UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08189

J.P. Morgan Fleming Mutual Fund Group, Inc.

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2015 through December 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

J.P. Morgan Mid Cap/Multi-Cap Funds

December 31, 2015 (Unaudited)

JPMorgan Growth Advantage Fund

JPMorgan Mid Cap Equity Fund

JPMorgan Mid Cap Growth Fund

JPMorgan Mid Cap Value Fund

JPMorgan Multi-Cap Market Neutral Fund

JPMorgan Value Advantage Fund

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

January 29, 2016 (Unaudited)

Dear Shareholders,

The past six months have cemented key divergences between the U.S. and the rest of the world and between developed market economies and emerging market economies. In the face of slowing economic growth in China and a tentative economic recovery in Europe, U.S. employment and consumer spending were strong enough to persuade the U.S. Federal Reserve (the “Fed”) to raise interest rates in December for the first time in a decade.

| | |

| | “Investors may take comfort from a relatively healthy U.S. economy and the stated determination of central banks in China, the European Union and elsewhere to support both economic growth and financial markets.” |

While U.S. equity and bond markets posted small positive returns for the six month period, the broader U.S. economy continued to strengthen. Unemployment dropped to 5.0% and remained there for the final three months of 2015, the lowest levels since April 2008. Thanks to cheap gasoline, easy credit and overall economic improvement, the U.S. auto industry continued to show strong sales growth through the second half of 2015, on pace for an all-time high of 17.5 million vehicles for the full year. While U.S. wage growth had averaged 2% throughout most of the post financial crisis recovery, U.S. wages rose 2.5% from one year earlier in both October and December 2015.

While the Fed determined the domestic economy was healthy enough to move toward normalized interest rate policy, U.S. gross domestic product fluctuated throughout 2015 and slowed to 2.0% in the July-September period and an estimated 0.7% in the October-December period. It became apparent during the second half of 2015, that economic weakness in both developed and emerging markets was a significant drag on U.S. growth. Furthermore, the strength of the U.S. dollar against other currencies — particularly those of emerging market exporting nations — put U.S. exports at a comparative disadvantage.

Against this backdrop, demand for oil and most other commodities decreased. Prices for energy, metals, foods and precious metals were trading at levels not seen since the 1990s. While an oversupply of petroleum and natural gas hurt global energy prices, slowing economic growth in China and the nation’s transition away from a decade-long construction boom reduced demand for a range of other basic materials. The consequences of China’s shrinking appetite for raw materials are sobering: In 2014, the latest available full year of data, China consumed an estimated 60% of the world’s iron ore, 50% of its copper, 48% of its aluminum, 47% of its zinc, 45% of its nickel and 12% of its crude oil.

China’s slowing economy and the accompanying financial market turmoil held investors’ attention for most of the second half of 2015. After posting year-to-date gains that reached 30% in the first half of the year, Chinese equity prices began to fall in June. While Chinese authorities undertook a range of actions to bolster economic growth and stabilize financial markets — including a 2% devaluation of the yuan — the “Black Monday” sell-off that originated in the Shanghai and Shenzhen markets on August 24th dragged the Standard & Poor’s 500 Index (S&P 500) down 3.9% for the day.

U.S. equity prices remained subdued through September and finally rebounded in October and the S&P 500 posted its best monthly performance since October 2011. Overall, U.S. equities markets in the second half of 2015 were marked by large gains in a few stocks — particularly those of large cap technology companies — while a large number of stocks underperformed and the median stock was flat for the year. Notably, U.S mergers and acquisitions activity in 2015 had surpassed previous records by November and in December the U.S. bull market for equities reached 82 consecutive months. For the six months ended December 31, 2015, the S&P 500 returned 0.15% and closed 4.08% below its all-time high, reached on May 21, 2015.

Investors endured a sharp increase in financial market volatility over the past six months. Selling in China’s financial markets, struggling commodities prices and uncertainty about global economic growth all fueled market gyrations. However, the Fed removed a key uncertainty in December when it lifted interest rates. Investors may take comfort from a relatively healthy U.S. economy and the stated determination of central banks in China, the European Union and elsewhere to support both economic growth and financial markets. However, increased market volatility and the divergent performance of developed and emerging market economies may be best managed through a properly diversified portfolio and a patient approach to investing.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management,

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 1 | |

J.P. Morgan Mid Cap/Multi-Cap Funds

MARKET OVERVIEW

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

U.S. equities financial markets provided slim returns for the second half of 2015. Global weakness in commodities prices, slowing economic growth in China, anxiety over U.S. interest rate policy and slowing growth in corporate earnings combined to put pressure on equity prices during the summer months.

In mid-August, Chinese authorities devalued the yuan by 2% amid declines in the Shanghai and Shenzhen equity markets. A global sell-off followed on August 24th, dragging down the Standard & Poor’s 500 Index (“S&P 500”) by 3.9% for the day.

However, U.S. equity markets rebounded in October as China’s central bank undertook further actions to bolster domestic financial markets and the U.S. Federal Reserve held interest rates at historically low levels. The S&P 500 turned in its best one-month performance since October 2011.

In general, the U.S. equities market for the six month reporting period was marked by large gains in a few select stocks, especially technology sector stocks, while most other stocks ended the period lower or essentially flat. The energy, materials and industrials sectors underperformed the broader market, while the consumer discretionary, consumer staples and health care sectors outperformed the broader market. Over the reporting period, growth stocks generally outperformed value stocks and small cap stocks generally underperformed both mid cap and large cap stocks. For the six months ended December 31, 2015, the S&P 500 returned 0.15% and the Russell Mid Cap Index returned -4.68%.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

JPMorgan Growth Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class A Shares, without a sales charge)* | | | -1.19% | |

| Russell 3000 Growth Index | | | 0.73% | |

| |

| Net Assets as of 12/31/2015 (In Thousands) | | | $6,474,576 | |

INVESTMENT OBJECTIVE**

The JPMorgan Growth Advantage Fund (the “Fund”) seeks to provide long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Class A Shares, without a sales charge) underperformed the Russell 3000 Growth Index (the “Benchmark”) for the six months ended December 31, 2015. The Fund’s security selection in the health care and financial services sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and consumer discretionary sectors was a leading positive contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Valeant Pharmaceuticals International Inc., Range Resources Corp. and Nimble Storage Inc. Shares of Valeant Pharmaceuticals, a drug maker not held in the Benchmark, fell amid questions about its revenue accounting practices. Shares of Range Resources, an oil and gas producer, declined on global weakness in energy prices. Shares of Nimble Storage, a data storage provider, declined after the company lowered its forecast for earnings and revenue.

Leading individual contributors to relative performance included the Fund’s overweight positions in Acuity Brands Inc., Amazon.com Inc. and Facebook Inc. Shares of Acuity Brands, a maker of commercial and residential lighting, rose on better-than-expected quarterly results amid growth in the U.S. construction sector. Shares of Amazon.com, an online retailer not held in the Benchmark, rose on continued expansion of its business and an overall increase in online shopping during the 2015 holiday season. Shares of Facebook, an online social media business, rose on growth in advertising sales.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies across

market capitalizations in an effort to construct portfolios of stocks that have strong fundamentals. The Fund’s portfolio managers sought to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Alphabet, Inc., Class C | | | 5.2 | % |

| | 2. | | | Facebook, Inc., Class A | | | 4.2 | |

| | 3. | | | Amazon.com, Inc. | | | 3.5 | |

| | 4. | | | Apple, Inc. | | | 2.5 | |

| | 5. | | | Acuity Brands, Inc. | | | 2.2 | |

| | 6. | | | Regeneron Pharmaceuticals, Inc. | | | 2.2 | |

| | 7. | | | Gilead Sciences, Inc. | | | 2.2 | |

| | 8. | | | UnitedHealth Group, Inc. | | | 2.0 | |

| | 9. | | | MasterCard, Inc., Class A | | | 2.0 | |

| | 10. | | | Home Depot, Inc. (The) | | | 2.0 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Information Technology | | | 34.2 | % |

| Consumer Discretionary | | | 18.6 | |

| Health Care | | | 17.2 | |

| Industrials | | | 12.5 | |

| Financials | | | 7.7 | |

| Materials | | | 4.1 | |

| Consumer Staples | | | 1.6 | |

| Energy | | | 1.5 | |

| Short-Term Investment | | | 2.6 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 3 | |

JPMorgan Growth Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | October 29, 1999 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | (1.19 | )% | | | 8.54 | % | | | 14.34 | % | | | 10.38 | % |

With Sales Charge** | | | | | (6.36 | ) | | | 2.86 | | | | 13.13 | | | | 9.79 | |

CLASS C SHARES | | May 1, 2006 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (1.46 | ) | | | 8.04 | | | | 13.80 | | | | 9.79 | |

With CDSC*** | | | | | (2.46 | ) | | | 7.04 | | | | 13.80 | | | | 9.79 | |

CLASS R5 SHARES | | January 8, 2009 | | | (0.96 | ) | | | 9.03 | | | | 14.82 | | | | 10.77 | |

CLASS R6 SHARES | | December 23, 2013 | | | (0.90 | ) | | | 9.16 | | | | 14.86 | | | | 10.79 | |

SELECT CLASS SHARES | | May 1, 2006 | | | (1.10 | ) | | | 8.71 | | | | 14.56 | | | | 10.61 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

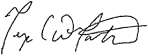

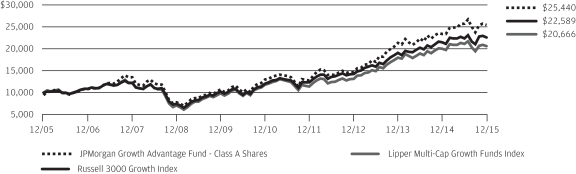

TEN YEAR PERFORMANCE (12/31/05 TO 12/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for the Class C Shares prior to its inception date are based on the performance of Class B Shares, all of which converted to Class A Shares on June 19, 2015 and are no longer offered. The actual returns of Class C Shares would have been similar to those shown because Class C Shares had similar expenses to Class B Shares at the time of their inception.

Returns for the Select Class Shares prior to its inception date are based on the performance of Class A Shares. During this period, the actual returns of Select Class Shares would have been different than those shown because Select Class Shares have different expenses than Class A Shares.

Returns for Class R5 Shares prior to its inception date are based on the performance of Select Class Shares from May 1, 2006 to January 7, 2009 and Class A Shares prior to May 1, 2006. The actual returns of Class R5 Shares would have been different than those shown because Class R5 Shares have different expenses than Select Class and Class A Shares.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class R5 Shares from January 8, 2009 to December 23, 2013, Select Class Shares from May 1, 2006 to January 8, 2009 and Class A Shares prior to May 1, 2006. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than the other classes.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Growth Advantage Fund, the Russell 3000 Growth Index and the Lipper Multi-Cap Growth Funds Index from December 31, 2005 to December 31, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Russell 3000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Multi-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell 3000 Growth Index is an unmanaged index which measures the performance of those Russell 3000 companies (largest 3000 U.S. companies) with higher price-to-book ratios and higher forecasted growth values. The Lipper Multi-Cap Growth Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

JPMorgan Mid Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | -5.43% | |

| Russell Midcap Index | | | -4.68% | |

| |

| Net Assets as of 12/31/2015 (In Thousands) | | $ | 3,215,761 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Equity Fund (the “Fund”) seeks long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) underperformed the Russell Midcap Index (the “Benchmark”) for the six months ended December 31, 2015. The Fund’s security selection in the health care and consumer discretionary sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the materials & processing and producer durables sectors was a leading positive contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Energen Corp., Southwestern Energy Co. and Brookdale Senior Living Inc. Shares of oil and natural gas producers Energen and Southwest Energy declined on continued weakness in global energy prices. Shares of Brookdale, an operator of assisted living and retirement homes, fell on lower-than-expected earnings and the company’s reduced earnings forecast.

Leading individual contributors to relative performance included the Fund’s overweight positions in Acuity Brands Inc., Delta Air Lines Inc. and Netflix.com Inc. Acuity Brands, a maker of commercial and residential lighting that was not held in the Benchmark, rose on strength in its LED lighting business and market share gains. Shares of Delta Air Lines rose amid lower fuel costs and increased U.S. consumer spending. Shares of Netflix, an Internet television programming provider, rose on increased subscriptions and growth in its business.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing a portfolio based on company fundamentals, quantitative screening and proprietary fundamental analysis. The Fund’s portfolio managers sought to identify dominant franchises with predictable business models

deemed capable of achieving, in their view, sustained growth, as well as undervalued companies with the potential to grow their intrinsic value per share.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Mohawk Industries, Inc. | | | 2.0 | % |

| | 2. | | | Humana, Inc. | | | 1.4 | |

| | 3. | | | Amphenol Corp., Class A | | | 1.3 | |

| | 4. | | | Carlisle Cos., Inc. | | | 1.3 | |

| | 5. | | | Acuity Brands, Inc. | | | 1.3 | |

| | 6. | | | Fortune Brands Home & Security, Inc. | | | 1.2 | |

| | 7. | | | Sherwin-Williams Co. (The) | | | 1.2 | |

| | 8. | | | CBRE Group, Inc., Class A | | | 1.2 | |

| | 9. | | | Delta Air Lines, Inc. | | | 1.2 | |

| | 10. | | | McGraw Hill Financial, Inc. | | | 1.0 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Financials | | | 20.8 | % |

| Consumer Discretionary | | | 19.5 | |

| Information Technology | | | 17.1 | |

| Industrials | | | 13.5 | |

| Health Care | | | 9.7 | |

| Materials | | | 4.6 | |

| Consumer Staples | | | 4.4 | |

| Utilities | | | 4.4 | |

| Energy | | | 3.3 | |

| Short-Term Investment | | | 2.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 5 | |

JPMorgan Mid Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | November 2, 2009 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | (5.60 | )% | | | (0.22 | )% | | | 11.98 | % | | | 8.46 | % |

With Sales Charge** | | | | | (10.55 | ) | | | (5.46 | ) | | | 10.78 | | | | 7.87 | |

CLASS C SHARES | | November 2, 2009 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (5.84 | ) | | | (0.70 | ) | | | 11.43 | | | | 8.12 | |

With CDSC*** | | | | | (6.84 | ) | | | (1.70 | ) | | | 11.43 | | | | 8.12 | |

CLASS R2 SHARES | | March 14, 2014 | | | (5.72 | ) | | | (0.47 | ) | | | 11.88 | | | | 8.41 | |

CLASS R5 SHARES | | March 14, 2014 | | | (5.39 | ) | | | 0.24 | | | | 12.42 | | | | 8.71 | |

CLASS R6 SHARES | | March 14, 2014 | | | (5.37 | ) | | | 0.29 | | | | 12.44 | | | | 8.72 | |

SELECT CLASS SHARES | | January 1, 1997 | | | (5.43 | ) | | | 0.15 | | | | 12.38 | | | | 8.69 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

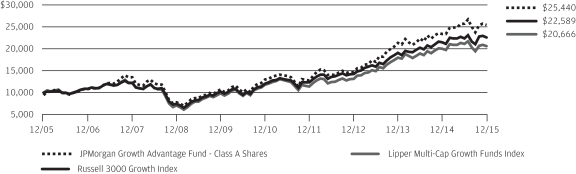

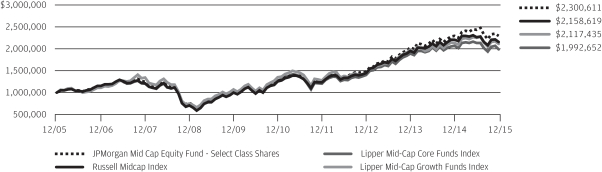

TEN YEAR PERFORMANCE (12/31/05 TO 12/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class A and Class C Shares prior to their inception date are based on the performance of Select Class Shares. The actual returns of Class A and Class C Shares would have been lower than those shown because Class A and Class C Shares have higher expenses than Select Class Shares.

Returns for Class R2 Shares prior to their inception date are based of Class A Shares from November 2, 2009 to March 13, 2014 and Select Class Shares prior to November 2, 2009. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A and Select Class Shares.

Returns for Class R5 and Class R6 Shares prior to their inception date are based on the performance of Select Class Shares. The actual returns of Class R5 and Class R6 Shares would have been different because Class R5 and Class R6 Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in the Select Class Shares of JPMorgan Mid Cap Equity Fund, the Russell Midcap Index, Lipper Mid-Cap Core Funds Index and the Lipper Mid-Cap Growth Funds Index from December 31, 2005 to December 31, 2015. The performance of the Fund

assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Mid-Cap Core Funds Index and Lipper Mid-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Index is an unmanaged index which measures the performance of the 800 smallest companies in the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index and the Lipper Mid-Cap Growth Funds Index are indices based on total returns of certain mutual funds within the mid cap fund categories as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

JPMorgan Mid Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Select Class Shares)* | | | -6.86% | |

| Russell Midcap Growth Index | | | -4.20% | |

| |

| Net Assets as of 12/31/2015 (In Thousands) | | $ | 2,866,011 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Growth Fund (the “Fund”) seeks growth of capital.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) underperformed the Russell Midcap Growth Index (the “Benchmark”) for the six months ended December 31, 2015. The Fund’s security selection in the health care and financial services sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the materials & processing sector and the technology sector was a leading positive contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Horizon Pharma PLC., Range Resources Corp. and Envision Healthcare Holdings Inc. Shares of Horizon Pharmaceuticals, a specialty drug maker not held in the Benchmark, fell on its failed takeover bid for Depomed Inc. and its acquisition of Crealta Holdings. Shares of Range Resources, an oil and gas company, declined amid overall weakness in global energy prices. Shares of Envision Healthcare, a provider of health care services, fell after the company reduced its earnings forecast.

Leading individual contributors to relative performance included the Fund’s overweight positions in Acuity Brands Inc., Delta Air Lines Inc. and Netflix.com Inc. Shares of Acuity Brands, a maker of commercial and residential lighting, rose on strength in its LED lighting business and market share gains. Shares of Delta Air Lines rose amid lower fuel costs and increased U.S. consumer spending. Shares of Netflix, an Internet television programming provider, rose on increased subscriptions and growth in its business.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies in an effort

to construct a portfolio of stocks that have strong fundamentals. The Fund’s portfolio managers sought to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings growth.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Acuity Brands, Inc. | | | 2.5 | % |

| | 2. | | | CBRE Group, Inc., Class A | | | 2.2 | |

| | 3. | | | Delta Air Lines, Inc. | | | 2.2 | |

| | 4. | | | Mohawk Industries, Inc. | | | 2.2 | |

| | 5. | | | McGraw Hill Financial, Inc. | | | 2.0 | |

| | 6. | | | Electronic Arts, Inc. | | | 2.0 | |

| | 7. | | | Harris Corp. | | | 1.9 | |

| | 8. | | | Dollar General Corp. | | | 1.9 | |

| | 9. | | | Monster Beverage Corp. | | | 1.8 | |

| | 10. | | | Ulta Salon Cosmetics & Fragrance, Inc. | | | 1.8 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Information Technology | | | 24.8 | % |

| Consumer Discretionary | | | 21.6 | |

| Industrials | | | 17.7 | |

| Health Care | | | 13.8 | |

| Financials | | | 10.3 | |

| Materials | | | 4 .1 | |

| Consumer Staples | | | 2 .8 | |

| Energy | | | 1 .6 | |

Short-Term Investment | | | 3 .3 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 7 | |

JPMorgan Mid Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 18, 1992 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | (6.99 | )% | | | 2.51 | % | | | 11.80 | % | | | 8.55 | % |

With Sales Charge** | | | | | (11.89 | ) | | | (2.86 | ) | | | 10.60 | | | | 7.97 | |

CLASS C SHARES | | November 4, 1997 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (7.23 | ) | | | 1.97 | | | | 11.25 | | | | 7.95 | |

With CDSC*** | | | | | (8.23 | ) | | | 0.97 | | | | 11.25 | | | | 7.95 | |

CLASS R2 SHARES | | June 19, 2009 | | | (7.07 | ) | | | 2.32 | | | | 11.63 | | | | 8.38 | |

CLASS R5 SHARES | | November 1, 2011 | | | (6.81 | ) | | | 2.94 | | | | 12.29 | | | | 8.93 | |

CLASS R6 SHARES | | November 1, 2011 | | | (6.76 | ) | | | 3.01 | | | | 12.34 | | | | 8.96 | |

SELECT CLASS SHARES | | March 2, 1989 | | | (6.85 | ) | | | 2.81 | | | | 12.15 | | | | 8.87 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

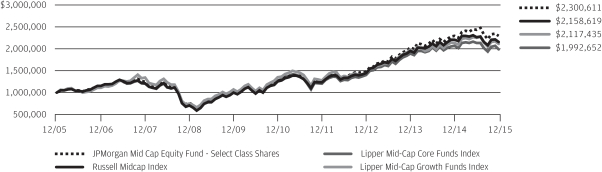

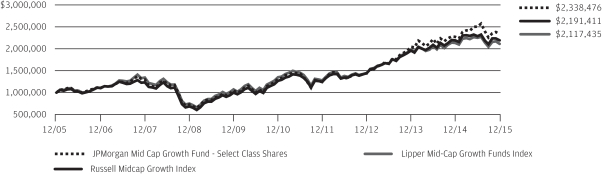

TEN YEAR PERFORMANCE (12/31/05 TO 12/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for the Class R2, Class R5 and Class R6 Shares prior to their inception dates are based on the performance of Select Class Shares. Prior performance for Class R2 Shares has been adjusted to reflect the differences in expenses between classes. The actual returns of Class R5 and Class R6 Shares would have been different than those shown because Class R5 and Class R6 Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Mid Cap Growth Fund, the Russell Midcap Growth Index and the Lipper Mid-Cap Growth Funds Index from December 31, 2005 to December 31, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual

fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Mid-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Growth Index is an unmanaged index which measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Lipper Mid-Cap Growth Funds Index is an index based on total returns of certain mutual funds as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

JPMorgan Mid Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Institutional Class Shares)* | | | -3.93% | |

| Russell Midcap Value Index | | | -5.17% | |

| |

| Net Assets as of 12/31/2015 (In Thousands) | | $ | 14,700,150 | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Value Fund (the “Fund”) seeks growth from capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) outperformed the Russell Midcap Value Index (the “Benchmark”) for the six months ended December 31, 2015. The Fund’s security selection in the materials sector and its underweight position in the energy sector were leading contributors to performance relative to the Benchmark, while the Fund’s security selection and overweight position in the consumer discretionary sector and its security section and underweight position in the utilities sector were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Jack Henry & Associates Inc. and Chubb Corp. and its underweight position in Freeport-McMoRan Inc. Shares of Jack Henry, a provider of data processing systems to the financial services sector that was not included in the Benchmark, rose on better than expected earnings and revenue amid increased market share. Shares of Chubb, an insurance company not held in the Fund, rose on news of its acquisition by Ace Ltd. Shares of Freeport-Mc MoRan, a copper mining and petroleum producer not held in the Fund, fell on weak global commodities prices, particularly for copper and oil.

Leading individual detractors from relative performance included the Fund’s overweight positions in Energen Corp., Gap Inc. and EQT Corp. Shares of Energen, an oil and gas exploration company, fell amid low energy prices and general weakness in the energy sector. Shares of Gap, an apparel retailer not held in the Benchmark, fell on sales weakness due to the relative strength of the U.S. dollar and disappointing holiday season sales at its Old Navy brand. Shares of EQT, a natural gas producer and transporter, fell amid continued weakness in global energy prices.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection and sought to identify durable franchises

possessing the ability to generate, in their view, sustainable levels of free cash flow.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Jack Henry & Associates, Inc. | | | 1.9 | % |

| | 2. | | | M&T Bank Corp. | | | 1.8 | |

| | 3. | | | Mohawk Industries, Inc. | | | 1.8 | |

| | 4. | | | Loews Corp. | | | 1.6 | |

| | 5. | | | Arrow Electronics, Inc. | | | 1.5 | |

| | 6. | | | Fifth Third Bancorp | | | 1.5 | |

| | 7. | | | Energen Corp. | | | 1.5 | |

| | 8. | | | Synopsys, Inc. | | | 1.5 | |

| | 9. | | | SunTrust Banks, Inc. | | | 1.5 | |

| | 10. | | | Kroger Co. (The) | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Financials | | | 32.2 | % |

| Consumer Discretionary | | | 17.5 | |

| Utilities | | | 9.1 | |

| Industrials | | | 9.1 | |

| Information Technology | | | 9.1 | |

| Consumer Staples | | | 6.2 | |

| Health Care | | | 5.4 | |

| Materials | | | 5.3 | |

Energy | | | 4.9 | |

Short-Term Investment | | | 1.2 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 9 | |

JPMorgan Mid Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | April 30, 2001 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | (4.16 | )% | | | (2.82 | )% | | | 12.31 | % | | | 8.24 | % |

With Sales Charge** | | | | | (9.19 | ) | | | (7.92 | ) | | | 11.10 | | | | 7.65 | |

CLASS C SHARES | | April 30, 2001 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (4.41 | ) | | | (3.33 | ) | | | 11.73 | | | | 7.69 | |

With CDSC*** | | | | | (5.41 | ) | | | (4.33 | ) | | | 11.73 | | | | 7.69 | |

CLASS R2 SHARES | | November 3, 2008 | | | (4.28 | ) | | | (3.06 | ) | | | 12.01 | | | | 8.03 | |

INSTITUTIONAL CLASS SHARES | | November 13, 1997 | | | (3.93 | ) | | | (2.35 | ) | | | 12.86 | | | | 8.77 | |

SELECT CLASS SHARES | | October 31, 2001 | | | (4.05 | ) | | | (2.59 | ) | | | 12.58 | | | | 8.50 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

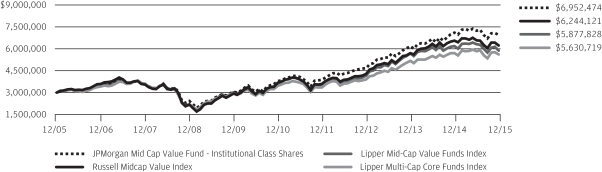

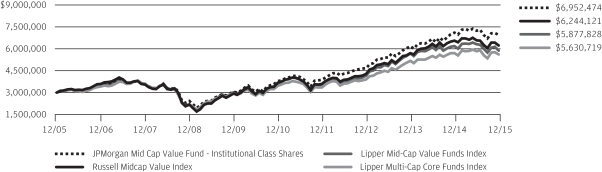

TEN YEAR PERFORMANCE (12/31/05 TO 12/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 Shares prior to its inception date are based on the performance of Class A Shares. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Mid Cap Value Fund, the Russell Midcap Value Index, the Lipper Mid-Cap Value Funds Index and the Lipper Multi-Cap Core Funds Index from December 31, 2005 to December 31, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper

Mid-Cap Value Funds Index and the Lipper Multi-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Russell Midcap Value Index is an unmanaged index which measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The Lipper Mid-Cap Value Funds Index and the Lipper Multi-Cap Core Funds Index are indices based on total returns of certain mutual funds within the mid cap and multi cap fund categories, respectively, as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

JPMorgan Multi-Cap Market Neutral Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Select Class Shares)* | | | 3.48% | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.04% | |

| |

| Net Assets as of 12/31/15 (In Thousands) | | $ | 272,017 | |

INVESTMENT OBJECTIVE**

The JPMorgan Multi-Cap Market Neutral Fund (the “Fund”) seeks long-term capital preservation and growth by using strategies designed to produce returns which have no correlation with general domestic market performance.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Select Class Shares) outperformed the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index (the “Benchmark”) for the six months ended December 31, 2015. The Fund’s security selection process produced positive returns in the energy and producer durables sectors and negative returns in the financial services and consumer discretionary sector.

Leading individual contributors to Fund returns included its short positions in SM Energy Co., Consol Energy Inc. and Tenet Healthcare Corp. Shares of oil and gas producers SM Energy and Consol Energy fell on continued weakness in global energy prices. Shares of Tenet Healthcare, a hospitals operator, fell on a third quarter loss amid declining patient visits.

Leading individual detractors from Fund returns included its long positions in Staples Inc., Denbury Resources Inc. and Mosaic Co. Shares of Staples, an office supply retail chain, fell amid regulatory obstacles to its proposed takeover of Office Depot Inc. Shares of Denbury Resources, an oil and gas producer, declined amid continued weakness in global energy prices. Shares of Mosaic, a fertilizer company, fell on a decline in slower sales and earnings.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing a portfolio based on company fundamentals, quantitative screening and proprietary fundamental analysis. The Fund’s portfolio managers sought to identify dominant franchises with predictable business models deemed capable of achieving, in their view, sustained growth, as well as undervalued companies with the potential to grow their intrinsic value per share. Companies that ranked lowest in the above factors were selected by the Fund’s portfolio managers for possible short sales.

| | | | | | | | |

| TOP TEN LONG POSITIONS OF THE PORTFOLIO*** | |

| | 1. | | �� | Leidos Holdings, Inc. | | | 1.2 | % |

| | 2. | | | VeriSign, Inc. | | | 1.1 | |

| | 3. | | | Hologic, Inc. | | | 1.1 | |

| | 4. | | | Entergy Corp. | | | 1.1 | |

| | 5. | | | Express Scripts Holding Co. | | | 1.1 | |

| | 6. | | | Nuance Communications, Inc. | | | 1.0 | |

| | 7. | | | Humana, Inc. | | | 1.0 | |

| | 8. | | | Gilead Sciences, Inc. | | | 1.0 | |

| | 9. | | | Ingredion, Inc. | | | 1.0 | |

| | 10. | | | ServiceMaster Global Holdings, Inc. | | | 1.0 | |

| | | | | | | | |

| TOP TEN SHORT POSITIONS OF THE PORTFOLIO**** | |

| | 1. | | | Estee Lauder Cos., Inc. (The), Class A | | | 1.4 | % |

| | 2. | | | Waste Connections, Inc. | | | 1.3 | |

| | 3. | | | J.B. Hunt Transport Services, Inc. | | | 1.2 | |

| | 4. | | | Fortune Brands Home & Security, Inc. | | | 1.2 | |

| | 5. | | | Dominion Resources, Inc. | | | 1.2 | |

| | 6. | | | Stericycle, Inc. | | | 1.1 | |

| | 7. | | | Fastenal Co. | | | 1.1 | |

| | 8. | | | Markel Corp. | | | 1.1 | |

| | 9. | | | Aramark | | | 1.1 | |

| | 10. | | | ViaSat, Inc. | | | 1.1 | |

| | | | |

LONG POSITION PORTFOLIO COMPOSITION BY SECTOR*** | |

| Information Technology | | | 26.2 | % |

| Industrials | | | 15.2 | |

| Health Care | | | 12.1 | |

| Consumer Discretionary | | | 11.5 | |

| Consumer Staples | | | 6.7 | |

| Materials | | | 5.6 | |

| Energy | | | 4.7 | |

| Financials | | | 3.8 | |

| Utilities | | | 2.5 | |

| Telecommunication Services | | | 1.6 | |

| Short-Term Investment | | | 10.1 | |

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 11 | |

JPMorgan Multi-Cap Market Neutral Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited) (continued)

| | | | |

SHORT POSITION PORTFOLIO COMPOSITION BY SECTOR**** | |

| Information Technology | | | 27.5 | % |

| Industrials | | | 19.2 | |

| Health Care | | | 12.6 | |

| Consumer Discretionary | | | 12.4 | |

| Consumer Staples | | | 9.5 | |

| Materials | | | 5.3 | |

| Energy | | | 5.1 | |

| Financials | | | 4.4 | |

| Utilities | | | 2.4 | |

| Telecommunication Services | | | 1.6 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total long investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| **** | | Percentages indicated are based on total short investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | May 23, 2003 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | 3.24 | % | | | 1.19 | % | | | 1.24 | % | | | 0.49 | % |

With Sales Charge** | | | | | (2.21 | ) | | | (4.14 | ) | | | 0.16 | | | | (0.05 | ) |

CLASS C SHARES | | May 23, 2003 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | 3.11 | | | | 0.73 | | | | 0.66 | | | | (0.19 | ) |

With CDSC*** | | | | | 2.11 | | | | (0.27 | ) | | | 0.66 | | | | (0.19 | ) |

SELECT CLASS SHARES | | May 23, 2003 | | | 3.48 | | | | 1.46 | | | | 1.51 | | | | 0.75 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

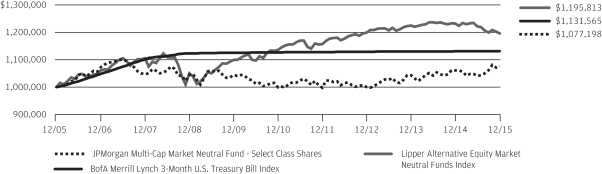

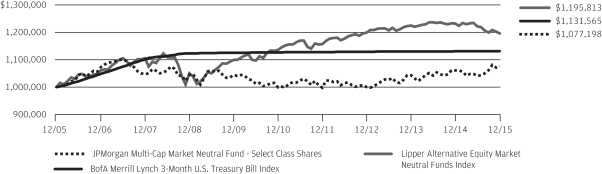

TEN YEAR PERFORMANCE (12/31/05 TO 12/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Multi-Cap Market Neutral Fund, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index and the Lipper Alternative Equity Market Neutral Funds Index from December 31, 2005 to December 31, 2015. Return information prior to October 31, 2005 for the Lipper Alternative Equity Market Neutral Funds Index is not provided by Lipper, Inc. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund’s inception. The performance of the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Alternative Equity Market Neutral Funds Index

includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. The Lipper Alternative Equity Market Neutral Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 13 | |

JPMorgan Value Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED DECEMBER 31, 2015 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Institutional Class Shares)* | | | -5.04% | |

| Russell 3000 Value Index | | | -3.64% | |

| |

| Net Assets as of 12/31/2015 (In Thousands) | | $ | 11,154,765 | |

INVESTMENT OBJECTIVE**

The JPMorgan Value Advantage Fund (the “Fund”) seeks to provide long-term total return from a combination of income and capital gains.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Institutional Class Shares) underperformed the Russell 3000 Value Index (the “Benchmark”) for the six months ended December 31, 2015. The Fund’s security selection and its overweight position in the consumer discretionary sector and its security selection in the health care sector were leading detractors from performance relative to the Benchmark, while the Fund’s underweight position in the energy sector and its security selection in the consumer staples sectors were leading positive contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in General Electric Co. and its overweight positions in Southwestern Energy Co. and Bed Bath & Beyond Inc. Shares of General Electric, an industrial conglomerate, rose after the company moved to shed its consumer financing business. Southwestern Energy, an oil and gas exploration and production company, fell amid continued weakness in global energy prices. Shares of Bed Bath & Beyond, a home products retailer, fell after the company reduced its earnings forecast.

Leading individual contributors to relative performance included the Fund’s overweight positions in Delta Air Lines Inc., Dr. Pepper Snapple Group Inc. and PBF Energy Inc. Shares of Delta Air Lines, which were not included in the Benchmark, rose amid lower fuel costs and increased U.S. consumer spending. Shares of Dr. Pepper Snapple, a maker and distributor of non-alcoholic beverages not included in the Benchmark, rose after the company raised its earnings forecast. Shares of PBF Energy, a petroleum refiner and transportation company, rose on investor expectations that demand for refined products will exceed new refinery capacity amid weakness in energy prices.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection and sought to identify durable franchises

possessing the ability to generate, in the portfolio managers’ view, significant levels of free cash flow. The Fund’s largest overweight position remained the consumer discretionary sector, where the Fund’s portfolio managers found what they believed to be compelling investment opportunities. The Fund’s largest underweight position was in the energy sector.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Wells Fargo & Co. | | | 4.0 | % |

| | 2. | | | Pfizer, Inc. | | | 2.6 | |

| | 3. | | | Exxon Mobil Corp. | | | 2.2 | |

| | 4. | | | Capital One Financial Corp. | | | 2.0 | |

| | 5. | | | Bank of America Corp. | | | 2.0 | |

| | 6. | | | Loews Corp. | | | 1.9 | |

| | 7. | | | Delta Air Lines, Inc. | | | 1.6 | |

| | 8. | | | American International Group, Inc. | | | 1.5 | |

| | 9. | | | Johnson & Johnson | | | 1.5 | |

| | 10. | | | M&T Bank Corp. | | | 1.5 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR*** | |

| Financials | | | 36.2 | % |

| Consumer Discretionary | | | 14.4 | |

| Health Care | | | 8.6 | |

| Industrials | | | 7.5 | |

| Information Technology | | | 6.9 | |

| Utilities | | | 6.4 | |

| Energy | | | 6.4 | |

| Consumer Staples | | | 4.9 | |

| Materials | | | 4.0 | |

| Telecommunication Services | | | 2.0 | |

| Short-Term Investment | | | 2.7 | �� |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of December 31, 2015. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2015 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 28, 2005 | | | | | | | | | | | | | | | | |

Without Sales Charge | | | | | (5.28 | )% | | | (4.73 | )% | | | 11.19 | % | | | 8.32 | % |

With Sales Charge** | | | | | (10.24 | ) | | | (9.72 | ) | | | 9.99 | | | | 7.74 | |

CLASS C SHARES | | February 28, 2005 | | | | | | | | | | | | | | | | |

Without CDSC | | | | | (5.49 | ) | | | (5.17 | ) | | | 10.64 | | | | 7.79 | |

With CDSC*** | | | | | (6.49 | ) | | | (6.17 | ) | | | 10.64 | | | | 7.79 | |

INSTITUTIONAL CLASS SHARES | | February 28, 2005 | | | (5.04 | ) | | | (4.24 | ) | | | 11.75 | | | | 8.88 | |

SELECT CLASS SHARES | | February 28, 2005 | | | (5.13 | ) | | | (4.46 | ) | | | 11.47 | | | | 8.60 | |

| ** | | Sales Charge for Class A Shares is 5.25%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

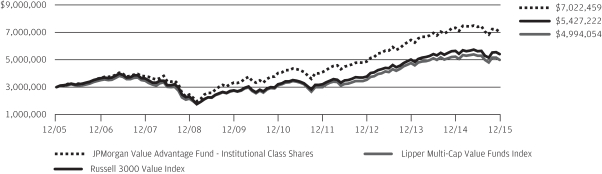

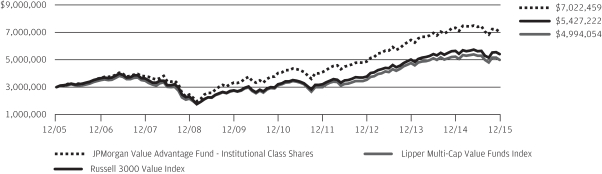

TEN YEAR PERFORMANCE (12/31/05 TO 12/31/15)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Value Advantage Fund, the Russell 3000 Value Index and the Lipper Multi-Cap Value Funds Index from December 31, 2005 to December 31, 2015. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 3000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Multi-Cap Value Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the

Fund. The Russell 3000 Value Index is an unmanaged index which measures the performance of those Russell 3000 companies (largest 3000 U.S. companies) with lower price-to-book ratios and lower forecasted growth values. The Lipper Multi-Cap Value Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 15 | |

JPMorgan Growth Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2015 (Unaudited)

(Amounts in thousands)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| Common Stocks — 97.0% | |

| | | | Consumer Discretionary — 18.5% | |

| | | | Automobiles — 1.0% | |

| | 283 | | | Tesla Motors, Inc. (a) | | | 67,923 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 3.5% | |

| | 3,706 | | | Hilton Worldwide Holdings, Inc. | | | 79,300 | |

| | 1,125 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 65,913 | |

| | 1,395 | | | Starbucks Corp. | | | 83,754 | |

| | | | | | | | |

| | | | | | | 228,967 | |

| | | | | | | | |

| | | | Household Durables — 1.9% | |

| | 633 | | | Mohawk Industries, Inc. (a) | | | 119,884 | |

| | | | | | | | |

| | | | Internet & Catalog Retail — 6.9% | |

| | 332 | | | Amazon.com, Inc. (a) | | | 224,666 | |

| | 651 | | | Netflix, Inc. (a) | | | 74,461 | |

| | 72 | | | Priceline Group, Inc. (The) (a) | | | 92,306 | |

| | 1,202 | | | Wayfair, Inc., Class A (a) | | | 57,216 | |

| | | | | | | | |

| | | | | | | 448,649 | |

| | | | | | | | |

| | | | Multiline Retail — 1.3% | |

| | 1,135 | | | Dollar General Corp. | | | 81,536 | |

| | | | | | | | |

| | | | Specialty Retail — 3.9% | |

| | 1,192 | | | GameStop Corp., Class A | | | 33,413 | |

| | 960 | | | Home Depot, Inc. (The) | | | 126,973 | |

| | 492 | | | Ulta Salon Cosmetics & Fragrance, Inc. (a) | | | 90,983 | |

| | | | | | | | |

| | | | | | | 251,369 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 1,198,328 | |

| | | | | | | | |

| | | | Consumer Staples — 1.6% | |

| | | | Beverages — 0.9% | |

| | 389 | | | Monster Beverage Corp. (a) | | | 57,931 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 0.7% | |

| | 1,684 | | | Sprouts Farmers Market, Inc. (a) | | | 44,790 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 102,721 | |

| | | | | | | | |

| | | | Energy — 1.5% | |

| | | | Oil, Gas & Consumable Fuels — 1.5% | |

| | 874 | | | Concho Resources, Inc. (a) | | | 81,178 | |

| | 713 | | | Range Resources Corp. | | | 17,550 | |

| | | | | | | | |

| | | | Total Energy | | | 98,728 | |

| | | | | | | | |

| | | | Financials — 7.7% | |

| | | | Banks — 1.7% | |

| | 919 | | | East West Bancorp, Inc. | | | 38,206 | |

| | 460 | | | Signature Bank (a) | | | 70,520 | |

| | | | | | | | |

| | | | | | | 108,726 | |

| | | | | | | | |

| | | | Capital Markets — 2.8% | |

| | 347 | | | Affiliated Managers Group, Inc. (a) | | | 55,405 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Capital Markets — continued | |

| | 2,155 | | | Charles Schwab Corp. (The) | | | 70,964 | |

| | 1,217 | | | Lazard Ltd., (Bermuda), Class A | | | 54,759 | |

| | | | | | | | |

| | | | | | | 181,128 | |

| | | | | | | | |

| | | | Diversified Financial Services — 1.3% | |

| | 848 | | | McGraw Hill Financial, Inc. | | | 83,556 | |

| | | | | | | | |

| | | | Insurance — 0.4% | |

| | 393 | | | AmTrust Financial Services, Inc. | | | 24,172 | |

| | | | | | | | |

| | | | Real Estate Management & Development — 1.5% | |

| | 2,817 | | | CBRE Group, Inc., Class A (a) | | | 97,412 | |

| | | | | | | | |

| | | | Total Financials | | | 494,994 | |

| | | | | | | | |

| | | | Health Care — 17.1% | |

| | | | Biotechnology — 8.1% | |

| | 1,045 | | | Celgene Corp. (a) | | | 125,089 | |

| | 1,382 | | | Gilead Sciences, Inc. | | | 139,834 | |

| | 591 | | | Kite Pharma, Inc. (a) | | | 36,430 | |

| | 263 | | | Regeneron Pharmaceuticals, Inc. (a) | | | 142,612 | |

| | 630 | | | Vertex Pharmaceuticals, Inc. (a) | | | 79,223 | |

| | | | | | | | |

| | | | | | | 523,188 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies — 0.3% | |

| | 1,566 | | | Novadaq Technologies, Inc., (Canada) (a) | | | 19,955 | |

| | | | | | | | |

| | | | Health Care Providers & Services — 5.1% | |

| | 1,017 | | | Acadia Healthcare Co., Inc. (a) | | | 63,534 | |

| | 398 | | | Aetna, Inc. | | | 43,032 | |

| | 1,691 | | | Envision Healthcare Holdings, Inc. (a) | | | 43,926 | |

| | 287 | | | Humana, Inc. | | | 51,179 | |

| | 1,117 | | | UnitedHealth Group, Inc. | | | 131,345 | |

| | | | | | | | |

| | | | | | | 333,016 | |

| | | | | | | | |

| | | | Health Care Technology — 0.7% | |

| | 1,623 | | | Veeva Systems, Inc., Class A (a) | | | 46,826 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services — 1.5% | |

| | 506 | | | Illumina, Inc. (a) | | | 97,028 | |

| | | | | | | | |

| | | | Pharmaceuticals — 1.4% | |

| | 967 | | | Revance Therapeutics, Inc. (a) | | | 33,029 | |

| | 545 | | | Valeant Pharmaceuticals International, Inc. (a) | | | 55,399 | |

| | | | | | | | |

| | | | | | | 88,428 | |

| | | | | | | | |

| | | | Total Health Care | | | 1,108,441 | |

| | | | | | | | |

| | | | Industrials — 12.4% | |

| | | | Airlines — 1.1% | |

| | 1,379 | | | Delta Air Lines, Inc. | | | 69,922 | |

| | | | | | | | |

| | | | Building Products — 2.9% | |

| | 678 | | | Advanced Drainage Systems, Inc. | | | 16,283 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | DECEMBER 31, 2015 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| Common Stocks — continued | |

| | | | Building Products — continued | |

| | 808 | | | Caesarstone Sdot-Yam Ltd., (Israel) (a) | | | 35,032 | |

| | 1,224 | | | Fortune Brands Home & Security, Inc. | | | 67,938 | |

| | 545 | | | Lennox International, Inc. | | | 68,070 | |

| | | | | | | | |

| | | | | | | 187,323 | |

| | | | | | | | |

| | | | Commercial Services & Supplies — 2.1% | |

| | 551 | | | Stericycle, Inc. (a) | | | 66,499 | |

| | 1,211 | | | Waste Connections, Inc. | | | 68,214 | |

| | | | | | | | |

| | | | | | | 134,713 | |

| | | | | | | | |

| | | | Electrical Equipment — 2.7% | |

| | 617 | | | Acuity Brands, Inc. | | | 144,278 | |

| | 572 | | | SolarCity Corp. (a) | | | 29,199 | |

| | | | | | | | |

| | | | | | | 173,477 | |

| | | | | | | | |

| | | | Industrial Conglomerates — 1.1% | |

| | 840 | | | Carlisle Cos., Inc. | | | 74,464 | |

| | | | | | | | |

| | | | Road & Rail — 0.4% | |

| | 496 | | | Old Dominion Freight Line, Inc. (a) | | | 29,313 | |

| | | | | | | | |

| | | | Trading Companies & Distributors — 2.1% | |

| | 2,826 | | | HD Supply Holdings, Inc. (a) | | | 84,862 | |

| | 414 | | | Watsco, Inc. | | | 48,480 | |

| | | | | | | | |

| | | | | | | 133,342 | |

| | | | | | | | |

| | | | Total Industrials | | | 802,554 | |

| | | | | | | | |

| | | | Information Technology — 34.1% | |

| | | | Communications Equipment — 3.7% | |

| | 1,065 | | | Arista Networks, Inc. (a) | | | 82,915 | |

| | 1,265 | | | Harris Corp. | | | 109,885 | |

| | 246 | | | Palo Alto Networks, Inc. (a) | | | 43,401 | |

| | | | | | | | |

| | | | | | | 236,201 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 0.8% | |

| | 1,017 | | | Amphenol Corp., Class A | | | 53,113 | |

| | | | | | | | |

| | | | Internet Software & Services — 10.2% | |

| | 443 | | | Alphabet, Inc., Class C (a) | | | 336,491 | |

| | 260 | | | CoStar Group, Inc. (a) | | | 53,719 | |

| | 2,581 | | | Facebook, Inc., Class A (a) | | | 270,106 | |

| | | | | | | | |

| | | | | | | 660,316 | |

| | | | | | | | |

| | | | IT Services — 6.3% | |

| | 557 | | | Gartner, Inc. (a) | | | 50,511 | |

| | 1,315 | | | MasterCard, Inc., Class A | | | 128,009 | |

| | 1,857 | | | PayPal Holdings, Inc. (a) | | | 67,231 | |

| | 1,393 | | | VeriFone Systems, Inc. (a) | | | 39,029 | |

| | 1,604 | | | Visa, Inc., Class A | | | 124,351 | |

| | | | | | | | |

| | | | | | | 409,131 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 3.3% | |

| | 638 | | | Avago Technologies Ltd., (Singapore) | | | 92,649 | |

| | 462 | | | Lam Research Corp. | | | 36,716 | |

| | 990 | | | NXP Semiconductors N.V., (Netherlands) (a) | | | 83,408 | |

| | | | | | | | |

| | | | | | | 212,773 | |

| | | | | | | | |

| | | | Software — 7.3% | |

| | 641 | | | Adobe Systems, Inc. (a) | | | 60,206 | |

| | 1,283 | | | Electronic Arts, Inc. (a) | | | 88,175 | |

| | 970 | | | Guidewire Software, Inc. (a) | | | 58,349 | |

| | 1,552 | | | Microsoft Corp. | | | 86,094 | |

| | 978 | | | Mobileye N.V., (Israel) (a) | | | 41,362 | |

| | 619 | | | ServiceNow, Inc. (a) | | | 53,572 | |

| | 533 | | | Splunk, Inc. (a) | | | 31,328 | |

| | 703 | | | Workday, Inc., Class A (a) | | | 56,039 | |

| | | | | | | | |

| | | | | | | 475,125 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals — 2.5% | |

| | 1,511 | | | Apple, Inc. | | | 159,064 | |

| | 158 | | | Nimble Storage, Inc. (a) | | | 1,451 | |

| | | | | | | | |

| | | | | | | 160,515 | |

| | | | | | | | |

| | | | Total Information Technology | | | 2,207,174 | |

| | | | | | | | |

| | | | Materials — 4.1% | |

| | | | Chemicals — 2.8% | |

| | 457 | | | Air Products & Chemicals, Inc. | | | 59,421 | |

| | 633 | | | PPG Industries, Inc. | | | 62,593 | |

| | 215 | | | Sherwin-Williams Co. (The) | | | 55,892 | |

| | | | | | | | |

| | | | | | | 177,906 | |

| | | | | | | | |

| | | | Construction Materials — 1.3% | |

| | 612 | | | Eagle Materials, Inc. | | | 36,959 | |

| | 516 | | | Vulcan Materials Co. | | | 48,957 | |

| | | | | | | | |

| | | | | | | 85,916 | |

| | | | | | | | |

| | | | Total Materials | | | 263,822 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $4,895,537) | | | 6,276,762 | |

| | | | | | | | |

| Short-Term Investment — 2.6% | |

| | | | Investment Company — 2.6% | |

| | 170,071 | | | JPMorgan Prime Money Market Fund, Institutional Class Shares, 0.170% (b) (l)

(Cost $170,071) | | | 170,071 | |

| | | | | | | | |

| | | | Total Investments — 99.6%

(Cost $5,065,608) | | | 6,446,833 | |

| | | | Other Assets in Excess of

Liabilities — 0.4% | | | 27,743 | |

| | | | | | | | |

| | | | NET ASSETS — 100.0% | | $ | 6,474,576 | |

| | | | | | | | |

Percentages indicated are based on net assets.

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| DECEMBER 31, 2015 | | J.P. MORGAN MID CAP/MULTI-CAP FUNDS | | | | | 17 | |

JPMorgan Mid Cap Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2015 (Unaudited)

(Amounts in thousands)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| Common Stocks — 97.3% | |

| | | | Consumer Discretionary — 19.5% | |

| | | | Automobiles — 0.5% | |

| | 62 | | | Tesla Motors, Inc. (a) | | | 14,761 | |

| | | | | | | | |

| | | | Distributors — 0.5% | |

| | 188 | | | Genuine Parts Co. | | | 16,131 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 2.7% | |

| | 356 | | | Aramark | | | 11,468 | |

| | 16 | | | Chipotle Mexican Grill, Inc. (a) | | | 7,870 | |

| | 1,234 | | | Hilton Worldwide Holdings, Inc. | | | 26,397 | |

| | 165 | | | Marriott International, Inc., Class A | | | 11,073 | |

| | 463 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 27,113 | |

| | 30 | | | Starwood Hotels & Resorts Worldwide, Inc. | | | 2,086 | |

| | | | | | | | |

| | | | | | | 86,007 | |

| | | | | | | | |

| | | | Household Durables — 3.1% | |

| | 370 | | | Jarden Corp. (a) | | | 21,122 | |

| | 337 | | | Mohawk Industries, Inc. (a) | | | 63,744 | |

| | 425 | | | Toll Brothers, Inc. (a) | | | 14,142 | |

| | | | | | | | |

| | | | | | | 99,008 | |

| | | | | | | | |

| | | | Internet & Catalog Retail — 1.8% | |

| | 179 | | | Expedia, Inc. | | | 22,246 | |

| | 107 | | | Netflix, Inc. (a) | | | 12,239 | |

| | 118 | | | TripAdvisor, Inc. (a) | | | 10,043 | |

| | 302 | | | Wayfair, Inc., Class A (a) | | | 14,362 | |

| | | | | | | | |

| | | | | | | 58,890 | |

| | | | | | | | |

| | | | Media — 1.3% | |

| | 196 | | | CBS Corp. (Non-Voting), Class B | | | 9,246 | |

| | 264 | | | DISH Network Corp., Class A (a) | | | 15,076 | |

| | 472 | | | TEGNA, Inc. | | | 12,056 | |

| | 357 | | | Time, Inc. | | | 5,595 | |

| | | | | | | | |

| | | | | | | 41,973 | |

| | | | | | | | |

| | | | Multiline Retail — 2.0% | |