UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-09689

Wells Fargo Master Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Alexander Kymn

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-222-8222

Date of fiscal year end: May 31

Registrant is making a filing for 13 of its series:

Wells Fargo C&B Large Cap Value Portfolio, Wells Fargo Emerging Growth Portfolio, Wells Fargo Index Portfolio, Wells Fargo International Value Portfolio, Wells Fargo Small Company Growth Portfolio, Wells Fargo Small Company Value Portfolio, Wells Fargo Core Bond Portfolio, Wells Fargo Real Return Portfolio, Wells Fargo Diversified Large Cap Growth Portfolio, Wells Fargo Disciplined Large Cap Portfolio, Wells Fargo International Growth Portfolio, Wells Fargo Large Company Value Portfolio, and Wells Fargo Managed Fixed Income Portfolio.

Date of reporting period: November 30, 2018

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

November 30, 2018

Diversified Large Cap Growth Portfolio

Contents

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Fund information (unaudited) |

Investment objective

The Portfolio seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

John R. Campbell, CFA®‡

Joseph M. Eberhardy, CFA®‡, CPA

Jeff C. Moser, CFA®‡

Thomas C. Ognar, CFA®‡

| | | | |

| Ten largest holdings (%) as of November 30, 20181 | |

Amazon.com Incorporated | | | 5.09 | |

Microsoft Corporation | | | 4.62 | |

Alphabet Incorporated Class A | | | 3.39 | |

Visa Incorporated Class A | | | 2.66 | |

MasterCard Incorporated Class A | | | 2.38 | |

Microchip Technology Incorporated | | | 2.07 | |

Alphabet Incorporated Class C | | | 1.85 | |

PayPal Holdings Incorporated | | | 1.83 | |

Apple Incorporated | | | 1.83 | |

Texas Instruments Incorporated | | | 1.68 | |

|

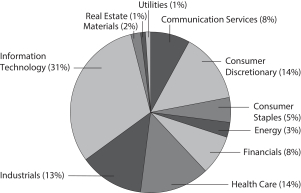

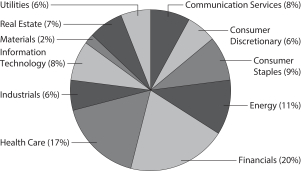

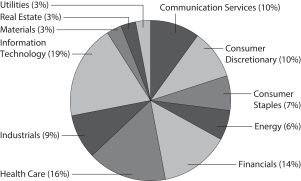

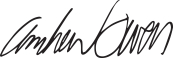

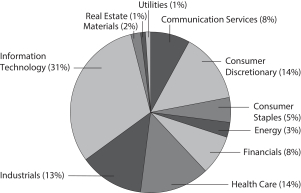

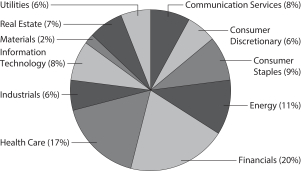

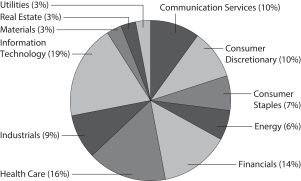

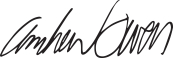

| Sector distribution as of November 30, 20182 |

|

|

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by the total net assets of the Portfolio. Holdings are subject to change and may have changed since the date specified. |

| 2 | Amounts are calculated based on the total long-term investments of the Portfolio. These amounts are subject to change and may have changed since the date specified. |

| | | | | | |

| Portfolio of investments—November 30, 2018 (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 3 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 98.27% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 8.11% | | | | | | | | | | | | | | | | |

| | | | |

| Entertainment: 1.90% | | | | | | | | | | | | | | | | |

Activision Blizzard Incorporated | | | | | | | | | | | 43,914 | | | $ | 2,190,430 | |

Electronic Arts Incorporated † | | | | | | | | | | | 9,533 | | | | 801,439 | |

Live Nation Incorporated † | | | | | | | | | | | 19,230 | | | | 1,070,726 | |

Netflix Incorporated † | | | | | | | | | | | 7,471 | | | | 2,137,677 | |

Take-Two Interactive Software Incorporated † | | | | | | | | | | | 9,858 | | | | 1,081,127 | |

| | | | |

| | | | | | | | | | | | | | | 7,281,399 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Interactive Media & Services: 6.21% | | | | | | | | | | | | | | | | |

Alphabet Incorporated Class A † | | | | | | | | | | | 11,685 | | | | 12,966,260 | |

Alphabet Incorporated Class C † | | | | | | | | | | | 6,483 | | | | 7,095,190 | |

Facebook Incorporated Class A † | | | | | | | | | | | 20,841 | | | | 2,930,453 | |

Match Group Incorporated « | | | | | | | | | | | 19,535 | | | | 786,674 | |

| | | | |

| | | | | | | | | | | | | | | 23,778,577 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 13.48% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 0.53% | | | | | | | | | | | | | | | | |

Lear Corporation | | | | | | | | | | | 14,832 | | | | 2,020,860 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 2.38% | | | | | | | | | | | | | | | | |

Carnival Corporation | | | | | | | | | | | 15,470 | | | | 932,686 | |

Domino’s Pizza Incorporated | | | | | | | | | | | 4,585 | | | | 1,271,512 | |

Marriott International Incorporated Class A | | | | | | | | | | | 7,080 | | | | 814,412 | |

Norwegian Cruise Line Holdings Limited † | | | | | | | | | | | 33,881 | | | | 1,738,773 | |

Planet Fitness Incorporated Class A † | | | | | | | | | | | 17,040 | | | | 940,949 | |

Royal Caribbean Cruises Limited | | | | | | | | | | | 22,354 | | | | 2,527,567 | |

Vail Resorts Incorporated | | | | | | | | | | | 3,200 | | | | 893,376 | |

| | | | |

| | | | | | | | | | | | | | | 9,119,275 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 0.18% | | | | | | | | | | | | | | | | |

Roku Incorporated †« | | | | | | | | | | | 17,035 | | | | 694,176 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet & Direct Marketing Retail: 5.35% | | | | | | | | | | | | | | | | |

Amazon.com Incorporated † | | | | | | | | | | | 11,526 | | | | 19,480,901 | |

Farfetch Limited Class A † | | | | | | | | | | | 26,703 | | | | 607,493 | |

MercadoLibre Incorporated | | | | | | | | | | | 1,054 | | | | 370,976 | |

| | | | |

| | | | | | | | | | | | | | | 20,459,370 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multiline Retail: 1.43% | | | | | | | | | | | | | | | | |

Dollar Tree Incorporated † | | | | | | | | | | | 3,232 | | | | 280,441 | |

Macy’s Incorporated | | | | | | | | | | | 75,534 | | | | 2,584,773 | |

Target Corporation | | | | | | | | | | | 36,761 | | | | 2,608,561 | |

| | | | |

| | | | | | | | | | | | | | | 5,473,775 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 3.61% | | | | | | | | | | | | | | | | |

Burlington Stores Incorporated † | | | | | | | | | | | 25,125 | | | | 4,164,720 | |

O’Reilly Automotive Incorporated † | | | | | | | | | | | 2,930 | | | | 1,016,065 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 4 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Portfolio of investments—November 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Specialty Retail(continued) | | | | | | | | | | | | | | | | |

The Home Depot Incorporated | | | | | | | | | | | 28,396 | | | $ | 5,120,367 | |

The TJX Companies Incorporated | | | | | | | | | | | 45,766 | | | | 2,235,669 | |

ULTA Beauty Incorporated † | | | | | | | | | | | 4,359 | | | | 1,298,067 | |

| | | | |

| | | | | | | | | | | | | | | 13,834,888 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 4.78% | | | | | | | | | | | | | | | | |

| | | | |

| Beverages: 1.64% | | | | | | | | | | | | | | | | |

Constellation Brands Incorporated Class A | | | | | | | | | | | 11,221 | | | | 2,196,623 | |

The Coca-Cola Company | | | | | | | | | | | 80,887 | | | | 4,076,705 | |

| | | | |

| | | | | | | | | | | | | | | 6,273,328 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food & Staples Retailing: 2.49% | | | | | | | | | | | | | | | | |

Costco Wholesale Corporation | | | | | | | | | | | 20,315 | | | | 4,698,453 | |

Sysco Corporation | | | | | | | | | | | 34,960 | | | | 2,356,304 | |

Wal-Mart Stores Incorporated | | | | | | | | | | | 25,426 | | | | 2,482,849 | |

| | | | |

| | | | | | | | | | | | | | | 9,537,606 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Personal Products: 0.65% | | | | | | | | | | | | | | | | |

The Estee Lauder Companies Incorporated Class A | | | | | | | | | | | 17,465 | | | | 2,491,557 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 2.71% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 2.71% | | | | | | | | | | | | | | | | |

Chevron Corporation | | | | | | | | | | | 16,739 | | | | 1,990,937 | |

Concho Resources Incorporated † | | | | | | | | | | | 20,517 | | | | 2,674,186 | |

Exxon Mobil Corporation | | | | | | | | | | | 21,188 | | | | 1,684,446 | |

Marathon Petroleum Corporation | | | | | | | | | | | 30,617 | | | | 1,995,004 | |

Valero Energy Corporation | | | | | | | | | | | 25,426 | | | | 2,031,537 | |

| | | | |

| | | | | | | | | | | | | | | 10,376,110 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 7.89% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 1.94% | | | | | | | | | | | | | | | | |

Bank of America Corporation | | | | | | | | | | | 85,068 | | | | 2,415,931 | |

Citizens Financial Group Incorporated | | | | | | | | | | | 53,711 | | | | 1,952,932 | |

JPMorgan Chase & Company | | | | | | | | | | | 27,544 | | | | 3,062,617 | |

| | | | |

| | | | | | | | | | | | | | | 7,431,480 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 4.55% | | | | | | | | | | | | | | | | |

BlackRock Incorporated | | | | | | | | | | | 780 | | | | 333,848 | |

CME Group Incorporated | | | | | | | | | | | 14,719 | | | | 2,797,788 | |

E*TRADE Financial Corporation | | | | | | | | | | | 3,925 | | | | 205,238 | |

Evercore Partners Incorporated Class A | | | | | | | | | | | 22,460 | | | | 1,854,298 | |

MarketAxess Holdings Incorporated | | | | | | | | | | | 8,807 | | | | 1,917,548 | |

Morgan Stanley | | | | | | | | | | | 9,260 | | | | 411,051 | |

Northern Trust Corporation | | | | | | | | | | | 23,095 | | | | 2,291,717 | |

Raymond James Financial Incorporated | | | | | | | | | | | 41,121 | | | | 3,278,577 | |

The Charles Schwab Corporation | | | | | | | | | | | 96,398 | | | | 4,318,630 | |

| | | | |

| | | | | | | | | | | | | | | 17,408,695 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—November 30, 2018 (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 5 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Insurance: 1.40% | | | | | | | | | | | | | | | | |

Prudential Financial Incorporated | | | | | | | | | | | 19,387 | | | $ | 1,817,725 | |

The Progressive Corporation | | | | | | | | | | | 53,693 | | | | 3,559,309 | |

| | | | |

| | | | | | | | | | | | | | | 5,377,034 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 14.22% | | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology: 3.43% | | | | | | | | | | | | | | | | |

AbbVie Incorporated | | | | | | | | | | | 21,294 | | | | 2,007,385 | |

Agios Pharmaceuticals Incorporated † | | | | | | | | | | | 951 | | | | 62,576 | |

Alexion Pharmaceuticals Incorporated † | | | | | | | | | | | 5,721 | | | | 704,541 | |

Amgen Incorporated | | | | | | | | | | | 10,701 | | | | 2,228,483 | |

BioMarin Pharmaceutical Incorporated † | | | | | | | | | | | 6,114 | | | | 587,127 | |

Ligand Pharmaceuticals Incorporated † | | | | | | | | | | | 3,150 | | | | 496,976 | |

Neurocrine Biosciences Incorporated † | | | | | | | | | | | 10,134 | | | | 894,528 | |

Sage Therapeutics Incorporated † | | | | | | | | | | | 4,033 | | | | 464,965 | |

Sarepta Therapeutics Incorporated † | | | | | | | | | | | 5,595 | | | | 724,385 | |

Vertex Pharmaceuticals Incorporated † | | | | | | | | | | | 27,383 | | | | 4,950,573 | |

| | | | |

| | | | | | | | | | | | | | | 13,121,539 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 4.03% | | | | | | | | | | | | | | | | |

Abbott Laboratories | | | | | | | | | | | 79,887 | | | | 5,915,632 | |

Baxter International Incorporated | | | | | | | | | | | 49,339 | | | | 3,382,189 | |

Boston Scientific Corporation † | | | | | | | | | | | 110,332 | | | | 4,156,206 | |

Intuitive Surgical Incorporated † | | | | | | | | | | | 1,513 | | | | 803,206 | |

Stryker Corporation | | | | | | | | | | | 6,743 | | | | 1,183,127 | |

| | | | |

| | | | | | | | | | | | | | | 15,440,360 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 2.69% | | | | | | | | | | | | | | | | |

Centene Corporation † | | | | | | | | | | | 31,658 | | | | 4,503,351 | |

Encompass Health Corporation | | | | | | | | | | | 33,371 | | | | 2,509,833 | |

Humana Incorporated | | | | | | | | | | | 940 | | | | 309,702 | |

UnitedHealth Group Incorporated | | | | | | | | | | | 10,595 | | | | 2,981,009 | |

| | | | |

| | | | | | | | | | | | | | | 10,303,895 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Technology: 0.26% | | | | | | | | | | | | | | | | |

Veeva Systems Incorporated Class A † | | | | | | | | | | | 10,307 | | | | 991,121 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 1.83% | | | | | | | | | | | | | | | | |

Agilent Technologies Incorporated | | | | | | | | | | | 76,922 | | | | 5,565,306 | |

PRA Health Sciences Incorporated † | | | | | | | | | | | 12,276 | | | | 1,433,100 | |

| | | | |

| | | | | | | | | | | | | | | 6,998,406 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 1.98% | | | | | | | | | | | | | | | | |

Elanco Animal Health Incorporated †« | | | | | | | | | | | 14,117 | | | | 471,649 | |

Johnson & Johnson | | | | | | | | | | | 16,209 | | | | 2,381,102 | |

Zoetis Incorporated | | | | | | | | | | | 50,299 | | | | 4,721,567 | |

| | | | |

| | | | | | | | | | | | | | | 7,574,318 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 6 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Portfolio of investments—November 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Industrials: 12.41% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 2.03% | | | | | | | | | | | | | | | | |

HEICO Corporation | | | | | | | | | | | 11,815 | | | $ | 998,604 | |

Northrop Grumman Corporation | | | | | | | | | | | 7,311 | | | | 1,899,983 | |

The Boeing Company | | | | | | | | | | | 13,989 | | | | 4,850,826 | |

| | | | |

| | | | | | | | | | | | | | | 7,749,413 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Air Freight & Logistics: 0.71% | | | | | | | | | | | | | | | | |

FedEx Corporation | | | | | | | | | | | 1,784 | | | | 408,536 | |

XPO Logistics Incorporated † | | | | | | | | | | | 30,496 | | | | 2,313,427 | |

| | | | |

| | | | | | | | | | | | | | | 2,721,963 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Airlines: 0.51% | | | | | | | | | | | | | | | | |

Southwest Airlines Company | | | | | | | | | | | 35,860 | | | | 1,958,315 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 1.96% | | | | | | | | | | | | | | | | |

KAR Auction Services Incorporated | | | | | | | | | | | 30,689 | | | | 1,753,569 | |

Rollins Incorporated | | | | | | | | | | | 22,020 | | | | 1,399,591 | |

Waste Connections Incorporated | | | | | | | | | | | 55,390 | | | | 4,347,007 | |

| | | | |

| | | | | | | | | | | | | | | 7,500,167 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction & Engineering: 0.53% | | | | | | | | | | | | | | | | |

EMCOR Group Incorporated | | | | | | | | | | | 27,862 | | | | 2,030,025 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 0.79% | | | | | | | | | | | | | | | | |

3M Company | | | | | | | | | | | 1,662 | | | | 345,563 | |

Roper Industries Incorporated | | | | | | | | | | | 9,017 | | | | 2,683,369 | |

| | | | |

| | | | | | | | | | | | | | | 3,028,932 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 1.73% | | | | | | | | | | | | | | | | |

Allison Transmission Holdings Incorporated | | | | | | | | | | | 50,957 | | | | 2,400,584 | |

Cummins Incorporated | | | | | | | | | | | 13,349 | | | | 2,016,500 | |

Fortive Corporation | | | | | | | | | | | 28,806 | | | | 2,191,272 | |

| | | | |

| | | | | | | | | | | | | | | 6,608,356 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Professional Services: 0.70% | | | | | | | | | | | | | | | | |

CoStar Group Incorporated † | | | | | | | | | | | 4,913 | | | | 1,814,813 | |

TransUnion | | | | | | | | | | | 13,639 | | | | 880,670 | |

| | | | |

| | | | | | | | | | | | | | | 2,695,483 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail: 2.86% | | | | | | | | | | | | | | | | |

CSX Corporation | | | | | | | | | | | 46,103 | | | | 3,348,461 | |

Norfolk Southern Corporation | | | | | | | | | | | 21,081 | | | | 3,599,370 | |

Union Pacific Corporation | | | | | | | | | | | 25,988 | | | | 3,996,435 | |

| | | | |

| | | | | | | | | | | | | | | 10,944,266 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 0.59% | | | | | | | | | | | | | | | | |

Applied Industrial Technologies Incorporated | | | | | | | | | | | 34,642 | | | | 2,259,698 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—November 30, 2018 (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 7 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Information Technology: 30.64% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.67% | | | | | | | | | | | | | | | | |

Cisco Systems Incorporated | | | | | | | | | | | 53,817 | | | $ | 2,576,220 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 1.34% | | | | | | | | | | | | | | | | |

Jabil Circuit Incorporated | | | | | | | | | | | 72,461 | | | | 1,809,351 | |

Zebra Technologies Corporation Class A † | | | | | | | | | | | 18,328 | | | | 3,295,374 | |

| | | | |

| | | | | | | | | | | | | | | 5,104,725 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 8.72% | | | | | | | | | | | | | | | | |

Euronet Worldwide Incorporated † | | | | | | | | | | | 987 | | | | 116,081 | |

Global Payments Incorporated | | | | | | | | | | | 8,892 | | | | 994,215 | |

MasterCard Incorporated Class A | | | | | | | | | | | 45,268 | | | | 9,102,037 | |

PayPal Holdings Incorporated † | | | | | | | | | | | 81,838 | | | | 7,022,519 | |

Shopify Incorporated Class A † | | | | | | | | | | | 11,692 | | | | 1,784,901 | |

Square Incorporated Class A † | | | | | | | | | | | 35,998 | | | | 2,514,100 | |

Visa Incorporated Class A | | | | | | | | | | | 71,812 | | | | 10,176,479 | |

Worldpay Incorporated Class A † | | | | | | | | | | | 19,605 | | | | 1,682,305 | |

| | | | |

| | | | | | | | | | | | | | | 33,392,637 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 6.30% | | | | | | | | | | | | | | | | |

Intel Corporation | | | | | | | | | | | 46,295 | | | | 2,282,806 | |

Microchip Technology Incorporated « | | | | | | | | | | | 105,892 | | | | 7,941,900 | |

Monolithic Power Systems Incorporated | | | | | | | | | | | 5,900 | | | | 779,213 | |

NVIDIA Corporation | | | | | | | | | | | 28,440 | | | | 4,647,949 | |

ON Semiconductor Corporation † | | | | | | | | | | | 104,666 | | | | 2,007,494 | |

Texas Instruments Incorporated | | | | | | | | | | | 64,515 | | | | 6,441,823 | |

| | | | |

| | | | | | | | | | | | | | | 24,101,185 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 10.36% | | | | | | | | | | | | | | | | |

Adobe Systems Incorporated † | | | | | | | | | | | 16,135 | | | | 4,048,110 | |

Dropbox Incorporated Class A †« | | | | | | | | | | | 46,680 | | | | 1,091,845 | |

Microsoft Corporation | | | | | | | | | | | 159,622 | | | | 17,700,484 | |

Pivotal Software Incorporated Class A † | | | | | | | | | | | 28,446 | | | | 509,468 | |

Proofpoint Incorporated † | | | | | | | | | | | 11,822 | | | | 1,146,852 | |

RealPage Incorporated † | | | | | | | | | | | 13,645 | | | | 703,809 | |

Salesforce.com Incorporated † | | | | | | | | | | | 29,735 | | | | 4,244,969 | |

ServiceNow Incorporated † | | | | | | | | | | | 14,760 | | | | 2,734,585 | |

Splunk Incorporated † | | | | | | | | | | | 11,909 | | | | 1,330,593 | |

The Ultimate Software Group Incorporated † | | | | | | | | | | | 8,287 | | | | 2,187,105 | |

VMware Incorporated Class A † | | | | | | | | | | | 23,753 | | | | 3,974,827 | |

| | | | |

| | | | | | | | | | | | | | | 39,672,647 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 3.25% | | | | | | | | | | | | | | | | |

Apple Incorporated | | | | | | | | | | | 39,149 | | | | 6,991,228 | |

HP Incorporated | | | | | | | | | | | 107,421 | | | | 2,470,683 | |

NetApp Incorporated | | | | | | | | | | | 44,494 | | | | 2,975,314 | |

| | | | |

| | | | | | | | | | | | | | | 12,437,225 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Portfolio of investments—November 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Materials: 2.00% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 1.38% | | | | | | | | | | | | | | | | |

Air Products & Chemicals Incorporated | | | | | | | | | | | 3,188 | | | $ | 512,854 | |

Huntsman Corporation | | | | | | | | | | | 77,864 | | | | 1,574,410 | |

Linde plc | | | | | | | | | | | 20,077 | | | | 3,193,247 | |

| | | | |

| | | | | | | | | | | | | | | 5,280,511 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.62% | | | | | | | | | | | | | | | | |

Avery Dennison Corporation | | | | | | | | | | | 24,790 | | | | 2,389,756 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 1.51% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 1.24% | | | | | | | | | | | | | | | | |

American Tower Corporation | | | | | | | | | | | 15,574 | | | | 2,561,767 | |

Prologis Incorporated | | | | | | | | | | | 32,524 | | | | 2,190,166 | |

| | | | |

| | | | | | | | | | | | | | | 4,751,933 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Real Estate Management & Development: 0.27% | | | | | | | | | | | | | | | | |

CBRE Group Incorporated Class A † | | | | | | | | | | | 23,655 | | | | 1,033,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 0.52% | | | | | | | | | | | | | | | | |

| | | | |

| Multi-Utilities: 0.52% | | | | | | | | | | | | | | | | |

CenterPoint Energy Incorporated | | | | | | | | | | | 71,296 | | | | 1,997,001 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $341,046,397) | | | | | | | | | | | | | | | 376,221,477 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | | | | | |

| Short-Term Investments: 4.00% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 4.00% | | | | | | | | | | | | | | | | |

Securities Lending Cash Investments LLC (l)(r)(u) | | | 2.38 | % | | | | | | | 9,710,512 | | | | 9,711,483 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 2.13 | | | | | | | | 5,601,857 | | | | 5,601,857 | |

| | | | |

Total Short-Term Investments (Cost $15,313,340) | | | | | | | | | | | | | | | 15,313,340 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $356,359,737) | | | 102.27 | % | | | 391,534,817 | |

Other assets and liabilities, net | | | (2.27 | ) | | | (8,696,510 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 382,838,307 | |

| | | | | | | | |

| † | Non-income-earning security |

| « | All or a portion of this security is on loan. |

| (l) | The issuer of the security is an affiliated person of the Portfolio as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

Abbreviations:

| REIT | Real estate investment trust |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—November 30, 2018 (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 9 | |

Investments in Affiliates

An affiliated investment is an investment in which the Portfolio owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Portfolio and the issuer having the same adviser or investment manager. Transactions with issuers that were either affiliated persons of the Portfolio at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning of

period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value,

end

of period | | | % of

net

assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investments LLC | | | 2,198,826 | | | | 45,016,007 | | | | 37,504,321 | | | | 9,710,512 | | | $ | (322 | ) | | $ | (10 | ) | | $ | 12,899 | | | $ | 9,711,483 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 417,874 | | | | 84,104,456 | | | | 78,920,473 | | | | 5,601,857 | | | | 0 | | | | 0 | | | | 35,452 | | | | 5,601,857 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (322 | ) | | $ | (10 | ) | | $ | 48,351 | | | $ | 15,313,340 | | | | 4.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Statement of assets and liabilities—November 30, 2018 (unaudited) |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities (including $9,511,777 of securities loaned), at value (cost $341,046,397) | | $ | 376,221,477 | |

Investments in affiliated securities, at value (cost $15,313,340) | | | 15,313,340 | |

Receivable for investments sold | | | 982,817 | |

Receivable for dividends | | | 577,286 | |

Receivable for securities lending income | | | 3,063 | |

| | | | |

Total assets | | | 393,097,983 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 9,711,727 | |

Payable for investments purchased | | | 241,557 | |

Advisory fee payable | | | 193,157 | |

Accrued expenses and other liabilities | | | 113,235 | |

| | | | |

Total liabilities | | | 10,259,676 | |

| | | | |

Total net assets | | $ | 382,838,307 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of operations—six months ended November 30, 2018 (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 11 | |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends (net of foreign withholding taxes of $2,695) | | $ | 1,951,739 | |

Income from affiliated securities | | | 48,351 | |

| | | | |

Total investment income | | | 2,000,090 | |

| | | | |

| |

Expenses | | | | |

Advisory fee | | | 1,105,290 | |

Custody and accounting fees | | | 27,618 | |

Professional fees | | | 24,352 | |

Shareholder report expenses | | | 1,036 | |

Trustees’ fees and expenses | | | 11,014 | |

Other fees and expenses | | | 6,774 | |

| | | | |

Total expenses | | | 1,176,084 | |

Less: Fee waivers and/or expense reimbursements | | | (118,237 | ) |

| | | | |

Net expenses | | | 1,057,847 | |

| | | | |

Net investment income | | | 942,243 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

| |

Net realized gains (losses) on: | | | | |

Unaffiliated securities | | | 944,196 | |

Affiliated securities | | | (322 | ) |

| | | | |

Net realized gains on investments | | | 943,874 | |

| | | | |

| |

Net change in unrealized gains (losses) on: | | | | |

Unaffiliated securities | | | (214,619 | ) |

Affiliated securities | | | (10 | ) |

| | | | |

Net change in unrealized gains (losses) on investments | | | (214,629 | ) |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 729,245 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 1,671,488 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Statement of changes in net assets |

| | | | | | | | |

| | | Six months ended November 30, 2018 (unaudited) | | | Year ended

May 31, 2018 | |

| | |

Operations | | | | | | | | |

Net investment income | | $ | 942,243 | | | $ | 504,456 | |

Net realized gains on investments | | | 943,874 | | | | 19,836,626 | |

Net change in unrealized gains (losses) on investments | | | (214,629 | ) | | | 566,404 | |

| | | | |

Net increase in net assets resulting from operations | | | 1,671,488 | | | | 20,907,486 | |

| | | | |

| | |

Capital transactions | | | | | | | | |

Transactions in investors’ beneficial interests | | | | | | | | |

Contributions | | | 363,610,503 | | | | 831,948 | |

Withdrawals | | | (68,562,517 | ) | | | (41,873,014 | ) |

| | | | |

Net increase (decrease) in net assets resulting from capital transactions | | | 295,047,986 | | | | (41,041,066 | ) |

| | | | |

Total increase (decrease) in net assets | | | 296,719,474 | | | | (20,133,580 | ) |

| | | | |

| | |

Net assets | | | | | | | | |

Beginning of period | | | 86,118,833 | | | | 106,252,413 | |

| | | | |

End of period | | $ | 382,838,307 | | | $ | 86,118,833 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

November 30, 2018

(unaudited) | | | Year ended May 31 | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Total return1 | | | (0.92 | )% | | | 24.12 | % | | | 15.36 | % | | | (2.28 | )% | | | 13.11 | % | | | 21.70 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.69 | % | | | 0.80 | % | | | 0.78 | % | | | 0.74 | % | | | 0.72 | % | | | 0.72 | % |

Net expenses | | | 0.62 | % | | | 0.62 | % | | | 0.62 | % | | | 0.62 | % | | | 0.62 | % | | | 0.62 | % |

Net investment income | | | 0.55 | % | | | 0.53 | % | | | 0.51 | % | | | 0.29 | % | | | 0.28 | % | | | 0.15 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 33 | % | | | 37 | % | | | 98 | % | | | 59 | % | | | 46 | % | | | 54 | % |

| 1 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Notes to financial statements (unaudited) |

1. ORGANIZATION

Wells Fargo Master Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Diversified Large Cap Growth Portfolio (the “Portfolio”) which is a diversified series of the Trust.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Portfolio, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Portfolio may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Portfolio’s Valuation Procedures.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Portfolio. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Wells Fargo Asset Management Pricing Committee at Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Wells Fargo Asset Management Pricing Committee which may include items for ratification.

Foreign currency translation

The accounting records of the Portfolio are maintained in U.S. dollars. The values of other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at rates provided by an independent foreign currency pricing source at a time each business day specified by the Wells Fargo Asset Management Pricing Committee. Purchases and sales of securities, and income and expenses are converted at the rate of exchange on the respective dates of such transactions. Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded and the U.S. dollar equivalent of the amounts actually paid or received. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities other than investments in securities resulting from changes in exchange rates. The changes in net assets arising from changes in exchange rates of securities and the changes in net assets resulting from changes in market prices of securities are not separately presented. Such changes are included in net realized and unrealized gains or losses from investments.

Securities lending

The Portfolio may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Portfolio continues to receive interest or dividends on the securities loaned. The Portfolio receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Portfolio on the next business day. In a securities lending transaction, the net asset value of the Portfolio will be affected by an increase or decrease in the value

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 15 | |

of the securities loaned and by an increase or decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Portfolio fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Portfolio may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Portfolio has the right under the lending agreement to recover the securities from the borrower on demand.

The Portfolio lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the “Securities Lending Portfolio”). The Securities Lending Portfolio is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Portfolios Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”), an affiliate of Portfolios Management and an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). Portfolios Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Portfolio increase. All of the fees received by Portfolios Management are paid to WellsCap for its services as subadviser. The Securities Lending Portfolio seeks to provide a positive return compared to the daily Fed Portfolios Open Rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Portfolio investments are valued at the evaluated bid price provided by an independent pricing service. Income earned from investment in the Securities Lending Portfolio, if any, is included in income from affiliated securities on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date. Dividend income is recorded net of foreign taxes withheld where recovery of such taxes is not assured.

Federal and other taxes

The Portfolio is treated as a separate entity for federal income tax purposes. The Portfolio is not required to pay federal income taxes on its net investment income and net capital gains as it is treated as a partnership for federal income tax purposes. All interest, dividends, gains and losses of the Portfolio are deemed to have been “passed through” to the interest holders in proportion to their holdings of the Portfolio regardless of whether such interest, dividends and gains have been distributed by the Portfolio.

The Portfolio’s income tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal revenue authority. Management has analyzed the Portfolio’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of November 30, 2018, the aggregate cost of all investments for federal income tax purposes was $356,568,633 and the unrealized gains (losses) consisted of:

| | | | |

Gross unrealized gains | | $ | 45,099,363 | |

Gross unrealized losses | | | (10,133,179 | ) |

Net unrealized gains | | $ | 34,966,184 | |

3. FAIR VALUATION MEASUREMENTS

Fair value measurements of investments are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Portfolio’s investments. The three-level hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The Portfolio’s investments are classified within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The inputs are summarized into three broad levels as follows:

| ∎ | | Level 1 – quoted prices in active markets for identical securities |

| ∎ | | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ∎ | | Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

| | | | |

| 16 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Notes to financial statements (unaudited) |

The inputs or methodologies used for valuing investments in securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities as of November 30, 2018:

| | | | | | | | | | | | | | | | |

| | | Quoted prices

(Level 1) | | | Other significant

observable inputs

(Level 2) | | | Significant

unobservable inputs (Level 3) | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Investments in: | | | | | | | | | | | | | | | | |

| | | | |

Common stocks | | | | | | | | | | | | | | | | |

Communication services | | $ | 31,059,976 | | | $ | 0 | | | $ | 0 | | | $ | 31,059,976 | |

Consumer discretionary | | | 51,602,344 | | | | 0 | | | | 0 | | | | 51,602,344 | |

Consumer staples | | | 18,302,491 | | | | 0 | | | | 0 | | | | 18,302,491 | |

Energy | | | 10,376,110 | | | | 0 | | | | 0 | | | | 10,376,110 | |

Financials | | | 30,217,209 | | | | 0 | | | | 0 | | | | 30,217,209 | |

Health care | | | 54,429,639 | | | | 0 | | | | 0 | | | | 54,429,639 | |

Industrials | | | 47,496,618 | | | | 0 | | | | 0 | | | | 47,496,618 | |

Information technology | | | 117,284,639 | | | | 0 | | | | 0 | | | | 117,284,639 | |

Materials | | | 7,670,267 | | | | 0 | | | | 0 | | | | 7,670,267 | |

Real estate | | | 5,785,183 | | | | 0 | | | | 0 | | | | 5,785,183 | |

Utilities | | | 1,997,001 | | | | 0 | | | | 0 | | | | 1,997,001 | |

| | | | |

Short-term investments | | | | | | | | | | | | | | | | |

Investment companies | | | 5,601,857 | | | | 9,711,483 | | �� | | 0 | | | | 15,313,340 | |

Total assets | | $ | 381,823,334 | | | $ | 9,711,483 | | | $ | 0 | | | $ | 391,534,817 | |

Additional sector, industry or geographic detail is included in the Portfolio of Investments.

At November 30, 2018, the Portfolio did not have any transfers into/out of Level 3.

4. TRANSACTIONS WITH AFFILIATES

Advisory fee

The Trust has entered into an advisory contract with Funds Management, an indirect wholly owned subsidiary of Wells Fargo. The adviser is responsible for implementing investment policies and guidelines and for supervising the subadviser, who is responsible for day-to-day portfolio management of the Portfolio. Pursuant to the contract, Funds Management is entitled to receive an annual advisory fee starting at 0.65% and declining to 0.475% as the average daily net assets of the Portfolio increase. For the six months ended November 30, 2018, the advisory fee was equivalent to an annual rate of 0.65% of the Portfolio’s average daily net assets.

Funds Management has retained the services of a subadviser to provide daily portfolio management to the Portfolio. The fee for subadvisory services is borne by Funds Management. WellsCap is the subadviser to the Portfolio and is entitled to receive a fee from Funds Management at an annual rate starting at 0.30% and declining to 0.20% as the average daily net assets of the Portfolio increase.

Funds Management has voluntarily waived and/or reimbursed advisory fees to the extent necessary to maintain the net operating expense ratio of the Portfolio.

Interfund transactions

The Portfolio may purchase or sell portfolio investment securities to certain other Wells Fargo affiliates pursuant to Rule 17a-7 under the 1940 Act and under procedures adopted by the Board of Trustees. The procedures have been designed to ensure that these interfund transactions, which do not incur broker commissions, are effected at current market prices.

5. INVESTMENT PORTFOLIO TRANSACTIONS

Purchases and sales of investments, excluding U.S. government obligations (if any) and short-term securities, for the six months ended November 30, 2018 were $400,710,700 and $110,695,655, respectively.

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 17 | |

6. BANK BORROWINGS

Effective August 28, 2018, the Trust, along with Wells Fargo Variable Trust and Wells Fargo Funds Trust (excluding the money market funds), are parties to a $280,000,000 revolving credit agreement whereby the Portfolio is permitted to use bank borrowings for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest under the credit agreement is charged to the Portfolio based on a borrowing rate equal to the higher of the Federal Funds rate in effect on that day plus 1.25% or the overnight LIBOR rate in effect on that day plus 1.25%. In addition, an annual commitment fee equal to 0.25% of the unused balance is allocated to each participating fund.

For the six months ended November 30, 2018, there were no borrowings by the Portfolio under the agreement.

7. CONCENTRATION RISK

Concentration risks result from exposure to a limited number of sectors. A portfolio that invests a substantial portion of its assets in any sector may be more affected by changes in that sector than would be a portfolio whose investments are not heavily weighted in any sector.

8. INDEMNIFICATION

Under the Trust’s organizational documents, the officers and Trustees have been granted certain indemnification rights against certain liabilities that may arise out of performance of their duties to the Trust. Additionally, in the normal course of business, the Trust may enter into contracts with service providers that contain a variety of indemnification clauses. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolio and, therefore, cannot be estimated.

9. NEW ACCOUNTING PRONOUNCEMENT

In August 2018, FASB issued Accounting Standards Update (“ASU”) No. 2018-13, Fair Value Measurement (Topic 820)Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. ASU 2018-13 updates the disclosure requirements for fair value measurements by modifying or removing certain disclosures and adding certain new disclosures. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted. Management has adopted the removal and modification of disclosures early, as permitted, and will adopt the additional new disclosures at the effective date.

| | | | |

| 18 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Other information (unaudited) |

PROXY VOTING INFORMATION

A description of the policies and procedures used to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling1-800-222-8222, visiting our website atwellsfargofunds.com, or visiting the SEC website at sec.gov. Information regarding how the proxies related to portfolio securities were voted during the most recent 12-month period ended June 30 is available on the website atwellsfargofunds.comor by visiting the SEC website at sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The Portfolio files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q, which is available by visiting the SEC website at sec.gov. In addition, the Portfolio’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and at regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900. Information about the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | | | |

| Other information (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 19 | |

BOARD OF TRUSTEES AND OFFICERS

Each of the Trustees and Officers1 listed in the table below acts in identical capacities for each fund in the Wells Fargo family of funds, which consists of 152 mutual funds comprising the Wells Fargo Funds Trust, Wells Fargo Variable Trust, Wells Fargo Master Trust and four closed-end funds (collectively the “Fund Complex”). This table should be read in conjunction with the Prospectus and the Statement of Additional Information2. The mailing address of each Trustee and Officer is 525 Market Street, 12th Floor, San Francisco, CA 94105. Each Trustee and Officer serves an indefinite term, however, each Trustee serves such term until reaching the mandatory retirement age established by the Trustees.

Independent Trustees

| | | | | | |

Name and

year of birth | | Position held and

length of service* | | Principal occupations during past five years or longer | | Current other

public company or

investment company

directorships |

William R. Ebsworth

(Born 1957) | | Trustee, since 2015 | | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Board member of the Vincent Memorial Hospital Endowment (non-profit organization), where he serves on the Investment Committee and as a Chair of the Audit Committee. Mr. Ebsworth is a CFA® charterholder. | | N/A |

Jane A. Freeman

(Born 1953) | | Trustee, since 2015; Chair Liaison, since 2018 | | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is a Board Member of The Ruth Bancroft Garden (non-profit organization). She is also an inactive Chartered Financial Analyst. | | N/A |

Isaiah Harris, Jr.3

(Born 1952) | | Trustee, since 2009 | | Retired. Chairman of the Board of CIGNA Corporation since 2009, and Director since 2005. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory Board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Child Evangelism Fellowship (non-profit). Mr. Harris is a certified public accountant (inactive status). | | CIGNA Corporation |

Judith M. Johnson3

(Born 1949) | | Trustee, since 2008; Audit Committee Chairman, since 2009 | | Retired. Prior thereto, Chief Executive Officer and Chief Investment Officer of Minneapolis Employees Retirement Fund from 1996 to 2008. Ms. Johnson is an attorney, certified public accountant and a certified managerial accountant. | | N/A |

David F. Larcker

(Born 1950) | | Trustee, since 2009 | | James Irvin Miller Professor of Accounting at the Graduate School of Business, Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | | N/A |

| | | | |

| 20 | | Wells Fargo Diversified Large Cap Growth Portfolio | | Other information (unaudited) |

| | | | | | |

Name and

year of birth | | Position held and

length of service* | | Principal occupations during past five years or longer | | Current other

public company or

investment company

directorships |

Olivia S. Mitchell

(Born 1953) | | Trustee, since 2006; Nominating and Governance Committee Chairman, since 2018 | | International Foundation of Employee Benefit Plans Professor, Wharton School of the University of Pennsylvania since 1993. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously, Cornell University Professor from 1978 to 1993. | | N/A |

Timothy J. Penny

(Born 1951) | | Trustee, since 1996; Chairman, since 2018; Vice Chairman, from 2017 to 2018 | | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, since 2007. | | N/A |

James G. Polisson

(Born 1959) | | Trustee, since 2018; Advisory Board Member, from 2017 to 2018 | | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non-profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | | N/A |

Michael S. Scofield4 (Born 1943) | | Trustee, since 2010 | | Served on the Investment Company Institute’s Board of Governors and Executive Committee from 2008-2011 as well the Governing Council of the Independent Directors Council from 2006-2011 and the Independent Directors Council Executive Committee from 2008-2011. Trustee of the Evergreen Fund complex (and its predecessors) from 1984 to 2010. Chairman of the Evergreen Funds from 2000-2010. Former Trustee of the Mentor Funds. Retired Attorney, Law Offices of Michael S. Scofield. | | N/A |

Pamela Wheelock

(Born 1959) | | Trustee, since 2018; Advisory Board Member, from 2017 to 2018 | | Chief Operating Officer, Twin Cities Habitat for Humanity, since January, 2017. Vice President of University Services, University of Minnesota from 2012 to 2017. Prior thereto, on the Board of Directors, Governance Committee and Finance Committee for the Minnesota Philanthropy Partners (Saint Paul Foundation) from 2012 to 2018, Interim President and Chief Executive Officer of Blue Cross Blue Shield of Minnesota from 2010 to 2011, Chairman of the Board from 2009 to 2011 and Board Director from 2003 to 2015. Vice President, Leadership and Community Engagement, Bush Foundation, Saint Paul, Minnesota (a private foundation) from 2009 to 2011. Executive Vice President and Chief Financial Officer, Minnesota Sports and Entertainment from 2004 to 2009 and Senior Vice President from 2002 to 2004. Commissioner of Finance, State of Minnesota, from 1999 to 2002. Currently the Board Chair of the Minnesota Wild Foundation since 2010. | | N/A |

| * | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

| | | | | | |

| Other information (unaudited) | | Wells Fargo Diversified Large Cap Growth Portfolio | | | 21 | |

Officers

| | | | | | |

Name and

year of birth | | Position held and

length of service | | Principal occupations during past five years or longer | | |

Andrew Owen

(Born 1960) | | President, since 2017 | | Executive Vice President of Wells Fargo & Company and Head of Affiliated Managers, Wells Fargo Asset Management, since 2014. In addition, Mr. Owen is currently President, Chief Executive Officer and Director of Wells Fargo Funds Management, LLC since 2017. Prior thereto, Executive Vice President responsible for marketing, investments and product development for Wells Fargo Funds Management, LLC, from 2009 to 2014. | | |

Nancy Wiser1

(Born 1967) | | Treasurer, since 2012 | | Executive Vice President of Wells Fargo Funds Management, LLC since 2011. Chief Operating Officer and Chief Compliance Officer at LightBox Capital Management LLC, from 2008 to 2011. | | |

Alexander Kymn

(Born 1973) | | Secretary, since 2018; Chief Legal Officer, since 2018 | | Senior Company Counsel of Wells Fargo Bank, N.A. since 2018 (previously Senior Counsel from 2007 to 2018). Vice President of Wells Fargo Funds Management, LLC from 2008 to 2014. | | |

Michael H. Whitaker

(Born 1967) | | Chief Compliance Officer, since 2016 | | Senior Vice President and Chief Compliance Officer since 2016. Senior Vice President and Chief Compliance Officer for Fidelity Investments from 2007 to 2016. | | |

David Berardi

(Born 1975) | | Assistant Treasurer, since 2009 | | Vice President of Wells Fargo Funds Management, LLC since 2009. Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010. Manager of Fund Reporting and Control for Evergreen Investment Management Company, LLC from 2004 to 2010. | | |

Jeremy DePalma1

(Born 1974) | | Assistant Treasurer, since 2009 | | Senior Vice President of Wells Fargo Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. | | |

| 1 | Nancy Wiser acts as Treasurer of 76 funds in the Fund Complex. Jeremy DePalma acts as Treasurer of 76 funds and Assistant Treasurer of 76 funds in the Fund Complex. |

| 2 | The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request, by calling1-800-222-8222 or by visiting the website atwellsfargofunds.com. |

| 3 | Mr. Harris will replace Ms. Johnson as the Chairman of the Audit Committee effective January 1, 2019. |

| 4 | Mr. Scofield is expected to retire on December 31, 2018. |

This page is intentionally left blank.

This page is intentionally left blank.

This page is intentionally left blank.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

© 2019 Wells Fargo Funds Management, LLC. All rights reserved.

Semi-Annual Report

November 30, 2018

Disciplined Large Cap Portfolio

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports atwellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of November 30, 2018, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Disciplined Large Cap Portfolio | | Performance highlights (unaudited) |

Investment objective

The Portfolio seeks long-term capital appreciation.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Justin P. Carr, CFA®‡

Greg W. Golden, CFA®‡

| | | | |

| Ten largest holdings (%) as of November 30, 20181 | |

Apple Incorporated | | | 3.76 | |

Microsoft Corporation | | | 3.57 | |

Amazon.com Incorporated | | | 2.62 | |

Exxon Mobil Corporation | | | 1.67 | |

Berkshire Hathaway Incorporated Class B | | | 1.65 | |

Johnson & Johnson | | | 1.64 | |

Facebook Incorporated Class A | | | 1.51 | |

JPMorgan Chase & Company | | | 1.48 | |

Alphabet Incorporated Class A | | | 1.46 | |

Bank of America Corporation | | | 1.44 | |

|

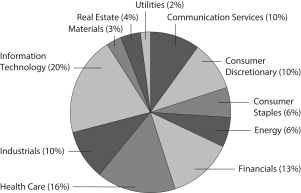

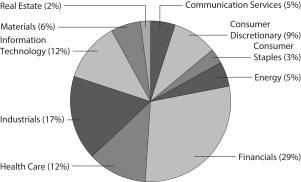

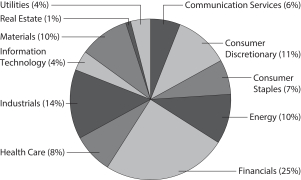

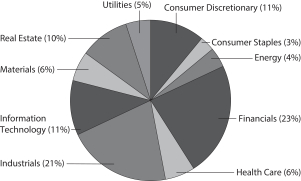

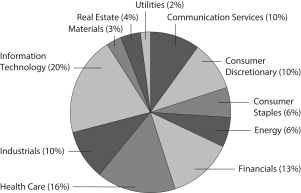

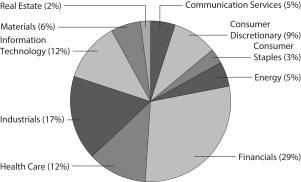

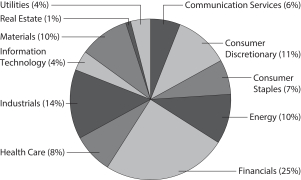

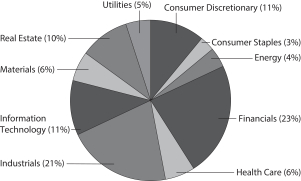

| Sector distribution as of November 30, 20182 |

|

|

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by the total net assets of the portfolio. Holdings are subject to change and may have changed since the date specified. |

| 2 | Amounts are calculated based on the total long-term investments of the Portfolio. These amounts are subject to change and may have changed since the date specified. |

| | | | | | |

| Portfolio of investments—November 30, 2018 (unaudited) | | Wells Fargo Disciplined Large Cap Portfolio | | | 3 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 99.25% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 10.00% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services: 1.88% | | | | | | | | | | | | | | | | |

AT&T Incorporated | | | | | | | | | | | 134,067 | | | $ | 4,188,253 | |

Verizon Communications Incorporated | | | | | | | | | | | 52,940 | | | | 3,192,282 | |

| | | | |

| | | | | | | | | | | | | | | 7,380,535 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Entertainment: 1.91% | | | | | | | | | | | | | | | | |

Netflix Incorporated † | | | | | | | | | | | 3,294 | | | | 942,512 | |

The Walt Disney Company | | | | | | | | | | | 30,209 | | | | 3,488,837 | |

Twenty-First Century Fox Incorporated Class A | | | | | | | | | | | 28,121 | | | | 1,391,146 | |

Twenty-First Century Fox Incorporated Class B | | | | | | | | | | | 9,165 | | | | 449,360 | |

Viacom Incorporated Class B | | | | | | | | | | | 40,292 | | | | 1,243,411 | |

| | | | |

| | | | | | | | | | | | | | | 7,515,266 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Interactive Media & Services: 4.59% | | | | | | | | | | | | | | | | |

Alphabet Incorporated Class A † | | | | | | | | | | | 5,167 | | | | 5,733,562 | |

Alphabet Incorporated Class C † | | | | | | | | | | | 5,182 | | | | 5,671,336 | |

Facebook Incorporated Class A † | | | | | | | | | | | 42,259 | | | | 5,942,038 | |

IAC Corporation † | | | | | | | | | | | 3,871 | | | | 688,883 | |

| | | | |

| | | | | | | | | | | | | | | 18,035,819 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 1.54% | | | | | | | | | | | | | | | | |

Comcast Corporation Class A | | | | | | | | | | | 106,534 | | | | 4,155,891 | |

John Wiley & Sons Incorporated Class A | | | | | | | | | | | 11,908 | | | | 658,393 | |

Sirius XM Holdings Incorporated | | | | | | | | | | | 197,089 | | | | 1,227,864 | |

| | | | |

| | | | | | | | | | | | | | | 6,042,148 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Wireless Telecommunication Services: 0.08% | | | | | | | | | | | | | | | | |

Sprint Corporation † | | | | | | | | | | | 49,959 | | | | 313,743 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 9.63% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components: 0.33% | | | | | | | | | | | | | | | | |

Gentex Corporation | | | | | | | | | | | 56,849 | | | | 1,280,239 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Automobiles: 0.65% | | | | | | | | | | | | | | | | |

Ford Motor Company | | | | | | | | | | | 172,359 | | | | 1,621,898 | |

General Motors Company | | | | | | | | | | | 24,187 | | | | 917,897 | |

| | | | |

| | | | | | | | | | | | | | | 2,539,795 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Consumer Services: 0.16% | | | | | | | | | | | | | | | | |

H&R Block Incorporated | | | | | | | | | | | 15,670 | | | | 423,247 | |

Service Corporation International | | | | | | | | | | | 4,397 | | | | 203,141 | |

| | | | |

| | | | | | | | | | | | | | | 626,388 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 0.54% | | | | | | | | | | | | | | | | |

Carnival Corporation | | | | | | | | | | | 6,881 | | | | 414,855 | |

Chipotle Mexican Grill Incorporated † | | | | | | | | | | | 800 | | | | 378,568 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 4 | | Wells Fargo Disciplined Large Cap Portfolio | | Portfolio of investments—November 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Hotels, Restaurants & Leisure(continued) | | | | | | | | | | | | | | | | |

Domino’s Pizza Incorporated | | | | | | | | | | | 1,324 | | | $ | 367,172 | |

Las Vegas Sands Corporation | | | | | | | | | | | 8,218 | | | | 451,497 | |

McDonald’s Corporation | | | | | | | | | | | 2,821 | | | | 531,787 | |

| | | | |

| | | | | | | | | | | | | | | 2,143,879 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 0.33% | | | | | | | | | | | | | | | | |

NVR Incorporated † | | | | | | | | | | | 182 | | | | 445,900 | |

Pulte Group Incorporated | | | | | | | | | | | 32,848 | | | | 871,129 | |

| | | | |

| | | | | | | | | | | | | | | 1,317,029 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet & Direct Marketing Retail: 2.71% | | | | | | | | | | | | | | | | |

Amazon.com Incorporated † | | | | | | | | | | | 6,093 | | | | 10,298,206 | |

GrubHub Incorporated † | | | | | | | | | | | 4,479 | | | | 350,661 | |

| | | | |

| | | | | | | | | | | | | | | 10,648,867 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multiline Retail: 0.72% | | | | | | | | | | | | | | | | |

Kohl’s Corporation | | | | | | | | | | | 12,776 | | | | 858,164 | |

Macy’s Incorporated | | | | | | | | | | | 38,369 | | | | 1,312,987 | |

Target Corporation | | | | | | | | | | | 9,198 | | | | 652,690 | |

| | | | |

| | | | | | | | | | | | | | | 2,823,841 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 3.78% | | | | | | | | | | | | | | | | |

Best Buy Company Incorporated | | | | | | | | | | | 24,621 | | | | 1,590,270 | |

Burlington Stores Incorporated † | | | | | | | | | | | 2,535 | | | | 420,202 | |

Dick’s Sporting Goods Incorporated | | | | | | | | | | | 35,919 | | | | 1,292,366 | |

Foot Locker Incorporated | | | | | | | | | | | 16,537 | | | | 932,687 | |

Lowe’s Companies Incorporated | | | | | | | | | | | 22,655 | | | | 2,137,952 | |

Penske Auto Group Incorporated | | | | | | | | | | | 4,434 | | | | 193,322 | |

Ross Stores Incorporated | | | | | | | | | | | 12,317 | | | | 1,078,969 | |

The Gap Incorporated | | | | | | | | | | | 31,037 | | | | 847,000 | |

The Home Depot Incorporated | | | | | | | | | | | 24,642 | | | | 4,443,445 | |

The TJX Companies Incorporated | | | | | | | | | | | 22,764 | | | | 1,112,021 | |

Urban Outfitters Incorporated † | | | | | | | | | | | 20,704 | | | | 788,615 | |

| | | | |

| | | | | | | | | | | | | | | 14,836,849 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods: 0.41% | | | | | | | | | | | | | | | | |

Michael Kors Holdings Limited † | | | | | | | | | | | 4,021 | | | | 175,919 | |

Nike Incorporated Class B | | | | | | | | | | | 10,614 | | | | 797,324 | |

Ralph Lauren Corporation | | | | | | | | | | | 5,726 | | | | 637,876 | |

| | | | |

| | | | | | | | | | | | | | | 1,611,119 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 6.40% | | | | | | | | | | | | | | | | |

| | | | |

| Beverages: 1.22% | | | | | | | | | | | | | | | | |

Molson Coors Brewing Company Class B | | | | | | | | | | | 6,574 | | | | 432,372 | |

PepsiCo Incorporated | | | | | | | | | | | 13,786 | | | | 1,681,065 | |

The Coca-Cola Company | | | | | | | | | | | 53,550 | | | | 2,698,920 | |

| | | | |

| | | | | | | | | | | | | | | 4,812,357 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—November 30, 2018 (unaudited) | | Wells Fargo Disciplined Large Cap Portfolio | | | 5 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Food & Staples Retailing: 2.36% | | | | | | | | | | | | | | | | |

Costco Wholesale Corporation | | | | | | | | | | | 8,575 | | | $ | 1,983,226 | |

Sysco Corporation | | | | | | | | | | | 2,900 | | | | 195,460 | |

The Kroger Company | | | | | | | | | | | 54,478 | | | | 1,615,817 | |

US Foods Holding Corporation † | | | | | | | | | | | 12,830 | | | | 425,699 | |

Wal-Mart Stores Incorporated | | | | | | | | | | | 36,920 | | | | 3,605,238 | |

Walgreens Boots Alliance Incorporated | | | | | | | | | | | 17,310 | | | | 1,465,638 | |

| | | | |

| | | | | | | | | | | | | | | 9,291,078 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 1.02% | | | | | | | | | | | | | | | | |

Archer Daniels Midland Company | | | | | | | | | | | 12,257 | | | | 564,067 | |

Ingredion Incorporated | | | | | | | | | | | 3,838 | | | | 400,917 | |

Kellogg Company | | | | | | | | | | | 6,115 | | | | 389,220 | |

Lamb Weston Holdings Incorporated | | | | | | | | | | | 5,144 | | | | 394,545 | |

Pilgrim’s Pride Corporation † | | | | | | | | | | | 20,368 | | | | 404,101 | |

Tyson Foods Incorporated Class A | | | | | | | | | | | 31,334 | | | | 1,847,139 | |

| | | | |

| | | | | | | | | | | | | | | 3,999,989 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Products: 0.99% | | | | | | | | | | | | | | | | |

Energizer Holdings Incorporated | | | | | | | | | | | 6,772 | | | | 303,589 | |

Kimberly-Clark Corporation | | | | | | | | | | | 3,526 | | | | 406,795 | |

Spectrum Brands Holdings Incorporated | | | | | | | | | | | 12,098 | | | | 597,399 | |

The Procter & Gamble Company | | | | | | | | | | | 27,515 | | | | 2,600,443 | |

| | | | |

| | | | | | | | | | | | | | | 3,908,226 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Personal Products: 0.20% | | | | | | | | | | | | | | | | |

NU Skin Enterprises Incorporated Class A | | | | | | | | | | | 11,734 | | | | 774,092 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tobacco: 0.61% | | | | | | | | | | | | | | | | |

Altria Group Incorporated | | | | | | | | | | | 13,959 | | | | 765,372 | |

Philip Morris International Incorporated | | | | | | | | | | | 18,619 | | | | 1,611,102 | |

| | | | |

| | | | | | | | | | | | | | | 2,376,474 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 5.59% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 0.61% | | | | | | | | | | | | | | | | |

Schlumberger Limited | | | | | | | | | | | 53,247 | | | | 2,401,440 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 4.98% | | | | | | | | | | | | | | | | |

Chevron Corporation | | | | | | | | | | | 41,116 | | | | 4,890,337 | |

ConocoPhillips | | | | | | | | | | | 16,150 | | | | 1,068,807 | |

Exxon Mobil Corporation | | | | | | | | | | | 82,637 | | | | 6,569,642 | |

Kinder Morgan Incorporated | | | | | | | | | | | 101,076 | | | | 1,725,367 | |

Marathon Petroleum Corporation | | | | | | | | | | | 10,654 | | | | 694,215 | |

Occidental Petroleum Corporation | | | | | | | | | | | 5,479 | | �� | | 385,009 | |

ONEOK Incorporated | | | | | | | | | | | 30,511 | | | | 1,874,291 | |

PBF Energy Incorporated Class A | | | | | | | | | | | 19,258 | | | | 744,899 | |

Valero Energy Corporation | | | | | | | | | | | 20,377 | | | | 1,628,122 | |

| | | | |

| | | | | | | | | | | | | | | 19,580,689 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 6 | | Wells Fargo Disciplined Large Cap Portfolio | | Portfolio of investments—November 30, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Financials: 13.33% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 5.04% | | | | | | | | | | | | | | | | |

Bank of America Corporation | | | | | | | | | | | 199,769 | | | $ | 5,673,440 | |

BB&T Corporation | | | | | | | | | | | 15,002 | | | | 766,602 | |

Citigroup Incorporated | | | | | | | | | | | 57,304 | | | | 3,712,726 | |

Citizens Financial Group Incorporated | | | | | | | | | | | 17,999 | | | | 654,444 | |

First Hawaiian Incorporated | | | | | | | | | | | 30,317 | | | | 788,848 | |

JPMorgan Chase & Company | | | | | | | | | | | 52,383 | | | | 5,824,466 | |