| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | August 31, 2011 |

Estimated average burden |

hours per response: | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08895

ING Funds Trust

(Exact name of registrant as specified in charter)

| | |

| 7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

| (Address of principal executive offices) | | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: March 31

Date of reporting period: April l, 2008 to September 30, 2008

Semi-Annual Report

September 30, 2008

Classes A, B, C, I, IS, O, Q, R and W

Fixed-Income Funds

| n | ING High Yield Bond Fund |

| n | ING Intermediate Bond Fund |

| n | ING National Tax-Exempt Bond Fund |

Money Market Funds

| n | ING Classic Money Market Fund |

| n | ING Institutional Prime Money Market Fund |

| | |

| | E-Delivery Sign-up – details inside |

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

F U N D S |

|

TABLE OF CONTENTS

| | | | |

| | | |

| | Go Paperless with E-Delivery! | |  |

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs. Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll. You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail. |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Funds use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Funds’ website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. Information regarding how the Funds voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Funds’ website at www.ingfunds.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the website at www.sec.gov. The Funds’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Funds by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT’S LETTER

Dear Shareholders,

We are in the midst of one of the most challenging periods ever faced by investors and we at ING Funds are aware of the anxiety that you may be feeling at this time.

I want to assure you that we are actively engaged in monitoring the situation and are committed to keeping you fully informed of how the rapidly unfolding events around us may impact your investments with our company.

We recognize that the confidence of many investors is being tested, perhaps as never before. It is understandable that some of you may be second guessing your investment strategy due to these recent events. We encourage you to work with your investment professional and seek out their advice about your portfolio in light of the current conditions. But we also urge investors not to make rash decisions. ING Funds still believes that a well-diversified, globally allocated portfolio remains the most effective investment strategy of all. We ask that investors not lose sight of their commitment to the long-term.

We thank you for your support and confidence and we look forward to continuing to do business with you in the future.

Sincerely,

Shaun Mathews,

President

ING Funds

October 17, 2008

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

For more complete information, or to obtain a prospectus for any ING Fund, please call your investment professional or ING Funds Distributor, LLC at (800) 992-0180 or log on to www.ingfunds.com. The prospectus should be read carefully before investing. Consider the fund’s investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the fund. Check with your investment professional to determine which funds are available for sale within their firm. Not all funds are available for sale at all firms.

1

MARKET PERSPECTIVE: SIX MONTHS ENDED SEPTEMBER 30, 2008

For a while, as our new fiscal year got under way, it seemed as if the worst had passed. Bear Stearns’ forced sale to JP Morgan had proved that some market players were indeed too connected to fail. The Federal Reserve Board (the “Fed”), which had been reducing rates since August, had then cut the discount rate further, by 100 basis points to 2.5% and the federal funds rate by 75 basis points to 2.25%, following this up by opening the discount window to other primary dealers. The improved sentiment was sustained by another federal funds rate cut of 0.25%.

But what had really changed? The housing market continued its inexorable slide, with the Standard & Poor’s (“S&P”)/Case-Shiller National U.S. Home Price Index(1) of house prices in 20 major cities down a record 16.3%. New home sales were at the lowest level since early 1991 and one third of existing home sales were distressed. Banks continued to restrict credit and 30-year fixed mortgage rates reached a six-year high. By September, payrolls had declined for eight consecutive months and the unemployment rate rose to 6.1%, a five-year high.

And there were more fireworks in the financial sector.

Government sponsored mortgage lending agencies, specifically, the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”), lightly capitalized for their trillions in liabilities, were by any rational assessment, insolvent. The systemic risk to the broader economy was obvious and with their stock prices in free-fall the Treasury took control of Fannie Mae and Freddie Mac on September 7, putting them into “conservatorship” and removing their CEOs.

Lehman Brothers and Merrill Lynch had both declared losses in the billions, due to mortgage securities write downs. The following weekend Lehman Brothers filed for Chapter 11 protection and Merrill Lynch, with official encouragement, was acquired by Bank of America.

Days later, global insurer AIG, in trouble because it insured enormous volumes of bonds (including mortgage related) through credit default swaps, was refused a massive loan from the government. But there was an additional dimension to the emergency, due to the fact that short-term Lehman Brothers and AIG paper was widely-held in money market funds. Fearing that such funds might now turn their backs on commercial credit, the government took a 79.9% stake in AIG, with an $85 billion loan on terms that threatened to wipe out shareholders.

So after more than one year of the credit crisis, nothing that had been tried had worked. The Administration was now in the position of choosing winners and losers among financial institutions. Credit markets faced systemic collapse. A systemic remedy was called for.

On Friday, September 19, 2008, Mr. Paulson proposed a Troubled Asset Relief Plan (“TARP”) under which a $700 billion fund would be set up to buy illiquid mortgage securities from financial institutions. The required new legislation was written with much wrangling in the ten days that followed.

This was a ten-day period with enough news in it to fill a quarter. The last two major independents: Morgan Stanley and Goldman Sachs abandoned the investment banking business model. Washington Mutual, in the biggest bank failure ever, was seized by the Office of Thrift Supervision. Wachovia agreed to sell almost all of its banking business to Citigroup.

On September 29, 2008, Congress sensationally voted down the TARP legislation and the quarter ended with credit markets in a state of atrophy, evidenced by record spreads between commercial interest rates and Treasury yields of comparable terms.

Market movements for the period were defined by the trauma of September.

In US fixed income markets, the Treasury yield curve steepened as investors sought ultimate safety. For the six months ended September 30, 2008, the Treasury Bill yield fell 37 basis points to 0.90%, while the ten-year Treasury Note rose 40 basis points to 3.83%, supported by headline consumer price inflation of 5.4% and increasing calls on the public purse. The Lehman Brothers® U.S. Aggregate Bond (“LBAB”) Index(2) of investment grade bonds returned (1.50)%. But high yield bonds, represented by the Lehman Brothers® High Yield Bond — 2% Issuer Constrained Composite Index(3) returned (6.77)%.

In currencies, the dollar at first continued its weakening trend against the euro. But the tide turned in mid-July and for the whole six months the dollar strengthened by 9.4%. The dollar gained 6.7% on the yen, and 9.8% against the pound.

U.S. equities, represented by the S&P 500® Composite Stock Price Index (“S&P 500® Index”)(4) including dividends, returned (10.90)% for the half-year. Profits for S&P 500® companies suffered their fourth straight quarter of decline, led down by the financials sector. On September 29, 2008, the day TARP legislation was voted down, the S&P 500® Index

2

MARKET PERSPECTIVE: SIX MONTHS ENDED SEPTEMBER 30, 2008

suffered the biggest drop since “Black Monday” in October 1987: 8.8%, before recovering about 60% of this the next day.

In international markets, the Morgan Stanley Capital International (“MSCI”) Japan Index(5) fell 10.0% for the six-month period. The export dependent economy suffered from slowing global demand, while high energy prices and political deadlock sapped domestic confidence. The longest postwar expansion came to an end as a dip in exports led to a decline in gross domestic product (“GDP”) of 0.70% in the second quarter of 2008. The MSCI Europe ex UK® Index(6) slumped 15.3%, beset by sharply falling economic activity and inflation at a 16-year high causing the European Central Bank to raise interest rates. In the final few days of September, governments had to throw life-lines to Belgian insurer Fortis, German property company Hypo and Franco-Belgian bank Dexia. In the UK, the MSCI UK® Index(7) fell 12.6%, as elsewhere lenders were tightening their rules and house price declines were accelerating. In the last two weeks of September the Bank of England force-marched Halifax Bank of Scotland into the arms of Lloyds TSB and nationalized mortgage lender Bradford and Bingley.

(1) The S&P/Case-Shiller National U.S. Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated quarterly.

(2) The LBAB Index is an unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The Lehman Brothers® High Yield Bond — 2% Issuer Constrained Composite Index is an

unmanaged index that measures the performance of fixed-income securities.

(4) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

(5) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(6) The MSCI Europe ex UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(7) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Funds’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING’s Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

| | |

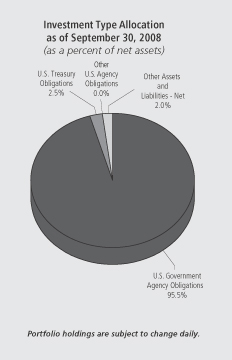

| ING GNMA INCOME FUND | | PORTFOLIO MANAGERS’ REPORT |

ING GNMA Income Fund (the “Fund”) seeks to generate a high level of current income, consistent with liquidity and safety of principal, through investment primarily in Government National Mortgage Association (“GNMA”) mortgage-backed securities (also known as GNMA Certificates) that are guaranteed as to the timely payment of principal and interest by the U.S. government. The Fund is managed by Denis P. Jamison, CFA, Senior Vice President and Senior Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Securities issued by the U.S. Treasury are backed by the full faith and credit of the federal government. Securities issued by individual agencies and organizations may be backed by the full faith and credit of the federal government as to principal or interest but are not direct obligations of the U.S. Treasury. Securities of some agencies and organizations are backed solely by the entity’s own resources or by the ability of the entity to borrow from the U.S. Treasury. Government securities also include certain mortgage-related securities that are sponsored by a U.S. government agency or organization and are not direct obligations of the U.S. government.

Performance: For the six-month period ended September 30, 2008, the Fund’s Class A shares, excluding sales charges, provided a total return of 0.43% compared to the Lehman Brothers® U.S. Mortgage-Backed Securities (“MBS”) Index(1) which returned 1.37%, for the same period.

Portfolio Specifics: Mortgages performed relatively well over the last six months as the yield spread between these securities and U.S. Treasury obligations narrowed. In March, the markets were suffering from a flight to quality prompted by the collapse of Bear Stearns. Investors were worried about contagion to other financial firms and, in our opinion, this caused them to shun

mortgage securities. Of course, hindsight has shown these worries were well founded and we are now in the midst of turmoil again. This time around, however, investors seem better able to distinguish good quality, liquid securities such as government-guaranteed mortgages from those at greater risk. Accordingly, the yield spreads between current coupon government-guaranteed mortgages and U.S. Treasuries have not reverted to levels as high as those seen in March.

The various mortgage initiatives designed in Washington to mitigate defaults and widen the scope of government-guaranteed programs are producing new forms of GNMA securities. The FHA-Secure program is designed to help mortgage holders who cannot meet current obligations, while the GNMA JM program is available to borrowers who require loans larger than those formerly available under the Federal Housing Administration (“FHA”) programs. Because the new products are unfamiliar, they typically are priced slightly below standard GNMA offerings. Since the start of the year, the Fund has purchased about $50 million worth of securities issued under the new mandates. So far, these investments have provided modest price appreciation.

The Fund’s benchmark consists primarily of Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corporation (“FHLMC”) guaranteed mortgages. At least 80% of the Fund’s holdings must consist of GNMAs Certificates, which put the Fund at a relative disadvantage for the reporting period. FHLMC and FNMA securities returned 25 basis points (or 0.25%) and 40 basis points (or 0.40%), respectively, more than GNMAs during the last six months.

There were no individual positions that significantly enhanced results during the period. Detracting from results was the Fund’s 4%-plus position in low yielding cash and short-term securities. We felt this was necessary given the high level of market volatility. Normally, a significant portion of these non-GNMA holdings would have been invested in longer dated U.S. Treasury obligations, a segment of the market that returned nearly 5% in the quarter ended September.

Current Outlook and Strategy: We believe there is considerable risk that the current period of instability will continue into 2009. Also, the prospect of a significant reduction in the already low federal funds rate lingers over the market. It is our opinion, that in such an environment, U.S. Treasury securities and low coupon mortgages should continue to perform well. However, longer term, we believe the overriding advantage of mortgages is their high yield. Currently, the yield spread between GNMA mortgages priced at par and five-year U.S. Treasury notes exceeds 2.50%. Moreover, mortgage pools priced slightly above par provide a projected 0.40% excess yield to maturity over discount securities. We expect to continue buying higher coupon offerings instead of securities perceived to have better appreciation potential.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

(1) | | The Lehman Brothers® U.S. MBS Index is an unmanaged index composed of fixed-income security mortgage pools sponsored by GNMA, FNMA and FHLMC, including GNMA Graduated Payment Mortgages. |

4

| | |

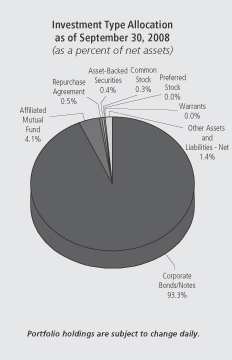

| PORTFOLIO MANAGERS’ REPORT | | ING HIGH YIELD BOND FUND |

ING High Yield Bond Fund (the “Fund”) seeks to provide investors with a high level of current income and total return. The Fund is managed by Randall Parrish, CFA and Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the six-month period ended September 30, 2008, the Fund’s Class A shares, excluding sales charges, provided a total return of (7.30)% compared to the Lehman Brothers® High Yield Bond Index(1) and the Lehman Brothers® High Yield Bond — 2% Issuer Constrained Composite Index(2), which returned (7.28)% and (6.77)%, respectively, for the same period.

Portfolio Specifics: The Fund underperformed its benchmark, the Lehman Brothers® High Yield Bond — 2% Issuer Constrained Composite Index, for the six-month period ended September 30, 2008.

For generations to come, the reporting period will fill finance textbooks with case studies. During this time, the markets feared inflation, recession, depression, high oil prices, falling oil prices, hedge fund failures and systemic risk in the financial system. We saw the failure of banks and brokerage houses, government sponsored enterprises, insurance companies, money market funds and a wide range of non-financial companies. The federal government committed its resources to guarantee money market funds, purchase mortgages and commercial paper and invest directly in private financial institutions in an effort to break the freeze that has gripped financial markets here and abroad.

These events wreaked havoc across all risk asset classes. The S&P 500® Index (equities) lost 11.80%, the Lehman US Investment Grade Corporate Index (investment grade debt) lost 8.44% and the Lehman US High Yield Loan Index — a measure of high yield debt — lost 6.77%. Though defaults to date remain low by historical standards, the market priced in greater default risk, widening the performance differential between higher and lower quality bonds (BB-rated bonds: -3.83%, B-rated bonds: -6.08% and CCC-rated bonds: - -9.58%).

The reduction in cyclical risk benefited the Fund in the period. An underweight of BB-rated bonds detracted from performance. On the other hand, sector positioning helped. Overweight positions in the environmental, energy, healthcare and wireless sectors added to results, as did underweight positions in retailers, gaming and high-yield financials. An off-benchmark exposure to investment-grade bank hybrid capital issues hurt performance. These securities dropped sharply in price when the U.S. government failed to include the Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corporation (“FHLMC”) preferred issues in its rescue of the two mortgage giants.

Given the extent of the sell-off during the period, the “wins” in security selection generally came from the bonds we did not own. The Fund did not hold any bonds that defaulted, and successfully avoided a number of the largest losers. The largest negative impacts came from holdings in directories publishers Idearc, Inc. and RH Donnelley Corp. and holdings related to the planned Huntsman Corp. (“Huntsman”)/Hexion US Finance Corp. (“Hexion”) merger. In anticipation of the deal closing, the Fund held positions in the bonds and also a small position in Huntsman equity. When Hexion sued to get out of the deal, the prices of both the bonds and the stock declined significantly. Huntsman recently won an initial victory in court, and the Fund continues to hold these positions pending resolution of the outstanding lawsuits.

Current Outlook and Strategy: We have expected for several months that the tightening of credit would lead to an acceleration of the default rate. We continue to believe most high yield issuers are well positioned to weather the downturn, but risk has clearly increased for companies

with marginal financial profiles. With the United States and much of Europe now likely in recession, we believe the increase in defaults will be more severe than previously anticipated. There has been little liquidity in the market in recent weeks, but we have continued to work to concentrate our holdings in companies we believe are well positioned through the downturn. In our opinion, the market has clearly priced in a much worse outcome, and we believe the sell-off into early October leaves the market near a bottom as spreads now appear to offer attractive compensation even for a higher level of credit losses. Governments worldwide are acting aggressively to head off a worst-case outcome, but we await some sign of success before taking on additional credit risk.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

(1) | | The Lehman Brothers® High Yield Bond Index is an unmanaged index that measures the performance of fixed-income securities generally representative of corporate bonds rated below investment grade. |

(2) | | The Lehman Brothers® High Yield Bond — 2% Issuer Constrained Composite Index is an unmanaged index that measures the performance of fixed-income securities. |

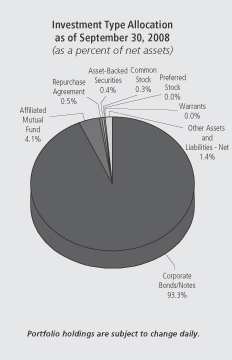

Top Ten Industries as of September 30, 2008

(as a percent of net assets)

| | |

Diversified Financial Services | | 14.3% |

Media | | 9.7% |

Telecommunications | | 9.4% |

Electric | | 8.0% |

Oil & Gas | | 7.9% |

Healthcare - Services | | 6.8% |

Commercial Services | | 3.6% |

Environmental Control | | 3.0% |

Entertainment | | 2.8% |

Chemicals | | 2.6% |

Portfolio holdings are subject to change daily.

5

| | |

| ING INTERMEDIATE BOND FUND | | PORTFOLIO MANAGERS’ REPORT |

Investment Type Allocation

as of September 30, 2008

(as a percent of net assets)

| | | |

U.S. Government Agency Obligations | | 42.0% | |

Collateralized Mortgage Obligations | | 24.8% | |

U.S. Treasury Obligations | | 22.8% | |

Corporate Bonds/Notes | | 22.1% | |

Affiliated Mutual Fund | | 11.4% | |

Asset-Backed Securities | | 2.7% | |

Municipal Bonds | | 1.1% | |

Preferred Stock | | 0.8% | |

Repurchase Agreement | | 0.5% | |

Warrants | | 0.0% | |

Other Assets and Liabilities—Net* | | (28.2 | )% |

| | | |

Net Assets | | 100.0% | |

| | | |

| | * | Includes Securities Lending Collateral |

Portfolio holdings are subject to change daily.

ING Intermediate Bond Fund (the “Fund”) seeks to provide investors with a high level of current income, consistent with the preservation of capital and liquidity. The Fund is managed by James B. Kauffmann, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the six-month period ended September 30, 2008, the Fund’s Class A shares, excluding sales charges, provided a total return of (5.95)% compared to the Lehman Brothers® U.S. Aggregate Bond (“LBAB”) Index(1), which returned (1.50)%, for the same period.

Portfolio Specifics: The period witnessed a worldwide and multi-sector collapse of virtually all risk-based asset classes. Disregarding successive and innovative moves by regulators and central banks, markets flew into the hands of perceived safety at an accelerating rate. The House and Senate swiftly passed legislation supporting FNMA and FHLMC explicitly in July. The bankruptcy of Lehman challenged its commercial paper investors, bond holders and derivatives counterparties. The money market fund industry buckled, and several funds either broke the buck or suspended redemptions.

Housing prices continued to drop. The commercial paper markets — a critical source of short-term financing for manufacturing, municipal and financial services — evaporated. The U.S. Congress eventually enacted a $700 billion bailout program but only after adding $150 billion in tax breaks to the bill. Despite this and other innovative responses to the liquidity crisis by central banks, fear continued to grip the lending markets.

In general, the Fund’s duration and yield curve positions detracted from results for the period. Positive real yields abroad compared favorably to negative real yields in the U.S. for the third quarter and resulted in our shorting the U.S. ten-year Treasury and going long ten-year exposures in the UK, Germany and Australia which was positive for the portfolio as foreign rates declined relative to those in the U.S. These positions helped performance by the end of the period.

We actively managed currency exposures during the period, which generally added to performance. While our long yen position was a detractor, shorts in the British pound, Australian and New Zealand dollars were positive.

Developing overweights to investment grade credit and financials hurt performance over the period. The Fund’s exposure to financial companies, such as banks, brokers and insurers, hurt performance relative to the benchmark significantly in the third quarter.

Just as our positions in single name credit default swaps and index credit default swaps helped the Fund endure some of the spread widening early in the period, subsequent spread contraction hurt performance later in the period.

Allocations to non-agency residential mortgage-backed securities (“RMBS”), which are not in the index, were the largest source of underperformance for the portfolio over the last six months. Holdings of sub-prime, Alt-A, non-agency adjustable rate mortgages (“ARMs”) and option ARMs were a significant drag.

Current Strategy and Outlook: We believe that U.S. investment grade credit and securitized assets may be the most undervalued securities in global capital markets. We suspect that many of the battered sectors of the U.S. fixed income market, in our opinion, may rebound before the economy itself bottoms or before other markets feel maximum pain. Nevertheless, recovering from this massive unwinding of leverage is not likely to be instantaneous, and the key is to carefully acquire undervalued bonds and be patient.

We remain overweight securitized assets and RMBS in particular. We do not expect the decline in home prices in the United States to abate soon, yet a number of relative value opportunities may exist in this challenging mortgage market. We are overweight a variety of mortgages and generally view the sector as deeply undervalued.

We are still avoiding the high yield sector, which has not sustained as much pressure as the investment grade credit markets. We will wait for more generalized price weakness or more compelling relative value before entering the emerging markets debt market in a large way.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

(1) | | The LBAB Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. |

Top Ten Industries as of September 30, 2008

(as a percent of net assets)

| | |

Collateralized Mortgage Obligations | | 24.8% |

Federal National Mortgage Association | | 17.5% |

Federal Home Loan Mortgage Corporation | | 13.6% |

U.S. Treasury Notes | | 13.6% |

Government National Mortgage Association | | 10.9% |

U.S. Treasury Bonds | | 8.1% |

Diversified Financial Services | | 7.0% |

Banks | | 5.8% |

Electric | | 1.7% |

Other Asset-Backed Securities | | 1.7% |

Portfolio holdings are subject to change daily.

6

| | |

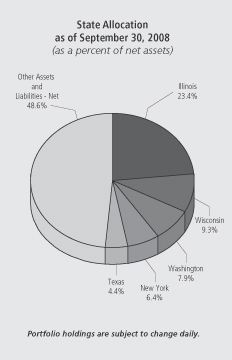

| PORTFOLIO MANAGERS’ REPORT | | ING NATIONAL TAX-EXEMPT BOND FUND |

ING National Tax-Exempt Bond Fund(1) (the “Fund”) seeks to provide investors with a high level of current income that is exempt from federal income taxes, consistent with the preservation of capital. The Fund is managed by Robert Schonbrunn, Karen Cronk, and Richard Kilbride, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.

Performance: For the six-month period ended September 30, 2008, the Fund’s Class A shares, excluding sales charges, provided a total return of (2.07)% compared to the Lehman Brothers® Municipal Bond Index(2) and the Lehman Brothers® U.S. Aggregate Bond (“LBAB”) Index(3), which returned (2.59)% and (1.50)%, respectively, for the same period.

Portfolio Specifics: The municipal bond market has been in a volatile downward trend during the last six months as the combination of monoline insurance capital adequacy issues and the unwinding of leveraged positions increased selling pressure. Tax-exempt interest rates have been forced above comparable Treasury issues all along the yield curve, reflecting the municipal bond market’s weakness compared to Treasuries. Credit quality became the focal point of bond performance during this period, and lower quality sectors severely under performed the higher quality sectors.

This was a difficult market environment in which to be liquidating the Fund, with thin markets and a dearth of buyers. Fortunately, we were

able to sell a substantial part of the Fund in late August and early September before conditions in the municipal bond market deteriorated further.

During the first part of the period, the Fund performed relatively well as longer term yields declined while yields on issues maturing in less than 15 years rose. With approximately 46% of the Fund in issues maturing in 10 years and longer, the Fund benefited. Because of the problems at the insurance companies, AAA-rated bonds underperformed AAs and As, which helped the Fund thanks to its heavy weightings in AA- and A-rated issues.

Weaker credits underperformed and the Fund was hurt by its exposure to BBBs and unrated securities. In the third quarter negative pressure built on longer-term issues and weaker credits, which had an adverse effect on the Fund. The program to liquidate holdings in the Fund dominated activity in the latter part of the reporting period.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

(1) | | Please note that effective October 23, 2008, the Fund was completely liquidated. |

(2) | | The Lehman Brothers Municipal Bond Index is an unmanaged index of approximately 1,100 investment-grade tax-exempt bonds classified into four sectors: general obligation, revenue, insured and pre-refunded. |

(3) | | The LBAB Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. |

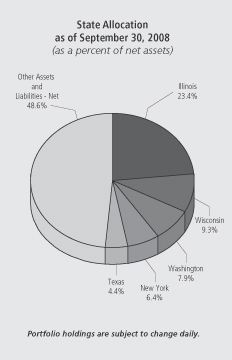

Top Ten Holdings

as of September 30, 2008

(as a percent of net assets)

| | |

Illinois Finance Authority, 5.000%, due 08/15/24 | | 23.4% |

State of Wisconsin, 5.125%, due 11/01/08 | | 9.3% |

City of Seattle, 5.250%, due 12/15/17 | | 7.9% |

New York City Transitional Finance Authority, 5.250%, due 08/15/11 | | 6.4% |

Harris County-Houston Sports Authority,

5.000%, due 11/15/28 | | 4.4% |

Portfolio holdings are subject to change daily.

7

| | |

| ING CLASSIC MONEY MARKET FUND | | PORTFOLIO MANAGERS’ REPORT |

ING Classic Money Market Fund (the “Fund”) seeks to provide investors with a high level of current income, consistent with the preservation of capital and liquidity and the maintenance of a stable $1.00 net asset value per share. The Fund is managed by David S. Yealy, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Portfolio Specifics: The reporting period was one of the most difficult periods on record for money market funds. The seizing up of the credit markets and subsequent loss of confidence in numerous issuers led to unprecedented actions by the Federal Reserve, U.S. Treasury and other major central banks across the globe. The systemic risk and capital market panic that ensued has resulted in a worldwide multi-sector collapse of virtually all risk-based asset prices.

Money market funds were no exception as several funds either “broke the buck” or suspended redemptions. The result was a run on prime money funds as investors sought to redeem their funds and move into lower risk Treasury or government money funds or direct government securities. The flight to quality caused the yield on these short-term government securities to drop precipitously while the market for commercial paper and other short-term bank funding evaporated. Asset-backed commercial paper (“ABCP”), which is viewed by the market and the Federal Reserve Board (the “Fed”) as a safe-haven, was the exception as the Fed agreed to buy back ABCP from money market mutual funds at their cost in order to provide liquidity for the funds to meet the redemptions.

Due to extreme risks in the market we chose to focus on increasing liquidity and reducing risk in the Fund and not on maximizing yield.

Daily liquidity was increased from approximately 9% as of June 30, 2008 to approximately 20% as of September 30, 2008. The increase in daily liquidity was accomplished by investing the proceeds of maturing credit-risk issues into overnight repurchase agreements, instead of the normal practice of buying new securities of those issuers or similar credits out in longer maturities. In addition to the increase in daily liquidity, the Fund maintained an overweight exposure to ABCP at 34% and held a 7% U.S. Government agency exposure. These changes allowed us to reduce credit exposure and risk over the period.

Current Outlook and Strategy: We think the recent actions taken by the Fed, the U.S. Treasury and central banks globally will unfreeze inter-bank lending and ultimately lending to corporations and consumers. We believe the government will continue to play a major role in providing short-term funding via the discount window, the various auction facilities, the ABCP purchase program or the new commercial paper purchase program. We expect LIBOR and rates for money market securities to decline over the near term.

Money market funds in general should slowly resume buying the commercial paper and CDs of the top-tier issuers that they recently stopped funding. We expect that ABCP with maturities of January 31, 2009 or shorter and repurchase agreements will continue to be the primary Fund holdings in the near-term, as the short-term funding markets attempt to return to normalcy. This is likely to be a slow process. Recent developments do not guarantee it, but we believe a return to normalcy has become more likely. We are taking a cautious approach with the Fund. We want to be sure that the recent central bank actions will translate into actual improved market conditions and lending before increasing our exposure to the large, top-tier banks that have received the backing of their central banks and governments. Liquidity and low risk are still our primary objectives, with yield taking either a back seat or waiting for the next train.

Principal Risk Factors: Please see the “Notes to Financial Statements” section for information regarding the Fund’s participation in the U.S. Treasury Department’s Temporary Guarantee Program for money market funds and the Capital Support Agreement that the Fund has entered into.

Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund may differ from that presented for other ING Funds.

The views expressed in this report reflect those of the portfolio managers only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

8

| | |

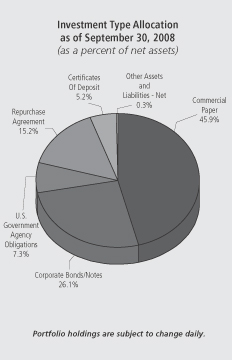

| PORTFOLIO MANAGERS’ REPORT | | ING INSTITUTIONAL PRIME MONEY MARKET FUND |

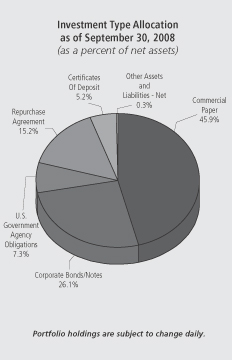

Investment Type Allocation

as of September 30, 2008

(as a percent of net assets)

| | |

Commercial Paper | | 63.0% |

Repurchase Agreement | | 26.1% |

Corporate Bond/Notes | | 9.1% |

Certificates of Deposit | | 4.5% |

U.S. Government Agency Obligations | | 2.0% |

Other Assets and Liabilities — Net | | (4.7)% |

Portfolio holdings are subject to change daily.

ING Institutional Prime Money Market Fund (the “Fund”) seeks to provide investors with a high level of current income, consistent with the preservation of capital and liquidity and the maintenance of a stable $1.00 net asset value per share. The Fund is managed by David S. Yealy, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Portfolio Specifics: The reporting period was one of the most difficult periods on record for money market funds. The seizing up of the credit markets and subsequent loss of confidence in numerous issuers led to unprecedented actions by the Federal Reserve, U.S. Treasury and other major central banks across the globe. The systemic risk and capital market panic that ensued has resulted in a worldwide multi-sector collapse of virtually all risk-based asset prices.

Money market funds were no exception as several funds either “broke the buck” or suspended redemptions. The result was a run on prime money funds as investors sought to redeem their funds and move into lower risk Treasury or government money funds or direct government securities. The flight to quality caused the yield on these short-term government securities to drop precipitously while the market for commercial paper and other short-term bank funding evaporated. Asset-backed commercial paper (ABCP), which is viewed by the market and the Federal Reserve as a safe-haven, was the exception as the Fed agreed to buy back ABCP from money market mutual funds at their cost in order to provide liquidity for the funds to meet the redemptions.

Due to extreme risks in the market we chose to focus on increasing liquidity and reducing risk in the Fund and not on maximizing yield. Daily liquidity was increased from approximately 23% as of June 30, 2008 to over 34% as of September 30, 2008. The increase in daily liquidity was accomplished by investing the proceeds of maturing credit-risk issues into overnight repurchase agreements, instead of the normal practice of buying new securities of those issuers or similar credits out in longer maturities. In addition to the increase in daily liquidity, the Fund maintained an overweight exposure to ABCP at 40% and held a 2% U.S. Govt. agency exposure. These changes allowed us to reduce credit exposure and risk over the period.

Current Outlook and Strategy: We think the recent actions taken by the Fed, the U.S. Treasury and central banks globally will unfreeze inter-bank lending and ultimately lending to corporations and consumers. We believe the government will continue to play a major role in providing short-term funding via the discount window, the various auction facilities, the ABCP purchase program or the new commercial paper purchase program. We expect LIBOR and rates for money market securities to decline over the near term.

Money market funds in general should slowly resume buying the commercial paper and CDs of the top-tier issuers that they recently stopped funding. We expect that ABCP with maturities of January 31, 2009 or shorter and repurchase agreements will continue to be the primary Fund holdings in the near-term, as the short-term funding markets attempt to return to normalcy. This is likely to be a slow process. Recent developments do not guarantee it, but we believe a return to normalcy has become more likely. We are taking a cautious approach with the Fund. We want to be sure that the recent central bank actions will translate into actual improved market conditions and lending before increasing our exposure to the large, top-tier banks that have received the backing of their central banks and governments. Liquidity and low risk are still our primary objectives, with yield taking either a back seat or waiting for the next train.

Principal Risk Factors: Please see the “Notes to Financial Statements” section for information regarding the Fund’s participation in the U.S. Treasury Department’s Temporary Guarantee Program for money market funds and the Capital Support Agreement that the Fund has entered into.

Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Fund may differ from that presented for other ING Funds.

The views expressed in this report reflect those of the portfolio managers only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

9

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2008 to September 30, 2008. The Funds’ expenses are shown without the imposition of any sales charges or fees. Expenses would have been higher if such charges were included.

Actual Expenses

The first section of the table shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | ING GNMA Income Fund | | Beginning Account Value April 1, 2008 | | Ending Account Value September 30, 2008 | | Annualized Expense Ratio | | | Expenses Paid During the Period Ended September 30, 2008* | | |

| | Actual Fund Return | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,004.30 | | 0.97 | % | | $ | 4.87 | | |

| | Class B | | | 1,000.00 | | | 1,001.60 | | 1.72 | | | | 8.63 | | |

| | Class C | | | 1,000.00 | | | 1,001.70 | | 1.72 | | | | 8.63 | | |

| | Class I | | | 1,000.00 | | | 1,005.90 | | 0.66 | | | | 3.32 | | |

| | Class Q | | | 1,000.00 | | | 1,005.80 | | 0.91 | | | | 4.58 | | |

| | Class W | | | 1,000.00 | | | 1,005.70 | | 0.66 | | | | 3.32 | | |

| | Hypothetical (5% return before expenses) | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,020.26 | | 0.97 | % | | $ | 4.91 | | |

| | Class B | | | 1,000.00 | | | 1,016.50 | | 1.72 | | | | 8.69 | | |

| | Class C | | | 1,000.00 | | | 1,016.50 | | 1.72 | | | | 8.69 | | |

| | Class I | | | 1,000.00 | | | 1,021.76 | | 0.66 | | | | 3.35 | | |

| | Class Q | | | 1,000.00 | | | 1,020.51 | | 0.91 | | | | 4.61 | | |

| | Class W | | | 1,000.00 | | | 1,021.51 | | 0.66 | | | | 3.35 | | |

| | | | | | | | | | | | | | | | |

| * | | Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 to reflect the most recent fiscal half-year. |

10

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) (CONTINUED)

| | | | | | | | | | | | | | | | |

| | | ING High Yield Bond Fund | | Beginning Account Value April 1, 2008 | | Ending Account Value September 30, 2008 | | Annualized Expense Ratio | | | Expenses Paid During the Period Ended September 30, 2008* | | |

| | Actual Fund Return | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 927.00 | | 1.10 | % | | $ | 5.31 | | |

| | Class B | | | 1,000.00 | | | 923.40 | | 1.85 | | | | 8.92 | | |

| | Class C | | | 1,000.00 | | | 923.60 | | 1.85 | | | | 8.92 | | |

| | Class I(1) | | | 1,000.00 | | | 932.00 | | 0.85 | | | | 1.39 | | |

| | Hypothetical (5% return before expenses) | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,019.55 | | 1.10 | % | | $ | 5.57 | | |

| | Class B | | | 1,000.00 | | | 1,015.79 | | 1.85 | | | | 9.35 | | |

| | Class C | | | 1,000.00 | | | 1,015.79 | | 1.85 | | | | 9.35 | | |

| | Class I | | | 1,000.00 | | | 1,020.81 | | 0.85 | | | | 4.31 | | |

| | ING Intermediate Bond Fund | | | | | | | | | | | | | | |

| | Actual Fund Return | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 940.50 | | 0.69 | % | | $ | 3.36 | | |

| | Class B | | | 1,000.00 | | | 936.60 | | 1.44 | | | | 6.99 | | |

| | Class C | | | 1,000.00 | | | 935.70 | | 1.44 | | | | 6.99 | | |

| | Class I | | | 1,000.00 | | | 941.40 | | 0.36 | | | | 1.75 | | |

| | Class O | | | 1,000.00 | | | 939.60 | | 0.69 | | | | 3.35 | | |

| | Class R | | | 1,000.00 | | | 938.60 | | 0.94 | | | | 4.57 | | |

| | Class W | | | 1,000.00 | | | 944.20 | | 0.44 | | | | 2.14 | | |

| | Hypothetical (5% return before expenses) | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,021.61 | | 0.69 | % | | $ | 3.50 | | |

| | Class B | | | 1,000.00 | | | 1,017.85 | | 1.44 | | | | 7.28 | | |

| | Class C | | | 1,000.00 | | | 1,017.85 | | 1.44 | | | | 7.28 | | |

| | Class I | | | 1,000.00 | | | 1,023.26 | | 0.36 | | | | 1.83 | | |

| | Class O | | | 1,000.00 | | | 1,021.61 | | 0.69 | | | | 3.50 | | |

| | Class R | | | 1,000.00 | | | 1,020.36 | | 0.94 | | | | 4.76 | | |

| | Class W | | | 1,000.00 | | | 1,022.86 | | 0.44 | | | | 2.23 | | |

| | ING National Tax-Exempt Bond Fund | | | | | | | | | | | | | | |

| | Actual Fund Return | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 979.30 | | 0.87 | % | | $ | 4.32 | | |

| | Hypothetical (5% return before expenses) | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,020.71 | | 0.87 | % | | $ | 4.41 | | |

| | ING Classic Money Market Fund | | | | | | | | | | | | | | |

| | Actual Fund Return | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,010.80 | | 0.77 | % | | $ | 3.88 | | |

| | Class B | | | 1,000.00 | | | 1,006.90 | | 1.34 | | | | 6.74 | | |

| | Class C | | | 1,000.00 | | | 1,006.90 | | 1.34 | | | | 6.74 | | |

| | Hypothetical (5% return before expenses) | | | | | | | | | | | | | | |

| | Class A | | $ | 1,000.00 | | $ | 1,021.21 | | 0.77 | % | | $ | 3.90 | | |

| | Class B | | | 1,000.00 | | | 1,018.35 | | 1.34 | | | | 6.78 | | |

| | Class C | | | 1,000.00 | | | 1,018.35 | | 1.34 | | | | 6.78 | | |

| | | | | | | | | | | | | | | | |

| * | | Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 to reflect the most recent fiscal half-year. |

(1) | | Commencement of operations for Class I was July 31, 2008. Expenses paid reflect the 62 day period ended September 30, 2008. |

11

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED) (CONTINUED)

| | | | | | | | | | | | | | | | | |

| | | ING Institutional Prime Money Market Fund | | Beginning Account Value April 1, 2008 | | Ending Account Value September 30, 2008 | | Annualized Expense Ratio | | | Expenses Paid During the Period Ended September 30, 2008* | | |

| | Actual Fund Return | | | | | | | | | | | | | | | |

| | Class I | | $ | 1,000.00 | | $ | 1,013.00 | | $ | 0.15 | % | | $ | 0.76 | | |

| | Class IS | | | 1,000.00 | | | 1,013.50 | | | 0.20 | | | | 1.01 | | |

| | Hypothetical (5% return before expenses) | | | | | | | | | | | | | | | |

| | Class I | | $ | 1,000.00 | | $ | 1,024.32 | | | 0.15 | % | | $ | 0.76 | | |

| | Class IS | | | 1,000.00 | | | 1,024.07 | | | 0.20 | | | | 1.01 | | |

| | | | | | | | | | | | | | | | | |

| * | | Expenses are equal to each Fund’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 to reflect the most recent fiscal half-year. |

12

STATEMENTS OF ASSETS AND LIABILITIESASOF SEPTEMBER 30, 2008 (UNAUDITED)

| | | | | | | | | | | | |

| | | ING GNMA Income

Fund | | | ING High Yield Bond Fund | | | ING Intermediate Bond Fund | |

ASSETS: | | | | | | | | | | | | |

Investments in securities at value+* | | $ | 590,037,304 | | | $ | 93,150,189 | | | $ | 1,454,719,809 | |

Short-term investments** | | | — | | | | — | | | | 214,736,704 | |

Short-term investments in affiliates at amortized cost | | | — | | | | 4,000,000 | | | | 142,450,000 | |

Short-term investments at amortized cost | | | — | | | | 513,000 | | | | 6,324,000 | |

Cash | | | 7,208,608 | | | | — | | | | — | |

Cash collateral for futures | | | — | | | | — | | | | 9,162,043 | |

Swap collateral | | | — | | | | 380,000 | | | | 1,150,000 | |

Foreign currencies at value*** | | | — | | | | — | | | | 2,318,519 | |

Receivables: | | | | | | | | | | | | |

Investment securities sold | | | 3,048,823 | | | | 118,000 | | | | 1,223,778 | |

Investment securities sold on a delayed-delivery or when-issued basis | | | — | | | | — | | | | 30,430,290 | |

Fund shares sold | | | 3,097,911 | | | | 208,356 | | | | 4,607,509 | |

Dividends and interest | | | 3,017,510 | | | | 2,841,213 | | | | 10,081,477 | |

Variation margin | | | — | | | | — | | | | 5,704,341 | |

Unrealized appreciation on forward foreign currency contracts | | | — | | | | — | | | | 1,374,128 | |

Upfront payments made on swap agreements | | | — | | | | — | | | | 7,297,163 | |

Unrealized appreciation on swap agreements | | | — | | | | 504,909 | | | | 24,477,179 | |

Prepaid expenses | | | 49,682 | | | | 37,361 | | | | 63,997 | |

Reimbursement due from manager | | | — | | | | 15,139 | | | | 49,755 | |

| | | | | | | | | | | | |

Total assets | | | 606,459,838 | | | | 101,768,167 | | | | 1,916,170,692 | |

| | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | |

Payable for investment securities purchased on a delayed-delivery or

when-issued basis | | | — | | | | — | | | | 422,374,948 | |

Payable for investment securities purchased | | | — | | | | — | | | | 354,061 | |

Payable for fund shares redeemed | | | 3,691,181 | | | | 330,843 | | | | 5,856,431 | |

Payable for futures variation margin | | | — | | | | — | | | | 425,157 | |

Payable upon receipt of securities loaned | | | — | | | | — | | | | 217,650,328 | |

Unrealized depreciation on forward foreign currency contracts | | | — | | | | — | | | | 1,024,268 | |

Upfront payments received on swap agreements | | | — | | | | 362,500 | | | | 5,074,810 | |

Unrealized depreciation on swap agreements | | | — | | | | 992,830 | | | | 9,886,244 | |

Income distribution payable | | | — | | | | 381,326 | | | | 896,240 | |

Payable to affiliates | | | 448,791 | | | | 93,561 | | | | 520,779 | |

Payable to custodian due to bank overdraft | | | — | | | | 463,030 | | | | 1,281,939 | |

Payable for trustee fees | | | 22,931 | | | | 4,067 | | | | 6,866 | |

Other accrued expenses and liabilities | | | 158,838 | | | | 94,072 | | | | 474,151 | |

| | | | | | | | | | | | |

Total liabilities | | | 4,321,741 | | | | 2,722,229 | | | | 665,826,222 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 602,138,097 | | | $ | 99,045,938 | | | $ | 1,250,344,470 | |

| | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

Paid-in capital | | $ | 613,893,656 | | | $ | 412,608,621 | | | $ | 1,388,949,112 | |

Undistributed net investment income (distributions in excess of net investment income) | | | 1,574,497 | | | | (562,291 | ) | | | 510,293 | |

Accumulated net realized gain (loss) on investments, foreign currency related transactions, futures, short positions and swaps | | | (15,112,805 | ) | | | (294,624,664 | ) | | | 13,920,369 | |

Net unrealized appreciation or depreciation on investments, foreign currency related transactions, futures and swaps | | | 1,782,749 | | | | (18,375,728 | ) | | | (153,035,304 | ) |

| | | | | | | | | | | | |

NET ASSETS | | $ | 602,138,097 | | | $ | 99,045,938 | | | $ | 1,250,344,470 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

+ Including securities loaned at value | | $ | — | | | $ | — | | | $ | 207,667,983 | |

* Cost of investments in securities | | $ | 588,254,555 | | | $ | 111,037,996 | | | $ | 1,621,898,956 | |

** Cost of short-term investments | | $ | — | | | $ | — | | | $ | 217,650,328 | |

*** Cost of foreign currencies | | $ | — | | | $ | — | | | $ | 2,333,619 | |

See Accompanying Notes to Financial Statements

13

STATEMENTS OF ASSETS AND LIABILITIESASOF SEPTEMBER 30, 2008 (UNAUDITED) (CONTINUED)

| | | | | | | | | |

| | | ING GNMA Income Fund | | ING High Yield Bond Fund | | ING

Intermediate Bond Fund |

Class A: | | | | | | | | | |

Net assets | | $ | 502,014,891 | | $ | 71,381,634 | | $ | 652,470,474 |

Shares authorized | | | unlimited | | | unlimited | | | unlimited |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 |

Shares outstanding | | | 59,828,400 | | | 10,200,887 | | | 70,102,697 |

Net asset value and redemption price per share | | $ | 8.39 | | $ | 7.00 | | $ | 9.31 |

Maximum offerering price per share (2.50%)(1) | | $ | 8.61 | | $ | 7.18 | | $ | 9.55 |

Class B: | | | | | | | | | |

Net assets | | $ | 40,021,952 | | $ | 18,246,693 | | $ | 31,792,617 |

Shares authorized | | | unlimited | | | unlimited | | | unlimited |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 |

Shares outstanding | | | 4,795,919 | | | 2,609,095 | | | 3,422,245 |

Net asset value and redemption price per share(2) | | $ | 8.35 | | $ | 6.99 | | $ | 9.29 |

Maximum offering price per share | | $ | 8.35 | | $ | 6.99 | | $ | 9.29 |

Class C: | | | | | | | | | |

Net assets | | $ | 39,751,269 | | $ | 9,414,863 | | $ | 67,800,614 |

Shares authorized | | | unlimited | | | unlimited | | | unlimited |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 |

Shares outstanding | | | 4,757,365 | | | 1,344,915 | | | 7,294,324 |

Net asset value and redemption price per share(2) | | $ | 8.36 | | $ | 7.00 | | $ | 9.29 |

Maximum offering price per share | | $ | 8.36 | | $ | 7.00 | | $ | 9.29 |

Class I: | | | | | | | | | |

Net assets | | $ | 19,245,865 | | $ | 2,748 | | $ | 426,791,949 |

Shares authorized | | | unlimited | | | unlimited | | | unlimited |

Par value | | $ | 0.001 | | $ | 0.001 | | $ | 0.001 |

Shares outstanding | | | 2,291,559 | | | 393 | | | 45,851,559 |

Net asset value and redemption price per share | | $ | 8.40 | | $ | 7.00 | | $ | 9.31 |

Maximum offering price per share | | $ | 8.40 | | $ | 7.00 | | $ | 9.31 |

Class O: | | | | | | | | | |

Net assets | | | n/a | | | n/a | | $ | 48,455,030 |

Shares authorized | | | n/a | | | n/a | | | unlimited |

Par value | | | n/a | | | n/a | | $ | 0.001 |

Shares outstanding | | | n/a | | | n/a | | | 5,204,379 |

Net asset value and redemption price per share | | | n/a | | | n/a | | $ | 9.31 |

Maximum offering price per share | | | n/a | | | n/a | | $ | 9.31 |

Class Q: | | | | | | | | | |

Net assets | | $ | 42,844 | | | n/a | | | n/a |

Shares authorized | | | unlimited | | | n/a | | | n/a |

Par value | | $ | 0.001 | | | n/a | | | n/a |

Shares outstanding | | | 5,091 | | | n/a | | | n/a |

Net asset value and redemption price per share | | $ | 8.42 | | | n/a | | | n/a |

Maximum offering price per share | | $ | 8.42 | | | n/a | | | n/a |

Class R: | | | | | | | | | |

Net assets | | | n/a | | | n/a | | $ | 17,800,005 |

Shares authorized | | | n/a | | | n/a | | | unlimited |

Par value | | | n/a | | | n/a | | $ | 0.001 |

Shares outstanding | | | n/a | | | n/a | | | 1,909,824 |

Net asset value and redemption price per share | | | n/a | | | n/a | | $ | 9.32 |

Maximum offering price per share | | | n/a | | | n/a | | $ | 9.32 |

Class W: | | | | | | | | | |

Net assets | | $ | 1,061,276 | | | n/a | | $ | 5,233,781 |

Shares authorized | | | unlimited | | | n/a | | | unlimited |

Par value | | $ | 0.001 | | | n/a | | $ | 0.001 |

Shares outstanding | | | 126,276 | | | n/a | | | 562,732 |

Net asset value and redemption price per share | | $ | 8.40 | | | n/a | | $ | 9.30 |

Maximum offering price per share | | $ | 8.40 | | | n/a | | $ | 9.30 |

(1) | | Maximum offering price is computed at 100/97.50 of net asset value. On purchases of $100,000 or more, the offering price is reduced. |

(2) | | Redemption price per share may be reduced for any applicable contingent deferred sales charges. |

See Accompanying Notes to Financial Statements

14

STATEMENTS OF ASSETS AND LIABILITIESASOF SEPTEMBER 30, 2008 (UNAUDITED)

| | | | | | | | | | | | |

| | | ING National Tax-

Exempt Bond Fund | | | ING Classic Money Market Fund | | | ING

Institutional Prime

Money Market Fund | |

ASSETS: | | | | | | | | | | | | |

Investments in securities at value* | | $ | 1,660,733 | | | $ | — | | | $ | — | |

Short-term investments at amortized cost | | | — | | | | 1,161,733,997 | | | | 1,226,033,460 | |

Repurchase Agreements | | | — | | | | 209,729,000 | | | | 407,662,000 | |

Cash | | | 1,578,977 | | | | 227,740 | | | | 22,575 | |

Receivables: | | | | | | | | | | | | |

Fund shares sold | | | — | | | | 3,518,999 | | | | 81,948,858 | |

Dividends and interest | | | 21,111 | | | | 3,122,526 | | | | 1,621,880 | |

Prepaid expenses | | | — | | | | 230,911 | | | | 34,033 | |

Reimbursement due from manager | | | 22,522 | | | | 63,000 | | | | — | |

| | | | | | | | | | | | |

Total assets | | | 3,283,343 | | | | 1,378,626,173 | | | | 1,717,322,806 | |

| | | | | | | | | | | | |

LIABILITIES: | | | | | | | | | | | | |

Payable for fund shares redeemed | | | — | | | | 2,373,030 | | | | 153,275,250 | |

Income distribution payable | | | 18,141 | | | | 9,516 | | | | 2,814,783 | |

Payable to affiliates | | | 17,908 | | | | 760,301 | | | | 93,065 | |

Payable for trustee fees | | | 1,618 | | | | 20,717 | | | | 6,950 | |

Other accrued expenses and liabilities | | | 12,949 | | | | 186 | | | | 99,837 | |

| | | | | | | | | | | | |

Total liabilities | | | 50,616 | | | | 3,163,750 | | | | 156,289,885 | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 3,232,727 | | | $ | 1,375,462,423 | | | $ | 1,561,032,921 | |

| | | | | | | | | | | | |

NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

Paid-in capital | | $ | 4,973,854 | | | $ | 1,374,902,556 | | | $ | 1,561,260,498 | |

Undistributed net investment income (distributions in excess of net investment income) | | | (17,972 | ) | | | 591,154 | | | | (21,216 | ) |

Accumulated net realized loss on investments | | | (1,485,851 | ) | | | (31,287 | ) | | | (206,361 | ) |

Net unrealized depreciation on investments | | | (237,304 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

NET ASSETS | | $ | 3,232,727 | | | $ | 1,375,462,423 | | | $ | 1,561,032,921 | |

| | | | | | | | | | | | |

* Cost of investments in securities | | $ | 1,898,037 | | | $ | — | | | $ | — | |

See Accompanying Notes to Financial Statements

15

STATEMENTS OF ASSETS AND LIABILITIESASOF SEPTEMBER 30, 2008 (UNAUDITED) (CONTINUED)

| | | | | | | | | | |

| | | ING

National Tax-

Exempt Bond Fund | | | ING Classic

Money Market Fund | | ING

Institutional Prime Money Market Fund |

Class A: | | | | | | | | | | |

Net assets | | $ | 3,232,727 | | | $ | 1,347,051,307 | | | n/a |

Shares authorized | | | unlimited | | | | unlimited | | | n/a |

Par value | | $ | 0.001 | | | $ | 0.001 | | | n/a |

Shares outstanding | | | 342,000 | | | | 1,346,478,375 | | | n/a |

Net asset value and redemption price per share | | $ | 9.45 | | | $ | 1.00 | | | n/a |

Maximum offerering price per share (2.50%) | | $ | 9.69 | (1) | | $ | 1.00 | | | n/a |

Class B: | | | | | | | | | | |

Net assets | | | n/a | | | $ | 16,855,576 | | | n/a |

Shares authorized | | | n/a | | | | unlimited | | | n/a |

Par value | | | n/a | | | $ | 0.001 | | | n/a |

Shares outstanding | | | n/a | | | | 16,868,442 | | | n/a |

Net asset value and redemption price per share(2) | | | n/a | | | $ | 1.00 | | | n/a |

Maximum offering price per share | | | n/a | | | $ | 1.00 | | | n/a |

Class C: | | | | | | | | | | |

Net assets | | | n/a | | | $ | 11,555,540 | | | n/a |

Shares authorized | | | n/a | | | | unlimited | | | n/a |

Par value | | | n/a | | | $ | 0.001 | | | n/a |

Shares outstanding | | | n/a | | | | 11,556,341 | | | n/a |

Net asset value and redemption price per share(2) | | | n/a | | | $ | 1.00 | | | n/a |

Maximum offering price per share | | | n/a | | | $ | 1.00 | | | n/a |

Class I: | | | | | | | | | | |

Net assets | | | n/a | | | | n/a | | $ | 1,561,031,920 |

Shares authorized | | | n/a | | | | n/a | | | unlimited |

Par value | | | n/a | | | | n/a | | $ | 0.001 |

Shares outstanding | | | n/a | | | | n/a | | | 1,561,288,533 |

Net asset value and redemption price per share | | | n/a | | | | n/a | | $ | 1.00 |

Maximum offering price per share | | | n/a | | | | n/a | | $ | 1.00 |

Class IS: | | | | | | | | | | |

Net assets | | | n/a | | | | n/a | | $ | 1,001 |

Shares authorized | | | n/a | | | | n/a | | | unlimited |

Par value | | | n/a | | | | n/a | | $ | 0.001 |

Shares outstanding | | | n/a | | | | n/a | | | 1,001 |

Net asset value and redemption price per share | | | n/a | | | | n/a | | $ | 1.00 |

Maximum offering price per share | | | n/a | | | | n/a | | $ | 1.00 |

(1) | | Maximum offering price is computed at 100/97.50 of net asset value. On purchases of $100,000 or more, the offering price is reduced. |

(2) | | Redemption price per share may be reduced for any applicable contingent deferred sales charges. |

See Accompanying Notes to Financial Statements

16

STATEMENTS OF OPERATIONSFORTHE SIX MONTHS ENDED SEPTEMBER 30, 2008 (UNAUDITED)

| | | | | | | | | | | | |

| | | ING GNMA

Income

Fund | | | ING High Yield

Bond Fund | | | ING

Intermediate

Bond Fund | |

INVESTMENT INCOME: | | | | | | | | | | | | |

Dividends(1) | | $ | — | | | $ | 23,392 | | | $ | 1,972,480 | |

Interest | | | 16,336,051 | | | | 5,142,696 | | | | 35,079,927 | |

Securities lending income, net | | | — | | | | — | | | | 957,266 | |

| | | | | | | | | | | | |

Total investment income | | | 16,336,051 | | | | 5,166,088 | | | | 38,009,673 | |

| | | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | | |

Investment management fees | | | 1,424,496 | | | | 293,297 | | | | 1,144,326 | |

Distribution and service fees: | | | | | | | | | | | | |

Class A | | | 631,779 | | | | 102,515 | | | | 925,194 | |

Class B | | | 213,716 | | | | 113,656 | | | | 184,379 | |

Class C | | | 181,252 | | | | 51,373 | | | | 387,530 | |

Class O | | | — | | | | — | | | | 66,940 | |

Class Q | | | 53 | | | | — | | | | — | |

Class R | | | — | | | | — | | | | 45,906 | |

Transfer agent fees: | | | | | | | | | | | | |

Class A | | | 182,416 | | | | 63,324 | | | | 473,901 | |

Class B | | | 17,821 | | | | 17,552 | | | | 23,610 | |

Class C | | | 13,111 | | | | 7,933 | | | | 49,547 | |

Class I | | | 1,078 | | | | — | | | | 98,559 | |

Class O | | | — | | | | — | | | | 34,201 | |

Class Q | | | 1 | | | | — | | | | — | |

Class R | | | — | | | | — | | | | 11,149 | |

Class W | | | 234 | | | | — | | | | 1,107 | |

Administrative service fees | | | 303,082 | | | | 57,509 | | | | 673,132 | |

Shareholder reporting expense | | | 86,715 | | | | 54,970 | | | | 174,000 | |

Registration fees | | | 56,210 | | | | 33,656 | | | | 69,831 | |

Professional fees | | | 26,343 | | | | 9,544 | | | | 46,229 | |

Custody and accounting expense | | | 33,124 | | | | 15,934 | | | | 86,685 | |

Trustee fees | | | 13,335 | | | | 985 | | | | 17,754 | |

Miscellaneous expense | | | 10,788 | | | | 7,519 | | | | 20,976 | |

Interest expense | | | — | | | | 3,300 | | | | — | |

| | | | | | | | | | | | |

Total expenses | | | 3,195,554 | | | | 833,067 | | | | 4,534,956 | |

Net waived and reimbursed fees | | | — | | | | (73,984 | ) | | | (123,782 | ) |

| | | | | | | | | | | | |

Net expenses | | | 3,195,554 | | | | 759,083 | | | | 4,411,174 | |

| | | | | | | | | | | | |

Net investment income | | | 13,140,497 | | | | 4,407,005 | | | | 33,598,499 | |

| | | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY RELATED TRANSACTIONS, FUTURES, SHORT POSITIONS AND SWAPS: | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Investments | | | (1,340,406 | ) | | | (3,334,358 | ) | | | 2,405,460 | |

Foreign currency related transactions | | | — | | | | 103 | | | | 3,067,148 | |

Futures | | | — | | | | — | | | | (13,470,221 | ) |

Short positions | | | — | | | | 1,500 | | | | — | |

Swaps | | | — | | | | 58,153 | | | | (4,206,677 | ) |

| | | | | | | | | | | | |

Net realized loss on investments, foreign currency related transactions, futures, short positions and swaps | | | (1,340,406 | ) | | | (3,274,602 | ) | | | (12,204,290 | ) |

| | | | | | | | | | | | |

Net change in unrealized appreciation or depreciation on: | | | | | | | | | | | | |

Investments | | | (9,758,491 | ) | | | (7,642,645 | ) | | | (105,250,388 | ) |

Foreign currency related transactions | | | — | | | | — | | | | 1,018,353 | |

Futures | | | — | | | | — | | | | 3,562,869 | |

Short positions | | | — | | | | (3,750 | ) | | | — | |

Swaps | | | — | | | | (1,261,640 | ) | | | (1,028,968 | ) |

| | | | | | | | | | | | |

Net change in unrealized appreciation or depreciation on investments, foreign currency related transaction, futures, short positions and swaps | | | (9,758,491 | ) | | | (8,908,035 | ) | | | (101,698,134 | ) |

| | | | | | | | | | | | |

Net realized and unrealized loss on investments, foreign currency related transactions, futures, short positions and swaps | | | (11,098,897 | ) | | | (12,182,637 | ) | | | (113,902,424 | ) |

| | | | | | | | | | | | |

Increase (decrease) in net assets resulting from operations | | $ | 2,041,600 | | | $ | (7,775,632 | ) | | $ | (80,303,925 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) Affiliated dividend income | | $ | — | | | $ | 18,653 | | | $ | 1,491,687 | |

See Accompanying Notes to Financial Statements

17

STATEMENTS OF OPERATIONSFORTHE SIX MONTHS ENDED SEPTEMBER 30, 2008 (UNAUDITED)

| | | | | | | | | | | |

| | | ING National Tax- Exempt Bond Fund | | | ING Classic

Money Market Fund | | | ING

Institutional Prime Money Market Fund |

INVESTMENT INCOME: | | | | | | | | | | | |

Interest | | $ | 628,653 | | | $ | 20,177,850 | | | $ | 11,259,536 |

| | | | | | | | | | | |

Total investment income | | | 628,653 | | | | 20,177,850 | | | | 11,259,536 |

| | | | | | | | | | | |

EXPENSES: | | | | | | | | | | | |

Investment management fees | | | 44,229 | | | | 1,797,961 | | | | 328,350 |

Distribution and service fees: | | | | | | | | | | | |

Class A | | | 29,534 | | | | 5,278,547 | | | | — |

Class B | | | 13,284 | | | | 88,087 | | | | — |

Class C | | | 16,010 | | | | 65,695 | | | | — |

Transfer agent fees: | | | | | | | | | | | |

Class A | | | 1,755 | | | | 70,388 | | | | — |

Class B | | | 200 | | | | 881 | | | | — |

Class C | | | 237 | | | | 657 | | | | — |

Class I | | | — | | | | — | | | | 22,218 |

Administrative service fees | | | 14,743 | | | | — | | | | — |

Shareholder reporting expense | | | 1,041 | | | | 162,537 | | | | 60,066 |

Registration fees | | | 51,122 | | | | 245,811 | | | | 52,688 |

Professional fees | | | 2,798 | | | | 69,250 | | | | 61,168 |

Custody and accounting expense | | | 1,243 | | | | 66,713 | | | | 41,013 |

Trustee fees | | | 350 | | | | 13,726 | | | | 15,531 |

Miscellaneous expense | | | 1,750 | | | | 13,795 | | | | 35,574 |

Interest expense | | | — | | | | 1,868 | | | | — |

| | | | | | | | | | | |

Total expenses | | | 178,296 | | | | 7,875,916 | | | | 616,608 |

Net waived and reimbursed fees | | | (28,410 | ) | | | (2,251,184 | ) | | | — |

| | | | | | | | | | | |

Net expenses | | | 149,886 | | | | 5,624,732 | | | | 616,608 |

| | | | | | | | | | | |

Net investment income | | | 478,767 | | | | 14,553,118 | | | | 10,642,928 |

| | | | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | | | | |

Net realized gain (loss) on investments | | | (1,454,245 | ) | | | 34,711 | | | | 17,521 |

Net change in unrealized appreciation or depreciation on investments | | | 518,403 | | | | — | | | | — |

| | | | | | | | | | | |

Net realized and unrealized gain (loss) on investments | | | (935,842 | ) | | | 34,711 | | | | 17,521 |

| | | | | | | | | | | |

Increase (decrease) in net assets resulting from operations | | $ | (457,075 | ) | | $ | 14,587,829 | | | $ | 10,660,449 |

| | | | | | | | | | | |

See Accompanying Notes to Financial Statements

18

STATEMENTS OF CHANGES IN NET ASSETS (UNAUDITED)

| | | | | | | | | | | | | | | | |

| | | ING GNMA Income Fund | | | ING High Yield Bond Fund | |

| | | Six Months Ended September 30, 2008 | | | Year Ended March 31, 2008 | | | Six Months Ended September 30, 2008 | | | Year Ended March 31, 2008 | |

FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 13,140,497 | | | $ | 26,323,003 | | | $ | 4,407,005 | | | $ | 10,709,919 | |

Net realized loss on investments, foreign currency related transactions, short positions and swaps | | | (1,340,406 | ) | | | (557,710 | ) | | | (3,274,602 | ) | | | (3,519,737 | ) |

Net change in unrealized appreciation or depreciation on investments, foreign currency related transactions, short positions and swaps | | | (9,758,491 | ) | | | 14,431,867 | | | | (8,908,035 | ) | | | (14,311,005 | ) |

| | | | | | | | | | | | | | | | |

Increase (decrease) in net assets resulting from operations | | | 2,041,600 | | | | 40,197,160 | | | | (7,775,632 | ) | | | (7,120,823 | ) |

| | | | | | | | | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | | | | | |

Class A | | | (11,073,477 | ) | | | (22,746,437 | ) | | | (3,540,155 | ) | | | (7,399,555 | ) |

Class B | | | (787,998 | ) | | | (1,928,106 | ) | | | (892,898 | ) | | | (2,347,829 | ) |

Class C | | | (658,721 | ) | | | (1,327,518 | ) | | | (405,912 | ) | | | (879,834 | ) |

Class I | | | (501,263 | ) | | | (752,915 | ) | | | (50 | ) | | | — | |

Class Q | | | (942 | ) | | | (2,196 | ) | | | — | | | | — | |

Class W | | | (12,784 | ) | | | (13 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (13,035,185 | ) | | | (26,757,185 | ) | | | (4,839,015 | ) | | | (10,627,218 | ) |

| | | | | | | | | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

Net proceeds from sale of shares | | | 72,602,964 | | | | 135,282,097 | | | | 6,874,122 | | | | 19,716,245 | |

Reinvestment of distributions | | | 10,848,406 | | | | 22,263,959 | | | | 2,497,225 | | | | 5,417,037 | |

| | | | | | | | | | | | | | | | |

| | | 83,451,370 | | | | 157,546,056 | | | | 9,371,347 | | | | 25,133,282 | |