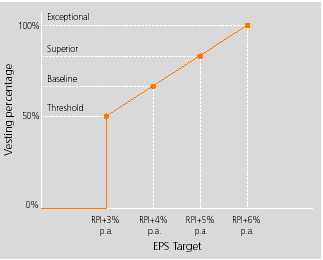

The following vesting schedules apply to awards made in 2003, 2004 and 2006.

In his capacity as SVP, Worldwide Business Development, Dr Slaoui was eligible to participate in the GSK Share Value Plan. Both Dr Slaoui and his wife, as an employee of GSK, received awards under the Share Value Plan. Following the announcement of his appointment to the Board, in February 2006, he ceased to be eligible to receive awards under this plan. The awards are subject to a 3-year vesting period and the vesting is contingent on their continued employment with GSK.

The Mid-Term Incentive Plan (MTIP) was a share award scheme operated by SmithKline Beecham. The plan closed to new entrants upon completion of the merger and no further participations have been granted.

Where a final award of ADSs is made, receipt of the award may be deferred by a Director. Dr Garnier deferred receipt of the full amounts vested in 1999, 2000, 2001, 2002 and 2003. The deferred awards, together with any additional ADSs subsequently received through dividend reinvestment, are not included in the Directors’ interests table on page 76 since they are retained in the MTIP until paid out.

Back to Contents

| |

| Remuneration Report |

| continued |

|

| |

| | | | Average |

| Stock Appreciation Rights (SARs) – ADSs | At 31.12.05 | At 17.05.06 | grant price |

|

| Dr L Shapiro | 872 | 872 | $57.25 |

|

Dr Shapiro did not exercise any SARS in 2006. Her gain on exercise in 2005 was $6,380.

All SARs held by Dr Shapiro had a grant price above the market price of a GlaxoSmithKline ADS at 17th May 2006, the date she retired from the Board of GlaxoSmithKline.

Dr Shapiro is a member of GlaxoSmithKline’s Scientific Advisory Board (SAB). Dr Shapiro was a member of SmithKline Beecham’s SAB from 1993 until the completion of the merger with Glaxo Wellcome. Along with other members of the SAB, she received annual grants of SmithKline Beecham SARs which, in general, vested three years from the date of grant and will expire 10 years from the date of grant. Grants of SARs to SAB members ceased in 1999.

SARs entitle the holder to a cash sum at a future date based on share price growth between the date of grant and the date of exercise. Full provision is made in the financial statements for accrued gains on SARs from the date of grant. In connection with the merger, all previously granted SARs became immediately exercisable.

Pensions

The accrued annual pension benefits and transfer values for Executive Directors on retirement are set out below.

The regulations require disclosure of the accrued benefit at the end of the year, the change in accrued benefit over the year, the transfer value at both the beginning and end of the year, and the change in the transfer value over the year. The Listing Rules require additional disclosure of the change in the accrued benefit net of inflation and the transfer value of this change. Pensions for the Executive Directors have been disclosed in the currency in which the pension is payable.

| | | | | | | | | | | | Personal | | | | | | | | | | | | Change in | | | | |

| | | | | | | | | Change in | | | contributions | | | | | | | | | | | | accrued | | | Transfer value | |

| | | Accrued | | | Accrued | | | accrued | | | made to the | | | Transfer | | | Transfer | | | Change | | | benefit over | | | of change | |

| | | benefit at | | | benefit at | | | benefit | | | scheme during | | | value at | | | value | | | in transfer | | | year net | | | in accrued | |

| | | 31.12.05 | | | 31.12.06 | | | over year | | | the year | | | 31.12.05 | | | at 31.12.06 | | | value* | | | of inflation | | | benefit* | |

| | | 000 | | | 000 | | | 000 | | | 000 | | | 000 | | | 000 | | | 000 | | | 000 | | | 000 | |

|

| Current Executive Directors | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dr JP Garnier | $ | 1,093 | | $ | 1,202 | | $ | 109 | | | – | | $ | 13,240 | | $ | 14,680 | | $ | 1,440 | | $ | 87 | | $ | 1,440 | |

|

| Dr M Slaoui | | – | | $ | 26 | | $ | 26 | | | – | | | – | | $ | 131 | | $ | 131 | | $ | 26 | | $ | 131 | |

| | € | 52 | | € | 53 | | € | 1 | | | – | | € | 493 | | € | 538 | | € | 45 | | | – | | € | 45 | |

|

| Mr J Heslop | £ | 75 | | £ | 111 | | £ | 36 | | £ | 11 | | £ | 1,260 | | £ | 1,930 | | £ | 659 | | £ | 34 | | £ | 415 | |

|

| Former Executive Directors | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dr T Yamada | $ | 168 | | $ | 169 | | $ | 1 | | | – | | $ | 1,985 | | $ | 2,110 | | $ | 125 | | | – | | $ | 125 | |

|

| * | These are shown net of contributions made by the individual. |

Dr Garnier is a member of the All Employee US Cash Balance Pension Plan, under which GlaxoSmithKline makes annual contributions calculated as a percentage of the employee’s base salary and bonus. GlaxoSmithKline makes annual contributions of 15% of Dr Garnier’s annual salary and bonus, as detailed in his contract. The fund increases at an interest rate set annually in advance based on the 30 year US treasury bond rate to provide a cash sum at retirement. This cash sum is used to purchase a pension at retirement based on the annuity rates applicable at that time. The plan has no entitlement to a spouse’s pension or to pension increases, other than by reducing the executive’s own initial pension.

The transfer value, or cash sum, of Dr Garnier’s plan has increased by $1,440,430 over the year as a result of further accumulation of interest and contributions paid by the company.

With effect from 1st June 2006, Dr Slaoui became a member of the US Executive Cash Balance Pension Plan, under which GlaxoSmithKline makes annual contributions calculated as a percentage of the executive’s base salary. GlaxoSmithKline makes annual contributions of 38% of Dr Slaoui’s annual salary. The fund increases at an interest rate set annually in advance based on the 30 year US treasury bond rate to provide a cash sum at retirement. This cash sum is used to purchase a pension at retirement based on the annuity rates applicable at that time. The plan has no entitlement to a spouse’s pension or to pension increases, other than by reducing the executive's own initial pension.

Dr Slaoui was an active participant of the Belgium Fortes Plan until 31st May 2006. This plan is a defined benefit plan with a lump sum payable at Normal Retirement age for the plan which is 60 years of age. The transfer value, or cash sum, of Dr Slaoui’s plan has increased by ¤45,042 over the year as a result of the further accumulation of interest and contributions paid by the company.

Mr Heslop participates in the Glaxo Wellcome Defined Benefit Plan with an accrual rate of 1/30th of final pensionable salary per annum. In 2000 all benefits accrued under the Glaxo Wellcome UK pension arrangements were augmented by the Trustees of the plans by 5% to reflect a distribution of surplus. This augmentation will apply to that element of Mr Heslop’s pension earnings before 31st March 2000.

Back to Contents

| |

| Remuneration Report |

| continued |

|

Mr Heslop’s transfer value has been calculated on the basis of actuarial advice in accordance with Actuarial Guidance Note GN11. The transfer value represents the present value of future payments to be made under the pension plan. Mr Heslop’s annual accrued benefit has increased by £36,401 (£34,389 excluding the effects of inflation), and the transfer value less personal contributions has increased by £658,794 over the year. The increase in Mr Heslop’s pensionable salary of £80,000 is the primary reason for the increase in transfer value.

Dr Yamada retired on 31st May 2006, as a member of the All Employee US Cash Balance Pension Plan, under which GlaxoSmithKline makes annual contributions calculated as a percentage of the employee’s base salary and bonus. GlaxoSmithKline made annual contributions of 18% of Dr Yamada’s annual salary and bonus (as detailed in his contract). The fund increases at an interest rate set annually in advance based on the 30 year US treasury bond rate to provide a cash sum at retirement. This cash sum is used to purchase a pension at retirement based on the annuity rates applicable at that time. The plan has no entitlement to a spouse’s pension or to pension increases, other than by reducing the executive’s own initial pension. Dr Yamada commenced his pension benefit in the form of an annuity on 1st June 2006.

Dr Garnier, Dr Slaoui and Dr Yamada are also members of the US Retirement Savings Plan, a savings scheme open to all US employees and the Executive Supplemental Savings Plan, a savings scheme open to executives to restore US government limits imposed on the Retirement Savings Plan. Contributions to both plans are invested in a range of funds and the value of the accumulated funds is paid at retirement. During 2006, contributions of $183,840 (£99,373) were paid into these two schemes by the company in respect of Dr Garnier. In respect of Dr Slaoui, contributions of $20,354 (£11,002) were paid into the scheme. In respect of Dr Yamada, contributions of $62,494 (£33,781) were paid into the scheme.

Directors and Senior Management

For US reporting purposes, it is necessary to provide information on compensation and interests of Directors and Senior Management as a group (‘the group’). For the purpose, the group is defined as the Directors, members of the CET and the Company Secretary. For the financial year 2006, the total compensation paid to members of the group for the periods during which they served in that capacity was £14,906,027, the aggregate increase in accrued pension benefits, net of inflation, was £290,013 and the aggregate payment to defined contribution schemes was £446,115. During 2006, the group were granted 887,150 share options and 1,060,000 ADS options under the Share Option Scheme, 383,070 shares and 462,000 ADSs under the Performance Share Plan and were awarded 3,160 shares under the Share Value Plan. Members of the group were also awarded 21,339 shares and 38,458 ADSs through the reinvestment of dividends in the Performance Share Plan.

At 23rd February 2007, the group (comprising 25 persons) owned 573,400 shares and 346,738 ADSs, constituting less than 1% of the issued share capital of the company. The group also held, at that date: options to purchase 6,302,356 shares and 7,720,807 ADSs; 1,104,369 shares and 1,611,659 ADSs awarded under the Performance Share Plan, including those shares and ADSs that are vested and deferred; 222,403 vested and deferred ADSs under the legacy SmithKline Beecham Mid-Term Incentive Plan and 21,020 shares and 3,850 ADSs awarded under the Share Value Plan. These holdings were issued under the various executive share option plans described in Note 40 to the financial statements, ‘Employee share schemes’.

Directors’ interests in contracts

Except as described in Note 33 to the financial statements, ‘Related party transactions’, during or at the end of the financial year no Director or connected person had any material interest in any contract of significance in relation to the Group’s business with a Group company.

The Directors’ Remuneration Report has been approved by the Board of Directors and signed on its behalf by

Sir Christopher Gent

Chairman

28th February 2007

<Back to Contents

<Back to Contents

| |

| Directors’ statements of responsibility |

| |

|

| |

Directors’ statement of responsibility in relation to the consolidated financial statements

The Directors are responsible for:

| • | ensuring the maintenance of proper accounting records, whichdisclose with reasonable accuracy the financial position of the Groupat any time and from which financial statements can be preparedto comply with the Companies Act 1985 and Article 4 of the IASRegulation |

| | |

| • | preparing financial statements for each financial period which givea true and fair view, in accordance with IFRS as adopted for use inthe European Union, of the state of affairs of the Group as at theend of the financial period and of the profit or loss for that period |

| | |

| • | ensuring the operation of systems of internal control and for takingreasonable steps to safeguard the assets of the Group and forpreventing and detecting fraud and other irregularities. |

The financial statements for the year ended 31st December 2006, comprising principal statements and supporting notes, are set out in ‘Financial statements’ on pages 86 to 164 of this report.

The Directors confirm that suitable accounting policies have been consistently applied in the preparation of the financial statements, supported by reasonable and prudent judgements and estimates as necessary.

The responsibilities of the auditors in relation to the financial statements are set out in the Independent Auditors’ report (page 85 opposite).

The financial statements for the year ended 31st December 2006 are included in the Annual Report 2006, which is published in hard-copy printed form and made available on the website. The Directors are responsible for the maintenance and integrity of the Annual Report on the website in accordance with UK legislation governing the preparation and dissemination of financial statements. Access to the website is available from outside the UK, where comparable legislation may be different.

Disclosure of information to auditors

The Directors, in office at the date of this Report, have each confirmed that:

| • | so far as they are aware, there is no relevant audit information ofwhich the company’s auditors are unaware; and |

| | |

| • | each Director has taken all the steps that he/she ought to have takenas a Director to make himself/herself aware of any relevant auditinformation and to establish that the company’s auditors are awareof that information. |

This confirmation is given and should be interpreted in accordance with the provisions of Section 234 ZA of the Companies Act 1985.

Directors’ remuneration

The Remuneration Report on pages 65 to 82 sets out the remuneration policies operated by GlaxoSmithKline and disclosures on Directors’ remuneration and other disclosable information relating to Directors and officers and their interests. It has been prepared in accordance with the Companies Act 1985 and complies with Section B of the Combined Code on Corporate Governance.

Going concern basis

After making enquiries, the Directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future. For this reason, they continue to adopt the going concern basis in preparing the financial statements.

Internal control

The Board, through the Audit Committee, has reviewed the assessment of risks and the internal control framework that operates in GlaxoSmithKline and has considered the effectiveness of the system of internal control in operation in the Group for the year covered by this report and up to the date of its approval by the Board of Directors.

The Combined Code

The Board considers that GlaxoSmithKline plc applies the principles of the Combined Code on Corporate Governance of the Financial Reporting Council, as described under ‘Corporate governance’ on pages 53 to 63, and has complied with its provisions except as described on page 62.

As required by the Listing Rules of the Financial Services Authority, the auditors have considered the Directors’ statement of compliance in relation to those points of the Combined Code which are specified for their review.

Annual Report

The Annual Report for the year ended 31st December 2006, comprising the Report of the Directors, the Remuneration Report, the Financial statements and additional information for investors, has been approved by the Board of Directors and signed on its behalf by

Sir Christopher Gent

Chairman

28th February 2007

<Back to Contents

| |

| Report of Independent Registered Public Accounting Firm |

| To the Board of Directors and Shareholders of GlaxoSmithKline plc |

|

| |

We have completed an integrated audit of GlaxoSmithKline’s 2006 consolidated financial statements and of its internal control over financial reporting as of 31st December 2006 and an audit of its 2005 and 2004 consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Our opinions, based on our audits, are presented below.

Consolidated financial statements

In our opinion, the accompanying consolidated balance sheets and the related consolidated income statements, consolidated statements of cash flows and, consolidated statements of recognised income and expense present fairly, in all material respects, the financial position of GlaxoSmithKline and its subsidiaries at 31st December 2006 and 2005 and the results of their operations and cash flows for each of the three years in the period ended 31st December 2006, in conformity with International Financial Reporting Standards (IFRSs) as adopted by the European Union. These financial statements are the responsibility of GlaxoSmithKline’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit of financial statements includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statements presentation. We believe that our audits present a reasonable basis for our opinion.

IFRSs as adopted by the European Union vary in certain significant respects from accounting principles generally accepted in the United States of America. Information relating to the nature and effect of such differences is presented in Note 41 to the consolidated financial statements.

Internal control over financial reporting

Also, in our opinion, management’s assessment, included in ‘Management’s annual report on internal control over financial reporting’ on page 64, that the Group maintained effective internal control over financial reporting as of 31st December 2006 based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) is fairly stated, in all material respects, based on those criteria. Furthermore, in our opinion, the Group maintained, in all material respects, effective internal control over financial reporting as of 31st December 2006, based on criteria established in Internal Control – Integrated Framework issued by the COSO. The Group’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express opinions on management’s assessment and on the effectiveness of the Group’s internal control over financial reporting based on our audit.

We conducted our audit of internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. An audit of internal control over financial reporting includes obtaining an understanding of internal control over financial reporting, evaluating management’s assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we consider necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting standards and principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting standards and principles, and that receipts and expenditures of the company are being made only in accordance with authorisations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

PricewaterhouseCoopers LLP

London

United Kingdom

28 February 2007

<Back to Contents

| |

| Consolidated income statement |

| for the year ended 31st December 2006 |

|

| |

| | | | 2006 | | 2005 | | 2004 | |

| | Notes | | £m | | £m | | £m | |

|

|

|

|

|

|

|

| |

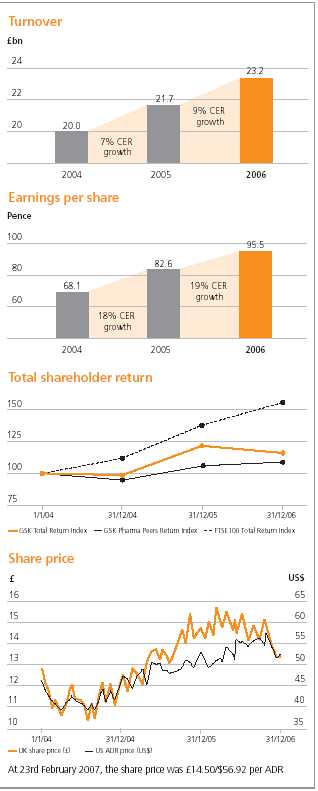

| Turnover | 5 | | 23,225 | | 21,660 | | 19,986 | |

| Cost of sales | | | (5,010 | ) | (4,764 | ) | (4,360 | ) |

|

|

|

|

|

|

|

| |

| Gross profit | | | 18,215 | | 16,896 | | 15,626 | |

| Selling, general and administration | | | (7,257 | ) | (7,250 | ) | (7,201 | ) |

| Research and development | | | (3,457 | ) | (3,136 | ) | (2,904 | ) |

| Other operating income | 6 | | 307 | | 364 | | 235 | |

|

|

|

|

|

|

|

| |

| Operating profit | 7,8 | | 7,808 | | 6,874 | | 5,756 | |

| | | | | | | | | |

| Finance income | 9 | | 287 | | 257 | | 176 | |

| Finance costs | 10 | | (352 | ) | (451 | ) | (362 | ) |

| Share of after tax profits of associates and joint ventures | 11 | | 56 | | 52 | | 60 | |

| Profit on disposal of interest in associates | 36 | | – | | – | | 149 | |

|

|

|

|

|

|

|

| |

| Profit before taxation | | | 7,799 | | 6,732 | | 5,779 | |

| | | | | | | | | |

| Taxation | 12 | | (2,301 | ) | (1,916 | ) | (1,757 | ) |

|

|

|

|

|

|

|

| |

| Profit after taxation for the year | | | 5,498 | | 4,816 | | 4,022 | |

|

|

|

|

|

|

|

| |

| Profit attributable to minority interests | | | 109 | | 127 | | 114 | |

| Profit attributable to shareholders | | | 5,389 | | 4,689 | | 3,908 | |

|

|

|

|

|

|

|

| |

| | | | 5,498 | | 4,816 | | 4,022 | |

|

|

|

|

|

|

|

| |

| Basic earnings per share (pence) | 13 | | 95.5 | p | 82.6 | p | 68.1 | p |

| Diluted earnings per share (pence) | 13 | | 94.5 | p | 82.0 | p | 68.0 | p |

|

|

|

|

|

|

|

| |

<Back to Contents

| |

| Consolidated balance sheet |

| at 31st December 2006 |

|

| |

| | | | 2006 | | 2005 | |

| | Notes | | £m | | £m | |

|

|

|

|

|

| |

| Non-current assets | | | | | | |

| Property, plant and equipment | 15 | | 6,930 | | 6,652 | |

| Goodwill | 16 | | 758 | | 696 | |

| Other intangible assets | 17 | | 3,293 | | 3,383 | |

| Investments in associates and joint ventures | 18 | | 295 | | 276 | |

| Other investments | 19 | | 441 | | 362 | |

| Deferred tax assets | 12 | | 2,123 | | 2,214 | |

| Other non-current assets | 20 | | 721 | | 438 | |

|

|

|

|

|

| |

| Total non-current assets | | | 14,561 | | 14,021 | |

|

|

|

|

|

| |

| | | | | | | |

| Current assets | | | | | | |

| Inventories | 21 | | 2,437 | | 2,177 | |

| Current tax recoverable | 12 | | 186 | | 416 | |

| Trade and other receivables | 22 | | 5,317 | | 5,348 | |

| Liquid investments | 30 | | 1,035 | | 1,025 | |

| Cash and cash equivalents | 23 | | 2,005 | | 4,209 | |

| Assets held for sale | 24 | | 12 | | 2 | |

|

|

|

|

|

| |

| Total current assets | | | 10,992 | | 13,177 | |

|

|

|

|

|

| |

| Total assets | | | 25,553 | | 27,198 | |

|

|

|

|

|

| |

| | | | | | | |

| Current liabilities | | | | | | |

| Short-term borrowings | 30 | | (718 | ) | (1,200 | ) |

| Trade and other payables | 25 | | (4,871 | ) | (5,147 | ) |

| Current tax payable | 12 | | (621 | ) | (2,269 | ) |

| Short-term provisions | 27 | | (1,055 | ) | (895 | ) |

|

|

|

|

|

| |

| Total current liabilities | | | (7,265 | ) | (9,511 | ) |

|

|

|

|

|

| |

| | | | | | | |

| Non-current liabilities | | | | | | |

| Long-term borrowings | 30 | | (4,772 | ) | (5,271 | ) |

| Deferred tax provision | 12 | | (595 | ) | (569 | ) |

| Pensions and other post-employment benefits | 26 | | (2,339 | ) | (3,069 | ) |

| Other provisions | 27 | | (528 | ) | (741 | ) |

| Other non-current liabilities | 28 | | (406 | ) | (467 | ) |

|

|

|

|

|

| |

| Total non-current liabilities | | | (8,640 | ) | (10,117 | ) |

|

|

|

|

|

| |

| Total liabilities | | | (15,905 | ) | (19,628 | ) |

|

|

|

|

|

| |

| Net assets | | | 9,648 | | 7,570 | |

|

|

|

|

|

| |

| | | | | | | |

| Equity | | | | | | |

| Share capital | 31 | | 1,498 | | 1,491 | |

| Share premium account | 31 | | 858 | | 549 | |

| Retained earnings | 32 | | 6,965 | | 5,579 | |

| Other reserves | 32 | | 65 | | (308 | ) |

|

|

|

|

|

| |

| Shareholders’ equity | | | 9,386 | | 7,311 | |

|

|

|

|

|

| |

| Minority interests | | | 262 | | 259 | |

|

|

|

|

|

| |

| Total equity | | | 9,648 | | 7,570 | |

|

|

|

|

|

| |

Approved by the Board on 28th February 2007

Sir Christopher Gent

Chairman

<Back to Contents

| |

| Consolidated cash flow statement |

| for the year ended 31st December 2006 |

|

| |

| | | | | 2006 | | 2005 | | 2004 | |

| | | Notes | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

| |

| Cash flow from operating activities | | | | | | | | | |

| Cash generated from operations | | 34 | | 8,203 | | 7,665 | | 6,527 | |

| Taxation paid | | | | (3,846 | ) | (1,707 | ) | (1,583 | ) |

|

|

|

|

|

|

|

|

| |

| Net cash inflow from operating activities | | | | 4,357 | | 5,958 | | 4,944 | |

|

|

|

|

|

|

|

|

| |

| |

| Cash flow from investing activities | | | | | | | | | |

| Purchase of property, plant and equipment | | | | (1,366 | ) | (903 | ) | (788 | ) |

| Proceeds from sale of property, plant and equipment | | | | 43 | | 54 | | 53 | |

| Proceeds from sale of intangible assets | | | | 175 | | 221 | | – | |

| Purchase of intangible assets | | | | (224 | ) | (278 | ) | (255 | ) |

| Purchase of equity investments | | | | (57 | ) | (23 | ) | (103 | ) |

| Proceeds from sale of equity investments | | | | 32 | | 35 | | 58 | |

| Share transactions with minority shareholders | | 36 | | (157 | ) | (36 | ) | – | |

| Purchase of businesses, net of cash acquired | | 36 | | (273 | ) | (1,026 | ) | (297 | ) |

| Disposal of businesses and interest in associates | | 36 | | 5 | | (2 | ) | 230 | |

| Investments in associates and joint ventures | | 36 | | (13 | ) | (2 | ) | (2 | ) |

| Interest received | | | | 299 | | 290 | | 173 | |

| Dividends from associates and joint ventures | | | | 15 | | 10 | | 11 | |

|

|

|

|

|

|

|

|

| |

| Net cash outflow from investing activities | | | | (1,521 | ) | (1,660 | ) | (920 | ) |

|

|

|

|

|

|

|

|

| |

| |

| Cash flow from financing activities | | | | | | | | | |

| (Increase)/decrease in liquid investments | | | | (55 | ) | 550 | | (53 | ) |

| Proceeds from own shares for employee share options | | | | 151 | | 68 | | 23 | |

| Issue of share capital | | 31 | | 316 | | 252 | | 42 | |

| Share capital purchased for cancellation | | | | – | | – | | (201 | ) |

| Purchase of Treasury shares | | | | (1,348 | ) | (999 | ) | (799 | ) |

| Redemption of preference shares issued by subsidiary | | | | – | | – | | (489 | ) |

| Increase in long-term loans | | | | – | | 982 | | 1,365 | |

| Repayment of long-term loans | | | | – | | (70 | ) | (15 | ) |

| Net repayment of short-term loans | | | | (739 | ) | (857 | ) | (407 | ) |

| Net repayment of obligations under finance leases | | | | (34 | ) | (36 | ) | (22 | ) |

| Interest paid | | | | (414 | ) | (381 | ) | (350 | ) |

| Dividends paid to shareholders | | | | (2,598 | ) | (2,390 | ) | (2,475 | ) |

| Dividends paid to minority interests | | | | (87 | ) | (86 | ) | (73 | ) |

| Dividends paid on preference shares | | | | – | | – | | (2 | ) |

| Other financing cash flows | | | | 16 | | 53 | | 49 | |

|

|

|

|

|

|

|

|

| |

| Net cash outflow from financing activities | | | | (4,792 | ) | (2,914 | ) | (3,407 | ) |

|

|

|

|

|

|

|

|

| |

| |

| (Decrease)/increase in cash and bank overdrafts | | 35 | | (1,956 | ) | 1,384 | | 617 | |

| |

| Exchange adjustments | | | | (254 | ) | 233 | | (93 | ) |

| Cash and bank overdrafts at beginning of year | | | | 3,972 | | 2,355 | | 1,831 | |

|

|

|

|

|

|

|

|

| |

| Cash and bank overdrafts at end of year | | | | 1,762 | | 3,972 | | 2,355 | |

|

|

|

|

|

|

|

|

| |

| |

| Cash and bank overdrafts at end of year comprise: | | | | | | | | | |

| Cash and cash equivalents | | | | 2,005 | | 4,209 | | 2,467 | |

| Overdrafts | | | | (243 | ) | (237 | ) | (112 | ) |

|

|

|

|

|

|

|

|

| |

| | | | | 1,762 | | 3,972 | | 2,355 | |

|

|

|

|

|

|

|

|

| |

<Back to Contents

| |

| Consolidated statement of recognised income and expense |

| for the year ended 31st December 2006 |

|

| |

| | 2006 | | 2005 | | 2004 | |

| | £m | | £m | | £m | |

|

|

|

|

|

| |

| Exchange movements on overseas net assets | (390 | ) | 203 | | (47 | ) |

| Tax on exchange movements | (78 | ) | 99 | | (73 | ) |

| Fair value movements on available-for-sale investments | 84 | | (1 | ) | – | |

| Deferred tax on fair value movements on available-for-sale investments | (15 | ) | (10 | ) | – | |

| Exchange movements on goodwill in reserves | 31 | | 9 | | 6 | |

| Actuarial gains/(losses) on defined benefit plans | 429 | | (794 | ) | 108 | |

| Deferred tax on actuarial movements in defined benefit plans | (161 | ) | 257 | | (17 | ) |

| Fair value movements on cash flow hedges | (5 | ) | (4 | ) | – | |

| Deferred tax on fair value movements on cash flow hedges | 2 | | 1 | | – | |

|

|

|

|

|

| |

| Net losses recognised directly in equity | (103 | ) | (240 | ) | (23 | ) |

| Profit for the year | 5,498 | | 4,816 | | 4,022 | |

|

|

|

|

|

| |

| Total recognised income and expense for the year | 5,395 | | 4,576 | | 3,999 | |

|

|

|

|

|

| |

| |

| Total recognised income and expense for the year attributable to: | | | | | | |

| Shareholders | 5,307 | | 4,423 | | 3,906 | |

| Minority interests | 88 | | 153 | | 93 | |

|

|

|

|

|

| |

| | 5,395 | | 4,576 | | 3,999 | |

|

|

|

|

|

| |

Back to Contents

| |

| Notes to the financial statements |

|

| |

1 Presentation of the financial statements

Description of business

GlaxoSmithKline is a major global healthcare group which is engaged in the creation and discovery, development, manufacture and marketing of pharmaceutical products, including vaccines, over-the-counter (OTC) medicines and health-related consumer products. GlaxoSmithKline’s principal pharmaceutical products include medicines in the following therapeutic areas: central nervous system, respiratory, anti-virals, anti-bacterials, vaccines, oncology and emesis, metabolic, cardiovascular and urogenital.

Compliance with applicable law and IFRS

The financial statements have been prepared in accordance with the Companies Act 1985, Article 4 of the IAS Regulation and International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) and related interpretations, as adopted by the European Union.

For GSK, there are no differences between IFRS as adopted for use in the European Union and full IFRS as published by the International Accounting Standards Board.

Financial period

These financial statements cover the financial year from 1st January to 31st December 2006, with comparative figures for the financial years from 1st January to 31st December 2005 and, where appropriate, from 1st January to 31st December 2004.

Composition of the Group

A list of the subsidiary and associated undertakings which, in the opinion of the Directors, principally affected the amount of profit or the net assets of the Group is given in ‘Principal Group companies’, Note 42.

Composition of financial statements

The consolidated financial statements are drawn up in accordance with IFRS and with IFRS accounting presentation. The financial statements comprise:

| • | Consolidated income statement |

| • | Consolidated balance sheet |

| • | Consolidated cash flow statement |

| • | Consolidated statement of recognised income and expense |

| • | Notes to the financial statements. |

Additional information in accordance with the requirements of US generally accepted accounting principles (US GAAP) is included in the notes to the financial statements. In Note 41 a statement of differences, and reconciliations of net income and shareholders’ equity, between IFRS and US GAAP are provided.

Accounting convention

The financial statements have been prepared using the historical cost convention, modified for certain items carried at fair value, as stated in the accounting policies.

Accounting principles and policies

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The financial statements have been prepared in accordance with the Group’s accounting policies approved by the Board and described in Note 2.

2 Accounting policies

Information on the application of these accounting policies, including areas of estimation and judgement is given under ‘Critical Accounting Policies’ in ‘Financial Review 2006’ on page 37.

Consolidation

The consolidated financial statements include:

| • | the assets and liabilities, and the results and cash flows, of thecompany and its subsidiaries, including ESOP Trusts |

| | |

| • | the Group’s share of the results and net assets of associates andjoint ventures. |

The financial statements of entities consolidated are made up to 31st December.

Entities over which the Group has the power to govern the financial and operating policies are accounted for as subsidiaries. Where the Group has the ability to exercise joint control, the entities are accounted for as joint ventures, and where the Group has the ability to exercise significant influence, they are accounted for as associates.

Interests acquired in entities are consolidated from the date the Group acquires control and interests sold are de-consolidated from the date control ceases.

Transactions and balances between subsidiaries are eliminated; no profit before tax is taken on sales between subsidiaries or on sales to joint ventures and associates until the products are sold to customers outside the Group. Deferred tax relief on unrealised intra-Group profit is accounted for only to the extent that it is considered recoverable.

Goodwill arising on the acquisition of interests in subsidiaries, joint ventures and associates, representing the excess of the acquisition cost over the Group’s share of the fair values of the identifiable assets, liabilities and contingent liabilities acquired, is capitalised as a separate item in the case of subsidiaries and as part of the cost of investment in the case of joint ventures and associates. Goodwill is denominated in the currency of the operation acquired. Where the cost of acquisition is below the fair value of the net assets acquired, the difference is recognised directly in the income statement.

The results and assets and liabilities of associates and joint ventures are incorporated into the consolidated financial statements using the equity method of accounting.

<Back to Contents

| |

| Notes to the financial statements |

| continued |

|

| |

2 Accounting policiescontinued

Foreign currency translation

Foreign currency transactions are booked in the functional currency of the Group company at the exchange rate ruling on the date of transaction. Foreign currency monetary assets and liabilities are retranslated into local currency at rates of exchange ruling at the balance sheet date. Exchange differences are included in the income statement.

Assets and liabilities, including related goodwill, of overseas subsidiaries, associates and joint ventures, are translated into Sterling at rates of exchange ruling at the balance sheet date. The results and cash flows of overseas subsidiaries, associates and joint ventures are translated into Sterling using average rates of exchange. Exchange adjustments arising when the opening net assets and the profits for the year retained by overseas subsidiaries, associates and joint ventures are translated into Sterling, less exchange differences arising on related foreign currency borrowings which hedge the Group’s net investment in these operations, are taken to a separate component of equity.

When translating into Sterling the assets, liabilities, results and cash flows of overseas subsidiaries, associates and joint ventures which are reported in currencies of hyper-inflationary economies, adjustments are made to reflect current price levels. Any loss on net monetary assets is charged to the consolidated income statement.

Revenue

Revenue is recognised in the income statement when goods or services are supplied or made available to external customers against orders received and when title and risk of loss passes to the customer. Turnover represents net invoice value after the deduction of discounts and allowances given and accruals for estimated future rebates and returns. The methodology and assumptions used to estimate rebates and returns are monitored and adjusted regularly in the light of contractual and legal obligations, historical trends, past experience and projected market conditions. Market conditions are evaluated using wholesaler and other third-party analyses, market research data and internally generated information. Turnover also includes co-promotion income where the Group records its share of the revenue but no related cost of sales. Value added tax and other sales taxes are excluded from revenue.

Expenditure

Expenditure is recognised in respect of goods and services received when supplied in accordance with contractual terms. Provision is made when an obligation exists for a future liability in respect of a past event and where the amount of the obligation can be reliably estimated. Manufacturing start-up costs between validation and the achievement of normal production are expensed as incurred. Advertising and promotion expenditure is charged to the income statement as incurred. Shipment costs on intercompany transfers are charged to cost of sales; distribution costs on sales to customers are included in selling, general and administrative expenditure. Restructuring costs are recognised in respect of the direct expenditure of a business reorganisation where the plans are sufficiently detailed and well advanced, and where appropriate communication to those affected has been undertaken.

Research and development

Research and development expenditure is charged to the income statement in the period in which it is incurred. Development expenditure is capitalised when the criteria for recognising an asset are met, usually when a regulatory filing has been made in a major market and approval is considered highly probable. Property, plant and equipment used for research and development is depreciated in accordance with the Group’s policy.

Environmental expenditure

Environmental expenditure related to existing conditions resulting from past or current operations and from which no current or future benefit is discernible is charged to the income statement. The Group recognises its liability on a site-by-site basis when it can be reliably estimated. This liability includes the Group’s portion of the total costs and also a portion of other potentially responsible parties’ costs when it is probable that they will not be able to satisfy their respective shares of the clean-up obligation. Recoveries of reimbursements are recorded as assets when virtually certain.

Legal and other disputes

Provision is made for anticipated settlement costs where a reasonable estimate can be made of the likely outcome of legal or other disputes against the Group. In addition, provision is made for legal or other expenses arising from claims received or other disputes. In respect of product liability claims related to products where there is sufficient history of claims made and settlements, an “incurred but not reported” (IBNR) actuarial technique is used to determine a reasonable estimate of the Group’s exposure to unasserted claims for those products and a provision is made on that basis.

No provision is made for other unasserted claims or where an obligation exists under a dispute but it is not possible to make a reasonable estimate. Costs associated with claims made by the Group against third parties are charged to the income statement as they are incurred.

Pensions and other post-employment benefits

The costs of providing pensions under defined benefit schemes are calculated using the projected unit credit method and spread over the period during which benefit is expected to be derived from the employees’ services, in accordance with the advice of qualified actuaries. Pension obligations are measured as the present value of estimated future cash flows discounted at rates reflecting the yields of high quality corporate bonds.

Pension scheme assets are measured at fair value at the balance sheet date. Actuarial gains and losses, differences between the expected and actual returns, and the effect of changes in actuarial assumptions are recognised in the statement of recognised income and expense in the year in which they arise. The Group’s contributions to defined contribution plans are charged to the income statement as incurred.

The costs of other post-employment liabilities are calculated in a similar way to defined benefit pension schemes and spread over the period during which benefit is expected to be derived from the employees’ services, in accordance with the advice of qualified actuaries.

<Back to Contents

| |

| Notes to the financial statements |

| continued |

|

| |

2 Accounting policies continued

Employee share plans

Incentives in the form of shares are provided to employees under share option and share award schemes. These options and awards are fair valued at their grant dates and the cost is charged to the income statement over the relevant vesting periods. This has been applied on a fully retrospective basis. The Group provides finance to ESOP Trusts to purchase company shares on the open market to meet the obligation to provide shares when employees exercise their options or awards. Costs of running the ESOP Trusts are charged to the income statement. Shares held by the ESOP Trusts are deducted from other reserves. A transfer is made between other reserves and retained earnings over the vesting periods of the related share options or awards to reflect the ultimate proceeds receivable from employees on exercise. If there is deemed to be a permanent impairment in value this is also reflected by a transfer to retained earnings.

Property, plant and equipment

Property, plant and equipment (PP&E) is stated at the cost of purchase or construction less provisions for depreciation and impairment. Financing costs are not capitalised.

Depreciation is calculated to write off the cost less residual value of PP&E, excluding freehold land, using the straight-line basis over the expected useful life. Residual values and lives are reviewed and, where appropriate, adjusted annually. The normal expected useful lives of the major categories of PP&E are:

|

|

| Freehold buildings | 20 to 50 years |

| Leasehold land and buildings | Lease term or 20 to 50 years |

| Plant and machinery | 10 to 20 years |

| Fixtures and equipment | 3 to 10 years |

|

|

On disposal of PP&E, the cost and related accumulated depreciation and impairments are removed from the financial statements and the net amount, less any proceeds, is taken to the income statement.

Leases

Leasing agreements which transfer to the Group substantially all the benefits and risks of ownership of an asset are treated as finance leases, as if the asset had been purchased outright. The assets are included in PP&E or computer software and the capital elements of the leasing commitments are shown as obligations under finance leases. Assets held under finance leases are depreciated on a basis consistent with similar owned assets or the lease term if shorter. The interest element of the lease rental is included in the income statement. All other leases are operating leases and the annual rentals are included in the income statement on a straight-line basis over the lease term.

Goodwill

Goodwill is stated at cost less impairments. Goodwill is deemed to have an indefinite useful life and is tested for impairment annually.

Where the fair value of the interest acquired in an entity’s assets, liabilities and contingent liabilities exceeds the consideration paid, this excess is recognised immediately as a gain in the income statement.

Other intangible assets

Intangible assets are stated at cost less provisions for amortisation and impairments.

Licences, patents, know-how and marketing rights separately acquired or acquired as part of a business combination are amortised over their estimated useful lives, using the straight-line basis, from the time they are available for use. The estimated useful lives for determining the amortisation charge are reviewed annually, and take into account the estimated time it takes to bring the compounds or products to market. Any development costs incurred by the Group and associated with acquired licences, patents, know-how or marketing rights are written off to the income statement when incurred, unless the criteria for recognition of an internally generated intangible asset are met, usually when a regulatory filing has been made in a major market and approval is considered highly probable.

Brands are valued independently as part of the fair value of businesses acquired from third parties where the brand has a value which is substantial and long-term and where the brands can be sold separately from the rest of the businesses acquired. Brands are amortised over their estimated useful lives, except where it is considered that the useful economic life is indefinite.

The costs of acquiring and developing computer software for internal use and internet sites for external use are capitalised as intangible fixed assets where the software or site supports a significant business system and the expenditure leads to the creation of a durable asset. ERP systems software is amortised over seven years and other computer software over three to five years.

Impairment of non-current assets

The carrying values of all non-current assets are reviewed for impairment when there is an indication that the assets might be impaired. Additionally, goodwill, intangible assets with indefinite useful lives and intangible assets which are not yet available for use are tested for impairment annually. Any provision for impairment is charged to the income statement in the year concerned.

Investments in associates and joint ventures

Investments in associates and joint ventures are carried in the consolidated balance sheet at the Group’s share of their net assets at date of acquisition and of their post-acquisition retained profits or losses together with any goodwill arising on the acquisition.

<Back to Contents

| |

| Notes to the financial statements |

| continued |

|

| |

2 Accounting policiescontinued

Available-for-sale investments

Liquid investments and other investments are treated as available-for-sale investments and are initially recorded at cost and then remeasured at subsequent reporting dates to fair value. Unrealised gains and losses on available-for-sale investments are recognised directly in equity. On disposal or impairment of the investments, the gains and losses in equity are recycled into the income statement. Equity investments are recorded in non-current assets unless they are expected to be sold within one year.

Purchases and sales of equity investments are accounted for on the trade date and purchases and sales of other available-for-sale investments are accounted for on settlement date.

In 2004 equity investments are recorded at cost.

Inventories

Inventories are included in the financial statements at the lower of cost (including raw materials, direct labour, other direct costs and related production overheads) and net realisable value. Cost is generally determined on a first in, first out basis. Pre-launch inventory is held as an asset when there is a high probability of regulatory approval for the product. Before that point a provision is made against the carrying value to its recoverable amount, which is then reversed at the point when a high probability of regulatory approval is determined.

Trade receivables

Trade receivables are carried at original invoice amount less any provisions for doubtful debts. Provisions are made where there is evidence of a risk of non-payment, taking into account ageing, previous experience and general economic conditions. Receivables are discounted where the effect is material.

Cash and cash equivalents

Cash and cash equivalents comprise cash in hand, current balances with banks and similar institutions and highly liquid investments with maturities of three months or less when acquired. They are readily convertible into known amounts of cash and have an insignificant risk of changes in value.

Taxation

Current tax is provided at the amounts expected to be paid applying tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. Deferred tax assets are recognised to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised.

Deferred tax is provided on temporary differences arising on investments in subsidiaries, associates and joint ventures, except where the timing of the reversal of the temporary difference can be controlled and it is probable that the temporary difference will not reverse in the foreseeable future.

Deferred tax is provided using rates of tax that have been enacted or substantively enacted by the balance sheet date. Deferred tax liabilities and assets are not discounted.

Discounting

Where the time effect of money is material, balances are discounted to current values using appropriate rates of interest. The unwinding of the discounts is recorded in finance income/costs.

Derivative financial instruments and hedging (2006 and 2005)

Derivative financial instruments are used to manage exposure to market risks from treasury operations. The principal derivative instruments used by GlaxoSmithKline are foreign currency swaps, interest rate swaps and forward foreign exchange contracts. The Group does not hold or issue derivative financial instruments for trading or speculative purposes.

Derivative financial instruments are initially recognised in the balance sheet at cost and then remeasured at subsequent reporting dates to fair value. Derivatives designated as hedging instruments are classified on inception as fair value hedges, cash flow hedges or net investment hedges. Changes in the fair value of derivatives designated as fair value hedges are recorded in the income statement, with the changes in the fair value of the hedged asset or liability.

Changes in the fair value of derivatives designated as cash flow hedges are recognised in equity, to the extent that the hedges are effective. Ineffective portions are recognised in profit or loss immediately. Amounts deferred in equity are recycled to the income statement when the hedged item affects profit or loss.

Hedges of net investments in foreign entities are accounted for in a similar way to cash flow hedges.

Changes in the fair value of any derivative instruments that do not qualify for hedge accounting are recognised immediately in the income statement.

Derivative financial instruments and hedging (2004 )

IAS 32 and 39 were adopted by the Group on 1st January 2005. In accordance with an exemption permitted under IFRS I, the 2004 information relating to financial instruments remains as reported under UK GAAP and applying the following policies.

Derivative contracts are treated from inception as an economic hedge of the underlying financial instrument with matching accounting treatment and cash flows. Derivative instruments no longer designated as hedges are restated at market value and any future changes in value are taken directly to the profit and loss account.

Currency swaps and forward exchange contracts used to fix the value of the related asset or liability in the contract currency and at the contract rate are accrued to the profit and loss account over the life of the contract.

Gains and losses on foreign exchange contracts designated as hedges of forecast foreign exchange transactions are deferred and included in the measurement of the related foreign currency transactions in the period they occur. Gains and losses on balance sheet hedges are accrued and are taken directly to reserves except that forward premiums/discounts are recognised as interest over the life of the contracts.

Interest differentials under interest swap agreements are recognised in the profit and loss account by adjustment of interest expense over the life of the agreement.

Back to Contents

| |

| Notes to the financial statements |

| continued |

|

| |

3 New accounting requirements

The following IFRS and IFRIC interpretations have been issued by the IASB and are likely to affect future Annual Reports, although none is expected to have a material impact on the results or financial position of the Group.

IFRS 7 ‘Financial instruments: disclosures’ was issued in August 2005 and is required to be implemented by GSK from 1st January 2007. This new standard incorporates the disclosure requirements of IAS 32, which it supersedes, and adds further quantitative and qualitative disclosures in relation to financial instruments.

Amendment to IAS 1 ‘Capital disclosures’ was issued in August 2005 and is required to be implemented by GSK from 1st January 2007. The amendment requires new disclosures about how an entity manages its capital resources.

IFRS 8 ‘Operating segments’ was issued in November 2006 and is required to be implemented by GSK from 1st January 2009. This standard replaces IAS 14 and aligns the segmental reporting requirements with those of the equivalent US standard. The new standard adopts a ‘management approach’ under which segmental information is to be disclosed on the same basis as that used for internal reporting purposes.

IFRIC 9 ‘Reassessment of embedded derivatives’ was issued in March 2006 and is required to be implemented by GSK from 1st January 2007. This interpretation clarifies that an embedded derivative should be assessed on its inception and only reassessed if there is a change in the terms of the relevant contract.

IFRIC 10 ‘Interim financial reporting and impairment’ was issued in July 2006 and is required to be implemented by GSK from 1st January 2007. Under this interpretation any impairment losses on goodwill and equity investments recognised in a quarterly interim statement may not be reversed in subsequent interim or annual financial statements.

IFRIC 11 ‘IFRS 2 - Group and treasury share transactions’ was issued in November 2006 and is required to be implemented by GSK from 1st January 2008. This interpretation provides guidance on whether share-based transactions involving group entities should be accounted for as equity settled or cash settled transactions.

4 Exchange rates

The Group uses the average of exchange rates prevailing during the period to translate the results and cash flows of overseas subsidiaries, joint ventures and associated undertakings into Sterling and period end rates to translate the net assets of those undertakings. The currencies which most influence these translations, and the relevant exchange rates, were:

| | | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

|

| |

| Average rates: | | | | | | | |

| £/US$ | | 1.85 | | 1.82 | | 1.83 | |

| £/Euro | | 1.47 | | 1.46 | | 1.47 | |

| £/Yen | | 215 | | 200 | | 197 | |

| Period end rates: | | | | | | | |

| £/US$ | | 1.96 | | 1.72 | | 1.92 | |

| £/Euro | | 1.48 | | 1.46 | | 1.41 | |

| £/Yen | | 233 | | 203 | | 197 | |

|

|

|

|

|

|

| |

5 Segment information

The Group’s primary segment reporting is by business sector with geographical reporting being the secondary format. The business sectors consist of Pharmaceuticals (prescription pharmaceuticals and vaccines) and Consumer Healthcare (oral care, OTC medicines and nutritional healthcare). The geographical sectors of the USA, Europe and International (other Rest of World markets) reflect the Group’s most significant regional markets and are consistent with the Group’s regional market management reporting structure. Business sector data includes an allocation of corporate costs to each sector on an appropriate basis. There are no sales between business sectors.The Group’s activities are organised on a global basis. The geographical sector figures are therefore influenced by the location of the Group’s operating resources, in particular manufacturing and research, and by variations over time in intra-Group trading and funding arrangements. Turnover is shown by business sector, by location of customer and by location of subsidiary. Other geographic information is given by location of subsidiary. The UK segment information gives turnover by location of customer and location of subsidiary. The UK operating profit, total assets and net assets are also shown. Where the Group co-promotes a product and the third party records the sale, the Group records its share of revenue as co-promotion income within turnover. The nature of co-promotion activities is such that the Group records no costs of sales. Pharmaceutical turnover includes co-promotion revenue of £182 million (2005 –£112 million, 2004 – £65 million).

<Back to Contents

| |

| Notes to the financial statements |

| continued |

|

5 Segment informationcontinued

| Turnover by business sector | 2006 | | 2005 | | 2004 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Pharmaceuticals | 20,078 | | 18,661 | | 17,100 | |

| Consumer Healthcare | 3,147 | | 2,999 | | 2,886 | |

|

|

|

|

|

| |

| Turnover | 23,225 | | 21,660 | | 19,986 | |

|

|

|

|

|

| |

| Profit by business sector | | | | | | |

|

|

|

|

|

| |

| Pharmaceuticals | 7,125 | | 6,159 | | 5,126 | |

| Consumer Healthcare | 683 | | 715 | | 630 | |

|

|

|

|

|

| |

| Operating profit | 7,808 | | 6,874 | | 5,756 | |

|

|

|

|

|

| |

| Finance income | 287 | | 257 | | 176 | |

| Finance costs | (352 | ) | (451 | ) | (362 | ) |

| Share of after tax profits of associates and joint ventures: | | | | | | |

| Pharmaceuticals | 56 | | 52 | | 60 | |

| Consumer Healthcare | – | | – | | – | |

| Profit on disposal of interest in associates | – | | – | | 149 | |

|

|

|

|

|

| |

| Profit before taxation | 7,799 | | 6,732 | | 5,779 | |

|

|

|

|

|

| |

| Taxation | (2,301 | ) | (1,916 | ) | (1,757 | ) |

|

|

|

|

|

| |

| Profit after taxation for the year | 5,498 | | 4,816 | | 4,022 | |

|

|

|

|

|

| |

| Investments in associates and joint ventures by business sector | | | | | | |

|

|

|

| | | |

| Pharmaceuticals | 295 | | 276 | | | |

| Consumer Healthcare | – | | – | | | |

|

|

|

| | | |

| Investment in associates and joint ventures | 295 | | 276 | | | |

|

|

|

| | | |

| Property, plant and equipment and other intangible assets by business sector | | | | | | |

|

|

|

| | | |

| Additions | | | | | | |

| Pharmaceuticals | 1,795 | | 2,031 | | | |

| Consumer Healthcare | 139 | | 164 | | | |

|

|

|

| | | |

| Total additions | 1,934 | | 2,195 | | | |

|

|

|

| | | |

| Depreciation/amortisation | | | | | | |

| Pharmaceuticals | (849 | ) | (807 | ) | | |

| Consumer Healthcare | (109 | ) | (97 | ) | | |

|

|

|

| | | |

| Total depreciation/amortisation | (958 | ) | (904 | ) | | |

|

|

|

| | | |

| Impairment | | | | | | |

| Pharmaceuticals | (241 | ) | (92 | ) | | |

| Consumer Healthcare | (3 | ) | – | | | |

|

|

|

| | | |

| Total impairment | (244 | ) | (92 | ) | | |

|

|

|

| | | |

| Impairment reversal | | | | | | |

| Pharmaceuticals | 61 | | 3 | | | |

| Consumer Healthcare | – | | – | | | |

|

|

|

| | | |

| Total impairment reversal | 61 | | 3 | | | |

|

|

|

| | | |

<Back to Contents

| |

| Notes to the financial statements |

| continued |

|

5 Segment informationcontinued

| Total assets by business sector | 2006 | | 2005 | | | |

| £m | £m | |

|

|

|

| | | |

| Pharmaceuticals | 16,936 | | 16,431 | | | |

| Consumer Healthcare | 2,768 | | 2,446 | | | |

|

|

|

| | | |

| Total operating assets | 19,704 | | 18,877 | | | |

|

|

|

| | | |

| Investments in associates and joint ventures | 295 | | 276 | | | |

| Liquid investments | 1,035 | | 1,025 | | | |

| Derivative financial instruments | 193 | | 179 | | | |

| Cash and cash equivalents | 2,005 | | 4,209 | | | |

| Current and deferred taxation | 2,309 | | 2,630 | | | |

| Tangible assets held for sale | 12 | | 2 | | | |

|

|

|

| | | |

| Total assets | 25,553 | | 27,198 | | | |

|

|

|

| | | |

| |

| Total liabilities by business sector | | | | | | |

|

|

|

| | | |

| Pharmaceuticals | (8,148 | ) | (9,099 | ) | | |

| Consumer healthcare | (951 | ) | (1,070 | ) | | |

|

|

|

| | | |

| Total operating liabilities | (9,099 | ) | (10,169 | ) | | |

|

|

|

| | | |

| Short-term borrowings | (718 | ) | (1,200 | ) | | |

| Long-term borrowings | (4,772 | ) | (5,271 | ) | | |

| Derivative financial instruments | (100 | ) | (150 | ) | | |

| Current and deferred taxation | (1,216 | ) | (2,838 | ) | | |

|

|

|

| | | |

| Total liabilities | (15,905 | ) | (19,628 | ) | | |

|

|

|

| | | |

| |

| Net assets by business sector | | | | | | |

|

|

|

| | | |

| Pharmaceuticals | 8,788 | | 7,332 | | | |

| Consumer Healthcare | 1,817 | | 1,376 | | | |

|

|

|

| | | |

| Net operating assets | 10,605 | | 8,708 | | | |

| Net debt | (2,450 | ) | (1,237 | ) | | |

| Investments in associates and joint ventures | 295 | | 276 | | | |

| Derivative financial instruments | 93 | | 29 | | | |

| Current and deferred taxation | 1,093 | | (208 | ) | | |

| Tangible assets held for sale | 12 | | 2 | | | |

|

|

|

| | | |

| Net assets | 9,648 | | 7,570 | | | |

|

|

|

| | | |

| | | | | | | |

| Turnover by location of customer | 2006 | | 2005 | | 2004 | |

| £m | £m | £m |

|

|

|

|

|

| |

| USA | 11,102 | | 9,867 | | 9,191 | |

| Europe | 7,010 | | 6,892 | | 6,395 | |

| International | 5,113 | | 4,901 | | 4,400 | |

|

|

|

|

|

| |

| Turnover | 23,225 | | 21,660 | | 19,986 | |

|

|

|

|

|

| |

| |

| Turnover by location of subsidiary undertaking | | | | | | |

|

|

|

|

|

| |

| USA | 11,362 | | 10,185 | | 9,511 | |

| Europe | 14,007 | | 12,303 | | 11,192 | |

| International | 9,349 | | 8,547 | | 7,787 | |

|

|

|

|

|

| |

| Turnover including inter-segment turnover | 34,718 | | 31,035 | | 28,490 | |

|

|

|

|

|

| |

| USA | 339 | | 308 | | 327 | |

| Europe | 6,337 | | 4,836 | | 4,304 | |

| International | 4,817 | | 4,231 | | 3,873 | |

|

|

|

|

|

| |

| Inter-segment turnover | 11,493 | | 9,375 | | 8,504 | |

|

|

|

|

|

| |

| USA | 11,023 | | 9,877 | | 9,184 | |

| Europe | 7,670 | | 7,467 | | 6,888 | |

| International | 4,532 | | 4,316 | | 3,914 | |

|

|

|

|

|

| |

| External turnover | 23,225 | | 21,660 | | 19,986 | |

|

|

|

|

|

| |

<Back to Contents

| |

| Notes to the financial statements |

| continued |

|

5 Segment informationcontinued

| Property, plant and equipment and other intangible asset additions by location | 2006 | | 2005 | | | |

| £m | £m | |

|

|

|

| | | |

| USA | 637 | | 509 | | | |

| Europe | 1,020 | | 742 | | | |

| International | 277 | | 944 | | | |

|

|

|

| | | |

| Total additions | 1,934 | | 2,195 | | | |

|

|

|

| | | |

| |

| Total assets by location | | | | | | |

|

|

|

| | | |

| USA | 4,830 | | 4,459 | | | |

| Europe | 15,166 | | 16,423 | | | |

| International | 5,389 | | 5,020 | | | |

| Inter-segment trading balances | (5,681 | ) | (7,025 | ) | | |

|

|

|

| | | |

| Total operating assets | 19,704 | | 18,877 | | | |

|

|

|

| | | |

| Investments in associates and joint ventures | 295 | | 276 | | | |

| Liquid investments | 1,035 | | 1,025 | | | |

| Derivative financial instruments | 193 | | 179 | | | |

| Cash and cash equivalents | 2,005 | | 4,209 | | | |

| Current and deferred taxation | 2,309 | | 2,630 | | | |

| Tangible assets held for sale | 12 | | 2 | | | |

|

|

|

| | | |

| Total assets | 25,553 | | 27,198 | | | |

|

|

|

| | | |

| |

| Net assets by location | | | | | | |

|

|

|

| | | |

| USA | 919 | | 446 | | | |

| Europe | 11,151 | | 11,628 | | | |

| International | 4,216 | | 3,659 | | | |

| Inter-segment trading balances | (5,681 | ) | (7,025 | ) | | |

|

|

|

| | | |

| Net operating assets | 10,605 | | 8,708 | | | |

| Net debt | (2,450 | ) | (1,237 | ) | | |

| Investments in associates and joint ventures | 295 | | 276 | | | |

| Derivative financial instruments | 93 | | 29 | | | |

| Current and deferred taxation | 1,093 | | (208 | ) | | |

| Tangible assets held for sale | 12 | | 2 | | | |

|

|

|

| | | |

| Net assets | 9,648 | | 7,570 | | | |

|

|

|

| | | |

UK Segment

For the purposes of US GAAP information is given separately in respect of the UK, which, although included in the Group’s Europe market region, is considered the Group’s home segment for the purposes of segmental reporting.

| | 2006 | | 2005 | | 2004 | |

| £m | £m | £m |

|

|

|

|

|

| |

| Turnover by location of customer | 1,501 | | 1,431 | | 1,382 | |

|

|

|

|

|

| |

| Turnover including inter-segment turnover | 4,890 | | 4,414 | | 4,386 | |

| Inter-segment turnover | 3,086 | | 2,657 | | 2,709 | |

|

|

|

|

|

| |

| Turnover by location of subsidiary | 1,804 | | 1,757 | | 1,677 | |

|

|

|

|

|

| |

| Operating profit | 1,468 | | 1,576 | | 1,327 | |

|

|

|

|

|

| |

| Total assets | 6,208 | | 7,057 | | 6,521 | |

|

|

|

|

|

| |

| Net operating assets | 2,829 | | 2,290 | | 2,253 | |

|

|

|

|

|

| |

Back to Contents

| |

| Notes to the financial statements |

| continued |

|

6 Other operating income

| 2006 | | 2005 | | 2004 | |

| £m | | £m | | £m | |

|

|

|

|

|

| |

| Royalties | 112 | | 83 | | 96 | |

| Asset disposal profits | 169 | | 290 | | 146 | |

| Other income including fair value adjustments | 26 | | (9 | ) | (7 | ) |

|

|

|

|

|

| |

| 307 | | 364 | | 235 | |

|

|

|

|

|

| |

Royalties are principally a core of recurring income from the out-licensing of intellectual property. Asset disposal profits include product divestments and disposals of equity investments, intellectual property and tangible property. Other income includes equity investment carrying value adjustments arising from stock market changes and fair value adjustments arising on the Quest Collar and Theravance put and call options.

7 Operating profit

| 2006 | | 2005 | | 2004 | |

| £m | | £m | | £m | |

|

|

|

|

|

| |

| The following items have been charged in operating profit: | | | | | | |

| Employee costs (Note 8) | 5,495 | | 5,254 | | 5,054 | |

| Advertising | 759 | | 697 | | 599 | |

| Distribution costs | 276 | | 270 | | 266 | |

| Depreciation of property, plant and equipment | 732 | | 710 | | 691 | |

| Amortisation of intangible assets | 226 | | 194 | | 168 | |

| Net foreign exchange losses/(gains) | 36 | | (3 | ) | 72 | |

| Inventories: | | | | | | |

| Cost of inventories included in cost of sales | 4,480 | | 4,335 | | 4,032 | |

| Write-down of inventories | 146 | | 119 | | 142 | |

| Reversal of prior year write-down of inventories | (93 | ) | (61 | ) | (49 | ) |

| Operating lease rentals: | | | | | | |

| Minimum lease payments | 114 | | 104 | | 110 | |

| Contingent rents | 11 | | 12 | | 9 | |

| Sub-lease payments | 2 | | 1 | | – | |

| Fees payable to company’s auditor for the audit of parent company and | | | | | | |

| consolidated financial statements | 1.7 | | 1.4 | | 1.1 | |

| Fees payable to the company’s auditor and its associates for other services | 15.9 | | 13.1 | | 13.4 | |

|

|

|

|

|

| |

The reversals of prior year write-downs of inventories principally arise from the reassessment of usage or demand expectations prior to inventory expiration.

| 2006 | | 2005 | | 2004 | |

| Fees payable to the company’s auditor and its associates for other services | £m | | £m | | £m | |

|

|

|

|

|

| |

| Audit of accounts of the Group’s UK and overseas subsidiaries and related pension | | | | | | |

| schemes of the company, pursuant to legislation | 7.7 | | 6.7 | | 5.7 | |

| Other assurance services, pursuant to such legislation | 4.4 | | 2.6 | | 2.2 | |

| Other tax services | 1.9 | | 2.3 | | 3.0 | |

| All other services, including regulatory, compliance and treasury related services | 1.9 | | 1.5 | | 2.5 | |

|

|

|

|

|

| |

| 15.9 | | 13.1 | | 13.4 | |

|

|

|

|

|

| |

At 31st December 2006, the amount due to PricewaterhouseCoopers LLP and its associates for fees yet to be invoiced was £3.7 million, comprising statutory audit £3.4 million and taxation services £0.3 million.

Fees in respect of the GlaxoSmithKline plc pension scheme included above:

| 2006 | | 2005 | | 2004 | |

| £m | | £m | | £m | |

|

|

|

|

|

| |

| Audit | 0.3 | | 0.2 | | 0.2 | |

| Other services | 0.1 | | – | | – | |

|

|

|

|

|

| |

| 0.4 | | 0.2 | | 0.2 | |

|

|

|

|

|

| |

Back to Contents

| |

| Notes to the financial statements |

| continued |

|

8 Employee costs

| 2006 | | 2005 | | 2004 | |

| £m | | £m | | £m | |

|

|

|

|

|

| |

| Wages and salaries | 4,363 | | 4,152 | | 3,864 | |

| Social security costs | 461 | | 432 | | 430 | |

| Pension and other post-employment costs (see Note 26) | 377 | | 350 | | 347 | |

| Cost of share-based incentive plans | 226 | | 236 | | 333 | |

| Severance and other costs from integration and restructuring activities | 68 | | 84 | | 80 | |

|

|

|

|

|

| |

| | 5,495 | | 5,254 | | 5,054 | |

|

|

|

|

|

| |

The Group provides benefits to employees, commensurate with local practice in individual countries, including, in some markets, healthcare insurance, subsidised car schemes and personal life assurance.

| 2006 | | 2005 | | 2004 | |

| The average number of persons employed by the Group (including Directors) during the year | Number | | Number | | Number | |

|

|

|

|

|

| |

| Manufacturing | 32,403 | | 30,906 | | 31,427 | |

| Selling, general and administration | 53,665 | | 53,634 | | 53,513 | |

| Research and development | 15,734 | | 14,963 | | 14,897 | |

|

|

|

|

|

| |

| 101,802 | | 99,503 | | 99,837 | |

|

|

|

|

|

| |