Exhibit 99.15

NOTICE OF ANNUAL AND SPECIAL MEETING

OF SHAREHOLDERS TO BE HELD MAY 16, 2011

- AND -

MANAGEMENT INFORMATION CIRCULAR

AND

PROXY STATEMENT

April 15, 2011

ANDERSON ENERGY LTD.

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

May 16, 2011

TO THE SHAREHOLDERS:

Notice is hereby given that the annual and special meeting of shareholders (the “Meeting”) of Anderson Energy Ltd. (the “Corporation”) will be held at the Metropolitan Conference Centre, 333 – 4th Avenue S.W., Calgary, Alberta, on May 16, 2011 at the hour of 2:00 p.m. (Calgary time) for the following purposes, namely:

| 1. | to receive and consider the audited financial statements of the Corporation for the year ended December 31, 2010 and the report of the auditors thereon; |

| 2. | to elect directors of the Corporation for the ensuing year; |

| 3. | to appoint auditors for the ensuing year at a remuneration to be determined by the board of directors; |

| 4. | to consider and if thought advisable, to pass, with or without variation, an ordinary resolution to reduce the Corporation’s share capital for accounting purposes, without payment or reduction to the Corporation’s stated capital or paid up capital, by the amount of the consolidated accounting deficit of the Corporation on January 1, 2011, the effective date of the conversion of accounting standards to International Financial Reporting Standards; |

| 5. | to transact such other business as may properly come before the Meeting or any adjournment thereof. |

Particulars of the matters referred to above are set forth in the accompanying Management Information Circular and Proxy Statement (the “Information Circular”).

A shareholder may attend the Meeting in person or may be represented thereat by proxy. Shareholders who are unable to attend the Meeting in person are requested to date, sign and return the enclosed instrument of proxy, or other appropriate form of proxy, in accordance with the instructions set forth in the Information Circular. An instrument of proxy will not be valid and acted upon at the Meeting or any adjournment thereof unless it is deposited at the offices of Valiant Trust Company (Attention: Proxy Department) Suite 600 – 750 Cambie St., Vancouver, B.C. V6B 0A2 or by facsimile at (604) 681-3067, not less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting or any adjournment thereof. A proxyholder need not be a shareholder of the Corporation.

Only shareholders of record at the close of business on April 7, 2011 are entitled to notice of the Meeting and to vote thereat or at any adjournment thereof, except that a transferee of common shares after such record date may, not later than 10 days before the Meeting, establish a right to vote at the Meeting by providing evidence of ownership of common shares and demanding that his or her name be placed on the shareholder list for the Meeting in place of the transferor.

DATED at Calgary, Alberta this 15th day of April, 2011.

By Order of the Board of Directors

(signed) “Brian H. Dau”

President and Chief Executive Officer

ANDERSON ENERGY LTD.

MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT

FOR THE

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

MAY 16, 2011

GENERAL PROXY INFORMATION

Solicitation of Proxies by Management

This management information circular and proxy statement (“Information Circular”) is being provided by our board of directors in connection with the solicitation of proxies by management of Anderson Energy Ltd. (“Anderson” or the “Corporation”) for use at the annual and special meeting of holders of common shares of the Corporation (the “Meeting”) to be held at the Metropolitan Conference Centre 333 – 4th Avenue S.W., Calgary, Alberta at 2:00 p.m. (Calgary time) on May 16, 2011 and any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting.

Solicitation of proxies will be primarily by mail, but may also be by telephone, facsimile, electronic or oral communication by our directors, officers and employees at no additional compensation. No remuneration will be paid to any person for soliciting proxies, but Anderson may, upon request, pay to brokerage firms, fiduciaries or other persons holding shares in their name for others the charges entailed for sending out instruments of proxy to the persons for whom they hold shares. All costs incurred to solicit proxies will be borne by the Corporation. Information contained herein is given as of March 31, 2011 unless otherwise specifically stated.

Appointment of Proxies

The persons named in the accompanying instrument of proxy are officers of Anderson. A shareholder submitting an instrument of proxy has the right to appoint some other person (who need not be a shareholder) to represent him at the Meeting other than the persons designated in the enclosed instrument of proxy by inserting such person’s name in the blank space provided for that purpose in the accompanying instrument of proxy or by submitting another appropriate proxy.

An instrument of proxy will not be valid for the Meeting or any adjournment thereof unless it is signed by the shareholder or by the shareholder’s attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized in writing. The proxy, to be valid and acted upon at the Meeting and any adjournment thereof, must be deposited with Valiant Trust Company (Attention: Proxy Department) Suite 600 – 750 Cambie St., Vancouver, B.C. V6B 0A2 or by facsimile at (604) 681-3067, not less than forty-eight (48) hours (excluding Saturdays, Sundays and holidays) prior to the time of the Meeting or any adjournment thereof.

Revocation of Proxies

A shareholder who has submitted a proxy may revoke it: (a) by depositing an instrument in writing executed by the shareholder or by the shareholder’s attorney authorized in writing or, if the shareholder is a corporation, in its corporate name under its corporate seal or by an officer or attorney thereof duly authorized in writing: (i) at the registered office of the Corporation at 700, 555 – 4th Avenue S.W. Calgary, Alberta T2P 3E7 on or before the last business day preceding the day of the Meeting or any adjournment thereof; or (ii) with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof; or (b) in any other manner permitted by law.

Voting of Proxies

The persons named in the accompanying instrument of proxy will vote the shares in respect of which they are appointed in accordance with the direction of the shareholders appointing them. In the absence of such direction, such shares will be voted: (i) FOR the election as directors of the Corporation of the nominees set forth in this Information Circular; (ii) FOR the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation at a remuneration to be determined by the board of directors; and (iii) FOR and in favour of the ordinary resolution to reduce the Corporation’s share capital for accounting purposes, without payment or reduction to the Corporation’s stated capital or paid up capital, by the amount of the consolidated accounting deficit of the Corporation on January 1, 2011, the effective date of the conversion of accounting standards to International Financial Reporting Standards.

Exercise of Discretion by Proxies

The accompanying instrument of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of printing this Information Circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Meeting. If any other business or amendments or variations to the matters identified in the Notice of Meeting properly come before the Meeting then the persons named in the enclosed instrument of proxy will vote on such matters in accordance with their best judgment.

Signing of Proxy

The accompanying instrument of proxy must be executed by the shareholder or his or her attorney authorized in writing or, if a shareholder is a corporation, in its corporate name under its corporate seal or by an officer or attorney thereof duly authorized in writing. A proxy signed by a person acting as attorney, executor, administrator, trustee or in some other representative capacity (including a representative of a corporate holder of common shares) should reflect that person’s capacity following his signature and should be accompanied by the appropriate instrument evidencing qualification and authority to act.

Voting by Internet

Shareholders may use the internet site at www.valianttrust.com to transmit their voting instructions. Shareholders should have the form of proxy in hand when they access the web site. Shareholders will be prompted to enter their Control Number, which is located on the form of proxy. If shareholders vote by internet, their vote must be received not later than 2:00 p.m. (Calgary time) on the 12th of May, 2011 or 48 hours prior to the time of any adjournment of the Meeting. The website may be used to appoint a proxyholder to attend and vote on a shareholder’s behalf at the Meeting and to convey a shareholder’s voting instructions. Please note that if a shareholder appoints a

2

proxyholder and submits their voting instructions and subsequently wishes to change their appointment, a shareholder may resubmit their proxy and/or voting direction, prior to the deadline noted above. When resubmitting a proxy, the most recently submitted proxy will be recognized as the only valid one, and all previous proxies submitted will be disregarded and considered as revoked, provided that the last proxy is submitted by the deadline noted above.

Advice to Beneficial Holders of Common Shares

This section applies to beneficial holders of common shares only. The information set forth in this section is of significant importance to many of the Corporation’s shareholders as many shareholders do not hold their common shares in their own name. Shareholders who do not hold their common shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only proxies deposited by shareholders whose names appear on the records of the Corporation as the registered holders of common shares can be recognized and acted upon at the Meeting. If common shares are listed in an account statement provided to a shareholder by a broker or other intermediary, then, in almost all cases, those shares will not be registered in the shareholder’s name on the Corporation’s record. Such shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the nominee for The Canadian Depositary for Securities Limited, which acts as nominee for many Canadian brokerage firms and financial institutions). Common shares held by brokers or their agents or nominees can only be voted upon the instructions of the Beneficial Shareholder. Without specific instructions, a broker and its agents and nominees are prohibited from voting shares for the broker’s clients. Therefore, Beneficial Shareholders should ensure that instructions respecting the voting of their common shares are communicated to the appropriate person or that the common shares are duly registered in their name.

Applicable Canadian regulatory policy requires intermediaries (such as a broker, financial institution, custodian or other nominee holding securities on behalf of another) to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. Often, the voting instruction form supplied to a Beneficial Shareholder by its intermediary (or the agent of the intermediary) is identical to the form of proxy provided by the Corporation to registered shareholders. However, its purpose is limited to instructing the registered shareholder (the intermediary or its agent) how to vote on behalf of the Beneficial Shareholder. In Canada, the majority of intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). In most cases, Broadridge mails a scannable voting instruction form in lieu of the instrument of proxy provided by the Corporation, and asks Beneficial Shareholders to return the voting instruction form to Broadridge. Alternatively, Beneficial Shareholders can either call their toll-free telephone number at 1-800-474-7493 to vote their common shares, or access Broadridge’s dedicated voting web site at www.proxyvotecanada.com to deliver their voting instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting. A Beneficial Shareholder receiving a voting instruction form from Broadridge cannot use that form to vote their common shares directly at the Meeting – the voting instruction form must be returned to Broadridge or, alternatively, instructions must be received by Broadridge well in advance of the Meeting in order to have such shares voted.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting common shares registered in the name of their intermediary (or an agent of the intermediary), a Beneficial Shareholder may attend at the Meeting as proxyholder for the registered shareholder and vote the common shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their common shares as proxyholder for the registered shareholder, should enter their own names in the blank space on the voting instruction or other form provided to them and

3

return the same to their intermediary (or the agent of the intermediary) in accordance with the instructions provided by such intermediary (or agent), well in advance of the Meeting.

Voting Securities and Principal Holders of Voting Securities

Shareholders at the close of business on April 7, 2011 are entitled to receive notice of the Meeting and to vote thereat or at any adjournment thereof on the basis of one vote for each common share held.

As of March 31, 2011, 172,545,301 common shares were issued and outstanding as fully paid and non-assessable, each carrying the right to one vote.

To the knowledge of the directors and executive officers of the Corporation, no person or corporation beneficially owns, directly or indirectly, or controls or directs more than 10% of the voting rights attached to all the issued and outstanding common shares as at March 31, 2011.

EXECUTIVE COMPENSATION

Composition of the Compensation and Corporate Governance Committee

The Compensation and Corporate Governance Committee is comprised of Chris Fong, David Scobie and David Sandmeyer, each of whom is a current director of the Corporation. Chris Fong serves as chair. All of the members of the Compensation and Corporate Governance Committee are independent directors.

Compensation Discussion and Analysis

The Compensation Discussion and Analysis section of this Information Circular discusses the role of the Compensation and Corporate Governance Committee, the Corporation’s philosophy for executive compensation, the elements of compensation and the objectives for such elements. This disclosure is intended to communicate the compensation provided to the Corporation’s President and Chief Executive Officer (the “CEO”), the Vice President Finance, Chief Financial Officer and Secretary (the “CFO”) and the next three most highly compensated executive officers of Anderson whose total compensation was, individually, more than $150,000 (collectively, the “Named Executive Officers” or “NEOs”) and the directors of the Corporation.

The Compensation and Corporate Governance Committee has adopted a compensation program that covers these key elements: (i) a base amount of salary and benefits; (ii) a discretionary bonus plan; and (iii) stock options.

Base Salary

The objective of base salary compensation is to reward and retain NEOs. The program is designed to reward NEOs for maximizing shareholder value in a volatile commodity based business in a safe, environmentally responsible, regulatory compliant and ethical manner. In setting base compensation levels, consideration is given to such factors as level of responsibility, experience and expertise. Subjective factors such as leadership, commitment and attitude are also considered. The Corporation has participated in annual compensation surveys for Canadian oil and gas companies conducted by independent third parties and has reviewed the public disclosure available for other junior oil and gas companies to assist in determining the competitiveness of base salary, bonuses, benefits and stock options paid to each of the executive officers of the Corporation. Other companies used in the benchmark analysis of total compensation included Angle Energy Inc., Bellatrix Exploration Ltd., Birchcliff Energy Ltd., Bonterra Energy Corp., Celtic Exploration Ltd., Compton Petroleum Corporation,

4

Crew Energy Inc., Delphi Energy Corp., Equal Energy Ltd., Fairborne Energy Ltd., Galleon Energy Inc., Terra Energy Corp., Vero Energy Inc. and Zargon Oil and Gas Ltd. The Corporation pays base salary compensation to retain the NEOs and has historically tried to pay base salary near the median of the salary surveys.

Bonus Plan

In addition to base salaries, the Corporation has a discretionary bonus plan. Based on recommendations from the Compensation and Corporate Governance Committee, the Board can award annual cash bonuses to NEOs. The bonus element of Anderson’s executive compensation program is designed to retain top quality talent and reward both corporate and individual performance. It is the Compensation Committee and Corporate Governance Committee’s philosophy that the individual bonus should be tied primarily to that individual’s contribution to corporate performance. In addition, the discretionary bonus plan is intended to help ensure that overall executive cash compensation (salary plus bonus) is comparable to the average cash compensation of executives through third party surveys and peer surveyed companies. The amount of bonus paid is not determined by a formula or specific criteria but is a result of a subjective determination of the Corporation’s and the individual’s performance. This bonus program is open to NEOs, as well as all other permanent employees of the Corporation based on personal and corporate performance. The Corporation did not pay a bonus for the year ended December 31, 2008 due to market conditions. A bonus was approved in the first quarter of 2010 relating to the period from April 1, 2009 to March 31, 2010. Half of the bonus was paid in 2010 and the other half was paid on March 31, 2011 if the NEO was still an employee of the Corporation on such date. As such, only the amount paid during 2010 is included in the Summary Compensation Table as the conditions for earning the second half of the bonus were not met in 2010.

Stock Options

The maximization of shareholder value is encouraged by the granting of stock options at all levels. The Corporation has in place a stock option plan under which awards have been made to NEOs in amounts relative to positions, performance, and what is considered competitive in the industry. The objective of the stock option plan is to reward and retain NEOs. The program is designed to reward NEOs for maximizing shareholder value in a volatile commodity based business in a safe, environmentally responsible, regulatory compliant and ethical manner. The Corporation has participated in annual compensation surveys for Canadian oil and gas companies conducted by independent third parties and has reviewed the public disclosure available for other junior oil and gas companies to assist in determining the competitiveness of stock option awards. The Chief Executive Officer makes recommendations to the Compensation and Corporate Governance Committee based on these surveys. The recommendations do not generally take into account awards made in the previous year. The Compensation and Corporate Governance Committee assesses the CEO recommendations and then makes recommendations to the Board of Directors who ratify the recommendations. The Compensation and Corporate Governance Committee makes its own recommendations directly to the Board with respect to Chief Executive Officer stock option awards.

Stock options are normally granted on the commencement of an individual’s employment with the Corporation based on the level of responsibility within the Corporation. Additional grants may be made periodically, generally on an annual basis, to ensure that the number of stock options granted to any particular individual is commensurate with the individual’s level of ongoing responsibility within the Corporation. In considering additional grants, a number of factors are considered including the number of options held by the individual, the exercise price and value of the stock options and the term remaining on those stock options See “Incentive Plan Awards – Stock Option Plan” for a description of the plan.

5

Compensation of Chief Executive Officer

Mr. Dau has been employed by the Corporation since 2002 in his present capacity as President and Chief Executive Officer. Mr. Dau retains an important equity interest in the Corporation, as well as directing its activities. This interest provides a strong incentive to maintain corporate performance. For 2010, Mr. Dau’s compensation was determined by the same procedures used to develop compensation arrangements for other executive officers of the Corporation. The Compensation and Corporate Governance Committee, in addressing its recommendations, will give regard to a number of factors, including, but not limited to, operating results achieved by the Corporation, industry conditions and the relative salary level, relative bonus level and relative level of stock options of Mr. Dau as compared with chief executive officers of comparable companies, Mr. Dau’s management experience, and the challenges addressed to Mr. Dau in managing the business and affairs of the Corporation.

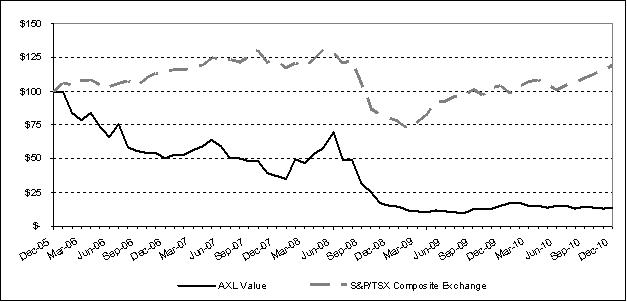

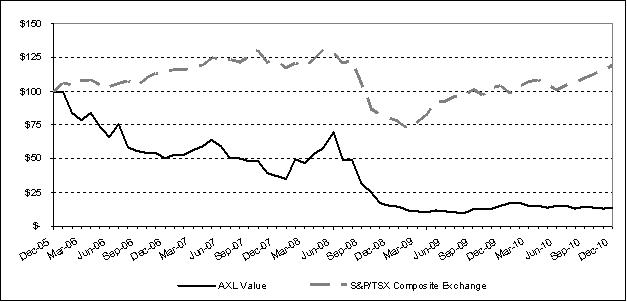

Performance Graph of Common Shares

The following chart compares the percentage change in the cumulative shareholder return on common shares since December 31, 2005 (assuming a $100 investment was made on December 31, 2005 and reinvestment of dividends) with the S&P/TSX Composite Index.

The Corporation’s share price has trended downward or remained flat while NEO compensation has trended upward. The Corporation’s share price performance has been below that of the S&P/TSX Composite Index. Many junior oil and gas companies have had a similar experience. The Corporation’s executive compensation is not directly linked to the performance of the S&P TSX Composite Index but rather is designed to reward and retain NEOs to maximize shareholder value in a volatile commodity based business.

6

Summary Compensation Table

The following table sets forth all compensation paid, payable, awarded, granted, given, or otherwise provided, directly or indirectly, by Anderson, in Canadian dollars, to the Named Executive Officers. Aspects of this compensation are dealt with in further detail in the tables set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Non-equity incentive

plan compensation

($) | | | | | | | |

Name and principal position | | Year | | | Salary

($) | | | Option-

based

awards

(1)

($) | | | Annual

incentive

plans | | | Long-

term

incentive

plans | | | All other

compensation

(2)(3)

($) | | | Total

compensation

($) | |

Brian H. Dau President and Chief Executive Officer | |

| 2010

2009 2008 |

| |

| 249,838

243,512 236,500 |

| |

| 159,633

125,119 138,197 |

| |

| 30,000

– – |

| |

| –

– – |

| |

| 9,639

3,301 6,468 |

| |

| 449,110

371,932 381,165 |

|

| | | | | | | |

M. Darlene Wong Vice President Finance, Chief Financial Officer and Secretary | |

| 2010

2009 2008 |

| |

| 213,300

207,900 202,875 |

| |

| 132,975

104,224 107,130 |

| |

| 25,000

– – |

| |

| –

– – |

| |

| 8,252

2,839 5,543 |

| |

| 379,527

314,963 315,548 |

|

| | | | | | | |

David M. Spyker Chief Operating Officer | |

| 2010

2009 2008 |

| |

| 213,300

201,562 190,625 |

| |

| 132,975

104,224 86,775 |

| |

| 25,000

– – |

| |

| –

– – |

| |

| 8,252

2,676 5,218 |

| |

| 379,527

308,462 282,618 |

|

| | | | | | | |

Blaine M. Chicoine Vice President, Operations | |

| 2010

2009 2008 |

| |

| 200,462

195,388 190,625 |

| |

| 106,475

83,454 86,775 |

| |

| 20,000

– – |

| |

| –

– – |

| |

| 7,764

2,676 5,218 |

| |

| 334,701

281,518 282,618 |

|

| | | | | | | |

Philip A. Harvey Vice President, Exploitation | |

| 2010

2009 2008 |

| |

| 200,462

195,388 190,625 |

| |

| 106,475

83,454 86,775 |

| |

| 20,000

– – |

| |

| –

– – |

| |

| 7,764

2,676 5,218 |

| |

| 334,701

281,518 282,618 |

|

Notes:

| (1) | Amounts reported for option based awards are based on grant date fair value as determined using the Black-Scholes model. To date, no stock options have been exercised by the current NEOs and only the stock options issued in 2009 and 2010 have any value based on the Corporation’s share price at December 31, 2010 as noted under “Incentive Plan Awards – Outstanding Share-based Awards and Option-based Awards” below. |

| (2) | Consists of employer contributions under the employee stock savings plan from July 1, 2008 to December 31, 2010, and premiums paid on life insurance. The employee stock savings plan was suspended between April 1, 2009 and March 31, 2010. |

| (3) | The aggregate amount of perquisites and other personal benefits received by each of the Named Executive Officers do not exceed the lesser of $50,000 and 10 percent of the total of the annual salary and bonus (if any) paid to the named executive officer. |

7

Incentive Plan Awards

Outstanding Share-based Awards and Option-based Awards

The following table sets forth, for each Named Executive Officer, all option-based awards outstanding at December 31, 2010.

| | | | | | | | |

| | | Option-based Awards |

| Name and principal position | | Number of

securities

underlying

unexercised options

(#) | | Option

exercise

price

($) | | Option expiration date | | Value of unexercised in-the-money options (1)

($) |

Brian H. Dau President and Chief Executive Officer | | 75,000

15,000 534,850 129,000 96,750 300,000 300,000 | | 4.05

4.13 4.00 3.92 2.66 0.79 1.04 | | Sept 26, 2011 Mar 27, 2012 Apr 23, 2012 Sept 6, 2012 Sept 18, 2013 Aug 21, 2014 Aug 20, 2015 | | –

– – – – 78,000 3,000 |

| | | | |

M. Darlene Wong Vice President Finance, Chief Financial Officer and Secretary | | 75,000

267,424 99,000 75,000 249,900 249,900 | | 4.05

4.00 3.92 2.66 0.79 1.04 | | Sept 26, 2011 Apr 23, 2012 Sept 6, 2012 Sept 18, 2013 Aug 21, 2014 Aug 20, 2015 | | –

– – – 64,974 2,499 |

| | | | |

David M. Spyker Chief Operating Officer | | 75,000

267,424 81,000 60,750 249,900 249,900 | | 4.05

4.00 3.92 2.66 0.79 1.04 | | Sept 26, 2011 Apr 23, 2012 Sept 6, 2012 Sept 18, 2013 Aug 21, 2014 Aug 20, 2015 | | –

– – – 64,974 2,499 |

| | | | |

Blaine M. Chicoine Vice President, Operations | | 75,000

267,424 81,000 60,750 200,100 200,100 | | 4.05

4.00 3.92 2.66 0.79 1.04 | | Sept 26, 2011 Jun 17, 2012 Sept 6, 2012 Sept 18, 2013 Aug 21, 2014 Aug 20, 2015 | | –

– – – 52,026 2,001 |

| | | | |

Philip A. Harvey Vice President, Exploitation | | 75,000

267,424 81,000 60,750 200,100 200,100 | | 4.05

4.00 3.92 2.66 0.79 1.04 | | Sept 26, 2011 Apr 23, 2012 Sept 6, 2012 Sept 18, 2013 Aug 21, 2014 Aug 20, 2015 | | –

– – – 52,026 2,001 |

Note:

| (1) | Based on the closing price of the common shares on the TSX on December 31, 2010 of $1.05. |

8

Incentive Plan Awards—Value Vested or Earned During the Year

The following table sets forth, for each Named Executive Officer, the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending December 31, 2010.

| | |

| Name and principal position | | Option-based awards – Value

vested during the year (1) ($) |

Brian H. Dau President and Chief Executive Officer | | 22,000 |

| |

M. Darlene Wong Vice President Finance, Chief Financial Officer and Secretary | | 18,326 |

| |

David M. Spyker Chief Operating Officer | | 18,326 |

| |

Blaine M. Chicoine Vice President, Operations | | 14,674 |

| |

Philip A. Harvey Vice President, Exploitation | | 14,674 |

Note:

| | (1) | Represents the value vested for options granted during 2009. Option exercise prices on other options vested exceeded the market price of the common shares on the vesting dates, therefore the value vested during the year on these options was $nil. |

Stock Option Plan

The Option Plan of Anderson (the “Option Plan”) was adopted effective September 1, 2005. Pursuant to the Option Plan, the board of directors of the Corporation (the “Board”) is authorized to grant options to purchase common shares to directors, officers, employees and consultants of Anderson or of any of Anderson’s subsidiaries or any other person or company engaged to provide ongoing management or consulting services to Anderson or for any entity controlled by Anderson.

The aggregate number of common shares reserved for issuance under the Option Plan is equal to 10% of the number of issued and outstanding common shares from time to time. Accordingly, as additional common shares are issued and become outstanding the maximum number of common shares issuable under the Option Plan is automatically adjusted, and, as options are exercised, the number of common shares issued upon the exercise will thereupon become reserved for future grants. In the event that a previously granted option expires or is terminated or cancelled for any reason without having been exercised, the number of common shares to which the expired, terminated or cancelled option relates will also be available for the purpose of further grants under the Option Plan. At no time, however, can the number of common shares issuable under the Option Plan exceed 10% of the number of common shares then issued and outstanding.

In addition, the aggregate number of common shares reserved for issuance to any one person under the Option Plan, together with all other share compensation arrangements of Anderson, shall not exceed 5% of the total number of issued and outstanding common shares (on a non-diluted basis). The Option Plan also provides that no options shall be granted without shareholder approval if such grant, together with all other share compensation arrangements of Anderson, could result in: (i) a number of common shares reserved for issuance pursuant to options granted to insiders exceeding 10% of the issued and outstanding common shares; and (ii) the issuance within a one year period of a number of common shares exceeding 10% of the issued and outstanding common shares; and (iii) the issuance to any one insider and such insider’s associates, within a one-year period, of a number of common shares exceeding 5% of the issued and outstanding common shares.

9

The price per share at which common shares may be purchased under the Option Plan (the “Option Price”), as may be adjusted pursuant to the provisions of the Option Plan, shall be fixed by the Board at the time of the grant but under no circumstances shall any Option Price at the time of the grant be lower than the “Market Price” as defined in the Option Plan. For the purposes of the Option Plan, the Market Price is the volume weighted average trading price of the common shares on the Toronto Stock Exchange (“TSX”) for the five trading days immediately preceding the date of grant of the option. The volume weighted average trading price is calculated by dividing the total value of the common shares traded over the five day period by the total volume of common shares traded over the same period.

The term of options granted under the Option Plan, to a maximum of 10 years from the date of the grant, and any vesting limitations shall also be determined by the Board in its discretion at the time of the grant.

Options are non-assignable and non-transferable by the person to whom they are granted except by will or the laws of descent and distribution. In the event the holder of stock options ceases to be employed by Anderson or its subsidiaries for any reason (except as a result of death or permanent disability), the holder’s stock options shall be terminated on the earlier of the expiration of the option period and 30 days after the date of such termination. In the event of a holder’s death or permanent disability, an option shall be exercisable until the earlier of the expiration period or the date that is 12 months after the date of death or permanent disability, whichever is earlier.

In the event of a “change of control” (as defined in the Option Plan), all stock options shall immediately vest and be exercisable until the earlier of the expiry date of the stock option and the date that is 30 days after the date of termination of employment of the holder of the stock option.

The Board may, at any time, suspend or terminate the Option Plan. The Board may amend or revise the terms of the Option Plan, subject to the receipt of all necessary regulatory approvals, provided that no such amendment or revisions shall materially adversely affect the terms of any stock options granted under the Option Plan.

The Board may amend the Option Plan or an option to purchase Common Shares at any time and from time to time, for any reason except for those changes where the Option Plan specifically requires shareholder approval (“Amendment Procedures”). Under the Amendment Procedures, the Option Plan would require shareholder approval for the following changes to the Option Plan or options granted under it:

| | a. | increasing the maximum percentage of the issued and outstanding Common Shares issuable pursuant to the Option Plan; |

| | b. | reducing the exercise price of outstanding options (including, without limitation, any cancellation and reissuance of an option, constituting a reduction of the exercise price of such option); |

| | c. | extending the expiry date of an outstanding option or amending the Option Plan to permit the grant of an option that is exercisable for a period exceeding 10 years from the grant date; and |

| | d. | permitting options to be transferable or assignable other than, in the event of death or permanent disability of an optionholder, by the person or persons to whom the optionholder’s rights under such options pass by the optionholder’s will or applicable law, unless the changes result from application of the anti-dilution provisions of the Option Plan. |

The Corporation amended the Option Plan in 2010 in order to address the changes in withholding tax requirements which became effective in 2011.

10

The Corporation had 172,545,301 common shares issued and outstanding as of March 31, 2011. As of March 31, 2011, 11,278,332 options were outstanding in accordance with the Option Plan (representing 6.5% of the outstanding common shares) and 5,976,198 options remain issuable thereunder (representing 3.5% of the outstanding common shares).

Employee Stock Savings Plan

Effective July 1, 2008, the Corporation initiated an Employee Stock Savings Plan. Employees are able to contribute up to 5% of their base salaries towards the purchase of common shares and Anderson matches those contributions. Shares vest immediately and contribution levels can be changed up to four times in a calendar year. The plan was suspended effective April 1, 2009 due to market conditions. The plan was reinstated effective April 1, 2010.

Termination of Employment, Change of Control Benefits

The Corporation has employment contracts with each of the Named Executive Officers. Each contract provides that should the Named Executive Officer experience involuntary termination of employment or a reduction in base salary or benefits without consent for any reason including a change of control, a payment will be made to the Named Executive Officer equal to 18 months salary and benefits, plus 1.5 times the highest annual bonus received in the previous two years. In the event that the Named Executive Officer chooses to terminate employment under these conditions, he is required to give not less than 90 days and not more than 150 days notice. In the case of voluntary termination of employment, the named executive officer is required to give 30 days notice.

The estimated incremental payment obligation of the Corporation related to the termination entitlements set forth above for each of the Named Executive Officers, assuming that the triggering event took place on December 31, 2010, are as follows:

| | | | |

| Name and principal position | | Total ($) | |

| |

Brian H. Dau President and Chief Executive Officer | | | 507,693 | |

| |

M. Darlene Wong Vice President Finance, Chief Financial Officer and Secretary | | | 434,247 | |

| |

David M. Spyker Chief Operating Officer | | | 434,015 | |

| |

Blaine M. Chicoine Vice President, Operations | | | 398,942 | |

| |

Philip A. Harvey Vice President, Exploitation | | | 398,805 | |

Compensation of Directors

The following table sets forth all compensation paid, payable, awarded, granted, given, or otherwise provided, directly or indirectly, by Anderson, or a subsidiary of Anderson, in Canadian dollars, to the following individuals who were Directors of Anderson for the most recently completed financial year, excluding those Directors who were Named Executive Officers of Anderson. Compensation for Directors that were Named Executive Officers is included under the headings “Summary Compensation Table”, “Incentive Plan Awards – Outstanding Share-based Awards and Option-based Awards” and “Incentive Plan Awards – Value Vested or Earned During the Year”.

11

The Corporation had an annual retainer fee of $9,500 for Board members and $14,250 for the Chairman of the Board and attendance fees of $950 per Board meeting and $475 per committee meeting. Under these arrangements, Mr. Fong was paid $19,950, Mr. Hockley was paid $19,950, Mr. Scobie was paid $19,950, Mr. Sandmeyer was paid $9,500 and Mr. Anderson was paid $22,325 in 2010. Mr. Sandmeyer became a Board member on May 13, 2010. Mr. Dau does not receive these fees as he is paid as an employee of the Corporation. The Corporation also reimburses directors for reasonable expenses incurred in order to attend meetings.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees

earned

in 2010 ($) | | | Share-

based

awards ($) | | | Option-

based

awards ($) | | | Non-equity

incentive plan

compensation ($) | | | Pension

value

($) | | | All other

compensation

($) | | | Total

($) | |

| | | | | | | |

James C. Anderson | | | 22,325 | | | | — | | | | 26,659 | | | | — | | | | — | | | | — | | | | 48,984 | |

| | | | | | | |

Christopher L. Fong | | | 19,950 | | | | — | | | | 26,659 | | | | — | | | | — | | | | — | | | | 46,609 | |

| | | | | | | |

Glenn D. Hockley | | | 19,950 | | | | — | | | | 26,659 | | | | — | | | | — | | | | — | | | | 46,609 | |

| | | | | | | |

David J. Sandmeyer (1) | | | 9,500 | | | | | | | | 44,222 | | | | — | | | | — | | | | — | | | | 53,722 | |

| | | | | | | |

David G. Scobie | | | 19,950 | | | | — | | | | 26,659 | | | | — | | | | — | | | | — | | | | 46,609 | |

Note:

| (1) | Mr. Sandmeyer was appointed as a director on May 13, 2010. |

Incentive Plan Awards – Directors

Outstanding Share-Based Awards and Option Based Awards

The following table sets forth for each Director, other than a Director that is a Named Executive Officer, all option-based and share-based awards outstanding at December 31, 2010.

| | | | | | | | | | | | | | |

| | | Option-based Awards | |

| Name and principal position | | Number of securities underlying unexercised options (#) | | | Option exercise price ($) | | | Option expiration date | | Value of unexercised in-the- money options (1) ($) | |

James C. Anderson | |

| 267,424

45,000 50,100 50,100 |

| |

| 4.00

3.92 0.79 1.04 |

| | Apr 23, 2012

Sept 6, 2012 Aug 21, 2014 Aug 20, 2015 | |

| —

— 13,026 501 |

|

| | | | |

Christopher L. Fong | |

| 50,100

50,100 |

| |

| 0.79

1.04 |

| | Aug 21, 2014

Aug 20, 2015 | |

| 13,026

501 |

|

| | | | |

Glenn D. Hockley | |

| 45,000

50,100 50,100 |

| |

| 3.92

0.79 1.04 |

| | Sept 6, 2012

Aug 21, 2014 Aug 20, 2015 | |

| —

13,026 501 |

|

| | | | |

David J. Sandmeyer | |

| 50,100

25,050 |

| |

| 1.17

1.04 |

| | May 13, 2015

Aug 20, 2015 | |

| —

251 |

|

| | | | |

David G. Scobie | |

| 133,712

45,000 50,100 50,100 |

| |

| 4.00

3.92 0.79 1.04 |

| | Apr 23, 2012

Sept 6, 2012 Aug 21, 2014 Aug 20, 2015 | |

| —

— 13,026 501 |

|

Note:

| (1) | Based on the closing price of the common shares on the TSX on December 31, 2010 of $1.05. |

12

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth for each Director, other than a Director that is a Named Executive Officer, the value vested or earned on all option-based awards, share-based awards, and non-equity incentive plan compensation during the financial year ending December 31, 2010.

| | | | |

| Name and principal position | | Option-based awards –Value vested during the year (1) ($) | |

| |

James C. Anderson | | | 3,674 | |

| |

Christopher L. Fong | | | 3,674 | |

| |

Glenn D. Hockley | | | 3,674 | |

| |

David J. Sandmeyer(2) | | | — | |

| |

David G. Scobie | | | 3,674 | |

Note:

| | (1) | Represents the value vested for options granted during 2009. Option exercise prices on other options vested exceeded the market price of the common shares on the vesting dates, therefore the value vested during the year on these options was $nil. |

| | (2) | Mr. Sandmeyer was appointed as a director on May 13, 2010. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table provides information with respect to the total number of common shares authorized for issuance under Anderson’s Stock Option Plan as at December 31, 2010:

| | | | | | | | | | | | |

Plan Category | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a) (#) | | | Weighted-average exercise

price of outstanding

options, warrants and

rights

(b) ($) | | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c) (#) | |

Equity compensation plans approved by securityholders | | | 12,006,232 | | | | 2.32 | | | | 5,242,298 | |

Equity compensation plans not approved by securityholders | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | | 12,006,232 | | | | 2.32 | | | | 5,242,298 | |

| | | | | | | | | | | | |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

As of the date hereof, no director or executive officer of the Corporation, or any associate of any such director or executive officer is or has been, at any time in 2010, indebted to the Corporation, nor has, at any time in 2010, any indebtedness of such persons been the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as set forth herein, there were no material interests, direct or indirect, of directors or senior executive officers of the Corporation, proposed nominees for election as director, any shareholder

13

of the Corporation who beneficially owns, directly or indirectly, more than 10% of the outstanding common shares or any known associate or affiliate of such persons in any transaction since January 1, 2010 or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

STATEMENT OF CORPORATE GOVERNANCE

The Board is aware of its responsibility for corporate governance and recognizes the importance of enhancing corporate governance practices of the Corporation. As part of the Corporation’s commitment to effective corporate governance, the Board, with the assistance of the Compensation and Corporate Governance Committee, monitors changes in corporate governance practices and regulatory requirements and develops its governance principles and guidelines accordingly.

Under National Instrument 58-101 Disclosure of Corporate Governance Practices (“NI 58-101”) of the Canadian Securities Administrators, the Corporation is required to disclose certain information relating to its corporate governance practices. This information is set out in Schedule A to this Information Circular. In accordance with NI 58-101 the disclosure in Appendix A is made in respect of the existing directors of the Corporation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED ON

Management of the Corporation is not aware of any material interest, direct or indirect, by way of beneficial ownership of common shares or otherwise, of any director or executive officer, or anyone who has held office as such since January 1, 2010 or of any associate or affiliate of any of the foregoing in any matter to be acted on at the Meeting other than as set forth herein.

PARTICULARS OF THE MATTERS TO BE ACTED UPON AT THE MEETING

Receiving and Considering the Audited Financial Statements

The Corporation’s audited financial statements for the financial year ended December 31, 2010, the report of the auditors thereon and its annual report were previously mailed to shareholders, and are available on the Internet on the Canadian System for Electronic Document Analysis and Retrieval (“SEDAR”) and can be accessed at www.sedar.com. No formal action will be taken at the Meeting to approve the financial statements which have already been approved by the Board. If any shareholders have questions respecting the audited financial statements, the questions may be brought forward at the Meeting.

Election of Directors

The term of office for each director is from the date of the meeting at which they are elected until the close of the next annual meeting of shareholders or until their respective successor is duly elected or appointed, or their office is earlier vacated. At the Meeting, a board of six (6) directors is to be elected. It is the intention of the persons named in the accompanying instrument of proxy, if not expressly directed to the contrary in such instrument of proxy, to vote the shares represented by such proxies FOR the election of the nominees specified below as directors of the Corporation.

The following table states the names of the persons proposed to be nominated for election as directors, all other positions and offices with the Corporation now held by them, if applicable, their principal occupations, businesses or employments and their principal occupations, businesses or employments during the past five years, the date on which they became directors of the Corporation and

14

the approximate number of common shares beneficially owned, directly or indirectly, or controlled or directed by each of them as at March 31, 2011:

| | | | | | | | | | |

Name and Municipality of Residence | | Date Appointed

Director | | Office

Held(5) | | Principal Occupation for the Last Five Years | | Common Shares

Owned or

Controlled(1) | |

| | | | |

J.C. Anderson Calgary, Alberta | | 2002 | | Chairman of the Board | | Chairman of the Board of Anderson since January 2002 | | | 11,000,000 | (6) |

| | | | |

Brian H. Dau Calgary, Alberta | | 2002 | | President and Chief Executive Officer and Director | | President and Chief Executive Officer of Anderson since February 2002 | | | 2,191,681 | |

| | | | |

Christopher L. Fong(2) (3)(4) Calgary, Alberta | | 2009 | | Director | | Corporate Director since June 2009; Global Head, Corporate Banking, Energy, with RBC Capital Markets until May 2009 | | | — | |

| | | | |

Glenn D. Hockley(2)(3) Calgary, Alberta | | 2005 | | Director | | Independent Businessman since 2005; Chairman of Aquest Energy Ltd. from January 2004 to September 2005 | | | 1,603,539 | |

| | | | |

David G. Scobie(3)(4) Calgary, Alberta | | 2002 | | Director | | Corporate Director since April 2002 | | | 242,424 | |

| | | | |

David J. Sandmeyer(2) (4) Calgary, Alberta | | 2010 | | Director | | Corporate Director since May 2009; President and CEO of Freehold Royalty Trust and Rife Resources Ltd. until May 2009 | | | — | |

Notes:

| (1) | The information as to the common shares beneficially owned or controlled by the current directors and officers, not being within the knowledge of Anderson, has been furnished by the directors of Anderson individually. |

| (2) | Member of Reserves Committee. |

| (3) | Member of Audit Committee. |

| (4) | Member of Compensation and Corporate Governance Committee. |

| (5) | Anderson does not have an Executive Committee of the Board. |

| (6) | Mr. Anderson also holds $1,000,000 of convertible unsecured subordinated debentures of the Corporation. |

Corporate Cease Trade Orders or Bankruptcies

Other than as disclosed below, in the ten years preceding the date of this Information Circular, none of the directors, officers or insiders of Anderson are or have been a director, officer or promoter of any other issuer that, while acting in such capacity:

| | (i) | was the subject of a cease trade or similar order or an order that denied the issuer access to any statutory exemptions for a period of more than 30 consecutive days; or |

15

| | (ii) | was declared bankrupt or made a voluntary assignment in bankruptcy, made a proposal under any legislation relating to bankruptcy and insolvency or been subject to or instituted any proceedings, arrangement, or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of that person’s stock. |

J.C. Anderson was a director of Venus Exploration Inc., which was involuntarily petitioned into bankruptcy by its creditors in the United States Bankruptcy Court for the Eastern District of Texas in 2004.

Penalties or Sanctions

None of the directors, officers or insiders of Anderson have been subject to any penalties or sanctions under securities legislations.

Personal Bankruptcies

None of the proposed directors, officers or insiders of Anderson have in the 10 years preceding the date of this Information Circular become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or been subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold their assets.

Appointment of Auditors

Anderson proposes to nominate the Corporation’s existing auditor, KPMG LLP, Chartered Accountants, to act as Anderson’s independent auditors until the next annual general meeting of shareholders. It is the intention of the persons named in the accompanying instrument of proxy if not expressly directed to the contrary in such instrument of proxy, to vote the shares represented by such proxies FOR the appointment of KPMG LLP, Chartered Accountants as auditors of the Corporation to hold office until the next annual meeting of shareholders, at a remuneration to be determined by the board of directors. KPMG LLP, Chartered Accountants was first appointed as the Corporation’s auditor in April of 2002.

Reduction of Share Capital

The conversion of accounting standards from Canadian Generally Accepted Accounting Principles (“GAAP”) to International Financial Reporting Standards (“IFRS”) was effective January 1, 2011. The conversion to IFRS resulted in changes to the Corporation’s accounting policies, some of which were applied to the opening deficit at January 1, 2010 and some of which changed provisions previously recorded in 2010 under Canadian GAAP. The Corporation’s accumulated deficit at January 1, 2011 is largely the result of the implementation of IFRS combined with the significant reduction in natural gas prices in recent years which reduced profitability and resulted in write downs of historical costs. Management is proposing to reduce share capital for accounting purposes without payment or reduction to stated capital or paid up capital by the amount of the deficit at January 1, 2011 after the implementation of IFRS and in conjunction with the Corporation’s change in focus to oil prospects. While the exact amount of the deficit will not be determined until the consolidated financial statements are prepared for the three months ended March 31, 2011, management estimates that the amount of the reduction will likely be between $250 and $300 million. Management believes that the elimination of the consolidated accounting deficit, in connection with the implementation of IFRS, is beneficial on a go-forward basis. The accounting adjustment should allow shareholders to better evaluate reporting under IFRS as well as measure the success of the Corporation’s response to detrimental changes in the natural gas business by transitioning to a more oil weighted company.

16

At the Meeting, shareholders will be asked to consider and, if thought advisable, pass an ordinary resolution approving the reduction to the Corporation’s share capital. In order to be approved by shareholders, the resolution must be passed by a majority of the votes cast in respect thereof at the Meeting. The form of the resolution to approve the reduction to the Corporation’s share capital to be put to shareholders is as follows:

“Be it resolved that, as an ordinary resolution of the shareholders of Anderson Energy Ltd. (the “Corporation”):

| 1. | the Corporation’s share capital for accounting purposes be reduced, without payment or reduction to the Corporation’s stated capital or paid up capital, by the amount of the consolidated accounting deficit of the Corporation on January 1, 2011, the effective date of the conversion of accounting standards to International Financial Reporting Standards; |

| 2. | notwithstanding that this resolution has been duly passed, the board of directors of the Corporation may, without further notice to or approval of the shareholders of the Corporation, revoke this resolution at any time prior to implementation of the reduction to the Corporation’s share capital without further approval of the shareholders of the Corporation; and |

| 3. | any one director or officer of the Corporation be and is hereby authorized and directed, for and in the name and on behalf of the Corporation, to execute (whether under the corporate seal of the Corporation or otherwise) and deliver all such certificates, instruments, waivers, consents, applications, agreements, amendments, and other documents and to do all such acts and things as such director or officer may determine to be necessary or advisable to give effect to, and to carry out the intent of, the foregoing resolution and the matters contemplated thereby, such determination to be evidenced conclusively by the execution and delivery of any such document or the taking of any such other act or thing by any director or officer of the Corporation.” |

It is the intention of the persons named in the accompanying instrument of proxy if not expressly directed to the contrary in such instrument of proxy, to vote the shares represented by such proxies FOR and in favour of the ordinary resolution to reduce the Corporation’s share capital for accounting purposes, without payment or reduction to the Corporation’s stated capital or paid up capital, by the amount of the consolidated accounting deficit of the Corporation on January 1, 2011, the effective date of the conversion of accounting standards to International Financial Reporting Standards.

ADDITIONAL INFORMATION

Additional information relating to the Corporation including the Corporation’s annual and interim financial statements and related management’s discussion and analysis, can be found on SEDAR at www.sedar.com. Shareholders can receive copies of the Corporation’s financial statements and management’s discussion and analysis by sending a request to M. Darlene Wong, Vice President Finance, Chief Financial Officer and Secretary, 700, 555 – 4th Avenue S.W., Calgary, Alberta T2P 3E7.

Financial information about the Corporation is provided in the Corporation’s comparative financial statements and management’s discussion and analysis for the year ended December 31, 2010.

17

SCHEDULE A

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

| | | | | | |

Governance Disclosure Guideline under NI 58-101 | | Comments |

| 1. | | Board of Directors | | | | |

| | |

| | (a) Disclose the identity of directors who are independent. | | The board of directors (the “Board”) has determined that five of the six Directors are “independent” within the meaning of NI 58-101. The five independent Directors are: • J.C. Anderson • Christopher L. Fong • Glenn D. Hockley • David J. Sandmeyer • David G. Scobie |

| | |

| | (b) Disclose the identity of directors who are not independent, and describe the basis for that determination. | | Brian H. Dau is the President and Chief Executive Officer of the Corporation and is therefore not considered to be an independent director within the meaning of NI 58-101. |

| | |

| | (c) Disclose whether or not a majority of directors are independent. If a majority of directors are not independent, describe what the board of directors does to facilitate its exercise of independent judgment in carrying out its responsibilities. | | The Board has determined that five of the six Directors are “independent”, within the meaning of NI 58-101. |

| | | |

| | (d) If a director is presently a director of any other issuer that is a reporting issuer (or the equivalent) in a jurisdiction or a foreign jurisdiction, identify both the director and the other issuer. | | The following Directors currently serve on the board of other issuers that are reporting issuers (or equivalent) which are set out below: | | |

| | | | Director | | Directorships |

| | | | Glenn D. Hockley | | TriOil Resources Ltd. |

| | | | Christopher L. Fong | | Canadian Natural Resources Ltd. and WestFire Energy Ltd. |

| | | | David J. Sandmeyer | | Freehold Royalties Ltd. and Delphi Energy Corp. |

| | |

| | (e) Disclose whether or not the independent directors hold regularly scheduled meetings at which members of management are not in attendance. If the independent directors hold such meetings, disclose the number of meetings held during the preceding 12 months. If the independent directors do not hold such meetings, describe what the board does to facilitate open and candid discussion among its independent directors. | | The Board has determined that appropriate in camera sessions of the Board without management will be held in conjunction with every regular meeting of the Board. The independent members of the Board can also request to meet, at any meeting of the Board, without the members of the Board who are not independent. Independent directors sit on the Audit Committee and the Compensation and Corporate Governance Committee of the Board. These committees also have in camera sessions in conjunction with every regular meeting of the committee. During the financial year ended December 31, 2010, there were 7 in camera meetings of the independent directors. The independent members of the Board are authorized to retain independent financial, legal and other experts as required whenever, in their opinion, matters come before the Board which require an independent analysis by the independent members of the Board. |

| | |

| | (f) Disclose whether or not the chair of the board is independent. If the board has a chair or lead director who is independent, disclose the identity of the independent chair or lead director, and describe his or her role and responsibilities. If the board has neither a chair that is independent nor a lead director that is independent, describe what the board does to provide leadership for its independent directors. | | Mr. J.C. Anderson, the chair of the Board (the “Chair”), is “independent” of the Corporation within the meaning of NI 58-101. |

18

| | | | | | |

Governance Disclosure Guideline under NI 58-101 | | Comments |

| | (g) Disclose the attendance record of each director for all board meetings held since the beginning of the issuer’s most recently completed financial year. | | Director | | Board of Directors Meetings Attended (8 Meetings held in total) |

| | | | J.C. Anderson | | 7 |

| | | | Brian H. Dau | | 8 |

| | | | Christopher L. Fong | | 8 |

| | | | Glenn D. Hockley | | 8 |

| | | | David Sandmeyer (1) | | 5 |

| | | | David G. Scobie | | 8 |

| | |

| | | | (1) Mr. Sandmeyer was appointed as a director on May 13, 2010. Five meetings were held after that date. |

2. | | Mandate of the Board of Directors | | | | |

| | |

| | Disclose the text of the board’s written mandate. If the board does not have a written mandate, describe how the board delineates its role and responsibilities. | | The Board has responsibility for the stewardship of the Corporation and has adopted terms of reference that set forth the Board’s stewardship responsibilities. The terms of reference of the Board are attached as Schedule B to this Information Circular. |

| | | |

3. | | Position Descriptions | | | | |

| | |

| | (a) Disclose whether or not the board has developed written position descriptions for the chair and the chair of each board committee. If the board has not developed written position descriptions for the chair and/or the chair of each board committee, briefly describe how the board delineates the role and responsibilities of each such position. | | The Board has developed written position descriptions for the Chair of the Board and the Chair of each of the Audit Committee, the Compensation and Corporate Governance Committee and the Reserves Committee. The primary role of the chair of each such committee is managing the affairs of the committee, including ensuring the committee is organized properly, functions effectively and meets its obligations and responsibilities. The Chair of the Audit Committee also maintains on-going communications with the Corporation’s external auditors in order to lead the committee in performing its oversight and other audit-related functions. |

| | |

| | (b) Disclose whether or not the board and CEO have developed a written position description for the CEO. If the board and CEO have not developed such a position description, briefly describe how the board delineates the role and responsibilities of the CEO. | | The Board has developed a written position description for the Chief Executive Officer of the Corporation. |

| | | |

4. | | Orientation and Continuing Education | | | | |

| | |

| | (a) Briefly describe what measures the board takes to orient new directors regarding (i) the role of the board, its committees and its directors, and (ii) the nature and operation of the issuer’s business. | | The Board is mandated to oversee an orientation and education program for new Directors and ongoing educational opportunities for all Directors as appropriate. The objectives of such programs are to ensure that new Directors fully understand the role of the Board and its committees, as well as the contribution individual Directors are expected to make (including, in particular, the commitment of time and resources that the Corporation expects from its Directors) to the operation of the Corporation’s affairs. |

19

| | |

Governance Disclosure Guideline under NI 58-101 | | Comments |

(b) Briefly describe what measures, if any, the board takes to provide continuing education for its directors. If the board does not provide continuing education, describe how the board ensures that its directors maintain the skill and knowledge necessary to meet their obligations as directors | | Continuing education opportunities are directed at enabling individual Directors to maintain or enhance their skills and abilities as Directors, as well as ensuring that their knowledge and understanding of the Corporation’s affairs remains current. All new Directors are provided with a baseline of knowledge about the Corporation which serves as a basis for informed decision-making. This includes a combination of written material, one-on-one meetings with the President and Chief Executive Officer, and other briefings and training, as appropriate. The Corporation will pay reasonable course fees for Directors to attend appropriate training. |

| |

5. Ethical Business Conduct | | |

| |

(a) Disclose whether or not the board has adopted a written code for the directors, officers and employees. If the board has adopted a written code: (i) disclose how a person or company may obtain a copy of the code; (ii) describe how the board monitors compliance with its code, or if the board does not monitor compliance, explain whether and how the board satisfies itself regarding compliance with its code; and (iii) provide a cross-reference to any material change report filed since the beginning of the issuer’s most recently completed financial year that pertains to any conduct of a director or executive officer that constitutes a departure from the code. | | The Board has adopted a Code of Business Conduct for the Corporation (the “Code”). The Code has been filed on and is accessible under the Corporation’s profile on SEDAR at www.sedar.com. A copy of the Code may also be obtained, upon request, from the Corporation at 700, 555 – 4th Avenue SW, Calgary, Alberta T2P 3E7. The Board expects Directors and employees to act ethically at all times and to acknowledge their adherence to the policies comprising the Code. Any material issues regarding compliance with the Code are brought forward by management at either the Board or appropriate committee meetings, or are referred to the senior executive officers of the Corporation, as may be appropriate in the circumstances. The Board and/or appropriate committee or senior executive officers determine what remedial steps, if any, are required. Any waivers from the Code that are granted for the benefit of a director or an employee may be granted only by the Board. The Board has not granted any such waivers since adoption of the Code. |

| |

(b) Describe any steps the board takes to ensure directors exercise independent judgment in considering transactions and agreements in respect of which a director or executive officer has a material interest. | | Each Director must disclose all actual or potential conflicts of interest and refrain from voting on matters in which such Director has a conflict of interest. In addition, the Director must excuse himself or herself from any discussion or decision on any matter in which the Director is precluded from voting as a result of a conflict of interest. |

| |

(c) Describe any other steps the board takes to encourage and promote a culture of ethical business conduct. | | See the Board Terms of Reference contained in Schedule B hereto. |

| |

6. Nomination of Directors | | |

| |

(a) Describe the process by which the board identifies new candidates for board nomination. | | The Board has established a Compensation and Corporate Governance Committee to serve as the nominating committee of the Board. The Compensation and Corporate Governance Committee is mandated to review the competencies and skills applicable to candidates to be considered for nomination to the Board. The objective of this review is to maintain the composition of the Board in a way that provides, in the judgment of the Board, the best mix of competencies, skills and experience to provide for the overall stewardship of the Corporation. |

| |

(b) Disclose whether or not the board has a nominating committee composed entirely of independent directors. If the board does not have a nominating committee composed entirely of independent directors, describe what steps the board takes to encourage an objective nomination process. | | The Compensation and Corporate Governance Committee, which serves as the nominating committee is composed of Messrs. Fong, Scobie and Anderson, all of whom are independent. |

20

| | |

Governance Disclosure Guideline under NI 58-101 | | Comments |

(c) If the board has a nominating committee, describe the responsibilities, powers and operation of the nominating committee. | | The Compensation and Corporate Governance Committee serves as the nominating committee of the Board, its responsibilities in this regard are set forth in paragraph 6(a) above. See the Board Terms of Reference contained in Schedule B attached hereto. |

| |

7. Compensation | | |

| |

(a) Describe the process by which the board determines the compensation for the issuer’s directors and officers. | | See “Executive Compensation – Compensation Discussion and Analysis” in this Information Circular. |

| |

(b) Disclose whether or not the board has a compensation committee composed entirely of independent directors. If the board does not have a compensation committee composed entirely of independent directors, describe what steps the board takes to ensure an objective process for determining such compensation. | | The Compensation and Corporate Governance Committee, which serves as the compensation committee, is composed of Messrs. Fong, Scobie and Anderson, all of whom are independent. |

| |

(c) If the board has a compensation committee, describe the responsibilities, powers and operation of the Compensation Committee. | | The Compensation and Corporate Governance Committee has the responsibility of reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation, evaluating the Chief Executive Officer’s performance in light of those corporate goals and objectives, and making recommendations to the Board with respect to the Chief Executive Officer’s compensation level based on this evaluation. The Compensation and Corporate Governance Committee also makes recommendations to the Board with respect to non-Chief Executive Officer and director compensation, incentive-compensation plans and equity-based plans. |

| |

(d) If a compensation consultant or advisor has, at any time since the beginning of the issuer’s most recently completed financial year, been retained to assist in determining compensation for any of the issuer’s directors and officers, disclose the identity of the consultant or advisor and briefly summarize the mandate for which they have been retained. If the consultant or advisor has been retained to perform any other work for the issuer, state that fact and briefly describe the nature of the work. | | Not applicable. |

| |

8. Other Board Committees | | |

| |

If the board has standing committees other than the audit, compensation and nominating committees, identify the committees and describe their function. | | In addition to the Audit Committee and the Compensation and Corporate Governance Committee, the Board has established the Reserves Committee. The mandate of the Reserves Committee is to assist the Board in fulfilling its responsibilities under National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities. |

21

| | |

Governance Disclosure Guideline under NI 58-101 | | Comments |

9. Assessments | | |

| |

Disclose whether or not the board, its committees and individual directors are regularly assessed with respect to their effectiveness and contribution. If assessments are regularly conducted, describe the process used for the assessments. If assessments are not regularly conducted, describe how the board satisfies itself that the board, its committees, and its individual directors are performing effectively. | | The Board is responsible for making regular assessments of the overall performance, effectiveness and contribution of the Board and each Director. The objective of the assessments is to ensure the continued effectiveness of the Board in the execution of its responsibilities and to contribute to a process of continuing improvement. An assessment was carried out during the year ended December 31, 2010 by having each director complete a confidential questionnaire. The Compensation and Corporate Governance Committee has the responsibility of making recommendations to the board with respect to assessment practices. |

22

SCHEDULE B

BOARD TERMS OF REFERENCE

The board of directors (the “Board”) of Anderson Energy Ltd. (the “Corporation”) shall have a majority of “independent” directors. A director is independent if the director has no direct or indirect material relationship with the Corporation. A “material relationship” means a relationship that could, in the view of the Board, reasonably interfere with the exercise of a director’s independent judgment. The independent directors shall hold regularly scheduled meetings at which non-independent directors and members of management are not present.

The Board shall be responsible for the stewardship of the Corporation, including responsibility for:

| | 2.1 | To the extent feasible, satisfying itself as to the integrity of the chief executive officer (the “CEO”) and other executive officers and that the CEO and other executive officers create a culture of integrity throughout the organization; |

| | 2.2 | Adopting a strategic planning process and approving, on at least an annual basis, a strategic plan which takes into account, among other things, the opportunities and risks of the business; |

| | 2.3 | Approving annually the goals and objectives of the Corporation that the CEO is responsible for meeting; |

| | 2.4 | The identification of the principal risks of the Corporation’s business, and ensuring the implementation of appropriate systems to manage these risks; |

| | 2.5 | Succession planning (including appointing, training and monitoring senior management); |

| | 2.6 | The Corporation’s internal control and management information systems; |

| | 2.7 | Verifying that the Corporation’s financial results are reported fairly to securityholders, regulators and the public in accordance with generally accepted accounting principles; and |

| | 2.8 | Adopting a communications policy for the Corporation and verifying the timely reporting of developments material to the Corporation. |

Members of the Board are expected to attend all meetings of the Board (and committees of the Board of which they are a member) whenever possible and to adequately prepare for such meetings.

The Board shall establish and approve terms of reference for an audit committee, a reserves committee and a compensation and corporate governance committee. The Board shall establish special or independent committees at such times and for such purposes as it sees fit.

23

The Board shall approve position descriptions for the chair of the Board and the chair of each of the committees of the Board. In addition, the Board, together with the CEO, shall develop a position description for the CEO, which includes a description of management’s responsibilities.

| 5. | Orientation and Continuing Education: |

The Board shall ensure that all new directors receive a comprehensive orientation and, where appropriate, shall provide continuing education opportunities for all directors so that individuals may maintain or enhance their skills and abilities as directors, as well as to ensure their knowledge and understanding of the Corporation’s business remains current.

| 6. | Code of Business Conduct and Ethics: |

The Board shall adopt a written code of business conduct and ethics (the “Code”) applicable to directors, officers and employees. The Code shall include written standards that are reasonably designed to promote integrity and to deter wrongdoing and shall address the following:

| | 6.1 | Conflicts of interest, including transactions and agreements in respect of which a director or executive officer has a material interest; |