As filed with the Securities and Exchange Commission on June 7, 2007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-10267

Investment Company Act file number

ASSETMARK FUNDS

(Exact name of registrant as specified in charter)

2300 CONTRA COSTA BOULEVARD, SUITE 600,

PLEASANT HILL, CA 94523-3967

(Address of principal executive offices) (Zip code)

CARRIE HANSEN

ASSETMARK INVESTMENT SERVICES, INC.

2300 CONTRA COSTA BOULEVARD, SUITE 600

PLEASANT HILL, CA 94523-3967

(Name and address of agent for service)

800-664-5345

Registrant's telephone number, including area code

Date of fiscal year end: MARCH 31, 2007

Date of reporting period: APRIL 1, 2006 to MARCH 31, 2007

Item 1. Report to Stockholders.

Dear Shareholder,

You will find enclosed our Annual Report for the AssetMark Funds. This Annual Report covers the twelve-month period from April 1, 2006 through March 31, 2007.

Economic & Market Overview:

Over the last twelve months, markets, domestic and international, equity and fixed income, have provided positive returns, and in some cases have provided returns above 10%. The world has continued to experience positive economic growth, in addition to increased merger and acquisition activity, which helped to drive the strong market performance.

International developed equity markets, as measured by the MSCI EAFE, outperformed the U.S. markets, as returns were boosted by the depreciating U.S. dollar. Domestically, the tide started to turn in the equity markets as U.S. large capitalization companies outperformed their smaller capitalization counterparts. However, real estate remained the clear winner, significantly outperforming the broader market. Within the fixed income markets, high yield and emerging markets provided the strongest returns while domestically the long-end of the yield curve outperformed the shorter-end.

AssetMark Funds Overview:

In consultation with Wilshire Associates, an institutional investment consulting and research firm, AssetMark Investment Services, Inc. seeks to consistently identify and engage highly skilled investment managers as Sub-Advisors for each Fund, as well as effectively combine managers with complementary skills to reduce volatility and achieve more consistent investment results.

During this period, we replaced both Sub-Advisors in the Small/Mid Cap Value Fund, replaced a Sub-Advisor in the Large Cap Growth Fund and replaced the sole Sub-Advisor in the Tax-Exempt Fund with two new Sub-Advisors.

| • | On April 17, 2006, First Quadrant L.P. (“First Quadrant”) and Advisory Research Inc. (“Advisory Research”) were engaged to replace Cramer Rosenthal and McGlynn LLC., (CRM) and Ariel Capital Management (Ariel). |

| • | On December 5, 2006, Wellington Asset Management (“Wellington”) was engaged to replace Loomis, Sayles & Company, L.P. (“Loomis”). |

| • | On May 2, 2006, Nuveen Asset Management (“Nuveen”) and Delaware Investments (“Delaware”) were engaged to replace Weiss, Peck & Greer LLC (“WPG”). |

The following is a discussion of the performance of each of the eight AssetMark Funds during the period:

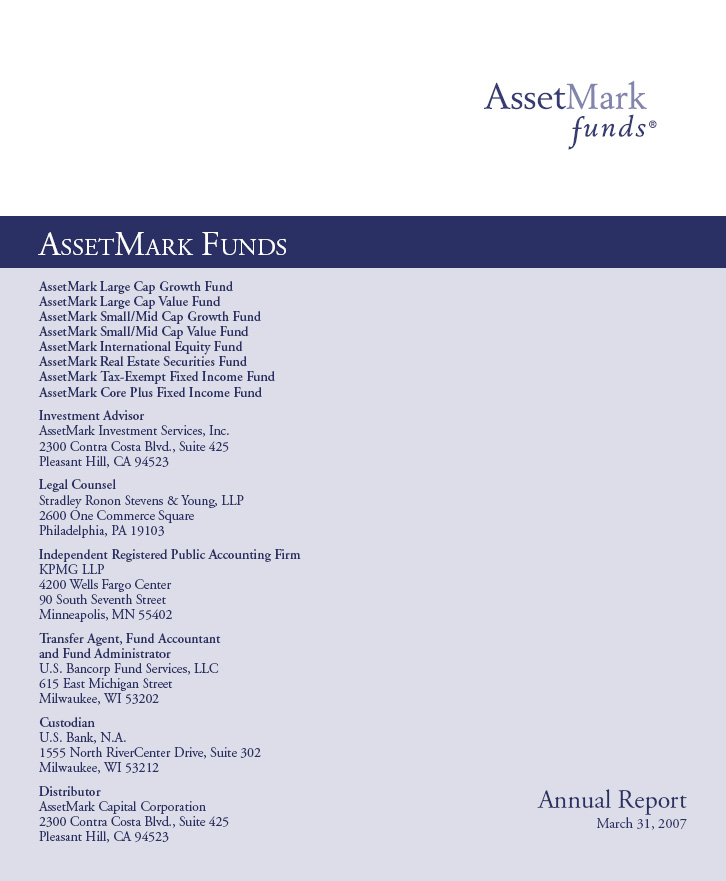

The AssetMark Large Cap Growth Fund returned -0.80% on a net basis for the twelve months ended March 31, 2007, underperforming the Russell 1000 Growth Index1 a widely accepted unmanaged benchmark for large cap growth portfolios, which returned 7.06%. This underperformance was largely due to the significant lagging performance of the core manager, Loomis, which was replaced in December 2006, in addition to the underperformance of TCW Investment Management Company (“TCW”). TCW’s underperformance primarily resulted from five core holdings that were adversely affected by negative market sentiment. Additionally TCW’s concentration on quality growth companies caused a drag on performance as lower quality companies continued to drive the benchmark returns. Atlanta Capital Management Company, LLC (“Atlanta”) also trailed the benchmark and while benefiting from broad diversification, Atlanta’s focus on high quality growth companies led to lagging performance. As noted above, during the period Loomis was replaced as a Sub-Advisor by Wellington, and since being added to the fund, Wellington has outperformed the benchmark through its strong stock selection methodology.

1Source: All benchmark return data provided by U.S. Bancorp Fund Services, LLC. One can not invest directly in an index, nor is an index representative of any Fund’s portfolio. The indexes provided are widely accepted benchmarks for the associated portfolios. The performance data quoted represents past performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

The AssetMark Large Cap Value Fund returned 15.32% on a net basis for the twelve months ended March 31, 2007, underperforming the Russell 1000 Value Index, a widely accepted unmanaged benchmark for large cap value portfolios, which returned 16.83%. The core manager, NFJ Investment Group, L.P. (“NFJ”) provided the strongest performance of the three sub-advisors during the period. In addition to an overweight position in materials, stock selection benefited performance, especially in the energy, industrials and utilities sectors. Brandes Investment Partners, L.P. (“Brandes”) returns were in line with the index with stock selection being the driver of performance as some of the large overweight allocations were to poorly performing sectors. Davis Selected Advisors, L.P. (“Davis”) experienced trailing performance, which mainly resulted from a lack of exposure to the strongest performing sectors – utilities and telecommunication services – and Davis’ large overweight exposure to financials.

The AssetMark Small/Mid Cap Growth Fund returned 4.84% on a net basis for the twelve months ended March 31, 2007, outperforming the Russell 2500 Growth Index, a widely accepted unmanaged benchmark for Small/Mid Cap Growth portfolios, which rose 4.44%. Nicholas-Applegate Capital Management (“NACM”) significantly outperformed the benchmark due to stock selection across a broad variety of industries. Copper Rock Capital Partners, LLC (“Copper Rock”), trailed the benchmark due to their large exposures in technology and consumer discretionary, which suffered due to the market volatility in these sectors.

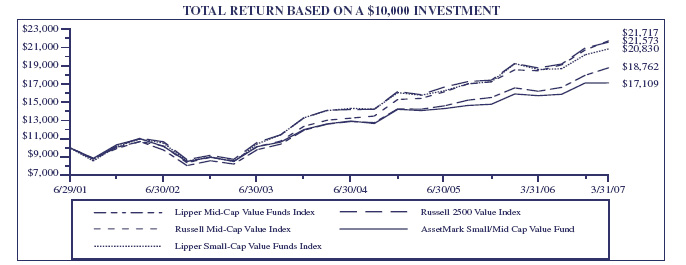

The AssetMark Small/Mid Cap Value Fund returned 7.63% on a net basis for the twelve months ended March 31, 2007, underperforming the Russell 2500 Value Index, a widely accepted unmanaged benchmark for Small/Mid Cap Value portfolios, which rose 12.15%. As noted above, during the period, CRM and Ariel were replaced as Sub-Advisors by Advisory Research and First Quadrant. Since being added to the fund, Advisory Research performed slightly above the benchmark, aided by their stock selection. First Quadrant’s performance has suffered since being added to the Fund. Most of the lagging performance came in the first quarter of 2007 as First Quadrant had sub-prime mortgage exposure that was removed from the portfolio by the end of the quarter.

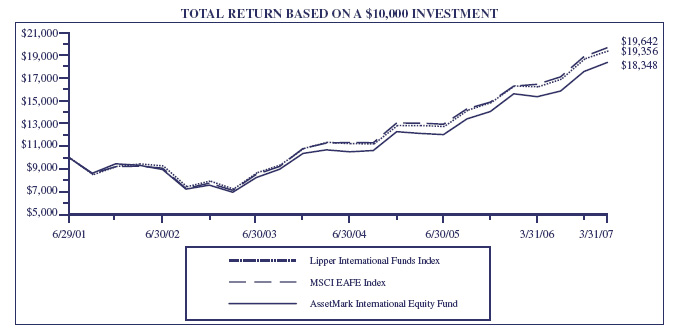

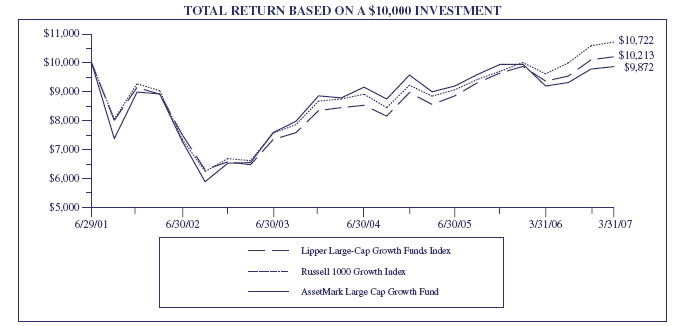

The AssetMark International Equity Fund returned 17.65% on a net basis for the twelve months ended March 31, 2007, trailing the MSCI EAFE Index of developed country non-U.S. stocks, which returned 20.69%. This unmanaged index is a widely accepted benchmark for developed market, international equity portfolios. Clay Finlay, Inc. (“Clay Finlay”) lagged the benchmark for the period suffering with an overweight exposure to Japan in addition to an underweight exposure to Europe. Oppenheimer Capital LLC (“Oppenheimer”) also trailed the benchmark. While benefiting from an overweight exposure to Europe, Oppenheimer’s underweight exposure to Asia ex-Japan and UK caused a drag on performance.

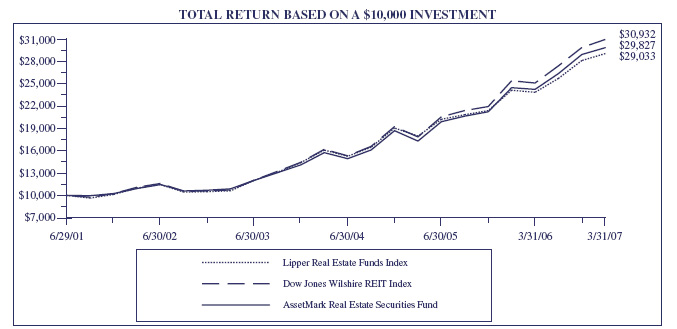

The AssetMark Real Estate Securities Fund returned 21.96% on a net basis for the twelve months ended March 31, 2007, outperforming the Dow Jones Wilshire REIT Index, which gained 21.85% for the period. Both sub-advisors, Adelante Capital Management, LLC (“Adelante”) and AEW Management and Advisors, L.P. (“AEW”), outperformed the benchmark primarily being driven by a strong fourth quarter in 2006. Adelante’s overweight to apartments has been a drag on performance, however solid security selection in hotels and regional malls contributed positively to performance. Security selection was also the main driver of performance returns for AEW, especially in the hotels and shopping center sectors.

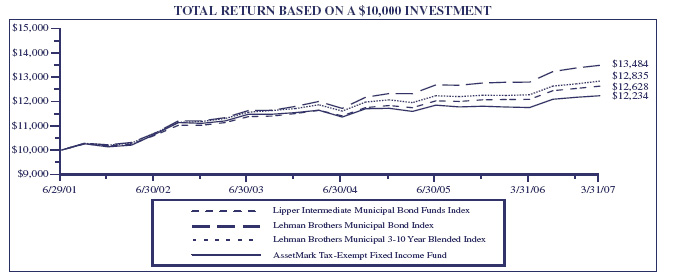

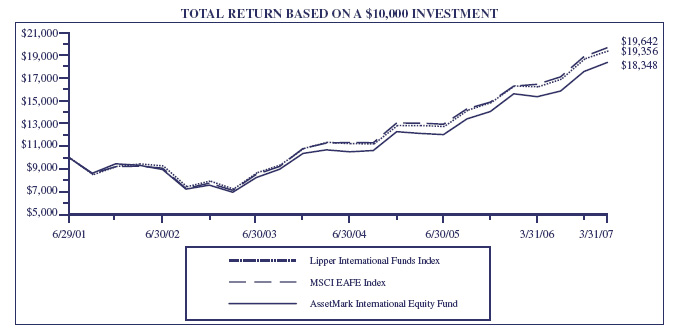

The AssetMark Tax-Exempt Fixed Income Fund returned 3.92% on a net basis for the twelve-month period ended March 31, 2007, underperforming the Lehman Municipal Bond Index, which returned 5.43%. This managed index is a widely accepted benchmark for broad tax-exempt portfolios. The AssetMark Fund is positioned towards the short and intermediate end of the municipal curve, whereas the benchmark has broad exposure across the full maturity spectrum and includes a larger allocation to longer-term maturities. With longer-term maturities providing the strongest performance over the twelve month period, the limited exposure in this space led to the lagging performance of the Fund. As noted above, during the period WPG was replaced as a Sub-Advisor by Nuveen and Delaware. Since being added to the Fund, Nuveen performed in line with the benchmark as the portfolio expanded its maturity exposure along the curve benefiting from some longer-term securities with higher yields. Delaware marginally trailed the benchmark since being added to the fund due to their slightly shorter duration and higher exposure to more intermediate-term securities.

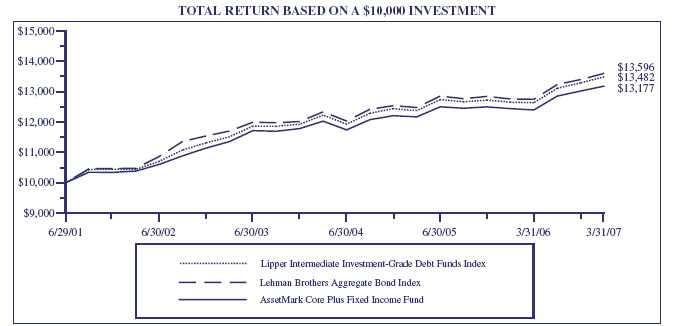

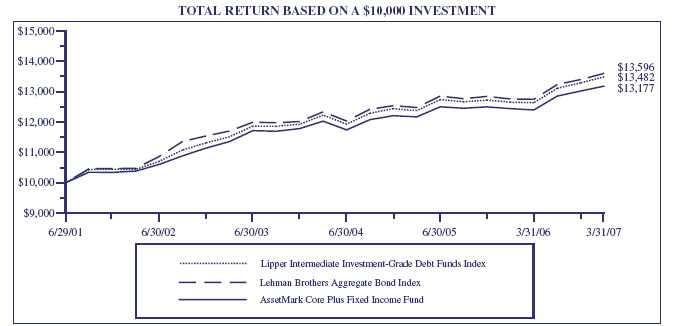

The AssetMark Core Plus Fixed Income Fund returned 5.96% on a net basis for the twelve months ended March 31, 2007, trailing the Lehman Brothers Aggregate Bond Index, which returned 6.59%. The Lehman Brothers Aggregate Bond Index is a widely accepted unmanaged benchmark for core U.S. fixed income portfolios. Goldman Sachs Asset Management, L.P. (“GSAM”) marginally outperformed the benchmark. While being short in duration hurt performance, solid security selection within corporate bonds benefited performance along with the overweight mortgage exposure. Western Asset Management Company (“WAMCO”) outperformed the benchmark, benefiting from its small exposure to non-benchmark sectors, including exposure to emerging markets and high yield.

We greatly appreciate your decision, in working closely with your investment advisor, to include the AssetMark Funds as a component of your overall investment portfolio, and we remain confident that each Fund is well positioned to deliver strong long-term value to our shareholders.

Sincerely,

Ronald D. Cordes

President

AssetMark Funds

AssetMark Funds

EXPENSE EXAMPLE (Unaudited)

March 31, 2007

As a shareholder of the AssetMark Funds (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (October 1, 2006 – March 31, 2007).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Funds charge no sales load or transactions fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense or dividends on short positions taken by the Funds and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

AssetMark Large Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,059.10 | $6.78 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.35 | 6.64 |

| | |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.32%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

AssetMark Funds

EXPENSE EXAMPLE (Continued) (Unaudited)

March 31, 2007

AssetMark Large Cap Value Fund | | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,072.20 | $6.77 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.40 | 6.59 |

| | |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.31%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

| | | | |

AssetMark Small/Mid Cap Growth Fund | | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,169.80 | $7.68 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.85 | 7.14 |

| | |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.42%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

| | | | |

AssetMark Small/Mid Cap Value Fund | | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,078.60 | $7.93 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.30 | 7.70 |

| | |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.53%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

| | | | |

AssetMark International Equity Fund | | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,158.40 | $7.43 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.05 | 6.94 |

| |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.38%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

AssetMark Funds

EXPENSE EXAMPLE (Continued) (Unaudited)

March 31, 2007

AssetMark Real Estate Securities Fund | | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,131.90 | $7.76 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,017.65 | 7.34 |

| |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.46%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

| | | |

AssetMark Tax-Exempt Fixed Income Fund | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,011.90 | $6.37 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.60 | 6.39 |

| |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.27%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

| | | | |

AssetMark Core Plus Fixed Income Fund | | | |

| | | | |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period* |

| | October 1, 2006 | March 31, 2007 | October 1, 2006 - March 31, 2007 |

| | | | |

| Actual | $1,000.00 | $1,025.50 | $5.81 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.20 | 5.79 |

| | |

| * Expenses are equal to the Fund’s annualized expense ratio of 1.15%, mutiplied by the average account value over the period, muliplied by |

| 182/365 to reflect the one-half year period. | | | |

AssetMark Funds

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2007

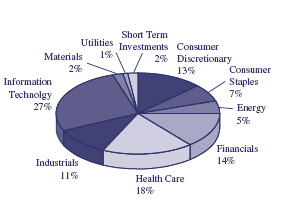

AssetMark Large Cap Growth Fund | | |

| | | | |

Components of Portfolio Holdings | |

| Consumer Discretionary | | $100,876,008 | |

| Consumer Staples | | 50,807,391 | |

| Energy | | 38,766,685 | |

| Financials | | 107,795,111 | |

| Health Care | | 135,043,479 | |

| Industrials | | 85,089,482 | |

| Information Technology | | 201,747,588 | |

| Materials | | 13,717,924 | |

| Utilities | | 8,751,054 | |

| Short Term Investments | | 14,110,418 | |

| | Total | $756,705,140 | (1) |

| | | | |

(1) Total excludes $236,995,445 of Securities Lending Collateral

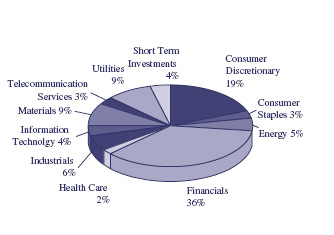

Pie chart represents percentages of total portfolio.

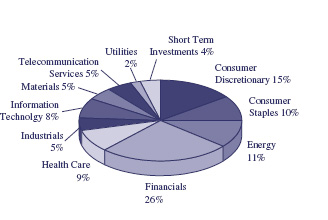

AssetMark Large Cap Value Fund | | |

| | | | |

Components of Portfolio Holdings | |

| Consumer Discretionary | | $99,371,696 | |

| Consumer Staples | | 71,354,329 | |

| Energy | | 73,695,868 | |

| Financials | | 176,499,882 | |

| Health Care | | 62,309,759 | |

| Industrials | | 37,522,630 | |

| Information Technology | | 54,733,393 | |

| Materials | | 32,694,542 | |

| Telecommunication Services | | 33,258,354 | |

| Utilities | | 13,107,530 | |

| Short Term Investments | | 27,337,235 | |

| | Total | $681,885,218 | (1) |

| | | | |

(1) Total excludes $202,616,856 of Securities Lending Collateral

Pie chart represents percentages of total portfolio.

AssetMark Funds

ALLOCATION OF PORTFOLIO HOLDINGS (Continued)

March 31, 2007

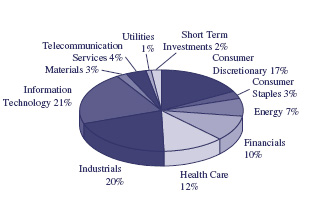

AssetMark Small/Mid Cap Growth Fund | | |

| | | | |

Components of Portfolio Holdings | |

| Consumer Discretionary | | $28,469,624 | |

| Consumer Staples | | 6,058,209 | |

| Energy | | 11,579,814 | |

| Financials | | 17,990,322 | |

| Health Care | | 20,647,543 | |

| Industrials | | 34,792,444 | |

| Information Technology | | 36,108,576 | |

| Materials | | 5,954,562 | |

| Telecommunication Services | | 7,104,913 | |

| Utilities | | 977,461 | |

| Short Term Investments | | 3,289,135 | |

| | Total | $172,972,603 | (1) |

| | | | |

(1) Total excludes $57,934,484 of Securities Lending Collateral

Pie chart represents percentages of total portfolio.

AssetMark Small/Mid Cap Value Fund | | |

| | | | |

Components of Portfolio Holdings | |

| Consumer Discretionary | | $ 21,487,274 | |

| Consumer Staples | | 3,588,284 | |

| Energy | | 5,712,308 | |

| Financials | | 40,051,224 | |

| Health Care | | 2,326,092 | |

| Industrials | | 6,930,853 | |

| Information Technology | | 4,702,041 | |

| Materials | | 9,441,722 | |

| Telecommunication Services | | 2,912,956 | |

| Utilities | | 9,564,676 | |

| Short Term Investments | | 4,206,766 | |

| | Total | $110,924,196 | (1) |

| | | | |

(1) Total excludes $41,311,210 of Securities Lending Collateral

Pie chart represents percentages of total portfolio.

AssetMark Funds

ALLOCATION OF PORTFOLIO HOLDINGS (Continued)

March 31, 2007

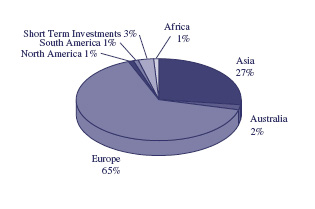

AssetMark International Equity Fund | | |

| | | | |

Components of Portfolio Holdings | |

| Africa | | $4,589,277 | |

| Asia | | 213,480,660 | |

| Australia | | 12,151,001 | |

| Europe | | 511,449,716 | |

| North America | | 5,021,300 | |

| South America | | 12,064,530 | |

| Short Term Investments | | 23,752,439 | |

| | Total | $782,508,923 | (1) |

| | | | |

(1) Total excludes $67,961,428 of Securities Lending Collateral

Pie chart represents percentages of total portfolio.

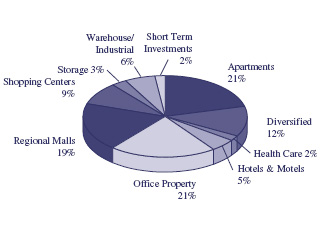

AssetMark Real Estate Securities Fund | | |

| | | | |

Components of Portfolio Holdings | |

| Apartments | | $23,869,364 | |

| Diversified | | 14,412,603 | |

| Health Care | | 1,856,808 | |

| Hotels & Motels | | 5,564,107 | |

| Office Property | | 23,960,533 | |

| Regional Malls | | 22,376,662 | |

| Shopping Centers | | 11,111,053 | |

| Storage | | 3,633,710 | |

| Warehouse/Industrial | | 7,590,684 | |

| Short Term Investments | | 2,918,441 | |

| | Total | $117,293,965 | (1) |

| | | | |

(1) Total excludes $45,923,235 of Securities Lending Collateral

Pie chart represents percentages of total portfolio.

AssetMark Funds

ALLOCATION OF PORTFOLIO HOLDINGS (Continued)

March 31, 2007

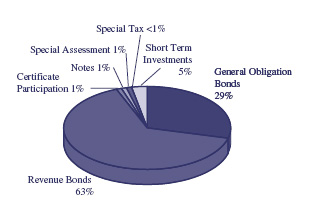

AssetMark Tax-Exempt Fixed Income Fund | |

| | | | |

Components of Portfolio Holdings | |

| General Obligation Bonds | | $72,074,160 | |

| Revenue Bonds | | 157,849,281 | |

| Certificate Participation | | 2,534,816 | |

| Notes | | 2,254,605 | |

| Special Assessment | | 1,067,192 | |

| Special Tax | | 510,775 | |

| Short Term Investments | | 11,801,785 | |

| | Total | $248,092,614 | |

| | | | |

Pie chart represents percentages of total portfolio.

AssetMark Core Plus Fixed Income Fund

Components of Portfolio Holdings |

| Asset Backed Securities | $33,248,200 | |

| Collateralized Mortgage Obligations | 23,878,244 | |

| Convertible Preferred Stocks | 309,750 | |

| Corporate Bonds | 131,166,656 | |

| Foreign Government Note/Bonds | 6,450,727 | |

| Mortgage Backed Securities | 267,929,298 | |

| Purchased Options | 12,148 | |

| Preferred Stocks | 1,045,936 | |

| Supranational Obligations | 3,669,596 | |

| U.S. Government Agency Issues | 183,875,689 | |

| U.S. Treasury Obligations | 67,515,669 | |

| Municipal Bonds | 2,863,569 | |

| Short Term Investments | 69,304,744 | |

| Total | $791,270,226 | (1) |

| | | |

(1) Total excludes $212,879,454 of Securities Lending Collateral

Pie chart represents percentages of total portfolio.

AssetMark Large Cap Growth Fund

PERFORMANCE DATA

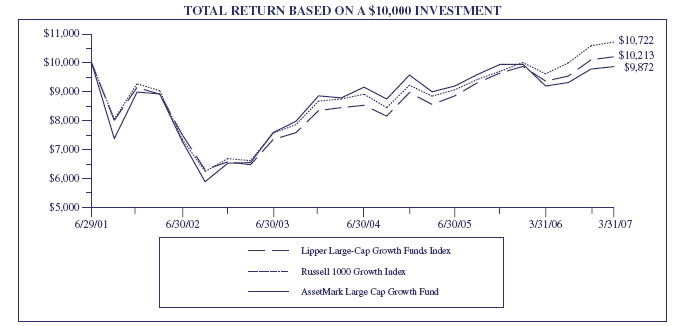

This chart assumes an initial gross investment of $10,000 made on June 29, 2001 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

RUSSELL 1000 GROWTH INDEX – An unmanaged index which measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index is an unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

LIPPER LARGE-CAP GROWTH FUNDS INDEX – The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. These funds, by portfolio practice, invest at least 75% of equity assets in companies with market capitalizations (on three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the Standard & Poor’s (“S&P”) Super Composite 1500® Index. These funds typically have an above average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value, compared to the Standard & Poor’s 500 Composite Index (“S&P 500® Index”).

AVERAGE ANNUAL TOTAL RETURN (for the periods ended March 31) | | |

| | One Year | Five Year | Since Inception (6/29/01) |

| AssetMark Large Cap Growth Fund | -0.80% | 2.02% | -0.23% |

| Russell 1000 Growth Index | 7.06% | 3.48% | 1.22% |

| Lipper Large-Cap Growth Funds Index | 3.39% | 2.75% | 0.37% |

AssetMark Large Cap Growth Fund

SCHEDULE OF INVESTMENTS

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS - 98.17% | | | |

| | | Aerospace & Defense - 1.94% | | | |

| | 95,100 | | Lockheed Martin Corp. (b) | | $ | 9,226,602 | |

| | 13,000 | | Precision Castparts Corp. (b) | | | 1,352,650 | |

| | 62,500 | | United Technologies Corp. (b) | | | 4,062,500 | |

| | | | | | | 14,641,752 | |

| | | | Air Freight & Logistics - 1.29% | | | | |

| | 104,120 | | C.H. Robinson Worldwide, Inc. (b) | | | 4,971,730 | |

| | 114,100 | | Expeditors International | | | | |

| | | | Washington, Inc. (b) | | | 4,714,612 | |

| | | | | | | 9,686,342 | |

| | | | Auto Components - 0.29% | | | | |

| | 70,200 | | The Goodyear Tire & | | | | |

| | | | Rubber Co. (a)(b) | | | 2,189,538 | |

| | | | Beverages - 1.03% | | | | |

| | 77,000 | | The Coca-Cola Co | | | 3,696,000 | |

| | 63,450 | | PepsiCo, Inc | | | 4,032,882 | |

| | | | | | | 7,728,882 | |

| | | | Biotechnology - 3.34% | | | | |

| | 161,419 | | Amgen, Inc. (a)(b) | | | 9,020,094 | |

| | 130,160 | | Genentech, Inc. (a) | | | 10,688,739 | |

| | 344,100 | | Millennium Pharmaceuticals, | | | | |

| | | | Inc. (a)(b) | | | 3,908,976 | |

| | 56,600 | | Vertex Pharmaceuticals, Inc. (a) | | | 1,587,064 | |

| | | | | | | 25,204,873 | |

| | | | Capital Markets - 2.56% | | | | |

| | 99,400 | | The Bank of New York Co., Inc. | | | 4,030,670 | |

| | 42,400 | | The Goldman Sachs Group, Inc. | | | 8,761,112 | |

| | 58,190 | | Merrill Lynch & Co., Inc. (b) | | | 4,752,377 | |

| | 28,500 | | SEI Investments Co | | | 1,716,555 | |

| | | | | | | 19,260,714 | |

| | | | Chemicals - 0.84% | | | | |

| | 52,800 | | Air Products & Chemicals, Inc | | | 3,905,088 | |

| | 81,000 | | Lyondell Chemical Co. (b) | | | 2,427,570 | |

| | | | | | | 6,332,658 | |

| | | | Commercial Banks - 2.26% | | | | |

| | 123,660 | | Bank of America Corp | | | 6,309,133 | |

| | 235,957 | | Commerce Bancorp, Inc. (b) | | | 7,876,245 | |

| | 52,100 | | Wachovia Corp. (b) | | | 2,868,105 | |

| | | | | | | 17,053,483 | |

| | | | Commercial Services & Supplies - 1.74% | | | | |

| | 68,800 | | ITT Educational Services, Inc. (a)(b) | | | 5,606,512 | |

| | 66,700 | | Manpower, Inc. (b) | | | 4,920,459 | |

| | 130,200 | | Steelcase, Inc. (b) | | | 2,589,678 | |

| | | | | | | 13,116,649 | |

| | | | Communications Equipment - 5.39% | | | | |

| | 616,180 | | Cisco Systems, Inc. (a) | | | 15,731,075 | |

| | 201,950 | | Motorola, Inc | | | 3,568,457 | |

| | 455,201 | | QUALCOMM, Inc. (b) | | | 19,418,875 | |

| | 13,900 | | Research In Motion Ltd. (a)(b) | | | 1,897,211 | |

| | | | | | | 40,615,618 | |

| | | | | | | | |

| | | | Computers & Peripherals - 6.71% | | | | |

| | 160,400 | | Apple, Inc. (a)(b) | | | 14,902,764 | |

| | 133,225 | | Dell, Inc. (a) | | | 3,092,152 | |

| | 268,990 | | Hewlett-Packard Co. | | | 10,797,259 | |

| | 92,990 | | International Business achines Corp. | | | 8,765,237 | |

| | 355,475 | | Network Appliance, Inc. (a) | | | 12,981,947 | |

| | | | | | | 50,539,359 | |

| | | | | | | | |

| | | | Consumer Finance - 1.68% | | | | |

| | 53,750 | | American Express Co | | | 3,031,500 | |

| | 36,900 | | Capital One Financial Corp. (b) | | | 2,784,474 | |

| | 168,080 | | SLM Corp. (b) | | | 6,874,472 | |

| | | | | | | 12,690,446 | |

| | | | | | | | |

| | | | Diversified Financial Services - 1.42% | | | | |

| | 177,750 | | Citigroup, Inc. | | | 9,125,685 | |

| | 35,600 | | The First Marblehead Corp | | | 1,598,084 | |

| | | | | | | 10,723,769 | |

| | | | | | | | |

| | | | Electric Utilities - 0.40% | | | | |

| | 46,500 | | TXU Corp | | | 2,980,650 | |

| | | | | | | | |

| | | | Electrical Equipment - 0.86% | | | | |

| | 51,400 | | Cooper Industries Ltd. | | | 2,312,486 | |

| | 97,000 | | Emerson Electric Co | | | 4,179,730 | |

| | | | | | | 6,492,216 | |

| | | | | | | | |

| | | | Electronic Equipment & Instruments - 0.99% | | | | |

| | 66,800 | | Avnet, Inc. (a)(b) | | | 2,414,152 | |

| | 48,800 | | CDW Corp. (b) | | | 2,997,784 | |

| | 71,650 | | Molex, Inc. (b) | | | 2,020,530 | |

| | | | | | | 7,432,466 | |

See notes to financial statements.

AssetMark Large Cap Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Energy Equipment & Services - 3.57% | | | |

| | 76,150 | | Baker Hughes, Inc. (b) | | $ | 5,035,799 | |

| | 52,350 | | National-Oilwell, Inc. (a)(b) | | | 4,072,307 | |

| | 257,240 | | Schlumberger Ltd. (b) | | | 17,775,284 | |

| | | | | | | 26,883,390 | |

| | | | Food & Staples Retailing - 1.87% | | | | |

| | 69,900 | | Costco Wholesale Corp. (b) | | | 3,763,416 | |

| | 87,600 | | CVS Corp. (b) | | | 2,990,664 | |

| | 77,829 | | Walgreen Co. (b) | | | 3,571,573 | |

| | 79,870 | | Wal-Mart Stores, Inc | | | 3,749,896 | |

| | | | | | | 14,075,549 | |

| | | | Food Products - 0.51% | | | | |

| | 65,640 | | General Mills, Inc | | | 3,821,561 | |

| | | | | |

| | | | Health Care Equipment & Supplies - 2.83% | |

| | 67,100 | | Dentsply International, Inc. (b) | | | 2,197,525 | |

| | 50,600 | | Kinetic Concepts, Inc. (a) | | | 2,562,384 | |

| | 88,100 | | Medtronic, Inc. (b) | | | 4,322,186 | |

| | 52,300 | | St Jude Medical, Inc. (a) | | | 1,967,003 | |

| | 184,617 | | Varian Medical Systems, Inc. (a)(b) | | | 8,804,385 | |

| | 17,145 | | Zimmer Holdings, Inc. (a) | | | 1,464,354 | |

| | | | | | | 21,317,837 | |

| | | | | | | | |

| | | | Health Care Providers & Services - 4.67% | | | | |

| | 83,900 | | Cerner Corp. (a)(b) | | | 4,568,355 | |

| | 79,600 | | Coventry Health Care, Inc. (a) | | | 4,461,580 | |

| | 140,900 | | McKesson Corp | | | 8,248,286 | |

| | 66,040 | | Medco Health Solutions, Inc. (a) | | | 4,789,881 | |

| | 151,100 | | UnitedHealth Group, Inc | | | 8,003,767 | |

| | 62,900 | | Wellpoint, Inc. (a) | | | 5,101,190 | |

| | | | | | | 35,173,059 | |

| | | | Hotels, Restaurants & Leisure - 0.81% | | | | |

| | 57,600 | | International Game Technology (b) | | | 2,325,888 | |

| | 66,000 | | Yum! Brands, Inc. (b) | | | 3,812,160 | |

| | | | | | | 6,138,048 | |

| | | | Household Durables - 0.63% | | | | |

| | 180,175 | | Pulte Homes, Inc. (b) | | | 4,767,431 | |

| | | | | | | | |

| | | | Household Products - 2.00% | | | | |

| | 28,150 | | Colgate-Palmolive Co | | | 1,880,138 | |

| | 111,500 | | Kimberly-Clark Corp | | | 7,636,635 | |

| | 88,550 | | Procter & Gamble Co. (b) | | | 5,592,818 | |

| | | | | | | 15,109,591 | |

| | | | | | | | |

| | | | Industrial Conglomerates - 2.53% | | | | |

| | 539,475 | | General Electric Co | | | 19,075,836 | |

| | | | | | | | |

| | | | Insurance - 4.93% | | | | |

| | 70,600 | | ACE Ltd | | | 4,028,436 | |

| | 80,250 | | Aflac, Inc | | | 3,776,565 | |

| | 107,650 | | American International Group, Inc. (b) | | | 7,236,233 | |

| | 46,600 | | Everest Re Group Ltd | | | 4,481,522 | |

| | 33,700 | | Hartford Financial Services Group, Inc. (b) | | | 3,221,046 | |

| | 40,700 | | MBIA, Inc | | | 2,665,443 | |

| | 538,092 | | The Progressive Corp. (b) | | | 11,741,167 | |

| | | | | | | 37,150,412 | |

| | | | | | | | |

| | | | Internet & Catalog Retail - 3.20% | | | | |

| | 316,965 | | Amazon.Com, Inc. (a)(b) | | | 12,612,038 | |

| | 348,055 | | eBay, Inc. (a)(b) | | | 11,538,023 | |

| | | | | | | 24,150,061 | |

| | | | | | | | |

| | | | Internet Software & Services - 2.15% | | | | |

| | 29,902 | | Google, Inc. (a) | | | 13,699,900 | |

| | 18,030 | | VeriSign, Inc. (a)(b) | | | 452,914 | |

| | 66,185 | | Yahoo!, Inc. (a)(b) | | | 2,070,929 | |

| | | | | | | 16,223,743 | |

| | | | | | | | |

| | | | IT Services - 2.49% | | | | |

| | 207,900 | | Accenture Ltd | | | 8,012,466 | |

| | 53,700 | | Automatic Data Processing, Inc | | | 2,599,080 | |

| | 17,800 | | Cognizant Technology Solutions Corp. (a)(b) | | | 1,571,206 | |

| | 28,400 | | DST Systems, Inc. (a)(b) | | | 2,135,680 | |

| | 202,900 | | Western Union Co | | | 4,453,655 | |

| | | | | | | 18,772,087 | |

| | | | | | | | |

| | | | Machinery - 2.93% | | | | |

| | 86,470 | | AGCO Corp. (a)(b) | | | 3,196,796 | |

| | 207,400 | | Dover Corp | | | 10,123,194 | |

| | 54,440 | | Gardner Denver, Inc. (a) | | | 1,897,234 | |

| | 50,930 | | Manitowoc Co | | | 3,235,583 | |

| | 50,500 | | Terex Corp. (a) | | | 3,623,880 | |

| | | | | | | 22,076,687 | |

| | | | | | | | |

| | | | Media - 1.94% | | | | |

| | 82,250 | | The McGraw-Hill Companies, Inc. (b) | | | 5,171,880 | |

| | 57,800 | | Omnicom Group, Inc | | | 5,917,564 | |

| | 101,600 | | The Walt Disney Co. (b) | | | 3,498,088 | |

| | | | | | | 14,587,532 | |

See notes to financial statements.

AssetMark Large Cap Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Metals & Mining - 0.98% | | | |

| | 49,200 | | Alcoa, Inc | | $ | 1,667,880 | |

| | 52,600 | | Freeport-McMoRan Copper & | | | | |

| | | | Gold, Inc. (b) | | | 3,481,594 | |

| | 31,200 | | Southern Copper Corp. (b) | | | 2,235,792 | |

| | | | | | | 7,385,266 | |

| | | | Multiline Retail - 2.47% | | | | |

| | 62,170 | | Dollar Tree Stores, Inc. (a) | | | 2,377,381 | |

| | 164,100 | | Kohl’s Corp. (a)(b) | | | 12,571,701 | |

| | 62,200 | | Target Corp. (b) | | | 3,685,972 | |

| | | | | | | 18,635,054 | |

| | | | Multi-Utilities - 0.77% | | | | |

| | 80,100 | | NRG Energy, Inc. (a)(b) | | | 5,770,404 | |

| | | | Office Electronics - 0.26% | | | | |

| | 51,600 | | Zebra Technologies Corp. (a)(b) | | | 1,992,276 | |

| | | | Oil & Gas - 1.58% | | | | |

| | 59,900 | | Apache Corp | | | 4,234,930 | |

| | 111,900 | | ConocoPhillips | | | 7,648,365 | |

| | | | | | | 11,883,295 | |

| | | | Pharmaceuticals - 7.08% | | | | |

| | 150,500 | | Abbott Laboratories | | | 8,397,900 | |

| | 98,900 | | Amylin Pharmaceuticals, Inc. (a)(b) | | | 3,694,904 | |

| | 311,700 | | Bristol-Myers Squibb Co | | | 8,652,792 | |

| | 20,500 | | Eli Lilly & Co. (b) | | | 1,101,055 | |

| | 143,100 | | Forest Laboratories, Inc. (a)(b) | | | 7,361,064 | |

| | 95,600 | | Genzyme Corp. (a)(b) | | | 5,737,912 | |

| | 44,970 | | Johnson & Johnson (b) | | | 2,709,892 | |

| | 67,300 | | Merck & Co., Inc | | | 2,972,641 | |

| | 382,900 | | Schering Plough Corp | | | 9,767,779 | |

| | 59,000 | | Wyeth | | | 2,951,770 | |

| | | | | | | 53,347,709 | |

| | | | Semiconductor & | | | | |

| | | | Semiconductor Equipment - 2.80% | | | | |

| | 141,600 | | Lam Research Corp. (a)(b) | | | 6,703,344 | |

| | 104,300 | | Linear Technology Corp. (b) | | | 3,294,837 | |

| | 72,940 | | MEMC Electronic Materials, Inc. (a) | | | 4,418,705 | |

| | 112,410 | | Nvidia Corp. (a) | | | 3,235,160 | |

| | 114,500 | | Texas Instruments, Inc. (b) | | | 3,446,450 | |

| | | | | | | 21,098,496 | |

| | | | Software - 5.98% | | | | |

| | 204,555 | | Autodesk, Inc. (a) | | | 7,691,268 | |

| | 92,510 | | BMC Software, Inc. (a)(b) | | | 2,848,383 | |

| | 508,900 | | Microsoft Corp | | | 14,183,043 | |

| | 518,800 | | Oracle Corp. (a) | | | 9,405,844 | |

| | 183,488 | | Salesforce.com, Inc. (a)(b) | | | 7,856,956 | |

| | 178,500 | | Symantec Corp. (a)(b) | | | 3,088,050 | |

| | | | | | | 45,073,544 | |

| | | | Specialty Retail - 2.66% | | | | |

| | 83,200 | | AnnTaylor Stores Corp. (a) | | | 3,226,496 | |

| | 96,400 | | The Gap Inc | | | 1,659,044 | |

| | 75,600 | | Lowe’s Cos, Inc. (b) | | | 2,380,644 | |

| | 125,210 | | Rent-A-Center, Inc. (a) | | | 3,503,376 | |

| | 159,990 | | Ross Stores, Inc | | | 5,503,656 | |

| | 146,275 | | Staples, Inc | | | 3,779,746 | |

| | | | | | | 20,052,962 | |

| | | | Textiles, Apparel & Luxury Goods - 1.37% | | | | |

| | 137,370 | | Coach, Inc. (a)(b) | | | 6,875,368 | |

| | 32,750 | | Nike, Inc | | | 3,480,015 | |

| | | | | | | 10,355,383 | |

| | | | Thrifts & Mortgage Finance - 1.08% | | | | |

| | 242,120 | | Countrywide Financial Corp. (b) | | | 8,144,917 | |

| | | | Tobacco - 1.34% | | | | |

| | 114,700 | | Altria Group, Inc | | | 10,071,807 | |

| | | | | | | | |

| | | | Total Common Stocks | | | | |

| | | | (Cost $673,571,837) | | | 739,823,352 | |

| | | | INVESTMENT COMPANIES - 0.37% | | | | |

| | | | Investment Company - 0.37% | | | | |

| | 49,800 | | iShares Russell 1000 Growth | | | | |

| | | | Index Fund | | | 2,771,370 | |

| | | | Total Investment Companies | | | | |

| | | | (Cost $2,769,518) | | | 2,771,370 | |

| | | | SHORT TERM INVESTMENTS - 1.87% | | | | |

| | | | Money Market Funds - 1.87% | | | | |

| | 14,110,418 | | Federated Prime Obligations Fund | | | | |

| | | | 5.18%, 01/01/2050 (d) | | | 14,110,418 | |

| | | | Total Short Term Investments | | | | |

| | | | (Cost $14,110,418) | | | 14,110,418 | |

See notes to financial statements.

AssetMark Large Cap Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Principal | | | | Market | |

Amount | | | | Value | |

| | | INVESTMENTS PURCHASED | | | |

| | | AS SECURITIES LENDING | | | |

| | | COLLATERAL - 31.44% | | | |

| | | COMMERCIAL PAPER - 13.31% | | | |

| $ | 10,951,451 | | Antalis Funding, | | | |

| | | | 5.37%, 04/10/07 (c) | | $ | 10,933,514 | |

| | 821,359 | | Chesham Finance LLC, | | | | |

| | | | 5.46%, 04/02/07 (c) | | | 820,985 | |

| | 9,582,519 | | Concord Minutemen Capital Co., | | | | |

| | | | 5.30%, 04/04/07 (c) (d) | | | 9,582,519 | |

| | 2,464,076 | | Duke Funding, | | | | |

| | | | 5.32%, 04/20/07 (c) | | | 2,453,193 | |

| | 9,034,947 | | Duke Funding, | | | | |

| | | | 5.32%, 04/13/07 (c) | | | 8,995,080 | |

| | 9,582,519 | | Fenway Funding LLC, | | | | |

| | | | 5.48%, 04/02/07 (c) | | | 9,578,143 | |

| | 10,951,451 | | KKR Atlantic Funding Trust, | | | | |

| | | | 5.33%, 04/23/07 (c) | | | 10,901,375 | |

| | 8,213,588 | | Laguna Corp., | | | | |

| | | | 5.34%, 05/31/07 (c) | | | 8,102,969 | |

| | 9,856,306 | | Mortgage Interest Networking Trust, | | | | |

| | | | 5.52%, 04/02/07 (c) | | | 9,851,772 | |

| | 4,654,367 | | Ocala Funding, | | | | |

| | | | 5.33%, 04/20/07 (c) | | | 4,633,084 | |

| | 4,928,153 | | Rams Funding LLC, | | | | |

| | | | 5.33%, 04/24/07 (c) | | | 4,907,073 | |

| | 8,213,588 | | Thornburg Mortgage Capital LLC, | | | | |

| | | | 5.33%, 04/13/07 (c) | | | 8,177,311 | |

| | 8,213,588 | | Valcour Bay Capital LLC, | | | | |

| | | | 5.36%, 04/02/07 (c) | | | 8,106,170 | |

| | 3,285,435 | | Valcour Bay Capital LLC, | | | | |

| | | | 5.34%, 04/02/07 (c) | | | 3,272,326 | |

| | | | Total Commercial Paper | | | | |

| | | | (Cost $100,315,514) | | | 100,315,514 | |

| | | | CORPORATE BONDS AND NOTES - 0.80% | | | | |

| | 2,737,863 | | Bayerische Landesbank, | | | | |

| | | | 5.37%, 12/24/15 | | | 2,737,863 | |

| | 3,285,435 | | Metlife Global, 5.42%, 04/28/08 | | | 3,285,435 | |

| | | | Total Corporate Bonds and Notes | | | | |

| | | | (Cost $6,023,298) | | | 6,023,298 | |

Principal | | | | Market | |

Amount | | | | Value | |

| | | CORPORATE PAYDOWN | | | |

| | | SECURITIES - 1.34% | | | |

| $ | 2,737,863 | | Duke Funding, 5.43%, 04/08/07 (c) | | $ | 2,737,863 | |

| | 7,343,649 | | Leafs LLC, 5.32%, 04/20/07 (c). . . | | | 7,343,649 | |

| | | | Total Corporate Paydown Securities | | | | |

| | | | (Cost $10,081,512) | | | 10,081,512 | |

Number of | | | | | |

Shares | | | | | |

| | | MUTUAL FUNDS - 0.19% | | | |

| | 1,478,093 | | AIM STIT-Liquid Assets Portfolio | | | 1,478,093 | |

| | | | Total Mutual Funds | | | | |

| | | | (Cost $1,478,093) | | | 1,478,093 | |

Principal | | | | | |

Amount | | | | | |

| | | | | | |

| | | REPURCHASE AGREEMENTS - 15.80% | | | |

| $ | 5,475,725 | | Bear Stearns Repurchase Agreement, | | | |

| | | | 5.56%, 04/02/07 (Collateralized | | | |

| | | | by non-U.S. Government debt | | | |

| | | | securities, value $5,724,117, 5.82% | | | |

| | | | to 6.37%, 01/01/12 to 03/01/17) | | | 5,475,725 | |

| | 13,689,314 | | Cantor Fitzgerald Repurchase | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | |

| | | | (Collateralized by U.S. | | | | |

| | | | Government Agency Issues, | | | | |

| | | | value $14,450,393, 4.00% to | | | | |

| | | | 7.50%, 06/01/08 to 03/01/37) | | | 13,689,314 | |

| | 13,689,314 | | Cantor Fitzgerald Repurchase | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | |

| | | | (Collateralized by U.S. Government | | | | |

| | | | Agency Issues, value $13,900,328, | | | | |

| | | | 4.50% to 9.00%, 01/01/08 to | | | | |

| | | | 03/01/37) | | | 13,689,314 | |

| | 27,378,627 | | CS First Boston Repurchase | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | |

| | | | (Collateralized by non-U.S. | | | | |

| | | | Government debt securities, | | | | |

| | | | value $27,775,848, 0.00% to | | | | |

| | | | 9.16%, 10/15/22 to 02/25/37) | | | 27,378,627 | |

| | 2,737,863 | | CS First Boston Repurchase | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | |

| | | | (Collateralized by non-U.S. Government | | | | |

| | | | debt securities, value $2,874,520, | | | | |

| | | | | | | 2,737,863 | |

See notes to financial statements.

AssetMark Large Cap Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Principal | | | | Market | |

Amount | | | | Value | |

| | | REPURCHASE AGREEMENTS (Continued) | | | |

| $ | 2,737,863 | | CS First Boston Repurchase | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | |

| | | | (Collateralized by non-U.S. | | | |

| | | | Government debt securities, | | | |

| | | | value $2,860,830, 6.25%, | | | |

| | | | 02/25/37) | | $ | 2,737,863 | |

| | 2,737,863 | | CS First Boston Repurchase | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | |

| | | | (Collateralized by U.S. Government | | | | |

| | | | Agency Issues, value $2,787,410, | | | | |

| | | | 0.00%, 04/25/37) | | | 2,737,863 | |

| | 1,368,931 | | Merrill Lynch Repurchase | | | | |

| | | | Agreement, 5.37%, 04/02/07 | | | | |

| | | | (Collateralized by U.S. | | | | |

| | | | Government Agency Issues, | | | | |

| | | | value $1,390,683, 5.50%, | | | | |

| | | | 03/01/37) | | | 1,368,931 | |

| | 49,281,528 | | Morgan Stanley Repurchase | | | | |

| | | | Agreement, 5.51%, 04/02/07 | | | | |

| | | | (Collateralized by non-U.S. | | | | |

| | | | Government debt securities, | | | | |

| | | | value $52,995,041, 0.00% to 6.99%, | | | | |

| | | | 11/20/08 to 09/20/43) | | | 49,281,528 | |

| | | | Total Repurchase Agreements | | | | |

| | | | (Cost $119,097,028) | | | 119,097,028 | |

| | | | Total Investments Purchased as | | | | |

| | | | Securities Lending Collateral | | | | |

| | | | (Cost $236,995,445) | | | 236,995,445 | |

| | | | Total Investments | | | | |

| | | | (Cost $927,447,218) - 131.85% | | | 993,700,585 | |

| | | | Liabilities in Excess of | | | | |

| | | | Other Assets - (31.85)% | | | (240,062,282 | ) |

| | | | TOTAL NET | | | | |

| | | | ASSETS - 100.00% | | $ | 753,638,303 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| (b) | All or a portion of this security is on loan. |

| (c) | Restricted securities as defined in Rule 144(a) under the Securities Act of 1933. Such securities are treated as liquid securities according to the Fund’s liquidity guidelines. The market value of these securities total $110,397,026, which represents 14.65% of total net assets. |

| (d) | Variable Rate Security. The rate shown is the rate in effect on March 31, 2007. |

See notes to financial statements.

AssetMark Large Cap Value Fund

PERFORMANCE DATA

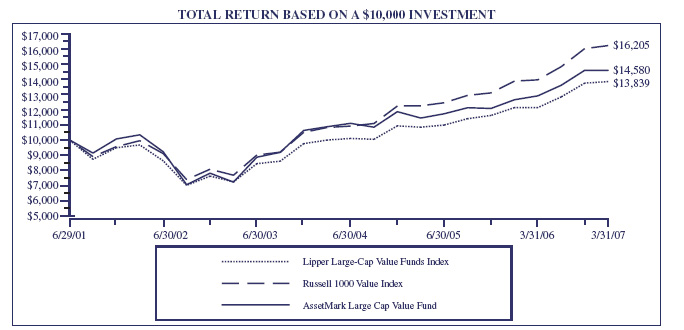

This chart assumes an initial gross investment of $10,000 made on June 29, 2001 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

RUSSELL 1000 VALUE INDEX – An unmanaged index which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index is an unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

LIPPER LARGE-CAP VALUE FUNDS INDEX – The Lipper Large-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Value Funds Category. These funds, by portfolio practice, invest at least 75% of equity assets in companies with market capitalizations (on three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P Super Composite 1500® Index. Large-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value, compared to the S&P 500® Index.

AVERAGE ANNUAL TOTAL RETURN (for the periods ended March 31) | | |

| | One Year | Five Year | Since Inception (6/29/01) |

| AssetMark Large Cap Value Fund | 15.32% | 7.12% | 6.77% |

| Russell 1000 Value Index | 16.83% | 10.25% | 8.76% |

| Lipper Large-Cap Value Funds Index | 14.14% | 7.42% | 5.81% |

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS - 95.92% | | | |

| | | Aerospace & Defense - 0.96% | | | |

| | 88,200 | | Northrop Grumman Corp. | | $ | 6,546,204 | |

| | | | Auto Components - 0.95% | | | | |

| | 1,038,246 | | Delphi Corp. (a)(b) | | | 3,010,913 | |

| | 36,500 | | Johnson Controls, Inc. (b) | | | 3,453,630 | |

| | | | | | | 6,464,543 | |

| | | | Automobiles - 3.94% | | | | |

| | 888,836 | | Ford Motor Co. (b) | | | 7,012,916 | |

| | 453,125 | | General Motors Corp. (b) | | | 13,883,750 | |

| | 101,650 | | Harley-Davidson, Inc. (b) | | | 5,971,938 | |

| | | | | | | 26,868,604 | |

| | | | Beverages - 1.29% | | | | |

| | 64,300 | | Anheuser-Busch Companies, Inc. (b) | | | 3,244,578 | |

| | 156,800 | | Coca-Cola Enterprises, Inc. | | | 3,175,200 | |

| | 29,350 | | Diageo PLC - ADR | | | 2,375,882 | |

| | | | | | | 8,795,660 | |

| | | | Building Products - 0.41% | | | | |

| | 103,100 | | Masco Corp. (b) | | | 2,824,940 | |

| | | | Capital Markets - 1.91% | | | | |

| | 37,770 | | Ameriprise Financial, Inc. | | | 2,158,178 | |

| | 132,600 | | Lehman Brothers Holdings, Inc. (b) | | | 9,291,282 | |

| | 37,200 | | Mellon Financial Corp. (b) | | | 1,604,808 | |

| | | | | | | 13,054,268 | |

| | | Chemicals - 2.46% | | | |

| | 294,270 | | The Dow Chemical Co. | | | 13,495,222 | |

| | 46,400 | | PPG Industries, Inc. (b) | | | 3,262,384 | |

| | | | | | | 16,757,606 | |

| | | | Commercial Banks - 5.95% | | | | |

| | 189,800 | | Bank of America Corp | | | 9,683,596 | |

| | 141,130 | | Fifth Third Bancorp (b) | | | 5,460,320 | |

| | 57,709 | | HSBC Holdings PLC - ADR (b) | | | 5,067,427 | |

| | 186,910 | | Popular, Inc. (b) | | | 3,095,229 | |

| | 237,134 | | Wachovia Corp. | | | 13,054,227 | |

| | 123,600 | | Wells Fargo & Co. | | | 4,255,548 | |

| | | | | | | 40,616,347 | |

| | | | Commercial Services & Supplies - 1.05% | |

| | 14,150 | | Dun & Bradstreet Corp. | | | 1,290,480 | |

| | 279,480 | | H&R Block, Inc. (b) | | | 5,880,259 | |

| | | | | | | 7,170,739 | |

| | | Communications Equipment - 0.87% | | | |

| | 501,689 | | Alcatel SA - ADR (b) | | $ | 5,929,964 | |

| | | | Computers & Peripherals - 2.16% | | | | |

| | 287,730 | | Dell, Inc. (a) | | | 6,678,213 | |

| | 79,500 | | Hewlett-Packard Co. | | | 3,191,130 | |

| | 51,690 | | International Business | | | | |

| | | | Machines Corp. | | | 4,872,300 | |

| | | | | | | 14,741,643 | |

| | | | Construction Materials - 0.23% | | | | |

| | 13,550 | | Vulcan Materials Co. (b) | | | 1,578,304 | |

| | | | Consumer Finance - 1.69% | | | | |

| | 148,300 | | American Express Co. | | | 8,364,120 | |

| | 76,700 | | SLM Corp. | | | 3,137,030 | |

| | | | | | | 11,501,150 | |

| | | | Containers & Packaging - 0.62% | | | | |

| | 133,200 | | Sealed Air Corp. | | | 4,209,120 | |

| | | | Diversified Financial Services - 3.40% | | | | |

| | 266,770 | | Citigroup, Inc. | | | 13,695,972 | |

| | 152,738 | | J.P. Morgan Chase & Co. | | | 7,389,464 | |

| | 34,350 | | Moody’s Corp. (b) | | | 2,131,761 | |

| | | | | | | 23,217,197 | |

| | | | Diversified Telecommunication | | | | |

| | | | Services - 4.87% | | | | |

| | 336,742 | | AT&T Inc. (b) | | | 13,277,737 | |

| | 108,100 | | Sprint Corp. (b) | | | 2,049,576 | |

| | 472,865 | | Verizon Communications, Inc. (b) | | | 17,931,041 | |

| | | | | | | 33,258,354 | |

| | | Electric Utilities - 1.92% | | | |

| | 69,000 | | Edison International | | | 3,389,970 | |

| | 151,600 | | TXU Corp. | | | 9,717,560 | |

| | | | | | | 13,107,530 | |

| | | | Energy Equipment & Services - 1.71% | | | | |

| | 109,600 | | GlobalSantaFe Corp. (b) | | | 6,760,128 | |

| | 107,500 | | Halliburton Co. | | | 3,412,050 | |

| | 18,600 | | Transocean, Inc. (a) | | | 1,519,620 | |

| | | | | | | 11,691,798 | |

| | | | Food & Staples Retailing - 4.06% | | | | |

| | 121,100 | | Costco Wholesale Corp. (b) | | | 6,520,024 | |

| | 67,217 | | CVS Corp. | | | 2,294,788 | |

| | 165,596 | | The Kroger Co. (b) | | | 4,678,087 | |

| | 140,285 | | Safeway, Inc. (b) | | | 5,140,042 | |

See notes to financial statements.

AssetMark Large Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Food & Staples Retailing (Continued) | | | |

| | 151,410 | | Supervalu, Inc. (b) | | $ | 5,915,589 | |

| | 67,250 | | Wal-Mart Stores, Inc | | | 3,157,388 | |

| | | | | | | 27,705,918 | |

| | | | Food Products - 1.33% | | | | |

| | 91,600 | | Archer-Daniels-Midland Co. (b) | | | 3,361,720 | |

| | 338,860 | | Sara Lee Corp. | | | 5,733,511 | |

| | | | | | | 9,095,231 | |

| | | | Health Care Equipment & Supplies - 0.79% | | | | |

| | 369,220 | | Boston Scientific Corp. (a) | | | 5,368,459 | |

| | | | Health Care Providers & Services - 1.89% | | | | |

| | 23,650 | | Cardinal Health, Inc. | | | 1,725,268 | |

| | 44,800 | | Cigna Corp. | | | 6,391,168 | |

| | 427,500 | | Tenet Healthcare Corp. (a)(b) | | | 2,748,825 | |

| | 38,900 | | UnitedHealth Group, Inc. | | | 2,060,533 | |

| | | | | | | 12,925,794 | |

| | | | Hotels, Restaurants & Leisure - 0.96% | | | | |

| | 69,000 | | Carnival Corp. (b) | | | 3,233,340 | |

| | 73,000 | | McDonald’s Corp. | | | 3,288,650 | |

| | | | | | | 6,521,990 | |

| | | | Household Durables - 1.10% | | | | |

| | 40,500 | | Fortune Brands, Inc. | | | 3,192,210 | |

| | 50,860 | | Whirlpool Corp. (b) | | | 4,318,523 | |

| | | | | | | 7,510,733 | |

| | | | Household Products - 1.19% | | | | |

| | 94,800 | | Kimberly-Clark Corp | | | 6,492,852 | |

| | 25,900 | | Procter & Gamble Co. (b) | | | 1,635,844 | |

| | | | | | | 8,128,696 | |

| | | | Industrial Conglomerates - 2.03% | | | | |

| | 42,000 | | 3M Co. (b) | | | 3,210,060 | |

| | 91,400 | | General Electric Co. | | | 3,231,904 | |

| | 234,050 | | Tyco International Ltd. | | | 7,384,278 | |

| | | | | | | 13,826,242 | |

| | | | Insurance - 9.27% | | | | |

| | 212,600 | | The Allstate Corp. | | | 12,768,756 | |

| | 110,100 | | American International Group, Inc. | | | 7,400,922 | |

| | 32,350 | | AON Corp. | | | 1,228,006 | |

| | 1,703 | | Berkshire Hathaway, Inc. (a)(b) | | | 6,198,920 | |

| | 138,880 | | Conseco, Inc. (a)(b) | | | 2,402,624 | |

| | 88,200 | | Loews Corp. | | | 4,006,926 | |

| | | Insurance (Continued) | | | |

| | 131,860 | | Marsh & McLennan | | | |

| | | | Companies, Inc. (b) | | $ | 3,862,179 | |

| | 159,800 | | Metlife, Inc. | | | 10,091,370 | |

| | 154,900 | | The Progressive Corp. (b) | | | 3,379,918 | |

| | 31,866 | | Transatlantic Holdings, Inc. (b) | | | 2,075,114 | |

| | 189,700 | | Travelers Companies, Inc. | | | 9,820,769 | |

| | | | | | | 63,235,504 | |

| | | | IT Services - 1.20% | | | | |

| | 59,637 | | Electronic Data Systems Corp. | | | 1,650,752 | |

| | 83,325 | | Iron Mountain, Inc. (a) | | | 2,177,283 | |

| | 515,175 | | Unisys Corp. (a)(b) | | | 4,342,925 | |

| | | | | | | 8,170,960 | |

| | | | Leisure Equipment & Products - 0.81% | | | | |

| | 245,286 | | Eastman Kodak Co. (b) | | | 5,533,652 | |

| | | | Machinery - 1.44% | | | | |

| | 57,600 | | Deere & Co. (b) | | | 6,257,664 | |

| | 48,500 | | Paccar, Inc. (b) | | | 3,559,900 | |

| | | | | | | 9,817,564 | |

| | | Media - 4.93% | | | |

| | 211,800 | | CBS Corp. (b) | | | 6,478,962 | |

| | 216,525 | | Comcast Corp. (a) | | | 5,514,892 | |

| | 221,725 | | Gannett Co., Inc. | | | 12,480,900 | |

| | 10,493 | | Idearc, Inc. | | | 368,304 | |

| | 17,890 | | McClatchy Co. | | | 565,503 | |

| | 135,700 | | News Corp. | | | 3,137,384 | |

| | 158,380 | | Tribune Co. (b) | | | 5,085,582 | |

| | | | | | | 33,631,527 | |

| | | | Metals & Mining - 1.49% | | | | |

| | 197,670 | | Alcoa, Inc. | | | 6,701,013 | |

| | 52,100 | | Freeport-McMoRan Copper & | | | | |

| | | | Gold, Inc. | | | 3,448,499 | |

| | | | | | | 10,149,512 | |

| | | | Multiline Retail - 0.55% | | | | |

| | 82,600 | | Federated Department Stores (b) | | | 3,721,130 | |

| | | | Office Electronics - 0.66% | | | | |

| | 265,230 | | Xerox Corp. (a) | | | 4,479,735 | |

| | | | Oil & Gas - 9.09% | | | | |

| | 146,300 | | Apache Corp. | | | 10,343,410 | |

| | 306,152 | | ConocoPhillips (b) | | | 20,925,489 | |

| | 58,100 | | Devon Energy Corp. (b) | | | 4,021,682 | |

| | 103,795 | | El Paso Corp. | | | 1,501,914 | |

See notes to financial statements.

AssetMark Large Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS (Continued) | | | |

| | | Oil & Gas (Continued) | | | |

| | 50,750 | | EOG Resources, Inc. (b) | | $ | 3,620,505 | |

| | 288,900 | | Occidental Petroleum Corp. (b) | | | 14,245,659 | |

| | 113,900 | | Valero Energy Corp. | | | 7,345,411 | |

| | | | | | | 62,004,070 | |

| | | | Pharmaceuticals - 6.45% | | | | |

| | 232,324 | | Bristol-Myers Squibb Co. | | | 6,449,314 | |

| | 104,900 | | Johnson & Johnson | | | 6,321,274 | |

| | 271,530 | | Merck & Co., Inc. (b) | | | 11,993,480 | |

| | 470,616 | | Pfizer, Inc. | | | 11,887,760 | |

| | 237,795 | | Schering Plough Corp. | | | 6,066,151 | |

| | 25,935 | | Wyeth | | | 1,297,528 | |

| | | | | | | 44,015,507 | |

| | | | Road & Rail - 0.47% | | | | |

| | 40,000 | | Burlington Northern Santa Fe | | | | |

| | | | Corp. (b) | | | 3,217,200 | |

| | | | Semiconductor & | | | | |

| | | | Semiconductor Equipment - 1.83% | | | | |

| | 356,200 | | Intel Corp. | | | 6,814,106 | |

| | 471,166 | | Micron Technology, Inc. (a) | | | 5,691,685 | |

| | | | | | | 12,505,791 | |

| | | Software - 1.30% | | | |

| | 319,530 | | Microsoft Corp. | | | 8,905,301 | |

| | | | Specialty Retail - 0.47% | | | | |

| | 124,300 | | Limited Brands, Inc. | | | 3,239,258 | |

| | | | Thrifts & Mortgage Finance - 3.64% | | | | |

| | 176,700 | | Countrywide Financial Corp. (b) | | | 5,944,188 | |

| | 157,900 | | Federal Home Loan Mortgage | | | | |

| | | | Corp. (b) | | | 9,393,471 | |

| | 236,200 | | Washington Mutual, Inc. (b) | | | 9,537,756 | |

| | | | | | | 24,875,415 | |

| | | | Tobacco - 2.58% | | | | |

| | 200,761 | | Altria Group, Inc. | | | 17,628,823 | |

| | | | Total Common Stocks | | | | |

| | | | (Cost $554,199,127) | | | 654,547,983 | |

| | | | SHORT TERM INVESTMENTS - 4.00% | | | | |

| | | | Money Market Funds - 4.00% | | | | |

| | 27,337,235 | | Federated Prime Obligations Fund | | | | |

| | | | 5.18%, 01/01/2050 (d) | | | 27,337,235 | |

| | | | Total Short Term Investments | | | | |

| | | | (Cost $27,337,235) | | | 27,337,235 | |

Principal | | | | Market | |

Amount | | | | Value | |

| | | INVESTMENTS PURCHASED | | | |

| | | AS SECURITIES LENDING | | | |

| | | COLLATERAL - 29.69% | | | |

| | | COMMERCIAL PAPER - 12.57% | | | |

| $ | 9,362,832 | | Antalis Funding, | | | |

| | | | 5.37%, 04/10/07 (c) | | $ | 9,347,498 | |

| | 702,212 | | Chesham Finance LLC, | | | | |

| | | | 5.46%, 04/02/07 (c) | | | 701,893 | |

| | 8,192,478 | | Concord Minutemen Capital Co., | | | | |

| | | | 5.30%, 04/04/07 (c)(d) | | | 8,192,478 | |

| | 2,106,637 | | Duke Funding, | | | | |

| | | | 5.32%, 04/20/07 (c) | | | 2,097,333 | |

| | 7,724,335 | | Duke Funding, | | | | |

| | | | 5.32%, 04/13/07 (c) | | | 7,690,252 | |

| | 8,192,478 | | Fenway Funding LLC, | | | | |

| | | | 5.48%, 04/02/07 (c) | | | 8,188,737 | |

| | 9,362,832 | | KKR Atlantic Funding Trust, | | | | |

| | | | 5.33%, 04/23/07 (c) | | | 9,320,020 | |

| | 7,022,124 | | Laguna Corp., | | | | |

| | | | 5.34%, 05/31/07 (c) | | | 6,927,552 | |

| | 8,426,548 | | Mortgage Interest Networking Trust, | | | | |

| | | | 5.52%, 04/02/07 (c) | | | 8,422,671 | |

| | 3,979,204 | | Ocala Funding, | | | | |

| | | | 5.33%, 04/20/07 (c) | | | 3,961,008 | |

| | 4,213,274 | | Rams Funding LLC, | | | | |

| | | | 5.33%, 04/24/07 (c) | | | 4,195,252 | |

| | 7,022,124 | | Thornburg Mortgage Capital LLC, | | | | |

| | | | 5.33%, 04/13/07 (c) | | | 6,991,109 | |

| | 7,022,124 | | Valcour Bay Capital LLC, | | | | |

| | | | 5.36%, 04/02/07 (c) | | | 6,930,288 | |

| | 2,808,850 | | Valcour Bay Capital LLC, | | | | |

| | | | 5.34%, 04/02/07 (c) | | | 2,797,642 | |

| | | | Total Commercial Paper | | | | |

| | | | (Cost $85,763,733) | | | 85,763,733 | |

| | | | CORPORATE BONDS AND NOTES - 0.75% | | | | |

| | 2,340,708 | | Bayerische Landesbank, | | | |

| | | | 5.37%, 12/24/15 | | | 2,340,708 | |

| | 2,808,850 | | Metlife Global, 5.42%, 04/28/08 | | | 2,808,850 | |

| | | | Total Corporate Bonds and Notes | | | | |

| | | | (Cost $5,149,558) | | | 5,149,558 | |

| | | | CORPORATE PAYDOWN | | | | |

| | | | SECURITIES - 1.26% | | | | |

| | 2,340,708 | | Duke Funding, 5.43%, 04/08/07 (c) | | | 2,340,708 | |

| | 6,278,379 | | Leafs LLC, 5.32%, 04/20/07 (c) | | | 6,278,379 | |

| | | | Total Corporate Paydown Securities | | | | |

| | | | (Cost $8,619,087) | | | 8,619,087 | |

See notes to financial statements.

AssetMark Large Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Number of | | | | | | | Market | |

Shares | | | | | | | Value | |

| | | MUTUAL FUNDS - 0.19% | | | | | | |

| | 1,263,681 | | AIM STIT-Liquid Assets Portfolio | | | | | $ | 1,263,681 | |

| | | | Total Mutual Funds | | | | | | | |

| | | | (Cost $1,263,681) | | | | 1,263,681 | |

| | | | | | | | | | |

Principal | | | | | | | | | |

Amount | | | | | | | | | |

| | | | REPURCHASE AGREEMENTS - 14.92% | |

| $ | 4,681,416 | | Bear Stearns Repurchase Agreement, | | | | | |

| | | | 5.56%, 04/02/07 (Collateralized | | | | | | | |

| | | | by non-U.S. Government debt | | | | | | | |

| | | | securities, value $4,893,775, 5.82% | | | | | |

| | | | to 6.37%, 01/01/12 to 03/01/17) | | | | | | | 4,681,416 | |

| | 11,703,540 | | Cantor Fitzgerald Repurchase | | | | | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | | | | | |

| | | | (Collateralized by U.S. | | | | | | | | |

| | | | Government Agency Issues, | | | | | | | | |

| | | | value $12,354,217, 4.00% to | | | | | | | | |

| | | | 7.50%, 06/01/08 to 03/01/37) | | | . | | | | 11,703,540 | |

| | 11,703,540 | | Cantor Fitzgerald Repurchase | | | | | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | | | | | |

| | | | (Collateralized by U.S. | | | | | | | | |

| | | | Government Agency Issues, | | | | | | | | |

| | | | value $11,883,945, 4.50% to | | | | | | | | |

| | | | 9.00%, 01/01/08 to 03/01/37) | | | | | | | 11,703,540 | |

| | 23,407,080 | | CS First Boston Repurchase | | | | | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | | | | | |

| | | | (Collateralized by non-U.S. | | | | | | | | |

| | | | Government debt securities, | | | | | | | | |

| | | | value $23,746,680, 0.00% to | | | | | | | | |

| | | | 9.16%, 10/15/22 to 02/25/37) | | | | | | | 23,407,080 | |

| | 2,340,708 | | CS First Boston Repurchase | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | |

| | | | (Collateralized by non-U.S. | | | |

| | | | Government debt securities, | | | |

| | | | value $2,457,541, 6.25%, | | | |

| | | | 02/25/37) | | | 2,340,708 | |

| | 2,340,708 | | CS First Boston Repurchase | | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | | |

| | | | (Collateralized by non-U.S. | | | | |

| | | | Government debt securities, | | | | |

| | | | value $2,445,838, 6.25%, | | | | |

| | | | 02/25/37) | | | 2,340,708 | |

Principal | | | | Market | |

Amount | | | | Value | |

| $ | 2,340,708 | | CS First Boston Repurchase | | | |

| | | | Agreement, 5.38%, 04/02/07 | | | |

| | | | (Collateralized by U.S. | | | |

| | | | Government Agency Issues, | | | |

| | | | value $2,383,068, 0.00%, | | | |

| | | | 04/25/37) | | $ | 2,340,708 | |

| | 1,170,354 | | Merrill Lynch Repurchase | | | | |

| | | | Agreement, 5.37%, 04/02/07 | | | | |

| | | | (Collateralized by U.S. | | | | |

| | | | Government Agency Issues, | | | | |

| | | | value $1,188,950, 5.50%, | | | | |

| | | | 03/01/37) | | | 1,170,354 | |

| | 42,132,743 | | Morgan Stanley Repurchase | | | | |

| | | | Agreement, 5.51%, 04/02/07 | | | | |

| | | | (Collateralized by non-U.S. | | | | |

| | | | Government debt securities, | | | | |

| | | | value $45,307,574, 0.00% to | | | | |

| | | | 6.99%, 11/20/28 to 09/20/43) | | | 42,132,743 | |

| | | | Total Repurchase Agreements | | | | |

| | | | (Cost $101,820,797) | | | 101,820,797 | |

| | | | Total Investments Purchased as | | | | |

| | | | Securities Lending Collateral | | | | |

| | | | (Cost $202,616,856) | | | 202,616,856 | |

| | | | Total Investments | | | | |

| | | | (Cost $784,153,218) - 129.61% | | | 884,502,074 | |

| | | | Liabilities in Excess of | | | | |

| | | | Other Assets - (29.61)% | | | (202,093,096 | ) |

TOTAL NET | | | |

ASSETS - 100.00% | | $ | 682,408,978 | |

| | | | | |

| Percentages are stated as a percent of net assets. |

| ADR - | American Depository Receipt |

| (a) | Non Income Producing. |

| (b) | All or a portion of this security is on loan. |

| (c) | Restricted securities as defined in Rule 144(a) under the |

| | Securities Act of 1933. Such securities are treated as liquid |

| | securities according to the Fund’s liquidity guidelines. The |

| | market value of these securities total $94,382,820, which |

| | represents 13.83% of total net assets. |

| (d) | Variable Rate Security. The rate shown is the rate in effect on |

| | March 31, 2007. |

See notes to financial statements.

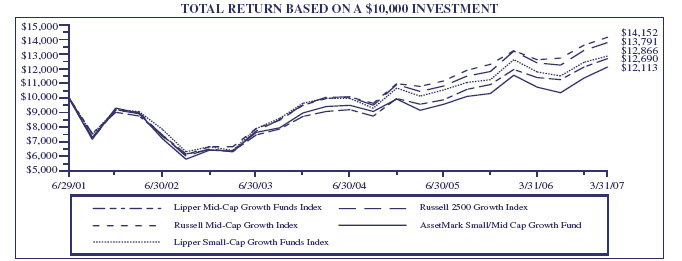

This chart assumes an initial gross investment of $10,000 made on June 29, 2001 (commencement of operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

RUSSELL 2500 GROWTH INDEX - An unmanaged index which measures the performance of those Russell 2500 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index which measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

RUSSELL MID-CAP GROWTH INDEX - Measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000 Growth Index. The Russell 1000 Growth Index contains those securities in the Russell 1000 Index with a greater-than-average growth orientation.

LIPPER SMALL-CAP GROWTH FUNDS INDEX - The Lipper Small-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Growth Funds Category. These funds, by portfolio practice, invest 75% of equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median market capitalization of the smallest 500 of the middle 1,000 securities of the S&P Super Composite 1500® Index. These funds typically have an above average price-to-earnings ratio, price-to-book ratio and three-year sales-per-share growth value, compared to the S&P SmallCap 600 IndexTM.

LIPPER MID-CAP GROWTH FUNDS INDEX - Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) of less than 300% of the dollar-weighted median market capitalization of the S&P Mid-Cap 400 Index. Mid-Cap Growth funds normally invest in companies with long-term earnings expected to grow significantly faster than the earnings of the stocks represented in a major unmanaged stock index. These funds will normally have an above-average price-to-earnings ratio, price-to-book ratio and three-year earnings growth figure, compared to the U.S. diversified mid-cap funds universe average.

AVERAGE ANNUAL TOTAL RETURN (for the periods ended March 31) | | |

| | One Year | Five Year | Since Inception (6/29/01) |

| AssetMark Small/Mid Cap Growth Fund | 4.84% | 6.21% | 3.38% |

| Russell 2500 Growth Index | 4.44% | 9.13% | 5.74% |

| Russell Mid-Cap Growth Index | 6.90% | 9.45% | 6.22% |

| Lipper Small-Cap Growth Funds Index | 1.96% | 7.26% | 4.48% |

| Lipper Mid-Cap Growth Funds Index | 6.22% | 7.70% | 4.23% |

| | | | |

AssetMark Small/Mid Cap Growth Fund

SCHEDULE OF INVESTMENTS

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |

| | | COMMON STOCKS - 98.99% | | | |

| | | Aerospace & Defense - 5.92% | | | |

| | 19,600 | | Armor Holdings, Inc. (a)(b) | | $ | 1,319,668 | |

| | 81,643 | | BE Aerospace, Inc. (a)(b) | | | 2,588,083 | |

| | 25,700 | | Ceradyne, Inc. (a)(b) | | | 1,406,818 | |

| | 30,325 | | Precision Castparts Corp. (b) | | | 3,155,316 | |

| | 52,800 | | Spirit Aerosystems Holdings, Inc. (a) | | | 1,681,680 | |

| | | | | | | 10,151,565 | |

| | | | Airlines - 1.43% | | | | |

| | 13,200 | | AMR Corp. (a)(b) | | | 401,940 | |

| | 31,800 | | Continental Airlines, Inc. (a)(b) | | | 1,157,202 | |

| | 19,600 | | US Airways Group, Inc. (a) | | | 891,408 | |

| | | | | | | 2,450,550 | |

| | | | Auto Components - 0.23% | | | | |

| | 22,800 | | Standard Motor Products, Inc. (b) | | | 389,196 | |

| | | | Banks - 0.87% | | | | |

| | 45,855 | | Signature Bank (a) | | | 1,492,122 | |

| | | | Beverages - 0.64% | | | | |

| | 11,500 | | Molson Coors Brewing Co. (b) | | | 1,088,130 | |

| | | | Biotechnology - 1.42% | | | | |

| | 11,500 | | Kendle International, Inc. (a) | | | 408,480 | |

| | 85,575 | | Keryx Biopharmaceuticals, | | | | |

| | | | Inc. (a)(b) | | | 900,249 | |

| | 45,275 | | Lifecell Corp. (a)(b) | | | 1,130,517 | |

| | | | | | | 2,439,246 | |

| | | Capital Markets - 2.37% | | | |

| | 21,330 | | Affiliated Managers Group, Inc. (a)(b) | | | 2,311,105 | |

| | 4,368 | | Evercore Partners, Inc. | | | 136,238 | |

| | 23,869 | | GFI Group Inc. (a)(b) | | | 1,622,376 | |

| | | | | | | 4,069,719 | |

| | | | Chemicals - 1.98% | | | | |

| | 33,200 | | CF Industries Holdings, Inc. | | | 1,279,860 | |

| | 24,700 | | Headwaters, Inc. (a)(b) | | | 539,695 | |

| | 8,500 | | Lubrizol Corp. | | | 438,005 | |

| | 25,300 | | OM Group, Inc. (a) | | | 1,130,404 | |

| | | | | | | 3,387,964 | |

| | | | Commercial Services & Supplies - 7.89% | | | | |

| | 30,805 | | American Reprographics Co. (a) | | | 948,486 | |

| | 8,895 | | The Corporate Executive Board Co. | | | 675,664 | |

| | 12,400 | | Dun & Bradstreet Corp. | | | 1,130,880 | |

| | 11,300 | | First Advantage Corp. (a) | | | 270,861 | |

| | 95,259 | | InnerWorkings, Inc. (a)(b) | | | 1,124,056 | |

| | | Commercial Services & Supplies (Continued) | | | |

| | 16,500 | | ITT Educational Services, Inc. (a)(b) | | $ | 1,344,585 | |

| | 37,184 | | Kenexa Corp. (a)(b) | | | 1,157,538 | |

| | 15,770 | | Sotheby’s Holdings | | | 701,450 | |

| | 12,200 | | Strayer Education, Inc. | | | 1,525,000 | |

| | 88,228 | | TeleTech Holdings, Inc. (a)(b) | | | 3,237,085 | |

| | 35,900 | | United Rentals, Inc. (a) | | | 987,250 | |

| | 6,600 | | Volt Information Sciences, Inc. (a)(b) | | | 172,854 | |

| | 5,200 | | Watson Wyatt Worldwide, Inc. (b) | | | 252,980 | |

| | | | | | | 13,528,689 | |

| | | | Communications Equipment - 3.10% | | | | |

| | 9,400 | | Avocent Corp. (a) | | | 253,518 | |

| | 25,400 | | Belden CDT, Inc. (b) | | | 1,361,186 | |

| | 20,040 | | Ciena Corp. (a) | | | 560,118 | |

| | 38,621 | | CommScope, Inc. (a)(b) | | | 1,656,841 | |

| | 12,000 | | NICE Systems Ltd. - ADR (a) | | | 408,240 | |

| | 38,805 | | Riverbed Technology, Inc. (a)(b) | | | 1,072,570 | |

| | | | | | | 5,312,473 | |

| | | Computers & Peripherals - 0.67% | | | |

| | 83,800 | | Brocade Communications Systems, | | | |

| | | | Inc. (a)(b) | | | 797,776 | |

| | 7,500 | | Diebold, Inc. | | | 357,825 | |

| | | | | | | 1,155,601 | |

| | | | Construction & Engineering - 1.41% | | | | |

| | 15,900 | | EMCOR Group, Inc. (a) | | | 937,782 | |

| | 31,600 | | Jacobs Engineering Group, Inc. (a) | | | 1,474,140 | |

| | | | | | | 2,411,922 | |

| | | | Containers & Packaging - 0.33% | | | | |

| | 8,400 | | Aptargroup, Inc. | | | 562,212 | |

| | | | Distributors - 0.15% | | | | |

| | 14,000 | | Building Material Holding Corp. (b) | | | 253,540 | |

| | | | Diversified Financial Services - 3.39% | | | | |

| | 31,600 | | The First Marblehead Corp. | | | 1,418,524 | |

| | 9,490 | | Huron Consulting Group, Inc. (a) | | | 577,372 | |

| | 31,011 | | International Securities Exchange | | | | |

| | | | Holdings, Inc. (b) | | | 1,513,337 | |

| | 25,000 | | NewStar Financial, Inc. (a)(b) | | | 419,000 | |

| | 13,848 | | Nymex Holdings, Inc. (a)(b) | | | 1,880,004 | |

| | | | | | | 5,808,237 | |

| | | | Diversified Telecommunication Services - 3.35% | | | | |

| | 62,635 | | Cbeyond Communications, Inc. (a)(b) | | | 1,837,085 | |

| | 57,416 | | Cogent Comm Group, Inc. (a) | | | 1,356,740 | |

See notes to financial statements.

AssetMark Small/Mid Cap Growth Fund

SCHEDULE OF INVESTMENTS (Continued)

March 31, 2007

Number of | | | | Market | |

Shares | | | | Value | |