UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 12 of its series:

Allspring Diversified Capital Builder Fund, Allspring Diversified Income Builder Fund, Allspring Index Asset Allocation Fund, Allspring International Bond Fund, Allspring Income Plus Fund, Allspring Global Investment Grade Credit Fund, Allspring C&B Mid Cap Value Fund, Allspring Common Stock Fund, Allspring Discovery SMID Cap Growth Fund, Allspring Discovery Mid Cap Growth Fund, Allspring Opportunity Fund, and Allspring Special Mid Cap Value Fund.

Date of reporting period: March 31, 2023

| ITEM 1. | REPORT TO STOCKHOLDERS |

Semi-Annual Report

March 31, 2023

Allspring International Bond Fund

The views expressed and any forward-looking statements are as of March 31, 2023, unless otherwise noted, and are those of the Fund's portfolio managers and/or Allspring Global Investments. Discussions of individual securities or the markets generally are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Allspring Global Investments disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Allspring International Bond Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Allspring Funds

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Allspring International Bond Fund for the six-month period that ended March 31, 2023. Globally, stocks and bonds rebounded strongly despite ongoing volatility. While navigating persistently high inflation and the impact of ongoing aggressive central bank rate hikes, markets rallied on signs of declining inflation, anticipation of an end to the central bank monetary tightening cycle, and the stimulating impact of China removing its strict COVID-19 lockdowns in December. For the six-month period, domestic U.S. and global stocks and bonds had strong results. After suffering deep and broad losses through 2022, recent fixed income performance benefited from a base of higher yields that can now generate higher income.

For the period, U.S. stocks, based on the S&P 500 Index,1 returned 15.62%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 returned 22.13%, while the MSCI EM Index (Net) (USD)3 returned 14.04%. Among bond indexes, the Bloomberg U.S. Aggregate Bond Index4 returned 4.89%, the Bloomberg Global Aggregate ex-USD Index (unhedged)5 returned 10.07%, the Bloomberg Municipal Bond Index6 gained 7.00%, and the ICE BofA U.S. High Yield Index7 returned 7.89%.

Despite high inflation and central bank rate hikes, markets rally.

Equities had a reprieve in October. Value stocks and small caps fared best. Globally, developed markets outpaced emerging market equities, which were hurt by weakness among Chinese stocks. Central banks continued to try to curtail high inflation with aggressive interest rate hikes. Geopolitical risks persisted, including the ongoing Russia-Ukraine war and economic, financial market, and political turmoil in the U.K. Concerns over Europe’s energy crisis eased thanks to unseasonably warm weather and plentiful gas on hand. The U.S. labor market continued its resilience against rising prices as unemployment remained near a record low.

Stocks and bonds rallied in November. Economic news was encouraging, driven by U.S. labor market strength. Although central banks kept raising rates, hopes rose for an easing in the pace of rate hikes and a possible end to central bank monetary tightening in 2023. Although inflation remained at record highs in the eurozone, we began to see signs of a possible decline in inflationary pressures as U.S. inflation moderated, with a 7.1% annual price rise in November and a monthly price increase of just 0.1%. China’s economic data remained weak, reflecting its zero-COVID-19 policy.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the U.S. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) (USD) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S.-dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Global Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S.-dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2023. ICE Data Indices, LLC. All rights reserved. |

2 | Allspring International Bond Fund

Letter to shareholders (unaudited)

Financial markets cooled in December, with U.S. equities posting negative overall results in response to a weakening U.S. dollar. Fixed income securities ended one of their worst years ever with flat overall monthly returns as markets weighed the hopes for an end to the monetary tightening cycle with the reality that central banks had not completed their jobs yet. U.S. Consumer Price Index (CPI)1 data showed a strong consistent trend downward, which brought down the 12-month CPI to 6.5% in December from 9.1% in June. Other countries and regions reported still-high but declining inflation rates as the year winded down.

The year 2023 began with a rally across global equities and fixed income securities. Investor optimism rose in response to data indicating declining inflation rates and the reopening of China’s economy with the abrupt end to its zero-COVID-19 policy. The U.S. reported surprisingly strong job gains––employers added more than 500,000 jobs––and unemployment fell to 3.4%, the lowest level since 1969. Meanwhile, wage growth, seen as a potential contributor to ongoing high inflation, continued to moderate. All eyes remained fixed on the Federal Reserve (Fed) and on how many more rate hikes remain in this tightening cycle. The 0.25% federal funds rate hike announced in January was the Fed’s smallest rate increase since March 2022.

Financial markets declined in February as investors responded unfavorably to resilient economic data. The takeaway: Central banks will likely continue their monetary tightening cycle for longer than markets had priced in. In this environment—where strong economic data is seen as bad news—the resilient U.S. labor market was seen as a negative while the inflation rate has not been falling quickly enough for the Fed, which raised interest rates by 0.25% in early February. Meanwhile, the Bank of England and the European Central Bank both raised rates by 0.50%. At this stage in the economic cycle, the overriding question remained: “What will central banks do?” In February, the answer appeared to be: “Move rates higher for longer.”

The collapse of Silicon Valley Bank in March, the second-largest banking failure in U.S. history, led to a classic bank run that spread to Europe, where Switzerland’s Credit Suisse was taken over by its rival, UBS. The sudden banking industry uncertainty led some clients of regional banks to transfer deposits to a handful of U.S. banking giants while bank shareholders sold stock. The banking industry turmoil could make the job of central banks more challenging as they weigh inflationary concerns against potential economic weakening. Meanwhile, recent data pointed to economic strength in the U.S., Europe, and China. The U.S. labor market remained resilient. The euro-area composite Purchasing Managers’ Index2 rose to 53.70, indicating expansion, for March. And China’s economy continued to rebound after the removal of its COVID-19 lockdown. Inflation rates in the U.S., the U.K., and Europe all remained higher than central bank targets, leading to additional rate hikes in March.

“ The banking industry turmoil could make the job of central banks more challenging as they weigh inflationary concerns against potential economic weakening. Meanwhile, recent data pointed to economic strength in the U.S., Europe, and China.”

| 1 | The U.S. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. You cannot invest directly in an index. |

| 2 | The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. You cannot invest directly in an index. |

Allspring International Bond Fund | 3

Letter to shareholders (unaudited)

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Allspring Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Allspring Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Allspring Funds

For further information about your fund, contact your investment professional, visit our website at allspringglobal.com, or call us directly at 1-800-222-8222.

4 | Allspring International Bond Fund

This page is intentionally left blank.

Performance highlights (unaudited)

| Investment objective | The Fund seeks total return, consisting of income and capital appreciation. |

| Manager | Allspring Funds Management, LLC |

| Subadviser | Allspring Global Investments (UK) Limited |

| Portfolio managers | Michael Lee, Henrietta Pacquement, CFA, Alex Perrin, Lauren van Biljon, CFA |

| Average annual total returns (%) as of March 31, 2023 |

| | | Including sales charge | | Excluding sales charge | | Expense ratios1 (%) |

| | Inception date | 1 year | 5 year | 10 year | | 1 year | 5 year | 10 year | | Gross | Net 2 |

| Class A (ESIYX) | 9-30-2003 | -17.61 | -5.65 | -2.76 | | -13.75 | -4.79 | -2.31 | | 1.25 | 1.03 |

| Class C (ESIVX) | 9-30-2003 | -15.36 | -5.38 | -2.84 | | -14.36 | -5.38 | -2.84 | | 2.00 | 1.78 |

| Class R6 (ESIRX) | 11-30-2012 | – | – | – | | -13.40 | -4.41 | -1.93 | | 0.87 | 0.65 |

| Administrator Class (ESIDX) | 7-30-2010 | – | – | – | | -13.70 | -4.62 | -2.15 | | 1.19 | 0.85 |

| Institutional Class (ESICX) | 12-15-1993 | – | – | – | | -13.46 | -4.47 | -1.99 | | 0.92 | 0.70 |

| Bloomberg Global Aggregate ex-USD Index3 | – | – | – | – | | -10.72 | -3.17 | -0.99 | | – | – |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, allspringglobal.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 4.50%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R6, Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

| 1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 2 | The manager has contractually committed through January 31, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 1.03% for Class A, 1.78% for Class C, 0.65% for Class R6, 0.85% for Administrator Class, and 0.70% for Institutional Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 3 | The Bloomberg Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment grade fixed income markets excluding the U.S. dollar denominated debt market. You cannot invest directly in an index. |

Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. The use of derivatives may reduce returns and/or increase volatility. Securities issued by U.S. government agencies or government-sponsored entities may not be guaranteed by the U.S. Treasury. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This fund is exposed to high-yield securities risk and geographic risk. Consult the Fund’s prospectus for additional information on these and other risks.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

6 | Allspring International Bond Fund

Performance highlights (unaudited)

| Ten largest holdings (%) as of March 31, 20231 |

| Network Rail Infrastructure Finance plc, 4.75%, 11-29-2035 | 4.57 |

| Canada, 1.90%, 3-15-2031 | 4.29 |

| Italy, 0.95%, 6-1-2032 | 3.99 |

| Spain, 1.25%, 10-31-2030 | 3.98 |

| U.S. Treasury Note, 2.75%, 8-15-2032 | 3.72 |

| United Kingdom, 0.88%, 7-31-2033 | 2.73 |

| U.S. Treasury Note, 4.13%, 9-30-2027 | 2.56 |

| Australia, 2.75%, 11-21-2028 | 2.53 |

| Queensland Treasury Corporation, 1.50%, 8-20-2032 | 2.41 |

| Norway, 2.13%, 5-18-2032 | 2.35 |

| 1 | Figures represent the percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified. |

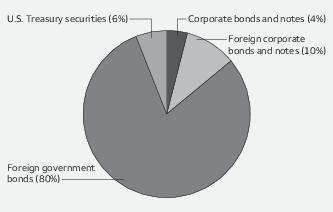

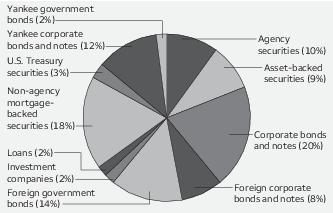

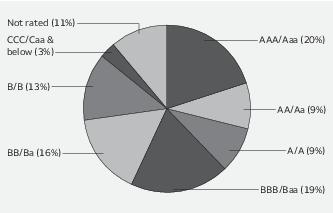

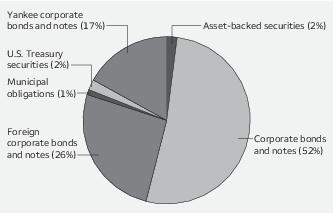

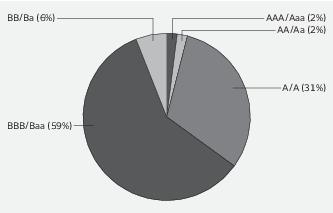

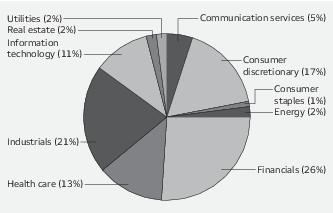

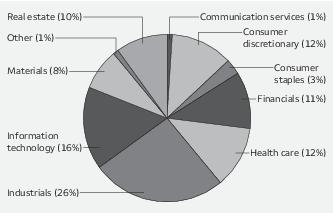

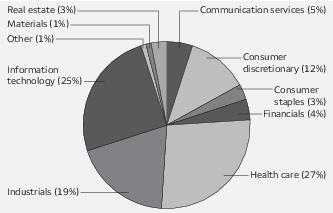

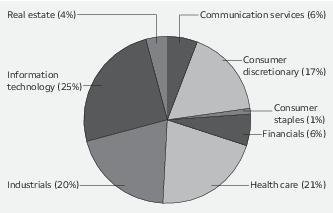

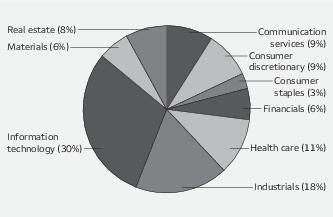

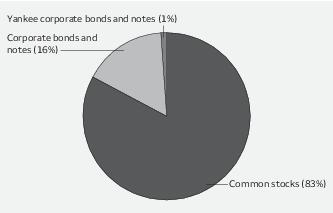

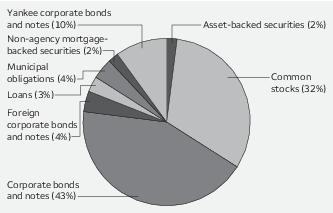

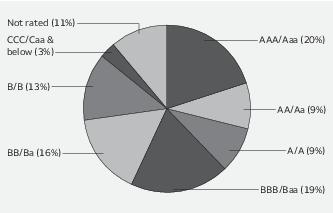

| Portfolio allocation as of March 31, 20231 |

| 1 | Figures represent the percentage of the Fund's long-term investments. Allocations are subject to change and may have changed since the date specified. |

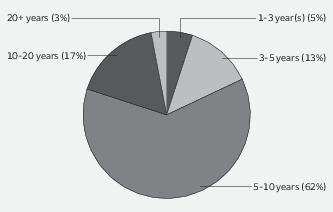

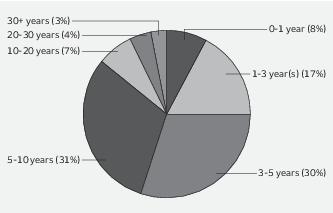

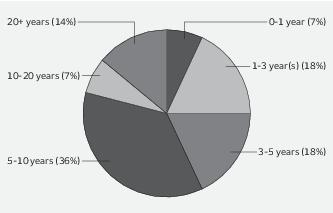

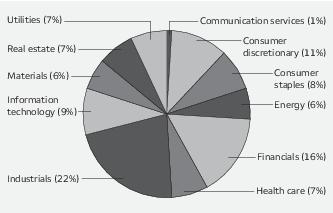

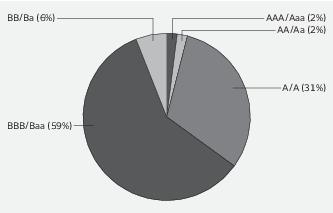

| Effective maturity distribution as of March 31, 20231 |

| 1 | Figures represent the percentage of the Fund's long-term investments. Allocations are subject to change and may have changed since the date specified. |

Allspring International Bond Fund | 7

Fund expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from October 1, 2022 to March 31, 2023.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

account value

10-1-2022 | Ending

account value

3-31-2023 | Expenses

paid during

the period1 | Annualized net

expense ratio |

| Class A | | | | |

| Actual | $1,000.00 | $1,086.61 | $5.36 | 1.03% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.80 | $5.19 | 1.03% |

| Class C | | | | |

| Actual | $1,000.00 | $1,081.72 | $9.24 | 1.78% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.06 | $8.95 | 1.78% |

| Class R6 | | | | |

| Actual | $1,000.00 | $1,088.01 | $3.38 | 0.65% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.69 | $3.28 | 0.65% |

| Administrator Class | | | | |

| Actual | $1,000.00 | $1,085.49 | $4.42 | 0.85% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.69 | $4.28 | 0.85% |

| Institutional Class | | | | |

| Actual | $1,000.00 | $1,088.46 | $3.64 | 0.70% |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.44 | $3.53 | 0.70% |

1 Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 182 divided by 365 (to reflect the one-half-year period).

8 | Allspring International Bond Fund

Portfolio of investments—March 31, 2023 (unaudited)

| | | Interest

rate | Maturity

date | | Principal | Value |

| Corporate bonds and notes: 4.20% | | | | | | |

| United States: 4.20% | | | | | | |

| American Tower Corporation (Real estate, Specialized REITs) | | 3.80% | 8-15-2029 | $ | 200,000 | $ 185,869 |

| Anthem Incorporated (Health care, Health care providers & services) | | 2.55 | 3-15-2031 | | 200,000 | 172,124 |

| Bank of America Corporation (3 Month LIBOR +1.21%) (Financials, Banks) ± | | 3.97 | 2-7-2030 | | 200,000 | 186,936 |

| Berry Global Incorporated (Materials, Containers & packaging) | | 1.00 | 1-15-2025 | | 150,000 | 154,137 |

| BP Capital Markets America Incorporated (Energy, Oil, gas & consumable fuels) | | 1.75 | 8-10-2030 | | 200,000 | 165,504 |

| Broadcom Incorporated (Information technology, Semiconductors & semiconductor equipment) 144A | | 4.15 | 4-15-2032 | | 150,000 | 136,678 |

| Citigroup Incorporated (Financials, Banks) | | 3.20 | 10-21-2026 | | 150,000 | 141,511 |

| Coca Cola Company (Consumer staples, Beverages) | | 0.38 | 3-15-2033 | | 300,000 | 241,350 |

| JPMorgan Chase & Company (3 Month EURIBOR +1.13%) (Financials, Banks) ± | | 1.96 | 3-23-2030 | | 175,000 | 167,524 |

| Magallanes Incorporated (Communication services, Media) 144A | | 4.28 | 3-15-2032 | | 200,000 | 178,559 |

| McDonald's Corporation (Consumer discretionary, Hotels, restaurants & leisure) | | 2.38 | 5-31-2029 | | 175,000 | 176,100 |

| Motorola Solutions Incorporated (Information technology, Communications equipment) | | 2.75 | 5-24-2031 | | 200,000 | 165,160 |

| Oracle Corporation (Information technology, Software) | | 6.25 | 11-9-2032 | | 150,000 | 161,333 |

| Thermo Fisher Scientific Incorporated (Health care, Life sciences tools & services) | | 1.13 | 10-18-2033 | | 200,000 | 168,885 |

| Total Corporate bonds and notes (Cost $2,641,470) | | | | | | 2,401,670 |

| Foreign corporate bonds and notes: 9.56% | | | | | | |

| Belgium: 0.71% | | | | | | |

| Anheuser-Busch InBev SA (Consumer staples, Beverages) | | 2.88 | 4-2-2032 | EUR | 200,000 | 204,828 |

| KBC Group NV (Financials, Banks) | | 3.00 | 8-25-2030 | EUR | 200,000 | 201,463 |

| | | | | | | 406,291 |

| Canada: 0.31% | | | | | | |

| Toronto Dominion Bank (Financials, Banks) | | 2.55 | 8-3-2027 | EUR | 175,000 | 177,856 |

| France: 0.71% | | | | | | |

| BNP Paribas (Financials, Banks) | | 3.63 | 9-1-2029 | EUR | 200,000 | 209,607 |

| BPCE SA (Financials, Banks) | | 0.38 | 2-2-2026 | EUR | 200,000 | 197,172 |

| | | | | | | 406,779 |

| Germany: 0.37% | | | | | | |

| Eurogrid Company (Utilities, Electric utilities) | | 3.28 | 9-5-2031 | EUR | 100,000 | 106,232 |

| RWE AG (Utilities, Independent power & renewable electricity producers) | | 2.75 | 5-24-2030 | EUR | 100,000 | 100,735 |

| | | | | | | 206,967 |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 9

Portfolio of investments—March 31, 2023 (unaudited)

| | | Interest

rate | Maturity

date | | Principal | Value |

| Ireland: 0.17% | | | | | | |

| Smurfit Kappa Treasury Company (Materials, Paper & forest products) | | 1.50% | 9-15-2027 | EUR | 100,000 | $ 97,561 |

| Netherlands: 1.58% | | | | | | |

| ABN Amro Bank NV (Financials, Banks) | | 0.50 | 9-23-2029 | EUR | 200,000 | 173,464 |

| American Medical Systems Europe BV (Health care, Health care providers & services) | | 1.63 | 3-8-2031 | EUR | 200,000 | 185,740 |

| Enel Finance International NV (Utilities, Electric utilities) | | 0.38 | 6-17-2027 | EUR | 175,000 | 165,095 |

| Koninklijke Philips NV (Health care, Health care equipment & supplies) | | 2.63 | 5-5-2033 | EUR | 175,000 | 168,572 |

| Shell International Finance Company (Financials, Financial services) | | 1.88 | 4-7-2032 | EUR | 225,000 | 210,019 |

| | | | | | | 902,890 |

| United Kingdom: 5.71% | | | | | | |

| Nationwide Building Society (Financials, Financial services) | | 3.25 | 9-5-2029 | EUR | 175,000 | 178,439 |

| NatWest Markets plc (Financials, Banks) | | 1.38 | 3-2-2027 | EUR | 175,000 | 170,873 |

| Network Rail Infrastructure Finance plc (Industrials, Transportation infrastructure) | | 4.75 | 11-29-2035 | GBP | 2,000,000 | 2,614,895 |

| Pinewood Finance Company Limited (Financials, Financial services) | | 3.25 | 9-30-2025 | GBP | 100,000 | 115,342 |

| Thames Water Utilities Finance plc (Utilities, Water utilities) | | 0.88 | 1-31-2028 | EUR | 200,000 | 187,154 |

| | | | | | | 3,266,703 |

| Total Foreign corporate bonds and notes (Cost $6,726,790) | | | | | | 5,465,047 |

| Foreign government bonds: 78.02% | | | | | | |

| Australia | | 1.75 | 11-21-2032 | AUD | 1,825,000 | 1,064,522 |

| Australia | | 2.75 | 11-21-2028 | AUD | 2,200,000 | 1,445,566 |

| Brazil | | 10.00 | 1-1-2031 | BRL | 875,000 | 151,219 |

| Brazil | | 10.00 | 1-1-2025 | BRL | 1,100,000 | 210,586 |

| Brazil | | 10.00 | 1-1-2029 | BRL | 2,850,000 | 507,066 |

| Canada | | 1.50 | 12-1-2031 | CAD | 640,000 | 423,702 |

| Canada 144A | | 1.90 | 3-15-2031 | CAD | 3,675,000 | 2,456,064 |

| Canada | | 2.00 | 6-1-2032 | CAD | 950,000 | 652,875 |

| Canada | | 2.00 | 12-1-2051 | CAD | 700,000 | 414,235 |

| Chile | | 4.50 | 3-1-2026 | CLP | 120,000,000 | 144,322 |

| China | | 3.02 | 5-27-2031 | CNY | 1,750,000 | 258,202 |

| China | | 3.03 | 3-11-2026 | CNY | 2,600,000 | 383,998 |

| Colombia | | 6.00 | 4-28-2028 | COP | 1,885,000,000 | 323,775 |

| Czech Republic | | 0.25 | 2-10-2027 | CZK | 4,000,000 | 154,918 |

| Czech Republic | | 1.75 | 6-23-2032 | CZK | 37,000,000 | 1,342,590 |

| France | | 0.50 | 5-25-2029 | EUR | 675,000 | 643,219 |

| France | | 1.25 | 5-25-2038 | EUR | 1,010,000 | 849,252 |

| France | | 2.00 | 11-25-2032 | EUR | 1,050,000 | 1,060,877 |

| Germany ¤ | | 0.00 | 8-15-2029 | EUR | 775,000 | 728,141 |

| Germany | | 0.20 | 6-14-2024 | EUR | 355,000 | 373,140 |

| Germany | | 1.00 | 5-15-2038 | EUR | 1,180,000 | 1,046,306 |

| Germany | | 1.70 | 8-15-2032 | EUR | 350,000 | 361,401 |

| Hungary | | 1.50 | 8-26-2026 | HUF | 30,000,000 | 64,539 |

| Hungary | | 2.25 | 4-20-2033 | HUF | 40,000,000 | 68,241 |

| Indonesia | | 6.38 | 4-15-2032 | IDR | 13,600,000,000 | 886,773 |

The accompanying notes are an integral part of these financial statements.

10 | Allspring International Bond Fund

Portfolio of investments—March 31, 2023 (unaudited)

| | | Interest

rate | Maturity

date | | Principal | Value |

| Foreign government bonds: 78.02% (continued) | | | | | | |

| Indonesia | | 6.50% | 6-15-2025 | IDR | 3,150,000,000 | $ 210,728 |

| Indonesia | | 7.00 | 2-15-2033 | IDR | 14,000,000,000 | 947,924 |

| Italy ¤ | | 0.00 | 4-1-2026 | EUR | 775,000 | 760,295 |

| Italy 144A | | 0.60 | 8-1-2031 | EUR | 750,000 | 624,753 |

| Italy | | 0.95 | 6-1-2032 | EUR | 2,725,000 | 2,279,346 |

| Korea | | 1.88 | 6-10-2029 | KRW | 900,000,000 | 637,069 |

| Korea | | 2.38 | 12-10-2031 | KRW | 740,000,000 | 529,119 |

| Korea | | 3.13 | 9-10-2027 | KRW | 1,450,000,000 | 1,107,754 |

| Malaysia | | 3.58 | 7-15-2032 | MYR | 3,700,000 | 816,926 |

| Malaysia | | 3.90 | 11-30-2026 | MYR | 1,100,000 | 252,788 |

| Mexico | | 5.75 | 3-5-2026 | MXN | 7,400,000 | 370,333 |

| Mexico | | 7.50 | 5-26-2033 | MXN | 8,700,000 | 440,084 |

| Mexico | | 8.00 | 11-7-2047 | MXN | 6,000,000 | 296,221 |

| Mexico | | 8.50 | 5-31-2029 | MXN | 22,215,000 | 1,212,912 |

| Netherlands 144A | | 2.50 | 7-15-2033 | EUR | 475,000 | 507,766 |

| New South Wales | | 1.50 | 2-20-2032 | AUD | 980,000 | 533,083 |

| New South Wales | | 3.00 | 5-20-2027 | AUD | 1,040,000 | 683,792 |

| New Zealand | | 1.50 | 5-15-2031 | NZD | 1,300,000 | 661,686 |

| New Zealand | | 3.50 | 4-14-2033 | NZD | 1,300,000 | 766,227 |

| Norway 144A | | 2.13 | 5-18-2032 | NOK | 15,100,000 | 1,345,152 |

| Poland | | 0.25 | 10-25-2026 | PLN | 1,075,000 | 204,042 |

| Poland | | 1.25 | 10-25-2030 | PLN | 1,275,000 | 211,963 |

| Poland | | 1.75 | 4-25-2032 | PLN | 4,000,000 | 656,180 |

| Poland | | 2.75 | 10-25-2029 | PLN | 425,000 | 81,564 |

| Queensland Treasury Corporation 144A | | 1.50 | 8-20-2032 | AUD | 2,550,000 | 1,376,309 |

| Republic of Peru | | 6.35 | 8-12-2028 | PEN | 600,000 | 155,497 |

| Republic of South Africa | | 8.75 | 2-28-2048 | ZAR | 7,700,000 | 330,142 |

| Republic of South Africa | | 8.75 | 2-28-2048 | ZAR | 4,750,000 | 203,659 |

| Republic of South Africa | | 10.50 | 12-21-2026 | ZAR | 16,000,000 | 955,705 |

| Romania | | 2.50 | 10-25-2027 | RON | 475,000 | 85,109 |

| Romania | | 3.25 | 6-24-2026 | RON | 650,000 | 126,315 |

| Romania | | 3.65 | 9-24-2031 | RON | 2,475,000 | 414,708 |

| Romania | | 4.85 | 4-22-2026 | RON | 2,550,000 | 522,743 |

| Romania | | 5.00 | 2-12-2029 | RON | 2,675,000 | 520,172 |

| Russia (Acquired 9-23-2020, cost $3,553,656) ♦†> | | 4.50 | 7-16-2025 | RUB | 283,800,000 | 0 |

| Spain ¤ | | 0.00 | 1-31-2026 | EUR | 675,000 | 675,305 |

| Spain 144A | | 1.00 | 7-30-2042 | EUR | 640,000 | 438,075 |

| Spain 144A | | 1.25 | 10-31-2030 | EUR | 2,395,000 | 2,276,776 |

| Thailand | | 1.60 | 12-17-2029 | THB | 35,500,000 | 1,001,082 |

| Thailand | | 3.35 | 6-17-2033 | THB | 6,500,000 | 205,908 |

| United Kingdom | | 0.88 | 7-31-2033 | GBP | 1,645,000 | 1,564,065 |

| United Kingdom | | 1.25 | 7-31-2051 | GBP | 925,000 | 635,182 |

| United Kingdom | | 3.25 | 1-31-2033 | GBP | 410,000 | 494,671 |

| United Kingdom | | 3.75 | 1-29-2038 | GBP | 400,000 | 490,031 |

| Total Foreign government bonds (Cost $52,259,873) | | | | | | 44,624,690 |

| U.S. Treasury securities: 6.28% | | | | | | |

| U.S. Treasury Note | | 2.75 | 8-15-2032 | $ | 2,260,000 | 2,126,872 |

| U.S. Treasury Note | | 4.13 | 9-30-2027 | | 1,440,000 | 1,467,112 |

| Total U.S. Treasury securities (Cost $3,513,670) | | | | | | 3,593,984 |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 11

Portfolio of investments—March 31, 2023 (unaudited)

| | | Yield | | | Shares | Value |

| Short-term investments: 1.38% | | | | | | |

| Investment companies: 1.38% | | | | | | |

| Allspring Government Money Market Fund Select Class ♠∞ | | 4.69% | | | 790,099 | $ 790,099 |

| Total Short-term investments (Cost $790,099) | | | | | | 790,099 |

| Total investments in securities (Cost $65,931,902) | 99.44% | | | | | 56,875,490 |

| Other assets and liabilities, net | 0.56 | | | | | 321,038 |

| Total net assets | 100.00% | | | | | $57,196,528 |

| ± | Variable rate investment. The rate shown is the rate in effect at period end. |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| ¤ | The security is issued in zero coupon form with no periodic interest payments. |

| ♦ | The security is fair valued in accordance with Allspring Funds Management's valuation procedures, as the Board-designated valuation designee. |

| † | Non-income-earning security |

| > | Restricted security as to resale, excluding Rule 144A securities. The Fund held restricted securities with an aggregate current value of $0 (original aggregate cost of $3,553,656), representing 0.00% of its net assets as of period end. |

| ♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| ∞ | The rate represents the 7-day annualized yield at period end. |

| Abbreviations: |

| AUD | Australian dollar |

| BRL | Brazilian real |

| CAD | Canadian dollar |

| CLP | Chile Peso |

| CNY | China yuan |

| COP | Colombian peso |

| CZK | Czech Republic koruna |

| EUR | Euro |

| EURIBOR | Euro Interbank Offered Rate |

| GBP | Great British pound |

| HUF | Hungarian forint |

| IDR | Indonesian rupiah |

| KRW | Republic of Korea won |

| LIBOR | London Interbank Offered Rate |

| MXN | Mexican peso |

| MYR | Malaysian ringgit |

| NOK | Norwegian krone |

| NZD | New Zealand dollar |

| PEN | Peruvian sol |

| PLN | Polish zloty |

| REIT | Real estate investment trust |

| RON | Romanian lei |

| RUB | Russian ruble |

| THB | Thai baht |

| ZAR | South African rand |

The accompanying notes are an integral part of these financial statements.

12 | Allspring International Bond Fund

Portfolio of investments—March 31, 2023 (unaudited)

Investments in affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were affiliates of the Fund at the end of the period were as follows:

| | Value,

beginning of

period | Purchases | Sales

proceeds | Net

realized

gains

(losses) | Net

change in

unrealized

gains

(losses) | Value,

end of

period | Shares,

end

of period | Income

from

affiliated

securities |

| Short-term investments | | | | | | | |

| Allspring Government Money Market Fund Select Class | $831,989 | $10,059,291 | $(10,101,181) | $0 | $0 | $790,099 | 790,099 | $16,737 |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 13

Portfolio of investments—March 31, 2023 (unaudited)

Forward foreign currency contracts

Currency to be

received | Currency to be

delivered | Counterparty | Settlement

date | Unrealized

gains | Unrealized

losses |

| 3,640,323 USD | 5,380,000 AUD | State Street Bank & Trust Company | 6-6-2023 | $ 35,883 | $ 0 |

| 502,100 USD | 465,000 EUR | State Street Bank & Trust Company | 4-11-2023 | 0 | (2,384) |

| 100,000 EUR | 106,057 USD | State Street Bank & Trust Company | 4-11-2023 | 2,434 | 0 |

| 2,235,199 USD | 1,845,000 GBP | State Street Bank & Trust Company | 5-17-2023 | 0 | (42,796) |

| 177,407 USD | 68,000,000 HUF | State Street Bank & Trust Company | 4-11-2023 | 0 | (16,223) |

| 1,095,747 USD | 420,000,000 HUF | State Street Bank & Trust Company | 4-11-2023 | 0 | (100,201) |

| 135,848 USD | 51,000,000 HUF | State Street Bank & Trust Company | 4-11-2023 | 0 | (9,374) |

| 183,000,000 HUF | 495,989 USD | State Street Bank & Trust Company | 4-11-2023 | 25,103 | 0 |

| 288,000,000 HUF | 784,934 USD | State Street Bank & Trust Company | 4-11-2023 | 35,145 | 0 |

| 100,000,000 HUF | 280,371 USD | State Street Bank & Trust Company | 4-11-2023 | 4,378 | 0 |

| 850,449 USD | 13,250,000,000 IDR | State Street Bank & Trust Company | 4-12-2023 | 0 | (32,994) |

| 1,088,676 USD | 1,500,000 CAD | State Street Bank & Trust Company | 6-12-2023 | 0 | (22,439) |

| 475,686 USD | 7,190,000,000 IDR | State Street Bank & Trust Company | 4-12-2023 | 0 | (3,706) |

| 1,480,000,000 JPY | 11,375,646 USD | State Street Bank & Trust Company | 6-30-2023 | 0 | (86,214) |

| 1,266,024 USD | 1,590,000,000 KRW | State Street Bank & Trust Company | 5-8-2023 | 42,065 | 0 |

| 827,620 USD | 15,875,000 MXN | State Street Bank & Trust Company | 4-25-2023 | 0 | (49,734) |

| 281,521 USD | 5,400,000 MXN | State Street Bank & Trust Company | 4-25-2023 | 0 | (16,917) |

| 437,605 USD | 8,225,000 MXN | State Street Bank & Trust Company | 4-25-2023 | 0 | (16,961) |

| 400,000 MYR | 89,586 USD | State Street Bank & Trust Company | 6-1-2023 | 1,406 | 0 |

| 1,249,883 USD | 13,300,000 NOK | State Street Bank & Trust Company | 5-15-2023 | 0 | (22,841) |

| 28,214 USD | 300,000 NOK | State Street Bank & Trust Company | 5-15-2023 | 0 | (494) |

| 1,308,668 USD | 2,100,000 NZD | State Street Bank & Trust Company | 6-6-2023 | 0 | (4,532) |

| 51,400,000 CNY | 7,624,416 USD | State Street Bank & Trust Company | 5-15-2023 | 0 | (118,683) |

| 639,534 USD | 2,885,000 PLN | State Street Bank & Trust Company | 5-30-2023 | 0 | (26,532) |

| 987,368 USD | 34,000,000 THB | State Street Bank & Trust Company | 4-27-2023 | 0 | (9,398) |

| 16,900,000 THB | 498,672 USD | State Street Bank & Trust Company | 6-30-2023 | 0 | (134) |

| 1,100,000 TRY | 55,708 USD | State Street Bank & Trust Company | 4-26-2023 | 96 | 0 |

The accompanying notes are an integral part of these financial statements.

14 | Allspring International Bond Fund

Portfolio of investments—March 31, 2023 (unaudited)

Forward foreign currency contracts (continued)

Currency to be

received | Currency to be

delivered | Counterparty | Settlement

date | Unrealized

gains | | Unrealized

losses |

| 270,385 USD | 4,700,000 ZAR | State Street Bank & Trust Company | 4-28-2023 | $ 6,977 | | $ 0 |

| 498,586 USD | 9,130,000 ZAR | State Street Bank & Trust Company | 4-28-2023 | 0 | | (13,100) |

| 49,742 USD | 900,000 ZAR | State Street Bank & Trust Company | 4-28-2023 | 0 | | (698) |

| 123,579 USD | 2,750,000 CZK | State Street Bank & Trust Company | 4-24-2023 | 0 | | (3,365) |

| 1,505,415 USD | 33,500,000 CZK | State Street Bank & Trust Company | 4-24-2023 | 0 | | (40,994) |

| 11,400,000 CZK | 515,884 USD | State Street Bank & Trust Company | 4-24-2023 | 10,357 | | 0 |

| 3,580,000 EUR | 3,822,316 USD | State Street Bank & Trust Company | 4-11-2023 | 61,672 | | 0 |

| 210,000 EUR | 228,699 USD | State Street Bank & Trust Company | 4-11-2023 | 0 | | (868) |

| 590,308 USD | 550,000 EUR | State Street Bank & Trust Company | 4-11-2023 | 0 | | (6,394) |

| | | | | $225,516 | | $(647,976) |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 15

Statement of assets and liabilities—March 31, 2023 (unaudited)

| | |

| Assets | |

Investments in unaffiliated securities, at value (cost $65,141,803)

| $ 56,085,391 |

Investments in affiliated securities, at value (cost $790,099)

| 790,099 |

Cash

| 2,210 |

Foreign currency, at value (cost $20,236)

| 20,305 |

Receivable for investments sold

| 997,915 |

Receivable for interest

| 582,154 |

Unrealized gains on forward foreign currency contracts

| 225,516 |

Receivable for Fund shares sold

| 103,511 |

Prepaid expenses and other assets

| 100,273 |

Total assets

| 58,907,374 |

| Liabilities | |

Payable for investments purchased

| 1,038,162 |

Unrealized losses on forward foreign currency contracts

| 647,976 |

Payable for Fund shares redeemed

| 15,447 |

Administration fees payable

| 4,407 |

Management fee payable

| 4,393 |

Trustees’ fees and expenses payable

| 365 |

Distribution fee payable

| 96 |

Total liabilities

| 1,710,846 |

Total net assets

| $ 57,196,528 |

| Net assets consist of | |

Paid-in capital

| $ 95,627,567 |

Total distributable loss

| (38,431,039) |

Total net assets

| $ 57,196,528 |

| Computation of net asset value and offering price per share | |

Net assets – Class A

| $ 4,540,452 |

Shares outstanding – Class A1

| 548,130 |

Net asset value per share – Class A

| $8.28 |

Maximum offering price per share – Class A2

| $8.67 |

Net assets – Class C

| $ 145,009 |

Shares outstanding – Class C1

| 18,561 |

Net asset value per share – Class C

| $7.81 |

Net assets – Class R6

| $ 1,145,154 |

Shares outstanding – Class R61

| 134,178 |

Net asset value per share – Class R6

| $8.53 |

Net assets – Administrator Class

| $ 3,696,749 |

Shares outstanding – Administrator Class1

| 440,985 |

Net asset value per share – Administrator Class

| $8.38 |

Net assets – Institutional Class

| $ 47,669,164 |

Shares outstanding – Institutional Class1

| 5,612,300 |

Net asset value per share – Institutional Class

| $8.49 |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/95.50 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

16 | Allspring International Bond Fund

Statement of operations—six months ended March 31, 2023 (unaudited)

| | |

| Investment income | |

Interest (net of foreign withholding taxes of $27,488)

| $ 1,100,425 |

Income from affiliated securities

| 16,737 |

Total investment income

| 1,117,162 |

| Expenses | |

Management fee

| 197,007 |

| Administration fees | |

Class A

| 3,683 |

Class C

| 118 |

Class R6

| 187 |

Administrator Class

| 6,038 |

Institutional Class

| 19,038 |

| Shareholder servicing fees | |

Class A

| 5,744 |

Class C

| 184 |

Administrator Class

| 15,067 |

| Distribution fee | |

Class C

| 551 |

Custody and accounting fees

| 28,701 |

Professional fees

| 32,674 |

Registration fees

| 41,138 |

Shareholder report expenses

| 20,607 |

Trustees’ fees and expenses

| 11,086 |

Other fees and expenses

| 12,920 |

Total expenses

| 394,743 |

| Less: Fee waivers and/or expense reimbursements | |

Fund-level

| (140,910) |

Class A

| (231) |

Administrator Class

| (4,238) |

Institutional Class

| (2,386) |

Net expenses

| 246,978 |

Net investment income

| 870,184 |

| Realized and unrealized gains (losses) on investments | |

| Net realized losses on | |

Unaffiliated securities

| (8,714,252) |

Forward foreign currency contracts

| (887,362) |

Net realized losses on investments

| (9,601,614) |

| Net change in unrealized gains (losses) on | |

Unaffiliated securities

| 16,085,001 |

Forward foreign currency contracts

| (407,309) |

Net change in unrealized gains (losses) on investments

| 15,677,692 |

Net realized and unrealized gains (losses) on investments

| 6,076,078 |

Net increase in net assets resulting from operations

| $ 6,946,262 |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 17

Statement of changes in net assets

| | | | | |

| | Six months ended

March 31, 2023

(unaudited) | Year ended

September 30, 2022 |

| Operations | | | | |

Net investment income

| | $ 870,184 | | $ 2,235,938 |

Net realized losses on investments

| | (9,601,614) | | (19,305,584) |

Net change in unrealized gains (losses) on investments

| | 15,677,692 | | (21,066,278) |

Net increase (decrease) in net assets resulting from operations

| | 6,946,262 | | (38,135,924) |

| Distributions to shareholders from | | | | |

| Net investment income and net realized gains | | | | |

Class A

| | 0 | | (10,524) |

Class R6

| | 0 | | (9,965) |

Administrator Class

| | 0 | | (67,210) |

Institutional Class

| | 0 | | (245,781) |

Total distributions to shareholders

| | 0 | | (333,480) |

| Capital share transactions | Shares | | Shares | |

| Proceeds from shares sold | | | | |

Class A

| 20,144 | 161,689 | 32,938 | 316,163 |

Class C

| 98 | 751 | 372 | 3,552 |

Class R6

| 751 | 6,200 | 87,313 | 957,617 |

Administrator Class

| 94,173 | 749,353 | 574,161 | 5,502,525 |

Institutional Class

| 606,507 | 5,036,657 | 2,126,667 | 21,193,712 |

| | | 5,954,650 | | 27,973,569 |

| Reinvestment of distributions | | | | |

Class A

| 0 | 0 | 930 | 9,909 |

Class R6

| 0 | 0 | 300 | 3,281 |

Administrator Class

| 0 | 0 | 4,433 | 47,744 |

Institutional Class

| 0 | 0 | 21,939 | 238,697 |

| | | 0 | | 299,631 |

| Payment for shares redeemed | | | | |

Class A

| (80,102) | (642,062) | (391,949) | (4,060,241) |

Class C

| (2,030) | (16,019) | (5,908) | (48,948) |

Class R6

| (44,340) | (361,877) | (149,383) | (1,428,129) |

Administrator Class

| (3,042,513) | (25,568,768) | (768,586) | (7,225,233) |

Institutional Class

| (1,019,896) | (8,466,916) | (4,414,997) | (42,373,569) |

| | | (35,055,642) | | (55,136,120) |

Net decrease in net assets resulting from capital share transactions

| | (29,100,992) | | (26,862,920) |

Total decrease in net assets

| | (22,154,730) | | (65,332,324) |

| Net assets | | | | |

Beginning of period

| | 79,351,258 | | 144,683,582 |

End of period

| | $ 57,196,528 | | $ 79,351,258 |

The accompanying notes are an integral part of these financial statements.

18 | Allspring International Bond Fund

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Class A | Six months ended

March 31, 2023

(unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period

| $7.62 | $10.86 | $11.08 | $10.45 | $9.69 | $10.31 |

Net investment income

| 0.10 1 | 0.16 1 | 0.10 1 | 0.18 1 | 0.32 1 | 0.27 1 |

Payment from affiliate

| 0.00 | 0.00 | 0.00 | 0.00 2 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments

| 0.56 | (3.38) | (0.24) | 0.45 | 0.44 | (0.89) |

Total from investment operations

| 0.66 | (3.22) | (0.14) | 0.63 | 0.76 | (0.62) |

| Distributions to shareholders from | | | | | | |

Net investment income

| 0.00 | (0.02) | (0.07) | 0.00 | 0.00 | 0.00 |

Tax basis return of capital

| 0.00 | 0.00 | (0.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| 0.00 | (0.02) | (0.08) | 0.00 | 0.00 | 0.00 |

Net asset value, end of period

| $8.28 | $7.62 | $10.86 | $11.08 | $10.45 | $9.69 |

Total return3

| 8.66% | (29.73)% | (1.30)% | 6.03% 4 | 7.84% | (6.01)% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.47% | 1.25% | 1.22% | 1.50% | 1.30% | 1.08% |

Net expenses

| 1.03% | 1.03% | 1.03% | 1.03% | 1.03% | 1.03% |

Net investment income

| 2.37% | 1.65% | 0.90% | 1.68% | 3.21% | 2.75% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 28% | 92% | 77% | 158% | 129% | 99% |

Net assets, end of period (000s omitted)

| $4,540 | $4,635 | $10,492 | $11,237 | $12,329 | $44,519 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Amount is less than $0.005. |

| 3 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 4 | During the year ended September 30, 2020, the Fund received a payment from an affiliate that had an impact of less than 0.005% on total return. |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 19

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Class C | Six months ended

March 31, 2023

(unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period

| $7.22 | $10.34 | $10.56 | $9.98 | $9.32 | $10.00 |

Net investment income

| 0.06 1 | 0.08 1 | 0.02 1 | 0.09 1 | 0.24 1 | 0.19 1 |

Payment from affiliate

| 0.00 | 0.00 | 0.00 | 0.06 | 0.00 | 0.00 |

Net realized and unrealized gains (losses) on investments

| 0.53 | (3.20) | (0.24) | 0.43 | 0.42 | (0.87) |

Total from investment operations

| 0.59 | (3.12) | (0.22) | 0.58 | 0.66 | (0.68) |

Net asset value, end of period

| $7.81 | $7.22 | $10.34 | $10.56 | $9.98 | $9.32 |

Total return2

| 8.17% | (30.17)% | (2.08)% | 5.81% 3 | 7.08% | (6.80)% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 2.21% | 2.00% | 1.98% | 2.25% | 2.04% | 1.83% |

Net expenses

| 1.78% | 1.78% | 1.78% | 1.78% | 1.78% | 1.78% |

Net investment income

| 1.61% | 0.91% | 0.16% | 0.94% | 2.51% | 2.00% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 28% | 92% | 77% | 158% | 129% | 99% |

Net assets, end of period (000s omitted)

| $145 | $148 | $269 | $704 | $1,027 | $2,652 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

| 3 | During the year ended September 30, 2020, the Fund received a payment from an affiliate which had a 0.58% impact on the total return. |

The accompanying notes are an integral part of these financial statements.

20 | Allspring International Bond Fund

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Class R6 | Six months ended

March 31, 2023

(unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period

| $7.84 | $11.14 | $11.36 | $10.68 | $9.86 | $10.45 |

Net investment income

| 0.11 1 | 0.20 1 | 0.15 1 | 0.23 1 | 0.37 1 | 0.31 1 |

Net realized and unrealized gains (losses) on investments

| 0.58 | (3.47) | (0.25) | 0.45 | 0.45 | (0.90) |

Total from investment operations

| 0.69 | (3.27) | (0.10) | 0.68 | 0.82 | (0.59) |

| Distributions to shareholders from | | | | | | |

Net investment income

| 0.00 | (0.03) | (0.11) | 0.00 | 0.00 | 0.00 |

Tax basis return of capital

| 0.00 | 0.00 | (0.01) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| 0.00 | (0.03) | (0.12) | 0.00 | 0.00 | 0.00 |

Net asset value, end of period

| $8.53 | $7.84 | $11.14 | $11.36 | $10.68 | $9.86 |

Total return2

| 8.80% | (29.42)% | (0.89)% | 6.37% | 8.32% | (5.65)% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.08% | 0.87% | 0.85% | 1.13% | 0.90% | 0.72% |

Net expenses

| 0.65% | 0.65% | 0.65% | 0.65% | 0.65% | 0.65% |

Net investment income

| 2.75% | 2.03% | 1.27% | 2.08% | 3.68% | 3.18% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 28% | 92% | 77% | 158% | 129% | 99% |

Net assets, end of period (000s omitted)

| $1,145 | $1,393 | $2,668 | $6,020 | $8,979 | $49,749 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 21

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Administrator Class | Six months ended

March 31, 2023

(unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period

| $7.72 | $10.98 | $11.19 | $10.53 | $9.75 | $10.36 |

Net investment income

| 0.10 1 | 0.18 1 | 0.12 1 | 0.20 1 | 0.34 1 | 0.29 1 |

Net realized and unrealized gains (losses) on investments

| 0.56 | (3.42) | (0.24) | 0.46 | 0.44 | (0.90) |

Total from investment operations

| 0.66 | (3.24) | (0.12) | 0.66 | 0.78 | (0.61) |

| Distributions to shareholders from | | | | | | |

Net investment income

| 0.00 | (0.02) | (0.07) | 0.00 | 0.00 | 0.00 |

Tax basis return of capital

| 0.00 | 0.00 | (0.02) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| 0.00 | (0.02) | (0.09) | 0.00 | 0.00 | 0.00 |

Net asset value, end of period

| $8.38 | $7.72 | $10.98 | $11.19 | $10.53 | $9.75 |

Total return2

| 8.55% | (29.56)% | (1.11)% | 6.27% | 8.00% | (5.89)% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.35% | 1.20% | 1.16% | 1.44% | 1.24% | 1.01% |

Net expenses

| 0.85% | 0.85% | 0.85% | 0.85% | 0.85% | 0.85% |

Net investment income

| 2.59% | 1.86% | 1.09% | 1.87% | 3.37% | 2.93% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 28% | 92% | 77% | 158% | 129% | 99% |

Net assets, end of period (000s omitted)

| $3,697 | $26,159 | $39,296 | $34,221 | $18,213 | $27,911 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

22 | Allspring International Bond Fund

Financial highlights

(For a share outstanding throughout each period)

| | | Year ended September 30 |

| Institutional Class | Six months ended

March 31, 2023

(unaudited) | 2022 | 2021 | 2020 | 2019 | 2018 |

Net asset value, beginning of period

| $7.80 | $11.09 | $11.31 | $10.64 | $9.83 | $10.43 |

Net investment income

| 0.11 1 | 0.19 1 | 0.14 1 | 0.22 1 | 0.37 1 | 0.31 1 |

Net realized and unrealized gains (losses) on investments

| 0.58 | (3.45) | (0.24) | 0.45 | 0.44 | (0.91) |

Total from investment operations

| 0.69 | (3.26) | (0.10) | 0.67 | 0.81 | (0.60) |

| Distributions to shareholders from | | | | | | |

Net investment income

| 0.00 | (0.03) | (0.09) | 0.00 | 0.00 | 0.00 |

Tax basis return of capital

| 0.00 | 0.00 | (0.03) | 0.00 | 0.00 | 0.00 |

Total distributions to shareholders

| 0.00 | (0.03) | (0.12) | 0.00 | 0.00 | 0.00 |

Net asset value, end of period

| $8.49 | $7.80 | $11.09 | $11.31 | $10.64 | $9.83 |

Total return2

| 8.85% | (29.48)% | (0.93)% | 6.30% | 8.24% | (5.75)% |

| Ratios to average net assets (annualized) | | | | | | |

Gross expenses

| 1.14% | 0.92% | 0.89% | 1.17% | 0.95% | 0.74% |

Net expenses

| 0.70% | 0.70% | 0.70% | 0.70% | 0.70% | 0.70% |

Net investment income

| 2.69% | 1.96% | 1.23% | 2.04% | 3.61% | 3.06% |

| Supplemental data | | | | | | |

Portfolio turnover rate

| 28% | 92% | 77% | 158% | 129% | 99% |

Net assets, end of period (000s omitted)

| $47,669 | $47,016 | $91,959 | $57,264 | $77,727 | $245,633 |

| 1 | Calculated based upon average shares outstanding |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

Allspring International Bond Fund | 23

Notes to financial statements (unaudited)

1. ORGANIZATION

Allspring Funds Trust (the "Trust"), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Allspring International Bond Fund (the "Fund") which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Debt securities are valued at the evaluated bid price provided by an independent pricing service (e.g. taking into account various factors, including yields, maturities, or credit ratings) or, if a reliable price is not available, the quoted bid price from an independent broker-dealer.

The values of securities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Valuation Committee established by Allspring Funds Management, LLC ("Allspring Funds Management").

Forward foreign currency contracts are recorded at the forward rate provided by an independent foreign currency pricing source at a time each business day specified by the Valuation Committee.

Investments in registered open-end investment companies (other than those listed on a foreign or domestic exchange or market) are valued at net asset value.

Investments which are not valued using the methods discussed above are valued at their fair value, as determined in good faith by Allspring Funds Management, which was named the valuation designee by the Board of Trustees. As the valuation designee, Allspring Funds Management is responsible for day-to-day valuation activities for the Allspring Funds. In connection with these responsibilities, Allspring Funds Management has established a Valuation Committee and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities. On a quarterly basis, the Board of Trustees receives reports of valuation actions taken by the Valuation Committee. On at least an annual basis, the Board of Trustees receives an assessment of the adequacy and effectiveness of Allspring Funds Management's process for determining the fair value of the portfolio of investments.

Foreign currency translation

The accounting records of the Fund are maintained in U.S. dollars. The values of other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Valuation Committee. Purchases and sales of securities, and income and expenses are converted at the rate of exchange on the respective dates of such transactions. Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting from changes in exchange rates. The changes in net assets arising from changes in exchange rates of securities and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are included in net realized and unrealized gains or losses from investments.

Forward foreign currency contracts

A forward foreign currency contract is an agreement between two parties to purchase or sell a specific currency for an agreed-upon price at a future date. The Fund enters into forward foreign currency contracts to facilitate transactions in foreign-denominated securities and to attempt to minimize the risk to the Fund from adverse changes in the relationship between

24 | Allspring International Bond Fund

Notes to financial statements (unaudited)

currencies. Forward foreign currency contracts are recorded at the forward rate and marked-to-market daily. When the contracts are closed, realized gains and losses arising from such transactions are recorded as realized gains or losses on forward foreign currency contracts. The Fund is subject to foreign currency risk and may be exposed to risks if the counterparties to the contracts are unable to meet the terms of their contracts or if the value of the foreign currency changes unfavorably. The Fund's maximum risk of loss from counterparty credit risk is the unrealized gains on the contracts. This risk may be mitigated if there is a master netting arrangement between the Fund and the counterparty.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has been determined to be doubtful based on consistently applied procedures and the fair value has decreased. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status. Interest income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-dividend date and paid from net investment income quarterly and any net realized gains are paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund's fiscal year end. Therefore, a portion of the Fund's distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund's tax positions taken on federal, state, and foreign tax returns, as applicable, for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of March 31, 2023, the aggregate cost of all investments for federal income tax purposes was $64,489,213 and the unrealized gains (losses) consisted of:

| Gross unrealized gains | $ 696,517 |

| Gross unrealized losses | (8,732,700) |

| Net unrealized losses | $(8,036,183) |

As of September 30, 2022, the Fund had capital loss carryforwards which consisted of $6,089,338 in short-term capital losses and $4,425,206 in long-term capital losses.

As of September 30, 2022, the Fund had a qualified late-year ordinary loss of $7,671,337 which was recognized on the first day of the current fiscal year.

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common fund-level expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

Allspring International Bond Fund | 25

Notes to financial statements (unaudited)

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Fund’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ■ | Level 1 – quoted prices in active markets for identical securities |

| ■ | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ■ | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of March 31, 2023:

| | Quoted prices

(Level 1) | Other significant

observable inputs

(Level 2) | Significant

unobservable inputs

(Level 3) | Total |

| Assets | | | | |

| Investments in: | | | | |

| Corporate bonds and notes | $ 0 | $ 2,401,670 | $0 | $ 2,401,670 |

| Foreign corporate bonds and notes | 0 | 5,465,047 | 0 | 5,465,047 |

| Foreign government bonds | 0 | 44,624,690 | 0 | 44,624,690 |

| U.S. Treasury securities | 3,593,984 | 0 | 0 | 3,593,984 |

| Short-term investments | | | | |

| Investment companies | 790,099 | 0 | 0 | 790,099 |

| | 4,384,083 | 52,491,407 | 0 | 56,875,490 |

| Forward foreign currency contracts | 0 | 225,516 | 0 | 225,516 |

| Total assets | $4,384,083 | $52,716,923 | $0 | $57,101,006 |

| Liabilities | | | | |

| Forward foreign currency contracts | $ 0 | $ 647,976 | $0 | $ 647,976 |

| Total liabilities | $ 0 | $ 647,976 | $0 | $ 647,976 |

Forward foreign currency contracts are reported at their cumulative unrealized gains (losses) at measurement date as reported in the table following the Portfolio of Investments. All other assets and liabilities are reported at their market value at measurement date.

Additional sector, industry or geographic detail, if any, is included in the Portfolio of Investments.

For the six months ended March 31, 2023, the Fund did not have any transfers into/out of Level 3.

4. TRANSACTIONS WITH AFFILIATES

Management fee

Allspring Funds Management, a wholly owned subsidiary of Allspring Global Investments Holdings, LLC, a holding company indirectly owned by certain private funds of GTCR LLC and Reverence Capital Partners, L.P., is the manager of the Fund and provides advisory and fund-level administrative services under an investment management agreement. Under the investment management agreement, Allspring Funds Management is responsible for, among other services, implementing the investment objectives and strategies of the Fund, supervising the subadviser and providing fund-level administrative services in connection with the Fund’s operations. As compensation for its services under the investment management agreement, Allspring Funds Management is entitled to receive a management fee at the following annual rate based on the Fund’s average daily net assets:

26 | Allspring International Bond Fund

Notes to financial statements (unaudited)

| Average daily net assets | Management fee |

| First $500 million | 0.600% |

| Next $500 million | 0.575 |

| Next $2 billion | 0.550 |

| Next $2 billion | 0.525 |

| Next $5 billion | 0.490 |

| Over $10 billion | 0.480 |

For the six months ended March 31, 2023, the management fee was equivalent to an annual rate of 0.60% of the Fund’s average daily net assets.

Allspring Funds Management has retained the services of a subadviser to provide daily portfolio management to the Fund. The fee for subadvisory services is borne by Allspring Funds Management. Allspring Global Investments (UK) Limited, an affiliate of Allspring Funds Management and a wholly owned subsidiary of Allspring Global Investments Holdings, LLC, is the subadviser to the Fund and is entitled to receive a fee from Allspring Funds Management at an annual rate starting at 0.35% and declining to 0.20% as the average daily net assets of the Fund increase.

Administration fees

Under a class-level administration agreement, Allspring Funds Management provides class-level administrative services to the Fund, which includes paying fees and expenses for services provided by the transfer agent, sub-transfer agents, omnibus account servicers and record-keepers. As compensation for its services under the class-level administration agreement, Allspring Funds Management receives an annual fee which is calculated based on the average daily net assets of each class as follows:

| | Class-level

administration fee |

| Class A | 0.16% |

| Class C | 0.16 |

| Class R6 | 0.03 |

| Administrator Class | 0.10 |

| Institutional Class | 0.08 |

Waivers and/or expense reimbursements

Allspring Funds Management has contractually committed to waive and/or reimburse management and administration fees to the extent necessary to maintain certain net operating expense ratios for the Fund. When each class of the Fund has exceeded its expense cap, Allspring Funds Management will waive fees and/or reimburse expenses from fund-level expenses on a proportionate basis and then from class specific expenses. When only certain classes exceed their expense caps, waivers and/or reimbursements are applied against class specific expenses before fund-level expenses. Allspring Funds Management has contractually committed through January 31, 2024 to waive fees and/or reimburse expenses to the extent necessary to cap expenses. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. As of March 31, 2023, the contractual expense caps are as follows:

| | Expense ratio caps |

| Class A | 1.03% |

| Class C | 1.78 |

| Class R6 | 0.65 |

| Administrator Class | 0.85 |

| Institutional Class | 0.70 |

Allspring International Bond Fund | 27

Notes to financial statements (unaudited)

Distribution fee

The Trust has adopted a distribution plan for Class C shares pursuant to Rule 12b-1 under the 1940 Act. A distribution fee is charged to Class C shares and paid to Allspring Funds Distributor, LLC ("Allspring Funds Distributor"), the principal underwriter, an affiliate of Allspring Funds Management, at an annual rate up to 0.75% of the average daily net assets of Class C shares.

In addition, Allspring Funds Distributor is entitled to receive the front-end sales charge from the purchase of Class A shares and a contingent deferred sales charge on the redemption of certain Class A shares. Allspring Funds Distributor is also entitled to receive the contingent deferred sales charges from redemptions of Class C shares. For the six months ended March 31, 2023, Allspring Funds Distributor received $66 from the sale of Class A shares. No contingent deferred sales charges were incurred by Class A and Class C shares for the six months ended March 31, 2023.

Shareholder servicing fees

The Trust has entered into contracts with one or more shareholder servicing agents, whereby Class A, Class C and Administrator Class are charged a fee at an annual rate up to 0.25% of the average daily net assets of each respective class. A portion of these total shareholder servicing fees were paid to affiliates of the Fund.

Interfund transactions

The Fund may purchase or sell portfolio investment securities to certain affiliates pursuant to Rule 17a-7 under the 1940 Act and under procedures adopted by the Board of Trustees. The procedures have been designed to ensure that these interfund transactions, which do not incur broker commissions, are effected at current market prices.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding short-term securities, for the six months ended March 31, 2023 were as follows:

| Purchases at cost | | Sales proceeds |

U.S.

government | Non-U.S.

government | | U.S.

government | Non-U.S.

government |

| $4,481,295 | $14,000,966 | | $982,046 | $45,764,299 |

6. DERIVATIVE TRANSACTIONS

During the six months ended March 31, 2023, the Fund entered into forward foreign currency contracts for economic hedging purposes. The Fund had average contract amounts of $35,170,765 in forward foreign currency contracts to buy and $31,854,969 in forward foreign currency contracts to sell during the six months ended March 31, 2023.

The fair value, realized gains or losses and change in unrealized gains or losses, if any, on derivative instruments are reflected in the corresponding financial statement captions.

For certain types of derivative transactions, the Fund has entered into International Swaps and Derivatives Association, Inc. master agreements (“ISDA Master Agreements”) or similar agreements with approved counterparties. The ISDA Master Agreements or similar agreements may have requirements to deliver/deposit securities or cash to/with an exchange or broker-dealer as collateral and allows the Fund to offset, with each counterparty, certain derivative financial instrument’s assets and/or liabilities with collateral held or pledged. Collateral requirements differ by type of derivative. Collateral or margin requirements are set by the broker or exchange clearinghouse for exchange traded derivatives while collateral terms are contract specific for over-the-counter traded derivatives. Cash collateral that has been pledged to cover obligations of the Fund under ISDA Master Agreements or similar agreements, if any, are reported separately in the Statement of Assets and Liabilities. Securities pledged as collateral, if any, are noted in the Portfolio of Investments. With respect to balance sheet offsetting, absent an event of default by the counterparty or a termination of the agreement, the reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities are not offset across transactions between the Fund and the applicable counterparty. A reconciliation of the gross amounts on the Statement of Assets and Liabilities to the net amounts by counterparty, including any collateral exposure, for OTC derivatives is as follows:

28 | Allspring International Bond Fund

Notes to financial statements (unaudited)

| Counterparty | Gross amounts

of assets in the

Statement of