Exhibit 99.16

| | |

| | 700 Selkirk House 555 – 4th Avenue S.W. Calgary, Alberta Canada T2P 3E7 Phone: (403) 262-6307 Fax: (403) 261-2792 |

ANDERSON ENERGY LTD. PROVIDES OPERATIONAL UPDATE ON WINTER DRILLING PROGRAM AND EXPANDED CARDIUM HORIZONTAL WELL DEVELOPMENT INVENTORY

Calgary, Alberta, January 14, 2010 (TSX: AXL)—Anderson Energy Ltd. (“Anderson Energy” or the “Company”) commenced its operated Edmonton Sands winter drilling program on November 4, 2009. As of January 14, 2010, the Company has drilled 122 gross Edmonton Sands wells, with a success rate of 85%, consistent with expectations and historical results. Four additional wells will be drilled in this program in the first quarter of 2010. The Company’s approximate capital working interest in the wells drilled is 75%. Based on field cost estimates, the Company estimates that its average Edmonton Sands winter 2009/2010 drilling and completion cost is $215,000 per well, which is 31% lower than the drilling and completion cost in the fourth quarter of 2008 of $313,000 per well. Well tie-in and plant construction is underway in the field. Due to the installation of this new plant and gathering system infrastructure, the Company expects to bring on the new production from this winter’s drilling program in the second quarter of 2010 at an average operating expense of $5.00 per BOE, which is substantially less than the historical Edmonton Sands average operating expense of $9.00 per BOE. The Company’s estimated production guidance for 2010 remains at 8,000 to 8,500 BOED. The Company’s 2010 capital program is estimated to be $75 million.

HORIZONTAL MULTI STAGE FRAC INVENTORY

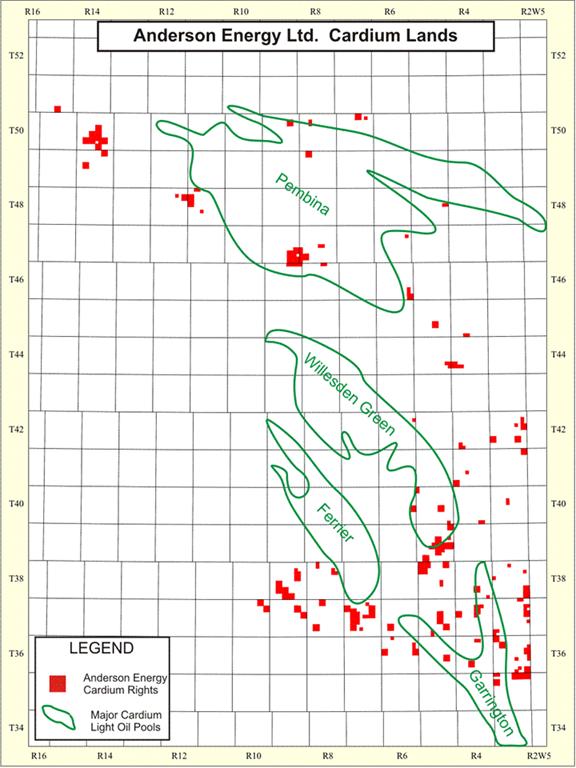

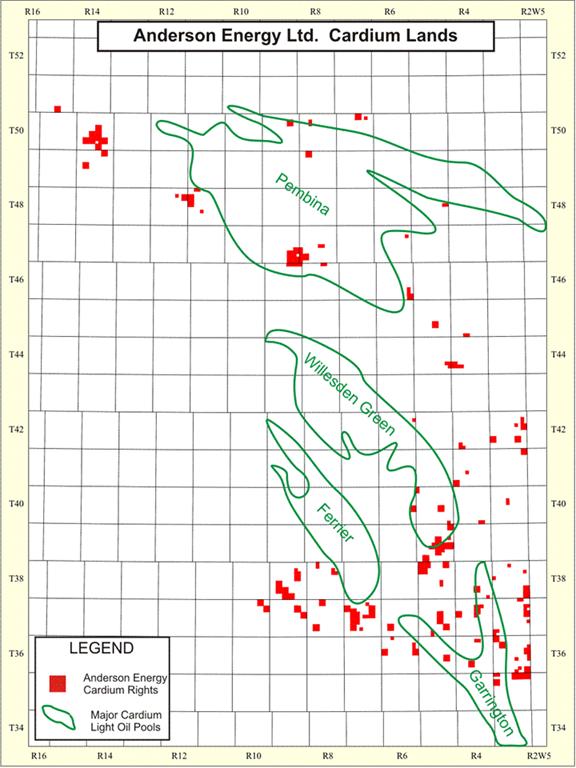

Cardium. Anderson Energy has 80 gross (47 net) sections of land in the Cardium light oil fairway. Anderson Energy’s land position is west of the Pembina field, east of Pembina field, and in Garrington, Markerville and Willesden Green.

In the first quarter of 2010, the Company is planning to drill one 100% working interest Cardium horizontal well on either the east side of the Pembina field or in Garrington. The Company also plans to participate in a 25% working interest outside operated Cardium horizontal well on the west side of the Pembina field. Based on industry activity, potential development drilling density could be two to four wells per section. On a three well per section drilling density, the Company has a potential inventory of 240 gross (141 net) locations.

A map of Anderson Energy’s Cardium acreage is attached.

2

Whitemud Sands. Anderson Energy is expecting to spud two Whitemud Sands horizontal wells in the first quarter of 2010. The Whitemud Sands are at an average of 600 meters vertical depth and each horizontal well is expected to traverse 1,000 meters through the formation. The Company has an approximate working interest of 60% in 200 sections of Whitemud Sands prospective lands.

HEDGING

To protect its 2010 first quarter capital program, the Company has entered into fixed price natural gas contracts for an average of 20,000 GJ per day at an average AECO Canadian dollar price of $5.41 per GJ for the months of January, February and March 2010. This is approximately 19 MMcfd of natural gas production at an average AECO Canadian dollar price of $5.71 per Mcf. On a BOE basis, this represents approximately 43% of the Company’s estimated production in the first quarter and approximately 9% of its estimated production for the year.

For further information on the Company, please visit the Company’s website at www.andersonenergy.ca or contact:

Brian H. Dau

President and Chief Executive Officer

Anderson Energy Ltd.

(403) 262-6307

ADVISORY

Certain information regarding Anderson Energy Ltd. in this news release including, without limitation, management’s assessment of future plans and operations, number of locations in drilling inventory and wells to be drilled, timing and location of drilling and tie-in of wells and the costs thereof, productive capacity of the wells, timing of and construction of facilities, expected production rates, dates of commencement of production, amount of capital expenditures and timing thereof, value of undeveloped land, extent of reserves additions, ability to attain cost savings, drilling program success, commodity price outlook and general economic outlook may constitute forward-looking statements under applicable securities laws and necessarily involve risks and assumptions made by management of the Company including, without limitation, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of reserves estimates, environmental risks, competition from other producers, inability to retain drilling rigs and other services, capital expenditure costs, including drilling, completion and facilities costs, unexpected decline rates in wells, wells not performing as expected, incorrect assessment of the value of acquisitions and farm-ins, failure to realize the anticipated benefits of acquisitions and farm-ins, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources. As a consequence, actual results may differ materially from those anticipated in the forward-looking statements. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on these and other factors that could affect Anderson Energy’s operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com) and at Anderson Energy’s website (www.andersonenergy.ca).

Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Anderson Energy does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Disclosure provided herein in respect of barrels of oil equivalent (BOE) may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

3