UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09689

Wells Fargo Master Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: February 28

Registrant is making a filing for 11 of its series:

Wells Fargo Bloomberg Barclays U.S. Aggregate ex-Corporate Credit Portfolio, Wells Fargo Emerging Markets Bond Portfolio, Wells Fargo Factor Enhanced Emerging Markets Portfolio, Wells Fargo Factor Enhanced International Portfolio, Wells Fargo Factor Enhanced Large Cap Portfolio, Wells Fargo Factor Enhanced Small Cap Portfolio, Wells Fargo High Yield Corporate Bond Portfolio, Wells Fargo Investment Grade Corporate Bond Portfolio, Wells Fargo Strategic Retirement Bond Portfolio, Wells Fargo U.S. REIT Portfolio, and Wells Fargo International Government Bond Portfolio.

Date of reporting period: August 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

August 31, 2017

Target Date Funds

| ∎ | | Wells Fargo Target Today Fund (formerly Wells Fargo Dow Jones Target Today Fund) |

| ∎ | | Wells Fargo Target 2010 Fund (formerly Wells Fargo Dow Jones Target 2010 Fund) |

| ∎ | | Wells Fargo Target 2015 Fund (formerly Wells Fargo Dow Jones Target 2015 Fund) |

| ∎ | | Wells Fargo Target 2020 Fund (formerly Wells Fargo Dow Jones Target 2020 Fund) |

| ∎ | | Wells Fargo Target 2025 Fund (formerly Wells Fargo Dow Jones Target 2025 Fund) |

| ∎ | | Wells Fargo Target 2030 Fund (formerly Wells Fargo Dow Jones Target 2030 Fund) |

| ∎ | | Wells Fargo Target 2035 Fund (formerly Wells Fargo Dow Jones Target 2035 Fund) |

| ∎ | | Wells Fargo Target 2040 Fund (formerly Wells Fargo Dow Jones Target 2040 Fund) |

| ∎ | | Wells Fargo Target 2045 Fund (formerly Wells Fargo Dow Jones Target 2045 Fund) |

| ∎ | | Wells Fargo Target 2050 Fund (formerly Wells Fargo Dow Jones Target 2050 Fund) |

| ∎ | | Wells Fargo Target 2055 Fund (formerly Wells Fargo Dow Jones Target 2055 Fund) |

| ∎ | | Wells Fargo Target 2060 Fund (formerly Wells Fargo Dow Jones Target 2060 Fund) |

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

Dow Jones® and Dow Jones Target Date IndexesSM are service marks of Dow Jones Trademark Holdings LLC (Dow Jones); have been licensed to CME Group Index Services LLC (CME Indexes); and have been sublicensed for use for certain purposes by Wells Fargo Funds Management, LLC. The Wells Fargo Target Date Funds are not sponsored, endorsed, sold, or promoted by Dow Jones, CME Indexes, or their respective affiliates, and none of them makes any representation regarding the advisability of investing in such product(s).

The views expressed and any forward-looking statements are as of August 31, 2017, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Target Date Funds | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

Hiring remained strong, and business and consumer sentiment improved.

During the second quarter, most equity markets in the U.S. and abroad advanced.

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Target Date Funds for the six-month period that ended August 31, 2017. Effective July 14, 2017, the Wells Fargo Target Date Funds, following a vote of the Wells Fargo Funds Board of Trustees, approved several enhancements to the Wells Fargo Dow Jones Target Date Funds. Despite heightened market volatility at times, in general, global stocks delivered double-digit results and bond markets had smaller, but positive, results as well. U.S. and international stocks returned 5.65% and 13.05%, respectively, for the six-month period, as measured by the S&P 500 Index1 and the MSCI ACWI ex USA Index (Net)2; within fixed income, the Bloomberg Barclays U.S. Aggregate Bond Index3 returned 2.74% and the Bloomberg Barclays Municipal Bond Index4 returned 3.79% as interest rates rose from low levels.

Equity and bond markets advanced during the first half of 2017.

Stocks rallied globally through the first quarter of 2017, supported by signs of improvement in the U.S. and global economies. U.S. economic data released during the quarter reflected a healthy economy. Hiring remained strong, and business and consumer sentiment improved. In March, U.S. Federal Reserve (Fed) officials raised their target interest rate by a quarter percentage point to a range of 0.75% to 1.00%. With the Fed’s target interest-rate increase, short-term bond yields rose during the quarter. Meanwhile, longer-term Treasury yields were little changed, leading to positive performance. Investment-grade and high-yield bonds benefited from strong demand. Municipal bond returns were positive in the quarter, helped by strong demand and constrained new-issue supply. Stocks in emerging markets generally outperformed stocks in the U.S. and international developed markets because they benefited from both global economic growth and recent weakening in the U.S. dollar. Stocks in Asia, Europe, and Latin America also outperformed the U.S. market during the quarter.

During the second quarter, most equity markets in the U.S. and abroad advanced. Steady, albeit modest, economic growth both in the U.S. and abroad and generally favorable corporate earnings announcements after the second quarter supported higher valuations. Within the economy, U.S. inflation trended lower despite the unemployment rate continuing to decline. Ten-year U.S. Treasury yields declined, resulting in stronger prices for long-term bonds. As was widely expected, in June, the Fed raised the target interest rate by a quarter percentage point to a range of 1.00% to 1.25%. In addition, the Fed indicated that it would begin to sell bonds accumulated on its balance sheet during quantitative easing programs conducted since 2008, likely beginning later this year.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 5 | The Chicago Board Options Exchange Market Volatility Index (CBOE VIX) is a popular measure of the implied volatility of S&P 500 Index options. It represents one measure of the market’s expectation of stock market volatility over the next 30-day period. You cannot invest directly in an index. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Target Date Funds | | | 3 | |

Volatility increased during the third quarter of 2017.

Early in July and again in August, volatility expectations increased and then receded, as measured by the CBOE VIX5, amid geopolitical tensions, particularly in Asia, and declining investor optimism about President Trump’s potential to move forward with his agenda for tax and regulatory reforms. Economic momentum increased in Europe; the European Central Bank held its rates steady at low levels and continued its quantitative easing bond buying program, which is intended to spark economic activity. In emerging markets, many countries benefited from stronger currencies versus the U.S. dollar.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222. We are available 24 hours a day, 7 days a week.

| | | | |

| 4 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Wells Fargo Target Date Funds1

Investment objective

Each Fund seeks total return over time, consistent with its strategic target asset allocation.

Manager

Wells Fargo Funds Management, LLC

Subadviser‡

Wells Fargo Capital Management Incorporated

Portfolio managers‡

Kandarp R. Acharya, CFA®, FRM

Petros Bocray, CFA®, FRM

Christian L. Chan, CFA®

The target date represents the year in which investors may likely begin withdrawing assets. The Funds gradually seek to reduce market risk as the target date approaches and after it arrives by decreasing equity exposure and increasing fixed income exposure. The principal value is not guaranteed at any time, including at the target date.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Funds. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the Funds and its share price can be sudden and unpredictable. High-yield securities have a greater risk of default and tend to be more volatile than higher-rated debt securities. The use of derivatives may reduce returns and/or increase volatility. Securities issued by U.S. government agencies or government sponsored entities may not be guaranteed by the U.S. Treasury. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Funds are exposed to foreign investment risk, mortgage- and asset-backed securities risk, new fund risk, regulatory risk, and smaller-company investment risk. Consult the Funds’ prospectus for additional information on these and other risks.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 5 | |

Target Today Fund

Average annual total returns (%) as of August 31, 20172

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios3 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STWRX) | | 3-1-1994 | | | (4.61 | ) | | | 0.56 | | | | 2.58 | | | | 1.17 | | | | 1.75 | | | | 3.19 | | | | 0.75 | | | | 0.65 | |

| Class C (WFODX) | | 12-1-1998 | | | (0.58 | ) | | | 1.00 | | | | 2.42 | | | | 0.42 | | | | 1.00 | | | | 2.42 | | | | 1.50 | | | | 1.40 | |

| Class R (WFRRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 1.01 | | | | 1.53 | | | | 3.06 | | | | 1.00 | | | | 0.90 | |

| Class R4 (WOTRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 1.16 | | | | 2.08 | | | | 3.61 | | | | 0.47 | | | | 0.34 | |

| Class R6 (WOTDX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 1.63 | | | | 2.27 | | | | 3.71 | | | | 0.32 | | | | 0.19 | |

| Administrator Class (WFLOX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 1.33 | | | | 1.91 | | | | 3.37 | | | | 0.67 | | | | 0.54 | |

| Wells Fargo Target Today Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target Today Index8 | | – | | | – | | | | – | | | | – | | | | 1.88 | | | | 2.55 | | | | 4.10 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | |

| 6 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Target 2010 Fund

Average annual total returns (%) as of August 31, 201710

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios11 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STNRX) | | 3-1-1994 | | | (4.61 | ) | | | 1.06 | | | | 2.44 | | | | 1.18 | | | | 2.27 | | | | 3.05 | | | | 0.78 | | | | 0.65 | |

| Class C (WFOCX) | | 12-1-1998 | | | (0.61 | ) | | | 1.50 | | | | 2.28 | | | | 0.39 | | | | 1.50 | | | | 2.28 | | | | 1.53 | | | | 1.40 | |

| Class R (WFARX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 0.90 | | | | 2.02 | | | | 2.90 | | | | 1.03 | | | | 0.90 | |

| Class R4 (WFORX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 1.50 | | | | 2.64 | | | | 3.50 | | | | 0.50 | | | | 0.34 | |

| Class R6 (WFOAX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 1.68 | | | | 2.77 | | | | 3.57 | | | | 0.35 | | | | 0.19 | |

| Administrator Class (WFLGX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 1.30 | | | | 2.42 | | | | 3.24 | | | | 0.70 | | | | 0.54 | |

| Wells Fargo Target 2010 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2010 Index8 | | – | | | – | | | | – | | | | – | | | | 1.96 | | | | 3.11 | | | | 4.00 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 7 | |

Target 2015 Fund

Average annual total returns (%) as of August 31, 201712

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios11 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (WFACX) | | 11-30-2012 | | | (4.33 | ) | | | 2.10 | | | | 2.72 | | | | 1.51 | | | | 3.31 | | | | 3.33 | | | | 0.76 | | | | 0.65 | |

| Class R (WFBRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 1.27 | | | | 3.03 | | | | 3.09 | | | | 1.01 | | | | 0.90 | |

| Class R4 (WFSRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 1.82 | | | | 3.65 | | | | 3.64 | | | | 0.48 | | | | 0.34 | |

| Class R6 (WFSCX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 1.91 | | | | 3.76 | | | | 3.70 | | | | 0.33 | | | | 0.19 | |

| Administrator Class (WFFFX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 1.76 | | | | 3.43 | | | | 3.39 | | | | 0.68 | | | | 0.54 | |

| Wells Fargo Target 2015 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2015 Index8 | | – | | | – | | | | – | | | | – | | | | 2.63 | | | | 4.20 | | | | 4.15 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | |

| 8 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Target 2020 Fund

Average annual total returns (%) as of August 31, 20172

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios13 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STTRX) | | 3-1-1994 | | | (2.68 | ) | | | 3.30 | | | | 2.85 | | | | 3.26 | | | | 4.53 | | | | 3.46 | | | | 0.75 | | | | 0.65 | |

| Class C (WFLAX) | | 12-1-1998 | | | 1.41 | | | | 3.74 | | | | 2.68 | | | | 2.41 | | | | 3.74 | | | | 2.68 | | | | 1.50 | | | | 1.40 | |

| Class R (WFURX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 3.07 | | | | 4.32 | | | | 3.33 | | | | 1.00 | | | | 0.90 | |

| Class R4 (WFLRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 3.57 | | | | 4.90 | | | | 3.91 | | | | 0.47 | | | | 0.34 | |

| Class R6 (WFOBX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 3.67 | | | | 5.02 | | | | 3.97 | | | | 0.32 | | | | 0.19 | |

| Administrator Class (WFLPX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 3.33 | | | | 4.67 | | | | 3.64 | | | | 0.67 | | | | 0.54 | |

| Wells Fargo Target 2020 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2020 Index8 | | – | | | – | | | | – | | | | – | | | | 4.82 | | | | 5.56 | | | | 4.45 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 9 | |

Target 2025 Fund

Average annual total returns (%) as of August 31, 201712

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios11 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (WFAYX) | | 11-30-2012 | | | (0.91 | ) | | | 4.66 | | | | 3.39 | | | | 5.15 | | | | 5.91 | | | | 4.00 | | | | 0.74 | | | | 0.65 | |

| Class R (WFHRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 4.14 | | | | 5.48 | | | | 3.69 | | | | 0.99 | | | | 0.90 | |

| Class R4 (WFGRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 5.51 | | | | 6.28 | | | | 4.34 | | | | 0.46 | | | | 0.34 | |

| Class R6 (WFTYX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 5.72 | | | | 6.41 | | | | 4.40 | | | | 0.31 | | | | 0.19 | |

| Administrator Class (WFTRX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 5.38 | | | | 6.03 | | | | 4.08 | | | | 0.66 | | | | 0.54 | |

| Wells Fargo Target 2025 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2025 Index8 | | – | | | – | | | | – | | | | – | | | | 6.78 | | | | 6.91 | | | | 4.80 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | |

| 10 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Target 2030 Fund

Average annual total returns (%) as of August 31, 20172

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios13 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STHRX) | | 3-1-1994 | | | 1.54 | | | | 6.01 | | | | 3.60 | | | | 7.71 | | | | 7.27 | | | | 4.22 | | | | 0.75 | | | | 0.65 | |

| Class C (WFDMX) | | 12-1-1998 | | | 5.89 | | | | 6.48 | | | | 3.45 | | | | 6.89 | | | | 6.48 | | | | 3.45 | | | | 1.50 | | | | 1.40 | |

| Class R (WFJRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 7.26 | | | | 7.00 | | | | 4.06 | | | | 1.00 | | | | 0.90 | |

| Class R4 (WTHRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 8.06 | | | | 7.67 | | | | 4.68 | | | | 0.47 | | | | 0.34 | |

| Class R6 (WFOOX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 8.16 | | | | 7.79 | | | | 4.74 | | | | 0.32 | | | | 0.19 | |

| Administrator Class (WFLIX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 7.87 | | | | 7.42 | | | | 4.41 | | | | 0.67 | | | | 0.54 | |

| Wells Fargo Target 2030 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2030 Index8 | | – | | | – | | | | – | | | | – | | | | 9.21 | | | | 8.28 | | | | 5.16 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 11 | |

Target 2035 Fund

Average annual total returns (%) as of August 31, 201712

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios13 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (WFQBX) | | 11-30-2012 | | | 3.62 | | | | 7.17 | | | | 4.15 | | | | 9.92 | | | | 8.44 | | | | 4.77 | | | | 0.76 | | | | 0.65 | |

| Class R (WFKRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 9.62 | | | | 8.13 | | | | 4.48 | | | | 1.01 | | | | 0.90 | |

| Class R4 (WTTRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 10.24 | | | | 8.79 | | | | 5.09 | | | | 0.48 | | | | 0.34 | |

| Class R6 (WFQRX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 10.41 | | | | 8.93 | | | | 5.16 | | | | 0.33 | | | | 0.19 | |

| Administrator Class (WFQWX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 10.05 | | | | 8.54 | | | | 4.79 | | | | 0.68 | | | | 0.54 | |

| Wells Fargo Target 2035 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2035 Index8 | | – | | | – | | | | – | | | | – | | | | 11.38 | | | | 9.40 | | | | 5.47 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | |

| 12 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Target 2040 Fund

Average annual total returns (%) as of August 31, 20172

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios13 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (STFRX) | | 3-1-1994 | | | 5.34 | | | | 7.99 | | | | 4.24 | | | | 11.78 | | | | 9.29 | | | | 4.86 | | | | 0.75 | | | | 0.65 | |

| Class C (WFOFX) | | 7-1-1998 | | | 9.98 | | | | 8.47 | | | | 4.08 | | | | 10.98 | | | | 8.47 | | | | 4.08 | | | | 1.50 | | | | 1.40 | |

| Class R (WFMRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 11.56 | | | | 9.06 | | | | 4.73 | | | | 1.00 | | | | 0.90 | |

| Class R4 (WTFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 12.13 | | | | 9.67 | | | | 5.31 | | | | 0.47 | | | | 0.34 | |

| Class R6 (WFOSX) | | 6-30-2004 | | | – | | | | – | | | | – | | | | 12.28 | | | | 9.82 | | | | 5.39 | | | | 0.32 | | | | 0.19 | |

| Administrator Class (WFLWX) | | 11-8-1999 | | | – | | | | – | | | | – | | | | 11.92 | | | | 9.43 | | | | 5.05 | | | | 0.67 | | | | 0.54 | |

| Wells Fargo Target 2040 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2040 Index8 | | – | | | – | | | | – | | | | – | | | | 13.18 | | | | 10.26 | | | | 5.76 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 13 | |

Target 2045 Fund

Average annual total returns (%) as of August 31, 201712

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios13 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (WFQVX) | | 11-30-2012 | | | 6.51 | | | | 8.53 | | | | 4.69 | | | | 13.05 | | | | 9.81 | | | | 5.32 | | | | 0.77 | | | | 0.65 | |

| Class R (WFNRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 12.72 | | | | 9.53 | | | | 5.06 | | | | 1.02 | | | | 0.90 | |

| Class R4 (WFFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 13.42 | | | | 10.21 | | | | 5.66 | | | | 0.49 | | | | 0.34 | |

| Class R6 (WFQPX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.54 | | | | 10.32 | | | | 5.71 | | | | 0.34 | | | | 0.19 | |

| Administrator Class (WFQYX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.11 | | | | 9.92 | | | | 5.38 | | | | 0.69 | | | | 0.54 | |

| Wells Fargo Target 2045 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2045 Index8 | | – | | | – | | | | – | | | | – | | | | 14.41 | | | | 10.76 | | | | 5.99 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | |

| 14 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Target 2050 Fund

Average annual total returns (%) as of August 31, 201714

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios11 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net4 | |

| Class A (WFQAX) | | 11-30-2012 | | | 7.08 | | | | 8.66 | | | | 4.73 | | | | 13.56 | | | | 9.95 | | | | 5.36 | | | | 0.74 | | | | 0.65 | |

| Class C (WFQCX) | | 11-30-2012 | | | 11.72 | | | | 9.13 | | | | 4.57 | | | | 12.72 | | | | 9.13 | | | | 4.57 | | | | 1.49 | | | | 1.40 | |

| Class R (WFWRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 13.37 | | | | 9.68 | | | | 5.10 | | | | 0.99 | | | | 0.90 | |

| Class R4 (WQFRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 13.95 | | | | 10.32 | | | | 5.69 | | | | 0.46 | | | | 0.34 | |

| Class R6 (WFQFX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 14.14 | | | | 10.47 | | | | 5.76 | | | | 0.31 | | | | 0.19 | |

| Administrator Class (WFQDX) | | 6-29-2007 | | | – | | | | – | | | | – | | | | 13.75 | | | | 10.09 | | | | 5.41 | | | | 0.66 | | | | 0.54 | |

| Wells Fargo Target 2050 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 4.40 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 7.61 | | | | – | | | | – | |

| Dow Jones Global Target 2050 Index8 | | – | | | – | | | | – | | | | – | | | | 14.95 | | | | 10.89 | | | | 6.05 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 7.70 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 15 | |

Target 2055 Fund

Average annual total returns (%) as of August 31, 201712

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios11 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | Since

inception | | | 1 year | | | 5 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFQZX) | | 11-30-2012 | | | 7.00 | | | | 8.64 | | | | 6.90 | | | | 13.53 | | | | 9.94 | | | | 7.94 | | | | 0.80 | | | | 0.65 | |

| Class R (WFYRX) | | 6-28-2013 | | | – | | | | – | | | | – | | | | 13.15 | | | | 9.66 | | | | 7.56 | | | | 1.05 | | | | 0.90 | |

| Class R4 (WFVRX) | | 11-30-2012 | | | – | | | | – | | | | – | | | | 13.84 | | | | 10.31 | | | | 8.30 | | | | 0.52 | | | | 0.34 | |

| Class R6 (WFQUX) | | 6-30-2011 | | | – | | | | – | | | | – | | | | 14.00 | | | | 10.45 | | | | 8.41 | | | | 0.37 | | | | 0.19 | |

| Administrator Class (WFLHX) | | 6-30-2011 | | | – | | | | – | | | | – | | | | 13.71 | | | | 10.07 | | | | 8.05 | | | | 0.72 | | | | 0.54 | |

| Wells Fargo Target 2055 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | – | | | | 0.49 | | | | 2.19 | | | | 3.21 | ** | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | – | | | | 16.23 | | | | 14.34 | | | | 13.09** | | | | – | | | | – | |

| Dow Jones Global Target 2055 Index8 | | – | | | – | | | | – | | | | – | | | | 14.97 | | | | 10.89 | | | | 8.74 | ** | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | – | | | | 16.06 | | | | 14.27 | | | | 12.72 | ** | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

| ** | | Return is based on the inception date of the oldest class. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | |

| 16 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

Target 2060 Fund

Average annual total returns (%) as of August 31, 201714

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios13 (%) | |

| | | Inception date | | 1 year | | | Since

inception | | | 1 year | | | Since

inception | | | Gross | | | Net4 | |

| Class A (WFAFX) | | 6-30-2015 | | | 7.14 | | | | 4.05 | | | | 13.66 | | | | 6.93 | | | | 2.25 | | | | 0.65 | |

| Class C (WFCFX) | | 6-30-2015 | | | 11.85 | | | | 6.12 | | | | 12.85 | | | | 6.12 | | | | 3.00 | | | | 1.40 | |

| Class R (WFRFX) | | 6-30-2015 | | | – | | | | – | | | | 13.36 | | | | 6.64 | | | | 2.50 | | | | 0.90 | |

| Class R4 (WFSFX) | | 6-30-2015 | | | – | | | | – | | | | 13.99 | | | | 7.28 | | | | 1.97 | | | | 0.34 | |

| Class R6 (WFUFX) | | 6-30-2015 | | | – | | | | – | | | | 14.18 | | | | 7.39 | | | | 1.82 | | | | 0.19 | |

| Administrator Class (WFDFX) | | 6-30-2015 | | | – | | | | – | | | | 13.79 | | | | 7.05 | | | | 2.17 | | | | 0.54 | |

| Wells Fargo Target 2060 Blended Index5* | | – | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Bloomberg Barclays U.S. Aggregate Bond Index6 | | – | | | – | | | | – | | | | 0.49 | | | | 3.20 | | | | – | | | | – | |

| S&P 500 Index7 | | – | | | – | | | | – | | | | 16.23 | | | | 11.04 | | | | – | | | | – | |

| Dow Jones Global Target 2060 Index8 | | – | | | – | | | | – | | | | 14.97 | | | | 7.65 | | | | – | | | | – | |

| Russell 3000® Index9 | | – | | | – | | | | – | | | | 16.06 | | | | 10.24 | | | | – | | | | – | |

| * | | The inception date of the index is July 14, 2017. Performance results for the periods indicated are not yet available. |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Class R, Class R4, Class R6, and Administrator Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Please see footnotes on pages 18-19.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 17 | |

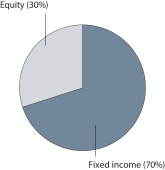

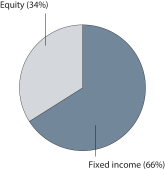

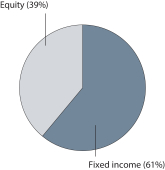

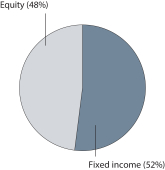

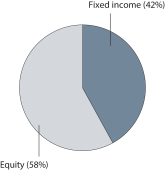

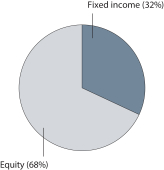

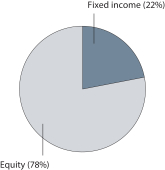

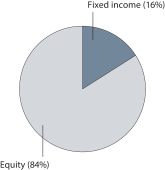

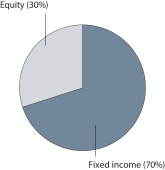

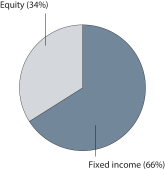

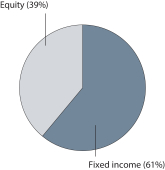

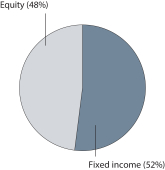

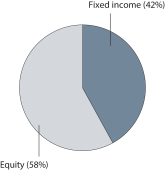

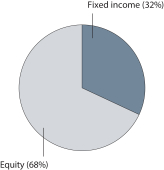

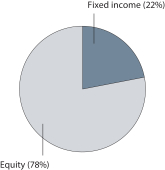

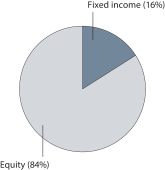

Portfolio allocation as of August 31, 201715

| | | | |

| Target Today Fund | | Target 2010 Fund | | Target 2015 Fund |

| | | |

| |  | |  |

| | | | |

| Target 2020 Fund | | Target 2025 Fund | | Target 2030 Fund |

| | | |

| |  | |  |

| | | | |

| Target 2035 Fund | | Target 2040 Fund | | Target 2045 Fund |

| | | |

| |  | |  |

Please see footnotes on pages 18-19.

| | | | |

| 18 | | Wells Fargo Target Date Funds | | Performance highlights (unaudited) |

| | | | |

| Target 2050 Fund | | Target 2055 Fund | | Target 2060 Fund |

| | | |

| |  | |  |

| ‡ | The subadviser and portfolio managers began management of each Fund effective July 14, 2017. |

| 1 | The Funds are gateway funds that invest in various affiliated master portfolios which in turn invest in a combination of securities to gain exposure to equity and fixed income asset classes. References to the investment activities of the Funds are intended to refer to the investment activities of the underlying affiliated master portfolios in which the Funds invest. |

| 2 | Historical performance shown for Class R shares prior to their inception reflects the performance of the Class A shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| 3 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.15% of acquired fund fees and expenses which represent the net expenses from the underlying affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 4 | The manager has contractually committed through July 31, 2018, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waivers at the amounts shown. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the expense cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Net expenses from the underlying affiliated master portfolios are included in the expense cap. Without this cap, the Fund’s return would have been lower. The expense ratio paid by an investor is the net expense ratio or the Fund’s Total Annual Fund Operating Expenses After Fee Waivers, as stated in the prospectuses. |

| 5 | Effective July 14, 2017, the Fund replaced the Dow Jones Global Target Date Indexes with the Wells Fargo Blended Indexes in order to better align with the Wells Fargo Target Date Funds. See Appendix for additional details on Wells Fargo Target Date Blended Indexes. |

| 6 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 7 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 8 | The Dow Jones Global Target Date Indexes (each an “index” or collectively the “indexes”) are a series of indexes designed as benchmarks for multi-asset class portfolios with risk profiles that became more conservative over time. The index weightings among the major asset classes are adjusted monthly based on a published set of index rules. The indexes with longer time horizons have higher allocations to equity securities, while the indexes with shorter time horizons replace some of their stock allocations with allocations to fixed income securities and money market instruments. You cannot invest directly in an index. |

| 9 | The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. You cannot invest directly in an index. |

| 10 | Historical performance shown for Class R shares prior to their inception reflects the performance of Class A shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares, and includes the higher expenses applicable to Class R6. If these expenses had not been included, returns for Class R4 shares would be higher. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Target Date Funds | | | 19 | |

| 11 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.16% of acquired fund fees and expenses which represent the net expenses from the underlying affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 12 | Historical performance shown for Class A shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A shares. Historical performance shown for Class R shares prior to their inception reflects the performance of the former Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R4. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| 13 | Reflects the expense ratios as stated in the most recent prospectuses, which include the impact of 0.17% of acquired fund fees and expenses which represent the net expenses from the underlying affiliated master portfolios. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 14 | Historical performance shown for Class A and Class C shares prior to their inception reflects the performance of Class R6 shares and has been adjusted to reflect the higher expenses applicable to Class A and Class C shares. Historical performance shown for Class R shares prior to their inception reflects the performance of the former Investor Class shares and has been adjusted to reflect the higher expenses applicable to Class R shares. Historical performance shown for Class R4 shares prior to their inception reflects the performance of Class R6 shares and includes the expenses applicable to Class R6. If these expenses had not been included, returns for Class R4 shares would be higher. Effective June 1, 2013, Institutional Class was renamed Class R6 and modified to assume the features and attributes of Class R6. Historical performance shown for Class R6 shares from inception through May 31, 2013, reflects Institutional Class performance and expenses. |

| 15 | Each chart represents the composite of the portfolio allocations of the affiliated master portfolios in which the Fund invests and is calculated based on the total investments of the underlying affiliated master portfolios. Portfolio holdings are subject to change and may have changed since the date specified. See the Portfolio of investments of each underlying affiliated master portfolio which is also included in this report. |

| | | | |

| 20 | | Wells Fargo Target Date Funds | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from March 1, 2017 to August 31, 2017.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| Target Today Fund | | Beginning

account value

3-1-2017 | | | Ending

account value

8-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,023.67 | | | $ | 3.72 | | | | 0.73 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.53 | | | $ | 3.72 | | | | 0.73 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,019.50 | | | $ | 7.53 | | | | 1.48 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.74 | | | $ | 7.53 | | | | 1.48 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,022.79 | | | $ | 5.00 | | | | 0.98 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.27 | | | $ | 4.99 | | | | 0.98 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,022.20 | | | $ | 2.29 | | | | 0.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 | | | | 0.45 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.97 | | | $ | 1.43 | | | | 0.28 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.79 | | | $ | 1.43 | | | | 0.28 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.05 | | | $ | 3.16 | | | | 0.62 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.08 | | | $ | 3.16 | | | | 0.62 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Target Date Funds | | | 21 | |

| | | | | | | | | | | | | | | | |

| Target 2010 Fund | | Beginning

account value

3-1-2017 | | | Ending

account value

8-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,024.98 | | | $ | 3.83 | | | | 0.75 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.42 | | | $ | 3.82 | | | | 0.75 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 7.64 | | | | 1.50 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.64 | | | $ | 7.63 | | | | 1.50 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,023.52 | | | $ | 5.10 | | | | 1.00 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.09 | | | | 1.00 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,026.29 | | | $ | 2.25 | | | | 0.44 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.99 | | | $ | 2.24 | | | | 0.44 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.11 | | | $ | 1.48 | | | | 0.29 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.74 | | | $ | 1.48 | | | | 0.29 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,025.50 | | | $ | 3.27 | | | | 0.64 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.98 | | | $ | 3.26 | | | | 0.64 | % |

| Target 2015 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,028.64 | | | $ | 3.83 | | | | 0.75 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.42 | | | $ | 3.82 | | | | 0.75 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.73 | | | $ | 5.11 | | | | 1.00 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.09 | | | | 1.00 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.03 | | | $ | 2.30 | | | | 0.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 | | | | 0.45 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.81 | | | $ | 1.54 | | | | 0.30 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.69 | | | $ | 1.53 | | | | 0.30 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,029.47 | | | $ | 3.27 | | | | 0.64 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.98 | | | $ | 3.26 | | | | 0.64 | % |

| | | | |

| 22 | | Wells Fargo Target Date Funds | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

| Target 2020 Fund | | Beginning

account value

3-1-2017 | | | Ending

account value

8-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,034.97 | | | $ | 3.95 | | | | 0.77 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.32 | | | $ | 3.92 | | | | 0.77 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.51 | | | $ | 7.78 | | | | 1.52 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.54 | | | $ | 7.73 | | | | 1.52 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,034.44 | | | $ | 5.33 | | | | 1.04 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.96 | | | $ | 5.30 | | | | 1.04 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,036.30 | | | $ | 2.41 | | | | 0.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.84 | | | $ | 2.40 | | | | 0.47 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,036.99 | | | $ | 1.59 | | | | 0.31 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.64 | | | $ | 1.58 | | | | 0.31 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,035.79 | | | $ | 3.39 | | | | 0.66 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.88 | | | $ | 3.36 | | | | 0.66 | % |

| Target 2025 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,039.12 | | | $ | 3.96 | | | | 0.77 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.32 | | | $ | 3.92 | | | | 0.77 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,030.51 | | | $ | 5.37 | | | | 1.05 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.91 | | | $ | 5.35 | | | | 1.05 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,040.87 | | | $ | 2.42 | | | | 0.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.84 | | | $ | 2.40 | | | | 0.47 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.87 | | | $ | 1.60 | | | | 0.31 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.64 | | | $ | 1.58 | | | | 0.31 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,038.86 | | | $ | 3.39 | | | | 0.66 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.88 | | | $ | 3.36 | | | | 0.66 | % |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Target Date Funds | | | 23 | |

| | | | | | | | | | | | | | | | |

| Target 2030 Fund | | Beginning

account value

3-1-2017 | | | Ending

account value

8-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,044.91 | | | $ | 3.97 | | | | 0.77 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.32 | | | $ | 3.92 | | | | 0.77 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.26 | | | $ | 7.82 | | | | 1.52 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.54 | | | $ | 7.73 | | | | 1.52 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.42 | | | $ | 5.45 | | | | 1.06 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.86 | | | $ | 5.40 | | | | 1.06 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,046.61 | | | $ | 2.42 | | | | 0.47 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.84 | | | $ | 2.40 | | | | 0.47 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,047.25 | | | $ | 1.65 | | | | 0.32 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.59 | | | $ | 1.63 | | | | 0.32 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,045.45 | | | $ | 3.45 | | | | 0.67 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.41 | | | | 0.67 | % |

| Target 2035 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,049.87 | | | $ | 4.03 | | | | 0.78 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.27 | | | $ | 3.97 | | | | 0.78 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,047.69 | | | $ | 5.32 | | | | 1.03 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.01 | | | $ | 5.24 | | | | 1.03 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.25 | | | $ | 2.53 | | | | 0.49 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.74 | | | $ | 2.50 | | | | 0.49 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.99 | | | $ | 1.66 | | | | 0.32 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.59 | | | $ | 1.63 | | | | 0.32 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,050.79 | | | $ | 3.46 | | | | 0.67 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.41 | | | | 0.67 | % |

| | | | |

| 24 | | Wells Fargo Target Date Funds | | Fund expenses (unaudited) |

| | | | | | | | | | | | | | | | |

| Target 2040 Fund | | Beginning

account value

3-1-2017 | | | Ending

account value

8-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.53 | | | $ | 4.04 | | | | 0.78 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.27 | | | $ | 3.97 | | | | 0.78 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,050.03 | | | $ | 7.91 | | | | 1.53 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.49 | | | $ | 7.78 | | | | 1.53 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,053.20 | | | $ | 5.49 | | | | 1.06 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.86 | | | $ | 5.40 | | | | 1.06 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,055.39 | | | $ | 2.49 | | | | 0.48 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.79 | | | $ | 2.45 | | | | 0.48 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,056.42 | | | $ | 1.66 | | | | 0.32 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.59 | | | $ | 1.63 | | | | 0.32 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,054.49 | | | $ | 3.47 | | | | 0.67 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.41 | | | | 0.67 | % |

| Target 2045 Fund | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,056.39 | | | $ | 4.09 | | | | 0.79 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.22 | | | $ | 4.02 | | | | 0.79 | % |

Class R | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,055.54 | | | $ | 5.34 | | | | 1.03 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.01 | | | $ | 5.24 | | | | 1.03 | % |

Class R4 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,058.46 | | | $ | 2.54 | | | | 0.49 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.74 | | | $ | 2.50 | | | | 0.49 | % |

Class R6 | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,059.34 | | | $ | 1.66 | | | | 0.32 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.59 | | | $ | 1.63 | | | | 0.32 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,057.03 | | | $ | 3.47 | | | | 0.67 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.83 | | | $ | 3.41 | | | | 0.67 | % |

| | | | | | |

| Fund expenses (unaudited) | | Wells Fargo Target Date Funds | | | 25 | |

| | | | | | | | | | | | | | | | |

| Target 2050 Fund | | Beginning

account value

3-1-2017 | | | Ending

account value

8-31-2017 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,057.96 | | | $ | 4.05 | | | | 0.78 | % |