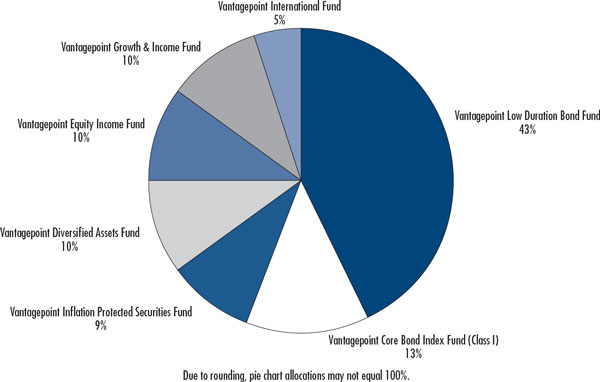

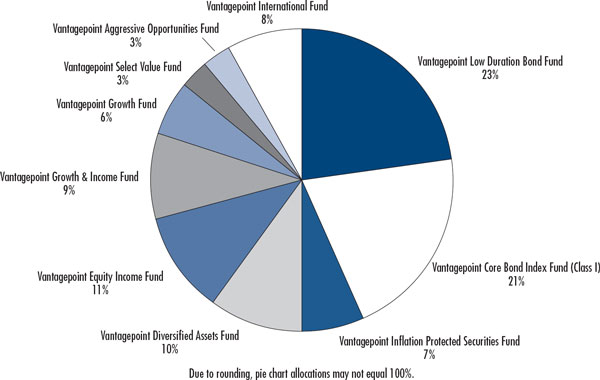

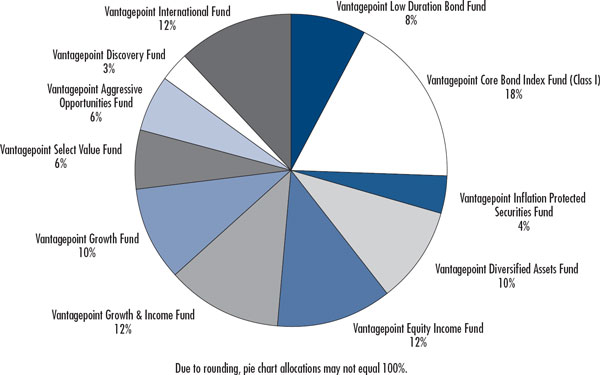

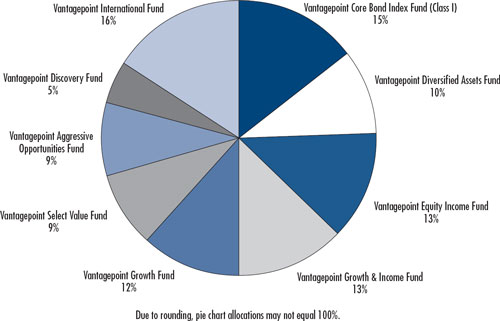

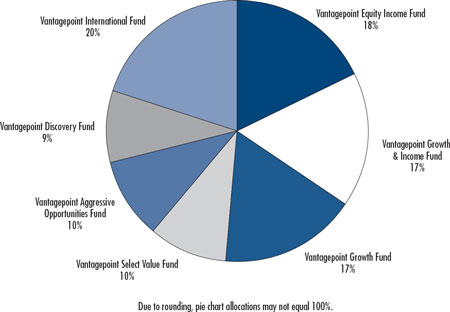

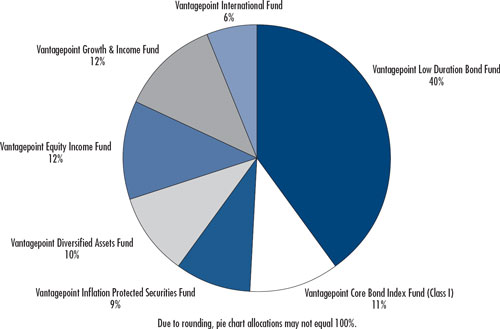

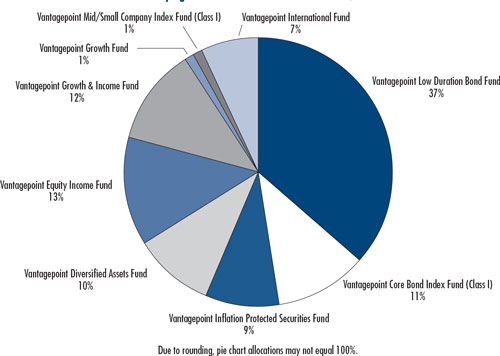

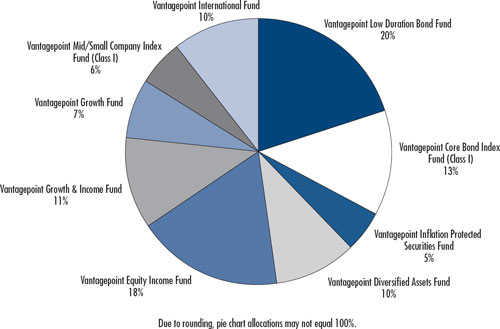

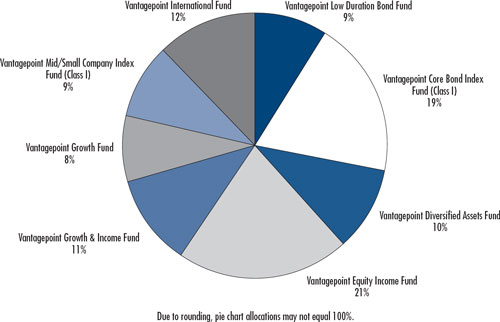

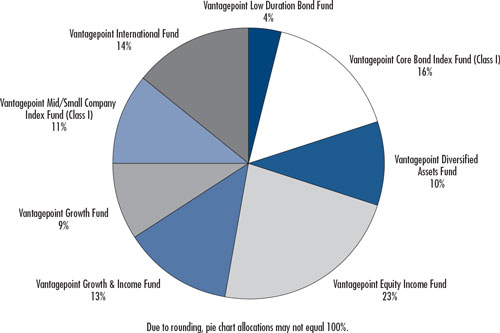

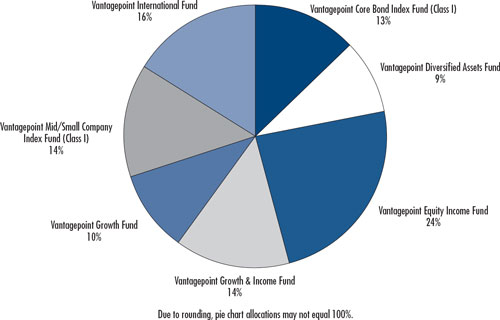

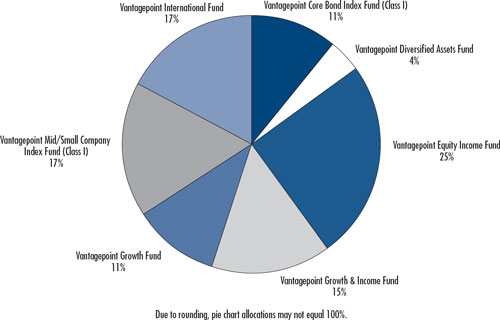

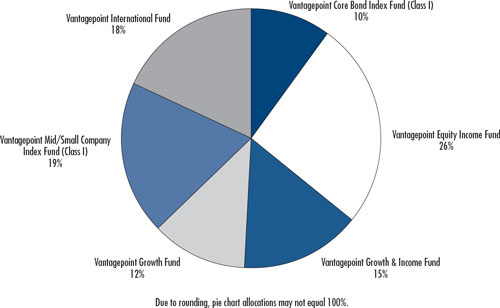

The Milestone Funds invest entirely in underlying funds. Subject to the supervision of the Board, VIA may make allocation changes to the underlying funds based on its periodic analysis to identify the allocation of assets among the different underlying funds that it believes is optimum for each Milestone Fund. Each fund invests in a combination of underlying funds that is believed to be appropriate given the time remaining until a Milestone Fund’s stated retirement date, except for the Milestone Retirement Fund, which is designed for investors who are very close or who at retirement. VIA adjusts the asset allocation of each “dated” Milestone Fund to become more conservative as the designated year approaches*. Each Milestone Fund has a different degree of potential risk and reward and is diversified among various underlying funds in differing allocations. The underlying funds of each Milestone Fund and the investment allocation in each underlying fund as of December 31, 2009, were as follows:

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Since the Model Portfolio Funds and Milestone Funds invest entirely in underlying funds, investment earnings are composed of:

| 1. | | ordinary and capital gain dividends from the underlying funds, |

| 2. | | unrealized appreciation/depreciation on investments in the underlying funds, and |

| 3. | | realized gain/loss from sales of the shares of the underlying funds triggered by net outflows associated with normal capital stock activity and rebalancing of the Model Portfolio Funds and Milestone Funds. |

Subadviser Changes from December 31, 2008 to December 31, 2009

At a meeting held on December 12, 2008 (the “December 2008 Meeting”), VIA recommended and the Board approved, the appointment of Fiduciary Management, Inc. (“FMI”) to serve as a subadviser to the Growth & Income Fund, which became effective in January 2009. Also at the December 2008 Meeting, VIA recommended and the Board approved, the termination of Capital Guardian Trust Company (“Capital Guardian”) as subadviser to the Growth & Income Fund, which became effective on January 21, 2009.

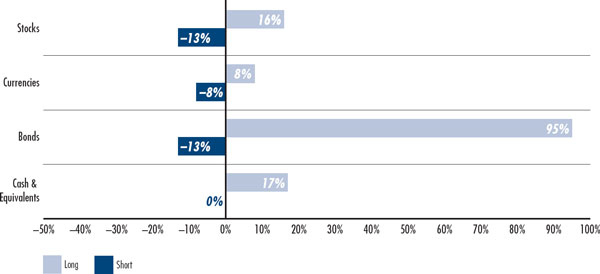

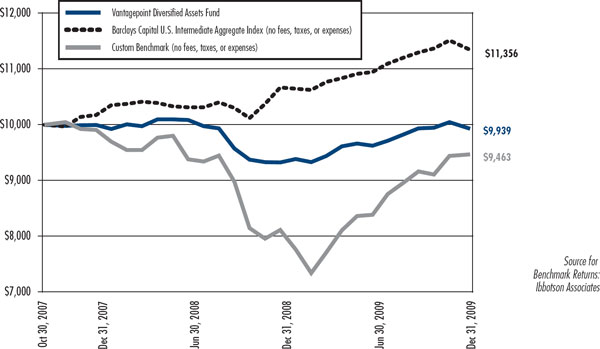

Drake Capital Management, LLC (“Drake”) was terminated as a subadviser to the Diversified Assets Fund on April 10, 2009. At a meeting held on March 27, 2009, VIA recommended and the Board, approved an amendment to the existing subadvisory agreement among VIA, the Company and Payden & Rygel providing for Payden & Rygel to receive a fee for managing additional assets of the Diversified Assets Fund, on an interim basis, pursuant to a low duration global fixed income strategy. These assets were previously managed by Drake. The amendment became effective April 3, 2009.

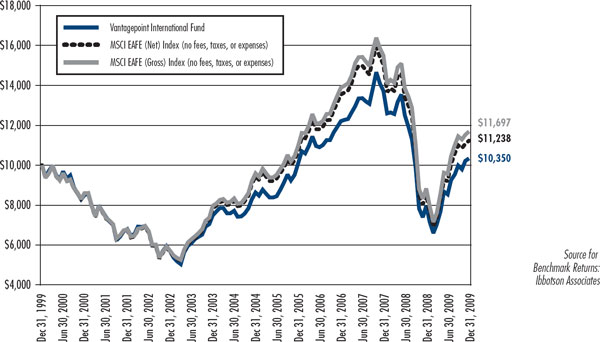

At a meeting on September 25, 2009 (the “September Meeting”), VIA recommended and the Board, approved the termination of Capital Guardian Trust Company (“Capital Guardian”) as a subadviser to the International Fund. Also, at the September Meeting, VIA recommended and the Board, approved the appointment of Mondrian Investment Partners Limited (“Mondrian”) as a subadviser to the International Fund effective October 12, 2009. Also, at the September Meeting, VIA recommended and the Board, approved Payden & Rygel’s appointment to manage the Diversified Assets Fund’s low duration bond strategy on an ongoing basis and approved an amendment to the existing fee schedule with Payden & Rygel (the Board had previously appointed Payden & Rygel to manage this strategy on an interim basis at a meeting on March 27, 2009). Also at the September Meeting, VIA recommended and the Board, approved the appointment of Calamos Advisors, LLC and Shenkman Capital Management, Inc. to manage the convertible securities strategy of the Diversified Assets Fund effective January 4, 2010.

2. | | Significant Accounting Policies |

The Company’s significant accounting policies are consistently applied in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States of America. Management makes estimates and assumptions in the preparation of financial statements that affect the reported amounts of assets and liabilities, including the disclosure of contingent assets and liabilities at the date of the financial statements as well as the revenue and expense amounts during the reporting period. Actual results could differ from those estimates and those differences could be material. Certain prior year amounts have been reclassified to conform to the current year presentation.

FASB Financial Accounting Standards Codification

In June 2009, the Financial Accounting Standards Board (“FASB”) issued FASB ASC 105, The FASB Accounting Standards CodificationTM (“ASC”) and the Hierarchy of Generally Accepted Accounting Principles, (formerly FAS 168). FASB ASC 105 replaces the FAS 162, The Hierarchy of Generally Accepted Accounting Principles, and establishes the FASB Accounting Standards Codification (“Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by non-governmental entities in the preparation of financial statements in conformity with GAAP. The Codification became the exclusive authoritative reference at September 30, 2009. Updates to the Codification Standards are issued as Accounting Standard Updates (“ASU”s) by the FASB. The adoption of the Codification does not impact the Company’s financial statements except for references made to authoritative accounting literature in the accompanying notes to the financial statements.

Investment Policy and Security Valuation

The equity securities that are traded on a national securities exchange (other than Nasdaq Global/Global Select and Capital Market securities traded primarily on the Nasdaq Stock Market, Inc. exchange (“Nasdaq”)) held by each fund normally will be valued at the last reported sale price on the exchange on which the security is primarily traded. If,

161

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

on a particular day, an exchange-traded security does not trade on its primary exchange, then the price normally will be the mean between the closing bid and closing offer reported to the primary exchange and made available to quotation vendors or disseminated through an automated quotation system, or obtained by a pricing service from other quotation sources believed to be reliable. Nasdaq Global/Global Select and Capital Market securities traded primarily on Nasdaq will be valued at the Nasdaq Official Closing Price (“NOCP”). If, on any given day, no NOCP is available, the price normally will be the mean between the closing bid and closing offer reported on Nasdaq prior to the calculation of the NAV of a Fund. All equity securities not traded on a national securities exchange (“OTC Equities”) normally are valued at the last reported sale price in the over-the-counter market. If an OTC Equity does not trade in an over-the-counter market on a particular day, then the price normally will be the mean between the closing bid and closing offer obtained from a quotation service or other service believed to be reliable. Short-term debt instruments, such as commercial paper, banker’s acceptances, and U.S. Treasury Bills, with a remaining maturity of less than 60 days are valued at amortized cost. Prices for debt instruments normally will be obtained from a pricing service that may use methodologies designed to identify the market value of debt instruments, which may include reference to actual market transactions, broker-dealer supplied quotations or valuations, matrix pricing, or other valuation techniques. These techniques generally consider such factors as securities’ prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. In the event a pricing service is unable to provide a price for a particular security, the security may be priced based on the average of two or more independent broker-dealer quotations. Any security for which market value as described above is not readily available is valued at fair value as determined in good faith in accordance with policies approved by the Board (“Valuation Procedures”). The valuation of certain foreign equity securities is described later in the note.

Shares of the underlying funds in which the Model Portfolio and Milestone Funds invest are valued by using the underlying funds’ current net asset values (“NAVs”) for purchase and/or redemption orders that day.

The Money Market Fund invests substantially all of its assets in the Institutional Class of Short-Term Investments Trust Liquid Assets Portfolio (“Portfolio”) advised by Invesco Aim Advisors, Inc. The Portfolio uses the amortized cost method to value its portfolio securities in accordance with Rule 2a-7 under the 1940 Act. The shares of the Portfolio are valued by the Money Market Fund using the Portfolio’s NAV for purchase or redemption orders placed that day.

On September 10, 2009, in accordance with applicable orders of the United States Bankruptcy Court for the Southern District of New York, the Vantagepoint Diversified Assets Fund filed claims, each in the amount of $54,298, against Lehman Brothers Special Financing Inc. (“LBSF”) and its parent company, Lehman Brothers Holdings, Inc. (“LBHI”). The claims arise out of certain derivatives transactions between the Diversified Assets Fund and LBSF that were guaranteed as to payment by LBHI. The derivatives transactions were terminated upon the bankruptcy filings of LBHI and LBSF and subsequently liquidated, resulting in claims. The timing and amount of distributions payable in connection with the claims (if any) is not presently known.

Valuation of Foreign Equity Securities

For foreign equity securities held by the funds and principally traded in markets outside North and South America, the Board approved the use of a third party fair valuation service. The service uses a multifactor model to calculate a factor that is then applied to adjust the market price for each such security. Additionally, the Board has approved the use of the fair value prices provided by this service on a daily basis without a market trigger or confidence interval filter for all foreign equity securities held by funds that are primarily traded in markets outside North and South America. In the event prices for such foreign securities are not available through the service or another fair value pricing service approved by the Board, the securities may be priced at the average of two or more independent broker-dealer quotations or at the fair value of the security in accordance with the Company’s Valuation Procedures.

ASC 820

The Company adopted Financial Accounting Standards Board’s Accounting Standards CodificationTM (“ASC”), Fair Value Measurements and Disclosures (“ASC 820”), (formerly known as FAS 157), effective January 1, 2008. In accordance with ASC 820, fair value is defined as the price that the fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. ASC 820 established a three-tier hierarchy, which maximizes the use of observable market data and minimizes the use of unobservable inputs to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly

162

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| Level 1— | | quoted prices in active markets for identical investments |

| Level 2— | | other significant observable inputs (including quoted prices for similar investments in active markets, interest rates and yield curves, prepayment speeds, credit risks, etc.) |

| Level 3— | | significant unobservable inputs (including the fund’s own assumptions about the assumptions that market participants would use in determining the fair value of investments) |

The valuation techniques used by the funds to measure fair value during the year ended December 31, 2009, maximized the use of observable inputs and minimized the use of unobservable inputs. The funds utilized fair value techniques such as multi-dimensional relational pricing model and option adjusted spread pricing to estimate prices that would have prevailed in a liquid market given information available at the time of evaluation.

The following is a summary of the inputs used as of December 31, 2009, in valuing each fund’s investment carried at value:

Investment Type | | | �� | Level 1 | | Level 2 | | Level 3 | | Total |

Low Duration Bond Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Corporate Obligations | | | | $ | — | | | $ | 222,183,654 | | | $ | — | | | $ | 222,183,654 | |

| U.S. Government Agency Obligations | | | | | — | | | | 29,624,576 | | | | — | | | | 29,624,576 | |

| U.S. Government Agency Mortgage-Backed Securities | | | | | — | | | | 29,548,560 | | | | — | | | | 29,548,560 | |

| U.S. Treasury Obligations | | | | | — | | | | 25,662,021 | | | | — | | | | 25,662,021 | |

| Municipal Obligations | | | | | — | | | | 8,236,626 | | | | — | | | | 8,236,626 | |

| Sovereign Debt Obligations | | | | | — | | | | 5,502,691 | | | | — | | | | 5,502,691 | |

| Asset Backed Securities | | | | | — | | | | 85,762,932 | | | | — | | | | 85,762,932 | |

| Non-Government Mortgage-Backed Securities | | | | | — | | | | 10,453,055 | | | | — | | | | 10,453,055 | |

| Non-U.S. Government Agency Obligations | | | | | — | | | | 7,194,538 | | | | — | | | | 7,194,538 | |

| Cash Equivalents | | | | | 134,520,370 | | | | — | | | | — | | | | 134,520,370 | |

Total Investments in Securities | | | | $ | 134,520,370 | | | $ | 424,168,653 | | | $ | — | | | $ | 558,689,023 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 127,803 | | | | — | | | | — | | | | 127,803 | |

| Forward Currency Contracts | | | | | — | | | | 244,664 | | | | — | | | | 244,664 | |

Total Assets | | | | $ | 127,803 | | | $ | 244,664 | | | $ | — | | | $ | 372,467 | |

Total Derivative Instruments | | | | $ | 127,803 | | | $ | 244,664 | | | $ | — | | | $ | 372,467 | |

163

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Investment Type

| | | | Level 1

| | Level 2

| | Level 3

| | Total

|

|---|

Inflation Protected Securities Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Corporate Obligations | | | | $ | — | | | $ | 2,635,694 | | | $ | — | | | $ | 2,635,694 | |

| U.S. Government Agency Obligations | | | | | — | | | | 12,103,531 | | | | — | | | | 12,103,531 | |

| U.S. Treasury Obligations | | | | | — | | | | 307,666,284 | | | | — | | | | 307,666,284 | |

| Sovereign Debt Obligations | | | | | — | | | | 533,871 | | | | — | | | | 533,871 | |

| Cash Equivalents | | | | | 66,519,801 | | | | — | | | | — | | | | 66,519,801 | |

Total Investments in Securities | | | | $ | 66,519,801 | | | $ | 322,939,380 | | | $ | — | | | $ | 389,459,181 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 32,326 | | | | — | | | | — | | | | 32,326 | |

| Forward Currency Contracts | | | | | — | | | | 79,451 | | | | — | | | | 79,451 | |

| Written Options | | | | | — | | | | 91,492 | | | | — | | | | 91,492 | |

| Swap Agreements | | | | | — | | | | 112,296 | | | | — | | | | 112,296 | |

Total Assets | | | | $ | 32,326 | | | $ | 283,239 | | | $ | — | | | $ | 315,565 | |

| |

Liabilities: | | | | | | | | | | | | | | | | | | |

| Futures | | | | | (60,430 | ) | | | — | | | | — | | | | (60,430 | ) |

| Forward Currency Contracts | | | | | — | | | | (16,720 | ) | | | — | | | | (16,720 | ) |

| Written Options | | | | | — | | | | (184,310 | ) | | | — | | | | (184,310 | ) |

Total Liabilities | | | | | (60,430 | ) | | | (201,030 | ) | | | — | | | | (261,460 | ) |

Total Derivative Instruments | | | | $ | (28,104 | ) | | $ | 82,209 | | | $ | — | | | $ | 54,105 | |

| |

Asset Allocation Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 279,116,497 | | | $ | — | | | $ | — | | | $ | 279,116,497 | |

| U.S. Treasury Obligations | | | | | — | | | | 94,717,292 | | | | — | | | | 94,717,292 | |

| Commercial Paper | | | | | — | | | | 49,583,927 | | | | — | | | | 49,583,927 | |

| Cash Equivalents | | | | | 62,594,598 | | | | — | | | | — | | | | 62,594,598 | |

Total Investments in Securities | | | | $ | 341,711,095 | | | $ | 144,301,219 | | | $ | — | | | $ | 486,012,314 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 494,208 | | | | — | | | | — | | | | 494,208 | |

Total Assets | | | | $ | 494,208 | | | $ | — | | | $ | — | | | $ | 494,208 | |

| |

Liabilities: | | | | | | | | | | | | | | | | | | |

| Futures | | | | | (1,787,808 | ) | | | — | | | | — | | | | (1,787,808 | ) |

Total Liabilities | | | | | (1,787,808 | ) | | | — | | | | — | | | | (1,787,808 | ) |

Total Derivative Instruments | | | | $ | (1,293,600 | ) | | $ | — | | | $ | — | | | $ | (1,293,600 | ) |

164

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Investment Type

| | | | Level 1

| | Level 2

| | Level 3

| | Total

|

|---|

Equity Income Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 1,383,418,125 | | | $ | 3,354,846 | | | $ | — | | | $ | 1,386,772,971 | |

| Convertible Debt Obligations | | | | | — | | | | 2,676,960 | | | | — | | | | 2,676,960 | |

| Cash Equivalents | | | | | 310,604,691 | | | | — | | | | — | | | | 310,604,691 | |

Total Investments in Securities | | | | $ | 1,694,022,816 | | | $ | 6,031,806 | | | $ | — | | | $ | 1,700,054,622 | |

| |

Growth & Income Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 983,898,255 | | | $ | 5,106,384 | | | $ | — | | | $ | 989,004,639 | |

| Convertible Preferred Stocks | | | | | — | | | | 3,912,024 | | | | — | | | | 3,912,024 | |

| Cash Equivalents | | | | | 111,173,942 | | | | — | | | | — | | | | 111,173,942 | |

Total Investments in Securities | | | | $ | 1,095,072,197 | | | $ | 9,018,408 | | | $ | — | | | $ | 1,104,090,605 | |

Growth Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 1,764,952,445 | | | $ | — | | | $ | — | | | $ | 1,764,952,445 | |

| Cash Equivalents | | | | | 248,117,256 | | | | — | | | | — | | | | 248,117,256 | |

Total Investments in Securities | | | | $ | 2,013,069,701 | | | $ | — | | | $ | — | | | $ | 2,013,069,701 | |

| |

Select Value Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 274,841,972 | | | $ | — | | | $ | — | | | $ | 274,841,972 | |

| Cash Equivalents | | | | | 56,729,100 | | | | — | | | | �� | | | | 56,729,100 | |

Total Investments in Securities | | | | $ | 331,571,072 | | | $ | — | | | $ | — | | | $ | 331,571,072 | |

| |

Aggressive Opportunities Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 937,718,705 | | | $ | 16,521,568 | | | $ | — | | | $ | 954,240,273 | |

| Warrants | | | | | 173,727 | | | | — | | | | — | | | | 173,727 | |

| Cash Equivalents | | | | | 297,399,519 | | | | — | | | | — | | | | 297,399,519 | |

Total Investments in Securities | | | | $ | 1,235,291,951 | | | $ | 16,521,568 | | | $ | — | | | $ | 1,251,813,519 | |

165

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Investment Type

| | | | Level 1

| | Level 2

| | Level 3

| | Total

| | | | | | | | | | | | | | | |

|---|

Discovery Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 78,898,665 | | | $ | 601,255 | | | $ | — | | | $ | 79,499,920 | |

| Convertible Preferred Stocks | | | | | — | | | | 1,033,905 | | | | — | | | | 1,033,905 | |

| Warrants | | | | | 69,317 | | | | — | | | | — | | | | 69,317 | |

| Corporate Obligations | | | | | — | | | | 32,590,310 | | | | — | | | | 32,590,310 | |

| U.S. Government Agency Obligations | | | | | — | | | | 21,231,901 | | | | — | | | | 21,231,901 | |

| U.S. Government Agency Mortgage-Backed Securities | | | | | — | | | | 8,702,588 | | | | — | | | | 8,702,588 | |

| U.S. Treasury Obligations | | | | | — | | | | 11,990,199 | | | | — | | | | 11,990,199 | |

| Municipal Obligations | | | | | — | | | | 1,277,231 | | | | — | | | | 1,277,231 | |

| Sovereign Debt Obligations | | | | | — | | | | 411,414 | | | | — | | | | 411,414 | |

| Asset Backed Securities | | | | | — | | | | 5,517,081 | | | | — | | | | 5,517,081 | |

| Non-Government Mortgage-Backed Securities | | | | | — | | | | 2,263,733 | | | | — | | | | 2,263,733 | |

| Non-U.S. Government Agency Obligations | | | | | — | | | | 908,967 | | | | — | | | | 908,967 | |

| Commercial Paper | | | | | — | | | | 799,912 | | | | — | | | | 799,912 | |

| Cash Equivalents | | | | | 38,192,031 | | | | — | | | | — | | | | 38,192,031 | |

Total Investments in Securities | | | | $ | 117,160,013 | | | $ | 87,328,496 | | | $ | — | | | $ | 204,488,509 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 2,934,446 | | | | — | | | | — | | | | 2,934,446 | |

| Forward Currency Contracts | | | | | — | | | | 22,262 | | | | — | | | | 22,262 | |

Total Assets | | | | $ | 2,934,446 | | | $ | 22,262 | | | $ | — | | | $ | 2,956,708 | |

Total Derivative Instruments | | | | $ | 2,934,446 | | | $ | 22,262 | | | $ | — | | | $ | 2,956,708 | |

International Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 83,827,150 | | | $ | 897,145,025 | | | $ | — | | | $ | 980,972,175 | |

| Preferred Stocks | | | | | — | | | | 1,280,052 | | | | — | | | | 1,280,052 | |

| Cash Equivalents | | | | | 101,025,566 | | | | — | | | | — | | | | 101,025,566 | |

Total Investments in Securities | | | | $ | 184,852,716 | | | $ | 898,425,077 | | | $ | — | | | $ | 1,083,277,793 | |

166

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Investment Type

| | | | Level 1

| | Level 2

| | Level 3

| | Total

|

|---|

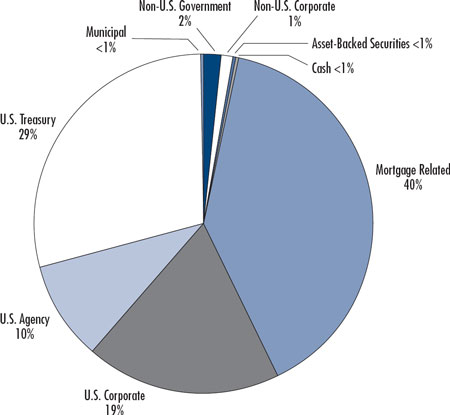

Diversified Assets Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Corporate Obligations | | | | $ | — | | | $ | 166,097,712 | | | $ | — | | | $ | 166,097,712 | |

| U.S. Government Agency Obligations | | | | | — | | | | 89,411,110 | | | | — | | | | 89,411,110 | |

| U.S. Government Agency Mortgage-Backed Securities | | | | | — | | | | 16,686,230 | | | | — | | | | 16,686,230 | |

| U.S. Treasury Obligations | | | | | — | | | | 62,203,146 | | | | — | | | | 62,203,146 | |

| Municipal Obligations | | | | | — | | | | 9,500,378 | | | | — | | | | 9,500,378 | |

| Sovereign Debt Obligations | | | | | — | | | | 8,559,496 | | | | — | | | | 8,559,496 | |

| Asset Backed Securities | | | | | — | | | | 31,449,515 | | | | — | | | | 31,449,515 | |

| Non-Government Mortgage-Backed Securities | | | | | — | | | | 2,592,344 | | | | — | | | | 2,592,344 | |

| Non-U.S. Government Agency Obligations | | | | | — | | | | 2,454,350 | | | | — | | | | 2,454,350 | |

| Certificates of Deposit | | | | | — | | | | 6,759,143 | | | | — | | | | 6,759,143 | |

| Commercial Paper | | | | | — | | | | 2,199,441 | | | | — | | | | 2,199,441 | |

| Cash Equivalents | | | | | 51,214,149 | | | | — | | | | — | | | | 51,214,149 | |

Total Investments in Securities | | | | $ | 51,214,149 | | | $ | 397,912,865 | | | $ | — | | | $ | 449,127,014 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 1,267,112 | | | | — | | | | — | | | | 1,267,112 | |

| Forward Currency Contracts | | | | | — | | | | 1,064,738 | | | | — | | | | 1,064,738 | |

| Purchased Options | | | | | 2,393,316 | | | | — | | | | — | | | | 2,393,316 | |

Total Assets | | | | $ | 3,660,428 | | | $ | 1,064,738 | | | $ | — | | | $ | 4,725,166 | |

| |

Liabilities: | | | | | | | | | | | | | | | | | | |

| Futures | | | | | (2,017,894 | ) | | | — | | | | — | | | | (2,017,894 | ) |

| Forward Currency Contracts | | | | | — | | | | (2,109,370 | ) | | | — | | | | (2,109,370 | ) |

Total Liabilities | | | | | (2,017,894 | ) | | | (2,109,370 | ) | | | — | | | | (4,127,264 | ) |

Total Derivative Instruments | | | | $ | 1,642,534 | | | $ | (1,044,632 | ) | | $ | — | | | $ | 597,902 | |

167

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Investment Type

| | | | Level 1

| | Level 2

| | Level 3

| | Total

|

|---|

Core Bond Index Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Corporate Obligations | | | | $ | — | | | $ | 211,806,196 | | | $ | — | | | $ | 211,806,196 | |

| U.S. Government Agency Obligations | | | | | — | | | | 90,903,478 | | | | — | | | | 90,903,478 | |

| U.S. Government Agency Mortgage-Backed Securities | | | | | — | | | | 401,523,759 | | | | — | | | | 401,523,759 | |

| U.S. Treasury Obligations | | | | | — | | | | 314,181,190 | | | | — | | | | 314,181,190 | |

| Municipal Obligations | | | | | — | | | | 2,553,646 | | | | — | | | | 2,553,646 | |

| Sovereign Debt Obligations | | | | | — | | | | 16,251,582 | | | | — | | | | 16,251,582 | |

| Asset Backed Securities | | | | | — | | | | 3,627,371 | | | | — | | | | 3,627,371 | |

| Non-Government Mortgage-Backed Securities | | | | | — | | | | 29,216,398 | | | | — | | | | 29,216,398 | |

| Non-U.S. Government Agency Obligations | | | | | — | | | | 13,300,591 | | | | — | | | | 13,300,591 | |

| Cash Equivalents | | | | | 279,775,475 | | | | — | | | | — | | | | 279,775,475 | |

Total Investments in Securities | | | | $ | 279,775,475 | | | $ | 1,083,364,211 | | | $ | — | | | $ | 1,363,139,686 | |

| |

500 Stock Index Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 316,727,745 | | | $ | — | | | $ | — | | | $ | 316,727,745 | |

| U.S. Treasury Obligations | | | | | — | | | | 459,971 | | | | — | | | | 459,971 | |

| Cash Equivalents | | | | | 36,450,753 | | | | — | | | | — | | | | 36,450,753 | |

Total Investments in Securities | | | | $ | 353,178,498 | | | $ | 459,971 | | | $ | — | | | $ | 353,638,469 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 35,558 | | | | — | | | | — | | | | 35,558 | |

Total Assets | | | | $ | 35,558 | | | $ | — | | | $ | — | | | $ | 35,558 | |

Total Derivative Instruments | | | | $ | 35,558 | | | $ | — | | | $ | — | | | $ | 35,558 | |

| |

Broad Market Index Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 472,808,703 | | | $ | 3,169 | | | $ | — | | | $ | 472,811,872 | |

| Rights | | | | | 509 | | | | — | | | | — | | | | 509 | |

| Warrants | | | | | — | | | | — | | | | — | | | | — | |

| U.S. Treasury Obligations | | | | | — | | | | 389,975 | | | | — | | | | 389,975 | |

| Cash Equivalents | | | | | 59,453,972 | | | | — | | | | — | | | | 59,453,972 | |

Total Investments in Securities | | | | $ | 532,263,184 | | | $ | 393,144 | | | $ | — | | | $ | 532,656,328 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 84,442 | | | | — | | | | — | | | | 84,442 | |

Total Assets | | | | $ | 84,442 | | | $ | — | | | $ | — | | | $ | 84,442 | |

Total Derivative Instruments | | | | $ | 84,442 | | | $ | — | | | $ | — | | | $ | 84,442 | |

168

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Investment Type

| | | | Level 1

| | Level 2

| | Level 3

| | Total

|

|---|

Mid/Small Company Index Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | 225,405,017 | | | $ | 7,072 | | | $ | — | | | $ | 225,412,089 | |

| Rights | | | | | 4,301 | | | | 76 | | | | — | | | | 4,377 | |

| Warrants | | | | | — | | | | — | | | | — | | | | — | |

| U.S. Treasury Obligations | | | | | — | | | | 454,971 | | | | — | | | | 454,971 | |

| Cash Equivalents | | | | | 65,146,103 | | | | — | | | | — | | | | 65,146,103 | |

Total Investments in Securities | | | | $ | 290,555,421 | | | $ | 462,119 | | | $ | — | | | $ | 291,017,540 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 143,075 | | | | — | | | | — | | | | 143,075 | |

Total Assets | | | | $ | 143,075 | | | $ | — | | | $ | — | | | $ | 143,075 | |

Total Derivative Instruments | | | | $ | 143,075 | | | $ | — | | | $ | — | | | $ | 143,075 | |

| |

Overseas Equity Index Fund | | | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | | | |

| Common Stocks | | | | $ | — | | | $ | 177,985,986 | | | $ | — | | | $ | 177,985,986 | |

| Preferred Stocks | | | | | — | | | | 630,721 | | | | — | | | | 630,721 | |

| Rights | | | | | — | | | | — | | | | — | | | | — | |

| Warrants | | | | | — | | | | 1,551 | | | | — | | | | 1,551 | |

| U.S. Treasury Obligations | | | | | — | | | | 164,990 | | | | — | | | | 164,990 | |

| Cash Equivalents | | | | | 14,649,806 | | | | — | | | | — | | | | 14,649,806 | |

Total Investments in Securities | | | | $ | 14,649,806 | | | $ | 178,783,248 | | | $ | — | | | $ | 193,433,054 | |

Derivative Instruments: | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | |

| Futures | | | | | 34,562 | | | | — | | | | — | | | | 34,562 | |

| Forward Currency Contracts | | | | | — | | | | 139,056 | | | | — | | | | 139,056 | |

Total Assets | | | | $ | 34,562 | | | $ | 139,056 | | | $ | — | | | $ | 173,618 | |

| |

Liabilities: | | | | | | | | | | | | | | | | | | |

| Forward Currency Contracts | | | | | — | | | | (293,395 | ) | | | — | | | | (293,395 | ) |

Total Liabilities | | | | | — | | | | (293,395 | ) | | | — | | | | (293,395 | ) |

Total Derivative Instruments | | | | $ | 34,562 | | | $ | (154,339 | ) | | $ | — | | | $ | (119,777 | ) |

All investments in the Money Market Fund, Model Portfolios, and Milestone Funds are categorized as Level 1.

As of December 31, 2009, the funds did not hold any investment with significant unobservable inputs (Level 3).

When Issued Securities

When issued securities or “To Be Announced” securities are sometimes held by the funds. The funds maintain security positions and cash positions such that sufficient liquid assets will be available to make payments for such securities purchased.

Foreign Currency

The accounting records of the funds are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated (but not actually converted) into U.S. dollars daily at the closing spot rates supplied by the WM/Reuters Intraday Spot exchange rates provided as of 4:00 pm Eastern Time. Purchases and sales of securities, income receipts and expense payments are translated (but not actually converted) into U.S. dollars

169

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

at the prevailing exchange rate on the respective dates of such transactions. Unrealized gains and losses, not relating to securities, that result from changes in foreign currency exchange rates, have been included in unrealized appreciation/(depreciation) of securities. Net realized foreign currency gains and losses include foreign currency gains and losses resulting from changes in exchange rates between trade date and settlement date on investment securities transactions, gains and losses on foreign currency transactions, and the difference between the amounts of interest and dividends recorded on the books of the funds and the amounts actually received. The portion of foreign currency gains and losses related to fluctuations in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gains/(losses) from security transactions.

Currency symbols utilized throughout the notes to the financial statements are defined as follows:

| AUD— Australian Dollar | | | | JPY— Japanese Yen |

| BRL— Brazilian Real | | | | NOK— Norwegian Krona |

| CAD— Canadian Dollar | | | | NZD— New Zealand Dollar |

| CHF— Swiss Franc | | | | SEK— Swedish Krona |

| EUR— European Monetary Unit | | | | USD— U.S. Dollar |

| GBP— British Pound | | | | | | |

Options (other than Swaptions)

Exchange traded options normally will be priced based on the last reported sale price or official closing price (if available) on the exchange on which the option is primarily traded. Certain markets are not closed at valuation time. In these situations, a pricing service may provide snapshot prices. If no sales are reported on a particular day, a pricing service normally will use the mean between the last bid and asked quotations. Non-exchange traded options normally will be priced using an option valuation model and will be provided by a pricing service.

Futures

Futures contracts normally will be priced at their settlement prices established and reported each day on the exchange on which they are traded, as provided by a pricing service.

Futures exchange abbreviations utilized throughout the notes to the financial statements are defined as follows:

| CBT— Chicago Board of Trade Exchange | | | | MIL— Borsa Italiana Exchange |

| CME— Chicago Mercantile Exchange | | | | MSE— Montreal Exchange |

| EOE— Dutch Options Exchange | | | | NYF— New York Futures Exchange |

| EOP— Euronext Paris Exchange | | | | SFE— Sydney Futures Exchange |

| EUX— Eurex Deutschland Exchange | | | | SGX— Singapore Exchange |

| HKG— Hong Kong Futures Exchange | | | | SSE— Stockholm Stock Exchange |

| LIF— Liffe Exchange | | | | TSE— Tokyo Stock Exchange |

| MFM— Meff Renta Variable Exchange | | | | | | |

Forward Currency Contracts

These contracts normally will be priced using the WM/Reuters Intraday Forwards rates provided as of 4:00 pm Eastern Time.

Interest Rate Swaps and Inflation Swaps

Interest rate and inflation swaps normally will be priced based on the applicable swap valuation model (i.e. interest rate or inflation) which incorporates a snapshot of the relevant swap curve (interest rate curve or inflation rate curve, as applicable). In the event a pricing service is unable to provide a price for a particular swap, the swap will be priced at its fair value in accordance with the Valuation Procedures.

Interest Rate Swaptions

Interest rate swaptions normally will be priced based on a snapshot taken of the relevant swap curve, deriving an implied volatility surface from actual and/or indicative broker-dealer swaption prices, and combining them in a swaption valuation model. In the event a pricing service is unable to provide a price for a particular swaption, the swaption will be priced at its fair value in accordance with the Valuation Procedures.

170

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Total Return Swaps

Total return swaps are normally priced based on a valuation model that incorporates cash flow forecasts for the reference asset and a snapshot of the relevant interest rate swap curve. Such prices will be provided by a pricing service. In the event a pricing service is unable to provide a price for a particular total return swap, the total return swap will be priced at its fair value in accordance with the Valuation Procedures.

Security Transactions and Income Recognition

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Dividend income is recognized on the ex-dividend date and interest income is accrued daily. Realized gains or losses are reported on the basis of identified cost of securities delivered. Bond discounts and premiums are amortized for both financial reporting and tax purposes, except for the Core Bond Index Fund, which does not amortize bond premium for tax purposes.

Reclassification of Financial Information—Low Duration Bond Fund

As a result of a revision to the year ended December 31, 2008, amortized premium and discount on debt securities, certain amounts for the fiscal year ended December 31, 2008 have been restated. The impact to net investment income was an increase of $1,609,713 with a corresponding decrease to realized gain and increase to unrealized depreciation of $136,204 and $1,473,509, respectively. The revision has no impact on the net assets and is not material to the financial statements taken as a whole.

Dividends and Distributions to Shareholders

Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividends from net investment income, if any, are declared and paid monthly to shareholders of the Core Bond Index, Low Duration Bond, and Inflation Protected Securities Funds. Dividends from net investment income, if any, are declared daily and paid monthly to shareholders of the Money Market Fund. For the remaining funds, dividends from net investment income, if any, are declared and paid annually to shareholders. Distributions from any net realized capital gains, if any, are generally declared and paid annually to shareholders. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments of income and gains on investment securities, and differing characterizations of distributions being made by each fund.

Certain differences are permanent, and result in reclassifications among paid-in capital, net investment income or realized gains. These include net operating losses not utilized during the current year, commission adjustments, pay-down gains and losses, bond premium amortization, foreign currency gains and losses, treasury inflation-protected securities adjustments, taxable over-distributions or returns of capital, and adjustments relating to income received from, or dispositions of, real estate investment trust, passive foreign investment company, publicly traded partnership, and mutual fund company securities. The following reclassifications were made in the financial statements to present the components of fund net assets and distributions on a tax basis for the year ended December 31, 2009. These reclassifications have no effect on net assets or net asset values per share, and they do not affect the net investment income per share calculations presented in the Financial Highlights.

Fund

| | | | Paid-in Capital

Increase/(Decrease)

| | Undistributed Net

Investment Income

Increase/(Decrease)

| | Accumulated Net

Realized Gain/(Loss)

Increase/(Decrease)

|

|---|

| Low Duration Bond | | | | $ | — | | | $ | (899,177 | ) | | $ | 899,177 | |

| Inflation Protected Securities | | | | | — | | | | 489,338 | | | | (489,338 | ) |

| Asset Allocation | | | | | 543 | | | | (357,711 | ) | | | 357,168 | |

| Equity Income | | | | | 1 | | | | (616,666 | ) | | | 616,665 | |

| Growth & Income | | | | | — | | | | (3,904 | ) | | | 3,904 | |

| Growth | | | | | (32,952 | ) | | | 265,327 | | | | (232,375 | ) |

| Select Value | | | | | (110,733 | ) | | | (1,182,281 | ) | | | 1,293,014 | |

| Aggressive Opportunities | | | | | (294,066 | ) | | | (818,495 | ) | | | 1,112,561 | |

171

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Fund

| | | | Paid-in Capital

Increase/(Decrease)

| | Undistributed Net

Investment Income

Increase/(Decrease)

| | Accumulated Net

Realized Gain/(Loss)

Increase/(Decrease)

|

|---|

| Discovery | | | | $ | (51,453 | ) | | $ | (321,502 | ) | | $ | 372,955 | |

| International | | | | | (10,637 | ) | | | 2,585,624 | | | | (2,574,987 | ) |

| Diversified Assets | | | | | — | | | | 2,366,462 | | | | (2,366,462 | ) |

| Core Bond Index | | | | | (71,898 | ) | | | 5,900,124 | | | | (5,828,226 | ) |

| 500 Stock Index | | | | | 18,103,366 | | | | (209,510 | ) | | | (17,893,856 | ) |

| Broad Market Index | | | | | 4,086,920 | | | | (610,654 | ) | | | (3,476,266 | ) |

| Mid/Small Company Index | | | | | 1,776,790 | | | | (131,469 | ) | | | (1,645,321 | ) |

| Overseas Equity Index | | | | | 1,112,207 | | | | 431,900 | | | | (1,544,107 | ) |

| Model Portfolio Savings Oriented | | | | | — | | | | (35,330 | ) | | | 35,330 | |

| Model Portfolio Conservative Growth | | | | | — | | | | (80,482 | ) | | | 80,482 | |

| Model Portfolio Traditional Growth | | | | | — | | | | (178,492 | ) | | | 178,492 | |

| Model Portfolio Long-Term Growth | | | | | — | | | | (58,081 | ) | | | 58,081 | |

| Model Portfolio All-Equity Growth | | | | | — | | | | (23,814 | ) | | | 23,814 | |

| Milestone Retirement Income | | | | | — | | | | (14,197 | ) | | | 14,197 | |

| Milestone 2010 | | | | | — | | | | (17,887 | ) | | | 17,887 | |

| Milestone 2015 | | | | | — | | | | (16,440 | ) | | | 16,440 | |

| Milestone 2020 | | | | | — | | | | (3,081 | ) | | | 3,081 | |

| Milestone 2025 | | | | | (1,196 | ) | | | (682 | ) | | | 1,878 | |

| Milestone 2030 | | | | | (736 | ) | | | (969 | ) | | | 1,705 | |

| Milestone 2035 | | | | | (119 | ) | | | (826 | ) | | | 945 | |

| Milestone 2040 | | | | | (829 | ) | | | 36 | | | | 793 | |

Federal Income Taxes

Each fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code for federal tax purposes. Accordingly, each fund intends to make distributions of substantially all of its net investment company taxable income and any net realized capital gains (after reduction for capital loss carry forwards) sufficient to relieve it from all, or substantially all, federal income and excise taxes. Any taxable income or gains remaining at fiscal year-end are distributed in the following year. Therefore, no provision for federal income or excise taxes was required.

The Financial Accounting Standards Board issued Interpretation ASC 740 (formerly known as “FIN 48”), “Income Taxes,” which establishes guidelines for recognizing, measuring, and disclosing tax return positions in financial statements. Management has evaluated the Company’s tax positions and determined that the application of ASC 740 had no material impact on the Company’s financial statements. Accordingly, no adjustments for unrecognized tax benefits or related interest or penalties were required as of December 31, 2009. If applicable, the Company recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in “Other Expenses” in the Statement of Operations. The Company is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly increase or decrease in the next twelve months. Each of the tax years in the four year period ending December 31, 2009 remains subject to examination by taxing authorities.

At December 31, 2009, the components of distributable earnings on a tax basis were as follows:

Fund

| | | | Undistributed

Ordinary Income

| | Undistributed

Long-Term Gains

| | Total Distributable

Earnings

|

|---|

| Low Duration Bond | | | | $ | 134,813 | | | $ | — | | | $ | 134,813 | |

| Inflation Protected Securities | | | | | 118,975 | | | | — | | | | 118,975 | |

| Asset Allocation | | | | | 1,428,535 | | | | — | | | | 1,428,535 | |

| Equity Income | | | | | 17,872,857 | | | | — | | | | 17,872,857 | |

| Growth & Income | | | | | 3,181,205 | | | | — | | | | 3,181,205 | |

| Growth | | | | | 490,902 | | | | — | | | | 490,902 | |

| International | | | | | 14,111,892 | | | | — | | | | 14,111,892 | |

| Diversified Assets | | | | | 2,823,013 | | | | — | | | | 2,823,013 | |

172

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Fund

| | | | Undistributed

Ordinary Income

| | Undistributed

Long-Term Gains

| | Total Distributable

Earnings

|

|---|

| 500 Stock Index | | | | $ | 107,139 | | | $ | — | | | $ | 107,139 | |

| Broad Market Index | | | | | 5,213,300 | | | | — | | | | 5,213,300 | |

| Mid/Small Company Index | | | | | 1,806,344 | | | | — | | | | 1,806,344 | |

| Overseas Equity Index | | | | | 184,429 | | | | — | | | | 184,429 | |

| Model Portfolio Savings Oriented | | | | | 513,500 | | | | — | | | | 513,500 | |

| Model Portfolio Conservative Growth | | | | | 1,229,673 | | | | — | | | | 1,229,673 | |

| Model Portfolio Traditional Growth | | | | | 6,245,449 | | | | — | | | | 6,245,449 | |

| Model Portfolio Long-Term Growth | | | | | 7,275,975 | | | | — | | | | 7,275,975 | |

| Model Portfolio All-Equity Growth | | | | | 1,091,762 | | | | — | | | | 1,091,762 | |

| Milestone Retirement Income | | | | | 177,046 | | | | — | | | | 177,046 | |

| Milestone 2010 | | | | | 398,746 | | | | — | | | | 398,746 | |

| Milestone 2015 | | | | | 1,002,663 | | | | — | | | | 1,002,663 | |

| Milestone 2020 | | | | | 77,861 | | | | — | | | | 77,861 | |

The tax character of distributions paid during 2009 was as follows:

Fund

| | | | Distributions

Paid from

Ordinary

Income

| | Distributions

Paid from

Long-Term

Capital Gains

| | Returns of

Capital

| | Total

Distributions

|

|---|

| Money Market | | | | $ | 749,334 | | | $ | — | | | $ | — | | | $ | 749,334 | |

| Low Duration Bond | | | | | 13,619,201 | | | | — | | | | — | | | | 13,619,201 | |

| Inflation Protected Securities | | | | | 3,796,019 | | | | — | | | | — | | | | 3,796,019 | |

| Asset Allocation | | | | | 6,232,625 | | | | — | | | | — | | | | 6,232,625 | |

| Equity Income | | | | | 25,286,784 | | | | — | | | | — | | | | 25,286,784 | |

| Growth & Income | | | | | 11,876,196 | | | | — | | | | — | | | | 11,876,196 | |

| Growth | | | | | 9,946,245 | | | | — | | | | — | | | | 9,946,245 | |

| Select Value | | | | | 2,291,563 | | | | — | | | | — | | | | 2,291,563 | |

| Aggressive Opportunities | | | | | 2,051,261 | | | | — | | | | — | | | | 2,051,261 | |

| Discovery | | | | | 1,533,607 | | | | — | | | | — | | | | 1,533,607 | |

| International | | | | | 18,665,287 | | | | — | | | | — | | | | 18,665,287 | |

| Diversified Assets | | | | | 2,104,166 | | | | — | | | | — | | | | 2,104,166 | |

| Core Bond Index | | | | | 45,263,235 | | | | — | | | | — | | | | 45,263,235 | |

| 500 Stock Index | | | | | 6,624,175 | | | | — | | | | — | | | | 6,624,175 | |

| Broad Market Index | | | | | 8,412,133 | | | | — | | | | — | | | | 8,412,133 | |

| Mid/Small Company Index | | | | | 2,719,710 | | | | — | | | | — | | | | 2,719,710 | |

| Overseas Equity Index | | | | | 4,518,504 | | | | — | | | | — | | | | 4,518,504 | |

| Model Portfolio Savings Oriented | | | | | 6,178,805 | | | | 89,456 | | | | — | | | | 6,268,261 | |

| Model Portfolio Conservative Growth | | | | | 10,102,929 | | | | — | | | | — | | | | 10,102,929 | |

| Model Portfolio Traditional Growth | | | | | 19,944,289 | | | | 989,933 | | | | — | | | | 20,934,222 | |

| Model Portfolio Long-Term Growth | | | | | 17,548,530 | | | | 7,065,993 | | | | — | | | | 24,614,523 | |

| Model Portfolio All-Equity Growth | | | | | 4,890,721 | | | | 4,261,652 | | | | — | | | | 9,152,373 | |

| Milestone Retirement Income | | | | | 1,194,129 | | | | 68,883 | | | | — | | | | 1,263,012 | |

| Milestone 2010 | | | | | 1,254,740 | | | | 362,908 | | | | — | | | | 1,617,648 | |

| Milestone 2015 | | | | | 2,039,306 | | | | 1,178,592 | | | | — | | | | 3,217,898 | |

| Milestone 2020 | | | | | 3,020,640 | | | | 1,486,573 | | | | — | | | | 4,507,213 | |

| Milestone 2025 | | | | | 2,222,049 | | | | 1,239,920 | | | | — | | | | 3,461,969 | |

| Milestone 2030 | | | | | 1,712,689 | | | | 1,159,773 | | | | — | | | | 2,872,462 | |

| Milestone 2035 | | | | | 1,050,895 | | | | 732,331 | | | | — | | | | 1,783,226 | |

| Milestone 2040 | | | | | 1,260,704 | | | | 792,731 | | | | — | | | | 2,053,435 | |

173

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

At December 31, 2009, the following funds had net capital loss carryovers:

| | | | Expiring December 31

| |

|---|

Fund

| | | | 2010

| | 2011

| | 2012

| | 2013

|

|---|

| Low Duration Bond | | | | $ | — | | | $ | — | | | $ | — | | | $ | 2,517,298 | |

| Inflation Protected Securities | | | | | — | | | | — | | | | — | | | | — | |

| Asset Allocation | | | | | — | | | | — | | | | — | | | | — | |

| Equity Income | | | | | — | | | | — | | | | — | | | | — | |

| Growth & Income | | | | | — | | | | — | | | | — | | | | — | |

| Growth | | | | | 125,817,886 | | | | 82,974,331 | | | | — | | | | — | |

| Select Value | | | | | — | | | | — | | | | — | | | | — | |

| Aggressive Opportunities | | | | | — | | | | — | | | | — | | | | — | |

| Discovery | | | | | — | | | | — | | | | — | | | | — | |

| International | | | | | — | | | | — | | | | — | | | | — | |

| Diversified Assets | | | | | — | | | | — | | | | — | | | | — | |

| Core Bond Index | | | | | — | | | | — | | | | — | | | | 4,825,601 | |

| 500 Stock Index | | | | | 8,310,436 | | | | 3,056,924 | | | | — | | | | — | |

| Broad Market Index | | | | | 7,397,404 | | | | 7,434,496 | | | | — | | | | — | |

| Overseas Equity Index | | | | | — | | | | — | | | | — | | | | — | |

| Model Portfolio Savings Oriented | | | | | — | | | | — | | | | — | | | | — | |

| Model Portfolio Conservative Growth | | | | | — | | | | — | | | | — | | | | — | |

| Model Portfolio Traditional Growth | | | | | — | | | | — | | | | — | | | | — | |

| Model Portfolio Long-Term Growth | | | | | — | | | | — | | | | — | | | | — | |

| Model Portfolio All-Equity Growth | | | | | — | | | | — | | | | — | | | | — | |

| Milestone Retirement Income | | | | | — | | | | — | | | | — | | | | — | |

| Milestone 2010 | | | | | — | | | | — | | | | — | | | | — | |

| Milestone 2015 | | | | | — | | | | — | | | | — | | | | — | |

| Milestone 2020 | | | | | — | | | | — | | | | — | | | | — | |

| | | | Expiring December 31

| |

|---|

Fund

| | | | 2014

| | 2015

| | 2016

| | 2017

|

|---|

| Low Duration Bond | | | | $ | 3,180,132 | | | $ | 261,945 | | | $ | — | | | $ | 5,317,652 | |

| Inflation Protected Securities | | | | | 422,040 | | | | 48,256 | | | | 1,913,837 | | | | — | |

| Asset Allocation | | | | | — | | | | — | | | | 53,747,955 | | | | 16,049,109 | |

| Equity Income | | | | | — | | | | — | | | | 78,459,730 | | | | 44,412,591 | |

| Growth & Income | | | | | — | | | | — | | | | 75,418,372 | | | | 120,473,836 | |

| Growth | | | | | — | | | | — | | | | 218,570,902 | | | | 314,413,233 | |

| Select Value | | | | | — | | | | — | | | | 35,743,246 | | | | 37,613,177 | |

| Aggressive Opportunities | | | | | — | | | | — | | | | 45,967,040 | | | | 101,968,528 | |

| Discovery | | | | | — | | | | — | | | | 32,801,107 | | | | 16,410,988 | |

| International | | | | | — | | | | — | | | | 36,965,418 | | | | 150,182,044 | |

| Diversified Assets | | | | | — | | | | — | | | | 5,949,499 | | | | — | |

| Core Bond Index | | | | | 8,705,385 | | | | 4,299,528 | | | | 2,798,291 | | | | 4,404,280 | |

| 500 Stock Index | | | | | — | | | | — | | | | 7,028,727 | | | | 1,183,403 | |

| Broad Market Index | | | | | — | | | | — | | | | 265,032 | | | | — | |

| Overseas Equity Index | | | | | — | | | | — | | | | — | | | | 3,000,588 | |

| Model Portfolio Savings Oriented | | | | | — | | | | — | | | | — | | | | 2,061,533 | |

| Model Portfolio Conservative Growth | | | | | — | | | | — | | | | 19,410 | | | | 6,632,356 | |

| Model Portfolio Traditional Growth | | | | | — | | | | — | | | | — | | | | 17,709,713 | |

| Model Portfolio Long-Term Growth | | | | | — | | | | — | | | | — | | | | 7,029,301 | |

| Model Portfolio All-Equity Growth | | | | | — | | | | — | | | | — | | | | 1,085,637 | |

| Milestone Retirement Income | | | | | — | | | | — | | | | — | | | | 224,204 | |

| Milestone 2010 | | | | | — | | | | — | | | | — | | | | 2,710,996 | |

| Milestone 2015 | | | | | — | | | | — | | | | — | | | | 1,002,314 | |

| Milestone 2020 | | | | | — | | | | — | | | | — | | | | 79,247 | |

174

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

At December 31, 2009, the following funds elected to defer post-October net capital losses and currency losses of:

Fund

| | | | Capital Losses

| | Currency Losses

|

|---|

| Inflation Protected Securities | | | | $ | — | | | $ | 102,877 | |

| Growth & Income | | | | | 3,038,127 | | | | — | |

| Growth | | | | | 6,578,549 | | | | — | |

| Select Value | | | | | 2,161,000 | | | | — | |

| Discovery | | | | | — | | | | 1,788 | |

| International | | | | | 3,094,439 | | | | — | |

| Diversified Assets | | | | | 1,946,551 | | | | 71,859 | |

| 500 Stock Index | | | | | 160,206 | | | | — | |

| Overseas Equity Index | | | | | — | | | | 200,738 | |

| Model Portfolio Savings Oriented | | | | | 78,014 | | | | — | |

| Milestone 2010 | | | | | 231,730 | | | | — | |

| Milestone 2015 | | | | | 4,523 | | | | — | |

| Milestone 2020 | | | | | 3,122 | | | | — | |

| Milestone 2025 | | | | | 11,755 | | | | — | |

| Milestone 2030 | | | | | 165,837 | | | | — | |

| Milestone 2035 | | | | | 4,518 | | | | — | |

| Milestone 2040 | | | | | 25,678 | | | | — | |

3. | | Investments in Derivative Instruments |

Some of the funds use derivative instruments in pursuing their investment objectives. The following discussion provides more detailed information about each type of derivative instrument held by the funds during or as of the end of the reporting period.

Futures Contracts

A futures contract is an agreement between two parties to buy and sell a security, commodity, or index at a set price on a future date.

A fund may enter into futures contracts for purposes of seeking to protect portfolio value against the risk of decline (overall price risk) or seeking to increase portfolio value. Use of derivatives to seek increased portfolio value increases the funds exposure to the risk of loss due to adverse market changes.

Certain funds may enter into futures contracts to seek to manage or “hedge” against certain investment risks to which a fund may be exposed from time to time in pursuing its investment objectives. These risks may include, for example, interest rate risk (which is the risk that interest rates will rise, causing bond prices to fall) or stock market risk (which is the risk that stock prices overall will decline over short or extended periods). Some funds also may use futures contracts to obtain investment exposure to an asset or asset class without purchasing or selling those assets directly.

Funds that may use futures contracts to seek to manage interest rate risk include: the Low Duration Bond Fund, Inflation Protected Securities Fund, Asset Allocation Fund, Discovery Fund, Diversified Assets Fund, and Core Bond Index Fund. Funds that may use futures contracts to seek to manage stock market risks include: Asset Allocation Fund, Equity Income Fund, Growth & Income Fund, Growth Fund, Select Value Fund, Aggressive Opportunities Fund, Discovery Fund, International Fund, Diversified Assets Fund, 500 Stock Index Fund, Broad Market Index Fund, Mid/Small Company Index Fund, and Overseas Equity Index Fund. Funds that may use futures contracts to obtain investment exposure to a certain asset or asset class include: the Asset Allocation Fund, Discovery Fund, Diversified Asset Fund, Low Duration Bond Fund, Inflation Protected Securities Fund, 500 Stock Index Fund, Broad Market Index Fund, Mid/Small Company Index Fund and Overseas Equity Index Fund. Certain funds also may be permitted (but are not required) to use futures contracts for other purposes, as described in the prospectus and statement of additional information, but any such uses generally would not be as common as the uses described above. No fund is required to use futures contracts for any or all of the uses described herein.

A fund may enter into futures contracts based on an equity index in order to increase or to decrease its exposure to changes in equity market conditions, including the risk of market value decreases (equity price risk) or the risk of not participating in equity market increases (risk of missing opportunities for gains).

175

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

A fund may enter into futures contracts based on a bond index or a specific underlying fixed income security to increase or decrease its exposure to changes in bond market conditions or to changes in the market value of the specific underlying security, including the risk of market value decreases (price risk, interest rate risk, credit risk) or the risk of not participating in market increases (risk of missing opportunities for gains).

Pursuant to the contract, upon entering the contract the fund agrees to deposit an amount equal to a certain percentage of the contract value (initial margin). The fund agrees to subsequently receive from or pay an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments are known as “variation margin” and are recorded by the fund as unrealized gains or losses. When the contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Realized gains and losses are a component of net realized gain (loss) on futures contracts in the Statements of Operations.

Risks of entering into futures contracts include the possibility that there may be an illiquid market for the contract and that a change in the value of the contracts may not correlate with the changes in the value of the underlying securities. The amount of risk associated with a futures contract may significantly exceed the amount(s) reflected in the financial statements.

During the year ended December 31, 2009, the following funds purchased or sold futures contracts: Low Duration Bond Fund, Inflation Protected Securities Fund, Asset Allocation Fund, Discovery Fund, Diversified Assets Fund, 500 Stock Index Fund, Broad Market Index Fund, Mid/Small Company Index Fund, and Overseas Equity Index Fund.

As of December 31, 2009, the following funds had open futures contracts outstanding:

Low Duration Bond Fund

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation

|

|---|

Sold | | | | | | | | | | | | | | | | | | | | |

| 23 | | | | CBT | | U.S. 10 Year Treasury Note | | March 2010 | | $ | 2,655,422 | | | $ | 66,761 | |

| 19 | | | | CBT | | U.S. 2 Year Treasury Note | | March 2010 | | | 4,109,047 | | | | 16,854 | |

| 26 | | | | CBT | | U.S. 5 Year Treasury Note | | March 2010 | | | 2,973,953 | | | | 44,188 | |

| | | | | | | | | | | | | | | $ | 127,803 | |

Inflation Protected Securities Fund

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 8 | | | | CBT | | U.S. 10 Year Treasury Note | | March 2010 | | $ | 923,625 | | | $ | (2,394 | ) |

| 39 | | | | CBT | | U.S. 5 Year Treasury Note | | March 2010 | | | 4,460,930 | | | | (58,036 | ) |

| | | | | | | | | | | | | | | $ | (60,430 | ) |

Sold | | | | | | | | | | | | | | | | | | | | |

| 11 | | | | CBT | | U.S. 30 Year Treasury Bond | | March 2010 | | $ | 1,269,125 | | | $ | 32,326 | |

| | | | | | | | | | | | | | | $ | (28,104 | ) |

176

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Asset Allocation Fund

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 128 | | | | CME | | S&P 500 Index | | March 2010 | | $ | 35,542,400 | | | $ | 484,402 | |

| 324 | | | | CBT | | U.S. 30 Year Treasury Bond | | March 2010 | | | 37,381,500 | | | | (1,787,808 | ) |

| | | | | | | | | | | | | | | $ | (1,303,406 | ) |

Sold | | | | | | | | | | | | | | | | | | | | |

| 29 | | | | CME | | E-MINI S&P 500 Index | | March 2010 | | $ | 1,610,515 | | | $ | 9,806 | |

| | | | | | | | | | | | | | | $ | (1,293,600 | ) |

Discovery Fund

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 1,388 | | | | NYF | | E-MINI Russell 2000 Index | | March 2010 | | $ | 86,597,320 | | | $ | 2,927,648 | |

| |

Sold | | | | | | | | | | | | | | | | | | | | |

| 4 | | | | CBT | | U.S. 5 Year Treasury Note | | March 2010 | | $ | 457,531 | | | | 6,798 | |

| | | | | | | | | | | | | | | $ | 2,934,446 | |

Diversified Assets Fund

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 4 | | | | EOE | | Amsterdam Index | | January 2010 | | $ | 384,765 | | | $ | 11,924 | |

| 120 | | | | SFE | | Australian Government

10 Year Bond | | March 2010 | | | 10,973,590 | | | | (148,753 | ) |

| 190 | | | | EOP | | CAC 40 Index | | January 2010 | | | 10,735,641 | | | | 256,875 | |

| 45 | | | | MSE | | Canadian Government

10 Year Bond | | March 2010 | | | 5,070,326 | | | | (78,471 | ) |

| 8 | | | | EUX | | DAX Index | | March 2010 | | | 1,708,648 | | | | 18,693 | |

| 125 | | | | CME | | E-MINI S&P 500 Index | | March 2010 | | | 6,941,875 | | | | (19,562 | ) |

| 180 | | | | LIF | | FTSE 100 Index | | March 2010 | | | 15,587,811 | | | | 292,072 | |

| 6 | | | | MIL | | FTSE/MIB Index | | March 2010 | | | 1,001,320 | | | | 19,713 | |

| 100 | | | | MFM | | IBEX 35 Index | | January 2010 | | | 17,093,650 | | | | 424,985 | |

| 1,026 | | | | SSE | | OMX Stockholm 30 Index | | January 2010 | | | 13,659,159 | | | | (95,334 | ) |

| 4 | | | | MSE | | S&P/TSX 60 Index | | March 2010 | | | 528,412 | | | | 13,458 | |

| 24 | | | | SFE | | SPI 200 Index | | March 2010 | | | 2,629,537 | | | | 141,419 | |

| 1 | | | | CBT | | U.S. 10 Year Treasury Note | | March 2010 | | | 115,453 | | | | (2,148 | ) |

| 72 | | | | LIF | | UK Gilt Long Bond | | March 2010 | | | 13,309,894 | | | | (293,830 | ) |

| | | | | | | | | | | | | | | $ | 541,041 | |

177

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Diversified Assets Fund (continued)

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

Sold | | | | | | | | | | | | | | | | | | | | |

| 336 | | | | SGX | | 10 Year Mini-JGB | | March 2010 | | $ | 50,409,921 | | | $ | (124,502 | ) |

| 15 | | | | EOE | | Amsterdam Index | | January 2010 | | | 1,442,868 | | | | (52,728 | ) |

| 248 | | | | EOP | | CAC 40 Index | | January 2010 | | | 14,012,836 | | | | (412,495 | ) |

| 23 | | | | EUX | | DAX Index | | March 2010 | | | 4,912,364 | | | | (135,734 | ) |

| 129 | | | | CME | | E-MINI S&P 500 Index | | March 2010 | | | 7,164,015 | | | | (91,478 | ) |

| 35 | | | | MIL | | FTSE/MIB Index | | March 2010 | | | 5,841,035 | | | | (142,730 | ) |

| 20 | | | | HKG | | Hang Seng Index | | January 2010 | | | 2,827,792 | | | | (88,870 | ) |

| 18 | | | | SFE | | SPI 200 Index | | March 2010 | | | 1,972,153 | | | | (90,859 | ) |

| 207 | | | | TSE | | TOPIX Index | | March 2010 | | | 20,103,237 | | | | (240,400 | ) |

| 5 | | | | CBT | | U.S. 10 Year Treasury Note | | March 2010 | | | 577,266 | | | | 14,379 | |

| 44 | | | | CBT | | U.S. 5 Year Treasury Note | | March 2010 | | | 5,032,844 | | | | 73,594 | |

| | | | | | | | | | | | | | | $ | (1,291,823 | ) |

| | | | | | | | | | | | | | | $ | (750,782 | ) |

500 Stock Index Fund | | | | | | | | | | | | | | | | | | | | |

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation

|

|---|

Purchased | | | | | | | | | | �� | | | | | | | | | | |

| 118 | | | | CME | | E-MINI S&P 500 Index | | March 2010 | | $ | 6,553,130 | | | $ | 35,558 | |

| | | | | | | | | | | | | | | $ | 35,558 | |

Broad Market Index Fund | | | | | | | | | | | | | | | | | | | | |

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 13 | | | | NYF | | E-MINI Russell 2000 Index | | March 2010 | | $ | 811,070 | | | $ | 34,806 | |

| 79 | | | | CME | | E-MINI S&P 500 Index | | March 2010 | | | 4,387,265 | | | | 49,636 | |

| | | | | | | | | | | | | | | $ | 84,442 | |

Mid/Small Company Index Fund | | | | | | | | | | | | | | | | | | | | |

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 48 | | | | NYF | | E-MINI Russell 2000 Index | | March 2010 | | $ | 2,994,720 | | | $ | 81,052 | |

| 41 | | | | CME | | E-MINI S&P MidCap 400 | | March 2010 | | | 2,972,090 | | | | 62,023 | |

| | | | | | | | | | | | | | | $ | 143,075 | |

178

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Overseas Equity Index Fund

Number of

Contracts

| | | | Exchange

| | Contract

| | Expiration Date

| | Contract Value

| | Net

Unrealized

Appreciation

|

|---|

Purchased | | | | | | | | | | | | | | | | | | | | |

| 23 | | | | EUX | | DJ Euro STOXX 50 Index | | March 2010 | | $ | 979,917 | | | $ | 14,639 | |

| 6 | | | | LIF | | FTSE 100 Index | | March 2010 | | | 519,594 | | | | 9,274 | |

| 2 | | | | SFE | | SPI 200 Index | | March 2010 | | | 219,128 | | | | 9,836 | |

| 6 | | | | TSE | | TOPIX Index | | March 2010 | | | 582,703 | | | | 813 | |

| | | | | | | | | | | | | | | $ | 34,562 | |

Forward Foreign Currency Exchange Contracts

A forward foreign currency exchange contract is a privately negotiated agreement to pay or receive specific amounts of a currency at a future date in exchange for another currency at an agreed upon exchange rate.

Certain funds may enter into forward foreign currency exchange contracts to seek to manage or “hedge” against the currency risks to which a fund may be exposed from time to time in pursuing its investment objective(s). Generally, currency risk is the risk that foreign currency values will decline relative to the U.S. dollar. This risk may arise in connection with a fund’s investments in securities or other assets that are denominated in foreign currencies, a fund’s direct investment in foreign currency or a fund’s investment in a derivative instrument that provides exposure to a foreign currency. A decline in the value of a foreign currency relative to the U.S. dollar will reduce the value of any securities held by a fund and denominated in that currency. Certain funds may enter into forward foreign currency exchange contracts in order to gain investment exposure to a foreign currency.

The following funds are permitted (but not required) to use forward foreign currency exchange contracts to manage any foreign currency risk to which they may be exposed from time to time: the Low Duration Bond Fund, Inflation Protected Securities Fund, Equity Income Fund, Growth & Income Fund, Growth Fund, Select Value Fund, Aggressive Opportunities Fund, Discovery Fund, International Fund, Diversified Assets Fund, and Overseas Equity Index Fund. Certain funds, such as the Diversified Assets Fund, may enter into forward foreign currency exchange contracts in order to gain investment exposure to a foreign currency. Certain funds may be permitted (but are not required) to enter into forward foreign currency exchange contracts for other purposes, as described in the prospectus and/or statement of additional information, but any such uses generally would not be as common as the primary and secondary uses described above. No fund is required to use forward foreign currency exchange contracts for any or all of the uses described herein.

Risks of entering into forward foreign currency exchange contracts include the possibility that foreign currency values may change unfavorably relative to the U.S. dollar, there may be an illiquid market or a change in the value of the contracts may not correlate with changes in the value of the underlying currency. The amount at risk for such forward foreign currency exchange contracts may exceed the amount reflected in the financial statements. The use of over-the-counter forward foreign currency exchange contracts includes counterparty risk, which is the risk that the other party to a contract may not fulfill its obligations. The risk of loss from non-performance by the counterparty may be reduced by the use of a written agreement with the counterparty that includes certain safeguards regarding the counterparty’s obligations.

The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily using prevailing exchange rates. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on forward contracts and foreign currency transactions in the Statements of Operations, respectively.

During the year ended December 31, 2009, the following funds purchased or sold forward foreign currency exchange contracts: Low Duration Bond Fund, Inflation Protected Securities Fund, Discovery Fund, Diversified Assets Fund, and Overseas Equity Index Fund.

179

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

As of December 31, 2009, the following funds had open forward foreign currency exchange contracts outstanding:

Low Duration Bond Fund

Contract Type

| | | | Currency to

Deliver

| | In

Exchange

For

| | Exchange

Date

| | Foreign Currency

Cost/Proceeds

(U.S.$)

| | U.S. Dollar Value at

December 31, 2009

| | Net

Unrealized

Appreciation

|

|---|

| Sale | | | | EUR | | USD | | 01/11/2010 | | $ | 7,475,490 | | | $ | 7,230,826 | | | $ | 244,664 | |

Inflation Protected Securities Fund

Contract Type

| | | | Currency to

Deliver

| | In

Exchange

For

| | Exchange

Date

| | Foreign Currency

Cost/Proceeds

(U.S.$)

| | U.S. Dollar Value at

December 31, 2009

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

| Purchase | | | | EUR | | JPY | | 02/05/2010 | | $ | 1,548,230 | | | $ | 1,531,510 | | | $ | (16,720 | ) |

| Purchase | | | | JPY | | EUR | | 02/05/2010 | | | 1,541,810 | | | | 1,548,230 | | | | 6,420 | |

| | | | | | | | | | | | | | | | | | | $ | (10,300 | ) |

| Sale | | | | EUR | | USD | | 01/20/2010 | | $ | 1,498,697 | | | $ | 1,425,666 | | | $ | 73,031 | |

| | | | | | | | | | | | | | | | | | | $ | 62,731 | |

Discovery Fund

Contract Type

| | | | Currency

to Deliver

| | In

Exchange

For

| | Exchange

Date

| | Foreign Currency

Cost/Proceeds

(U.S.$)

| | U.S. Dollar Value at

December 31, 2009

| | Net

Unrealized

Appreciation

|

|---|

| Sale | | | | EUR | | USD | | 01/11/2010 | | $ | 680,261 | | | $ | 657,999 | | | $ | 22,262 | |

Diversified Assets Fund

Contract Type

| | | | Currency

to Deliver

| | In

Exchange

For

| | Exchange

Date

| | Foreign Currency

Cost/Proceeds

(U.S.$)

| | U.S. Dollar Value at

December 31, 2009

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

| Purchase | | | | USD | | AUD | | 01/07/2010 | | $ | 22,051,368 | | | $ | 21,725,211 | | | $ | (326,157 | ) |

| Purchase | | | | USD | | AUD | | 02/03/2010 | | | 18,447,691 | | | | 18,423,279 | | | | (24,412 | ) |

| Purchase | | | | USD | | CAD | | 01/07/2010 | | | 3,440,348 | | | | 3,456,117 | | | | 15,769 | |

| Purchase | | | | USD | | CHF | | 01/07/2010 | | | 11,604,055 | | | | 11,347,024 | | | | (257,031 | ) |

| Purchase | | | | USD | | CHF | | 02/03/2010 | | | 7,950,131 | | | | 7,944,622 | | | | (5,509 | ) |

| Purchase | | | | USD | | EUR | | 01/07/2010 | | | 10,410,667 | | | | 10,073,556 | | | | (337,111 | ) |

| Purchase | | | | USD | | GBP | | 01/07/2010 | | | 32,666,822 | | | | 32,721,166 | | | | 54,344 | |

| Purchase | | | | USD | | JPY | | 01/07/2010 | | | 14,267,657 | | | | 13,194,526 | | | | (1,073,131 | ) |

| Purchase | | | | USD | | JPY | | 02/03/2010 | | | 10,022,733 | | | | 10,018,374 | | | | (4,359 | ) |

| Purchase | | | | USD | | NOK | | 01/07/2010 | | | 4,736,787 | | | | 4,737,879 | | | | 1,092 | |

| Purchase | | | | USD | | NOK | | 02/03/2010 | | | 4,743,091 | | | | 4,732,215 | | | | (10,876 | ) |

| Purchase | | | | USD | | NZD | | 01/07/2010 | | | 8,788,798 | | | | 8,942,449 | | | | 153,651 | |

| Purchase | | | | USD | | NZD | | 02/03/2010 | | | 6,343,172 | | | | 6,328,091 | | | | (15,081 | ) |

| Purchase | | | | USD | | SEK | | 01/07/2010 | | | 2,547,417 | | | | 2,542,198 | | | | (5,219 | ) |

| | | | | | | | | | | | | | | | | | | $ | (1,834,030 | ) |

180

VANTAGEPOINT FUNDS

NOTES TO THE FINANCIAL STATEMENTS—(Continued)

Contract Type

| | | | Currency

to Deliver

| | In

Exchange

For

| | Exchange

Date

| | Foreign Currency

Cost/Proceeds

(U.S.$)

| | U.S. Dollar Value at

December 31, 2009

| | Net

Unrealized

Appreciation/

(Depreciation)

|

|---|

| Sale | | | | AUD | | USD | | 01/07/2010 | | $ | 21,823,133 | | | $ | 21,725,211 | | | $ | 97,922 | |