the stock continued to perform well on the strength of its potential to monetize the use of mobile devices. Shares of FleetCor, a manager of commercial vehicle fuel cards, gained from overall growth in its core business line as it continued to generate strong organic growth and improved profit margins, while gaining global market share through acquisitions.

Individual detractors from relative performance included Urban Outfitters Inc., MSC Industrial Direct Inc and Gap Inc. Shares of Urban Oufitters, a retail clothing chain, were weak after the company reported a difficult back-to-school season at its core brand. Shares of MSC Industrial, a maker of metalworking tools and related products, fell due to a difficult outlook for profit margins amid rising expenses. Shares of Gap, a retail clothing chain, fell as sales among retailers were weak ahead of the holiday shopping season.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing a portfolio based on company fundamentals, quantitative screening and proprietary fundamental analysis. The Fund’s portfolio managers sought to identify dominant franchises with predictable business models deemed capable of achieving, in their view, sustained growth, as well as undervalued companies with the potential to grow their intrinsic value per share.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Amphenol Corp., Class A | | | 1.5 | % |

| | 2. | | | Carlisle Cos., Inc. | | | 1.3 | |

| | 3. | | | Harley-Davidson, Inc. | | | 1.3 | |

| | 4. | | | Mohawk Industries, Inc. | | | 1.2 | |

| | 5. | | | Xilinx, Inc. | | | 1.2 | |

| | 6. | | | Fortune Brands Home & Security, Inc. | | | 1.1 | |

| | 7. | | | Humana, Inc. | | | 1.0 | |

| | 8. | | | Alliance Data Systems Corp. | | | 1.0 | |

| | 9. | | | KLA-Tencor Corp. | | | 1.0 | |

| | 10. | | | MSC Industrial Direct Co., Inc., Class A | | | 1.0 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Consumer Discretionary | | | 21.3 | % |

| Financials | | | 18.7 | |

| Industrials | | | 15.9 | |

| Information Technology | | | 13.9 | |

| Health Care | | | 9.1 | |

| Materials | | | 4.8 | |

| Energy | | | 4.5 | |

| Utilities | | | 4.4 | |

| Consumer Staples | | | 2.3 | |

| Short-Term Investment | | | 5.1 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | | 11/2/09 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 18.51 | % | | | 36.26 | % | | | 21.07 | % | | | 10.13 | % |

With Sales Charge** | | | | | | | 12.29 | | | | 29.09 | | | | 19.77 | | | | 9.54 | |

CLASS C SHARES | | | 11/2/09 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 18.22 | | | | 35.58 | | | | 20.57 | | | | 9.90 | |

With CDSC*** | | | | | | | 17.22 | | | | 34.58 | | | | 20.57 | | | | 9.90 | |

SELECT CLASS SHARES | | | 1/1/97 | | | | 18.72 | | | | 36.74 | | | | 21.42 | | | | 10.29 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

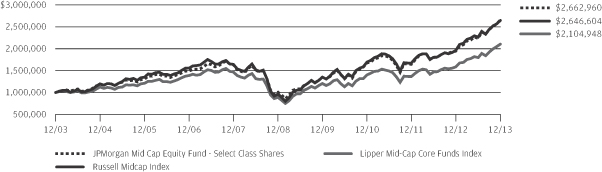

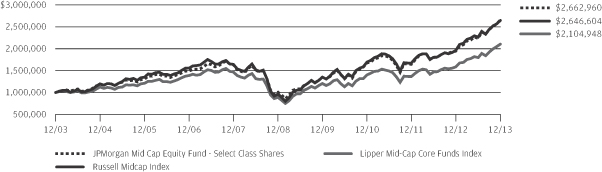

TEN YEAR PERFORMANCE (12/31/03 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class A and Class C Shares prior to their inception date are based on the performance of Select Class Shares. The actual returns of Class A and Class C Shares would have been lower than those shown because Class A and Class C Shares have higher expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in the Select Class Shares of JPMorgan Mid Cap Equity Fund, the Russell Midcap Index and the Lipper Mid-Cap Core Funds Index from December 31, 2003 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The

performance of the Lipper Mid-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Index is an unmanaged index which measures the performance of the 800 smallest companies in the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 9 | |

JPMorgan Mid Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 23.45% | |

| Russell Midcap Growth Index | | | 18.34% | |

| |

| Net Assets as of 12/31/2013 (In Thousands) | | $ | 1,908,183 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Growth Fund (the “Fund”) seeks growth of capital and secondarily, current income by investing primarily in equity securities.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the Russell Midcap Growth Index (the “Benchmark”) for the six months ended December 31, 2013. The Fund’s stock selection in the financial services sector and the technology sector contributed to relative performance. The Fund’s stock selection in the consumer discretionary sector and the energy sector detracted from performance, though in the latter case the impact was not significant.

Individual contributors to relative performance included Twitter Inc., Alliance Data Systems Inc. and Onyx Pharmaceuticals Inc. Shares of Twitter, a provider of social networking and micro-blogging services, contributed to performance given our participation in their successful IPO and continued strength in the stock given their strong mobile monetization potential. Shares of Alliance Data, a provider of marketing and customer loyalty programs, rose on continued strong growth in the private label credit card business. Driving the stock’s performance was also the accelerating growth in the Epsilon marketing business due to secular growth in targeted loyalty based marketing programs. Shares of Onyx, a maker of anti-cancer drugs, rose sharply after it agreed to an all-cash takeover offer from Amgen Inc.

Individual detractors to relative performance included Urban Outfitters Inc., Lululemon Athletica Inc. and Plains All American Pipeline LP. Shares of Urban Oufitters, a retail clothing chain, were weak after reporting a difficult back-to-school season at its core Urban Outfitters brand as lack of compelling fashion across retail led to a more promotional environment. Shares of Lululemon, a maker of athletic apparel, fell after the company cut its forecast for its fiscal fourth-quarter results, which indicated much lower organic retail growth than market expectations. Shares of Plains All American, an operator of pipelines and storage for crude, natural gas and refined product, were weak due to the increase in interest rates, which put pressure on high yielding equities and master limited partnerships like Plains All American.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies in an effort to construct a portfolio of stocks that have strong fundamentals. The Fund’s portfolio managers sought to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Harley-Davidson, Inc. | | | 2.7 | % |

| | 2. | | | Alliance Data Systems Corp. | | | 2.0 | |

| | 3. | | | Flowserve Corp. | | | 1.8 | |

| | 4. | | | Pall Corp. | | | 1.8 | |

| | 5. | | | Illumina, Inc. | | | 1.8 | |

| | 6. | | | Affiliated Managers Group, Inc. | | | 1.8 | |

| | 7. | | | Michael Kors Holdings Ltd. | | | 1.7 | |

| | 8. | | | Moody’s Corp. | | | 1.7 | |

| | 9. | | | Agilent Technologies, Inc. | | | 1.7 | |

| | 10. | | | Acuity Brands, Inc. | | | 1.6 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Consumer Discretionary | | | 23.7 | % |

| Industrials | | | 22.3 | |

| Information Technology | | | 19.1 | |

| Health Care | | | 13.9 | |

| Financials | | | 11.9 | |

| Energy | | | 4.7 | |

| Materials | | | 2.2 | |

| Short-Term Investment | | | 2.2 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | | 2/18/92 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 23.28 | % | | | 41.90 | % | | | 22.46 | % | | | 9.57 | % |

With Sales Charge** | | | | | | | 16.81 | | | | 34.48 | | | | 21.13 | | | | 8.98 | |

CLASS B SHARES | | | 1/14/94 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 22.97 | | | | 41.21 | | | | 21.82 | | | | 9.03 | |

With CDSC*** | | | | | | | 17.97 | | | | 36.21 | | | | 21.63 | | | | 9.03 | |

CLASS C SHARES | | | 11/4/97 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 22.97 | | | | 41.19 | | | | 21.81 | | | | 8.92 | |

With CDSC**** | | | | | | | 21.97 | | | | 40.19 | | | | 21.81 | | | | 8.92 | |

CLASS R2 SHARES | | | 6/19/09 | | | | 23.17 | | | | 41.68 | | | | 22.25 | | | | 9.40 | |

CLASS R5 SHARES | | | 11/1/11 | | | | 23.55 | | | | 42.53 | | | | 22.91 | | | | 9.92 | |

CLASS R6 SHARES | | | 11/1/11 | | | | 23.57 | | | | 42.59 | | | | 22.93 | | | | 9.93 | |

SELECT CLASS SHARES | | | 3/2/89 | | | | 23.45 | | | | 42.34 | | | | 22.82 | | | | 9.88 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| **** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

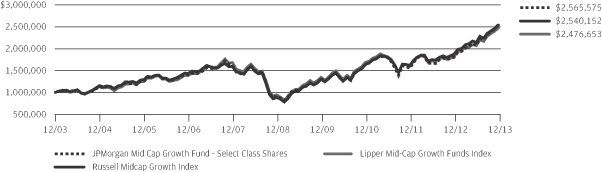

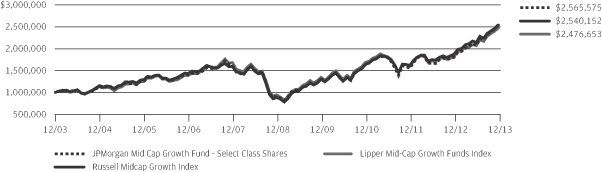

TEN YEAR PERFORMANCE (12/31/03 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for the Class R2, Class R5 and Class R6 Shares prior to their inception dates are based on the performance of Select Class Shares. Prior performance for Class R2 Shares has been adjusted to reflect the differences in expenses between classes. The actual returns of Class R5 and Class R6 Shares would have been different than those shown because Class R5 and Class R6 Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Mid Cap Growth Fund, the Russell Midcap Growth Index and the Lipper Mid-Cap Growth Funds Index from December 31, 2003 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The

performance of the Lipper Mid-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Growth Index is an unmanaged index which measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Lipper Mid-Cap Growth Funds Index is an index based on total returns of certain mutual funds as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 11 | |

JPMorgan Mid Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| Reporting Period Return: | | | |

| Fund (Institutional Class Shares)* | | | 14.52% | |

| Russell Midcap Value Index | | | 14.95% | |

| |

| Net Assets as of 12/31/2013 (In Thousands) | | $ | 14,825,753 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Value Fund (the “Fund”) seeks growth from capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) underperformed the Russell Midcap Value Index (the “Benchmark”) for the six months ended December 31, 2013. The Fund’s stock selection in the materials sector and its underweight position in the health care sector detracted from relative performance. The Fund’s stock selection and underweight position in the financials sector and its underweight position in the utilities sector contributed to relative performance.

Shares of real estate investment trusts Rayonier Inc. and HCP Inc. struggled as investor expectations of rising interest rates led to a de-emphasis on yield. Shares of Rayonier declined after the company’s 2014 pricing outlook indicated that price-per-unit declines might be structural. Investors responded by revising downward their long-term growth estimates for revenue and earnings, as well as the long-term outlook for the company’s dividends. Shares of HCP underperformed largely due to expectations of near-term headwinds, including a refinancing in February and the potential exercise of a buy option by one of its main tenants. The potentially more expensive debt from the refinancing and the reinvestment risks from the potential sale of assets are expected to meaningfully reduce income in 2014. The company also experienced a CEO change which introduced some uncertainty on future strategy.

Individual contributors to relative performance included the Fund’s positions in out-of-benchmark companies Ball Corp. and Idex Corp., and Dish Network Corp. Shares of Ball Corp., a metal and plastic packaging manufacturer, gained from better-than-expected volumes, earnings growth and a strong forecast of earnings growth. Shares of Idex, a maker of industrial and engineering equipment, jumped on its forecast of earnings and revenue growth and its announcement of a $300 million share repurchase plan. Shares of Dish Network, a provider of satellite television service, rose on the company’s aggressive moves to make deals and acquire companies that could help it expand beyond its core business.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection and sought to identify durable franchises possessing the ability to generate, in their view, sustainable levels of free cash flow. The portfolio continued to have a large overweight position in consumer discretionary stocks. The portfolio’s largest underweight position remained the financial sector due to the portfolio’s underweighting of REITs, based on their valuations. However, the Fund’s portfolio managers have been slowly and selectively adding positions in certain REITs that have niche business models.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Ball Corp. | | | 2.0 | % |

| | 2. | | | Marsh & McLennan Cos., Inc. | | | 1.9 | |

| | 3. | | | Loews Corp. | | | 1.8 | |

| | 4. | | | Ameriprise Financial, Inc. | | | 1.6 | |

| | 5. | | | Amphenol Corp., Class A | | | 1.6 | |

| | 6. | | | AutoZone, Inc. | | | 1.6 | |

| | 7. | | | Kohl’s Corp. | | | 1.6 | |

| | 8. | | | Fifth Third Bancorp | | | 1.5 | |

| | 9. | | | Gap, Inc. (The) | | | 1.5 | |

| | 10. | | | Arrow Electronics, Inc. | | | 1.5 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Financials | | | 27.0 | % |

| Consumer Discretionary | | | 20.0 | |

| Industrials | | | 10.2 | |

| Information Technology | | | 9.6 | |

| Utilities | | | 9.1 | |

| Materials | | | 7.8 | |

| Health Care | | | 4.7 | |

| Consumer Staples | | | 4.7 | |

| Energy | | | 4.6 | |

| Short-Term Investment | | | 2.3 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | | 4/30/01 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 14.22 | % | | | 31.34 | % | | | 19.95 | % | | | 10.01 | % |

With Sales Charge** | | | | | | | 8.20 | | | | 24.43 | | | | 18.67 | | | | 9.42 | |

CLASS B SHARES | | | 4/30/01 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 13.95 | | | | 30.71 | | | | 19.35 | | | | 9.55 | |

With CDSC*** | | | | | | | 8.95 | | | | 25.71 | | | | 19.16 | | | | 9.55 | |

CLASS C SHARES | | | 4/30/01 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 13.93 | | | | 30.66 | | | | 19.35 | | | | 9.44 | |

With CDSC**** | | | | | | | 12.93 | | | | 29.66 | | | | 19.35 | | | | 9.44 | |

CLASS R2 SHARES | | | 11/3/08 | | | | 14.07 | | | | 30.99 | | | | 19.64 | | | | 9.86 | |

INSTITUTIONAL CLASS SHARES | | | 11/13/97 | | | | 14.52 | | | | 31.99 | | | | 20.55 | | | | 10.56 | |

SELECT CLASS SHARES | | | 10/31/01 | | | | 14.39 | | | | 31.66 | | | | 20.25 | | | | 10.29 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| **** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

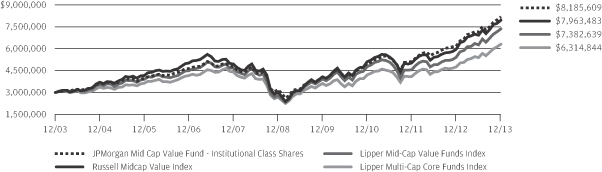

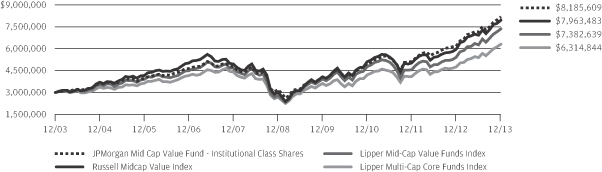

TEN YEAR PERFORMANCE (12/31/03 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 Shares prior to its inception date are based on the performance of Class A Shares. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Mid Cap Value Fund, the Russell Midcap Value Index, the Lipper Mid-Cap Value Funds Index and the Lipper Multi-Cap Core Funds Index from December 31, 2003 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Mid-Cap Value Funds Index and the Lipper Multi-Cap Core Funds Index includes

expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Value Index is an unmanaged index which measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The Lipper Mid-Cap Value Funds Index and the Lipper Multi-Cap Core Funds Index are indexes based on total returns of certain groups of mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because Class B Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 13 | |

JPMorgan Multi-Cap Market Neutral Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 1.61% | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.03% | |

| |

| Net Assets as of 12/31/13 (In Thousands) | | $ | 422,119 | |

INVESTMENT OBJECTIVE**

The JPMorgan Multi-Cap Market Neutral Fund (the “Fund”) seeks long-term capital preservation and growth by using strategies designed to produce returns which have no correlation with general domestic market performance.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index for the six months ended December 31, 2013.

The Fund’s portfolio managers employed a quantitative bottom-up approach for their stock selection process, focusing on both valuation and fundamentals. The valuation stock selection model seeks to determine how a stock is priced relative to what the Fund’s portfolio managers believe is its intrinsic value by considering valuation factors such as a company’s cash flow and price-to-book values. The fundamental stock selection model attempts to identify how healthy a company’s short-term operating trends are by using metrics such as stock price momentum and earnings momentum.

During the reporting period, the Fund’s stock selection process produced positive returns in the industrials and health care sectors and negative returns in the energy and consumer staples sectors.

Individual contributors to Fund returns included long positions in Pitney Bowes Inc., Yahoo! Inc. and United Therapeutics Corp. Shares of Pitney Bowes, a maker of mail processing equipment, software and services, rose on the company’s good cash flow and expanding profit margins. Shares of Yahoo, an online portal, rose on its acquisition of Tumblr and investors response to Chief Executive Marissa Mayer’s strategic plans. Shares of United Therapeutics, a biotechnology company, climbed after the U.S. Food and Drug Administration approved the company’s oral formulation of its high blood pressure drug.

Individual detractors from Fund returns included short positions in Stratasys Ltd., United Natural Foods Inc. and athenahealth Inc. Shares of Stratasys, a maker of three-dimensional printers and materials, rose on the company’s upward revisions to its forecast for revenue and earnings growth. Shares of

United Natural, a distributor of natural foods and products, gained from growth in quarterly earnings and sales. Shares of athenahealth, a provider of business services to the health care sector, benefited from positive comments from several securities analysts and from a general increase in health care stocks overall.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing a portfolio based on company fundamentals, quantitative screening and proprietary fundamental analysis. The Fund’s portfolio managers sought to identify dominant franchises with predictable business models deemed capable of achieving, in their view, sustained growth, as well as undervalued companies with the potential to grow their intrinsic value per share.

| | | | | | | | |

| TOP TEN LONG POSITIONS OF THE PORTFOLIO*** | |

| | 1. | | | Pitney Bowes, Inc. | | | 1.1 | % |

| | 2. | | | R.R. Donnelley & Sons Co. | | | 1.1 | |

| | 3. | | | Activision Blizzard, Inc. | | | 1.1 | |

| | 4. | | | Manpowergroup, Inc. | | | 1.1 | |

| | 5. | | | Computer Sciences Corp. | | | 1.0 | |

| | 6. | | | Yahoo!, Inc. | | | 1.0 | |

| | 7. | | | Omnicare, Inc. | | | 1.0 | |

| | 8. | | | United Therapeutics Corp. | | | 1.0 | |

| | 9. | | | Western Digital Corp. | | | 1.0 | |

| | 10. | | | Medtronic, Inc. | | | 1.0 | |

| | | | | | | | |

| TOP TEN SHORT POSITIONS OF THE PORTFOLIO**** | |

| | 1. | | | Hain Celestial Group, Inc. (The) | | | 1.2 | % |

| | 2. | | | Salesforce.com, Inc. | | | 1.2 | |

| | 3. | | | Copart, Inc. | | �� | 1.2 | |

| | 4. | | | Stratasys Ltd. | | | 1.1 | |

| | 5. | | | Brown-Forman Corp., Class B | | | 1.1 | |

| | 6. | | | United Natural Foods, Inc. | | | 1.1 | |

| | 7. | | | Paychex, Inc. | | | 1.1 | |

| | 8. | | | Trimble Navigation Ltd. | | | 1.1 | |

| | 9. | | | McDermott International, Inc. | | | 1.1 | |

| | 10. | | | Charter Communications, Inc., Class A | | | 1.1 | |

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

| | | | |

LONG POSITION PORTFOLIO COMPOSITION BY SECTOR*** | |

| Information Technology | | | 20.1 | % |

| Industrials | | | 16.6 | |

| Consumer Discretionary | | | 15.1 | |

| Health Care | | | 11.5 | |

| Consumer Staples | | | 7.9 | |

| Energy | | | 7.2 | |

| Financials | | | 5.5 | |

| Materials | | | 5.5 | |

| Utilities | | | 2.7 | |

| Telecommunication Services | | | 1.4 | |

| Short-Term Investment | | | 6.5 | |

| | | | |

SHORT POSITION PORTFOLIO COMPOSITION BY SECTOR**** | |

| Information Technology | | | 20.5 | % |

| Industrials | | | 18.9 | |

| Consumer Discretionary | | | 15.1 | |

| Health Care | | | 12.2 | |

| Energy | | | 8.9 | |

| Consumer Staples | | | 8.9 | |

| Financials | | | 7.0 | |

| Materials | | | 4.6 | |

| Utilities | | | 3.2 | |

| Telecommunication Services | | | 0.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total long investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| **** | | Percentages indicated are based on total short investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 15 | |

JPMorgan Multi-Cap Market Neutral Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | | 5/23/03 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 1.43 | % | | | 4.09 | % | | | (0.28 | )% | | | 1.04 | % |

With Sales Charge** | | | | | | | (3.87 | ) | | | (1.39 | ) | | | (1.35 | ) | | | 0.50 | |

CLASS B SHARES | | | 5/23/03 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 1.29 | | | | 3.51 | | | | (0.97 | ) | | | 0.44 | |

With CDSC*** | | | | | | | (3.71 | ) | | | (1.49 | ) | | | (1.39 | ) | | | 0.44 | |

CLASS C SHARES | | | 5/23/03 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 1.18 | | | | 3.51 | | | | (0.99 | ) | | | 0.31 | |

With CDSC**** | | | | | | | 0.18 | | | | 2.51 | | | | (0.99 | ) | | | 0.31 | |

SELECT CLASS SHARES | | | 5/23/03 | | | | 1.61 | | | | 4.34 | | | | (0.02 | ) | | | 1.29 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| **** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

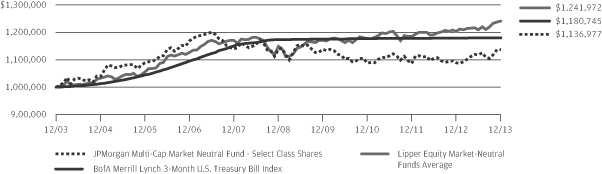

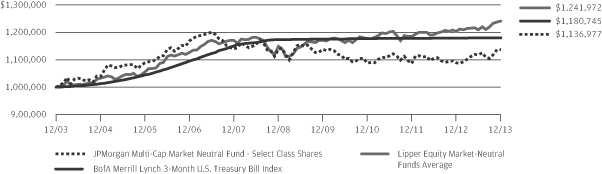

TEN YEAR PERFORMANCE (12/31/03 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Multi-Cap Market Neutral Fund, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index and the Lipper Equity Market-Neutral Funds Average from December 31, 2003 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund’s inception. The performance of the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Equity Market-Neutral Funds Average includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is

comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index. The Lipper Equity Market-Neutral Funds Average is an average based on the total returns of all mutual funds within the Fund’s designated category as determined by Lipper, Inc.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Because the Class B Shares automatically convert to Class A Shares after eight years, the since inception average annual total return shown above for Class B reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

JPMorgan Value Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Institutional Class Shares)* | | | 13.72% | |

| Russell 3000 Value Index | | | 14.60% | |

| |

| Net Assets as of 12/31/2013 (In Thousands) | | $ | 5,458,712 | |

INVESTMENT OBJECTIVE**

The JPMorgan Value Advantage Fund (the “Fund”) seeks to provide long-term total return from a combination of income and capital gains.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) underperformed the Russell 3000 Value Index (the “Benchmark”) for the six months ended December 31, 2013. The Fund’s stock selection in the materials sector and the materials sector were leading detractors from relative performance, while the Fund’s stock selection in the financials sector and the energy sector were leading contributors to relative performance.

Individual detractors from relative performance included Rayonier Inc., Cisco Systems Inc. and Xcel Energy Inc. Shares of Rayonier, a real estate investment trust that also provides forest products and performance fibers, fell after the company posted significantly lower than expected earnings. Shares of Cisco, a provider of networking products and services, fell on weakness in orders from emerging markets. Shares of Xcel Energy, an electricity and natural gas utility, performed well during the period but the Fund’s lack of a position in the stock hurt performance relative to the Benchmark.

Individual contributors to relative performance included Exxon Mobil Corp., Capital One Financial Corp. and Wells Fargo & Co. Shares of Exxon, an integrated oil and natural gas company, rose on news of its joint venture with Russian oil giant Rosneft, and on expectations of rising demand amid global economic growth. Shares of Capital One, a banking and credit-card lender, gained from better-than-expected earnings. Shares of Wells Fargo, a financial services company, weakened on expectations that rising interest rates would curb demand for the company’s residential mortgage business.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection and sought to identify durable franchises possessing the ability to generate, in their view, significant levels of free cash flow. The portfolio’s largest overweight continued to be the consumer discretionary sector, where the

Fund’s portfolio managers found what they believed to be compelling investment opportunities. The portfolio’s largest underweight was the industrials sector. In addition, the portfolio’s 2013 relative performance was hindered by above-average cash holdings. The cash position accrued because the Fund’s portfolio managers believed valuations were stretched and they did not want to invest in overvalued securities.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Exxon Mobil Corp. | | | 4.4 | % |

| | 2. | | | Wells Fargo & Co. | | | 4.1 | |

| | 3. | | | Pfizer, Inc. | | | 2.2 | |

| | 4. | | | Capital One Financial Corp. | | | 2.1 | |

| | 5. | | | Loews Corp. | | | 1.8 | |

| | 6. | | | Merck & Co., Inc. | | | 1.7 | |

| | 7. | | | Bank of America Corp. | | | 1.7 | |

| | 8. | | | Johnson & Johnson | | | 1.7 | |

| | 9. | | | Kohl’s Corp. | | | 1.6 | |

| | 10. | | | AutoZone, Inc. | | | 1.5 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Financials | | | 30.4 | % |

| Consumer Discretionary | | | 16.4 | |

| Energy | | | 9.4 | |

| Health Care | | | 9.4 | |

| Utilities | | | 6.5 | |

| Information Technology | | | 6.1 | |

| Industrials | | | 5.8 | |

| Consumer Staples | | | 5.6 | |

| Materials | | | 3.0 | |

| Telecommunication Services | | | 1.0 | |

| Short-Term Investment | | | 6.4 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2013. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2013 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 17 | |

JPMorgan Value Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2013 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2013 | |

| | | | | |

| | | INCEPTION DATE

OF CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | 2/28/05 | | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 13.43 | % | | | 31.59 | % | | | 20.65 | % | | | 9.41 | % |

With Sales Charge** | | | | | | | 7.45 | | | | 24.66 | | | | 19.36 | | | | 8.75 | |

CLASS C SHARES | | | 2/28/05 | | | | | | | | | | | | | | | | | |

Without CDSC | | | | | | | 13.18 | | | | 30.95 | | | | 20.04 | | | | 8.87 | |

With CDSC*** | | | | | | | 12.18 | | | | 29.95 | | | | 20.04 | | | | 8.87 | |

INSTITUTIONAL CLASS SHARES | | | 2/28/05 | | | | 13.72 | | | | 32.27 | | | | 21.26 | | | | 9.90 | |

SELECT CLASS SHARES | | | 2/28/05 | | | | 13.57 | | | | 31.93 | | | | 20.94 | | | | 9.69 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

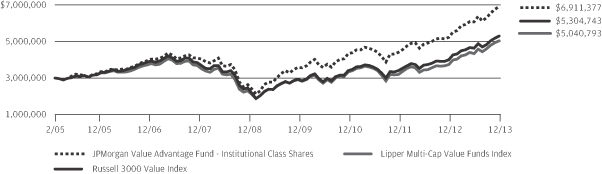

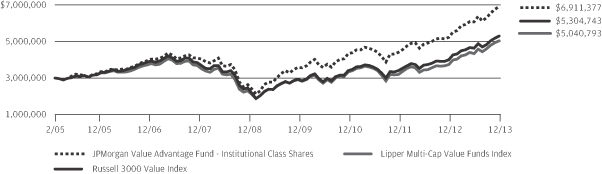

LIFE OF FUND PERFORMANCE (2/28/05 TO 12/31/13)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 28, 2005.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Value Advantage Fund, the Russell 3000 Value Index and the Lipper Multi-Cap Value Funds Index from February 28, 2005 to December 31, 2013. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 3000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Multi-Cap Value Funds Index includes expenses associated with a mutual fund, such as investment

management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 3000 Value Index is an unmanaged index which measures the performance of those Russell 3000 companies (largest 3000 U.S. companies) with lower price-to-book ratios and lower forecasted growth values. The Lipper Multi-Cap Value Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 18 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2013 |

JPMorgan Growth Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2013 (Unaudited)

(Amounts in thousands)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| Common Stocks — 97.4% | | | | |

| | | | Consumer Discretionary — 20.0% | | | | |

| | | | Automobiles — 2.8% | | | | |

| | 955 | | | Harley-Davidson, Inc. | | | 66,110 | |

| | 105 | | | Tesla Motors, Inc. (a) | | | 15,715 | |

| | | | | | | | |

| | | | | | | 81,825 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 3.9% | | | | |

| | 762 | | | Apollo Global Management LLC, Class A | | | 24,092 | |

| | 1,089 | | | Hilton Worldwide Holdings, Inc. (a) | | | 24,239 | |

| | 399 | | | Las Vegas Sands Corp. | | | 31,454 | |

| | 461 | | | Starbucks Corp. | | | 36,122 | |

| | | | | | | | |

| | | | | | | 115,907 | |

| | | | | | | | |

| | | | Household Durables — 1.3% | | | | |

| | 266 | | | Mohawk Industries, Inc. (a) | | | 39,592 | |

| | | | | | | | |

| | | | Internet & Catalog Retail — 4.3% | | | | |

| | 158 | | | Amazon.com, Inc. (a) | | | 62,969 | |

| | 68 | | | Netflix, Inc. (a) | | | 24,888 | |

| | 32 | | | priceline.com, Inc. (a) | | | 37,662 | |

| | | | | | | | |

| | | | | | | 125,519 | |

| | | | | | | | |

| | | | Specialty Retail — 4.7% | | | | |

| | 270 | | | Advance Auto Parts, Inc. | | | 29,906 | |

| | 812 | | | GameStop Corp., Class A | | | 40,019 | |

| | 526 | | | Home Depot, Inc. (The) | | | 43,278 | |

| | 446 | | | Williams-Sonoma, Inc. | | | 26,004 | |

| | | | | | | | |

| | | | | | | 139,207 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 3.0% | | | | |

| | 512 | | | Lululemon Athletica, Inc., (Canada) (a) | | | 30,223 | |

| | 483 | | | Michael Kors Holdings Ltd., (Hong Kong) (a) | | | 39,239 | |

| | 601 | | | Wolverine World Wide, Inc. | | | 20,397 | |

| | | | | | | | |

| | | | | | | 89,859 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 591,909 | |

| | | | | | | | |

| | | | Energy — 4.8% | | | | |

| | | | Energy Equipment & Services — 1.5% | | | | |