Exhibit 99(a)(5)(xiii)

[ubiqus]

CERTIFICATE OF ACCURACY

I, the undersigned, Arend Bakker, declare that I am fluent in the English and Dutch languages; that I have translated, transcribed, reviewed and/or edited the following Dutch source file.

Van Dijck Tab 38.pdf

I certify that to the best of my knowledge, ability and belief the same is a true and complete translation/transcription of the documents presented to me.

/s/ Arend Bakker |

| (Translator) |

JX 246a |

www.ubiqus.com

Ubiqus — West Coast 2222 Martin Street, Suite 212 Irvine, CA 92612 ph. (949) 477 4972 | Maeling Services Transcription Translation / Interpretation Audience Response Systems | Ubiqus — East Coast 22 Cortlandt Street, Suite 802 New York, NY 10007 ph. (212) 227 7440 |

From: Dijk, van, J.A. (Johannes) (W&O Financial BC Carrier Services)

Sent: Tuesday, April 14, 2009 11:05:57 AM

To: Meijden, van der, J.G. (Julian) (W&O Financial Segment Control W&O); Farwerck, J.F.E. (Joost)

(W&O Director); Costermans, N.J. (Huib) (W&O Financial Manager); Schot, van der, P.J. (W&O CS DIR

Changing Management); Postma, J.J.L. (Jaap) (W&O Carrier Services Director); Erp, van, P.C. (Peter)

(W&O PFM WS Interconnection Servives)

Cc: Nijs, de, H.W. (Henk) (W&O Finances BC Portfolio Management)

Subject: JEV iBasis

Attachments: Copy of scenario_iBasis_2009-2010-HN-14-03-2009.xlx

Gentlemen,

In particular Henk has fought today with the JEV 09/10 of iBasis. This is not an easy question,

because they are mainly focused on margin at this moment. This causes that there has been $ 50

million turnover less than was foreseen in the plan. Compared to Q1 2008 is this even $70 million.

Therefore we are in descending line in minutes and turnover. The question is when will this stop and

when will we grow again?

For 2009 we think that the JEV on margin (ebitda and FCF) is considered realistic. They score a

reasonable Gross margin and the opex expenses are well under control. We expect a growth in

minutes during the coming quarters of the year. We think that 22 billion minutes with a turnover

over $ 1.1 billion is a realistic forecast. I have approached iBasis about this and this is not denied.

iBasis is not ready to submit a JEV for 2009. So we really have to count on a lower turnover. In

market shares this is a worrisome development, what counts in business is expansion,

expansion.............

For 2010 it is even more difficult to give a forecast. There we propose 4 scenarios.

Going concern, iBasis takes up the market growth again and maintains a margin of appr. 11% (a little

lower than Q1 09)

Going concern, with insourcing deals (2.5 billion minutes)

Organic growth of 12% and a margin of 10.6%

Organic growth of 12% + insourcing deals (2.5 billion minutes).

If we do not do anything, we think that the absolute margin will eventually come under pressure,

because the business is faced with continuous decreases in price. In our perception we must do

something in terms of extra growth. Therefore the aiming at iBasis must be changed.

For the various scenarios see the excel file.

Willing to debate and discussion. We are in my perception at a difficult decision point.

With kindest regards,

Johannes van Dijk

Financial Portfolio Management Wholesale and Operations

KPN

W&O Financial

Regulusweg 1, suite HV4 BC 1.11

2516 AC The Hague

Telephone: (070) 34 36 205

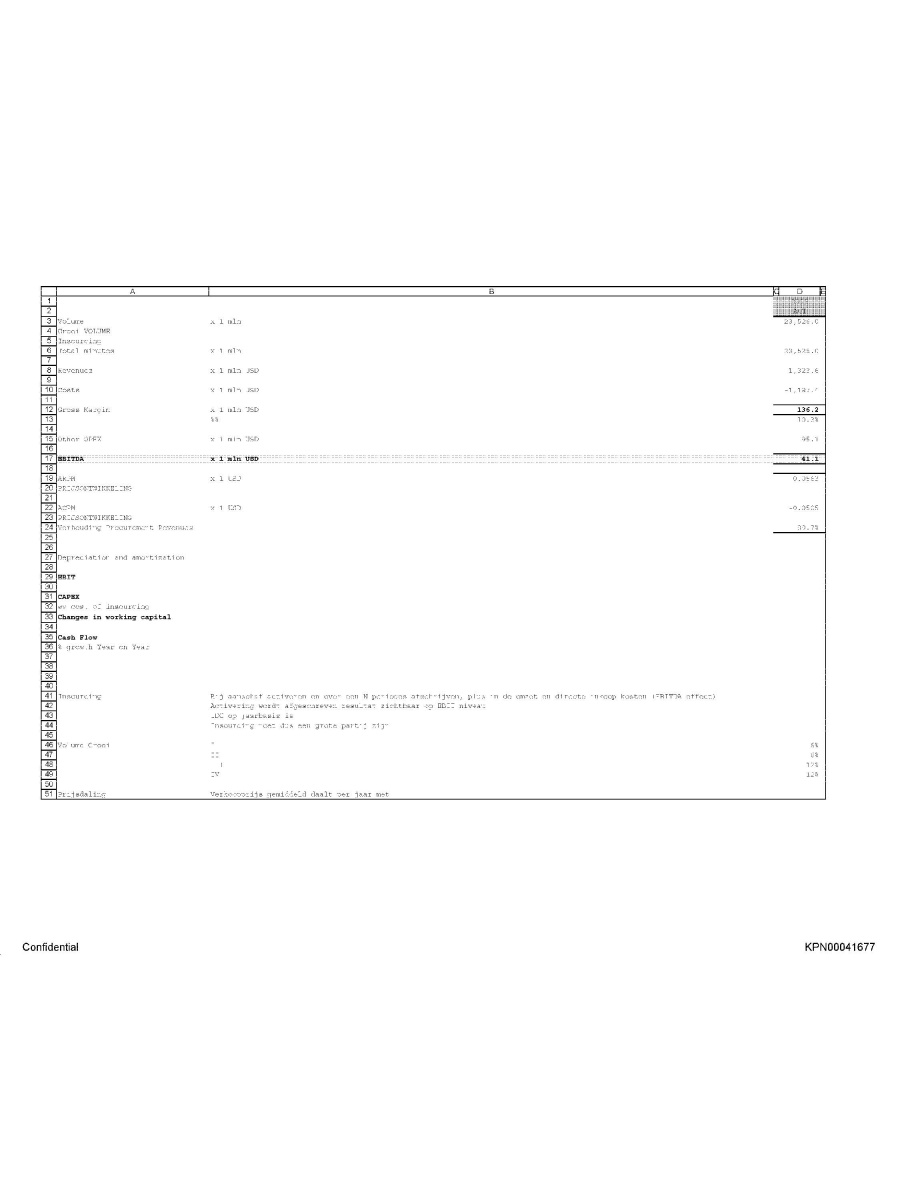

Column A

Row 3: Volume

Row 4: Growth VOLUME

Row 20: PRICE DEVELOPMENT

Row 23: PRICE DEVELOPMENT

Row 24: Relation Procurement Revenues

Row 46: Volume growth

Row 51: Decrease in price

Column B

Row 41: Activate when purchased and write off in N periods, plus in the turnover and direct costs

(EBITDA effect)

Row 42: Activation is written off result visible at EBIT level

Row 43: TDC on a yearly basis is

Row 44: Therefore insourcing has to be a big party

Row 51: Selling price decreases per year on average with

Column C

Row 4: Share 01 in ACTUAL YEAR

Row 17: Share Q1 in ACTUAL YEAR

Row 25: Relation Procurement Revenues

Column F

Row 46: Normal

Row 47: Normal and insourcing

Row 48: Aggressive

Row 49: Aggressive and Insourcing

Column H

Row 43: million minutes

Column J

Row 43: with Gross Margin

Row 44: HIGH MARGIN

Column O

Row 2: GROWTH

Column AA, AC and AE

Row 6: TURNOVER

From: Dijk, van, J.A. (Johannes) (W&O Financien BC Carrier Services)

Sent Tuesday, April 14, 2009 11:05:57 AM

To: Meijden, van der, J.G. (Julian) (W&O Financidn Segment Control W&O); Farwerck, J.F.E. (Joost) (W&O Directeur); Costermans, H.J. (Huib)

(W&O Financidn Manager); Schot, van der, P.J. (Paul) (W&O CS DIR Veranderingsmanagement); Posima, J.J.L. (Jaap) (W&O Carrier

Services Dir); Erp, van, P.C. (Peter) (W&O CS CPM Interconnection Services)

Cc: Nijs, de, H.W. (Henk) (W&O Financien BC Carrier Services)

Subject JEV IBasis

Attachments: Kopie van scenario_iBasis_2009-2010-HN-14-03-2009.xls

Heren,

Met name Henk heeft vandaag gestoeid met de JEV 09/10 van iBasis. Dit is geen gemakkelijke vraag, omdat zij op dit moment vooral gefocust

zijn op merge. Dit heeft als gevolg dat men 50 min dollar minder omzet heeft gedraaid dan in het plan was voorzien. T.o.v. van Q1 2008 is dit

zelfs 70 min dollar. We zitten dus in een neergaande lijn in minuten en omzet. De vraag is wanneer houdt dit op en gaan we weer groeien?

Voor 2009 denken we dat de JEV op merge (ebitda en FCF) realistisch moat worden geacht. Ze scorn een redelijke Gross margin en de opex

uitgaven zijn goad onder controle. We veronderstellen een groei in minuten in de komende kwartalen. We denken dat 22 mrd minuten met een

omzet van 1.1 mrd dollar een realistische forcast is. lk heb hier ook iBasis over gepolst en dit wordt niet direct ontkend. iBasis is nog niet zover

om een JEV af te geven voor 2009. Dus we moeten echt rekening gaan houden met lagere omzet. Dit is in maridaandelen gezien een

zorgelijke ontwikkeling, waar het in de business draait op schaalgroofie, schaalgrootte...........

Voor 2010 is hetrtyrdoellijker om een forcast af te geven. We stellen hier 4 scenario's voor:

Going concern, iBasis pakt de marktgroei weer op en behoudt een marge van ca. 11% (iets lager dan Q1 09)

Going concern, met insourcing deals (2.5 mrd minutes)

Organic growth van 12% en een merge van 10.6%

Organic growth van 12% + insourcing deals (2.5 mrd minutes).

Als we niks doen, denken we dat de absolute merge toch uiteindelijk onder druk komt te staan, doordat de business met voortdurende

prijsdalingen wordt geconfronteerd. We moeten in onze beleving wel wet doen in termen van extra groei. Hiervoor zal de aansturing richting

iBasis moeten worden veranderd.

Zie voor de verschillende scenario's de excel file.

Graag bereid tot overieg en discussie. We zitten in mijn beleving op een moeilijk beslispunt.

Met vriendelijke groet,

Johannes van Dijk

Finanoidn Portfolio Management Wholesale en Operations

KPN

W&O financiën

Regulusweg 1, kamer HV4 BC 1.11

2516 AC 's Gravenhage

Telefoon: (070) 34 36 205

| Confidential | KPN00041676 |

Volume Groei Volume Insourcing Total minutes Revenues Costs Gross margin Other OPEX EBITDA ARPM Prijsontwikkeling ACPM Prijsontwikkeling Verhouding procurement Revenues Depreciation and amortization EBIT CAPEX WV cost of insourcing Changes in working capital Cash Flow % growth year on Year Insourcing Volume Groei Prijsdaling Bij aanschaf activeren en over een N periodes afschrijven, plus in de omzet en directe inkeep kosten (EBITDA effect) Activering wordt afgeschreven resultat zichtbaar op EBIt niveau TDC op jaarbasis is Insourcing moet du seen grote partij zijn Verkoopprijs gemiddeld dealt per jaar met Confidential KPN00041677

2008 2009 2010 2010 2010 IV 2010 Groei Insource mln minuten met Bruto marge 2 mln USD Hoge Marge 11% Normaal normal en insourcing Agressief Agressief en Insourcing Confidential KPN00041678

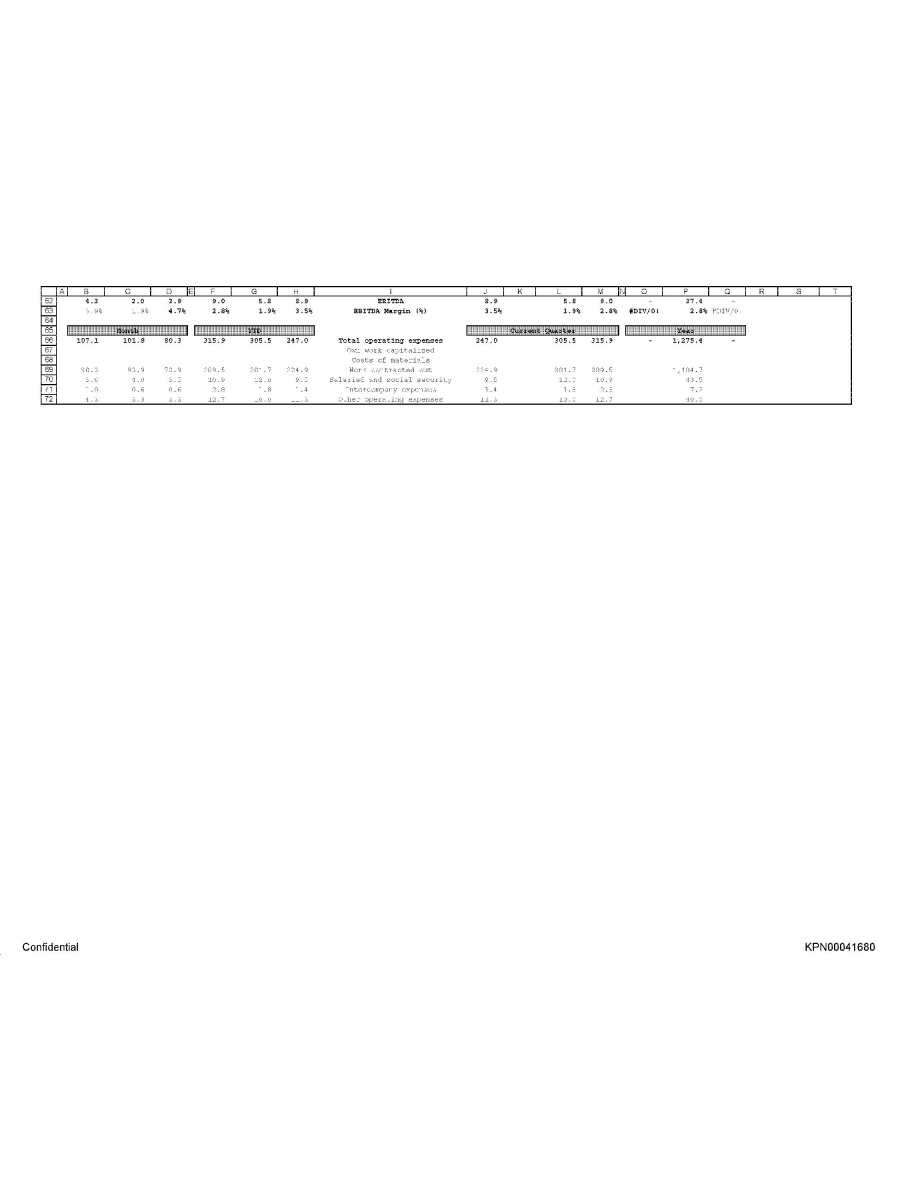

Glenn Meloni Report April 2009 In millions of USD Unless other stated Total net revenue % growth year on Year Cost of services and goods Gross margin Other operating expenses Other income/expenses Total operating expenses % growth Year on Year EBITDA EBITDA Margin (%) Depreciation and amortization Operating result (EBIT) EBIT margin (%) Capex changes in working capital Cash Flow % growth Year on Year In millions of USD Unless otherwise stated Total Revenues % growth year on Year Cost of access Distribution fees cost of goods sold Costs of services sold Costs of services and good % growth Year on Year Contribution Margin Network costs Marketing & sales costs General 7 admin. costs Changes in provision & other Other operating expenses % growth year on Year Total costs and expenses Confidential KPN00041679

EBITDA EBITDA margin (%) Total operating expenses Own work capitalized Costs of materials Work contracted out Salaried and social security Intercompany expenses Other operating expenss Confidential KPN00041680

Year Actual % Year Plan YKK YKK 2010 Confidential KPN00041681

| U | V | W | X | Y | Z | AA | AB | AC | AD | AE | |

| 62 | |||||||||||

| 63 | |||||||||||

| 64 | |||||||||||

| 65 | |||||||||||

| 66 | |||||||||||

| 67 | |||||||||||

| 68 | |||||||||||

| 69 | |||||||||||

| 70 | |||||||||||

| 71 | |||||||||||

| 72 | |||||||||||

Confidential KPN00041682

| Confidential | KPN00041682 |

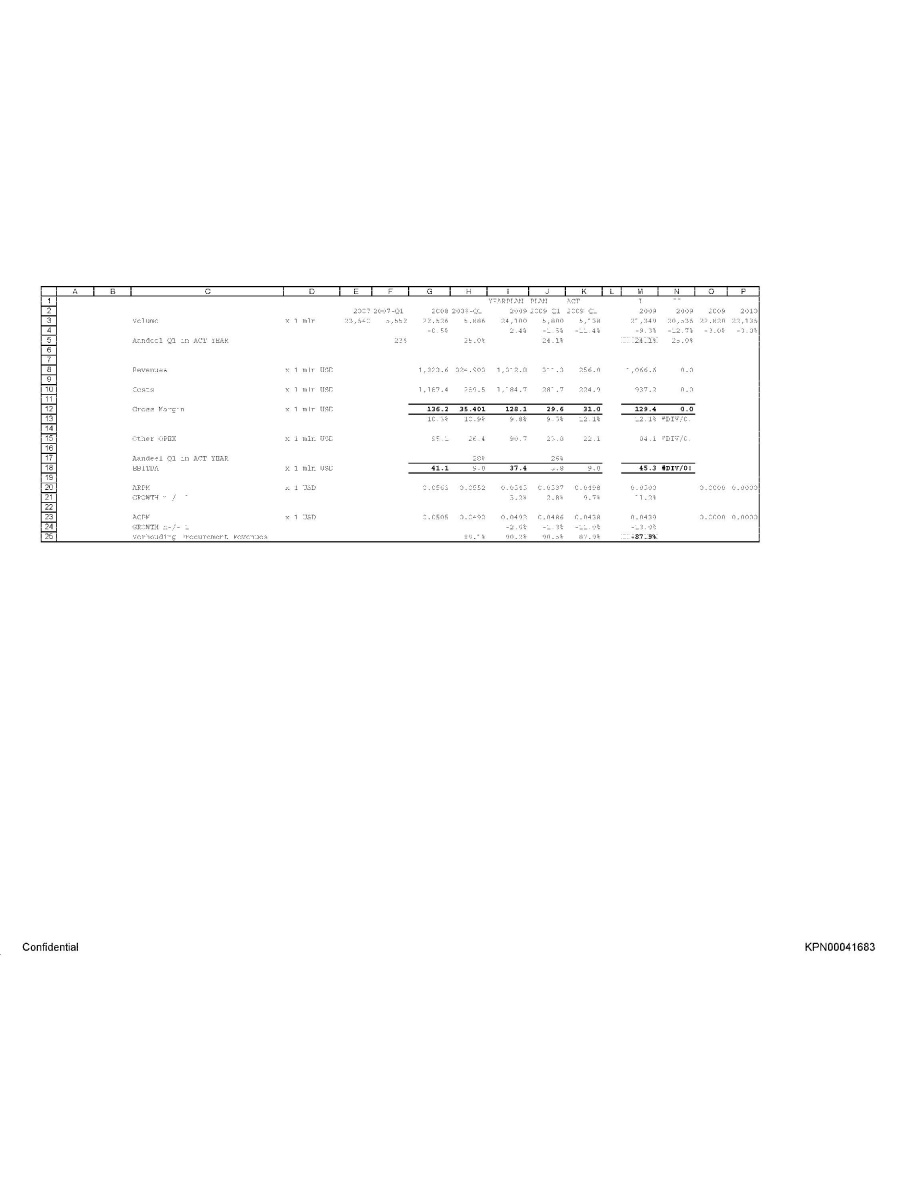

Year Plan Act Volume Aandeel Q1 in ACT YEAR Revenues Costs Gross Margin Other OPEX Aandeel Q1 in ACT YEAR EBITDA ARPM Growth n - / - 1 ACPM GROWTH n - / - 1 Verhouding Procurement Revenues Confidential KPN00041683