Exhibit 99(a)(5)(xviii)

From: Rodenburg, J.J. (Jan) (KPNCC M&A Management)

Sent: Tuesday, June 02, 2009 2:37:17 PM

To: Manning, Matthew; Kadaba, Arvind (IBD)

Cc: Braat, D. (Daniel) (KPNCC M&A Management); House, M. (Matthew) (KPNCC M&A Management)

Subject: Celtic - Business Case

Attachments: 090602 Project Celtic - Business Case v_senttoMS_2.xls

Matt, Arvind,

Please find attached the updated version of the business case as discussed over the phone with Matthew.

Let me know should you have any questions.

Thanks and regards,

Jan

_______________________________________

Jan Rodenburg

KPN Royal Dutch Telecom

Mergers & Acquisitions

Maanplein 55

2516 CK The Hague

The Netherlands

Tel: +31 70 343 4861

Mob: +31 6 4714 2925

Email: HYPERLINK “mailto:jan.rodenburg@kpn.com”jan.rodenburg@kpn.com

| | JX 103 |

| | |

| Confidential | KPN00080076 |

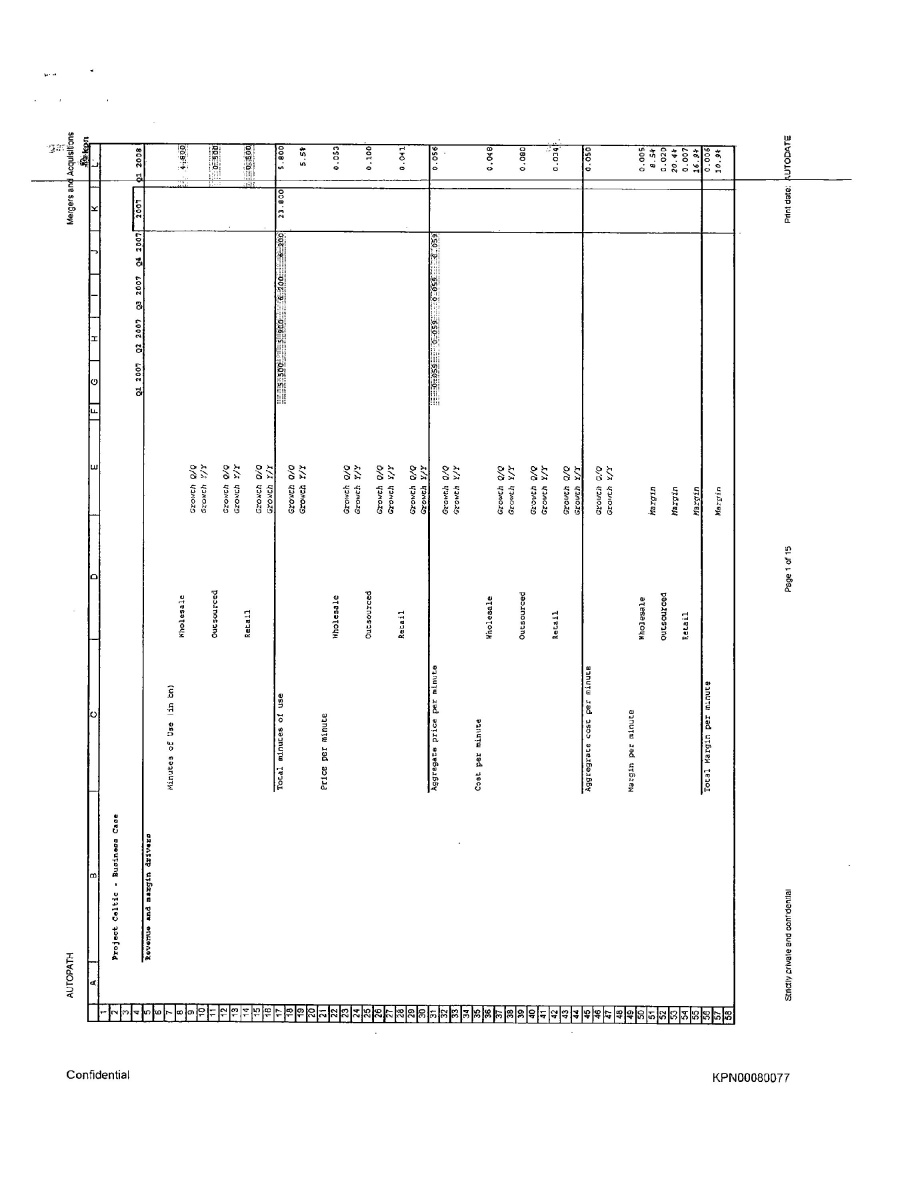

AUTOPATH Mergers and Acquisitions Project Celtic - Business Case Q1 2007 Q2 2007 Q3 2007 Q4 2007 2007 Q1 2008 Revenue and margin drivers Minutes of Use (in bn) Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Total minutes of use Growth Q/Q Growth Y/Y Price per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate price per minute Growth Q/Q Growth Y/Y Cost per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate cost per minute Growth Q/Q Growth Y/Y Margin per minute Wholesale Margin Outsourced Margin Retail Margin Total Margin per minute Margin Strictly private and confidential Page 1 of 15 Print date: AUTODATE Confidential KPN00080077

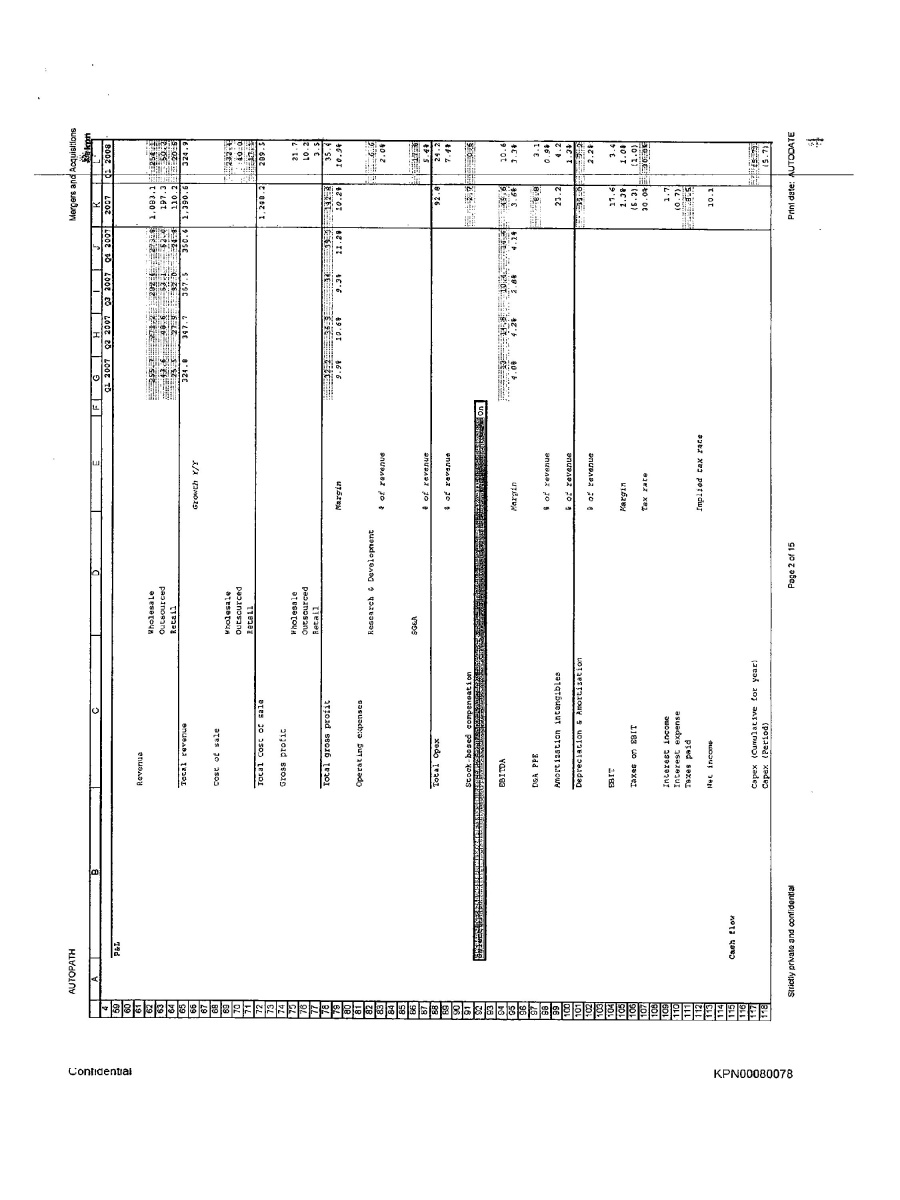

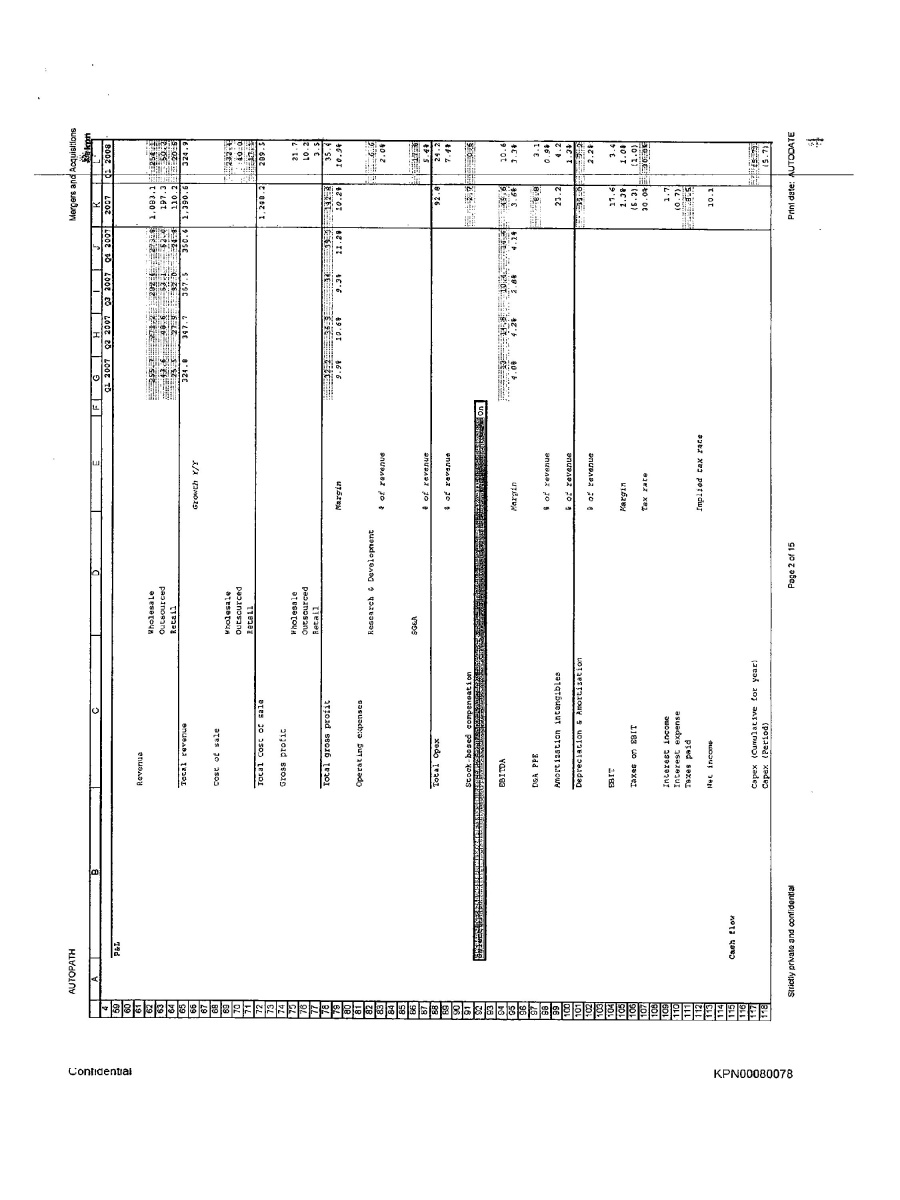

AUTOPATH Mergers and Acquisitions P&L Q1 2007 Q2 2007 Q3 2007 Q4 2007 2007 Q1 2008 Revenue Wholesale Outsourced Retail Total revenue Growth Y/Y Cost of sale Wholesale Outsourced Retail Total cost of sale Gross profit Wholesale Outsourced Retail Total gross profit Margin Operating expenses Research & Development % of revenue SG&A % of revenue Total Opex % of revenue Stock-based compensation EBITDA Margin D&A PPE % of revenue Amortization intangibles % of revenue Depreciation & Amortization % of revenue EBIT Margin Taxes on EBIT Tax rate Interest income Interest expense Taxes paid Implied tax rate Net income Cash flow Capex (Cumulative for year) Capex (Period) Strictly private and confidential Page 2 of 15 Print date: AUTODATE Confidential KPN00080078

AUTOPATH | | | | | | | | | Mergers and Acquisitions [kpn logo] |

| | A | B | C | D | E | F | G | H | I | J | K | L |

| 4 | �� | | | | | | Q1 2007 | Q2 2007 | Q3 2007 | Q4 2007 | 2007 | Q1 2008 |

| 119 | | % of sales | | 1.7% |

| 120 | | | | | | | | | | | | |

| 121 | | | EBITDA less capex | | | | | | | | | 5.0 |

| Strictly private and confidential | Page 3 of 15 | Print date: AUTODATE |

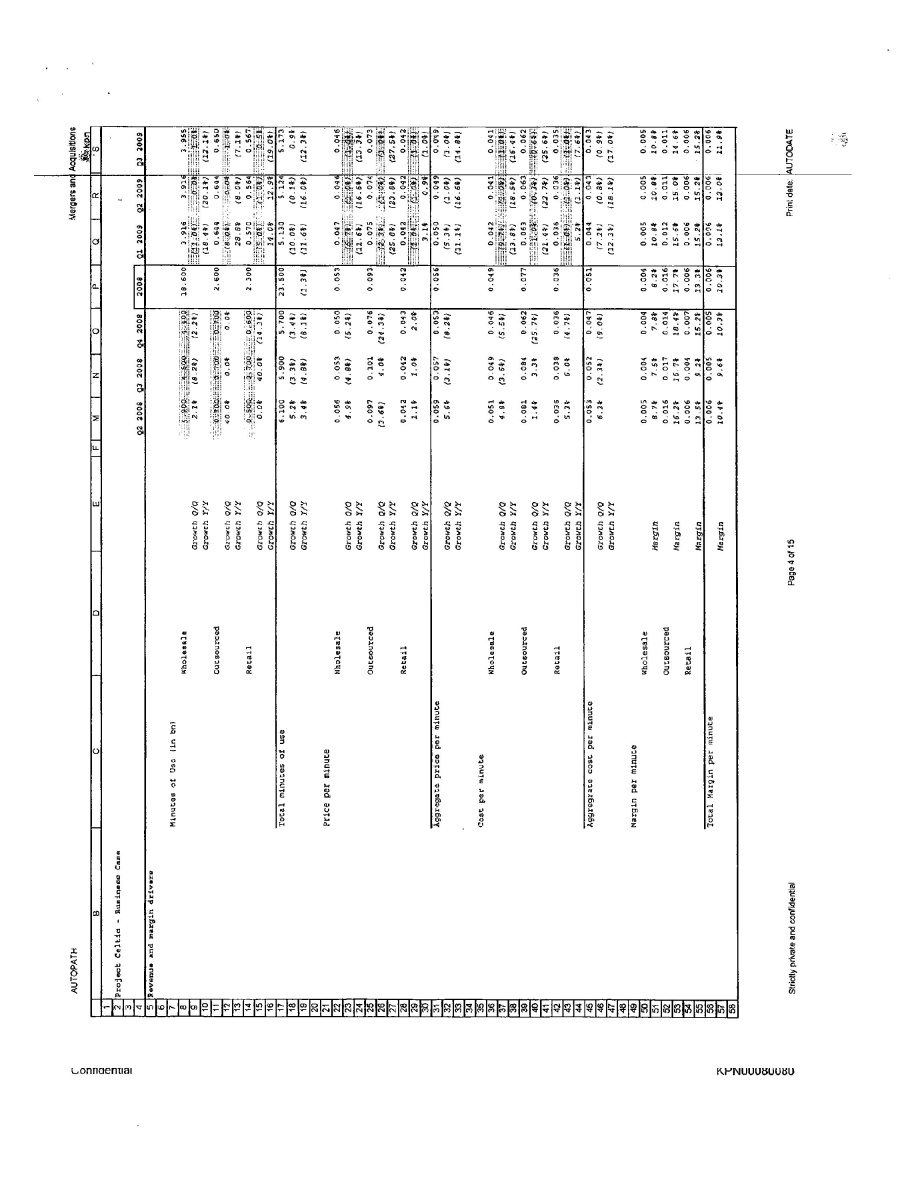

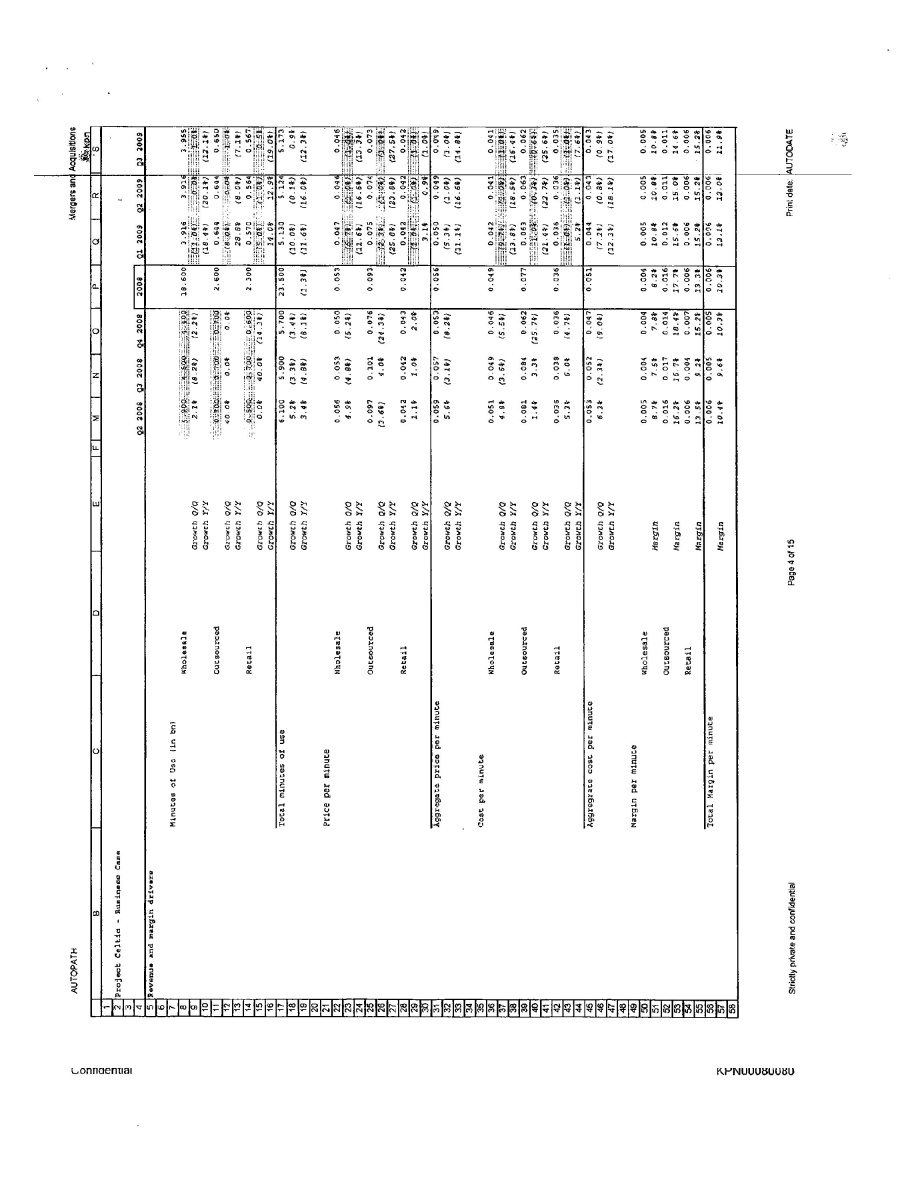

AUTOPATH Mergers and Acquisitions Project Celtic - Business Case Q2 2008 Q3 2008 Q4 2008 2008 Q1 2009 Q2 2009 Q3 2009 Revenue and margin drivers Minutes of Use (in bn) Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Total minutes of use Growth Q/Q Growth Y/Y Price per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate price per minute Growth Q/Q Growth Y/Y Cost per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate cost per minute Growth Q/Q Growth Y/Y Margin per minute Wholesale Margin Outsourced Margin Retail Margin Total Margin per minute Margin Strictly private and confidential Page 4 of 15 Print date: AUTODATE Confidential KPN00080080

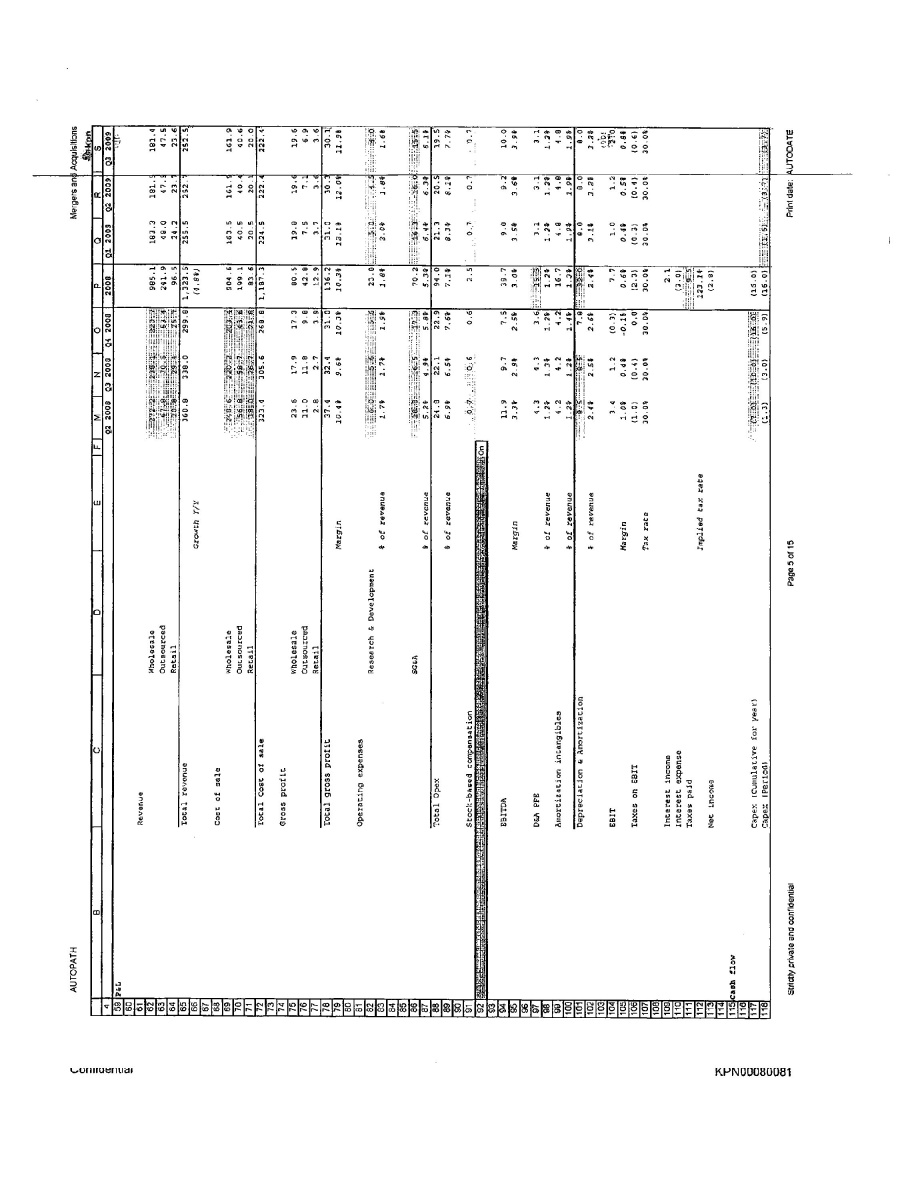

AUTOPATH Mergers and Acquisitions P&L Q2 2008 Q3 2008 Q4 2008 2008 Q1 2009 Q2 2009 Q3 2009 Revenue Wholesale Outsourced Retail Total revenue Growth Y/Y Cost of sale Wholesale Outsourced Retail Total Cost of sale Gross profit Wholesale Outsourced Retail Total gross profit Margin Operating expenses Research & Development % of revenue SG&A % of revenue Total Opex % of revenue Stock-based compensation EBITDA Margin D&A PPE % of revenue Amortization intangibles % of revenue Depreciation & Amortization % of revenue EBIT Margin Taxes on EBIT Tax rate Interest income Interest expense Taxes paid Implied tax rate Net income Cash flow Capex (Cumulative for year) Capex (Period) Strictly private and confidential Page 5 of 15 Print date: AUTODATE Confidential KPN00080081

| AUTOPATH | Mergers and Acquisitions [kpn logo] |

| | B | C | D | E | F | M | N | O | P | Q | R | S |

| 4 | | | | | | Q2 2008 | Q3 2008 | Q4 2008 | 2008 | Q1 2009 | Q2 2009 | Q3 2009 |

| 119 | | | % of sales | | | 0.4% | 0.9% | 2.0% | 1.2% | 0.6% | 1.4% | 1.4% |

| 120 | | | | | | | | | | | | |

| 121 | | EBITDA less capex | | | | 10.6 | 6.6 | 1.6 | 23.8 | 7.5 | 5.5 | 6.3 |

| Strictly private and confidential | Page 6 of 15 | Print date: AUTODATE |

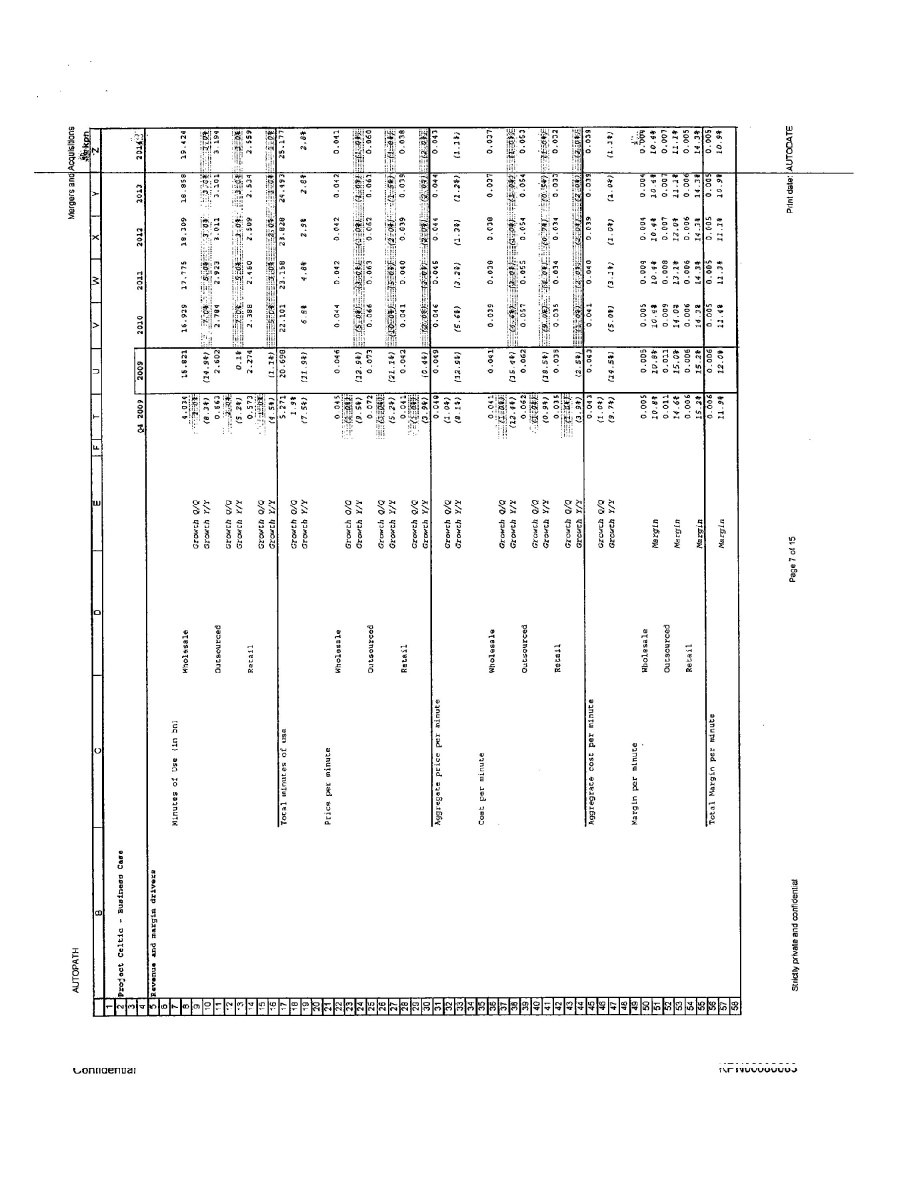

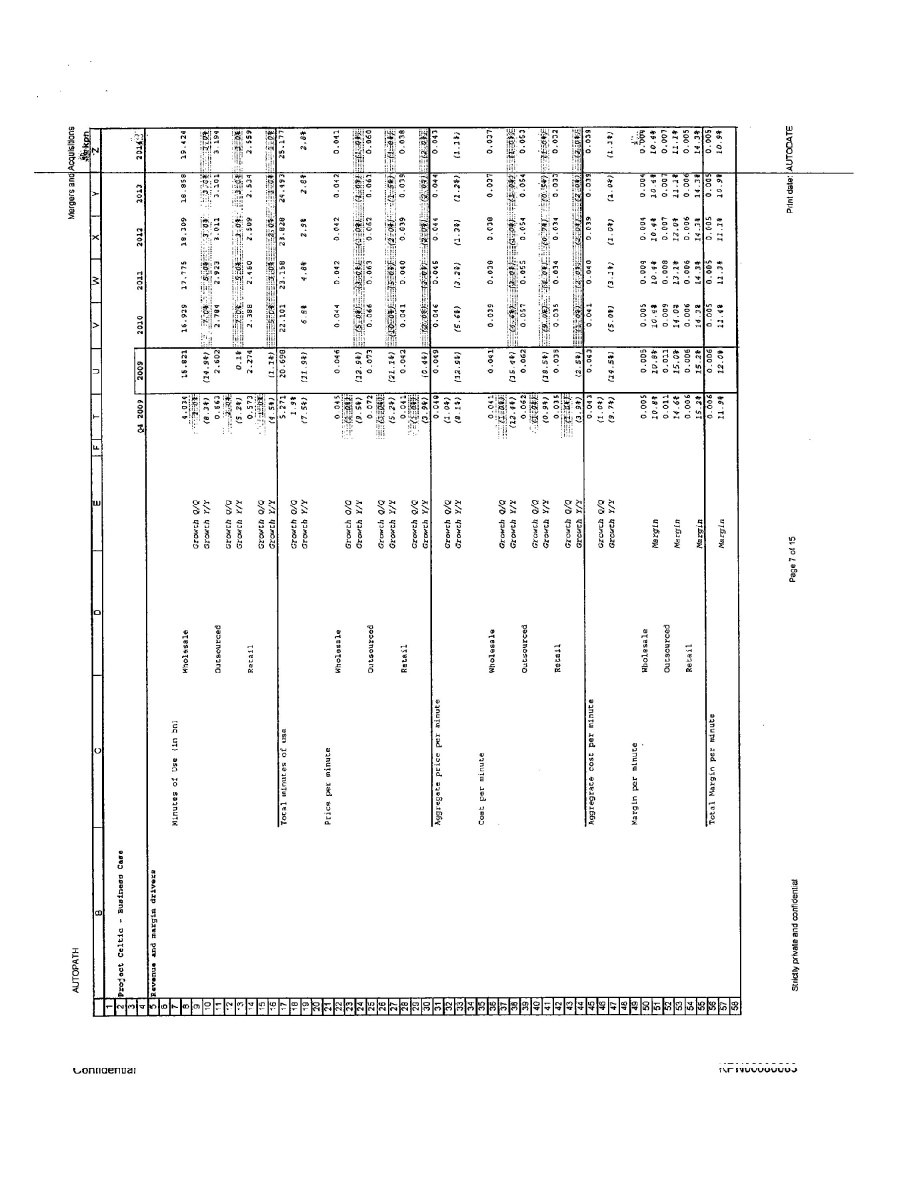

AUTOPATH Mergers and Acquisitions Project Celtic - Business Case Q4 2009 2009 2010 2011 2012 2013 2014 Revenue and margin drivers Minutes of Use (in bn) Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Total minutes of use Growth Q/Q Growth Y/Y Price per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate price per minute Growth Q/Q Growth Y/Y Cost per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate cost per minute Growth Q/Q Growth Y/Y Margin per minute Wholesale Margin Outsourced Margin Retail Margin Total Margin per minute Margin Strictly private and confidential Page 7 of 15 Print date: AUTODATE Confidential KPN00080083

AUTOPATH Mergers and Acquisitions P&L Q4 2009 2009 2010 2011 2012 2013 2014 Revenue Wholesale Outsourced Retail Total revenue Growth Y/Y Cost of sale Wholesale Outsourced Retail Total cost of sale Gross profit Wholesale Outsourced Retail Total gross profit Margin Operating expenses Research & Development % of revenue SG&A % of revenue Total Opex % of revenue Stock-based compensation EBITDA Margin D&A PPE % of revenue Amortization intangibles % of revenue Depreciation & Amortization % of revenue EBIT Margin Taxes on EBIT Tax rate Interest income Interest expense Taxes paid Implied tax rate Net income Cash flow Capex (Cumulative for year) Capex (Period) Strictly private and confidential Page 8 of 15 Print date: AUTODATE Confidential KPN00080084

| AUTOPATH | Mergers and Acquisitions [kpn logo] |

| | B | C | D | E | F | T | U | V | W | X | Y | Z |

| 4 | | | | | | Q4 2009 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| 119 | | | % of sales | | | 1.4% | 1.2% | 1.2% | 1.2% | 1.2% | 1.2% | 1.2% |

| 120 | | | | | | | | | | | | |

| 121 | | EBITDA less capex | | | | 7.1 | 26.4 | 22.6 | 21.2 | 19.0 | 17.1 | 17.0 |

| Strictly private and confidential | Page 9 of 15 | Print date: AUTODATE |

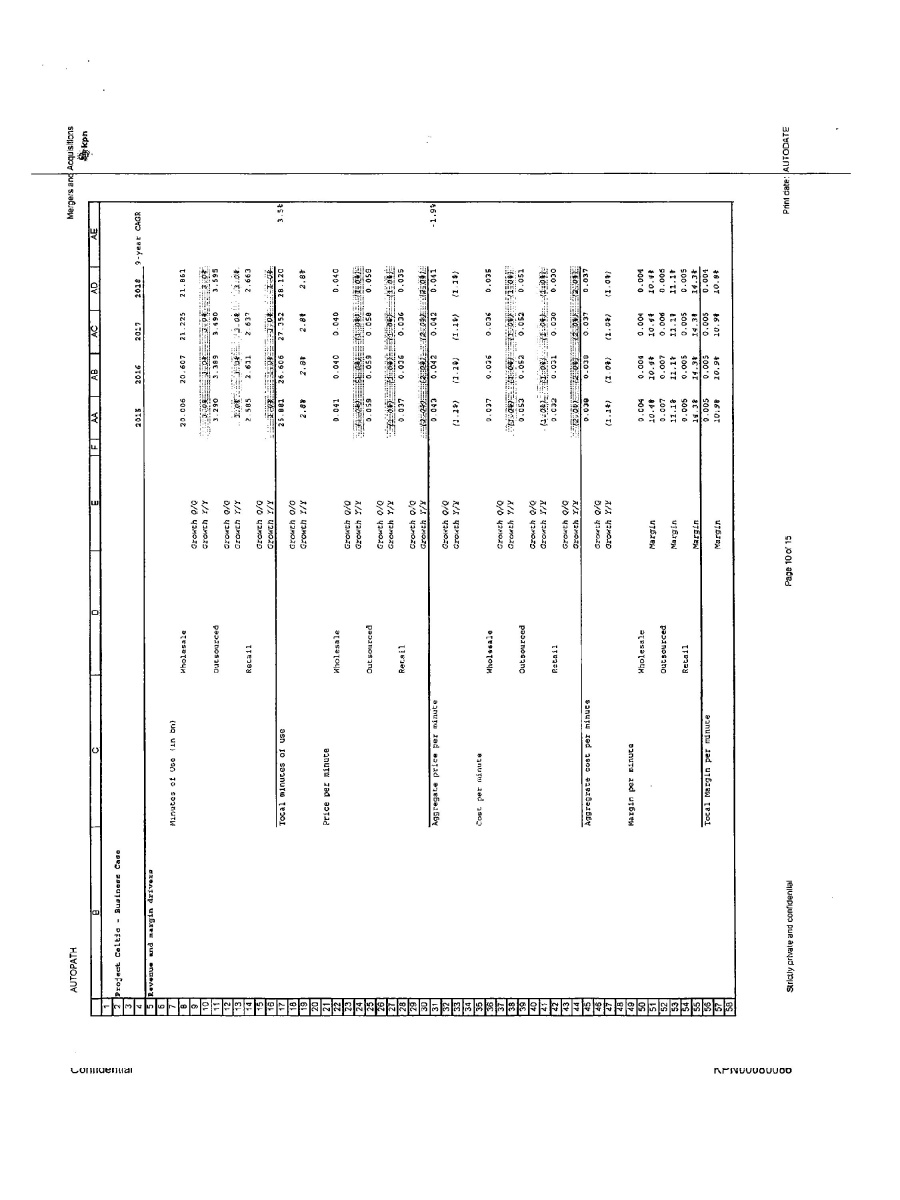

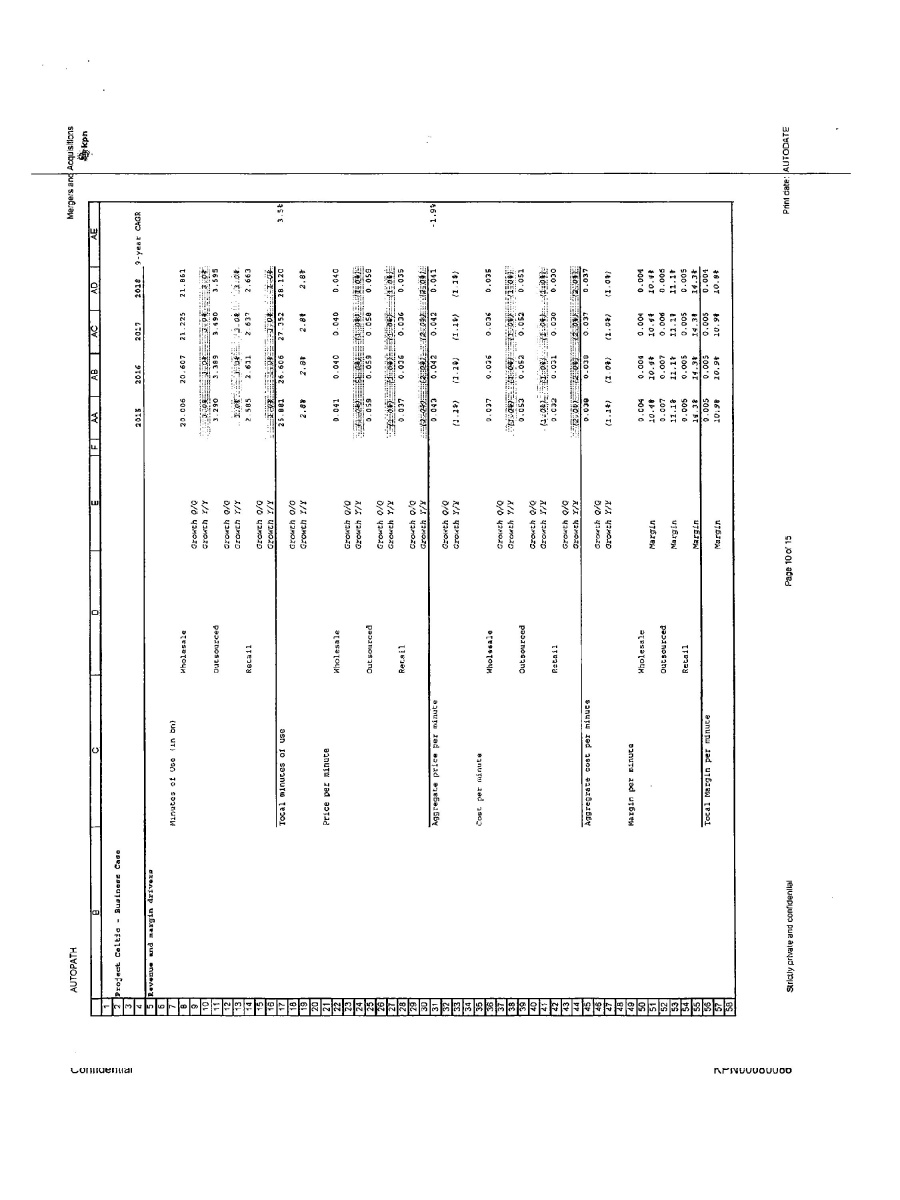

AUTOPATH Mergers and Acquisitions Project Celtic - Business Case 2015 2016 2017 2018 9-year CAGR Revenue and margin drivers Minutes of Use (in bn) Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Total minutes of use Growth Q/Q Growth Y/Y Price per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate price per minute Growth Q/Q Growth Y/Y Cost per minute Wholesale Growth Q/Q Growth Y/Y Outsourced Growth Q/Q Growth Y/Y Retail Growth Q/Q Growth Y/Y Aggregate cost per minute Growth Q/Q Growth Y/Y Margin per minute Wholesale Margin Outsourced Margin Retail Margin Total Margin per minute Margin Strictly private and confidential Page 10 of 15 Print date: AUTODATE Confidential KPN00080086

AUTOPATH Mergers and Acquisitions P&L 2015 2016 2017 2018 9-year CAGR Revenue Wholesale Outsourced Retail Total revenue Growth Y/Y Cost of sale Wholesale Outsourced Retail Total cost of sale Gross profit Wholesale Outsourced Retail Total gross profit Margin Operating expenses Research & Development % of revenue SG&A % of revenue Total Opex % of revenue Stock-based compensation EBITDA Margin D&A PPE % of revenue Amortization intangibles % of revenue Depreciation & Amortization % of revenue EBIT Margin Taxes on EBIT Tax rate Interest income Interest expense Taxes paid Implied tax rate Net income Cash flow Capex (Cumulative for year) Capex (Period) Strictly private and confidential Page 11 of 15 Print date: AUTODATE Confidential KPN00080087

| AUTOPATH | Mergers and Acquisitions [kpn logo] |

| | B | C | D | E | F | AA | AB | AC | AD | AE |

| 4 | | | | | | 2015 | 2016 | 2017 | 2018 | 9-year CAGR |

| 119 | | | % of sales | | | 1.2% | 1.2% | 1.2% | 1.2% | |

| 120 | | | | | | | | | | |

| 121 | | EBITDA less capex | | | | 17.2 | 17.5 | 17.8 | 18.1 | |

| Strictly private and confidential | Page 12 of 15 | Print date: AUTODATE |

| AUTOPATH | Mergers and Acquisitions [kpn logo] |

Cell: L8

Comment: Jan Rodenburg:

IBAS press release (all Q’s)

Cell: L11

Comment: Jan Rodenburg:

IBAS press release (all Q’s)

Cell: L14

Comment: Jan Rodenburg:

IBAS press release (all Q’s)

Cell: G17

Comment: Jan Rodenburg:

Jefferies

Cell: G31

Comment: Jan Rodenburg:

Jefferies

Cell: Q31

Comment: Jan Rodenburg:

IBAS press release

Cell: Q45

Comment: Jan Rodenburg:

IBAS press release

Cell: G62

Comment: Jan Rodenburg:

Jefferies

Cell: L62

Comment: Jan Rodenburg:

Jefferies (all Q’s)

Cell: Q62

Comment: Jan Rodenburg:

IBAS press release

Cell: L63

Comment: Jan Rodenburg:

Jefferies (all Q’s)

Cell: Q63

Comment: Jan Rodenburg:

IBAS press release

Cell: L64

Comment: Jan Rodenburg:

Jefferies (all Q’s)

Cell: Q64

Comment: Jan Rodenburg:

IBAS press release

Cell: L69

Comment: Jan Rodenburg:

Jefferies (all Q’s)

Cell: L70

Comment: Jan Rodenburg:

Jefferies (all Q’s)

Cell: L71

Comment: Jan Rodenburg:

Jefferies (all Q’s)

| Strictly private and confidential | Page 13 of 15 | Print date: AUTODATE |

| AUTOPATH | Mergers and Acquisitions [kpn logo] |

Cell: Q75

Comment: Jan Rodenburg:

IBAS press release

Cell: Q76

Comment: Jan Rodenburg:

IBAS press release

Cell: Q77

Comment: Jan Rodenburg:

IBAS press release

Cell: L82

Comment: Jan Rodenburg:

Jefferies

Cell: M82

Comment: Jan Rodenburg:

Jefferies

Cell: N82

Comment: Jan Rodenburg:

Jefferies

Cell: O82

Comment: Jan Rodenburg:

Jefferies

Cell: L86

Comment: Jan Rodenburg:

Jefferies

Cell: M86

Comment: Jan Rodenburg:

Jefferies

Cell: N86

Comment: Jan Rodenburg:

Jefferies

Cell: O86

Comment: Jan Rodenburg:

Jefferies

Cell: V91

Comment: Jan Rodenburg:

Jefferies forecast

Cell: W91

Comment: Jan Rodenburg:

Jefferies forecast

Cell: X91

Comment: Jan Rodenburg:

Jefferies forecast

Cell: Y91

Comment: Jan Rodenburg:

Jefferies forecast

Cell: Z91

Comment: Jan Rodenburg:

Jefferies forecast

Cell: P97

Comment: Jan Rodenburg:

10K ’08 page 88

| Strictly private and confidential | Page 14 of 15 | Print date: AUTODATE |

| AUTOPATH | Mergers and Acquisitions [kpn logo] |

Cell: U97

Comment: Jan Rodenburg:

Set equal to capex

Cell: U99

Comment: Jan Rodenburg:

10K ’08 page 89

Cell: V99

Comment: Jan Rodenburg:

10K ’08 page 89

Cell: W99

Comment: Jan Rodenburg:

10K ’08 page 89

Cell: X99

Comment: Jan Rodenburg:

10K ’08 page 89

Cell: Y99

Comment: Jan Rodenburg:

10K ’08 page 89

Cell: P101

Comment: Jan Rodenburg:

10K ’08 page 67

Cell: K111

Comment: Jan Rodenburg:

10K ’08 page 52

Cell: P111

Comment: Jan Rodenburg:

10K ’08 page 52

Cell: U118

Comment: Jan Rodenburg:

Company guidance

| Strictly private and confidential | Page 15 of 15 | Print date: AUTODATE |