| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | October 31, 2006 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .19.3 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08895 |

|

ING Funds Trust |

(Exact name of registrant as specified in charter) |

|

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

|

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-992-0180 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | April 1, 2005 to September 30, 2005 | |

| | | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Semi-Annual Report

September 30, 2005

Classes A, B, C, M, O and R

Fixed Income Funds

• ING GNMA Income Fund

• ING High Yield Bond Fund

• ING Intermediate Bond Fund

• ING National Tax-Exempt Bond Fund

Money Market Funds

• ING Classic Money Market Fund

• ING Institutional Prime Money Market Fund

E-Delivery Sign-up – details inside

E-Delivery Sign-up – details inside

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. |

|

| Go Paperless with E-Delivery! |

|

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs. |

Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll. |

You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail. |

(THIS PAGE INTENTIONALLY LEFT BLANK)

JAMES M. HENNESSY

| Dear Shareholder, |

|

We are in the midst of an exciting time here at ING Funds. We began the year by introducing the ING |

Global Equity Dividend and Premium Opportunity Fund that gave investors an opportunity to invest in |

global companies with a history of attractive dividend yields. |

|

When the Fund’s initial offering period closed, it proved to be one of the five largest unleveraged |

closed-end funds in history. |

|

The success of the Fund offering illustrates what ING Funds is really all about: fresh thinking in |

financial services. The Fund’s offering success also confirmed something else that we have long |

believed; namely, that investors are excited about opportunities beyond our shores. |

|

As globalization grows, investment opportunities grow as well. In 1970, only about one-third of equity market capitalization was located abroad; by 2004, that number had jumped to 50 percent1. It is often said that the world is becoming ever more complicated. This is undoubtedly true in the world of investments where the range of asset classes and investment techniques has never been wider. To take advantage of the opportunities that are now available, it is essential to seek investment partners who have the required breadth and depth of experience — on a global basis. |

|

Our goal at ING Funds is to deliver innovative investment products that help you, the investor, to achieve your financial dreams. We have also long been committed to uncovering opportunities worldwide. |

|

We will continue to bring you opportunities — wherever they occur. With access to more than 700 ING investment management professionals who are located around the world and who, in our consideration, deliver exceptional insight into markets in Europe, the Americas and the Asia-Pacific region, we believe we are in a unique position to help you take advantage of the opportunities that the world has to offer. |

|

On behalf of everyone here at ING Funds, I thank you for your continued support and loyalty. We look forward to serving you in the future. |

|

Sincerely, |

|

|

|

James M. Hennessy

President

ING Funds

October 27, 2005 |

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1 Morgan Stanley Capital International

1

MARKET PERSPECTIVE: SIX MONTHS ENDED SEPTEMBER 30, 2005

In the six months through September 30, 2005, major markets recovered after first quarter losses. Global equities rose 7.4%, according to the Morgan Stanley Capital International (“MSCI”) World Index(1) (which is calculated in dollars and includes net reinvested dividends). Nearly half of the gain came in July, the best month since 2003. As for currencies, the dollar extended first quarter strength, based on faster U.S. growth and rising short-term interest rates. The euro was further buffeted by the defeat of a proposal for a European constitution, followed by an acrimonious stalemate on a European budget. For the six months, the U.S. currency rose 7.8% against the euro, 7.2% against the pound and 5.9% against the oil price sensitive yen.

Trends in investment grade U.S. fixed income securities had been dominated since the middle of 2004 by the flattening of the U.S. Treasury yield curve as ten-year yields fell even as the Federal Open Market Committee (“FOMC”) raised short-term interest rates seven times to the end of March 2005. In the next five months, apart from approximately five weeks in July 2005 and early August 2005 when the economic data was more upbeat, fears of slowing activity and increasing inflation in the face of repeated record oil prices continued to mount. Inflation would only be controlled by continual “measured” increases in short-term interest rates. The curve-flattening trend was accordingly sustained by three more increases in May, June and August. August ended with second quarter GDP growth being revised downward and a final new record oil price of almost $70 as Hurricane Katrina’s devastation became known. The spread between ten-year and 13-week U.S. Treasury yields had shrunk to 59 basis points, the narrowest since March of 2001. The rebound was swift in early September. However, in Katrina’s aftermath gasoline prices soared: deflationary on demand, inflationary on costs. President Bush lunched with Chairman Greenspan and many hoped that the FOMC might then relent. This caused short-term interest rates to drift down and longer-term rates to rise. But by mid-September, factory prices were reported to have risen by the most in decades. The FOMC duly struck for the 11th time by raising short term interest rates. Katrina was only a near-term setback: the FOMC was still not done. Short rates snapped back, joining longer rates now on the way up. For the half-year the yield on the ten-year U.S. Treasury Note fell by 17 basis points to 4.33%, while the yield on 13-week U.S. Treasury Bills rose 75 basis points to 3.47%. The return on the broader Lehman Brothers Aggregate Bond Index(2) was 2.31%, with not much difference between the Treasury and Corporate components on average. High yield bonds did rather well as investors chased yield. The Lehman Brothers High Yield Bond Index(3) returned 3.71%.

The U.S. equities market in the form of the Standard & Poor’s 500 Index (“S&P 500 Index”)(4), gained 5.0% (including dividends) in the half-year through September. The period started with stocks on the downswing after reaching a 2005 high point on March 7. Economists keenly watched the swirling crosscurrents in the fixed income markets described above. Falling bond yields generally make stocks relatively more attractive. Falling mortgage interest rates have encouraged refinancing on a massive scale and the funds raised have tended not to stay long in the wallets of American consumers, keeping expansion strong. But inexorably rising short-term rates tend to dampen demand and profit margins. Still, stocks benefited from July’s positive reports, especially robust second quarter company earnings figures. On August 3, 2005, the S&P 500 Index reached its highest level in four years, but then fell back. It was not a sell-off, more the drift down of a market that was not particularly cheap or expensive, just one whose best days were probably behind it. Little headway was made in September after Hurricane Katrina followed by Rita. High prices at the pump were already here. An expensive winter for heating fuel appeared to be certain. Evidence of sharply rising factory prices started to be found in local Federal Reserve and purchasing managers’ reports. By month end, with consumer confidence slumping, some commentators could be heard grumbling about stagflation.

Internationally, Japan equities soared 15.0%, based on the MSCI Japan Index(5) calculated in dollars plus net dividends. The market did little until August, but thereafter a new sense of optimism took hold, based on an encouraging improvement in domestic demand. However mostly was due to the chance of a new reformist beginning under Prime Minister Koizumi, who won a landslide election victory in support of his proposal to privatize Japan Post, the savings vehicle of choice among the Japanese public and, improbably, the world’s largest financial institution.

European ex UK markets added 7.4% in the half-year according to the MSCI Europe ex UK Index(6) including net dividends. Such bullish performance belied bearish economic conditions. High unemployment and restrictive employment practices continued to depress

2

MARKET PERSPECTIVE: SIX MONTHS ENDED SEPTEMBER 30, 2005

domestic demand while political deadlock in Germany disappointed reformers. But this served only to depress the euro. Stock markets cheered the weaker currency, while corporate profits held up and merger and acquisition activity revived, allowing stocks to advance in the face of record low bond yields.

The UK market gained 5.7% calculated in dollars, based on the MSCI UK Index(7) including net dividends. The period was dominated by the effect of five interest rate increases to restrain over-stretched consumers and soaring property prices. By the period end, house prices were falling, manufacturing was in decline, retail sales were at multi-year lows and second quarter GDP growth was the slowest since 1993. Nonetheless, company earnings held up and despite terrorist attacks, investors supported an inexpensive market that paid over 3% in dividends as they waited for better times.

(1) The MSCI World Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The Lehman Brothers High Yield Bond Index is an unmanaged index that measures the performance of fixed-income securities generally representative of corporate bonds rated below investment-grade.

(4) The Standard & Poor’s 500 Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

(5) The MSCI Japan Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(6) The MSCI Europe ex UK Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(7) The MSCI UK Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Funds’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of the Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

ING GNMA INCOME FUND | | PORTFOLIO MANAGERS’ REPORT |

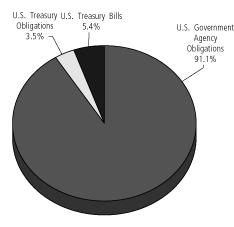

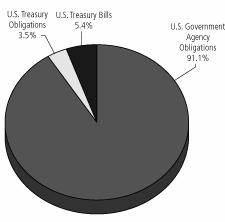

Investment Types

as of September 30, 2005

(as a percent of total investments)

Portfolio holdings are subject to change daily.

The ING GNMA Income Fund (the “Fund”) seeks to generate a high level of current income, consistent with liquidity and safety of principal, through investment primarily in Government National Mortgage Association (“GNMA”) mortgage-backed securities (also known as GNMA Certificates) that are guaranteed as to the timely payment of principal and interest by the U.S. Government. The Fund is managed by Denis P. Jamison, CFA ING Investment Management Co. — the Sub-Adviser.

Performance: For the six months ended September 30, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 1.68% compared to 2.12% return for the Lehman Brothers Mortgage-Backed Securities Index (“Lehman MBS Index”)(5).

Portfolio Specifics: The Federal Reserve’s on-going policy of gradually raising short term interest rates has negatively impacted the value of bonds with maturities of five years and less. For example, since March 31, the five-year segment of the U.S. Treasury market has returned just 1.5% compared with a gain of 5.1% for long-term government bonds. Call-protected mortgages on multi-family properties account for about 25% of the Fund’s assets and these securities tend to be valued in line with three- to five-year U.S. Treasury notes rather than single-family mortgages. Accordingly, the softness in this sector of the yield curve hampered the Fund’s return and we do not expect a quick turnaround. The Federal Reserve shows no signs of changing monetary policy near term. Short-term interest rates are expected to continue to rise and the yield curve will flatten. Despite this near term problem, our multi-family loans are the source of the Fund’s relatively high income return because they have an average coupon of 7.3% and a relatively low cost basis. We are not inclined to reduce this holding and are attempting to mitigate the problem by opportunistically increasing and decreasing our holdings of 30-year U.S. Treasury bonds and adding some extra capital gains.

Our single family mortgage investments are defensive. The average coupon for this 66% slice of the portfolio is still 5.72% compared with 5.85% six months ago and 5.36% for the Lehman Mortgage-Backed Securities Index. The higher coupon mortgages tend to be less sensitive to interest rate changes and provide shareholders with a higher income return. Of course, these bonds tend to pay down more quickly and related losses are higher. For the six months ended September 30, prepayment losses amounted to 34 basis points more than that of the benchmark index.

Current Strategy and Outlook: The key factor determining the relative performance of the Fund is the return on three-five year U.S. Treasury securities compared with that of mortgages. In turn, this relates to the changes in the shape of the yield curve and overall market volatility. A flat yield curve and low volatility — the current condition — weigh against strong performance by the Fund. Unfortunately, we view this as the likely investment environment for the remainder of the year. However, we face considerable uncertainty in 2006. Economic expansion is closely tied to the health of the housing market and this sector is facing ever stronger headwinds as interest rates increase. Also, a change in leadership of the Federal Reserve could have an adverse impact on market volatility. We think there will be opportunities to increase the interest rate sensitivity of the Fund through the purchases of both U.S. Treasury bonds and lower coupon mortgages, which could lead to better absolute returns.

4

PORTFOLIO MANAGERS’ REPORT | | ING GNMA INCOME FUND |

| Average Annual Total Returns for the Periods Ended September 30, 2005 | |

| |

| | | | | | | | | Since Inception | | Since Inception | | Since Inception | |

| | | | | | | | | of Class B | | of Class C | | of Class M | |

| | | 1 Year | | 5 Year | | 10 Year | | October 6, 2000 | | October 13, 2000 | | February 23, 2001 | |

| | | | | | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | | | | | | | | | | | |

| Class A(1) | | (2.81 | )% | | 4.72 | % | | 5.73 | % | | — | | | — | | | — | | |

| Class B(2) | | (3.58 | )% | | — | | | — | | | 4.67 | % | | — | | | — | | |

| Class C(3) | | 0.29 | % | | — | | | — | | | — | | | 4.94 | % | | — | | |

| Class M(4) | | (1.78 | )% | | — | | | — | | | — | | | | | | 3.73 | % | |

| | | | | | | | | | | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | | | | | | | | | | |

| Class A | | 2.03 | % | | 5.74 | % | | 6.25 | % | | — | | | — | | | — | | |

| Class B | | 1.27 | % | | — | | | — | | | 5.00 | % | | — | | | — | | |

| Class C | | 1.26 | % | | — | | | — | | | — | | | 4.94 | % | | — | | |

| Class M | | 1.52 | % | | — | | | — | | | — | | | — | | | 4.47 | % | |

| Lehman Brothers Mortgage-Backed Securities Index(5) | | 3.29 | % | | 6.12 | % | | 6.46 | % | | 6.12 | %(6) | | 6.12 | %(6) | | 5.32 | %(7) | |

| | | | | | | | | | | | | | | | | | | | |

Based on a $10,000 initial investment, the table above illustrates the total return of ING GNMA Income Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance table does not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions.

(1) Reflects deduction of the maximum Class A sales charge of 4.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) Reflects deduction of the maximum Class M sales charge of 3.25%.

(5) The Lehman Brothers Mortgage-Backed Securities Index is an unmanaged index composed of fixed income security mortgage pools sponsored by GNMA, FNMA and FHLMC, including GNMA Graduated Payment Mortgages.

(6) Since inception performance for index is shown from October 1, 2000.

(7) Since inception performance for index is shown from March 1, 2001.

5

ING HIGH YIELD BOND FUND | | PORTFOLIO MANAGERS’ REPORT |

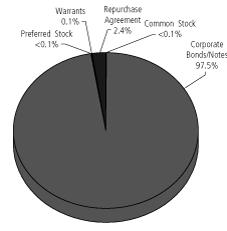

Investment Types

as of September 30, 2005

(as a percent of total investments)

Portfolio holdings are subject to change daily.

The ING High Yield Bond Fund (the “Fund”) seeks to provide investors with a high level of current income and total return by investing at least 80% of its assets in high yield (high risk) bonds, that are unrated or rated below investment grade. The Fund is managed by a team of investment professionals led by Greg Jacobs, CFA and Kurt Kringelis, CFA, CPA, ING Investment Management Co. — the Sub-Adviser.

Performance: For the six months ended September 30, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 2.81% compared to 3.71% for the Lehman Brothers High Yield Bond Index(4).

Portfolio Specifics: During the last six months, the portfolio continued to be overweight the middle tier, B-rated part of the universe, and underweight BB-rated securities and CCC-rated securities. During the period, higher quality outperformed lower quality, as BB-rated issues outperformed CCC-rated issues on average by 1.1%. This credit quality positioning had a neutral impact on performance, as the advantage of being underweight with lower quality issuers was offset by the disadvantage of being underweight BB-rated securities.

From a sector standpoint, the Fund benefited from being underweight the two worst performing sectors, automotives and airlines. Both sectors continued to exhibit fundamental declines, with autos experiencing downgrades (Ford and General Motors) and airlines experiencing defaults (Delta and Northwest). As a result, both groups underperformed the benchmark by nearly 5%. The Fund’s overweight positions in consumer-related areas, over the semi-annual period was neutral. All earlier gains were lost as the consumer-related issuers underperformed post Hurricane Katrina, as investors inferred that rising energy costs may finally curtail consumer spending.

Another factor that negatively affected relative performance was related to the benchmark. On June 1, 2005, Ford and General Motors became part of the Lehman Brothers High Yield Index, accounting for approximately 13% of the Index. On August 1, 2005, the Fund changed the official benchmark to the Lehman Brothers High Yield Index 2% Issuer Constrained benchmark. During this period, the Lehman Brothers High Yield Index outperformed the 2% constrained index by 0.34%.

Top Ten Industries

as of September 30, 2005

(as a percent of net assets)

Telecommunications | | 10.9 | % |

Media | | 10.7 | % |

Electric | | 8.9 | % |

Retail | | 5.7 | % |

Oil and Gas | | 5.2 | % |

Diversified Financial Services | | 5.1 | % |

Food | | 4.9 | % |

Lodging | | 4.5 | % |

Chemicals | | 3.7 | % |

Healthcare-Services | | 3.6 | % |

Portfolio holdings are subject to change daily.

Current Strategy and Outlook: We continue to believe that from a fundamental standpoint, the economy remains healthy. However, the impact of Hurricanes Katrina and Rita on energy prices and other related raw materials have yet to be fully understood and could lead to compressed margins for issuers in cyclical sectors and/or higher inflation in the U.S. Either scenario would have a negative impact on the market, although the order of magnitude is a bit uncertain. In the near term, higher energy costs are also likely to squeeze consumers and potentially weigh on their confidence, as they adapt to paying more for goods in general and in particular for fuel for their automobiles and to heat their homes this coming winter. Our current expectations are for GDP growth to moderate before picking up again as the hurricane rebuilding efforts add stimulus to the economy. Despite expectations for slower but relatively healthy near term GDP growth, we believe that consumer confidence will be an important factor in contributing to the sustainability of the economic expansion.

While we expect relatively healthy GDP growth near term, certain cyclical and consumer oriented issuers could be at risk for earnings disappointments. We remain less confident that the trend of improving issuer credit quality will continue and expect to see some moderation in the pace of improvement as the increased focus on shareholder friendly activity and financial transactions keeps the level of event risk in the marketplace elevated. To protect our downside risk, we have reallocated some exposure away from certain cyclical and consumer dependent issuers to other sectors but have made an effort to maintain yield given the possibility that any softness in the economy and market may prove to be temporary.

6

PORTFOLIO MANAGERS’ REPORT | | ING HIGH YIELD BOND FUND |

| Average Annual Total Returns for the Periods Ended September 30, 2005 | |

| | | | | | | |

| | | | | | Since Inception | |

| | 1 Year | | 5 Year | | December 15, 1998 | |

| | | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | | |

| Class A(1) | | (0.80 | )% | | 4.92 | % | | 5.11 | % | |

| Class B(2) | | (1.53 | )% | | 4.90 | % | | 5.09 | % | |

| Class C(3) | | 2.40 | % | | 5.19 | % | | 5.10 | % | |

| | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | |

| Class A | | 4.15 | % | | 5.95 | % | | 5.86 | % | |

| Class B | | 3.37 | % | | 5.20 | % | | 5.09 | % | |

| Class C | | 3.38 | % | | 5.19 | % | | 5.10 | % | |

| Lehman Brothers High Yield Bond Index(4) | | 6.71 | % | | 7.54 | % | | 5.75 | %(6) | |

| Lehman Brothers High Yield Bond Index — 2% Issuer Constrained(5) | | 6.58 | % | | 7.80 | % | | 5.93 | %(6) | |

| | | | | | | | | | | |

Based on a $10,000 initial investment, the table above illustrates the total return of ING High Yield Bond Fund against the Index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance table does not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 4.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The Lehman Brothers High Yield Bond Index is an unmanaged index that measures the performance of fixed-income securities that are similar, but not identical, to those in the Fund’s portfolio.

(5) This index is the 2% Issuer Cap component of the Lehman Brothers High Yield Bond Index.

(6) Since inception performance for index is shown from December 1, 1998.

7

ING INTERMEDIATE BOND FUND | | PORTFOLIO MANAGERS’ REPORT |

Investment Types

as of September 30, 2005

(as a percent of total investments)

Portfolio holdings are subject to change daily.

The ING Intermediate Bond Fund (the “Fund”) seeks to provide investors with a high level of current income, consistent with the preservation of capital and liquidity by investing at least 80% of its assets in investment grade debt securities. The Fund is managed by James B. Kauffmann, ING Investment Management Co. — the Sub-Adviser.

Performance: For the six months ended September 30, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 2.37% compared to 2.31% for the Lehman Brothers Aggregate Bond Index(4).

Portfolio Specifics: The Fund matched its benchmark during April largely due to our short duration posture in a rally. We maintained our underweight to credit on a contribution-to-duration and market-weight basis, which was beneficial in a market largely characterized by widening spreads; however, our overweight in commercial mortgage-backed securities was a drag on performance. We maintained a reduced mortgage allocation of 30% versus approximately 35% with a significant emphasis on adjustable rate mortgages and collateralized mortgage obligations over traditional pass-through securities.

The Fund underperformed its benchmark during May due again to our short duration posture in a rally. This duration call was partially offset by overweighting maturities that performed better than others. We initiated positions in auto industry bonds following the rapid price declines early in the month. Furthermore, we continued an underweight to credit. This was also a hindrance as the credit sensitive sectors recouped some of their losses in the final week of the month.

Our short duration posture in June was not beneficial. Term structure exposure was generally flat to the benchmark with a slight bias against the front-end of the yield curve; however, the curve flattened significantly. We continued to add automakers in June, but our positioning may have lagged the market. While we closed the month underweight the sector, the mortgage-backed securities portion of the portfolio was designed to benefit from a curve flattening, which did not occur as we had expected. Credit markets became more risk embracing during July and produced positive excess returns thus rewarding holders — such as ourselves of riskier or less liquid instruments. We actively traded our auto sector during the month with exposures ranging from around 1.00% to 0% to 0.50%, and trust preferred securities (TRUPs) continue to play a significant role in the credit allocation. (TRUPs are trust preferred securities and are a unique form of preferred stock. The Fund has focused on TRUPs that pay floating rate interest. Floating rate securities tend to fare well in environments of increasing short-term interest rates which has been the case this year as the Federal Reserve has raised the Federal Funds rate repeatedly. Generally, TRUPs are subordinate to other debt issued by companies.)

The Fund slightly outperformed the index in August after we quickly withdrew our short duration posture in response to uncertainty about the impact of Hurricane Katrina. Although total returns were positive across the board, the month witnessed negative excess returns in every sector save agencies, asset-backed securities, and commercial mortgage-backed securities. Our modest exposure to high yield was not beneficial this month. The credit-sensitive markets were generally softer following the further downgrades of Ford and GM.

Awareness of inflation risks began to dominate in September. The Fund slightly underperformed the index during the month as we reinstated the short duration posture that we had in place before the storms with an overweight in 30-year maturities. Corporate bonds underperformed by 0.09% with the drag particularly acute in long-dated industrials and utilities. While our underweight in longer-dated corporates helped performance somewhat, exposures to commercial mortgage-backed securities did not.

Top Ten Industries

as of September 30, 2005

(as a percent of net assets)

U.S. Treasury Obligations | | 27.7 | % |

Federal National Mortgage Association | | 23.1 | % |

Whole Loan Collateralized Mortgage Obligations | | 12.8 | % |

Federal Home Loan Mortgage Corporation | | 7.3 | % |

Diversified Financial Sevices | | 5.7 | % |

Asset-Backed Securities | | 5.4 | % |

Commercial Mortgage-Backed Securities | | 5.4 | % |

Banks | | 5.1 | % |

Electric | | 2.6 | % |

Oil and Gas | | 1.6 | % |

Portfolio holdings are subject to change daily.

Current Strategy and Outlook: We have positioned the Fund for the potentiality that sentiment will reverse and higher risk premiums will be required by the market. Indeed, we are keenly aware that preserving capital and receiving adequate compensation for risk are essential elements of successful bond management. Specifically, the ING credit team continues to avoid companies with depressed stock prices and under-utilized assets on the books. Moreover, the contribution to duration of the corporate bond portion of the portfolio is less than the index. Our mortgage team has constructed a portfolio designed to offset an increase in volatility and a change in prepayments. Finally, our portfolio duration is shorter than the index with an overweight in the longest maturity bucket in anticipation of continued tightening by the Federal Reserve.

8

PORTFOLIO MANAGERS’ REPORT | | ING INTERMEDIATE BOND FUND |

| Average Annual Total Returns for the Periods Ended September 30, 2005 | |

| | | | | | | | | | | |

| | | | | | Since Inception | | Since Inception | | Since Inception | |

| | | | | | of Class A, B and C | | of Class O | | of Class R | |

| | 1 Year | | 5 Year | | December 15, 1998 | | August 13, 2004 | | March 16, 2004 | |

| | | | | | | | | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | | | | | | | | |

| Class A(1) | | (1.72 | )% | | 7.22 | % | | 6.14 | % | | — | | | — | | |

| Class B(2) | | (2.56 | )% | | 7.13 | % | | 6.08 | % | | — | | | — | | |

| Class C(3) | | 1.42 | % | | 7.46 | % | | 6.11 | % | | — | | | — | | |

| Class O | | 3.25 | % | | — | | | — | | | 3.59 | % | | — | | |

| Class R | | 3.03 | % | | — | | | — | | | — | | | 2.33 | % | |

| | | | | | | | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | | | | | | | |

| Class A | | 3.18 | % | | 8.27 | % | | 6.91 | % | | — | | | — | | |

| Class B | | 2.41 | % | | 7.43 | % | | 6.08 | % | | — | | | — | | |

| Class C | | 2.41 | % | | 7.46 | % | | 6.11 | % | | — | | | — | | |

| Class O | | 3.25 | % | | — | | | — | | | 3.59 | % | | — | | |

| Class R | | 3.03 | % | | — | | | — | | | — | | | 2.33 | % | |

| Lehman Brothers Aggregate Bond Index(4) | | 2.80 | % | | 6.62 | % | | 5.78 | %(5) | | 2.83 | %(6) | | 2.31 | %(7) | |

| | | | | | | | | | | | | | | | | |

Based on a $10,000 initial investment, the table above illustrates the total return of ING Intermediate Bond Fund against the Index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance table does not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 4.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(5) Since inception performance for index is shown from December 1, 1998.

(6) Since inception performance for index is shown from September 1, 2004.

(7) Since inception performance for index is shown from April 1, 2004.

9

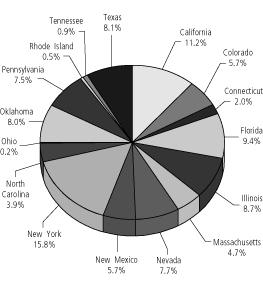

ING NATIONAL TAX-EXEMPT BOND FUND | | PORTFOLIO MANAGERS’ REPORT |

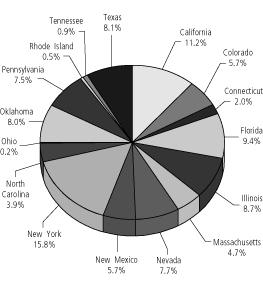

Investment Types

as of September 30, 2005

(as a percent of total investments)

Portfolio holdings are subject to change daily.

The ING National-Tax Exempt Bond Fund (the “Fund”) seeks to provide investors with a high level of current income that is exempt from federal income taxes, consistent with preservation of capital. The Fund is managed by Robert Schonbrunn, Managing Director and Portfolio Manager, Karen Cronk, Portfolio Manager, Richard Killbride, Portfolio Manager, ING Investment Management Co. — the Sub-Adviser.

Performance: For the six months ended September 30, 2005, the Fund’s Class A shares, excluding sales charges, returned 2.20% compared to 2.80% for the Lehman Brothers Municipal Bond Index(4) and 2.31% for the Lehman Brothers Aggregate Bond Index(5).

Portfolio Specifics: Over the past six months, interest rates on municipal bonds, as measured by AAA-rated general obligations, maturing in less than four years rose, while rates on bonds maturing in longer than four years actually declined. This condition, known as a flattening of the yield curve, was an important factor affecting performance during this period. Shorter term bond interest rates rose in response to the Federal Reserve’s program of raising the Federal Funds rate, while longer term interest rates declined as inflation remained lower than anticipated. The best performing bonds in the past six months were the longest maturities and the worst were the shortest maturities. We positioned the Fund in a “barbell” structure with overweight positions in the two extreme parts of the yield curve — short and long maturity bonds — to be in a defensive posture while the yield curve flattened. This move was beneficial to the Fund overall, but the shorter term portion of the “barbell” was a drag on performance. In addition, many of the bonds held in the Fund have call options of 10 years or less. The higher coupon bonds that the Fund owns in the portfolio were often priced to the call date instead of to the actual maturity date, which tended to reduce the positive impact of the longer term bonds as interest rates declined.

The Fund is rated AA in quality and currently holds over 45% in AAA-rated bonds which is comparable to the Lehman Municipal Bond Index. An overweight in hospital/medical and BBB-rated bonds during this period added to our returns as lower quality out performed higher quality issues. The Fund is structured with a higher coupon and yield than the benchmark. The Fund began the period with a lower sensitivity to interest rate change known as duration, which hurt performance. In the past six months, the Fund has increased its duration by shifting assets toward longer maturity bonds, which had a positive affect on returns.

Current Strategy and Outlook: Our outlook is for the yield curve to continue to flatten as short-term interest rates rise more than longer-term interest rates. We believe that the Federal Reserve will continue to raise the Federal Funds rate and that the economy will slow but not fall into a recession. It is our opinion that inflation will remain near current levels based upon the impact of globalization, productivity and the low absolute level of interest rates. In this environment the Fund, given its high yield and “barbell” structure, should be well positioned. We continue to look for additional opportunities to increase yield, as this becomes the most important component of investment return when interest rate movement slows.

10

PORTFOLIO MANAGERS’ REPORT | | ING NATIONAL TAX-EXEMPT BOND FUND |

| Average Annual Total Returns for the Periods Ended September 30, 2005 | |

| | | | | | | |

| | | | | | Since Inception | |

| | 1 Year | | 5 Year | | November 8, 1999 | |

| | | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | | |

| Class A(1) | | (2.22 | )% | | 4.41 | % | | 4.59 | % | |

| Class B(2) | | (3.04 | )% | | 4.33 | % | | 4.52 | % | |

| Class C(3) | | 0.92 | % | | 4.65 | % | | 4.68 | % | |

| | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | |

| Class A | | 2.66 | % | | 5.43 | % | | 5.46 | % | |

| Class B | | 1.90 | % | | 4.66 | % | | 4.66 | % | |

| Class C | | 1.91 | % | | 4.65 | % | | 4.68 | % | |

| Lehman Brothers Municipal Bond Index(4) | | 4.05 | % | | 6.34 | % | | 6.60 | %(6) | |

| Lehman Brothers Aggregate Bond Index(5) | | 2.80 | % | | 6.62 | % | | 6.72 | %(6) | |

| | | | | | | | | | | |

| | | | | | | | | | | | | |

Based on a $10,000 initial investment, the table above illustrates the total return of ING National Tax-Exempt Bond Fund against the Indices indicated. An index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance table does not reflect the deduction of taxes that a shareholder will pay (if any) on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 4.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 1%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The Lehman Brothers Municipal Bond Index is an unmanaged index of approximately 1,100 investment grade tax-exempt bonds classified into four sectors: general obligation, revenue, insured and pre-refunded.

(5) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(6) Since inception performance for index is shown from November 1, 1999.

11

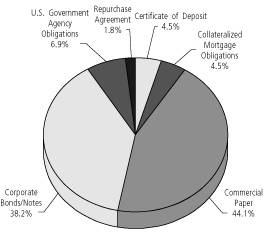

ING CLASSIC MONEY MARKET FUND | | PORTFOLIO MANAGERS’ REPORT |

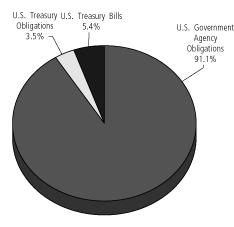

Investment Types

as of September 30, 2005

(as a percent of total investments)

Portfolio holdings are subject to change daily.

The ING Classic Money Market Fund (the “Fund”) seeks to provide a high level of current income, consistent with preservation of capital and liquidity and the maintenance of a stable $1.00 net asset value per share. The Fund is managed by David S. Yealy, ING Investment Management Co. — the Sub-Adviser.

Portfolio Specifics: The Federal Open Market Committee (“FOMC”) continued its measured pace of increasing short-term interest rates, raising the Federal Funds rate from 3.25% as of June 30 to 3.75% as of September 30th, despite concerns about the short-term economic growth impact and spike in energy costs related to Hurricane Katrina. The FOMC has raised rates eleven times and a total of 2.75% since the end of June last year. Chairman Greenspan and other FOMC members do not appear to be done raising rates any time soon. In various speeches following Hurricane Katrina and the September 20th FOMC meeting, the FOMC participants focused on the potential for inflation to pick up in 2006 due to higher energy costs and rebuilding efforts following Hurricane Katrina.

Rates for short-term money market securities rose approximately 50 basis points in response to the increases in the Federal Funds rate and in anticipation of more increases in 2005 and 2006. The Fund benefited from the large amount of interest sensitive floating rate securities owned throughout the quarter. In addition to our emphasis on floating rate securities, we continued to focus new purchases on very short maturity securities that typically matured prior to the next FOMC meeting, which also performed well during the rising rate environment. We maintained a short weighted average maturity similar to or shorter than the iMoneyNet First Tier Average.

Current Strategy and Outlook: The short-term market consensus as of the end of September is for the Federal Funds rate to be 4% at year-end. We believe that the FOMC will keep raising the Federal Funds rate at least 25 basis points at each of the meetings in the fourth quarter, taking the rate to 4.25% or higher with additional increases in 2006. We will continue to maintain a high exposure to floating rate notes and make selective purchases in the three-month and under maturity sector where yield levels fully price in 25 basis point increases at each of the Federal Reserve meetings in between. We intend to keep our weighted average maturity relatively short until the markets start to price in a more aggressive Federal Reserve policy than is currently reflected in the market.

12

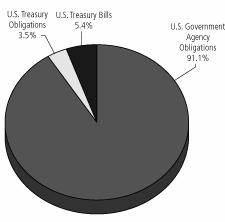

ING INSTITUTIONAL PRIME MONEY MARKET FUND | | PORTFOLIO MANAGERS’ REPORT |

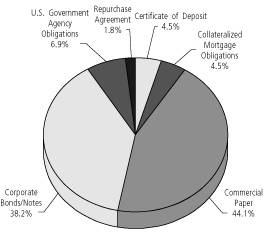

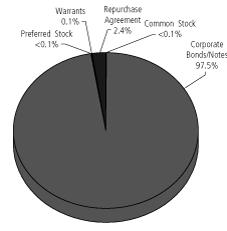

Investment Types

as of September 30, 2005

(as a percent of total investments)

Portfolio holdings are subject to change daily.

The ING Institutional Money Market Fund (the “Fund”) seeks to provide a high level of current income, consistent with preservation of capital and liquidity and the maintenance of a stable $1.00 net asset value per share. The Fund is managed by David S. Yealy, ING Investment Management Co. — the Sub-Adviser.

Portfolio Specifics: The Federal Open Market Committee (“FOMC”) continued its measured pace of increasing short-term interest rates in order to remove some additional monetary accommodation. The FOMC raised the Federal Funds rate 25 basis points at the two third quarter FOMC Meetings taking the rate from 3.25% at June 30th to 3.75% as of September 30th, despite the concerns about the short-term economic growth impact and spike in energy costs related to Hurricane Katrina. The FOMC has raised rates a total of eleven times and 2.75% since they started increasing the Federal Funds rate at the end of June last year. Chairman Greenspan and the other FOMC members do not appear to be done raising rates any time soon. In various speeches following Hurricane Katrina and the September 20th FOMC meeting, the FOMC participants focused on the potential for inflation to pickup in 2006 due to higher energy costs and the rebuilding efforts

Rates for short-term money market securities increased during the quarter approximately 50 basis points in response to the increases in the Federal Funds rate and in anticipation of more increases in 2005 and 2006. The Fund benefited from starting up in a rising rate environment and from the large amount of interest sensitive floating rate securities purchased during the quarter. In addition to our emphasis on floating rate securities, we focused initial purchases on very short maturity securities that typically matured prior to the next one or two FOMC meetings which also performed well during this rising rate environment. We maintained a short weighted average maturity (WAM) similar to or shorter than the iMoneyNet First Tier Average WAM.

Current Strategy and Outlook: The short-term market consensus as of the end of September is for the Federal Funds rate to be 4% at year-end. We believe that the FOMC will keep raising the Federal Funds rate at least 25 basis points at each of the meetings in the fourth quarter, taking the rate to 4.25% or higher with additional increases in 2006. We will continue to maintain a high exposure to floating rate notes and make selective purchases in the three-month and under maturity sector where yield levels fully price in 25 basis point increases at each of the Federal Reserve meetings in between. We intend to keep our weighted average maturity relatively short until the markets start to price in a more aggressive Federal Reserve policy than is currently reflected in the market.

13

SHAREHOLDER EXPENSE EXAMPLES (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution [and/or service] (12b–1) fees; and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2005 to September 30, 2005.

Actual Expenses

The first section of the table shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | | | Expenses Paid | |

| | | Account | | Account | | Annualized | | During the | |

| | | Value | | Value | | Expense | | Six Months Ended | |

| ING GNMA Income Fund | | April 1, 2005 | | September 30, 2005 | | Ratio | | September 30, 2005* | |

| | | | | | | | | | |

| Actual Fund Return | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,016.80 | | | 1.01 | % | | $5.11 | | |

| Class B | | 1,000.00 | | | 1,013.10 | | | 1.76 | | | 8.88 | | |

| Class C | | 1,000.00 | | | 1,013.00 | | | 1.76 | | | 8.88 | | |

| Class M | | 1,000.00 | | | 1,014.20 | | | 1.50 | | | 7.57 | | |

| Hypothetical (5% return before expenses) | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,020.00 | | | 1.01 | % | | $5.11 | | |

| Class B | | 1,000.00 | | | 1,016.24 | | | 1.76 | | | 8.90 | | |

| Class C | | 1,000.00 | | | 1,016.24 | | | 1.76 | | | 8.90 | | |

| Class M | | 1,000.00 | | | 1,017.55 | | | 1.50 | | | 7.59 | | |

| | | | | | | | | | | | | | |

* Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 to reflect the most recent fiscal half-year.

14

SHAREHOLDER EXPENSE EXAMPLES (Unaudited) (CONTINUED)

| | Beginning | | Ending | | | | Expenses Paid | |

| | Account | | Account | | Annualized | | During the | |

| | Value | | Value | | Expense | | Six Months Ended | |

| ING High Yield Bond Fund | | April 1, 2005 | | September 30, 2005 | | Ratio | | September 30, 2005* | |

| Actual Fund Return | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,028.10 | | | 1.21 | % | | $6.15 | | |

| Class B | | 1,000.00 | | | 1,025.40 | | | 1.96 | | | 9.95 | | |

| Class C | | 1,000.00 | | | 1,024.20 | | | 1.96 | | | 9.95 | | |

| Hypothetical (5% return before expenses) | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,018.50 | | | 1.31 | % | | $6.63 | | |

| Class B | | 1,000.00 | | | 1,015.74 | | | 1.86 | | | 9.40 | | |

| Class C | | 1,000.00 | | | 1,015.24 | | | 1.96 | | | 9.90 | | |

| | | | | | | | | | | | | | |

| ING Intermediate Bond Fund | | | | | | | | | | | | | |

| Actual Fund Return | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,023.70 | | | 1.00 | % | | $5.07 | | |

| Class B | | 1,000.00 | | | 1,019.90 | | | 1.75 | | | 8.86 | | |

| Class C | | 1,000.00 | | | 1,019.90 | | | 1.75 | | | 8.86 | | |

| Class O | | 1,000.00 | | | 1,024.20 | | | 1.00 | | | 5.07 | | |

| Class R | | 1,000.00 | | | 1,022.20 | | | 1.25 | | | 6.34 | | |

| Hypothetical (5% return before expenses) | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,020.05 | | | 1.00 | % | | $5.06 | | |

| Class B | | 1,000.00 | | | 1,016.29 | | | 1.75 | | | 8.85 | | |

| Class C | | 1,000.00 | | | 1,016.29 | | | 1.75 | | | 8.85 | | |

| Class O | | 1,000.00 | | | 1,020.05 | | | 1.00 | | | 5.06 | | |

| Class R | | 1,000.00 | | | 1,018.80 | | | 1.25 | | | 6.33 | | |

| | | | | | | | | | | | | | |

| ING National Tax-Exempt Bond Fund | | | | | | | | | | | | | |

| Actual Fund Return | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,022.00 | | | 1.10 | % | | $5.58 | | |

| Class B | | 1,000.00 | | | 1,017.20 | | | 1.85 | | | 9.36 | | |

| Class C | | 1,000.00 | | | 1,018.10 | | | 1.85 | | | 9.36 | | |

| Hypothetical (5% return before expenses) | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,019.55 | | | 1.10 | % | | $5.57 | | |

| Class B | | 1,000.00 | | | 1,015.79 | | | 1.85 | | | 9.35 | | |

| Class C | | 1,000.00 | | | 1,015.79 | | | 1.85 | | | 9.35 | | |

| | | | | | | | | | | | | | |

* Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 to reflect the most recent fiscal half-year.

15

SHAREHOLDER EXPENSE EXAMPLES (Unaudited) (CONTINUED)

| | Beginning | | Ending | | | | Expenses Paid | |

| | Account | | Account | | Annualized | | During the | |

| | Value | | Value | | Expense | | Six Months Ended | |

| ING Classic Money Market Fund | | April 1, 2005 | | September 30, 2005 | | Ratio | | September 30, 2005* | |

| Actual Fund Return | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,012.60 | | | 0.77 | % | | $3.88 | | |

| Class B | | 1,000.00 | | | 1,009.70 | | | 1.32 | | | 6.65 | | |

| Class C | | 1,000.00 | | | 1,009.80 | | | 1.32 | | | 6.65 | | |

| Hypothetical (5% return before expenses) | | | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,021.21 | | | 0.77 | % | | $3.90 | | |

| Class B | | 1,000.00 | | | 1,018.45 | | | 1.32 | | | 6.68 | | |

| Class C | | 1,000.00 | | | 1,018.45 | | | 1.32 | | | 6.68 | | |

| | | | | | | | | | | | | | |

| ING Institutional Prime Money Market Fund (a) | | | | | | | | | | | | | |

| Actual Fund Return | | $1,000.00 | | | $1,005.90 | | | 0.17 | % | | $0.30 | | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | | $1,024.22 | | | 0.17 | % | | $0.86 | | |

| | | | | | | | | | | | | | |

* Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 to reflect the most recent fiscal half-year (except for ING Institutional Prime Money Market Fund’s “Actual Fund Return” information which reflects the 64 day period ended September 30, 2005 due to its inception date of July 28, 2005.

(a) Fund commenced operations July 28, 2005.

16

STATEMENTS OF ASSETS AND LIABILITIES as of September 30, 2005 (UNAUDITED)

| | ING | | ING | | ING | |

| | GNMA Income | | High Yield Bond | | Intermediate Bond | |

| | Fund | | Fund | | Fund | |

ASSETS: | | | | | | | |

Investments in securities at value*+ | | | $ | 611,970,497 | | | $ | 221,959,050 | | | $ | 916,344,134 | |

Short-term investments at amortized cost | | | 34,684,685 | | | — | | | — | |

Repurchase agreement | | | — | | | 5,438,000 | | | 82,978,000 | |

Cash | | | 1,007,825 | | | 290,959 | | | 56,256 | |

Cash collateral for futures | | | — | | | — | | | 261,282 | |

Cash collateral for securities loaned | | | — | | | — | | | 189,517,473 | |

Foreign currencies at value** | | | — | | | — | | | 8,957 | |

Receivables: | | | | | | | | | | |

Investment securities sold | | | — | | | 4,269,544 | | | 12,173,384 | |

Fund shares sold | | | 173,520 | | | 120,961 | | | 1,573,888 | |

Dividends and interest | | | 3,080,644 | | | 4,711,833 | | | 5,626,506 | |

Variation margin receivable | | | — | | | — | | | 19,238 | |

Prepaid expenses | | | 68,738 | | | 26,333 | | | 94,890 | |

Unrealized appreciation on swap agreements | | | — | | | — | | | 149,829 | |

Reimbursement due from manager | | | — | | | 163 | | | — | |

Total assets | | | 650,985,909 | | | 236,816,843 | | | 1,208,803,837 | |

| | | | | | | | | | |

LIABILITIES: | | | | | | | | | | |

Payable for investment securities purchased | | | — | | | 7,504,536 | | | 149,918,457 | |

Payable for fund shares redeemed | | | 442,558 | | | 563,707 | | | 3,737,920 | |

Payable for futures variation margin | | | — | | | — | | | 60,750 | |

Income distribution payable | | | — | | | 574,470 | | | 533,372 | |

Payable upon receipt of securities loaned | | | — | | | — | | | 189,517,473 | |

Payable to affiliates | | | 537,645 | | | 267,507 | | | 665,780 | |

Payable for trustee fees | | | 19,781 | | | 8,066 | | | 7,836 | |

Other accrued expenses and liabilities | | | 361,831 | | | 242,100 | | | 563,405 | |

Total liabilities | | | 1,361,815 | | | 9,160,386 | | | 345,004,993 | |

NET ASSETS | | | $ | 649,624,094 | | | $ | 227,656,457 | | | $ | 863,798,844 | |

| | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | |

Paid-in capital | | | $ | 662,079,607 | | | $ | 667,806,521 | | | $ | 866,313,807 | |

Undistributed net investment income (accumulated net investment loss) | | | 725,397 | | | (352,648 | ) | | (558,490 | ) |

Accumulated net realized gain (loss) on investments, foreign currency related transactions, futures and swaps | | | (18,951,005 | ) | | (422,612,064 | ) | | 6,398,900 | |

Net unrealized appreciation or depreciation on investments foreign currency related transactions, futures and swaps | | | 5,770,095 | | | (17,185,352 | ) | | (8,355,373 | ) |

NET ASSETS | | | $ | 649,624,094 | | | $ | 227,656,457 | | | $ | 863,798,844 | |

| | | | | | | | | | | | | |

|

+ | | Including securities loaned at value | | | $ | — | | | $ | — | | | $ | 185,179,131 | |

* | | Cost of investments in securities | | | $ | 606,215,034 | | | $ | 239,144,402 | | | $ | 924,611,548 | |

** | | Cost of foreign currencies | | | $ | — | | | $ | — | | | $ | 9,217 | |

| | | | | | | | | | | | | | | | |

See Accompanying Notes to Financial Statements

17

STATEMENTS OF ASSETS AND LIABILITIES as of September 30, 2005 (UNAUDITED) (CONTINUED)

| | ING | | ING | | ING | |

| | GNMA Income | | High Yield Bond | Intermediate Bond | |

| | Fund | | Fund | | Fund | |

Class A: | | | | | | | |

Net assets | | $ | 508,424,239 | | $ | 105,472,999 | | $ | 534,202,800 | |

Shares authorized | | unlimited | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 60,143,323 | | 12,091,430 | | 51,503,815 | |

Net asset value and redemption price per share | | $ | 8.45 | | $ | 8.72 | | $ | 10.37 | |

Maximum offering price per share (4.75%)(1) | | $ | 8.87 | | $ | 9.15 | | $ | 10.89 | |

| | | | | | | |

Class B: | | | | | | | |

Net assets | | $ | 90,397,461 | | $ | 101,079,537 | | $ | 64,641,606 | |

Shares authorized | | unlimited | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 10,745,208 | | 11,591,544 | | 6,244,547 | |

Net asset value and redemption price per share(2) | | $ | 8.41 | | $ | 8.72 | | $ | 10.35 | |

Maximum offering price per share | | $ | 8.41 | | $ | 8.72 | | $ | 10.35 | |

| | | | | | | |

Class C: | | | | | | | |

Net assets | | $ | 39,067,482 | | $ | 21,103,921 | | $ | 73,880,602 | |

Shares authorized | | unlimited | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 4,637,363 | | 2,418,967 | | 7,131,907 | |

Net asset value and redemption price per share(2) | | $ | 8.42 | | $ | 8.72 | | $ | 10.36 | |

Maximum offering price per share | | $ | 8.42 | | $ | 8.72 | | $ | 10.36 | |

| | | | | | | |

Class I: | | | | | | | |

Net assets | | $ | 11,459,484 | | N/A | | $ | 149,921,722 | |

Shares authorized | | unlimited | | N/A | | unlimited | |

Par value | | $ | 0.001 | | N/A | | $ | 0.001 | |

Shares outstanding | | 1,354,237 | | N/A | | 14,450,352 | |

Net asset value and redemption price per share | | $ | 8.46 | | N/A | | $ | 10.37 | |

Maximum offering price per share | | $ | 8.46 | | N/A | | $ | 10.37 | |

| | | | | | | |

Class M: | | | | | | | |

Net assets | | $ | 194,179 | | N/A | | N/A | |

Shares authorized | | unlimited | | N/A | | N/A | |

Par value | | $ | 0.001 | | N/A | | N/A | |

Shares outstanding | | 22,930 | | N/A | | N/A | |

Net asset value and redemption price per share | | $ | 8.47 | | N/A | | N/A | |

Maximum offering price per share (3.25%)(3) | | $ | 8.75 | | N/A | | N/A | |

| | | | | | | |

Class O: | | | | | | | |

Net assets | | N/A | | N/A | | $ | 40,497,262 | |

Shares authorized | | N/A | | N/A | | unlimited | |

Par value | | N/A | | N/A | | $ | 0.001 | |

Shares outstanding | | N/A | | N/A | | 3,902,909 | |

Net asset value and redemption price per share | | N/A | | N/A | | $ | 10.38 | |

Maximum offering price per share | | N/A | | N/A | | $ | 10.38 | |

| | | | | | | |

Class Q: | | | | | | | |

Net assets | | $ | 81,249 | | N/A | | N/A | |

Shares authorized | | unlimited | | N/A | | N/A | |

Par value | | $ | 0.001 | | N/A | | N/A | |

Shares outstanding | | 9,593 | | N/A | | N/A | |

Net asset value and redemption price per share | | $ | 8.47 | | N/A | | N/A | |

Maximum offering price per share | | $ | 8.47 | | N/A | | N/A | |

| | | | | | | |

Class R: | | | | | | | |

Net assets | | N/A | | N/A | | $ | 654,852 | |

Shares authorized | | N/A | | N/A | | unlimited | |

Par value | | N/A | | N/A | | $ | 0.001 | |

Shares outstanding | | N/A | | N/A | | 63,042 | |

Net asset value and redemption price per share | | N/A | | N/A | | $ | 10.39 | |

Maximum offering price per share | | N/A | | N/A | | $ | 10.39 | |

| | | | | | | | | | | | | | | |

(1) Maximum offering price is computed at 100/95.25 of net asset value. On purchases of $50,000 or more, the offering price is reduced.

(2) Redemption price per share may be reduced for any applicable contingent deferred sales charges.

(3) Maximum offering price is computed at 100/96.75 of net asset value. On purchases of $50,000 or more, the offering price is reduced.

See Accompanying Notes to Financial Statements

18

STATEMENTS OF ASSETS AND LIABILITIES as of September 30, 2005 (UNAUDITED)

| | ING | | ING | |

| | National Tax- | | Classic Money | |

| | Exempt Bond | | Market | |

| | Fund | | Fund | |

ASSETS: | | | | | |

Investments in securities at value* | | $ | 27,990,152 | | $ | — | |

Short-term investments at amortized cost | | — | | 573,455,101 | |

Repurchase agreement | | — | | 10,706,000 | |

Cash | | 301,154 | | 56,391 | |

Receivables: | | | | | |

Investment securities sold | | — | | 5,691,934 | |

Fund shares sold | | 10,201 | | 12,332,338 | |

Dividends and interest | | 386,779 | | 1,618,229 | |

Prepaid expenses | | 27,661 | | 185,851 | |

Reimbursement due from manager | | 1,111 | | — | |

Total assets | | 28,717,058 | | 604,045,844 | |

| | | | | |

LIABILITIES: | | | | | |

Payable for fund shares redeemed | | 178 | | 513,225 | |

Income distribution payable | | 80,702 | | 18,614 | |

Payable to affiliates | | 27,222 | | 514,572 | |

Payable for trustee fees | | 994 | | 12,718 | |

Other accrued expenses and liabilities | | 13,454 | | 178,965 | |

Total liabilities | | 122,550 | | 1,238,094 | |

NET ASSETS | | $ | 28,594,508 | | $ | 602,807,750 | |

| | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | |

Paid-in capital | | $ | 27,355,798 | | $ | 603,001,729 | |

Accumulated net investment loss | | (1,160 | ) | (5 | ) |

Accumulated net realized gain (loss) on investments | | 286,747 | | (193,974 | ) |

Net unrealized appreciation or depreciation on investments | | 953,123 | | — | |

NET ASSETS | | $ | 28,594,508 | | $ | 602,807,750 | |

* Cost of investments in securities | | $ | 27,037,029 | | $ | — | |

See Accompanying Notes to Financial Statements

19

STATEMENTS OF ASSETS AND LIABILITIES as of September 30, 2005 (UNAUDITED) (CONTINUED)

| | ING | | ING | |

| | National Tax- | | Classic Money | |

| | Exempt Bond | | Market | |

| | Fund | | Fund | |

Class A: | | | | | |

Net assets | | $ | 23,501,279 | | $ | 566,598,470 | |

Shares authorized | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 2,228,504 | | 566,761,681 | |

Net asset value and redemption price per share | | $ | 10.55 | | $ | 1.00 | |

Maximum offering price per share (4.75%)(1) | | $ | 11.08 | | $ | 1.00 | |

| | | | | |

Class B: | | | | | |

Net assets | | $ | 3,195,466 | | $ | 31,159,293 | |

Shares authorized | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 303,169 | | 31,182,906 | |

Net asset value and redemption price per share(2) | | $ | 10.54 | | $ | 1.00 | |

Maximum offering price per share | | $ | 10.54 | | $ | 1.00 | |

| | | | | |

Class C: | | | | | |

Net assets | | $ | 1,897,763 | | $ | 5,049,987 | |

Shares authorized | | unlimited | | unlimited | |

Par value | | $ | 0.001 | | $ | 0.001 | |

Shares outstanding | | 179,919 | | 5,057,726 | |

Net asset value and redemption price per share(2) | | $ | 10.55 | | $ | 1.00 | |

Maximum offering price per share | | $ | 10.55 | | $ | 1.00 | |

(1) Maximum offering price is computed at 100/95.25 of net asset value. On purchases of $50,000 or more, the offering price is reduced.

(2) Redemption price per share may be reduced for any applicable contingent deferred sales charges.

See Accompanying Notes to Financial Statements

20

STATEMENTS OF ASSETS AND LIABILITIES as of September 30, 2005 (UNAUDITED)

| | ING | |

| | Institutional Prime | |

| | Money Market | |

| | Fund | |

ASSETS: | | | |

Short-term investments at amortized cost | | | $ | 71,289,043 | | |

Repurchase agreement | | | 14,366,000 | | |

Cash | | | 26 | | |

Receivables: | | | | | |

Investment securities sold | | | 3,022,266 | | |

Dividends and interest | | | 461,126 | | |

Prepaid expenses | | | 83,347 | | |

Offering expense | | | 17,260 | | |

Total assets | | | 89,239,068 | | |

| | | | | |

LIABILITIES: | | | | | |

Income distribution payable | | | 159,852 | | |

Payable to affiliates | | | 5,716 | | |

Payable for trustee fees | | | 686 | | |

Other accrued expenses and liabilities | | | 109,805 | | |

Total liabilities | | | 276,059 | | |

NET ASSETS (equivalent to $1.00 per share on 88,961,245 shares outstanding) | | | $ | 88,963,009 | | |

| | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | |

Paid-in capital — shares of beneficial interest at $0.001 par value (unlimited shares authorized) | | | $ | 88,961,245 | | |

Accumulated net realized gain on investments | | | 1,764 | | |

NET ASSETS | | | $ | 88,963,009 | | |

See Accompanying Notes to Financial Statements

21

STATEMENTS OF OPERATIONS for the year ended September 30, 2005 (UNAUDITED)

| | ING | | ING | | ING | |

| | GNMA Income | | High Yield Bond | | Intermediate Bond | |

| | Fund | | Fund | | Fund | |

INVESTMENT INCOME: | | | | | | | |

Dividends, net of foreign taxes withheld* | | $ | — | | $ | 348,245 | | $ | 213,499 | |

Interest | | 19,549,552 | | 8,718,666 | | 16,122,693 | |

Securities lending income | | — | | 42,685 | | 367,412 | |

Total investment income | | 19,549,552 | | 9,109,596 | | 16,703,604 | |

EXPENSES: | | | | | | | |

Investment management fees | | 1,675,044 | | 802,054 | | 1,775,769 | |

Distribution and service fees | | | | | | | |

Class A | | 648,251 | | 195,717 | | 875,505 | |

Class B | | 478,059 | | 559,276 | | 326,995 | |

Class C | | 204,256 | | 116,207 | | 367,476 | |

Class M | | 736 | | — | | — | |

Class Q | | 117 | | — | | — | |

Class O | | — | | — | | 47,983 | |

Class R | | — | | — | | 988 | |

Transfer agent fees | | | | | | | |

Class A | | 191,088 | | 80,974 | | 235,063 | |

Class B | | 35,166 | | 81,095 | | 30,695 | |

Class C | | 15,031 | | 16,855 | | 34,494 | |

Class M | | 68 | | — | | — | |

Class I | | 976 | | — | | 9,166 | |

Class Q | | 9 | | — | | — | |

Class O | | — | | — | | 18,263 | |

Class R | | — | | — | | 185 | |

Administrative service fees | | 333,233 | | 123,467 | | 366,758 | |

Shareholder reporting expense | | 101,110 | | 39,345 | | 103,429 | |

Registration fees | | 43,494 | | 36,991 | | 56,156 | |

Professional fees | | 39,635 | | 16,309 | | 23,800 | |

Custody and accounting fees | | 42,960 | | 17,875 | | 50,835 | |

Trustee fees | | 17,020 | | 3,631 | | 13,160 | |

Insurance expense | | 8,628 | | 4,326 | | 7,324 | |

Miscellaneous expense | | 13,065 | | 9,048 | | 7,660 | |

Total expenses | | 3,847,946 | | 2,103,170 | | 4,351,704 | |

Net waived and reimbursed fees | | — | | (108,336 | ) | (250,133 | ) |

Net expenses | | 3,847,946 | | 1,994,834 | | 4,101,571 | |

Net investment income | | 15,701,606 | | 7,114,762 | | 12,602,033 | |

| | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY RELATED TRANSACTIONS, FUTURES AND SWAPS: | | | | | | | |

Net realized gain (loss) on: | | | | | | | |

Investments | | 954,637 | | 611,789 | | 3,619,745 | |

Foreign currency related transactions | | — | | 64,787 | | (12,415 | ) |

Futures and swaps | | — | | — | | 1,328,925 | |

Net realized gain on investments, foreign currency related transactions, futures and swaps | | 954,637 | | 676,576 | | 4,936,255 | |

Net change in unrealized appreciation or depreciation on: | | | | | | | |

Investments | | (5,764,626 | ) | (987,549 | ) | (3,043,040 | ) |

Foreign currency related transactions | | — | | (90,038 | ) | (325 | ) |

Futures and swaps | | — | | — | | 419,791 | |

Net change in unrealized depreciation on investments, foreign currency related transactions, futures and swaps | | (5,764,626 | ) | (1,077,587 | ) | (2,623,574 | ) |

Net realized and unrealized gain (loss) on investments, foreign currency related transactions, futures and swaps | | (4,809,989 | ) | (401,011 | ) | 2,312,681 | |

Increase in net assets resulting from operations | | $ | 10,891,617 | | $ | 6,713,751 | | $ | 14,914,714 | |

| | | | | | | | | | | | | | | | | |

*Foreign taxes | | $ | — | | $ | 60,885 | | $ | 650 | |

See Accompanying Notes to Financial Statements

22

STATEMENTS OF OPERATIONS for the year ended September 30, 2005 (UNAUDITED) (CONTINUED)

| | ING

National Tax-

Exempt Bond

Fund | | ING

Classic Money

Market

Fund | | ING

Institutional Prime

Money Market

Fund | |

INVESTMENT INCOME: | | | | | | | | | | | | | |

Interest | | | $ | 646,948 | | | | $ | 9,410,456 | | | | $ | 504,567 | | |

Total investment income | | | 646,948 | | | | 9,410,456 | | | | 504,567 | | |

| | | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | | |

Investment management fees | | | 71,740 | | | | 717,984 | | | | 10,969 | | |

Distribution and service fees | | | | | | | | | | | | | |

Class A | | | 41,401 | | | | 2,026,347 | | | | — | | |

Class B | | | 15,900 | | | | 145,880 | | | | — | | |

Class C | | | 9,290 | | | | 24,260 | | | | — | | |

Transfer agent fees | | | | | | | | | | | | | |

Class A | | | 355 | | | | 22,404 | | | | 1,714 | | |

Class B | | | 48 | | | | 1,212 | | | | — | | |

Class C | | | 28 | | | | 201 | | | | — | | |

Administrative service fees | | | 14,348 | | | | — | | | | — | | |

Shareholder reporting expense | | | 3,370 | | | | 65,466 | | | | 2,742 | | |

Registration fees | | | 22,895 | | | | 20,257 | | | | 4,120 | | |

Professional fees | | | 2,722 | | | | 41,707 | | | | 1,372 | | |

Custody and accounting expense | | | 458 | | | | 33,003 | | | | 1,714 | | |

Trustee fees | | | 549 | | | | 8,967 | | | | 686 | | |

Offering expense | | | — | | | | — | | | | 17,260 | | |

Insurance expense | | | 342 | | | | 6,303 | | | | — | | |

Miscellaneous expense | | | 826 | | | | 7,709 | | | | 3 | | |

Total expenses | | | 184,272 | | | | 3,121,700 | | | | 40,580 | | |

Net waived and reimbursed fees | | | (7,488 | ) | | | (816,369 | ) | | | (17,260 | ) | |

Net expenses | | | 176,784 | | | | 2,305,331 | | | | 23,320 | | |