UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: April 30

Registrant is making a filing for 2 of its series:

Wells Fargo Absolute Return Fund

Wells Fargo Asset Allocation Fund.

Date of reporting period: April 30, 2016

| ITEM 1. | REPORT TO STOCKHOLDERS |

Annual Report

April 30, 2016

Wells Fargo Absolute Return Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of April 30, 2016, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ¡ NO BANK GUARANTEE ¡ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Absolute Return Fund | | Letter to shareholders (unaudited) |

Karla M. Rabusch

President

Wells Fargo Funds

All three equity market indexes reversed course in mid-February 2016 as global investors regained a measure of confidence, business data improved, and central bankers reasserted their commitment to initiatives that are intended to spark economic growth.

Bond markets were volatile as well.

Dear Valued Shareholder:

We are pleased to offer you this annual report for the Wells Fargo Absolute Return Fund for the 12-month period that ended April 30, 2016. During the period, investors, concerned about economic growth, tended to focus on the ability of central bank policymakers globally to spur business activity. Investor sentiment shifted with the potential of each new economic data point to influence policymakers, which drove volatility in equity, interest-rate, and currency markets.

Economic conditions and central bank policies influenced equity and fixed-income markets.

In the U.S., the experience of the S&P 500 Index,1 a common measure of stock performance, illustrates shifts in investor sentiment during the period. Beginning in May 2015 through mid-August, the S&P 500 Index traded in a narrow range as investors sorted through conflicting economic and business data. In August, the Index fell into correction territory—defined as a loss of 10% or more—then recovered a portion of those losses and traded in a narrow range at its lower level for another month. At the end of September, the Index retested August lows then regained most of its year-to-date losses from October through December, once again dipping into correction territory in February 2016. During the first six weeks of 2016, the Index suffered the worst loss to open a year on record. Overseas, the Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index2 and the MSCI Emerging Markets (EM) Index3 traced more persistently negative return patterns before bottoming early in 2016.

All three equity market indexes reversed course in mid-February 2016 as global investors regained a measure of confidence, business data improved, and central bankers reasserted their commitment to initiatives that are intended to spark economic growth. By the end of the period, the S&P 500 Index recorded a 1.7% gain and the MSCI ACWI ex USA Index and MSCI EM Index reduced their losses.

Bond markets were volatile as well. The U.S. Federal Reserve (Fed), which consistently signaled its desire to raise the federal funds rate, did so in December 2015, the first such increase since 2006. The Fed’s monetary policy tightening contrasted with actions by the European Central Bank (ECB), the People’s Bank of China (PBOC), and the Bank of Japan (BOJ), which each implemented currency and interest-rate policies that were more accommodative of business activity. The ECB and BOJ conducted bond purchasing programs similar to the Fed’s quantitative easing programs. Overseas, bond markets benefited during the period, with the Barclays Global Aggregate ex U.S. Dollar Bond Index4 gaining 6.7%. In the U.S., interest-rate increases that many investors anticipated after the Fed raised the federal funds rate were slow to occur, limiting investor interest in U.S. bonds. The Barclays U.S. Aggregate Bond Index5 and the Barclays U.S. Treasury Index6 gained 2.7% and 2.8%, respectively, during the period.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI EM Index consists of the following 23 emerging markets country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. You cannot invest directly in an index. |

| 4 | The Barclays Global Aggregate ex U.S. Dollar Bond Index tracks an international basket of government, corporate, agency, and mortgage-related bonds. You cannot invest directly in an index. |

| 5 | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS. You cannot invest directly in an index. |

| 6 | The Barclays U.S. Treasury Index is an unmanaged index of prices of U.S. Treasury bonds with maturities of 1 to 30 years. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Absolute Return Fund | | | 3 | |

Shifting investor sentiment reflected changing economic and business data.

Throughout the period, changing economic and business data drove stock and bond market volatility. As the period opened, the U.S. equity bull market entered its eighth year, making it the second longest bull market of the past 50 years. U.S. unemployment data improved. Major European economies reported second-quarter gross domestic product growth.

As the summer months arrived, however, counterbalancing influences raised investor concerns. Oil prices declined once again after a spring rally. Concerns arose about Greece’s ability to repay its sovereign debt, and the U.S. dollar strengthened in anticipation of a federal funds interest-rate increase. By July 2015, equity markets were declining, led by stocks in China, which endured the largest one-day loss since 2007 on July 27, 2015.

In August 2015, China allowed its currency’s value to decline in an attempt to bolster exports and the PBOC lowered interest rates to encourage lending. In September, the Fed reported “modest to moderate growth” across sectors and regions in the U.S. In contrast, Japan’s economy contracted in the fourth quarter, China’s manufacturing sector continued to retrench, and growth appeared to slow in Europe.

As global growth concerns restrained enthusiasm, investors appeared to react to each new data point as indication that central bankers might pursue policies to accommodate economic growth. In January 2016, amid falling stock markets and oil prices globally, U.S. Treasury values fell and U.S. corporate profits declined for the second consecutive quarter. The Fed expressed hesitancy about additional monetary tightening through interest-rate increases in the near term. The BOJ implemented a negative interest-rate policy that was similar to the policy enacted by the ECB in 2014. Negative interest rates are intended to encourage banks to lend money rather than keep it on deposit. In March 2016, the ECB pushed its interest rates deeper into negative territory and expanded its bond purchases. Overall, these policy actions and intermittently positive economic data heartened investors as the period drew to a close.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Karla M. Rabusch

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

| | | | |

| 4 | | Wells Fargo Absolute Return Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks a positive total return.

Manager

Wells Fargo Funds Management, LLC

Portfolio managers

Ben Inker, CFA®1

Sam Wilderman, CFA®1,2

Average annual total returns (%) as of April 30, 20163

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios4 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net5 | |

| Class A (WARAX) | | 3-1-2012 | | | (12.18 | ) | | | 1.32 | | | | 3.40 | | | | (6.82 | ) | | | 2.53 | | | | 4.02 | | | | 1.51 | | | | 1.51 | |

| Class C (WARCX) | | 3-1-2012 | | | (8.59 | ) | | | 1.74 | | | | 3.23 | | | | (7.59 | ) | | | 1.74 | | | | 3.23 | | | | 2.26 | | | | 2.26 | |

| Class R (WARHX) | | 9-30-2015 | | | – | | | | – | | | | – | | | | (7.10 | ) | | | 2.44 | | | | 4.33 | | | | 1.76 | | | | 1.76 | |

| Class R6 (WARRX) | | 10-31-2014 | | | – | | | | – | | | | – | | | | (6.42 | ) | | | 2.89 | | | | 4.28 | | | | 1.08 | | | | 1.08 | |

| Administrator Class (WARDX) | | 3-1-2012 | | | – | | | | – | | | | – | | | | (6.85 | ) | | | 2.67 | | | | 4.17 | | | | 1.43 | | | | 1.42 | |

| Institutional Class (WABIX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | (6.51 | ) | | | 2.88 | | | | 4.27 | | | | 1.18 | | | | 1.17 | |

| MSCI ACWI Index (Net)6 | | – | | | – | | | | – | | | | – | | | | (5.66 | ) | | | 4.69 | | | | 3.89 | | | | – | | | | – | |

| Barclays U.S. TIPS 1-10 Year Index7 | | – | | | – | | | | – | | | | – | | | | 1.23 | | | | 1.51 | | | | 3.98 | | | | – | | | | – | |

| Consumer Price Index8 | | – | | | – | | | | – | | | | – | | | | 1.13 | | | | 1.25 | | | | 1.73 | | | | – | | | | – | |

| MSCI World Index (Net)9 | | – | | | – | | | | – | | | | – | | | | (4.17 | ) | | | 5.96 | | | | 4.13 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R6, Administrator Class, and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Absolute return funds are not intended to outperform stocks and bonds in strong markets, and there is no guarantee of positive returns or that the Fund’s objectives will be achieved. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Borrowing money to purchase securities or to cover short positions magnifies losses and incurs expenses. Short selling is generally considered speculative, has the potential for unlimited loss, and may involve leverage. Alternative investments, such as commodities and merger arbitrage strategies, are speculative and entail a high degree of risk. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. The Fund will indirectly be exposed to all of the risks of an investment in the underlying funds and will indirectly bear expenses of the underlying funds. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to asset-backed securities risk, nondiversification risk, geographic risk, and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on pages 5-6.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Absolute Return Fund | | | 5 | |

|

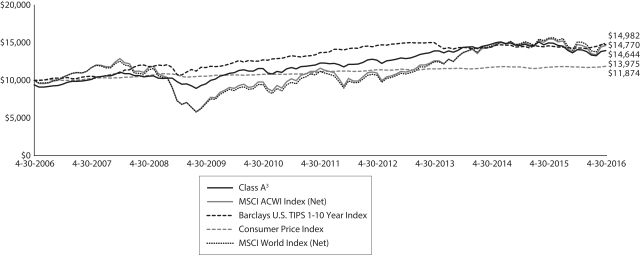

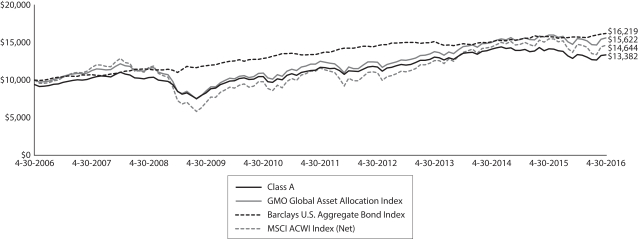

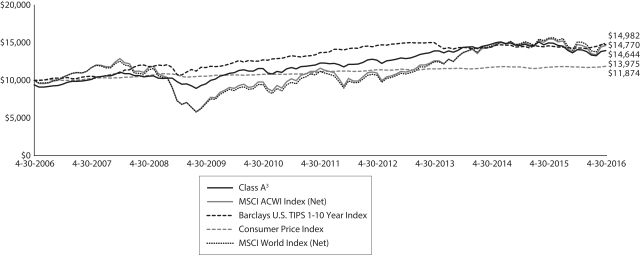

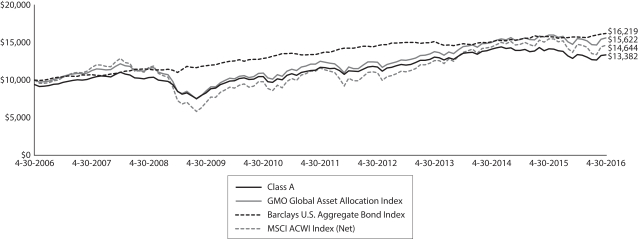

| Growth of $10,000 investment as of April 30, 201610 |

|

|

| 1 | The Fund invests substantially all of its investable assets directly in GMO Benchmark-Free Allocation Fund, an investment company advised by Grantham, Mayo, Van Otterloo & Co. LLC (GMO). Mr. Inker and Mr. Wilderman, co-heads and senior members of GMO’s Asset Allocation Team, have been primarily responsible for coordinating the portfolio management of GMO Benchmark-Free Allocation Fund since 2003 and 2012, respectively. |

| 2 | Effective December 31, 2016, Sam Wilderman will leave GMO. Effective January 1, 2017, Ben Inker will be the sole portfolio manager on the Fund. |

| 3 | Historical performance shown for Class A, Class C, and Administrator Class prior to their inception is based on the performance of Class III shares of GMO Benchmark-Free Allocation Fund (GBMFX), in which the Fund invests all of its investable assets. The inception date of GMO Benchmark-Free Allocation Fund Class III shares is July 23, 2003. Returns for the Class III shares do not reflect GMO Benchmark-Free Allocation Fund’s current fee arrangement and have been adjusted downward to reflect the higher expense ratios applicable to Class A, Class C, and Administrator Class at their inception. These ratios were 1.66% for Class A, 2.41% for Class C, and 1.50% for Administrator Class. Historical performance shown for the Class R shares prior to their inception reflects the performance of the Administrator Class shares, and is not adjusted to reflect Class R expenses. If these expenses had been included, returns for Class R would be lower. Historical performance shown for Class R6 shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns would be higher. Historical performance shown for Institutional Class prior to its inception reflects the performance of the Administrator Class, and is not adjusted to reflect Institutional Class expenses. If these expenses had been included, returns for Institutional Class would be higher. |

| 4 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.78% in acquired fund fees and expenses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report, which do not include acquired fund fees and expenses. |

| 5 | The manager has contractually committed through August 31, 2016 (August 31, 2017 for Class R), to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Operating Expenses After Fee Waiver at 0.71% for Class A, 1.46% for Class C, 0.96% for Class R, 0.28% for Class R6, 0.57% for Administrator Class, and 0.33% for Institutional Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (including the expenses of GMO Benchmark-Free Allocation Fund), and extraordinary expenses are excluded from the cap. Without these caps, the Fund’s returns would have been lower. |

| 6 | In light of the Fund’s investment strategy, the Fund’s benchmark was changed from the Morgan Stanley Capital Index (MSCI) World Index (Net) to MSCI ACWI Index (Net) in order to more completely compare the Fund’s equity holdings to an index representing a broader array of countries. The MSCI World Index (Net) includes developed-markets equity securities only, while the MSCI ACWI Index (Net) includes equity securities from both developed and emerging markets. The MSCI ACWI Index (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 7 | The Barclays U.S. TIPS 1-10 Year Index is an independently maintained and widely published index comprised of inflation-protected securities issued by the U.S. Treasury having a maturity of 1-10 years. You cannot invest directly in an index. |

| 8 | The Consumer Price Index for All Urban Consumers in U.S. All Items (Consumer Price Index) is published monthly by the U.S. government as an indicator of changes in price levels (or inflation) paid by urban consumers for a representative basket of goods and services. You cannot invest directly in an index. |

| 9 | The MSCI World Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index (Net) consists of the following 23 developed markets country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. You cannot invest directly in an index. |

| 10 | The chart compares the performance of Class A shares for the most recent ten years with the performance of the MSCI ACWI Index (Net), Barclays U.S. TIPS 1-10 Year Index, Consumer Price Index, and the MSCI World Index (Net). The chart assumes a hypothetical investment of $10,000 in Class A shares and reflects all operating expenses and assumes the maximum initial sales charge of 5.75%. |

| 11 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 12 | The MSCI World ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of world markets excluding the U.S. and Canada. You cannot invest directly in an index. |

| | | | |

| 6 | | Wells Fargo Absolute Return Fund | | Performance highlights (unaudited) |

| 13 | The MSCI Emerging Markets Index is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 23 emerging markets country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. You cannot invest directly in an index. |

| 14 | The MSCI Europe Value Index captures large- and mid-cap securities exhibiting overall value style characteristics across the 15 developed markets countries in Europe. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price, and dividend yield. With 220 constituents, the index targets 50% coverage of the free-float-adjusted market capitalization of the MSCI Europe Index. You cannot invest directly in an index. |

| 15 | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS. You cannot invest directly in an index. |

| 16 | The holdings, excluding cash and cash equivalents, are calculated based on the value of the investments of GMO Benchmark-Free Allocation Fund divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

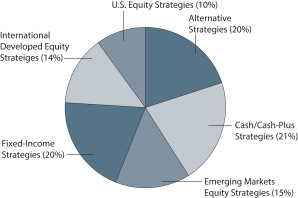

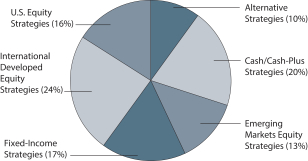

| 17 | Portfolio allocation represents the portfolio allocation of the GMO Benchmark-Free Allocation Fund, which is calculated based on the investment exposures of the underlying GMO funds. Portfolio allocation is subject to change and may have changed since the date specified. |

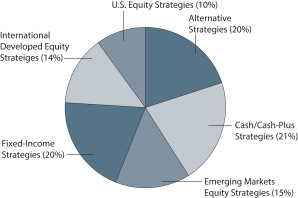

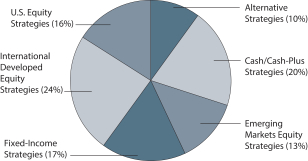

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Absolute Return Fund | | | 7 | |

MANAGER’S DISCUSSION

Fund highlights

| n | | The Fund underperformed its benchmarks and the Consumer Price Index for the 12-month period that ended April 30, 2016. |

| n | | The Fund’s allocations to emerging markets stocks; European value stocks; other international opportunistic value stocks; relative-value interest rates and currency positions; and cash/cash-plus positions detracted from performance. |

| n | | Contributing to performance were the Fund’s allocations to U.S. high-quality stocks; U.S. opportunistic value stocks; U.S. Treasury Inflation-Protected Securities (TIPS); asset-backed securities; emerging country debt, which is composed of fundamentally researched opportunities across geographies and capital structures. |

Equity, alternative strategy, and cash/cash-plus exposures all detracted from returns in the 12-month period that ended April 30, 2016, while fixed income contributed.

Global equities, represented by the Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) Index (Net), declined 5.7% during the 12-month period that ended April 30, 2016. During the period, U.S. stocks recorded muted returns of 1.2% as measured by the S&P 500 Index11 in U.S. dollar terms, which outpaced non-U.S. markets. The MSCI World ex USA Index (Net)12 declined 9.4%, while emerging markets as measured by the MSCI Emerging Markets Index13 and European value equities as measured by the MSCI Europe Value Index14 did significantly worse, chalking up returns of -17.9% and -14.4%, respectively. Equities fell on a variety of concerns, ranging from China-related issues, including falling equity markets, slowing growth, currency devaluation, and perceived haphazard policymaker response; to falling global commodity prices; to worries about overall weak global growth. A more risk-averse investment environment benefited fixed-income markets, leading the Barclays U.S. Aggregate Bond Index15 to return 2.7% for the period.

| | | | |

| Holdings (%) as of April 30, 201616 | |

GMO Implementation Fund | | | 80.93 | |

GMO Special Opportunities Fund Class VI | | | 5.01 | |

GMO SGM Major Markets Fund Class VI | | | 4.96 | |

GMO Debt Opportunities Fund Class VI | | | 4.88 | |

GMO Emerging Country Debt Fund Class IV | | | 4.54 | |

We made a number of strategic changes during the period in response to changes in valuations and evolution in our portfolio management process.

Our equity allocation remained largely constant during the 12 months that ended April 30, 2016, ending at approximately 40% of the portfolio. During the year, we decreased our exposure to U.S. quality positions and emerging markets while increasing our exposure to a

broader set of U.S. value stocks (including some opportunistic value positions) and international developed equities. Our alternatives allocation increased during the period. In addition, we modestly increased the weight in the GMO Special Opportunities Strategy. The overall exposure to our fixed-income allocation decreased 10% to approximately 20%. We added to U.S. TIPS and high yield and modestly to asset-backed securities during the period. The portfolio’s cash/cash-plus position increased nearly 5%. We added to the Fund’s liquidity by increasing our cash allocation.

Going forward, we see value in international stocks (both developed ex-U.S. and emerging markets value) and select alternative strategies.

|

| Portfolio allocation as of April 30, 201617 |

|

|

We believe that equity markets are priced to deliver below-average returns, even negative in certain cases. Within equity markets, we have a strong preference for international equities over U.S. equities and for the emerging markets, in particular. Within international stocks, we believe value stocks are priced to potentially deliver a higher return than growth stocks, and emerging markets value stocks remain our favored equity asset class. We still have a preference for higher-quality stocks within the U.S. given their marginally higher expected returns and relative defensive characteristics in both recessions and market declines.

Please see footnotes on pages 5-6.

| | | | |

| 8 | | Wells Fargo Absolute Return Fund | | Performance highlights (unaudited) |

Fixed-income interest-rate spread widening, increased volatility, and more dispersion have created opportunities for risk assets beyond equities. Over the past few quarters, expected returns for U.S. corporate credit have increased, especially high yield. We added modestly to our exposure but spread tightening more recently limits our enthusiasm. As volatility and dispersion increased late in the period, the GMO Special Opportunities Strategy team began to see more compelling investment opportunities. Merger arbitrage continues to look like an attractive diversifying source of returns, but the tightening of deal spreads has somewhat tempered our expectations for the strategy. We continued to hold significant positions in what we perceived to be safer assets like U.S. cash and U.S. TIPS but reduced our position in TIPS as prices rose late in the period. We hope to have the opportunity soon to rotate some of this capital into risk assets at more attractive valuations.

Please see footnotes on pages 5-6.

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Absolute Return Fund | | | 9 | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from November 1, 2015 to April 30, 2016.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

Wells Fargo Absolute Return Fund (excluding GMO Benchmark-

Free Allocation Fund and underlying fund expenses) | | Beginning

account value

11-1-2015 | | | Ending

account value

4-30-2016 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 991.37 | | | $ | 3.35 | | | | 0.68 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.50 | | | $ | 3.40 | | | | 0.68 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 987.82 | | | $ | 7.05 | | | | 1.43 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.77 | | | $ | 7.16 | | | | 1.43 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 990.85 | | | $ | 4.58 | | | | 0.93 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.26 | | | $ | 4.65 | | | | 0.93 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 993.53 | | | $ | 1.23 | | | | 0.25 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.63 | | | $ | 1.24 | | | | 0.25 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 991.84 | | | $ | 2.82 | | | | 0.57 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.03 | | | $ | 2.87 | | | | 0.57 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 993.51 | | | $ | 1.64 | | | | 0.33 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.22 | | | $ | 1.66 | | | | 0.33 | % |

Please see footnote on page 10.

| | | | |

| 10 | | Wells Fargo Absolute Return Fund | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

Wells Fargo Absolute Return Fund (including GMO Benchmark-

Free Allocation Fund and underlying fund expenses) | | Beginning

account value

11-1-2015 | | | Ending

account value

4-30-2016 | | | Expenses

paid during

the period¹ | | | Net annualized

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 991.37 | | | $ | 7.26 | | | | 1.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.57 | | | $ | 7.35 | | | | 1.47 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 987.82 | | | $ | 10.95 | | | | 2.22 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,013.84 | | | $ | 11.10 | | | | 2.22 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 990.85 | | | $ | 8.49 | | | | 1.72 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.33 | | | $ | 8.60 | | | | 1.72 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 993.53 | | | $ | 5.14 | | | | 1.04 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.70 | | | $ | 5.21 | | | | 1.04 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 991.84 | | | $ | 6.74 | | | | 1.36 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 6.83 | | | | 1.36 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 993.51 | | | $ | 5.55 | | | | 1.12 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.29 | | | $ | 5.62 | | | | 1.12 | % |

| 1 | Expenses paid is equal to the annualized expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—April 30, 2016 | | Wells Fargo Absolute Return Fund | | | 11 | |

| | | | | | | | | | | | |

| Security name | | | | | | Shares | | | Value | |

| | | | |

Investment Companies: 99.91% | | | | | | | | | | | | |

GMO Benchmark-Free Allocation Fund Class MF (l) | | | | | | | 329,716,891 | | | $ | 8,150,601,541 | |

| | | | | | | | | | | | |

| | | | |

Total Investment Companies (Cost $8,442,990,093) | | | | | | | | | | | 8,150,601,541 | |

| | | | | | | | | | | | |

| | | | | | | | |

| Total investments (Cost $8,442,990,093) * | | | 99.91 | % | | | 8,150,601,541 | |

Other assets and liabilities, net | | | 0.09 | | | | 7,202,927 | |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 8,157,804,468 | |

| | | | | | | | |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| * | Cost for federal income tax purposes is $8,559,431,133 and unrealized gains (losses) consists of: |

| | | | |

Gross unrealized gains | | $ | 0 | |

Gross unrealized losses | | | (408,829,592 | ) |

| | | | |

Net unrealized losses | | $ | (408,829,592 | ) |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Absolute Return Fund | | Statement of assets and liabilities—April 30, 2016 |

| | | | |

| | | | |

| |

Assets | | | | |

Investment in affiliated investment companies, at value (cost $8,442,990,093) | | $ | 8,150,601,541 | |

Cash | | | 69,761,527 | |

Receivable for investments sold | | | 10,238,473 | |

Receivable for Fund shares sold | | | 8,001,014 | |

Prepaid expenses and other assets | | | 56,123 | |

| | | | |

Total assets | | | 8,238,658,678 | |

| | | | |

| |

Liabilities | | | | |

Payable for Fund shares redeemed | | | 76,730,117 | |

Management fee payable | | | 1,251,507 | |

Distribution fees payable | | | 779,471 | |

Administration fees payable | | | 1,077,776 | |

Accrued expenses and other liabilities | | | 1,015,339 | |

| | | | |

Total liabilities | | | 80,854,210 | |

| | | | |

Total net assets | | $ | 8,157,804,468 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 8,829,749,163 | |

Undistributed net investment income | | | 49,999,369 | |

Accumulated net realized losses on investments | | | (429,555,512 | ) |

Net unrealized losses on investments | | | (292,388,552 | ) |

| | | | |

Total net assets | | $ | 8,157,804,468 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 1,185,630,696 | |

Shares outstanding – Class A1 | | | 115,725,834 | |

Net asset value per share – Class A | | | $10.25 | |

Maximum offering price per share – Class A2 | | | $10.88 | |

Net assets – Class C | | $ | 1,207,966,935 | |

Shares outstanding – Class C1 | | | 120,180,404 | |

Net asset value per share – Class C | | | $10.05 | |

Net assets – Class R | | $ | 56,279 | |

Shares outstanding – Class R1 | | | 5,508 | |

Net asset value per share – Class R | | | $10.22 | |

Net assets – Class R6 | | $ | 8,274,483 | |

Shares outstanding – Class R61 | | | 806,488 | |

Net asset value per share – Class R6 | | | $10.26 | |

Net assets – Administrator Class | | $ | 1,409,515,652 | |

Shares outstanding – Administrator Class1 | | | 137,180,762 | |

Net asset value per share – Administrator Class | | | $10.27 | |

Net assets – Institutional Class | | $ | 4,346,360,423 | |

Shares outstanding – Institutional Class1 | | | 423,392,231 | |

Net asset value per share – Institutional Class | | | $10.27 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of operations—year ended April 30, 2016 | | Wells Fargo Absolute Return Fund | | | 13 | |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends from affiliated investment companies | | $ | 157,879,410 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 19,284,393 | |

Administration fees | | | | |

Class A | | | 3,501,551 | |

Class C | | | 3,337,193 | |

Class R | | | 32 | 1 |

Class R6 | | | 2,066 | |

Administrator Class | | | 3,089,782 | |

Institutional Class | | | 5,539,671 | |

Shareholder servicing fees | | | | |

Class A | | | 3,976,087 | |

Class C | | | 3,793,911 | |

Class R | | | 38 | 1 |

Administrator Class | | | 6,270,651 | |

Distribution fees | | | | |

Class C | | | 11,381,733 | |

Class R | | | 38 | 1 |

Custody and accounting fees | | | 23,506 | |

Professional fees | | | 37,401 | |

Registration fees | | | 1,132,081 | |

Shareholder report expenses | | | 682,539 | |

Trustees’ fees and expenses | | | 13,109 | |

Interest expense | | | 27,001 | |

Other fees and expenses | | | 221,475 | |

| | | | |

Total expenses | | | 62,314,258 | |

Less: Fee waivers and/or expense reimbursements | | | (810,239 | ) |

| | | | |

Net expenses | | | 61,504,019 | |

| | | | |

Net investment income | | | 96,375,391 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains (losses) on: | | | | |

Sale of affiliated investment companies | | | (457,941,394 | ) |

Capital gain distributions from affiliated investment companies | | | 79,692,381 | |

| | | | |

Net realized losses on investments | | | (378,249,013 | ) |

| | | | |

Net change in unrealized gains (losses) on investments | | | (575,093,705 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | (953,342,718 | ) |

| | | | |

Net decrease in net assets resulting from operations | | $ | (856,967,327 | ) |

| | | | |

| 1 | For the period from September 30, 2015 (commencement of class operations) to April 30, 2016 |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Absolute Return Fund | | Statement of changes in net assets |

| | | | | | | | | | | | | | | | |

| | | Year ended April 30, 2016 | | | Year ended April 30, 2015 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 96,375,391 | | | | | | | $ | 161,360,592 | |

Net realized gains (losses) on investments | | | | | | | (378,249,013 | ) | | | | | | | 282,382,617 | |

Net change in unrealized gains (losses) on investments | | | | | | | (575,093,705 | ) | | | | | | | (306,084,237 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | | | | | (856,967,327 | ) | | | | | | | 137,658,972 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (2,018,950 | ) | | | | | | | (46,771,237 | ) |

Class C | | | | | | | 0 | | | | | | | | (32,930,720 | ) |

Class R | | | | | | | (146 | )1 | | | | | | | N/A | |

Class R6 | | | | | | | (58,776 | ) | | | | | | | (722 | )2 |

Administrator Class | | | | | | | (3,770,480 | ) | | | | | | | (96,932,949 | ) |

Institutional Class | | | | | | | (26,670,082 | ) | | | | | | | (127,892,812 | ) |

Net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (17,724,798 | ) | | | | | | | (19,085,961 | ) |

Class C | | | | | | | (17,245,982 | ) | | | | | | | (17,608,903 | ) |

Class R | | | | | | | (301 | )1 | | | | | | | N/A | |

Class R6 | | | | | | | (86,330 | ) | | | | | | | (235 | )2 |

Administrator Class | | | | | | | (24,788,212 | ) | | | | | | | (36,474,143 | ) |

Institutional Class | | | | | | | (50,775,694 | ) | | | | | | | (42,411,716 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (143,139,751 | ) | | | | | | | (420,109,398 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 25,253,503 | | | | 265,906,642 | | | | 70,082,675 | | | | 793,603,767 | |

Class C | | | 14,188,599 | | | | 147,204,154 | | | | 48,665,679 | | | | 545,035,379 | |

Class R | | | 5,464 | 1 | | | 55,695 | 1 | | | N/A | | | | N/A | |

Class R6 | | | 809,160 | | | | 8,887,149 | | | | 7,388 | 2 | | | 82,908 | 2 |

Administrator Class | | | 47,517,188 | | | | 505,709,473 | | | | 168,608,782 | | | | 1,915,693,998 | |

Institutional Class | | | 271,417,954 | | | | 2,789,272,415 | | | | 338,198,480 | | | | 3,832,004,737 | |

| | | | |

| | | | | | | 3,717,035,528 | | | | | | | | 7,086,420,789 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 1,789,350 | | | | 18,022,752 | | | | 5,507,060 | | | | 60,098,192 | |

Class C | | | 1,440,101 | | | | 14,242,598 | | | | 3,813,839 | | | | 41,146,022 | |

Class R | | | 44 | 1 | | | 447 | 1 | | | N/A | | | | N/A | |

Class R6 | | | 13,857 | | | | 140,549 | | | | 88 | 2 | | | 957 | 2 |

Administrator Class | | | 2,803,172 | | | | 28,327,921 | | | | 12,017,771 | | | | 131,321,751 | |

Institutional Class | | | 6,001,051 | | | | 60,876,054 | | | | 10,381,003 | | | | 113,553,390 | |

| | | | |

| | | | | | | 121,610,321 | | | | | | | | 346,120,312 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (86,614,528 | ) | | | (893,970,500 | ) | | | (100,178,392 | ) | | | (1,136,238,269 | ) |

Class C | | | (60,792,347 | ) | | | (617,070,041 | ) | | | (29,135,027 | ) | | | (321,826,353 | ) |

Class R6 | | | (24,004 | ) | | | (245,100 | ) | | | (1 | )2 | | | (12 | )2 |

Administrator Class | | | (249,895,879 | ) | | | (2,587,358,806 | ) | | | (213,759,666 | ) | | | (2,402,284,698 | ) |

Institutional Class | | | (285,196,205 | ) | | | (2,945,458,316 | ) | | | (108,063,864 | ) | | | (1,208,607,788 | ) |

| | | | |

| | | | | | | (7,044,102,763 | ) | | | | | | | (5,068,957,120 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital share transactions | | | | | | | (3,205,456,914 | ) | | | | | | | 2,363,583,981 | |

| | | | |

Total increase (decrease) in net assets | | | | | | | (4,205,563,992 | ) | | | | | | | 2,081,133,555 | |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 12,363,368,460 | | | | | | | | 10,282,234,905 | |

| | | | |

End of period | | | | | | $ | 8,157,804,468 | | | | | | | $ | 12,363,368,460 | |

| | | | |

Undistributed (overdistributed) net investment income | | | | | | $ | 49,999,369 | | | | | | | $ | (22,935,312 | ) |

| | | | |

| 1 | For the period from September 30, 2015 (commencement of class operations) to April 30, 2016 |

| 2 | For the period from October 31, 2014 (commencement of class operations) to April 30, 2015 |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Absolute Return Fund | | | 15 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended April 30 | | | Year ended September 30 | |

| CLASS A | | 2016 | | | 2015 | | | 20141 | | | 2013 | | | 20122 | |

Net asset value, beginning of period | | | $11.15 | | | | $11.39 | | | | $10.94 | | | | $10.16 | | | | $10.00 | |

Net investment income (loss) | | | 0.11 | | | | 0.14 | 3 | | | 0.10 | | | | 0.08 | | | | (0.02 | )3 |

Net realized and unrealized gains (losses) on investments | | | (0.88 | ) | | | (0.01 | ) | | | 0.51 | | | | 0.73 | | | | 0.18 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.77 | ) | | | 0.13 | | | | 0.61 | | | | 0.81 | | | | 0.16 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01 | ) | | | (0.26 | ) | | | (0.16 | ) | | | (0.03 | ) | | | 0.00 | |

Net realized gains | | | (0.12 | ) | | | (0.11 | ) | | | (0.00 | )4 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.13 | ) | | | (0.37 | ) | | | (0.16 | ) | | | (0.03 | ) | | | 0.00 | |

Net asset value, end of period | | | $10.25 | | | | $11.15 | | | | $11.39 | | | | $10.94 | | | | $10.16 | |

Total return5 | | | (6.82 | )% | | | 1.23 | % | | | 5.66 | % | | | 8.02 | % | | | 1.60 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 0.68 | % | | | 0.71 | % | | | 0.72 | % | | | 0.73 | % | | | 0.79 | % |

Net expenses6 | | | 0.68 | % | | | 0.71 | % | | | 0.72 | % | | | 0.73 | % | | | 0.78 | % |

Net investment income (loss)6 | | | 0.87 | % | | | 1.21 | % | | | 1.55 | % | | | 0.92 | % | | | (0.36 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 8 | % | | | 6 | % | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $1,185,631 | | | | $1,954,792 | | | | $2,277,448 | | | | $1,512,891 | | | | $398,557 | |

| 1 | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2 | For the period from March 1, 2012 (commencement of class operations) to September 30, 2012 |

| 3 | Calculated based upon average shares outstanding |

| 4 | Amount is less than $0.005. |

| 5 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 6 | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Year ended April 30, 2016 | | | 0.59 | % |

Year ended April 30, 2015 | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 2013 | | | 0.50 | % |

Year ended September 30, 20122 | | | 0.49 | % |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Absolute Return Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended April 30 | | | Year ended September 30 | |

| CLASS C | | 2016 | | | 2015 | | | 20141 | | | 2013 | | | 20122 | |

Net asset value, beginning of period | | | $11.01 | | | | $11.27 | | | | $10.82 | | | | $10.11 | | | | $10.00 | |

Net investment income (loss) | | | 0.01 | 3 | | | 0.06 | 3 | | | 0.06 | | | | 0.03 | | | | (0.06 | )3 |

Net realized and unrealized gains (losses) on investments | | | (0.85 | ) | | | (0.01 | ) | | | 0.50 | | | | 0.70 | | | | 0.17 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.84 | ) | | | 0.05 | | | | 0.56 | | | | 0.73 | | | | 0.11 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.00 | | | | (0.20 | ) | | | (0.11 | ) | | | (0.02 | ) | | | 0.00 | |

Net realized gains | | | (0.12 | ) | | | (0.11 | ) | | | (0.00 | )4 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.12 | ) | | | (0.31 | ) | | | (0.11 | ) | | | (0.02 | ) | | | 0.00 | |

Net asset value, end of period | | | $10.05 | | | | $11.01 | | | | $11.27 | | | | $10.82 | | | | $10.11 | |

Total return5 | | | (7.59 | )% | | | 0.47 | % | | | 5.23 | % | | | 7.20 | % | | | 1.10 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 1.43 | % | | | 1.47 | % | | | 1.47 | % | | | 1.48 | % | | | 1.54 | % |

Net expenses6 | | | 1.43 | % | | | 1.47 | % | | | 1.47 | % | | | 1.48 | % | | | 1.53 | % |

Net investment income (loss)6 | | | 0.08 | % | | | 0.53 | % | | | 0.78 | % | | | 0.14 | % | | | (1.11 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 8 | % | | | 6 | % | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $1,207,967 | | | | $1,820,384 | | | | $1,600,482 | | | | $1,042,487 | | | | $268,171 | |

| 1 | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2 | For the period from March 1, 2012 (commencement of class operations) to September 30, 2012 |

| 3 | Calculated based upon average shares outstanding |

| 4 | Amount is less than $0.005. |

| 5 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 6 | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Year ended April 30, 2016 | | | 0.59 | % |

Year ended April 30, 2015 | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 2013 | | | 0.50 | % |

Year ended September 30, 20122 | | | 0.49 | % |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Absolute Return Fund | | | 17 | |

(For a share outstanding throughout the period)

| | | | |

| CLASS R | | Year ended

April 30, 20161 | |

Net asset value, beginning of period | | | $10.19 | |

Net investment loss | | | (0.05 | )2 |

Net realized and unrealized gains (losses) on investments | | | 0.26 | |

| | | | |

Total from investment operations | | | 0.21 | |

Distributions to shareholders from | | | | |

Net investment income | | | (0.06 | ) |

Net realized gains | | | (0.12 | ) |

| | | | |

Total distributions to shareholders | | | (0.18 | ) |

Net asset value, end of period | | | $10.22 | |

Total return3 | | | 2.10 | % |

Ratios to average net assets (annualized) | | | | |

Gross expenses4 | | | 0.93 | % |

Net expenses4 | | | 0.93 | % |

Net investment loss4 | | | (0.92 | )% |

Supplemental data | | | | |

Portfolio turnover rate | | | 8 | % |

Net assets, end of period (000s omitted) | | | $56 | |

| 1 | For the period from September 30, 2015 (commencement of class operations) to April 30, 2016 |

| 2 | Calculated based upon average shares outstanding |

| 3 | Returns for periods of less than one year are not annualized. |

| 4 | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were 0.59%. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Absolute Return Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | |

| | | Year ended April 30 | |

| CLASS R6 | | 2016 | | | 20151 | |

Net asset value, beginning of period | | | $11.18 | | | | $11.32 | |

Net investment income | | | 0.10 | 2 | | | 0.09 | 2 |

Net realized and unrealized gains (losses) on investments | | | (0.82 | ) | | | 0.20 | |

| | | | | | | | |

Total from investment operations | | | (0.72 | ) | | | 0.29 | |

Distributions to shareholders from | | | | | | | | |

Net investment income | | | (0.08 | ) | | | (0.32 | ) |

Net realized gains | | | (0.12 | ) | | | (0.11 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (0.20 | ) | | | (0.43 | ) |

Net asset value, end of period | | | $10.26 | | | | $11.18 | |

Total return3 | | | (6.42 | )% | | | 2.68 | % |

Ratios to average net assets (annualized) | | | | | | | | |

Gross expenses4 | | | 0.24 | % | | | 0.24 | % |

Net expenses4 | | | 0.24 | % | | | 0.24 | % |

Net investment income4 | | | 0.99 | % | | | 1.67 | % |

Supplemental data | | | | | | | | |

Portfolio turnover rate | | | 8 | % | | | 6 | % |

Net assets, end of period (000s omitted) | | | $8,274 | | | | $84 | |

| 1 | For the period from October 31, 2014 (commencement of class operations) to April 30, 2015 |

| 2 | Calculated based upon average shares outstanding |

| 3 | Returns for periods of less than one year are not annualized. |

| 4 | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Year ended April 30, 2016 | | | 0.59 | % |

Year ended April 30, 20151 | | | 0.55 | % |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Absolute Return Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended April 30 | | | Year ended September 30 | |

| ADMINISTRATOR CLASS | | 2016 | | | 2015 | | | 20141 | | | 2013 | | | 20122 | |

Net asset value, beginning of period | | | $11.18 | | | | $11.42 | | | | $10.97 | | | | $10.17 | | | | $10.00 | |

Net investment income (loss) | | | 0.14 | 3 | | | 0.14 | 3 | | | 0.11 | | | | 0.09 | | | | (0.01 | )3 |

Net realized and unrealized gains (losses) on investments | | | (0.91 | ) | | | 0.01 | | | | 0.51 | | | | 0.75 | | | | 0.18 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.77 | ) | | | 0.15 | | | | 0.62 | | | | 0.84 | | | | 0.17 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.28 | ) | | | (0.17 | ) | | | (0.04 | ) | | | 0.00 | |

Net realized gains | | | (0.12 | ) | | | (0.11 | ) | | | (0.00 | )4 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.14 | ) | | | (0.39 | ) | | | (0.17 | ) | | | (0.04 | ) | | | 0.00 | |

Net asset value, end of period | | | $10.27 | | | | $11.18 | | | | $11.42 | | | | $10.97 | | | | $10.17 | |

Total return5 | | | (6.85 | )% | | | 1.40 | % | | | 5.74 | % | | | 8.25 | % | | | 1.70 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 0.58 | % | | | 0.55 | % | | | 0.55 | % | | | 0.55 | % | | | 0.62 | % |

Net expenses6 | | | 0.57 | % | | | 0.55 | % | | | 0.55 | % | | | 0.55 | % | | | 0.59 | % |

Net investment income (loss)6 | | | 1.31 | % | | | 1.26 | % | | | 1.69 | % | | | 1.03 | % | | | (0.16 | )% |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 8 | % | | | 6 | % | | | 0 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $1,409,516 | | | | $3,763,871 | | | | $4,223,678 | | | | $2,763,630 | | | | $914,872 | |

| 1 | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2 | For the period from March 1, 2012 (commencement of class operations) to September 30, 2012 |

| 3 | Calculated based upon average shares outstanding |

| 4 | Amount is less than $0.005. |

| 5 | Returns for periods of less than one year are not annualized. |

| 6 | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Year ended April 30, 2016 | | | 0.59 | % |

Year ended April 30, 2015 | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 2013 | | | 0.50 | % |

Year ended September 30, 20122 | | | 0.49 | % |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Absolute Return Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | |

| | | Year ended April 30 | | | Year ended

September 30 20132 | |

| INSTITUTIONAL CLASS | | 2016 | | | 2015 | | | 20141 | | |

Net asset value, beginning of period | | | $11.19 | | | | $11.44 | | | | $10.99 | | | | $10.18 | |

Net investment income | | | 0.11 | 3 | | | 0.23 | 3 | | | 0.12 | | | | 0.14 | 3 |

Net realized and unrealized gains (losses) on investments | | | (0.84 | ) | | | (0.05 | ) | | | 0.52 | | | | 0.71 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.73 | ) | | | 0.18 | | | | 0.64 | | | | 0.85 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | (0.07 | ) | | | (0.32 | ) | | | (0.19 | ) | | | (0.04 | ) |

Net realized gains | | | (0.12 | ) | | | (0.11 | ) | | | (0.00 | )4 | | | 0.00 | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.19 | ) | | | (0.43 | ) | | | (0.19 | ) | | | (0.04 | ) |

Net asset value, end of period | | | $10.27 | | | | $11.19 | | | | $11.44 | | | | $10.99 | |

Total return5 | | | (6.51 | )% | | | 1.65 | % | | | 5.93 | % | | | 8.41 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | |

Gross expenses6 | | | 0.33 | % | | | 0.29 | % | | | 0.29 | % | | | 0.30 | % |

Net expenses6 | | | 0.32 | % | | | 0.29 | % | | | 0.29 | % | | | 0.30 | % |

Net investment income6 | | | 1.05 | % | | | 2.00 | % | | | 1.84 | % | | | 1.56 | % |

Supplemental data | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 8 | % | | | 6 | % | | | 0 | % | | | 0 | % |

Net assets, end of period (000s omitted) | | | $4,346,360 | | | | $4,824,238 | | | | $2,180,627 | | | | $982,490 | |

| 1 | For the seven months ended April 30, 2014. The Fund changed its fiscal year end from September 30 to April 30, effective April 30, 2014. |

| 2 | For the period from November 30, 2012 (commencement of class operations) to September 30, 2013 |

| 3 | Calculated based upon average shares outstanding |

| 4 | Amount is less than $0.005. |

| 5 | Returns for periods of less than one year are not annualized. |

| 6 | Ratios do not include the expenses of GMO Benchmark-Free Allocation Fund, Class MF which were as follows: |

| | | | |

Year ended April 30, 2016 | | | 0.59 | % |

Year ended April 30, 2015 | | | 0.55 | % |

Year ended April 30, 20141 | | | 0.54 | % |

Year ended September 30, 20132 | | | 0.50 | % |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Notes to financial statements | | Wells Fargo Absolute Return Fund | | | 21 | |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Absolute Return Fund (the “Fund”) which is a diversified series of the Trust.

The Fund invests all of its investable assets in the GMO Benchmark-Free Allocation Fund (the “Benchmark-Free Allocation Fund”), an investment company managed by Grantham, Mayo, Van Otterloo & Co. LLC (“GMO”). Benchmark-Free Allocation Fund is a fund-of-funds that gains its investment exposures primarily by investing in GMO Implementation Fund. In addition, Benchmark-Free Allocation Fund may invest in other GMO Funds (together with GMO Implementation Fund, the “underlying funds”), whether currently existing or created in the future. These additional underlying Funds may include, among others, GMO Alpha Only Fund, GMO Debt Opportunities Fund, GMO Emerging Country Debt Fund, GMO Special Opportunities Fund, and GMO Systematic Global Macro Opportunity Fund. GMO Implementation Fund is permitted to invest in any asset class. Benchmark-Free Allocation Fund also may invest in securities or derivatives directly. As of April 30, 2016, the Fund owned 49% of Benchmark-Free Allocation Fund. Because the Fund invests all of its assets in Benchmark-Free Allocation Fund, the shareholders of the Fund bear the fees and expense of Benchmark-Free Allocation Fund which are not included in the Statement of Operations but are incurred indirectly because they are considered in the calculation of the net asset value of Benchmark-Free Allocation Fund. As a result, the Fund’s actual expenses may be higher than those of other mutual funds that invest directly in securities.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

The Fund values its investment in Benchmark-Free Allocation Fund at net asset value. The valuation of investments in securities and the underlying funds held by Benchmark-Free Allocation Fund is discussed in the annual report of Benchmark-Free Allocation Fund which is included in the mailing of this shareholder report. An unaudited Statement of Assets and Liabilities and an unaudited Schedule of Investments for Benchmark-Free Allocation Fund as of April 30, 2016 have also been included as an Appendix in this report for your reference.

Investment transactions and income recognition

Investment transactions are recorded on a trade date basis. Realized gains and losses resulting from investment transactions are determined on the identified cost basis.

Income dividends and capital gain distributions from Benchmark-Free Allocation Fund are recorded on the ex-dividend date. Capital gain distributions from Benchmark-Free Allocation Fund are treated as realized gains.

Distributions to shareholders

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with federal income tax regulations, which may differ in amount or character from net investment income and realized gains recognized for purposes of U.S. generally accepted accounting principles.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

| | | | |

| 22 | | Wells Fargo Absolute Return Fund | | Notes to financial statements |

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under federal income tax regulations. U.S. generally accepted accounting principles require that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The primary permanent difference causing such reclassifications is due to dividends from certain securities. At April 30, 2016, as a result of permanent book-to-tax differences, the following reclassification adjustments were made on the Statement of Assets and Liabilities:

| | | | |

| Paid-in capital | | Undistributed net investment income | | Accumulated net realized losses on investments |

| $(5,508) | | $9,077,724 | | $(9,072,216) |

As of April 30, 2016, the Fund had capital loss carryforwards which consist of $5,919,794 in short-term capital losses and $307,194,678 in long-term capital losses.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

3. FAIR VALUATION MEASUREMENTS

As of April 30, 2016, the Fund’s investment in Benchmark-Free Allocation Fund was measured at fair value using the net asset value per share as a practical expedient. Benchmark-Free Allocation Fund seeks positive total return, not “relative” return, by investing in asset classes GMO believes offer the most attractive return and risk opportunities. The Fund’s investment in Benchmark-Free Allocation Fund valued at $8,150,601,541 does not have a redemption period notice, can be redeemed daily and does not have any unfunded commitments.

4. TRANSACTIONS WITH AFFILIATES

Management fee

Wells Fargo Funds Management, LLC (“Funds Management”), an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”), is the manager of the Fund. Under the investment management agreement, Funds Management is responsible for, among other services, implementing the investment policies and guidelines of the Fund and for the day-to-day portfolio management of the Fund along with, providing fund-level administrative services in connection with the Fund’s operations, and providing any other fund-level administrative services reasonably necessary for the operation of the Fund. As compensation for its services under the investment management agreement, Funds Management is entitled to receive an annual management fee starting at 0.225% and declining to 0.16% as the average daily net assets of the Fund increase. Prior to September 1, 2015, Funds Management was entitled to receive an annual advisory and fund level administration fee which started at 0.225% and declined to 0.165% as the average daily net assets of the Fund increased. For the year ended April 30, 2016, the management fee was equivalent to an annual rate of 0.19% of the Fund’s average daily net assets.

Administration fees

Under a class-level administration agreement, Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus

| | | | | | |

| Notes to financial statements | | Wells Fargo Absolute Return Fund | | | 23 | |

account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Funds Management receives an annual fee which is calculated based on the average daily net assets of each class as follows:

| | | | | | | | |

| | | Class-level administration fee | |

| | | Current rate | | | Rate prior to

July 1, 2015 | |

Class A, Class C | | | 0.21 | % | | | 0.26 | % |

Class R | | | 0.21 | | | | N/A | |

Class R6 | | | 0.03 | | | | 0.03 | |

Administrator Class | | | 0.13 | | | | 0.10 | |

Institutional Class | | | 0.13 | | | | 0.08 | |

Funds Management has contractually waived and/or reimbursed management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. Waiver of fees and/or reimbursement of expenses by Funds Management were made first from fund level expenses on a proportionate basis and then from class specific expenses. Funds Management has committed to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s expenses (excluding expenses of Benchmark-Free Allocation Fund and acquired fund fees and expenses) as follows:

| | | | | | |

| | | Expense

ratio cap | | | Expiration date |

Class A | | | 0.71 | % | | August 31, 2016 |

Class C | | | 1.46 | | | August 31, 2016 |

Class R | | | 0.96 | | | August 31, 2017 |

Class R6 | | | 0.28 | | | August 31, 2016 |

Administrator Class | | | 0.57 | | | August 31, 2016 |

Institutional Class | | | 0.33 | | | August 31, 2016 |

Distribution fees

The Trust has adopted a distribution plan for Class C and Class R shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are charged to Class C and Class R shares and paid to Wells Fargo Funds Distributor, LLC (“Funds Distributor”), the principal underwriter, at an annual rate of 0.75% of the average daily net assets of Class C shares and 0.25% of the average daily net assets of Class R shares.

In addition, Funds Distributor is entitled to receive the front-end sales charge from the purchase of Class A shares and a contingent deferred sales charge on the redemption of certain Class A shares. Funds Distributor is also entitled to receive the contingent deferred sales charges from redemptions of Class C shares. For the year ended April 30, 2016, Funds Distributor received $227,865 from the sale of Class A shares and $6,354 and $21,764 in contingent deferred sales charges from redemptions of Class A and Class C shares, respectively.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C, Class R, and Administrator Class of the Fund are charged a fee at an annual rate of 0.25% of the average daily net assets of each respective class.

A portion of these total shareholder servicing fees were paid to affiliates of Wells Fargo.

5. INVESTMENT TRANSACTIONS

For the year ended April 30, 2016, the Fund made aggregate purchases and sales of $792,427,811 and $3,943,216,392, respectively, in its investment in Benchmark-Free Allocation Fund.

As a result of its investment in Benchmark-Free Allocation Fund, the Fund incurs purchase premium and redemption fees. These purchase premium and redemption fees are paid by the Fund to Benchmark-Free Allocation Fund to help offset estimated portfolio transaction and related costs incurred as a result of a purchase or redemption order by allocating estimated transaction costs to the purchasing or redeeming shareholder. The Fund is currently charged 0.18% for purchases and redemptions which are reflected in paid in capital. Prior to June 30, 2015, the Fund was charged 0.13% for purchases and redemptions. GMO reassesses these fees annually.

| | | | |

| 24 | | Wells Fargo Absolute Return Fund | | Notes to financial statements |

6. BANK BORROWINGS

The Trust (excluding the money market funds and certain other funds) and Wells Fargo Variable Trust are parties to a $200,000,000 revolving credit agreement whereby the Fund is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Fund based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.20% of the unused balance is allocated to each participating fund. Prior to September 1, 2015, the revolving credit agreement amount was $150,000,000 and the annual commitment fee was equal to 0.10% of the unused balance which was allocated to each participating fund.

During the year ended April 30, 2016, the Fund had average borrowings outstanding of $1,901,479 at an average rate of 1.42% and paid interest in the amount of $27,001.

7. DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the years ended April 30, 2016 and April 30, 2015 were as follows:

| | | | | | | | |

| | | Year ended April 30 | |

| | | 2016 | | | 2015 | |

Ordinary income | | $ | 32,518,434 | | | $ | 304,528,440 | |

Long-term capital gain | | | 110,621,317 | | | | 115,580,958 | |

As of April 30, 2016, the components of distributable earnings on a tax basis were as follows:

| | | | |