The Directors reviewed information provided by VIA (which was based on an independent third-party source) on the fees charged to accounts with assets comparable to the amount of assets to be allocated initially to each New Subadviser of the applicable Fund by a group of U.S. separate account investment managers that employ a similar investment style to the investment style each New Subadviser is to employ for the applicable Fund. According to the information provided, the effective fee rate to be paid by the applicable Fund to each New Subadviser at the proposed initial asset allocation level for each New Subadviser would be below the median fee charged by such managers.

With respect to the Growth Fund, the Directors then considered that there would be a two basis point increase in overall contractual subadvisory fees and also considered the impact on the total expense ratio of the Growth Fund associated with the appointment of CCI and D.G. Capital, the termination of GSAM and Peregrine and the increase in the amount of the Growth Fund’s assets to be allocated to Westfield. Referring to data provided by VIA and compiled by Morningstar, Inc. (“Morningstar”), a provider of independent investment company data, the Directors also noted that the expected total contractual investment advisory fee for the Growth Fund, taking into account the proposed subadviser changes, was lower than the average and median investment advisory fee of a group of U.S. open-end mutual funds in Morningstar’s large-cap growth category. The Directors also considered information provided by VIA and compiled by Morningstar on the total expense ratios of a group of U.S. open-end mutual funds in Morningstar’s large-cap growth category, which showed that, if CCI and D.G. Capital each served as a subadviser to the Growth Fund at the proposed subadvisory fee rates and initial asset allocation levels, along with the Growth Fund’s three other existing subadvisers at their current contractual subadvisory fee rates, the Growth Fund’s expected total expense ratio would be below the average and median expense ratios of such funds.

With respect to the Select Value Fund, the Directors also considered that there would be an increase in overall subadvisory fees of approximately five basis points, and, therefore, the total expense ratio of the Select Value Fund associated with the appointment of Artisan Partners and the termination of GSAM. The Directors noted that, unlike GSAM’s quantitative approach, Artisan Partners employs an active investment strategy. Referring to data provided by VIA and compiled by Morningstar, the Directors also noted that the expected total investment advisory fee for the Select Value Fund, taking into account the proposed subadviser change, was lower than the average and median investment advisory fee of a group of mutual funds in Morningstar’s mid-cap value category. The Directors also considered information provided by VIA and compiled by Morningstar on the total expense ratios of a group of mutual funds in Morningstar’s mid-cap value category, which showed that, if Artisan Partners served as a subadviser to the Select Value Fund at the proposed subadvisory fee rate and initial asset allocation level, along with the Select Value Fund’s two other existing subadvisers, WEDGE Capital Management, LLP (“WEDGE”) and Systematic Financial Management, L.P. (“Systematic”), at their current subadvisory fee rates, the Select Value Fund’s expected total expense ratio would be below the average and median expense ratios of such funds.

The foregoing comparisons assisted the Directors in considering each Growth Subadvisory Agreement and the Select Value Subadvisory Agreement by providing them with a basis for evaluating each New Subadviser’s fees, including in light of the applicable Fund’s expected overall investment advisory fee and total expense ratio, on a relative basis. Based on this information, the Directors concluded that each New Subadviser’s subadvisory fees each appeared to be within a reasonable range for the services to be provided.

The Directors also reviewed the information provided by each New Subadviser regarding the estimated profits to be realized from each New Subadviser’s relationship with the applicable Fund. In reviewing the extent to which economies of scale may be realized by each New Subadviser as the assets of the applicable Fund to be managed by each New Subadviser grow, and whether the proposed fee levels reflect these economies, the Directors considered that each New Subadviser’s proposed fee schedule included breakpoints, which indicates that each proposed subadvisory fee rate is intended to capture certain anticipated economies of scale for the benefit of the applicable Fund’s shareholders in connection with the services to be provided. The Directors concluded that the proposed fee schedule with respect to each New Subadviser was appropriate at this time.

VANTAGEPOINT FUNDS

Additional Information (Unaudited)—(Continued)

returns. The Directors also considered VIA’s judgment that the addition of Artisan Partners as a subadviser to the Select Value Fund would add value by complementing the investment approach of the Select Value Fund’s current investment subadvisers, WEDGE and Systematic. In this regard, the Directors considered VIA’s belief that the addition of Artisan Partners as a subadviser, along with VIA’s recommendation to terminate GSAM should serve to enhance the Select Value Fund’s risk/return profile while increasing its potential for higher and more consistent expected returns.

The Directors considered the selection and due diligence process employed by VIA in deciding to recommend each New Subadviser as a subadviser to the applicable Fund and also considered VIA’s conclusion that the fees to be paid to each New Subadviser for their respective services to the applicable Fund are reasonable and appropriate in light of the nature and quality of services to be provided by each New Subadviser and the reasons supporting that conclusion. The Directors also considered information from VIA concerning its strategy to efficiently implement the subadviser transitions. The Directors concluded that VIA’s recommendations and conclusions supported approval of each Growth Subadvisory Agreement and the Select Value Subadvisory Agreement.

The Directors also considered the potential “fall-out” or ancillary benefits that may accrue to each New Subadviser due to its relationship with the applicable Fund. The Directors considered that each New Subadviser may direct the applicable Fund’s brokerage transactions to certain brokers to obtain research and other services. However, the Directors noted that all subadvisers are required to select brokers who meet each Fund’s requirements for seeking best execution, and that VIA monitors and evaluates the subadvisers’ trade execution with respect to Fund brokerage transactions on a regular basis and provides reports to the Board in this regard. The Directors concluded that the potential benefits accruing to each New Subadviser by virtue of its relationship with the applicable Fund appeared to be reasonable.

Conclusion. After full consideration of the foregoing factors, with no single factor identified as being of paramount importance, the Directors, including a majority of the Independent Directors, concluded that: (i) the initial approval of each Growth Subadvisory Agreement with CCI and D.G. Capital was in the best interests of the Growth Fund and its shareholders, and approved the Growth Subadvisory Agreements with, and the fee to be paid to, each of CCI and D.G. Capital; and (ii) the initial approval of the Select Value Subadvisory Agreement with Artisan Partners was in the best interests of the Select Value Fund and its shareholders, and approved the Select Value Subadvisory Agreement with, and the fee to be paid to, Artisan Partners.

Vantagepoint Growth & Income Fund

At the December Meeting the Board, including a majority of the Independent Directors, approved an initial Subadvisory Agreement (“G&I Subadvisory Agreement”) among the Company, VIA and FMI, relating to the Growth & Income Fund. Also at the December Meeting, VIA recommended and the Board approved the termination of Capital Guardian as a subadviser to the Growth & Income Fund. Before approving the appointment of FMI as a subadviser to the Growth & Income Fund, the Board of the Company, at the December Meeting, considered the recommendations of, and supporting analyses and data presented by, VIA.

With respect to the Board’s consideration of the G&I Subadvisory Agreement with FMI, the Directors received written information in advance of the December Meeting from VIA, which included: (1) the process by which VIA selected and recommended for Board approval FMI as a subadviser of the Growth & Income Fund; (2) the nature, extent and quality of the services that FMI would provide to the Growth & Income Fund; (3) FMI’s experience, investment management business, personnel and operations; (4) FMI’s brokerage and trading policies and practices; (5) the level of the subadvisory fee to be charged to the Growth & Income Fund by FMI and a comparison of that fee to the: (a) fees charged by FMI to manage other large-cap equity accounts; and (b) fees charged by a group of U.S. separate account investment managers utilizing a large-cap core equity style; (6) FMI’s compliance program; (7) FMI’s historical performance returns utilizing a large-cap equity mandate and such performance compared to a relevant benchmark and peer group; (8) the Growth & Income Fund’s expected overall investment advisory fee and projected total expense ratio, taking into account the change in subadvisers, compared to a group of large-cap equity funds; and (9) FMI’s financial condition.

In considering the information and materials described above, the Independent Directors received assistance from and met separately with their independent legal counsel and were provided with a written description of their statutory responsibilities and the legal standards that are applicable to approvals of advisory agreements.

In determining whether to approve the G&I Subadvisory Agreement, the Directors considered the information received in advance of the December Meeting, the presentations made by, and discussions held with, representatives of FMI,

196

VANTAGEPOINT FUNDS

Additional Information (Unaudited)—(Continued)

VIA’s personnel and the Company’s Chief Compliance Officer at an Investment Committee meeting held prior to the December Meeting and at the December Meeting, as applicable, as well as a variety of factors. Although not meant to be all-inclusive, the following discusses some of the factors relevant to the Board’s decision to approve the G&I Subadvisory Agreement.

Nature, Extent and Quality of Services. With respect to the nature, extent and quality of the services expected to be provided by FMI under the G&I Subadvisory Agreement, the Directors considered the specific investment process to be employed by FMI in managing the assets of the Growth & Income Fund to be allocated to it; the qualifications of FMI’s investment management team with regard to implementing a large-cap equity mandate; FMI’s overall favorable performance record as compared to a relevant benchmark and peer group; FMI’s infrastructure and whether it appeared to adequately support a large-cap equity strategy; and VIA’s review process and favorable assessment as to the nature, quality and extent of the subadvisory services expected to be provided by FMI to the Growth & Income Fund. The Directors acknowledged that FMI has a successful performance record as a large-cap equity manager; has an experienced portfolio management team; and appears to have adequate infrastructure and support staff to seek to achieve favorable results implementing a large-cap equity mandate for the Growth & Income Fund. The Directors concluded that the nature, extent and quality of the subadvisory services expected to be provided by FMI were appropriate for the Growth & Income Fund in light of its investment strategy and, thus, supported a decision to approve the G&I Subadvisory Agreement.

Investment Performance. The Directors evaluated FMI’s historical investment performance record in managing its clients’ assets utilizing a large-cap equity mandate and considered the performance record versus a relevant benchmark and peer group (based on information provided by an independent third-party source). The Directors concluded that the historical investment performance record of FMI supported approval of the G&I Subadvisory Agreement with FMI.

Subadvisory Fee, Expense Ratio Impact and Economies of Scale. In evaluating the proposed subadvisory fee, the Directors reviewed FMI’s subadvisory fee schedule. The Directors considered comparisons of the subadvisory fee to be charged by FMI to the Growth & Income Fund with its fee schedule for managing other accounts with an investment mandate similar to the mandate FMI is to employ on behalf of the Growth & Income Fund. The Directors also considered that, according to the information provided by VIA and statements made by FMI representatives, the proposed fee schedule for FMI reflected the lowest fee rate currently charged by FMI to other accounts for which FMI provides advisory services utilizing a similar mandate, and, according to the information provided by VIA, is lower than its standard fee schedule for managing accounts with a similar mandate. Additionally, the nature of the subadvisory services FMI is to provide to the Growth & Income Fund appeared to be comparable to those FMI currently provides to its other subadvisory clients.

The Directors reviewed information provided by VIA (which was based on an independent third-party source) on the fees charged to accounts with assets comparable to the amount of assets to be allocated initially to FMI to a group of U.S. separate account investment managers that employ a similar investment style to the investment style FMI is to employ for the Growth & Income Fund. According to the information provided, the effective fee rate to be paid by the Growth & Income Fund to FMI at the proposed initial asset allocation level for FMI would be below the median fee charged by such managers.

The Directors also considered that there would be an increase in the overall contractual subadvisory fees of less than one basis point, and, therefore, the total expense ratio of the Growth & Income Fund, due to the appointment of FMI and the termination of Capital Guardian. Referring to data provided by VIA and compiled by Morningstar, the Directors also noted that the expected total contractual investment advisory fee for the Growth & Income Fund, taking into account the proposed subadviser change, was lower than the average and median investment advisory fee of a group of mutual funds in Morningstar’s large-cap blend category. The Directors also considered information provided by VIA and compiled by Morningstar on the total expense ratios of a group of mutual funds in Morningstar’s large-cap blend category, which showed that, if FMI served as a subadviser to the Growth & Income Fund at the proposed subadvisory fee rate and initial asset allocation level, along with the Growth & Income Fund’s two other existing subadvisers, Wellington Management Company, LLP (“Wellington”) and T. Rowe Price at their current subadvisory fee rates, the Growth & Income Fund’s expected total expense ratio would be below the average and median expense ratios of such funds.

The foregoing comparisons assisted the Directors in considering the G&I Subadvisory Agreement by providing them with a basis for evaluating FMI’s fee, including in light of the Growth & Income Fund’s expected overall investment

197

VANTAGEPOINT FUNDS

Additional Information (Unaudited)—(Continued)

advisory fee and total expense ratio, on a relative basis. Based on this information, the Directors concluded that FMI’s subadvisory fee appeared to be within a reasonable range for the services to be provided.

The Directors also reviewed the information provided by FMI regarding the estimated profits to be realized from its relationship with the Growth & Income Fund. In reviewing the extent to which economies of scale may be realized by FMI as the assets of the Growth & Income Fund to be managed by it grow, and whether the proposed fee levels reflect these economies, the Directors considered that FMI’s proposed fee schedule included breakpoints, which indicates that the proposed subadvisory fee rate is intended to capture certain anticipated economies of scale for the benefit of the Growth & Income Fund’s shareholders in connection with the services to be provided. The Directors concluded that the proposed fee schedule with respect to FMI was appropriate at this time.

Other Considerations. The Directors considered VIA’s judgment that the addition of FMI as a subadviser to the Growth & Income Fund would add value by complementing the investment approach of the Growth & Income Fund’s current investment subadvisers, Wellington and T. Rowe. In this regard, the Directors considered VIA’s belief that the addition of FMI as a subadviser, along with VIA’s recommendation to terminate Capital Guardian, should serve to enhance the Growth & Income Fund’s return/risk profile as the styles and underlying characteristics of the subadvisers are complementary, resulting in higher and more consistent expected returns.

The Directors considered the selection and due diligence process employed by VIA in deciding to recommend FMI as a subadviser to the Growth & Income Fund and also considered VIA’s conclusion that the fee to be paid to FMI for its services to the Growth & Income Fund is reasonable and appropriate in light of the nature and quality of services to be provided by FMI and the reasons supporting that conclusion. The Directors also considered information from VIA concerning its strategy to efficiently implement the subadviser transition. The Directors concluded that VIA’s recommendations and conclusions supported approval of the G&I Subadvisory Agreement.

The Directors also considered the potential “fall-out” or ancillary benefits that may accrue to FMI due to its relationship with the Growth & Income Fund. The Directors considered that FMI anticipates it might experience some added visibility in the institutional investment community due to its relationship with the Growth & Income Fund. In addition, the Directors noted that FMI may direct the Growth & Income Fund’s brokerage transactions to certain brokers to obtain research and other services. However, the Directors noted that all subadvisers are required to select brokers who meet the Growth & Income Fund’s requirements for seeking best execution, and that VIA monitors and evaluates the subadvisers’ trade execution with respect to Growth & Income Fund brokerage transactions on a regular basis and provides reports to the Board in this regard. The Directors concluded that the potential benefits accruing to FMI by virtue of its relationship with the Growth & Income Fund appeared to be reasonable.

Conclusion. After full consideration of the foregoing factors, with no single factor identified as being of paramount importance, the Directors, including a majority of the Independent Directors, concluded that the initial approval of the G&I Subadvisory Agreement was in the best interests of the Growth & Income Fund and its shareholders, and approved the G&I Subadvisory Agreement with, and the fee to be paid to, FMI.

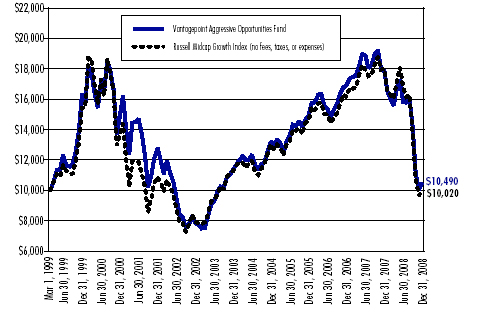

Vantagepoint Aggressive Opportunities Fund

At the December Meeting, the Board, including a majority of the Independent Directors, approved the continuance of the Subadvisory Agreements (“Aggressive Opportunities Subadvisory Agreements”) among VIA, the Company and each of LMCM and TimesSquare Capital Management, LLC with respect to the Vantagepoint Aggressive Opportunities Fund for the period January 25, 2009 through February 28, 2009. The Board approved the short-term continuance of the Aggressive Opportunities Subadvisory Agreements at the December Meeting so that the annual consideration of all applicable Investment Advisory and Subadvisory Agreements of the Company may be considered at the same Board meeting each year in order to make future administration of the Board’s annual consideration of such Agreements more efficient. The Board considered and approved the continuance of these two Aggressive Opportunities Subadvisory Agreements for the one-year period beginning March 1, 2009 through February 28, 2010 at its January 9, 2009 meeting.

Only one copy of this Annual Report may be mailed to households, even if more than one person in a household is a shareholder of record, unless the Company has received instructions to the contrary. If you need additional copies of this Annual Report, please contact The Vantagepoint Funds toll free at 1-800-669-7400 or in writing at 777 North

198

VANTAGEPOINT FUNDS

Additional Information (Unaudited)—(Continued)

Capitol Street, NE, Suite 600, Washington, D.C. 20002. If you do not want this mailing of this Annual Report to be combined with those for other members of your household, contact The Vantagepoint Funds in writing at 777 North Capitol Street, NE, Suite 600, Washington, D.C. 20002 or toll free at 1-800-669-7400.

I. | | Other Available Information |

A description of the Company’s proxy voting policies and procedures and the proxy voting record for the 12-month period ended June 30, 2008 are available on the Company’s website at www.icmarc.org or by accessing the Securities and Exchange Commission’s website at www.sec.gov.

The Company files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q; the Company’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

199

SCHEDULE OF INVESTMENTS

December 31, 2008

Vantagepoint

Money Market Fund

|

|

|

| Shares

|

|

|

| Value

|

|---|

MUTUAL FUND—100.0% |

AIM Short-Term Investments Trust Liquid Assets Portfolio

(Cost $458,084,379) | | | | | 458,084,379 | | | | | | | $ | 458,084,379 | |

TOTAL INVESTMENTS—100.0% | | | | | | | |

| (Cost $458,084,379) | | | | | | 458,084,379 | |

| Other assets less liabilities—(0.0%) | | | | | | (49,353 | ) |

NET ASSETS—100.0% | | | | | | | | | | | | $ | 458,035,026 | |

See accompanying notes to financial statements.

200

SCHEDULE OF INVESTMENTS

December 31, 2008

Vantagepoint Low Duration

Bond Fund

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

CORPORATE OBLIGATIONS—43.5% |

Banks—5.3% |

| Bank of America Corp. |

| 4.875% | 09/15/2012 | | † | | $ 3,910,000 | | | $ | 3,861,489 | |

| 4.375% | 12/01/2010 | | | | | 1,240,000 | | | | 1,243,138 | |

| Bank of America Corp. MTN |

| 4.900% | 05/01/2013 | | | | | 1,000,000 | | | | 991,456 | |

| Citigroup, Inc. |

| 4.125% | 02/22/2010 | | | | | 1,250,000 | | | | 1,232,116 | |

| 3.849% | 05/15/2018 | | # | | | 7,186,000 | | | | 5,252,736 | |

| JPMorgan Chase & Co. |

| 6.750% | 02/01/2011 | | | | | 1,240,000 | | | | 1,271,825 | |

| 4.750% | 05/01/2013 | | | | | 6,900,000 | | | | 6,815,275 | |

| Nationsbank Corp. |

| 6.600% | 05/15/2010 | | | | | 200,000 | | | | 202,350 | |

| | | | | | | | | | | 20,870,385 | |

Beverages—0.3% |

| Bottling Group LLC |

| 6.950% | 03/15/2014 | | | | | 975,000 | | | | 1,059,817 | |

Biotechnology—0.5% |

| Amgen, Inc. |

| 4.000% | 11/18/2009 | | | | | 1,800,000 | | | | 1,798,895 | |

Capital Markets—1.8% |

| Bank of New York Mellon Corp. (The) |

| 5.125% | 08/27/2013 | | | | | 2,660,000 | | | | 2,720,874 | |

| Northern Trust Corp. |

| 5.500% | 08/15/2013 | | | | | 4,290,000 | | | | 4,409,292 | |

| | | | | | | | | | | 7,130,166 | |

Chemicals—0.1% |

| Nalco Co. |

| 7.750% | 11/15/2011 | | † | | | 545,000 | | | | 525,925 | |

Commercial Banks—8.9% |

| Barclays Bank plc (United Kingdom) |

| 5.450% | 09/12/2012 | | | | | 7,440,000 | | | | 7,540,805 | |

| First Union Corp., Bank Note |

| 7.800% | 08/18/2010 | | | | | 1,750,000 | | | | 1,737,536 | |

| Glitnir Banki HF (Iceland) |

| 6.375% | 09/25/2012 | | | | | 6,270,000 | | | | 329,175 | |

| M&T Bank Corp. |

| 5.375% | 05/24/2012 | | | | | 6,680,000 | | | | 6,143,750 | |

| Marshall & Ilsley Corp. |

| 5.626% | 08/17/2009 | | | | | 6,500,000 | | | | 6,115,889 | |

| SunTrust Banks, Inc. |

| 5.250% | 11/05/2012 | | | | | 6,700,000 | | | | 6,569,551 | |

| Toronto-Dominion Bank MTN (Canada) |

| 4.288% | 09/10/2010 | | # | | | EUR 750,000 | | | | 1,028,462 | |

| US Bancorp MTN |

| 3.106% | 05/06/2010 | | # | | | 1,200,000 | | | | 1,176,586 | |

| Wachovia Corp. |

| 2.353% | 06/01/2010 | | # | | | 3,280,000 | | | | 3,095,608 | |

| Wells Fargo & Co. |

| 5.300% | 08/26/2011 | | † | | | 1,240,000 | | | | 1,258,243 | |

| | | | | | | | | | | 34,995,605 | |

Commercial Services & Supplies—0.1% |

| Allied Waste North America, Inc. |

| 7.875% | 04/15/2013 | | | | | 580,000 | | | | 551,490 | |

Communications Equipment—0.3% |

| Cisco Systems, Inc. |

| 5.250% | 02/22/2011 | | | | $ | 1,250,000 | | | $ | 1,298,317 | |

Computers & Peripherals—0.3% |

| International Business Machines Corp. |

| 4.950% | 03/22/2011 | | | | | 1,250,000 | | | | 1,295,929 | |

Consumer Finance—5.6% |

| American Express Credit Corp., Series C |

| 7.300% | 08/20/2013 | | | | | 2,450,000 | | | | 2,510,238 | |

| CIT Group, Inc. |

| 4.250% | 02/01/2010 | | | | | 275,000 | | | | 252,176 | |

| 3.796% | 07/28/2011 | | # | | | 125,000 | | | | 102,717 | |

| 2.219% | 03/12/2010 | | # | | | 5,780,000 | | | | 5,361,499 | |

| Household Finance Corp. |

| 6.375% | 10/15/2011 | | | | | 3,150,000 | | | | 3,101,068 | |

| 4.750% | 05/15/2009 | | † | | | 4,480,000 | | | | 4,478,723 | |

| International Lease Finance Corp. |

| 6.375% | 03/25/2013 | | | | | 3,200,000 | | | | 2,175,574 | |

| John Deere Capital Corp. MTN |

| 5.203% | 01/18/2011 | | # | | | 1,170,000 | | | | 1,083,997 | |

| SLM Corp., Series A MTN |

| 3.675% | 07/27/2009 | | # | | | 3,160,000 | | | | 2,979,011 | |

| | | | | | | | | | | 22,045,003 | |

Containers & Packaging—0.3% |

| Ball Corp. |

| 6.875% | 12/15/2012 | | † | | | 455,000 | | | | 452,725 | |

| Rock-Tenn Co. |

| 8.200% | 08/15/2011 | | | | | 555,000 | | | | 530,025 | |

| | | | | | | | | | | 982,750 | |

Diversified Financial Services—5.6% |

| Allstate Life Global Funding Trust, Series 2004-1 |

| 4.500% | 05/29/2009 | | | | | 3,750,000 | | | | 3,747,131 | |

| American Express Travel Related Services Co., Inc. |

| 5.250% | 11/21/2011 | | ˆ | | | 6,000,000 | | | | 5,721,150 | |

| BP Capital Markets plc (United Kingdom) |

| 5.250% | 11/07/2013 | | | | | 800,000 | | | | 836,038 | |

| General Electric Capital Corp. MTN |

| 4.875% | 10/21/2010 | | † | | | 4,060,000 | | | | 4,114,270 | |

| General Electric Capital Corp., Series A MTN |

| 4.250% | 09/13/2010 | | | | | 1,500,000 | | | | 1,505,906 | |

| Hutchison Whampoa International 03/33 Ltd. (Cayman Islands) |

| 5.450% | 11/24/2010 | | ˆ | | | 1,500,000 | | | | 1,512,870 | |

| National Rural Utilities Cooperative Finance Corp. |

| 5.750% | 08/28/2009 | | | | | 1,200,000 | | | | 1,207,927 | |

| Private Export Funding Corp., Series I |

| 7.200% | 01/15/2010 | | | | | 1,850,000 | | | | 1,973,495 | |

| Unilever Capital Corp. |

| 7.125% | 11/01/2010 | | | | | 1,175,000 | | | | 1,257,127 | |

| | | | | | | | | | | 21,875,914 | |

Diversified Telecommunication Services—2.3% |

| BellSouth Corp. |

| 4.200% | 09/15/2009 | | | | | 1,762,000 | | | | 1,769,212 | |

| Deutsche Telekom International Finance BV (Netherlands) |

| 5.375% | 03/23/2011 | | | | | 1,250,000 | | | | 1,237,157 | |

| Qwest Capital Funding, Inc. |

| 7.250% | 02/15/2011 | | | | | 265,000 | | | | 223,925 | |

| SBC Communications, Inc. |

| 4.125% | 09/15/2009 | | | | | 2,000,000 | | | | 2,008,534 | |

| Sprint Capital Corp. |

| 8.375% | 03/15/2012 | | | | | 590,000 | | | | 472,308 | |

See accompanying notes to financial statements.

201

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint Low Duration

Bond Fund

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

CORPORATE OBLIGATIONS—(Continued) |

| Verizon Communications, Inc. |

| 4.350% | 02/15/2013 | | | | $ | 2,145,000 | | | $ | 2,076,534 | |

| Verizon Global Funding Corp. | | | |

| 7.250% | 12/01/2010 | | | | | 1,250,000 | | | | 1,311,034 | |

| | | | | | | | | | | 9,098,704 | |

Electric Utilities—0.7% |

| Duke Energy Corp. |

| 6.250% | 01/15/2012 | | | | | 1,165,000 | | | | 1,207,973 | |

| Exelon Corp. |

| 6.750% | 05/01/2011 | | | | | 750,000 | | | | 732,360 | |

| Exelon Generation Co. LLC |

| 6.950% | 06/15/2011 | | | | | 450,000 | | | | 437,055 | |

| Mirant Americas Generation LLC |

| 8.300% | 05/01/2011 | | † | | | 520,000 | | | | 507,000 | |

| | | | | | | | | | | 2,884,388 | |

Food & Staples Retailing—0.5% |

| CVS Caremark Corp. |

| 4.000% | 09/15/2009 | | † | | | 2,000,000 | | | | 1,976,078 | |

Health Care Equipment & Supplies—0.1% |

| Boston Scientific Corp. |

| 6.000% | 06/15/2011 | | | | | 575,000 | | | | 549,125 | |

Health Care Providers & Services—0.5% |

| DaVita, Inc. |

| 6.625% | 03/15/2013 | | | | | 600,000 | | | | 573,000 | |

| UnitedHealth Group, Inc. |

| 2.297% | 03/02/2009 | | # | | | 800,000 | | | | 792,340 | |

| US Oncology, Inc. |

| 9.000% | 08/15/2012 | | | | | 590,000 | | | | 539,850 | |

| | | | | | | | | | | 1,905,190 | |

Insurance—1.5% |

| American International Group, Inc. |

| 4.700% | 10/01/2010 | | † | | | 1,000,000 | | | | 883,830 | |

| Metropolitan Life Global Funding I |

| 5.125% | 04/10/2013 | | ˆ | | | 5,480,000 | | | | 5,110,812 | |

| | | | | | | | | | | 5,994,642 | |

Machinery—0.3% |

| Bombardier, Inc. (Canada) |

| 6.750% | 05/01/2012 | | ˆ | | | 590,000 | | | | 526,575 | |

| Ingersoll-Rand Global Holding Co. Ltd. (Bermuda) |

| 3.675% | 08/13/2010 | | # | | | 845,000 | | | | 782,850 | |

| | | | | | | | | | | 1,309,425 | |

Media—1.0% |

| Comcast Corp. |

| 5.450% | 11/15/2010 | | | | | 2,250,000 | | | | 2,224,908 | |

| CSC Holdings, Inc., Series B |

| 7.625% | 04/01/2011 | | | | | 595,000 | | | | 563,762 | |

| Echostar DBS Corp. |

| 6.375% | 10/01/2011 | | | | | 600,000 | | | | 559,500 | |

| Lamar Media Corp. |

| 7.250% | 01/01/2013 | | † | | | 610,000 | | | | 489,525 | |

| | | | | | | | | | | 3,837,695 | |

Metals & Mining—2.8% |

| Alcoa, Inc. |

| 6.000% | 07/15/2013 | | | | $ | 5,525,000 | | | $ | 5,000,401 | |

| Rio Tinto Finance USA Ltd. (Australia) |

| 5.875% | 07/15/2013 | | | | | 6,974,000 | | | | 5,560,085 | |

| Steel Dynamics, Inc. |

| 7.375% | 11/01/2012 | | | | | 585,000 | | | | 429,975 | |

| | | | | | | | | | | 10,990,461 | |

Multi-National—1.2% |

| European Investment Bank MTN (Supranational) |

| 4.750% | 04/15/2011 | | EUR | | | 2,300,000 | | | | 3,339,988 | |

| International Bank for Reconstruction & Development (Supranational) |

| 3.125% | 11/15/2011 | | | | | 1,200,000 | | | | 1,235,883 | |

| | | | | | | | | | | 4,575,871 | |

Oil, Gas & Consumable Fuels—1.2% |

| Dynegy Holdings, Inc. |

| 6.875% | 04/01/2011 | | | | | 590,000 | | | | 519,200 | |

| Pemex Project Funding Master Trust |

| 7.875% | 02/01/2009 | | | | | 2,350,000 | | | | 2,356,218 | |

| Shell International Finance BV (Netherlands) |

| 5.625% | 06/27/2011 | | | | | 1,860,000 | | | | 1,977,351 | |

| | | | | | | | | | | 4,852,769 | |

Paper & Forest Products—0.1% |

| Georgia-Pacific LLC |

| 8.125% | 05/15/2011 | | † | | | 500,000 | | | | 472,500 | |

Personal Products—0.3% |

| Procter & Gamble Co. MTN |

| 2.366% | 03/09/2010 | | # | | | 1,280,000 | | | | 1,277,393 | |

Pharmaceuticals—0.3% |

| Abbott Laboratories |

| 5.600% | 05/15/2011 | | | | | 1,150,000 | | | | 1,214,898 | |

Software—0.4% |

| Oracle Corp. |

| 5.000% | 01/15/2011 | | | | | 1,547,000 | | | | 1,589,496 | |

Specialty Retail—0.1% |

| GameStop Corp./GameStop, Inc. |

| 8.000% | 10/01/2012 | | | | | 325,000 | | | | 303,875 | |

Tobacco—1.1% |

| Philip Morris International, Inc. |

| 4.875% | 05/16/2013 | | | | | 4,482,000 | | | | 4,499,202 | |

TOTAL CORPORATE OBLIGATIONS |

| (Cost $182,851,484) | | | | | | $ 171,761,908 | |

| |

U.S. GOVERNMENT AGENCY OBLIGATIONS—7.7% |

U.S. Government Agency Obligations—7.7% |

| Federal Home Loan Bank |

| 5.375% | 08/19/2011 | | | | | 8,500,000 | | | | 9,345,946 | |

| Federal Home Loan Mortgage Corp. |

| 4.625% | 10/25/2012 | | † | | | 10,000,000 | | | | 10,825,530 | |

| 2.875% | 06/28/2010 | | | | | 2,970,000 | | | | 3,049,623 | |

| Federal Home Loan Mortgage Corp. MTN |

| 3.000% | 04/01/2011 | | | | | 6,000,000 | | | | 6,030,660 | |

| Federal National Mortgage Association |

| 3.500% | 04/28/2011 | | | | | 1,300,000 | | | | 1,309,262 | |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

| (Cost $30,265,146) | | | | | | 30,561,021 | |

|

See accompanying notes to financial statements.

202

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint Low Duration

Bond Fund

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES—9.7% |

U.S. Government Agency Mortgage-Backed Securities—9.7% |

| Federal Home Loan Mortgage Corp. |

| 6.000% | 11/01/2022 | | | | $ | 1,659,259 | | | $ | 1,720,948 | |

| Federal Home Loan Mortgage Corp. REMICS |

| 5.000% | 06/15/2024 | | | | | 1,677,506 | | | | 1,692,182 | |

| 4.250% | 06/15/2024 | | | | | 1,106,993 | | | | 1,110,170 | |

| Federal National Mortgage Association |

| 5.090% | 09/01/2034 | | # | | | 421,873 | | | | 425,052 | |

| 5.066% | 10/01/2034 | | # | | | 3,720,067 | | | | 3,724,153 | |

| 4.886% | 09/01/2034 | | # | | | 335,126 | | | | 336,337 | |

| 4.721% | 10/01/2034 | | # | | | 635,409 | | | | 635,592 | |

| Government National Mortgage Association |

| 6.500% | 10/20/2037-

09/20/2038 | | | | | 17,772,703 | | | | 18,490,485 | |

| 6.000% | 07/20/2038 | | | | | 6,874,216 | | | | 7,087,915 | |

| 4.500% | 08/20/2035 | | | | | 3,204,860 | | | | 3,247,817 | |

TOTAL U.S. GOVERNMENT AGENCY

MORTGAGE-BACKED SECURITIES |

| (Cost $38,139,692) | | | | | | 38,470,651 | |

| |

U.S. TREASURY OBLIGATIONS—2.4% |

U.S. Treasury Notes—2.4% |

| U.S. Treasury Note |

| 3.125% | 11/30/2009 | | †‡‡ | | | 500,000 | | | | 512,559 | |

| 1.125% | 12/15/2011 | | | | | 9,000,000 | | | | 9,042,894 | |

TOTAL U.S. TREASURY OBLIGATIONS |

| (Cost $9,555,774) | | | | | | 9,555,453 | |

| |

SOVEREIGN DEBT OBLIGATIONS—2.5% |

Government Issued—2.5% |

| Caisse d’Amortissement de la Dette Sociale MTN (France) |

| 4.250% | 11/08/2010 | | | | | 1,200,000 | | | | 1,253,251 | |

| Export Development Canada (Canada) |

| 3.750% | 07/15/2011 | | | | | 1,365,000 | | | | 1,435,291 | |

| Province of Ontario (Canada) |

| 3.125% | 09/08/2010 | | † | | | 1,200,000 | | | | 1,212,792 | |

| 2.750% | 02/22/2011 | | † | | | 1,225,000 | | | | 1,217,734 | |

| Province of Quebec, Series PJ (Canada) |

| 6.125% | 01/22/2011 | | | | | 1,700,000 | | | | 1,791,093 | |

| Republic of South Africa (South Africa) |

| 9.125% | 05/19/2009 | | † | | | 2,750,000 | | | | 2,783,000 | |

TOTAL SOVEREIGN DEBT OBLIGATIONS |

| (Cost $9,574,084) | | | | | | 9,693,161 | |

| |

ASSET BACKED SECURITIES—25.0% |

Automobile—13.6% |

Bank of America Auto Trust

Series 2008-1A, Class A4 |

| 5.730% | 01/20/2013 | | ˆ | | | 2,630,000 | | | | 2,465,249 | |

Bank of America Auto Trust

Series 2008-1A, Class A3A |

| 4.970% | 09/20/2012 | | ˆ | | | 1,325,000 | | | | 1,270,494 | |

Capital Auto Receivables Asset Trust

Series 2008-1, Class A4B |

| 2.545% | 07/15/2014 | | # | | | 4,000,000 | | | | 3,287,021 | |

Capital Auto Receivables Asset Trust

Series 2008-1, Class A3A |

| 3.860% | 08/15/2012 | | | | $ | 1,000,000 | | | $ | 940,766 | |

Capital Auto Receivables Asset Trust

Series 2008-2, Class A3A |

| 4.680% | 10/15/2012 | | | | | 3,225,000 | | | | 2,998,945 | |

Capital Auto Receivables Asset Trust

Series 2006-SN1A, Class A4A |

| 5.320% | 03/20/2010 | | ˆ | | | 5,751,179 | | | | 5,691,447 | |

Capital Auto Receivables Asset Trust

Series 2007-1, Class A4B |

| 1.235% | 04/16/2012 | | # | | | 1,000,000 | | | | 863,046 | |

Carmax Auto Owner Trust

Series 2007-1, Class B |

| 5.340% | 10/15/2012 | | | | | 3,000,000 | | | | 2,388,554 | |

Chase Manhattan Auto Owner Trust

Series 2006-A, Class A4 |

| 5.360% | 01/15/2013 | | | | | 5,900,000 | | | | 5,779,109 | |

Chase Manhattan Auto Owner Trust

Series 2006-B, Class A4 |

| 5.110% | 04/15/2014 | | | | | 2,400,000 | | | | 2,320,112 | |

Daimler Chrysler Auto Trust

Series 2008-B, Class A4A |

| 5.320% | 11/10/2014 | | | | | 2,000,000 | | | | 1,763,432 | |

Daimler Chrysler Auto Trust

Series 2008-A, Class A3A |

| 3.700% | 06/08/2012 | | | | | 1,600,000 | | | | 1,494,681 | |

Daimler Chrysler Auto Trust

Series 2006-C, Class A4 |

| 4.980% | 11/08/2011 | | | | | 4,500,000 | | | | 4,305,614 | |

Ford Credit Auto Owner Trust

Series 2007-B, Class A4A |

| 5.240% | 07/15/2012 | | | | | 6,400,000 | | | | 5,868,156 | |

Ford Credit Auto Owner Trust

Series 2007-A, Class A4A |

| 5.470% | 06/15/2012 | | | | | 1,825,000 | | | | 1,695,838 | |

Ford Credit Auto Owner Trust

Series 2006-A, Class A3 |

| 5.050% | 03/15/2010 | | | | | 94,149 | | | | 93,966 | |

Ford Credit Auto Owner Trust

Series 2006-B, Class A3 |

| 5.260% | 10/15/2010 | | | | | 1,208,593 | | | | 1,198,654 | |

Harley-Davidson Motorcycle Trust

Series 2007-2, Class A4 |

| 5.120% | 08/15/2013 | | | | | 2,725,000 | | | | 2,620,433 | |

Harley-Davidson Motorcycle Trust

Series 2006-3, Class A3 |

| 5.240% | 01/15/2012 | | | | | 1,421,993 | | | | 1,414,110 | |

USAA Auto Owner Trust

Series 2007-2, Class A3 | | | |

| 4.900% | 02/15/2012 | | | | | 2,000,000 | | | | 1,976,770 | |

USAA Auto Owner Trust

Series 2008-2, Class A3 | | | |

| 4.640% | 10/15/2012 | | | | | 1,100,000 | | | | 1,048,319 | |

USAA Auto Owner Trust

Series 2005-2, Class A4 | | | |

| 4.170% | 02/15/2011 | | | | | 338,007 | | | | 332,340 | |

Wachovia Auto Owner Trust

Series 2005-B, Class A4 | | | |

| 4.840% | 04/20/2011 | | | | | 1,842,075 | | | | 1,826,719 | |

| | | | | | | | | | | 53,643,775 | |

Credit Card—11.4% | | | |

American Express Credit Account Master Trust

Series 2005-4, Class A |

| 1.265% | 01/15/2015 | | # | | | 7,363,000 | | | | 6,039,781 | |

BA Credit Card Trust

Series 2006-A15, Class A15 | | | |

| 1.195% | 04/15/2014 | | # | | | 4,200,000 | | | | 3,556,101 | |

|

See accompanying notes to financial statements.

203

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint Low Duration

Bond Fund

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

ASSET BACKED SECURITIES—(Continued) |

BA Credit Card Trust

Series 2008-A5, Class A5 |

| 2.395% | 12/16/2013 | | # | | $ | 4,173,000 | | | $ | 3,715,126 | |

Bank One Issuance Trust

Series 2004-A6, Class A6 | | | |

| 3.940% | 04/16/2012 | | | | | 1,000,000 | | | | 986,586 | |

Capital One Multi-Asset Execution Trust

Series 2005-A10, Class A |

| 1.275% | 09/15/2015 | | # | | | 1,560,000 | | | | 1,102,892 | |

Capital One Multi-Asset Execution Trust

Series 2008-A5, Class A5 |

| 4.850% | 02/18/2014 | | | | | 2,550,000 | | | | 2,369,814 | |

Chase Issuance Trust

Series 2005-A10, Class A10 |

| 4.650% | 12/17/2012 | | | | | 3,570,000 | | | | 3,415,730 | |

Chase Issuance Trust

Series 2007-A15, Class A |

| 4.960% | 09/17/2012 | | † | | | 1,200,000 | | | | 1,157,311 | |

Citibank Credit Card Issuance Trust

Series 2007-A5, Class A5 |

| 5.500% | 06/22/2012 | | | | | 4,125,000 | | | | 4,050,243 | |

Discover Card Master Trust

Series 2008-A3, Class A3 |

| 5.100% | 10/15/2013 | | | | | 7,755,000 | | | | 7,299,692 | |

GE Capital Credit Card Master Note Trust

Series 2007-3, Class A2 |

| 5.400% | 06/15/2013 | | | | | 5,915,000 | | | | 5,614,123 | |

Household Credit Card Master Note Trust I

Series 2007-2, Class A |

| 1.745% | 07/15/2013 | | # | | | 6,400,000 | | | | 4,709,178 | |

Household Credit Card Master Note Trust I

Series 2007-1, Class A |

| 1.245% | 04/15/2013 | | # | | | 1,500,000 | | | | 945,381 | |

| | | | | | | | | | | 44,961,958 | |

TOTAL ASSET BACKED SECURITIES |

| (Cost $107,699,856) | | | | | | 98,605,733 | |

| |

NON-U.S. GOVERNMENT MORTGAGE-BACKED SECURITIES—3.3% |

Mortgage Backed—3.3% |

Bank of America Mortgage Securities, Inc.

Series 2004-L, Class 1A1 |

| 5.720% | 01/25/2035 | | # | | | 1,118,132 | | | | 895,966 | |

GSR Mortgage Loan Trust

Series 2005-AR6, Class 2A1 |

| 4.540% | 09/25/2035 | | # | | | 3,861,778 | | | | 2,853,424 | |

Harborview Mortgage Loan Trust

Series 2005-14, Class 3A1A |

| 5.303% | 12/19/2035 | | # | | | 5,195,371 | | | | 4,355,192 | |

MLCC Mortgage Investors, Inc.

Series 2004-1, Class 2A2 |

| 4.713% | 12/25/2034 | | # | | | 3,038,060 | | | | 2,280,849 | |

Provident Funding Mortgage Loan Trust

Series 2004-1, Class 1A1 |

| 4.299% | 04/25/2034 | | # | | | 500,185 | | | | 478,699 | |

Structured Asset Mortgage Investments, Inc.

Series 2004-AR5, Class 2A1 |

| 6.162% | 10/19/2034 | | # | | | 751,805 | | | | 392,272 | |

Thornburg Mortgage Securities Trust

Series 2004-1, Class II2A |

| 3.356% | 03/25/2044 | | # | | $ | 762,999 | | | $ | 507,965 | |

Wells Fargo Mortgage Backed Securities Trust

Series 2004-S, Class B1 |

| 3.741% | 09/25/2034 | | # | | | 2,038,055 | | | | 1,165,539 | |

TOTAL NON-U.S. GOVERNMENT MORTGAGE-BACKED SECURITIES |

| (Cost $17,154,075) | | | | | | 12,929,906 | |

| |

NON-U.S. GOVERNMENT AGENCY OBLIGATIONS—0.9% |

Non-U.S. Government Agency Obligations—0.9% |

| Kreditanstalt fuer Wiederaufbau (Germany) |

| 3.750% | 06/27/2011 | | | | | 1,150,000 | | | | 1,197,254 | |

| Nederlandse Waterschapsbank NV MTN (Netherlands) |

| 4.625% | 07/25/2011 | | EUR | | | 1,500,000 | | | | 2,172,362 | |

TOTAL NON-U.S. GOVERNMENT AGENCY OBLIGATIONS |

| (Cost $3,402,007) | | | | | | 3,369,616 | |

| |

|

|

|

| Shares

|

| Value

|

|

|---|

CASH EQUIVALENTS—10.6% |

Institutional Money Market Funds—7.5% |

| AIM Short-Term Investments Trust Prime Assets Portfolio | †† | | | 6,534,334 | | | | 6,534,334 | |

Fidelity Institutional Money

Market: Money Market

Portfolio—Institutional Class | | 22,859,118 | | | | 22,859,118 | |

| | | | | | | | | 29,393,452 | |

| |

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

Certificates of Deposit—2.4% |

| Allied Irish Banks plc/New York |

| 1.000% | 01/20/2009 | | †† | | $ | 750,000 | | | | 750,000 | |

| Bayerische Landesbank/New York |

| 2.750% | 01/12/2009 | | †† | | | 1,000,000 | | | | 1,000,000 | |

| Credit Industriel et Commercial |

| 2.240% | 03/17/2009 | | †† | | | 500,000 | | | | 500,000 | |

| HSH Nordbank AG |

| 1.850% | 01/20/2009 | | †† | | | 1,000,044 | | | | 1,000,044 | |

| Landesbank Hessen-Thueringen Girozentrale/New York |

| 3.050% | 01/02/2009 | | †† | | | 750,000 | | | | 750,000 | |

| Natixis/New York |

| 4.133% | 01/02/2009 | | #†† | | | 3,992,787 | | | | 3,992,787 | |

| Norinchukin Bank/New York |

| 1.650% | 01/12/2009 | | †† | | | 900,000 | | | | 900,000 | |

| Westpac Securities NZ Ltd. | | | |

| 2.250% | 03/16/2009 | | †† | | | 745,759 | | | | 745,758 | |

| | | | | | | | | 9,638,589 | |

Medium Term Note—0.2% | | | |

| Royal Bank of Scotland Group plc | | | |

| 3.655% | 01/30/2009 | | †† | | | 754,119 | | | | 754,119 | |

|

See accompanying notes to financial statements.

204

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint Low Duration

Bond Fund

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

CASH EQUIVALENTS—(Continued) |

Time Deposits—0.5% | | | |

| Banco Popular Espanol SA | | | |

| 3.120% | 01/05/2009 | | †† | | $ | 1,000,000 | | | $ | 1,000,000 | |

| Raiffeisen Zentralbank Oesterreich AG | | | |

| 1.750% | 01/20/2009 | | †† | | | 900,000 | | | | 900,000 | |

| | | | | | | 1,900,000 | |

TOTAL CASH EQUIVALENTS | | | |

| (Cost $41,686,160) | | | | | | 41,686,160 | |

TOTAL INVESTMENTS—105.6% |

| (Cost $440,328,278) | | 416,633,609 | |

| Other assets less liabilities—(5.6%) | | (21,929,581 | ) |

NET ASSETS—100.0% | $ | 394,704,028 | |

| Notes to the Schedule of Investments: | |

|---|

| EUR | | | | European Monetary Unit |

| MTN | | | | Medium Term Note |

| REMICS | | | | Real Estate Mortgage Investment Conduits |

| † | | | | Denotes all or a portion of security on loan. |

| # | | | | Rate is subject to change. Rate shown reflects current rate. |

| 5 | | | | Security in default. |

| ˆ | | | | Securities are not registered under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Securities Act Rule 144A. 144A securities represent 5.4% of Total Investments. |

| ‡‡ | | | | Security has been pledged as collateral for futures contracts. |

| †† | | | | Represents reinvestment of collateral received in conjunction with securities lending. |

|

See accompanying notes to financial statements.

205

SCHEDULE OF INVESTMENTS

December 31, 2008

Vantagepoint Inflation Protected

Securities Fund

Coupon

Rate

| | Maturity

Date

| | | | Face | | Value | |

|---|

CORPORATE OBLIGATIONS—1.3% |

Banks—0.3% |

| Goldman Sachs Group, Inc. (The) |

| 6.750% | 10/01/2037 | | | | $ 100,000 | | | $ | 81,412 | |

| JPMorgan Chase & Co., Series C MTN |

| 5.390% | 06/28/2009 | | # | | | 505,000 | | | | 511,696 | |

| Morgan Stanley, Series F MTN |

| 6.625% | 04/01/2018 | | | | | 400,000 | | | | 351,496 | |

| Royal Bank of Scotland Group plc, Perpetual Bond (United Kingdom) |

| 7.092% | 09/29/2017 | | # | | | EUR 100,000 | | | | 63,247 | |

| | | | | | | | | | | 1,007,851 | |

Capital Markets—0.1% |

| Bear Stearns Cos. LLC (The), Series CPI MTN |

| 6.740% | 03/10/2014 | | # | | | 380,000 | | | | 308,609 | |

| Lehman Brothers Holdings, Inc., Series G MTN |

| 6.395% | 06/02/2009 | | 5 | | | 405,000 | | | | 38,475 | |

| | | | | | | | | | | 347,084 | |

Commercial Banks—0.1% |

| American Express Centurion Bank, Bank Note |

| 0.534% | 03/23/2010 | | # | | | 300,000 | | | | 277,357 | |

Consumer Finance—0.1% |

| SLM Corp. MTN |

| 5.280% | 04/01/2014 | | # | | | 465,000 | | | | 218,173 | |

| SLM Corp., Series CPI MTN |

| 5.030% | 06/01/2009 | | # | | | 120,000 | | | | 105,310 | |

| | | | | | | | | | | 323,483 | |

Diversified Financial Services—0.3% |

| General Electric Capital Corp. |

| 5.625% | 05/01/2018 | | | | | 810,000 | | | | 817,340 | |

Insurance—0.2% |

| ASIF II (Cayman Islands) |

| 3.685% | 07/26/2010 | | # | | | 600,000 | | | | 486,750 | |

Multi-National—0.1% |

| International Bank for Reconstruction & Development, Series CPI (Supranational) |

| 6.910% | 12/10/2013 | | # | | | 275,000 | | | | 229,262 | |

Wireless Telecommunication Services—0.1% |

| Verizon Wireless |

| 8.500% | 11/15/2018 | | ˆ | | | 300,000 | | | | 352,111 | |

TOTAL CORPORATE OBLIGATIONS |

| (Cost $4,510,940) | | | | | | 3,841,238 | |

| |

U.S. GOVERNMENT AGENCY OBLIGATIONS—2.3% |

U.S. Government Agency Obligations—2.3% |

| Federal Home Loan Bank |

| 5.375% | 05/18/2016 | | | | | 2,590,000 | | | | 2,966,019 | |

| Federal Home Loan Bank Discount Notes |

| 0.100% | 01/21/2009 | | | | | 2,300,000 | | | | 2,299,866 | |

| 0.080% | 01/22/2009 | | | | | 800,000 | | | | 799,961 | |

| Federal Home Loan Mortgage Corp. |

| 0.122% | 01/26/2009 | | | | $ 100,000 | | | $ | 100,002 | |

| Federal National Mortgage Association |

| 6.077% | 02/17/2009 | | # | | 780,000 | | | | 773,862 | |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS |

| (Cost $6,642,546) | | | | | | 6,939,710 | |

| |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES—0.9% |

U.S. Government Agency Mortgage-Backed

Securities—0.9% |

| Federal National Mortgage Association TBA |

| 5.500% | 01/25/2038 | | α | | | 2,300,000 | | | | 2,357,859 | |

| 5.000% | 01/25/2038 | | α | | | 500,000 | | | | 510,547 | |

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES |

| (Cost $2,831,895) | | | | | | 2,868,406 | |

| |

U.S. TREASURY OBLIGATIONS—89.4% |

U.S. Treasury Bonds—0.4% |

| U.S. Treasury Bond |

| 4.500% | 05/15/2038 | | | | | 850,000 | | | | 1,160,383 | |

| |

U.S. Treasury Inflation Protected Securities Bonds—31.7% |

| U.S. Treasury Bond |

| 3.875% | 04/15/2029 | | † | | | 7,685,000 | | | | 12,507,464 | |

| 3.625% | 04/15/2028 | | ‡‡ | | | 3,540,000 | | | | 5,648,534 | |

| 3.375% | 04/15/2032 | | | | | 510,000 | | | | 767,478 | |

| 2.375% | 01/15/2025-

01/15/2027 | | † | | | 38,230,000 | | | | 42,835,535 | |

| 2.000% | 01/15/2026 | | | | | 17,280,000 | | | | 17,766,819 | |

| 1.750% | 01/15/2028 | | † | | | 16,478,000 | | | | 15,743,726 | |

| | | | | | | | | | | 95,269,556 | |

| |

U.S. Treasury Inflation Protected Securities Notes—57.3% |

| U.S. Treasury Note |

| 4.250% | 01/15/2010 | | | | | 1,855,000 | | | | 2,345,875 | |

| 3.500% | 01/15/2011 | | | | | 2,640,000 | | | | 3,225,286 | |

| 3.375% | 01/15/2012 | | † | | | 4,340,000 | | | | 5,238,043 | |

| 3.000% | 07/15/2012 | | | | | 23,300,000 | | | | 27,514,983 | |

| 2.625% | 07/15/2017 | | | | | 2,055,000 | | | | 2,201,226 | |

| 2.500% | 07/15/2016 | | † | | | 6,230,000 | | | | 6,630,423 | |

| 2.375% | 04/15/2011-

01/15/2017 | | | | | 17,130,000 | | | | 18,258,003 | |

| 2.000% | 04/15/2012-

01/15/2016 | | † | | | 17,890,000 | | | | 18,682,152 | |

| 2.000% | 01/15/2014-

07/15/2014 | | | | | 26,150,000 | | | | 28,603,860 | |

| 1.875% | 07/15/2013-

07/15/2015 | | | | | 17,490,000 | | | | 19,166,920 | |

| 1.625% | 01/15/2015-

01/15/2018 | | | | | 24,930,000 | | | | 24,902,837 | |

| 1.375% | 07/15/2018 | | | | | 7,075,000 | | | | 6,647,655 | |

| 0.875% | 04/15/2010 | | | | | 3,105,000 | | | | 3,337,215 | |

| 0.625% | 04/15/2013 | | † | | | 5,445,000 | | | | 5,335,900 | |

| | | | | | | | | | | | | | | | 172,090,378 | |

TOTAL U.S. TREASURY OBLIGATIONS |

| (Cost $278,902,595) | | | | | | 268,520,317 | |

|

See accompanying notes to financial statements.

206

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint Inflation Protected

Securities Fund

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

SOVEREIGN DEBT OBLIGATIONS—0.0% |

Government Issued—0.0% | | | |

| France Government Bond, Series OATe (France) |

| 3.150% | 07/25/2032 | | | | | | | | | | | | |

| (Cost $74,628) | EUR | 45,660 | | | $ | 73,253 | |

| |

ASSET BACKED SECURITIES—0.4% |

Credit Card—0.3% |

BA Credit Card Trust

Series 2008-A5, Class A5 |

| 2.395% | 12/16/2013 | | # | | $ | 1,000,000 | | | | 890,277 | |

Other—0.1% |

Small Business Administration Participation Certificates

Series 2008-20D, Class 1 |

| 5.370% | 04/01/2028 | | | | | 194,801 | | | | 199,902 | |

TOTAL ASSET BACKED SECURITIES |

| (Cost $1,194,801) | | | | | | 1,090,179 | |

| |

NON-U.S. GOVERNMENT MORTGAGE-BACKED SECURITIES—0.1% |

Mortgage Backed—0.1% |

Countrywide Alternative Loan Trust

Series 2006-OA21, Class A1 |

| 0.698% | 03/20/2047 | | # | | | | | | | | |

| (Cost $495,040) | | 669,336 | | | | 275,268 | |

| |

|

|

|

| Shares

|

| Value

|

|

|---|

PURCHASED OPTIONS—0.1% |

| IRO USD 2 Year Call Swaption, Expires 2/2/2009, Strike 3.50 | | | | | | | |

| (Cost $55,000) | | 5,000,000 | | | | 196,618 | |

| |

CASH EQUIVALENTS—19.2% |

Institutional Money Market Funds—10.4% |

| AIM Short-Term Investments Trust Prime Assets Portfolio | †† | | | | | 14,912,350 | | | | 14,912,350 | |

| Fidelity Institutional Money Market: Money Market Portfolio—Institutional Class | | | | | | | | 16,319,092 | | | | 16,319,092 | |

| |

Coupon

Rate | | Maturity

Date | | | | Face | | Value | |

|---|

Certificates of Deposit—5.6% |

| Allied Irish Banks plc/New York |

| 1.000% | 01/20/2009 | | †† | | $ | 1,000,000 | | | | 1,000,000 | |

| Bayerische Landesbank/New York |

| 2.750% | 01/12/2009 | | †† | | | 2,000,000 | | | | 2,000,000 | |

| Calyon/New York |

| 4.615% | 01/16/2009 | | †† | | | 1,007,254 | | | | 1,007,254 | |

| Credit Industriel et Commercial |

| 2.240% | 03/17/2009 | | †† | | | 1,500,000 | | | | 1,500,000 | |

| HSH Nordbank AG |

| 1.850% | 01/20/2009 | | †† | | | 1,210,896 | | | | 1,210,896 | |

| Landesbank Hessen-Thueringen Girozentrale/New York |

| 3.050% | 01/02/2009 | | †† | | $ | 2,000,000 | | | $ | 2,000,000 | |

| Natixis/New York |

| 4.133% | 01/02/2009 | | #†† | | | 4,990,983 | | | | 4,990,983 | |

| Norinchukin Bank/New York |

| 1.650% | 01/12/2009 | | †† | | | 2,000,000 | | | | 2,000,000 | |

| Westpac Securities NZ Ltd. |

| 2.250% | 03/16/2009 | | †† | | | 994,345 | | | | 994,345 | |

| | | | | | | | | | | 16,703,478 | |

Medium Term Notes—1.5% |

| AT&T, Inc. |

| 4.973% | 04/27/2009 | | †† | | | 1,541,170 | | | | 1,541,170 | |

| BBVA Senior Finance SA |

| 4.620% | 04/17/2009 | | #†† | | | 1,006,866 | | | | 1,006,866 | |

| Royal Bank of Scotland Group plc |

| 3.655% | 01/30/2009 | | †† | | | 2,010,985 | | | | 2,010,985 | |

| | | | | | | | | | | 4,559,021 | |

Time Deposits—1.7% |

| Banco Popular Espanol SA |

| 3.120% | 01/05/2009 | | †† | | | 2,000,000 | | | | 2,000,000 | |

| Danske Bank A/S |

| 2.000% | 02/11/2009 | | †† | | | 1,500,000 | | | | 1,500,000 | |

| Raiffeisen Zentralbank Oesterreich AG |

| 1.750% | 01/20/2009 | | †† | | | 1,500,000 | | | | 1,500,000 | |

| | | | | | | | | | | 5,000,000 | |

TOTAL CASH EQUIVALENTS |

| (Cost $57,493,941) | | | | | | 57,493,941 | |

TOTAL INVESTMENTS—113.7% |

| (Cost $352,201,386) | | | | | | 341,298,930 | |

| Other assets less liabilities—(13.7%) | | (41,151,280 | ) |

NET ASSETS—100.0% | | | | | $ | 300,147,650 | |

| Notes to the Schedule of Investments: | |

|---|

| EUR | | | | European Monetary Unit |

| MTN | | | | Medium Term Note |

| TBA | | | | Security is subject to delayed delivery. |

| # | | | | Rate is subject to change. Rate shown reflects current rate. |

| 5 | | | | Security in default. |

| ˆ | | | | Securities are not registered under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Securities Act Rule 144A. 144A securities represent 0.1% of Total Investments. |

| α | | | | Illiquid security. |

| † | | | | Denotes all or a portion of security on loan. |

| ‡‡ | | | | Security has been pledged as collateral for futures contracts. |

| †† | | | | Represents reinvestment of collateral received in conjunction with securities lending. |

|

See accompanying notes to financial statements.

207

SCHEDULE OF INVESTMENTS

December 31, 2008

Vantagepoint

Asset Allocation Fund

| | | | Shares | | Value | |

|---|

COMMON STOCKS—80.1% |

Aerospace & Defense—2.3% |

| Boeing Co. (The) | | | | 31,475 | | | $ | 1,343,038 | |

| General Dynamics Corp. | | | | 16,884 | | | | 972,350 | |

| Goodrich Corp. | | | | 5,043 | | | | 186,692 | |

| Honeywell International, Inc. | | 31,638 | | | | 1,038,676 | |

| L-3 Communications Holdings, Inc. | | | | 5,148 | | | | 379,819 | |

| Lockheed Martin Corp. | † | | | 14,155 | | | | 1,190,152 | |

| Northrop Grumman Corp. | | | | 14,330 | | | | 645,423 | |

| Precision Castparts Corp. | | | | 5,890 | | | | 350,337 | |

| Raytheon Co. | | | | 17,712 | | | | 904,021 | |

| Rockwell Collins, Inc. | † | | | 6,648 | | | | 259,870 | |

| United Technologies Corp. | | | | 41,021 | | | | 2,198,726 | |

| | | | | | | | | | | | | | 9,469,104 | |

Air Freight & Logistics—0.9% |

| C.H. Robinson Worldwide, Inc. | † | | | 7,181 | | | | 395,170 | |

| Expeditors International of Washington, Inc. | † | | | 8,891 | | | | 295,804 | |

| FedEx Corp. | † | | | 13,223 | | | | 848,256 | |

| United Parcel Service, Inc., Class B | | | | 42,889 | | | | 2,365,757 | |

| | | | | | | | | | | | | | 3,904,987 | |

Airlines—0.1% |

| Southwest Airlines Co. | | | | 31,049 | | | | 267,642 | |

Auto Components—0.1% |

| Goodyear Tire & Rubber Co. (The) | * | | | 11,044 | | | | 65,933 | |

| Johnson Controls, Inc. | | | | 25,203 | | | | 457,686 | |

| | | | | | | | | | | | | | 523,619 | |

Automobiles—0.1% |

| Ford Motor Co. | *† | | | 100,868 | | | | 230,988 | |

| General Motors Corp. | † | | | 24,816 | | | | 79,411 | |

| Harley-Davidson, Inc. | † | | | 9,940 | | | | 168,682 | |

| | | | | | | | | | | | | | 479,081 | |

Beverages—2.1% |

| Brown-Forman Corp., Class B | | | | 3,983 | | | | 205,085 | |

| Coca-Cola Co. (The) | | | | 84,809 | | | | 3,839,303 | |

| Coca-Cola Enterprises, Inc. | | | | 14,629 | | | | 175,987 | |

| Constellation Brands, Inc., Class A | * | | | 8,617 | | | | 135,890 | |

| Dr. Pepper Snapple Group, Inc. | * | | | 10,577 | | | | 171,876 | |

| Molson Coors Brewing Co., Class B | | | | 6,466 | | | | 316,317 | |

| Pepsi Bottling Group, Inc. | | | | 5,916 | | | | 133,169 | |

| PepsiCo, Inc. | | | | 66,205 | | | | 3,626,048 | |

| | | | | | | | | | | | | | 8,603,675 | |

Biotechnology—1.7% |

| Amgen, Inc. | * | | | 45,011 | | | | 2,599,385 | |

| Biogen Idec, Inc. | * | | | 12,318 | | | | 586,706 | |

| Celgene Corp. | *† | | | 19,335 | | | | 1,068,839 | |

| Cephalon, Inc. | *† | | | 2,883 | | | | 222,106 | |

| Genzyme Corp. | *† | | | 11,412 | | | | 757,415 | |

| Gilead Sciences, Inc. | * | | | 39,119 | | | | 2,000,546 | |

| | | | | | | | | | | | | | 7,234,997 | |

Building Products—0.0% |

| Masco Corp. | | | | 14,946 | | | | 166,349 | |

Capital Markets—1.9% |

| American Capital Ltd. | † | | | 8,976 | | | $ | 29,082 | |

| Ameriprise Financial, Inc. | | | | 9,714 | | | | 226,919 | |

| Bank of New York Mellon Corp. (The) | | | | 48,730 | | | | 1,380,521 | |

| Charles Schwab Corp. (The) | | | | 39,634 | | | | 640,882 | |

| E*Trade Financial Corp. | *† | | | 18,346 | | | | 21,098 | |

| Federated Investors, Inc., Class B | | | | 4,054 | | | | 68,756 | |

| Franklin Resources, Inc. | | | | 6,457 | | | | 411,827 | |

| Goldman Sachs Group, Inc. (The) | | | | 18,477 | | | | 1,559,274 | |

| Invesco Ltd. | | | | 16,115 | | | | 232,701 | |

| Janus Capital Group, Inc. | † | | | 6,071 | | | | 48,750 | |

| Legg Mason, Inc. | † | | | 6,539 | | | | 143,269 | |

| Merrill Lynch & Co., Inc. | | | | 68,254 | | | | 794,476 | |

| Morgan Stanley | | | | 47,042 | | | | 754,554 | |

| Northern Trust Corp. | | | | 9,381 | | | | 489,125 | |

| State Street Corp. | | | | 18,342 | | | | 721,391 | |

| T. Rowe Price Group, Inc. | † | | | 10,974 | | | | 388,919 | |

| | | | | | | | | | | | | | 7,911,544 | |

Chemicals—1.4% |

| Air Products & Chemicals, Inc. | | 8,989 | | | | 451,877 | |

| CF Industries Holdings, Inc. | | | | 2,592 | | | | 127,423 | |

| Dow Chemical Co. (The) | | | | 39,310 | | | | 593,188 | |

| E.I. Du Pont de Nemours & Co. | | | | 38,359 | | | | 970,483 | |

| Eastman Chemical Co. | † | | | 3,033 | | | | 96,176 | |

| Ecolab, Inc. | † | | | 7,432 | | | | 261,235 | |

| International Flavors & Fragrances, Inc. | | | | 3,091 | | | | 91,865 | |

| Monsanto Co. | | | | 23,395 | | | | 1,645,838 | |

| PPG Industries, Inc. | | | | 6,936 | | | | 294,294 | |

| Praxair, Inc. | | | | 13,383 | | | | 794,415 | |

| Rohm & Haas Co. | | | | 5,246 | | | | 324,150 | |

| Sigma-Aldrich Corp. | † | | | 5,249 | | | | 221,718 | |

| | | | | | | | | | | | | | 5,872,662 | |

Commercial Banks—2.5% |

| BB&T Corp. | † | | | 23,339 | | | | 640,889 | |

| Comerica, Inc. | | | | 6,033 | | | | 119,755 | |

| Fifth Third Bancorp | † | | | 24,105 | | | | 199,107 | |

| First Horizon National Corp. | † | | | 9,479 | | | | 100,193 | |

| Huntington Bancshares, Inc./Ohio | † | | | 15,606 | | | | 119,542 | |

| KeyCorp | | | | 19,727 | | | | 168,074 | |

| M&T Bank Corp. | † | | | 3,140 | | | | 180,267 | |

| Marshall & Ilsley Corp. | † | | | 11,451 | | | | 156,192 | |

| National City Corp. | | | | 84,813 | | | | 153,512 | |

| PNC Financial Services Group, Inc. | † | | | 14,727 | | | | 721,623 | |

| Regions Financial Corp. | | | | 29,323 | | | | 233,411 | |

| SunTrust Banks, Inc. | † | | | 15,012 | | | | 443,455 | |

| U.S. Bancorp | | | | 74,111 | | | | 1,853,516 | |

| Wachovia Corp. | † | | | 91,585 | | | | 507,381 | |

| Wells Fargo & Co. | | | | 161,546 | | | | 4,762,376 | |

| Zions Bancorporation | † | | | 4,920 | | | | 120,589 | |

| | | | | | | | | | | | | | 10,479,882 | |

Commercial Services & Supplies—0.4% |

| Avery Dennison Corp. | † | | | 4,267 | | | | 139,659 | |

| Cintas Corp. | † | | | 6,084 | | | | 141,331 | |

| Pitney Bowes, Inc. | | | | 9,170 | | | | 233,652 | |

| R.R. Donnelley & Sons Co. | | | | 9,448 | | | | 128,304 | |

|

See accompanying notes to financial statements.

208

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint

Asset Allocation Fund

| | | | Shares | | Value | |

|---|

COMMON STOCKS—(Continued) |

| Republic Services, Inc. | | | | 13,589 | | | $ | 336,871 | |

| Stericycle, Inc. | *† | | | 3,619 | | | | 188,478 | |

| Waste Management, Inc. | † | | | 20,816 | | | | 689,842 | |

| | | | | | | | | | | | | | 1,858,137 | |

Communications Equipment—2.0% |

| Ciena Corp. | *† | | | 3,922 | | | | 26,277 | |

| Cisco Systems, Inc. | * | | | 249,909 | | | | 4,073,517 | |

| Corning, Inc. | | | | 67,043 | | | | 638,920 | |

| Harris Corp. | | | | 5,570 | | | | 211,938 | |

| JDS Uniphase Corp. | *† | | | 9,473 | | | | 34,576 | |

| Juniper Networks, Inc. | * | | | 23,038 | | | | 403,395 | |

| Motorola, Inc. | | | | 96,088 | | | | 425,670 | |

| QUALCOMM, Inc. | | | | 69,819 | | | | 2,501,615 | |

| Tellabs, Inc. | * | | | 12,897 | | | | 53,136 | |

| | | | | | | | | | | | | | 8,369,044 | |

Computers & Peripherals—3.4% |

| Apple, Inc. | * | | | 37,893 | | | | 3,234,168 | |

| Dell, Inc. | * | | | 74,077 | | | | 758,548 | |

| EMC Corp. | * | | | 87,984 | | | | 921,192 | |

| Hewlett-Packard Co. | | | | 104,399 | | | | 3,788,640 | |

| International Business Machines Corp. | | | | 57,371 | | | | 4,828,343 | |

| Lexmark International, Inc., Class A | *† | | | 2,924 | | | | 78,656 | |

| NetApp, Inc. | * | | | 15,873 | | | | 221,746 | |

| QLogic Corp. | *† | | | 6,052 | | | | 81,339 | |

| SanDisk Corp. | *† | | | 9,800 | | | | 94,080 | |

| Sun Microsystems, Inc. | *† | | | 30,172 | | | | 115,257 | |

| Teradata Corp. | * | | | 8,056 | | | | 119,470 | |

| | | | | | | | | | | | | | 14,241,439 | |

Construction & Engineering—0.1% |

| Fluor Corp. | | | | 7,559 | | | | 339,172 | |

| Jacobs Engineering Group, Inc. | * | | | 5,446 | | | | 261,953 | |

| | | | | | | | | | | | | | 601,125 | |

Construction Materials—0.1% |

| Vulcan Materials Co. | † | | | 4,749 | | | | 330,435 | |

Consumer Finance—0.4% |

| American Express Co. | | | | 49,287 | | | | 914,274 | |

| Capital One Financial Corp. | † | | | 15,949 | | | | 508,614 | |

| Discover Financial Services | † | | | 19,882 | | | | 189,475 | |

| SLM Corp. | *† | | | 18,723 | | | | 166,635 | |

| | | | | | | | | | | | | | 1,778,998 | |

Containers & Packaging—0.2% |

| Ball Corp. | | | | 3,826 | | | | 159,123 | |

| Bemis Co., Inc. | | | | 3,857 | | | | 91,334 | |

| Owens-Illinois, Inc. | * | | | 7,098 | | | | 193,988 | |

| Pactiv Corp. | * | | | 5,213 | | | | 129,700 | |

| Sealed Air Corp. | | | | 7,079 | | | | 105,760 | |

| | | | | | | | | | | | | | 679,905 | |

Distributors—0.1% |

| Genuine Parts Co. | | | | 6,736 | | | | 255,025 | |

Diversified Consumer Services—0.2% |

| Apollo Group, Inc., Class A | * | | | 4,364 | | | | 334,370 | |

| H&R Block, Inc. | † | | | 14,400 | | | | 327,168 | |

| | | | | | | | | | | | | | 661,538 | |

Diversified Financial Services—2.7% |

| Bank of America Corp. | | �� | | 212,076 | | | $ | 2,986,030 | |

| CIT Group, Inc. | † | | | 13,165 | | | | 59,769 | |

| Citigroup, Inc. | † | | | 231,713 | | | | 1,554,794 | |

| CME Group, Inc. | | | | 2,853 | | | | 593,738 | |

| IntercontinentalExchange, Inc. | *† | | | 3,141 | | | | 258,944 | |

| JPMorgan Chase & Co. | | | | 159,101 | | | | 5,016,455 | |

| Leucadia National Corp. | *† | | | 7,783 | | | | 154,103 | |

| Moody’s Corp. | † | | | 8,188 | | | | 164,497 | |

| NASDAQ OMX Group, Inc. (The) | *† | | | 5,785 | | | | 142,947 | |

| NYSE Euronext | | | | 10,907 | | | | 298,634 | |

| | | | | | | | | | | | | | 11,229,911 | |

Diversified Telecommunication Services—2.9% |

| AT&T, Inc. | | | | 251,203 | | | | 7,159,286 | |

| CenturyTel, Inc. | | | | 4,058 | | | | 110,905 | |

| Embarq Corp. | | | | 6,854 | | | | 246,470 | |

| Frontier Communications Corp. | † | | | 14,413 | | | | 125,970 | |

| Qwest Communications International, Inc. | † | | | 59,043 | | | | 214,917 | |

| Verizon Communications, Inc. | | 120,435 | | | | 4,082,746 | |

| Windstream Corp. | | | | 19,512 | | | | 179,510 | |

| | | | | | | | | | | | | | 12,119,804 | |

Electric Utilities—2.0% |

| Allegheny Energy, Inc. | † | | | 7,003 | | | | 237,122 | |

| American Electric Power Co., Inc. | | | | 17,066 | | | | 567,956 | |

| Duke Energy Corp. | | | | 53,735 | | | | 806,562 | |

| Edison International | | | | 13,816 | | | | 443,770 | |

| Entergy Corp. | | | | 8,131 | | | | 675,930 | |

| Exelon Corp. | | | | 27,950 | | | | 1,554,300 | |

| FirstEnergy Corp. | | | | 12,941 | | | | 628,674 | |

| FPL Group, Inc. | † | | | 17,346 | | | | 873,024 | |

| Pepco Holdings, Inc. | | | | 8,794 | | | | 156,181 | |

| Pinnacle West Capital Corp. | | | | 4,372 | | | | 140,472 | |

| PPL Corp. | | | | 15,888 | | | | 487,603 | |

| Progress Energy, Inc. | † | | | 11,107 | | | | 442,614 | |

| Southern Co. | † | | | 32,738 | | | | 1,211,306 | |

| | | | | | | | | | | | | | 8,225,514 | |

Electrical Equipment—0.4% |

| Cooper Industries Ltd., Class A | † | | | 7,241 | | | | 211,655 | |

| Emerson Electric Co. | | | | 32,985 | | | | 1,207,581 | |

| Rockwell Automation, Inc. | † | | | 6,426 | | | | 207,174 | |

| | | | | | | | | | | | | | 1,626,410 | |

Electronic Equipment, Instruments & Components—0.3% |

| Agilent Technologies, Inc. | * | | | 15,118 | | | | 236,294 | |

| Amphenol Corp., Class A | | | | 7,351 | | | | 176,277 | |

| Flir Systems, Inc. | * | | | 5,901 | | | | 181,043 | |

| Jabil Circuit, Inc. | | | | 8,930 | | | | 60,278 | |

| Molex, Inc. | † | | | 6,227 | | | | 90,229 | |

| Tyco Electronics Ltd. (Bermuda) | | | | 20,026 | | | | 324,621 | |

| | | | | | | | | | | | | | 1,068,742 | |

Energy Equipment & Services—1.2% |

| Baker Hughes, Inc. | † | | | 13,072 | | | | 419,219 | |

| BJ Services Co. | | | | 11,576 | | | | 135,092 | |

| Cameron International Corp. | *† | | | 9,069 | | | | 185,915 | |

| ENSCO International, Inc. | | | | 5,950 | | | | 168,921 | |

| Halliburton Co. | | | | 37,236 | | | | 676,950 | |

| Nabors Industries Ltd. (Bermuda) | *† | | | 11,281 | | | | 135,034 | |

|

See accompanying notes to financial statements.

209

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint

Asset Allocation Fund

| | | | Shares | | Value | |

|---|

COMMON STOCKS—(Continued) |

| National Oilwell Varco, Inc. | * | | | 17,697 | | | $ | 432,515 | |

| Noble Corp. | † | | | 11,071 | | | | 244,558 | |

| Rowan Cos., Inc. | | | | 4,817 | | | | 76,590 | |

| Schlumberger Ltd. | | | | 51,043 | | | | 2,160,650 | |

| Smith International, Inc. | | | | 9,127 | | | | 208,917 | |

| Weatherford International Ltd. | * | | | 28,799 | | | | 311,605 | |

| | | | | | | | | | | | | | 5,155,966 | |

Food & Staples Retailing—2.6% |

| Costco Wholesale Corp. | † | | | 18,479 | | | | 970,147 | |

| CVS Caremark Corp. | | | | 61,047 | | | | 1,754,491 | |

| Kroger Co. (The) | | | | 27,812 | | | | 734,515 | |

| Safeway, Inc. | | | | 18,422 | | | | 437,891 | |

| SUPERVALU, Inc. | | | | 8,528 | | | | 124,509 | |

| SYSCO Corp. | | | | 25,561 | | | | 586,369 | |

| Walgreen Co. | | | | 42,071 | | | | 1,037,892 | |

| Wal-Mart Stores, Inc. | | | | 94,971 | | | | 5,324,074 | |

| Whole Foods Market, Inc. | | | | 6,058 | | | | 57,188 | |

| | | | | | | | | | | | | | 11,027,076 | |

Food Products—1.4% |

| Archer-Daniels-Midland Co. | † | | | 27,321 | | | | 787,664 | |

| Campbell Soup Co. | | | | 8,636 | | | | 259,166 | |

| ConAgra Foods, Inc. | | | | 19,154 | | | | 316,041 | |

| Dean Foods Co. | *† | | | 5,435 | | | | 97,667 | |

| General Mills, Inc. | | | | 14,284 | | | | 867,753 | |

| H.J. Heinz Co. | † | | | 13,256 | | | | 498,426 | |

| Hershey Co. (The) | † | | | 6,909 | | | | 240,019 | |

| J.M. Smucker Co. (The) | | | | 5,015 | | | | 217,450 | |

| Kellogg Co. | | | | 10,626 | | | | 465,950 | |

| Kraft Foods, Inc., Class A | † | | | 64,571 | | | | 1,733,731 | |

| McCormick & Co., Inc. | † | | | 4,832 | | | �� | 153,948 | |

| Sara Lee Corp. | | | | 28,781 | | | | 281,766 | |

| Tyson Foods, Inc., Class A | † | | | 13,842 | | | | 121,256 | |

| | | | | | | | | | | | | | 6,040,837 | |

Gas Utilities—0.1% |

| Equitable Resources, Inc. | † | | | 5,542 | | | | 185,934 | |

| Nicor, Inc. | † | | | 1,963 | | | | 68,194 | |

| Questar Corp. | | | | 6,985 | | | | 228,340 | |

| | | | | | | | | | | | | | 482,468 | |

Health Care Equipment & Supplies—1.7% |

| Baxter International, Inc. | | | | 26,692 | | | | 1,430,424 | |

| Becton Dickinson & Co. | | | | 10,345 | | | | 707,495 | |

| Boston Scientific Corp. | * | | | 63,659 | | | | 492,721 | |

| C.R. Bard, Inc. | † | | | 4,200 | | | | 353,892 | |

| Covidien Ltd. | | | | 21,324 | | | | 772,782 | |

| Dentsply International, Inc. | † | | | 6,303 | | | | 177,997 | |

| Hospira, Inc. | * | | | 7,127 | | | | 191,146 | |

| Intuitive Surgical, Inc. | *† | | | 1,707 | | | | 216,772 | |

| Medtronic, Inc. | | | | 47,994 | | | | 1,507,971 | |

| St. Jude Medical, Inc. | * | | | 14,499 | | | | 477,887 | |

| Stryker Corp. | † | | | 10,499 | | | | 419,435 | |

| Varian Medical Systems, Inc. | * | | | 5,186 | | | | 181,717 | |

| Zimmer Holdings, Inc. | * | | | 9,556 | | | | 386,254 | |

| | | | | | | | | | | | | | 7,316,493 | |

Health Care Providers & Services—1.7% |

| Aetna, Inc. | | | | 20,018 | | | | 570,513 | |

| AmerisourceBergen Corp. | | | | 6,575 | | | | 234,464 | |

| Cardinal Health, Inc. | | | | 15,247 | | | | 525,564 | |

| Cigna Corp. | | | | 11,476 | | | | 193,370 | |

| Coventry Health Care, Inc. | * | | | 5,918 | | | | 88,060 | |

| DaVita, Inc. | *† | | | 4,338 | | | | 215,035 | |

| Express Scripts, Inc. | *† | | | 10,469 | | | $ | 575,586 | |

| Humana, Inc. | * | | | 6,882 | | | | 256,561 | |

| Laboratory Corp. of America Holdings | *† | | | 4,642 | | | | 298,991 | |

| McKesson Corp. | | | | 11,704 | | | | 453,296 | |

| Medco Health Solutions, Inc. | * | | | 21,486 | | | | 900,478 | |

| Patterson Cos., Inc. | *† | | | 3,837 | | | | 71,944 | |

| Quest Diagnostics, Inc. | † | | | 6,490 | | | | 336,896 | |

| Tenet Healthcare Corp. | *† | | | 19,138 | | | | 22,009 | |

| UnitedHealth Group, Inc. | | | | 51,743 | | | | 1,376,364 | |

| WellPoint, Inc. | * | | | 21,722 | | | | 915,148 | |

| | | | | | | | | | | | | | 7,034,279 | |

Health Care Technology—0.0% |

| IMS Health, Inc. | | | | 7,098 | | | | 107,606 | |

Hotels, Restaurants & Leisure—1.2% |

| Carnival Corp. | | | | 18,543 | | | | 450,966 | |

| Darden Restaurants, Inc. | | | | 5,557 | | | | 156,596 | |

| International Game Technology | | | | 12,516 | | | | 148,815 | |

| Marriott International, Inc., Class A | † | | | 12,456 | | | | 242,269 | |

| McDonald’s Corp. | | | | 47,851 | | | | 2,975,854 | |

| Starbucks Corp. | * | | | 30,892 | | | | 292,238 | |

| Starwood Hotels & Resorts Worldwide, Inc. | † | | | 7,519 | | | | 134,590 | |

| Wyndham Worldwide Corp. | † | | | 6,641 | | | | 43,499 | |

| Wynn Resorts Ltd. | *† | | | 2,420 | | | | 102,269 | |

| Yum! Brands, Inc. | | | | 19,894 | | | | 626,661 | |

| | | | | | | | | | | | | | 5,173,757 | |

Household Durables—0.3% |

| Black & Decker Corp. | | | | 2,731 | | | | 114,183 | |

| Centex Corp. | | | | 5,370 | | | | 57,137 | |

| D.R. Horton, Inc. | | | | 11,960 | | | | 84,557 | |

| Fortune Brands, Inc. | | | | 6,260 | | | | 258,413 | |

| Harman International Industries, Inc. | | | | 2,854 | | | | 47,748 | |

| KB Home | † | | | 3,394 | | | | 46,226 | |

| Leggett & Platt, Inc. | | | | 6,331 | | | | 96,168 | |

| Lennar Corp., Class A | † | | | 5,972 | | | | 51,777 | |

| Newell Rubbermaid, Inc. | | | | 11,995 | | | | 117,311 | |

| Pulte Homes, Inc. | † | | | 9,419 | | | | 102,950 | |

| Snap-On, Inc. | † | | | 2,539 | | | | 99,986 | |

| Stanley Works (The) | † | | | 3,363 | | | | 114,678 | |

| Whirlpool Corp. | † | | | 2,903 | | | | 120,039 | |

| | | | | | | | | | | | | | 1,311,173 | |

Household Products—2.5% |

| Clorox Co. | | | | 5,692 | | | | 316,247 | |

| Colgate-Palmolive Co. | | | | 21,503 | | | | 1,473,816 | |

| Kimberly-Clark Corp. | | | | 17,647 | | | | 930,703 | |

| Procter & Gamble Co. | | | | 127,048 | | | | 7,854,107 | |

| | | | | | | | | | | | | | 10,574,873 | |

Independent Power Producers & Energy Traders—0.1% |

| AES Corp. (The) | * | | | 27,982 | | | | 230,572 | |

| Constellation Energy Group, Inc. | † | | | 7,847 | | | | 196,881 | |

| Dynegy, Inc., Class A | *† | | | 20,516 | | | | 41,032 | |

| | | | | | | | | | | | | | 468,485 | |

Industrial Conglomerates—2.3% |

| 3M Co. | | | | 29,728 | | | | 1,710,549 | |

| General Electric Co. | | | | 447,698 | | | | 7,252,708 | |

| Textron, Inc. | | | | 10,317 | | | | 143,097 | |

| Tyco International Ltd. (Bermuda) | | | | 20,151 | | | | 435,261 | |

| | | | | | | | | | | | | | 9,541,615 | |

|

See accompanying notes to financial statements.

210

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2008

Vantagepoint

Asset Allocation Fund