UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21148

Eaton Vance New York Municipal Bond Fund

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2020

Date of Reporting Period

| Item��1. | Reports to Stockholders |

Eaton Vance

Municipal Bond Funds

Annual Report

September 30, 2020

Municipal (EIM) • California (EVM) • New York (ENX)

Important Note. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s annual and semi-annual shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (funds.eatonvance.com/closed-end-fund-and-term-trust-documents.php), and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold shares at the Funds’ transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), you may elect to receive shareholder reports and other communications from the Funds electronically by contacting AST. If you own your shares through a financial intermediary (such as a broker-dealer or bank), you must contact your financial intermediary to sign up.

You may elect to receive all future Fund shareholder reports in paper free of charge. If you hold shares at AST, you can inform AST that you wish to continue receiving paper copies of your shareholder reports by calling 1-866-439-6787. If you own these shares through a financial intermediary, you must contact your financial intermediary or follow instructions included with this disclosure, if applicable, to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with AST or to all funds held through your financial intermediary, as applicable.

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of each Fund. Accordingly, neither the Funds nor the adviser with respect to the operation of the Funds is subject to CFTC regulation. Because of its management of other strategies, the Funds’ adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Annual Report September 30, 2020

Eaton Vance

Municipal Bond Funds

Eaton Vance

Municipal Bond Funds

September 30, 2020

Management’s Discussion of Fund Performance1

Economic and Market Conditions

As the 12-month period opened on October 1, 2019, Treasury and municipal bond rates were trending modestly upward, amid better-than-expected U.S. employment reports and cautious optimism about a détente in U.S.-China trade relations. Rates continued to move upward through the end of 2019.

In January 2020, however, news of the outbreak of a new coronavirus in China raised investor concerns and led to a “flight to quality” that sparked a brief bond market rally. As the virus turned into a global pandemic in February and March, however, it ended the longest-ever U.S. economic expansion and brought about a global economic slowdown. Economic activity decreased and credit markets, along with equities, declined in value amid significant volatility.

In response, the U.S. Federal Reserve (the Fed) announced two emergency rate cuts in March 2020 — lowering the federal funds rate to 0.00%-0.25% — along with other measures intended to shore up credit markets. At its July meeting, the Fed provided additional reassurances that it would maintain rates around zero for the foreseeable future and use all the monetary tools at its disposal to support the U.S. economy. These moves helped calm the markets and initiated a new municipal bond rally that began in April and lasted through most of the summer.

The municipal bond rally was also driven by technical market factors as demand overwhelmed supply. As municipal bonds offered attractive tax-exempt yields versus other fixed-income asset classes, municipal bond funds reported net inflows from May through September 2020 — following substantial outflows in March and April.

Midway through August, however, the municipal rally stalled. Rates hit bottom for the fiscal year on August 11, with 10-year municipal bonds at a yield of 0.58%. During the rest of the period, prices fell and yields rose, driven in part by Congress’ failure to pass another stimulus bill, $400-$500 billion of which had been projected for state and local government assistance.

As issuers rushed to take advantage of low yields in late August and September, increased supply reversed the supply-demand dynamic from earlier in the summer — putting further downward pressure on municipal bond prices and upward pressure on yields. In addition, the Fed announced at the end of August a policy shift to allow inflation to run above its 2% target until the U.S. unemployment rate is very low — raising inflation concerns among some investors.

For the period as a whole, rates declined across the municipal bond yield curve, with the greatest declines occurring at the short end of the curve. The Bloomberg Barclays Municipal Bond Index (the Index), a broad

measure of the asset class, returned 4.09% during the period — despite a 3.63% decline in March 2020. Reflecting investors’ “flight to quality” in response to the pandemic, municipal bonds with higher credit ratings generally outperformed lower rated issues during the period.

Fund Performance

For the 12-month period ended September 30, 2020, Eaton Vance Municipal Bond Fund and Eaton Vance California Municipal Bond Fund at net asset value of its common shares (NAV) outperformed the 4.09% return of the Funds’ benchmark, the Index. Eaton Vance New York Municipal Bond Fund at NAV underperformed the Index during the period.

The Funds’ overall strategy is to invest primarily in higher quality bonds rated “A” or higher.

In managing the Funds, management employs leverage through residual interest bond financing to seek to enhance the Funds’ tax-exempt income. The use of leverage has the effect of achieving additional exposure to the municipal market, magnifying a Fund’s exposure to its underlying investments in both up and down market environments.

During this period, when rates fell and bond prices rose for the period as a whole, the leverage amplified the appreciation in the price of bonds held by the Funds and generated additional tax-exempt bond income, enhancing the total return of the Funds. By comparison, the Index does not employ leverage. The Fed’s actions during the period to lower interest rates also reduced the borrowing costs associated with residual interest bonds, further contributing to the positive performance impact of the Funds’ use of leverage.

Fund Specific Results

Eaton Vance Municipal Bond Fund returned 4.99% at NAV, outperforming the 4.09% return of the Index. The main contributors to performance versus the Index included leverage; an overweight position, relative to the Index, in the water and sewer sector, which was the best-performing sector in the Index during the period; and an overweight position in zero-coupon bonds. The chief detractors from results versus the Index included an overweight position in prerefunded, or escrowed, bonds; security selection in 4% coupon bonds; and an overweight position in Illinois bonds. Financially, Illinois was one of the hardest-hit states early in the coronavirus pandemic, and prices of Illinois bonds declined due to uncertainty about the economic effects of the pandemic.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Municipal Bond Funds

September 30, 2020

Management’s Discussion of Fund Performance1 — continued

Eaton Vance California Municipal Bond Fund returned 4.93% at NAV, outperforming the 4.09% return of the Index. Leverage, an overweight position in local general obligation bonds, and security selection in bonds with 22 or more years remaining to maturity contributed to performance relative to the Index. In contrast, security selection in the water and sewer sector, security selection in 4% coupon bonds, and security selection in zero-coupon bonds all detracted from performance versus the Index.

Eaton Vance New York Municipal Bond Fund returned 2.37% at NAV, underperforming the 4.09% return of the Index. Key detractors from performance versus the Index included security selection in the transportation and the water and sewer sectors, as well as security selection in zero-coupon bonds. Primary contributors to performance relative to the Index included leverage, security selection in 3% coupon bonds, and security selection in BBB-rated bonds.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Municipal Bond Fund

September 30, 2020

Performance2,3

Portfolio Manager Cynthia J. Clemson

| | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | |

Fund at NAV | | | 08/30/2002 | | | | 4.99 | % | | | 5.17 | % | | | 6.54 | % |

Fund at Market Price | | | — | | | | 6.15 | | | | 5.99 | | | | 5.22 | |

|

| |

| | | | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | 4.09 | % | | | 3.84 | % | | | 3.99 | % |

| | | | |

| % Premium/Discount to NAV4 | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | –6.26 | % |

| | | | |

| Distributions5 | | | | | | | | | | | | |

| | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | $ | 0.563 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | 4.24 | % |

Taxable-Equivalent Distribution Rate at NAV | | | | | | | | | | | | | | | 7.16 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | 4.52 | % |

Taxable-Equivalent Distribution Rate at Market Price | | | | | | | | | | | | | | | 7.64 | % |

| | | | |

| % Total Leverage6 | | | | | | | | | | | | |

| | | | |

Residual Interest Bond (RIB) Financing | | | | | | | | | | | | | | | 42.68 | % |

Fund Profile

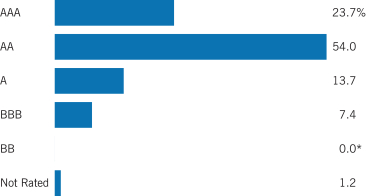

Credit Quality (% of total investments)7,8

| * | Amount is less than 0.05%. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

California Municipal Bond Fund

September 30, 2020

Performance2,3

Portfolio Managers Craig R. Brandon, CFA and Trevor G. Smith

| | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | |

Fund at NAV | | | 08/30/2002 | | | | 4.93 | % | | | 4.73 | % | | | 5.64 | % |

Fund at Market Price | | | — | | | | 4.46 | | | | 4.33 | | | | 3.95 | |

|

| |

| | | | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | 4.09 | % | | | 3.84 | % | | | 3.99 | % |

| | | | |

| % Premium/Discount to NAV4 | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | –10.27 | % |

| | | | |

| Distributions5 | | | | | | | | | | | | |

| | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | $ | 0.463 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | 3.97 | % |

Taxable-Equivalent Distribution Rate at NAV | | | | | | | | | | | | | | | 8.65 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | 4.43 | % |

Taxable-Equivalent Distribution Rate at Market Price | | | | | | | | | | | | | | | 9.65 | % |

| | | | |

| % Total Leverage6 | | | | | | | | | | | | |

| | | | |

RIB Financing | | | | | | | | | | | | | | | 41.05 | % |

Fund Profile

Credit Quality (% of total investments)7,8

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

New York Municipal Bond Fund

September 30, 2020

Performance2,3

Portfolio Managers Craig R. Brandon, CFA and Christopher J. Eustance, CFA

| | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | |

Fund at NAV | | | 08/30/2002 | | | | 2.37 | % | | | 3.73 | % | | | 5.05 | % |

Fund at Market Price | | | — | | | | –1.21 | | | | 3.42 | | | | 3.54 | |

|

| |

| | | | |

Bloomberg Barclays Municipal Bond Index | | | — | | | | 4.09 | % | | | 3.84 | % | | | 3.99 | % |

| | | | |

| % Premium/Discount to NAV4 | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | –10.94 | % |

| | | | |

| Distributions5 | | | | | | | | | | | | |

| | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | $ | 0.484 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | 3.98 | % |

Taxable-Equivalent Distribution Rate at NAV | | | | | | | | | | | | | | | 7.90 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | 4.47 | % |

Taxable-Equivalent Distribution Rate at Market Price | | | | | | | | | | | | | | | 8.87 | % |

| | | | |

| % Total Leverage6 | | | | | | | | | | | | |

| | | | |

RIB Financing | | | | | | | | | | | | | | | 38.34 | % |

Fund Profile

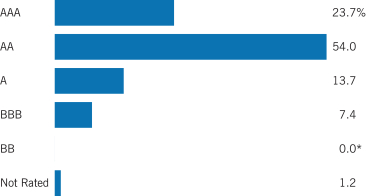

Credit Quality (% of total investments)7,8

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s Dividend Reinvestment Plan. Performance at market price will differ from performance at NAV due to variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9

Eaton Vance Municipal Bond Fund

Investment Objective and Principal Strategies

The Fund’s investment objective is to provide current income exempt from federal income.

During normal market conditions, at least 80% of the Fund’s net assets will be invested in municipal obligations, the interest on which is exempt from federal income tax, including the alternative minimum tax (“AMT”) and that are rated A or better by Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). The foregoing 80% policy may not be changed without shareholder approval. Under normal market conditions, the Fund expects to be fully invested (at least 95% of its net assets) in accordance with its investment objective. The Fund may invest up to 20% of its net assets in municipal obligations rated BBB/Baa or below (or unrated obligations deemed by the Fund’s adviser, Eaton Vance Management (“Eaton Vance”), to be of equivalent quality), provided that not more than 15% of its net assets may be invested in municipal obligations rated below B (or unrated obligations deemed by Eaton Vance to be of equivalent quality) and may invest up to 20% of its net assets in bonds on which the interest is subject to the AMT. When a municipal obligation is split rated (meaning rated in different categories by Moody’s, S&P or Fitch) the Fund will deem the higher rating to apply.

The Fund may purchase derivative instruments, which derive their value from another instrument, security or index, including financial futures contracts and related options, interest rate swaps and forward rate contracts. The Fund also may invest in residual interests of a trust (the “trust”) that holds municipal securities (“RIBs”). The trust will also issue floating-rate notes to third parties that may be senior to the Fund’s residual interest. The Fund may purchase and sell financial futures contracts and related options, including futures contracts and related options based on various debt securities and securities indices, as well as interest rate swaps and forward rate contracts, to seek to hedge against changes in interest rates or for other risk management purposes.

Except for certain fundamental investment restrictions set forth in the Fund’s registration statement and the 80% requirement pertaining to investment in municipal and insured municipal obligations set forth above, the investment objective and policies of the Fund may be changed by the Board without shareholder action.

The Fund employs leverage to seek opportunities for additional income. Leverage may amplify the Fund’s NAV of any increase or decrease in the value of investments held. The Fund generally will not use leverage if the investment adviser anticipates that it would result in a lower return to shareholders for any significant amount of time. There can be no assurance that the use of leverage will be successful.

Principal Risks

Market Discount Risk. The shares of closed-end management investment companies often trade at a discount from their NAV, and the common shares may likewise trade at a discount from NAV. This risk is separate and distinct from the risk that the Fund’s NAV could decrease as a result of its investment activities. The trading price of the common shares may be less than the initial public offering price, creating a risk of loss for investors purchasing in the initial public offering of the common shares.

Market Risk. The value of investments held by the Fund may increase or decrease in response to economic, political, financial, public health crises (such as epidemics or pandemics) or other disruptive events (whether real, expected or perceived) in the U.S. and global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Interest Rate Risk. In general, the value of debt instruments will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. Because the Fund is managed toward an income objective, it may hold more longer duration or maturity obligations and thereby be more exposed to interest rate risk than municipal income funds that are managed with a greater emphasis on total return. The impact of interest rate changes is significantly less for floating-rate instruments that have relatively short periodic rate resets (e.g., ninety days or less). In a rising interest rate environment, the durations or maturities of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund may pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is expected to be phased out by the end of 2021. While the effect of the phase out cannot yet be determined, it may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in municipal obligations and other debt obligations (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

expenses and adversely affect net asset value. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected.

Municipal Obligations Risk. The amount of public information available about municipal obligations is generally less than for corporate equities or bonds, meaning that the investment performance of municipal obligations may be more dependent on the analytical abilities of the investment adviser than stock or corporate bond investments. The secondary market for municipal obligations also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund’s ability to sell its municipal obligations at attractive prices. The differences between the price at which an obligation can be purchased and the price at which it can be sold may widen during periods of market distress. Less liquid obligations can become more difficult to value and be subject to erratic price movements. The increased presence of nontraditional participants (such as proprietary trading desks of investment banks and hedge funds) or the absence of traditional participants (such as individuals, insurance companies, banks and life insurance companies) in the municipal markets may lead to greater volatility in the markets because non-traditional participants may trade more frequently or in greater volume.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Leverage Risk. Certain Fund transactions may give rise to leverage. Leverage can result from a non-cash exposure to an asset, index, rate or instrument. Leverage can also result from borrowings, issuance of preferred shares or participation in residual interest bond transactions. Leverage can increase both the risk and return potential of the Fund. The Fund is required to segregate liquid assets or otherwise cover the Fund’s obligation created by a transaction that may give rise to leverage. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage may cause the Fund’s NAV to be more volatile than if it had not been leveraged, as certain types of leverage may exaggerate the effect of any increase or decrease in the Fund’s portfolio securities. The loss on leveraged investments may substantially exceed the initial investment. The Fund intends to use leverage to provide the holders of common shares with a potentially higher return. To the extent the income derived from securities purchased with funds received from leverage exceeds the cost of leverage, the Fund’s return will be greater than if leverage had not been used. Conversely, if the income from the securities purchased with such funds is not sufficient to cover the cost of leverage, the return to the Fund will be less than if leverage had not been used, and therefore the amount available for distribution to common shareholders as dividends and other distributions will be reduced. In the latter case, the investment adviser in its best judgment may nevertheless determine to maintain the Fund’s leveraged position if it deems such action to be appropriate. The use of leverage through issuance of preferred shares by the Fund creates an

opportunity for increased net income, but, at the same time, creates special risks. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

Risk of Residual Interest Bonds. The Fund may enter into residual interest bond transactions, which expose the Fund to leverage and greater risk than an investment in a fixed-rate municipal bond. The interest payments that each Fund receives on the residual interest bonds acquired in such transactions vary inversely with short-term interest rates, normally decreasing when short-term rates increase. The value and market for residual interest bonds are volatile and such bonds may have limited liquidity. As required by applicable accounting standards, each Fund records interest expense on its liability with respect to floating-rate notes and also records offsetting interest income in an amount equal to this expense.

Restricted Securities Risk. Unless registered for sale to the public under applicable federal securities law, restricted securities can be sold only in private transactions to qualified purchasers pursuant to an exemption from registration. The sale price realized from a private transaction could be less than the Fund’s purchase price for the restricted security. It may be difficult to identify a qualified purchaser for a restricted security held by the Fund and such security could be deemed illiquid. It may also be more difficult to value such securities.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment, particularly when there is no stated limit on the Fund’s use of derivatives. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Sector and Geographic Risk. Because the Fund may invest a significant portion of its assets in obligations issued in a particular state and/or U.S. territories and in certain types of municipal or other obligations and/or in certain sectors, the value of Fund shares may be affected by events that adversely affect that state, U.S. territory, sector or type of obligation and may fluctuate more than that of a fund that invests more broadly. General obligation bonds issued by municipalities are adversely affected by economic downturns and any resulting decline in tax revenues. Please refer to the Fund’s Statement of Additional Information for state-specific economic information as well as information about Puerto Rico, the U.S. Virgin Islands, Guam and American Samoa.

Issuer Diversification Risk. The Fund is “non-diversified,” which means it may invest a greater percentage of its assets in the securities of a single issuer than a fund that is “diversified.” Non-diversified funds may focus their investments in a small number of issuers, making them more susceptible to risks affecting such issuers than a more diversified fund might be.

Recent Market Conditions. An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in December 2019 and subsequently spread internationally. This coronavirus has resulted in closing borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general concern and uncertainty. The impact of this coronavirus may last for an extended period of time and result in a substantial economic downturn. Health crises caused by outbreaks, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks and disrupt normal market conditions and operations. The impact of this outbreak, and other epidemics and pandemics that may arise in the future, could negatively affect the worldwide economy, as well as the economies of individual countries, individual companies and the market in general in significant and unforeseen ways. Any such impact could adversely affect the Fund’s performance, or the performance of the securities in which the Fund invests and may lead to losses on your investment in the Fund.

Risks Associated with Active Management. The success of the Fund’s investment strategy depends on portfolio management’s successful application of analytical skills and investment judgment. Active management involves subjective decisions.

Tax Risk. Income from tax-exempt municipal obligations could be declared taxable because of changes in tax laws, adverse interpretations by the relevant taxing authority or the non-compliant conduct of the issuer of an obligation.

Tax-Sensitive Investing Risk. The Fund may hold a security in order to achieve more favorable tax-treatment or to sell a security in order to create tax losses. The Fund’s utilization of various tax-management techniques may be curtailed or eliminated by tax legislation, regulation or interpretations. The Fund may not be able to minimize taxable distributions to shareholders and a portion of the Fund’s distributions may be taxable.

Cybersecurity Risk. With the increased use of technologies by Fund service providers to conduct business, such as the Internet, the Fund is susceptible to operational, information security and related risks. In general, cyber incidents can result from deliberate attacks or unintentional events.

Cybersecurity failures by or breaches of the Fund’s investment adviser or administrator and other service providers (including, but not limited to, the custodian or transfer agent), and the issuers of securities in which the Fund invests, have the ability to cause disruptions and impact business operations potentially resulting in financial losses, interference with the Fund’s ability to calculate its net asset value, impediments to trading, the inability of Fund shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs.

General Fund Investing Risks. The Fund is not a complete investment program and there is no guarantee that the Fund will achieve its investment objective. It is possible to lose money by investing in the Fund. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

Eaton Vance California Municipal Bond Fund

Investment Objective and Principal Strategies

The Fund’s investment objective is to provide current income exempt from federal income tax and California State personal income taxes.

During normal market conditions, at least 80% of the Fund’s net assets will be invested in municipal obligations, the interest on which is exempt from federal income tax, including the alternative minimum tax (“AMT”), and California State personal income taxes and that are rated A or better by Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). The foregoing 80% policy may not be changed without shareholder approval. Under normal market conditions, the Fund expects to be fully invested (at least 95% of its net assets) in accordance with its investment objective. The Fund may invest up to 20% of its net assets in municipal obligations rated BBB/Baa or below (or unrated obligations deemed by the Fund’s adviser, Eaton Vance Management (“Eaton Vance”), to be of equivalent quality), provided that not more than 15% of its net assets may be invested in municipal obligations rated below B (or unrated obligations deemed by Eaton Vance to be of equivalent quality) and may invest up to 20% of its net assets in bonds on which the interest is subject to the AMT. When a municipal obligation is split rated (meaning rated in different categories by Moody’s, S&P or Fitch) the Fund will deem the higher rating to apply.

The Fund may purchase derivative instruments, which derive their value from another instrument, security or index, including financial futures contracts and related options, interest rate swaps and forward rate contracts. The Fund also may invest in residual interests of a trust (the “trust”) that holds municipal securities (“RIBs”). The trust will also issue floating-rate notes to third parties that may be senior to the Fund’s residual interest. The Fund may purchase and sell financial futures contracts and related options, including futures contracts and related options based on various debt securities and securities indices, as well as interest rate swaps and forward rate contracts, to seek to hedge against changes in interest rates or for other risk management purposes.

Except for certain fundamental investment restrictions set forth in the Fund’s registration statement and the 80% requirement pertaining to investment in municipal and insured municipal obligations set forth above, the investment objective and policies of the Fund may be changed by the Board without shareholder action.

The Fund employs leverage to seek opportunities for additional income. Leverage may amplify the Fund’s NAV of any increase or decrease in the value of investments held. The Fund generally will not use leverage if the investment adviser anticipates that it would result in a lower return to shareholders for any significant amount of time. There can be no assurance that the use of leverage will be successful.

Principal Risks

Market Discount Risk. The shares of closed-end management investment companies often trade at a discount from their NAV, and the common shares may likewise trade at a discount from NAV. This risk is separate and distinct from the risk that the Fund’s NAV could decrease as a result of its investment activities. The trading price of the common shares may be less than the initial public offering price, creating a risk of loss for investors purchasing in the initial public offering of the common shares.

Market Risk. The value of investments held by the Fund may increase or decrease in response to economic, political, financial, public health crises (such as epidemics or pandemics) or other disruptive events (whether real, expected or perceived) in the U.S. and global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Interest Rate Risk. In general, the value of debt instruments will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. Because the Fund is managed toward an income objective, it may hold more longer duration or maturity obligations and thereby be more exposed to interest rate risk than municipal income funds that are managed with a greater emphasis on total return. The impact of interest rate changes is significantly less for floating-rate instruments that have relatively short periodic rate resets (e.g., ninety days or less). In a rising interest rate environment, the durations or maturities of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund may pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is expected to be phased out by the end of 2021. While the effect of the phase out cannot yet be determined, it may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in municipal obligations and other debt obligations (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

downgraded by a rating agency, the value of such obligations may be negatively affected.

Municipal Obligations Risk. The amount of public information available about municipal obligations is generally less than for corporate equities or bonds, meaning that the investment performance of municipal obligations may be more dependent on the analytical abilities of the investment adviser than stock or corporate bond investments. The secondary market for municipal obligations also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund’s ability to sell its municipal obligations at attractive prices. The differences between the price at which an obligation can be purchased and the price at which it can be sold may widen during periods of market distress. Less liquid obligations can become more difficult to value and be subject to erratic price movements. The increased presence of nontraditional participants (such as proprietary trading desks of investment banks and hedge funds) or the absence of traditional participants (such as individuals, insurance companies, banks and life insurance companies) in the municipal markets may lead to greater volatility in the markets because non-traditional participants may trade more frequently or in greater volume.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Leverage Risk. Certain Fund transactions may give rise to leverage. Leverage can result from a non-cash exposure to an asset, index, rate or instrument. Leverage can also result from borrowings, issuance of preferred shares or participation in residual interest bond transactions. Leverage can increase both the risk and return potential of the Fund. The Fund is required to segregate liquid assets or otherwise cover the Fund’s obligation created by a transaction that may give rise to leverage. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage may cause the Fund’s NAV to be more volatile than if it had not been leveraged, as certain types of leverage may exaggerate the effect of any increase or decrease in the Fund’s portfolio securities. The loss on leveraged investments may substantially exceed the initial investment. The Fund intends to use leverage to provide the holders of common shares with a potentially higher return. To the extent the income derived from securities purchased with funds received from leverage exceeds the cost of leverage, the Fund’s return will be greater than if leverage had not been used. Conversely, if the income from the securities purchased with such funds is not sufficient to cover the cost of leverage, the return to the Fund will be less than if leverage had not been used, and therefore the amount available for distribution to common shareholders as dividends and other distributions will be reduced. In the latter case, the investment adviser in its best judgment may nevertheless determine to maintain the Fund’s leveraged position if it deems such action to be appropriate. The use of leverage through issuance of preferred shares by the Fund creates an opportunity for increased net income, but, at the same time, creates special

risks. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

Risk of Residual Interest Bonds. The Fund may enter into residual interest bond transactions, which expose the Fund to leverage and greater risk than an investment in a fixed-rate municipal bond. The interest payments that each Fund receives on the residual interest bonds acquired in such transactions vary inversely with short-term interest rates, normally decreasing when short-term rates increase. The value and market for residual interest bonds are volatile and such bonds may have limited liquidity. As required by applicable accounting standards, each Fund records interest expense on its liability with respect to floating-rate notes and also records offsetting interest income in an amount equal to this expense.

Restricted Securities Risk. Unless registered for sale to the public under applicable federal securities law, restricted securities can be sold only in private transactions to qualified purchasers pursuant to an exemption from registration. The sale price realized from a private transaction could be less than the Fund’s purchase price for the restricted security. It may be difficult to identify a qualified purchaser for a restricted security held by the Fund and such security could be deemed illiquid. It may also be more difficult to value such securities.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment, particularly when there is no stated limit on the Fund’s use of derivatives. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

Sector and Geographic Risk. Because the Fund may invest a significant portion of its assets in obligations issued in a particular state and/or U.S. territories and in certain types of municipal or other obligations and/or in certain sectors, the value of Fund shares may be affected by events that adversely affect that state, U.S. territory, sector or type of obligation and may fluctuate more than that of a fund that invests more broadly. General obligation bonds issued by municipalities are adversely affected by economic downturns and any resulting decline in tax revenues. Please refer to the Fund’s Statement of Additional Information for state-specific economic information as well as information about Puerto Rico, the U.S. Virgin Islands, Guam and American Samoa.

Issuer Diversification Risk. The Fund is “non-diversified,” which means it may invest a greater percentage of its assets in the securities of a single issuer than a fund that is “diversified.” Non-diversified funds may focus their investments in a small number of issuers, making them more susceptible to risks affecting such issuers than a more diversified fund might be.

Recent Market Conditions. An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in December 2019 and subsequently spread internationally. This coronavirus has resulted in closing borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general concern and uncertainty. The impact of this coronavirus may last for an extended period of time and result in a substantial economic downturn. Health crises caused by outbreaks, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks and disrupt normal market conditions and operations. The impact of this outbreak, and other epidemics and pandemics that may arise in the future, could negatively affect the worldwide economy, as well as the economies of individual countries, individual companies and the market in general in significant and unforeseen ways. Any such impact could adversely affect the Fund’s performance, or the performance of the securities in which the Fund invests and may lead to losses on your investment in the Fund.

Risks Associated with Active Management. The success of the Fund’s investment strategy depends on portfolio management’s successful application of analytical skills and investment judgment. Active management involves subjective decisions.

Tax Risk. Income from tax-exempt municipal obligations could be declared taxable because of changes in tax laws, adverse interpretations by the relevant taxing authority or the non-compliant conduct of the issuer of an obligation.

Tax-Sensitive Investing Risk. The Fund may hold a security in order to achieve more favorable tax-treatment or to sell a security in order to create tax losses. The Fund’s utilization of various tax-management techniques may be curtailed or eliminated by tax legislation, regulation or interpretations. The Fund may not be able to minimize taxable distributions to shareholders and a portion of the Fund’s distributions may be taxable.

Cybersecurity Risk. With the increased use of technologies by Fund service providers to conduct business, such as the Internet, the Fund is susceptible to operational, information security and related risks. In general, cyber incidents can result from deliberate attacks or unintentional events. Cybersecurity failures by or breaches of the Fund’s investment adviser or administrator and other service providers (including, but not limited to, the custodian or transfer agent), and the issuers of securities in which the Fund

invests, have the ability to cause disruptions and impact business operations potentially resulting in financial losses, interference with the Fund’s ability to calculate its net asset value, impediments to trading, the inability of Fund shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs.

General Fund Investing Risks. The Fund is not a complete investment program and there is no guarantee that the Fund will achieve its investment objective. It is possible to lose money by investing in the Fund. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

Eaton Vance New York Municipal Bond Fund

Investment Objective and Principal Strategies

The Fund’s investment objective is to provide current income exempt from federal income tax and New York State and New York City personal income taxes.

During normal market conditions, at least 80% of the Fund’s net assets will be invested in municipal obligations, the interest on which is exempt from federal income tax, including the alternative minimum tax (“AMT”), and New York State and New York City personal income taxes and that are rated A or better by Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). The foregoing 80% policy may not be changed without shareholder approval. Under normal market conditions, the Fund expects to be fully invested (at least 95% of its net assets) in accordance with its investment objective. The Fund may invest up to 20% of its net assets in municipal obligations rated BBB/Baa or below (or unrated obligations deemed by the Fund’s adviser, Eaton Vance Management (“Eaton Vance”), to be of equivalent quality), provided that not more than 15% of its net assets may be invested in municipal obligations rated below B (or unrated obligations deemed by Eaton Vance to be of equivalent quality) and may invest up to 20% of its net assets in bonds on which the interest is subject to the AMT. When a municipal obligation is split rated (meaning rated in different categories by Moody’s, S&P or Fitch) the Fund will deem the higher rating to apply.

The Fund may purchase derivative instruments, which derive their value from another instrument, security or index, including financial futures contracts and related options, interest rate swaps and forward rate contracts. The Fund also may invest in residual interests of a trust (the “trust”) that holds municipal securities (“RIBs”). The trust will also issue floating-rate notes to third parties that may be senior to the Fund’s residual interest. The Fund may purchase and sell financial futures contracts and related options, including futures contracts and related options based on various debt securities and securities indices, as well as interest rate swaps and forward rate contracts, to seek to hedge against changes in interest rates or for other risk management purposes.

Except for certain fundamental investment restrictions set forth in the Fund’s registration statement and the 80% requirement pertaining to investment in municipal and insured municipal obligations set forth above, the investment objective and policies of the Fund may be changed by the Board without shareholder action.

The Fund employs leverage to seek opportunities for additional income. Leverage may amplify the Fund’s NAV of any increase or decrease in the value of investments held. The Fund generally will not use leverage if the investment adviser anticipates that it would result in a lower return to shareholders for any significant amount of time. There can be no assurance that the use of leverage will be successful.

Principal Risks

Market Discount Risk. The shares of closed-end management investment companies often trade at a discount from their NAV, and the common shares may likewise trade at a discount from NAV. This risk is separate and distinct from the risk that the Fund’s NAV could decrease as a result of its investment activities. The trading price of the common shares may be less than the initial public offering price, creating a risk of loss for investors purchasing in the initial public offering of the common shares.

Market Risk. The value of investments held by the Fund may increase or decrease in response to economic, political, financial, public health crises (such as epidemics or pandemics) or other disruptive events (whether real, expected or perceived) in the U.S. and global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Interest Rate Risk. In general, the value of debt instruments will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. Because the Fund is managed toward an income objective, it may hold more longer duration or maturity obligations and thereby be more exposed to interest rate risk than municipal income funds that are managed with a greater emphasis on total return. The impact of interest rate changes is significantly less for floating-rate instruments that have relatively short periodic rate resets (e.g., ninety days or less). In a rising interest rate environment, the durations or maturities of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund may pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is expected to be phased out by the end of 2021. While the effect of the phase out cannot yet be determined, it may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in municipal obligations and other debt obligations (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

Municipal Obligations Risk. The amount of public information available about municipal obligations is generally less than for corporate equities or bonds, meaning that the investment performance of municipal obligations may be more dependent on the analytical abilities of the investment adviser than stock or corporate bond investments. The secondary market for municipal obligations also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund’s ability to sell its municipal obligations at attractive prices. The differences between the price at which an obligation can be purchased and the price at which it can be sold may widen during periods of market distress. Less liquid obligations can become more difficult to value and be subject to erratic price movements. The increased presence of nontraditional participants (such as proprietary trading desks of investment banks and hedge funds) or the absence of traditional participants (such as individuals, insurance companies, banks and life insurance companies) in the municipal markets may lead to greater volatility in the markets because non-traditional participants may trade more frequently or in greater volume.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Leverage Risk. Certain Fund transactions may give rise to leverage. Leverage can result from a non-cash exposure to an asset, index, rate or instrument. Leverage can also result from borrowings, issuance of preferred shares or participation in residual interest bond transactions. Leverage can increase both the risk and return potential of the Fund. The Fund is required to segregate liquid assets or otherwise cover the Fund’s obligation created by a transaction that may give rise to leverage. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage may cause the Fund’s NAV to be more volatile than if it had not been leveraged, as certain types of leverage may exaggerate the effect of any increase or decrease in the Fund’s portfolio securities. The loss on leveraged investments may substantially exceed the initial investment. The Fund intends to use leverage to provide the holders of common shares with a potentially higher return. To the extent the income derived from securities purchased with funds received from leverage exceeds the cost of leverage, the Fund’s return will be greater than if leverage had not been used. Conversely, if the income from the securities purchased with such funds is not sufficient to cover the cost of leverage, the return to the Fund will be less than if leverage had not been used, and therefore the amount available for distribution to common shareholders as dividends and other distributions will be reduced. In the latter case, the investment adviser in its best judgment may nevertheless determine to maintain the Fund’s leveraged position if it deems such action to be appropriate. The use of leverage through issuance of preferred shares by the Fund creates an opportunity for increased net income, but, at the same time, creates special risks. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

Risk of Residual Interest Bonds. The Fund may enter into residual interest bond transactions, which expose the Fund to leverage and greater risk than an investment in a fixed-rate municipal bond. The interest payments that each Fund receives on the residual interest bonds acquired in such transactions vary inversely with short-term interest rates, normally decreasing when short-term rates increase. The value and market for residual interest bonds are volatile and such bonds may have limited liquidity. As required by applicable accounting standards, each Fund records interest expense on its liability with respect to floating-rate notes and also records offsetting interest income in an amount equal to this expense.

Restricted Securities Risk. Unless registered for sale to the public under applicable federal securities law, restricted securities can be sold only in private transactions to qualified purchasers pursuant to an exemption from registration. The sale price realized from a private transaction could be less than the Fund’s purchase price for the restricted security. It may be difficult to identify a qualified purchaser for a restricted security held by the Fund and such security could be deemed illiquid. It may also be more difficult to value such securities.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the security, instrument, index, currency, commodity, economic indicator or event underlying a derivative (“reference instrument”), due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying reference instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying reference instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying reference instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment, particularly when there is no stated limit on the Fund’s use of derivatives. A derivative investment also involves the risks relating to the reference instrument underlying the investment.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Sector and Geographic Risk. Because the Fund may invest a significant portion of its assets in obligations issued in a particular state and/or U.S.

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Municipal Bond Funds

September 30, 2020

The Fund’s Investment Objectives, Principal Strategies and Principal Risks9 — continued

territories and in certain types of municipal or other obligations and/or in certain sectors, the value of Fund shares may be affected by events that adversely affect that state, U.S. territory, sector or type of obligation and may fluctuate more than that of a fund that invests more broadly. General obligation bonds issued by municipalities are adversely affected by economic downturns and any resulting decline in tax revenues. Please refer to the Fund’s Statement of Additional Information for state-specific economic information as well as information about Puerto Rico, the U.S. Virgin Islands, Guam and American Samoa.